MBA Financial Management: Capital Budgeting Evaluation of Jet Airways

VerifiedAdded on 2023/04/26

|14

|3214

|293

Report

AI Summary

This report presents a financial analysis of Jet Airways' proposed 'Project Beta,' which involves offering a Business Class service. The analysis incorporates revenue projections based on a customer base of 2100 paying RM 3100 per annum, with a 10% annual increase, and considers expenses like maintenance, crew costs, and depreciation. Investment appraisal tools, including Net Present Value (NPV) of RM 6.91 million, Internal Rate of Return (IRR) of 32%, and a payback period of 2.49 years, are applied to assess the project's financial viability. The report recommends accepting the project, as it promises to increase stakeholder wealth, and highlights the importance of considering both return and risk in alignment with company objectives.

Running head: FINANCIAL MANAGEMENT

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MANAGEMENT

Executive Summary

The aim of the assignment is to conduct a financial analysis on the expansion project that will be

initiated by the Jet Airways Company. The analysis of the investment will be done after taking

key expenses from the company in the trend period. The revenue of the company will be

generated from the various customers that will be using the services provided by the Jet Airways

for the Business Class Services. The revenue and expenses of the company has been taken at an

increasing trend of about 10% per year. The net profit of the project was derived after adding up

all the sources of income that will be generated by the company and key expenses that will be

incurred on a yearly basis by the company. The depreciation being non-cash expenses was added

back to the net profit of the company. Investment Appraisal tools like Net Present Value, Internal

Rate of Return and Payback period was applied for assessing the financial viability of the

project. The profitability and the return generated by the expansion project was considered to be

viable as the acceptance of the project will increase the wealth of the stakeholders of the

company.

Executive Summary

The aim of the assignment is to conduct a financial analysis on the expansion project that will be

initiated by the Jet Airways Company. The analysis of the investment will be done after taking

key expenses from the company in the trend period. The revenue of the company will be

generated from the various customers that will be using the services provided by the Jet Airways

for the Business Class Services. The revenue and expenses of the company has been taken at an

increasing trend of about 10% per year. The net profit of the project was derived after adding up

all the sources of income that will be generated by the company and key expenses that will be

incurred on a yearly basis by the company. The depreciation being non-cash expenses was added

back to the net profit of the company. Investment Appraisal tools like Net Present Value, Internal

Rate of Return and Payback period was applied for assessing the financial viability of the

project. The profitability and the return generated by the expansion project was considered to be

viable as the acceptance of the project will increase the wealth of the stakeholders of the

company.

2FINANCIAL MANAGEMENT

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Capital Budgeting........................................................................................................................3

Net Present Value........................................................................................................................5

Internal Rate of Return................................................................................................................5

Payback Period and Discounted Payback Period........................................................................6

Recommendation.............................................................................................................................7

Conclusion.......................................................................................................................................8

References........................................................................................................................................9

Appendix........................................................................................................................................11

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Capital Budgeting........................................................................................................................3

Net Present Value........................................................................................................................5

Internal Rate of Return................................................................................................................5

Payback Period and Discounted Payback Period........................................................................6

Recommendation.............................................................................................................................7

Conclusion.......................................................................................................................................8

References........................................................................................................................................9

Appendix........................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MANAGEMENT

Introduction

Evaluation of Capital Budgeting Project from the perspective of Jet Airways Company

for the expansion of the various products and services of the company. Expansion of the services

of the Airways Company in the form of providing Business Class Services to the consumers is

the plan presented. The company will be incurring fixed costs in the form of purchase of

equipment’s or assets for the company as well as direct operational expenses for the operations

of the company. Financial Sustainability and viability of a project plays a crucial role in the long-

term so that the company is able to create wealth for the shareholders of the company (Rossi

2015). The viability of the expansion project was done by analysing the same with the use of Net

Present Value, Internal Rate of Return and Payback Period. Various factors and conditions needs

to be taken into consideration while analysing the viability and sustainability of the project.

Expansion of the business services in the form of increasing the products and services provided

by the Jet Airways will be taken into account depending on the profitability and sustainability of

the project (Burns and Walker 2015).

Discussion

Capital Budgeting

The investment assessment tools will be applied by the company for assessing the

sustainability will be the NPV, IRR and Payback Period that will be guiding the company on the

fact of accepting or rejecting a project. The Capital Budgeting will help the company whether the

initial invested capital is generating significant returns for the company (Rossi 2014).

The revenue of the company was said to be primarily contributed from the business class

services that the company will be providing. The customer base of the company was taken at

Introduction

Evaluation of Capital Budgeting Project from the perspective of Jet Airways Company

for the expansion of the various products and services of the company. Expansion of the services

of the Airways Company in the form of providing Business Class Services to the consumers is

the plan presented. The company will be incurring fixed costs in the form of purchase of

equipment’s or assets for the company as well as direct operational expenses for the operations

of the company. Financial Sustainability and viability of a project plays a crucial role in the long-

term so that the company is able to create wealth for the shareholders of the company (Rossi

2015). The viability of the expansion project was done by analysing the same with the use of Net

Present Value, Internal Rate of Return and Payback Period. Various factors and conditions needs

to be taken into consideration while analysing the viability and sustainability of the project.

Expansion of the business services in the form of increasing the products and services provided

by the Jet Airways will be taken into account depending on the profitability and sustainability of

the project (Burns and Walker 2015).

Discussion

Capital Budgeting

The investment assessment tools will be applied by the company for assessing the

sustainability will be the NPV, IRR and Payback Period that will be guiding the company on the

fact of accepting or rejecting a project. The Capital Budgeting will help the company whether the

initial invested capital is generating significant returns for the company (Rossi 2014).

The revenue of the company was said to be primarily contributed from the business class

services that the company will be providing. The customer base of the company was taken at

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MANAGEMENT

2100 customers per annum who will be paying a sum of RM 3100 for the business class services.

The revenue of the company in the first initial year for the company will be around RM6.51mn.

The revenue base of the company is expected to increase for the company implying that the

demand for the services of the company is expected to increase in the trend period analysed for

the company. The expenses of the company is expected to also increase by about 10% for the

company (Andor, Mohanty and Toth 2015). The key expenses that the company will be incurring

is the maintenance cost on crew, maintenance materials, refreshment benefits, cabin crew costs,

overhead expenses and depreciation rate. The initial investment for the purchase of the

equipment’s of the company will be depreciated over a five year of useful life of the asset. It has

been assumed that the asset would not be having any salvage value at the end of the investment

project. Depreciation is a non-cash expenses which was shown in the account for showing that

the company would be getting a tax benefit from the same (Sari and Kahraman 2015). The

taxation rate at which the profits of the investment project will be charged will be the 25% tax

rate. The profit generated from the project in each of the following year was taken into

consideration for the purpose of the analysis of the company. Business factors and macro-

economic factors like interest rate, level of inflation rate, various government policies that may

significantly influence the operations of the company has been well taken into consideration

while analysing the investment project of the company. The expenses of the company for the

various operational and management work has been taken at an increasing rate of about 10% per

year for the company. The market research cost that has been incurred by the company

amounting RM 250,000 will be treated as a sunk cost and will not be added in the overall

expenses of the company. The nature and characteristics of the sunk cost of the company is the

cost that is already incurred and cannot be recovered thus the same has not been included in the

2100 customers per annum who will be paying a sum of RM 3100 for the business class services.

The revenue of the company in the first initial year for the company will be around RM6.51mn.

The revenue base of the company is expected to increase for the company implying that the

demand for the services of the company is expected to increase in the trend period analysed for

the company. The expenses of the company is expected to also increase by about 10% for the

company (Andor, Mohanty and Toth 2015). The key expenses that the company will be incurring

is the maintenance cost on crew, maintenance materials, refreshment benefits, cabin crew costs,

overhead expenses and depreciation rate. The initial investment for the purchase of the

equipment’s of the company will be depreciated over a five year of useful life of the asset. It has

been assumed that the asset would not be having any salvage value at the end of the investment

project. Depreciation is a non-cash expenses which was shown in the account for showing that

the company would be getting a tax benefit from the same (Sari and Kahraman 2015). The

taxation rate at which the profits of the investment project will be charged will be the 25% tax

rate. The profit generated from the project in each of the following year was taken into

consideration for the purpose of the analysis of the company. Business factors and macro-

economic factors like interest rate, level of inflation rate, various government policies that may

significantly influence the operations of the company has been well taken into consideration

while analysing the investment project of the company. The expenses of the company for the

various operational and management work has been taken at an increasing rate of about 10% per

year for the company. The market research cost that has been incurred by the company

amounting RM 250,000 will be treated as a sunk cost and will not be added in the overall

expenses of the company. The nature and characteristics of the sunk cost of the company is the

cost that is already incurred and cannot be recovered thus the same has not been included in the

5FINANCIAL MANAGEMENT

analysis of the expansion project. The applicable discount rate that was applied for the evaluation

of the profitability of the project would be 12% showing the minimum required return by the

project for the capital investment and the risk it would be taking (de Andrés, de Fuente and San

Martín 2015). The overhead expenses taken by the company was around 50% of the given

amount as the amount given represents existing fixed cost, which is related to an existing

company fixed cost. For the purpose of the evaluation of the net present value and viability of the

company, it is necessary for calculating the correct overhead expenses.

Net Present Value

The net present value of the investment project shows the overall profitability of the

project after taking all the cash inflows and outflows of the company. The net present value of

the company takes the discount rate as the key factor into analysis of the profitability of the

project. The net present value of the project shows exactly the amount by which the wealth of the

shareholders will be created from acceptance or rejection of a project. The net present value of

the expansion project was around RM 6.91 million (Daunfeldt and Hartwig 2014). The net

present value of the project shows that if Jet Airways goes ahead with the expansion project it

would be creating a wealth of the stakeholders of the company. The key benefit of applying the

net present value method will be it will be capturing all the cash flows irrespective of the timing

of the cash flows and pattern of cash flows. Both conventional and non-conventional cash flow

pattern gets reflected in the same. The result from the Net Present Value says that Jet Airways

should accept the expansion project as the demand for the new services will be taken by a wide

base of customers (Chittenden and Derregia 2015).

analysis of the expansion project. The applicable discount rate that was applied for the evaluation

of the profitability of the project would be 12% showing the minimum required return by the

project for the capital investment and the risk it would be taking (de Andrés, de Fuente and San

Martín 2015). The overhead expenses taken by the company was around 50% of the given

amount as the amount given represents existing fixed cost, which is related to an existing

company fixed cost. For the purpose of the evaluation of the net present value and viability of the

company, it is necessary for calculating the correct overhead expenses.

Net Present Value

The net present value of the investment project shows the overall profitability of the

project after taking all the cash inflows and outflows of the company. The net present value of

the company takes the discount rate as the key factor into analysis of the profitability of the

project. The net present value of the project shows exactly the amount by which the wealth of the

shareholders will be created from acceptance or rejection of a project. The net present value of

the expansion project was around RM 6.91 million (Daunfeldt and Hartwig 2014). The net

present value of the project shows that if Jet Airways goes ahead with the expansion project it

would be creating a wealth of the stakeholders of the company. The key benefit of applying the

net present value method will be it will be capturing all the cash flows irrespective of the timing

of the cash flows and pattern of cash flows. Both conventional and non-conventional cash flow

pattern gets reflected in the same. The result from the Net Present Value says that Jet Airways

should accept the expansion project as the demand for the new services will be taken by a wide

base of customers (Chittenden and Derregia 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MANAGEMENT

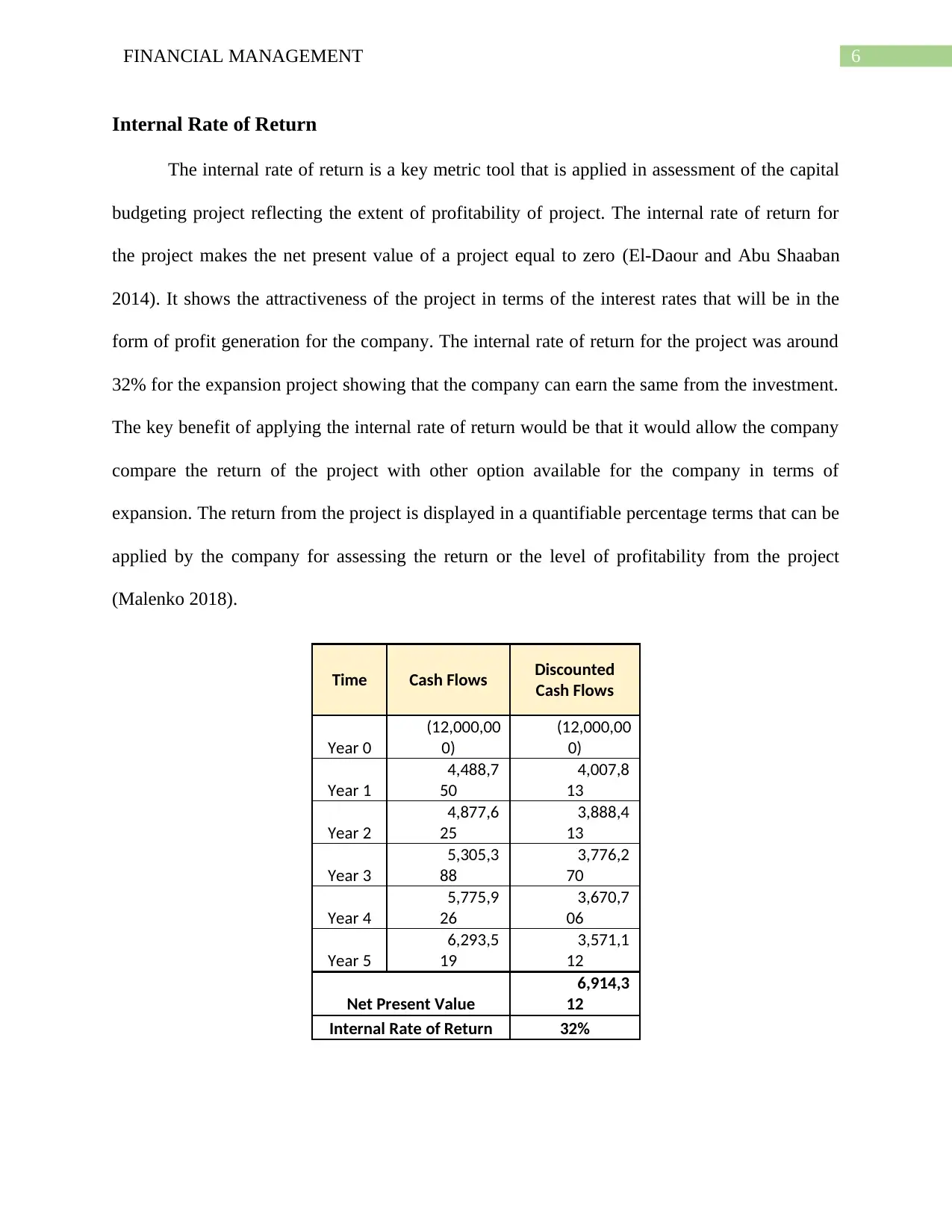

Internal Rate of Return

The internal rate of return is a key metric tool that is applied in assessment of the capital

budgeting project reflecting the extent of profitability of project. The internal rate of return for

the project makes the net present value of a project equal to zero (El-Daour and Abu Shaaban

2014). It shows the attractiveness of the project in terms of the interest rates that will be in the

form of profit generation for the company. The internal rate of return for the project was around

32% for the expansion project showing that the company can earn the same from the investment.

The key benefit of applying the internal rate of return would be that it would allow the company

compare the return of the project with other option available for the company in terms of

expansion. The return from the project is displayed in a quantifiable percentage terms that can be

applied by the company for assessing the return or the level of profitability from the project

(Malenko 2018).

Time Cash Flows Discounted

Cash Flows

Year 0

(12,000,00

0)

(12,000,00

0)

Year 1

4,488,7

50

4,007,8

13

Year 2

4,877,6

25

3,888,4

13

Year 3

5,305,3

88

3,776,2

70

Year 4

5,775,9

26

3,670,7

06

Year 5

6,293,5

19

3,571,1

12

Net Present Value

6,914,3

12

Internal Rate of Return 32%

Internal Rate of Return

The internal rate of return is a key metric tool that is applied in assessment of the capital

budgeting project reflecting the extent of profitability of project. The internal rate of return for

the project makes the net present value of a project equal to zero (El-Daour and Abu Shaaban

2014). It shows the attractiveness of the project in terms of the interest rates that will be in the

form of profit generation for the company. The internal rate of return for the project was around

32% for the expansion project showing that the company can earn the same from the investment.

The key benefit of applying the internal rate of return would be that it would allow the company

compare the return of the project with other option available for the company in terms of

expansion. The return from the project is displayed in a quantifiable percentage terms that can be

applied by the company for assessing the return or the level of profitability from the project

(Malenko 2018).

Time Cash Flows Discounted

Cash Flows

Year 0

(12,000,00

0)

(12,000,00

0)

Year 1

4,488,7

50

4,007,8

13

Year 2

4,877,6

25

3,888,4

13

Year 3

5,305,3

88

3,776,2

70

Year 4

5,775,9

26

3,670,7

06

Year 5

6,293,5

19

3,571,1

12

Net Present Value

6,914,3

12

Internal Rate of Return 32%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MANAGEMENT

Payback Period and Discounted Payback Period

The payback period shows the length or the time taken by the project for paying back the

initial investment amount. It show the recovery of the initial capital in the due course of the

project. The cash flows of the projects must be assessed in accordance with the various

requirement of the company financial plan and objectives so that it is well able to plan and

execute the operations of the company (Mendes-Da-Silva and Saito 2014). The payback period

would allow the company get an estimate about the timing of the cash flows of the project and

the time from which the profits of the project would start coming after the recovery of the initial

capital. The payback period for the project was around 2.49 years indicating that the recovery of

the initial investment would be done in the first 2.49 years and after that, the company would be

receiving profit from the project. The key limitation of the payback period could be considered

as the application of relevant discount rate in the scenario. The discounted payback period gives

a more realistic approach for the assessment of the cash flows from the project (Nurullah and

Kengatharan 2015). The discounted payback period for the company would take the 12%

discount rate by discounting the cash flows that will be flowing to the company so that the

company gets to know a more realistic approach for the cash flow pattern. The discounted

payback period for the project was around 3.09 years indicating that the company will be able to

receive the initial amount of capital in 3.09 years and later on the profits from the project would

start coming (Appendix 1). Based on the above analysis and the timing of the cash flows the

expansion project should be accepted by the company as the recovery of the initial investment of

capital will be done by the company at an early stage by the company (Rigopoulos 2015).

Payback Period and Discounted Payback Period

The payback period shows the length or the time taken by the project for paying back the

initial investment amount. It show the recovery of the initial capital in the due course of the

project. The cash flows of the projects must be assessed in accordance with the various

requirement of the company financial plan and objectives so that it is well able to plan and

execute the operations of the company (Mendes-Da-Silva and Saito 2014). The payback period

would allow the company get an estimate about the timing of the cash flows of the project and

the time from which the profits of the project would start coming after the recovery of the initial

capital. The payback period for the project was around 2.49 years indicating that the recovery of

the initial investment would be done in the first 2.49 years and after that, the company would be

receiving profit from the project. The key limitation of the payback period could be considered

as the application of relevant discount rate in the scenario. The discounted payback period gives

a more realistic approach for the assessment of the cash flows from the project (Nurullah and

Kengatharan 2015). The discounted payback period for the company would take the 12%

discount rate by discounting the cash flows that will be flowing to the company so that the

company gets to know a more realistic approach for the cash flow pattern. The discounted

payback period for the project was around 3.09 years indicating that the company will be able to

receive the initial amount of capital in 3.09 years and later on the profits from the project would

start coming (Appendix 1). Based on the above analysis and the timing of the cash flows the

expansion project should be accepted by the company as the recovery of the initial investment of

capital will be done by the company at an early stage by the company (Rigopoulos 2015).

8FINANCIAL MANAGEMENT

Recommendation

Return and risk are some of the important factors in an investment project and the same

should be in accordance with the objectives and policies of the company. The return generated

by the project shows that the company should accept the project as the shareholders of the

company would be benefitted from the same (Schlegel, Frank and Britzelmaier 2016). The

business class service would allow the company serves premium class services to the customers

and in turn enjoy a wider revenue and customer’s base for the company. RM 6.91 million of net

profitability from the investment project and a return of 32% over the investment project is

something that the company will be getting from the investment project. The payback period for

the project was also sound for the company indicating that the project will be paying off the

initial invested capital in just 2.49 years of time. Thus on an overall basis after the assessment of

the key factors and various scenarios the project would be creating wealth for the company and it

should be accepted (Kengatharan 2016).

Conclusion

The financial analysis of the investment was done after taking key expenses from the

company in the trend period. The viability of the expansion project was done by analysing the

same with the use of Net Present Value, Internal Rate of Return and Payback Period. Capital

budgeting tools have given us a significant idea about the various factors and scenarios under

which the company will be operating. Expansion of the business services in the form of

increasing the products and services provided by the Jet Airways was evaluated for the company

where the key revenue and income was analysed for the company. The revenue and expenses of

the company has been taken at an increasing trend of about 10% per year. Business factors and

macro-economic factors that may significantly influence the operations of the company has been

Recommendation

Return and risk are some of the important factors in an investment project and the same

should be in accordance with the objectives and policies of the company. The return generated

by the project shows that the company should accept the project as the shareholders of the

company would be benefitted from the same (Schlegel, Frank and Britzelmaier 2016). The

business class service would allow the company serves premium class services to the customers

and in turn enjoy a wider revenue and customer’s base for the company. RM 6.91 million of net

profitability from the investment project and a return of 32% over the investment project is

something that the company will be getting from the investment project. The payback period for

the project was also sound for the company indicating that the project will be paying off the

initial invested capital in just 2.49 years of time. Thus on an overall basis after the assessment of

the key factors and various scenarios the project would be creating wealth for the company and it

should be accepted (Kengatharan 2016).

Conclusion

The financial analysis of the investment was done after taking key expenses from the

company in the trend period. The viability of the expansion project was done by analysing the

same with the use of Net Present Value, Internal Rate of Return and Payback Period. Capital

budgeting tools have given us a significant idea about the various factors and scenarios under

which the company will be operating. Expansion of the business services in the form of

increasing the products and services provided by the Jet Airways was evaluated for the company

where the key revenue and income was analysed for the company. The revenue and expenses of

the company has been taken at an increasing trend of about 10% per year. Business factors and

macro-economic factors that may significantly influence the operations of the company has been

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MANAGEMENT

well taken into consideration while analysing the investment project of the company. The

applicable discount rate that was applied for the evaluation of the profitability of the project

would be 12% showing the minimum required return by the project for the capital investment

and the risk it would be taking. The profitability and the return generated by the expansion

project was considered to be viable as the acceptance of the project will increase the wealth of

the stakeholders of the company. The net present value of the project indicated that Jet Airways

goes ahead with the expansion project as it would be creating wealth of the stakeholders of the

company. The NPV of the project was RM 6.91 million, the IRR of the project was around 32%

and the payback period of the project was also 2.49 year. On an overall basis the

recommendation of expanding the business project was given to the company.

well taken into consideration while analysing the investment project of the company. The

applicable discount rate that was applied for the evaluation of the profitability of the project

would be 12% showing the minimum required return by the project for the capital investment

and the risk it would be taking. The profitability and the return generated by the expansion

project was considered to be viable as the acceptance of the project will increase the wealth of

the stakeholders of the company. The net present value of the project indicated that Jet Airways

goes ahead with the expansion project as it would be creating wealth of the stakeholders of the

company. The NPV of the project was RM 6.91 million, the IRR of the project was around 32%

and the payback period of the project was also 2.49 year. On an overall basis the

recommendation of expanding the business project was given to the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MANAGEMENT

References

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Bierman Jr, H. and Smidt, S., 2014. Advanced capital budgeting: Refinements in the economic

analysis of investment projects. Routledge.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Chittenden, F. and Derregia, M., 2015. Uncertainty, irreversibility and the use of ‘rules of

thumb’in capital budgeting. The British Accounting Review, 47(3), pp.225-236.

Daunfeldt, S.O. and Hartwig, F., 2014. What determines the use of capital budgeting methods?:

Evidence from Swedish listed companies. Journal of Finance and Economics, 2(4), pp.101-112.

de Andrés, P., de Fuente, G. and San Martín, P., 2015. Capital budgeting practices in

Spain. BRQ Business Research Quarterly, 18(1), pp.37-56.

El-Daour, J.I. and Abu Shaaban, M., 2014. The use of capital budgeting techniques in evaluating

investment projects: An applied study on the Palestinian corporations working in Gaza

Strip. Journal of Al-Quds Open University, 333(2300), pp.1-85.

Kengatharan, L., 2016. Capital budgeting theory and practice: a review and agenda for future

research. Applied Economics and Finance, 3(2), pp.15-38.

Malenko, A., 2018. Optimal dynamic capital budgeting. Available at SSRN 1710884.

Mendes-Da-Silva, W. and Saito, R., 2014. Stock exchange listing induces sophistication of

capital budgeting. Revista de Administração de Empresas, 54(5), pp.560-574.

References

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Bierman Jr, H. and Smidt, S., 2014. Advanced capital budgeting: Refinements in the economic

analysis of investment projects. Routledge.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Chittenden, F. and Derregia, M., 2015. Uncertainty, irreversibility and the use of ‘rules of

thumb’in capital budgeting. The British Accounting Review, 47(3), pp.225-236.

Daunfeldt, S.O. and Hartwig, F., 2014. What determines the use of capital budgeting methods?:

Evidence from Swedish listed companies. Journal of Finance and Economics, 2(4), pp.101-112.

de Andrés, P., de Fuente, G. and San Martín, P., 2015. Capital budgeting practices in

Spain. BRQ Business Research Quarterly, 18(1), pp.37-56.

El-Daour, J.I. and Abu Shaaban, M., 2014. The use of capital budgeting techniques in evaluating

investment projects: An applied study on the Palestinian corporations working in Gaza

Strip. Journal of Al-Quds Open University, 333(2300), pp.1-85.

Kengatharan, L., 2016. Capital budgeting theory and practice: a review and agenda for future

research. Applied Economics and Finance, 3(2), pp.15-38.

Malenko, A., 2018. Optimal dynamic capital budgeting. Available at SSRN 1710884.

Mendes-Da-Silva, W. and Saito, R., 2014. Stock exchange listing induces sophistication of

capital budgeting. Revista de Administração de Empresas, 54(5), pp.560-574.

11FINANCIAL MANAGEMENT

Nurullah, M. and Kengatharan, L., 2015. Capital budgeting practices: evidence from Sri

Lanka. Journal of Advances in Management Research, 12(1), pp.55-82.

Rigopoulos, G., 2015. A review on Real Options utilization in Capital Budgeting

practice. International Journal of Information, Business and Management, 7(2), p.1.

Rossi, M., 2014. Capital budgeting in Europe: confronting theory with practice. International

Journal of Managerial and Financial Accounting, 6(4), pp.341-356.

Rossi, M., 2015. The use of capital budgeting techniques: an outlook from Italy. International

Journal of Management Practice, 8(1), pp.43-56.

Sari, I.U. and Kahraman, C., 2015. Interval type-2 fuzzy capital budgeting. International Journal

of Fuzzy Systems, 17(4), pp.635-646.

Schlegel, D., Frank, F. and Britzelmaier, B., 2016. Investment decisions and capital budgeting

practices in German manufacturing companies. International Journal of Business and

Globalisation, 16(1), pp.66-78.

Nurullah, M. and Kengatharan, L., 2015. Capital budgeting practices: evidence from Sri

Lanka. Journal of Advances in Management Research, 12(1), pp.55-82.

Rigopoulos, G., 2015. A review on Real Options utilization in Capital Budgeting

practice. International Journal of Information, Business and Management, 7(2), p.1.

Rossi, M., 2014. Capital budgeting in Europe: confronting theory with practice. International

Journal of Managerial and Financial Accounting, 6(4), pp.341-356.

Rossi, M., 2015. The use of capital budgeting techniques: an outlook from Italy. International

Journal of Management Practice, 8(1), pp.43-56.

Sari, I.U. and Kahraman, C., 2015. Interval type-2 fuzzy capital budgeting. International Journal

of Fuzzy Systems, 17(4), pp.635-646.

Schlegel, D., Frank, F. and Britzelmaier, B., 2016. Investment decisions and capital budgeting

practices in German manufacturing companies. International Journal of Business and

Globalisation, 16(1), pp.66-78.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.