Financial Management Interim Assignment - Desklib

VerifiedAdded on 2023/05/28

|11

|2112

|131

AI Summary

Get a projected statement of profit and loss for the first year of operations of an unnamed business of Mrs. Chiara. Learn about the total amount of capital available in hand, cost of goods sold, operating expenses, and more.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Management

Interim Assignment

Interim Assignment

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

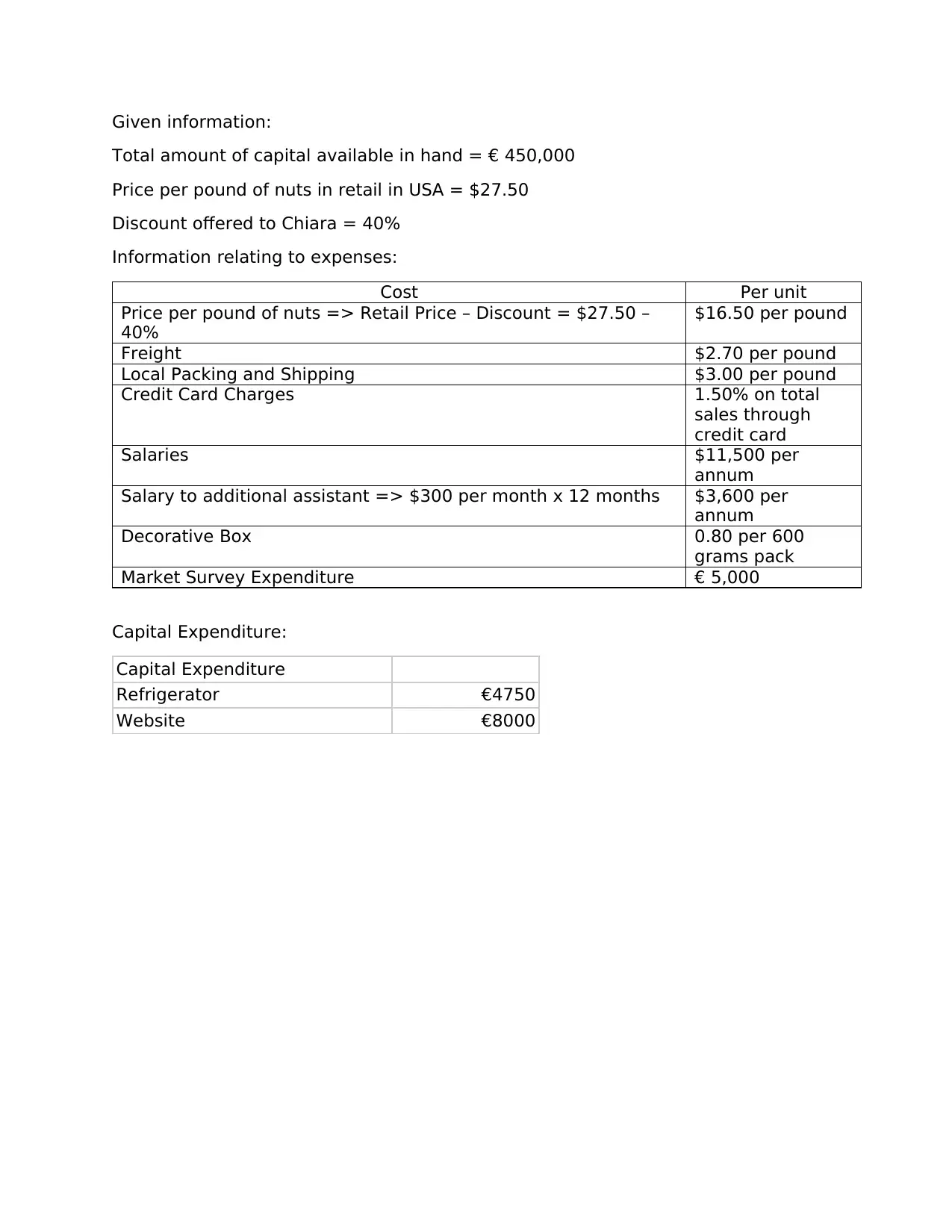

Given information:

Total amount of capital available in hand = € 450,000

Price per pound of nuts in retail in USA = $27.50

Discount offered to Chiara = 40%

Information relating to expenses:

Cost Per unit

Price per pound of nuts => Retail Price – Discount = $27.50 –

40%

$16.50 per pound

Freight $2.70 per pound

Local Packing and Shipping $3.00 per pound

Credit Card Charges 1.50% on total

sales through

credit card

Salaries $11,500 per

annum

Salary to additional assistant => $300 per month x 12 months $3,600 per

annum

Decorative Box 0.80 per 600

grams pack

Market Survey Expenditure € 5,000

Capital Expenditure:

Capital Expenditure

Refrigerator €4750

Website €8000

Total amount of capital available in hand = € 450,000

Price per pound of nuts in retail in USA = $27.50

Discount offered to Chiara = 40%

Information relating to expenses:

Cost Per unit

Price per pound of nuts => Retail Price – Discount = $27.50 –

40%

$16.50 per pound

Freight $2.70 per pound

Local Packing and Shipping $3.00 per pound

Credit Card Charges 1.50% on total

sales through

credit card

Salaries $11,500 per

annum

Salary to additional assistant => $300 per month x 12 months $3,600 per

annum

Decorative Box 0.80 per 600

grams pack

Market Survey Expenditure € 5,000

Capital Expenditure:

Capital Expenditure

Refrigerator €4750

Website €8000

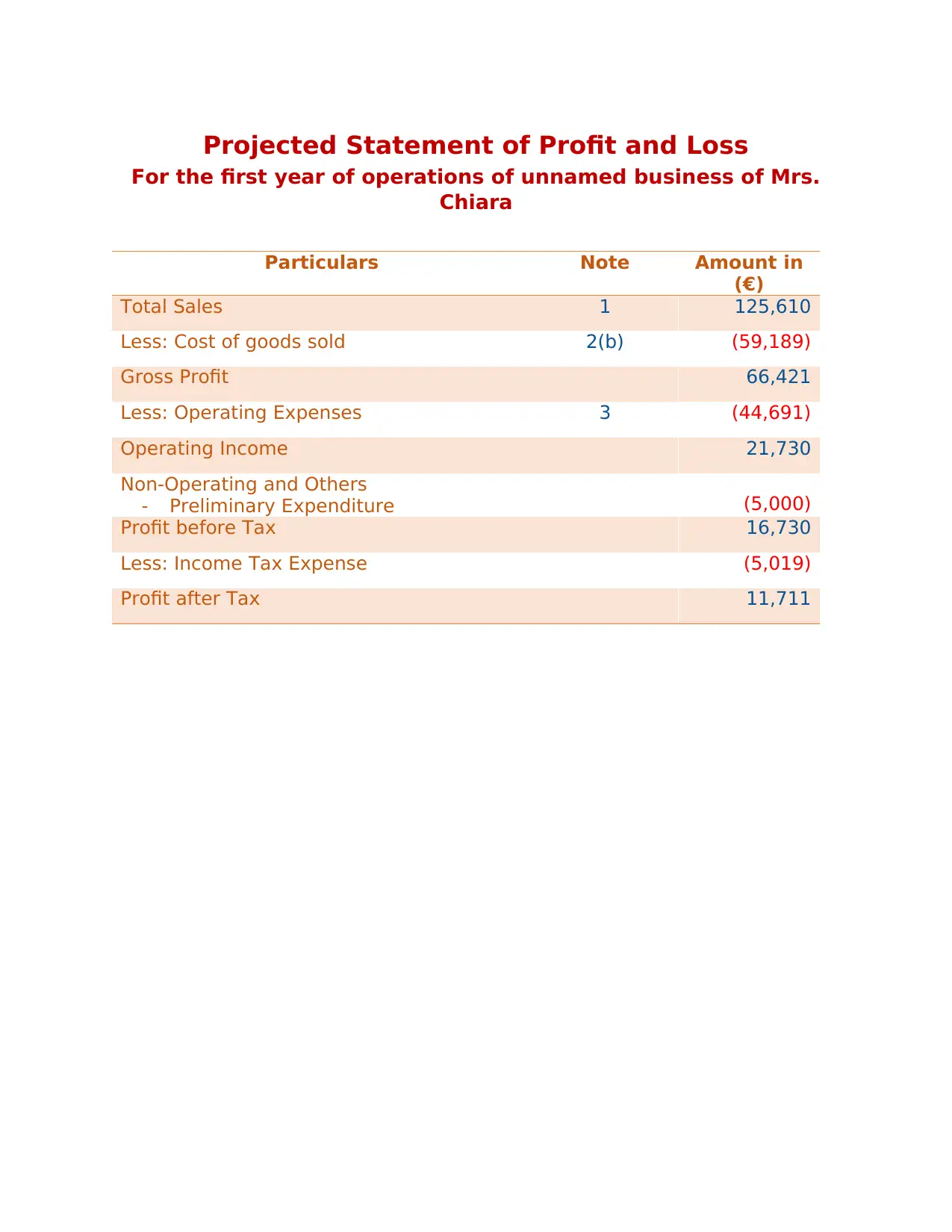

Projected Statement of Profit and Loss

For the first year of operations of unnamed business of Mrs.

Chiara

Particulars Note Amount in

(€)

Total Sales 1 125,610

Less: Cost of goods sold 2(b) (59,189)

Gross Profit 66,421

Less: Operating Expenses 3 (44,691)

Operating Income 21,730

Non-Operating and Others

- Preliminary Expenditure (5,000)

Profit before Tax 16,730

Less: Income Tax Expense (5,019)

Profit after Tax 11,711

For the first year of operations of unnamed business of Mrs.

Chiara

Particulars Note Amount in

(€)

Total Sales 1 125,610

Less: Cost of goods sold 2(b) (59,189)

Gross Profit 66,421

Less: Operating Expenses 3 (44,691)

Operating Income 21,730

Non-Operating and Others

- Preliminary Expenditure (5,000)

Profit before Tax 16,730

Less: Income Tax Expense (5,019)

Profit after Tax 11,711

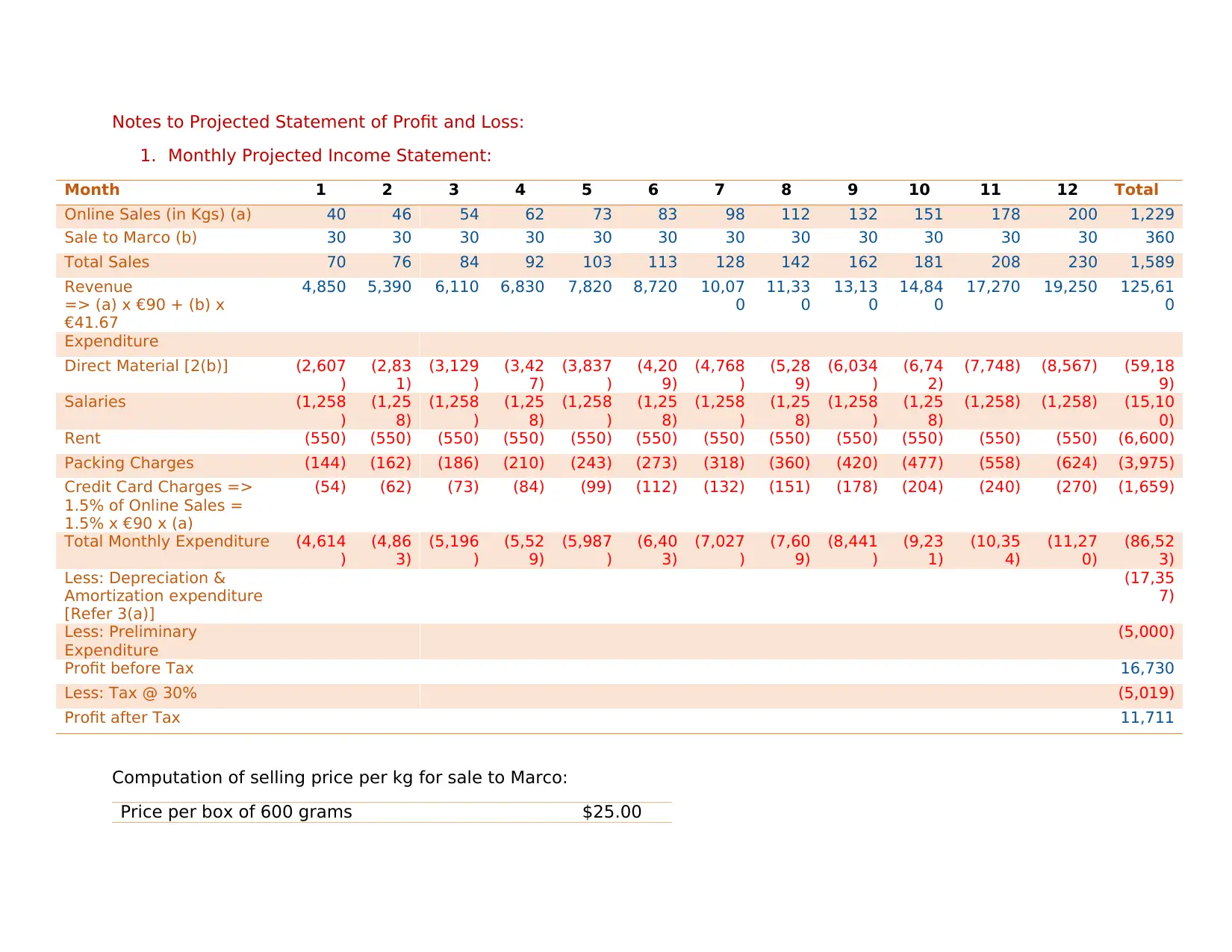

Notes to Projected Statement of Profit and Loss:

1. Monthly Projected Income Statement:

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in Kgs) (a) 40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco (b) 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Revenue

=> (a) x €90 + (b) x

€41.67

4,850 5,390 6,110 6,830 7,820 8,720 10,07

0

11,33

0

13,13

0

14,84

0

17,270 19,250 125,61

0

Expenditure

Direct Material [2(b)] (2,607

)

(2,83

1)

(3,129

)

(3,42

7)

(3,837

)

(4,20

9)

(4,768

)

(5,28

9)

(6,034

)

(6,74

2)

(7,748) (8,567) (59,18

9)

Salaries (1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258) (1,258) (15,10

0)

Rent (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (6,600)

Packing Charges (144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624) (3,975)

Credit Card Charges =>

1.5% of Online Sales =

1.5% x €90 x (a)

(54) (62) (73) (84) (99) (112) (132) (151) (178) (204) (240) (270) (1,659)

Total Monthly Expenditure (4,614

)

(4,86

3)

(5,196

)

(5,52

9)

(5,987

)

(6,40

3)

(7,027

)

(7,60

9)

(8,441

)

(9,23

1)

(10,35

4)

(11,27

0)

(86,52

3)

Less: Depreciation &

Amortization expenditure

[Refer 3(a)]

(17,35

7)

Less: Preliminary

Expenditure

(5,000)

Profit before Tax 16,730

Less: Tax @ 30% (5,019)

Profit after Tax 11,711

Computation of selling price per kg for sale to Marco:

Price per box of 600 grams $25.00

1. Monthly Projected Income Statement:

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in Kgs) (a) 40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco (b) 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

Revenue

=> (a) x €90 + (b) x

€41.67

4,850 5,390 6,110 6,830 7,820 8,720 10,07

0

11,33

0

13,13

0

14,84

0

17,270 19,250 125,61

0

Expenditure

Direct Material [2(b)] (2,607

)

(2,83

1)

(3,129

)

(3,42

7)

(3,837

)

(4,20

9)

(4,768

)

(5,28

9)

(6,034

)

(6,74

2)

(7,748) (8,567) (59,18

9)

Salaries (1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258

)

(1,25

8)

(1,258) (1,258) (15,10

0)

Rent (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (6,600)

Packing Charges (144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624) (3,975)

Credit Card Charges =>

1.5% of Online Sales =

1.5% x €90 x (a)

(54) (62) (73) (84) (99) (112) (132) (151) (178) (204) (240) (270) (1,659)

Total Monthly Expenditure (4,614

)

(4,86

3)

(5,196

)

(5,52

9)

(5,987

)

(6,40

3)

(7,027

)

(7,60

9)

(8,441

)

(9,23

1)

(10,35

4)

(11,27

0)

(86,52

3)

Less: Depreciation &

Amortization expenditure

[Refer 3(a)]

(17,35

7)

Less: Preliminary

Expenditure

(5,000)

Profit before Tax 16,730

Less: Tax @ 30% (5,019)

Profit after Tax 11,711

Computation of selling price per kg for sale to Marco:

Price per box of 600 grams $25.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Therefore equivalent price per kg => $25.00 *1000

/ 600

$41.67

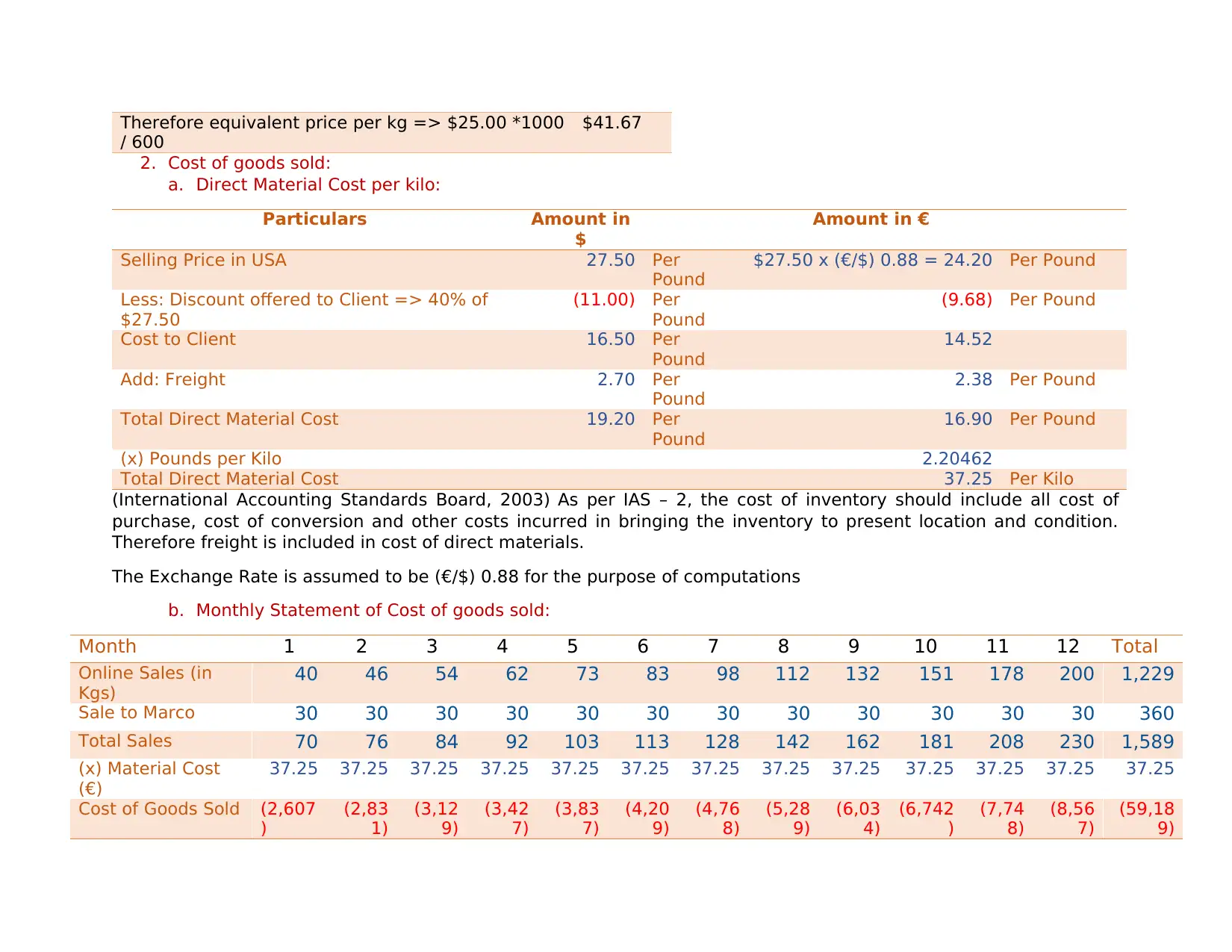

2. Cost of goods sold:

a. Direct Material Cost per kilo:

Particulars Amount in

$

Amount in €

Selling Price in USA 27.50 Per

Pound

$27.50 x (€/$) 0.88 = 24.20 Per Pound

Less: Discount offered to Client => 40% of

$27.50

(11.00) Per

Pound

(9.68) Per Pound

Cost to Client 16.50 Per

Pound

14.52

Add: Freight 2.70 Per

Pound

2.38 Per Pound

Total Direct Material Cost 19.20 Per

Pound

16.90 Per Pound

(x) Pounds per Kilo 2.20462

Total Direct Material Cost 37.25 Per Kilo

(International Accounting Standards Board, 2003) As per IAS – 2, the cost of inventory should include all cost of

purchase, cost of conversion and other costs incurred in bringing the inventory to present location and condition.

Therefore freight is included in cost of direct materials.

The Exchange Rate is assumed to be (€/$) 0.88 for the purpose of computations

b. Monthly Statement of Cost of goods sold:

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in

Kgs)

40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

(x) Material Cost

(€)

37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25

Cost of Goods Sold (2,607

)

(2,83

1)

(3,12

9)

(3,42

7)

(3,83

7)

(4,20

9)

(4,76

8)

(5,28

9)

(6,03

4)

(6,742

)

(7,74

8)

(8,56

7)

(59,18

9)

/ 600

$41.67

2. Cost of goods sold:

a. Direct Material Cost per kilo:

Particulars Amount in

$

Amount in €

Selling Price in USA 27.50 Per

Pound

$27.50 x (€/$) 0.88 = 24.20 Per Pound

Less: Discount offered to Client => 40% of

$27.50

(11.00) Per

Pound

(9.68) Per Pound

Cost to Client 16.50 Per

Pound

14.52

Add: Freight 2.70 Per

Pound

2.38 Per Pound

Total Direct Material Cost 19.20 Per

Pound

16.90 Per Pound

(x) Pounds per Kilo 2.20462

Total Direct Material Cost 37.25 Per Kilo

(International Accounting Standards Board, 2003) As per IAS – 2, the cost of inventory should include all cost of

purchase, cost of conversion and other costs incurred in bringing the inventory to present location and condition.

Therefore freight is included in cost of direct materials.

The Exchange Rate is assumed to be (€/$) 0.88 for the purpose of computations

b. Monthly Statement of Cost of goods sold:

Month 1 2 3 4 5 6 7 8 9 10 11 12 Total

Online Sales (in

Kgs)

40 46 54 62 73 83 98 112 132 151 178 200 1,229

Sale to Marco 30 30 30 30 30 30 30 30 30 30 30 30 360

Total Sales 70 76 84 92 103 113 128 142 162 181 208 230 1,589

(x) Material Cost

(€)

37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25 37.25

Cost of Goods Sold (2,607

)

(2,83

1)

(3,12

9)

(3,42

7)

(3,83

7)

(4,20

9)

(4,76

8)

(5,28

9)

(6,03

4)

(6,742

)

(7,74

8)

(8,56

7)

(59,18

9)

Notes and Assumptions:

- It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the

end of the year as per the results of market survey

- The sales of month 12 is rounded off to 200.

- Marco required 50 packets of 600 grams each per month => Requirement in Kgs = 50 packets x 600

grams = 30 Kgs.

- It is assumed that the sales will increase at a growth rate of 16% per month till they reach 200 units at the

end of the year as per the results of market survey

- The sales of month 12 is rounded off to 200.

- Marco required 50 packets of 600 grams each per month => Requirement in Kgs = 50 packets x 600

grams = 30 Kgs.

3. Operating Expenses:

Particulars Amount in

€

Salaries:

Operating Staff

Packing Assistant => 300 x 12 months

11,500.

00

3,600.0

0

15,100.00

Rent => 550 x 12 months 6,600.00

Packing Charges

Packing Material => 360 packs x €0.80

Local Packing & Shipping => 1,229 Kgs x

€3.00

288.00

3,687.0

0

3,975.00

Credit Card Expense 1,659.00

Depreciation & Amortization Expenses. Refer

3 (a)

17,357.00

Total Operating Expenses 44,691.00

a. Depreciation & Amortization Expenses:

Particulars Computation Amount

in €

Depreciation on

Refrigerator

(4,750 – 0) / 4 years 1,188.00 Per

annum

Amortization on Website 8,000 * (1,229 /

8,429)

2,000.00 Per

annum

Amortization of

Exclusivity

88,000 * (1,589 /

9,869)

14,169.00 Per

annum

Total Depreciation 17,357.00 Per

annum

Notes and Assumptions:

- It is assumed that the tangible assets acquired have a useful economic

life which lasts only the period for which the exclusivity was obtained by

the client. (4 years)

- Since the upfront payment made for obtaining the exclusivity is

unavailable, it is assumed that the amount paid is $100,000 (or)

$100,000 x €0.88 = €88,000

- In case of intangible assets, no. of units sold is used as a base for

computation of amortization expense

- While online sale quantity is treated as appropriate for computing

amortization expense for the website, total sale quantity is treated as

Particulars Amount in

€

Salaries:

Operating Staff

Packing Assistant => 300 x 12 months

11,500.

00

3,600.0

0

15,100.00

Rent => 550 x 12 months 6,600.00

Packing Charges

Packing Material => 360 packs x €0.80

Local Packing & Shipping => 1,229 Kgs x

€3.00

288.00

3,687.0

0

3,975.00

Credit Card Expense 1,659.00

Depreciation & Amortization Expenses. Refer

3 (a)

17,357.00

Total Operating Expenses 44,691.00

a. Depreciation & Amortization Expenses:

Particulars Computation Amount

in €

Depreciation on

Refrigerator

(4,750 – 0) / 4 years 1,188.00 Per

annum

Amortization on Website 8,000 * (1,229 /

8,429)

2,000.00 Per

annum

Amortization of

Exclusivity

88,000 * (1,589 /

9,869)

14,169.00 Per

annum

Total Depreciation 17,357.00 Per

annum

Notes and Assumptions:

- It is assumed that the tangible assets acquired have a useful economic

life which lasts only the period for which the exclusivity was obtained by

the client. (4 years)

- Since the upfront payment made for obtaining the exclusivity is

unavailable, it is assumed that the amount paid is $100,000 (or)

$100,000 x €0.88 = €88,000

- In case of intangible assets, no. of units sold is used as a base for

computation of amortization expense

- While online sale quantity is treated as appropriate for computing

amortization expense for the website, total sale quantity is treated as

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

appropriate for computing amortization expense of Exclusive Rights

obtained.

- It is further assumed that the refrigerator is depreciated on straight-line

basis. It is inherently assumed that there will be no salvage value left

after the end of useful economic life.

Total sales over life of exclusivity => 1,589 + {[(200 * 12) + (30 * 12)] * 3}

= 9,869 units

Online Sales over life of exclusivity > 1,229 + (200 * 12 * 3 years) = 8,492

units

obtained.

- It is further assumed that the refrigerator is depreciated on straight-line

basis. It is inherently assumed that there will be no salvage value left

after the end of useful economic life.

Total sales over life of exclusivity => 1,589 + {[(200 * 12) + (30 * 12)] * 3}

= 9,869 units

Online Sales over life of exclusivity > 1,229 + (200 * 12 * 3 years) = 8,492

units

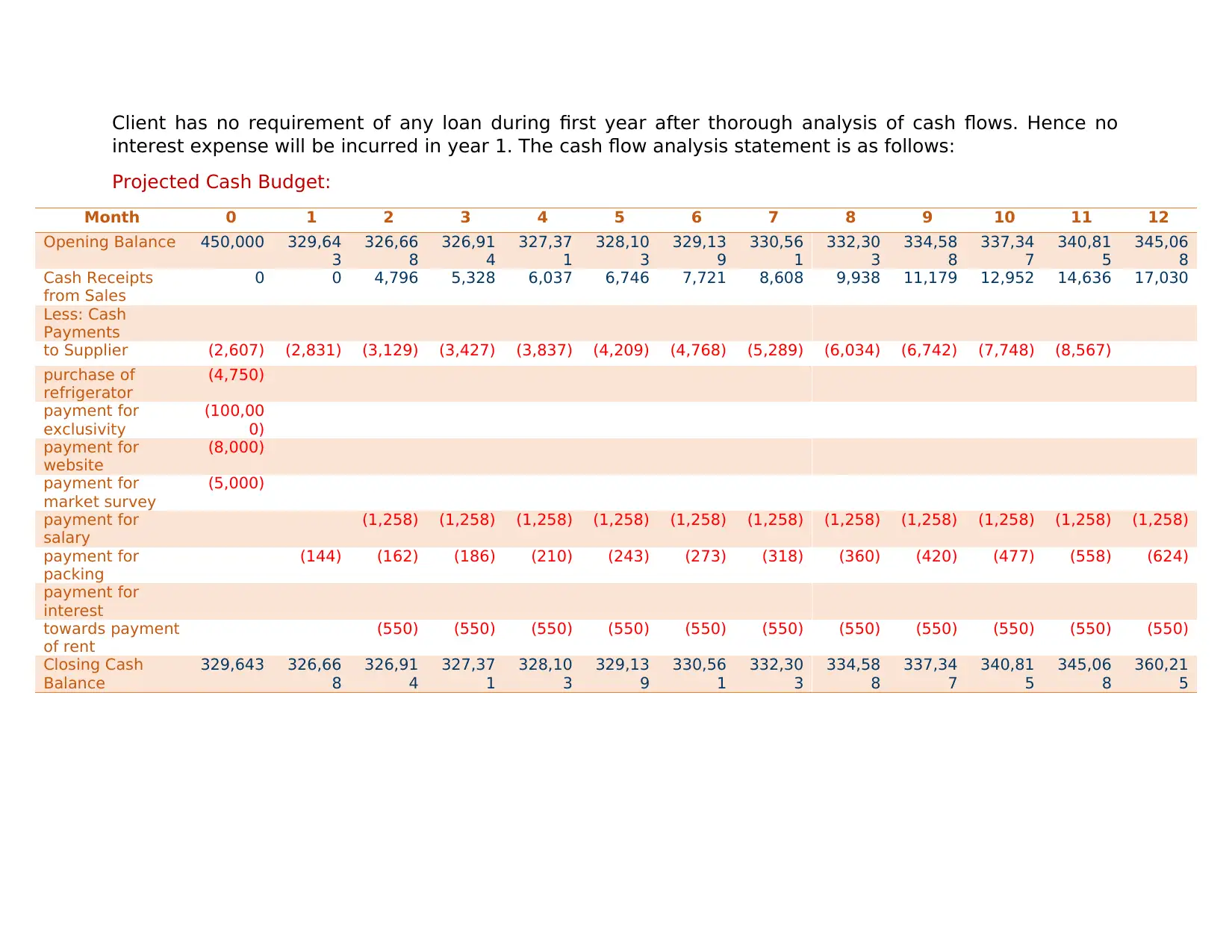

Client has no requirement of any loan during first year after thorough analysis of cash flows. Hence no

interest expense will be incurred in year 1. The cash flow analysis statement is as follows:

Projected Cash Budget:

Month 0 1 2 3 4 5 6 7 8 9 10 11 12

Opening Balance 450,000 329,64

3

326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

Cash Receipts

from Sales

0 0 4,796 5,328 6,037 6,746 7,721 8,608 9,938 11,179 12,952 14,636 17,030

Less: Cash

Payments

to Supplier (2,607) (2,831) (3,129) (3,427) (3,837) (4,209) (4,768) (5,289) (6,034) (6,742) (7,748) (8,567)

purchase of

refrigerator

(4,750)

payment for

exclusivity

(100,00

0)

payment for

website

(8,000)

payment for

market survey

(5,000)

payment for

salary

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258)

payment for

packing

(144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624)

payment for

interest

towards payment

of rent

(550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550)

Closing Cash

Balance

329,643 326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

360,21

5

interest expense will be incurred in year 1. The cash flow analysis statement is as follows:

Projected Cash Budget:

Month 0 1 2 3 4 5 6 7 8 9 10 11 12

Opening Balance 450,000 329,64

3

326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

Cash Receipts

from Sales

0 0 4,796 5,328 6,037 6,746 7,721 8,608 9,938 11,179 12,952 14,636 17,030

Less: Cash

Payments

to Supplier (2,607) (2,831) (3,129) (3,427) (3,837) (4,209) (4,768) (5,289) (6,034) (6,742) (7,748) (8,567)

purchase of

refrigerator

(4,750)

payment for

exclusivity

(100,00

0)

payment for

website

(8,000)

payment for

market survey

(5,000)

payment for

salary

(1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258) (1,258)

payment for

packing

(144) (162) (186) (210) (243) (273) (318) (360) (420) (477) (558) (624)

payment for

interest

towards payment

of rent

(550) (550) (550) (550) (550) (550) (550) (550) (550) (550) (550)

Closing Cash

Balance

329,643 326,66

8

326,91

4

327,37

1

328,10

3

329,13

9

330,56

1

332,30

3

334,58

8

337,34

7

340,81

5

345,06

8

360,21

5

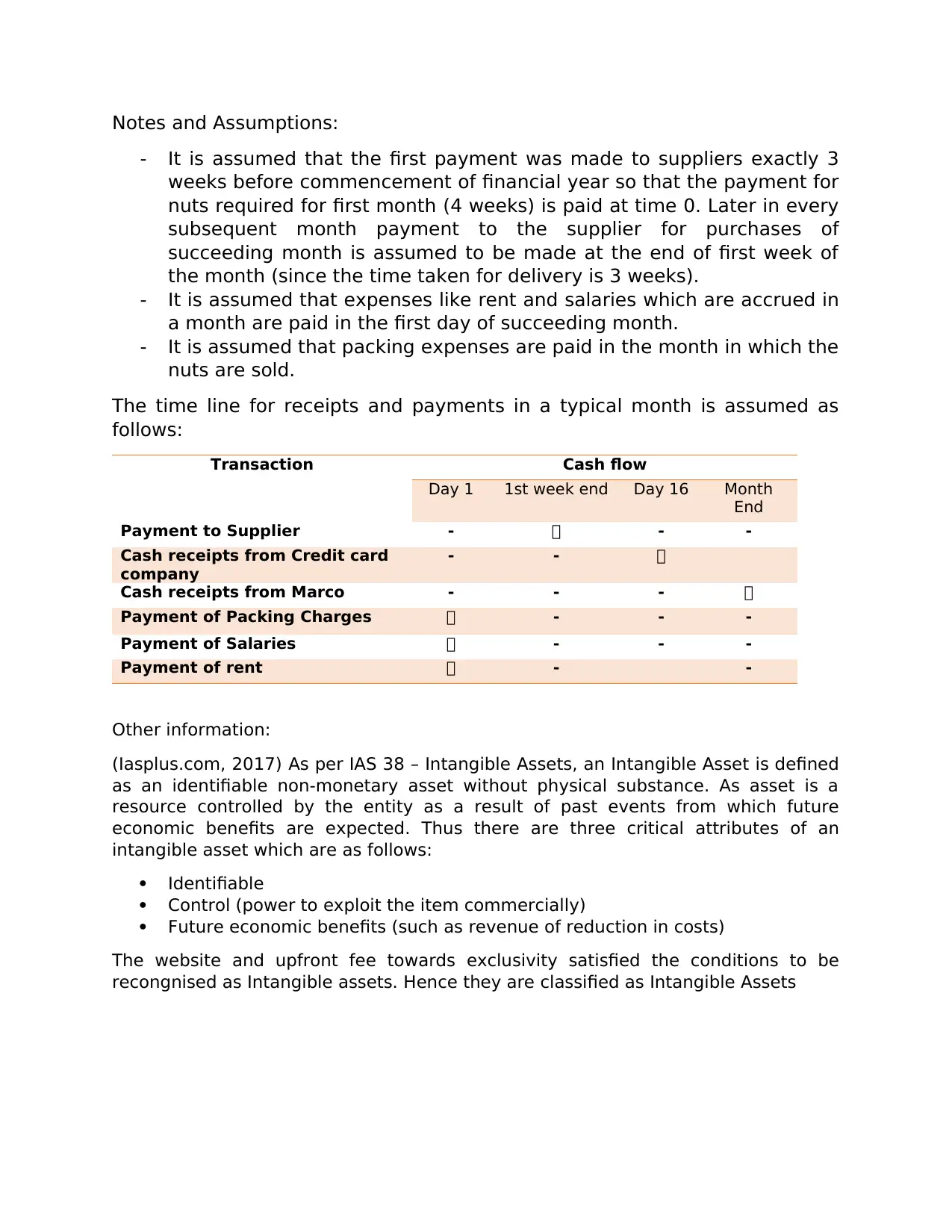

Notes and Assumptions:

- It is assumed that the first payment was made to suppliers exactly 3

weeks before commencement of financial year so that the payment for

nuts required for first month (4 weeks) is paid at time 0. Later in every

subsequent month payment to the supplier for purchases of

succeeding month is assumed to be made at the end of first week of

the month (since the time taken for delivery is 3 weeks).

- It is assumed that expenses like rent and salaries which are accrued in

a month are paid in the first day of succeeding month.

- It is assumed that packing expenses are paid in the month in which the

nuts are sold.

The time line for receipts and payments in a typical month is assumed as

follows:

Transaction Cash flow

Day 1 1st week end Day 16 Month

End

Payment to Supplier - - -

Cash receipts from Credit card

company

- -

Cash receipts from Marco - - -

Payment of Packing Charges - - -

Payment of Salaries - - -

Payment of rent - -

Other information:

(Iasplus.com, 2017) As per IAS 38 – Intangible Assets, an Intangible Asset is defined

as an identifiable non-monetary asset without physical substance. As asset is a

resource controlled by the entity as a result of past events from which future

economic benefits are expected. Thus there are three critical attributes of an

intangible asset which are as follows:

Identifiable

Control (power to exploit the item commercially)

Future economic benefits (such as revenue of reduction in costs)

The website and upfront fee towards exclusivity satisfied the conditions to be

recongnised as Intangible assets. Hence they are classified as Intangible Assets

- It is assumed that the first payment was made to suppliers exactly 3

weeks before commencement of financial year so that the payment for

nuts required for first month (4 weeks) is paid at time 0. Later in every

subsequent month payment to the supplier for purchases of

succeeding month is assumed to be made at the end of first week of

the month (since the time taken for delivery is 3 weeks).

- It is assumed that expenses like rent and salaries which are accrued in

a month are paid in the first day of succeeding month.

- It is assumed that packing expenses are paid in the month in which the

nuts are sold.

The time line for receipts and payments in a typical month is assumed as

follows:

Transaction Cash flow

Day 1 1st week end Day 16 Month

End

Payment to Supplier - - -

Cash receipts from Credit card

company

- -

Cash receipts from Marco - - -

Payment of Packing Charges - - -

Payment of Salaries - - -

Payment of rent - -

Other information:

(Iasplus.com, 2017) As per IAS 38 – Intangible Assets, an Intangible Asset is defined

as an identifiable non-monetary asset without physical substance. As asset is a

resource controlled by the entity as a result of past events from which future

economic benefits are expected. Thus there are three critical attributes of an

intangible asset which are as follows:

Identifiable

Control (power to exploit the item commercially)

Future economic benefits (such as revenue of reduction in costs)

The website and upfront fee towards exclusivity satisfied the conditions to be

recongnised as Intangible assets. Hence they are classified as Intangible Assets

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References:

International Accounting Standards Board (2003). IAS 2 - Inventories. pp.2.10.

Iasplus.com. (2017). IAS 38 — Intangible Assets. [online] Available at:

https://www.iasplus.com/en/standards/ias/ias38 [Accessed 8 Dec. 2018].

International Accounting Standards Board (2003). IAS 2 - Inventories. pp.2.10.

Iasplus.com. (2017). IAS 38 — Intangible Assets. [online] Available at:

https://www.iasplus.com/en/standards/ias/ias38 [Accessed 8 Dec. 2018].

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.