PGBM01 Financial Management and Control Assignment Solution

VerifiedAdded on 2023/01/19

|19

|4719

|62

Homework Assignment

AI Summary

This document presents a comprehensive solution to a Financial Management and Control assignment, addressing various aspects of financial analysis. Part A of the solution focuses on ratio analysis, including profitability, liquidity, gearing, asset utilization, and investor potential ratios, comparing data from 2016 and 2017 for Bitmap plc. It also includes a calculation and analysis of working capital and the working capital cycle. Part B delves into investment appraisal techniques, evaluating two machines (A and B) using payback period, discounted payback period, accounting rate of return, net present value (NPV), and internal rate of return (IRR) methods. The solution provides detailed calculations and recommendations based on each method, along with a discussion of the advantages and disadvantages of the payback period method. The assignment demonstrates a strong understanding of financial statement analysis and investment decision-making.

FINANCIAL MANAGEMENT AND CONTROL

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART A

Answer 1.

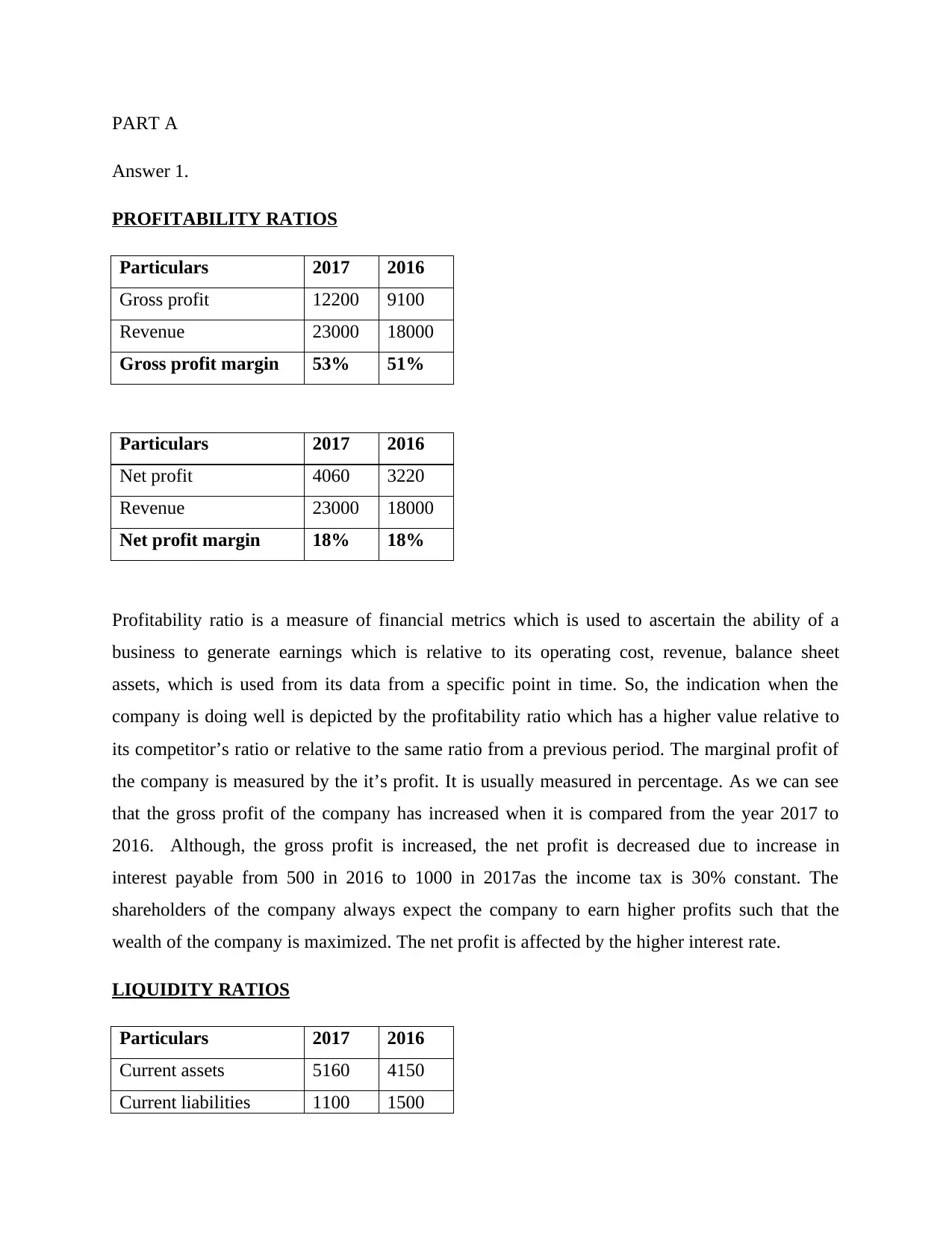

PROFITABILITY RATIOS

Particulars 2017 2016

Gross profit 12200 9100

Revenue 23000 18000

Gross profit margin 53% 51%

Particulars 2017 2016

Net profit 4060 3220

Revenue 23000 18000

Net profit margin 18% 18%

Profitability ratio is a measure of financial metrics which is used to ascertain the ability of a

business to generate earnings which is relative to its operating cost, revenue, balance sheet

assets, which is used from its data from a specific point in time. So, the indication when the

company is doing well is depicted by the profitability ratio which has a higher value relative to

its competitor’s ratio or relative to the same ratio from a previous period. The marginal profit of

the company is measured by the it’s profit. It is usually measured in percentage. As we can see

that the gross profit of the company has increased when it is compared from the year 2017 to

2016. Although, the gross profit is increased, the net profit is decreased due to increase in

interest payable from 500 in 2016 to 1000 in 2017as the income tax is 30% constant. The

shareholders of the company always expect the company to earn higher profits such that the

wealth of the company is maximized. The net profit is affected by the higher interest rate.

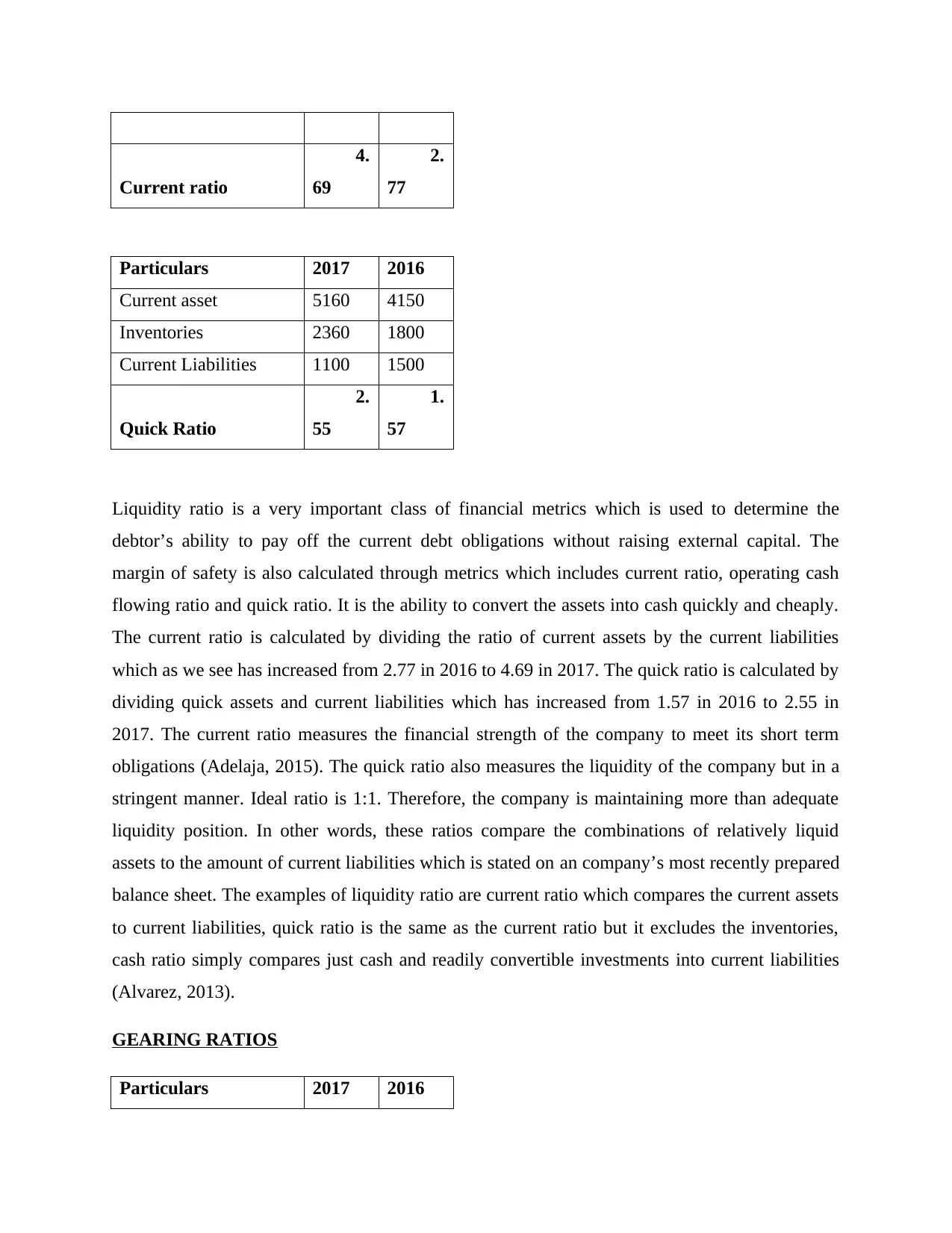

LIQUIDITY RATIOS

Particulars 2017 2016

Current assets 5160 4150

Current liabilities 1100 1500

Answer 1.

PROFITABILITY RATIOS

Particulars 2017 2016

Gross profit 12200 9100

Revenue 23000 18000

Gross profit margin 53% 51%

Particulars 2017 2016

Net profit 4060 3220

Revenue 23000 18000

Net profit margin 18% 18%

Profitability ratio is a measure of financial metrics which is used to ascertain the ability of a

business to generate earnings which is relative to its operating cost, revenue, balance sheet

assets, which is used from its data from a specific point in time. So, the indication when the

company is doing well is depicted by the profitability ratio which has a higher value relative to

its competitor’s ratio or relative to the same ratio from a previous period. The marginal profit of

the company is measured by the it’s profit. It is usually measured in percentage. As we can see

that the gross profit of the company has increased when it is compared from the year 2017 to

2016. Although, the gross profit is increased, the net profit is decreased due to increase in

interest payable from 500 in 2016 to 1000 in 2017as the income tax is 30% constant. The

shareholders of the company always expect the company to earn higher profits such that the

wealth of the company is maximized. The net profit is affected by the higher interest rate.

LIQUIDITY RATIOS

Particulars 2017 2016

Current assets 5160 4150

Current liabilities 1100 1500

Current ratio

4.

69

2.

77

Particulars 2017 2016

Current asset 5160 4150

Inventories 2360 1800

Current Liabilities 1100 1500

Quick Ratio

2.

55

1.

57

Liquidity ratio is a very important class of financial metrics which is used to determine the

debtor’s ability to pay off the current debt obligations without raising external capital. The

margin of safety is also calculated through metrics which includes current ratio, operating cash

flowing ratio and quick ratio. It is the ability to convert the assets into cash quickly and cheaply.

The current ratio is calculated by dividing the ratio of current assets by the current liabilities

which as we see has increased from 2.77 in 2016 to 4.69 in 2017. The quick ratio is calculated by

dividing quick assets and current liabilities which has increased from 1.57 in 2016 to 2.55 in

2017. The current ratio measures the financial strength of the company to meet its short term

obligations (Adelaja, 2015). The quick ratio also measures the liquidity of the company but in a

stringent manner. Ideal ratio is 1:1. Therefore, the company is maintaining more than adequate

liquidity position. In other words, these ratios compare the combinations of relatively liquid

assets to the amount of current liabilities which is stated on an company’s most recently prepared

balance sheet. The examples of liquidity ratio are current ratio which compares the current assets

to current liabilities, quick ratio is the same as the current ratio but it excludes the inventories,

cash ratio simply compares just cash and readily convertible investments into current liabilities

(Alvarez, 2013).

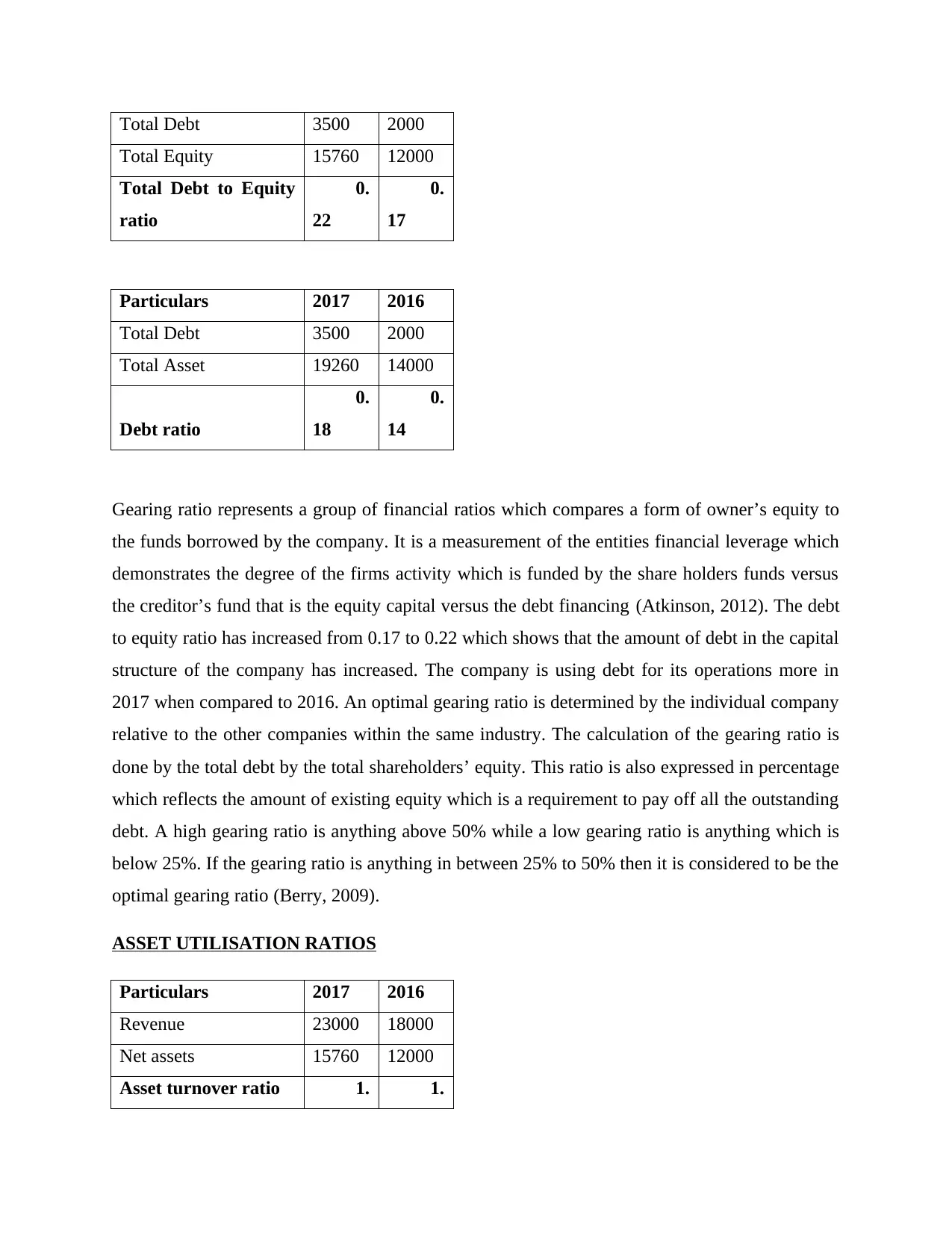

GEARING RATIOS

Particulars 2017 2016

4.

69

2.

77

Particulars 2017 2016

Current asset 5160 4150

Inventories 2360 1800

Current Liabilities 1100 1500

Quick Ratio

2.

55

1.

57

Liquidity ratio is a very important class of financial metrics which is used to determine the

debtor’s ability to pay off the current debt obligations without raising external capital. The

margin of safety is also calculated through metrics which includes current ratio, operating cash

flowing ratio and quick ratio. It is the ability to convert the assets into cash quickly and cheaply.

The current ratio is calculated by dividing the ratio of current assets by the current liabilities

which as we see has increased from 2.77 in 2016 to 4.69 in 2017. The quick ratio is calculated by

dividing quick assets and current liabilities which has increased from 1.57 in 2016 to 2.55 in

2017. The current ratio measures the financial strength of the company to meet its short term

obligations (Adelaja, 2015). The quick ratio also measures the liquidity of the company but in a

stringent manner. Ideal ratio is 1:1. Therefore, the company is maintaining more than adequate

liquidity position. In other words, these ratios compare the combinations of relatively liquid

assets to the amount of current liabilities which is stated on an company’s most recently prepared

balance sheet. The examples of liquidity ratio are current ratio which compares the current assets

to current liabilities, quick ratio is the same as the current ratio but it excludes the inventories,

cash ratio simply compares just cash and readily convertible investments into current liabilities

(Alvarez, 2013).

GEARING RATIOS

Particulars 2017 2016

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total Debt 3500 2000

Total Equity 15760 12000

Total Debt to Equity

ratio

0.

22

0.

17

Particulars 2017 2016

Total Debt 3500 2000

Total Asset 19260 14000

Debt ratio

0.

18

0.

14

Gearing ratio represents a group of financial ratios which compares a form of owner’s equity to

the funds borrowed by the company. It is a measurement of the entities financial leverage which

demonstrates the degree of the firms activity which is funded by the share holders funds versus

the creditor’s fund that is the equity capital versus the debt financing (Atkinson, 2012). The debt

to equity ratio has increased from 0.17 to 0.22 which shows that the amount of debt in the capital

structure of the company has increased. The company is using debt for its operations more in

2017 when compared to 2016. An optimal gearing ratio is determined by the individual company

relative to the other companies within the same industry. The calculation of the gearing ratio is

done by the total debt by the total shareholders’ equity. This ratio is also expressed in percentage

which reflects the amount of existing equity which is a requirement to pay off all the outstanding

debt. A high gearing ratio is anything above 50% while a low gearing ratio is anything which is

below 25%. If the gearing ratio is anything in between 25% to 50% then it is considered to be the

optimal gearing ratio (Berry, 2009).

ASSET UTILISATION RATIOS

Particulars 2017 2016

Revenue 23000 18000

Net assets 15760 12000

Asset turnover ratio 1. 1.

Total Equity 15760 12000

Total Debt to Equity

ratio

0.

22

0.

17

Particulars 2017 2016

Total Debt 3500 2000

Total Asset 19260 14000

Debt ratio

0.

18

0.

14

Gearing ratio represents a group of financial ratios which compares a form of owner’s equity to

the funds borrowed by the company. It is a measurement of the entities financial leverage which

demonstrates the degree of the firms activity which is funded by the share holders funds versus

the creditor’s fund that is the equity capital versus the debt financing (Atkinson, 2012). The debt

to equity ratio has increased from 0.17 to 0.22 which shows that the amount of debt in the capital

structure of the company has increased. The company is using debt for its operations more in

2017 when compared to 2016. An optimal gearing ratio is determined by the individual company

relative to the other companies within the same industry. The calculation of the gearing ratio is

done by the total debt by the total shareholders’ equity. This ratio is also expressed in percentage

which reflects the amount of existing equity which is a requirement to pay off all the outstanding

debt. A high gearing ratio is anything above 50% while a low gearing ratio is anything which is

below 25%. If the gearing ratio is anything in between 25% to 50% then it is considered to be the

optimal gearing ratio (Berry, 2009).

ASSET UTILISATION RATIOS

Particulars 2017 2016

Revenue 23000 18000

Net assets 15760 12000

Asset turnover ratio 1. 1.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

46 50

Asset utilisation ratio helps to determine whether the company is using its assets in the best

possible manner. This ratio is calculated by dividing revenue by net assets. A higher asset

utilisation ratio indicates that the company is able to generate higher revenues given the assets of

the company. As we can see that the asset turnover has fallen in 2017 when compared to 2016.

This shows that the efficiency of the company to manage and use its assets has fallen. In 2016,

the revenue generated by the company was 1.5 times its assets whereas in the year 2017 the

revenue generated was 1.46 times the assets it owns (Bierman & Smidt, 2010).

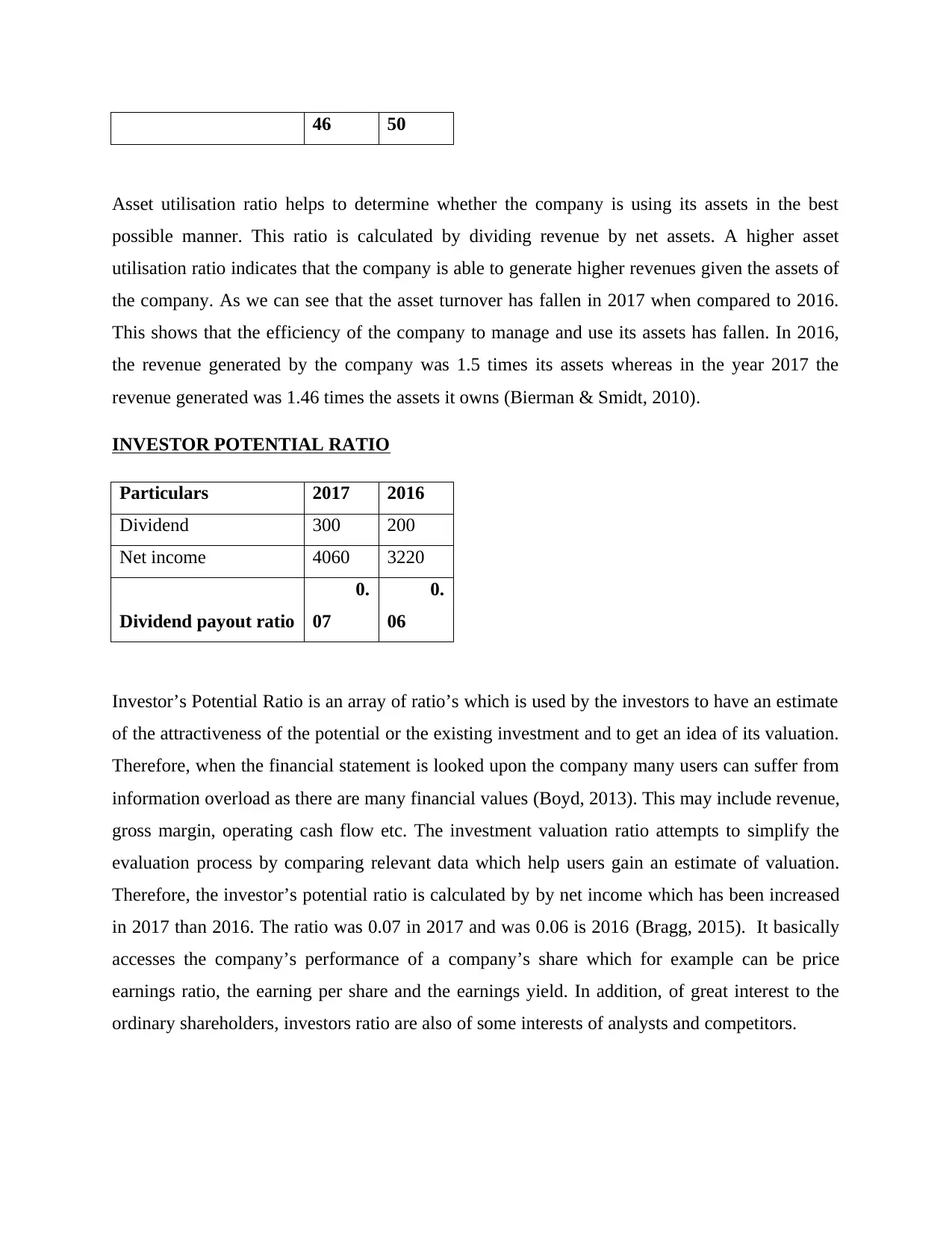

INVESTOR POTENTIAL RATIO

Particulars 2017 2016

Dividend 300 200

Net income 4060 3220

Dividend payout ratio

0.

07

0.

06

Investor’s Potential Ratio is an array of ratio’s which is used by the investors to have an estimate

of the attractiveness of the potential or the existing investment and to get an idea of its valuation.

Therefore, when the financial statement is looked upon the company many users can suffer from

information overload as there are many financial values (Boyd, 2013). This may include revenue,

gross margin, operating cash flow etc. The investment valuation ratio attempts to simplify the

evaluation process by comparing relevant data which help users gain an estimate of valuation.

Therefore, the investor’s potential ratio is calculated by by net income which has been increased

in 2017 than 2016. The ratio was 0.07 in 2017 and was 0.06 is 2016 (Bragg, 2015). It basically

accesses the company’s performance of a company’s share which for example can be price

earnings ratio, the earning per share and the earnings yield. In addition, of great interest to the

ordinary shareholders, investors ratio are also of some interests of analysts and competitors.

Asset utilisation ratio helps to determine whether the company is using its assets in the best

possible manner. This ratio is calculated by dividing revenue by net assets. A higher asset

utilisation ratio indicates that the company is able to generate higher revenues given the assets of

the company. As we can see that the asset turnover has fallen in 2017 when compared to 2016.

This shows that the efficiency of the company to manage and use its assets has fallen. In 2016,

the revenue generated by the company was 1.5 times its assets whereas in the year 2017 the

revenue generated was 1.46 times the assets it owns (Bierman & Smidt, 2010).

INVESTOR POTENTIAL RATIO

Particulars 2017 2016

Dividend 300 200

Net income 4060 3220

Dividend payout ratio

0.

07

0.

06

Investor’s Potential Ratio is an array of ratio’s which is used by the investors to have an estimate

of the attractiveness of the potential or the existing investment and to get an idea of its valuation.

Therefore, when the financial statement is looked upon the company many users can suffer from

information overload as there are many financial values (Boyd, 2013). This may include revenue,

gross margin, operating cash flow etc. The investment valuation ratio attempts to simplify the

evaluation process by comparing relevant data which help users gain an estimate of valuation.

Therefore, the investor’s potential ratio is calculated by by net income which has been increased

in 2017 than 2016. The ratio was 0.07 in 2017 and was 0.06 is 2016 (Bragg, 2015). It basically

accesses the company’s performance of a company’s share which for example can be price

earnings ratio, the earning per share and the earnings yield. In addition, of great interest to the

ordinary shareholders, investors ratio are also of some interests of analysts and competitors.

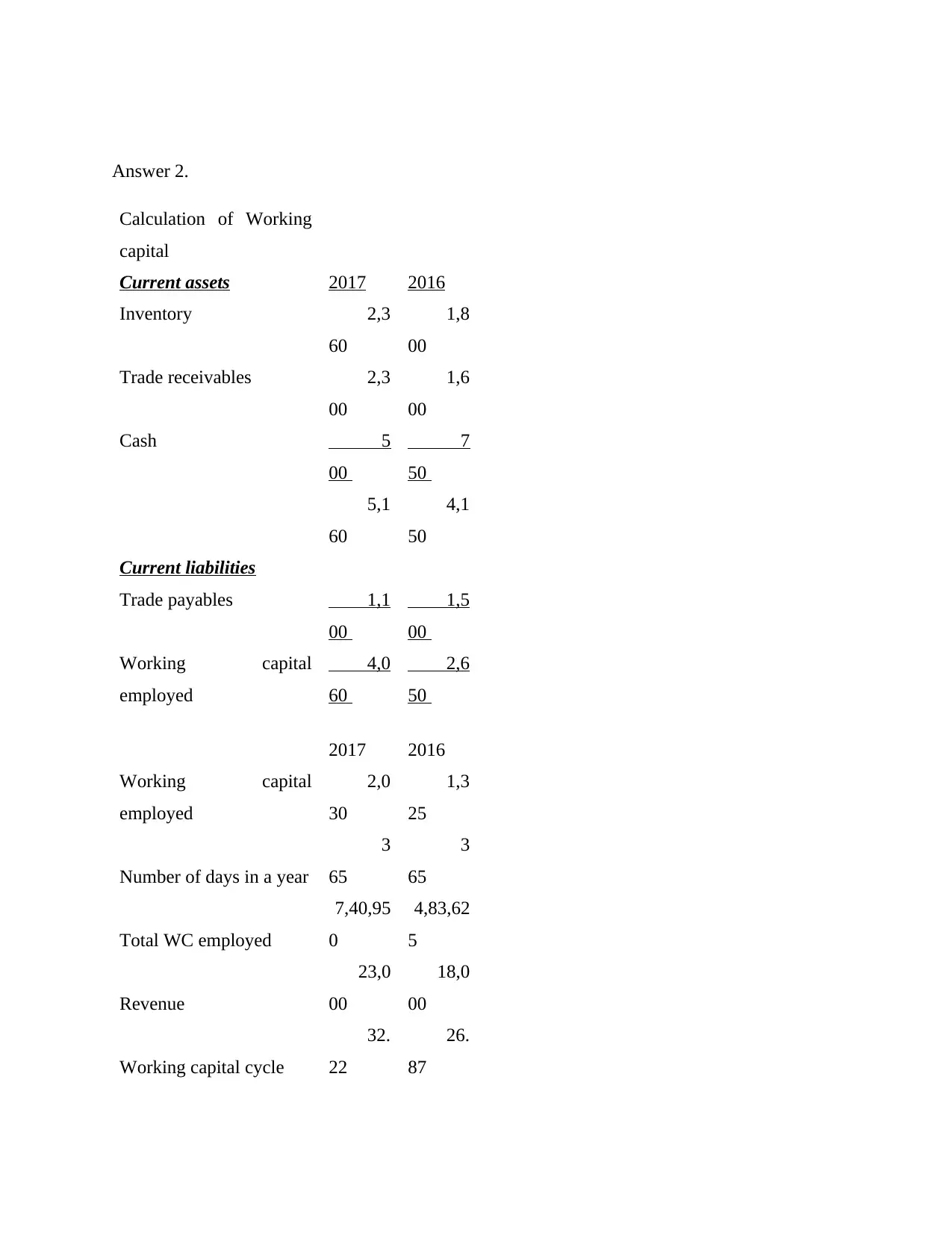

Answer 2.

Calculation of Working

capital

Current assets 2017 2016

Inventory 2,3

60

1,8

00

Trade receivables 2,3

00

1,6

00

Cash 5

00

7

50

5,1

60

4,1

50

Current liabilities

Trade payables 1,1

00

1,5

00

Working capital

employed

4,0

60

2,6

50

2017 2016

Working capital

employed

2,0

30

1,3

25

Number of days in a year

3

65

3

65

Total WC employed

7,40,95

0

4,83,62

5

Revenue

23,0

00

18,0

00

Working capital cycle

32.

22

26.

87

Calculation of Working

capital

Current assets 2017 2016

Inventory 2,3

60

1,8

00

Trade receivables 2,3

00

1,6

00

Cash 5

00

7

50

5,1

60

4,1

50

Current liabilities

Trade payables 1,1

00

1,5

00

Working capital

employed

4,0

60

2,6

50

2017 2016

Working capital

employed

2,0

30

1,3

25

Number of days in a year

3

65

3

65

Total WC employed

7,40,95

0

4,83,62

5

Revenue

23,0

00

18,0

00

Working capital cycle

32.

22

26.

87

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Working capital cycle can be defined as the time period that a company takes to convert its

working capital into cash. The working capital cycle for 2016 was 26.87 days whereas for 2017

is 32.22 days. This shows that the company has become inefficient than before and so it is not

able to convert its working capital into cash as fast as before. The company can reduce its

working capital by collecting the dues from receivables faster and sometimes also stretching the

accounts payable. The working capital cycle is calculated by adding inventory turns and account

receivable in day and then subtracting accounts payable in days. The working capital cycle of the

company can be positive or negative. If it is negative then the company is faster in collecting

payments and slow in paying off bills. However, in the given case the working capital cycle is

positive which means that the company is faster in making payment than in collecting it (Datar,

Cost accounting, 2015). A working capital cycle of 26.87 days indicate that the company makes

payment 5 days before it receives from the customers. The working capital cycle has increased

from 2016 to 2017 which shows that the company is inefficient in collecting its money from

customers (Datar, Horngren's Cost Accounting: A Managerial Emphasis, 2016).

working capital into cash. The working capital cycle for 2016 was 26.87 days whereas for 2017

is 32.22 days. This shows that the company has become inefficient than before and so it is not

able to convert its working capital into cash as fast as before. The company can reduce its

working capital by collecting the dues from receivables faster and sometimes also stretching the

accounts payable. The working capital cycle is calculated by adding inventory turns and account

receivable in day and then subtracting accounts payable in days. The working capital cycle of the

company can be positive or negative. If it is negative then the company is faster in collecting

payments and slow in paying off bills. However, in the given case the working capital cycle is

positive which means that the company is faster in making payment than in collecting it (Datar,

Cost accounting, 2015). A working capital cycle of 26.87 days indicate that the company makes

payment 5 days before it receives from the customers. The working capital cycle has increased

from 2016 to 2017 which shows that the company is inefficient in collecting its money from

customers (Datar, Horngren's Cost Accounting: A Managerial Emphasis, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

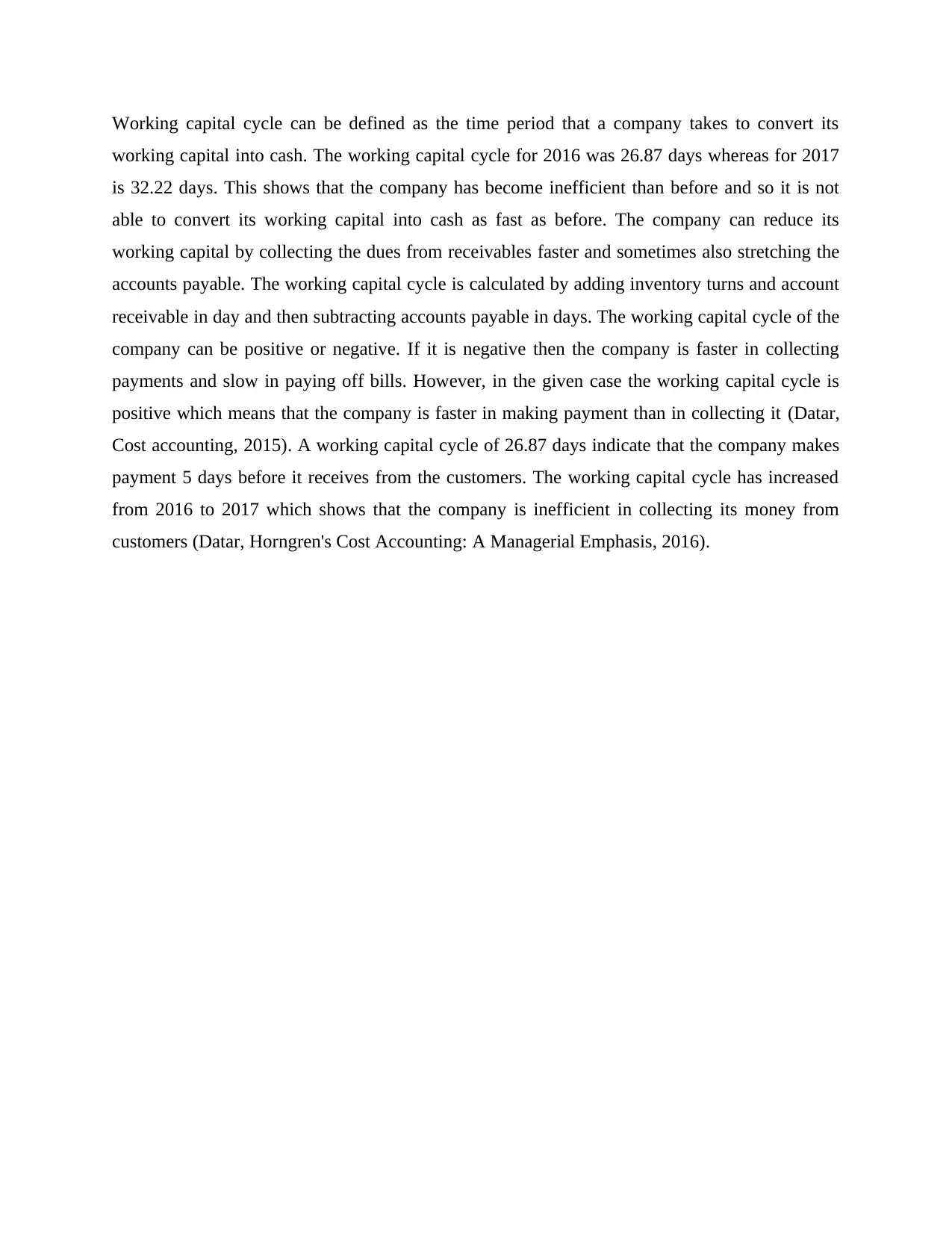

Part B

Answer 1.

a) The payback period

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Cumulative cash

flow

-

5,00,000

-

2,00,00

0

50,0

00

2,50,0

00

4,00,0

00

4,50,0

00

4,70,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Cumulative cash

flow

-

5,00,000

-

4,80,00

0

-

4,30,000

-

2,80,000

-

80,000

1,70,0

00

4,70,0

00

Pay-back period

Machine A

1

.80

Machine B

4

.32

Recommendation: Using the payback period technique, the company must invest in machine A

because of its shorter payback period.

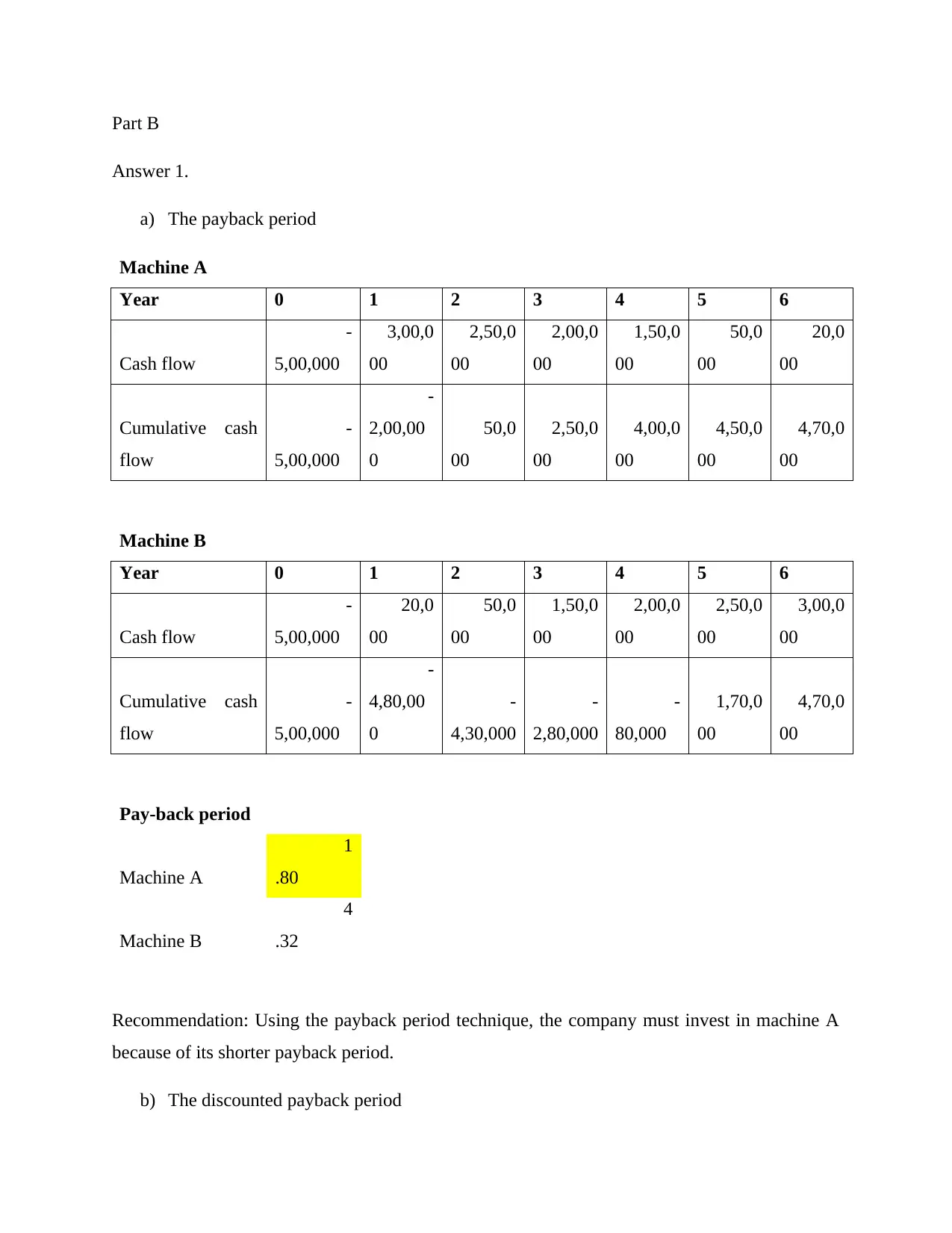

b) The discounted payback period

Answer 1.

a) The payback period

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Cumulative cash

flow

-

5,00,000

-

2,00,00

0

50,0

00

2,50,0

00

4,00,0

00

4,50,0

00

4,70,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Cumulative cash

flow

-

5,00,000

-

4,80,00

0

-

4,30,000

-

2,80,000

-

80,000

1,70,0

00

4,70,0

00

Pay-back period

Machine A

1

.80

Machine B

4

.32

Recommendation: Using the payback period technique, the company must invest in machine A

because of its shorter payback period.

b) The discounted payback period

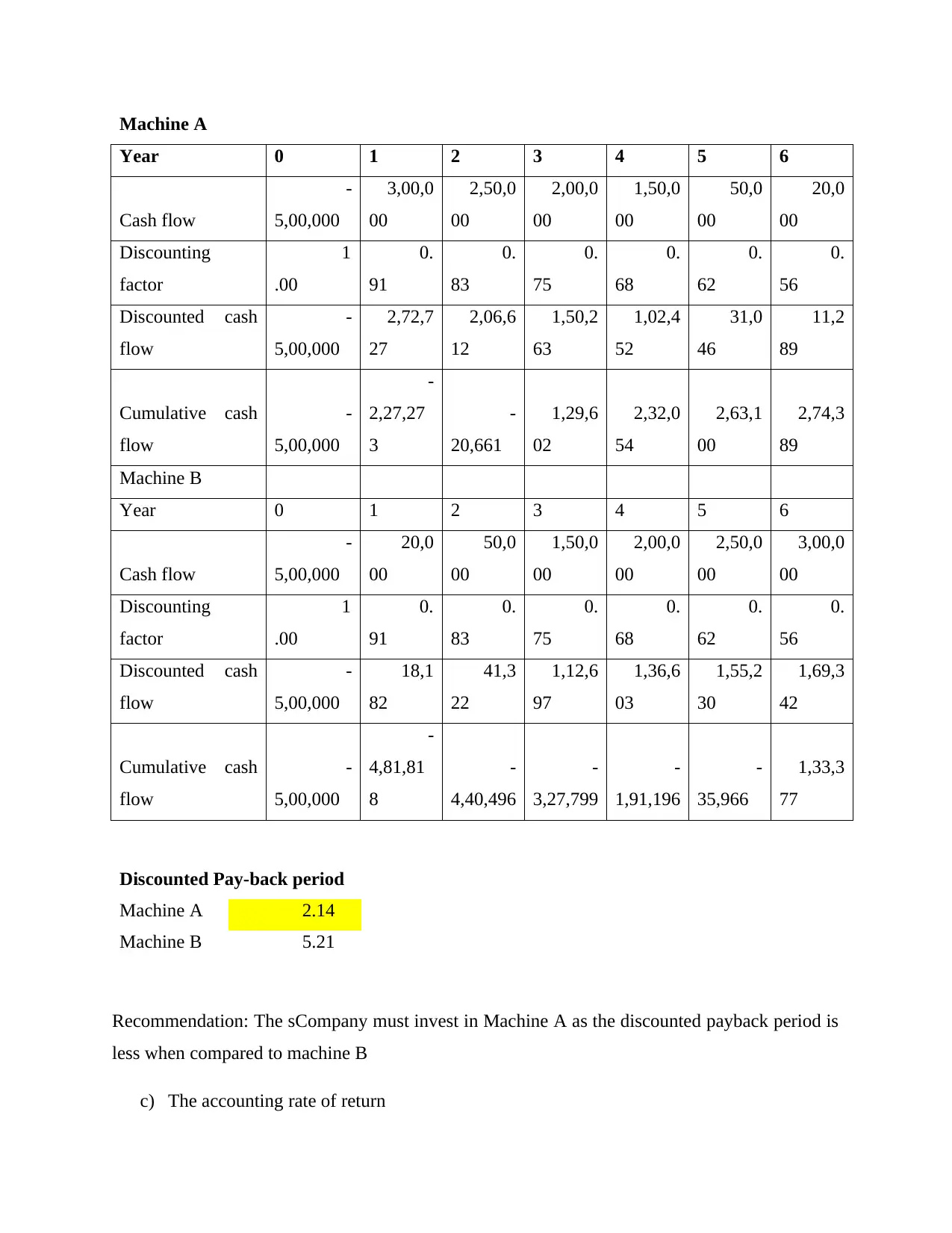

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Discounting

factor

1

.00

0.

91

0.

83

0.

75

0.

68

0.

62

0.

56

Discounted cash

flow

-

5,00,000

2,72,7

27

2,06,6

12

1,50,2

63

1,02,4

52

31,0

46

11,2

89

Cumulative cash

flow

-

5,00,000

-

2,27,27

3

-

20,661

1,29,6

02

2,32,0

54

2,63,1

00

2,74,3

89

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Discounting

factor

1

.00

0.

91

0.

83

0.

75

0.

68

0.

62

0.

56

Discounted cash

flow

-

5,00,000

18,1

82

41,3

22

1,12,6

97

1,36,6

03

1,55,2

30

1,69,3

42

Cumulative cash

flow

-

5,00,000

-

4,81,81

8

-

4,40,496

-

3,27,799

-

1,91,196

-

35,966

1,33,3

77

Discounted Pay-back period

Machine A 2.14

Machine B 5.21

Recommendation: The sCompany must invest in Machine A as the discounted payback period is

less when compared to machine B

c) The accounting rate of return

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Discounting

factor

1

.00

0.

91

0.

83

0.

75

0.

68

0.

62

0.

56

Discounted cash

flow

-

5,00,000

2,72,7

27

2,06,6

12

1,50,2

63

1,02,4

52

31,0

46

11,2

89

Cumulative cash

flow

-

5,00,000

-

2,27,27

3

-

20,661

1,29,6

02

2,32,0

54

2,63,1

00

2,74,3

89

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Discounting

factor

1

.00

0.

91

0.

83

0.

75

0.

68

0.

62

0.

56

Discounted cash

flow

-

5,00,000

18,1

82

41,3

22

1,12,6

97

1,36,6

03

1,55,2

30

1,69,3

42

Cumulative cash

flow

-

5,00,000

-

4,81,81

8

-

4,40,496

-

3,27,799

-

1,91,196

-

35,966

1,33,3

77

Discounted Pay-back period

Machine A 2.14

Machine B 5.21

Recommendation: The sCompany must invest in Machine A as the discounted payback period is

less when compared to machine B

c) The accounting rate of return

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

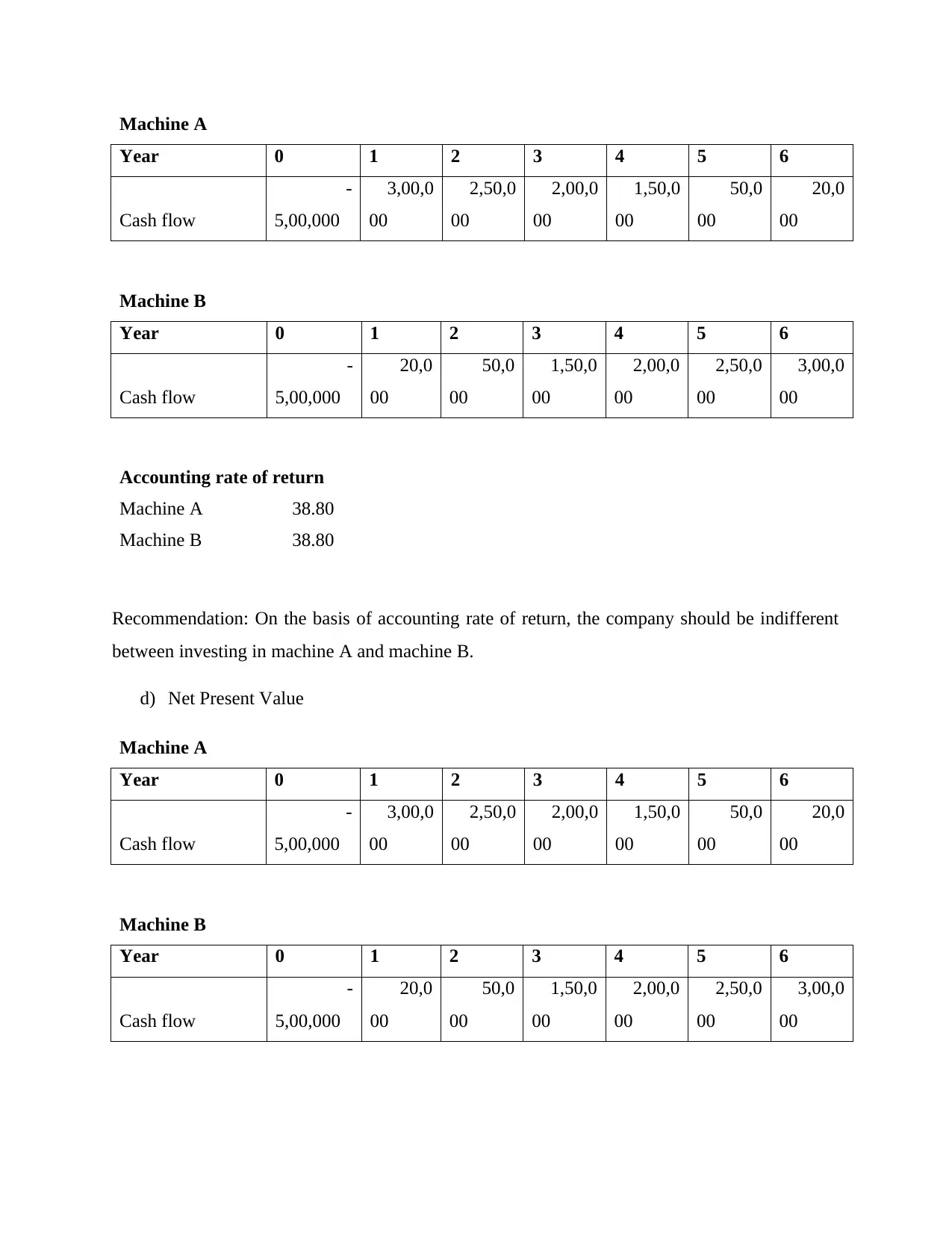

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Accounting rate of return

Machine A 38.80

Machine B 38.80

Recommendation: On the basis of accounting rate of return, the company should be indifferent

between investing in machine A and machine B.

d) Net Present Value

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Accounting rate of return

Machine A 38.80

Machine B 38.80

Recommendation: On the basis of accounting rate of return, the company should be indifferent

between investing in machine A and machine B.

d) Net Present Value

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

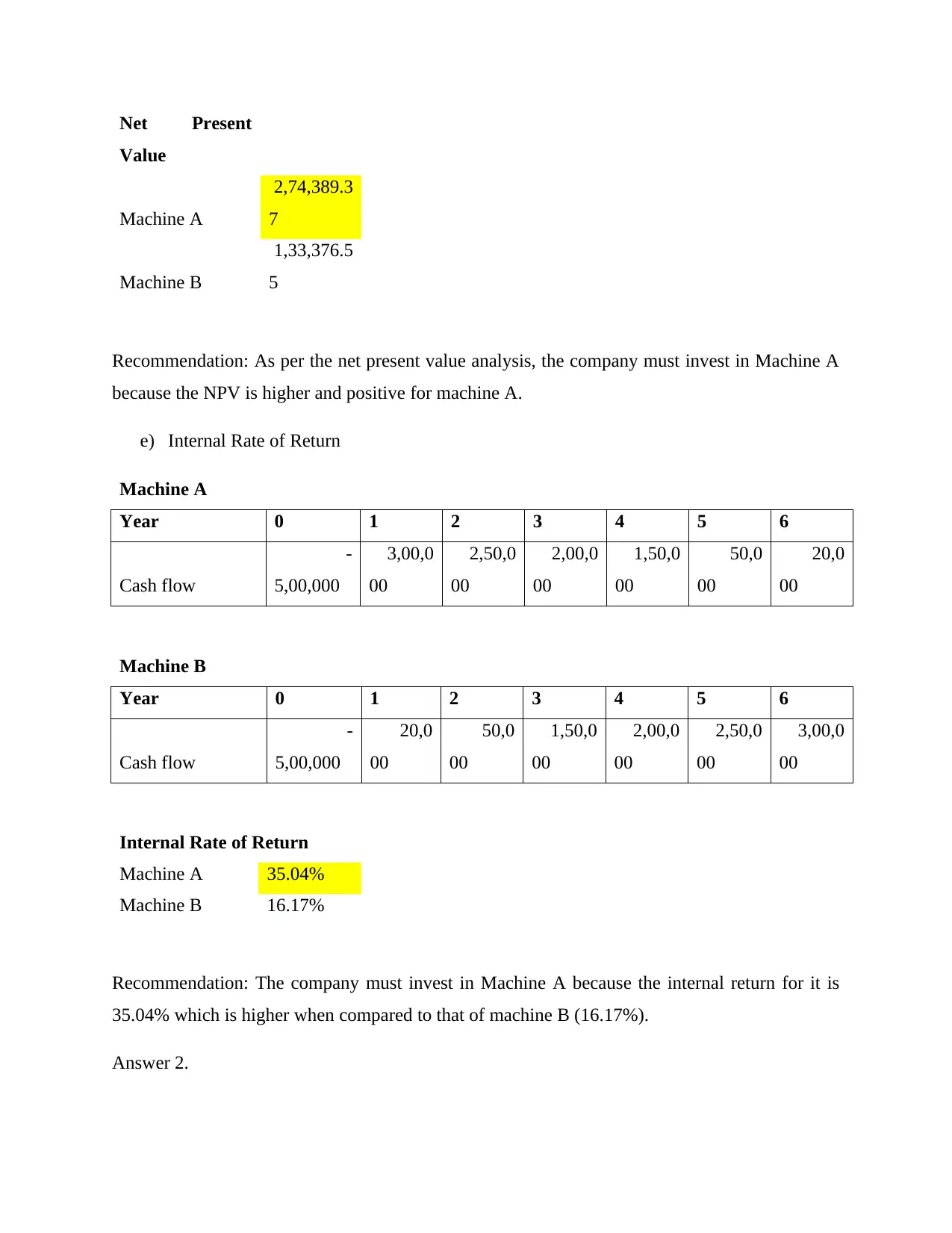

Net Present

Value

Machine A

2,74,389.3

7

Machine B

1,33,376.5

5

Recommendation: As per the net present value analysis, the company must invest in Machine A

because the NPV is higher and positive for machine A.

e) Internal Rate of Return

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Internal Rate of Return

Machine A 35.04%

Machine B 16.17%

Recommendation: The company must invest in Machine A because the internal return for it is

35.04% which is higher when compared to that of machine B (16.17%).

Answer 2.

Value

Machine A

2,74,389.3

7

Machine B

1,33,376.5

5

Recommendation: As per the net present value analysis, the company must invest in Machine A

because the NPV is higher and positive for machine A.

e) Internal Rate of Return

Machine A

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

3,00,0

00

2,50,0

00

2,00,0

00

1,50,0

00

50,0

00

20,0

00

Machine B

Year 0 1 2 3 4 5 6

Cash flow

-

5,00,000

20,0

00

50,0

00

1,50,0

00

2,00,0

00

2,50,0

00

3,00,0

00

Internal Rate of Return

Machine A 35.04%

Machine B 16.17%

Recommendation: The company must invest in Machine A because the internal return for it is

35.04% which is higher when compared to that of machine B (16.17%).

Answer 2.

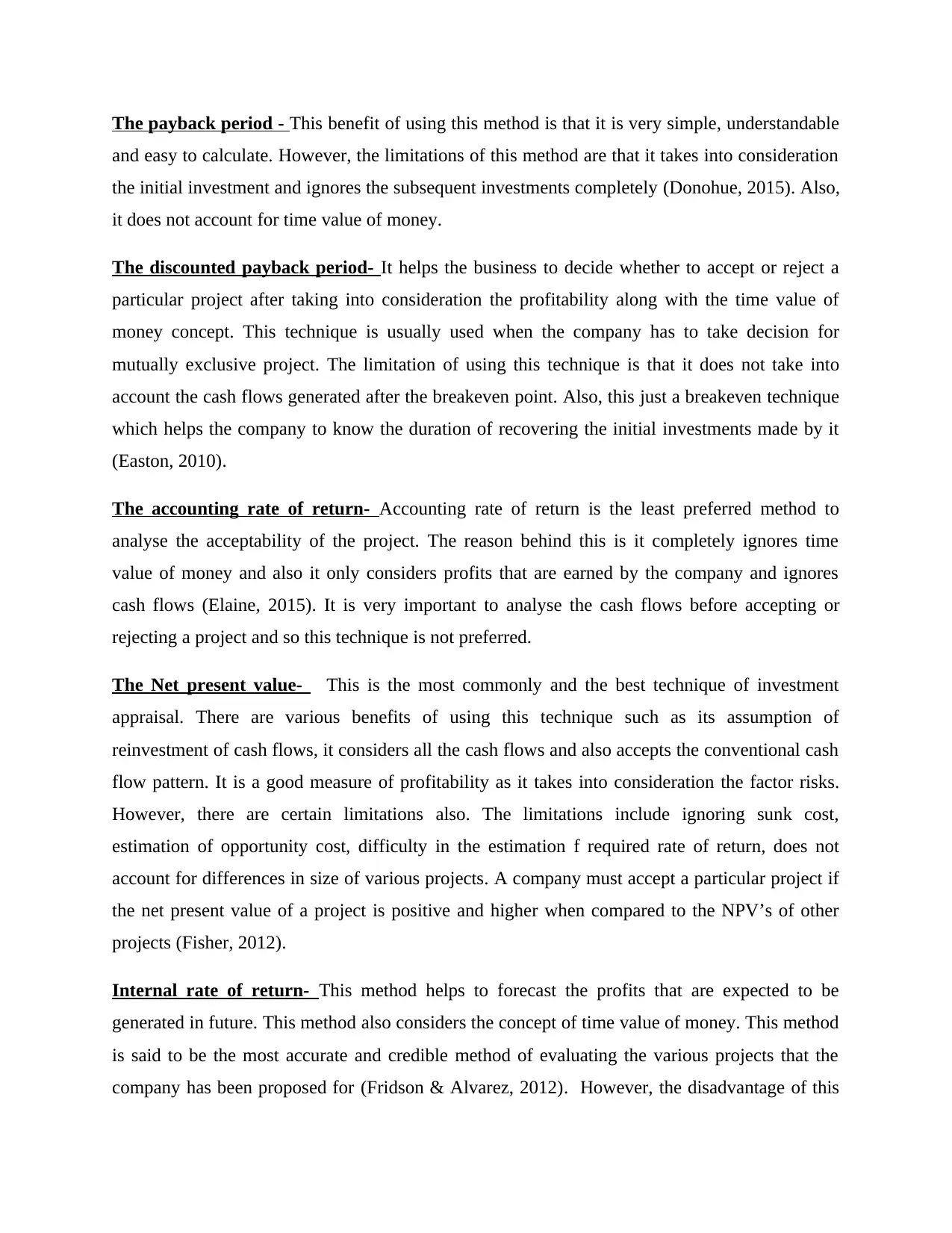

The payback period - This benefit of using this method is that it is very simple, understandable

and easy to calculate. However, the limitations of this method are that it takes into consideration

the initial investment and ignores the subsequent investments completely (Donohue, 2015). Also,

it does not account for time value of money.

The discounted payback period- It helps the business to decide whether to accept or reject a

particular project after taking into consideration the profitability along with the time value of

money concept. This technique is usually used when the company has to take decision for

mutually exclusive project. The limitation of using this technique is that it does not take into

account the cash flows generated after the breakeven point. Also, this just a breakeven technique

which helps the company to know the duration of recovering the initial investments made by it

(Easton, 2010).

The accounting rate of return- Accounting rate of return is the least preferred method to

analyse the acceptability of the project. The reason behind this is it completely ignores time

value of money and also it only considers profits that are earned by the company and ignores

cash flows (Elaine, 2015). It is very important to analyse the cash flows before accepting or

rejecting a project and so this technique is not preferred.

The Net present value- This is the most commonly and the best technique of investment

appraisal. There are various benefits of using this technique such as its assumption of

reinvestment of cash flows, it considers all the cash flows and also accepts the conventional cash

flow pattern. It is a good measure of profitability as it takes into consideration the factor risks.

However, there are certain limitations also. The limitations include ignoring sunk cost,

estimation of opportunity cost, difficulty in the estimation f required rate of return, does not

account for differences in size of various projects. A company must accept a particular project if

the net present value of a project is positive and higher when compared to the NPV’s of other

projects (Fisher, 2012).

Internal rate of return- This method helps to forecast the profits that are expected to be

generated in future. This method also considers the concept of time value of money. This method

is said to be the most accurate and credible method of evaluating the various projects that the

company has been proposed for (Fridson & Alvarez, 2012). However, the disadvantage of this

and easy to calculate. However, the limitations of this method are that it takes into consideration

the initial investment and ignores the subsequent investments completely (Donohue, 2015). Also,

it does not account for time value of money.

The discounted payback period- It helps the business to decide whether to accept or reject a

particular project after taking into consideration the profitability along with the time value of

money concept. This technique is usually used when the company has to take decision for

mutually exclusive project. The limitation of using this technique is that it does not take into

account the cash flows generated after the breakeven point. Also, this just a breakeven technique

which helps the company to know the duration of recovering the initial investments made by it

(Easton, 2010).

The accounting rate of return- Accounting rate of return is the least preferred method to

analyse the acceptability of the project. The reason behind this is it completely ignores time

value of money and also it only considers profits that are earned by the company and ignores

cash flows (Elaine, 2015). It is very important to analyse the cash flows before accepting or

rejecting a project and so this technique is not preferred.

The Net present value- This is the most commonly and the best technique of investment

appraisal. There are various benefits of using this technique such as its assumption of

reinvestment of cash flows, it considers all the cash flows and also accepts the conventional cash

flow pattern. It is a good measure of profitability as it takes into consideration the factor risks.

However, there are certain limitations also. The limitations include ignoring sunk cost,

estimation of opportunity cost, difficulty in the estimation f required rate of return, does not

account for differences in size of various projects. A company must accept a particular project if

the net present value of a project is positive and higher when compared to the NPV’s of other

projects (Fisher, 2012).

Internal rate of return- This method helps to forecast the profits that are expected to be

generated in future. This method also considers the concept of time value of money. This method

is said to be the most accurate and credible method of evaluating the various projects that the

company has been proposed for (Fridson & Alvarez, 2012). However, the disadvantage of this

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.