Financial Management Report on Brand PLC and Lovewell Ltd Analysis

VerifiedAdded on 2023/01/19

|14

|3790

|82

Report

AI Summary

This report delves into financial management, focusing on equity finance, specifically a rights issue by Brand PLC, and investment appraisal techniques for Lovewell Ltd. The report calculates the number of shares to be issued, the theoretical ex-rights price, and expected earnings per share, considering different rights issue prices, and also discusses scrip dividends and their benefits. Furthermore, it analyzes the feasibility of acquiring machinery for Lovewell Ltd using the payback period and accounting rate of return methods, evaluating the economic viability of the investment. The report provides detailed calculations and interpretations to aid in financial decision-making, offering valuable insights into long-term finance and investment strategies.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Question 2 Long term finance: Equity finance................................................................................3

(a) Determining the number of shares to be issued, the theoretical ex-rights price, the expected

earnings per share and the form of the issue for each rights issue price.....................................3

(b) Scrip dividends and its benefit for the company and the shareholders..................................6

Question 3 Investment appraisal techniques....................................................................................7

1. Analysing the feasibility of acquiring the machinery by calculating the feasibility using

different investment appraisal techniques...................................................................................7

2. Critical evaluation of benefits and limitations of different investment appraisal tools...........9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................3

Question 2 Long term finance: Equity finance................................................................................3

(a) Determining the number of shares to be issued, the theoretical ex-rights price, the expected

earnings per share and the form of the issue for each rights issue price.....................................3

(b) Scrip dividends and its benefit for the company and the shareholders..................................6

Question 3 Investment appraisal techniques....................................................................................7

1. Analysing the feasibility of acquiring the machinery by calculating the feasibility using

different investment appraisal techniques...................................................................................7

2. Critical evaluation of benefits and limitations of different investment appraisal tools...........9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial management refers to controlling, managing, directing, evaluating the business

operational activities of the business organisation. It obtains the required fund and utilized in the

business to effective operation of the business function (Castrogiovanni and et. al 2016). It also

applies the basic accounting concepts, general principle in the financial activities of the entity.

Financial management is generally concerned with regular and adequate supply of fund in the

enterprises. It may cover the financial aspects such as capital requirement, source of fund,

investment fund, management of cash and financial control over the enterprises. In the subject of

financial management some of the basic concepts includes that is defined in this report.

For the better understanding of the financial function in the business, report includes earning

per share and right issue concept for brand plc and investment appraisal techniques of a food

manufacturing company lovewell Ltd. This report of the financial management is beneficial for

the management of the particular companies in the decision making process regarding company's

earning or net profit and how much amount cost to the company for issue price. And business

can make decision regarding the investment proposal that will be benefited for the organisation

lovewell Ltd. So they can make decision which option is best for organisation as well as increase

the profitability in present situation.

Question 2 Long term finance: Equity finance

(a) Determining the number of shares to be issued, the theoretical ex-rights price, the expected

earnings per share and the form of the issue for each rights issue price

Brand Plc is a business organisation that wishes to raise £160,000 from a right issue. The

aim behind this right issue is to expand existing operations. It is important to first understand the

concept of right issue. Right issue is basically share that are provided by the company to existing

shareholder to the company. It is also called as right offer. In the basic terms, it is defined as

when an enterprises require some additional capital in the business than it goes to present

shareholder for the purpose to issue the share at discount price for these existing shareholders. It

is invitation to stakeholders to purchase the share in the company at certain discount on market

price (Cummins and Derrig, 2012). These are some benefit of the right issue that are discussed as

below:

4

Financial management refers to controlling, managing, directing, evaluating the business

operational activities of the business organisation. It obtains the required fund and utilized in the

business to effective operation of the business function (Castrogiovanni and et. al 2016). It also

applies the basic accounting concepts, general principle in the financial activities of the entity.

Financial management is generally concerned with regular and adequate supply of fund in the

enterprises. It may cover the financial aspects such as capital requirement, source of fund,

investment fund, management of cash and financial control over the enterprises. In the subject of

financial management some of the basic concepts includes that is defined in this report.

For the better understanding of the financial function in the business, report includes earning

per share and right issue concept for brand plc and investment appraisal techniques of a food

manufacturing company lovewell Ltd. This report of the financial management is beneficial for

the management of the particular companies in the decision making process regarding company's

earning or net profit and how much amount cost to the company for issue price. And business

can make decision regarding the investment proposal that will be benefited for the organisation

lovewell Ltd. So they can make decision which option is best for organisation as well as increase

the profitability in present situation.

Question 2 Long term finance: Equity finance

(a) Determining the number of shares to be issued, the theoretical ex-rights price, the expected

earnings per share and the form of the issue for each rights issue price

Brand Plc is a business organisation that wishes to raise £160,000 from a right issue. The

aim behind this right issue is to expand existing operations. It is important to first understand the

concept of right issue. Right issue is basically share that are provided by the company to existing

shareholder to the company. It is also called as right offer. In the basic terms, it is defined as

when an enterprises require some additional capital in the business than it goes to present

shareholder for the purpose to issue the share at discount price for these existing shareholders. It

is invitation to stakeholders to purchase the share in the company at certain discount on market

price (Cummins and Derrig, 2012). These are some benefit of the right issue that are discussed as

below:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The main benefit to the shareholder is shares are issued at less price so they can purchsed

it on discount or minimum price from market rate.

All the benefit is the same that is given on ordinary share such as dividend, bonus share.

Particular company can save the fund regarding the extra cost on issuing the share like

underwriter’s commission, promotional cost and other issue cost.

Share are issued to those stakeholders who are the holder of the share in prior allotment

of share so control of the company is in the hands of shareholder.

There are some types of Right issue that are discussed as under:

Renounce able right issue: The existing shareholder have right to transfer the particular

right share to anyone who may or may not a shareholder of the company.

Non- Renounce able right issue: For the existing shareholder, they do not have the right

to transfer the opted shares to anyone. But they have two option, either they skip this

right option or they purchase it for value maximization or divided purpose.

Limitation of the right issue:

Right issue is offer to existing shareholder in specific condition of the company like if

company may not have sufficient fund or resources in the business or they fail to find it

objectives in the particular year (Feng and et. al, 2016).

The value of shares may get cut so it wants to enlarge number of share that issued prior.

For the reputed company, it is going to create negative impact in market that company

has not adequate fund and it is troubled to operate the business function smoothly.

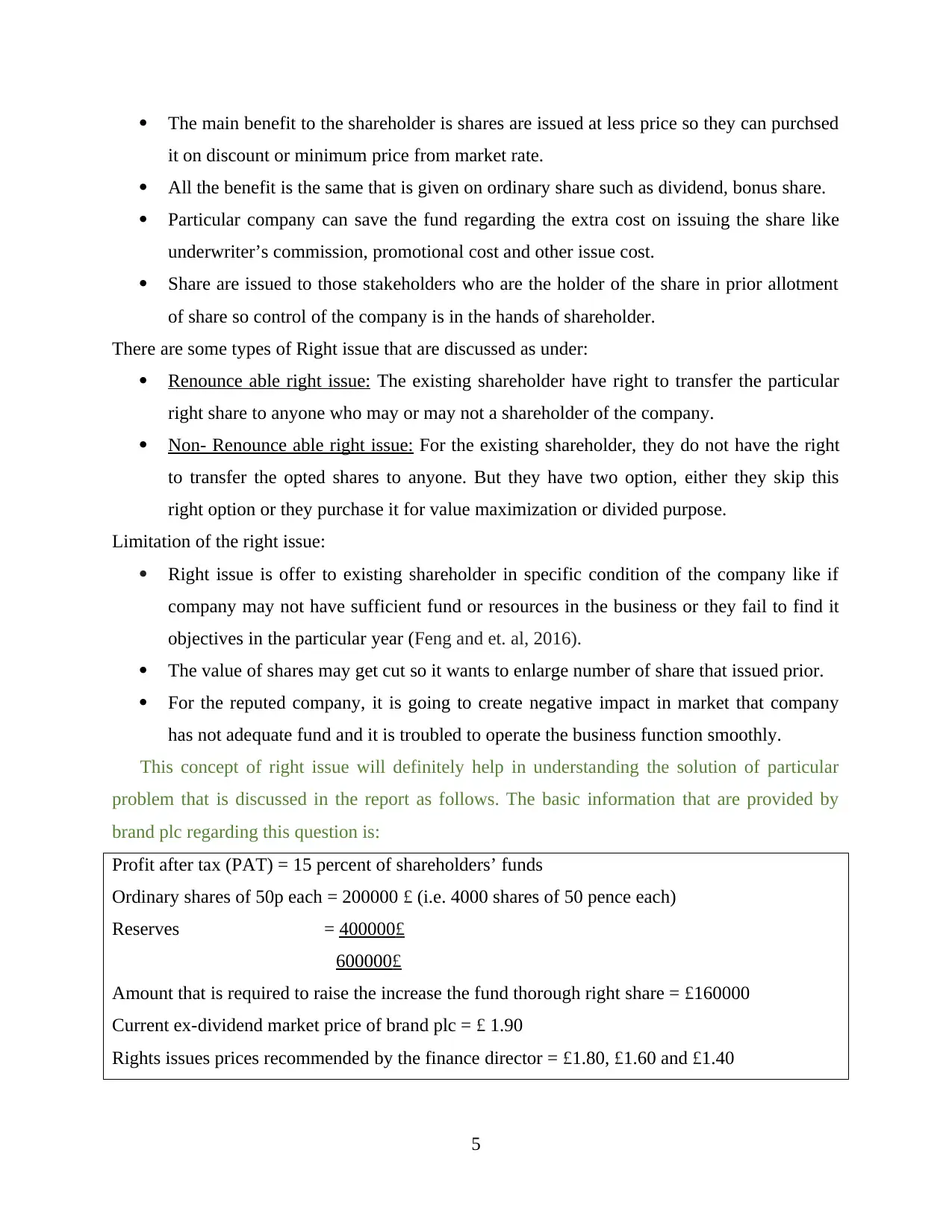

This concept of right issue will definitely help in understanding the solution of particular

problem that is discussed in the report as follows. The basic information that are provided by

brand plc regarding this question is:

Profit after tax (PAT) = 15 percent of shareholders’ funds

Ordinary shares of 50p each = 200000 £ (i.e. 4000 shares of 50 pence each)

Reserves = 400000£

600000£

Amount that is required to raise the increase the fund thorough right share = £160000

Current ex-dividend market price of brand plc = £ 1.90

Rights issues prices recommended by the finance director = £1.80, £1.60 and £1.40

5

it on discount or minimum price from market rate.

All the benefit is the same that is given on ordinary share such as dividend, bonus share.

Particular company can save the fund regarding the extra cost on issuing the share like

underwriter’s commission, promotional cost and other issue cost.

Share are issued to those stakeholders who are the holder of the share in prior allotment

of share so control of the company is in the hands of shareholder.

There are some types of Right issue that are discussed as under:

Renounce able right issue: The existing shareholder have right to transfer the particular

right share to anyone who may or may not a shareholder of the company.

Non- Renounce able right issue: For the existing shareholder, they do not have the right

to transfer the opted shares to anyone. But they have two option, either they skip this

right option or they purchase it for value maximization or divided purpose.

Limitation of the right issue:

Right issue is offer to existing shareholder in specific condition of the company like if

company may not have sufficient fund or resources in the business or they fail to find it

objectives in the particular year (Feng and et. al, 2016).

The value of shares may get cut so it wants to enlarge number of share that issued prior.

For the reputed company, it is going to create negative impact in market that company

has not adequate fund and it is troubled to operate the business function smoothly.

This concept of right issue will definitely help in understanding the solution of particular

problem that is discussed in the report as follows. The basic information that are provided by

brand plc regarding this question is:

Profit after tax (PAT) = 15 percent of shareholders’ funds

Ordinary shares of 50p each = 200000 £ (i.e. 4000 shares of 50 pence each)

Reserves = 400000£

600000£

Amount that is required to raise the increase the fund thorough right share = £160000

Current ex-dividend market price of brand plc = £ 1.90

Rights issues prices recommended by the finance director = £1.80, £1.60 and £1.40

5

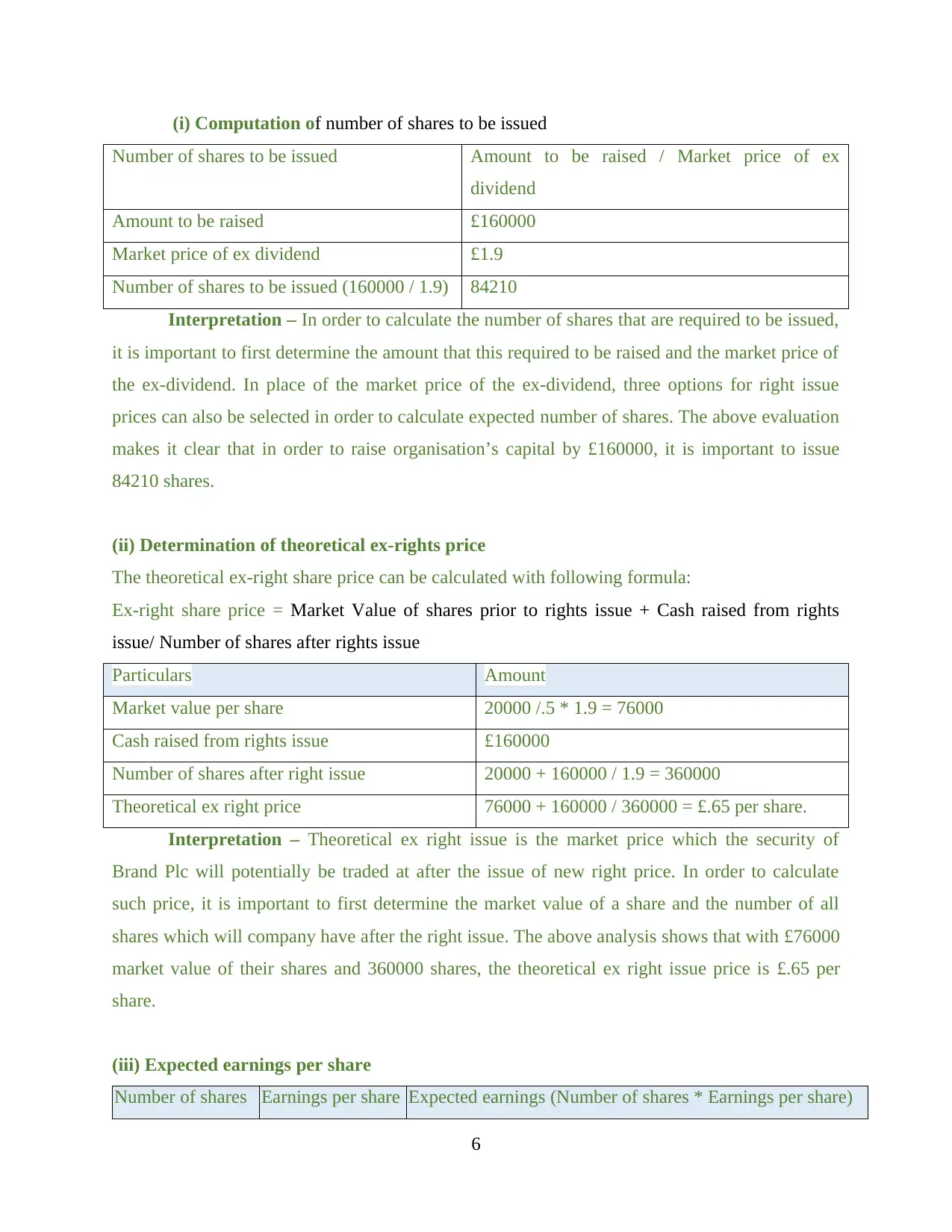

(i) Computation of number of shares to be issued

Number of shares to be issued Amount to be raised / Market price of ex

dividend

Amount to be raised £160000

Market price of ex dividend £1.9

Number of shares to be issued (160000 / 1.9) 84210

Interpretation – In order to calculate the number of shares that are required to be issued,

it is important to first determine the amount that this required to be raised and the market price of

the ex-dividend. In place of the market price of the ex-dividend, three options for right issue

prices can also be selected in order to calculate expected number of shares. The above evaluation

makes it clear that in order to raise organisation’s capital by £160000, it is important to issue

84210 shares.

(ii) Determination of theoretical ex-rights price

The theoretical ex-right share price can be calculated with following formula:

Ex-right share price = Market Value of shares prior to rights issue + Cash raised from rights

issue/ Number of shares after rights issue

Particulars Amount

Market value per share 20000 /.5 * 1.9 = 76000

Cash raised from rights issue £160000

Number of shares after right issue 20000 + 160000 / 1.9 = 360000

Theoretical ex right price 76000 + 160000 / 360000 = £.65 per share.

Interpretation – Theoretical ex right issue is the market price which the security of

Brand Plc will potentially be traded at after the issue of new right price. In order to calculate

such price, it is important to first determine the market value of a share and the number of all

shares which will company have after the right issue. The above analysis shows that with £76000

market value of their shares and 360000 shares, the theoretical ex right issue price is £.65 per

share.

(iii) Expected earnings per share

Number of shares Earnings per share Expected earnings (Number of shares * Earnings per share)

6

Number of shares to be issued Amount to be raised / Market price of ex

dividend

Amount to be raised £160000

Market price of ex dividend £1.9

Number of shares to be issued (160000 / 1.9) 84210

Interpretation – In order to calculate the number of shares that are required to be issued,

it is important to first determine the amount that this required to be raised and the market price of

the ex-dividend. In place of the market price of the ex-dividend, three options for right issue

prices can also be selected in order to calculate expected number of shares. The above evaluation

makes it clear that in order to raise organisation’s capital by £160000, it is important to issue

84210 shares.

(ii) Determination of theoretical ex-rights price

The theoretical ex-right share price can be calculated with following formula:

Ex-right share price = Market Value of shares prior to rights issue + Cash raised from rights

issue/ Number of shares after rights issue

Particulars Amount

Market value per share 20000 /.5 * 1.9 = 76000

Cash raised from rights issue £160000

Number of shares after right issue 20000 + 160000 / 1.9 = 360000

Theoretical ex right price 76000 + 160000 / 360000 = £.65 per share.

Interpretation – Theoretical ex right issue is the market price which the security of

Brand Plc will potentially be traded at after the issue of new right price. In order to calculate

such price, it is important to first determine the market value of a share and the number of all

shares which will company have after the right issue. The above analysis shows that with £76000

market value of their shares and 360000 shares, the theoretical ex right issue price is £.65 per

share.

(iii) Expected earnings per share

Number of shares Earnings per share Expected earnings (Number of shares * Earnings per share)

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

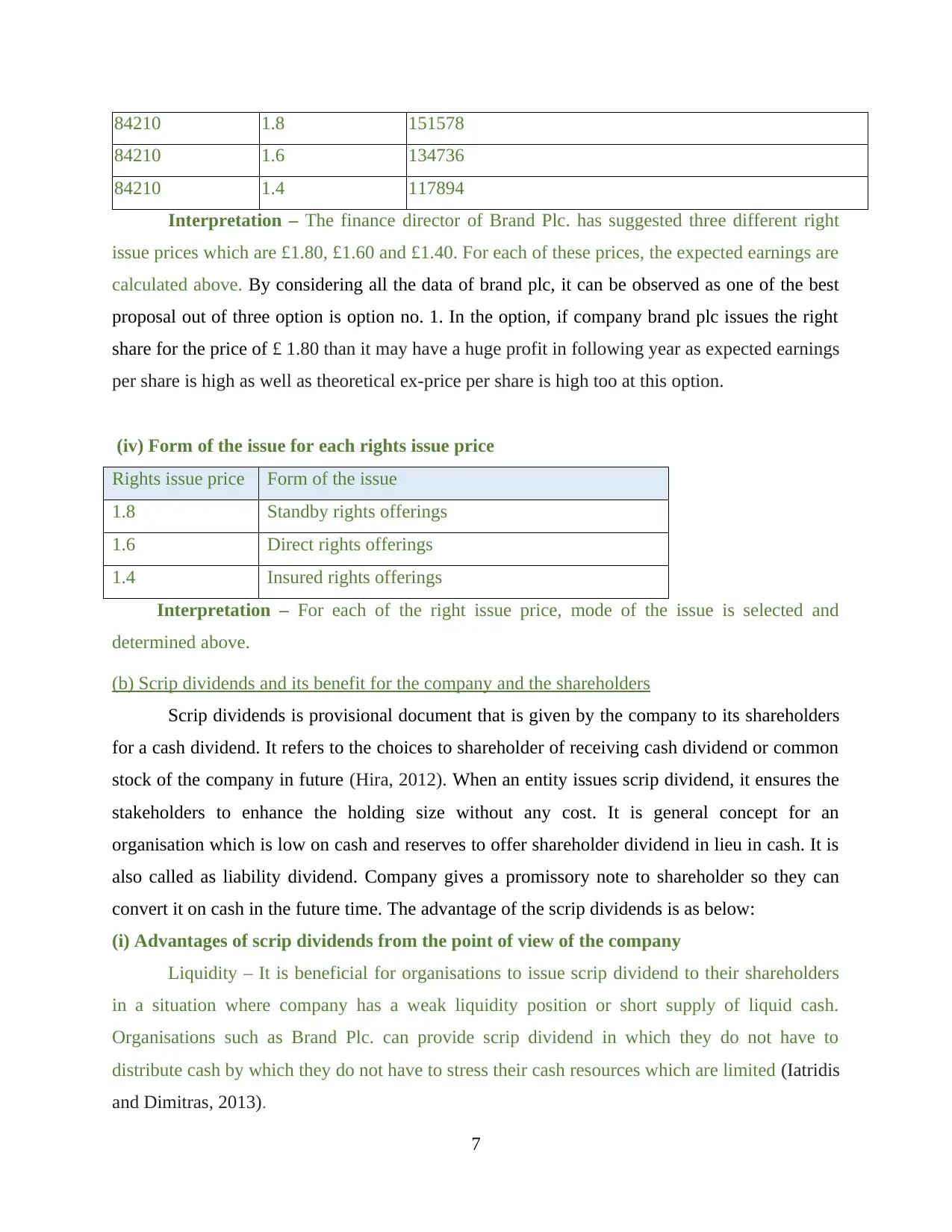

84210 1.8 151578

84210 1.6 134736

84210 1.4 117894

Interpretation – The finance director of Brand Plc. has suggested three different right

issue prices which are £1.80, £1.60 and £1.40. For each of these prices, the expected earnings are

calculated above. By considering all the data of brand plc, it can be observed as one of the best

proposal out of three option is option no. 1. In the option, if company brand plc issues the right

share for the price of £ 1.80 than it may have a huge profit in following year as expected earnings

per share is high as well as theoretical ex-price per share is high too at this option.

(iv) Form of the issue for each rights issue price

Rights issue price Form of the issue

1.8 Standby rights offerings

1.6 Direct rights offerings

1.4 Insured rights offerings

Interpretation – For each of the right issue price, mode of the issue is selected and

determined above.

(b) Scrip dividends and its benefit for the company and the shareholders

Scrip dividends is provisional document that is given by the company to its shareholders

for a cash dividend. It refers to the choices to shareholder of receiving cash dividend or common

stock of the company in future (Hira, 2012). When an entity issues scrip dividend, it ensures the

stakeholders to enhance the holding size without any cost. It is general concept for an

organisation which is low on cash and reserves to offer shareholder dividend in lieu in cash. It is

also called as liability dividend. Company gives a promissory note to shareholder so they can

convert it on cash in the future time. The advantage of the scrip dividends is as below:

(i) Advantages of scrip dividends from the point of view of the company

Liquidity – It is beneficial for organisations to issue scrip dividend to their shareholders

in a situation where company has a weak liquidity position or short supply of liquid cash.

Organisations such as Brand Plc. can provide scrip dividend in which they do not have to

distribute cash by which they do not have to stress their cash resources which are limited (Iatridis

and Dimitras, 2013).

7

84210 1.6 134736

84210 1.4 117894

Interpretation – The finance director of Brand Plc. has suggested three different right

issue prices which are £1.80, £1.60 and £1.40. For each of these prices, the expected earnings are

calculated above. By considering all the data of brand plc, it can be observed as one of the best

proposal out of three option is option no. 1. In the option, if company brand plc issues the right

share for the price of £ 1.80 than it may have a huge profit in following year as expected earnings

per share is high as well as theoretical ex-price per share is high too at this option.

(iv) Form of the issue for each rights issue price

Rights issue price Form of the issue

1.8 Standby rights offerings

1.6 Direct rights offerings

1.4 Insured rights offerings

Interpretation – For each of the right issue price, mode of the issue is selected and

determined above.

(b) Scrip dividends and its benefit for the company and the shareholders

Scrip dividends is provisional document that is given by the company to its shareholders

for a cash dividend. It refers to the choices to shareholder of receiving cash dividend or common

stock of the company in future (Hira, 2012). When an entity issues scrip dividend, it ensures the

stakeholders to enhance the holding size without any cost. It is general concept for an

organisation which is low on cash and reserves to offer shareholder dividend in lieu in cash. It is

also called as liability dividend. Company gives a promissory note to shareholder so they can

convert it on cash in the future time. The advantage of the scrip dividends is as below:

(i) Advantages of scrip dividends from the point of view of the company

Liquidity – It is beneficial for organisations to issue scrip dividend to their shareholders

in a situation where company has a weak liquidity position or short supply of liquid cash.

Organisations such as Brand Plc. can provide scrip dividend in which they do not have to

distribute cash by which they do not have to stress their cash resources which are limited (Iatridis

and Dimitras, 2013).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Increase of the company capital – By offering the scrip dividend to shareholders, an

organisation can increase their capital along with which they can even get benefitted as scrip

dividend does not dilute the share price.

(ii) Advantages of scrip dividends from the point of view of the shareholders

Benefit of choice – It is usual scenario for today’s companies to provide an option to their

shareholders that whether they prefer to receive their dividend in the form of a cash dividend or a

scrip dividend. If a scrip dividend has been selected by the shareholders, then they can enjoy the

benefit of choice. The shareholders can either hold the stocks given as dividend in the hope that

the values of shares will increase in future or they can sell their shares in order to create their

own cash dividend.

Tax savings – Another benefit of scrip dividend for shareholders is the benefit of tax

savings. Shareholders do not require to pay any tax on the values of the shares which they have

received as a form of dividend. This tax saving helps increases the profit of shareholders.

Question 3 Investment appraisal techniques

1. Analysing the feasibility of acquiring the machinery by calculating the feasibility using

different investment appraisal techniques

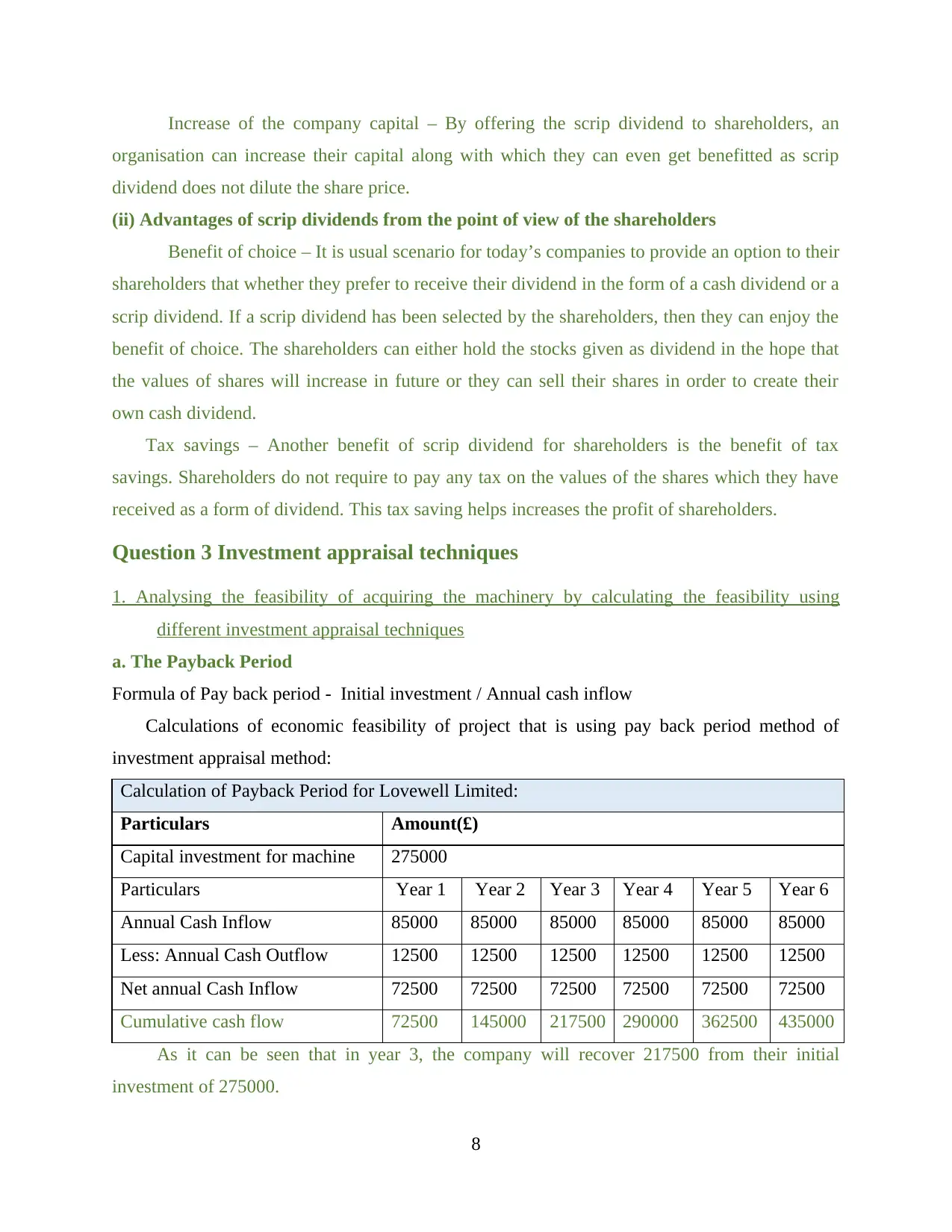

a. The Payback Period

Formula of Pay back period - Initial investment / Annual cash inflow

Calculations of economic feasibility of project that is using pay back period method of

investment appraisal method:

Calculation of Payback Period for Lovewell Limited:

Particulars Amount(£)

Capital investment for machine 275000

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Annual Cash Inflow 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflow 12500 12500 12500 12500 12500 12500

Net annual Cash Inflow 72500 72500 72500 72500 72500 72500

Cumulative cash flow 72500 145000 217500 290000 362500 435000

As it can be seen that in year 3, the company will recover 217500 from their initial

investment of 275000.

8

organisation can increase their capital along with which they can even get benefitted as scrip

dividend does not dilute the share price.

(ii) Advantages of scrip dividends from the point of view of the shareholders

Benefit of choice – It is usual scenario for today’s companies to provide an option to their

shareholders that whether they prefer to receive their dividend in the form of a cash dividend or a

scrip dividend. If a scrip dividend has been selected by the shareholders, then they can enjoy the

benefit of choice. The shareholders can either hold the stocks given as dividend in the hope that

the values of shares will increase in future or they can sell their shares in order to create their

own cash dividend.

Tax savings – Another benefit of scrip dividend for shareholders is the benefit of tax

savings. Shareholders do not require to pay any tax on the values of the shares which they have

received as a form of dividend. This tax saving helps increases the profit of shareholders.

Question 3 Investment appraisal techniques

1. Analysing the feasibility of acquiring the machinery by calculating the feasibility using

different investment appraisal techniques

a. The Payback Period

Formula of Pay back period - Initial investment / Annual cash inflow

Calculations of economic feasibility of project that is using pay back period method of

investment appraisal method:

Calculation of Payback Period for Lovewell Limited:

Particulars Amount(£)

Capital investment for machine 275000

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Annual Cash Inflow 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflow 12500 12500 12500 12500 12500 12500

Net annual Cash Inflow 72500 72500 72500 72500 72500 72500

Cumulative cash flow 72500 145000 217500 290000 362500 435000

As it can be seen that in year 3, the company will recover 217500 from their initial

investment of 275000.

8

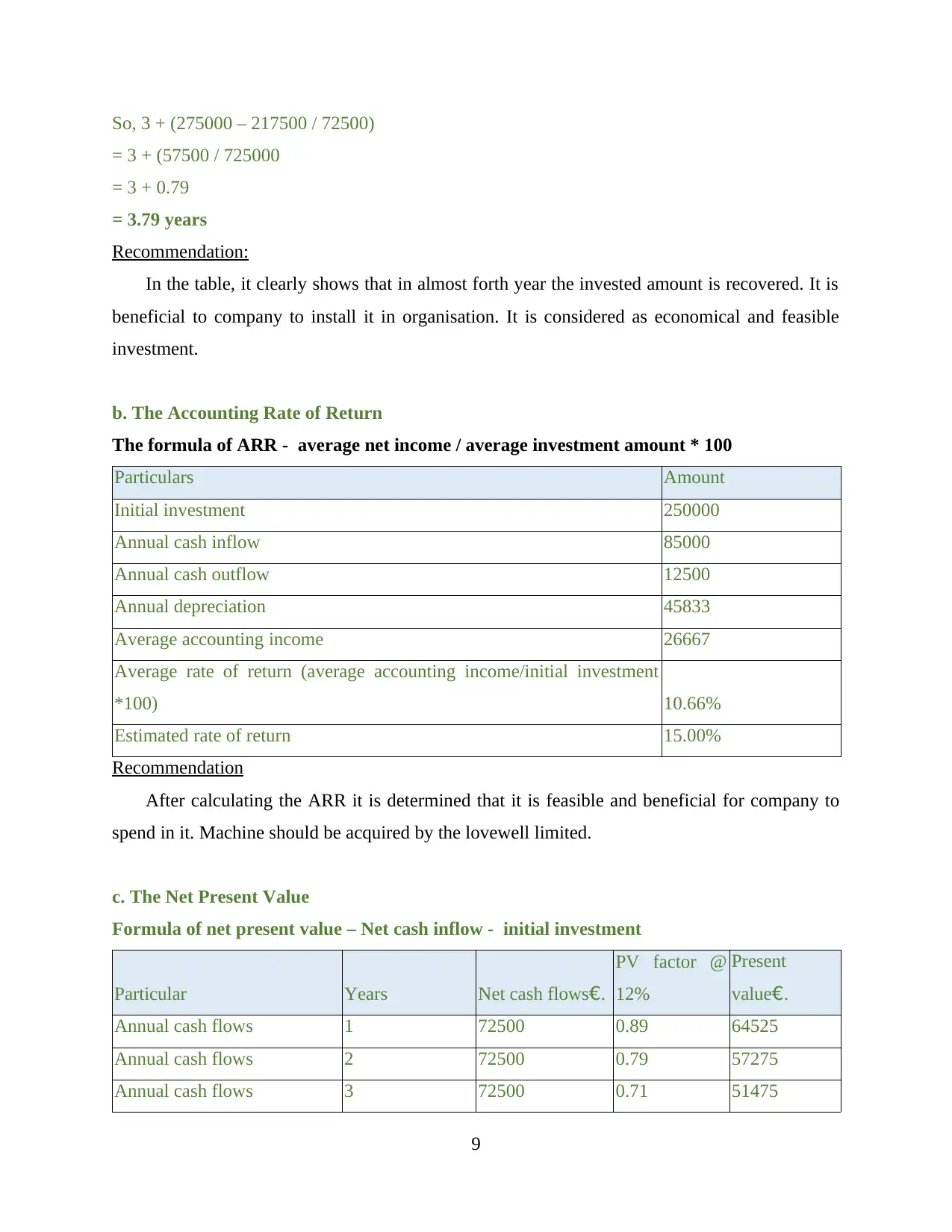

So, 3 + (275000 – 217500 / 72500)

= 3 + (57500 / 725000

= 3 + 0.79

= 3.79 years

Recommendation:

In the table, it clearly shows that in almost forth year the invested amount is recovered. It is

beneficial to company to install it in organisation. It is considered as economical and feasible

investment.

b. The Accounting Rate of Return

The formula of ARR - average net income / average investment amount * 100

Particulars Amount

Initial investment 250000

Annual cash inflow 85000

Annual cash outflow 12500

Annual depreciation 45833

Average accounting income 26667

Average rate of return (average accounting income/initial investment

*100) 10.66%

Estimated rate of return 15.00%

Recommendation

After calculating the ARR it is determined that it is feasible and beneficial for company to

spend in it. Machine should be acquired by the lovewell limited.

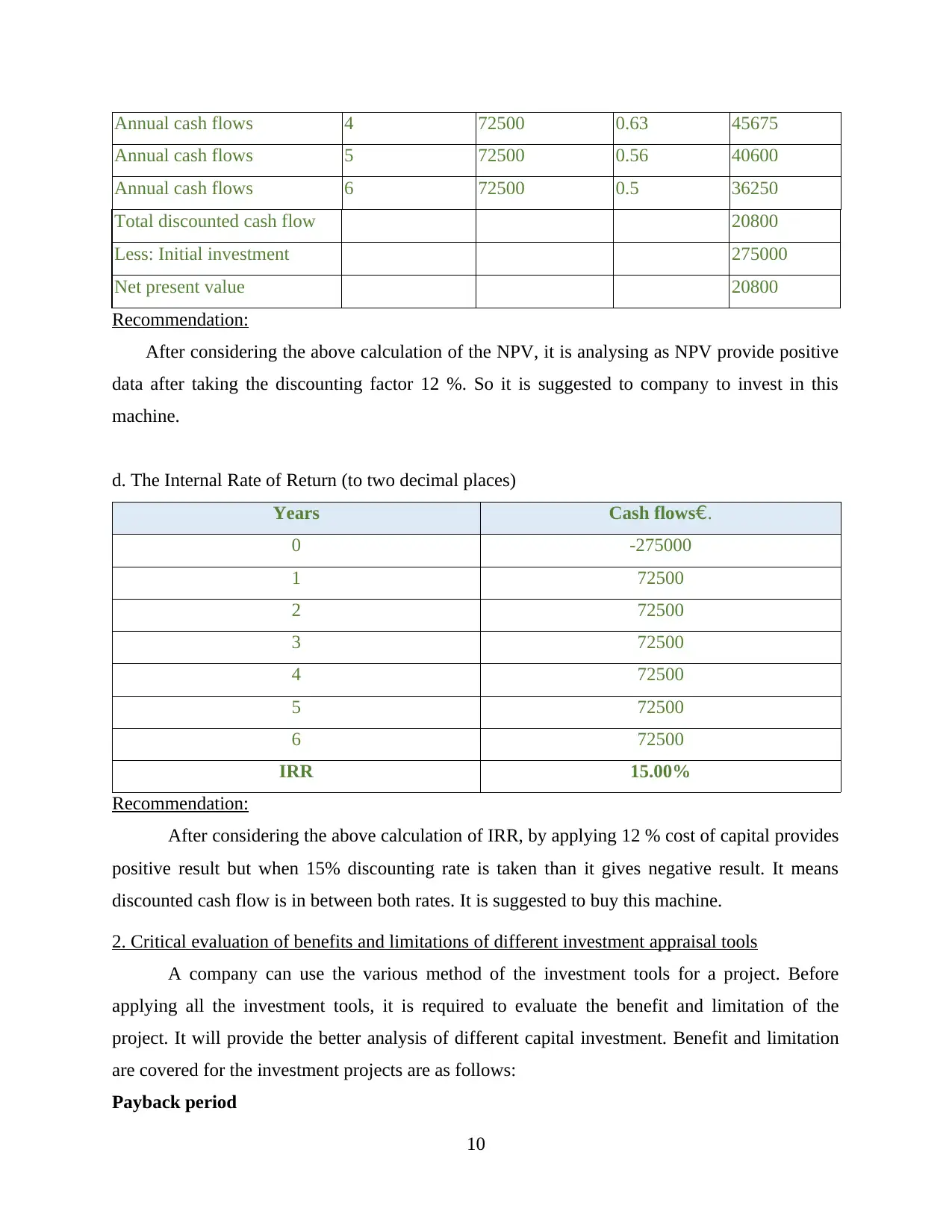

c. The Net Present Value

Formula of net present value – Net cash inflow - initial investment

Particular Years Net cash flows€.

PV factor @

12%

Present

value€.

Annual cash flows 1 72500 0.89 64525

Annual cash flows 2 72500 0.79 57275

Annual cash flows 3 72500 0.71 51475

9

= 3 + (57500 / 725000

= 3 + 0.79

= 3.79 years

Recommendation:

In the table, it clearly shows that in almost forth year the invested amount is recovered. It is

beneficial to company to install it in organisation. It is considered as economical and feasible

investment.

b. The Accounting Rate of Return

The formula of ARR - average net income / average investment amount * 100

Particulars Amount

Initial investment 250000

Annual cash inflow 85000

Annual cash outflow 12500

Annual depreciation 45833

Average accounting income 26667

Average rate of return (average accounting income/initial investment

*100) 10.66%

Estimated rate of return 15.00%

Recommendation

After calculating the ARR it is determined that it is feasible and beneficial for company to

spend in it. Machine should be acquired by the lovewell limited.

c. The Net Present Value

Formula of net present value – Net cash inflow - initial investment

Particular Years Net cash flows€.

PV factor @

12%

Present

value€.

Annual cash flows 1 72500 0.89 64525

Annual cash flows 2 72500 0.79 57275

Annual cash flows 3 72500 0.71 51475

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Annual cash flows 4 72500 0.63 45675

Annual cash flows 5 72500 0.56 40600

Annual cash flows 6 72500 0.5 36250

Total discounted cash flow 20800

Less: Initial investment 275000

Net present value 20800

Recommendation:

After considering the above calculation of the NPV, it is analysing as NPV provide positive

data after taking the discounting factor 12 %. So it is suggested to company to invest in this

machine.

d. The Internal Rate of Return (to two decimal places)

Years Cash flows€.

0 -275000

1 72500

2 72500

3 72500

4 72500

5 72500

6 72500

IRR 15.00%

Recommendation:

After considering the above calculation of IRR, by applying 12 % cost of capital provides

positive result but when 15% discounting rate is taken than it gives negative result. It means

discounted cash flow is in between both rates. It is suggested to buy this machine.

2. Critical evaluation of benefits and limitations of different investment appraisal tools

A company can use the various method of the investment tools for a project. Before

applying all the investment tools, it is required to evaluate the benefit and limitation of the

project. It will provide the better analysis of different capital investment. Benefit and limitation

are covered for the investment projects are as follows:

Payback period

10

Annual cash flows 5 72500 0.56 40600

Annual cash flows 6 72500 0.5 36250

Total discounted cash flow 20800

Less: Initial investment 275000

Net present value 20800

Recommendation:

After considering the above calculation of the NPV, it is analysing as NPV provide positive

data after taking the discounting factor 12 %. So it is suggested to company to invest in this

machine.

d. The Internal Rate of Return (to two decimal places)

Years Cash flows€.

0 -275000

1 72500

2 72500

3 72500

4 72500

5 72500

6 72500

IRR 15.00%

Recommendation:

After considering the above calculation of IRR, by applying 12 % cost of capital provides

positive result but when 15% discounting rate is taken than it gives negative result. It means

discounted cash flow is in between both rates. It is suggested to buy this machine.

2. Critical evaluation of benefits and limitations of different investment appraisal tools

A company can use the various method of the investment tools for a project. Before

applying all the investment tools, it is required to evaluate the benefit and limitation of the

project. It will provide the better analysis of different capital investment. Benefit and limitation

are covered for the investment projects are as follows:

Payback period

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It is tool of capital budgeting that includes the capital investment in a particular project. It

refers to the management that how much time it will take recover the amount that is invested in

the particular projects. This method finds the total of regain the amount of investment from the

installation of the projects. This method is also considered as breakeven point.

Benefits:

It is pretty simple method that provides accurate evaluation of investment projects.

The another benefit of this tools is it determine the actual risk involved in the projects.

It provides the liquidity information for short term period of food manufacturing

business.

Limitations:

Payback period method does not perceive the time value of money concepts that is not

provides the actual status of the project.

This tool eliminates the profitability of Lovewell so it is risky to choose the payback

period (Stead and Stead, 2017).

The other disadvantage of this method, it did not aid in the decision making system and it

gives confusion in the situation where cash flows are negative.

Accounting rate of return

This is another method of capital investment appraisal system. It is a financial ratio that

defines average net income over an investment cost. Time value of money is not applying in this

method (Lappalainen and Niskanen, 2012).

Benefits:

It is easy to calculate the ARR by considering the Average years’ profit that can be

available from inflow of the project.

It provides the clarity in the profitability over the year to lovewell Ltd. So it can be make

the decision regarding the project.

This is the fundamental accounting method that help to the management of lovewell in

measure the different method's probability rate.

Limitations:

It fails to provide the right solution in selecting the projects as it does not consider the

concept of time value of money in the computations.

11

refers to the management that how much time it will take recover the amount that is invested in

the particular projects. This method finds the total of regain the amount of investment from the

installation of the projects. This method is also considered as breakeven point.

Benefits:

It is pretty simple method that provides accurate evaluation of investment projects.

The another benefit of this tools is it determine the actual risk involved in the projects.

It provides the liquidity information for short term period of food manufacturing

business.

Limitations:

Payback period method does not perceive the time value of money concepts that is not

provides the actual status of the project.

This tool eliminates the profitability of Lovewell so it is risky to choose the payback

period (Stead and Stead, 2017).

The other disadvantage of this method, it did not aid in the decision making system and it

gives confusion in the situation where cash flows are negative.

Accounting rate of return

This is another method of capital investment appraisal system. It is a financial ratio that

defines average net income over an investment cost. Time value of money is not applying in this

method (Lappalainen and Niskanen, 2012).

Benefits:

It is easy to calculate the ARR by considering the Average years’ profit that can be

available from inflow of the project.

It provides the clarity in the profitability over the year to lovewell Ltd. So it can be make

the decision regarding the project.

This is the fundamental accounting method that help to the management of lovewell in

measure the different method's probability rate.

Limitations:

It fails to provide the right solution in selecting the projects as it does not consider the

concept of time value of money in the computations.

11

It is based on expected cash inflow of the projects that will receive over the life the

projects.

This technique of accounting rate of return also helps in determining the value of

interest involved in a project that results into satisfaction of owner as well.

Net present value

This is the capital budgeting method that is described as net income can be generated

from the capital investment by applying discounting factors. It is based on the current income

created by the capital expenditure (McPherson and Pincus, 2017).

Benefits:

This method is mostly used in the business organisation to find out the actual profitability

in present scenario.

It can be easily analysed whether the investment is beneficial or loss making in the future

by applying this method.

The project gets factored the risk that is involved in this project.

Limitations:

Short term projects like for 3 or 4 years will not enhance the net earning and return on

investment (Zafra-Gómez, Rodriguez Bolivar and Munoz, 2013).

Rate of the discounting factors of the particular projects may vary the net earnings of the

lovewell Ltd.

Internal rate of return

It is a rate of return where cost of the project and generated income are zero. This method

is most efficient in order to measure the effectiveness of the project by considering the rate of

return of the project. This method also calculates financial risk, different rate of return at certain

stages of the projects (Williams and Dobelman, 2017).

Benefits:

This method considered the time value of money and provides the exact solution by

applying this tools regarding the future income.

It provides the rough calculation of present income of investment by applying certain

discounting factors rate.

Limitations:

12

projects.

This technique of accounting rate of return also helps in determining the value of

interest involved in a project that results into satisfaction of owner as well.

Net present value

This is the capital budgeting method that is described as net income can be generated

from the capital investment by applying discounting factors. It is based on the current income

created by the capital expenditure (McPherson and Pincus, 2017).

Benefits:

This method is mostly used in the business organisation to find out the actual profitability

in present scenario.

It can be easily analysed whether the investment is beneficial or loss making in the future

by applying this method.

The project gets factored the risk that is involved in this project.

Limitations:

Short term projects like for 3 or 4 years will not enhance the net earning and return on

investment (Zafra-Gómez, Rodriguez Bolivar and Munoz, 2013).

Rate of the discounting factors of the particular projects may vary the net earnings of the

lovewell Ltd.

Internal rate of return

It is a rate of return where cost of the project and generated income are zero. This method

is most efficient in order to measure the effectiveness of the project by considering the rate of

return of the project. This method also calculates financial risk, different rate of return at certain

stages of the projects (Williams and Dobelman, 2017).

Benefits:

This method considered the time value of money and provides the exact solution by

applying this tools regarding the future income.

It provides the rough calculation of present income of investment by applying certain

discounting factors rate.

Limitations:

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.