Financial Management Report: APC308 Module, University of Sunderland

VerifiedAdded on 2023/01/16

|15

|3879

|70

Report

AI Summary

This report provides a comprehensive analysis of financial management concepts, focusing on the case of Kadlex Plc. It begins with an introduction to financial management, then delves into the calculation of the Weighted Average Cost of Capital (WACC) using both book and market values, alon...

Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

a. Calculation related to book and market value of cost of capital..............................................1

b. Reflection on the changes and comments on the projects of finance director.........................4

c. Minimisation of weighted average cost of capital by integrating a sensible level of gearing

into their capital structure............................................................................................................5

d. Effects of short termism on bankruptcy and the agency problem...........................................5

QUESTION 3...................................................................................................................................5

a. Different investment appraisal technique's calculations along with recommendations...........5

b. Benefits and limitations of all the investment appraisal techniques......................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

a. Calculation related to book and market value of cost of capital..............................................1

b. Reflection on the changes and comments on the projects of finance director.........................4

c. Minimisation of weighted average cost of capital by integrating a sensible level of gearing

into their capital structure............................................................................................................5

d. Effects of short termism on bankruptcy and the agency problem...........................................5

QUESTION 3...................................................................................................................................5

a. Different investment appraisal technique's calculations along with recommendations...........5

b. Benefits and limitations of all the investment appraisal techniques......................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Financial management can be defined as the process of managing all the resources which

are used by an organisation to carry out operational activities. If top level executives of a

company are not able to pay attention towards the same then it may result in inappropriate

execution of operations. Present report is based financial management in different scenarios

(Antonopoulos and Hall, 2015). For the completion of the same question 1st and 3rd are selected.

Different topics which are covered in this assignment are calculation of WACC on market, book

and proposed changes value, effect of short termism on bankruptcy and agency problem. Along

with this, calculation for different investment appraisal techniques are also done in this report to

make sure that the management should investment should be made in the project or not.

QUESTION 1

a. Calculation related to book and market value of cost of capital

Capital structure can be defined as the way in which an organisation manages all its

securities and use them to execute business operations. For the purpose of evaluating cost of all

its elements such as equities, debts, binds, preference shares etc. cost of capital is followed. It is

an approach which is used to determine opportunity cost of an investment which is being

planned by an organisation (Ashmarina, Zotova and Smolina, 2016). Finance director of Kadlex

Plc have analysed that WACC of the organisation is very low therefore she has planned to issue

more debts in the markets so that funds could be acquired. For the purpose of determining effects

of such changes following calculations are done:

Growth calculation:

From year 1st to 5th growths are 21, 23, 25, 27 and 28p respectively. Its calculation is as

follows:

Formula for calculations: Sn = S0*(1+g)n

28 = 21 * (1 + g)4

28 / 21 = (1 + g)4

1.33 = (1 + g)4

(1.33)0.25= (1 + g)

g = 1 – 1.0757

= 0.0757 or 7.57%

1

Financial management can be defined as the process of managing all the resources which

are used by an organisation to carry out operational activities. If top level executives of a

company are not able to pay attention towards the same then it may result in inappropriate

execution of operations. Present report is based financial management in different scenarios

(Antonopoulos and Hall, 2015). For the completion of the same question 1st and 3rd are selected.

Different topics which are covered in this assignment are calculation of WACC on market, book

and proposed changes value, effect of short termism on bankruptcy and agency problem. Along

with this, calculation for different investment appraisal techniques are also done in this report to

make sure that the management should investment should be made in the project or not.

QUESTION 1

a. Calculation related to book and market value of cost of capital

Capital structure can be defined as the way in which an organisation manages all its

securities and use them to execute business operations. For the purpose of evaluating cost of all

its elements such as equities, debts, binds, preference shares etc. cost of capital is followed. It is

an approach which is used to determine opportunity cost of an investment which is being

planned by an organisation (Ashmarina, Zotova and Smolina, 2016). Finance director of Kadlex

Plc have analysed that WACC of the organisation is very low therefore she has planned to issue

more debts in the markets so that funds could be acquired. For the purpose of determining effects

of such changes following calculations are done:

Growth calculation:

From year 1st to 5th growths are 21, 23, 25, 27 and 28p respectively. Its calculation is as

follows:

Formula for calculations: Sn = S0*(1+g)n

28 = 21 * (1 + g)4

28 / 21 = (1 + g)4

1.33 = (1 + g)4

(1.33)0.25= (1 + g)

g = 1 – 1.0757

= 0.0757 or 7.57%

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Here, Sn = Last dividend

S0 = First dividend

n = number of years

g = growth

Calculation of growth rate for all the securities:

Cost of irredeemable bonds:

Formula for calculations: Kd = [ j * (1 – CT) ] * (Po / Pn)

Kd = [ 0.10 * (1 – 0.30)] * (100 / 107)

= 0.0654 or 6.54%

Here, Kd = Cost of Irredeemable Bonds

j = Rate of interest on bonds

CT = Rate of Corporate tax rate

P0 = Initial Price

Pn = Current Price

Cots of equities:

Formula for calculations: Ke = [Sn * (1 + g) + g ]) / P0

Ke = [28 * (1 + 0.075) + 0.075] / 2.65

= (28 * 1.15) / 2.65

=12.15%

Here, Ke = Cost of Equity

Sn = First dividend

g = Growth rate

P0 = Current share price of equity shares excluding dividend

Cost of preference share:

Formula for calculations: Kp= (j)/Pf

= 7 / 75

= 0.0933 or 9.33%

Here, Kp = Total cost of Preference Shares

j = Dividend on preference shares

Pf = Current [rice of preference share excluding dividend

Calculations of WACC on book and market value are as follows:

2

S0 = First dividend

n = number of years

g = growth

Calculation of growth rate for all the securities:

Cost of irredeemable bonds:

Formula for calculations: Kd = [ j * (1 – CT) ] * (Po / Pn)

Kd = [ 0.10 * (1 – 0.30)] * (100 / 107)

= 0.0654 or 6.54%

Here, Kd = Cost of Irredeemable Bonds

j = Rate of interest on bonds

CT = Rate of Corporate tax rate

P0 = Initial Price

Pn = Current Price

Cots of equities:

Formula for calculations: Ke = [Sn * (1 + g) + g ]) / P0

Ke = [28 * (1 + 0.075) + 0.075] / 2.65

= (28 * 1.15) / 2.65

=12.15%

Here, Ke = Cost of Equity

Sn = First dividend

g = Growth rate

P0 = Current share price of equity shares excluding dividend

Cost of preference share:

Formula for calculations: Kp= (j)/Pf

= 7 / 75

= 0.0933 or 9.33%

Here, Kp = Total cost of Preference Shares

j = Dividend on preference shares

Pf = Current [rice of preference share excluding dividend

Calculations of WACC on book and market value are as follows:

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

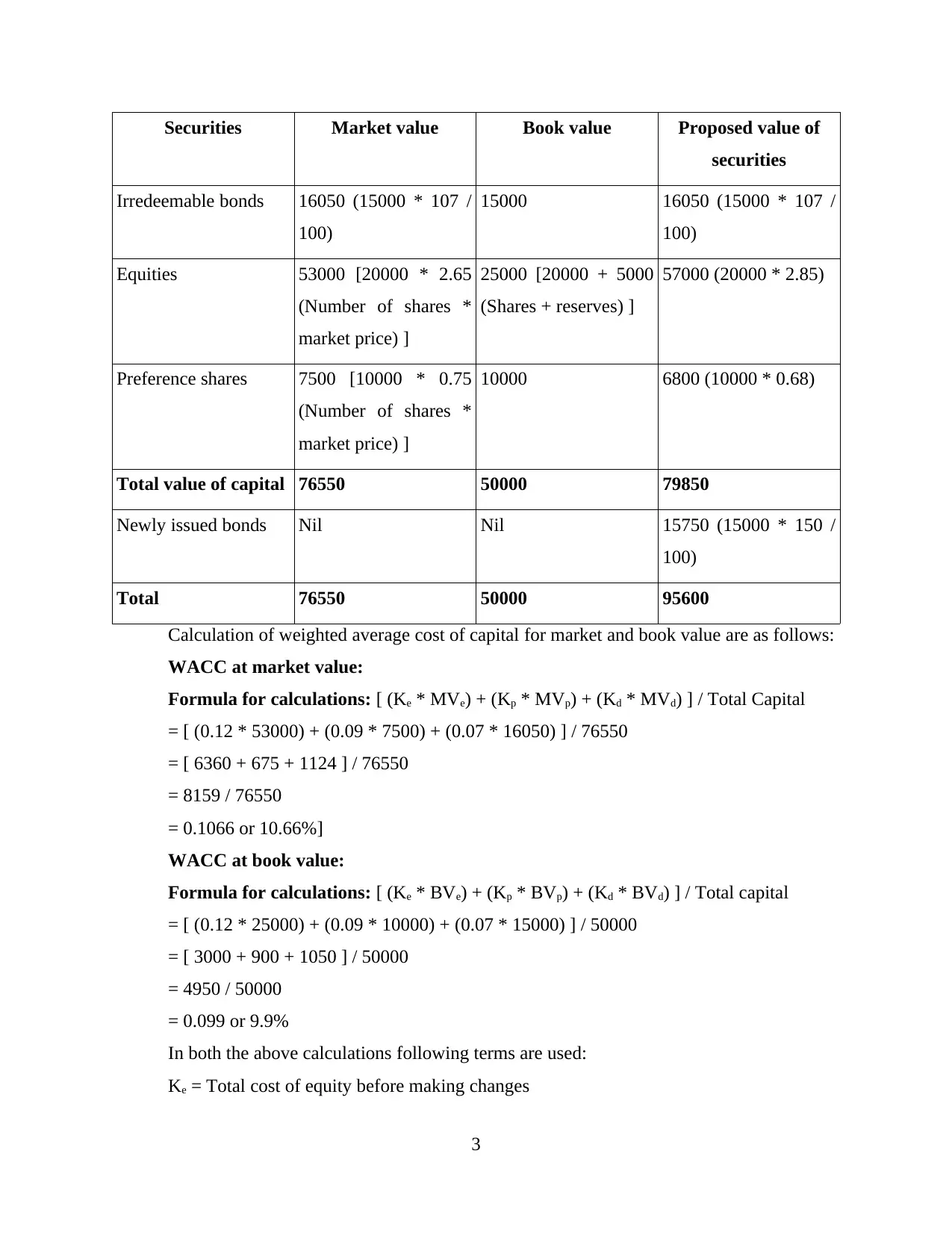

Securities Market value Book value Proposed value of

securities

Irredeemable bonds 16050 (15000 * 107 /

100)

15000 16050 (15000 * 107 /

100)

Equities 53000 [20000 * 2.65

(Number of shares *

market price) ]

25000 [20000 + 5000

(Shares + reserves) ]

57000 (20000 * 2.85)

Preference shares 7500 [10000 * 0.75

(Number of shares *

market price) ]

10000 6800 (10000 * 0.68)

Total value of capital 76550 50000 79850

Newly issued bonds Nil Nil 15750 (15000 * 150 /

100)

Total 76550 50000 95600

Calculation of weighted average cost of capital for market and book value are as follows:

WACC at market value:

Formula for calculations: [ (Ke * MVe) + (Kp * MVp) + (Kd * MVd) ] / Total Capital

= [ (0.12 * 53000) + (0.09 * 7500) + (0.07 * 16050) ] / 76550

= [ 6360 + 675 + 1124 ] / 76550

= 8159 / 76550

= 0.1066 or 10.66%]

WACC at book value:

Formula for calculations: [ (Ke * BVe) + (Kp * BVp) + (Kd * BVd) ] / Total capital

= [ (0.12 * 25000) + (0.09 * 10000) + (0.07 * 15000) ] / 50000

= [ 3000 + 900 + 1050 ] / 50000

= 4950 / 50000

= 0.099 or 9.9%

In both the above calculations following terms are used:

Ke = Total cost of equity before making changes

3

securities

Irredeemable bonds 16050 (15000 * 107 /

100)

15000 16050 (15000 * 107 /

100)

Equities 53000 [20000 * 2.65

(Number of shares *

market price) ]

25000 [20000 + 5000

(Shares + reserves) ]

57000 (20000 * 2.85)

Preference shares 7500 [10000 * 0.75

(Number of shares *

market price) ]

10000 6800 (10000 * 0.68)

Total value of capital 76550 50000 79850

Newly issued bonds Nil Nil 15750 (15000 * 150 /

100)

Total 76550 50000 95600

Calculation of weighted average cost of capital for market and book value are as follows:

WACC at market value:

Formula for calculations: [ (Ke * MVe) + (Kp * MVp) + (Kd * MVd) ] / Total Capital

= [ (0.12 * 53000) + (0.09 * 7500) + (0.07 * 16050) ] / 76550

= [ 6360 + 675 + 1124 ] / 76550

= 8159 / 76550

= 0.1066 or 10.66%]

WACC at book value:

Formula for calculations: [ (Ke * BVe) + (Kp * BVp) + (Kd * BVd) ] / Total capital

= [ (0.12 * 25000) + (0.09 * 10000) + (0.07 * 15000) ] / 50000

= [ 3000 + 900 + 1050 ] / 50000

= 4950 / 50000

= 0.099 or 9.9%

In both the above calculations following terms are used:

Ke = Total cost of equity before making changes

3

Kp = Total cost of preference shares before making changes

Kd = Total cost of debts before applying changes

Bve = Actual book value of equities

BVp = Actual book values of preference shares

BVd = Actual book value of debts for the organisation

MVe = Market value of total equities

MVp = Market value of all the preference shares

Mvd = Market value of debts of organisation

Total capital is the combination of all the securities for book and market value which are

used in the calculations.

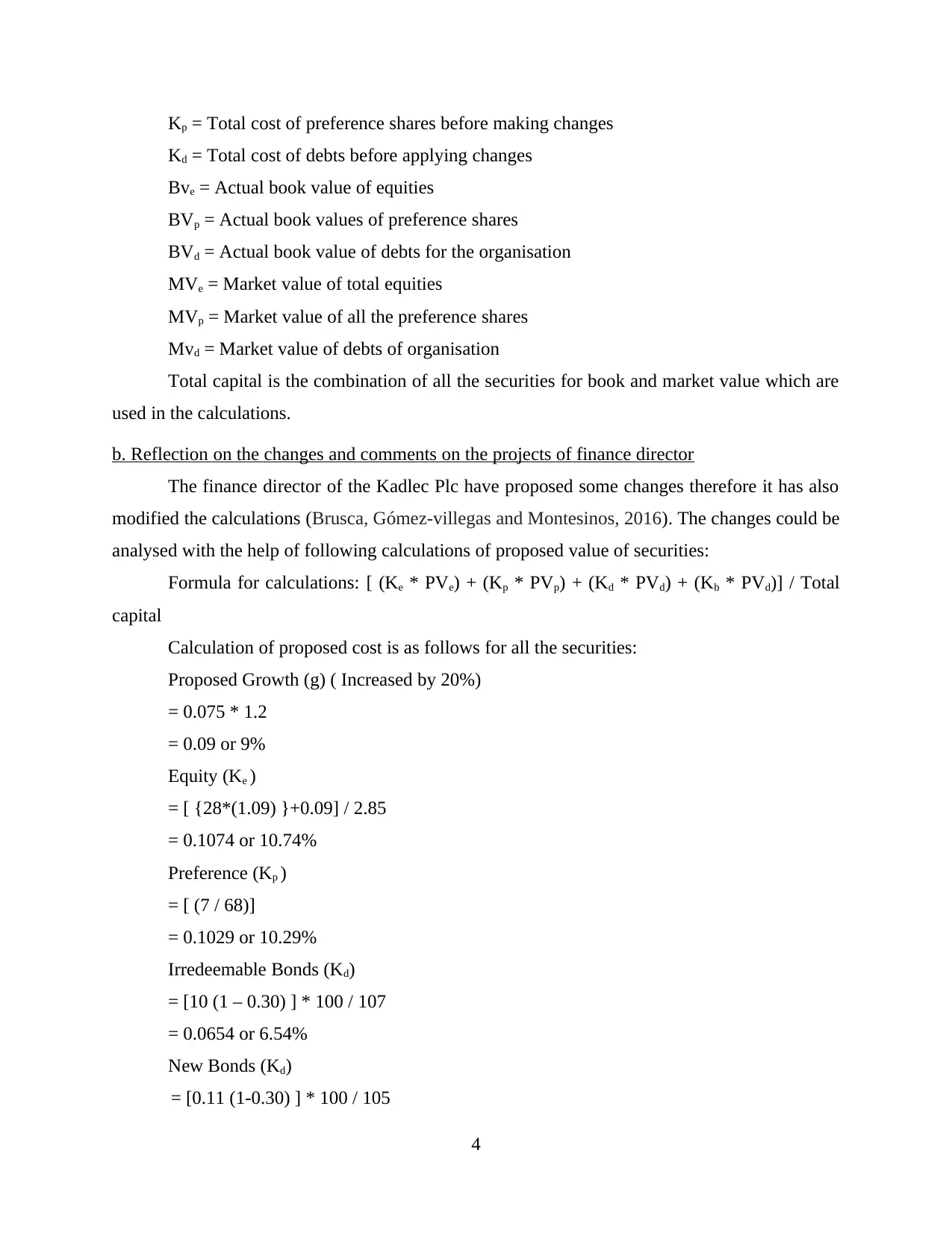

b. Reflection on the changes and comments on the projects of finance director

The finance director of the Kadlec Plc have proposed some changes therefore it has also

modified the calculations (Brusca, Gómez‐villegas and Montesinos, 2016). The changes could be

analysed with the help of following calculations of proposed value of securities:

Formula for calculations: [ (Ke * PVe) + (Kp * PVp) + (Kd * PVd) + (Kb * PVd)] / Total

capital

Calculation of proposed cost is as follows for all the securities:

Proposed Growth (g) ( Increased by 20%)

= 0.075 * 1.2

= 0.09 or 9%

Equity (Ke )

= [ {28*(1.09) }+0.09] / 2.85

= 0.1074 or 10.74%

Preference (Kp )

= [ (7 / 68)]

= 0.1029 or 10.29%

Irredeemable Bonds (Kd)

= [10 (1 – 0.30) ] * 100 / 107

= 0.0654 or 6.54%

New Bonds (Kd)

= [0.11 (1-0.30) ] * 100 / 105

4

Kd = Total cost of debts before applying changes

Bve = Actual book value of equities

BVp = Actual book values of preference shares

BVd = Actual book value of debts for the organisation

MVe = Market value of total equities

MVp = Market value of all the preference shares

Mvd = Market value of debts of organisation

Total capital is the combination of all the securities for book and market value which are

used in the calculations.

b. Reflection on the changes and comments on the projects of finance director

The finance director of the Kadlec Plc have proposed some changes therefore it has also

modified the calculations (Brusca, Gómez‐villegas and Montesinos, 2016). The changes could be

analysed with the help of following calculations of proposed value of securities:

Formula for calculations: [ (Ke * PVe) + (Kp * PVp) + (Kd * PVd) + (Kb * PVd)] / Total

capital

Calculation of proposed cost is as follows for all the securities:

Proposed Growth (g) ( Increased by 20%)

= 0.075 * 1.2

= 0.09 or 9%

Equity (Ke )

= [ {28*(1.09) }+0.09] / 2.85

= 0.1074 or 10.74%

Preference (Kp )

= [ (7 / 68)]

= 0.1029 or 10.29%

Irredeemable Bonds (Kd)

= [10 (1 – 0.30) ] * 100 / 107

= 0.0654 or 6.54%

New Bonds (Kd)

= [0.11 (1-0.30) ] * 100 / 105

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 0.0733 or 7.33%

Proposed WACC with changes =

= [ (0.11 * 57000) + (0.10 * 6800) + (0.07 * 16050) + (0.07 * 15750) / 95600

= (6270 + 680 + 1124 + 1103) / 95600

= 9177 / 95600

= 0.966 or 9.66%

c. Minimisation of weighted average cost of capital by integrating a sensible level of gearing into

their capital structure

The weighted average cost of capital for proposed changes is 9.66% but on the other hand

for market value it is 10.66%. It shows that the enterprise can save up to 1% of cost of capital. It

shows that if proposed capital structure will be integrated with the current one then the minimum

WACC could be decreased by 1% (Falconier, 2015). With the help of it the management can

fund different plan of the company. For example, new machine could be purchased or funds

could be invested in other assets so that higher profits could be generated in future.

d. Effects of short termism on bankruptcy and the agency problem

When an organisation pays attention towards the strategies which can help to generate

short objectives for generating higher profits. On the other hand, agency problem is the situation

of a business where interest of share holders are overlooked for the purpose of personal growth.

In other words it could be defined as a conflict of interest between management and stockholders

of an organisation. Short termism may leave negative impacts upon bankruptcy and also

increases chances of agency problem (Agency problem, 2020). When equities will be overused

then it may result in conflicts among managers of shareholders because they expect to generate

higher returns on their investments but it can affect their rate of dividend. Due to short termism

situation of bankruptcy may take place because if equities will be overused then it may create the

same condition for the entity.

QUESTION 3

a. Different investment appraisal technique's calculations along with recommendations

While planning to invest in a business project all the organisations use different types of

approaches so that appropriateness of the decision could be analysed. All of them are considered

as investment appraisal techniques. Lovewell Limited which is a food manufacturer is planning

5

Proposed WACC with changes =

= [ (0.11 * 57000) + (0.10 * 6800) + (0.07 * 16050) + (0.07 * 15750) / 95600

= (6270 + 680 + 1124 + 1103) / 95600

= 9177 / 95600

= 0.966 or 9.66%

c. Minimisation of weighted average cost of capital by integrating a sensible level of gearing into

their capital structure

The weighted average cost of capital for proposed changes is 9.66% but on the other hand

for market value it is 10.66%. It shows that the enterprise can save up to 1% of cost of capital. It

shows that if proposed capital structure will be integrated with the current one then the minimum

WACC could be decreased by 1% (Falconier, 2015). With the help of it the management can

fund different plan of the company. For example, new machine could be purchased or funds

could be invested in other assets so that higher profits could be generated in future.

d. Effects of short termism on bankruptcy and the agency problem

When an organisation pays attention towards the strategies which can help to generate

short objectives for generating higher profits. On the other hand, agency problem is the situation

of a business where interest of share holders are overlooked for the purpose of personal growth.

In other words it could be defined as a conflict of interest between management and stockholders

of an organisation. Short termism may leave negative impacts upon bankruptcy and also

increases chances of agency problem (Agency problem, 2020). When equities will be overused

then it may result in conflicts among managers of shareholders because they expect to generate

higher returns on their investments but it can affect their rate of dividend. Due to short termism

situation of bankruptcy may take place because if equities will be overused then it may create the

same condition for the entity.

QUESTION 3

a. Different investment appraisal technique's calculations along with recommendations

While planning to invest in a business project all the organisations use different types of

approaches so that appropriateness of the decision could be analysed. All of them are considered

as investment appraisal techniques. Lovewell Limited which is a food manufacturer is planning

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to buy a new machine so that higher profits and revenues could be generated. In order to

facilitate the management of the entity following techniques are used to make sure that the

decision is appropriate or not:

Pay back period: This is one of the simplest method to analyse the investment decision

in the business. As it refers to the time taken by an investment to recover the cost of the

generated at the initial stage. It is simply the length of time that investment takes to reach at its

break even point. A investment which involves the small time duration to recover its initial cost

will become more desirable then other (Finkler, Smith and Calabrese, 2018).

Formula for calculations = Total outflow of funds / inflows

Given information

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Actual inflow = Inflow – outflow

= 85000 – 12500

= 72500

Pay back period = 275000 / 72500

= 3.79 years

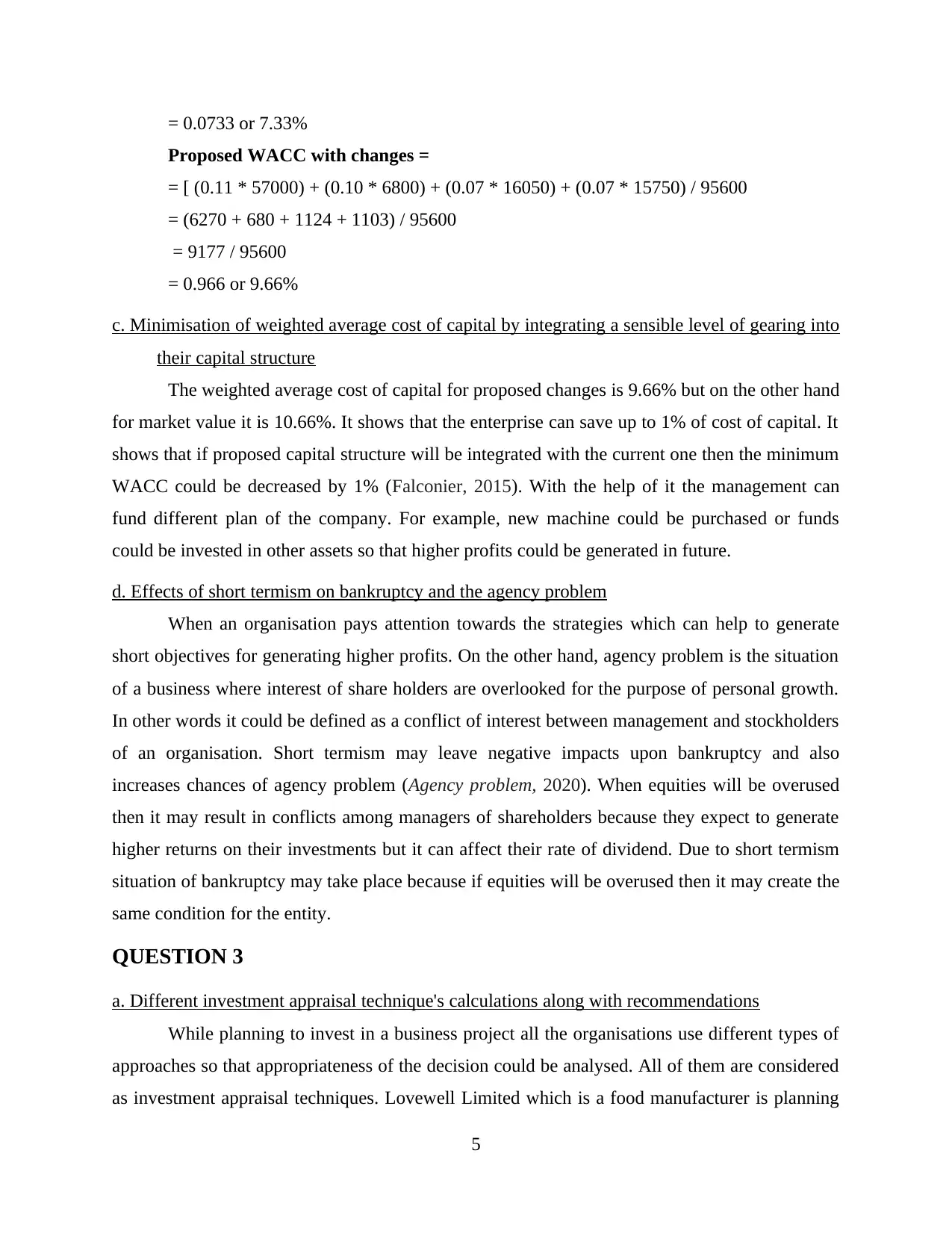

Accounting rate of return (ARR): In general terms it is defined as the percentage rate

of return that is expected to recover to cover the initial cost of investment. This is one of the

essential tool used to make investment decisions. When two mutually exclusive projects are

available then acceptance will be provided to the one which is available with highest amount of

ARR. Through this quick calculation for capital budgeting matrix will be made (Karadag, 2015).

Given information

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Total life of machine = 6 years

Residual value = 15% of original cost of machine

Formula for calculations = Average profit / Total outflow of funds * 100

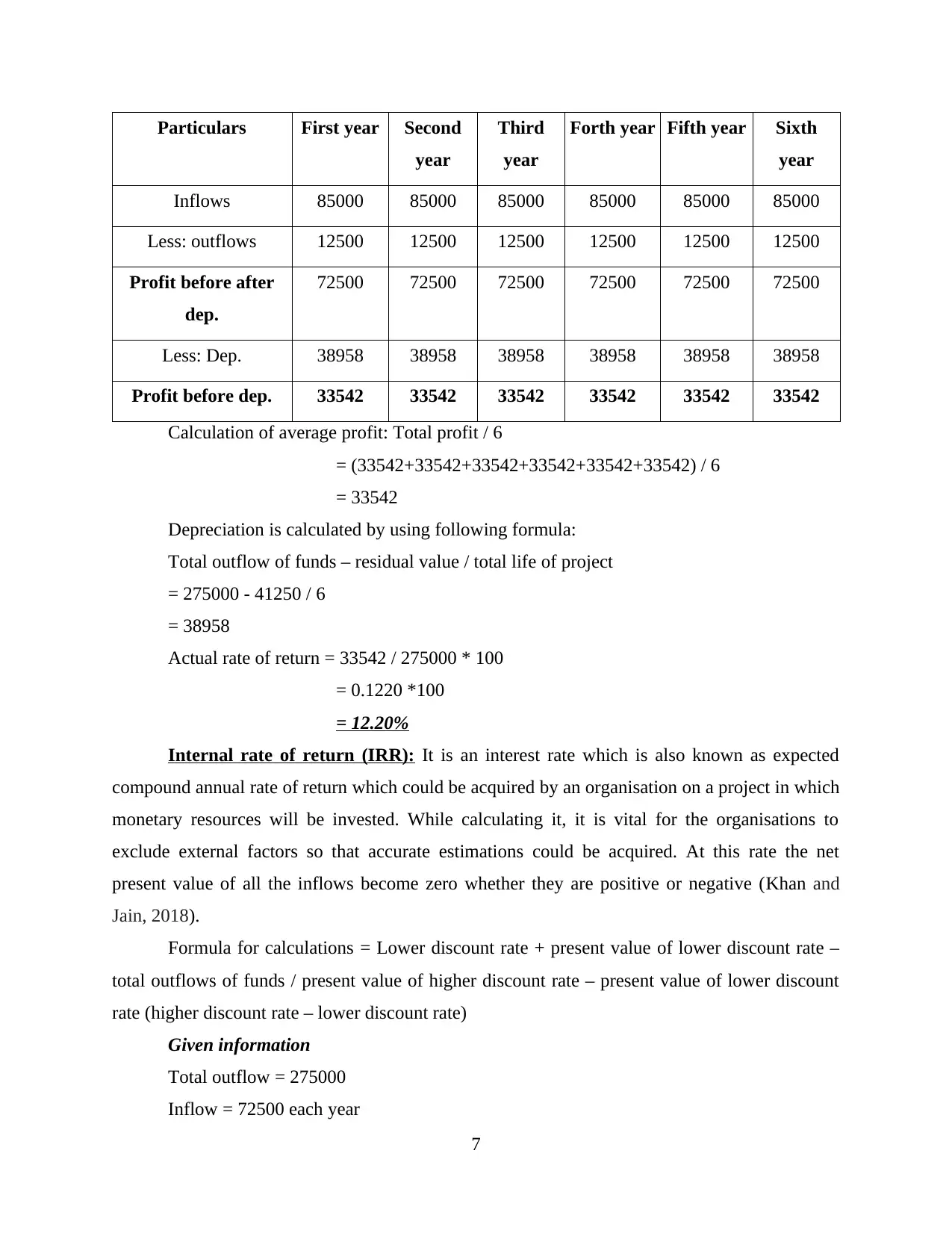

Calculation of profit on annual basis is as follows:

6

facilitate the management of the entity following techniques are used to make sure that the

decision is appropriate or not:

Pay back period: This is one of the simplest method to analyse the investment decision

in the business. As it refers to the time taken by an investment to recover the cost of the

generated at the initial stage. It is simply the length of time that investment takes to reach at its

break even point. A investment which involves the small time duration to recover its initial cost

will become more desirable then other (Finkler, Smith and Calabrese, 2018).

Formula for calculations = Total outflow of funds / inflows

Given information

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Actual inflow = Inflow – outflow

= 85000 – 12500

= 72500

Pay back period = 275000 / 72500

= 3.79 years

Accounting rate of return (ARR): In general terms it is defined as the percentage rate

of return that is expected to recover to cover the initial cost of investment. This is one of the

essential tool used to make investment decisions. When two mutually exclusive projects are

available then acceptance will be provided to the one which is available with highest amount of

ARR. Through this quick calculation for capital budgeting matrix will be made (Karadag, 2015).

Given information

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Total life of machine = 6 years

Residual value = 15% of original cost of machine

Formula for calculations = Average profit / Total outflow of funds * 100

Calculation of profit on annual basis is as follows:

6

Particulars First year Second

year

Third

year

Forth year Fifth year Sixth

year

Inflows 85000 85000 85000 85000 85000 85000

Less: outflows 12500 12500 12500 12500 12500 12500

Profit before after

dep.

72500 72500 72500 72500 72500 72500

Less: Dep. 38958 38958 38958 38958 38958 38958

Profit before dep. 33542 33542 33542 33542 33542 33542

Calculation of average profit: Total profit / 6

= (33542+33542+33542+33542+33542+33542) / 6

= 33542

Depreciation is calculated by using following formula:

Total outflow of funds – residual value / total life of project

= 275000 - 41250 / 6

= 38958

Actual rate of return = 33542 / 275000 * 100

= 0.1220 *100

= 12.20%

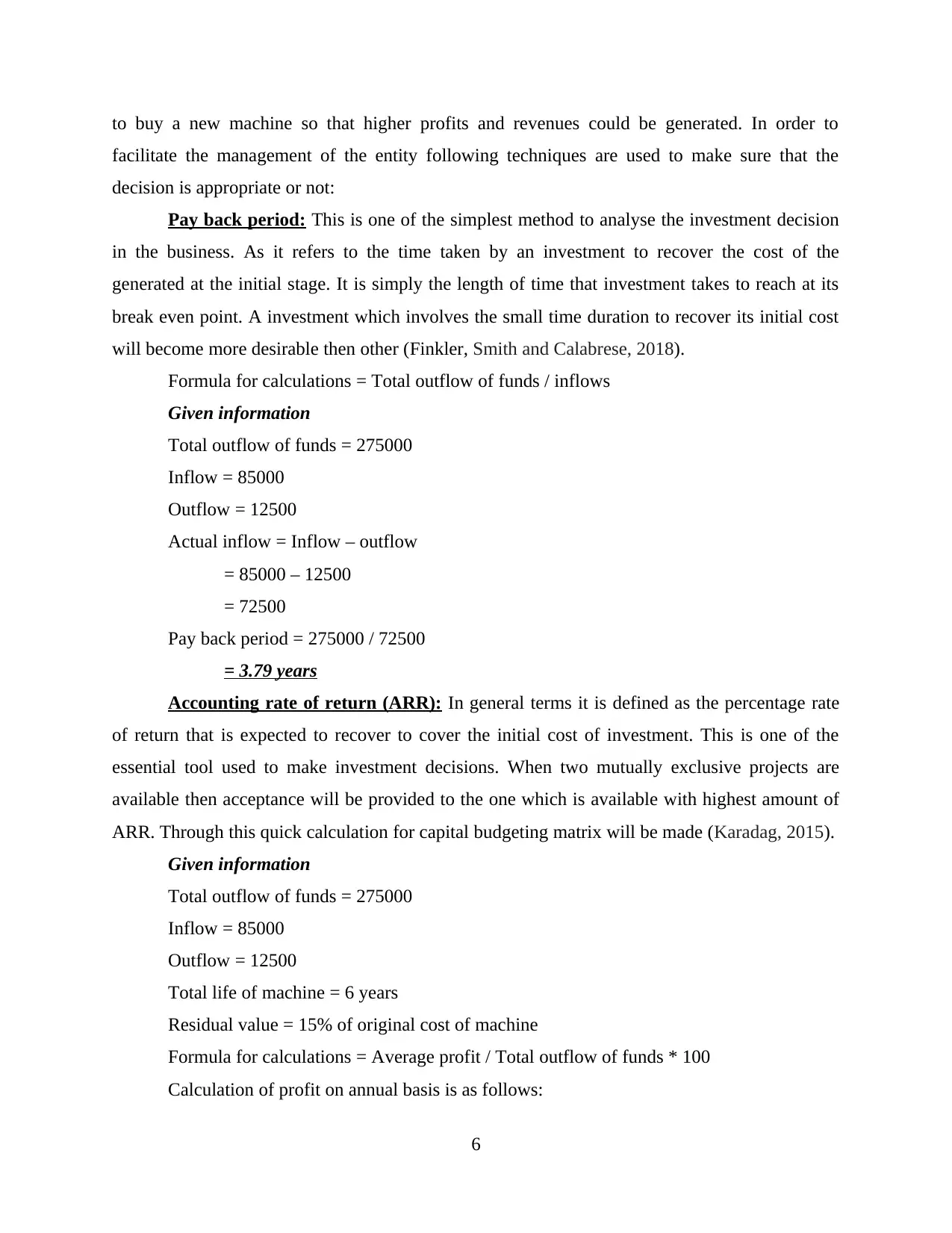

Internal rate of return (IRR): It is an interest rate which is also known as expected

compound annual rate of return which could be acquired by an organisation on a project in which

monetary resources will be invested. While calculating it, it is vital for the organisations to

exclude external factors so that accurate estimations could be acquired. At this rate the net

present value of all the inflows become zero whether they are positive or negative (Khan and

Jain, 2018).

Formula for calculations = Lower discount rate + present value of lower discount rate –

total outflows of funds / present value of higher discount rate – present value of lower discount

rate (higher discount rate – lower discount rate)

Given information

Total outflow = 275000

Inflow = 72500 each year

7

year

Third

year

Forth year Fifth year Sixth

year

Inflows 85000 85000 85000 85000 85000 85000

Less: outflows 12500 12500 12500 12500 12500 12500

Profit before after

dep.

72500 72500 72500 72500 72500 72500

Less: Dep. 38958 38958 38958 38958 38958 38958

Profit before dep. 33542 33542 33542 33542 33542 33542

Calculation of average profit: Total profit / 6

= (33542+33542+33542+33542+33542+33542) / 6

= 33542

Depreciation is calculated by using following formula:

Total outflow of funds – residual value / total life of project

= 275000 - 41250 / 6

= 38958

Actual rate of return = 33542 / 275000 * 100

= 0.1220 *100

= 12.20%

Internal rate of return (IRR): It is an interest rate which is also known as expected

compound annual rate of return which could be acquired by an organisation on a project in which

monetary resources will be invested. While calculating it, it is vital for the organisations to

exclude external factors so that accurate estimations could be acquired. At this rate the net

present value of all the inflows become zero whether they are positive or negative (Khan and

Jain, 2018).

Formula for calculations = Lower discount rate + present value of lower discount rate –

total outflows of funds / present value of higher discount rate – present value of lower discount

rate (higher discount rate – lower discount rate)

Given information

Total outflow = 275000

Inflow = 72500 each year

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Residual value = 15% of original cost of machine

Total life of machine = 6 years

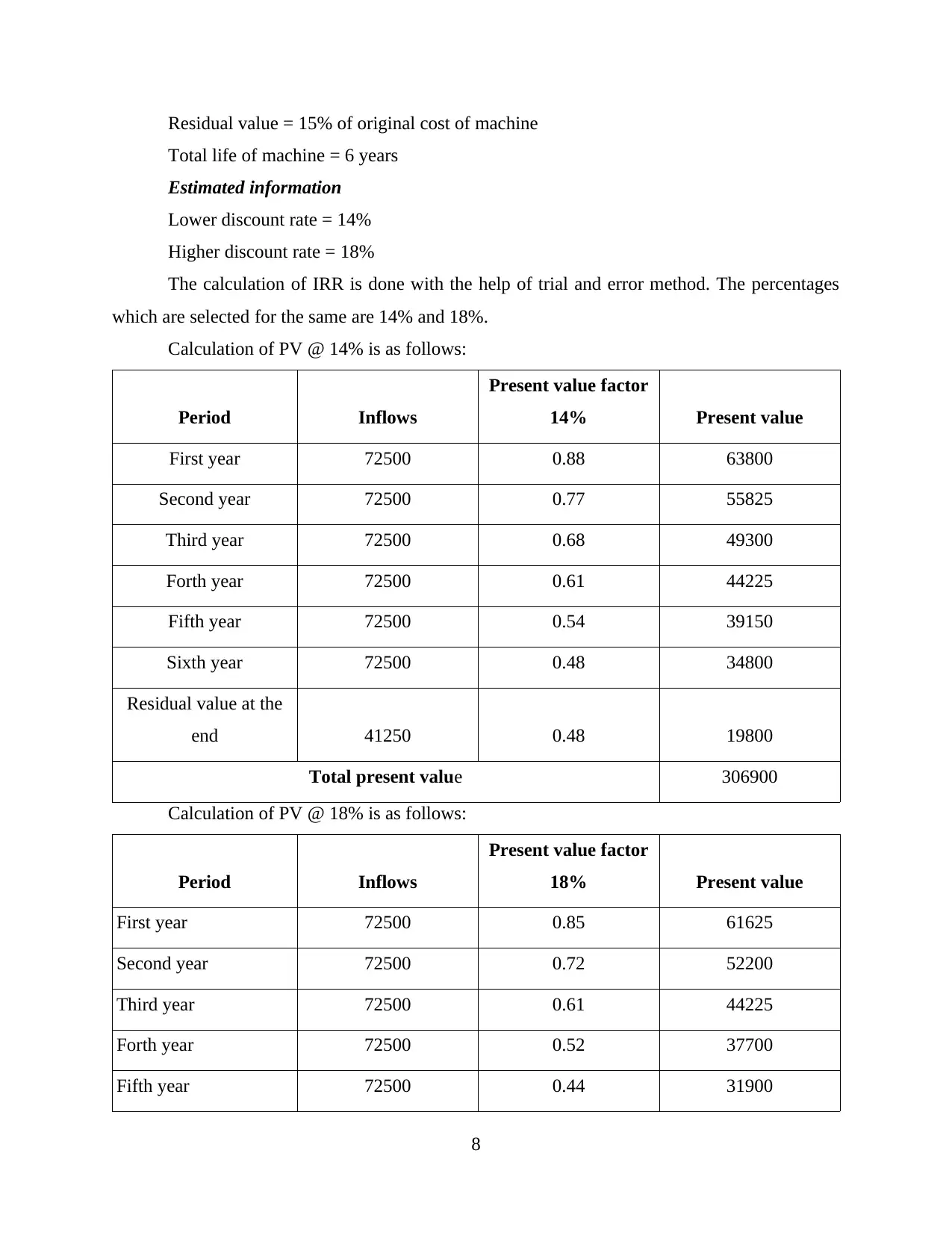

Estimated information

Lower discount rate = 14%

Higher discount rate = 18%

The calculation of IRR is done with the help of trial and error method. The percentages

which are selected for the same are 14% and 18%.

Calculation of PV @ 14% is as follows:

Period Inflows

Present value factor

14% Present value

First year 72500 0.88 63800

Second year 72500 0.77 55825

Third year 72500 0.68 49300

Forth year 72500 0.61 44225

Fifth year 72500 0.54 39150

Sixth year 72500 0.48 34800

Residual value at the

end 41250 0.48 19800

Total present value 306900

Calculation of PV @ 18% is as follows:

Period Inflows

Present value factor

18% Present value

First year 72500 0.85 61625

Second year 72500 0.72 52200

Third year 72500 0.61 44225

Forth year 72500 0.52 37700

Fifth year 72500 0.44 31900

8

Total life of machine = 6 years

Estimated information

Lower discount rate = 14%

Higher discount rate = 18%

The calculation of IRR is done with the help of trial and error method. The percentages

which are selected for the same are 14% and 18%.

Calculation of PV @ 14% is as follows:

Period Inflows

Present value factor

14% Present value

First year 72500 0.88 63800

Second year 72500 0.77 55825

Third year 72500 0.68 49300

Forth year 72500 0.61 44225

Fifth year 72500 0.54 39150

Sixth year 72500 0.48 34800

Residual value at the

end 41250 0.48 19800

Total present value 306900

Calculation of PV @ 18% is as follows:

Period Inflows

Present value factor

18% Present value

First year 72500 0.85 61625

Second year 72500 0.72 52200

Third year 72500 0.61 44225

Forth year 72500 0.52 37700

Fifth year 72500 0.44 31900

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

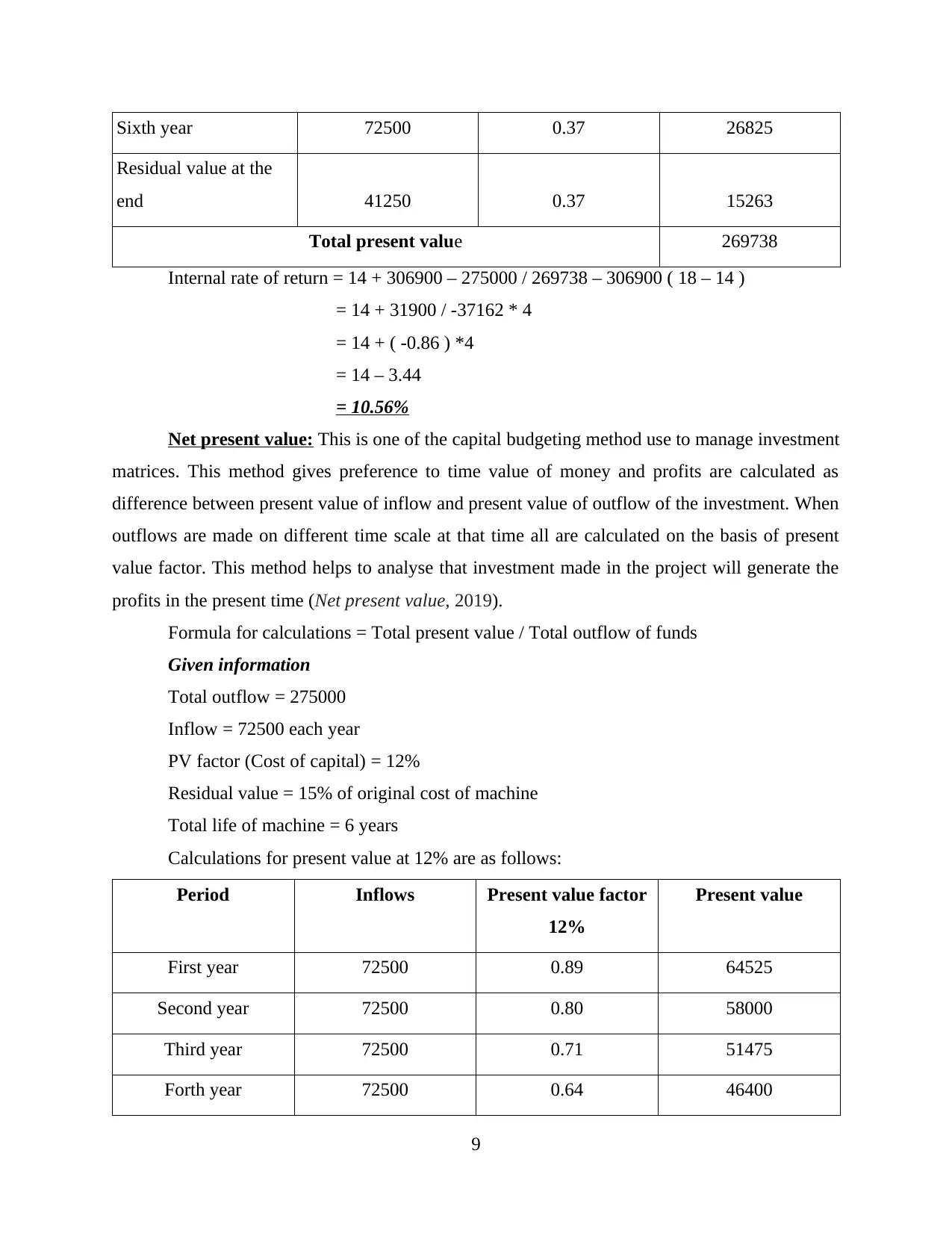

Sixth year 72500 0.37 26825

Residual value at the

end 41250 0.37 15263

Total present value 269738

Internal rate of return = 14 + 306900 – 275000 / 269738 – 306900 ( 18 – 14 )

= 14 + 31900 / -37162 * 4

= 14 + ( -0.86 ) *4

= 14 – 3.44

= 10.56%

Net present value: This is one of the capital budgeting method use to manage investment

matrices. This method gives preference to time value of money and profits are calculated as

difference between present value of inflow and present value of outflow of the investment. When

outflows are made on different time scale at that time all are calculated on the basis of present

value factor. This method helps to analyse that investment made in the project will generate the

profits in the present time (Net present value, 2019).

Formula for calculations = Total present value / Total outflow of funds

Given information

Total outflow = 275000

Inflow = 72500 each year

PV factor (Cost of capital) = 12%

Residual value = 15% of original cost of machine

Total life of machine = 6 years

Calculations for present value at 12% are as follows:

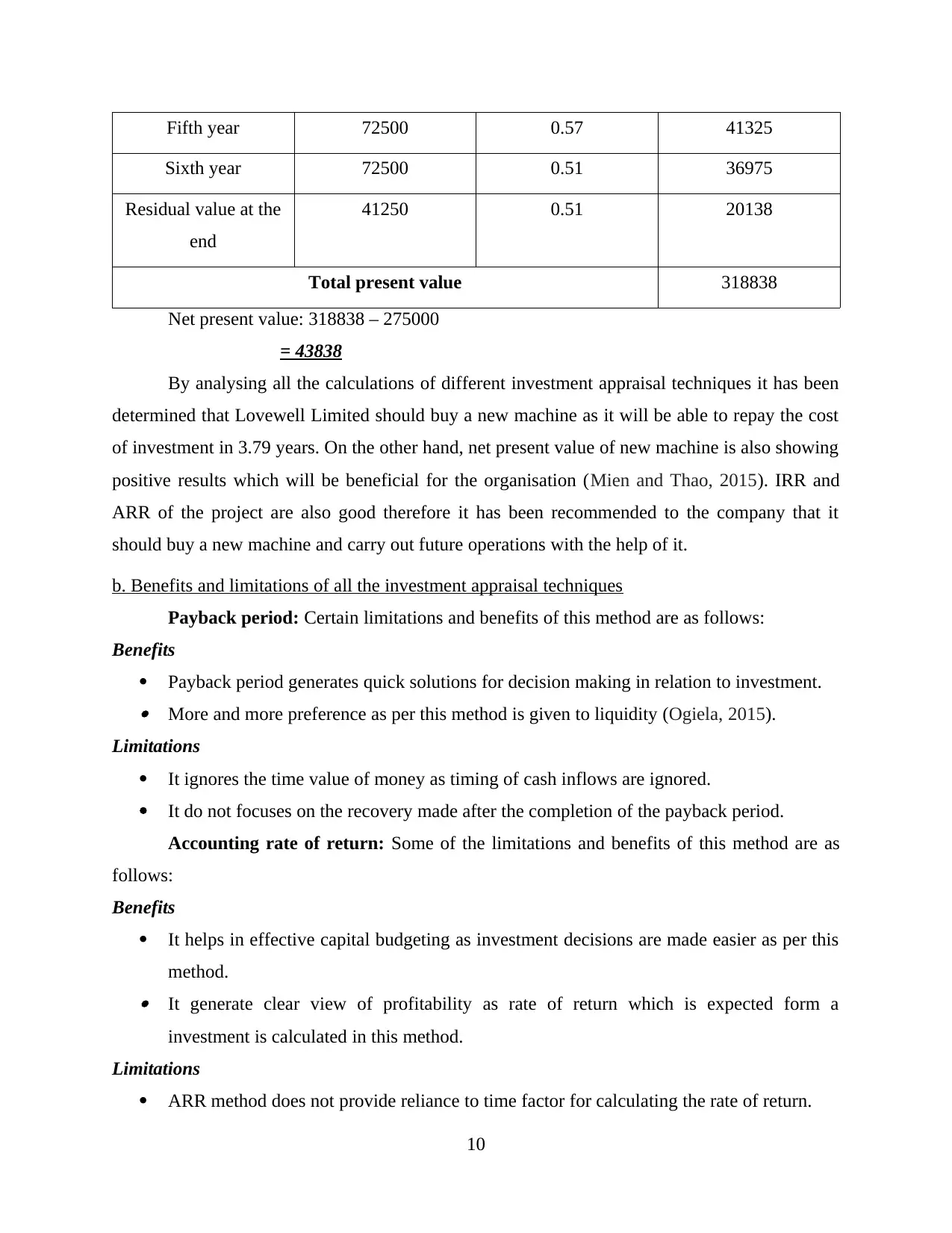

Period Inflows Present value factor

12%

Present value

First year 72500 0.89 64525

Second year 72500 0.80 58000

Third year 72500 0.71 51475

Forth year 72500 0.64 46400

9

Residual value at the

end 41250 0.37 15263

Total present value 269738

Internal rate of return = 14 + 306900 – 275000 / 269738 – 306900 ( 18 – 14 )

= 14 + 31900 / -37162 * 4

= 14 + ( -0.86 ) *4

= 14 – 3.44

= 10.56%

Net present value: This is one of the capital budgeting method use to manage investment

matrices. This method gives preference to time value of money and profits are calculated as

difference between present value of inflow and present value of outflow of the investment. When

outflows are made on different time scale at that time all are calculated on the basis of present

value factor. This method helps to analyse that investment made in the project will generate the

profits in the present time (Net present value, 2019).

Formula for calculations = Total present value / Total outflow of funds

Given information

Total outflow = 275000

Inflow = 72500 each year

PV factor (Cost of capital) = 12%

Residual value = 15% of original cost of machine

Total life of machine = 6 years

Calculations for present value at 12% are as follows:

Period Inflows Present value factor

12%

Present value

First year 72500 0.89 64525

Second year 72500 0.80 58000

Third year 72500 0.71 51475

Forth year 72500 0.64 46400

9

Fifth year 72500 0.57 41325

Sixth year 72500 0.51 36975

Residual value at the

end

41250 0.51 20138

Total present value 318838

Net present value: 318838 – 275000

= 43838

By analysing all the calculations of different investment appraisal techniques it has been

determined that Lovewell Limited should buy a new machine as it will be able to repay the cost

of investment in 3.79 years. On the other hand, net present value of new machine is also showing

positive results which will be beneficial for the organisation (Mien and Thao, 2015). IRR and

ARR of the project are also good therefore it has been recommended to the company that it

should buy a new machine and carry out future operations with the help of it.

b. Benefits and limitations of all the investment appraisal techniques

Payback period: Certain limitations and benefits of this method are as follows:

Benefits

Payback period generates quick solutions for decision making in relation to investment. More and more preference as per this method is given to liquidity (Ogiela, 2015).

Limitations

It ignores the time value of money as timing of cash inflows are ignored.

It do not focuses on the recovery made after the completion of the payback period.

Accounting rate of return: Some of the limitations and benefits of this method are as

follows:

Benefits

It helps in effective capital budgeting as investment decisions are made easier as per this

method. It generate clear view of profitability as rate of return which is expected form a

investment is calculated in this method.

Limitations

ARR method does not provide reliance to time factor for calculating the rate of return.

10

Sixth year 72500 0.51 36975

Residual value at the

end

41250 0.51 20138

Total present value 318838

Net present value: 318838 – 275000

= 43838

By analysing all the calculations of different investment appraisal techniques it has been

determined that Lovewell Limited should buy a new machine as it will be able to repay the cost

of investment in 3.79 years. On the other hand, net present value of new machine is also showing

positive results which will be beneficial for the organisation (Mien and Thao, 2015). IRR and

ARR of the project are also good therefore it has been recommended to the company that it

should buy a new machine and carry out future operations with the help of it.

b. Benefits and limitations of all the investment appraisal techniques

Payback period: Certain limitations and benefits of this method are as follows:

Benefits

Payback period generates quick solutions for decision making in relation to investment. More and more preference as per this method is given to liquidity (Ogiela, 2015).

Limitations

It ignores the time value of money as timing of cash inflows are ignored.

It do not focuses on the recovery made after the completion of the payback period.

Accounting rate of return: Some of the limitations and benefits of this method are as

follows:

Benefits

It helps in effective capital budgeting as investment decisions are made easier as per this

method. It generate clear view of profitability as rate of return which is expected form a

investment is calculated in this method.

Limitations

ARR method does not provide reliance to time factor for calculating the rate of return.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Decision as per this method is made on the basis of accounting profits and cash inflows

are ignored (Renz and Herman, 2016).

Internal rate of return: This method have various benefits and limitations which are as

follows:

Benefits

This capital budgeting technique take time value of money in to consideration which help

to get accurate results. The level of subjectivity is very low in this method which reduced difficulties in

calculations (Shapiro and Hanouna, 2019).

Limitations

While using it the management may face difficulties in project ranking as it provides

similar results.

This method assumes that the cash flow generated by the entity will be reinvested in

future (Wendy Morton-Huddleston CGFM, 2016).

Net present value: This capital budgeting method is available with following benefits

and limitations:

Benefits

One of the primary advantage of NPV method is that it consider time value of money in

the process of decision making. It helps better decision making for management as all the actions are taken on the basis of

some informed content.

Limitations

NPV method does not consider hidden cost involved in the process of calculating

outflows (Wolmarans and Meintjes, 2015).

Projects that involves different time period make decision of NPV irrelevant.

CONCLUSION

The above project report concludes that financial management is the process of managing

and maintaining all the available sources of funds used for carrying out operations. There are

various types of securities which are used by business entities to fund the operational activities.

These are equities, preference share, bonds etc. and cost of capital is used to analyse opportunity

cots for all of them. While planning for investing in a project it is very important for managers of

11

are ignored (Renz and Herman, 2016).

Internal rate of return: This method have various benefits and limitations which are as

follows:

Benefits

This capital budgeting technique take time value of money in to consideration which help

to get accurate results. The level of subjectivity is very low in this method which reduced difficulties in

calculations (Shapiro and Hanouna, 2019).

Limitations

While using it the management may face difficulties in project ranking as it provides

similar results.

This method assumes that the cash flow generated by the entity will be reinvested in

future (Wendy Morton-Huddleston CGFM, 2016).

Net present value: This capital budgeting method is available with following benefits

and limitations:

Benefits

One of the primary advantage of NPV method is that it consider time value of money in

the process of decision making. It helps better decision making for management as all the actions are taken on the basis of

some informed content.

Limitations

NPV method does not consider hidden cost involved in the process of calculating

outflows (Wolmarans and Meintjes, 2015).

Projects that involves different time period make decision of NPV irrelevant.

CONCLUSION

The above project report concludes that financial management is the process of managing

and maintaining all the available sources of funds used for carrying out operations. There are

various types of securities which are used by business entities to fund the operational activities.

These are equities, preference share, bonds etc. and cost of capital is used to analyse opportunity

cots for all of them. While planning for investing in a project it is very important for managers of

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

an organisation to use different investment appraisal techniques as all of them can help to

evaluate the appropriateness of the same. Some of them are pay back period, accounting rate of

return, internal rate of return and net present value.

12

evaluate the appropriateness of the same. Some of them are pay back period, accounting rate of

return, internal rate of return and net present value.

12

REFERENCES

Books and Journals:

Antonopoulos, G. A. and Hall, A., 2015. The financial management of the illicit tobacco trade in

the United Kingdom. British Journal of Criminology. 56(4). pp.709-728.

Ashmarina, S., Zotova, A. and Smolina, E., 2016. Implementation of financial sustainability in

organizations through valuation of financial leverage effect in Russian practice of

financial management. International journal of environmental & science education.

11(10). pp.3775-3782.

Brusca, I., Gómez‐villegas, M. and Montesinos, V., 2016. Public financial management reforms:

The role of IPSAS in Latin‐America. Public Administration and Development. 36(1).

pp.51-64.

Falconier, M. K., 2015. Together–A couples’ program to improve communication, coping, and

financial management skills: Development and initial pilot‐testing. Journal of marital

and family therapy. 41(2). pp.236-250.

Finkler, S. A., Smith, D. L. and Calabrese, T. D., 2018. Financial management for public, health,

and not-for-profit organizations. CQ Press.

Karadag, H., 2015. Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal. 5(1). pp.26-40.

Khan, M. Y. and Jain, P. K., 2018. Financial Management: Text, Problems and Cases, 8e.

McGraw-Hill Education.

Mien, N. T. N. and Thao, T. P., 2015. Factors affecting personal financial management

behaviors: evidence from vietnam. In Proceedings of the Second Asia-Pacific

Conference on Global Business, Economics, Finance and Social Sciences

(AP15Vietnam Conference). 10-12/07/2015.

Ogiela, L., 2015. Intelligent techniques for secure financial management in cloud

computing. Electronic commerce research and applications. 14(6). pp.456-464.

Renz, D. O. and Herman, R. D. eds., 2016. The Jossey-Bass handbook of nonprofit leadership

and management. John Wiley & Sons.

Shapiro, A. C. and Hanouna, P., 2019. Multinational financial management. Wiley.

Wendy Morton-Huddleston CGFM, P. M. P., 2016. Recruiting and retaining the next generation

of financial management professionals. The Journal of Government Financial

Management. 65(2). p.46.

Wolmarans, H. P. and Meintjes, Q., 2015. Financial management practices in successful Small

and Medium Enterprises (SMEs). The southern African journal of entrepreneurship and

small business management. 7(1). pp.88-116.

Online

Agency problem. 2020. [Online]. Available through:

<http://www.investorwords.com/18995/agency_problem.html>

Net present value. 2019. [Online]. Available through:

<https://sba.thehartford.com/finance/cash-flow/net-present-value/>

13

Books and Journals:

Antonopoulos, G. A. and Hall, A., 2015. The financial management of the illicit tobacco trade in

the United Kingdom. British Journal of Criminology. 56(4). pp.709-728.

Ashmarina, S., Zotova, A. and Smolina, E., 2016. Implementation of financial sustainability in

organizations through valuation of financial leverage effect in Russian practice of

financial management. International journal of environmental & science education.

11(10). pp.3775-3782.

Brusca, I., Gómez‐villegas, M. and Montesinos, V., 2016. Public financial management reforms:

The role of IPSAS in Latin‐America. Public Administration and Development. 36(1).

pp.51-64.

Falconier, M. K., 2015. Together–A couples’ program to improve communication, coping, and

financial management skills: Development and initial pilot‐testing. Journal of marital

and family therapy. 41(2). pp.236-250.

Finkler, S. A., Smith, D. L. and Calabrese, T. D., 2018. Financial management for public, health,

and not-for-profit organizations. CQ Press.

Karadag, H., 2015. Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal. 5(1). pp.26-40.

Khan, M. Y. and Jain, P. K., 2018. Financial Management: Text, Problems and Cases, 8e.

McGraw-Hill Education.

Mien, N. T. N. and Thao, T. P., 2015. Factors affecting personal financial management

behaviors: evidence from vietnam. In Proceedings of the Second Asia-Pacific

Conference on Global Business, Economics, Finance and Social Sciences

(AP15Vietnam Conference). 10-12/07/2015.

Ogiela, L., 2015. Intelligent techniques for secure financial management in cloud

computing. Electronic commerce research and applications. 14(6). pp.456-464.

Renz, D. O. and Herman, R. D. eds., 2016. The Jossey-Bass handbook of nonprofit leadership

and management. John Wiley & Sons.

Shapiro, A. C. and Hanouna, P., 2019. Multinational financial management. Wiley.

Wendy Morton-Huddleston CGFM, P. M. P., 2016. Recruiting and retaining the next generation

of financial management professionals. The Journal of Government Financial

Management. 65(2). p.46.

Wolmarans, H. P. and Meintjes, Q., 2015. Financial management practices in successful Small

and Medium Enterprises (SMEs). The southern African journal of entrepreneurship and

small business management. 7(1). pp.88-116.

Online

Agency problem. 2020. [Online]. Available through:

<http://www.investorwords.com/18995/agency_problem.html>

Net present value. 2019. [Online]. Available through:

<https://sba.thehartford.com/finance/cash-flow/net-present-value/>

13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.