University Financial Management: Tax, Capital Budgeting & Markets

VerifiedAdded on 2023/05/28

|11

|2744

|226

Homework Assignment

AI Summary

This financial management assignment addresses various questions related to tax, capital budgeting, and financial markets. It includes the calculation of corporate tax liability for Sandersen Inc., a discussion on the objectives of taxation beyond revenue generation, and an analysis of stock investments based on expected return and risk. The assignment also covers the determination of additional funding needed using different methods, ratio analysis to assess a company's liquidity and profitability, and capital budgeting techniques like payback period, average rate of return, NPV, and profitability index for project evaluation. Furthermore, it discusses the impact of inflation on inventory management and explains key financial concepts such as risk-return trade-off, time value of money, and the agency problem. Desklib offers a platform to explore similar solved assignments and past papers for students.

FINANCIAL

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

2

Contents

Abstract and Background............................................................................................................................3

Introduction.................................................................................................................................................3

Analysis and Discussion...............................................................................................................................3

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................4

Question 3...................................................................................................................................................5

Question 4...................................................................................................................................................6

Question 5...................................................................................................................................................7

Question 6...................................................................................................................................................9

Question 7...................................................................................................................................................9

Conclusion.................................................................................................................................................10

References.................................................................................................................................................10

2 | P a g e

Contents

Abstract and Background............................................................................................................................3

Introduction.................................................................................................................................................3

Analysis and Discussion...............................................................................................................................3

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................4

Question 3...................................................................................................................................................5

Question 4...................................................................................................................................................6

Question 5...................................................................................................................................................7

Question 6...................................................................................................................................................9

Question 7...................................................................................................................................................9

Conclusion.................................................................................................................................................10

References.................................................................................................................................................10

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Abstract and Background

In the given assignment, we have been asked several questions from different topics which have been

answered as per the requirements.

Introduction

There are seven questions in the given assignment relating to tax, capital budgeting and financial

markets. All the questions have been answered separately. The solution is followed in the analysis.

Analysis and Discussion

Question 1

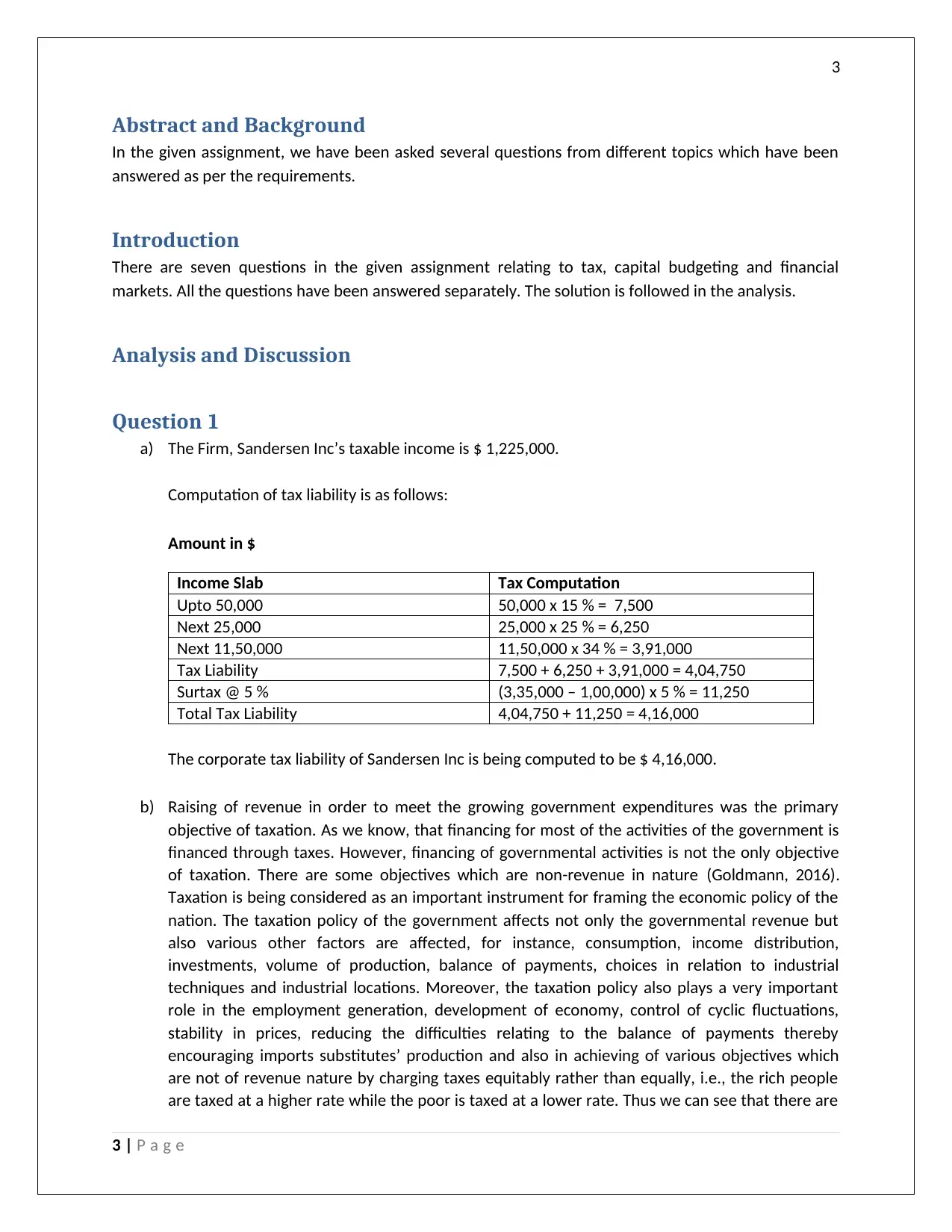

a) The Firm, Sandersen Inc’s taxable income is $ 1,225,000.

Computation of tax liability is as follows:

Amount in $

Income Slab Tax Computation

Upto 50,000 50,000 x 15 % = 7,500

Next 25,000 25,000 x 25 % = 6,250

Next 11,50,000 11,50,000 x 34 % = 3,91,000

Tax Liability 7,500 + 6,250 + 3,91,000 = 4,04,750

Surtax @ 5 % (3,35,000 – 1,00,000) x 5 % = 11,250

Total Tax Liability 4,04,750 + 11,250 = 4,16,000

The corporate tax liability of Sandersen Inc is being computed to be $ 4,16,000.

b) Raising of revenue in order to meet the growing government expenditures was the primary

objective of taxation. As we know, that financing for most of the activities of the government is

financed through taxes. However, financing of governmental activities is not the only objective

of taxation. There are some objectives which are non-revenue in nature (Goldmann, 2016).

Taxation is being considered as an important instrument for framing the economic policy of the

nation. The taxation policy of the government affects not only the governmental revenue but

also various other factors are affected, for instance, consumption, income distribution,

investments, volume of production, balance of payments, choices in relation to industrial

techniques and industrial locations. Moreover, the taxation policy also plays a very important

role in the employment generation, development of economy, control of cyclic fluctuations,

stability in prices, reducing the difficulties relating to the balance of payments thereby

encouraging imports substitutes’ production and also in achieving of various objectives which

are not of revenue nature by charging taxes equitably rather than equally, i.e., the rich people

are taxed at a higher rate while the poor is taxed at a lower rate. Thus we can see that there are

3 | P a g e

Abstract and Background

In the given assignment, we have been asked several questions from different topics which have been

answered as per the requirements.

Introduction

There are seven questions in the given assignment relating to tax, capital budgeting and financial

markets. All the questions have been answered separately. The solution is followed in the analysis.

Analysis and Discussion

Question 1

a) The Firm, Sandersen Inc’s taxable income is $ 1,225,000.

Computation of tax liability is as follows:

Amount in $

Income Slab Tax Computation

Upto 50,000 50,000 x 15 % = 7,500

Next 25,000 25,000 x 25 % = 6,250

Next 11,50,000 11,50,000 x 34 % = 3,91,000

Tax Liability 7,500 + 6,250 + 3,91,000 = 4,04,750

Surtax @ 5 % (3,35,000 – 1,00,000) x 5 % = 11,250

Total Tax Liability 4,04,750 + 11,250 = 4,16,000

The corporate tax liability of Sandersen Inc is being computed to be $ 4,16,000.

b) Raising of revenue in order to meet the growing government expenditures was the primary

objective of taxation. As we know, that financing for most of the activities of the government is

financed through taxes. However, financing of governmental activities is not the only objective

of taxation. There are some objectives which are non-revenue in nature (Goldmann, 2016).

Taxation is being considered as an important instrument for framing the economic policy of the

nation. The taxation policy of the government affects not only the governmental revenue but

also various other factors are affected, for instance, consumption, income distribution,

investments, volume of production, balance of payments, choices in relation to industrial

techniques and industrial locations. Moreover, the taxation policy also plays a very important

role in the employment generation, development of economy, control of cyclic fluctuations,

stability in prices, reducing the difficulties relating to the balance of payments thereby

encouraging imports substitutes’ production and also in achieving of various objectives which

are not of revenue nature by charging taxes equitably rather than equally, i.e., the rich people

are taxed at a higher rate while the poor is taxed at a lower rate. Thus we can see that there are

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

various economic and social objectives which have been added for taxation apart from the

purpose of meeting governmental expenditures.

Question 2

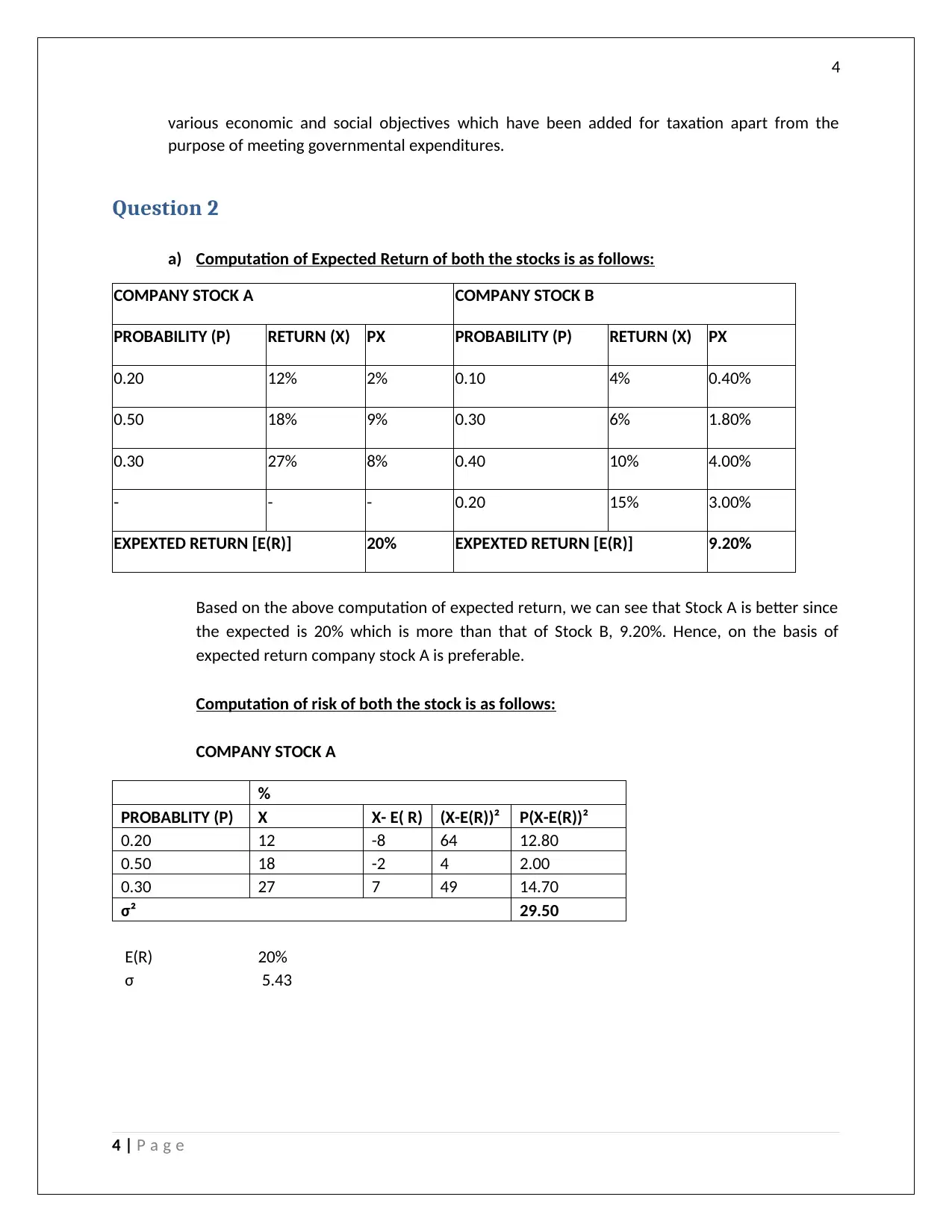

a) Computation of Expected Return of both the stocks is as follows:

COMPANY STOCK A COMPANY STOCK B

PROBABILITY (P) RETURN (X) PX PROBABILITY (P) RETURN (X) PX

0.20 12% 2% 0.10 4% 0.40%

0.50 18% 9% 0.30 6% 1.80%

0.30 27% 8% 0.40 10% 4.00%

- - - 0.20 15% 3.00%

EXPEXTED RETURN [E(R)] 20% EXPEXTED RETURN [E(R)] 9.20%

Based on the above computation of expected return, we can see that Stock A is better since

the expected is 20% which is more than that of Stock B, 9.20%. Hence, on the basis of

expected return company stock A is preferable.

Computation of risk of both the stock is as follows:

COMPANY STOCK A

%

PROBABLITY (P) X X- E( R) (X-E(R))² P(X-E(R))²

0.20 12 -8 64 12.80

0.50 18 -2 4 2.00

0.30 27 7 49 14.70

σ² 29.50

E(R) 20%

σ 5.43

4 | P a g e

various economic and social objectives which have been added for taxation apart from the

purpose of meeting governmental expenditures.

Question 2

a) Computation of Expected Return of both the stocks is as follows:

COMPANY STOCK A COMPANY STOCK B

PROBABILITY (P) RETURN (X) PX PROBABILITY (P) RETURN (X) PX

0.20 12% 2% 0.10 4% 0.40%

0.50 18% 9% 0.30 6% 1.80%

0.30 27% 8% 0.40 10% 4.00%

- - - 0.20 15% 3.00%

EXPEXTED RETURN [E(R)] 20% EXPEXTED RETURN [E(R)] 9.20%

Based on the above computation of expected return, we can see that Stock A is better since

the expected is 20% which is more than that of Stock B, 9.20%. Hence, on the basis of

expected return company stock A is preferable.

Computation of risk of both the stock is as follows:

COMPANY STOCK A

%

PROBABLITY (P) X X- E( R) (X-E(R))² P(X-E(R))²

0.20 12 -8 64 12.80

0.50 18 -2 4 2.00

0.30 27 7 49 14.70

σ² 29.50

E(R) 20%

σ 5.43

4 | P a g e

5

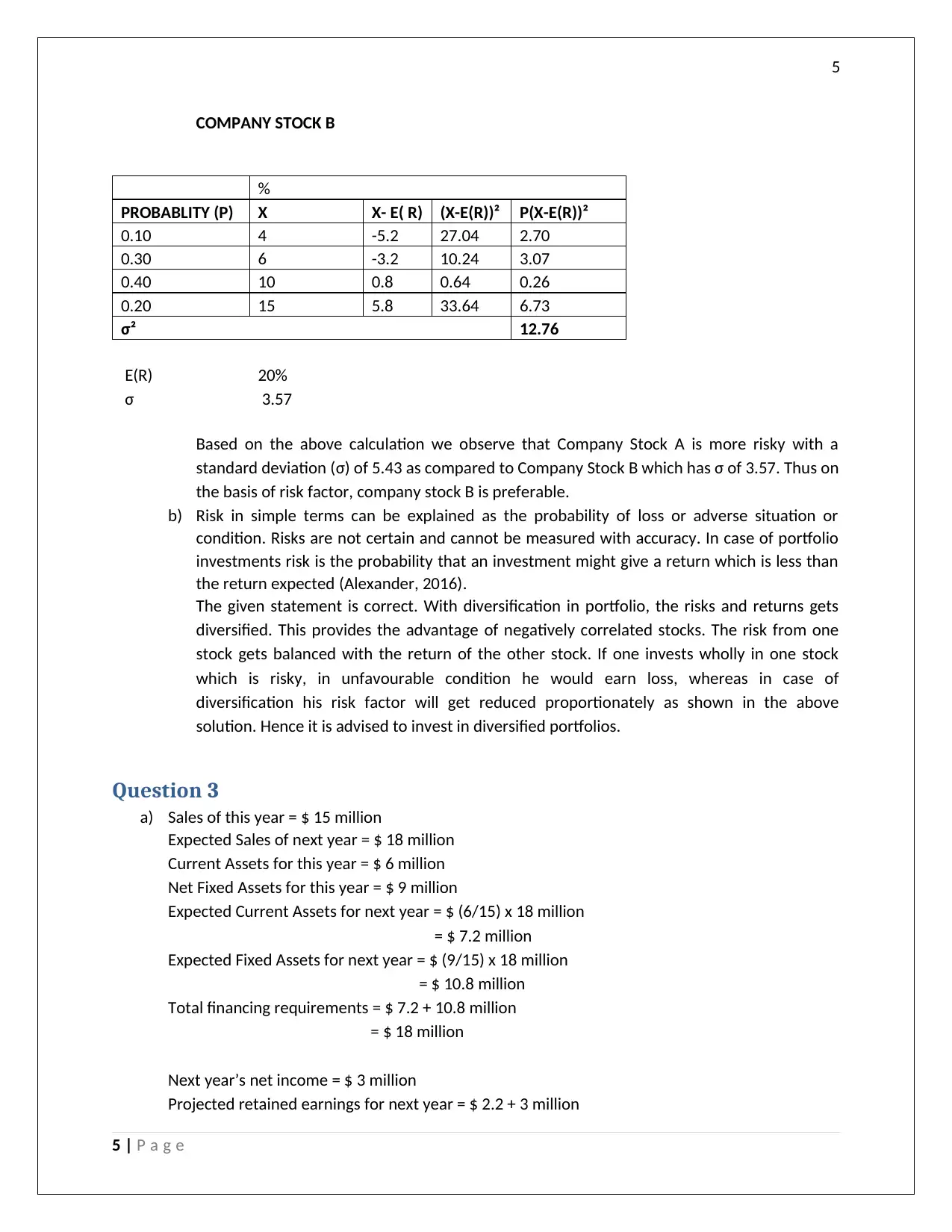

COMPANY STOCK B

%

PROBABLITY (P) X X- E( R) (X-E(R))² P(X-E(R))²

0.10 4 -5.2 27.04 2.70

0.30 6 -3.2 10.24 3.07

0.40 10 0.8 0.64 0.26

0.20 15 5.8 33.64 6.73

σ² 12.76

E(R) 20%

σ 3.57

Based on the above calculation we observe that Company Stock A is more risky with a

standard deviation (σ) of 5.43 as compared to Company Stock B which has σ of 3.57. Thus on

the basis of risk factor, company stock B is preferable.

b) Risk in simple terms can be explained as the probability of loss or adverse situation or

condition. Risks are not certain and cannot be measured with accuracy. In case of portfolio

investments risk is the probability that an investment might give a return which is less than

the return expected (Alexander, 2016).

The given statement is correct. With diversification in portfolio, the risks and returns gets

diversified. This provides the advantage of negatively correlated stocks. The risk from one

stock gets balanced with the return of the other stock. If one invests wholly in one stock

which is risky, in unfavourable condition he would earn loss, whereas in case of

diversification his risk factor will get reduced proportionately as shown in the above

solution. Hence it is advised to invest in diversified portfolios.

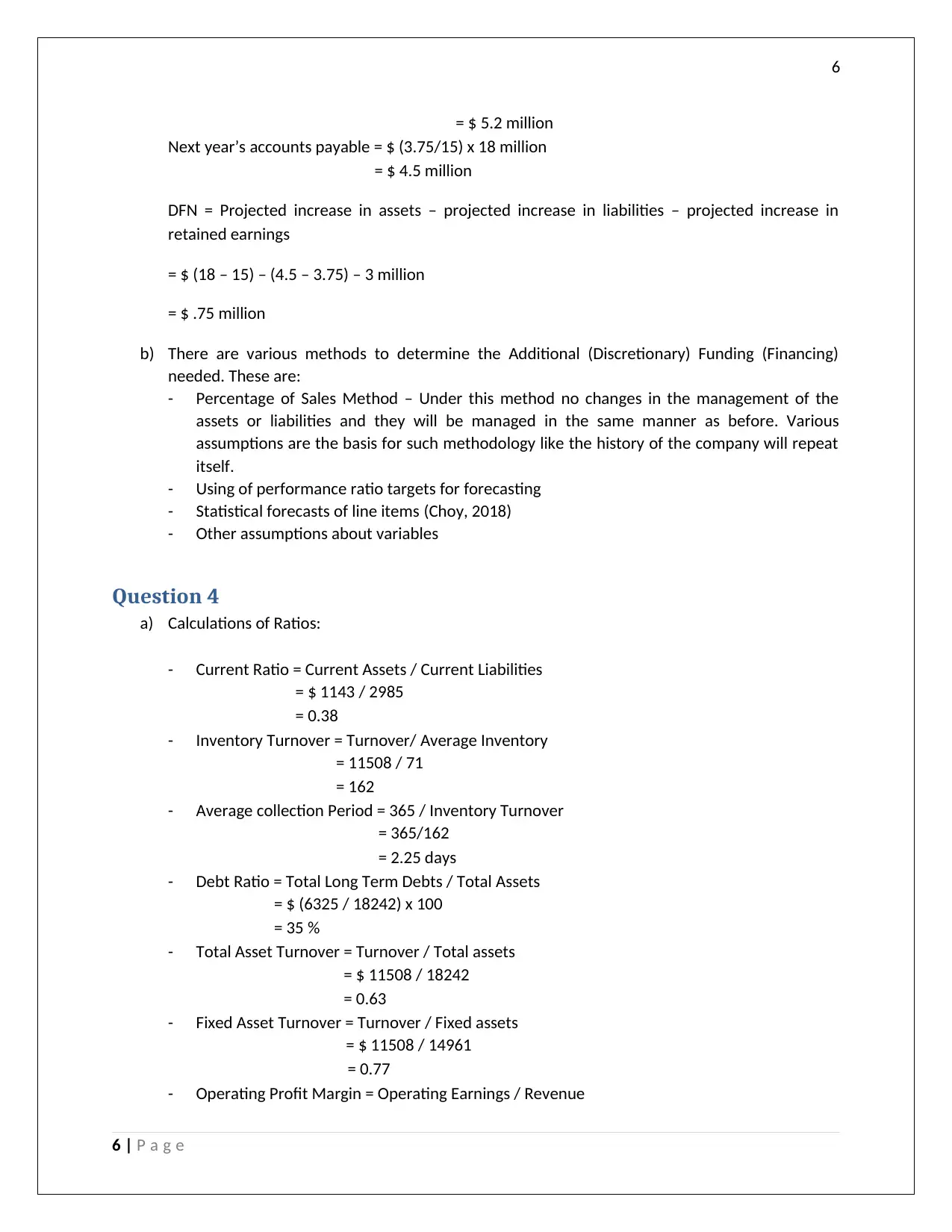

Question 3

a) Sales of this year = $ 15 million

Expected Sales of next year = $ 18 million

Current Assets for this year = $ 6 million

Net Fixed Assets for this year = $ 9 million

Expected Current Assets for next year = $ (6/15) x 18 million

= $ 7.2 million

Expected Fixed Assets for next year = $ (9/15) x 18 million

= $ 10.8 million

Total financing requirements = $ 7.2 + 10.8 million

= $ 18 million

Next year’s net income = $ 3 million

Projected retained earnings for next year = $ 2.2 + 3 million

5 | P a g e

COMPANY STOCK B

%

PROBABLITY (P) X X- E( R) (X-E(R))² P(X-E(R))²

0.10 4 -5.2 27.04 2.70

0.30 6 -3.2 10.24 3.07

0.40 10 0.8 0.64 0.26

0.20 15 5.8 33.64 6.73

σ² 12.76

E(R) 20%

σ 3.57

Based on the above calculation we observe that Company Stock A is more risky with a

standard deviation (σ) of 5.43 as compared to Company Stock B which has σ of 3.57. Thus on

the basis of risk factor, company stock B is preferable.

b) Risk in simple terms can be explained as the probability of loss or adverse situation or

condition. Risks are not certain and cannot be measured with accuracy. In case of portfolio

investments risk is the probability that an investment might give a return which is less than

the return expected (Alexander, 2016).

The given statement is correct. With diversification in portfolio, the risks and returns gets

diversified. This provides the advantage of negatively correlated stocks. The risk from one

stock gets balanced with the return of the other stock. If one invests wholly in one stock

which is risky, in unfavourable condition he would earn loss, whereas in case of

diversification his risk factor will get reduced proportionately as shown in the above

solution. Hence it is advised to invest in diversified portfolios.

Question 3

a) Sales of this year = $ 15 million

Expected Sales of next year = $ 18 million

Current Assets for this year = $ 6 million

Net Fixed Assets for this year = $ 9 million

Expected Current Assets for next year = $ (6/15) x 18 million

= $ 7.2 million

Expected Fixed Assets for next year = $ (9/15) x 18 million

= $ 10.8 million

Total financing requirements = $ 7.2 + 10.8 million

= $ 18 million

Next year’s net income = $ 3 million

Projected retained earnings for next year = $ 2.2 + 3 million

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

= $ 5.2 million

Next year’s accounts payable = $ (3.75/15) x 18 million

= $ 4.5 million

DFN = Projected increase in assets – projected increase in liabilities – projected increase in

retained earnings

= $ (18 – 15) – (4.5 – 3.75) – 3 million

= $ .75 million

b) There are various methods to determine the Additional (Discretionary) Funding (Financing)

needed. These are:

- Percentage of Sales Method – Under this method no changes in the management of the

assets or liabilities and they will be managed in the same manner as before. Various

assumptions are the basis for such methodology like the history of the company will repeat

itself.

- Using of performance ratio targets for forecasting

- Statistical forecasts of line items (Choy, 2018)

- Other assumptions about variables

Question 4

a) Calculations of Ratios:

- Current Ratio = Current Assets / Current Liabilities

= $ 1143 / 2985

= 0.38

- Inventory Turnover = Turnover/ Average Inventory

= 11508 / 71

= 162

- Average collection Period = 365 / Inventory Turnover

= 365/162

= 2.25 days

- Debt Ratio = Total Long Term Debts / Total Assets

= $ (6325 / 18242) x 100

= 35 %

- Total Asset Turnover = Turnover / Total assets

= $ 11508 / 18242

= 0.63

- Fixed Asset Turnover = Turnover / Fixed assets

= $ 11508 / 14961

= 0.77

- Operating Profit Margin = Operating Earnings / Revenue

6 | P a g e

= $ 5.2 million

Next year’s accounts payable = $ (3.75/15) x 18 million

= $ 4.5 million

DFN = Projected increase in assets – projected increase in liabilities – projected increase in

retained earnings

= $ (18 – 15) – (4.5 – 3.75) – 3 million

= $ .75 million

b) There are various methods to determine the Additional (Discretionary) Funding (Financing)

needed. These are:

- Percentage of Sales Method – Under this method no changes in the management of the

assets or liabilities and they will be managed in the same manner as before. Various

assumptions are the basis for such methodology like the history of the company will repeat

itself.

- Using of performance ratio targets for forecasting

- Statistical forecasts of line items (Choy, 2018)

- Other assumptions about variables

Question 4

a) Calculations of Ratios:

- Current Ratio = Current Assets / Current Liabilities

= $ 1143 / 2985

= 0.38

- Inventory Turnover = Turnover/ Average Inventory

= 11508 / 71

= 162

- Average collection Period = 365 / Inventory Turnover

= 365/162

= 2.25 days

- Debt Ratio = Total Long Term Debts / Total Assets

= $ (6325 / 18242) x 100

= 35 %

- Total Asset Turnover = Turnover / Total assets

= $ 11508 / 18242

= 0.63

- Fixed Asset Turnover = Turnover / Fixed assets

= $ 11508 / 14961

= 0.77

- Operating Profit Margin = Operating Earnings / Revenue

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

= $ (2794/ 11508) x 100

= 24.28 %

- Return on Common Equity = Profit / Common Equity Stock

= $ (1617 / 8852) x 100

= 18.27 %

b) The liquidity of a company can be measured on the basis of the current ratio. Greater the

current ratio, greater is the liquidity of the company. The current ratio in the given case has

been worked out to be 0.38 which is lower than the industrial norms. Hence, the company is

less liquid.

c) The operating profit margin of the company is 24.28 % which is greater than that of the

industrial norms. So, we can say that the operating margin of the company is better (Heminway,

2017).

d) The company is financing its assets through long term debts. However, the debt equity ratio is

35 % which is lower than the industry norms of 50 %. Hence, the company does not finance

more though debts but mostly internally.

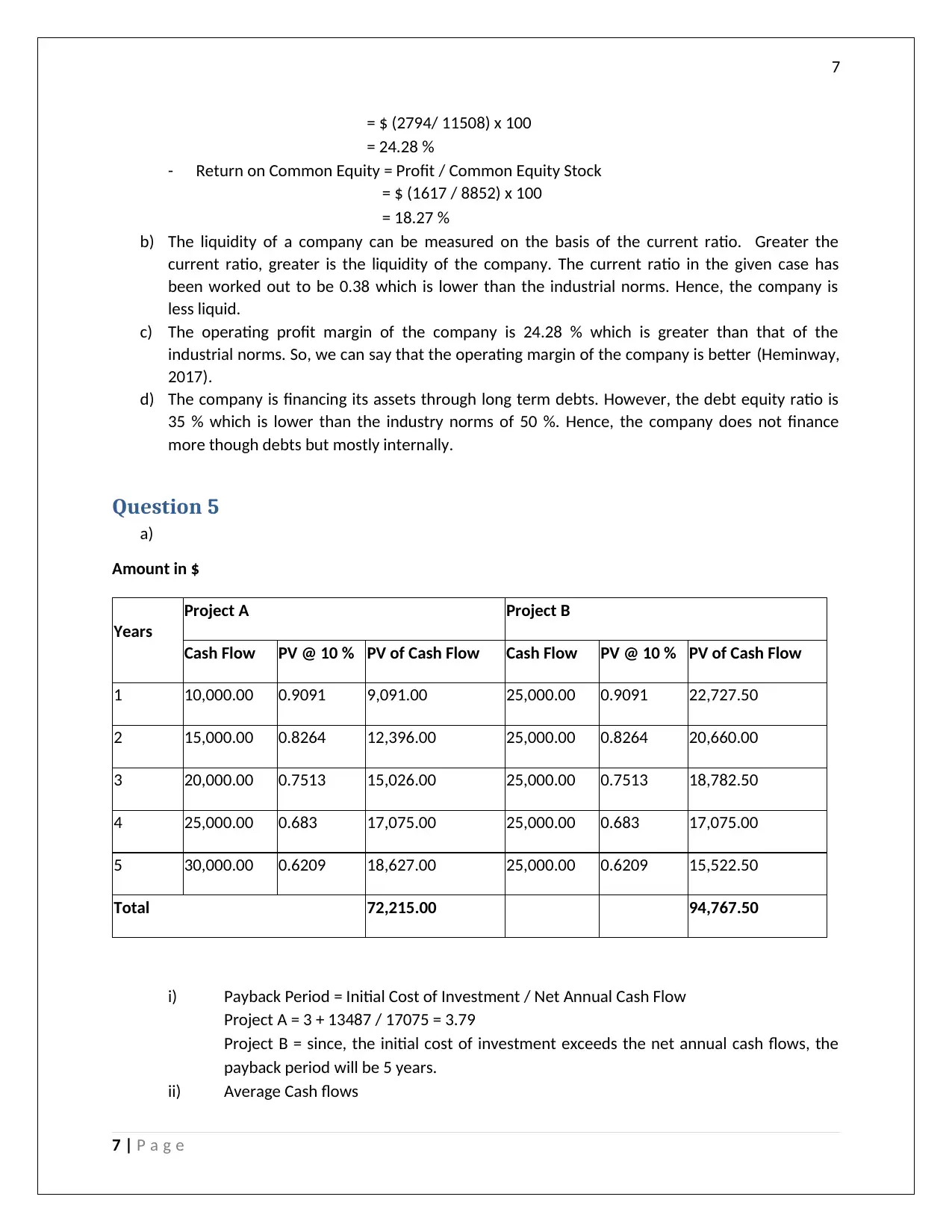

Question 5

a)

Amount in $

Years

Project A Project B

Cash Flow PV @ 10 % PV of Cash Flow Cash Flow PV @ 10 % PV of Cash Flow

1 10,000.00 0.9091 9,091.00 25,000.00 0.9091 22,727.50

2 15,000.00 0.8264 12,396.00 25,000.00 0.8264 20,660.00

3 20,000.00 0.7513 15,026.00 25,000.00 0.7513 18,782.50

4 25,000.00 0.683 17,075.00 25,000.00 0.683 17,075.00

5 30,000.00 0.6209 18,627.00 25,000.00 0.6209 15,522.50

Total 72,215.00 94,767.50

i) Payback Period = Initial Cost of Investment / Net Annual Cash Flow

Project A = 3 + 13487 / 17075 = 3.79

Project B = since, the initial cost of investment exceeds the net annual cash flows, the

payback period will be 5 years.

ii) Average Cash flows

7 | P a g e

= $ (2794/ 11508) x 100

= 24.28 %

- Return on Common Equity = Profit / Common Equity Stock

= $ (1617 / 8852) x 100

= 18.27 %

b) The liquidity of a company can be measured on the basis of the current ratio. Greater the

current ratio, greater is the liquidity of the company. The current ratio in the given case has

been worked out to be 0.38 which is lower than the industrial norms. Hence, the company is

less liquid.

c) The operating profit margin of the company is 24.28 % which is greater than that of the

industrial norms. So, we can say that the operating margin of the company is better (Heminway,

2017).

d) The company is financing its assets through long term debts. However, the debt equity ratio is

35 % which is lower than the industry norms of 50 %. Hence, the company does not finance

more though debts but mostly internally.

Question 5

a)

Amount in $

Years

Project A Project B

Cash Flow PV @ 10 % PV of Cash Flow Cash Flow PV @ 10 % PV of Cash Flow

1 10,000.00 0.9091 9,091.00 25,000.00 0.9091 22,727.50

2 15,000.00 0.8264 12,396.00 25,000.00 0.8264 20,660.00

3 20,000.00 0.7513 15,026.00 25,000.00 0.7513 18,782.50

4 25,000.00 0.683 17,075.00 25,000.00 0.683 17,075.00

5 30,000.00 0.6209 18,627.00 25,000.00 0.6209 15,522.50

Total 72,215.00 94,767.50

i) Payback Period = Initial Cost of Investment / Net Annual Cash Flow

Project A = 3 + 13487 / 17075 = 3.79

Project B = since, the initial cost of investment exceeds the net annual cash flows, the

payback period will be 5 years.

ii) Average Cash flows

7 | P a g e

8

Project A = 72215 / 5

= 14443

Project B = 94767.50 / 5

= 18953.5

Average investments

Project A = 50000/2

= 25000

Project B = 100000/2

= 50000

Average rate of return (ARR): Average Income / Average Investment

Project A = 14443 / 25000

= 57.77 %

Project B = 18953.5 / 50000

= 37.91 %

iii) NPV = Cash Inflows – Cash Outflows

Project A = 72215 – 50000

= 22215

Project B = 94767.50 – 100000

= - 5232.50

iv) Profitability Index = PV of future cash inflows / Initial Investments

Project A = 72215 / 50000

= 1.44

Project B = 94767.50 / 100000

= 0.95

b) Capital budgeting is the process of planning that whether the investment of the company in

respect of various long term projects, machinery, new plant, etc. are profitable or not. There are

various factors influencing Capital Budgeting (Linden & Freeman, 2017). These are cash flows,

changes in technologies, forecast of demand, types of management, competitive strategies,

productive efficiency, etc.

Question 6

The term inflation, in general, means a rise in the prices of all the goods and services. Inflation occurs

when the purchasing power of money drops. During inflation all the goods and services becomes

expensive. Hence, the prices of the raw materials, finished goods as well as semi-finished goods also

increases. So, it is feasible to keep the inventory turnover ratio as lower as possible during inflation.

However, a rise in price of everything also increases the cost of inventory holding, but the buyers might

feel that this cost will be met sufficiently if they are able to acquire inventories at a lower cost than later.

It is advisable to hold good stock of inventory during inflation (Jefferson, 2017).

8 | P a g e

Project A = 72215 / 5

= 14443

Project B = 94767.50 / 5

= 18953.5

Average investments

Project A = 50000/2

= 25000

Project B = 100000/2

= 50000

Average rate of return (ARR): Average Income / Average Investment

Project A = 14443 / 25000

= 57.77 %

Project B = 18953.5 / 50000

= 37.91 %

iii) NPV = Cash Inflows – Cash Outflows

Project A = 72215 – 50000

= 22215

Project B = 94767.50 – 100000

= - 5232.50

iv) Profitability Index = PV of future cash inflows / Initial Investments

Project A = 72215 / 50000

= 1.44

Project B = 94767.50 / 100000

= 0.95

b) Capital budgeting is the process of planning that whether the investment of the company in

respect of various long term projects, machinery, new plant, etc. are profitable or not. There are

various factors influencing Capital Budgeting (Linden & Freeman, 2017). These are cash flows,

changes in technologies, forecast of demand, types of management, competitive strategies,

productive efficiency, etc.

Question 6

The term inflation, in general, means a rise in the prices of all the goods and services. Inflation occurs

when the purchasing power of money drops. During inflation all the goods and services becomes

expensive. Hence, the prices of the raw materials, finished goods as well as semi-finished goods also

increases. So, it is feasible to keep the inventory turnover ratio as lower as possible during inflation.

However, a rise in price of everything also increases the cost of inventory holding, but the buyers might

feel that this cost will be met sufficiently if they are able to acquire inventories at a lower cost than later.

It is advisable to hold good stock of inventory during inflation (Jefferson, 2017).

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Hence, the given statement that “it is prudent to hold large inventories in an inflationary economy”

holds good and therefore we can conclude that it is totally correct.

Question 7

1. Risk – return trade off – The investments having higher risk is expected to provide higher rate of

return and the investments with lower risks has a probability of lower returns. This trade off

which is being faced by the investors are termed as risk return trade off.

2. Time Value of Money – Time Value of Money being abbreviated as TMV depicts a view that the

value that money has in present will be of more worth in future, because of its capacity of

revenue generation and moreover interest is also earned on money.

3. Cash is King - Cash is being considered as the fuel that runs a business. Cash is inevitably

required to run the day to day business activity smoothly by meeting the operating needs of the

business. It reflects the liquidity of an organization. Availability of an ample amount of cash is

very important for the success of an organization (Dichev, 2017).

4. Incremental Cash Flows – The amount of cash flow that an organization receives in addition as a

result of taking on new projects is known as incremental cash flows. These cash flows can be

positive as well as negative. A positive incremental cash flow reflects an increase in the cash

flow of the company with the project’s acceptance.

5. The agency Problem – The problem of conflict of interest which is innate in any association

where the interest of one party is not in the best of the interest of the other party is known as

the agency problem. These problems generally occurs between the management of the

company and its stakeholders.

6. Taxes bias business decision – It is very well versed that taxes affects the profits of a business to

great extent which is not in the favour of the company. Due to this the business management

makes decision on the basis of reduction on such taxes rather than on the basis of economic

factors. These decisions are taxes bias business decisions

7. All risk is not equal – A company faces various risks in various fields. All the risks are not similar

and hence not equal.

8. Ethical dilemma is everywhere in finance – The risk in relation to a project tends to change

whether it is being measured on standalone basis or in line with other projects. Ethical dilemma

is taking the right decision at the right time, which exists everywhere.

9. The curse of Competitive Market - Market these are highly competitive where number of

producers producing similar goods and services compete with each other.

10. Efficient Capital Markets – These are those securities market where the incorporation of any

news relating to the stock is very spontaneous.

Conclusion

We have answered all the questions with respect to the related topics which is quite varied. All the

requirements of the questions have been met.

9 | P a g e

Hence, the given statement that “it is prudent to hold large inventories in an inflationary economy”

holds good and therefore we can conclude that it is totally correct.

Question 7

1. Risk – return trade off – The investments having higher risk is expected to provide higher rate of

return and the investments with lower risks has a probability of lower returns. This trade off

which is being faced by the investors are termed as risk return trade off.

2. Time Value of Money – Time Value of Money being abbreviated as TMV depicts a view that the

value that money has in present will be of more worth in future, because of its capacity of

revenue generation and moreover interest is also earned on money.

3. Cash is King - Cash is being considered as the fuel that runs a business. Cash is inevitably

required to run the day to day business activity smoothly by meeting the operating needs of the

business. It reflects the liquidity of an organization. Availability of an ample amount of cash is

very important for the success of an organization (Dichev, 2017).

4. Incremental Cash Flows – The amount of cash flow that an organization receives in addition as a

result of taking on new projects is known as incremental cash flows. These cash flows can be

positive as well as negative. A positive incremental cash flow reflects an increase in the cash

flow of the company with the project’s acceptance.

5. The agency Problem – The problem of conflict of interest which is innate in any association

where the interest of one party is not in the best of the interest of the other party is known as

the agency problem. These problems generally occurs between the management of the

company and its stakeholders.

6. Taxes bias business decision – It is very well versed that taxes affects the profits of a business to

great extent which is not in the favour of the company. Due to this the business management

makes decision on the basis of reduction on such taxes rather than on the basis of economic

factors. These decisions are taxes bias business decisions

7. All risk is not equal – A company faces various risks in various fields. All the risks are not similar

and hence not equal.

8. Ethical dilemma is everywhere in finance – The risk in relation to a project tends to change

whether it is being measured on standalone basis or in line with other projects. Ethical dilemma

is taking the right decision at the right time, which exists everywhere.

9. The curse of Competitive Market - Market these are highly competitive where number of

producers producing similar goods and services compete with each other.

10. Efficient Capital Markets – These are those securities market where the incorporation of any

news relating to the stock is very spontaneous.

Conclusion

We have answered all the questions with respect to the related topics which is quite varied. All the

requirements of the questions have been met.

9 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

References

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview Analysis.

Ecological Economics, p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Goldmann, K., 2016. Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, 4(3), pp. 103-112.

Heminway, J., 2017. Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and

Organic Documents. SSRN, pp. 1-35.

Jefferson, M., 2017. Energy, Complexity and Wealth Maximization, R. Ayres. Springer, Switzerland.

Technological Forecasting and Social Change, pp. 353-354.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making. Business

Ethics Quarterly, 27(3), pp. 353-379.

10 | P a g e

References

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview Analysis.

Ecological Economics, p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Goldmann, K., 2016. Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, 4(3), pp. 103-112.

Heminway, J., 2017. Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and

Organic Documents. SSRN, pp. 1-35.

Jefferson, M., 2017. Energy, Complexity and Wealth Maximization, R. Ayres. Springer, Switzerland.

Technological Forecasting and Social Change, pp. 353-354.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making. Business

Ethics Quarterly, 27(3), pp. 353-379.

10 | P a g e

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.