Financial Management: Ratio Analysis Report for Hotel Industry

VerifiedAdded on 2023/01/10

|12

|808

|54

Report

AI Summary

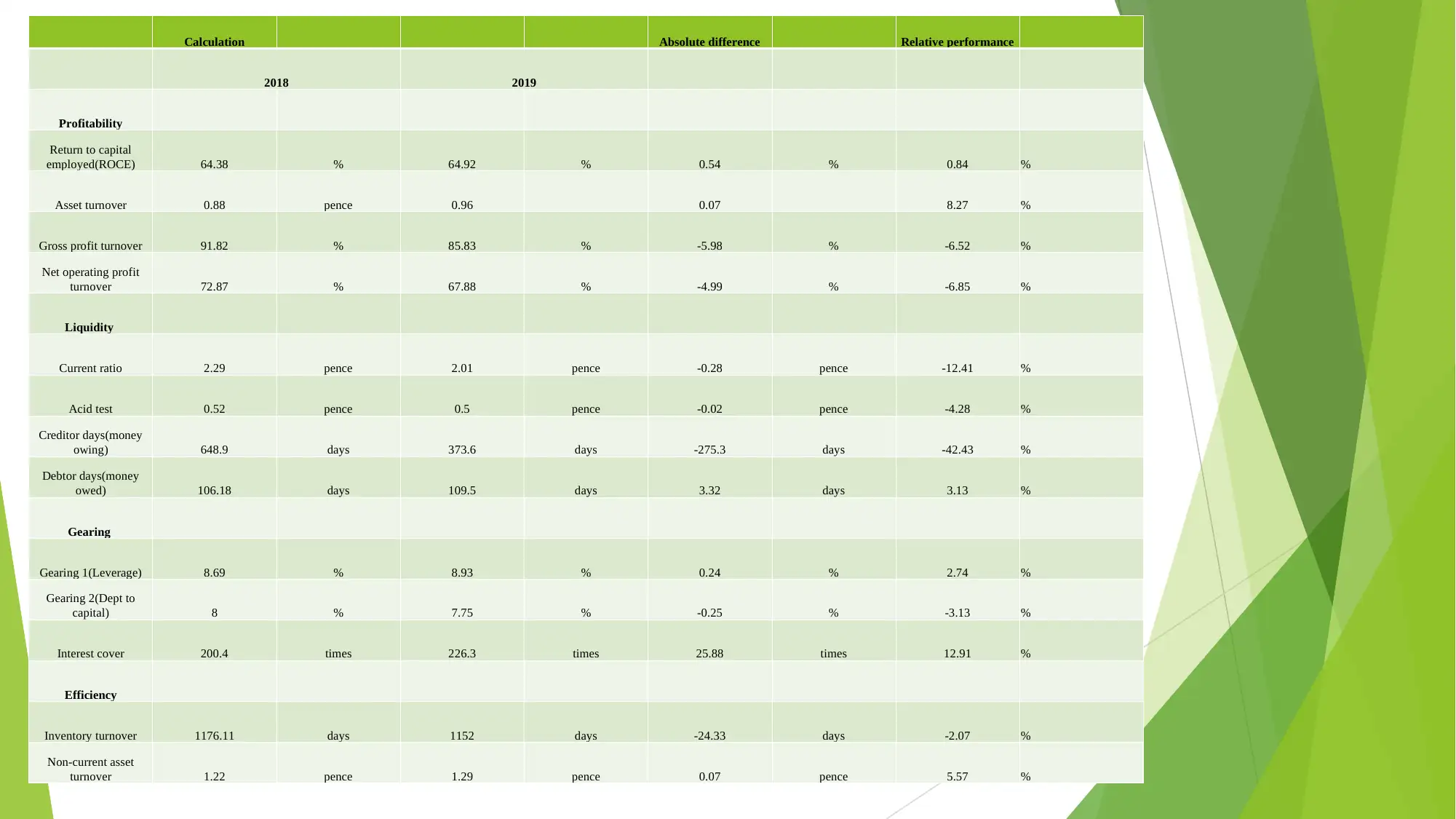

This report delves into the application of ratio analysis within the hotel industry, focusing on the financial performance of Gatsby Grange. It begins with an introduction to ratio analysis as a tool for evaluating financial health, followed by a detailed examination of profitability, liquidity, gearing, and efficiency ratios. The analysis includes calculations and interpretations of key ratios like Return on Capital Employed (ROCE), current ratio, acid test, and interest coverage, comparing performance across different years. The report highlights the relevance of ratio analysis for strategic decision-making in hotels, emphasizing its role in assessing current obligations, profitability, and long-term financial leverage. It also discusses the benefits of ratio analysis, such as simplifying financial statements and identifying problem areas, while acknowledging its limitations, including the potential for management manipulation of financial data. The conclusion underscores the importance of ratio analysis for identifying and addressing financial challenges, with recommendations for improving the financial performance of Gatsby Grange, particularly concerning liquidity and profitability.

1 out of 12

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)