Financial Management Report - Time Value, Bonds, Capital Budgeting

VerifiedAdded on 2021/01/03

|11

|2283

|68

Report

AI Summary

This financial management report delves into several key areas of finance. It begins with an analysis of the time value of money, including the calculation of present and future values of annuities, and how interest rates impact these calculations. The report then moves on to bond valuation, determining the current prices of bonds, and calculating coupon rates. Capital budgeting is also addressed, with a detailed analysis of cash flows, present values, and net present value (NPV), internal rate of return (IRR). Finally, the report explores risk and return, constructing a Capital Allocation Line (CAL) and calculating portfolio standard deviations. The report provides detailed calculations and explanations for each concept, offering a comprehensive overview of financial management principles. The report also includes references to relevant financial literature.

FINANCIAL

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1: TIME VALUE OF MONEY..................................................................................1

a) Time Line depicting Cash-flows with Broadbent's Retirement Annuity...........................1

b) Present Value of Annuity (PVA).......................................................................................1

c) Annual deposits made during the accumulation period.....................................................1

d) Calculating periodic payments, if rate of interest become 10%........................................2

e) Calculating periodic payments if retirement annuity is a perpetuity.................................2

QUESTION 2: BOND AND SHARE VALUATION.....................................................................3

A) Current Price of Bond A and B.........................................................................................3

B) Annual Coupon Rate Offered............................................................................................4

C) Buildcorp Commercial PTY Ltd.......................................................................................4

QUESTION 3: CAPITAL BUDGETING.......................................................................................5

QUESTION 4: RISK AND RETURN.............................................................................................6

a) Plotting CAL derived from Risk-Free Asset and Portfolio A............................................6

b) Fraction of portfolio to be invested in A to have a portfolio standard deviation of 12%. .7

REFERENCES................................................................................................................................8

QUESTION 1: TIME VALUE OF MONEY..................................................................................1

a) Time Line depicting Cash-flows with Broadbent's Retirement Annuity...........................1

b) Present Value of Annuity (PVA).......................................................................................1

c) Annual deposits made during the accumulation period.....................................................1

d) Calculating periodic payments, if rate of interest become 10%........................................2

e) Calculating periodic payments if retirement annuity is a perpetuity.................................2

QUESTION 2: BOND AND SHARE VALUATION.....................................................................3

A) Current Price of Bond A and B.........................................................................................3

B) Annual Coupon Rate Offered............................................................................................4

C) Buildcorp Commercial PTY Ltd.......................................................................................4

QUESTION 3: CAPITAL BUDGETING.......................................................................................5

QUESTION 4: RISK AND RETURN.............................................................................................6

a) Plotting CAL derived from Risk-Free Asset and Portfolio A............................................6

b) Fraction of portfolio to be invested in A to have a portfolio standard deviation of 12%. .7

REFERENCES................................................................................................................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

QUESTION 1: TIME VALUE OF MONEY

a) Time Line depicting Cash-flows with Broadbent's Retirement Annuity

Accumulation Period: Year 1 to Year 12 (12 years)

1 2 3 4 5 6 7 8 9 10 11 12

Distribution Period: Year 13 to Year 32 (20 years)

13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33

b) Present Value of Annuity (PVA)

Periodic Payments beyond year 12 = $42,000 per annum = P

Interest Rate at which such payments are made = 20% p.a. = r

Number of years such cash-outflows are incurred = 20 years = n

Present Value at the end of year 12 = P*[(1-(1+r)-n)/(r)]

PVA = $42,000*[(1-(1+0.20)-20)/(0.20)]

= $42,000*[(1-(1.20)-20)/(0.20)]

= $42,000*[(1-0.026)/0.20]

= $42,000*[0.974/0.20]

=$42,000*4.87

=$204,522.35

Hence, $204,522.35 is the lump-sum amount that needs to be accumulated by the end of

year 12 by Broadbent group to provide for the 20 year $42,000 annuity.

c) Annual deposits made during the accumulation period

The present value of annuity equalling an amount of $204,522.35 can be treated as the

future value of annuity payments to be accumulated between year 0 and 12 (Vernimmen, P. and

et.al., 2014).

Thus, PV at the end of year 13 in distribution period= FV at the end of year 12 in

accumulation period = $204,522.35

Thus, FV of annuity = P*[((1+r)n-1)/r]

$204,522.35 = P*[((1+0.09)12-1)/0.09]

$204,522.35 = P*[((1.09)12-1)/0.09]

1

a) Time Line depicting Cash-flows with Broadbent's Retirement Annuity

Accumulation Period: Year 1 to Year 12 (12 years)

1 2 3 4 5 6 7 8 9 10 11 12

Distribution Period: Year 13 to Year 32 (20 years)

13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33

b) Present Value of Annuity (PVA)

Periodic Payments beyond year 12 = $42,000 per annum = P

Interest Rate at which such payments are made = 20% p.a. = r

Number of years such cash-outflows are incurred = 20 years = n

Present Value at the end of year 12 = P*[(1-(1+r)-n)/(r)]

PVA = $42,000*[(1-(1+0.20)-20)/(0.20)]

= $42,000*[(1-(1.20)-20)/(0.20)]

= $42,000*[(1-0.026)/0.20]

= $42,000*[0.974/0.20]

=$42,000*4.87

=$204,522.35

Hence, $204,522.35 is the lump-sum amount that needs to be accumulated by the end of

year 12 by Broadbent group to provide for the 20 year $42,000 annuity.

c) Annual deposits made during the accumulation period

The present value of annuity equalling an amount of $204,522.35 can be treated as the

future value of annuity payments to be accumulated between year 0 and 12 (Vernimmen, P. and

et.al., 2014).

Thus, PV at the end of year 13 in distribution period= FV at the end of year 12 in

accumulation period = $204,522.35

Thus, FV of annuity = P*[((1+r)n-1)/r]

$204,522.35 = P*[((1+0.09)12-1)/0.09]

$204,522.35 = P*[((1.09)12-1)/0.09]

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

$204,522.35 = P*[(2.812664782-1)/0.09]

$204,522.35 = P*[1.812664782/0.09]

$204,522.35 = P*[20.140719798]

P=($204,522.35)/ (20.14)

P=$10,154.67

Thus, periodic payments (P) during accumulation period is $10,154.67. Therefore,

Broadbent needs to make such deposits every year in order to fully fund Mr. Tim Sprod's

retirement annuity.

d) Calculating periodic payments, if rate of interest become 10%

FV of annuity = P*[((1+r)n-1)/r]

$204,522.35 = P*[((1+0.10)12-1)/0.10]

$204,522.35 = P*[((1.10)12-1)/0.10]

$204,522.35 = P*[(3.138428377-1)/0.10]

$204,522.35 = P*[2.138/0.10]

$204,522.35 = P*[21.38]

P=($204,522.35)/ (20.14)

P=$9564.14

Thus, Broadbent needs to deposit $9564.14 annually during the accumulation period if it

could earn 10 per cent rather$204,522.35 than 9 per cent during the accumulation period.

e) Calculating periodic payments if retirement annuity is a perpetuity

During accumulation period,

PVA = $10,154.67*[(1-(1+0.09)-12)/(0.09)]

PVA = $10,154.67*[(1-(1.09)-12)/(0.09)]

PVA = $10,154.67*[(1-0.36)/(0.09)]

PVA = $10,154.67*[(0.65)/(0.09)]

PVA = $10,154.67*(7.16)

PVA = $72,707.4372

If Retirement Annuity is perpetuity then :

PV = C / R

Where:

PV = Present value

2

$204,522.35 = P*[1.812664782/0.09]

$204,522.35 = P*[20.140719798]

P=($204,522.35)/ (20.14)

P=$10,154.67

Thus, periodic payments (P) during accumulation period is $10,154.67. Therefore,

Broadbent needs to make such deposits every year in order to fully fund Mr. Tim Sprod's

retirement annuity.

d) Calculating periodic payments, if rate of interest become 10%

FV of annuity = P*[((1+r)n-1)/r]

$204,522.35 = P*[((1+0.10)12-1)/0.10]

$204,522.35 = P*[((1.10)12-1)/0.10]

$204,522.35 = P*[(3.138428377-1)/0.10]

$204,522.35 = P*[2.138/0.10]

$204,522.35 = P*[21.38]

P=($204,522.35)/ (20.14)

P=$9564.14

Thus, Broadbent needs to deposit $9564.14 annually during the accumulation period if it

could earn 10 per cent rather$204,522.35 than 9 per cent during the accumulation period.

e) Calculating periodic payments if retirement annuity is a perpetuity

During accumulation period,

PVA = $10,154.67*[(1-(1+0.09)-12)/(0.09)]

PVA = $10,154.67*[(1-(1.09)-12)/(0.09)]

PVA = $10,154.67*[(1-0.36)/(0.09)]

PVA = $10,154.67*[(0.65)/(0.09)]

PVA = $10,154.67*(7.16)

PVA = $72,707.4372

If Retirement Annuity is perpetuity then :

PV = C / R

Where:

PV = Present value

2

C = Amount of continuous cash payments

r = Interest rate or yield

PV = $72,707.4372

r = 0.09

C= $72,707.4372*0.09 = $6,543.67

Therefore, Broadbent has to deposit $6,543.67 annually during the accumulation period if

Mr Sprod's retirement annuity was a perpetuity and all other terms were the same as initially

described.

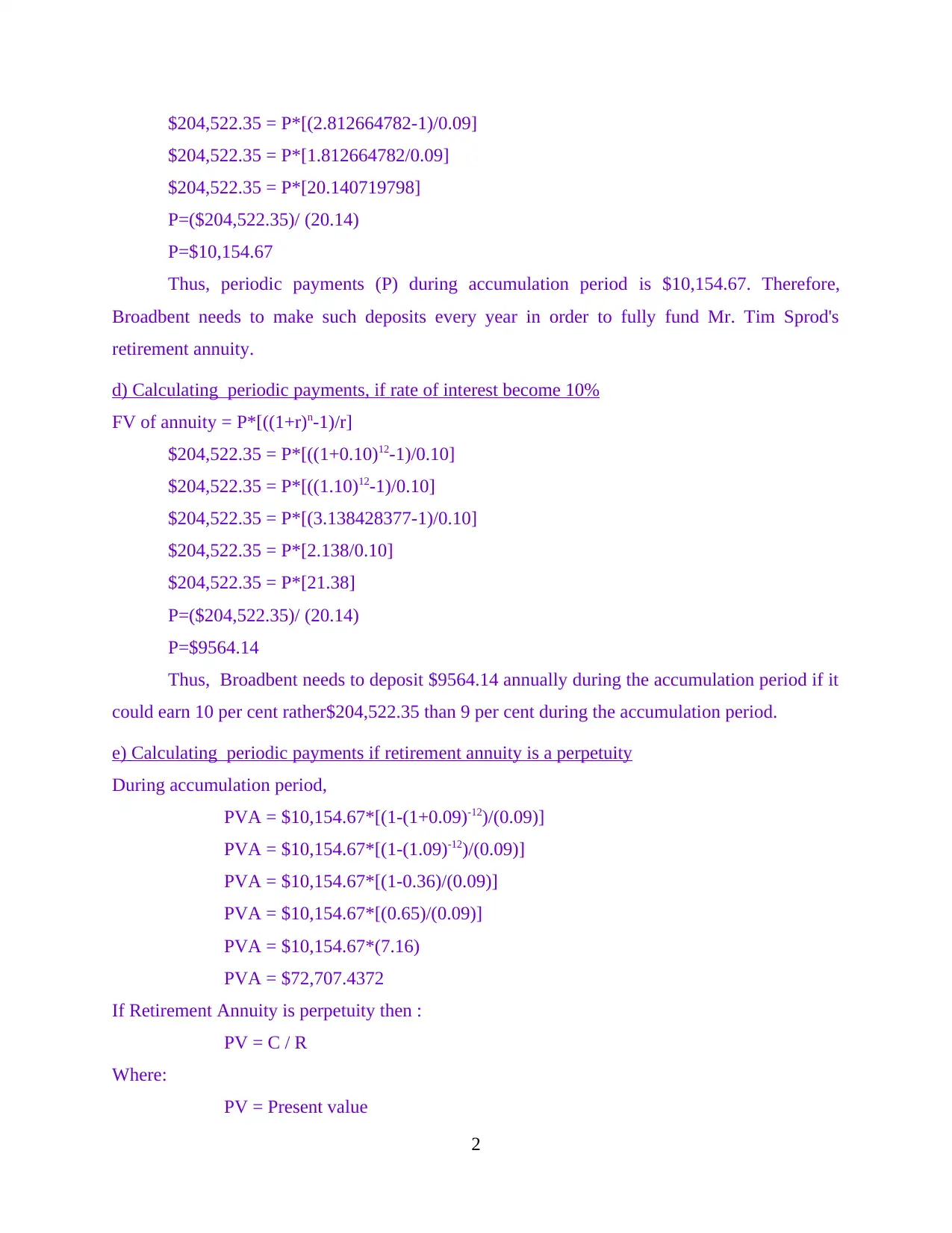

QUESTION 2: BOND AND SHARE VALUATION

A) Current Price of Bond A and B

Particulars Bond A Bond B

Face Value ($) 40,000 40,000

Years to Maturity 20 20

Coupon Payments Yes No

Method of Payment (yrs/$) First 6 years = No Coupon Payment

6th to 14th year = 2,000 semi-annually

15th to 20th year = 2,500 semi-annually

-

Price of Bond A:

Expected Rate of Return (%) = [(Face Value – Purchase Price)/Purchase Price]

0.12 = ($40,000 – P)/P

0.12*P = $40,000 – P

0.12P+P = $40,000

1.12P = $40,000

P =$40,000/ 1.12

P = $35,714.29

The purchase price of Bond A is equals to $35,714.29.

Price of Bond B:

Expected Rate of Return (%) = [(Face Value – Purchase Price)/Purchase Price]

P = 40,000/ (1.12)20

3

r = Interest rate or yield

PV = $72,707.4372

r = 0.09

C= $72,707.4372*0.09 = $6,543.67

Therefore, Broadbent has to deposit $6,543.67 annually during the accumulation period if

Mr Sprod's retirement annuity was a perpetuity and all other terms were the same as initially

described.

QUESTION 2: BOND AND SHARE VALUATION

A) Current Price of Bond A and B

Particulars Bond A Bond B

Face Value ($) 40,000 40,000

Years to Maturity 20 20

Coupon Payments Yes No

Method of Payment (yrs/$) First 6 years = No Coupon Payment

6th to 14th year = 2,000 semi-annually

15th to 20th year = 2,500 semi-annually

-

Price of Bond A:

Expected Rate of Return (%) = [(Face Value – Purchase Price)/Purchase Price]

0.12 = ($40,000 – P)/P

0.12*P = $40,000 – P

0.12P+P = $40,000

1.12P = $40,000

P =$40,000/ 1.12

P = $35,714.29

The purchase price of Bond A is equals to $35,714.29.

Price of Bond B:

Expected Rate of Return (%) = [(Face Value – Purchase Price)/Purchase Price]

P = 40,000/ (1.12)20

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P = 40,000/9.65

P = $4,145.08

The purchase price of Bond A is equals to $4,145.08 (Price of Zero Coupon Bond, 2018).

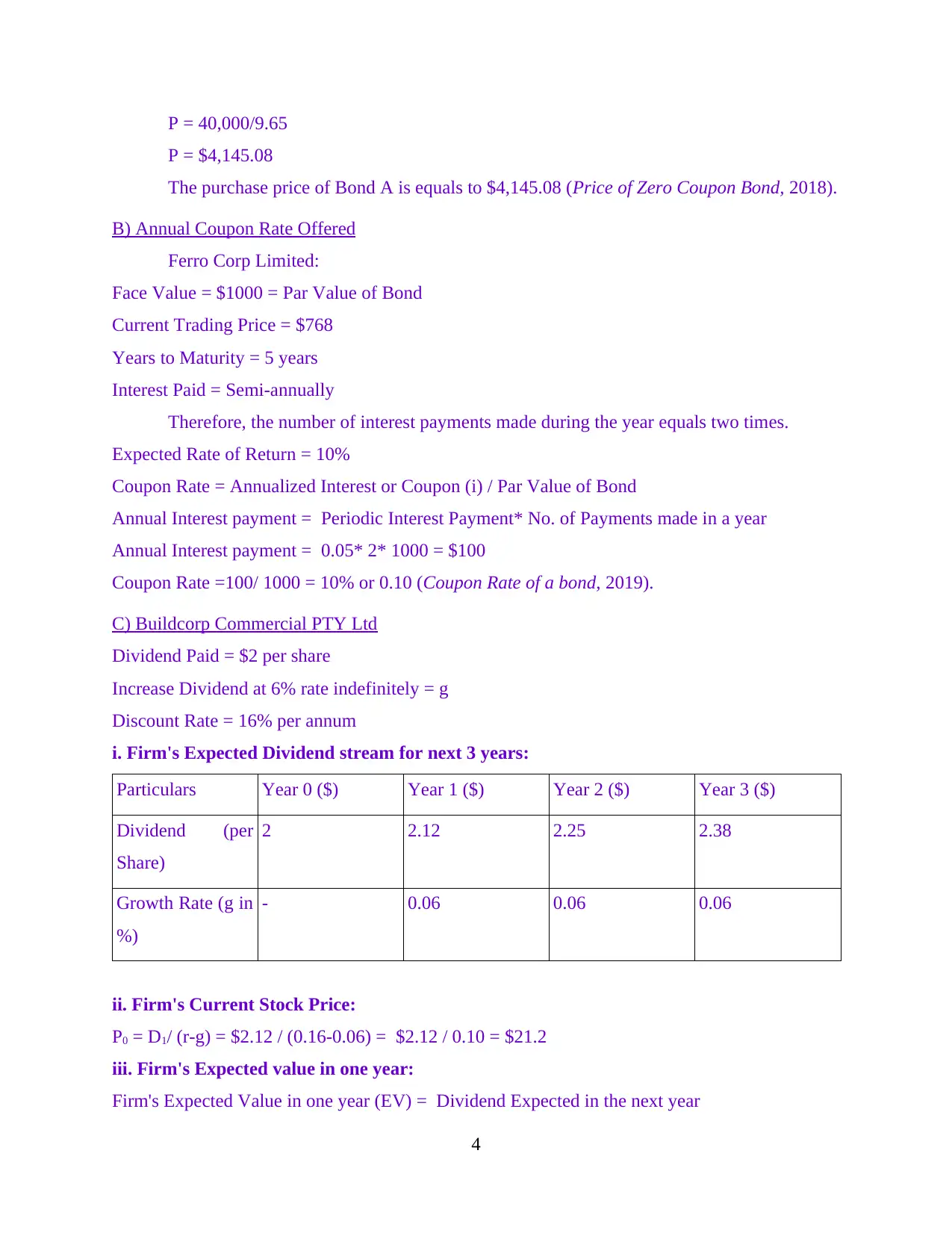

B) Annual Coupon Rate Offered

Ferro Corp Limited:

Face Value = $1000 = Par Value of Bond

Current Trading Price = $768

Years to Maturity = 5 years

Interest Paid = Semi-annually

Therefore, the number of interest payments made during the year equals two times.

Expected Rate of Return = 10%

Coupon Rate = Annualized Interest or Coupon (i) / Par Value of Bond

Annual Interest payment = Periodic Interest Payment* No. of Payments made in a year

Annual Interest payment = 0.05* 2* 1000 = $100

Coupon Rate =100/ 1000 = 10% or 0.10 (Coupon Rate of a bond, 2019).

C) Buildcorp Commercial PTY Ltd

Dividend Paid = $2 per share

Increase Dividend at 6% rate indefinitely = g

Discount Rate = 16% per annum

i. Firm's Expected Dividend stream for next 3 years:

Particulars Year 0 ($) Year 1 ($) Year 2 ($) Year 3 ($)

Dividend (per

Share)

2 2.12 2.25 2.38

Growth Rate (g in

%)

- 0.06 0.06 0.06

ii. Firm's Current Stock Price:

P0 = D1/ (r-g) = $2.12 / (0.16-0.06) = $2.12 / 0.10 = $21.2

iii. Firm's Expected value in one year:

Firm's Expected Value in one year (EV) = Dividend Expected in the next year

4

P = $4,145.08

The purchase price of Bond A is equals to $4,145.08 (Price of Zero Coupon Bond, 2018).

B) Annual Coupon Rate Offered

Ferro Corp Limited:

Face Value = $1000 = Par Value of Bond

Current Trading Price = $768

Years to Maturity = 5 years

Interest Paid = Semi-annually

Therefore, the number of interest payments made during the year equals two times.

Expected Rate of Return = 10%

Coupon Rate = Annualized Interest or Coupon (i) / Par Value of Bond

Annual Interest payment = Periodic Interest Payment* No. of Payments made in a year

Annual Interest payment = 0.05* 2* 1000 = $100

Coupon Rate =100/ 1000 = 10% or 0.10 (Coupon Rate of a bond, 2019).

C) Buildcorp Commercial PTY Ltd

Dividend Paid = $2 per share

Increase Dividend at 6% rate indefinitely = g

Discount Rate = 16% per annum

i. Firm's Expected Dividend stream for next 3 years:

Particulars Year 0 ($) Year 1 ($) Year 2 ($) Year 3 ($)

Dividend (per

Share)

2 2.12 2.25 2.38

Growth Rate (g in

%)

- 0.06 0.06 0.06

ii. Firm's Current Stock Price:

P0 = D1/ (r-g) = $2.12 / (0.16-0.06) = $2.12 / 0.10 = $21.2

iii. Firm's Expected value in one year:

Firm's Expected Value in one year (EV) = Dividend Expected in the next year

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EV =D2/ (r-g) = $2.25/ (0.16-0.06) = $2.25/0.10 = $22.5

iv. Expected Dividend Yield, Capital gains Yield and Total Return in Year 1:

Expected Dividend Yield = Dn/P(n-1) = $2.12/$21.20 = 0.1 or 10%

Expected Dividend Yield = (Pn-P(n-1))/ P(n-1) =(22.5-21.2)/21.2 =0.0613 or 6.13%

Total Return = Discount Rate = 16%

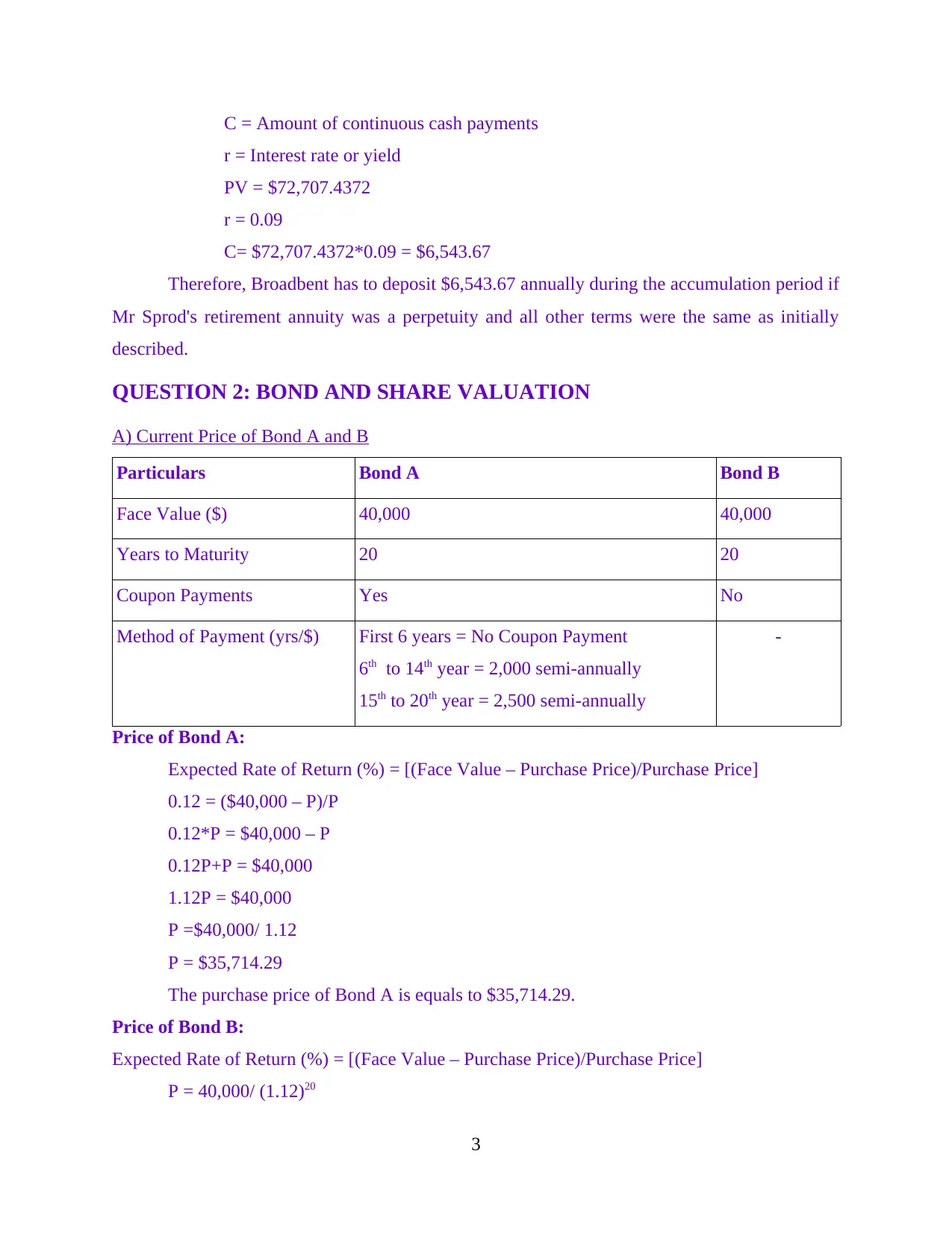

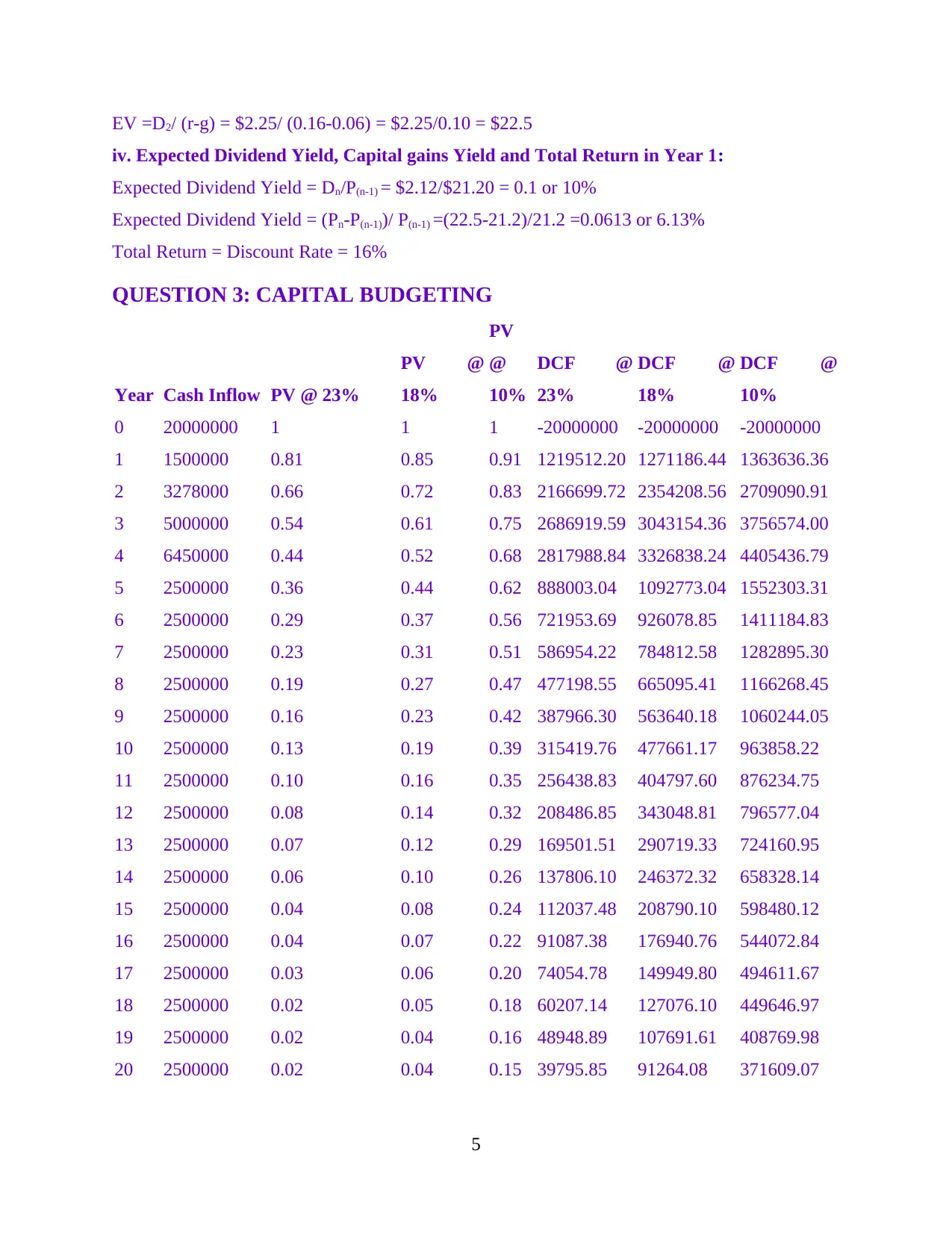

QUESTION 3: CAPITAL BUDGETING

Year Cash Inflow PV @ 23%

PV @

18%

PV

@

10%

DCF @

23%

DCF @

18%

DCF @

10%

0 20000000 1 1 1 -20000000 -20000000 -20000000

1 1500000 0.81 0.85 0.91 1219512.20 1271186.44 1363636.36

2 3278000 0.66 0.72 0.83 2166699.72 2354208.56 2709090.91

3 5000000 0.54 0.61 0.75 2686919.59 3043154.36 3756574.00

4 6450000 0.44 0.52 0.68 2817988.84 3326838.24 4405436.79

5 2500000 0.36 0.44 0.62 888003.04 1092773.04 1552303.31

6 2500000 0.29 0.37 0.56 721953.69 926078.85 1411184.83

7 2500000 0.23 0.31 0.51 586954.22 784812.58 1282895.30

8 2500000 0.19 0.27 0.47 477198.55 665095.41 1166268.45

9 2500000 0.16 0.23 0.42 387966.30 563640.18 1060244.05

10 2500000 0.13 0.19 0.39 315419.76 477661.17 963858.22

11 2500000 0.10 0.16 0.35 256438.83 404797.60 876234.75

12 2500000 0.08 0.14 0.32 208486.85 343048.81 796577.04

13 2500000 0.07 0.12 0.29 169501.51 290719.33 724160.95

14 2500000 0.06 0.10 0.26 137806.10 246372.32 658328.14

15 2500000 0.04 0.08 0.24 112037.48 208790.10 598480.12

16 2500000 0.04 0.07 0.22 91087.38 176940.76 544072.84

17 2500000 0.03 0.06 0.20 74054.78 149949.80 494611.67

18 2500000 0.02 0.05 0.18 60207.14 127076.10 449646.97

19 2500000 0.02 0.04 0.16 48948.89 107691.61 408769.98

20 2500000 0.02 0.04 0.15 39795.85 91264.08 371609.07

5

iv. Expected Dividend Yield, Capital gains Yield and Total Return in Year 1:

Expected Dividend Yield = Dn/P(n-1) = $2.12/$21.20 = 0.1 or 10%

Expected Dividend Yield = (Pn-P(n-1))/ P(n-1) =(22.5-21.2)/21.2 =0.0613 or 6.13%

Total Return = Discount Rate = 16%

QUESTION 3: CAPITAL BUDGETING

Year Cash Inflow PV @ 23%

PV @

18%

PV

@

10%

DCF @

23%

DCF @

18%

DCF @

10%

0 20000000 1 1 1 -20000000 -20000000 -20000000

1 1500000 0.81 0.85 0.91 1219512.20 1271186.44 1363636.36

2 3278000 0.66 0.72 0.83 2166699.72 2354208.56 2709090.91

3 5000000 0.54 0.61 0.75 2686919.59 3043154.36 3756574.00

4 6450000 0.44 0.52 0.68 2817988.84 3326838.24 4405436.79

5 2500000 0.36 0.44 0.62 888003.04 1092773.04 1552303.31

6 2500000 0.29 0.37 0.56 721953.69 926078.85 1411184.83

7 2500000 0.23 0.31 0.51 586954.22 784812.58 1282895.30

8 2500000 0.19 0.27 0.47 477198.55 665095.41 1166268.45

9 2500000 0.16 0.23 0.42 387966.30 563640.18 1060244.05

10 2500000 0.13 0.19 0.39 315419.76 477661.17 963858.22

11 2500000 0.10 0.16 0.35 256438.83 404797.60 876234.75

12 2500000 0.08 0.14 0.32 208486.85 343048.81 796577.04

13 2500000 0.07 0.12 0.29 169501.51 290719.33 724160.95

14 2500000 0.06 0.10 0.26 137806.10 246372.32 658328.14

15 2500000 0.04 0.08 0.24 112037.48 208790.10 598480.12

16 2500000 0.04 0.07 0.22 91087.38 176940.76 544072.84

17 2500000 0.03 0.06 0.20 74054.78 149949.80 494611.67

18 2500000 0.02 0.05 0.18 60207.14 127076.10 449646.97

19 2500000 0.02 0.04 0.16 48948.89 107691.61 408769.98

20 2500000 0.02 0.04 0.15 39795.85 91264.08 371609.07

5

NPV -6533019.28 -3347900.66 5593983.75

IRR -7.08% -3.15% 3.90%

Comment: Since out of the three discounting rates, 10% is the only rate which provides a

positive IRR as well as NPV of $5,593,983.75, it must be taken by the financial managers of the

company.

QUESTION 4: RISK AND RETURN

a) Plotting CAL derived from Risk-Free Asset and Portfolio A

Risky Portfolio A:

Name of Stock Number of

Shares

Share Price ($) Expected

Return (%)

Standard

Deviation (%)

Weight

(Probability)

DREXLA 1000 6 18% 22% 0.5

OGATO 4000 4 14% 20% 0.5

Return of Portfolio A: [0.5*0.18 + 0.5*0.14] = [0.09+0.07] = 0.16 or 16%

Risk of Portfolio A: [0.5*0.22 + 0.5*0.20] = [0.11 + 0.10] = 0.21 or 21%

Risk Free Asset:

A Risk Free Asset is one which does not have a default risk. Such assets include treasury

stocks and government Bonds. In relation to risky Portfolio A such an asset's:

Covariance = Correlation = Risk or Standard Deviation = 0

Capital Allocation Line (CAL):

Capital Allocation Line is one which is the graphical representation of required return

and risk, usually measured in terms of Standard Deviation, of a risk-free asset and a risky

portfolio.

σport =(1-WRF)* σa ; where

σport = Standard Deviation (Risk) of the portfolio when risk free asset is combined with

risky asset

rf = Risk-Free Rate = 0.08

σa = Standard Deviation of Security a = 0.22

6

IRR -7.08% -3.15% 3.90%

Comment: Since out of the three discounting rates, 10% is the only rate which provides a

positive IRR as well as NPV of $5,593,983.75, it must be taken by the financial managers of the

company.

QUESTION 4: RISK AND RETURN

a) Plotting CAL derived from Risk-Free Asset and Portfolio A

Risky Portfolio A:

Name of Stock Number of

Shares

Share Price ($) Expected

Return (%)

Standard

Deviation (%)

Weight

(Probability)

DREXLA 1000 6 18% 22% 0.5

OGATO 4000 4 14% 20% 0.5

Return of Portfolio A: [0.5*0.18 + 0.5*0.14] = [0.09+0.07] = 0.16 or 16%

Risk of Portfolio A: [0.5*0.22 + 0.5*0.20] = [0.11 + 0.10] = 0.21 or 21%

Risk Free Asset:

A Risk Free Asset is one which does not have a default risk. Such assets include treasury

stocks and government Bonds. In relation to risky Portfolio A such an asset's:

Covariance = Correlation = Risk or Standard Deviation = 0

Capital Allocation Line (CAL):

Capital Allocation Line is one which is the graphical representation of required return

and risk, usually measured in terms of Standard Deviation, of a risk-free asset and a risky

portfolio.

σport =(1-WRF)* σa ; where

σport = Standard Deviation (Risk) of the portfolio when risk free asset is combined with

risky asset

rf = Risk-Free Rate = 0.08

σa = Standard Deviation of Security a = 0.22

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

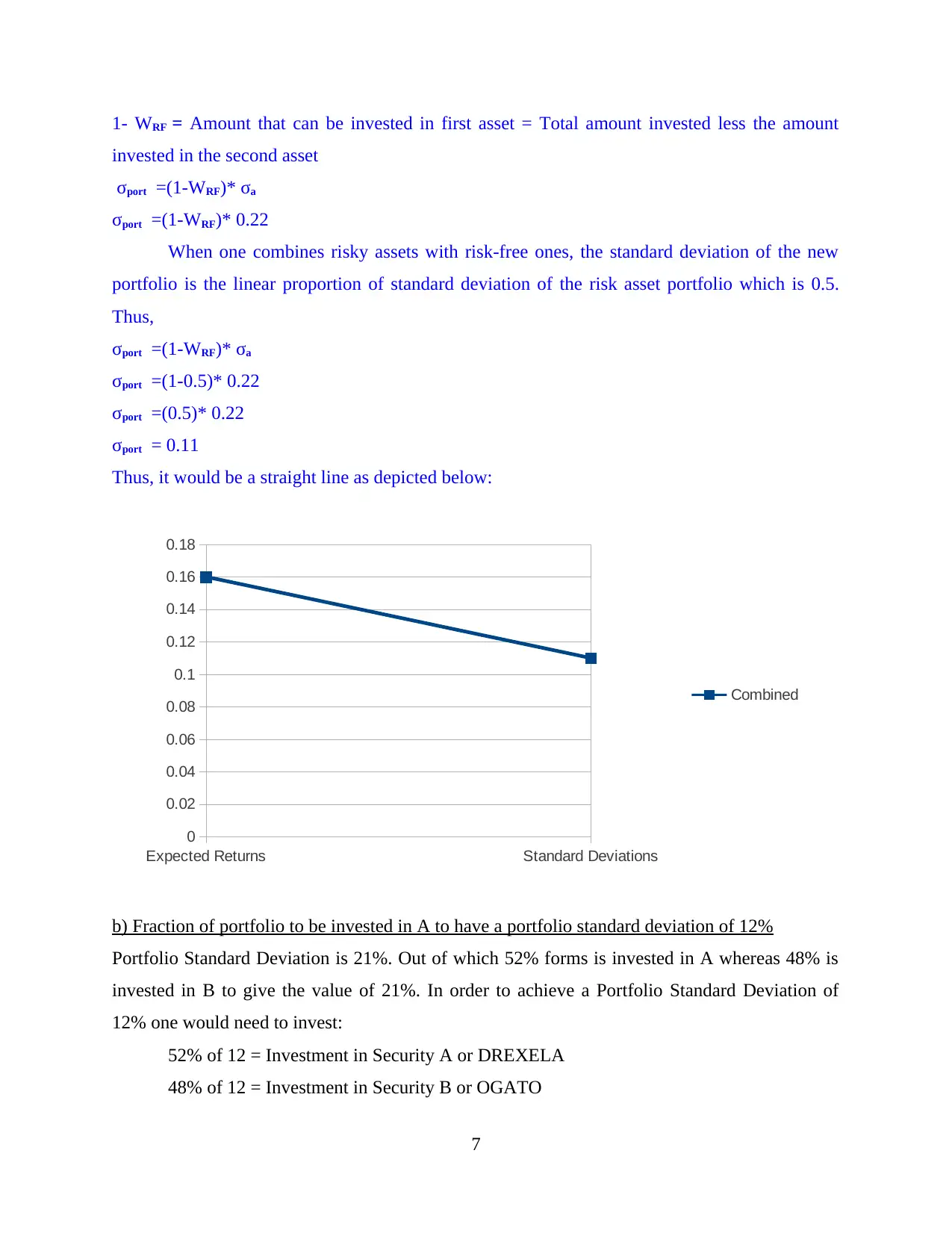

1- WRF = Amount that can be invested in first asset = Total amount invested less the amount

invested in the second asset

σport =(1-WRF)* σa

σport =(1-WRF)* 0.22

When one combines risky assets with risk-free ones, the standard deviation of the new

portfolio is the linear proportion of standard deviation of the risk asset portfolio which is 0.5.

Thus,

σport =(1-WRF)* σa

σport =(1-0.5)* 0.22

σport =(0.5)* 0.22

σport = 0.11

Thus, it would be a straight line as depicted below:

Expected Returns Standard Deviations

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.16

0.18

Combined

b) Fraction of portfolio to be invested in A to have a portfolio standard deviation of 12%

Portfolio Standard Deviation is 21%. Out of which 52% forms is invested in A whereas 48% is

invested in B to give the value of 21%. In order to achieve a Portfolio Standard Deviation of

12% one would need to invest:

52% of 12 = Investment in Security A or DREXELA

48% of 12 = Investment in Security B or OGATO

7

invested in the second asset

σport =(1-WRF)* σa

σport =(1-WRF)* 0.22

When one combines risky assets with risk-free ones, the standard deviation of the new

portfolio is the linear proportion of standard deviation of the risk asset portfolio which is 0.5.

Thus,

σport =(1-WRF)* σa

σport =(1-0.5)* 0.22

σport =(0.5)* 0.22

σport = 0.11

Thus, it would be a straight line as depicted below:

Expected Returns Standard Deviations

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.16

0.18

Combined

b) Fraction of portfolio to be invested in A to have a portfolio standard deviation of 12%

Portfolio Standard Deviation is 21%. Out of which 52% forms is invested in A whereas 48% is

invested in B to give the value of 21%. In order to achieve a Portfolio Standard Deviation of

12% one would need to invest:

52% of 12 = Investment in Security A or DREXELA

48% of 12 = Investment in Security B or OGATO

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Portfolio Standard Deviation = 0.0624 + 0.0576 = 12%

Hence, 0.0624 is the amount that needs to be invested in A to have a portfolio standard

deviation of 12%.

8

Hence, 0.0624 is the amount that needs to be invested in A to have a portfolio standard

deviation of 12%.

8

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.