Financial Management Analysis of Financial Statements Report

VerifiedAdded on 2022/12/28

|28

|7095

|419

Report

AI Summary

This report provides a comprehensive analysis of financial management principles, focusing on financial statement analysis for decision-making. Part 1 delves into evaluating decision-making approaches, management accounting functions, and financial strategies to maximize shareholder value. It also examines the role of management accounting in financial control, fraud detection techniques, and strategies for improving decision-making. Part 2 analyzes financial ratios for Mothercare plc, justifying their use in operational and strategic decisions. It compares investment appraisal techniques, discusses the role of cash flow statements and break-even analysis, and recommends management accounting techniques for long-term financial stability. The report covers a wide range of topics from evaluating approaches and techniques, to financial control and monitoring, fraud detection, and investment appraisal techniques, providing a holistic view of financial management and its practical application.

PRINCIPLE OF FINANCIAL

MANAGEMENT ANALYSIS OF

FINANCIAL STATEMENTS FOR

DECISION MAKER

MANAGEMENT ANALYSIS OF

FINANCIAL STATEMENTS FOR

DECISION MAKER

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

ASSIGNMENT: PART 1................................................................................................................3

1.0 Introduction ..........................................................................................................................3

2.1 Evaluating approaches, techniques and factors contributing in decision-making along with

management accounting functions..............................................................................................3

3.0 Evaluation of Principles for effective and efficient financial strategies to maximize

shareholder value and fulfil needs...............................................................................................5

4.0 Analysing role and functions of management account in regard to financial control and

monitoring...................................................................................................................................6

5.0 Analysing techniques for fraud detection and prevention approaches for ethical decision-

making.........................................................................................................................................7

5. Recommending strategies to management accountants for improving decision-making.......9

6.0 Conclusion .........................................................................................................................11

References ................................................................................................................................11

ASSIGNMENT: PART 2..............................................................................................................12

1. Introduction ..........................................................................................................................12

2.0. Determining ratios of Mothercare plc................................................................................12

3.0. Justification for ratios that how they help company to take operational and strategic

decisions....................................................................................................................................21

4.0 Comparing as well as contrasting investment appraisal techniques and their assistance in

maximizing ROI........................................................................................................................23

5.0 Discussing the role of cash flow statement and break even analysis in decision-making. .24

6.0 Evaluating and recommending management accounting techniques for long term financial

stability and decision making....................................................................................................24

7.0 Conclusion..........................................................................................................................25

References ................................................................................................................................26

APPENDIX ...................................................................................................................................27

ASSIGNMENT: PART 1................................................................................................................3

1.0 Introduction ..........................................................................................................................3

2.1 Evaluating approaches, techniques and factors contributing in decision-making along with

management accounting functions..............................................................................................3

3.0 Evaluation of Principles for effective and efficient financial strategies to maximize

shareholder value and fulfil needs...............................................................................................5

4.0 Analysing role and functions of management account in regard to financial control and

monitoring...................................................................................................................................6

5.0 Analysing techniques for fraud detection and prevention approaches for ethical decision-

making.........................................................................................................................................7

5. Recommending strategies to management accountants for improving decision-making.......9

6.0 Conclusion .........................................................................................................................11

References ................................................................................................................................11

ASSIGNMENT: PART 2..............................................................................................................12

1. Introduction ..........................................................................................................................12

2.0. Determining ratios of Mothercare plc................................................................................12

3.0. Justification for ratios that how they help company to take operational and strategic

decisions....................................................................................................................................21

4.0 Comparing as well as contrasting investment appraisal techniques and their assistance in

maximizing ROI........................................................................................................................23

5.0 Discussing the role of cash flow statement and break even analysis in decision-making. .24

6.0 Evaluating and recommending management accounting techniques for long term financial

stability and decision making....................................................................................................24

7.0 Conclusion..........................................................................................................................25

References ................................................................................................................................26

APPENDIX ...................................................................................................................................27

ASSIGNMENT: PART 1

1.0 Introduction

Financial management refers to planning, organising, directing and controlling monetary

resources of an organisation. Further, it includes applying financial management principles to

manage organisation’s resources for longer stability of business. The retail sector of UK plays

wide role in contributing in growth of the economy. In addition to this, the chosen company in

the report is Mothercare plc which is an established British retailer. Additionally, Mothercare plc

offers wide range of clothing, footwear, home and travel. The current reports describe principles

of management and how they assist business to take strategic decisions.

Further, report highlights financial strategies for maximizing shareholder’s wealth. Along

with this, the current report gives emphasis on role and functions of management for financial

controlling and monitoring. With respect to this, the present reports show fraud detection and

prevention techniques for strategic decision making. In addition to this, the report gives details of

ratio of Mothercare plc and their justification for operational decisions. In aspect to this, report

elaborates three investment appraisal tools for maximizing ROI.

2.1 Evaluating approaches, techniques and factors contributing in decision-making along with

management accounting functions

There are several techniques and tools that management accountant uses for making

decisions in organizations. These approaches include decision matrix, Pare-to analysis, cost

benefit, conjoint, SWOT and PEST evaluation. In addition to this, every organization use these

tools according to suitability to its scale and business structure (Pedroso and Gomes, 2020).

With respect to decision-making process management functions helps the organization to

identify, implement and monitor chosen tools, etc. These management functions include

forecasting, organizing, coordinating, controlling, analysing, communicating, etc.

Decision matrix

It helps business to evaluate all the options of decisions by formulating matrix table

which clarifies all the factors that can affect business. In regard to this, score is given in table in

turn it makes management to forecast and analyse that the decision will be appropriate for

business growth or not. In this tool final score reveal that which option of decision is best. In

1.0 Introduction

Financial management refers to planning, organising, directing and controlling monetary

resources of an organisation. Further, it includes applying financial management principles to

manage organisation’s resources for longer stability of business. The retail sector of UK plays

wide role in contributing in growth of the economy. In addition to this, the chosen company in

the report is Mothercare plc which is an established British retailer. Additionally, Mothercare plc

offers wide range of clothing, footwear, home and travel. The current reports describe principles

of management and how they assist business to take strategic decisions.

Further, report highlights financial strategies for maximizing shareholder’s wealth. Along

with this, the current report gives emphasis on role and functions of management for financial

controlling and monitoring. With respect to this, the present reports show fraud detection and

prevention techniques for strategic decision making. In addition to this, the report gives details of

ratio of Mothercare plc and their justification for operational decisions. In aspect to this, report

elaborates three investment appraisal tools for maximizing ROI.

2.1 Evaluating approaches, techniques and factors contributing in decision-making along with

management accounting functions

There are several techniques and tools that management accountant uses for making

decisions in organizations. These approaches include decision matrix, Pare-to analysis, cost

benefit, conjoint, SWOT and PEST evaluation. In addition to this, every organization use these

tools according to suitability to its scale and business structure (Pedroso and Gomes, 2020).

With respect to decision-making process management functions helps the organization to

identify, implement and monitor chosen tools, etc. These management functions include

forecasting, organizing, coordinating, controlling, analysing, communicating, etc.

Decision matrix

It helps business to evaluate all the options of decisions by formulating matrix table

which clarifies all the factors that can affect business. In regard to this, score is given in table in

turn it makes management to forecast and analyse that the decision will be appropriate for

business growth or not. In this tool final score reveal that which option of decision is best. In

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

addition to this, management accountant uses this tool to organize, evaluate and control its

financial resources of organization to ensure impelling operations of business.

Pareto analysis

This tool is used by manager when organization need to make numerous decision at

single time. It assists business to prioritize decisions which is very essential for managing

organizational activities. It makes easy for firm to evaluate that which decision should be made

first by determining overall impact on business activities. Further, this tool helps business to

identify a proper procedure for managing different functions of business to assure that it’s all

activities are carry out in systematic manner.

Cost-Benefit analysis

This tool is very beneficial to enterprise for making decisions regarding financial

resources of organisation. There are several benefits and drawbacks that business get from usage

of this approach. In addition to this, it plays vital part in managing business functions by

determining respective benefits and cost that firm need to incur for functioning of organisation. It

is majorly used by those businesses whose motive is to reduce cost of products than quality

management.

SWOT analysis

It refers to analysis of internal and external environment of business that helps it to take

strategic decision. In addition to this, the techniques identify company's internal strength and

weakness to measure its performance (Wahyuni and Triatmanto, 2020.). Further, it evaluates

external environment of firm by assessing available opportunities and threats of market. In turn

this analysis helps business to make critical decision by considering all its internal and external

factors which can impact its overall performance (What is SWOT analysis? 2021). This approach

aid firm to improve its strategies of managing functions such as organising coordinating,

controlling, and analysing its resources of enterprise.

PEST analysis

It refers to evaluation of political, economic, social and technological macro factors that

can influence functioning of organization (Lebedev, 2019). This method helps business to know

present trends so that it can modify its strategies of managing management functions to deliver

effective product and service into the market. It is one of the best decision-making tool that

enable company to recognize its macro elements of environment.

financial resources of organization to ensure impelling operations of business.

Pareto analysis

This tool is used by manager when organization need to make numerous decision at

single time. It assists business to prioritize decisions which is very essential for managing

organizational activities. It makes easy for firm to evaluate that which decision should be made

first by determining overall impact on business activities. Further, this tool helps business to

identify a proper procedure for managing different functions of business to assure that it’s all

activities are carry out in systematic manner.

Cost-Benefit analysis

This tool is very beneficial to enterprise for making decisions regarding financial

resources of organisation. There are several benefits and drawbacks that business get from usage

of this approach. In addition to this, it plays vital part in managing business functions by

determining respective benefits and cost that firm need to incur for functioning of organisation. It

is majorly used by those businesses whose motive is to reduce cost of products than quality

management.

SWOT analysis

It refers to analysis of internal and external environment of business that helps it to take

strategic decision. In addition to this, the techniques identify company's internal strength and

weakness to measure its performance (Wahyuni and Triatmanto, 2020.). Further, it evaluates

external environment of firm by assessing available opportunities and threats of market. In turn

this analysis helps business to make critical decision by considering all its internal and external

factors which can impact its overall performance (What is SWOT analysis? 2021). This approach

aid firm to improve its strategies of managing functions such as organising coordinating,

controlling, and analysing its resources of enterprise.

PEST analysis

It refers to evaluation of political, economic, social and technological macro factors that

can influence functioning of organization (Lebedev, 2019). This method helps business to know

present trends so that it can modify its strategies of managing management functions to deliver

effective product and service into the market. It is one of the best decision-making tool that

enable company to recognize its macro elements of environment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

These are tools and approaches that can be used by organization to take strategic

decisions. Additionally, SWOT and PEST can be considered better techniques to conduct

decision process as it provides platform to analyse micro and macro factors that helps business to

manage functions of organization.

3.0 Evaluation of Principles for effective and efficient financial strategies to maximize

shareholder value and fulfil needs

There are several principles of financial management that helps organization to meet its

objective of increase wealth of shareholders along with company. These principles include

formation of optimal capital structure, considering time value of money, wealth maximization,

determining cost of capital, diversifying investment and borrowings, etc.

For making effective functioning organization require to make optimal capital structure

so that it can fulfil needs of its shareholders (Prasad, 2020). Whenever investors evaluate options

of investment their primary expectation from the company is to be efficient in optimizing its

capital structure. So that investors can understand financial plan of organization and take

decision regarding investment. Additionally, it is essential for company to follow this principle

to ensure that it is acting accordingly so that it can execute need of shareholders.

On the contrary note, it is also essential for the company to be aware with principle of

time value of money. This principle assist company to know what is expected from it in terms of

return on investors' capital. It decides the company's intentions in turn to safeguard interest of

investors. Through these shareholders evaluate that organization is accomplishing their needs

and maximizing wealth or not.

Another principle on which company needs to focus is cost of capital. Effective financial

management always does a comparison of financial reward and cost associated with it. In

addition, this assists it to decide interest rate because company need to fulfil its own

requirements also along with maximizing wealth of shareholders. If the cost of capital is more

than rate of return, then investors will not take interest in investing their capital in the company.

So it is essential for the organization to considering this principle to make sure that it is matching

with expectations of its shareholders.

In addition to this, forecasting cash flow plays vital function in making financial strategic

decision. There are various ways through which company can evaluate its cash flow to determine

company's liquidity ratio (Rikhardsson and Yigitbasioglu, 2018). The liquidity ratio measures

decisions. Additionally, SWOT and PEST can be considered better techniques to conduct

decision process as it provides platform to analyse micro and macro factors that helps business to

manage functions of organization.

3.0 Evaluation of Principles for effective and efficient financial strategies to maximize

shareholder value and fulfil needs

There are several principles of financial management that helps organization to meet its

objective of increase wealth of shareholders along with company. These principles include

formation of optimal capital structure, considering time value of money, wealth maximization,

determining cost of capital, diversifying investment and borrowings, etc.

For making effective functioning organization require to make optimal capital structure

so that it can fulfil needs of its shareholders (Prasad, 2020). Whenever investors evaluate options

of investment their primary expectation from the company is to be efficient in optimizing its

capital structure. So that investors can understand financial plan of organization and take

decision regarding investment. Additionally, it is essential for company to follow this principle

to ensure that it is acting accordingly so that it can execute need of shareholders.

On the contrary note, it is also essential for the company to be aware with principle of

time value of money. This principle assist company to know what is expected from it in terms of

return on investors' capital. It decides the company's intentions in turn to safeguard interest of

investors. Through these shareholders evaluate that organization is accomplishing their needs

and maximizing wealth or not.

Another principle on which company needs to focus is cost of capital. Effective financial

management always does a comparison of financial reward and cost associated with it. In

addition, this assists it to decide interest rate because company need to fulfil its own

requirements also along with maximizing wealth of shareholders. If the cost of capital is more

than rate of return, then investors will not take interest in investing their capital in the company.

So it is essential for the organization to considering this principle to make sure that it is matching

with expectations of its shareholders.

In addition to this, forecasting cash flow plays vital function in making financial strategic

decision. There are various ways through which company can evaluate its cash flow to determine

company's liquidity ratio (Rikhardsson and Yigitbasioglu, 2018). The liquidity ratio measures

organisation’s ability to pay its current obligations. In addition to this, it becomes crucial for

company to evaluate its cash flow to make investors assure that their invested capital is safe. It

will result in gaining trust of investors that can motivate company to deliver good outcomes to

shareholders.

On the other side, maximizing wealth is also stated as an essential principle of financial

management. For achieving this, management accountant need to consider all the above

mentioned principles to have maximization of wealth. In addition to this, along with following

strategic financial management principles company need to be effective and efficient in

managing financial resources and fulfilling necessarily of investors.

4.0 Analysing role and functions of management account in regard to financial control and

monitoring

Roles

Management accountant is accountable for commencement, formulating and efficient

functioning of organization. He is responsible for collecting, compiling, preparing report and

interpreting internal financial information of the company.

He is obligated to prepare frame work of the cost and financial report so that all

departments of organization can perform effectively. In addition to this, management accountant

computes the variance of all activities to compare the difference between estimated and actual

performance so that improvement actions can be taken. The important role of management

accountant is to interpret financial reports to check the current performance of company in turn it

can evaluate reasons for errors so that corrections can be made.

The main role of management accountant is to keep control over activities of all

departments to make sure that company is performing better than prior stage. Additionally,

preparation of reports and interpretation helps him to identify lacking areas where firm need to

monitor and control effectively to achieve desire outcome.

Functions

There are several functions of management accountant that clarifies his roles and

responsibility which depends on capacity of organization. In addition to this, these functions

include planning, controlling, reporting, coordinating, interpreting, evaluating, advising

government reporting, economic appraisal and protection of assets, etc.

company to evaluate its cash flow to make investors assure that their invested capital is safe. It

will result in gaining trust of investors that can motivate company to deliver good outcomes to

shareholders.

On the other side, maximizing wealth is also stated as an essential principle of financial

management. For achieving this, management accountant need to consider all the above

mentioned principles to have maximization of wealth. In addition to this, along with following

strategic financial management principles company need to be effective and efficient in

managing financial resources and fulfilling necessarily of investors.

4.0 Analysing role and functions of management account in regard to financial control and

monitoring

Roles

Management accountant is accountable for commencement, formulating and efficient

functioning of organization. He is responsible for collecting, compiling, preparing report and

interpreting internal financial information of the company.

He is obligated to prepare frame work of the cost and financial report so that all

departments of organization can perform effectively. In addition to this, management accountant

computes the variance of all activities to compare the difference between estimated and actual

performance so that improvement actions can be taken. The important role of management

accountant is to interpret financial reports to check the current performance of company in turn it

can evaluate reasons for errors so that corrections can be made.

The main role of management accountant is to keep control over activities of all

departments to make sure that company is performing better than prior stage. Additionally,

preparation of reports and interpretation helps him to identify lacking areas where firm need to

monitor and control effectively to achieve desire outcome.

Functions

There are several functions of management accountant that clarifies his roles and

responsibility which depends on capacity of organization. In addition to this, these functions

include planning, controlling, reporting, coordinating, interpreting, evaluating, advising

government reporting, economic appraisal and protection of assets, etc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

With respect to this, the important function of management accountant is plan standards

for cost, sale forecast, capital budgeting, production and profit planning, etc. In addition to this

controlling all these activities for effective performance of firm by examination of standard and

actual results. With respect to this accountant analyses all reports and interpret to share details of

all departments with top management for formulation of rules and regulations. Through this it

analyses level of control require for smooth functioning of organization.

Another function of management accountant is to coordinate activities of all department

by framing proper policies. Such type of coordination helps management accountant to create

healthy atmosphere between all departments and top-level of hierarchy. In addition to this,

evaluation of formulated policies is also done by management accountant to know that adopted

structure and procedure are effective and suitable to system or not. For this purpose, he has to

consult top executives and functional managers.

Along with these functions he has to advice management of organization to improve

performance of operations. In addition to this, business organization is liable to pay tax which

needs to be address by management accountant by preparing proper financial reports. In this

aspect he is expected to pay tax and maintain records that can be shown as evidence in case of

any legal obligation.

In aspect to this, management accountant is also responsible for acquiring knowledge

regarding current economic conditions to identify its influence on overall business activities.

With respect to this it is essential for accountant of the company to keep records of each

transaction and details regarding performance evaluation to obtain exact impact of present

economic condition. Furthermore, management accountant keep control over business activities

by adhering his all duty.

5.0 Analysing techniques for fraud detection and prevention approaches for ethical decision-

making

Fraud takes place in businesses regardless of type, scale and structure of organization.

Fraud detection helps business to highlights frauds that have already happened and are taking

place in business. It is beneficial for firm to prevent frauds as this helps business to forbid losses

as this ensure stability and existence of organization for long term (Jariya, Velnampy and Lanka,

2021). There are several techniques that help business to determine prevailing fraud in the

business some of which are as follows

for cost, sale forecast, capital budgeting, production and profit planning, etc. In addition to this

controlling all these activities for effective performance of firm by examination of standard and

actual results. With respect to this accountant analyses all reports and interpret to share details of

all departments with top management for formulation of rules and regulations. Through this it

analyses level of control require for smooth functioning of organization.

Another function of management accountant is to coordinate activities of all department

by framing proper policies. Such type of coordination helps management accountant to create

healthy atmosphere between all departments and top-level of hierarchy. In addition to this,

evaluation of formulated policies is also done by management accountant to know that adopted

structure and procedure are effective and suitable to system or not. For this purpose, he has to

consult top executives and functional managers.

Along with these functions he has to advice management of organization to improve

performance of operations. In addition to this, business organization is liable to pay tax which

needs to be address by management accountant by preparing proper financial reports. In this

aspect he is expected to pay tax and maintain records that can be shown as evidence in case of

any legal obligation.

In aspect to this, management accountant is also responsible for acquiring knowledge

regarding current economic conditions to identify its influence on overall business activities.

With respect to this it is essential for accountant of the company to keep records of each

transaction and details regarding performance evaluation to obtain exact impact of present

economic condition. Furthermore, management accountant keep control over business activities

by adhering his all duty.

5.0 Analysing techniques for fraud detection and prevention approaches for ethical decision-

making

Fraud takes place in businesses regardless of type, scale and structure of organization.

Fraud detection helps business to highlights frauds that have already happened and are taking

place in business. It is beneficial for firm to prevent frauds as this helps business to forbid losses

as this ensure stability and existence of organization for long term (Jariya, Velnampy and Lanka,

2021). There are several techniques that help business to determine prevailing fraud in the

business some of which are as follows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Whistle-blowing hotline service

There are several tools and methods that are used by businesses to prevent safeguard of

business value. It is a technique that allows confidential agents and employees of system to give

details of inappropriate activities to management of business. This tool helps business to reduce

risk and building trust as it allows manager to detect misconduct at initial stage. With help of this

technique management of organization can prevent business from fraudulent activities to avoid

losses.

Fraud Detection by internal and external auditor

External auditor determines frauds of business by analysing all financial statement of

businesses. External auditor has the authority to assess all reports of business even if

organization does not want to show (Ameen and et.al., 2018). This type of auditor perform his

duty accurately so audited statements are considered to be fair. In addition to this internal auditor

also performs same activities as external. Further, he makes process of detection easy by

analysing statements on daily basis that results in low possibility of misconduct in the future.

This is also good strategy to prevent firm from misconduct activities.

Fraud detection by accident

It is a passive detection which is discovered in organization by accident, confession or

consolidated notification by other party. This assist firm to know those unknown details that are

frequently happening in management in unsystematic manner. This is another technique that

enable business to forbid losses.

Risk management

It is an essential technique that helps business to identify areas of high risk which is the

first step in detecting fraud. Further, it does fraud risk assessments covering all relevant areas for

operations that provide business platform for making strategies sustainable and long term

organization (DONNING and et.al., 2019.). This tool also helps business to detect and prevent

all fraudulent actions in initial stage only. In addition, this, main motive this approach is to make

positive environment in organizations by reducing and eliminating inappropriate activity.

These are some techniques which aids business to take decision regarding its policies and

structure of management. In addition to this, it assists management to find errors of financial

reports and make reconciliation in these statements. Further, this fraud detection and prevention

techniques enable firm to evaluate higher risk areas so that it can take respective actions to

There are several tools and methods that are used by businesses to prevent safeguard of

business value. It is a technique that allows confidential agents and employees of system to give

details of inappropriate activities to management of business. This tool helps business to reduce

risk and building trust as it allows manager to detect misconduct at initial stage. With help of this

technique management of organization can prevent business from fraudulent activities to avoid

losses.

Fraud Detection by internal and external auditor

External auditor determines frauds of business by analysing all financial statement of

businesses. External auditor has the authority to assess all reports of business even if

organization does not want to show (Ameen and et.al., 2018). This type of auditor perform his

duty accurately so audited statements are considered to be fair. In addition to this internal auditor

also performs same activities as external. Further, he makes process of detection easy by

analysing statements on daily basis that results in low possibility of misconduct in the future.

This is also good strategy to prevent firm from misconduct activities.

Fraud detection by accident

It is a passive detection which is discovered in organization by accident, confession or

consolidated notification by other party. This assist firm to know those unknown details that are

frequently happening in management in unsystematic manner. This is another technique that

enable business to forbid losses.

Risk management

It is an essential technique that helps business to identify areas of high risk which is the

first step in detecting fraud. Further, it does fraud risk assessments covering all relevant areas for

operations that provide business platform for making strategies sustainable and long term

organization (DONNING and et.al., 2019.). This tool also helps business to detect and prevent

all fraudulent actions in initial stage only. In addition, this, main motive this approach is to make

positive environment in organizations by reducing and eliminating inappropriate activity.

These are some techniques which aids business to take decision regarding its policies and

structure of management. In addition to this, it assists management to find errors of financial

reports and make reconciliation in these statements. Further, this fraud detection and prevention

techniques enable firm to evaluate higher risk areas so that it can take respective actions to

minimize these hazard effects on business activities (Zainal, Som and Mohamed,2017).

Furthermore, these approaches avail information related to its employees and departments so that

it can implement needed monitor and control technique to improve performance of business

concern. Additionally, management of organization get proper mechanism for preparing reports

which helps business to avoid further frauds.

5. Recommending strategies to management accountants for improving decision-making

There are several ways through which management accountant can improve decision-

making process to have effective and efficient business structure.

It can be recommended that management accountant need to have proper understanding

of all financial information that is important for business to grow. In addition to this,

proper reading of financial reports assists management accountant to have greater

understanding of business position. With respect to this, it can aid accountant to take

effective business decisions that makes the process of decision-making effective.

Further, it is also recommended that management accountant should keep continuous

monitoring on its activities to match its policies with financial governance standard.

Additionally, complying with financial management governance rules and regulations

enable accountant to take accurate decisions. It will help business to enhance its

productivity of employees as proper framework can be provided regarding their roles and

responsibility. in aspect to this, it will remove confusion among employees that will lead

in proper functioning of organisation.

It is to be suggested that management accountant should use modern budgetary system

which will help him to get accurate details of monetary resources. Further, modern

budgetary system will assist account to achieve desirable operation performance. With

respect to this, it will provide accurate information regarding sales and profit as modern

budgetary system considers all important costs for formulation of budget. With respect to

this budgetary system will give estimated figures to accountant so that he can compare

historical performance with current. Additionally, evaluated performance will aid

management accountant to take better strategic decisions.

Further, it can be advised that using current techniques rather than traditional approaches

for decision-making can reduce inaccuracy and inefficiency which result in higher

Furthermore, these approaches avail information related to its employees and departments so that

it can implement needed monitor and control technique to improve performance of business

concern. Additionally, management of organization get proper mechanism for preparing reports

which helps business to avoid further frauds.

5. Recommending strategies to management accountants for improving decision-making

There are several ways through which management accountant can improve decision-

making process to have effective and efficient business structure.

It can be recommended that management accountant need to have proper understanding

of all financial information that is important for business to grow. In addition to this,

proper reading of financial reports assists management accountant to have greater

understanding of business position. With respect to this, it can aid accountant to take

effective business decisions that makes the process of decision-making effective.

Further, it is also recommended that management accountant should keep continuous

monitoring on its activities to match its policies with financial governance standard.

Additionally, complying with financial management governance rules and regulations

enable accountant to take accurate decisions. It will help business to enhance its

productivity of employees as proper framework can be provided regarding their roles and

responsibility. in aspect to this, it will remove confusion among employees that will lead

in proper functioning of organisation.

It is to be suggested that management accountant should use modern budgetary system

which will help him to get accurate details of monetary resources. Further, modern

budgetary system will assist account to achieve desirable operation performance. With

respect to this, it will provide accurate information regarding sales and profit as modern

budgetary system considers all important costs for formulation of budget. With respect to

this budgetary system will give estimated figures to accountant so that he can compare

historical performance with current. Additionally, evaluated performance will aid

management accountant to take better strategic decisions.

Further, it can be advised that using current techniques rather than traditional approaches

for decision-making can reduce inaccuracy and inefficiency which result in higher

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

productivity. In aspect to this, it provides assistance to firm to have fair current position

of business that enable business to make modification in prevailing strategies.

Furthermore, benchmarking method should be adopted by management accountant for

evaluating standard performance with actual outcomes. This is the best technique to

analyse deviation in performance of all departments which assist business to take crucial

decisions. Additionally, benchmarking sets standards for performance of each activity

that motivates employees of business to performance better. This strategy not only

improves accountant decision-making skill but also gives various better opportunity for

growth to firm.

In addition to this, management accountant should develop the skill for effective

decision-making so that he can choose better alternative for progress of business.

Additionally, accountant should be capable of identifying consequences related to each

decision so that better performance can be achieved. Further, it is essential for

management account to make alternative solutions for each situation to evaluate better

strategy. Additionally, it will aid management of organisation to be confident for its

decision as every possible risk can be evaluated by comparing each option.

Another important suggestion for management accountant is that he should be capable of

analysing financial statement in appropriate manner so that correct interpretations can be

achieved. This will enable the management of business to be in position to take suitable

decisions related to circumstances of organisation. With respect to this, it is important or

management account to analyse, interpret and control each financial information for

better understanding of changing circumstances of firm.

Additionally, it can be suggested to management accountant that involving your team-

mates for taking decision related to their departments. With respect to this, it will help

accountant to understand perception of employees so that appropriate decision can be

taken so that such decision will motivate employees to enhance their productivity.

Another suggestion management accountant is that way of communication adopted by

him should be effective so that it can be simply understood by all workers in corrective

manner. In regards to this, the management accountant should choose the best choice

among ways of communication as at end it is essential for employees understand their

roles and responsibility clearly.

of business that enable business to make modification in prevailing strategies.

Furthermore, benchmarking method should be adopted by management accountant for

evaluating standard performance with actual outcomes. This is the best technique to

analyse deviation in performance of all departments which assist business to take crucial

decisions. Additionally, benchmarking sets standards for performance of each activity

that motivates employees of business to performance better. This strategy not only

improves accountant decision-making skill but also gives various better opportunity for

growth to firm.

In addition to this, management accountant should develop the skill for effective

decision-making so that he can choose better alternative for progress of business.

Additionally, accountant should be capable of identifying consequences related to each

decision so that better performance can be achieved. Further, it is essential for

management account to make alternative solutions for each situation to evaluate better

strategy. Additionally, it will aid management of organisation to be confident for its

decision as every possible risk can be evaluated by comparing each option.

Another important suggestion for management accountant is that he should be capable of

analysing financial statement in appropriate manner so that correct interpretations can be

achieved. This will enable the management of business to be in position to take suitable

decisions related to circumstances of organisation. With respect to this, it is important or

management account to analyse, interpret and control each financial information for

better understanding of changing circumstances of firm.

Additionally, it can be suggested to management accountant that involving your team-

mates for taking decision related to their departments. With respect to this, it will help

accountant to understand perception of employees so that appropriate decision can be

taken so that such decision will motivate employees to enhance their productivity.

Another suggestion management accountant is that way of communication adopted by

him should be effective so that it can be simply understood by all workers in corrective

manner. In regards to this, the management accountant should choose the best choice

among ways of communication as at end it is essential for employees understand their

roles and responsibility clearly.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6.0 Conclusion

From the above study it can be concluded that management accounting techniques helps

business to take various strategic decision. In addition to this, the reports have given

management techniques such as decision matrix, pare-to analysis, SWOT and PEST evaluation.

The report has explained tools like cost of capital, time value of money, etc for maximizing

shareholder’s wealth. Furthermore, present report gives details of management accountant role

and functions which implies organising, monitoring, preparing reports, etc of financial

information for better functioning of organisation. With respect to this, reports recommend

management accountant of the company to understand interpret financial information properly,

utilization of modern budgetary system, etc.

References

Books and journals

Ameen and et.al., 2018. The Impact of Management Accounting and How It Can Be

Implemented into the Organizational Culture. Dutch Journal of Finance and

Management. 2(1). p.02.

DONNING, H. and et.al., 2019. Prevention and Detection for Risk and Fraud in the Digital Age–

the Current Situation. ACRN Oxford Journal of Finance and Risk Perspectives. 8.

pp.86-97.

Jariya, A. M. I., Velnampy, T. and Lanka, O., 2021. Management Accounting Research

Approaches: A Critical Review. International Journal of Financial Research. 12(1).

Lebedev, P., 2019. Management Accounting Maturity Levels Continuum Model: a Conceptual

Framework. European Journal of Economics and Business Studies. 5(1). pp.24-36.

Pedroso, E. and Gomes, C. F., 2020. The effectiveness of management accounting systems in

SMEs: a multidimensional measurement approach. Journal of Applied Accounting

Research.

Prasad, L. M., 2020. Principles and practice of management. Sultan Chand & Sons.

Rikhardsson, P. and Yigitbasioglu, O., 2018. Business intelligence & analytics in management

accounting research: Status and future focus. International Journal of Accounting

Information Systems. 29. pp.37-58.

Wahyuni, N. and Triatmanto, B., 2020. The effect of the organizational change on company

performance mediated by changes in management accounting practices. Accounting.

6(4). pp.581-588.

Zainal, R., Som, A. M. and Mohamed, N., 2017. A review on computer technology applications

in fraud detection and prevention. Management & Accounting Review (MAR). 16(2).

pp.59-72.

Online

What is SWOT analysis? 2021. [Online]. Available through:

<https://www.mindtools.com/pages/article/newTMC_05.htm>

From the above study it can be concluded that management accounting techniques helps

business to take various strategic decision. In addition to this, the reports have given

management techniques such as decision matrix, pare-to analysis, SWOT and PEST evaluation.

The report has explained tools like cost of capital, time value of money, etc for maximizing

shareholder’s wealth. Furthermore, present report gives details of management accountant role

and functions which implies organising, monitoring, preparing reports, etc of financial

information for better functioning of organisation. With respect to this, reports recommend

management accountant of the company to understand interpret financial information properly,

utilization of modern budgetary system, etc.

References

Books and journals

Ameen and et.al., 2018. The Impact of Management Accounting and How It Can Be

Implemented into the Organizational Culture. Dutch Journal of Finance and

Management. 2(1). p.02.

DONNING, H. and et.al., 2019. Prevention and Detection for Risk and Fraud in the Digital Age–

the Current Situation. ACRN Oxford Journal of Finance and Risk Perspectives. 8.

pp.86-97.

Jariya, A. M. I., Velnampy, T. and Lanka, O., 2021. Management Accounting Research

Approaches: A Critical Review. International Journal of Financial Research. 12(1).

Lebedev, P., 2019. Management Accounting Maturity Levels Continuum Model: a Conceptual

Framework. European Journal of Economics and Business Studies. 5(1). pp.24-36.

Pedroso, E. and Gomes, C. F., 2020. The effectiveness of management accounting systems in

SMEs: a multidimensional measurement approach. Journal of Applied Accounting

Research.

Prasad, L. M., 2020. Principles and practice of management. Sultan Chand & Sons.

Rikhardsson, P. and Yigitbasioglu, O., 2018. Business intelligence & analytics in management

accounting research: Status and future focus. International Journal of Accounting

Information Systems. 29. pp.37-58.

Wahyuni, N. and Triatmanto, B., 2020. The effect of the organizational change on company

performance mediated by changes in management accounting practices. Accounting.

6(4). pp.581-588.

Zainal, R., Som, A. M. and Mohamed, N., 2017. A review on computer technology applications

in fraud detection and prevention. Management & Accounting Review (MAR). 16(2).

pp.59-72.

Online

What is SWOT analysis? 2021. [Online]. Available through:

<https://www.mindtools.com/pages/article/newTMC_05.htm>

ASSIGNMENT: PART 2

1. Introduction

The current report evaluates the ratios for the Mothercare plc which are appropriate for

determing essential decisions. Additionally, the report explains techniques, tools and approaches

that helps business to take strategic business decisions along with functions of management. It

entails the role of cash flow statement and break even analysis in regard to strategic decision-

making. The current study recommends management accounting techniques for longer financial

stability of Mothercare plc.

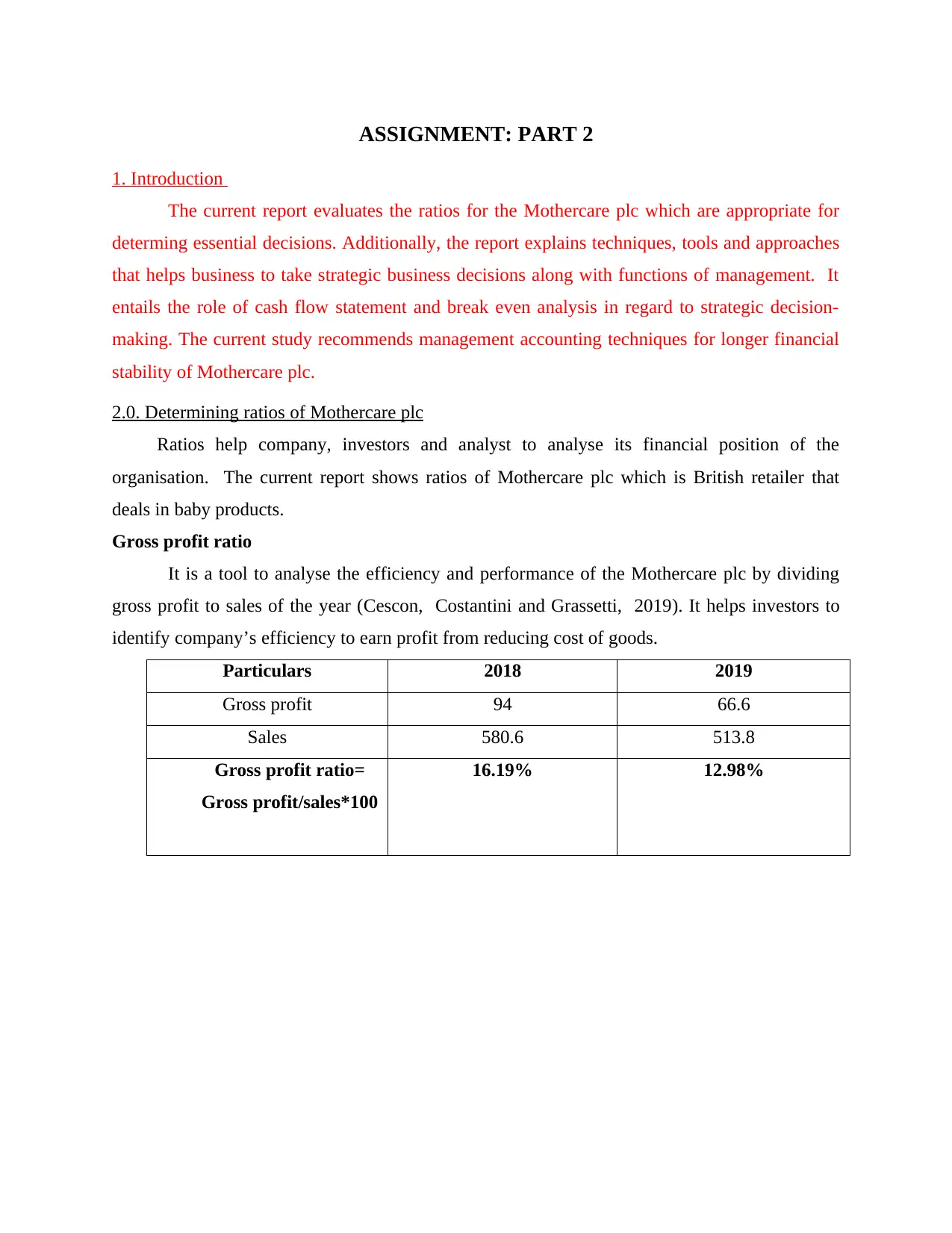

2.0. Determining ratios of Mothercare plc

Ratios help company, investors and analyst to analyse its financial position of the

organisation. The current report shows ratios of Mothercare plc which is British retailer that

deals in baby products.

Gross profit ratio

It is a tool to analyse the efficiency and performance of the Mothercare plc by dividing

gross profit to sales of the year (Cescon, Costantini and Grassetti, 2019). It helps investors to

identify company’s efficiency to earn profit from reducing cost of goods.

Particulars 2018 2019

Gross profit 94 66.6

Sales 580.6 513.8

Gross profit ratio=

Gross profit/sales*100

16.19% 12.98%

1. Introduction

The current report evaluates the ratios for the Mothercare plc which are appropriate for

determing essential decisions. Additionally, the report explains techniques, tools and approaches

that helps business to take strategic business decisions along with functions of management. It

entails the role of cash flow statement and break even analysis in regard to strategic decision-

making. The current study recommends management accounting techniques for longer financial

stability of Mothercare plc.

2.0. Determining ratios of Mothercare plc

Ratios help company, investors and analyst to analyse its financial position of the

organisation. The current report shows ratios of Mothercare plc which is British retailer that

deals in baby products.

Gross profit ratio

It is a tool to analyse the efficiency and performance of the Mothercare plc by dividing

gross profit to sales of the year (Cescon, Costantini and Grassetti, 2019). It helps investors to

identify company’s efficiency to earn profit from reducing cost of goods.

Particulars 2018 2019

Gross profit 94 66.6

Sales 580.6 513.8

Gross profit ratio=

Gross profit/sales*100

16.19% 12.98%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.