Financial Management Report: Dividend & Investment Appraisal

VerifiedAdded on 2023/01/19

|16

|3270

|51

Report

AI Summary

This report delves into the core concepts of financial management, focusing on dividend policy and investment appraisal techniques. It analyzes the dividend policy of Planet Company, utilizing Gordon's model to assess share valuation, and discusses the model's limitations. Furthermore, the report examines investment appraisal techniques, including payback period, accounting rate of return, net present value, and internal rate of return, applying them to a case study of Lovewell Limited. The analysis provides recommendations on investment decisions based on these financial tools, offering insights into financial risk, growth rate considerations, and the importance of accurate forecasting in financial planning. The report emphasizes the application of these concepts in business decision-making, highlighting their practical implications for financial managers. This report, contributed by a student, is available on Desklib, a platform providing AI-powered study tools for students, including past papers and solved assignments.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

FM is defined as planning, controlling, analysing, directing the basic business activities

in the business organisation (Gottschalk, 2016). It helps in dealing investment of a business

entity that help in the business decision making system. Financial management is application of

the fundamental accounting principle of management to financial aspects of a enterprises. It may

includes financial ratio, debts, equity, dividend pay out and investment methods. For the better

understanding of financial management, this report covers dividend policy of planet company

and investment appraisal techniques of a food manufacturing company. This report helps in the

decision making activities of the business that evaluates the dividend pay out policy of equity

share capital and investment tool like pay back period, average rate of return, internal rate of

return to choose the better option in the business that may produces the more profit in the future.

MAIN BODY

Question 01

(A) Dividend policy

It is a financial policy that defined as pay out cash dividend to the shareholders of the

company (Greenbaum, Thakor and Boot, 2015). It is financial decision that concerned with a

certain portion of the net profit after tax of a firm is to be paid out to its real owner or

shareholder. A business firm decides the dividend portion in order to pay the dividend out of the

net generated revenue. There are various model of the Dividend policy like Walter's model,

Gordon's model.

In the given context calculation of the fair price of the planet's shares has been done as

follows:

This year dividend has decided by the company 20p, required rate of the return is 14%.

As per the this question, Gordon's model of the dividend is more appropriate for the calculation

of the growth model. Growth rate is calculated for all of the year

D= 20p

k= 14%

g1 = (14-13) / 13 * 100 = 7.69%

g2 = (17-14) / 14 * 100 = 21.43%

1

FM is defined as planning, controlling, analysing, directing the basic business activities

in the business organisation (Gottschalk, 2016). It helps in dealing investment of a business

entity that help in the business decision making system. Financial management is application of

the fundamental accounting principle of management to financial aspects of a enterprises. It may

includes financial ratio, debts, equity, dividend pay out and investment methods. For the better

understanding of financial management, this report covers dividend policy of planet company

and investment appraisal techniques of a food manufacturing company. This report helps in the

decision making activities of the business that evaluates the dividend pay out policy of equity

share capital and investment tool like pay back period, average rate of return, internal rate of

return to choose the better option in the business that may produces the more profit in the future.

MAIN BODY

Question 01

(A) Dividend policy

It is a financial policy that defined as pay out cash dividend to the shareholders of the

company (Greenbaum, Thakor and Boot, 2015). It is financial decision that concerned with a

certain portion of the net profit after tax of a firm is to be paid out to its real owner or

shareholder. A business firm decides the dividend portion in order to pay the dividend out of the

net generated revenue. There are various model of the Dividend policy like Walter's model,

Gordon's model.

In the given context calculation of the fair price of the planet's shares has been done as

follows:

This year dividend has decided by the company 20p, required rate of the return is 14%.

As per the this question, Gordon's model of the dividend is more appropriate for the calculation

of the growth model. Growth rate is calculated for all of the year

D= 20p

k= 14%

g1 = (14-13) / 13 * 100 = 7.69%

g2 = (17-14) / 14 * 100 = 21.43%

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

g3 = (18-17) /17 * 100 = 5.88%

g4 = (20-18) /18 * 100 = 11.11%

here, D = dividend , k = cost of capital, g= growth rate for the years

after calculating the growth rate, dividend formula as follows

= D1 / (k-g)

here, D1 = dividend per share for the next year or expected year

k= required rate of return or cost of equity that is estimated by the dividend growth model

g= expected dividend growth rate

for the first year, share price is calculated as

value of the share price = D1 /(k-g)

= 14 / (0.14- 0.0769)

= 2.22$

for the second year,price of the share is estimated as

value of the share price = D1 /(k-g)

= 17 / 0.14-0.2143)

= 2.28$

for the third year, price of the share is reckoning as

value of the share price = D1 /(k-g)

= 18 / (0.14-.00588)

= 2.22$

for the forth year, price of the share is figuring out as

value of the share price = D1 /(k-g)

= 20 / ( 0.14- 0.1111)

= 6.92$

so here growth is inconsistent but the dividend pay out is average between 13 p to 20 p.

The average is 11.53% that indicates the dividend of the next year will be as follows

Growth in the price of share = (21.87 – 20)/ 20 *100

= 10.69%

2

g4 = (20-18) /18 * 100 = 11.11%

here, D = dividend , k = cost of capital, g= growth rate for the years

after calculating the growth rate, dividend formula as follows

= D1 / (k-g)

here, D1 = dividend per share for the next year or expected year

k= required rate of return or cost of equity that is estimated by the dividend growth model

g= expected dividend growth rate

for the first year, share price is calculated as

value of the share price = D1 /(k-g)

= 14 / (0.14- 0.0769)

= 2.22$

for the second year,price of the share is estimated as

value of the share price = D1 /(k-g)

= 17 / 0.14-0.2143)

= 2.28$

for the third year, price of the share is reckoning as

value of the share price = D1 /(k-g)

= 18 / (0.14-.00588)

= 2.22$

for the forth year, price of the share is figuring out as

value of the share price = D1 /(k-g)

= 20 / ( 0.14- 0.1111)

= 6.92$

so here growth is inconsistent but the dividend pay out is average between 13 p to 20 p.

The average is 11.53% that indicates the dividend of the next year will be as follows

Growth in the price of share = (21.87 – 20)/ 20 *100

= 10.69%

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fair share price is estimated as under:

value of the share price = D1 / ( k – g )

= 20 / ( 1 + 0.1153) / (0.14 – 11.53)

= 9.03 $

(b) company wants to increases its debt level, it may increases the financial risk that is associated

with equity share so here value of the share as follows

for the year 1, value of the share price = D1 / ( k-g )

= 14 / ( 0.154 – 0.0769 )

= 1.81 $

for the year 2, value of the share price = D1 / ( k-g )

= 17 / ( 0.154 – 0.2143)

= 2.81 $

for the year 3, value of the share price = D1 / ( k-g )

= 18 / (0.154 – 0.0588)

= 1.89 $

for the year 4, value of the share price = D1 / ( k-g )

= 20 / ( 15.4 – 0.1111)

= 4.19 $

for this year value of the share price = D1 / ( k-g )

= 20 ( 1+ 0.1153) / 0.154 – 0.1153)

= 22.306 / 0.0387

= 5.80 $

(c)

After observing this question, planet company is paying the dividend on regular basis and it

increases year by year but not on regular growing on yearly basis so here Gordon's model is the

most suitable with this references and data related to this company (Hopkin, 2018). But there are

many problem arises to ascertain the fair price of the shares. By using the dividend growth model

planet company has irregularity in the growth rate of the organisation. The main problem is

3

value of the share price = D1 / ( k – g )

= 20 / ( 1 + 0.1153) / (0.14 – 11.53)

= 9.03 $

(b) company wants to increases its debt level, it may increases the financial risk that is associated

with equity share so here value of the share as follows

for the year 1, value of the share price = D1 / ( k-g )

= 14 / ( 0.154 – 0.0769 )

= 1.81 $

for the year 2, value of the share price = D1 / ( k-g )

= 17 / ( 0.154 – 0.2143)

= 2.81 $

for the year 3, value of the share price = D1 / ( k-g )

= 18 / (0.154 – 0.0588)

= 1.89 $

for the year 4, value of the share price = D1 / ( k-g )

= 20 / ( 15.4 – 0.1111)

= 4.19 $

for this year value of the share price = D1 / ( k-g )

= 20 ( 1+ 0.1153) / 0.154 – 0.1153)

= 22.306 / 0.0387

= 5.80 $

(c)

After observing this question, planet company is paying the dividend on regular basis and it

increases year by year but not on regular growing on yearly basis so here Gordon's model is the

most suitable with this references and data related to this company (Hopkin, 2018). But there are

many problem arises to ascertain the fair price of the shares. By using the dividend growth model

planet company has irregularity in the growth rate of the organisation. The main problem is

3

related to uncertainty in the growth rate of the expected year or upcoming year. It may create a

problem in fair valuing the price of the shares. Uncertainty is the situation where the estimates

data may fails and fair share value may not exist in future. The other problem arises in deciding

the share price length of the extra ordinary growth rate period as growth rate is automatically

decline after reaching the maximum level of growth of a share. The fact behind this concepts is

that it is expected a decline after the stability position in the share value. Investment in a

particular share may decreases the return on value that is invested after a stable position. This

model is totally based on the higher growth rate that is always not corrects. This model is

assumed the expected grow in the value of the share but sometimes it may not true. The problem

in using this dividend growth model is arises when firm is not paying the affordable dividend in

the expected year that is happens gradually over the time period. Growth rate is based on the

forecasting the future cash pay out dividend that may be reliable or not to the company. Dividend

model requires an huge number of speculation in order to decide the value of the dividend. It

must be reliable, deep study and plenty of assumptions about the future which may require the

detailed analysis and study and knowledge of past records. The another problem is regarding

dividend discount model about multi stage that take a step closer to the expected result or reality

in the future as it is based on the assumption of the forecasting the growing rate by analysing the

records of the company. But the problem is related to varying the growth phases of an

organisation. Problem in assessing the growing rate of the business in dependent on the past

records and assumption that may not always corrects. And it is not ascertain the earning of the

enterprises (Knights and Tinker, 2016). This model is based on the pay out ratio of dividend but

not related to earnings. The main problem is using the dividend growth model in deciding the

value of the shares is related to figuring out the actual growth rate and the cost of equity. This

model is not applicable on the large or long term shareholders. shareholder buy the share of a

firm on the basis of the degree of control and return on investment but the return is not sufficient

then they sell the holding due to irrelevant dividend.

Question 02

Investment appraisal techniques

(a) Pay back period: It is tool of capital budgeting that concerned with the capital investment

requirement to make a capital expenditure and how much it will take to return its cost of capital.

4

problem in fair valuing the price of the shares. Uncertainty is the situation where the estimates

data may fails and fair share value may not exist in future. The other problem arises in deciding

the share price length of the extra ordinary growth rate period as growth rate is automatically

decline after reaching the maximum level of growth of a share. The fact behind this concepts is

that it is expected a decline after the stability position in the share value. Investment in a

particular share may decreases the return on value that is invested after a stable position. This

model is totally based on the higher growth rate that is always not corrects. This model is

assumed the expected grow in the value of the share but sometimes it may not true. The problem

in using this dividend growth model is arises when firm is not paying the affordable dividend in

the expected year that is happens gradually over the time period. Growth rate is based on the

forecasting the future cash pay out dividend that may be reliable or not to the company. Dividend

model requires an huge number of speculation in order to decide the value of the dividend. It

must be reliable, deep study and plenty of assumptions about the future which may require the

detailed analysis and study and knowledge of past records. The another problem is regarding

dividend discount model about multi stage that take a step closer to the expected result or reality

in the future as it is based on the assumption of the forecasting the growing rate by analysing the

records of the company. But the problem is related to varying the growth phases of an

organisation. Problem in assessing the growing rate of the business in dependent on the past

records and assumption that may not always corrects. And it is not ascertain the earning of the

enterprises (Knights and Tinker, 2016). This model is based on the pay out ratio of dividend but

not related to earnings. The main problem is using the dividend growth model in deciding the

value of the shares is related to figuring out the actual growth rate and the cost of equity. This

model is not applicable on the large or long term shareholders. shareholder buy the share of a

firm on the basis of the degree of control and return on investment but the return is not sufficient

then they sell the holding due to irrelevant dividend.

Question 02

Investment appraisal techniques

(a) Pay back period: It is tool of capital budgeting that concerned with the capital investment

requirement to make a capital expenditure and how much it will take to return its cost of capital.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

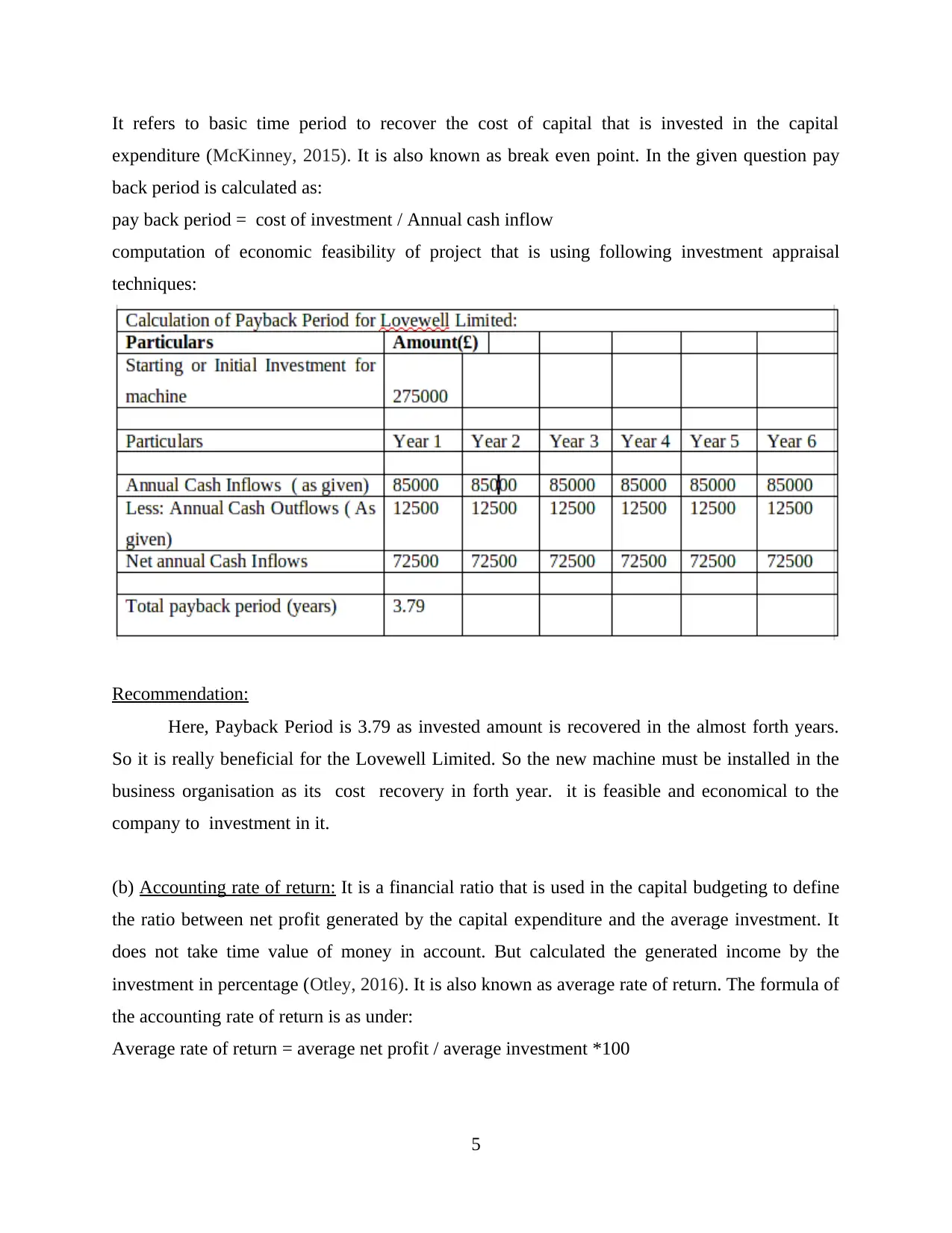

It refers to basic time period to recover the cost of capital that is invested in the capital

expenditure (McKinney, 2015). It is also known as break even point. In the given question pay

back period is calculated as:

pay back period = cost of investment / Annual cash inflow

computation of economic feasibility of project that is using following investment appraisal

techniques:

Recommendation:

Here, Payback Period is 3.79 as invested amount is recovered in the almost forth years.

So it is really beneficial for the Lovewell Limited. So the new machine must be installed in the

business organisation as its cost recovery in forth year. it is feasible and economical to the

company to investment in it.

(b) Accounting rate of return: It is a financial ratio that is used in the capital budgeting to define

the ratio between net profit generated by the capital expenditure and the average investment. It

does not take time value of money in account. But calculated the generated income by the

investment in percentage (Otley, 2016). It is also known as average rate of return. The formula of

the accounting rate of return is as under:

Average rate of return = average net profit / average investment *100

5

expenditure (McKinney, 2015). It is also known as break even point. In the given question pay

back period is calculated as:

pay back period = cost of investment / Annual cash inflow

computation of economic feasibility of project that is using following investment appraisal

techniques:

Recommendation:

Here, Payback Period is 3.79 as invested amount is recovered in the almost forth years.

So it is really beneficial for the Lovewell Limited. So the new machine must be installed in the

business organisation as its cost recovery in forth year. it is feasible and economical to the

company to investment in it.

(b) Accounting rate of return: It is a financial ratio that is used in the capital budgeting to define

the ratio between net profit generated by the capital expenditure and the average investment. It

does not take time value of money in account. But calculated the generated income by the

investment in percentage (Otley, 2016). It is also known as average rate of return. The formula of

the accounting rate of return is as under:

Average rate of return = average net profit / average investment *100

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ARR for Lovewell Limited

6

6

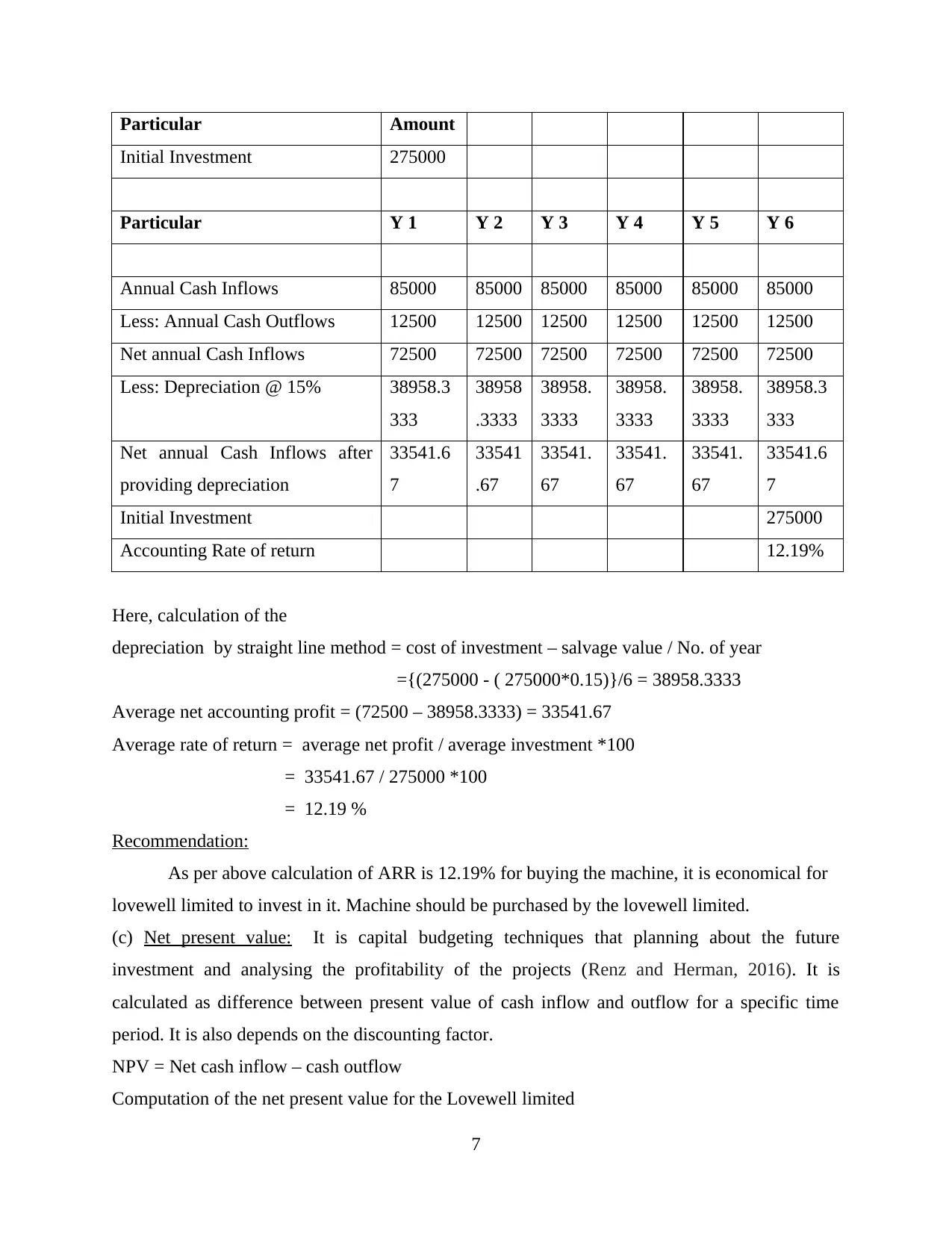

Particular Amount

Initial Investment 275000

Particular Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Annual Cash Inflows 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflows 12500 12500 12500 12500 12500 12500

Net annual Cash Inflows 72500 72500 72500 72500 72500 72500

Less: Depreciation @ 15% 38958.3

333

38958

.3333

38958.

3333

38958.

3333

38958.

3333

38958.3

333

Net annual Cash Inflows after

providing depreciation

33541.6

7

33541

.67

33541.

67

33541.

67

33541.

67

33541.6

7

Initial Investment 275000

Accounting Rate of return 12.19%

Here, calculation of the

depreciation by straight line method = cost of investment – salvage value / No. of year

={(275000 - ( 275000*0.15)}/6 = 38958.3333

Average net accounting profit = (72500 – 38958.3333) = 33541.67

Average rate of return = average net profit / average investment *100

= 33541.67 / 275000 *100

= 12.19 %

Recommendation:

As per above calculation of ARR is 12.19% for buying the machine, it is economical for

lovewell limited to invest in it. Machine should be purchased by the lovewell limited.

(c) Net present value: It is capital budgeting techniques that planning about the future

investment and analysing the profitability of the projects (Renz and Herman, 2016). It is

calculated as difference between present value of cash inflow and outflow for a specific time

period. It is also depends on the discounting factor.

NPV = Net cash inflow – cash outflow

Computation of the net present value for the Lovewell limited

7

Initial Investment 275000

Particular Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Annual Cash Inflows 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflows 12500 12500 12500 12500 12500 12500

Net annual Cash Inflows 72500 72500 72500 72500 72500 72500

Less: Depreciation @ 15% 38958.3

333

38958

.3333

38958.

3333

38958.

3333

38958.

3333

38958.3

333

Net annual Cash Inflows after

providing depreciation

33541.6

7

33541

.67

33541.

67

33541.

67

33541.

67

33541.6

7

Initial Investment 275000

Accounting Rate of return 12.19%

Here, calculation of the

depreciation by straight line method = cost of investment – salvage value / No. of year

={(275000 - ( 275000*0.15)}/6 = 38958.3333

Average net accounting profit = (72500 – 38958.3333) = 33541.67

Average rate of return = average net profit / average investment *100

= 33541.67 / 275000 *100

= 12.19 %

Recommendation:

As per above calculation of ARR is 12.19% for buying the machine, it is economical for

lovewell limited to invest in it. Machine should be purchased by the lovewell limited.

(c) Net present value: It is capital budgeting techniques that planning about the future

investment and analysing the profitability of the projects (Renz and Herman, 2016). It is

calculated as difference between present value of cash inflow and outflow for a specific time

period. It is also depends on the discounting factor.

NPV = Net cash inflow – cash outflow

Computation of the net present value for the Lovewell limited

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

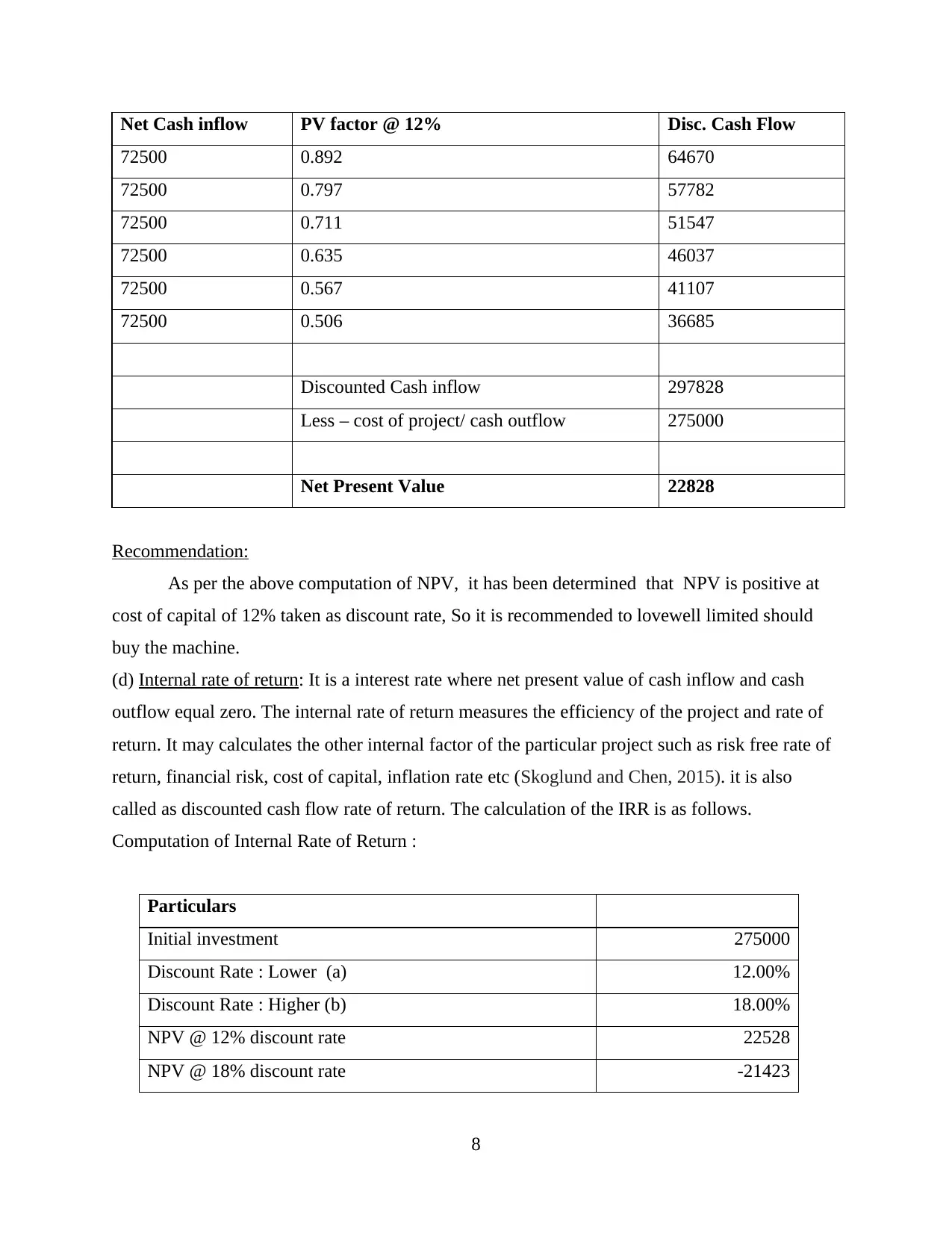

Net Cash inflow PV factor @ 12% Disc. Cash Flow

72500 0.892 64670

72500 0.797 57782

72500 0.711 51547

72500 0.635 46037

72500 0.567 41107

72500 0.506 36685

Discounted Cash inflow 297828

Less – cost of project/ cash outflow 275000

Net Present Value 22828

Recommendation:

As per the above computation of NPV, it has been determined that NPV is positive at

cost of capital of 12% taken as discount rate, So it is recommended to lovewell limited should

buy the machine.

(d) Internal rate of return: It is a interest rate where net present value of cash inflow and cash

outflow equal zero. The internal rate of return measures the efficiency of the project and rate of

return. It may calculates the other internal factor of the particular project such as risk free rate of

return, financial risk, cost of capital, inflation rate etc (Skoglund and Chen, 2015). it is also

called as discounted cash flow rate of return. The calculation of the IRR is as follows.

Computation of Internal Rate of Return :

Particulars

Initial investment 275000

Discount Rate : Lower (a) 12.00%

Discount Rate : Higher (b) 18.00%

NPV @ 12% discount rate 22528

NPV @ 18% discount rate -21423

8

72500 0.892 64670

72500 0.797 57782

72500 0.711 51547

72500 0.635 46037

72500 0.567 41107

72500 0.506 36685

Discounted Cash inflow 297828

Less – cost of project/ cash outflow 275000

Net Present Value 22828

Recommendation:

As per the above computation of NPV, it has been determined that NPV is positive at

cost of capital of 12% taken as discount rate, So it is recommended to lovewell limited should

buy the machine.

(d) Internal rate of return: It is a interest rate where net present value of cash inflow and cash

outflow equal zero. The internal rate of return measures the efficiency of the project and rate of

return. It may calculates the other internal factor of the particular project such as risk free rate of

return, financial risk, cost of capital, inflation rate etc (Skoglund and Chen, 2015). it is also

called as discounted cash flow rate of return. The calculation of the IRR is as follows.

Computation of Internal Rate of Return :

Particulars

Initial investment 275000

Discount Rate : Lower (a) 12.00%

Discount Rate : Higher (b) 18.00%

NPV @ 12% discount rate 22528

NPV @ 18% discount rate -21423

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

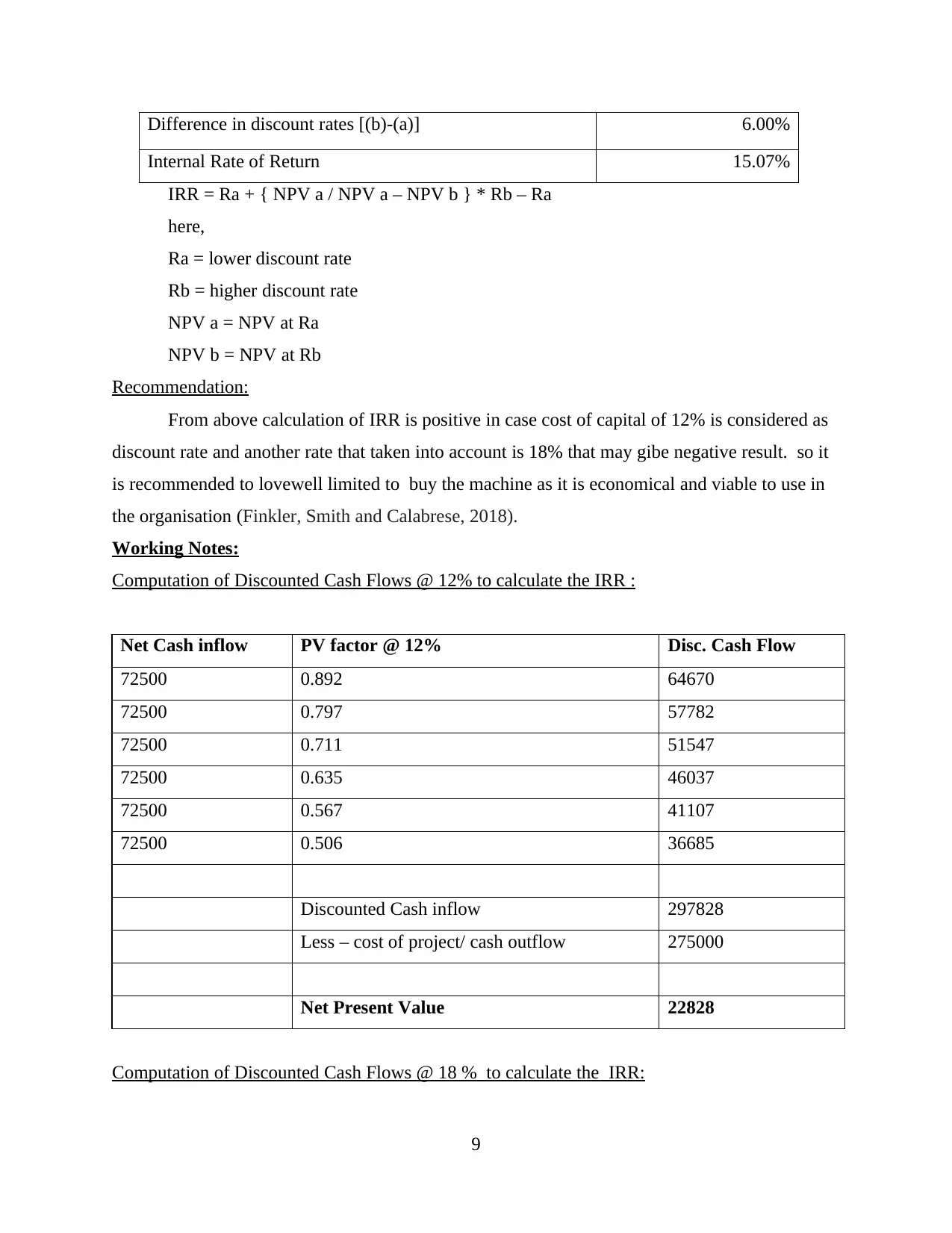

Difference in discount rates [(b)-(a)] 6.00%

Internal Rate of Return 15.07%

IRR = Ra + { NPV a / NPV a – NPV b } * Rb – Ra

here,

Ra = lower discount rate

Rb = higher discount rate

NPV a = NPV at Ra

NPV b = NPV at Rb

Recommendation:

From above calculation of IRR is positive in case cost of capital of 12% is considered as

discount rate and another rate that taken into account is 18% that may gibe negative result. so it

is recommended to lovewell limited to buy the machine as it is economical and viable to use in

the organisation (Finkler, Smith and Calabrese, 2018).

Working Notes:

Computation of Discounted Cash Flows @ 12% to calculate the IRR :

Net Cash inflow PV factor @ 12% Disc. Cash Flow

72500 0.892 64670

72500 0.797 57782

72500 0.711 51547

72500 0.635 46037

72500 0.567 41107

72500 0.506 36685

Discounted Cash inflow 297828

Less – cost of project/ cash outflow 275000

Net Present Value 22828

Computation of Discounted Cash Flows @ 18 % to calculate the IRR:

9

Internal Rate of Return 15.07%

IRR = Ra + { NPV a / NPV a – NPV b } * Rb – Ra

here,

Ra = lower discount rate

Rb = higher discount rate

NPV a = NPV at Ra

NPV b = NPV at Rb

Recommendation:

From above calculation of IRR is positive in case cost of capital of 12% is considered as

discount rate and another rate that taken into account is 18% that may gibe negative result. so it

is recommended to lovewell limited to buy the machine as it is economical and viable to use in

the organisation (Finkler, Smith and Calabrese, 2018).

Working Notes:

Computation of Discounted Cash Flows @ 12% to calculate the IRR :

Net Cash inflow PV factor @ 12% Disc. Cash Flow

72500 0.892 64670

72500 0.797 57782

72500 0.711 51547

72500 0.635 46037

72500 0.567 41107

72500 0.506 36685

Discounted Cash inflow 297828

Less – cost of project/ cash outflow 275000

Net Present Value 22828

Computation of Discounted Cash Flows @ 18 % to calculate the IRR:

9

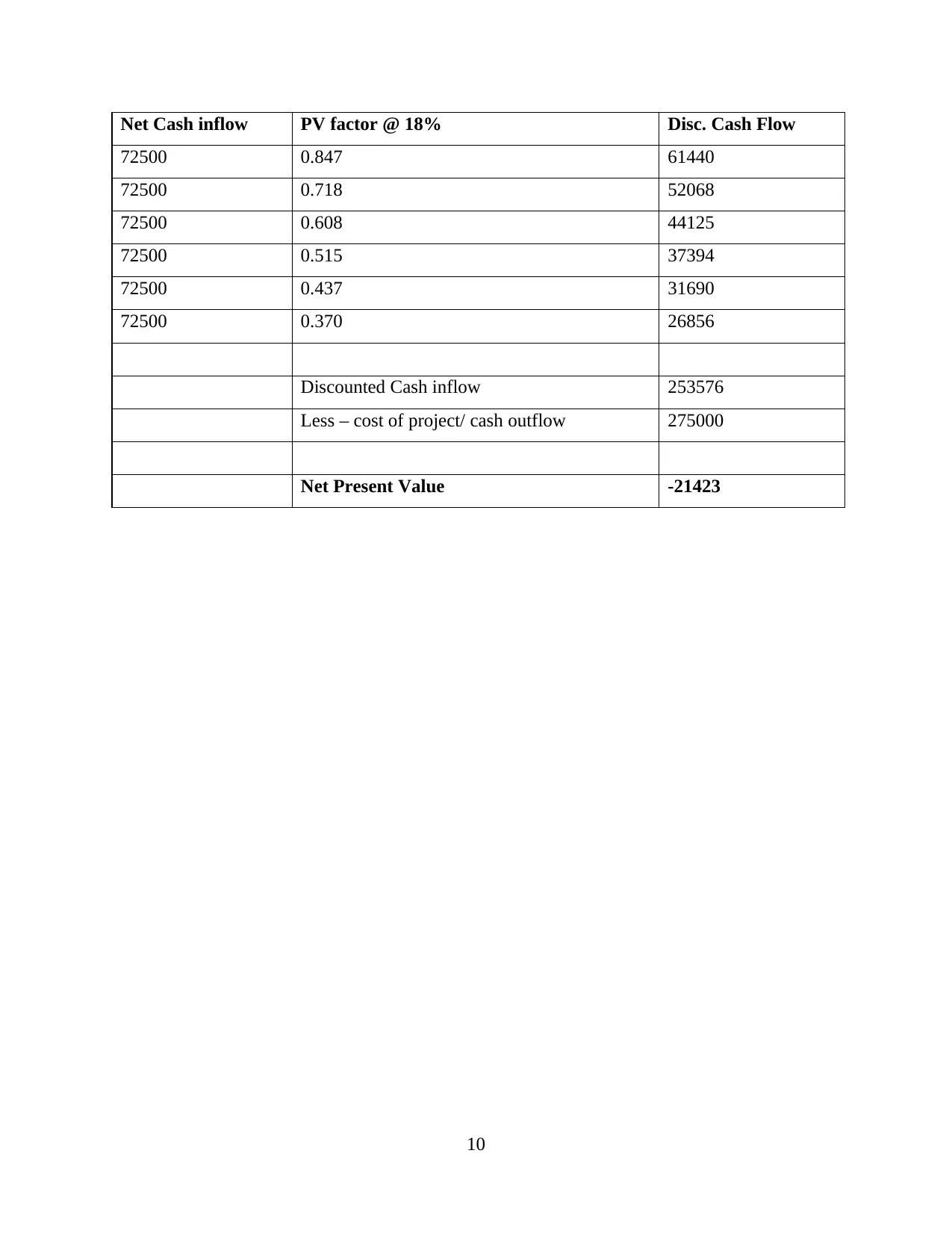

Net Cash inflow PV factor @ 18% Disc. Cash Flow

72500 0.847 61440

72500 0.718 52068

72500 0.608 44125

72500 0.515 37394

72500 0.437 31690

72500 0.370 26856

Discounted Cash inflow 253576

Less – cost of project/ cash outflow 275000

Net Present Value -21423

10

72500 0.847 61440

72500 0.718 52068

72500 0.608 44125

72500 0.515 37394

72500 0.437 31690

72500 0.370 26856

Discounted Cash inflow 253576

Less – cost of project/ cash outflow 275000

Net Present Value -21423

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.