Financial Performance Analysis: Business Review & Ratio Interpretation

VerifiedAdded on 2023/06/12

|15

|2548

|435

Report

AI Summary

This report provides an overview of financial management, emphasizing its importance in business operations and decision-making. It covers key financial statements, including the cash flow statement, income statement, and statement of financial position, and explains how financial ratios are used to analyze and compare financial performance. The report includes a business review template with financial data and computes various profitability, efficiency, and liquidity ratios for 2016, offering interpretations of the results. Furthermore, it elaborates on strategies businesses can use to improve their financial performance, such as repaying debt, minimizing operating expenses, reframing price structures, and investing idle assets. The ultimate goal is to maximize the wealth of the firm and increase shareholder value. Desklib provides access to similar documents and study tools for students.

16841 3005

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Section1............................................................................................................................................1

Discussing the concept and importance of financial management.........................................1

Section 2...........................................................................................................................................3

Explaining the main financial statements and use of ratios in financial management...........3

Section 3 .........................................................................................................................................4

Description of the completed information in the business review template..........................4

Statement of financial performance........................................................................................6

Statement of financial position ..............................................................................................7

Computation of financial ratios with interpretation. ...........................................................10

Section 4 ........................................................................................................................................12

Elaborating the process used by the business to improve financial performance. ..............12

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Section1............................................................................................................................................1

Discussing the concept and importance of financial management.........................................1

Section 2...........................................................................................................................................3

Explaining the main financial statements and use of ratios in financial management...........3

Section 3 .........................................................................................................................................4

Description of the completed information in the business review template..........................4

Statement of financial performance........................................................................................6

Statement of financial position ..............................................................................................7

Computation of financial ratios with interpretation. ...........................................................10

Section 4 ........................................................................................................................................12

Elaborating the process used by the business to improve financial performance. ..............12

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION

Financial management is the process of managing the funds of the business by using the

various management principles. For achieving the goals and objectives of the organisation, it is

crucial to effectively manage the finance of the organisation. It is also helpful in financial

planning which helps to know the amount of capital required by the business (Bao and et.al.,

2021).This report consists basic concept and importance of financial management. There are

several financial statements and use of ratios in the financial management. Ratios helps in

comparing the financial performance with another organisation. It is also helpful in forecasting

the future performance. It includes the computation of income statement, balance sheet and

various ratios. It also encompasses the process used by the business to improve their financial

performance.

MAIN BODY

Section1

Discussing the concept and importance of financial management.

In every organisation, there are several decisions which are broadly classified into:

investing decision, financing decision and dividend decision. The financing decision includes the

decision related to source of raising the funds. The process of financial planning helps in taking

the viable decisions of procuring funds(Coulon, 2020). There are various objectives of financial

management which can be described as given below:

1. It assists in ensuring regular and adequate supply of capital in the enterprise

2. It helps in planning the capital structure which results in increased value of the firm.

3. For optimum utilisation of funds, it is important to effectively utilise the resources.

4. The organisation has to manage the cash flow which helps in improving the profits of the

business.

Importance of financial management:

In every type of organisation, the financial management has its significance role. The

Importance of financial management can be described as given below:

1

Financial management is the process of managing the funds of the business by using the

various management principles. For achieving the goals and objectives of the organisation, it is

crucial to effectively manage the finance of the organisation. It is also helpful in financial

planning which helps to know the amount of capital required by the business (Bao and et.al.,

2021).This report consists basic concept and importance of financial management. There are

several financial statements and use of ratios in the financial management. Ratios helps in

comparing the financial performance with another organisation. It is also helpful in forecasting

the future performance. It includes the computation of income statement, balance sheet and

various ratios. It also encompasses the process used by the business to improve their financial

performance.

MAIN BODY

Section1

Discussing the concept and importance of financial management.

In every organisation, there are several decisions which are broadly classified into:

investing decision, financing decision and dividend decision. The financing decision includes the

decision related to source of raising the funds. The process of financial planning helps in taking

the viable decisions of procuring funds(Coulon, 2020). There are various objectives of financial

management which can be described as given below:

1. It assists in ensuring regular and adequate supply of capital in the enterprise

2. It helps in planning the capital structure which results in increased value of the firm.

3. For optimum utilisation of funds, it is important to effectively utilise the resources.

4. The organisation has to manage the cash flow which helps in improving the profits of the

business.

Importance of financial management:

In every type of organisation, the financial management has its significance role. The

Importance of financial management can be described as given below:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial planning: There is a financial necessity in each organisation. It helps to take

proactive action which helps in forecasting the need of financial resources. All the

business success depends on the financial planning of the enterprise.

Safeguarding and protecting resources : There are limited resources in every

organisation. The financial management helps in allocating resources to the several

departments. It helps in reducing the overspending to single activity( Cui, An, and Zhang,

2021). It assists in eliminating the unnecessary cost of the organisation.

Investment openings : For increasing the wealth of the organisation, it is vital to invest

in the several securities and different projects. The investments helps in improving the

returns and firms safeguard itself from the bad debts by creating a provision in advance.

Economic growth and consistency – When organisation is able to capture the large

market share, the value of the firm will also increase. The consistency in the activities of

the organisation brings growth and results in the increased profitability and turnover of

the business.

Improving standard of living: There are various financial and non financial indicators

for the success of the organisation. The non financial factors include standard of living.

When organisation is capable to improve its profitability, it will also boost the standard of

living of the employees too.

Valuation of the enterprise – When the organisation diversify its operations by

increasing the level of production and firm will be able to manufacture more product

lines which increase the value of firms by holding large market share(Dennison, 2018)

Tax planning : The financial planning also ensures the effective planning for tax. When

firm does not manage the liability of the tax, it will increase the tax payable by the firm.

Therefore, an enterprise should take effective measures to reduce the liability of the tax.

2

proactive action which helps in forecasting the need of financial resources. All the

business success depends on the financial planning of the enterprise.

Safeguarding and protecting resources : There are limited resources in every

organisation. The financial management helps in allocating resources to the several

departments. It helps in reducing the overspending to single activity( Cui, An, and Zhang,

2021). It assists in eliminating the unnecessary cost of the organisation.

Investment openings : For increasing the wealth of the organisation, it is vital to invest

in the several securities and different projects. The investments helps in improving the

returns and firms safeguard itself from the bad debts by creating a provision in advance.

Economic growth and consistency – When organisation is able to capture the large

market share, the value of the firm will also increase. The consistency in the activities of

the organisation brings growth and results in the increased profitability and turnover of

the business.

Improving standard of living: There are various financial and non financial indicators

for the success of the organisation. The non financial factors include standard of living.

When organisation is capable to improve its profitability, it will also boost the standard of

living of the employees too.

Valuation of the enterprise – When the organisation diversify its operations by

increasing the level of production and firm will be able to manufacture more product

lines which increase the value of firms by holding large market share(Dennison, 2018)

Tax planning : The financial planning also ensures the effective planning for tax. When

firm does not manage the liability of the tax, it will increase the tax payable by the firm.

Therefore, an enterprise should take effective measures to reduce the liability of the tax.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 2

Explaining the main financial statements and use of ratios in financial management.

Financial statements or records are the written records of the enterprise which shows the

financial performance of the company. There are three main financial statements of the

organisation which can be described as given below:

1,) Cash flow statements – It indicates the flow of cash in the organisation. There can be positive

or negative cash flows in the organisation. The positive cash flows occurs when the income is

higher than the expenses. On the other hand, when expenses are greater than the income, it is

termed as negative cash flows. There are three types of activities in the cash flow: cash flow

from operating activities, investing and financing activities(Di Fabio, 2021) . The cash flow

from operating activities includes the adjustment of working capital and day to day activities of

the organisation. The investing activities include the purchase and sale of fixed assets. In

financing activities, the issue and redemptions of shares and debentures is being recorded.

2.) Income statement – It is also known as profit and loss account. It includes income and

expenses of the organisation. It is a summarized form of statements which covers

revenue, cost and expenses incurred during a particular period. There are two methods of

preparing profit and loss which is cash method and accrual method. It is usually prepared

on annual and quarterly basis. It is also useful in computing the financial ratios such as

gross profit ratio, net profit ratio, turnover ratio etc. the expenses included in the profit

and loss are rent paid, printing and stationary expenses and selling expenses. The income

of profit and loss include commission received and interest received.

3.) Statement of financial position – The balance sheet is a statement which shows the net

assets and liabilities owned by the enterprise. The assets are further divided into current

assets and non current assets. The current assets include those assets which remain in the

business for less than or up to one year. Some of the examples of current assets are

debtors and bill receivable(Dindiene and et.al., 2021).. The non current assets are those

which remain in business for more than one year. Examples of fixed assets are plant,

machinery and fixtures. The liabilities of the business are divided into current liabilities

and non current liabilities. Examples of current liabilities are creditors and bill payable.

The non current liabilities include long term debentures and loans.

3

Explaining the main financial statements and use of ratios in financial management.

Financial statements or records are the written records of the enterprise which shows the

financial performance of the company. There are three main financial statements of the

organisation which can be described as given below:

1,) Cash flow statements – It indicates the flow of cash in the organisation. There can be positive

or negative cash flows in the organisation. The positive cash flows occurs when the income is

higher than the expenses. On the other hand, when expenses are greater than the income, it is

termed as negative cash flows. There are three types of activities in the cash flow: cash flow

from operating activities, investing and financing activities(Di Fabio, 2021) . The cash flow

from operating activities includes the adjustment of working capital and day to day activities of

the organisation. The investing activities include the purchase and sale of fixed assets. In

financing activities, the issue and redemptions of shares and debentures is being recorded.

2.) Income statement – It is also known as profit and loss account. It includes income and

expenses of the organisation. It is a summarized form of statements which covers

revenue, cost and expenses incurred during a particular period. There are two methods of

preparing profit and loss which is cash method and accrual method. It is usually prepared

on annual and quarterly basis. It is also useful in computing the financial ratios such as

gross profit ratio, net profit ratio, turnover ratio etc. the expenses included in the profit

and loss are rent paid, printing and stationary expenses and selling expenses. The income

of profit and loss include commission received and interest received.

3.) Statement of financial position – The balance sheet is a statement which shows the net

assets and liabilities owned by the enterprise. The assets are further divided into current

assets and non current assets. The current assets include those assets which remain in the

business for less than or up to one year. Some of the examples of current assets are

debtors and bill receivable(Dindiene and et.al., 2021).. The non current assets are those

which remain in business for more than one year. Examples of fixed assets are plant,

machinery and fixtures. The liabilities of the business are divided into current liabilities

and non current liabilities. Examples of current liabilities are creditors and bill payable.

The non current liabilities include long term debentures and loans.

3

Financial ratios are the important tool for financial management. It is a numerical value

which helps to compare the values of two given firms. Some of the examples of ratios are

liquidity ratios, profitability ratios, solvency ratios and activity ratios. The importance of

financial ratios can be described as given below:

Industry analysis and trends – The financial ratios signify the trend in the current

industry(Haddad, Shibly and Haddad, 2020). It helps to set benchmark for the complete

industry. The standards maintained helps to plan the organisational strategy and acts as a

yardstick for measuring performance.

Planning and performance – The financial ratios helps top level managers and higher

authorities to plan the strategical and financial plans for the organisation. The current

performance of the enterprise helps to forecast the future performance for improving the

financial health of the organisation.

Understanding diverse items of balance sheet – The financial ratios analyse the distinct

items of balance sheet, profit & loss to interpret the ratios of the organisation (Henager

and Cude, 2019)

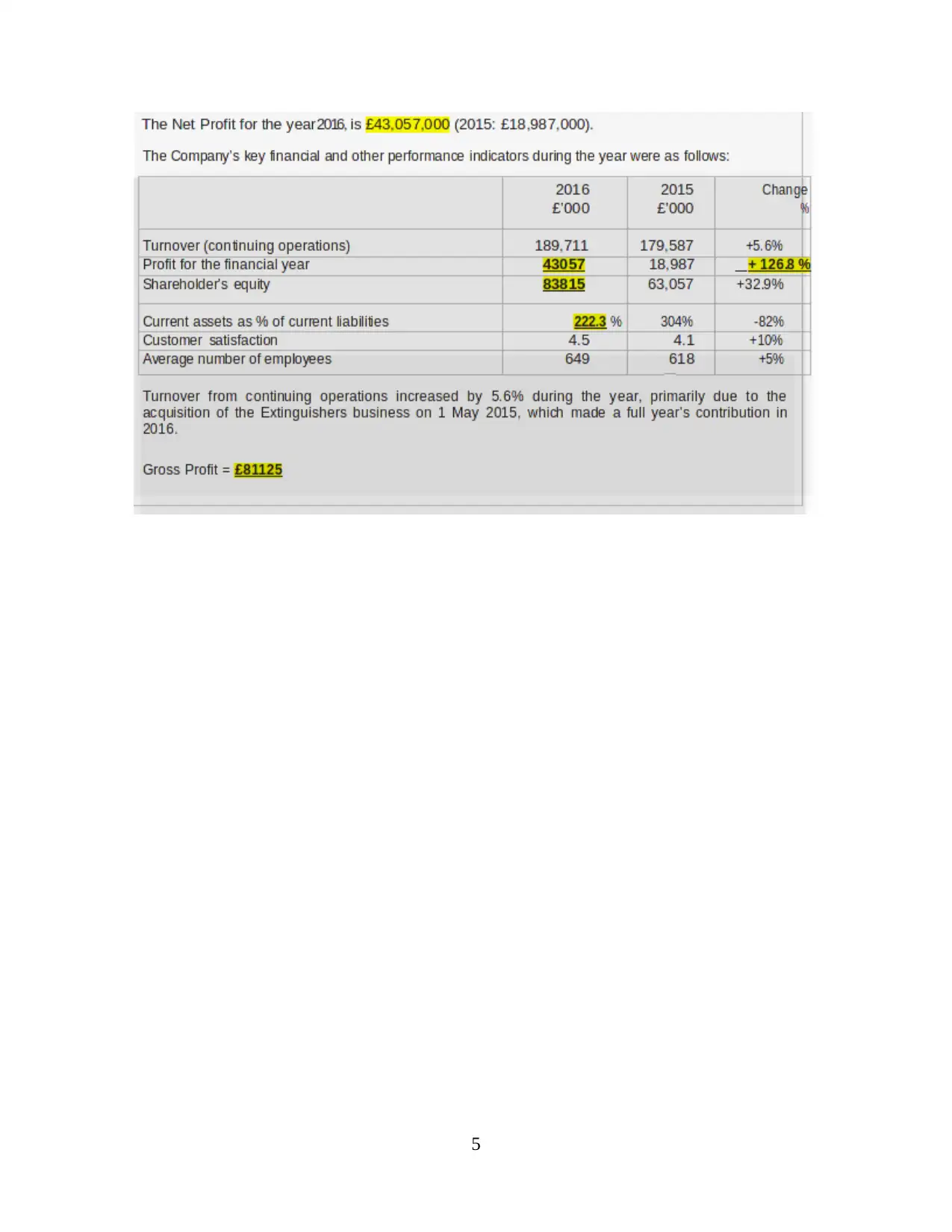

Section 3

Description of the completed information in the business review template

4

which helps to compare the values of two given firms. Some of the examples of ratios are

liquidity ratios, profitability ratios, solvency ratios and activity ratios. The importance of

financial ratios can be described as given below:

Industry analysis and trends – The financial ratios signify the trend in the current

industry(Haddad, Shibly and Haddad, 2020). It helps to set benchmark for the complete

industry. The standards maintained helps to plan the organisational strategy and acts as a

yardstick for measuring performance.

Planning and performance – The financial ratios helps top level managers and higher

authorities to plan the strategical and financial plans for the organisation. The current

performance of the enterprise helps to forecast the future performance for improving the

financial health of the organisation.

Understanding diverse items of balance sheet – The financial ratios analyse the distinct

items of balance sheet, profit & loss to interpret the ratios of the organisation (Henager

and Cude, 2019)

Section 3

Description of the completed information in the business review template

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

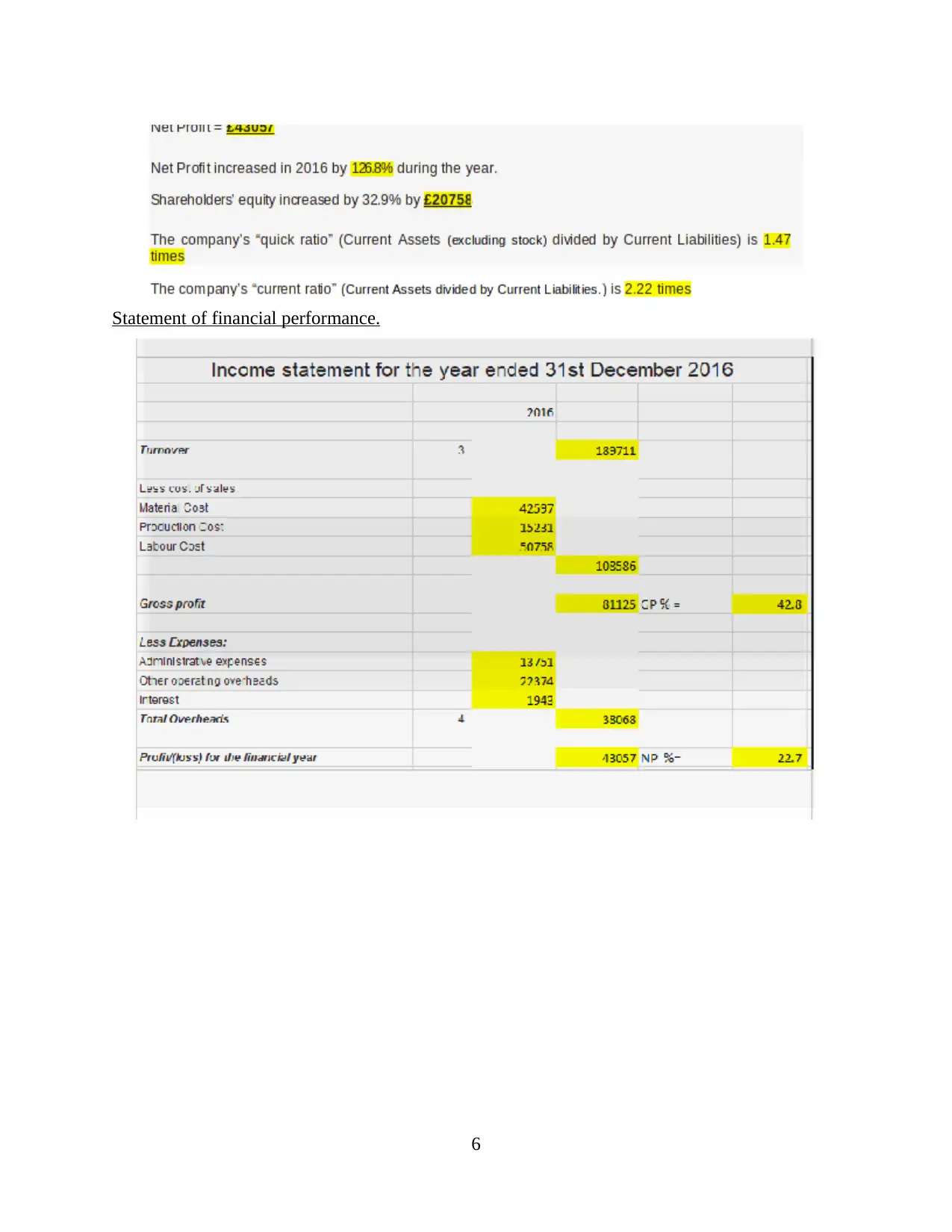

Statement of financial performance.

6

6

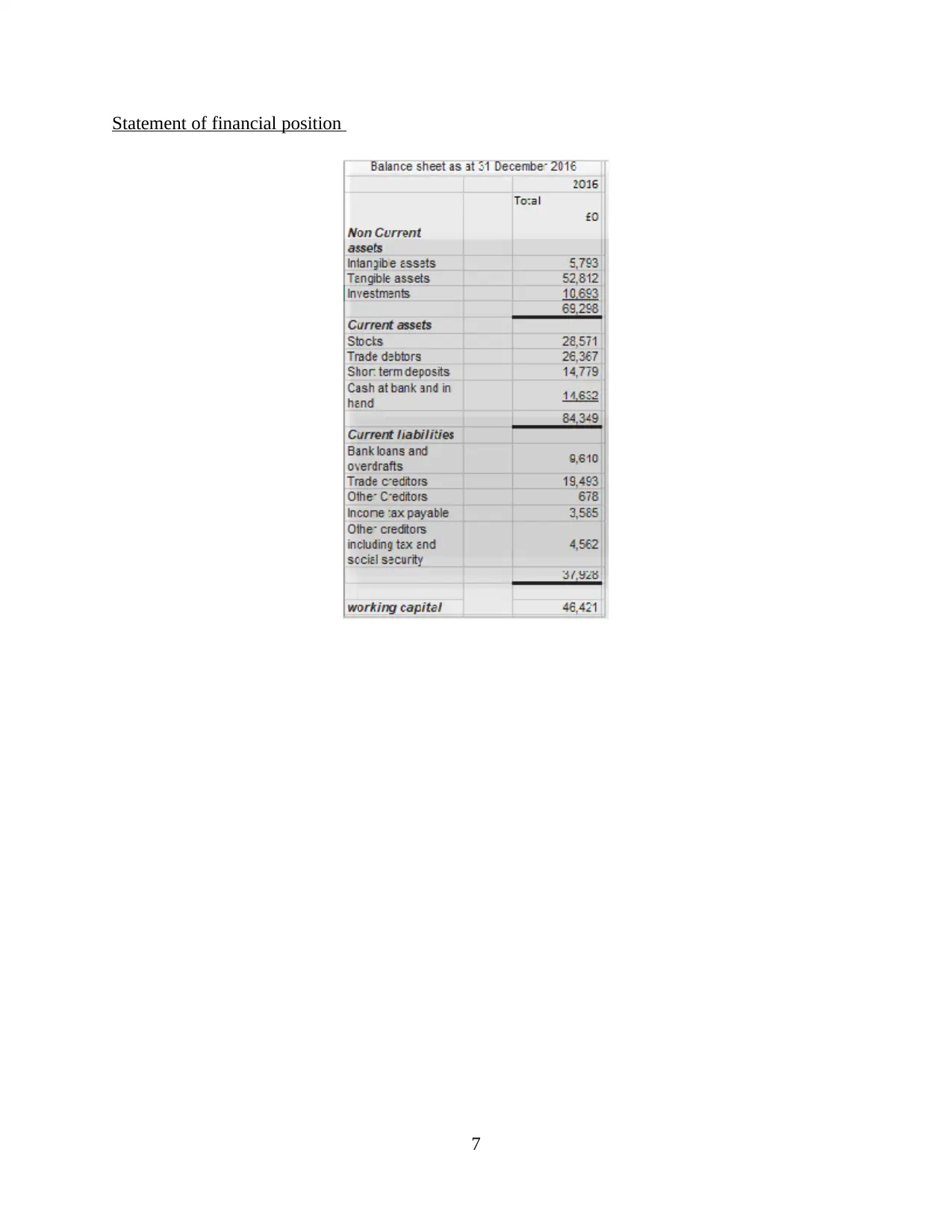

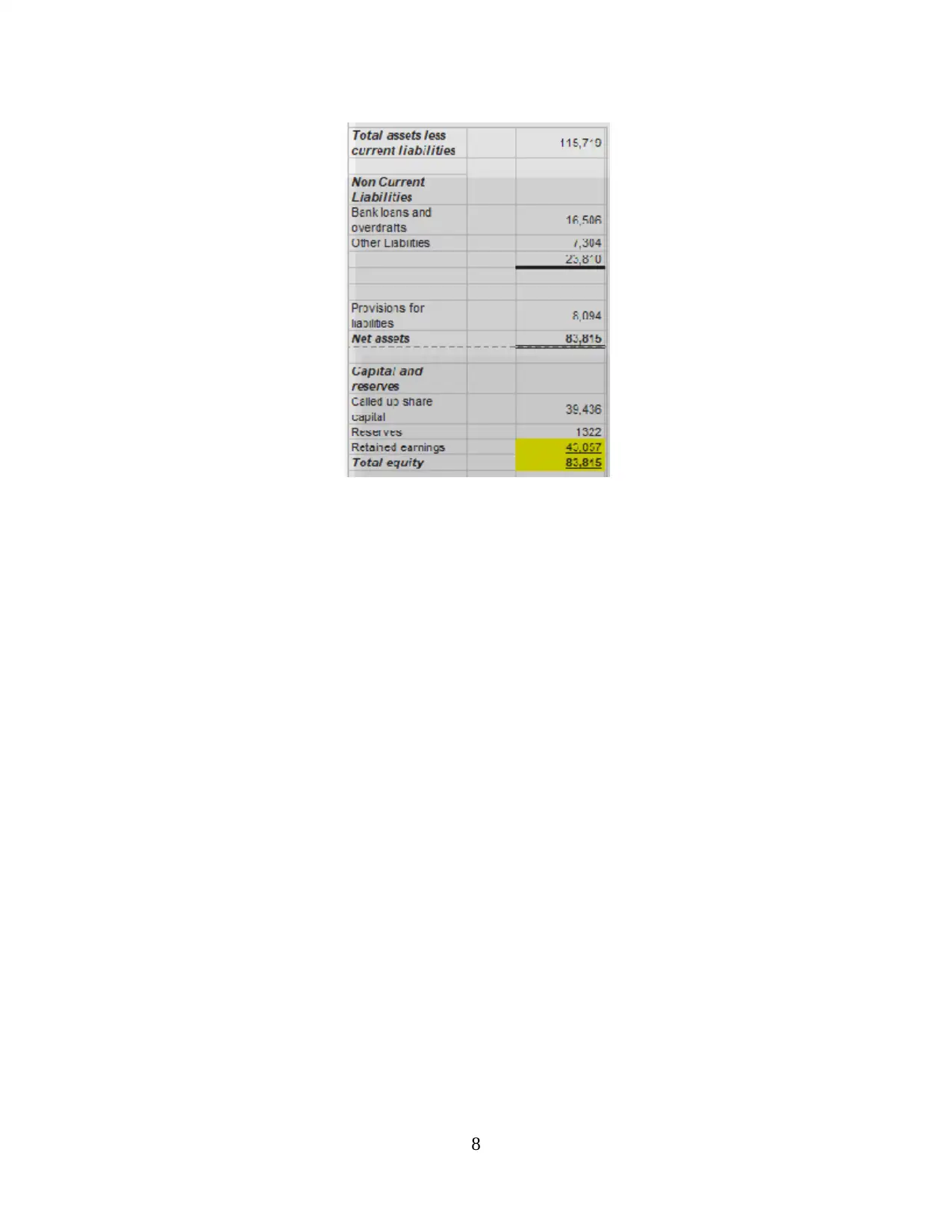

Statement of financial position

7

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

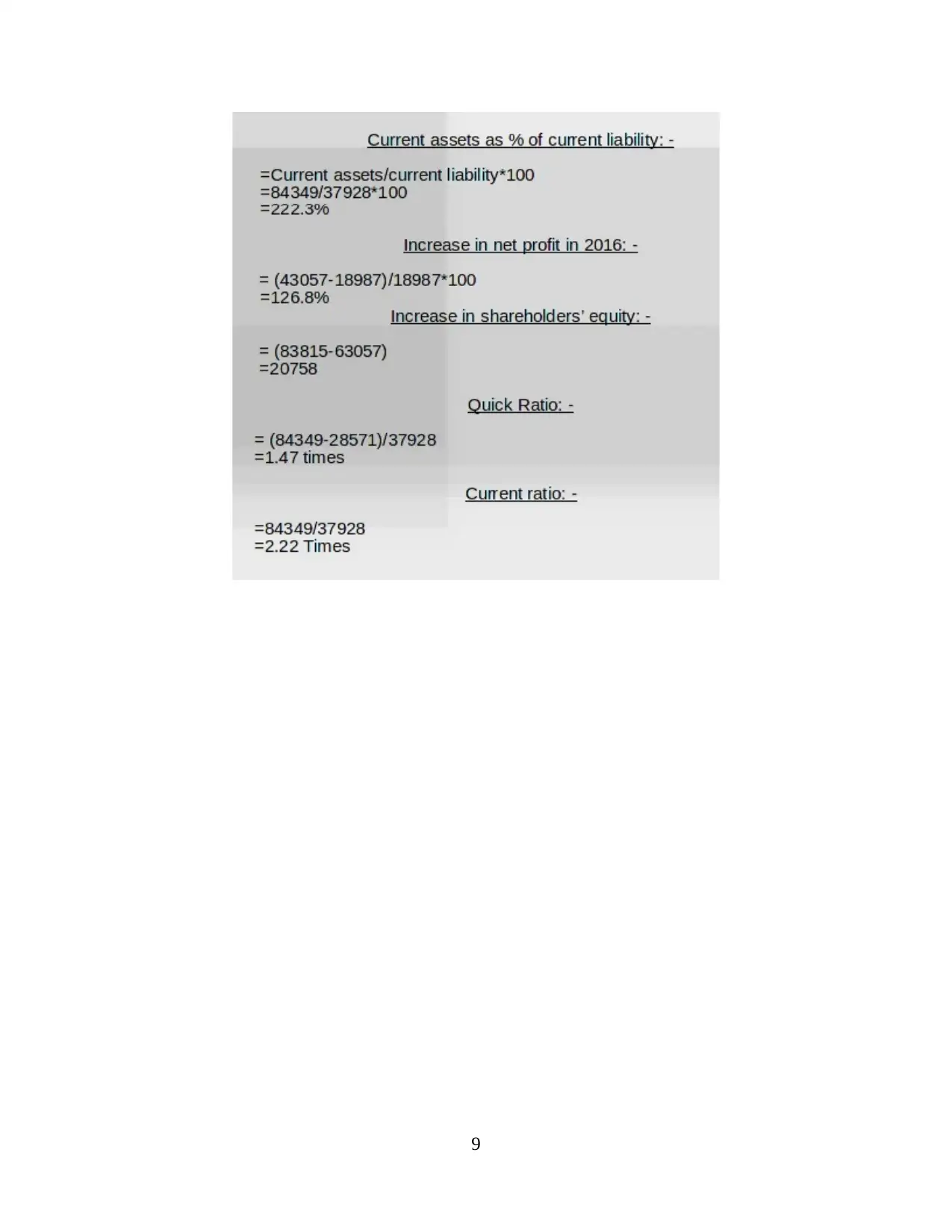

9

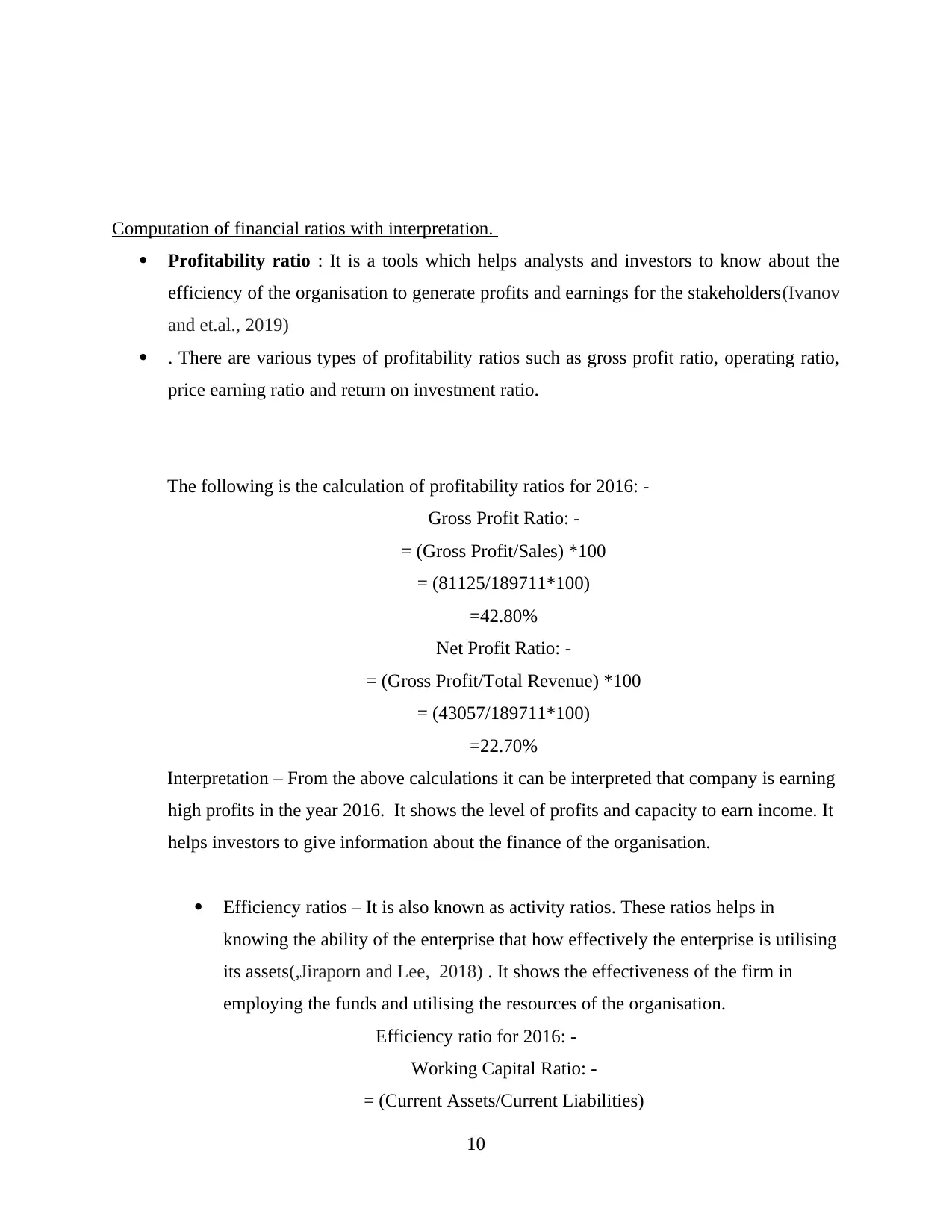

Computation of financial ratios with interpretation.

Profitability ratio : It is a tools which helps analysts and investors to know about the

efficiency of the organisation to generate profits and earnings for the stakeholders(Ivanov

and et.al., 2019)

. There are various types of profitability ratios such as gross profit ratio, operating ratio,

price earning ratio and return on investment ratio.

The following is the calculation of profitability ratios for 2016: -

Gross Profit Ratio: -

= (Gross Profit/Sales) *100

= (81125/189711*100)

=42.80%

Net Profit Ratio: -

= (Gross Profit/Total Revenue) *100

= (43057/189711*100)

=22.70%

Interpretation – From the above calculations it can be interpreted that company is earning

high profits in the year 2016. It shows the level of profits and capacity to earn income. It

helps investors to give information about the finance of the organisation.

Efficiency ratios – It is also known as activity ratios. These ratios helps in

knowing the ability of the enterprise that how effectively the enterprise is utilising

its assets(,Jiraporn and Lee, 2018) . It shows the effectiveness of the firm in

employing the funds and utilising the resources of the organisation.

Efficiency ratio for 2016: -

Working Capital Ratio: -

= (Current Assets/Current Liabilities)

10

Profitability ratio : It is a tools which helps analysts and investors to know about the

efficiency of the organisation to generate profits and earnings for the stakeholders(Ivanov

and et.al., 2019)

. There are various types of profitability ratios such as gross profit ratio, operating ratio,

price earning ratio and return on investment ratio.

The following is the calculation of profitability ratios for 2016: -

Gross Profit Ratio: -

= (Gross Profit/Sales) *100

= (81125/189711*100)

=42.80%

Net Profit Ratio: -

= (Gross Profit/Total Revenue) *100

= (43057/189711*100)

=22.70%

Interpretation – From the above calculations it can be interpreted that company is earning

high profits in the year 2016. It shows the level of profits and capacity to earn income. It

helps investors to give information about the finance of the organisation.

Efficiency ratios – It is also known as activity ratios. These ratios helps in

knowing the ability of the enterprise that how effectively the enterprise is utilising

its assets(,Jiraporn and Lee, 2018) . It shows the effectiveness of the firm in

employing the funds and utilising the resources of the organisation.

Efficiency ratio for 2016: -

Working Capital Ratio: -

= (Current Assets/Current Liabilities)

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.