Analysis of Financial Performance and Health: British American Tobacco

VerifiedAdded on 2023/01/16

|22

|4038

|37

Report

AI Summary

This report presents a critical analysis of British American Tobacco PLC's financial performance over a five-year period, focusing on key financial metrics. The analysis encompasses liquidity ratios, such as the current and quick ratios, revealing a fluctuating and generally declining liquidity position. Profitability is assessed through operating profit margin, gross profit margin, and net profit margin, showing variable performance with some years exhibiting better profitability than others. Efficiency ratios, including accounts receivable turnover, accounts payable turnover, inventory turnover, total assets turnover, and fixed assets turnover, are also examined, highlighting the company's ability to manage its assets and liabilities. The report provides detailed calculations, charts, and interpretations of these ratios, offering insights into the company's financial health and areas for potential improvement.

FINANCIAL

MANAGEMENT AND

ANALYSIS

MANAGEMENT AND

ANALYSIS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Critically analysis of changes in financial performance and health during last five years. ....3

2. Explanation of problem of analysis.......................................................................................19

3. Recommendation to above company in accordance of analysis............................................20

CONCLUSION .............................................................................................................................20

REFERENCES..............................................................................................................................22

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Critically analysis of changes in financial performance and health during last five years. ....3

2. Explanation of problem of analysis.......................................................................................19

3. Recommendation to above company in accordance of analysis............................................20

CONCLUSION .............................................................................................................................20

REFERENCES..............................................................................................................................22

INTRODUCTION

The financial management may be understood a process of planning, managing, guiding

and keeping control over financial activities (Delen, Kuzey and Uyar, 2013). The objective of

this management is to make full usage of available financial resources so that objectives can be

achieved. Basically, it is responsibility of finance managers to apply different techniques in order

to do better financial management. In the project report two companies have been selected which

are listed on London stock exchange. These companies are British American Tobacco plc. This

company manufactures cigarette and tobacco and it is headquartered in London, England. It is

world's 2nd largest producer of cigarette. The project report covers information about financial

health of above chosen company in regards to liquidity, profitability etc. As well as further part

of report enables readers about suggestion to company to overcome from weaker areas.

MAIN BODY

1. Critically analysis of variations in financial condition and health during previous five years.

Financial performance analysis- This is essential for companies to make proper analysis of

financial aspects so that internal and external stakeholders can become aware about company's

financial health. In order to do analysis of monetary condition of corporations, there are different

range of aspects that must be considered. In regards to British American Tobacco plc, herein

underneath some aspects are covered below for five years such as:

1. Liquidity- This is crucial for business entities to assess liquidity condition to know efficiency

of making payment of short term expenditures (Sohn and Kim, 2013). To analyse liquidity

condition of corporations, there are mainly two types of ratios that are calculated and interpreted.

Below these two ratios are mentioned related to above British American Tobacco plc: Current ratio- Current asset / current liability

All data in

GBP million

except current

ratio

2014 2015 2016 2017 2018

The financial management may be understood a process of planning, managing, guiding

and keeping control over financial activities (Delen, Kuzey and Uyar, 2013). The objective of

this management is to make full usage of available financial resources so that objectives can be

achieved. Basically, it is responsibility of finance managers to apply different techniques in order

to do better financial management. In the project report two companies have been selected which

are listed on London stock exchange. These companies are British American Tobacco plc. This

company manufactures cigarette and tobacco and it is headquartered in London, England. It is

world's 2nd largest producer of cigarette. The project report covers information about financial

health of above chosen company in regards to liquidity, profitability etc. As well as further part

of report enables readers about suggestion to company to overcome from weaker areas.

MAIN BODY

1. Critically analysis of variations in financial condition and health during previous five years.

Financial performance analysis- This is essential for companies to make proper analysis of

financial aspects so that internal and external stakeholders can become aware about company's

financial health. In order to do analysis of monetary condition of corporations, there are different

range of aspects that must be considered. In regards to British American Tobacco plc, herein

underneath some aspects are covered below for five years such as:

1. Liquidity- This is crucial for business entities to assess liquidity condition to know efficiency

of making payment of short term expenditures (Sohn and Kim, 2013). To analyse liquidity

condition of corporations, there are mainly two types of ratios that are calculated and interpreted.

Below these two ratios are mentioned related to above British American Tobacco plc: Current ratio- Current asset / current liability

All data in

GBP million

except current

ratio

2014 2015 2016 2017 2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

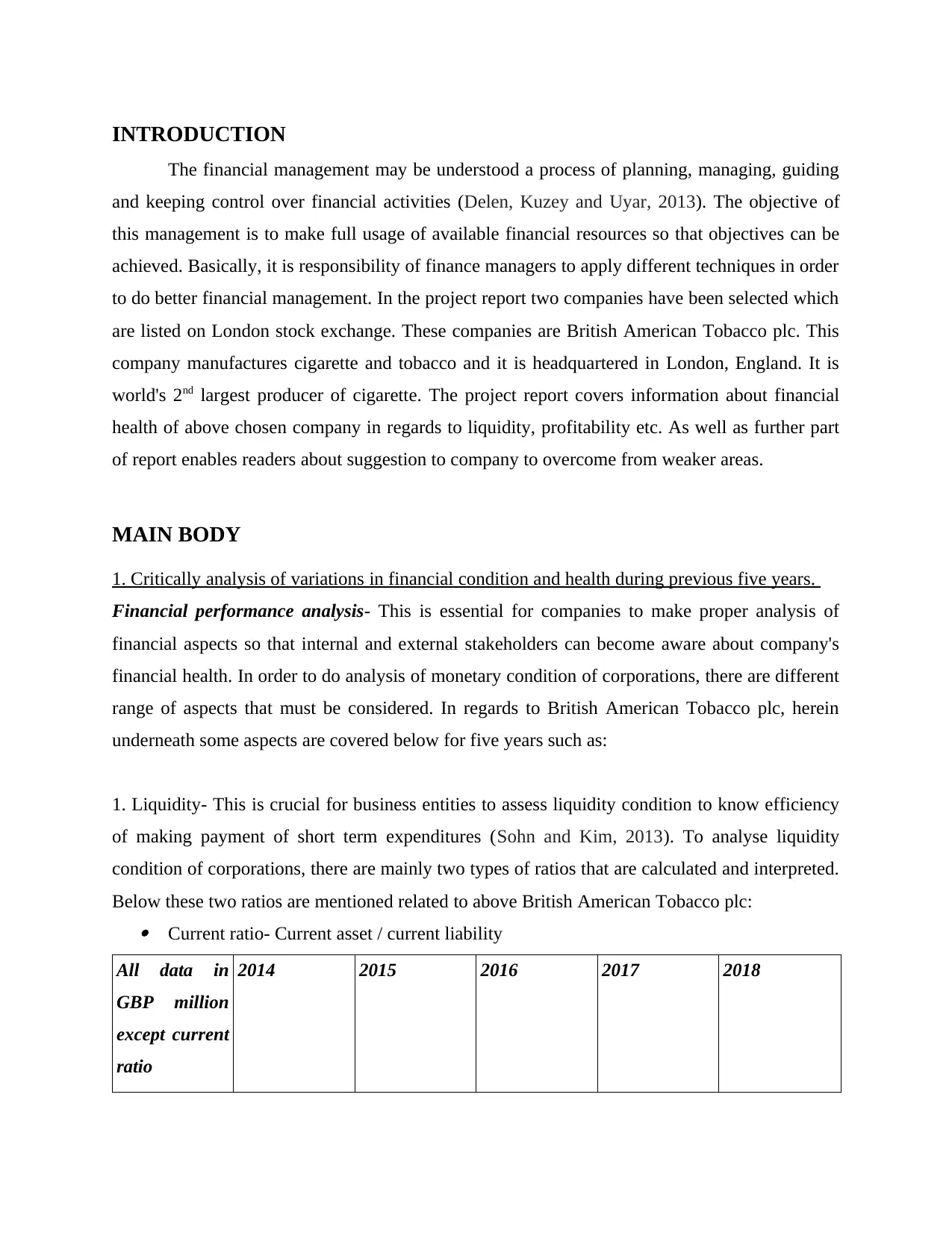

Current asset 9132 9814 12359 13966 12655

Current

liability

8769 9006 11856 15544 16329

Calculation 9132/8769 9814/9006 12359/11856 13966/15544 12655/16329

Current ratio 1.04 times 1.09 times 1.04 times 0.9 times 0.77 times

2014 2015 2016 2017 2018

0

0.2

0.4

0.6

0.8

1

1.2

1.04 1.09 1.04

0.9

0.77

Current ratio

Analysis- The current ratio computes efficiency of a company in order to make short term

payments. This becomes essential for companies to keep their current ratio in ideal form which is

2:1 times. In accordance of above presented line chart, this can be assessed that above

corporations’ liquidity position is not so good as their current ratio is decreasing in recent years.

Such as in year 2014, the current ratio was of 1.04 times that raised in next year till 1.09 times.

While in year 2016, it decreased and became of 1.04 times as well as in next years also it

reduced and became of 0.77 times in year 2018.

Quick ratio (Acid test ratio) = Quick asset / current liability

All data in

GBP million

except quick

2014 2015 2016 2017 2018

Current

liability

8769 9006 11856 15544 16329

Calculation 9132/8769 9814/9006 12359/11856 13966/15544 12655/16329

Current ratio 1.04 times 1.09 times 1.04 times 0.9 times 0.77 times

2014 2015 2016 2017 2018

0

0.2

0.4

0.6

0.8

1

1.2

1.04 1.09 1.04

0.9

0.77

Current ratio

Analysis- The current ratio computes efficiency of a company in order to make short term

payments. This becomes essential for companies to keep their current ratio in ideal form which is

2:1 times. In accordance of above presented line chart, this can be assessed that above

corporations’ liquidity position is not so good as their current ratio is decreasing in recent years.

Such as in year 2014, the current ratio was of 1.04 times that raised in next year till 1.09 times.

While in year 2016, it decreased and became of 1.04 times as well as in next years also it

reduced and became of 0.77 times in year 2018.

Quick ratio (Acid test ratio) = Quick asset / current liability

All data in

GBP million

except quick

2014 2015 2016 2017 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ratio

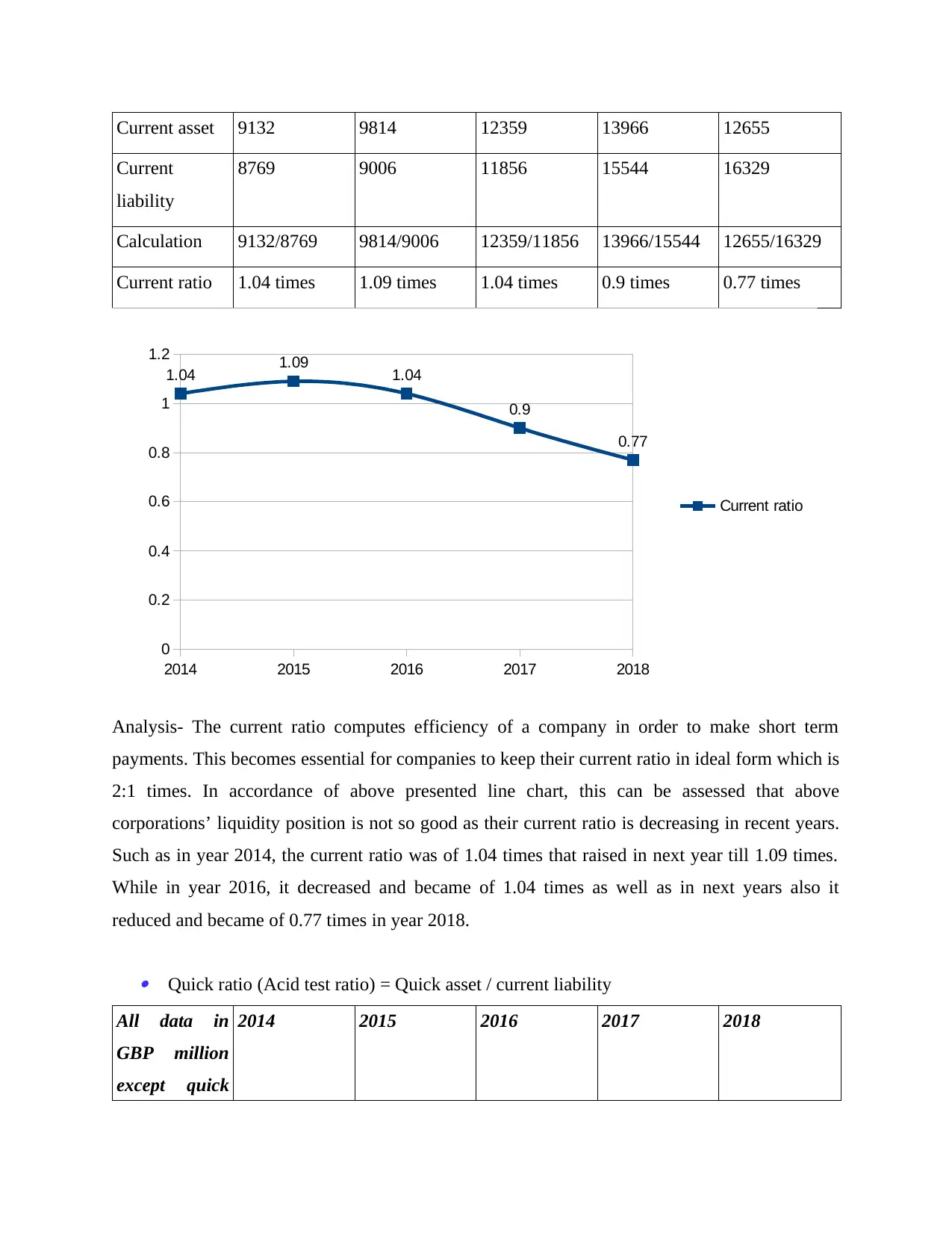

Quick assets 4999 5567 6566 8102 6626

Current

liabilities

8769 9006 11856 15544 16329

Calculation 4999/8769 5567/9006 6566/11856 8102/15544 6626/16329

Quick ratio 0.57 times 0.62 times 0.55 times 0.52 times 0.41 times

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.57

0.62

0.55 0.52

0.41

quick ratio

Analysis- The quick ratio is a sort of ratio which is computed by corporations to analyse value of

quick assets to make payment of current liability. Ideal quick ratio is 1.5:1 times (Erdogan,

2013). The above presented line chart presents quick ratio of above company that is not in ideal

form. In starting year 2014, this was of 0.57 time which raised in year 2015 and became of 0.62

time. Except this year, in rest of years their quick ratio decreased in a significant manner in all

next three years. In year 2018, the ratio was of 0.41 time that was 0.11 times lower in compare to

year 2017.

2. Profitability- It is common goal of all business entities to gain higher profit so that invested

cost can be covered. To evaluate profitability condition of corporations, there are rangeof ratios

Quick assets 4999 5567 6566 8102 6626

Current

liabilities

8769 9006 11856 15544 16329

Calculation 4999/8769 5567/9006 6566/11856 8102/15544 6626/16329

Quick ratio 0.57 times 0.62 times 0.55 times 0.52 times 0.41 times

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.57

0.62

0.55 0.52

0.41

quick ratio

Analysis- The quick ratio is a sort of ratio which is computed by corporations to analyse value of

quick assets to make payment of current liability. Ideal quick ratio is 1.5:1 times (Erdogan,

2013). The above presented line chart presents quick ratio of above company that is not in ideal

form. In starting year 2014, this was of 0.57 time which raised in year 2015 and became of 0.62

time. Except this year, in rest of years their quick ratio decreased in a significant manner in all

next three years. In year 2018, the ratio was of 0.41 time that was 0.11 times lower in compare to

year 2017.

2. Profitability- It is common goal of all business entities to gain higher profit so that invested

cost can be covered. To evaluate profitability condition of corporations, there are rangeof ratios

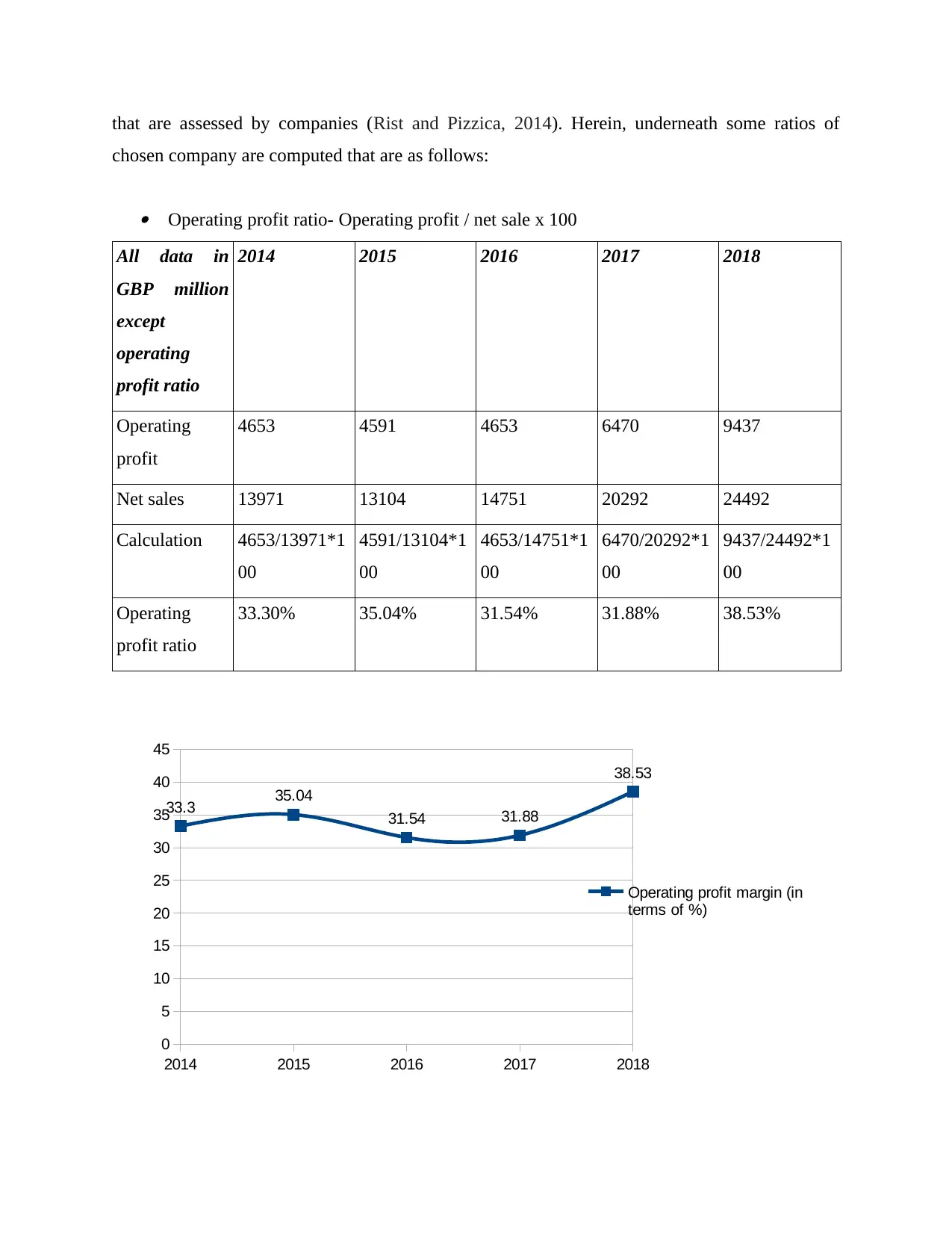

that are assessed by companies (Rist and Pizzica, 2014). Herein, underneath some ratios of

chosen company are computed that are as follows:

Operating profit ratio- Operating profit / net sale x 100

All data in

GBP million

except

operating

profit ratio

2014 2015 2016 2017 2018

Operating

profit

4653 4591 4653 6470 9437

Net sales 13971 13104 14751 20292 24492

Calculation 4653/13971*1

00

4591/13104*1

00

4653/14751*1

00

6470/20292*1

00

9437/24492*1

00

Operating

profit ratio

33.30% 35.04% 31.54% 31.88% 38.53%

2014 2015 2016 2017 2018

0

5

10

15

20

25

30

35

40

45

33.3 35.04

31.54 31.88

38.53

Operating profit margin (in

terms of %)

chosen company are computed that are as follows:

Operating profit ratio- Operating profit / net sale x 100

All data in

GBP million

except

operating

profit ratio

2014 2015 2016 2017 2018

Operating

profit

4653 4591 4653 6470 9437

Net sales 13971 13104 14751 20292 24492

Calculation 4653/13971*1

00

4591/13104*1

00

4653/14751*1

00

6470/20292*1

00

9437/24492*1

00

Operating

profit ratio

33.30% 35.04% 31.54% 31.88% 38.53%

2014 2015 2016 2017 2018

0

5

10

15

20

25

30

35

40

45

33.3 35.04

31.54 31.88

38.53

Operating profit margin (in

terms of %)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis- This ratio is computed by corporations to find out ability of generating revenue over

operating expenses (Erdogan and Ömürbek, 2015). The presented line chart indicates operating

margin of British American Tobacco plc for five years. Their operating margin is fluctuating in

all years. Like in year 2014, it was of 33.3% that increased in further period and became of

35.04%. While in next year it decreased till 31.54% and in last year 2018, it was of 38.53%.

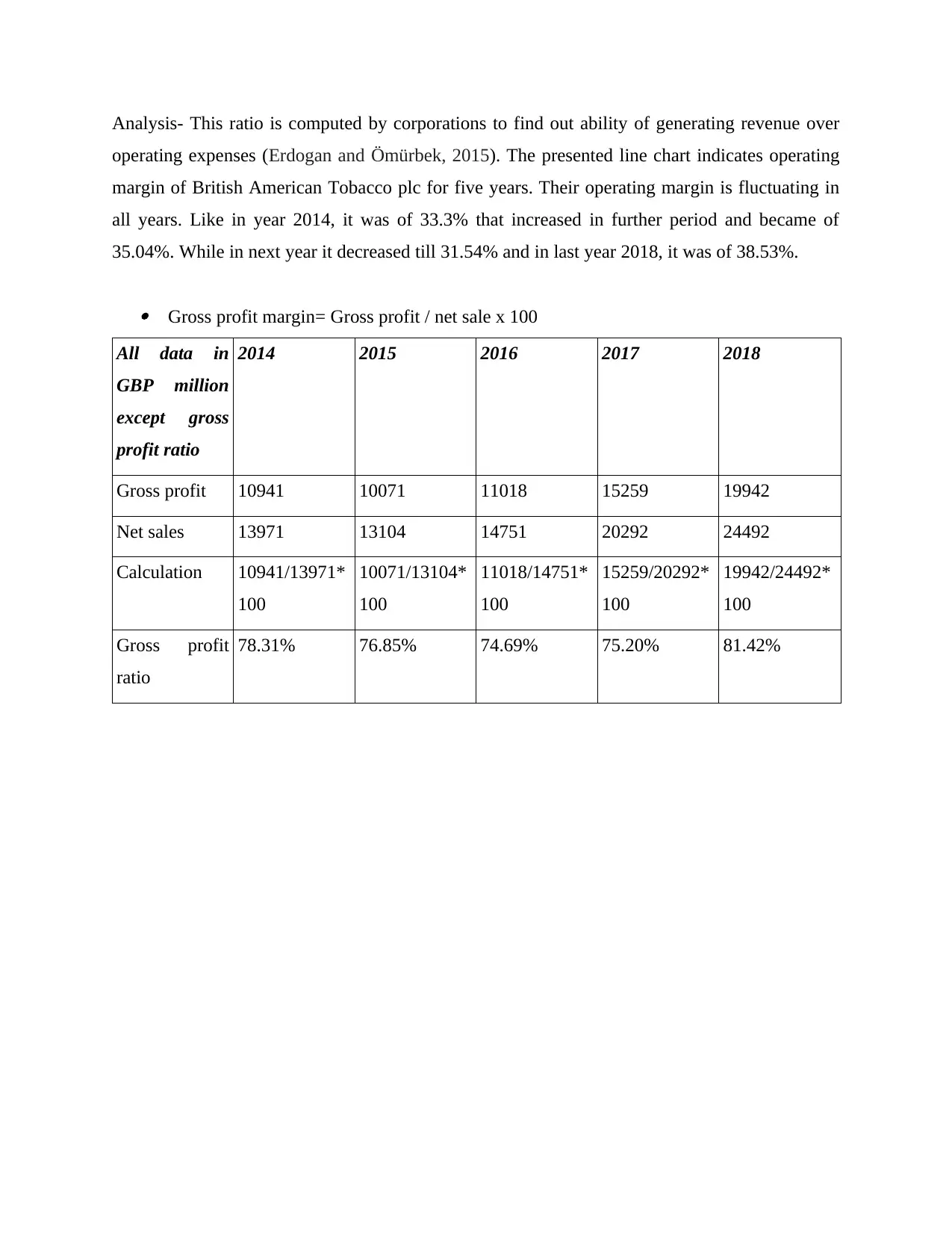

Gross profit margin= Gross profit / net sale x 100

All data in

GBP million

except gross

profit ratio

2014 2015 2016 2017 2018

Gross profit 10941 10071 11018 15259 19942

Net sales 13971 13104 14751 20292 24492

Calculation 10941/13971*

100

10071/13104*

100

11018/14751*

100

15259/20292*

100

19942/24492*

100

Gross profit

ratio

78.31% 76.85% 74.69% 75.20% 81.42%

operating expenses (Erdogan and Ömürbek, 2015). The presented line chart indicates operating

margin of British American Tobacco plc for five years. Their operating margin is fluctuating in

all years. Like in year 2014, it was of 33.3% that increased in further period and became of

35.04%. While in next year it decreased till 31.54% and in last year 2018, it was of 38.53%.

Gross profit margin= Gross profit / net sale x 100

All data in

GBP million

except gross

profit ratio

2014 2015 2016 2017 2018

Gross profit 10941 10071 11018 15259 19942

Net sales 13971 13104 14751 20292 24492

Calculation 10941/13971*

100

10071/13104*

100

11018/14751*

100

15259/20292*

100

19942/24492*

100

Gross profit

ratio

78.31% 76.85% 74.69% 75.20% 81.42%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2014 2015 2016 2017 2018

70

72

74

76

78

80

82

78.31

76.85

74.69 75.2

81.42

Gross profit margin (in terms of

%)

Analysis- The gross profit ratio indicates capacity of a corporation to generate revenue after

making payment of expenditures regards to sales. Above presented line chart shows that

company's gross profit margin is good in all years. Though, in some years it is decreasing like in

year 2015 and 2016 it reduced. Except from this, the gross profit margin was higher such as in

year 2014, it was of 78.31% and in year 2018, this was of 81.42%.

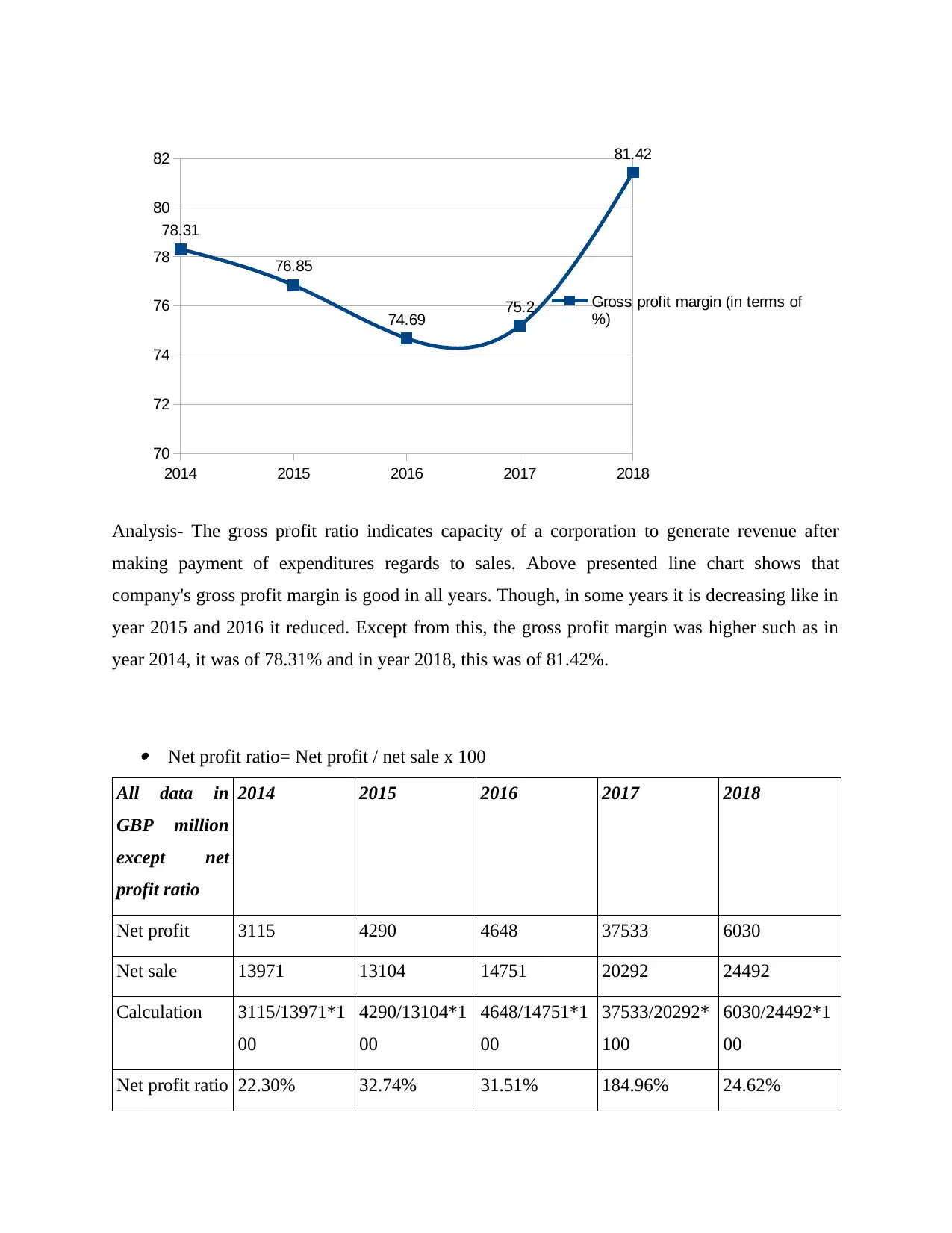

Net profit ratio= Net profit / net sale x 100

All data in

GBP million

except net

profit ratio

2014 2015 2016 2017 2018

Net profit 3115 4290 4648 37533 6030

Net sale 13971 13104 14751 20292 24492

Calculation 3115/13971*1

00

4290/13104*1

00

4648/14751*1

00

37533/20292*

100

6030/24492*1

00

Net profit ratio 22.30% 32.74% 31.51% 184.96% 24.62%

70

72

74

76

78

80

82

78.31

76.85

74.69 75.2

81.42

Gross profit margin (in terms of

%)

Analysis- The gross profit ratio indicates capacity of a corporation to generate revenue after

making payment of expenditures regards to sales. Above presented line chart shows that

company's gross profit margin is good in all years. Though, in some years it is decreasing like in

year 2015 and 2016 it reduced. Except from this, the gross profit margin was higher such as in

year 2014, it was of 78.31% and in year 2018, this was of 81.42%.

Net profit ratio= Net profit / net sale x 100

All data in

GBP million

except net

profit ratio

2014 2015 2016 2017 2018

Net profit 3115 4290 4648 37533 6030

Net sale 13971 13104 14751 20292 24492

Calculation 3115/13971*1

00

4290/13104*1

00

4648/14751*1

00

37533/20292*

100

6030/24492*1

00

Net profit ratio 22.30% 32.74% 31.51% 184.96% 24.62%

2014 2015 2016 2017 2018

0

20

40

60

80

100

120

140

160

180

200

22.3 32.74 31.51

184.96

24.62

Net profit (in terms of %)

Analysis- The net profit margin shows actual level of profitability after making payment of all

expenditures. The above presented line chart shows that company's performance is not so

effective because in year 2017, their net profit margin was more than expectation. While in rest

of years, their ratio was lower. In year 2015, the ratio was of 32.74% that reduced in year 2016

and became of 31.51%. As well as in year 2018, it decreased by huge margin as compare to last

year.

3. Efficiency- The efficiency of companies being measured in terms of different aspects such as

efficiency of making payment, receiving debt amount, managing inventories etc. (Michael and

Pizzica Albert, 2015). For this purpose, there are various types of ratios which are calculated

below in terms of above British American Tobacco plc: A/R turnover ratio= Revenue/ average A/R

All data in

GBP million

except A/R

turnover ratio

2014 2015 2016 2017 2018

Revenue 13971 13104 14751 20292 24492

0

20

40

60

80

100

120

140

160

180

200

22.3 32.74 31.51

184.96

24.62

Net profit (in terms of %)

Analysis- The net profit margin shows actual level of profitability after making payment of all

expenditures. The above presented line chart shows that company's performance is not so

effective because in year 2017, their net profit margin was more than expectation. While in rest

of years, their ratio was lower. In year 2015, the ratio was of 32.74% that reduced in year 2016

and became of 31.51%. As well as in year 2018, it decreased by huge margin as compare to last

year.

3. Efficiency- The efficiency of companies being measured in terms of different aspects such as

efficiency of making payment, receiving debt amount, managing inventories etc. (Michael and

Pizzica Albert, 2015). For this purpose, there are various types of ratios which are calculated

below in terms of above British American Tobacco plc: A/R turnover ratio= Revenue/ average A/R

All data in

GBP million

except A/R

turnover ratio

2014 2015 2016 2017 2018

Revenue 13971 13104 14751 20292 24492

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

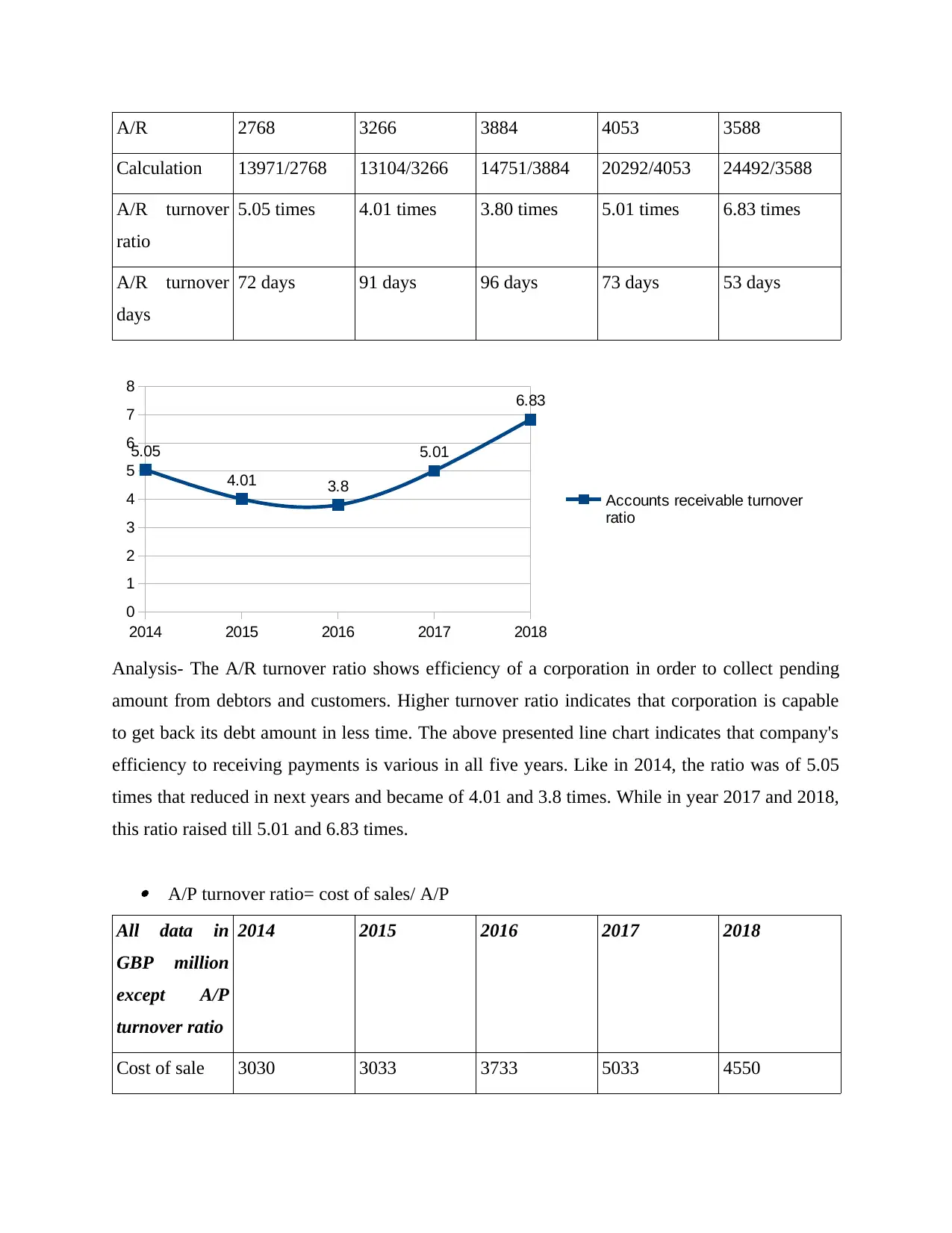

A/R 2768 3266 3884 4053 3588

Calculation 13971/2768 13104/3266 14751/3884 20292/4053 24492/3588

A/R turnover

ratio

5.05 times 4.01 times 3.80 times 5.01 times 6.83 times

A/R turnover

days

72 days 91 days 96 days 73 days 53 days

2014 2015 2016 2017 2018

0

1

2

3

4

5

6

7

8

5.05

4.01 3.8

5.01

6.83

Accounts receivable turnover

ratio

Analysis- The A/R turnover ratio shows efficiency of a corporation in order to collect pending

amount from debtors and customers. Higher turnover ratio indicates that corporation is capable

to get back its debt amount in less time. The above presented line chart indicates that company's

efficiency to receiving payments is various in all five years. Like in 2014, the ratio was of 5.05

times that reduced in next years and became of 4.01 and 3.8 times. While in year 2017 and 2018,

this ratio raised till 5.01 and 6.83 times.

A/P turnover ratio= cost of sales/ A/P

All data in

GBP million

except A/P

turnover ratio

2014 2015 2016 2017 2018

Cost of sale 3030 3033 3733 5033 4550

Calculation 13971/2768 13104/3266 14751/3884 20292/4053 24492/3588

A/R turnover

ratio

5.05 times 4.01 times 3.80 times 5.01 times 6.83 times

A/R turnover

days

72 days 91 days 96 days 73 days 53 days

2014 2015 2016 2017 2018

0

1

2

3

4

5

6

7

8

5.05

4.01 3.8

5.01

6.83

Accounts receivable turnover

ratio

Analysis- The A/R turnover ratio shows efficiency of a corporation in order to collect pending

amount from debtors and customers. Higher turnover ratio indicates that corporation is capable

to get back its debt amount in less time. The above presented line chart indicates that company's

efficiency to receiving payments is various in all five years. Like in 2014, the ratio was of 5.05

times that reduced in next years and became of 4.01 and 3.8 times. While in year 2017 and 2018,

this ratio raised till 5.01 and 6.83 times.

A/P turnover ratio= cost of sales/ A/P

All data in

GBP million

except A/P

turnover ratio

2014 2015 2016 2017 2018

Cost of sale 3030 3033 3733 5033 4550

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

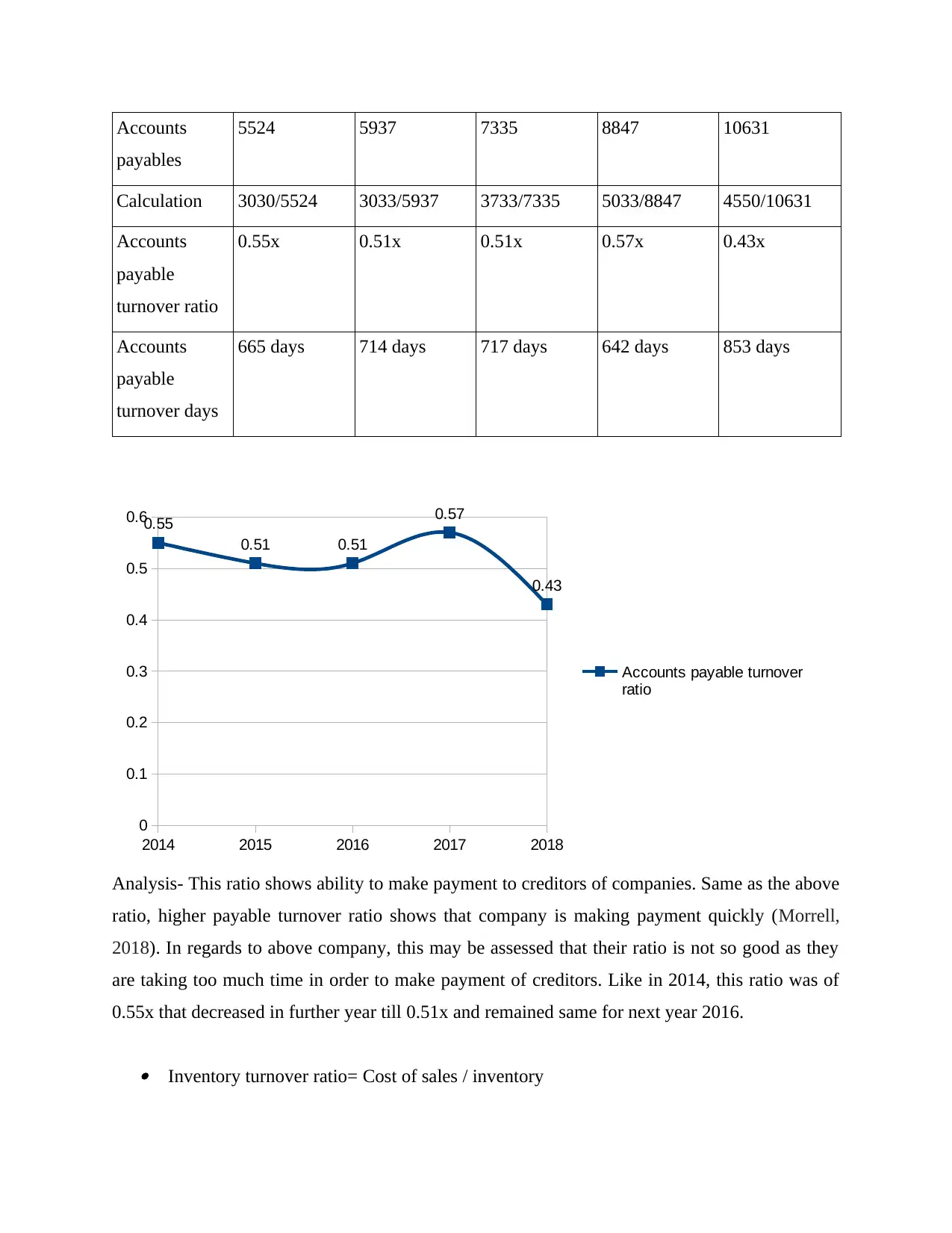

Accounts

payables

5524 5937 7335 8847 10631

Calculation 3030/5524 3033/5937 3733/7335 5033/8847 4550/10631

Accounts

payable

turnover ratio

0.55x 0.51x 0.51x 0.57x 0.43x

Accounts

payable

turnover days

665 days 714 days 717 days 642 days 853 days

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.60.55

0.51 0.51

0.57

0.43

Accounts payable turnover

ratio

Analysis- This ratio shows ability to make payment to creditors of companies. Same as the above

ratio, higher payable turnover ratio shows that company is making payment quickly (Morrell,

2018). In regards to above company, this may be assessed that their ratio is not so good as they

are taking too much time in order to make payment of creditors. Like in 2014, this ratio was of

0.55x that decreased in further year till 0.51x and remained same for next year 2016.

Inventory turnover ratio= Cost of sales / inventory

payables

5524 5937 7335 8847 10631

Calculation 3030/5524 3033/5937 3733/7335 5033/8847 4550/10631

Accounts

payable

turnover ratio

0.55x 0.51x 0.51x 0.57x 0.43x

Accounts

payable

turnover days

665 days 714 days 717 days 642 days 853 days

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.60.55

0.51 0.51

0.57

0.43

Accounts payable turnover

ratio

Analysis- This ratio shows ability to make payment to creditors of companies. Same as the above

ratio, higher payable turnover ratio shows that company is making payment quickly (Morrell,

2018). In regards to above company, this may be assessed that their ratio is not so good as they

are taking too much time in order to make payment of creditors. Like in 2014, this ratio was of

0.55x that decreased in further year till 0.51x and remained same for next year 2016.

Inventory turnover ratio= Cost of sales / inventory

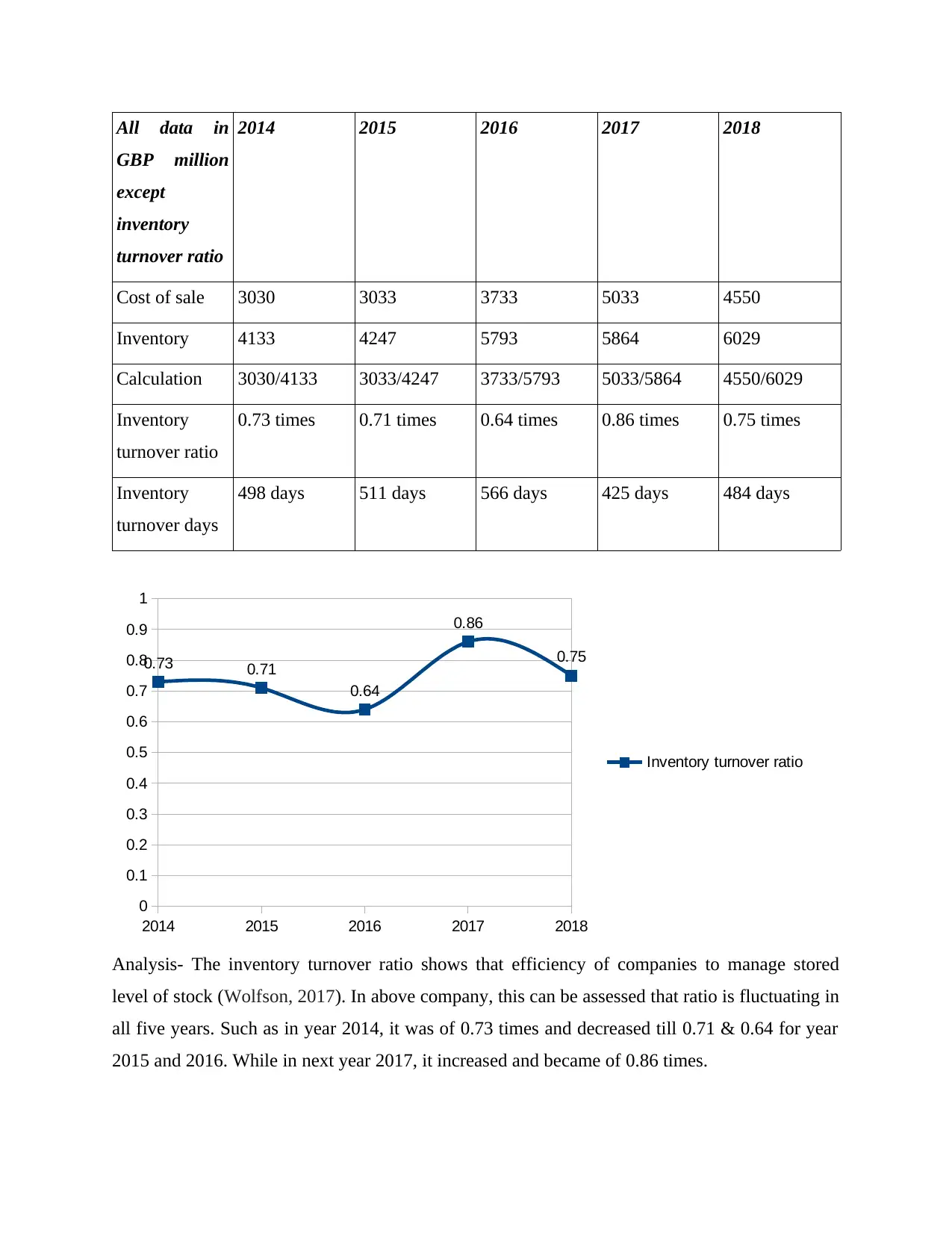

All data in

GBP million

except

inventory

turnover ratio

2014 2015 2016 2017 2018

Cost of sale 3030 3033 3733 5033 4550

Inventory 4133 4247 5793 5864 6029

Calculation 3030/4133 3033/4247 3733/5793 5033/5864 4550/6029

Inventory

turnover ratio

0.73 times 0.71 times 0.64 times 0.86 times 0.75 times

Inventory

turnover days

498 days 511 days 566 days 425 days 484 days

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0.73 0.71

0.64

0.86

0.75

Inventory turnover ratio

Analysis- The inventory turnover ratio shows that efficiency of companies to manage stored

level of stock (Wolfson, 2017). In above company, this can be assessed that ratio is fluctuating in

all five years. Such as in year 2014, it was of 0.73 times and decreased till 0.71 & 0.64 for year

2015 and 2016. While in next year 2017, it increased and became of 0.86 times.

GBP million

except

inventory

turnover ratio

2014 2015 2016 2017 2018

Cost of sale 3030 3033 3733 5033 4550

Inventory 4133 4247 5793 5864 6029

Calculation 3030/4133 3033/4247 3733/5793 5033/5864 4550/6029

Inventory

turnover ratio

0.73 times 0.71 times 0.64 times 0.86 times 0.75 times

Inventory

turnover days

498 days 511 days 566 days 425 days 484 days

2014 2015 2016 2017 2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0.73 0.71

0.64

0.86

0.75

Inventory turnover ratio

Analysis- The inventory turnover ratio shows that efficiency of companies to manage stored

level of stock (Wolfson, 2017). In above company, this can be assessed that ratio is fluctuating in

all five years. Such as in year 2014, it was of 0.73 times and decreased till 0.71 & 0.64 for year

2015 and 2016. While in next year 2017, it increased and became of 0.86 times.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.