Importance of Financial Management

VerifiedAdded on 2023/06/18

|12

|2904

|344

AI Summary

This article discusses the importance of financial management in a business. It covers the significance of fiscal administration, finance reports, and metrics like ratios. It also talks about the balance sheet, income statement, and cash flow statement. The article concludes by emphasizing the importance of financial management for a company's growth and success.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Importance of financial

management

management

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

SECTION 1.....................................................................................................................................1

The Significance of Fiscal Administration..................................................................................1

SECTION 2.....................................................................................................................................2

Finance reports and the use of metrics are discussed..................................................................2

SECTION 3.....................................................................................................................................3

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

APPENDIX....................................................................................................................................10

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

SECTION 1.....................................................................................................................................1

The Significance of Fiscal Administration..................................................................................1

SECTION 2.....................................................................................................................................2

Finance reports and the use of metrics are discussed..................................................................2

SECTION 3.....................................................................................................................................3

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

APPENDIX....................................................................................................................................10

INTRODUCTION

The capital and loan which a firm employs to fulfil its aims and ambitions are referred to

as corporate finance (Fan and Chatterjee, 2019). From the procurement of raw materials to the

delivery of goods and services to clients, firms require financing. The acquisition of money for

the aim of meeting market requirements is referred to as commercial finance. It offers funds for

investment operational financial regulations as well as financing diversity. This research involves

monetary administration and economic worth. There are also differences in the fiscal document

and the usage of ratios in fiscal accounting.

SECTION 1

The Significance of Fiscal Administration

The technique of managing an institution's money and financial planning and analysis

activities is known as fiscal administration. It guarantees that money is accessible to satisfy day-

to-day customer requirements and that monies are spent wisely. Corporate finance comprises,

amongst many other aspects, deciding on acquisitions, permanent capital inflows, and financing

options. It helps with fiscal production strategy, administration, and monitoring. It also involves

judgments on investor return on capital. It gives management information about the corporation's

profit, losses, and expenses, ability to generate educated choices. Management would be enabled

to monitor wherever the firm's money is going and would be equipped to save money. For the

reasons listed, fiscal administration is vital to a business's success:

Finance Administration- It assists in Company Budget Strategy and Financial

management helps in corporation budgeting. It comprises, amongst many other aspects, planning

for company resources, budgeting, and finance needs. It helps companies prepare for difficult

scenarios that happen as a consequence of shifts in the atmosphere. Finance planning aids firms

in achieving their stated goals. It controls the expenditures, liabilities, loans, and earnings of the

company (Guironnet, Attuyer and Halbert, 2016).

Procurement of funds: Finance administration assists the organisation in collecting

finances from less costly resources which are suitable for the requirements and specifications.

For a corporation's activities to run efficiently, it needs money. It guarantees that money are

accessible when a business requires them. It is required for daily activities, acquisitions, loan

repayments, and input materials purchasing, amongst many other reasons.

The capital and loan which a firm employs to fulfil its aims and ambitions are referred to

as corporate finance (Fan and Chatterjee, 2019). From the procurement of raw materials to the

delivery of goods and services to clients, firms require financing. The acquisition of money for

the aim of meeting market requirements is referred to as commercial finance. It offers funds for

investment operational financial regulations as well as financing diversity. This research involves

monetary administration and economic worth. There are also differences in the fiscal document

and the usage of ratios in fiscal accounting.

SECTION 1

The Significance of Fiscal Administration

The technique of managing an institution's money and financial planning and analysis

activities is known as fiscal administration. It guarantees that money is accessible to satisfy day-

to-day customer requirements and that monies are spent wisely. Corporate finance comprises,

amongst many other aspects, deciding on acquisitions, permanent capital inflows, and financing

options. It helps with fiscal production strategy, administration, and monitoring. It also involves

judgments on investor return on capital. It gives management information about the corporation's

profit, losses, and expenses, ability to generate educated choices. Management would be enabled

to monitor wherever the firm's money is going and would be equipped to save money. For the

reasons listed, fiscal administration is vital to a business's success:

Finance Administration- It assists in Company Budget Strategy and Financial

management helps in corporation budgeting. It comprises, amongst many other aspects, planning

for company resources, budgeting, and finance needs. It helps companies prepare for difficult

scenarios that happen as a consequence of shifts in the atmosphere. Finance planning aids firms

in achieving their stated goals. It controls the expenditures, liabilities, loans, and earnings of the

company (Guironnet, Attuyer and Halbert, 2016).

Procurement of funds: Finance administration assists the organisation in collecting

finances from less costly resources which are suitable for the requirements and specifications.

For a corporation's activities to run efficiently, it needs money. It guarantees that money are

accessible when a business requires them. It is required for daily activities, acquisitions, loan

repayments, and input materials purchasing, amongst many other reasons.

Utilisation of funds: Finance administration assists a firm's management in formulating

the most effective utilization of resources by distributing cash in a timely fashion. It gives

funding allocation to statistics, enabling firms to identify wherever the cash is spent and

minimising expenses.

Fiscal judgments: Finance administration assists governance in creating fiscal choices

which affect the processes of the firm. So all of a firm's functions require finances, investment

choices will have an impact on other sectors.. These decisions help the organisation achieve its

long-term goals.

Increase profitability: Corporate finance assists in the appropriate utilization of

resources in order to optimize a company's finance performance. Cost management, cost benefit

assessment, as well as other techniques are used to increase firm performance by cost

containment. Workers are encouraged to conserve, cutting the expense of obtaining cash

(Himawan, 2019).

SECTION 2

Finance reports and the use of metrics are discussed.

Finance accounts are measurements that help a firm run a reported month and provide a

thorough picture of the business's finance status and performance. Three types of fiscal accounts

which assist in the development of operational processes are as follows:

Income statements- This declaration depicts a corporation's long run success, including

its efficiency and the resources required to attain that outcome. The income and losses

statement validates the corporation's fiscal situation by showing precise revenues and

expenses. It is an important part of evaluating income and spending because to swings in

operational costs, R&D expenses, and basic materials expenses which affect the firm's

performance.

Balance sheet- The balancing sheets are an important part of fiscal reports since it shows

the firm's ultimate condition by showing managers in a plain and exact manner. This

comprises resources and debts, and also financial ownership, all of which seem to be

equivalent at the completion of the computations. These calculations indicate that

possessions, which reflect financial power, are comparable to loans and investment. As a

the most effective utilization of resources by distributing cash in a timely fashion. It gives

funding allocation to statistics, enabling firms to identify wherever the cash is spent and

minimising expenses.

Fiscal judgments: Finance administration assists governance in creating fiscal choices

which affect the processes of the firm. So all of a firm's functions require finances, investment

choices will have an impact on other sectors.. These decisions help the organisation achieve its

long-term goals.

Increase profitability: Corporate finance assists in the appropriate utilization of

resources in order to optimize a company's finance performance. Cost management, cost benefit

assessment, as well as other techniques are used to increase firm performance by cost

containment. Workers are encouraged to conserve, cutting the expense of obtaining cash

(Himawan, 2019).

SECTION 2

Finance reports and the use of metrics are discussed.

Finance accounts are measurements that help a firm run a reported month and provide a

thorough picture of the business's finance status and performance. Three types of fiscal accounts

which assist in the development of operational processes are as follows:

Income statements- This declaration depicts a corporation's long run success, including

its efficiency and the resources required to attain that outcome. The income and losses

statement validates the corporation's fiscal situation by showing precise revenues and

expenses. It is an important part of evaluating income and spending because to swings in

operational costs, R&D expenses, and basic materials expenses which affect the firm's

performance.

Balance sheet- The balancing sheets are an important part of fiscal reports since it shows

the firm's ultimate condition by showing managers in a plain and exact manner. This

comprises resources and debts, and also financial ownership, all of which seem to be

equivalent at the completion of the computations. These calculations indicate that

possessions, which reflect financial power, are comparable to loans and investment. As a

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

consequence, the 2 halves of a balancing statement should always be similar, as per the

fundamental idea of Asset = Liabilities.

Cash flow statements- This study concentrates on a firm's financial inflows and

expenditures over a specific time period. The operational, investment, and finance

accounting information indicate that however much revenue is flowing out and receiving

in from 3 primary sorts of activity. Such methods compute and evaluate a firm's fiscal

position, making it much easier for researchers and investors to make the correct

assessments of the outcomes. This makes it easier to make knowledgeable managerial

choices and prevent investment burden. This part highlights the financial balances that

show how successfully the company would be able to meet its borrowing commitments

and operational costs (Hollensen, Kotler and Opresnik, 2017).

Proportions are a type of computation that is used to determine the viability and solvency of a

firm's finance statements. They cover a wide variety of computations. Some instances of how

percentages are utilised in finance administration are as follows:

Helps in comparison- Proportions are particularly beneficial in presenting a business

with a comparative perspective, which could also aid in making pre-emptive changes that

are required. Owners and traders examined this in possible to correlate prior year's

outcomes to present year's achievement.

Useful in decision making- Workers are willing to support managers in formulating

appropriate judgement and executing appropriate commercial measures. Researchers can

develop inferences depending on them because they offer valuable knowledge about the

firm's performance.

Aids forecasts and planning- They were particularly useful in fiscal budgeting as well

as projecting upcoming scenarios and responsibilities by calculating the length of time.

These help to provide appropriate knowledge to owners and customers so that they may

design their investing strategy. This provides exterior entities with a stake in the

organization with a better grasp of its fiscal status.

SECTION 3

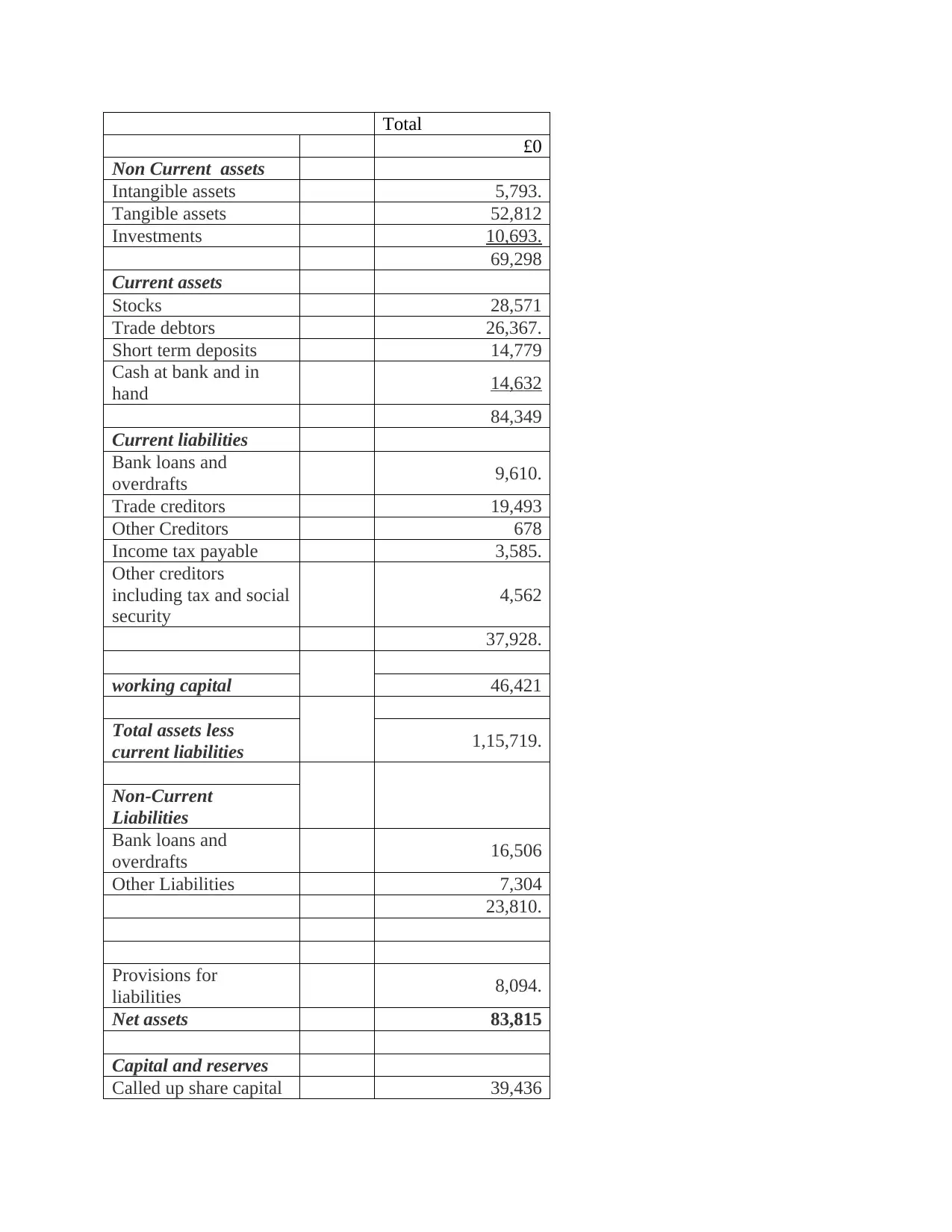

Balance sheet:

Amount

2016

fundamental idea of Asset = Liabilities.

Cash flow statements- This study concentrates on a firm's financial inflows and

expenditures over a specific time period. The operational, investment, and finance

accounting information indicate that however much revenue is flowing out and receiving

in from 3 primary sorts of activity. Such methods compute and evaluate a firm's fiscal

position, making it much easier for researchers and investors to make the correct

assessments of the outcomes. This makes it easier to make knowledgeable managerial

choices and prevent investment burden. This part highlights the financial balances that

show how successfully the company would be able to meet its borrowing commitments

and operational costs (Hollensen, Kotler and Opresnik, 2017).

Proportions are a type of computation that is used to determine the viability and solvency of a

firm's finance statements. They cover a wide variety of computations. Some instances of how

percentages are utilised in finance administration are as follows:

Helps in comparison- Proportions are particularly beneficial in presenting a business

with a comparative perspective, which could also aid in making pre-emptive changes that

are required. Owners and traders examined this in possible to correlate prior year's

outcomes to present year's achievement.

Useful in decision making- Workers are willing to support managers in formulating

appropriate judgement and executing appropriate commercial measures. Researchers can

develop inferences depending on them because they offer valuable knowledge about the

firm's performance.

Aids forecasts and planning- They were particularly useful in fiscal budgeting as well

as projecting upcoming scenarios and responsibilities by calculating the length of time.

These help to provide appropriate knowledge to owners and customers so that they may

design their investing strategy. This provides exterior entities with a stake in the

organization with a better grasp of its fiscal status.

SECTION 3

Balance sheet:

Amount

2016

Total

£0

Non Current assets

Intangible assets 5,793.

Tangible assets 52,812

Investments 10,693.

69,298

Current assets

Stocks 28,571

Trade debtors 26,367.

Short term deposits 14,779

Cash at bank and in

hand 14,632

84,349

Current liabilities

Bank loans and

overdrafts 9,610.

Trade creditors 19,493

Other Creditors 678

Income tax payable 3,585.

Other creditors

including tax and social

security

4,562

37,928.

working capital 46,421

Total assets less

current liabilities 1,15,719.

Non-Current

Liabilities

Bank loans and

overdrafts 16,506

Other Liabilities 7,304

23,810.

Provisions for

liabilities 8,094.

Net assets 83,815

Capital and reserves

Called up share capital 39,436

£0

Non Current assets

Intangible assets 5,793.

Tangible assets 52,812

Investments 10,693.

69,298

Current assets

Stocks 28,571

Trade debtors 26,367.

Short term deposits 14,779

Cash at bank and in

hand 14,632

84,349

Current liabilities

Bank loans and

overdrafts 9,610.

Trade creditors 19,493

Other Creditors 678

Income tax payable 3,585.

Other creditors

including tax and social

security

4,562

37,928.

working capital 46,421

Total assets less

current liabilities 1,15,719.

Non-Current

Liabilities

Bank loans and

overdrafts 16,506

Other Liabilities 7,304

23,810.

Provisions for

liabilities 8,094.

Net assets 83,815

Capital and reserves

Called up share capital 39,436

Reserves 1322.

Retained earnings 43,057

Total equity 83,802

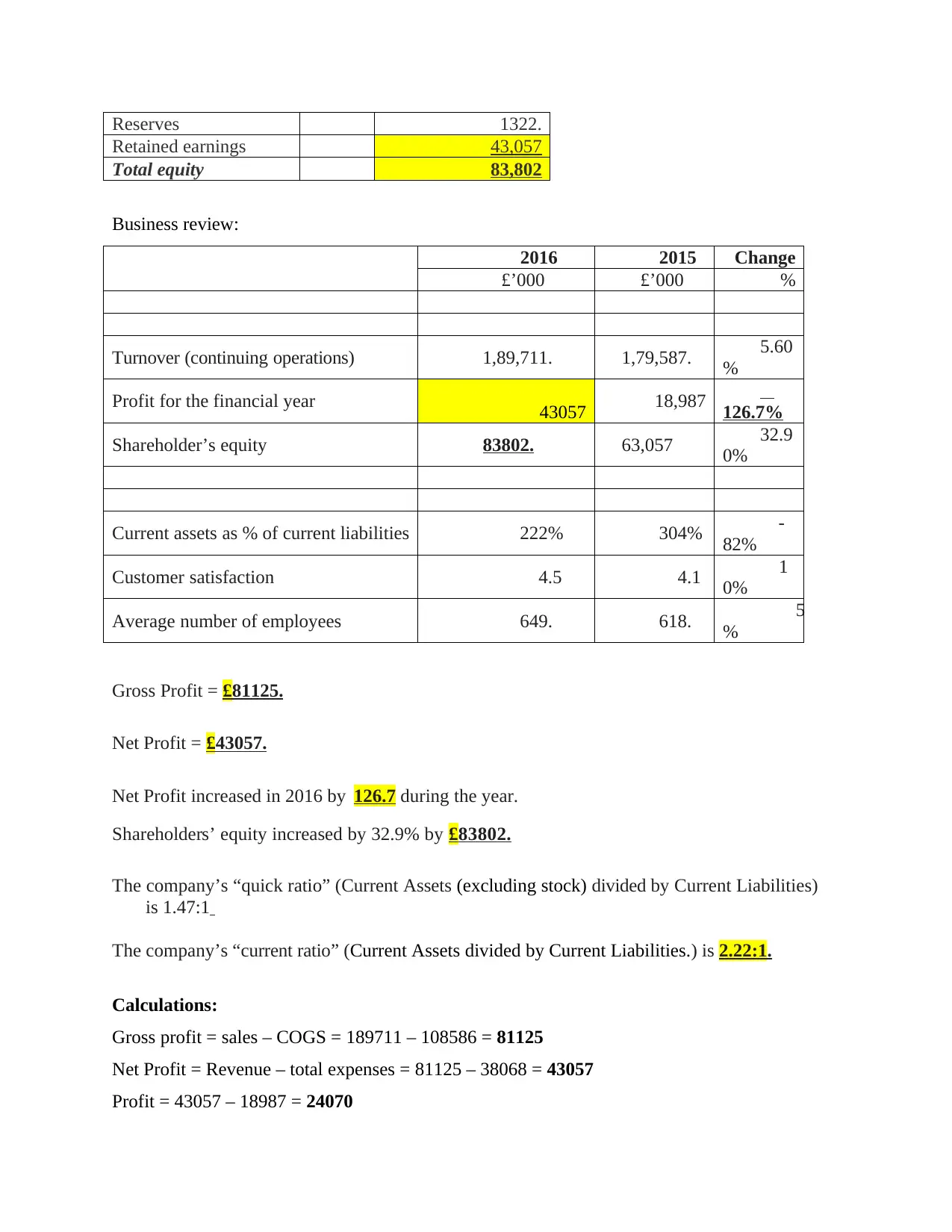

Business review:

2016 2015 Change

£’000 £’000 %

Turnover (continuing operations) 1,89,711. 1,79,587. 5.60

%

Profit for the financial year 43057 18,987 126.7%

Shareholder’s equity 83802. 63,057 32.9

0%

Current assets as % of current liabilities 222% 304% -

82%

Customer satisfaction 4.5 4.1 1

0%

Average number of employees 649. 618. 5

%

Gross Profit = £81125.

Net Profit = £43057.

Net Profit increased in 2016 by 126.7 during the year.

Shareholders’ equity increased by 32.9% by £83802.

The company’s “quick ratio” (Current Assets (excluding stock) divided by Current Liabilities)

is 1.47:1

The company’s “current ratio” (Current Assets divided by Current Liabilities.) is 2.22:1.

Calculations:

Gross profit = sales – COGS = 189711 – 108586 = 81125

Net Profit = Revenue – total expenses = 81125 – 38068 = 43057

Profit = 43057 – 18987 = 24070

Retained earnings 43,057

Total equity 83,802

Business review:

2016 2015 Change

£’000 £’000 %

Turnover (continuing operations) 1,89,711. 1,79,587. 5.60

%

Profit for the financial year 43057 18,987 126.7%

Shareholder’s equity 83802. 63,057 32.9

0%

Current assets as % of current liabilities 222% 304% -

82%

Customer satisfaction 4.5 4.1 1

0%

Average number of employees 649. 618. 5

%

Gross Profit = £81125.

Net Profit = £43057.

Net Profit increased in 2016 by 126.7 during the year.

Shareholders’ equity increased by 32.9% by £83802.

The company’s “quick ratio” (Current Assets (excluding stock) divided by Current Liabilities)

is 1.47:1

The company’s “current ratio” (Current Assets divided by Current Liabilities.) is 2.22:1.

Calculations:

Gross profit = sales – COGS = 189711 – 108586 = 81125

Net Profit = Revenue – total expenses = 81125 – 38068 = 43057

Profit = 43057 – 18987 = 24070

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current ratio = current assets / current liabilities = 54349 / 37928 = 2.22:1

Quick ratio = (current assets- stock) / current liabilities

= (84349- 28571) /37928 = 1.47:1

Equity = 63057 / 20745 = 83807

Increase in profit = 63057 / 32.9% = 20745

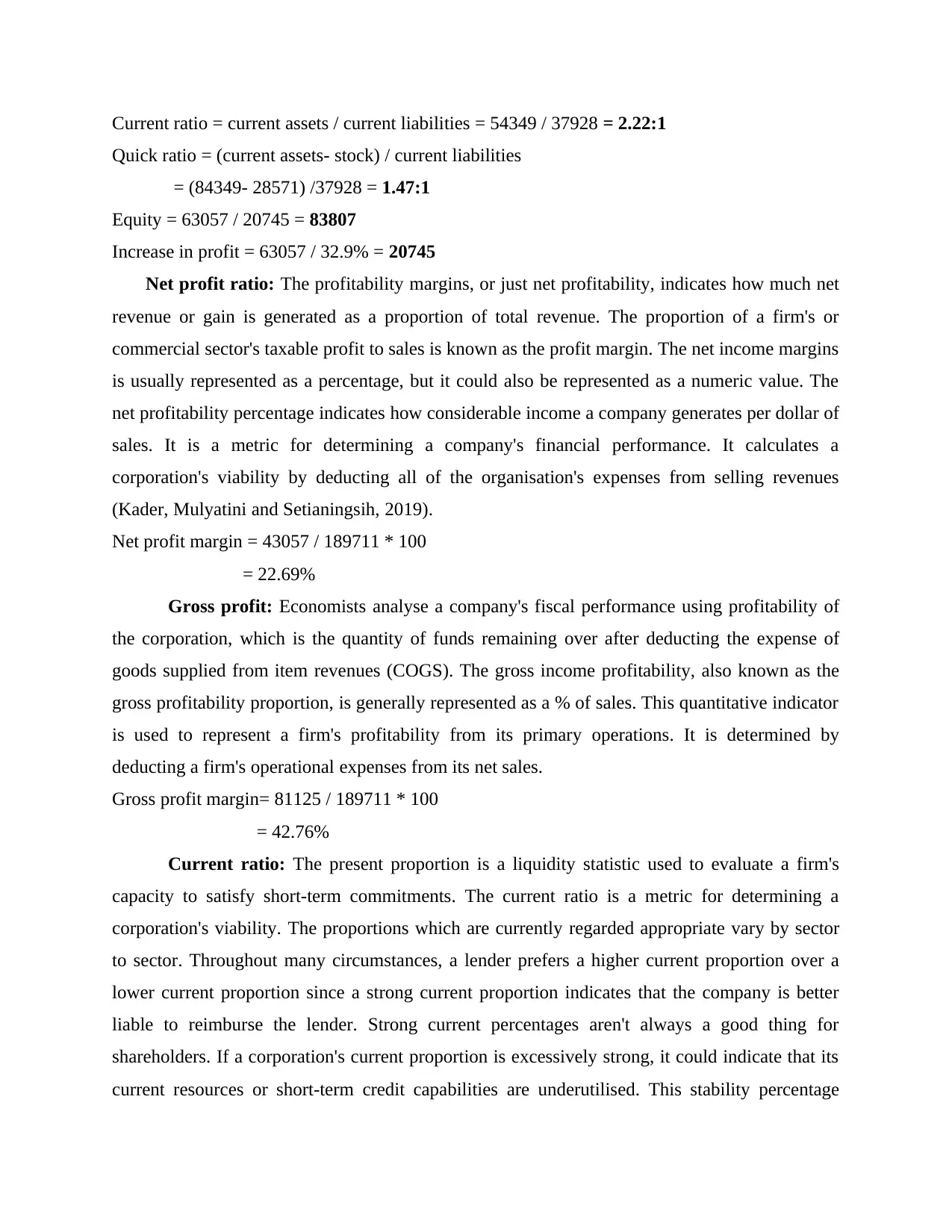

Net profit ratio: The profitability margins, or just net profitability, indicates how much net

revenue or gain is generated as a proportion of total revenue. The proportion of a firm's or

commercial sector's taxable profit to sales is known as the profit margin. The net income margins

is usually represented as a percentage, but it could also be represented as a numeric value. The

net profitability percentage indicates how considerable income a company generates per dollar of

sales. It is a metric for determining a company's financial performance. It calculates a

corporation's viability by deducting all of the organisation's expenses from selling revenues

(Kader, Mulyatini and Setianingsih, 2019).

Net profit margin = 43057 / 189711 * 100

= 22.69%

Gross profit: Economists analyse a company's fiscal performance using profitability of

the corporation, which is the quantity of funds remaining over after deducting the expense of

goods supplied from item revenues (COGS). The gross income profitability, also known as the

gross profitability proportion, is generally represented as a % of sales. This quantitative indicator

is used to represent a firm's profitability from its primary operations. It is determined by

deducting a firm's operational expenses from its net sales.

Gross profit margin= 81125 / 189711 * 100

= 42.76%

Current ratio: The present proportion is a liquidity statistic used to evaluate a firm's

capacity to satisfy short-term commitments. The current ratio is a metric for determining a

corporation's viability. The proportions which are currently regarded appropriate vary by sector

to sector. Throughout many circumstances, a lender prefers a higher current proportion over a

lower current proportion since a strong current proportion indicates that the company is better

liable to reimburse the lender. Strong current percentages aren't always a good thing for

shareholders. If a corporation's current proportion is excessively strong, it could indicate that its

current resources or short-term credit capabilities are underutilised. This stability percentage

Quick ratio = (current assets- stock) / current liabilities

= (84349- 28571) /37928 = 1.47:1

Equity = 63057 / 20745 = 83807

Increase in profit = 63057 / 32.9% = 20745

Net profit ratio: The profitability margins, or just net profitability, indicates how much net

revenue or gain is generated as a proportion of total revenue. The proportion of a firm's or

commercial sector's taxable profit to sales is known as the profit margin. The net income margins

is usually represented as a percentage, but it could also be represented as a numeric value. The

net profitability percentage indicates how considerable income a company generates per dollar of

sales. It is a metric for determining a company's financial performance. It calculates a

corporation's viability by deducting all of the organisation's expenses from selling revenues

(Kader, Mulyatini and Setianingsih, 2019).

Net profit margin = 43057 / 189711 * 100

= 22.69%

Gross profit: Economists analyse a company's fiscal performance using profitability of

the corporation, which is the quantity of funds remaining over after deducting the expense of

goods supplied from item revenues (COGS). The gross income profitability, also known as the

gross profitability proportion, is generally represented as a % of sales. This quantitative indicator

is used to represent a firm's profitability from its primary operations. It is determined by

deducting a firm's operational expenses from its net sales.

Gross profit margin= 81125 / 189711 * 100

= 42.76%

Current ratio: The present proportion is a liquidity statistic used to evaluate a firm's

capacity to satisfy short-term commitments. The current ratio is a metric for determining a

corporation's viability. The proportions which are currently regarded appropriate vary by sector

to sector. Throughout many circumstances, a lender prefers a higher current proportion over a

lower current proportion since a strong current proportion indicates that the company is better

liable to reimburse the lender. Strong current percentages aren't always a good thing for

shareholders. If a corporation's current proportion is excessively strong, it could indicate that its

current resources or short-term credit capabilities are underutilised. This stability percentage

assures that a company's ability to perform is evaluated in terms of short-term commitments. It

encompasses all present obligations and resources. If present obligations exceed present

resources, the current proportion will be lower than 1. If the existing proportion is less than 1, the

company might struggle to meet its short-term commitments. Certain businesses, on the other

hand, can operate with liquidity ratios of less than one. The current proportion of the corporation

would easily remain below one if merchandise turns into money quicker than accounts payable is

overdue. The expense of acquisitions is used to evaluate goods, with the intention of selling it for

a greater cost. As a consequence, the transaction could generate significantly greater revenue

than the balanced statement inventories worth. Organizations that really can collect revenue from

customers prior compensating their vendors might justify lower current percentages (Katrin and

Vanel, 2020).

Current ratio = Current assets / current liabilities

= 54349 / 37928

= 2.22:1

Quick ratio: The quick proportion is a measurement of a firm's capacity to meet short-

term commitments with being the most accessible resources, and it provides insight into its

short-term financial situation. It's also referred as the acid test proportion since it demonstrates an

organization's capacity to promptly pay off existing obligations with near-cash resources (assets

that can be converted quickly to cash). The term "acid test" refers to a quick test that produces

prompt results. It depicts a company's short-term financial situation and enables for the estimate

of its capacity to repay short-term borrowing. The acid test proportion is another name for it. One

to one is an excellent short percentage. The availability percentage is a metric for determining

how accessible a company is (Nyagadza, 2019).

Quick ratio = (Current assets – inventory) / current liabilities

= (84349 – 28571) / 37928

= 1.47: 1

In respect to its main activities, a firm's production degree produces a significant amount

of revenue, depending on the above proportion evaluation. It may be proven by looking at an

organization's gross profitability margins, as the corporation has a significant gross revenue

percentage. The corporation, on either extreme, must increase its net profitability margins, which

could be assessed by lowering wasteful spending. A corporation's economic situation is healthy

encompasses all present obligations and resources. If present obligations exceed present

resources, the current proportion will be lower than 1. If the existing proportion is less than 1, the

company might struggle to meet its short-term commitments. Certain businesses, on the other

hand, can operate with liquidity ratios of less than one. The current proportion of the corporation

would easily remain below one if merchandise turns into money quicker than accounts payable is

overdue. The expense of acquisitions is used to evaluate goods, with the intention of selling it for

a greater cost. As a consequence, the transaction could generate significantly greater revenue

than the balanced statement inventories worth. Organizations that really can collect revenue from

customers prior compensating their vendors might justify lower current percentages (Katrin and

Vanel, 2020).

Current ratio = Current assets / current liabilities

= 54349 / 37928

= 2.22:1

Quick ratio: The quick proportion is a measurement of a firm's capacity to meet short-

term commitments with being the most accessible resources, and it provides insight into its

short-term financial situation. It's also referred as the acid test proportion since it demonstrates an

organization's capacity to promptly pay off existing obligations with near-cash resources (assets

that can be converted quickly to cash). The term "acid test" refers to a quick test that produces

prompt results. It depicts a company's short-term financial situation and enables for the estimate

of its capacity to repay short-term borrowing. The acid test proportion is another name for it. One

to one is an excellent short percentage. The availability percentage is a metric for determining

how accessible a company is (Nyagadza, 2019).

Quick ratio = (Current assets – inventory) / current liabilities

= (84349 – 28571) / 37928

= 1.47: 1

In respect to its main activities, a firm's production degree produces a significant amount

of revenue, depending on the above proportion evaluation. It may be proven by looking at an

organization's gross profitability margins, as the corporation has a significant gross revenue

percentage. The corporation, on either extreme, must increase its net profitability margins, which

could be assessed by lowering wasteful spending. A corporation's economic situation is healthy

apart from that. As a consequence, the organization should increase efficiency by reducing

superfluous expenditures and keeping good fiscal management, allowing it to raise its degree of

commercial competency (Potrich and Vieira, 2018).

CONCLUSION

According to the findings of the research, finance administration is a company's vitality.

It refers to the process of overseeing or managing a company's financial activities. Financial

administration provides for the evaluation of an organisational progress. Fixed investment

administration, income recognition, bookkeeping, and payments systems are just a few of the

finance-related responsibilities that are included in this method. Accounting accounts also

provide an overview of a company's fiscal position. A fiscal report is a report that summarises a

company's fiscal position. A standardized document which tracks a corporation's economic

activity is referred to as a ledger. It includes all financial data that is pertinent to businesses. As a

consequence, accounting information can help the organisation devise effective strategies for

strengthening its fiscal status. Moreover, fiscal report calculation enables a firm's executive

group to conduct well-informed judgments, allowing the business to enhance its productivity and

deliver long-term productivity and prosperity. Finance accounts include the balancing sheet,

operating revenue, and cash flow report. In addition, proportion assessment assists a company in

evaluating its solvency, competitiveness, organization, and effectiveness aspects in addition to

determine its performance and production.

superfluous expenditures and keeping good fiscal management, allowing it to raise its degree of

commercial competency (Potrich and Vieira, 2018).

CONCLUSION

According to the findings of the research, finance administration is a company's vitality.

It refers to the process of overseeing or managing a company's financial activities. Financial

administration provides for the evaluation of an organisational progress. Fixed investment

administration, income recognition, bookkeeping, and payments systems are just a few of the

finance-related responsibilities that are included in this method. Accounting accounts also

provide an overview of a company's fiscal position. A fiscal report is a report that summarises a

company's fiscal position. A standardized document which tracks a corporation's economic

activity is referred to as a ledger. It includes all financial data that is pertinent to businesses. As a

consequence, accounting information can help the organisation devise effective strategies for

strengthening its fiscal status. Moreover, fiscal report calculation enables a firm's executive

group to conduct well-informed judgments, allowing the business to enhance its productivity and

deliver long-term productivity and prosperity. Finance accounts include the balancing sheet,

operating revenue, and cash flow report. In addition, proportion assessment assists a company in

evaluating its solvency, competitiveness, organization, and effectiveness aspects in addition to

determine its performance and production.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journal

Fan, L. and Chatterjee, S., 2019. Financial socialization, financial education, and student loan

debt. Journal of Family and Economic Issues, 40(1), pp.74-85.

Guironnet, A., Attuyer, K. and Halbert, L., 2016. Building cities on financial assets: The

financialisation of property markets and its implications for city governments in the

Paris city-region. Urban Studies, 53(7), pp.1442-1464.

Himawan, A.F.I., 2019. Digital marketing: peningkatan kapasitas dan brand awareness usaha

kecil menengah. Jurnal Analisis Bisnis Ekonomi, 17(2), pp.85-103.

Hollensen, S., Kotler, P. and Opresnik, M.O., 2017. Social media marketing: a practitioner

guide. Opresnik Management Consulting.

Kader, M.A., Mulyatini, N. and Setianingsih, W., 2019. MODEL PEMASARAN DIGITAL

MARKETING FB_Ads dan EMAIL MARKETING DALAM MENINGKATKAN

VOLUME PENJUALAN. Jurnal Ekonologi Ilmu Manajemen, 5(2), pp.299-305.

Katrin, K. and Vanel, Z., 2020. Strategi Pemasaran Komunikasi Digital Marketing Platform

(Cashbac) untuk Meningkatkan Daya Beli Konsumen. SOURCE: Jurnal Ilmu

Komunikasi, 6(1), pp.14-25.

Nyagadza, B., 2019. Conceptual model for financial inclusion development through agency

banking in competitive markets. Africanus, 49(2), pp.1-22.

Potrich, A.C.G. and Vieira, K.M., 2018. Demystifying financial literacy: a behavioral

perspective analysis. Management Research Review.

Books and Journal

Fan, L. and Chatterjee, S., 2019. Financial socialization, financial education, and student loan

debt. Journal of Family and Economic Issues, 40(1), pp.74-85.

Guironnet, A., Attuyer, K. and Halbert, L., 2016. Building cities on financial assets: The

financialisation of property markets and its implications for city governments in the

Paris city-region. Urban Studies, 53(7), pp.1442-1464.

Himawan, A.F.I., 2019. Digital marketing: peningkatan kapasitas dan brand awareness usaha

kecil menengah. Jurnal Analisis Bisnis Ekonomi, 17(2), pp.85-103.

Hollensen, S., Kotler, P. and Opresnik, M.O., 2017. Social media marketing: a practitioner

guide. Opresnik Management Consulting.

Kader, M.A., Mulyatini, N. and Setianingsih, W., 2019. MODEL PEMASARAN DIGITAL

MARKETING FB_Ads dan EMAIL MARKETING DALAM MENINGKATKAN

VOLUME PENJUALAN. Jurnal Ekonologi Ilmu Manajemen, 5(2), pp.299-305.

Katrin, K. and Vanel, Z., 2020. Strategi Pemasaran Komunikasi Digital Marketing Platform

(Cashbac) untuk Meningkatkan Daya Beli Konsumen. SOURCE: Jurnal Ilmu

Komunikasi, 6(1), pp.14-25.

Nyagadza, B., 2019. Conceptual model for financial inclusion development through agency

banking in competitive markets. Africanus, 49(2), pp.1-22.

Potrich, A.C.G. and Vieira, K.M., 2018. Demystifying financial literacy: a behavioral

perspective analysis. Management Research Review.

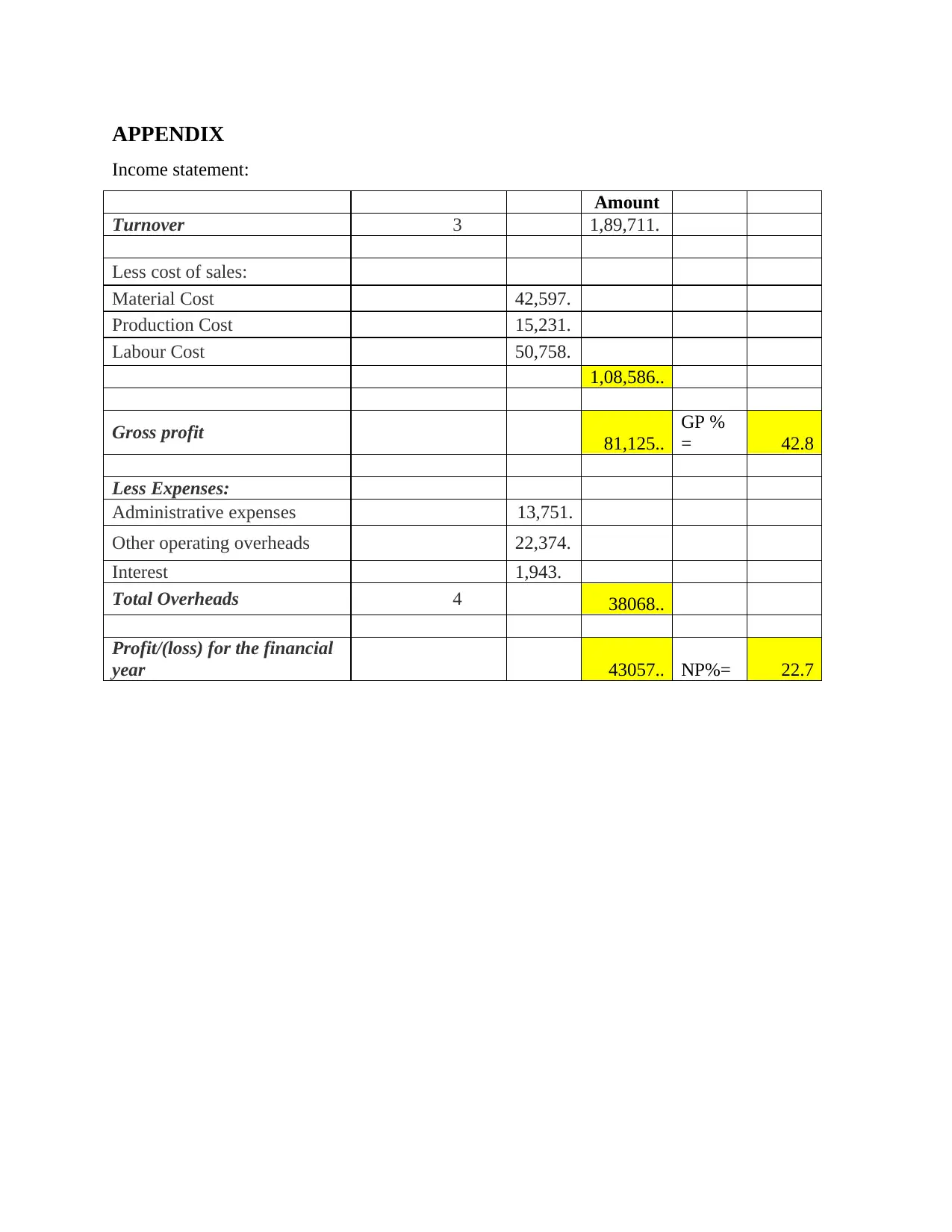

APPENDIX

Income statement:

Amount

Turnover 3 1,89,711.

Less cost of sales:

Material Cost 42,597.

Production Cost 15,231.

Labour Cost 50,758.

1,08,586..

Gross profit 81,125..

GP %

= 42.8

Less Expenses:

Administrative expenses 13,751.

Other operating overheads 22,374.

Interest 1,943.

Total Overheads 4 38068..

Profit/(loss) for the financial

year 43057.. NP%= 22.7

Income statement:

Amount

Turnover 3 1,89,711.

Less cost of sales:

Material Cost 42,597.

Production Cost 15,231.

Labour Cost 50,758.

1,08,586..

Gross profit 81,125..

GP %

= 42.8

Less Expenses:

Administrative expenses 13,751.

Other operating overheads 22,374.

Interest 1,943.

Total Overheads 4 38068..

Profit/(loss) for the financial

year 43057.. NP%= 22.7

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.