Financial Management: Obtaining Financial Data, Analyzing Financial Documents, Budget Formulation and Analysis

VerifiedAdded on 2023/06/08

|21

|4786

|478

AI Summary

This article discusses ways of obtaining financial data, analyzing financial documents, budget formulation and analysis in Financial Management. It covers financial barriers, target accomplishments, legal needs and accounting conventions at the time of budget formulation. The article also provides a case study of Sainsbury Plc to illustrate the concepts.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL MANAGEMENT

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL MANAGEMENT

Table of Contents

Task 1:.............................................................................................................................................3

AC 1.1 Ways of obtaining financial data and assessment of its validity:....................................3

AC 1.4 Review and question of financial data:...........................................................................4

Task 2:.............................................................................................................................................4

AC 1.2 Application of different types of analytical tools and techniques to a range of financial

documents:...................................................................................................................................4

AC 1.3 Comparative analyses of financial data:.........................................................................6

Task 3:.............................................................................................................................................8

AC 2.1 Financial barriers and target accomplishments, legal needs and accounting conventions

at the time of budget formulation:...............................................................................................8

Task 4:...........................................................................................................................................10

AC 2.2 Analysis of the budget outcomes against organisational objectives and identification of

alternatives:................................................................................................................................10

Task 5:...........................................................................................................................................12

AC 3.1 Identification of criteria for judging proposals:............................................................12

AC 3.2 Viability of the proposal for expenditure:.....................................................................13

AC 3.3 Identification of the strengths and weaknesses and feedback on the financial proposal:

...................................................................................................................................................15

AC 3.4 Impact of the proposal on the strategic objectives of the organisation:........................16

Table of Contents

Task 1:.............................................................................................................................................3

AC 1.1 Ways of obtaining financial data and assessment of its validity:....................................3

AC 1.4 Review and question of financial data:...........................................................................4

Task 2:.............................................................................................................................................4

AC 1.2 Application of different types of analytical tools and techniques to a range of financial

documents:...................................................................................................................................4

AC 1.3 Comparative analyses of financial data:.........................................................................6

Task 3:.............................................................................................................................................8

AC 2.1 Financial barriers and target accomplishments, legal needs and accounting conventions

at the time of budget formulation:...............................................................................................8

Task 4:...........................................................................................................................................10

AC 2.2 Analysis of the budget outcomes against organisational objectives and identification of

alternatives:................................................................................................................................10

Task 5:...........................................................................................................................................12

AC 3.1 Identification of criteria for judging proposals:............................................................12

AC 3.2 Viability of the proposal for expenditure:.....................................................................13

AC 3.3 Identification of the strengths and weaknesses and feedback on the financial proposal:

...................................................................................................................................................15

AC 3.4 Impact of the proposal on the strategic objectives of the organisation:........................16

2FINANCIAL MANAGEMENT

References:....................................................................................................................................18

References:....................................................................................................................................18

3FINANCIAL MANAGEMENT

Task 1:

AC 1.1 Ways of obtaining financial data and assessment of its validity:

For this section, Sainsbury Plc is chosen as the organisation, which is one of the leading

retailers holding 16.9% of the market share in the retail industry of UK (About.sainsburys.co.uk

2018). Financial data provide raw materials for driving conclusion of the financial position of the

business. Primarily, an organisation could obtain financial data from internal resources as well as

external resources (Bekaert and Hodrick 2017). The internal resources denote the records

generated by the business, while the external resources imply the sources available from the third

parties.

The internal financial data could be obtained from the accounting system of the

organisation, control function reports like sales department reports, other departmental

managerial reports and reports prepared by the suppliers, customers and staffs. These reports

provide details of the financial aspects of the departmental operations and thus, the accounts and

finance division of Sainsbury could be provided with information regarding revenue details and

necessary expenditure generated over a year (Cornwall, Vang and Hartman 2016). By combining

these reports, the financial department could accumulate and interpret data for developing

information to infer about its financial position. The other sources from which Sainsbury Plc

could obtain financial data include company house, company website, financial information

database and research reports, which are external data sources.

Validity implies the reasonableness and accuracy of financial data producing suitable

quality information for ascertaining financial condition of a specific organisation. Thus, it is

necessary for Sainsbury to evaluate the data collected based on regular sampling for validity to

Task 1:

AC 1.1 Ways of obtaining financial data and assessment of its validity:

For this section, Sainsbury Plc is chosen as the organisation, which is one of the leading

retailers holding 16.9% of the market share in the retail industry of UK (About.sainsburys.co.uk

2018). Financial data provide raw materials for driving conclusion of the financial position of the

business. Primarily, an organisation could obtain financial data from internal resources as well as

external resources (Bekaert and Hodrick 2017). The internal resources denote the records

generated by the business, while the external resources imply the sources available from the third

parties.

The internal financial data could be obtained from the accounting system of the

organisation, control function reports like sales department reports, other departmental

managerial reports and reports prepared by the suppliers, customers and staffs. These reports

provide details of the financial aspects of the departmental operations and thus, the accounts and

finance division of Sainsbury could be provided with information regarding revenue details and

necessary expenditure generated over a year (Cornwall, Vang and Hartman 2016). By combining

these reports, the financial department could accumulate and interpret data for developing

information to infer about its financial position. The other sources from which Sainsbury Plc

could obtain financial data include company house, company website, financial information

database and research reports, which are external data sources.

Validity implies the reasonableness and accuracy of financial data producing suitable

quality information for ascertaining financial condition of a specific organisation. Thus, it is

necessary for Sainsbury to evaluate the data collected based on regular sampling for validity to

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL MANAGEMENT

be conducted by internal as well as external auditors. The validity of financial data could be

evaluated by reviewing and questioning financial data, which is presented in the below section.

AC 1.4 Review and question of financial data:

The internal auditors are the employees of the organisation and they assess business

operations and accounting for bringing disciplined and systematic approach to analyse and

enhance risk management effectiveness along with processes of governance and control.

However, due to lack of independence, they are sometimes limited to report any error or fraud to

the top management due to perceived threats of their employment (Dyckman, Magee and Pfeiffer

2014). These auditors are not normal staffs and they are hired by the organisation, who are

responsible to report to the top management.

The external auditors give reasonable assurance that the financial reports do not contain

material misstatements, errors or frauds for providing unqualified audit opinion. In this context it

is noteworthy to mention that the external auditors are not and need not be expected to provide

complete assurance about validity and reliability of the financial statements. However, they audit

only published accounts by ensuring that certain rules are followed and they do not assure that

the company information is published in a comparable format.

Task 2:

AC 1.2 Application of different types of analytical tools and techniques to a range of

financial documents:

Ratio analysis is considered as the most powerful tool of analysing the financial

statements, as it ascertains the levels of financial performance along with formulating

be conducted by internal as well as external auditors. The validity of financial data could be

evaluated by reviewing and questioning financial data, which is presented in the below section.

AC 1.4 Review and question of financial data:

The internal auditors are the employees of the organisation and they assess business

operations and accounting for bringing disciplined and systematic approach to analyse and

enhance risk management effectiveness along with processes of governance and control.

However, due to lack of independence, they are sometimes limited to report any error or fraud to

the top management due to perceived threats of their employment (Dyckman, Magee and Pfeiffer

2014). These auditors are not normal staffs and they are hired by the organisation, who are

responsible to report to the top management.

The external auditors give reasonable assurance that the financial reports do not contain

material misstatements, errors or frauds for providing unqualified audit opinion. In this context it

is noteworthy to mention that the external auditors are not and need not be expected to provide

complete assurance about validity and reliability of the financial statements. However, they audit

only published accounts by ensuring that certain rules are followed and they do not assure that

the company information is published in a comparable format.

Task 2:

AC 1.2 Application of different types of analytical tools and techniques to a range of

financial documents:

Ratio analysis is considered as the most powerful tool of analysing the financial

statements, as it ascertains the levels of financial performance along with formulating

5FINANCIAL MANAGEMENT

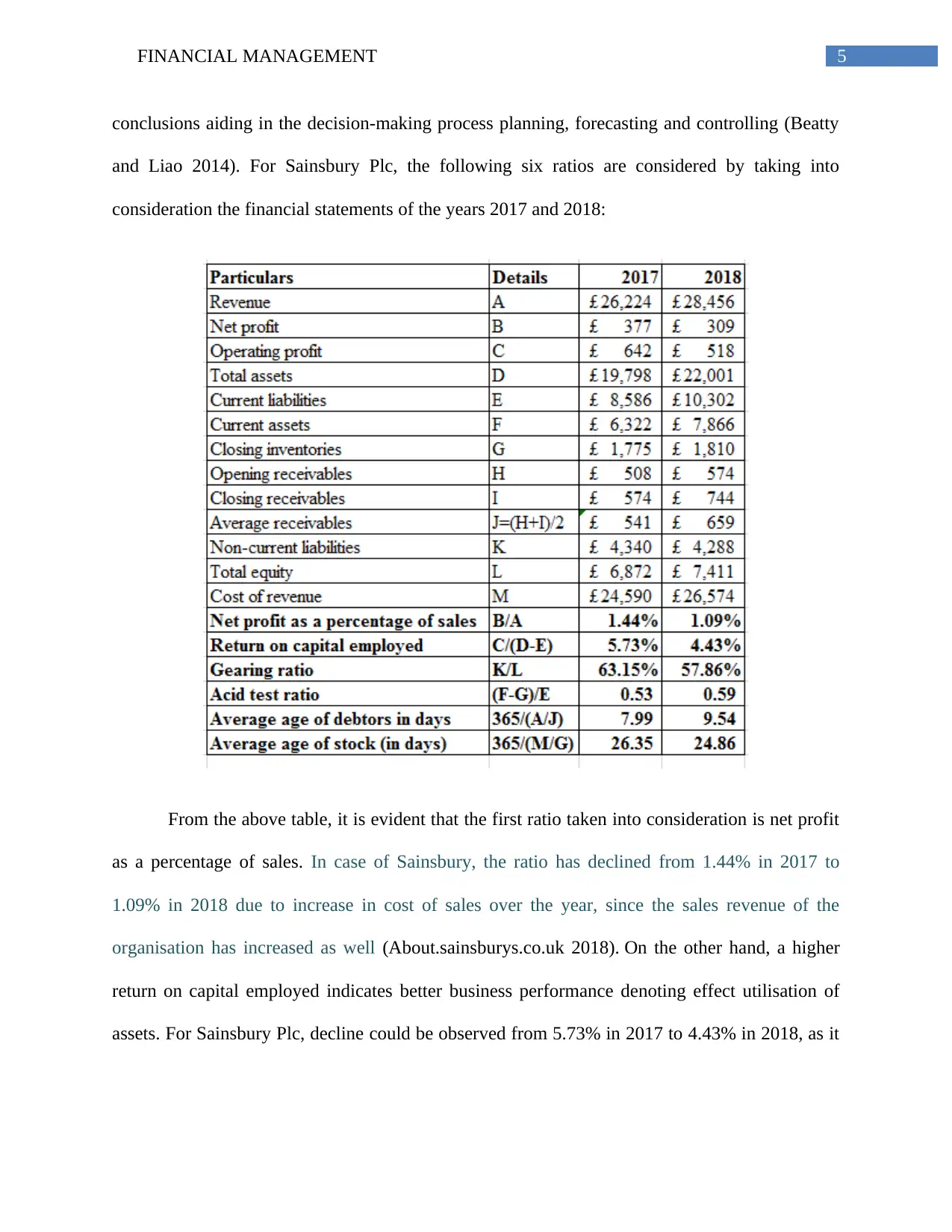

conclusions aiding in the decision-making process planning, forecasting and controlling (Beatty

and Liao 2014). For Sainsbury Plc, the following six ratios are considered by taking into

consideration the financial statements of the years 2017 and 2018:

From the above table, it is evident that the first ratio taken into consideration is net profit

as a percentage of sales. In case of Sainsbury, the ratio has declined from 1.44% in 2017 to

1.09% in 2018 due to increase in cost of sales over the year, since the sales revenue of the

organisation has increased as well (About.sainsburys.co.uk 2018). On the other hand, a higher

return on capital employed indicates better business performance denoting effect utilisation of

assets. For Sainsbury Plc, decline could be observed from 5.73% in 2017 to 4.43% in 2018, as it

conclusions aiding in the decision-making process planning, forecasting and controlling (Beatty

and Liao 2014). For Sainsbury Plc, the following six ratios are considered by taking into

consideration the financial statements of the years 2017 and 2018:

From the above table, it is evident that the first ratio taken into consideration is net profit

as a percentage of sales. In case of Sainsbury, the ratio has declined from 1.44% in 2017 to

1.09% in 2018 due to increase in cost of sales over the year, since the sales revenue of the

organisation has increased as well (About.sainsburys.co.uk 2018). On the other hand, a higher

return on capital employed indicates better business performance denoting effect utilisation of

assets. For Sainsbury Plc, decline could be observed from 5.73% in 2017 to 4.43% in 2018, as it

6FINANCIAL MANAGEMENT

fails to generate adequate profit from its long-term funding. Thus, in terms of profitability,

Sainsbury Plc is not placed in a favourable position in the UK retail market (Elliott 2017).

For Sainsbury Plc, gearing ratio is observed to decline from 63.15% in 2017 to 57.86% in

2018, as it has focused on raising additional funds through equity by minimising its long-term

liabilities. Thus, the organisation has managed to minimise its exposure to financial risk over the

years (Finkler et al. 2016).

Acid test ratio helps in evaluating the liquidity position of an organisation by not

including few current assets like inventories and prepaid expenses, as they could not be

converted into cash within shorter timeframe. Even though Sainsbury Plc has managed to

increase its acid test ratio from 0.53 in 2017 to 0.59 in 2018, it is below the industrial standard of

1. This is because it has been collecting amounts from the debtors lately due to which the cash

balance has not increased over the years.

In terms of average age of debtors in days, it could be observed that Sainsbury Plc has

increased its debtor terms from 7.99 days in 2017 to 9.54 days in 2018, as it is facing difficulties

in collecting from its customers. However, a decline in average age of stock in days is observed

from 26.35 days in 2017 to 24.86 days in 2018, as it has aligned its inventory base in accordance

with the market demand. Thus, in terms of efficiency, Sainsbury Plc is placed in a slightly

favourable position in the UK retail market.

AC 1.3 Comparative analyses of financial data:

Based on the above evaluation, the major strengths of Sainsbury Plc could be listed down as

follows:

fails to generate adequate profit from its long-term funding. Thus, in terms of profitability,

Sainsbury Plc is not placed in a favourable position in the UK retail market (Elliott 2017).

For Sainsbury Plc, gearing ratio is observed to decline from 63.15% in 2017 to 57.86% in

2018, as it has focused on raising additional funds through equity by minimising its long-term

liabilities. Thus, the organisation has managed to minimise its exposure to financial risk over the

years (Finkler et al. 2016).

Acid test ratio helps in evaluating the liquidity position of an organisation by not

including few current assets like inventories and prepaid expenses, as they could not be

converted into cash within shorter timeframe. Even though Sainsbury Plc has managed to

increase its acid test ratio from 0.53 in 2017 to 0.59 in 2018, it is below the industrial standard of

1. This is because it has been collecting amounts from the debtors lately due to which the cash

balance has not increased over the years.

In terms of average age of debtors in days, it could be observed that Sainsbury Plc has

increased its debtor terms from 7.99 days in 2017 to 9.54 days in 2018, as it is facing difficulties

in collecting from its customers. However, a decline in average age of stock in days is observed

from 26.35 days in 2017 to 24.86 days in 2018, as it has aligned its inventory base in accordance

with the market demand. Thus, in terms of efficiency, Sainsbury Plc is placed in a slightly

favourable position in the UK retail market.

AC 1.3 Comparative analyses of financial data:

Based on the above evaluation, the major strengths of Sainsbury Plc could be listed down as

follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MANAGEMENT

A slight improvement in liquidity could be observed due to minimised time of inventory

turnover in days.

The capital structure of the organisation is effectively balanced, as it has concentrated on

raising funds through equity, instead of relying too much on debt funding.

However, there are certain weaknesses evident from the above analysis for Sainsbury Plc,

which could be listed down as follows:

The organisation is struggling in terms of profitability due to its minimised earnings from

the banking subsidiary and as a result, it has failed to generate adequate returns from

investments made.

The organisation is following a lenient policy in collecting amounts from the debtors due

to which the working capital availability has fallen over the years.

In order to overcome these challenges, the following recommendations would be extremely

beneficial for Sainsbury Plc to improve its financial performance:

It needs to appoint a specialised market research firm in order to assess the changes in the

tastes and preferences of the customers towards the retail products. Accordingly, new

product lines could be added and they need to be marketed effectively, which would help

in increasing the overall revenues.

It needs to formulate stringent policy for its debtors in collecting amounts from them

within a shorter timeframe by providing discounts for timely payments, which would

help in increasing the availability of working capital.

However, it is to be borne in mind that the ratios are subject to certain limitations, which are

demonstrated briefly as follows:

A slight improvement in liquidity could be observed due to minimised time of inventory

turnover in days.

The capital structure of the organisation is effectively balanced, as it has concentrated on

raising funds through equity, instead of relying too much on debt funding.

However, there are certain weaknesses evident from the above analysis for Sainsbury Plc,

which could be listed down as follows:

The organisation is struggling in terms of profitability due to its minimised earnings from

the banking subsidiary and as a result, it has failed to generate adequate returns from

investments made.

The organisation is following a lenient policy in collecting amounts from the debtors due

to which the working capital availability has fallen over the years.

In order to overcome these challenges, the following recommendations would be extremely

beneficial for Sainsbury Plc to improve its financial performance:

It needs to appoint a specialised market research firm in order to assess the changes in the

tastes and preferences of the customers towards the retail products. Accordingly, new

product lines could be added and they need to be marketed effectively, which would help

in increasing the overall revenues.

It needs to formulate stringent policy for its debtors in collecting amounts from them

within a shorter timeframe by providing discounts for timely payments, which would

help in increasing the availability of working capital.

However, it is to be borne in mind that the ratios are subject to certain limitations, which are

demonstrated briefly as follows:

8FINANCIAL MANAGEMENT

Ratios are derived from past results and the same results are not expected to remain the

same in future.

Due to the difference in accounting policies concerning inventory valuation and

depreciation, the accounting data as well as ratios of the two organisations could not be

compared.

No particular standards are laid down for ideal ratios. For instance, current ratio is

considered to be ideal, if current assets are greater than current liabilities. However, this

standard might not be justified for those concerns having considerable agreements with

bankers to provide funds, as needed. Under such situation, it might be perfectly ideal if

current assets are slightly more or identical to current liabilities (Hoskin, Fizzell and

Cherry 2014).

Task 3:

AC 2.1 Financial barriers and target accomplishments, legal needs and accounting

conventions at the time of budget formulation:

Budget helps in providing comprehensive financial insight of planned company

operation. The budgets are prepared with the intent so that the incomes could be planned and the

expenses could be controlled by the organisation. The objectives of Sainsbury Plc drive its

budget preparation so that it could be compared with the actual outcomes (Barr and McClellan

2018). Many business variables could be budgeted including output, sales, variable and fixed

cost, cash flow, profits and capital investment. Budget needs to be SMART, which is specific,

measurable, achievable, realistic and time bound; whereas, in opposition, budget would not be

effective.

Ratios are derived from past results and the same results are not expected to remain the

same in future.

Due to the difference in accounting policies concerning inventory valuation and

depreciation, the accounting data as well as ratios of the two organisations could not be

compared.

No particular standards are laid down for ideal ratios. For instance, current ratio is

considered to be ideal, if current assets are greater than current liabilities. However, this

standard might not be justified for those concerns having considerable agreements with

bankers to provide funds, as needed. Under such situation, it might be perfectly ideal if

current assets are slightly more or identical to current liabilities (Hoskin, Fizzell and

Cherry 2014).

Task 3:

AC 2.1 Financial barriers and target accomplishments, legal needs and accounting

conventions at the time of budget formulation:

Budget helps in providing comprehensive financial insight of planned company

operation. The budgets are prepared with the intent so that the incomes could be planned and the

expenses could be controlled by the organisation. The objectives of Sainsbury Plc drive its

budget preparation so that it could be compared with the actual outcomes (Barr and McClellan

2018). Many business variables could be budgeted including output, sales, variable and fixed

cost, cash flow, profits and capital investment. Budget needs to be SMART, which is specific,

measurable, achievable, realistic and time bound; whereas, in opposition, budget would not be

effective.

9FINANCIAL MANAGEMENT

The strategic goal of Sainsbury Plc is the initial factor, which requires to be taken into

account at the time of preparing budgets, since failure would be obvious, if the budgets are not

aligned with the strategic objectives. After this step, it is necessary to identify the limiting factor

that the firm is encountered, which is identified as impediment. This might be restriction on the

selling volume of the business or direct labour hours of a specific kind of workforce. At the time

organisation detects the limiting factor, budgetary principle is set. The next step is coordination

and evaluation of internal factors, which are employee resources and capabilities along with draft

department budget (Irimia-Dieguez, Medina-Lopez and Alfalla-Luque 2015). Once when the

step is over, the organisation needs to evaluate the external factors like estimated political,

economic and international environment, which enables in reducing the risk related to budget.

Finally, Sainsbury should coordinate the overall department budget that include production

budget, sales budget, labour budget, material and overhead budget or master budget (Nilsson and

Stockenstrand 2015).

The master budget is an overview of the plans of an organisation for setting particular

targets for financing and distribution activities along with sales production. This is culminated

generally in budgeted profit and loss statement, cash budget and a budgeted balance sheet. The

initiation of master budget is made with sales estimations, which could be conducted by critical

evaluation of the previous selling trend, sales force estimations, actions of the competitors,

general economic conditions, variation in the prices of the organisation, market research along

with promotion plans for sales and advertising (Henderson et al. 2015). Sales estimations results

in sales budget, which is a detailed overview of the estimated sales for the budget period. This

could be represented in the form of currency and units. Thus, one of the significant pillars of

master budget is sales budget.

The strategic goal of Sainsbury Plc is the initial factor, which requires to be taken into

account at the time of preparing budgets, since failure would be obvious, if the budgets are not

aligned with the strategic objectives. After this step, it is necessary to identify the limiting factor

that the firm is encountered, which is identified as impediment. This might be restriction on the

selling volume of the business or direct labour hours of a specific kind of workforce. At the time

organisation detects the limiting factor, budgetary principle is set. The next step is coordination

and evaluation of internal factors, which are employee resources and capabilities along with draft

department budget (Irimia-Dieguez, Medina-Lopez and Alfalla-Luque 2015). Once when the

step is over, the organisation needs to evaluate the external factors like estimated political,

economic and international environment, which enables in reducing the risk related to budget.

Finally, Sainsbury should coordinate the overall department budget that include production

budget, sales budget, labour budget, material and overhead budget or master budget (Nilsson and

Stockenstrand 2015).

The master budget is an overview of the plans of an organisation for setting particular

targets for financing and distribution activities along with sales production. This is culminated

generally in budgeted profit and loss statement, cash budget and a budgeted balance sheet. The

initiation of master budget is made with sales estimations, which could be conducted by critical

evaluation of the previous selling trend, sales force estimations, actions of the competitors,

general economic conditions, variation in the prices of the organisation, market research along

with promotion plans for sales and advertising (Henderson et al. 2015). Sales estimations results

in sales budget, which is a detailed overview of the estimated sales for the budget period. This

could be represented in the form of currency and units. Thus, one of the significant pillars of

master budget is sales budget.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10FINANCIAL MANAGEMENT

After sales budget, production budget is necessary for Sainsbury, since it determines the

production volume based on the expected sales volume along with beginning and ending

inventories (Lafond, McAleer and Wentzel 2016). Another budgeting component is material

budget, which represents the cost and volume of buying materials for planned inventories and

production. Labour budget reflects the budget for both skilled and unskilled labour based on the

production level. Finally, Sainsbury Plc could prepare overhead budget for showing quantities of

a bigger number of cost items. These items include electricity, rent, salary and administrative

expenses (Karadag 2015). When all these budgets are prepared for Sainsbury, it could formulate

projected profit and loss statement, cash budget, cash inflows and outflows and budgeted balance

sheet.

Task 4:

AC 2.2 Analysis of the budget outcomes against organisational objectives and identification

of alternatives:

The actual performance and the budgeted performance often resemble each other and the

significant budgeting goal is to reduce the gap between actual performance and budgeted

performance. Because of faulty assumptions in budget numbers, mistakes in arithmetic of the

actual results, incorrect budget assumptions and actual results, timing variations and price

variance might take place. With the help of budget, it is possible to gauge the performance for

conducting the comparison between actual performance and budgeted performance (Martin

2016). Variances are utilised for gauging the gap between actual performance and budgeted

performance. This analysis helps the managers in identifying issues requiring additional

After sales budget, production budget is necessary for Sainsbury, since it determines the

production volume based on the expected sales volume along with beginning and ending

inventories (Lafond, McAleer and Wentzel 2016). Another budgeting component is material

budget, which represents the cost and volume of buying materials for planned inventories and

production. Labour budget reflects the budget for both skilled and unskilled labour based on the

production level. Finally, Sainsbury Plc could prepare overhead budget for showing quantities of

a bigger number of cost items. These items include electricity, rent, salary and administrative

expenses (Karadag 2015). When all these budgets are prepared for Sainsbury, it could formulate

projected profit and loss statement, cash budget, cash inflows and outflows and budgeted balance

sheet.

Task 4:

AC 2.2 Analysis of the budget outcomes against organisational objectives and identification

of alternatives:

The actual performance and the budgeted performance often resemble each other and the

significant budgeting goal is to reduce the gap between actual performance and budgeted

performance. Because of faulty assumptions in budget numbers, mistakes in arithmetic of the

actual results, incorrect budget assumptions and actual results, timing variations and price

variance might take place. With the help of budget, it is possible to gauge the performance for

conducting the comparison between actual performance and budgeted performance (Martin

2016). Variances are utilised for gauging the gap between actual performance and budgeted

performance. This analysis helps the managers in identifying issues requiring additional

11FINANCIAL MANAGEMENT

examinations for adopting corrective actions. Variances could be labour variance, material

variance and overhead variance.

In case of the provided budget, increase in sales receipts could be observed over the

months and the organisation has earned loan proceeds due to which the cash receipts are the

highest in the month of January. Positive variance could be observed in wages, as it has declined

over the half-year period. However, fixed costs have increased over the months, as more units

are produced in the later months of the year, due to which there is overall increase in the cost of

goods sold. Another reason that the net cash flow of the organisation has been negative from

February is due to the lease of new building, the payment of which has continued until June.

Advertising fees have been charged from the month of February, which remained same until

April with a slight increase in May; however, no such fees are charged in June. The organisation

has budgeted half-yearly tax payment scheduled to be paid in the month of June. On the other

hand, the most significant reason that the net cash flow of the organisation has been negative in

most of the months is due to the estimated capital expenditure in the month of March. Finally,

loan repayments are projected to begin from April to June due to which the overall payments

have increased. In this case, the closing cash balance is observed to be negative in the months of

May and June. The organisation has a bank overdraft of £750,000, which could help in offsetting

the negative cash flow.

This particular situation could be addressed with the help of variance analysis. In this

respect, labour rate and efficiency variances along with material price and volume variances are

benchmarks of efficiency and economy (Matthew 2017). With the help of selling price and

volume variances, it would become possible for the organisation to signify the effect on

performance due to the change in demand and price levels. The management could detect the

examinations for adopting corrective actions. Variances could be labour variance, material

variance and overhead variance.

In case of the provided budget, increase in sales receipts could be observed over the

months and the organisation has earned loan proceeds due to which the cash receipts are the

highest in the month of January. Positive variance could be observed in wages, as it has declined

over the half-year period. However, fixed costs have increased over the months, as more units

are produced in the later months of the year, due to which there is overall increase in the cost of

goods sold. Another reason that the net cash flow of the organisation has been negative from

February is due to the lease of new building, the payment of which has continued until June.

Advertising fees have been charged from the month of February, which remained same until

April with a slight increase in May; however, no such fees are charged in June. The organisation

has budgeted half-yearly tax payment scheduled to be paid in the month of June. On the other

hand, the most significant reason that the net cash flow of the organisation has been negative in

most of the months is due to the estimated capital expenditure in the month of March. Finally,

loan repayments are projected to begin from April to June due to which the overall payments

have increased. In this case, the closing cash balance is observed to be negative in the months of

May and June. The organisation has a bank overdraft of £750,000, which could help in offsetting

the negative cash flow.

This particular situation could be addressed with the help of variance analysis. In this

respect, labour rate and efficiency variances along with material price and volume variances are

benchmarks of efficiency and economy (Matthew 2017). With the help of selling price and

volume variances, it would become possible for the organisation to signify the effect on

performance due to the change in demand and price levels. The management could detect the

12FINANCIAL MANAGEMENT

reasons behind ineffective performance by evaluating variances. For instance, in case of the

provided organisation, material variances might take place due to increase in prices of raw

materials or damaged quality of raw materials resulting in greater levels of wastage (McKinney

2015). Therefore, corrective actions could be undertaken to reach desired level of performance

and it becomes easier to undertake corrective actions after the identification of ineffective

performance. Therefore, the three alternatives through which the organisation could identify the

issues include bank overdraft, effective production level and variance analysis.

Task 5:

AC 3.1 Identification of criteria for judging proposals:

Any organisation needs to evaluate the various alternative proposals, which provide yield

efficiency. Basically, an effective proposal could be selected based on the accepted risk level,

greatest benefit level, cost benefit ratio and lowest cost (Schipper, Francis and Weil 2017).

Therefore, the organisation could set the criteria for choosing the proposal including financial

project feasibility, effect on strategic objective, future financial ratios and significant financial

indicators coupled with the weaknesses and strengths of the project. The five question model of

Tucker is effective in evaluating the projects, which help the managers to undertake decisions.

The questions are summarised briefly as follows:

Is the project profitable?

What is the fairness of the project to the stakeholders?

Does the project meet legal requirements?

Is the project scrupulous?

What is the chance of project sustainability?

reasons behind ineffective performance by evaluating variances. For instance, in case of the

provided organisation, material variances might take place due to increase in prices of raw

materials or damaged quality of raw materials resulting in greater levels of wastage (McKinney

2015). Therefore, corrective actions could be undertaken to reach desired level of performance

and it becomes easier to undertake corrective actions after the identification of ineffective

performance. Therefore, the three alternatives through which the organisation could identify the

issues include bank overdraft, effective production level and variance analysis.

Task 5:

AC 3.1 Identification of criteria for judging proposals:

Any organisation needs to evaluate the various alternative proposals, which provide yield

efficiency. Basically, an effective proposal could be selected based on the accepted risk level,

greatest benefit level, cost benefit ratio and lowest cost (Schipper, Francis and Weil 2017).

Therefore, the organisation could set the criteria for choosing the proposal including financial

project feasibility, effect on strategic objective, future financial ratios and significant financial

indicators coupled with the weaknesses and strengths of the project. The five question model of

Tucker is effective in evaluating the projects, which help the managers to undertake decisions.

The questions are summarised briefly as follows:

Is the project profitable?

What is the fairness of the project to the stakeholders?

Does the project meet legal requirements?

Is the project scrupulous?

What is the chance of project sustainability?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13FINANCIAL MANAGEMENT

With the help of such criteria, the managers could choose the effective project containing

lower risk and suitable implementation.

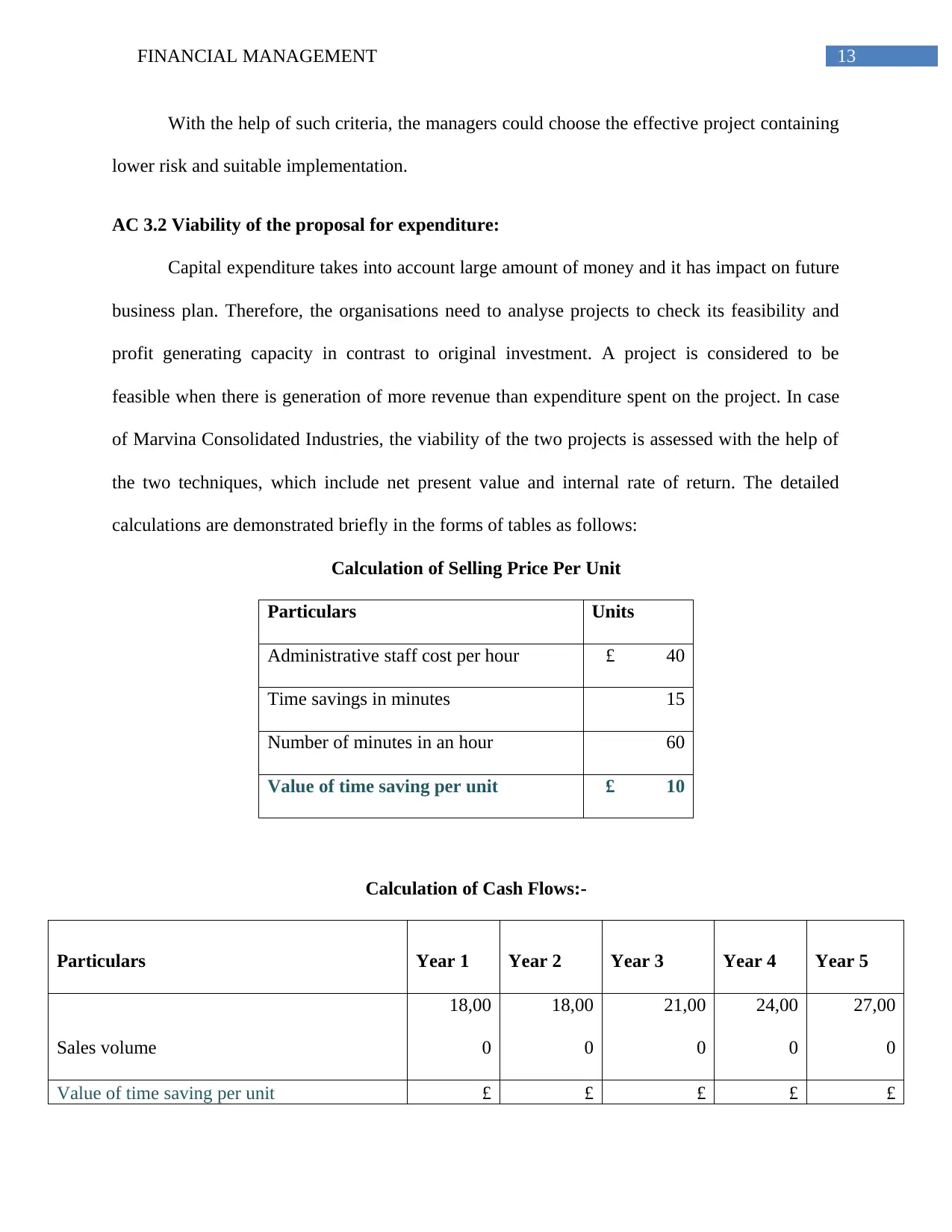

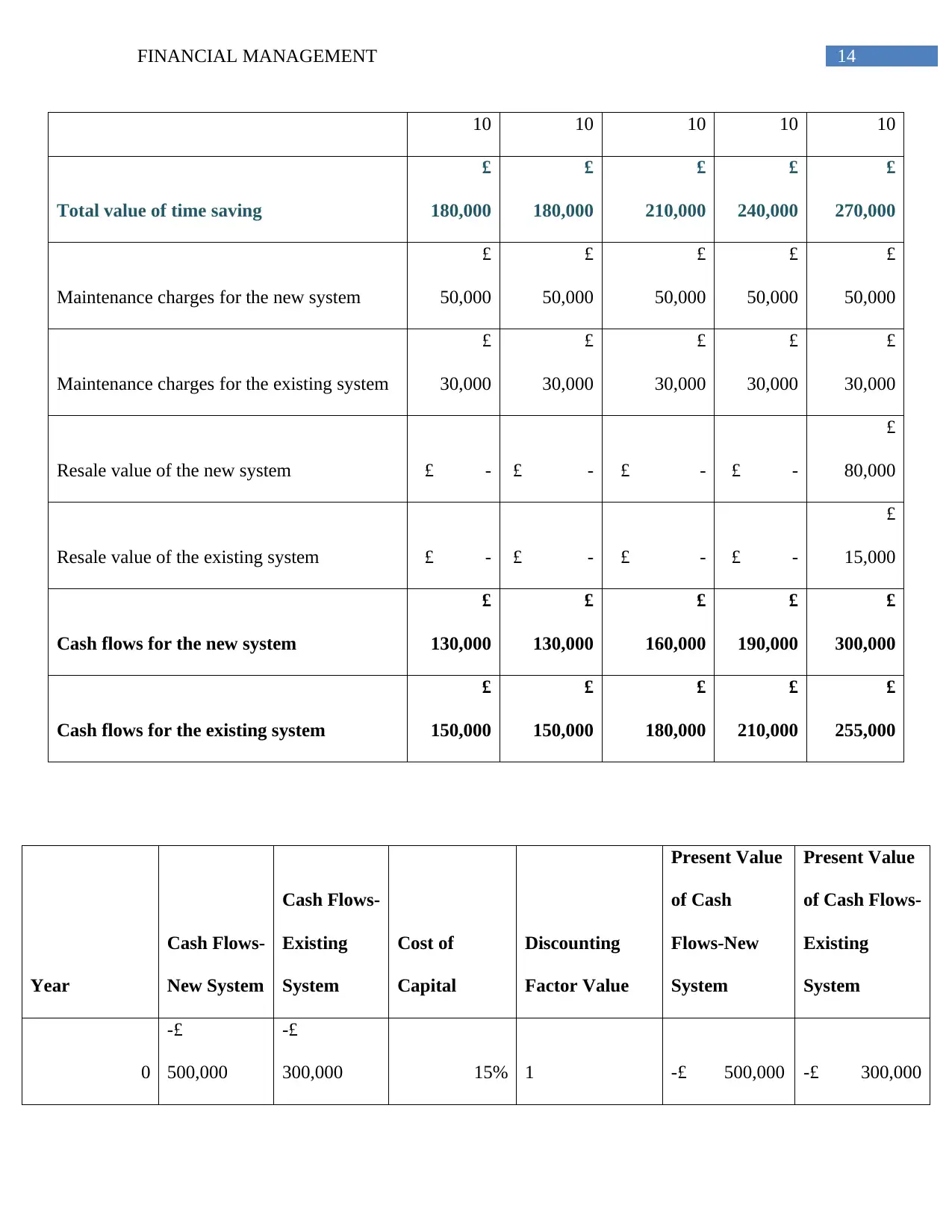

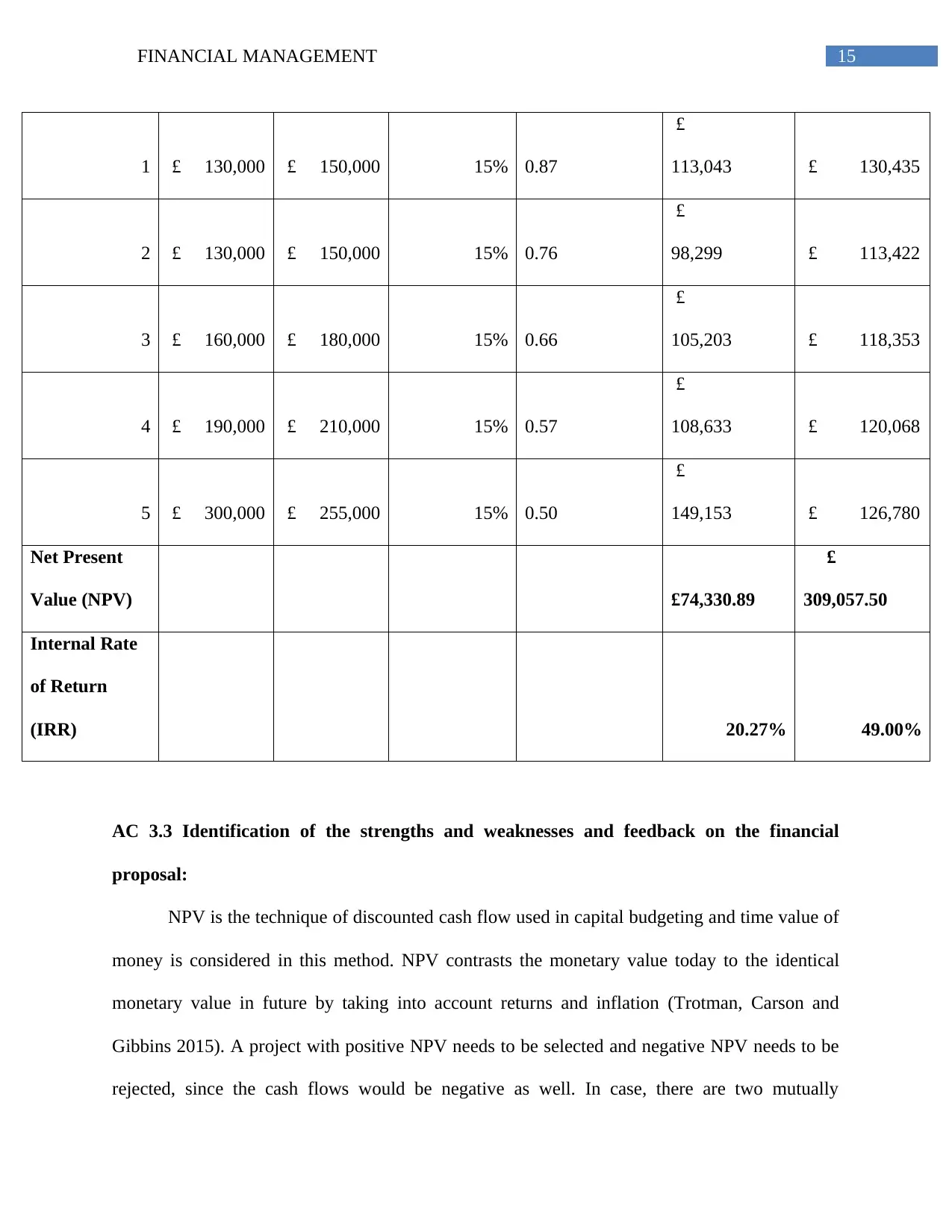

AC 3.2 Viability of the proposal for expenditure:

Capital expenditure takes into account large amount of money and it has impact on future

business plan. Therefore, the organisations need to analyse projects to check its feasibility and

profit generating capacity in contrast to original investment. A project is considered to be

feasible when there is generation of more revenue than expenditure spent on the project. In case

of Marvina Consolidated Industries, the viability of the two projects is assessed with the help of

the two techniques, which include net present value and internal rate of return. The detailed

calculations are demonstrated briefly in the forms of tables as follows:

Calculation of Selling Price Per Unit

Particulars Units

Administrative staff cost per hour £ 40

Time savings in minutes 15

Number of minutes in an hour 60

Value of time saving per unit £ 10

Calculation of Cash Flows:-

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Sales volume

18,00

0

18,00

0

21,00

0

24,00

0

27,00

0

Value of time saving per unit £ £ £ £ £

With the help of such criteria, the managers could choose the effective project containing

lower risk and suitable implementation.

AC 3.2 Viability of the proposal for expenditure:

Capital expenditure takes into account large amount of money and it has impact on future

business plan. Therefore, the organisations need to analyse projects to check its feasibility and

profit generating capacity in contrast to original investment. A project is considered to be

feasible when there is generation of more revenue than expenditure spent on the project. In case

of Marvina Consolidated Industries, the viability of the two projects is assessed with the help of

the two techniques, which include net present value and internal rate of return. The detailed

calculations are demonstrated briefly in the forms of tables as follows:

Calculation of Selling Price Per Unit

Particulars Units

Administrative staff cost per hour £ 40

Time savings in minutes 15

Number of minutes in an hour 60

Value of time saving per unit £ 10

Calculation of Cash Flows:-

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Sales volume

18,00

0

18,00

0

21,00

0

24,00

0

27,00

0

Value of time saving per unit £ £ £ £ £

14FINANCIAL MANAGEMENT

10 10 10 10 10

Total value of time saving

£

180,000

£

180,000

£

210,000

£

240,000

£

270,000

Maintenance charges for the new system

£

50,000

£

50,000

£

50,000

£

50,000

£

50,000

Maintenance charges for the existing system

£

30,000

£

30,000

£

30,000

£

30,000

£

30,000

Resale value of the new system £ - £ - £ - £ -

£

80,000

Resale value of the existing system £ - £ - £ - £ -

£

15,000

Cash flows for the new system

£

130,000

£

130,000

£

160,000

£

190,000

£

300,000

Cash flows for the existing system

£

150,000

£

150,000

£

180,000

£

210,000

£

255,000

Year

Cash Flows-

New System

Cash Flows-

Existing

System

Cost of

Capital

Discounting

Factor Value

Present Value

of Cash

Flows-New

System

Present Value

of Cash Flows-

Existing

System

0

-£

500,000

-£

300,000 15% 1 -£ 500,000 -£ 300,000

10 10 10 10 10

Total value of time saving

£

180,000

£

180,000

£

210,000

£

240,000

£

270,000

Maintenance charges for the new system

£

50,000

£

50,000

£

50,000

£

50,000

£

50,000

Maintenance charges for the existing system

£

30,000

£

30,000

£

30,000

£

30,000

£

30,000

Resale value of the new system £ - £ - £ - £ -

£

80,000

Resale value of the existing system £ - £ - £ - £ -

£

15,000

Cash flows for the new system

£

130,000

£

130,000

£

160,000

£

190,000

£

300,000

Cash flows for the existing system

£

150,000

£

150,000

£

180,000

£

210,000

£

255,000

Year

Cash Flows-

New System

Cash Flows-

Existing

System

Cost of

Capital

Discounting

Factor Value

Present Value

of Cash

Flows-New

System

Present Value

of Cash Flows-

Existing

System

0

-£

500,000

-£

300,000 15% 1 -£ 500,000 -£ 300,000

15FINANCIAL MANAGEMENT

1 £ 130,000 £ 150,000 15% 0.87

£

113,043 £ 130,435

2 £ 130,000 £ 150,000 15% 0.76

£

98,299 £ 113,422

3 £ 160,000 £ 180,000 15% 0.66

£

105,203 £ 118,353

4 £ 190,000 £ 210,000 15% 0.57

£

108,633 £ 120,068

5 £ 300,000 £ 255,000 15% 0.50

£

149,153 £ 126,780

Net Present

Value (NPV) £74,330.89

£

309,057.50

Internal Rate

of Return

(IRR) 20.27% 49.00%

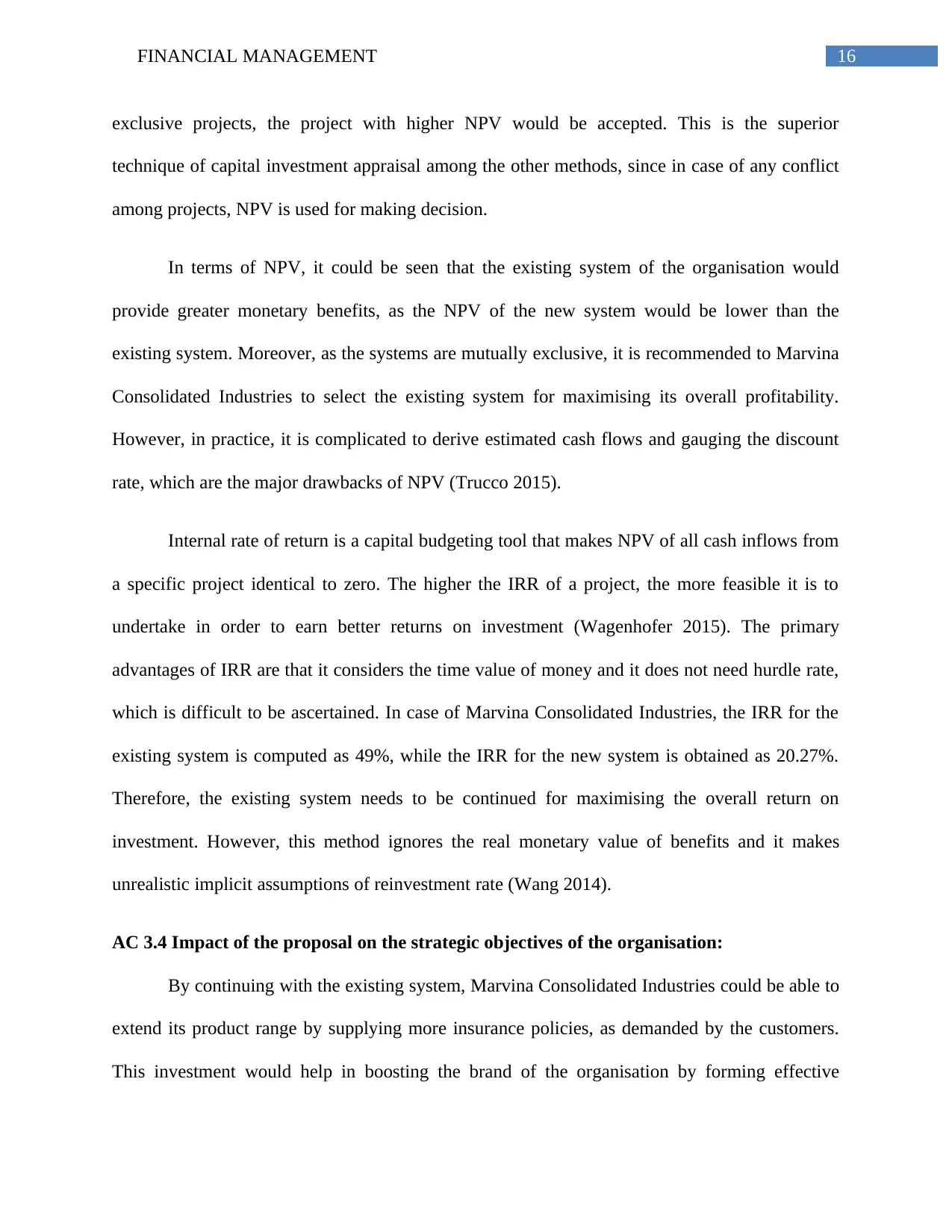

AC 3.3 Identification of the strengths and weaknesses and feedback on the financial

proposal:

NPV is the technique of discounted cash flow used in capital budgeting and time value of

money is considered in this method. NPV contrasts the monetary value today to the identical

monetary value in future by taking into account returns and inflation (Trotman, Carson and

Gibbins 2015). A project with positive NPV needs to be selected and negative NPV needs to be

rejected, since the cash flows would be negative as well. In case, there are two mutually

1 £ 130,000 £ 150,000 15% 0.87

£

113,043 £ 130,435

2 £ 130,000 £ 150,000 15% 0.76

£

98,299 £ 113,422

3 £ 160,000 £ 180,000 15% 0.66

£

105,203 £ 118,353

4 £ 190,000 £ 210,000 15% 0.57

£

108,633 £ 120,068

5 £ 300,000 £ 255,000 15% 0.50

£

149,153 £ 126,780

Net Present

Value (NPV) £74,330.89

£

309,057.50

Internal Rate

of Return

(IRR) 20.27% 49.00%

AC 3.3 Identification of the strengths and weaknesses and feedback on the financial

proposal:

NPV is the technique of discounted cash flow used in capital budgeting and time value of

money is considered in this method. NPV contrasts the monetary value today to the identical

monetary value in future by taking into account returns and inflation (Trotman, Carson and

Gibbins 2015). A project with positive NPV needs to be selected and negative NPV needs to be

rejected, since the cash flows would be negative as well. In case, there are two mutually

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16FINANCIAL MANAGEMENT

exclusive projects, the project with higher NPV would be accepted. This is the superior

technique of capital investment appraisal among the other methods, since in case of any conflict

among projects, NPV is used for making decision.

In terms of NPV, it could be seen that the existing system of the organisation would

provide greater monetary benefits, as the NPV of the new system would be lower than the

existing system. Moreover, as the systems are mutually exclusive, it is recommended to Marvina

Consolidated Industries to select the existing system for maximising its overall profitability.

However, in practice, it is complicated to derive estimated cash flows and gauging the discount

rate, which are the major drawbacks of NPV (Trucco 2015).

Internal rate of return is a capital budgeting tool that makes NPV of all cash inflows from

a specific project identical to zero. The higher the IRR of a project, the more feasible it is to

undertake in order to earn better returns on investment (Wagenhofer 2015). The primary

advantages of IRR are that it considers the time value of money and it does not need hurdle rate,

which is difficult to be ascertained. In case of Marvina Consolidated Industries, the IRR for the

existing system is computed as 49%, while the IRR for the new system is obtained as 20.27%.

Therefore, the existing system needs to be continued for maximising the overall return on

investment. However, this method ignores the real monetary value of benefits and it makes

unrealistic implicit assumptions of reinvestment rate (Wang 2014).

AC 3.4 Impact of the proposal on the strategic objectives of the organisation:

By continuing with the existing system, Marvina Consolidated Industries could be able to

extend its product range by supplying more insurance policies, as demanded by the customers.

This investment would help in boosting the brand of the organisation by forming effective

exclusive projects, the project with higher NPV would be accepted. This is the superior

technique of capital investment appraisal among the other methods, since in case of any conflict

among projects, NPV is used for making decision.

In terms of NPV, it could be seen that the existing system of the organisation would

provide greater monetary benefits, as the NPV of the new system would be lower than the

existing system. Moreover, as the systems are mutually exclusive, it is recommended to Marvina

Consolidated Industries to select the existing system for maximising its overall profitability.

However, in practice, it is complicated to derive estimated cash flows and gauging the discount

rate, which are the major drawbacks of NPV (Trucco 2015).

Internal rate of return is a capital budgeting tool that makes NPV of all cash inflows from

a specific project identical to zero. The higher the IRR of a project, the more feasible it is to

undertake in order to earn better returns on investment (Wagenhofer 2015). The primary

advantages of IRR are that it considers the time value of money and it does not need hurdle rate,

which is difficult to be ascertained. In case of Marvina Consolidated Industries, the IRR for the

existing system is computed as 49%, while the IRR for the new system is obtained as 20.27%.

Therefore, the existing system needs to be continued for maximising the overall return on

investment. However, this method ignores the real monetary value of benefits and it makes

unrealistic implicit assumptions of reinvestment rate (Wang 2014).

AC 3.4 Impact of the proposal on the strategic objectives of the organisation:

By continuing with the existing system, Marvina Consolidated Industries could be able to

extend its product range by supplying more insurance policies, as demanded by the customers.

This investment would help in boosting the brand of the organisation by forming effective

17FINANCIAL MANAGEMENT

relationships with the customers. Another advantage of this investment proposal would be the

key skills to be learnt by the business and the expected future opportunities (Zietlow et al. 2018).

However, such investment might restrict the flexibility of the organisation in making response to

future modifications. For instance, investing in a new system without knowing about the demand

of the product might lead to investment risk. Moreover, the shareholders might opt for

investments providing quick returns. The effects of the proposal on the strategic objectives of the

organisation consist of the following:

Identifying, characterising and assessing threats

Evaluating the vulnerability of critical assets to particular threats

Determination of risks

Identification of techniques for minimising these risks

Prioritisation of risk minimisation measures

relationships with the customers. Another advantage of this investment proposal would be the

key skills to be learnt by the business and the expected future opportunities (Zietlow et al. 2018).

However, such investment might restrict the flexibility of the organisation in making response to

future modifications. For instance, investing in a new system without knowing about the demand

of the product might lead to investment risk. Moreover, the shareholders might opt for

investments providing quick returns. The effects of the proposal on the strategic objectives of the

organisation consist of the following:

Identifying, characterising and assessing threats

Evaluating the vulnerability of critical assets to particular threats

Determination of risks

Identification of techniques for minimising these risks

Prioritisation of risk minimisation measures

18FINANCIAL MANAGEMENT

References:

About.sainsburys.co.uk., 2018. Results, Reports and Presentations. [online] Available at:

https://www.about.sainsburys.co.uk/investors/results-reports-and-presentations [Accessed 6 Aug.

2018].

About.sainsburys.co.uk., 2018. Welcome to Sainsburys Home. [online] Available at:

https://www.about.sainsburys.co.uk/ [Accessed 6 Aug. 2018].

Barr, M.J. and McClellan, G.S., 2018. Budgets and financial management in higher education.

John Wiley & Sons.

Beatty, A. and Liao, S., 2014. Financial accounting in the banking industry: A review of the

empirical literature. Journal of Accounting and Economics, 58(2-3), pp.339-383.

Bekaert, G. and Hodrick, R., 2017. International financial management. Cambridge University

Press.

Cornwall, J.R., Vang, D.O. and Hartman, J.M., 2016. Entrepreneurial financial management: An

applied approach. Routledge.

Dyckman, T.R., Magee, R.P. and Pfeiffer, G.M., 2014. Financial accounting. Cambridge

Business Publishers.

Elliott, B., 2017. Financial Accounting and Reporting 18th Edition. Pearson Higher Ed.

Finkler, S.A., Smith, D.L., Calabrese, T.D. and Purtell, R.M., 2016. Financial management for

public, health, and not-for-profit organizations. CQ Press.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hoskin, R.E., Fizzell, M.R. and Cherry, D.C., 2014. Financial Accounting: a user perspective.

Wiley Global Education.

References:

About.sainsburys.co.uk., 2018. Results, Reports and Presentations. [online] Available at:

https://www.about.sainsburys.co.uk/investors/results-reports-and-presentations [Accessed 6 Aug.

2018].

About.sainsburys.co.uk., 2018. Welcome to Sainsburys Home. [online] Available at:

https://www.about.sainsburys.co.uk/ [Accessed 6 Aug. 2018].

Barr, M.J. and McClellan, G.S., 2018. Budgets and financial management in higher education.

John Wiley & Sons.

Beatty, A. and Liao, S., 2014. Financial accounting in the banking industry: A review of the

empirical literature. Journal of Accounting and Economics, 58(2-3), pp.339-383.

Bekaert, G. and Hodrick, R., 2017. International financial management. Cambridge University

Press.

Cornwall, J.R., Vang, D.O. and Hartman, J.M., 2016. Entrepreneurial financial management: An

applied approach. Routledge.

Dyckman, T.R., Magee, R.P. and Pfeiffer, G.M., 2014. Financial accounting. Cambridge

Business Publishers.

Elliott, B., 2017. Financial Accounting and Reporting 18th Edition. Pearson Higher Ed.

Finkler, S.A., Smith, D.L., Calabrese, T.D. and Purtell, R.M., 2016. Financial management for

public, health, and not-for-profit organizations. CQ Press.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hoskin, R.E., Fizzell, M.R. and Cherry, D.C., 2014. Financial Accounting: a user perspective.

Wiley Global Education.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19FINANCIAL MANAGEMENT

Irimia-Dieguez, A.I., Medina-Lopez, C. and Alfalla-Luque, R., 2015. Financial management of

large projects: A research gap. Procedia Economics and finance, 23, pp.652-657.

Karadag, H., 2015. Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal, 5(1), pp.26-40.

Lafond, C.A., McAleer, A.C. and Wentzel, K., 2016. Enhancing the Link between Technology

and Accounting in Introductory Courses: Evidence From Students. Journal of the Academy of

Business Education, 17.

Martin, L.L., 2016. Financial management for human service administrators. Waveland Press.

Matthew, B.T., 2017. Financial management in the sport industry. Routledge.

McKinney, J.B., 2015. Effective financial management in public and nonprofit agencies. ABC-

CLIO.

Nilsson, F. and Stockenstrand, A.K., 2015. Financial accounting and management control. The

tensions and conflicts between uniformity and uniqueness. Springer, Cham.

Schipper, K., Francis, J. and Weil, R., 2017. Financial Accounting: Introduction to Concepts,

Methods and Uses. Cengage Learning.

Trotman, K., Carson, E. and Gibbins, M., 2015. Financial accounting: an integrated approach.

Cengage Australia.

Trucco, S., 2015. Drivers of the Alignment of Financial Accounting to Management Accounting.

In Financial Accounting (pp. 65-82). Springer, Cham.

Wagenhofer, A., 2015. Usefulness and implications for financial accounting. The Routledge

Companion to Financial Accounting Theory, p.341.

Wang, X.S., 2014. Financial management in the public sector: tools, applications and cases.

Routledge.

Irimia-Dieguez, A.I., Medina-Lopez, C. and Alfalla-Luque, R., 2015. Financial management of

large projects: A research gap. Procedia Economics and finance, 23, pp.652-657.

Karadag, H., 2015. Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal, 5(1), pp.26-40.

Lafond, C.A., McAleer, A.C. and Wentzel, K., 2016. Enhancing the Link between Technology

and Accounting in Introductory Courses: Evidence From Students. Journal of the Academy of

Business Education, 17.

Martin, L.L., 2016. Financial management for human service administrators. Waveland Press.

Matthew, B.T., 2017. Financial management in the sport industry. Routledge.

McKinney, J.B., 2015. Effective financial management in public and nonprofit agencies. ABC-

CLIO.

Nilsson, F. and Stockenstrand, A.K., 2015. Financial accounting and management control. The

tensions and conflicts between uniformity and uniqueness. Springer, Cham.

Schipper, K., Francis, J. and Weil, R., 2017. Financial Accounting: Introduction to Concepts,

Methods and Uses. Cengage Learning.

Trotman, K., Carson, E. and Gibbins, M., 2015. Financial accounting: an integrated approach.

Cengage Australia.

Trucco, S., 2015. Drivers of the Alignment of Financial Accounting to Management Accounting.

In Financial Accounting (pp. 65-82). Springer, Cham.

Wagenhofer, A., 2015. Usefulness and implications for financial accounting. The Routledge

Companion to Financial Accounting Theory, p.341.

Wang, X.S., 2014. Financial management in the public sector: tools, applications and cases.

Routledge.

20FINANCIAL MANAGEMENT

Zietlow, J., Hankin, J.A., Seidner, A. and O'Brien, T., 2018. Financial management for nonprofit

organizations: Policies and practices. John Wiley & Sons.

Zietlow, J., Hankin, J.A., Seidner, A. and O'Brien, T., 2018. Financial management for nonprofit

organizations: Policies and practices. John Wiley & Sons.

1 out of 21

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.