Financial Management: Dividend Policy and Mergers & Acquisitions

VerifiedAdded on 2023/01/11

|17

|4395

|27

AI Summary

This document discusses the concepts of dividend policy and mergers & acquisitions in financial management. It explores the factors that influence the size of dividends and how investment opportunities can affect company decisions. The document also provides a critical discussion on the impact of a £70 million investment opportunity on company decisions.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL

MANAGEMENT

MANAGEMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

1. DIVIDEND POLICY..................................................................................................................4

1.1 The size of the annual dividend to return to its shareholders................................................4

1.2 Practical issues that need to be considered when deciding on the size of the dividend

payment........................................................................................................................................6

1.3 Effect of options on the wealth of shareholder......................................................................7

1.4 Critically discuss how company’s decision will be influenced by opportunity to invest

£70m in a project.........................................................................................................................9

2. MERGERS AND TAKEOVERS..............................................................................................11

2.1 Price / earnings ratio:...........................................................................................................11

2.2 Dividend valuation method..................................................................................................11

2.3 Discounted cash flow method..............................................................................................13

2.4 Problems associated with using the valuation techniques...................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

1. DIVIDEND POLICY..................................................................................................................4

1.1 The size of the annual dividend to return to its shareholders................................................4

1.2 Practical issues that need to be considered when deciding on the size of the dividend

payment........................................................................................................................................6

1.3 Effect of options on the wealth of shareholder......................................................................7

1.4 Critically discuss how company’s decision will be influenced by opportunity to invest

£70m in a project.........................................................................................................................9

2. MERGERS AND TAKEOVERS..............................................................................................11

2.1 Price / earnings ratio:...........................................................................................................11

2.2 Dividend valuation method..................................................................................................11

2.3 Discounted cash flow method..............................................................................................13

2.4 Problems associated with using the valuation techniques...................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

The company is a joint organization that starts its work by receiving capital from its members.

Members invest capital in the company because they continue to receive a reasonable income

from it. If the companies cannot even pay dividends to the investors as much as they can

normally get easily in the money market, then it will be impossible to arrange additional capital

for such companies, as well as the capital for new companies it will also become very difficult to

raise. Mergers and acquisitions, amalgamations, takeovers, spin-offs, leveraged buy-outs, buy-

and-sell shares, capital restructuring, sale of business units and assets, etc. are the most popular

means of corporate restructuring or business combination. Ownership refers to changes in

ownership, business mix, asset mix and alliances with the aim of increasing the value of

shareholders. This project report is based on these two concepts dividend policy and mergers and

acquisitions; for better understanding different scenarios have been studied to get impact analysis

of each strategy on shareholders.

Two companies; Squeezeco and Aztec covers both dividend policy and mergers & acquisition

concepts; where dividend strategy consists three alternatives and the best option chosen method

is discussed to support company. On the other hand; the takeover of Trojan will evaluate main

issues face by Aztec while concluding value of takeover through implementing various tools like

price earnings ratio, dividend valuation method and application of discounted cash flow

technique to support management decision making process.

The company is a joint organization that starts its work by receiving capital from its members.

Members invest capital in the company because they continue to receive a reasonable income

from it. If the companies cannot even pay dividends to the investors as much as they can

normally get easily in the money market, then it will be impossible to arrange additional capital

for such companies, as well as the capital for new companies it will also become very difficult to

raise. Mergers and acquisitions, amalgamations, takeovers, spin-offs, leveraged buy-outs, buy-

and-sell shares, capital restructuring, sale of business units and assets, etc. are the most popular

means of corporate restructuring or business combination. Ownership refers to changes in

ownership, business mix, asset mix and alliances with the aim of increasing the value of

shareholders. This project report is based on these two concepts dividend policy and mergers and

acquisitions; for better understanding different scenarios have been studied to get impact analysis

of each strategy on shareholders.

Two companies; Squeezeco and Aztec covers both dividend policy and mergers & acquisition

concepts; where dividend strategy consists three alternatives and the best option chosen method

is discussed to support company. On the other hand; the takeover of Trojan will evaluate main

issues face by Aztec while concluding value of takeover through implementing various tools like

price earnings ratio, dividend valuation method and application of discounted cash flow

technique to support management decision making process.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1. DIVIDEND POLICY

1.1 The size of the annual dividend to return to its shareholders

Dividend is the share of profit of a company which is declared and distributed as a

percentage of the par of the shares or a fixed amount per share, under the decision and

option of the Board of Directors of the company. Dividend is actually a fraction of the

surplus remaining after making proper provision for different types of funds and taxes etc.

after deducting all expenses in total income. The members of the company have the right

over this surplus, although they cannot insist on its immediate distribution. If the company

needs capital, then the company can retain all the part of the profit by not giving it as

dividend. In such a situation dividend is not announced and the entire profit is allowed to be

in the form of various funds or surplus. When deciding about the declaration of dividend, the

operators must take into account the following two things (Renneboog and Szilagyi, 2020).

(i) Fair consideration to the shareholders:

The operators should make an accurate estimate of the extent to which the shareholders

expect to get a return in exchange for capital and risk taking. If this is not done, it can be

difficult to keep the shareholders satisfied and this may also adversely affect the market

value of the company's shares and the goodwill of the company.

(ii) Company requirements:

Maintaining the financial position of the company is the first duty of the managers, even if

members are expected to make some sacrifices to do so. Also, it is very important that the

operator can evaluate properly how much additional capital is required by the company for

development and expansion?

Some of the factors to be considered while deciding annual dividend are discussed below:

Age of the Company: New companies are often not in a position to pay fair dividends to

their members for a few years. In the initial years, they may require sufficient capital for

development, which they are not in a position to easily obtain from the market. Hence, they

1.1 The size of the annual dividend to return to its shareholders

Dividend is the share of profit of a company which is declared and distributed as a

percentage of the par of the shares or a fixed amount per share, under the decision and

option of the Board of Directors of the company. Dividend is actually a fraction of the

surplus remaining after making proper provision for different types of funds and taxes etc.

after deducting all expenses in total income. The members of the company have the right

over this surplus, although they cannot insist on its immediate distribution. If the company

needs capital, then the company can retain all the part of the profit by not giving it as

dividend. In such a situation dividend is not announced and the entire profit is allowed to be

in the form of various funds or surplus. When deciding about the declaration of dividend, the

operators must take into account the following two things (Renneboog and Szilagyi, 2020).

(i) Fair consideration to the shareholders:

The operators should make an accurate estimate of the extent to which the shareholders

expect to get a return in exchange for capital and risk taking. If this is not done, it can be

difficult to keep the shareholders satisfied and this may also adversely affect the market

value of the company's shares and the goodwill of the company.

(ii) Company requirements:

Maintaining the financial position of the company is the first duty of the managers, even if

members are expected to make some sacrifices to do so. Also, it is very important that the

operator can evaluate properly how much additional capital is required by the company for

development and expansion?

Some of the factors to be considered while deciding annual dividend are discussed below:

Age of the Company: New companies are often not in a position to pay fair dividends to

their members for a few years. In the initial years, they may require sufficient capital for

development, which they are not in a position to easily obtain from the market. Hence, they

have to resort to their own internal financial means. Conversely, older companies may

require relatively less capital, and even if it does, they get it from the market. In such a

situation a liberal dividend policy can be adopted (He, Zaiats and Zhang, 2017).

Nature of Business: Regular dividends can be paid only by Squeezeco whose income is also

regular. Companies in this category include companies that produce the requirements of

daily use. Only companies engaged in public utilities can pay dividends regularly to its

members. Companies which deal with luxury items production are not able to pay regular

dividends.

Current financial position of the company: Even if the Squeezeco is in a position to earn

sufficient profits and pay dividends, it is possible that the cash position of the company may

not be such that it can pay cash dividends. Despite profit and surplus, the liquid position of

the company may deteriorate. In this case the company can pay dividends in the form of

bonus shares.

Need for capital in future: The dividend policy also depends on the future plans of the

Squeezeco. If there is a definite plan for development before the company, then such a

company will follow a strict policy regarding dividends, so that additional capital can be

adequately managed by internal means. In such a situation, more importance will be given to

re-appropriation of benefits.

Ownership Structure: The ownership of the Squeezeco is in the hands of a few individuals,

so they can agree to follow a strict dividend-policy in the interests of the company and all of

them for some years. But if the shareholders of the company are very large and they are

divided then in such case they can insist for a liberal dividend-policy.

General Economic Conditions: Along with business cycles, there is a slight change in

dividend-policy. There is a decrease in the amount of profit in the goods of the temple.

Companies are forced to reduce dividend rates. Some companies, which hold substantial

amounts of Dividend Equalization Reserves, easily overcome such difficult times and do not

let their credibility fall by maintaining a reasonable rate of dividend.

require relatively less capital, and even if it does, they get it from the market. In such a

situation a liberal dividend policy can be adopted (He, Zaiats and Zhang, 2017).

Nature of Business: Regular dividends can be paid only by Squeezeco whose income is also

regular. Companies in this category include companies that produce the requirements of

daily use. Only companies engaged in public utilities can pay dividends regularly to its

members. Companies which deal with luxury items production are not able to pay regular

dividends.

Current financial position of the company: Even if the Squeezeco is in a position to earn

sufficient profits and pay dividends, it is possible that the cash position of the company may

not be such that it can pay cash dividends. Despite profit and surplus, the liquid position of

the company may deteriorate. In this case the company can pay dividends in the form of

bonus shares.

Need for capital in future: The dividend policy also depends on the future plans of the

Squeezeco. If there is a definite plan for development before the company, then such a

company will follow a strict policy regarding dividends, so that additional capital can be

adequately managed by internal means. In such a situation, more importance will be given to

re-appropriation of benefits.

Ownership Structure: The ownership of the Squeezeco is in the hands of a few individuals,

so they can agree to follow a strict dividend-policy in the interests of the company and all of

them for some years. But if the shareholders of the company are very large and they are

divided then in such case they can insist for a liberal dividend-policy.

General Economic Conditions: Along with business cycles, there is a slight change in

dividend-policy. There is a decrease in the amount of profit in the goods of the temple.

Companies are forced to reduce dividend rates. Some companies, which hold substantial

amounts of Dividend Equalization Reserves, easily overcome such difficult times and do not

let their credibility fall by maintaining a reasonable rate of dividend.

Changes in state policies: The economic, industrial and labor policies of the government

can have an adverse effect on the company's income. This reduces the profit of the

Squeezeco. Tariff policy can also affect this (Straehl and Ibbotson, 2018).

Tax Policy: The dividend-policy adopted by Squeezeco is closely related to the government-

tax policy. An increase in taxes reduces the amount of profit available for distribution and

the company cannot pay attractive dividends. The tax policy of the government can affect

the dividend policy of corporations in many ways. In fact, by making necessary changes in

government tax policy according to the economic conditions of the country, the government

can create a new twist in the dividend policy of companies.

Public Opinion: Public opinion also has an impact on the dividend-policy of Squeezeco.

Companies that pay very high dividends are criticized in all areas. Consumers start

demanding a decrease in the prices of goods and an increase in their wages. Even the

employees and officers of the company also demand more bonuses from that benefit.

1.2 Practical issues that need to be considered when deciding on the size of

the dividend payment

It isn't only the elements that impact the choice of ranking directors to come back to

investors for the size of the profit. Business issues are looked by the business while

executing profit strategy. A portion of these commonsense issues are talked about beneath:

Investors' Choice: The primary issue is the decision or selection of investors; As all

investors have various tastes and feelings. Some of the time investors don't care for profits,

rather they need the organization to contribute these earned salary on procurement of new

tasks or development of existing business. As this progression will improve the offer cost

just as increment the market cost of the offer value, which will profit the investors at the

hour of selling the offers (Khan, 2020).

Various alternatives: Business proprietors can deliver profits in two structures; Cash profit

and profit split. The principle issue by the organization is to choose which alternative ought

to be picked to fulfill investors by satisfying its choices between profit and money profit.

can have an adverse effect on the company's income. This reduces the profit of the

Squeezeco. Tariff policy can also affect this (Straehl and Ibbotson, 2018).

Tax Policy: The dividend-policy adopted by Squeezeco is closely related to the government-

tax policy. An increase in taxes reduces the amount of profit available for distribution and

the company cannot pay attractive dividends. The tax policy of the government can affect

the dividend policy of corporations in many ways. In fact, by making necessary changes in

government tax policy according to the economic conditions of the country, the government

can create a new twist in the dividend policy of companies.

Public Opinion: Public opinion also has an impact on the dividend-policy of Squeezeco.

Companies that pay very high dividends are criticized in all areas. Consumers start

demanding a decrease in the prices of goods and an increase in their wages. Even the

employees and officers of the company also demand more bonuses from that benefit.

1.2 Practical issues that need to be considered when deciding on the size of

the dividend payment

It isn't only the elements that impact the choice of ranking directors to come back to

investors for the size of the profit. Business issues are looked by the business while

executing profit strategy. A portion of these commonsense issues are talked about beneath:

Investors' Choice: The primary issue is the decision or selection of investors; As all

investors have various tastes and feelings. Some of the time investors don't care for profits,

rather they need the organization to contribute these earned salary on procurement of new

tasks or development of existing business. As this progression will improve the offer cost

just as increment the market cost of the offer value, which will profit the investors at the

hour of selling the offers (Khan, 2020).

Various alternatives: Business proprietors can deliver profits in two structures; Cash profit

and profit split. The principle issue by the organization is to choose which alternative ought

to be picked to fulfill investors by satisfying its choices between profit and money profit.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Investors desire; It is hard for an organization to assess investors' desires for profit esteem;

Paying more than anticipated will be suspected of by investors as the organization isn't

concentrating on development and will expect the offer cost to diminish later on.

Proprietors of profits: After welcoming the organization's offers on the open market, it

fundamentally experienced a few investors; The issue development is recognizing who is the

genuine proprietor of the offers and who needs to deliver profits. Firms are in this way

considered to have a recorded date to determine the issue; Shareholders must enroll

themselves as the genuine proprietors on the specific date given by the offer giving firm

(Setiawan, and et.al., 2016).

Guidelines Act: The administrative authority conformed to a lot of rules to the organization,

after which the organization would need to pay come what may, for example, the firm would

need to keep up a fixed proportion of save to profit installments. For instance, if the

organization delivered a 15% profit, it ought to be held in any event 7.5% for saves.

1.3 Effect of options on the wealth of shareholder

I. A cash dividend payment of 15p per share:

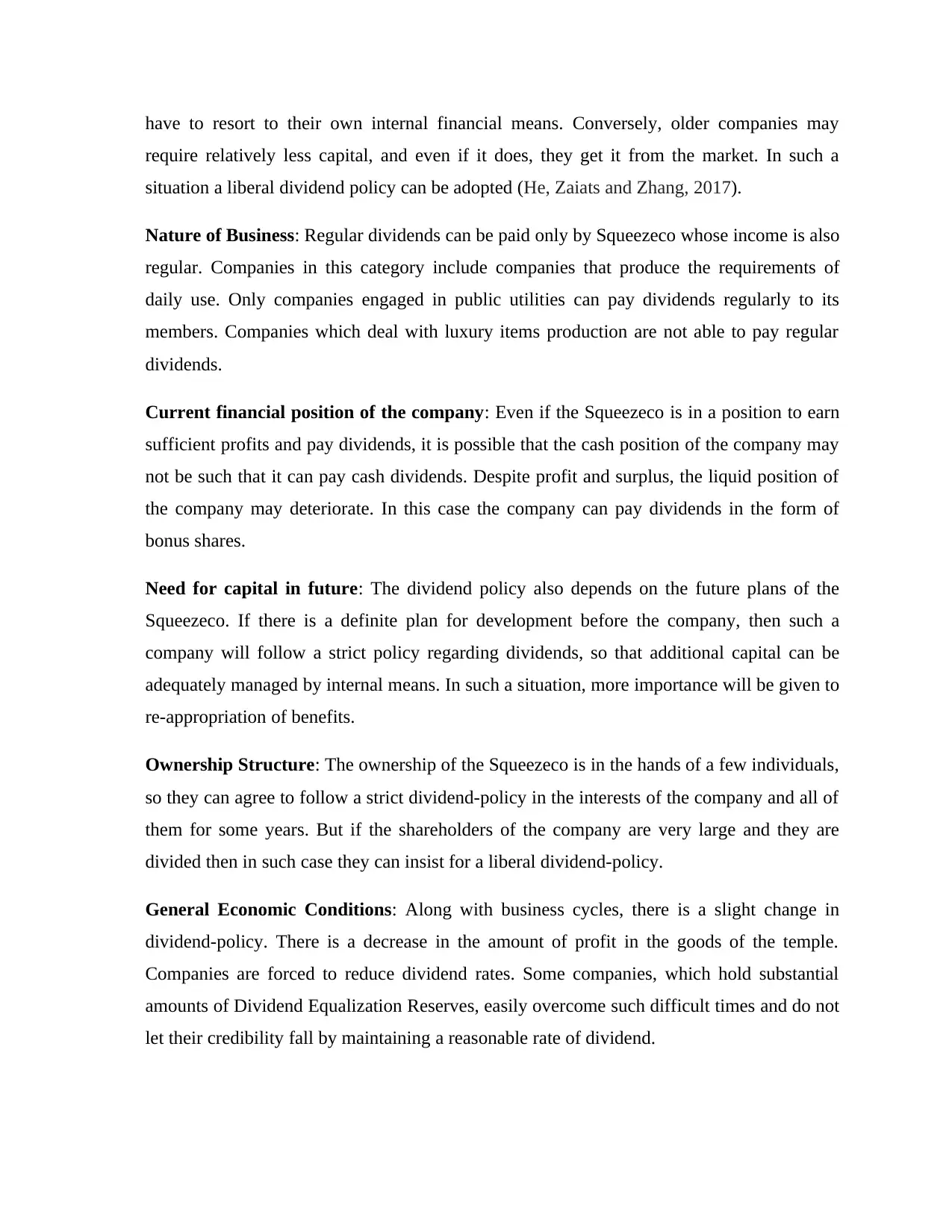

i. Cash Dividend:

A Total shares outstanding 1,250

B Dividend price per share 15p

Total cash dividend(A × B) £187.5

Cash Dividend: Cash dividend means dividend that is paid to shareholders in cash / bank.

When a company does not have cash to pay dividends, it pays dividends in the form of

equity or we can say that additional shares of the company are allocated to the shareholder.

The term is called stock dividend (Buchanan, and et.al., 2017).

Interpretation: The total shares outstanding are 1250 which are obligated to get profits; the

money prize here is the choice taken to deliver profits. That is the reason; the all out money

profit at 15p per investor is £ 187.5.

Paying more than anticipated will be suspected of by investors as the organization isn't

concentrating on development and will expect the offer cost to diminish later on.

Proprietors of profits: After welcoming the organization's offers on the open market, it

fundamentally experienced a few investors; The issue development is recognizing who is the

genuine proprietor of the offers and who needs to deliver profits. Firms are in this way

considered to have a recorded date to determine the issue; Shareholders must enroll

themselves as the genuine proprietors on the specific date given by the offer giving firm

(Setiawan, and et.al., 2016).

Guidelines Act: The administrative authority conformed to a lot of rules to the organization,

after which the organization would need to pay come what may, for example, the firm would

need to keep up a fixed proportion of save to profit installments. For instance, if the

organization delivered a 15% profit, it ought to be held in any event 7.5% for saves.

1.3 Effect of options on the wealth of shareholder

I. A cash dividend payment of 15p per share:

i. Cash Dividend:

A Total shares outstanding 1,250

B Dividend price per share 15p

Total cash dividend(A × B) £187.5

Cash Dividend: Cash dividend means dividend that is paid to shareholders in cash / bank.

When a company does not have cash to pay dividends, it pays dividends in the form of

equity or we can say that additional shares of the company are allocated to the shareholder.

The term is called stock dividend (Buchanan, and et.al., 2017).

Interpretation: The total shares outstanding are 1250 which are obligated to get profits; the

money prize here is the choice taken to deliver profits. That is the reason; the all out money

profit at 15p per investor is £ 187.5.

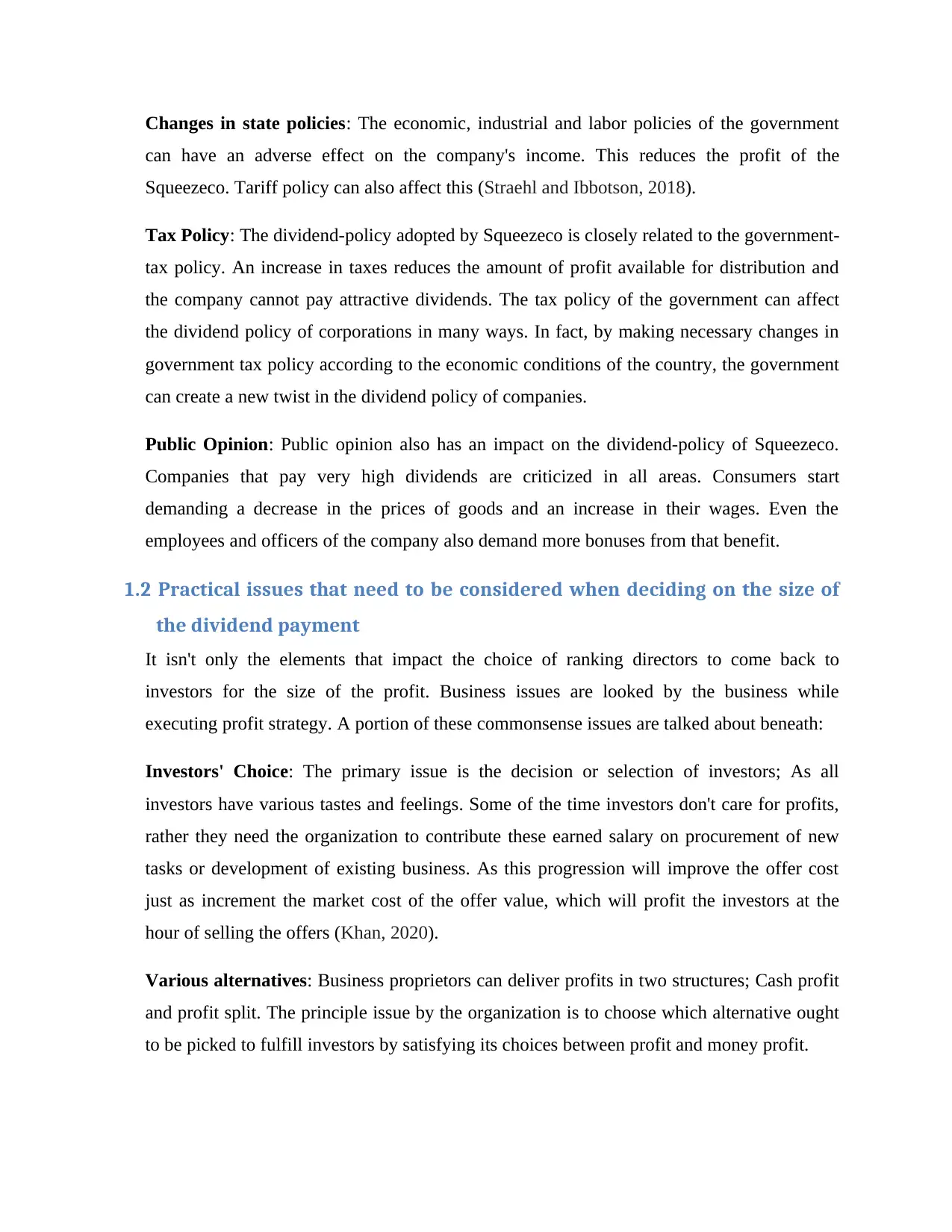

II. 5% scrip dividend:

Scrip Dividend: Instead of paying cash dividends to shareholders, the company grants

new shares to existing shareholders at a previously determined price. This allows

shareholders to join the program to acquire new shares without the transaction costs that

typically occur when they purchased these shares in the market. Cash reserves are the

primary reason for issuing scrip dividends to the company. Debatable (it looks like a clean

study, even though I've only skimmed it), whether script dividends are actually a beneficial

strategy for a company (Moortgat, Annaert and Deloof, 2017).

ii

. 5% Scrip Dividend

A Total shares outstanding 1250

B Scrip divided (A × 5%) 62.5

C Share price 432p

Total dividend worth (B ×

C) £270

Interpretation: Here, the total outstanding shares are 1250; a proportion of 5% is taken

from all out offers as all out profit which is 62.5. The cost per share is given at 432p per

share; Therefore the profit holder's complete profit by obtaining new offers is £ 270.

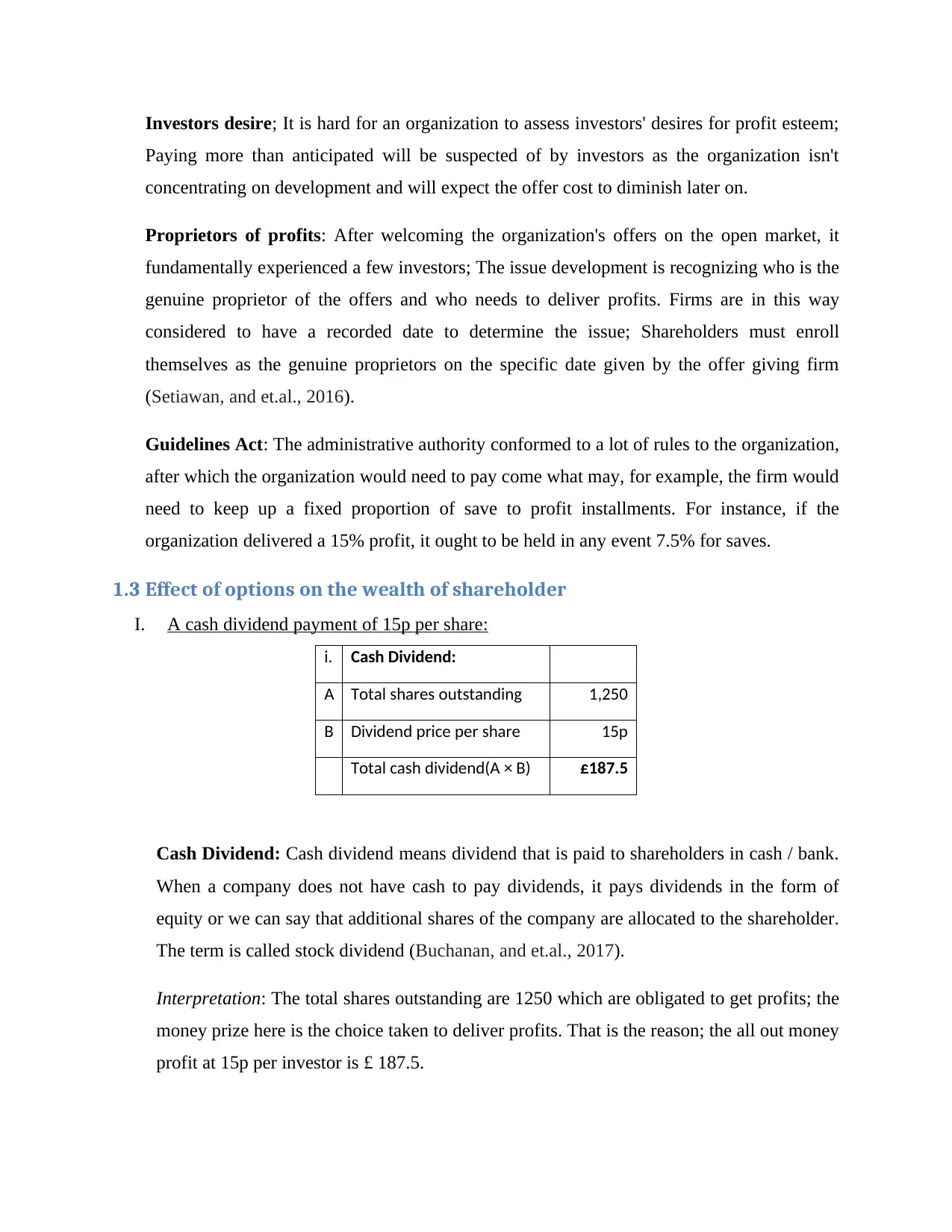

III. Repurchase of 15% of ordinary share capital at the current market price:

If the size of the share repurchases increases by more than 10 percent, then a special

proposal will have to be approved by the shareholders for it. Another condition of

permission for companies to buy back shares is that the ratio of the total debt, both

secured and unsecured, over the company should not be more than double the paid-up

capital and free reserves of the company after the share purchase. This can only be

increased if a higher average for debt-equity ratio is mentioned in the company law.

Scrip Dividend: Instead of paying cash dividends to shareholders, the company grants

new shares to existing shareholders at a previously determined price. This allows

shareholders to join the program to acquire new shares without the transaction costs that

typically occur when they purchased these shares in the market. Cash reserves are the

primary reason for issuing scrip dividends to the company. Debatable (it looks like a clean

study, even though I've only skimmed it), whether script dividends are actually a beneficial

strategy for a company (Moortgat, Annaert and Deloof, 2017).

ii

. 5% Scrip Dividend

A Total shares outstanding 1250

B Scrip divided (A × 5%) 62.5

C Share price 432p

Total dividend worth (B ×

C) £270

Interpretation: Here, the total outstanding shares are 1250; a proportion of 5% is taken

from all out offers as all out profit which is 62.5. The cost per share is given at 432p per

share; Therefore the profit holder's complete profit by obtaining new offers is £ 270.

III. Repurchase of 15% of ordinary share capital at the current market price:

If the size of the share repurchases increases by more than 10 percent, then a special

proposal will have to be approved by the shareholders for it. Another condition of

permission for companies to buy back shares is that the ratio of the total debt, both

secured and unsecured, over the company should not be more than double the paid-up

capital and free reserves of the company after the share purchase. This can only be

increased if a higher average for debt-equity ratio is mentioned in the company law.

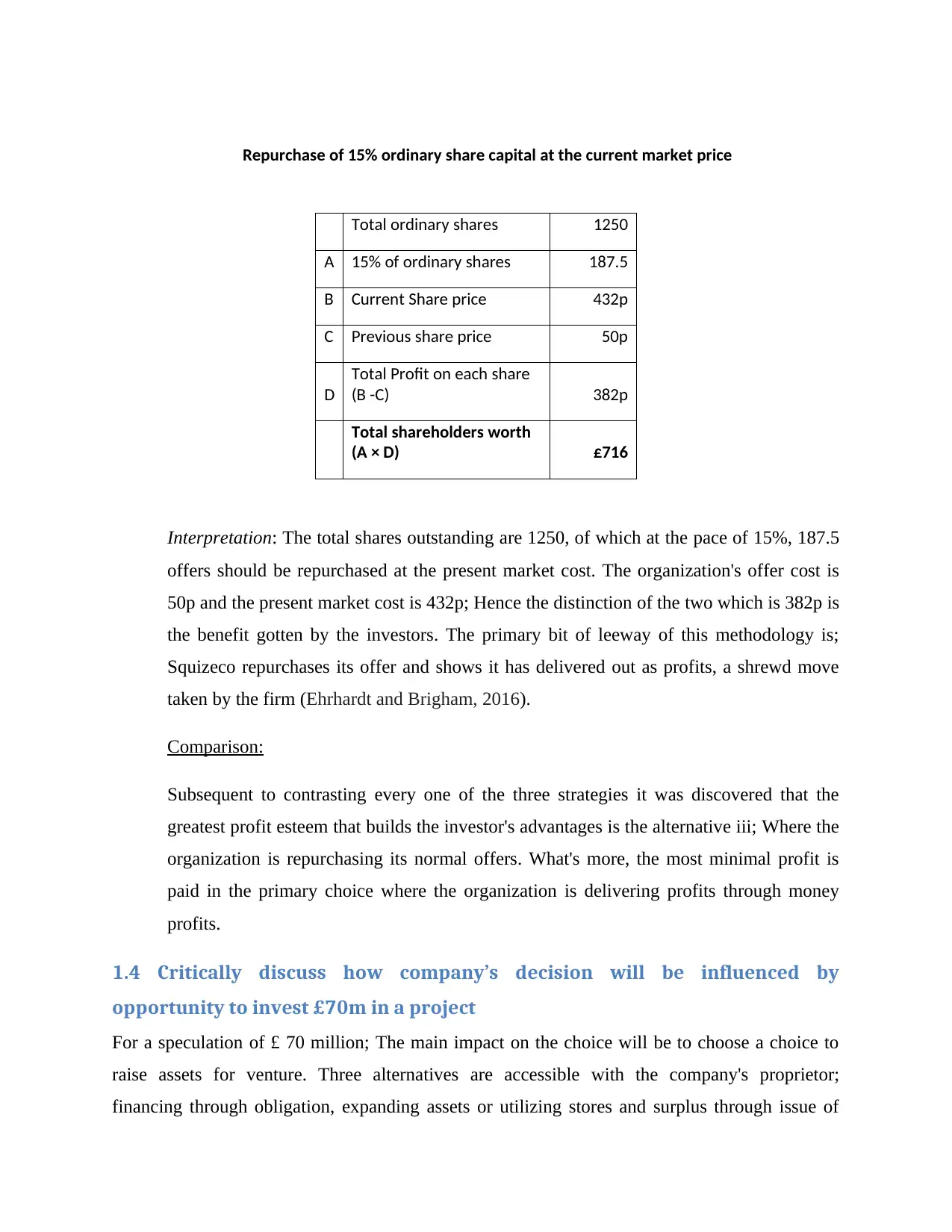

Repurchase of 15% ordinary share capital at the current market price

Total ordinary shares 1250

A 15% of ordinary shares 187.5

B Current Share price 432p

C Previous share price 50p

D

Total Profit on each share

(B -C) 382p

Total shareholders worth

(A × D) £716

Interpretation: The total shares outstanding are 1250, of which at the pace of 15%, 187.5

offers should be repurchased at the present market cost. The organization's offer cost is

50p and the present market cost is 432p; Hence the distinction of the two which is 382p is

the benefit gotten by the investors. The primary bit of leeway of this methodology is;

Squizeco repurchases its offer and shows it has delivered out as profits, a shrewd move

taken by the firm (Ehrhardt and Brigham, 2016).

Comparison:

Subsequent to contrasting every one of the three strategies it was discovered that the

greatest profit esteem that builds the investor's advantages is the alternative iii; Where the

organization is repurchasing its normal offers. What's more, the most minimal profit is

paid in the primary choice where the organization is delivering profits through money

profits.

1.4 Critically discuss how company’s decision will be influenced by

opportunity to invest £70m in a project

For a speculation of £ 70 million; The main impact on the choice will be to choose a choice to

raise assets for venture. Three alternatives are accessible with the company's proprietor;

financing through obligation, expanding assets or utilizing stores and surplus through issue of

Total ordinary shares 1250

A 15% of ordinary shares 187.5

B Current Share price 432p

C Previous share price 50p

D

Total Profit on each share

(B -C) 382p

Total shareholders worth

(A × D) £716

Interpretation: The total shares outstanding are 1250, of which at the pace of 15%, 187.5

offers should be repurchased at the present market cost. The organization's offer cost is

50p and the present market cost is 432p; Hence the distinction of the two which is 382p is

the benefit gotten by the investors. The primary bit of leeway of this methodology is;

Squizeco repurchases its offer and shows it has delivered out as profits, a shrewd move

taken by the firm (Ehrhardt and Brigham, 2016).

Comparison:

Subsequent to contrasting every one of the three strategies it was discovered that the

greatest profit esteem that builds the investor's advantages is the alternative iii; Where the

organization is repurchasing its normal offers. What's more, the most minimal profit is

paid in the primary choice where the organization is delivering profits through money

profits.

1.4 Critically discuss how company’s decision will be influenced by

opportunity to invest £70m in a project

For a speculation of £ 70 million; The main impact on the choice will be to choose a choice to

raise assets for venture. Three alternatives are accessible with the company's proprietor;

financing through obligation, expanding assets or utilizing stores and surplus through issue of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

value shares. These three choices have their points of interest and disservices. As well as can be

expected utilize a blend of every one of these techniques. For instance; The firm can break the

store necessity into three proportions, for example, 30% through obligation, 60% through

issuance of value shares and the staying 10% through stores. If there should arise an occurrence

of issue of offers, the organization has three alternatives:

Right issue of shares to existing equity holders.

Issuing preference shares having fixed rate of dividend payment and;

Issuing ordinary shares at reduced market price (Shapiro and Hanouna, 2019).

expected utilize a blend of every one of these techniques. For instance; The firm can break the

store necessity into three proportions, for example, 30% through obligation, 60% through

issuance of value shares and the staying 10% through stores. If there should arise an occurrence

of issue of offers, the organization has three alternatives:

Right issue of shares to existing equity holders.

Issuing preference shares having fixed rate of dividend payment and;

Issuing ordinary shares at reduced market price (Shapiro and Hanouna, 2019).

2. MERGERS AND TAKEOVERS

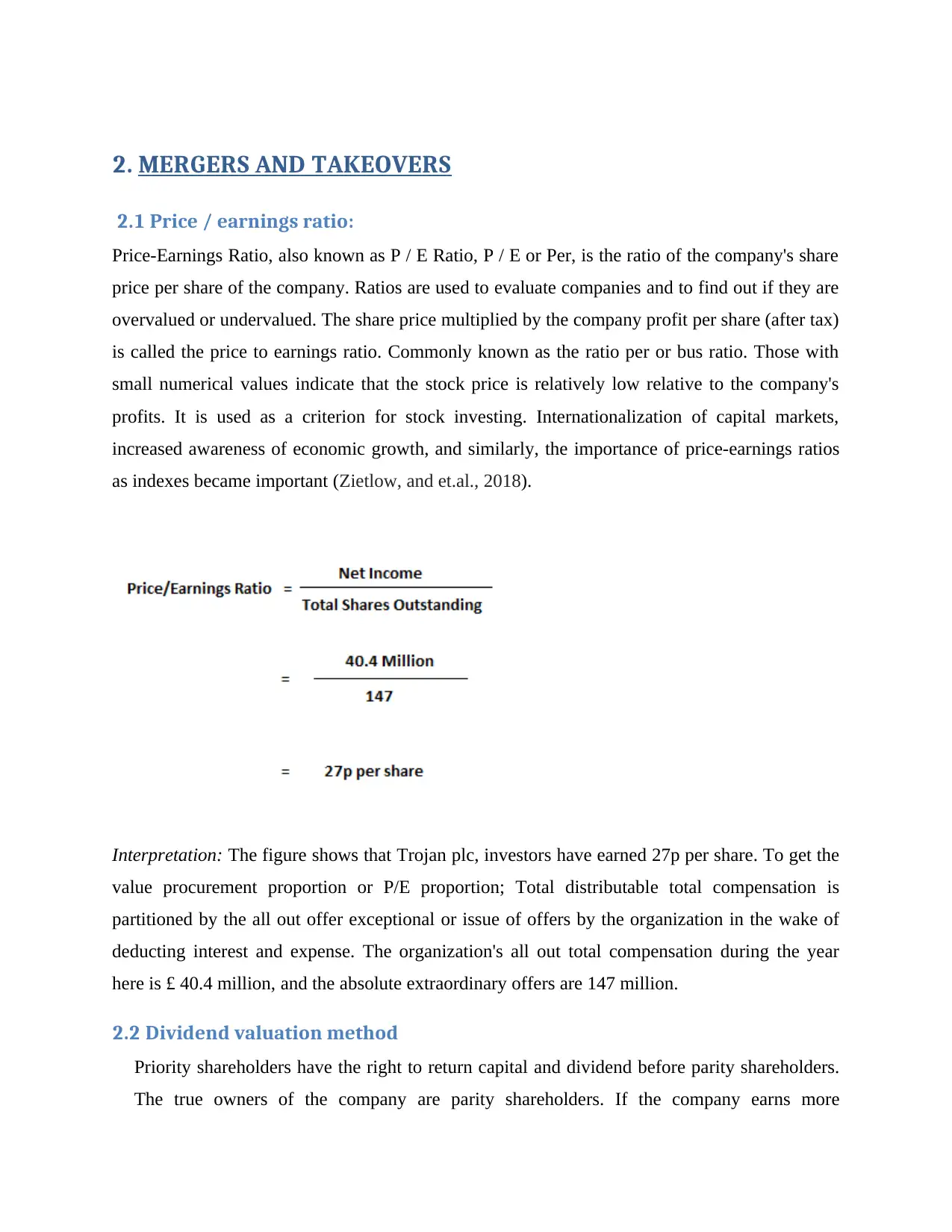

2.1 Price / earnings ratio:

Price-Earnings Ratio, also known as P / E Ratio, P / E or Per, is the ratio of the company's share

price per share of the company. Ratios are used to evaluate companies and to find out if they are

overvalued or undervalued. The share price multiplied by the company profit per share (after tax)

is called the price to earnings ratio. Commonly known as the ratio per or bus ratio. Those with

small numerical values indicate that the stock price is relatively low relative to the company's

profits. It is used as a criterion for stock investing. Internationalization of capital markets,

increased awareness of economic growth, and similarly, the importance of price-earnings ratios

as indexes became important (Zietlow, and et.al., 2018).

Interpretation: The figure shows that Trojan plc, investors have earned 27p per share. To get the

value procurement proportion or P/E proportion; Total distributable total compensation is

partitioned by the all out offer exceptional or issue of offers by the organization in the wake of

deducting interest and expense. The organization's all out total compensation during the year

here is £ 40.4 million, and the absolute extraordinary offers are 147 million.

2.2 Dividend valuation method

Priority shareholders have the right to return capital and dividend before parity shareholders.

The true owners of the company are parity shareholders. If the company earns more

2.1 Price / earnings ratio:

Price-Earnings Ratio, also known as P / E Ratio, P / E or Per, is the ratio of the company's share

price per share of the company. Ratios are used to evaluate companies and to find out if they are

overvalued or undervalued. The share price multiplied by the company profit per share (after tax)

is called the price to earnings ratio. Commonly known as the ratio per or bus ratio. Those with

small numerical values indicate that the stock price is relatively low relative to the company's

profits. It is used as a criterion for stock investing. Internationalization of capital markets,

increased awareness of economic growth, and similarly, the importance of price-earnings ratios

as indexes became important (Zietlow, and et.al., 2018).

Interpretation: The figure shows that Trojan plc, investors have earned 27p per share. To get the

value procurement proportion or P/E proportion; Total distributable total compensation is

partitioned by the all out offer exceptional or issue of offers by the organization in the wake of

deducting interest and expense. The organization's all out total compensation during the year

here is £ 40.4 million, and the absolute extraordinary offers are 147 million.

2.2 Dividend valuation method

Priority shareholders have the right to return capital and dividend before parity shareholders.

The true owners of the company are parity shareholders. If the company earns more

dividends, then they get more dividends and the dividends do not get when the profit is not

earned, that is, the rate of dividend on the foregoing shares remains constant while the rate of

dividend on equity shares keeps changing.

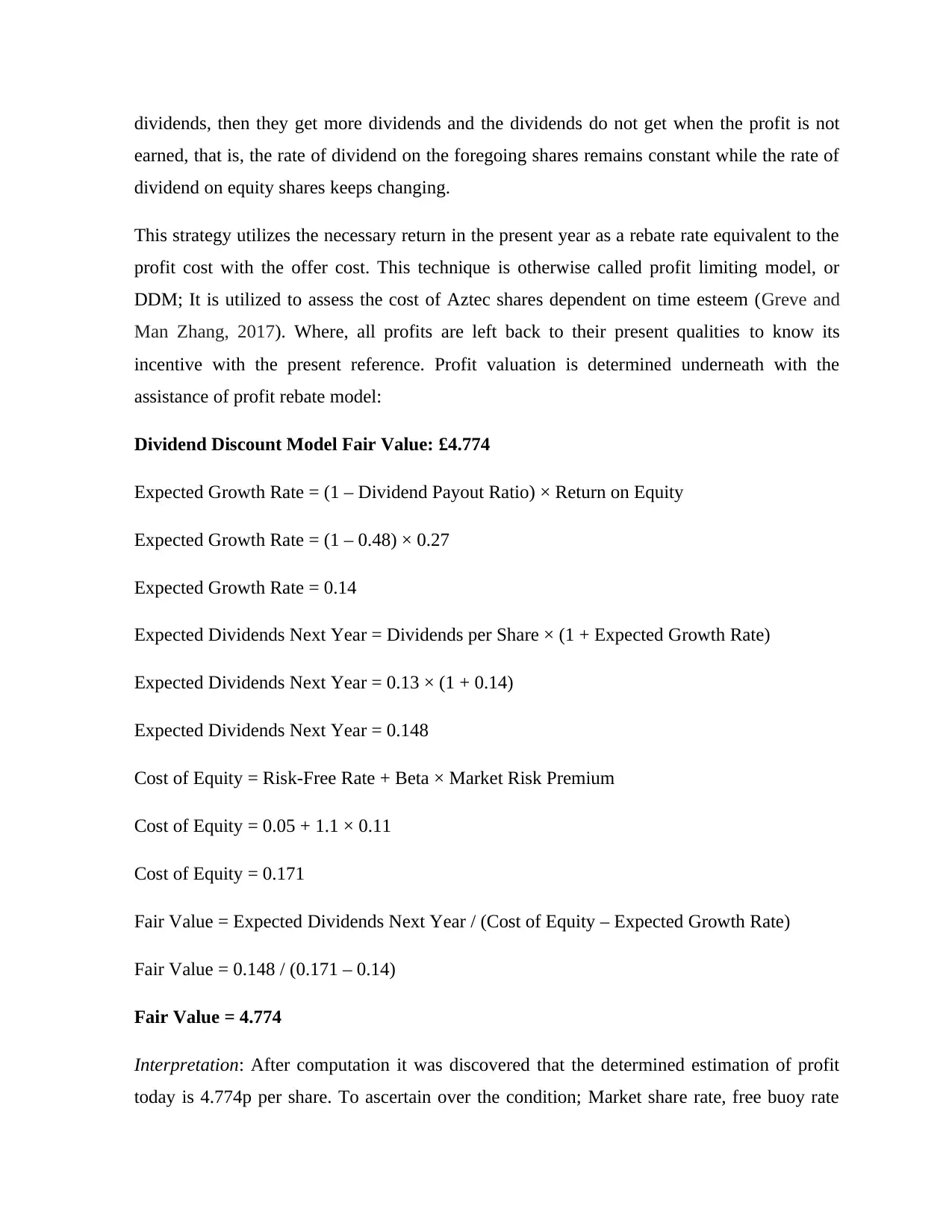

This strategy utilizes the necessary return in the present year as a rebate rate equivalent to the

profit cost with the offer cost. This technique is otherwise called profit limiting model, or

DDM; It is utilized to assess the cost of Aztec shares dependent on time esteem (Greve and

Man Zhang, 2017). Where, all profits are left back to their present qualities to know its

incentive with the present reference. Profit valuation is determined underneath with the

assistance of profit rebate model:

Dividend Discount Model Fair Value: £4.774

Expected Growth Rate = (1 – Dividend Payout Ratio) × Return on Equity

Expected Growth Rate = (1 – 0.48) × 0.27

Expected Growth Rate = 0.14

Expected Dividends Next Year = Dividends per Share × (1 + Expected Growth Rate)

Expected Dividends Next Year = 0.13 × (1 + 0.14)

Expected Dividends Next Year = 0.148

Cost of Equity = Risk-Free Rate + Beta × Market Risk Premium

Cost of Equity = 0.05 + 1.1 × 0.11

Cost of Equity = 0.171

Fair Value = Expected Dividends Next Year / (Cost of Equity – Expected Growth Rate)

Fair Value = 0.148 / (0.171 – 0.14)

Fair Value = 4.774

Interpretation: After computation it was discovered that the determined estimation of profit

today is 4.774p per share. To ascertain over the condition; Market share rate, free buoy rate

earned, that is, the rate of dividend on the foregoing shares remains constant while the rate of

dividend on equity shares keeps changing.

This strategy utilizes the necessary return in the present year as a rebate rate equivalent to the

profit cost with the offer cost. This technique is otherwise called profit limiting model, or

DDM; It is utilized to assess the cost of Aztec shares dependent on time esteem (Greve and

Man Zhang, 2017). Where, all profits are left back to their present qualities to know its

incentive with the present reference. Profit valuation is determined underneath with the

assistance of profit rebate model:

Dividend Discount Model Fair Value: £4.774

Expected Growth Rate = (1 – Dividend Payout Ratio) × Return on Equity

Expected Growth Rate = (1 – 0.48) × 0.27

Expected Growth Rate = 0.14

Expected Dividends Next Year = Dividends per Share × (1 + Expected Growth Rate)

Expected Dividends Next Year = 0.13 × (1 + 0.14)

Expected Dividends Next Year = 0.148

Cost of Equity = Risk-Free Rate + Beta × Market Risk Premium

Cost of Equity = 0.05 + 1.1 × 0.11

Cost of Equity = 0.171

Fair Value = Expected Dividends Next Year / (Cost of Equity – Expected Growth Rate)

Fair Value = 0.148 / (0.171 – 0.14)

Fair Value = 4.774

Interpretation: After computation it was discovered that the determined estimation of profit

today is 4.774p per share. To ascertain over the condition; Market share rate, free buoy rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and value beta assume significant jobs; Market rate is otherwise called premium or hazard rate

since this extra premium is taken to face challenge through speculation. While free buoy rates

are not liable to hazard as there will be no chance of losing the venture esteem.

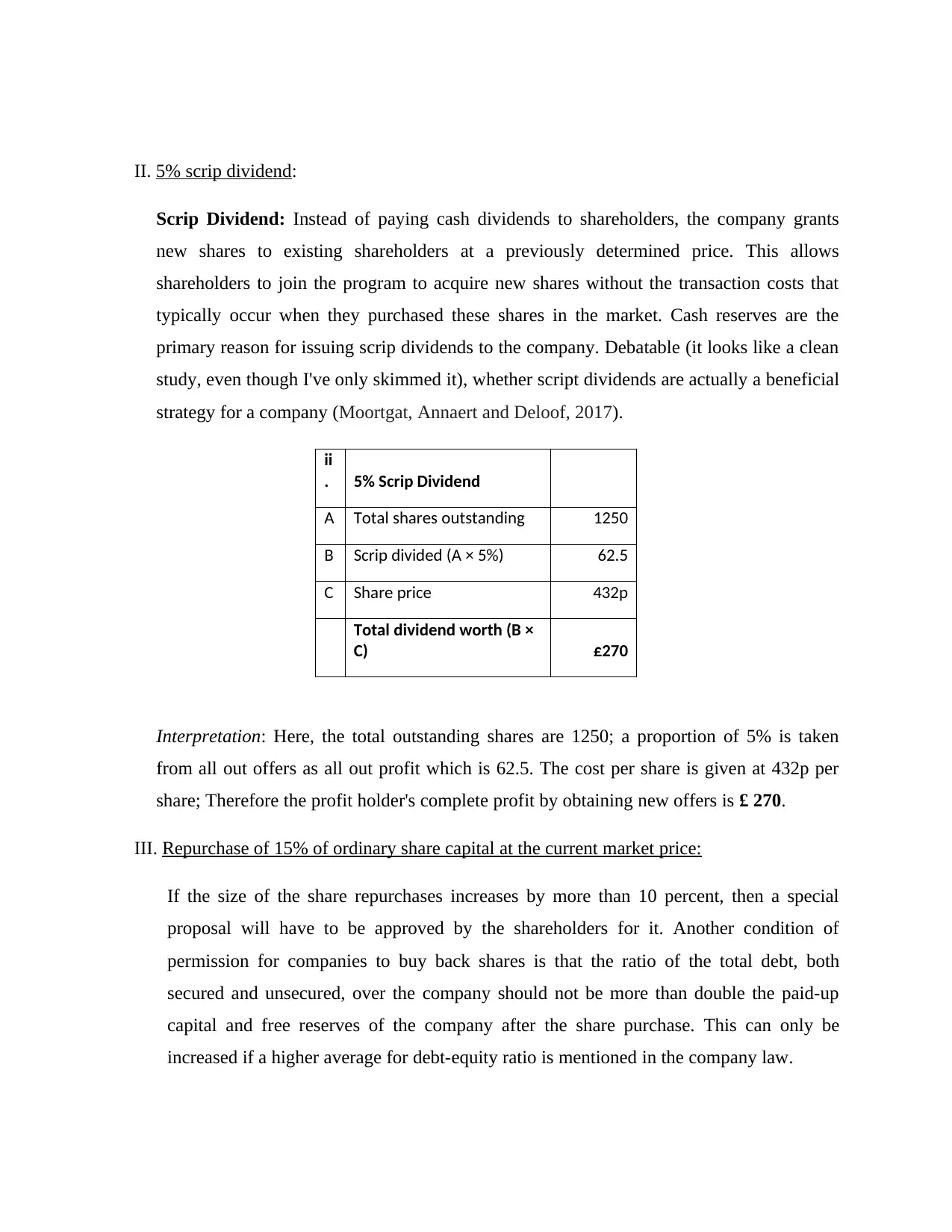

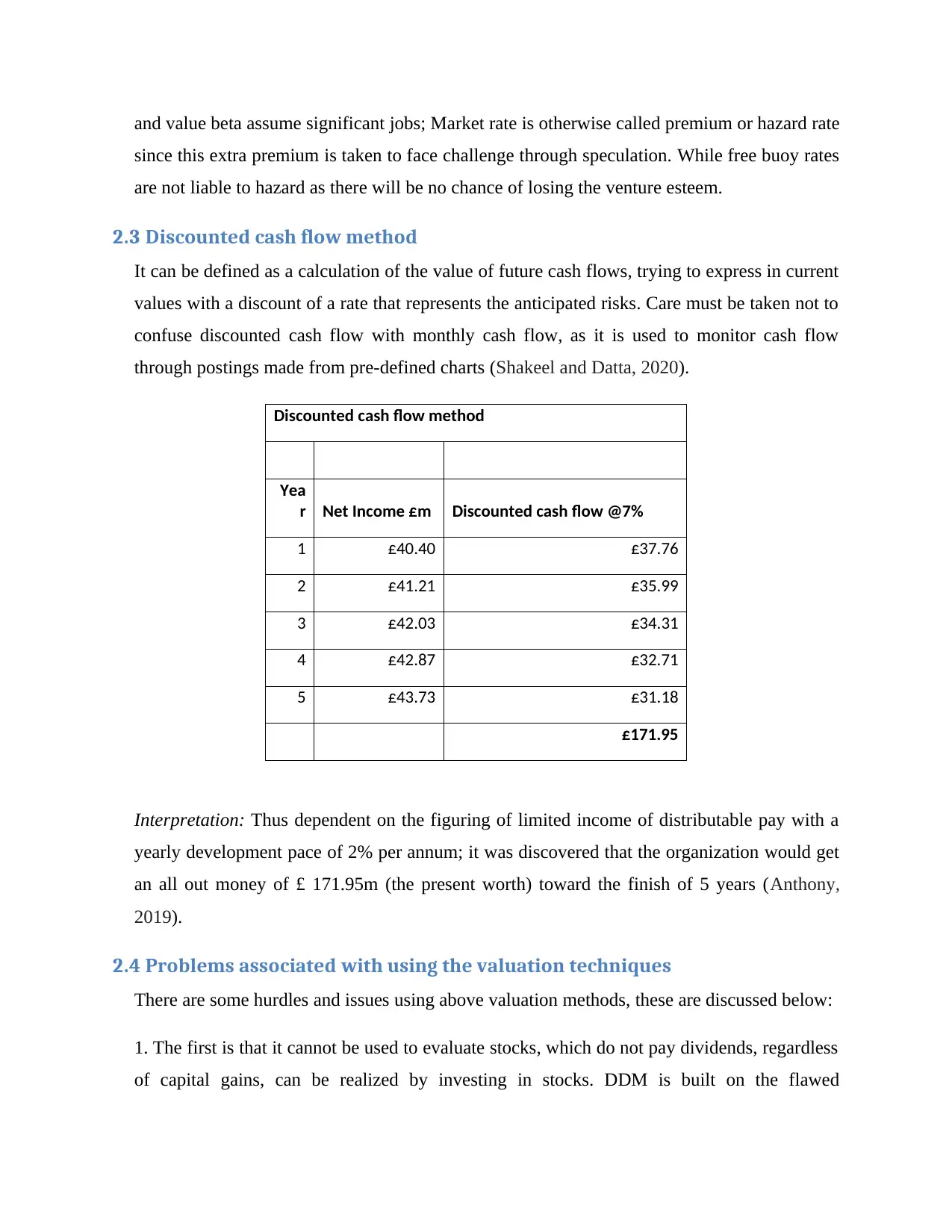

2.3 Discounted cash flow method

It can be defined as a calculation of the value of future cash flows, trying to express in current

values with a discount of a rate that represents the anticipated risks. Care must be taken not to

confuse discounted cash flow with monthly cash flow, as it is used to monitor cash flow

through postings made from pre-defined charts (Shakeel and Datta, 2020).

Discounted cash flow method

Yea

r Net Income £m Discounted cash flow @7%

1 £40.40 £37.76

2 £41.21 £35.99

3 £42.03 £34.31

4 £42.87 £32.71

5 £43.73 £31.18

£171.95

Interpretation: Thus dependent on the figuring of limited income of distributable pay with a

yearly development pace of 2% per annum; it was discovered that the organization would get

an all out money of £ 171.95m (the present worth) toward the finish of 5 years (Anthony,

2019).

2.4 Problems associated with using the valuation techniques

There are some hurdles and issues using above valuation methods, these are discussed below:

1. The first is that it cannot be used to evaluate stocks, which do not pay dividends, regardless

of capital gains, can be realized by investing in stocks. DDM is built on the flawed

since this extra premium is taken to face challenge through speculation. While free buoy rates

are not liable to hazard as there will be no chance of losing the venture esteem.

2.3 Discounted cash flow method

It can be defined as a calculation of the value of future cash flows, trying to express in current

values with a discount of a rate that represents the anticipated risks. Care must be taken not to

confuse discounted cash flow with monthly cash flow, as it is used to monitor cash flow

through postings made from pre-defined charts (Shakeel and Datta, 2020).

Discounted cash flow method

Yea

r Net Income £m Discounted cash flow @7%

1 £40.40 £37.76

2 £41.21 £35.99

3 £42.03 £34.31

4 £42.87 £32.71

5 £43.73 £31.18

£171.95

Interpretation: Thus dependent on the figuring of limited income of distributable pay with a

yearly development pace of 2% per annum; it was discovered that the organization would get

an all out money of £ 171.95m (the present worth) toward the finish of 5 years (Anthony,

2019).

2.4 Problems associated with using the valuation techniques

There are some hurdles and issues using above valuation methods, these are discussed below:

1. The first is that it cannot be used to evaluate stocks, which do not pay dividends, regardless

of capital gains, can be realized by investing in stocks. DDM is built on the flawed

assumption that the only value of a share is the return on investment provided through

dividends.

2. Another drawback is the fact that the price calculations used require many assumptions

about things such as the growth rate and the required rate of return. An example is that the

yield of dividends changes substantially over time. If any of the assumptions or assumptions

made in the calculation is slightly in error, it may result in an analyst, who determines the

value for the stock, significantly in terms of being overvalued or downgraded. Closed DDM

has many variations to overcome this problem. However, most of them involve making

additional estimates and calculations that are also subject to increased errors over time (Xu,

2017).

3. An additional criticism of DDM is that it ignores the effects of stock buybacks; there can

be a very large difference with respect to the share price returned to shareholders. Ignoring

stock buybacks reflects DDM's problem of overall, being conservative, over estimates of

share price.

Recommendation:

Based on the figuring and impediments of the over three techniques; It is suggested that

Aztec ought to incline toward the net present worth strategy to esteem Trojan PLC. The

explanation behind this is, every business works on its yearly pay and the two techniques

accept profit as their base worth; And the other strategy overlooks the size of speculation

and income which has no effect between a straightforward undertaking and a huge venture.

The rebate model is in this manner emphatically prescribed to be utilized in the examination

of the estimation of Trojan PLC (Zhang, Li and Ren, 2016).

dividends.

2. Another drawback is the fact that the price calculations used require many assumptions

about things such as the growth rate and the required rate of return. An example is that the

yield of dividends changes substantially over time. If any of the assumptions or assumptions

made in the calculation is slightly in error, it may result in an analyst, who determines the

value for the stock, significantly in terms of being overvalued or downgraded. Closed DDM

has many variations to overcome this problem. However, most of them involve making

additional estimates and calculations that are also subject to increased errors over time (Xu,

2017).

3. An additional criticism of DDM is that it ignores the effects of stock buybacks; there can

be a very large difference with respect to the share price returned to shareholders. Ignoring

stock buybacks reflects DDM's problem of overall, being conservative, over estimates of

share price.

Recommendation:

Based on the figuring and impediments of the over three techniques; It is suggested that

Aztec ought to incline toward the net present worth strategy to esteem Trojan PLC. The

explanation behind this is, every business works on its yearly pay and the two techniques

accept profit as their base worth; And the other strategy overlooks the size of speculation

and income which has no effect between a straightforward undertaking and a huge venture.

The rebate model is in this manner emphatically prescribed to be utilized in the examination

of the estimation of Trojan PLC (Zhang, Li and Ren, 2016).

CONCLUSION

Subsequent to dissecting and assessing both profit strategy and long haul financing value

matters, it is suggested that the organization ought to apply the refreshed instrument to compute

the genuine reasonable estimation of the stock. Since the reasonable estimation of offers in this

task is determined by considering the profit development model, which has numerous issues with

the evaluating of offers; To beat this restriction, the organization may execute a multi-stage

profit markdown model; This model will take care of the issue of assessing the incentive for

unpredictable profits and will assist with expecting near the specific incentive through the

computation of different development patterns.

Subsequent to dissecting and assessing both profit strategy and long haul financing value

matters, it is suggested that the organization ought to apply the refreshed instrument to compute

the genuine reasonable estimation of the stock. Since the reasonable estimation of offers in this

task is determined by considering the profit development model, which has numerous issues with

the evaluating of offers; To beat this restriction, the organization may execute a multi-stage

profit markdown model; This model will take care of the issue of assessing the incentive for

unpredictable profits and will assist with expecting near the specific incentive through the

computation of different development patterns.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Anthony, M.U.G.O., 2019. Effects of merger and acquisition on financial performance: case

study of commercial banks. International Journal of Business Management and

Finance, 1(1).

Buchanan, B.G., Cao, C.X., Liljeblom, E. and Weihrich, S., 2017. Uncertainty and firm dividend

policy—A natural experiment. Journal of Corporate Finance, 42, pp.179-197.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Greve, H.R. and Man Zhang, C., 2017. Institutional logics and power sources: Merger and

acquisition decisions. Academy of Management Journal, 60(2), pp.671-694.

He, W., Ng, L., Zaiats, N. and Zhang, B., 2017. Dividend policy and earnings management

across countries. Journal of Corporate Finance, 42, pp.267-286.

Khan, F., 2020. Does Dividend Policy Determine Stock Price Volatility?(A Case Study of

Malaysian Manufacturing Sector). Journal Global Policy and Governance, 9(1),

pp.67-78.

Moortgat, L., Annaert, J. and Deloof, M., 2017. Investor protection, taxation and dividend

policy: long-run evidence, 1838–2012. Journal of Banking & Finance, 85, pp.113-

131.

Renneboog, L. and Szilagyi, P.G., 2020. How relevant is dividend policy under low shareholder

protection?. Journal of International Financial Markets, Institutions and Money, 64,

p.100776.

Setiawan, D., Bandi, B., Phua, L.K. and Trinugroho, I., 2016. Ownership structure and dividend

policy in Indonesia. Journal of Asia Business Studies.

Shakeel, S. and Datta, S., 2020. Role of Internal Audit in Merger and Acquisition. The

Management Accountant Journal, 55(4), pp.40-45.

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. Wiley.

Straehl, P.U. and Ibbotson, R.G., 2018. “The Long-Run Drivers of Stock Returns: Total Payouts

and the Real Economy”: Author Response. Financial Analysts Journal, 74(1).

Xu, J., 2017. Growing through the merger and acquisition. Journal of Economic Dynamics and

Control, 80, pp.54-74.

Zhang, C., Li, D. and Ren, R., 2016. Pythagorean fuzzy multigranulation rough set over two

universes and its applications in merger and acquisition. International Journal of

Intelligent Systems, 31(9), pp.921-943.

Zietlow, J., Hankin, J.A., Seidner, A. and O'Brien, T., 2018. Financial management for nonprofit

organizations: policies and practices. John Wiley & Sons.

Books and Journals

Anthony, M.U.G.O., 2019. Effects of merger and acquisition on financial performance: case

study of commercial banks. International Journal of Business Management and

Finance, 1(1).

Buchanan, B.G., Cao, C.X., Liljeblom, E. and Weihrich, S., 2017. Uncertainty and firm dividend

policy—A natural experiment. Journal of Corporate Finance, 42, pp.179-197.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Greve, H.R. and Man Zhang, C., 2017. Institutional logics and power sources: Merger and

acquisition decisions. Academy of Management Journal, 60(2), pp.671-694.

He, W., Ng, L., Zaiats, N. and Zhang, B., 2017. Dividend policy and earnings management

across countries. Journal of Corporate Finance, 42, pp.267-286.

Khan, F., 2020. Does Dividend Policy Determine Stock Price Volatility?(A Case Study of

Malaysian Manufacturing Sector). Journal Global Policy and Governance, 9(1),

pp.67-78.

Moortgat, L., Annaert, J. and Deloof, M., 2017. Investor protection, taxation and dividend

policy: long-run evidence, 1838–2012. Journal of Banking & Finance, 85, pp.113-

131.

Renneboog, L. and Szilagyi, P.G., 2020. How relevant is dividend policy under low shareholder

protection?. Journal of International Financial Markets, Institutions and Money, 64,

p.100776.

Setiawan, D., Bandi, B., Phua, L.K. and Trinugroho, I., 2016. Ownership structure and dividend

policy in Indonesia. Journal of Asia Business Studies.

Shakeel, S. and Datta, S., 2020. Role of Internal Audit in Merger and Acquisition. The

Management Accountant Journal, 55(4), pp.40-45.

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. Wiley.

Straehl, P.U. and Ibbotson, R.G., 2018. “The Long-Run Drivers of Stock Returns: Total Payouts

and the Real Economy”: Author Response. Financial Analysts Journal, 74(1).

Xu, J., 2017. Growing through the merger and acquisition. Journal of Economic Dynamics and

Control, 80, pp.54-74.

Zhang, C., Li, D. and Ren, R., 2016. Pythagorean fuzzy multigranulation rough set over two

universes and its applications in merger and acquisition. International Journal of

Intelligent Systems, 31(9), pp.921-943.

Zietlow, J., Hankin, J.A., Seidner, A. and O'Brien, T., 2018. Financial management for nonprofit

organizations: policies and practices. John Wiley & Sons.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.