BMP3005 Applied Business Finance: Financial Management and Case Study

VerifiedAdded on 2023/06/15

|14

|2806

|200

Report

AI Summary

This report provides a comprehensive overview of financial management, emphasizing its importance in achieving organizational objectives. It defines financial management and discusses its key concepts, including working capital management and risk monitoring. The report details the main financial statements—balance sheets, income statements, and cash flow statements—explaining their use in evaluating a company's financial health. Ratio analysis, including profitability, liquidity, and efficiency ratios, is explored with calculations based on a case study, demonstrating how these metrics can inform business decisions. Furthermore, the report suggests strategies for improving financial performance, such as debt consolidation, maintaining positive income, minimizing overhead expenses, seeking professional help, and liquidating resources. It also presents an income statement and balance sheet using excel. This document is available on Desklib, a platform offering a wide range of study resources, including past papers and solved assignments, for students.

BSc (Hons) Business Management with

Foundation

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes

businesses might use to improve their

financial performance

Submitted by:

Name:

ID:

Contents

Introduction p

0

Foundation

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes

businesses might use to improve their

financial performance

Submitted by:

Name:

ID:

Contents

Introduction p

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1: Definition and discussion of the concept and

importance of financial management p

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

p

Section 3: Using the template provided p-p

i. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

p

ii. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study). This should be included within

your appendices p

iii. Using Excel completing the Balance Sheet p

iv. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of

ratio analysis p

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance p

Conclusion p

References

Appendix p

1

importance of financial management p

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

p

Section 3: Using the template provided p-p

i. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

p

ii. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study). This should be included within

your appendices p

iii. Using Excel completing the Balance Sheet p

iv. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of

ratio analysis p

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance p

Conclusion p

References

Appendix p

1

Introduction

Financial management is defined as very important part of any business which

helps them in evaluating their budget that could assist them in accomplishing their

organizational objectives effectively. There are various types of explicit roles which are

different in nature that are represented by financial management that assist in achieving

several aims and objectives (Lan and Li, 2021). This could be executed by increasing

advantages, restricting costs, selecting development of capital and may other factors. In

current scenario the thought of financial management is very much associated with

working capital management. It assists in controlling and monitoring uncertainties which

might influence the continuous functioning of companies. The following report focus on

various kinds of financial conceptual techniques in terms of financial management.

Furthermore, with the help of significant analysis such as ratio analysis several financial

outlines associated to business procedure of companies could be utilized. Lastly, this

would assist to improve overall performance and financial of organization.

Section 1: Definition and discussion of the concept and

importance of financial management

Financial management is describing as important organizing, coordinating,

balancing and controlling of budget in companies. It is also associated with execution

of wide range of ideas to the executive standards of monetary areas of business

ventures. It also helps in adequately monitoring and taking decisions about how

much budget would be assigned to different departments within the companies. It is

defined as the most general method of developing, creating and implementing

strategies which needs to be execute in order to make sure that all divisions in the

company are working effectively to achieve their goals (Zhang, 2020). It also assists

companies in managing the decisions associated with the crucial financial and

business venture actions for growth of firms driving them to believe applicable

selection in setting goals and destinations of the institutes. The financial authorities

of the companies guarantee that their availability of money in every department in

the firm that must empower to smoothly achieve their business operations.

Financial management is considered as one of the essential variable of the

organizations empowering them to guarantee the availability of the budget for every

2

Financial management is defined as very important part of any business which

helps them in evaluating their budget that could assist them in accomplishing their

organizational objectives effectively. There are various types of explicit roles which are

different in nature that are represented by financial management that assist in achieving

several aims and objectives (Lan and Li, 2021). This could be executed by increasing

advantages, restricting costs, selecting development of capital and may other factors. In

current scenario the thought of financial management is very much associated with

working capital management. It assists in controlling and monitoring uncertainties which

might influence the continuous functioning of companies. The following report focus on

various kinds of financial conceptual techniques in terms of financial management.

Furthermore, with the help of significant analysis such as ratio analysis several financial

outlines associated to business procedure of companies could be utilized. Lastly, this

would assist to improve overall performance and financial of organization.

Section 1: Definition and discussion of the concept and

importance of financial management

Financial management is describing as important organizing, coordinating,

balancing and controlling of budget in companies. It is also associated with execution

of wide range of ideas to the executive standards of monetary areas of business

ventures. It also helps in adequately monitoring and taking decisions about how

much budget would be assigned to different departments within the companies. It is

defined as the most general method of developing, creating and implementing

strategies which needs to be execute in order to make sure that all divisions in the

company are working effectively to achieve their goals (Zhang, 2020). It also assists

companies in managing the decisions associated with the crucial financial and

business venture actions for growth of firms driving them to believe applicable

selection in setting goals and destinations of the institutes. The financial authorities

of the companies guarantee that their availability of money in every department in

the firm that must empower to smoothly achieve their business operations.

Financial management is considered as one of the essential variable of the

organizations empowering them to guarantee the availability of the budget for every

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

division within firm. This will help the organization in guaranteeing the effective and

smooth supply of finances so that necessary assets could be obtained successfully

as well as proficiently. The proper implementation of financial management aid

companies in providing strong financial position through organizing the finances

effectively and successfully allocating the resources in every single department of

the firms empowering them to enhance their performance (Xu, 2019). Furthermore, it

also assists the finance manager to take all responsibility associated with financial

decisions which are adequately incorporated with aims of business.

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

Financial statements are described as the written summary of overall financial

transactions and budget allocated of companies. It assists in providing effective

growth to organizations and enhance their performance through evaluating financial

status. These financial statements are generally examined by various external

parties such as tax officials, government authorities, auditors and many more to

supervise the financial situation of organizations (Veledar and Letica, 2020). The

various kinds of financial statements which includes Balance Sheet, income

statements and cash flow that are described below in detail:

Balance sheet: This factor is related to financial summaries which are

arranged by companies that involves all kinds of liabilities and assets. It also

contains the investors value that empowers to take decisions regarding

financial situation of companies.

Equation: Assets= ( Liabilities + Owner's Fund )

Income statement: This is defined as another form of budget summary of

companies that mainly involves income statements, expenditures which are

mainly created from business operations (Liu, 2020). It also assists in

deciding the level of productivity that companies could achieve during a

particular financial year. It helps in evaluating overall pay, cost, incomes and

profit on shares critically.

Equation: Net Income=( Revenue - Expenses )

3

smooth supply of finances so that necessary assets could be obtained successfully

as well as proficiently. The proper implementation of financial management aid

companies in providing strong financial position through organizing the finances

effectively and successfully allocating the resources in every single department of

the firms empowering them to enhance their performance (Xu, 2019). Furthermore, it

also assists the finance manager to take all responsibility associated with financial

decisions which are adequately incorporated with aims of business.

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

Financial statements are described as the written summary of overall financial

transactions and budget allocated of companies. It assists in providing effective

growth to organizations and enhance their performance through evaluating financial

status. These financial statements are generally examined by various external

parties such as tax officials, government authorities, auditors and many more to

supervise the financial situation of organizations (Veledar and Letica, 2020). The

various kinds of financial statements which includes Balance Sheet, income

statements and cash flow that are described below in detail:

Balance sheet: This factor is related to financial summaries which are

arranged by companies that involves all kinds of liabilities and assets. It also

contains the investors value that empowers to take decisions regarding

financial situation of companies.

Equation: Assets= ( Liabilities + Owner's Fund )

Income statement: This is defined as another form of budget summary of

companies that mainly involves income statements, expenditures which are

mainly created from business operations (Liu, 2020). It also assists in

deciding the level of productivity that companies could achieve during a

particular financial year. It helps in evaluating overall pay, cost, incomes and

profit on shares critically.

Equation: Net Income=( Revenue - Expenses )

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flow statements: It mainly related to budget statements provided in

written that assist in sorting out monetary summaries that empowers

companies to take decision associated with the cash inflow and outflow of

business venture. It also assists the companies in critically examining the

capabilities to manufacture cash to take care of their financial obligations and

fulfill their consumption when needed.

Accounting ratios are mainly defined as evaluation of overall budget or

monetary information of approximately around two years to make sure their financial

situations are strong in competitive market. It is represented as one of the most

important as well as fundamental tool which is being utilized by various business

ventures to examine and investigate their advantage and monetary situations of

companies (Ukaigwe and Igbozuruike, 2018). Furthermore, the accounting ratios

which are significantly utilized to evaluating the performance and target marketplace

for the companies in relation with their rivals in the market. These ratios are

generally categorized into various kinds such as profitability ratios, liquidity ratios,

turnover ratios, solvency ratios and many others.

Section 3: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

Section 3: Using the template provided:

v. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

Refer to the appendix

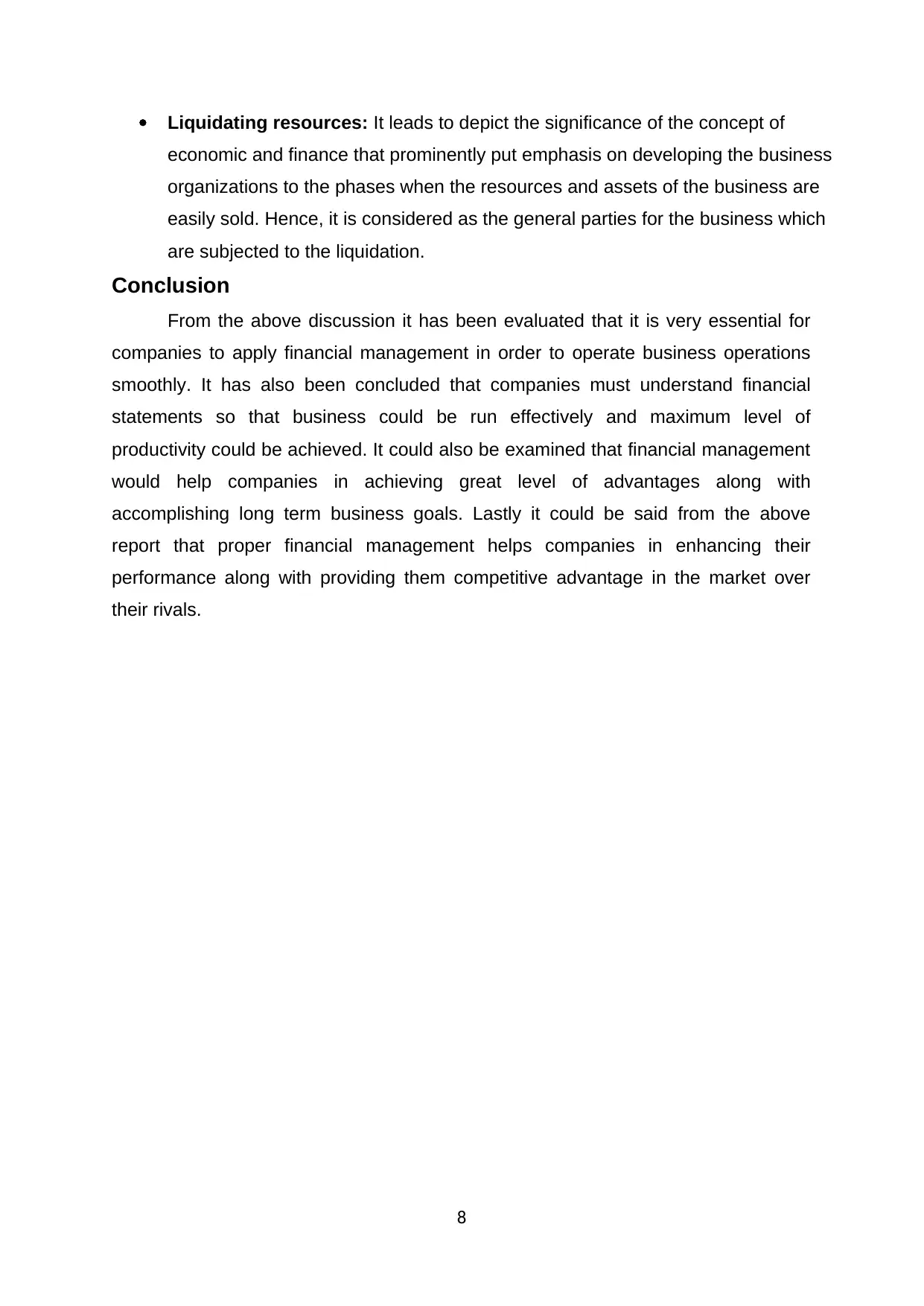

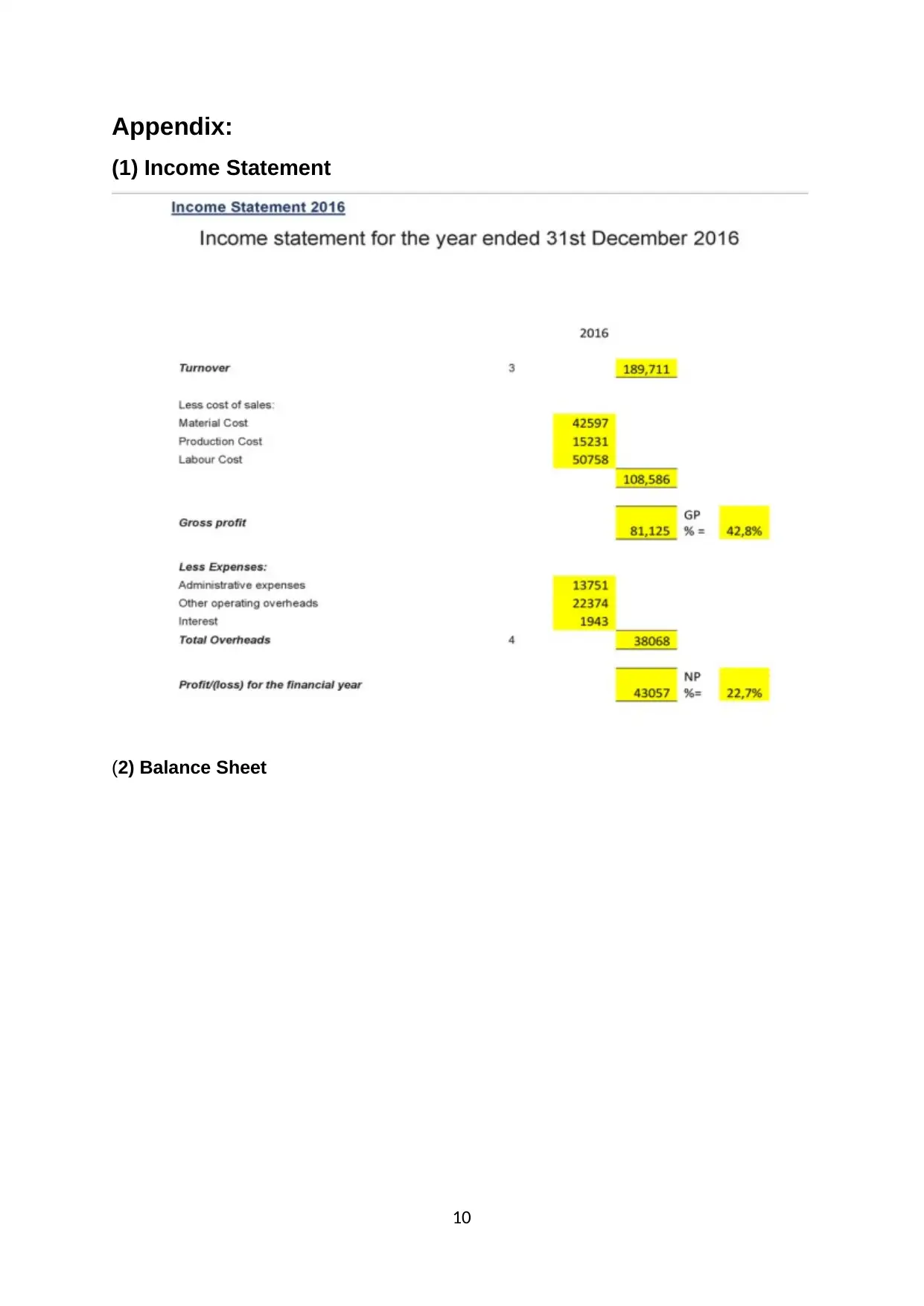

vi. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study)

Refer to the appendix

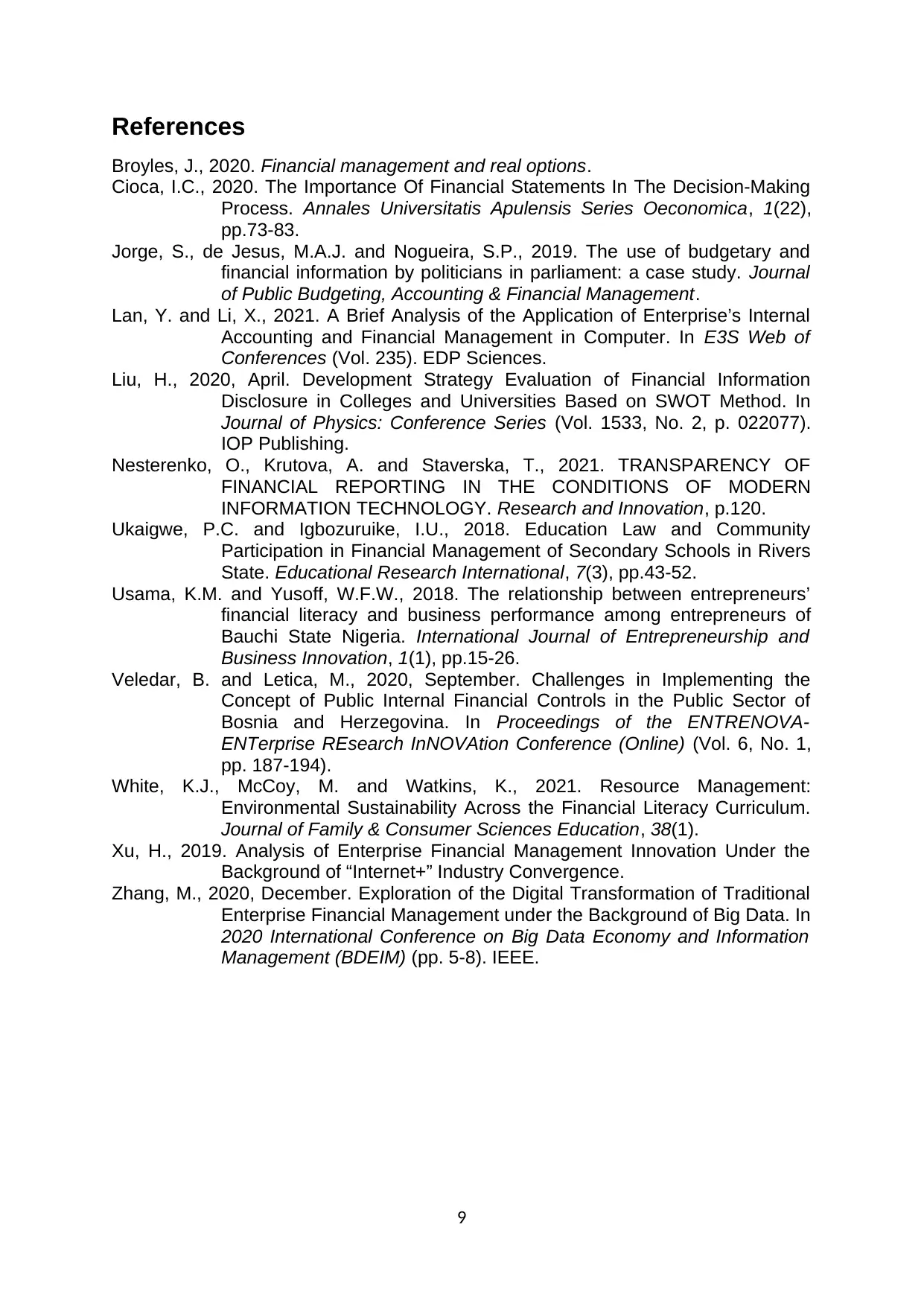

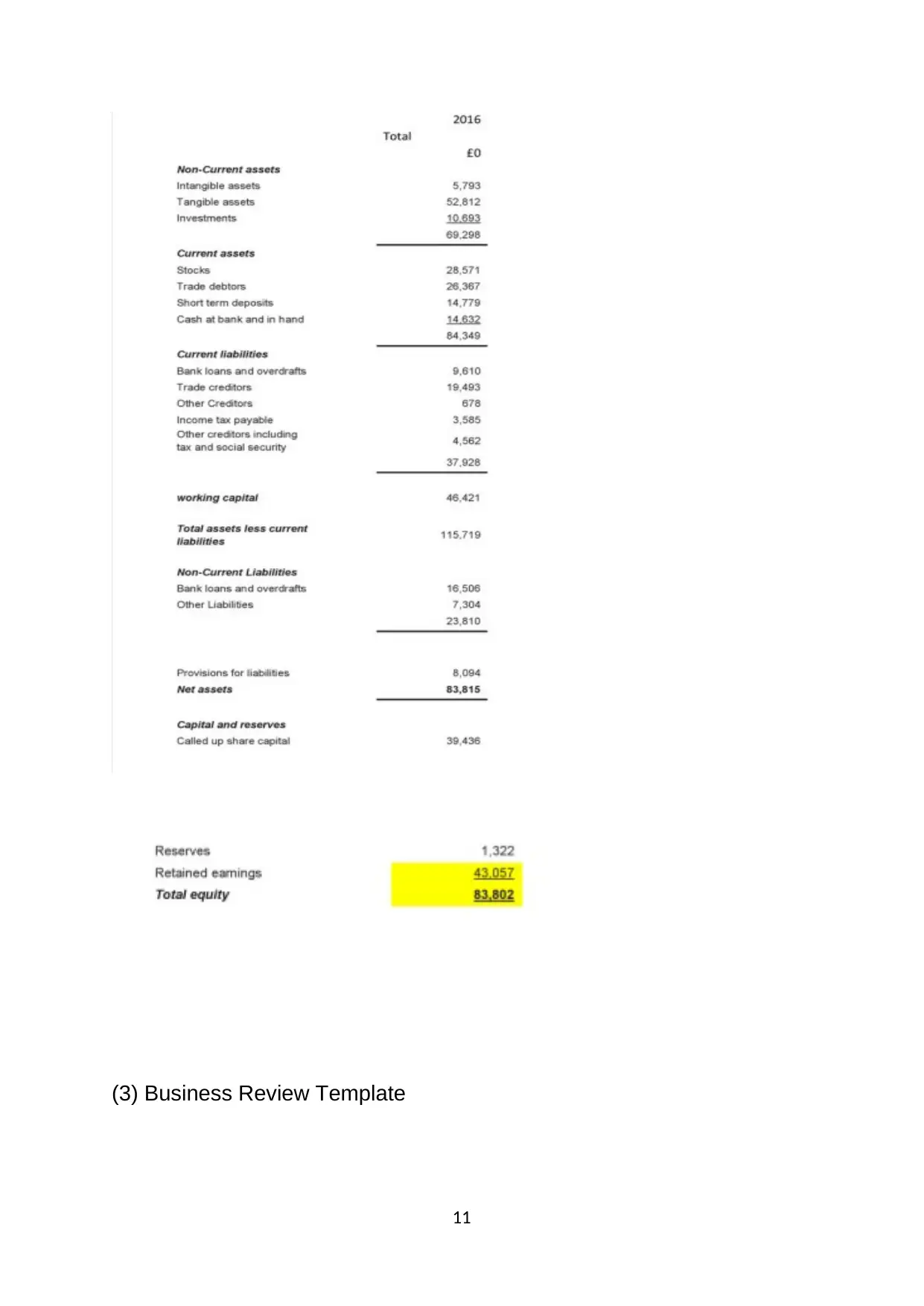

vii. Using Excel completing the Balance Sheet

Refer to the appendix

4

written that assist in sorting out monetary summaries that empowers

companies to take decision associated with the cash inflow and outflow of

business venture. It also assists the companies in critically examining the

capabilities to manufacture cash to take care of their financial obligations and

fulfill their consumption when needed.

Accounting ratios are mainly defined as evaluation of overall budget or

monetary information of approximately around two years to make sure their financial

situations are strong in competitive market. It is represented as one of the most

important as well as fundamental tool which is being utilized by various business

ventures to examine and investigate their advantage and monetary situations of

companies (Ukaigwe and Igbozuruike, 2018). Furthermore, the accounting ratios

which are significantly utilized to evaluating the performance and target marketplace

for the companies in relation with their rivals in the market. These ratios are

generally categorized into various kinds such as profitability ratios, liquidity ratios,

turnover ratios, solvency ratios and many others.

Section 3: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

Section 3: Using the template provided:

v. Completing the Information on the ‘Business Review Template

(Ensure that you display your calculations for this detail)

Refer to the appendix

vi. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study)

Refer to the appendix

vii. Using Excel completing the Balance Sheet

Refer to the appendix

4

viii. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of

ratio analysis

Profitability ratio: This ratio is useful in terms of analyzing the overall capacity to

procure the profits from their business operations, value their investors and

accounting report resources (Broyles, 2020). Most of the profitability ratios are

helpful in terms of conveying the overall information that how effective a company

create suitable benefits and also offer incentives to their investors.

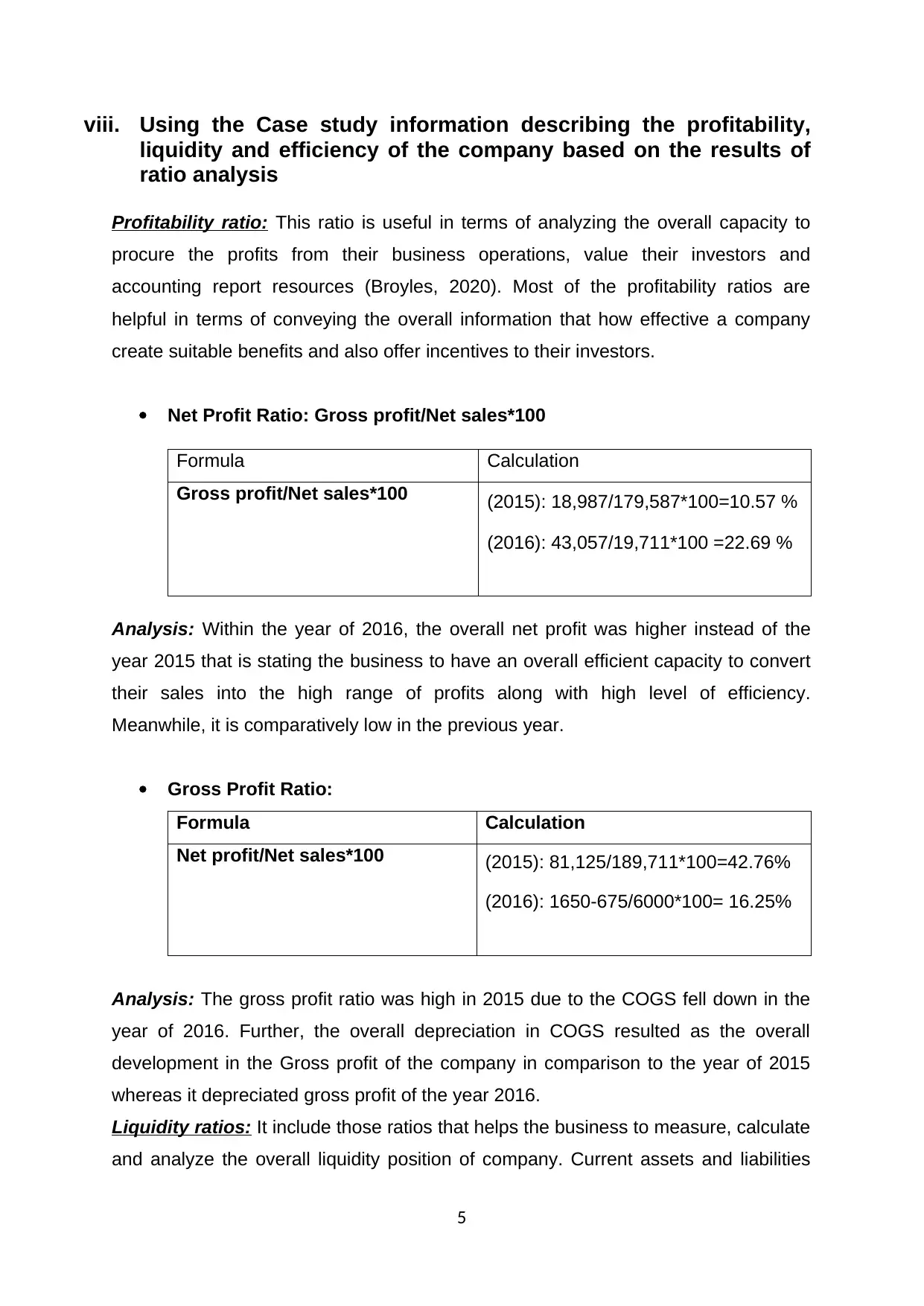

Net Profit Ratio: Gross profit/Net sales*100

Formula Calculation

Gross profit/Net sales*100 (2015): 18,987/179,587*100=10.57 %

(2016): 43,057/19,711*100 =22.69 %

Analysis: Within the year of 2016, the overall net profit was higher instead of the

year 2015 that is stating the business to have an overall efficient capacity to convert

their sales into the high range of profits along with high level of efficiency.

Meanwhile, it is comparatively low in the previous year.

Gross Profit Ratio:

Formula Calculation

Net profit/Net sales*100 (2015): 81,125/189,711*100=42.76%

(2016): 1650-675/6000*100= 16.25%

Analysis: The gross profit ratio was high in 2015 due to the COGS fell down in the

year of 2016. Further, the overall depreciation in COGS resulted as the overall

development in the Gross profit of the company in comparison to the year of 2015

whereas it depreciated gross profit of the year 2016.

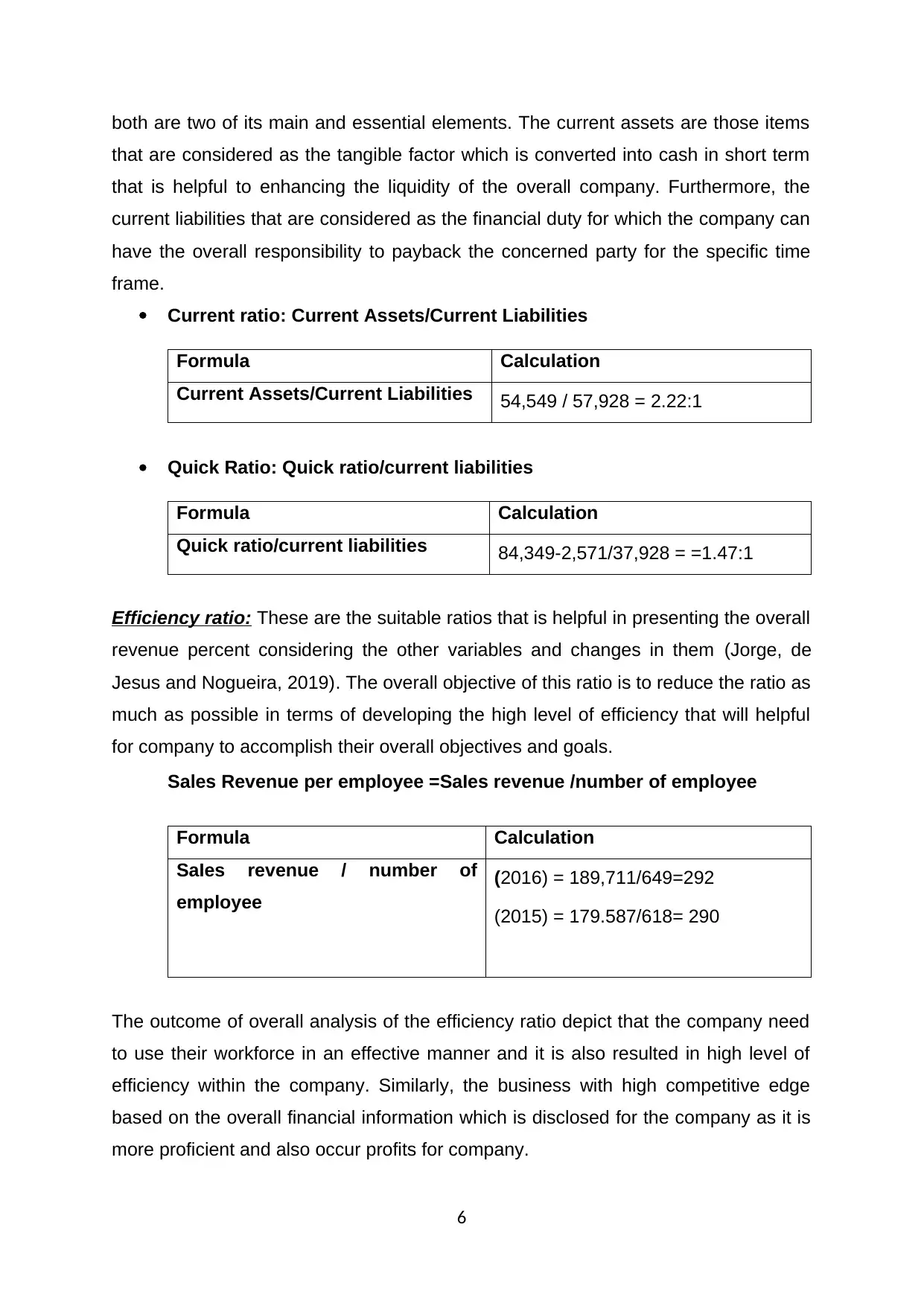

Liquidity ratios: It include those ratios that helps the business to measure, calculate

and analyze the overall liquidity position of company. Current assets and liabilities

5

liquidity and efficiency of the company based on the results of

ratio analysis

Profitability ratio: This ratio is useful in terms of analyzing the overall capacity to

procure the profits from their business operations, value their investors and

accounting report resources (Broyles, 2020). Most of the profitability ratios are

helpful in terms of conveying the overall information that how effective a company

create suitable benefits and also offer incentives to their investors.

Net Profit Ratio: Gross profit/Net sales*100

Formula Calculation

Gross profit/Net sales*100 (2015): 18,987/179,587*100=10.57 %

(2016): 43,057/19,711*100 =22.69 %

Analysis: Within the year of 2016, the overall net profit was higher instead of the

year 2015 that is stating the business to have an overall efficient capacity to convert

their sales into the high range of profits along with high level of efficiency.

Meanwhile, it is comparatively low in the previous year.

Gross Profit Ratio:

Formula Calculation

Net profit/Net sales*100 (2015): 81,125/189,711*100=42.76%

(2016): 1650-675/6000*100= 16.25%

Analysis: The gross profit ratio was high in 2015 due to the COGS fell down in the

year of 2016. Further, the overall depreciation in COGS resulted as the overall

development in the Gross profit of the company in comparison to the year of 2015

whereas it depreciated gross profit of the year 2016.

Liquidity ratios: It include those ratios that helps the business to measure, calculate

and analyze the overall liquidity position of company. Current assets and liabilities

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

both are two of its main and essential elements. The current assets are those items

that are considered as the tangible factor which is converted into cash in short term

that is helpful to enhancing the liquidity of the overall company. Furthermore, the

current liabilities that are considered as the financial duty for which the company can

have the overall responsibility to payback the concerned party for the specific time

frame.

Current ratio: Current Assets/Current Liabilities

Formula Calculation

Current Assets/Current Liabilities 54,549 / 57,928 = 2.22:1

Quick Ratio: Quick ratio/current liabilities

Formula Calculation

Quick ratio/current liabilities 84,349-2,571/37,928 = =1.47:1

Efficiency ratio: These are the suitable ratios that is helpful in presenting the overall

revenue percent considering the other variables and changes in them (Jorge, de

Jesus and Nogueira, 2019). The overall objective of this ratio is to reduce the ratio as

much as possible in terms of developing the high level of efficiency that will helpful

for company to accomplish their overall objectives and goals.

Sales Revenue per employee =SaIes revenue /number of employee

Formula Calculation

SaIes revenue / number of

employee

(2016) = 189,711/649=292

(2015) = 179.587/618= 290

The outcome of overall analysis of the efficiency ratio depict that the company need

to use their workforce in an effective manner and it is also resulted in high level of

efficiency within the company. Similarly, the business with high competitive edge

based on the overall financial information which is disclosed for the company as it is

more proficient and also occur profits for company.

6

that are considered as the tangible factor which is converted into cash in short term

that is helpful to enhancing the liquidity of the overall company. Furthermore, the

current liabilities that are considered as the financial duty for which the company can

have the overall responsibility to payback the concerned party for the specific time

frame.

Current ratio: Current Assets/Current Liabilities

Formula Calculation

Current Assets/Current Liabilities 54,549 / 57,928 = 2.22:1

Quick Ratio: Quick ratio/current liabilities

Formula Calculation

Quick ratio/current liabilities 84,349-2,571/37,928 = =1.47:1

Efficiency ratio: These are the suitable ratios that is helpful in presenting the overall

revenue percent considering the other variables and changes in them (Jorge, de

Jesus and Nogueira, 2019). The overall objective of this ratio is to reduce the ratio as

much as possible in terms of developing the high level of efficiency that will helpful

for company to accomplish their overall objectives and goals.

Sales Revenue per employee =SaIes revenue /number of employee

Formula Calculation

SaIes revenue / number of

employee

(2016) = 189,711/649=292

(2015) = 179.587/618= 290

The outcome of overall analysis of the efficiency ratio depict that the company need

to use their workforce in an effective manner and it is also resulted in high level of

efficiency within the company. Similarly, the business with high competitive edge

based on the overall financial information which is disclosed for the company as it is

more proficient and also occur profits for company.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance.

It is important for the company to have suitable financial performance. The

rationale for this is that it will represent that company have overall capacity to

develop high amount of income and effective understanding and financial strength of

the business. For this, company can use several technique and also useful for the

company to enhance the performance for business.

Debt Consolidation: It depict the overall process that can be used to

combine the different financial obligations by taking the developed factor into

the bigger financial duty. The overall objective or aim of this method is to keep

things away and the risk by taking different financial duties (Cioca, 2020). It

will result into the huge cost of financing and legal issues also. As per this

process, it will help in developing the overall financial performance of

business.

Maintaining positive income: Money is undertaken as the major factor for

business with positive income that turns into the effective duty of business to

keep up with the proper financial stability (White, McCoy and Watkins, 2021).

It is undertaken as the suitable justification for undertaking the income as the

key life saver of the company.

Minimize overhead expenses: The overhead expenses are undertaken the

essential cost that will help the business entity. These are considered as the

major functional cost that do not undertake any sort of profitability of business

venture which they made (Nesterenko, Krutova and Staverska, 2021). Along

with this, it is undertaken as the business to eliminate the overhead expenses

which an organization to enhance the income level and also guarantee

effective monetary dependability.

Professional help: Company can effectively depend on the professional help

in terms of working on the overall financial performance of business. The

financial stability and authority is helpful to work on the income of business

(Usama and Yusoff, 2018). As per the critical circumstance the consulting of

financial professional for the technical help is effective.

7

and discussing the processes this business might use to

improve their financial performance.

It is important for the company to have suitable financial performance. The

rationale for this is that it will represent that company have overall capacity to

develop high amount of income and effective understanding and financial strength of

the business. For this, company can use several technique and also useful for the

company to enhance the performance for business.

Debt Consolidation: It depict the overall process that can be used to

combine the different financial obligations by taking the developed factor into

the bigger financial duty. The overall objective or aim of this method is to keep

things away and the risk by taking different financial duties (Cioca, 2020). It

will result into the huge cost of financing and legal issues also. As per this

process, it will help in developing the overall financial performance of

business.

Maintaining positive income: Money is undertaken as the major factor for

business with positive income that turns into the effective duty of business to

keep up with the proper financial stability (White, McCoy and Watkins, 2021).

It is undertaken as the suitable justification for undertaking the income as the

key life saver of the company.

Minimize overhead expenses: The overhead expenses are undertaken the

essential cost that will help the business entity. These are considered as the

major functional cost that do not undertake any sort of profitability of business

venture which they made (Nesterenko, Krutova and Staverska, 2021). Along

with this, it is undertaken as the business to eliminate the overhead expenses

which an organization to enhance the income level and also guarantee

effective monetary dependability.

Professional help: Company can effectively depend on the professional help

in terms of working on the overall financial performance of business. The

financial stability and authority is helpful to work on the income of business

(Usama and Yusoff, 2018). As per the critical circumstance the consulting of

financial professional for the technical help is effective.

7

Liquidating resources: It leads to depict the significance of the concept of

economic and finance that prominently put emphasis on developing the business

organizations to the phases when the resources and assets of the business are

easily sold. Hence, it is considered as the general parties for the business which

are subjected to the liquidation.

Conclusion

From the above discussion it has been evaluated that it is very essential for

companies to apply financial management in order to operate business operations

smoothly. It has also been concluded that companies must understand financial

statements so that business could be run effectively and maximum level of

productivity could be achieved. It could also be examined that financial management

would help companies in achieving great level of advantages along with

accomplishing long term business goals. Lastly it could be said from the above

report that proper financial management helps companies in enhancing their

performance along with providing them competitive advantage in the market over

their rivals.

8

economic and finance that prominently put emphasis on developing the business

organizations to the phases when the resources and assets of the business are

easily sold. Hence, it is considered as the general parties for the business which

are subjected to the liquidation.

Conclusion

From the above discussion it has been evaluated that it is very essential for

companies to apply financial management in order to operate business operations

smoothly. It has also been concluded that companies must understand financial

statements so that business could be run effectively and maximum level of

productivity could be achieved. It could also be examined that financial management

would help companies in achieving great level of advantages along with

accomplishing long term business goals. Lastly it could be said from the above

report that proper financial management helps companies in enhancing their

performance along with providing them competitive advantage in the market over

their rivals.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Broyles, J., 2020. Financial management and real options.

Cioca, I.C., 2020. The Importance Of Financial Statements In The Decision-Making

Process. Annales Universitatis Apulensis Series Oeconomica, 1(22),

pp.73-83.

Jorge, S., de Jesus, M.A.J. and Nogueira, S.P., 2019. The use of budgetary and

financial information by politicians in parliament: a case study. Journal

of Public Budgeting, Accounting & Financial Management.

Lan, Y. and Li, X., 2021. A Brief Analysis of the Application of Enterprise’s Internal

Accounting and Financial Management in Computer. In E3S Web of

Conferences (Vol. 235). EDP Sciences.

Liu, H., 2020, April. Development Strategy Evaluation of Financial Information

Disclosure in Colleges and Universities Based on SWOT Method. In

Journal of Physics: Conference Series (Vol. 1533, No. 2, p. 022077).

IOP Publishing.

Nesterenko, O., Krutova, A. and Staverska, T., 2021. TRANSPARENCY OF

FINANCIAL REPORTING IN THE CONDITIONS OF MODERN

INFORMATION TECHNOLOGY. Research and Innovation, p.120.

Ukaigwe, P.C. and Igbozuruike, I.U., 2018. Education Law and Community

Participation in Financial Management of Secondary Schools in Rivers

State. Educational Research International, 7(3), pp.43-52.

Usama, K.M. and Yusoff, W.F.W., 2018. The relationship between entrepreneurs’

financial literacy and business performance among entrepreneurs of

Bauchi State Nigeria. International Journal of Entrepreneurship and

Business Innovation, 1(1), pp.15-26.

Veledar, B. and Letica, M., 2020, September. Challenges in Implementing the

Concept of Public Internal Financial Controls in the Public Sector of

Bosnia and Herzegovina. In Proceedings of the ENTRENOVA-

ENTerprise REsearch InNOVAtion Conference (Online) (Vol. 6, No. 1,

pp. 187-194).

White, K.J., McCoy, M. and Watkins, K., 2021. Resource Management:

Environmental Sustainability Across the Financial Literacy Curriculum.

Journal of Family & Consumer Sciences Education, 38(1).

Xu, H., 2019. Analysis of Enterprise Financial Management Innovation Under the

Background of “Internet+” Industry Convergence.

Zhang, M., 2020, December. Exploration of the Digital Transformation of Traditional

Enterprise Financial Management under the Background of Big Data. In

2020 International Conference on Big Data Economy and Information

Management (BDEIM) (pp. 5-8). IEEE.

9

Broyles, J., 2020. Financial management and real options.

Cioca, I.C., 2020. The Importance Of Financial Statements In The Decision-Making

Process. Annales Universitatis Apulensis Series Oeconomica, 1(22),

pp.73-83.

Jorge, S., de Jesus, M.A.J. and Nogueira, S.P., 2019. The use of budgetary and

financial information by politicians in parliament: a case study. Journal

of Public Budgeting, Accounting & Financial Management.

Lan, Y. and Li, X., 2021. A Brief Analysis of the Application of Enterprise’s Internal

Accounting and Financial Management in Computer. In E3S Web of

Conferences (Vol. 235). EDP Sciences.

Liu, H., 2020, April. Development Strategy Evaluation of Financial Information

Disclosure in Colleges and Universities Based on SWOT Method. In

Journal of Physics: Conference Series (Vol. 1533, No. 2, p. 022077).

IOP Publishing.

Nesterenko, O., Krutova, A. and Staverska, T., 2021. TRANSPARENCY OF

FINANCIAL REPORTING IN THE CONDITIONS OF MODERN

INFORMATION TECHNOLOGY. Research and Innovation, p.120.

Ukaigwe, P.C. and Igbozuruike, I.U., 2018. Education Law and Community

Participation in Financial Management of Secondary Schools in Rivers

State. Educational Research International, 7(3), pp.43-52.

Usama, K.M. and Yusoff, W.F.W., 2018. The relationship between entrepreneurs’

financial literacy and business performance among entrepreneurs of

Bauchi State Nigeria. International Journal of Entrepreneurship and

Business Innovation, 1(1), pp.15-26.

Veledar, B. and Letica, M., 2020, September. Challenges in Implementing the

Concept of Public Internal Financial Controls in the Public Sector of

Bosnia and Herzegovina. In Proceedings of the ENTRENOVA-

ENTerprise REsearch InNOVAtion Conference (Online) (Vol. 6, No. 1,

pp. 187-194).

White, K.J., McCoy, M. and Watkins, K., 2021. Resource Management:

Environmental Sustainability Across the Financial Literacy Curriculum.

Journal of Family & Consumer Sciences Education, 38(1).

Xu, H., 2019. Analysis of Enterprise Financial Management Innovation Under the

Background of “Internet+” Industry Convergence.

Zhang, M., 2020, December. Exploration of the Digital Transformation of Traditional

Enterprise Financial Management under the Background of Big Data. In

2020 International Conference on Big Data Economy and Information

Management (BDEIM) (pp. 5-8). IEEE.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Appendix:

(1) Income Statement

(2) Balance Sheet

10

(1) Income Statement

(2) Balance Sheet

10

(3) Business Review Template

11

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.