Managing Financial Resources and Decisions Report for Sweet Menu

VerifiedAdded on 2020/01/28

|16

|5484

|50

Report

AI Summary

This report analyzes the financial resource management and decision-making processes of Sweet Menu Restaurant, a firm planning to expand. It identifies internal and external sources of finance, including personal savings, retained earnings, share issuance, and bank loans, while also exploring their implications and associated costs like opportunity cost, dividends, and interest. The report emphasizes the importance of financial planning for optimal fund utilization, cash management, and investment selection. It also examines the information needs of various stakeholders, such as suppliers, government, investors, customers, and financial executives. Furthermore, the report covers budgeting, unit cost calculations, investment appraisal techniques, and the interpretation of financial statements, providing a comprehensive overview of financial management within the context of a growing restaurant business.

Managing financial resources

and decisions

and decisions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identification of sources of finance available to business.....................................................3

1.2 Implications of sources of finance identified.........................................................................4

1.3 Evaluation of most appropriate sources of finance................................................................4

TASK 2............................................................................................................................................5

2.1 Costs of different sources of finance for Sweet Menu Restaurant.........................................5

2.2 Importance of financial planning for Sweet Menu Restaurant..............................................6

2.3 Information needs of different decision makers....................................................................7

2.4 Impact of sources of finance on financial statements of Sweet Menu Restaurant.................7

TASK 3............................................................................................................................................8

3.1 Analysis of budgets and make appropriate decisions............................................................8

3.2 Calculation of unit costs and pricing decisions......................................................................9

3.3 Viability of two projects using investment appraisal technique..........................................10

TASK 4..........................................................................................................................................11

4.1 Main financial statements....................................................................................................11

4.2 Comparison of appropriate formats of financial statements for different types of business

....................................................................................................................................................12

4.3 Interpretation of financial statements of two restaurant using ratios...................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identification of sources of finance available to business.....................................................3

1.2 Implications of sources of finance identified.........................................................................4

1.3 Evaluation of most appropriate sources of finance................................................................4

TASK 2............................................................................................................................................5

2.1 Costs of different sources of finance for Sweet Menu Restaurant.........................................5

2.2 Importance of financial planning for Sweet Menu Restaurant..............................................6

2.3 Information needs of different decision makers....................................................................7

2.4 Impact of sources of finance on financial statements of Sweet Menu Restaurant.................7

TASK 3............................................................................................................................................8

3.1 Analysis of budgets and make appropriate decisions............................................................8

3.2 Calculation of unit costs and pricing decisions......................................................................9

3.3 Viability of two projects using investment appraisal technique..........................................10

TASK 4..........................................................................................................................................11

4.1 Main financial statements....................................................................................................11

4.2 Comparison of appropriate formats of financial statements for different types of business

....................................................................................................................................................12

4.3 Interpretation of financial statements of two restaurant using ratios...................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

2

INTRODUCTION

Financial management is referred to as a field where decision making regarding

utilization and allocation of funds takes place. It involves efficient and effective management of

financial resources that leads to attainment of success by the organization. With the assistance of

this, harmonization of individual’s motives can be done with that of business goals (Hall and

Lerner, 2010). Therefore, the role of financial management can be greatly viewed towards

planning and controlling in relation to monetary resources.

In the present report, management of financial resources and decisions has been

discussed with respect to Sweet Menu Restaurant. It is a reputable restaurant that is situated in

Gants Hill in East London. The firm is renowned for offering intercontinental menus at

reasonable prices. The present report entails to understand the sources of finance available to the

business. Further, it includes implications of financial sources within organization. At last, this

report also covers analysis of financial performance of Sweet Menu Restaurant.

TASK 1

1.1 Identification of sources of finance available to business

As per the case, Sweet Menu Restaurant is a reputable firm that offers inter-continental

menus at reasonable prices. The organization is planning to open two branches in Central

London and Croydon. It has been estimated that restaurant requires £300,000 and £500,000 to

start up proposed new branches. This calls for the needs of financial resources. Sources of

finance are divided into two. This includes internal and external. These have been enumerated in

the manner below:

Internal sources: It includes sources that are present within the organization. Further, for the

purpose of obtaining funds through such sources, business has to put little efforts. Owners personal saving: It is an amount that is being saved by the owner. This can be

used with the aim to meet expansion need of business (Calitz and Fourie, 2010). Such can

be used by individual while starting up new firm. Retained earnings: It is regarded as the part of profit that is kept aside with the aim to

meet future contingencies. This can be used by Sweet Menu Restaurant in order to

accomplish its financial needs in an effective manner.

3

Financial management is referred to as a field where decision making regarding

utilization and allocation of funds takes place. It involves efficient and effective management of

financial resources that leads to attainment of success by the organization. With the assistance of

this, harmonization of individual’s motives can be done with that of business goals (Hall and

Lerner, 2010). Therefore, the role of financial management can be greatly viewed towards

planning and controlling in relation to monetary resources.

In the present report, management of financial resources and decisions has been

discussed with respect to Sweet Menu Restaurant. It is a reputable restaurant that is situated in

Gants Hill in East London. The firm is renowned for offering intercontinental menus at

reasonable prices. The present report entails to understand the sources of finance available to the

business. Further, it includes implications of financial sources within organization. At last, this

report also covers analysis of financial performance of Sweet Menu Restaurant.

TASK 1

1.1 Identification of sources of finance available to business

As per the case, Sweet Menu Restaurant is a reputable firm that offers inter-continental

menus at reasonable prices. The organization is planning to open two branches in Central

London and Croydon. It has been estimated that restaurant requires £300,000 and £500,000 to

start up proposed new branches. This calls for the needs of financial resources. Sources of

finance are divided into two. This includes internal and external. These have been enumerated in

the manner below:

Internal sources: It includes sources that are present within the organization. Further, for the

purpose of obtaining funds through such sources, business has to put little efforts. Owners personal saving: It is an amount that is being saved by the owner. This can be

used with the aim to meet expansion need of business (Calitz and Fourie, 2010). Such can

be used by individual while starting up new firm. Retained earnings: It is regarded as the part of profit that is kept aside with the aim to

meet future contingencies. This can be used by Sweet Menu Restaurant in order to

accomplish its financial needs in an effective manner.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

External sources: It is comprised of sources that can be obtained by business from outside. Issue of shares: Through issuance of shares, firm can gain long term funds from public.

The amount which is received by the restaurant can be utilized as start-up capital by the

organization.

Long term bank loan: Bank acts as effective financial source that lends funds to business

for the specified time duration (Du and Girma, 2012). With this, new concern can fulfill

their long term needs. Such funds can be utilized with the aim to carry out business

operations in an appropriate manner.

1.2 Implications of sources of finance identified

Financial sources available to new business possess certain implications. When, firm

makes use of personal saving then, in such case there is dilution of control. This implies that

individuals lose control over the amount that could have been used in fulfilling the needs of

business in future course of time.

In addition to this, there are certain implications associated when new business obtains

funds through external sources. In order to start up new business, Sweet Menu Restaurant takes

loan from bank. For this, it has to keep certain assets as a part of security. In situation, when

business does not make payment of interest on time then at this situation, bank can take legal

action against the organization (Fabbri and Menichini, 2010). Moreover, financial institution can

acquire all the assets of business in order to recover the amount borrowed as loan. If, in case,

amount is not recovered through asset then bank declares firm as bankrupt. This has greater

impact on the credit rating of new business. Further, this affects the reputation of corporation to a

greater extent and influences its survival in the market for longer run. Sweet Menu Restaurant

also obtains funds through issue of shares. An implication to such is that in case firm does not

make timely payment of dividend to the shareholders then they can take legal action against the

business. Such greatly affects the goodwill of new concern in the marketplace.

1.3 Evaluation of most appropriate sources of finance

For the purpose of starting up new business, the most appropriate sources of finance are

as follows: Retained earnings: In accordance with the case scenario, Sweet Menu Restaurant requires

£300,000 and £500,000 to start up proposed new branches. Based upon the evaluation

4

The amount which is received by the restaurant can be utilized as start-up capital by the

organization.

Long term bank loan: Bank acts as effective financial source that lends funds to business

for the specified time duration (Du and Girma, 2012). With this, new concern can fulfill

their long term needs. Such funds can be utilized with the aim to carry out business

operations in an appropriate manner.

1.2 Implications of sources of finance identified

Financial sources available to new business possess certain implications. When, firm

makes use of personal saving then, in such case there is dilution of control. This implies that

individuals lose control over the amount that could have been used in fulfilling the needs of

business in future course of time.

In addition to this, there are certain implications associated when new business obtains

funds through external sources. In order to start up new business, Sweet Menu Restaurant takes

loan from bank. For this, it has to keep certain assets as a part of security. In situation, when

business does not make payment of interest on time then at this situation, bank can take legal

action against the organization (Fabbri and Menichini, 2010). Moreover, financial institution can

acquire all the assets of business in order to recover the amount borrowed as loan. If, in case,

amount is not recovered through asset then bank declares firm as bankrupt. This has greater

impact on the credit rating of new business. Further, this affects the reputation of corporation to a

greater extent and influences its survival in the market for longer run. Sweet Menu Restaurant

also obtains funds through issue of shares. An implication to such is that in case firm does not

make timely payment of dividend to the shareholders then they can take legal action against the

business. Such greatly affects the goodwill of new concern in the marketplace.

1.3 Evaluation of most appropriate sources of finance

For the purpose of starting up new business, the most appropriate sources of finance are

as follows: Retained earnings: In accordance with the case scenario, Sweet Menu Restaurant requires

£300,000 and £500,000 to start up proposed new branches. Based upon the evaluation

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

carried out above, it can be determined that internal sources of finance such as retained

earnings are the most suitable means of obtaining funds. The reason to this is that it does

not involve huge cost for the organization (Zager and Zager, 2006). Such source acts as a

continuous source for business that eliminates financial requirement for the organization. Issue of shares: By issuing shares, firm can acquire long term funds from public. It acts

as permanent sources of capital for Sweet Menu Restaurant. Company has to pay

dividend from the amount of profit in return of the amount invested by public within new

concern (Yescombe, 2011). This might decrease the profitability of firm but it can fulfill

the financial needs of business with effectiveness.

Long term loan from bank: In order to carry out the operations of business, it can borrow

funds from financial institution. Money acquired as loan can be taken for specified span

of time. But for the purpose of obtaining this, business is required to make payment of

interest on the amount of loan (Paim and et.al, 2011). Through this, company can meet its

financial contingencies in future course of time. It is considered as an effective source

that can accomplish short term, medium term and long term needs of Sweet Menu

Restaurant.

TASK 2

2.1 Costs of different sources of finance for Sweet Menu Restaurant

There are several cost associated with the different sources of finance. Such has been

enumerated in the manner below: Opportunity cost: It is regarded as the cost of sacrifice that is incurred by the organization

when it lets go next best alternative. The personal saving amount could utilize by the new

firm in accomplishing its need for future. Thus, this can be considered loss to the

organization as, it can be utilized in financing other crucial business activities (Saber and

Venayagamoorthy, 2011). Further, in case of retained earnings, the amount of profit can

be used to meet future contingencies. This acts as opportunity cost attached with retained

earnings. Dividends: By issuing share to the public, firm can obtain funds. Dividend is the cost

associated with issuance of shares. It is important for new business to make payment of

5

earnings are the most suitable means of obtaining funds. The reason to this is that it does

not involve huge cost for the organization (Zager and Zager, 2006). Such source acts as a

continuous source for business that eliminates financial requirement for the organization. Issue of shares: By issuing shares, firm can acquire long term funds from public. It acts

as permanent sources of capital for Sweet Menu Restaurant. Company has to pay

dividend from the amount of profit in return of the amount invested by public within new

concern (Yescombe, 2011). This might decrease the profitability of firm but it can fulfill

the financial needs of business with effectiveness.

Long term loan from bank: In order to carry out the operations of business, it can borrow

funds from financial institution. Money acquired as loan can be taken for specified span

of time. But for the purpose of obtaining this, business is required to make payment of

interest on the amount of loan (Paim and et.al, 2011). Through this, company can meet its

financial contingencies in future course of time. It is considered as an effective source

that can accomplish short term, medium term and long term needs of Sweet Menu

Restaurant.

TASK 2

2.1 Costs of different sources of finance for Sweet Menu Restaurant

There are several cost associated with the different sources of finance. Such has been

enumerated in the manner below: Opportunity cost: It is regarded as the cost of sacrifice that is incurred by the organization

when it lets go next best alternative. The personal saving amount could utilize by the new

firm in accomplishing its need for future. Thus, this can be considered loss to the

organization as, it can be utilized in financing other crucial business activities (Saber and

Venayagamoorthy, 2011). Further, in case of retained earnings, the amount of profit can

be used to meet future contingencies. This acts as opportunity cost attached with retained

earnings. Dividends: By issuing share to the public, firm can obtain funds. Dividend is the cost

associated with issuance of shares. It is important for new business to make payment of

5

fix amount from the part of profit. This can result in decreasing profitability of the

organization.

Interest: In order to start up new business, firm has to take long term loan from the bank.

Cost attached in acquiring this is interest (Demiroren and Yilmaz, 2010). Sweet Menu

Restaurant has to make payment of interest on time for the loan amount. This acts as cost

associated with funds obtained through bank.

2.2 Importance of financial planning for Sweet Menu Restaurant

There is huge importance of financial planning for the organization such as Sweet Menu

Restaurant which has been enumerated below: Optimum use of funds: The role of financial planning can be greatly viewed towards

making effective and efficient use of financial resources. Through this, financial manager

can take appropriate decisions regarding the allocation of resources to several activities of

new concern (Hillier, Grinblatt and Titman, 2011). With the assistance of budget

planning, firm can achieve success for the longer term. Ensures cash management: Financial planning plays a significant role for new business

project in the management of cash. Through this, Sweet Menu Restaurant can keep a

track on the outflow of cash. However, it also enhances the amount of cash inflow with

business. Therefore, with appropriate financial planning, business can grow and expand

its operations. Identifies shortages and surpluses: With the assistance of financial planning, executive

can examine the activities where surplus of funds is required (Drury, 2009). Further it

also determines the activities that require fewer amounts of financial resources.

Therefore, allocation of funds needs to be done with greater appropriateness. Makes selection of right investment option: It is essential to make selection of right

investment proposal. This can be done with the assistance of financial planning. This is

because it makes evaluation of investment on the basis of risk, objectives etc. Through

this, greater direction can be offered to the business regarding selection of the best suited

investment option for organization that fulfills their goal.

6

organization.

Interest: In order to start up new business, firm has to take long term loan from the bank.

Cost attached in acquiring this is interest (Demiroren and Yilmaz, 2010). Sweet Menu

Restaurant has to make payment of interest on time for the loan amount. This acts as cost

associated with funds obtained through bank.

2.2 Importance of financial planning for Sweet Menu Restaurant

There is huge importance of financial planning for the organization such as Sweet Menu

Restaurant which has been enumerated below: Optimum use of funds: The role of financial planning can be greatly viewed towards

making effective and efficient use of financial resources. Through this, financial manager

can take appropriate decisions regarding the allocation of resources to several activities of

new concern (Hillier, Grinblatt and Titman, 2011). With the assistance of budget

planning, firm can achieve success for the longer term. Ensures cash management: Financial planning plays a significant role for new business

project in the management of cash. Through this, Sweet Menu Restaurant can keep a

track on the outflow of cash. However, it also enhances the amount of cash inflow with

business. Therefore, with appropriate financial planning, business can grow and expand

its operations. Identifies shortages and surpluses: With the assistance of financial planning, executive

can examine the activities where surplus of funds is required (Drury, 2009). Further it

also determines the activities that require fewer amounts of financial resources.

Therefore, allocation of funds needs to be done with greater appropriateness. Makes selection of right investment option: It is essential to make selection of right

investment proposal. This can be done with the assistance of financial planning. This is

because it makes evaluation of investment on the basis of risk, objectives etc. Through

this, greater direction can be offered to the business regarding selection of the best suited

investment option for organization that fulfills their goal.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Increases the capital: With the assistance of proper financial planning, business can

increase the amount of cash inflow which results in improving the amount of capital in

the firm. It is important for improving well-being of Sweet Menu Restaurant.

2.3 Information needs of different decision makers

Decision maker is required to make choices. For the purpose of taking decisions, they

need information in relation to the firm. Decision makers along with their needs related to

information are as follows: Supplier: These are those decision makers who offer inputs in form of raw material to the

organization. They need information in relation to the credit rating of the business.

Further with the information they can development tactical plans that relates with

planning regarding whether to offer inputs or not. This is due to the reason that they

require business to pay for their invoices within reasonable time limit. Government: Information required by government involves profitability data of the firm.

With this, regulatory authority can gain insight to the amount of tax that needs to be paid

by Sweet Menu Restaurant. Moreover, government investigates whether the amount

deposited as tax is in a correct manner or not (Eccles and Holt, 2005).Along with this,

government needs information on whether organization is incorporated with corporate

social responsibility or not. Further, government takes action in order to exert pressure on

business to accomplish its responsibility towards society welfare. With this information

government can carry out its strategic operation that involves development of plan for the

company's next move. Investor: Investors need information in relation to the profitability and efficiency position

of the organization. With this, investor can decide on the firm where it can make

investment. It is important that valuable return is offered to the investor by business. Due

to this, information regarding profitability is essential for the investors as it facilitates in

decision making process. Customer: They need information in relation to the image of brand and goodwill of the

company. Therefore, this assists them in making decision with respect to the type of

goods that they need to be purchased and from who they will be. They need to take

7

increase the amount of cash inflow which results in improving the amount of capital in

the firm. It is important for improving well-being of Sweet Menu Restaurant.

2.3 Information needs of different decision makers

Decision maker is required to make choices. For the purpose of taking decisions, they

need information in relation to the firm. Decision makers along with their needs related to

information are as follows: Supplier: These are those decision makers who offer inputs in form of raw material to the

organization. They need information in relation to the credit rating of the business.

Further with the information they can development tactical plans that relates with

planning regarding whether to offer inputs or not. This is due to the reason that they

require business to pay for their invoices within reasonable time limit. Government: Information required by government involves profitability data of the firm.

With this, regulatory authority can gain insight to the amount of tax that needs to be paid

by Sweet Menu Restaurant. Moreover, government investigates whether the amount

deposited as tax is in a correct manner or not (Eccles and Holt, 2005).Along with this,

government needs information on whether organization is incorporated with corporate

social responsibility or not. Further, government takes action in order to exert pressure on

business to accomplish its responsibility towards society welfare. With this information

government can carry out its strategic operation that involves development of plan for the

company's next move. Investor: Investors need information in relation to the profitability and efficiency position

of the organization. With this, investor can decide on the firm where it can make

investment. It is important that valuable return is offered to the investor by business. Due

to this, information regarding profitability is essential for the investors as it facilitates in

decision making process. Customer: They need information in relation to the image of brand and goodwill of the

company. Therefore, this assists them in making decision with respect to the type of

goods that they need to be purchased and from who they will be. They need to take

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

tactical decisions which imply carrying out the plan regarding purchasing of the

company's product.

Financial executive: In includes higher level managers, middle level and lower level

managers. Higher level managers include CEO and directors that needs to take strategic

decision for development of firm. However middle level managers include division

managers and regional managers who are required to take decision in relation to strategic

business unit, motivation as well as improvement of performance.

2.4 Impact of sources of finance on financial statements of Sweet Menu Restaurant

Transactions that are being carried out within the firm are demonstrated in the financial

statements. It involves financial as well as operating transactions. Kinds of financial sources that

are utilized by Sweet Menu Restaurant impact the financial position of business. Further, cost

associated with financial sources affects the statement of profit to a greater extent. It has been

stated above that the most suitable sources of finance for Sweet Menu Restaurant include

retained earnings and loan from bank. Cost attached with retailed earning is opportunity cost that

is not reflected in profit and loss account. But, the retained earning amount is reflected in the

statement of changes under retained earnings.

In contrast to this, loan from bank involves cost of interest that is expenditure for

business. This is presented in profit and loss account at the expense side. In addition to this, it is

deducted from cash in balance sheet within the head of current asset (Mangan, Hughes and

Slack, 2010). As per the case scenario, cost will be shown in profit and loss amount. Further, this

interest will be subtracted from the amount of cash. However, amount borrowed is reflected in

balance sheet at the liability side. In case of Sweet Menu Restaurant, amount of loan will be

presented under non-current liabilities head as long term loan. This amount increases the cash of

business which is reflected on the asset side. In case of issuing shares, dividend paid to

shareholders is demonstrated in profit and loss account. Further, amount taken from public is

shown on the liability side in balance sheet.

From the above analysis it can be said that bank loan and retained earning can be

appropriate sources of finance for Sweet Menu Restaurant. With this company can effectively

open its branches.

8

company's product.

Financial executive: In includes higher level managers, middle level and lower level

managers. Higher level managers include CEO and directors that needs to take strategic

decision for development of firm. However middle level managers include division

managers and regional managers who are required to take decision in relation to strategic

business unit, motivation as well as improvement of performance.

2.4 Impact of sources of finance on financial statements of Sweet Menu Restaurant

Transactions that are being carried out within the firm are demonstrated in the financial

statements. It involves financial as well as operating transactions. Kinds of financial sources that

are utilized by Sweet Menu Restaurant impact the financial position of business. Further, cost

associated with financial sources affects the statement of profit to a greater extent. It has been

stated above that the most suitable sources of finance for Sweet Menu Restaurant include

retained earnings and loan from bank. Cost attached with retailed earning is opportunity cost that

is not reflected in profit and loss account. But, the retained earning amount is reflected in the

statement of changes under retained earnings.

In contrast to this, loan from bank involves cost of interest that is expenditure for

business. This is presented in profit and loss account at the expense side. In addition to this, it is

deducted from cash in balance sheet within the head of current asset (Mangan, Hughes and

Slack, 2010). As per the case scenario, cost will be shown in profit and loss amount. Further, this

interest will be subtracted from the amount of cash. However, amount borrowed is reflected in

balance sheet at the liability side. In case of Sweet Menu Restaurant, amount of loan will be

presented under non-current liabilities head as long term loan. This amount increases the cash of

business which is reflected on the asset side. In case of issuing shares, dividend paid to

shareholders is demonstrated in profit and loss account. Further, amount taken from public is

shown on the liability side in balance sheet.

From the above analysis it can be said that bank loan and retained earning can be

appropriate sources of finance for Sweet Menu Restaurant. With this company can effectively

open its branches.

8

TASK 3

3.1 Analysis of budgets and make appropriate decisions

Here, cash and inventory budget of Blue Island Restaurant for next four months has been

presented. Firm provides greater competition to Sweet Menu Restaurant. The analysis of cash

budget can be carried out by the determination of changes in the cash incomes and expenses. For

Blue Island Restaurant, changes in percentage have been enumerated in the manner below:

The estimated figure presents that sales contributes towards the cash incomes of firm. In

accordance with the budget, it can be said that cash sales are increasing in all the respective

months. Sales in the month of November are increasing significantly in comparison with other

two that is 16.12%. In the month of December, sales have declined. Thus, it is important for

manager to develop plans that can lead to increase in sales. In contrast to this, there are several

components that contribute towards business expenditures. It involves capital expenditure for

purchasing assets like Furniture and Vans whereas operational expenses is comprised of

expenditures related with salaries, petrol charges, lightning, energy charges etc (Lambert, Leuz

and Verrecchia, 2012). The expenses of the business declined in October whereas it has

increased in other two months. In contrast to this, changes in percentage show that in October,

cash expenses declined by 71.53% which is the reason of elimination in the capital expenses.

Based on the analysis, it has been determined that capital expenditure would result in increasing

expenses that has an adverse impact on the availability of cash. By execution of suitable control

tool, expenses can be reduced.

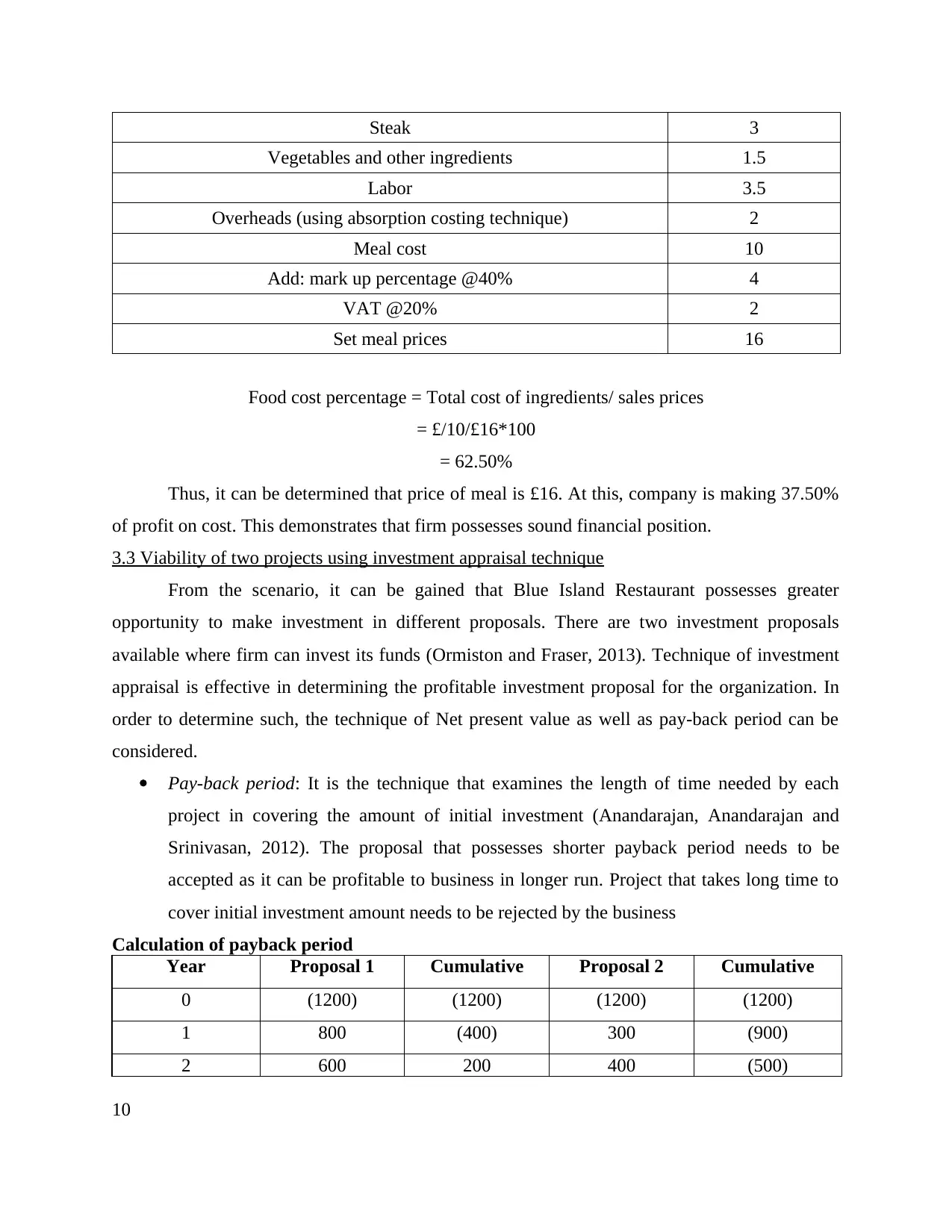

3.2 Calculation of unit costs and pricing decisions

Cost sheet of Blue Island Restaurant includes expenses involved in buying steak,

vegetables as well as other ingredients. Further, it involves payment of labor and other

overheads. The absorption of overhead is done through technique which is known as absorption

costing. Selling prices of meal offered is determined on the basis of cost incurred in the process

of production (Duchin, Ozbas and Sensoy, 2010). As per the scenario, determination of prices is

done by adding mark up of 40% on cost. Further, the rate of value added tax is 20%.

Determination of prices for Blue Island Restaurant is as under:

Item name Cost (In £)

9

3.1 Analysis of budgets and make appropriate decisions

Here, cash and inventory budget of Blue Island Restaurant for next four months has been

presented. Firm provides greater competition to Sweet Menu Restaurant. The analysis of cash

budget can be carried out by the determination of changes in the cash incomes and expenses. For

Blue Island Restaurant, changes in percentage have been enumerated in the manner below:

The estimated figure presents that sales contributes towards the cash incomes of firm. In

accordance with the budget, it can be said that cash sales are increasing in all the respective

months. Sales in the month of November are increasing significantly in comparison with other

two that is 16.12%. In the month of December, sales have declined. Thus, it is important for

manager to develop plans that can lead to increase in sales. In contrast to this, there are several

components that contribute towards business expenditures. It involves capital expenditure for

purchasing assets like Furniture and Vans whereas operational expenses is comprised of

expenditures related with salaries, petrol charges, lightning, energy charges etc (Lambert, Leuz

and Verrecchia, 2012). The expenses of the business declined in October whereas it has

increased in other two months. In contrast to this, changes in percentage show that in October,

cash expenses declined by 71.53% which is the reason of elimination in the capital expenses.

Based on the analysis, it has been determined that capital expenditure would result in increasing

expenses that has an adverse impact on the availability of cash. By execution of suitable control

tool, expenses can be reduced.

3.2 Calculation of unit costs and pricing decisions

Cost sheet of Blue Island Restaurant includes expenses involved in buying steak,

vegetables as well as other ingredients. Further, it involves payment of labor and other

overheads. The absorption of overhead is done through technique which is known as absorption

costing. Selling prices of meal offered is determined on the basis of cost incurred in the process

of production (Duchin, Ozbas and Sensoy, 2010). As per the scenario, determination of prices is

done by adding mark up of 40% on cost. Further, the rate of value added tax is 20%.

Determination of prices for Blue Island Restaurant is as under:

Item name Cost (In £)

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Steak 3

Vegetables and other ingredients 1.5

Labor 3.5

Overheads (using absorption costing technique) 2

Meal cost 10

Add: mark up percentage @40% 4

VAT @20% 2

Set meal prices 16

Food cost percentage = Total cost of ingredients/ sales prices

= £/10/£16*100

= 62.50%

Thus, it can be determined that price of meal is £16. At this, company is making 37.50%

of profit on cost. This demonstrates that firm possesses sound financial position.

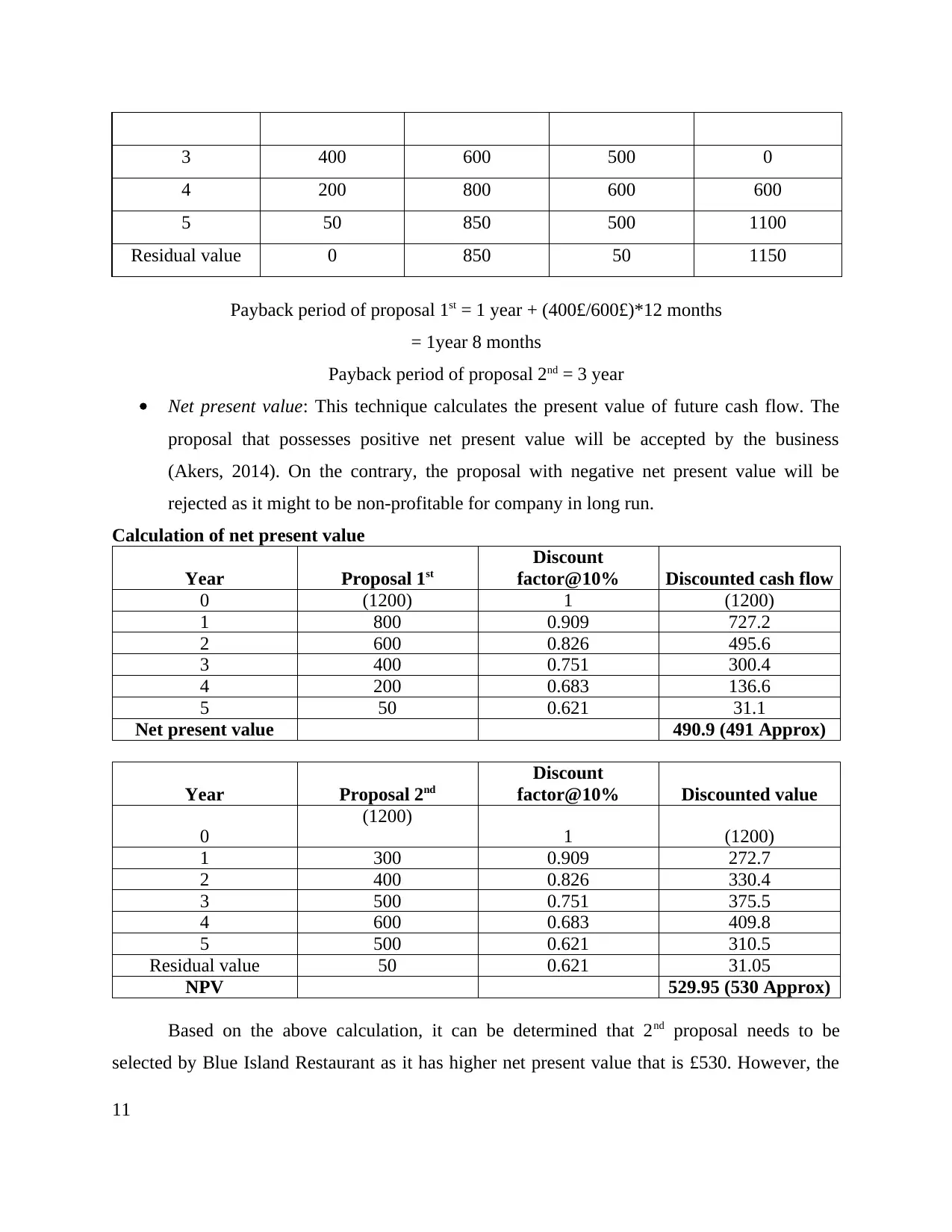

3.3 Viability of two projects using investment appraisal technique

From the scenario, it can be gained that Blue Island Restaurant possesses greater

opportunity to make investment in different proposals. There are two investment proposals

available where firm can invest its funds (Ormiston and Fraser, 2013). Technique of investment

appraisal is effective in determining the profitable investment proposal for the organization. In

order to determine such, the technique of Net present value as well as pay-back period can be

considered.

Pay-back period: It is the technique that examines the length of time needed by each

project in covering the amount of initial investment (Anandarajan, Anandarajan and

Srinivasan, 2012). The proposal that possesses shorter payback period needs to be

accepted as it can be profitable to business in longer run. Project that takes long time to

cover initial investment amount needs to be rejected by the business

Calculation of payback period

Year Proposal 1 Cumulative Proposal 2 Cumulative

0 (1200) (1200) (1200) (1200)

1 800 (400) 300 (900)

2 600 200 400 (500)

10

Vegetables and other ingredients 1.5

Labor 3.5

Overheads (using absorption costing technique) 2

Meal cost 10

Add: mark up percentage @40% 4

VAT @20% 2

Set meal prices 16

Food cost percentage = Total cost of ingredients/ sales prices

= £/10/£16*100

= 62.50%

Thus, it can be determined that price of meal is £16. At this, company is making 37.50%

of profit on cost. This demonstrates that firm possesses sound financial position.

3.3 Viability of two projects using investment appraisal technique

From the scenario, it can be gained that Blue Island Restaurant possesses greater

opportunity to make investment in different proposals. There are two investment proposals

available where firm can invest its funds (Ormiston and Fraser, 2013). Technique of investment

appraisal is effective in determining the profitable investment proposal for the organization. In

order to determine such, the technique of Net present value as well as pay-back period can be

considered.

Pay-back period: It is the technique that examines the length of time needed by each

project in covering the amount of initial investment (Anandarajan, Anandarajan and

Srinivasan, 2012). The proposal that possesses shorter payback period needs to be

accepted as it can be profitable to business in longer run. Project that takes long time to

cover initial investment amount needs to be rejected by the business

Calculation of payback period

Year Proposal 1 Cumulative Proposal 2 Cumulative

0 (1200) (1200) (1200) (1200)

1 800 (400) 300 (900)

2 600 200 400 (500)

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3 400 600 500 0

4 200 800 600 600

5 50 850 500 1100

Residual value 0 850 50 1150

Payback period of proposal 1st = 1 year + (400£/600£)*12 months

= 1year 8 months

Payback period of proposal 2nd = 3 year

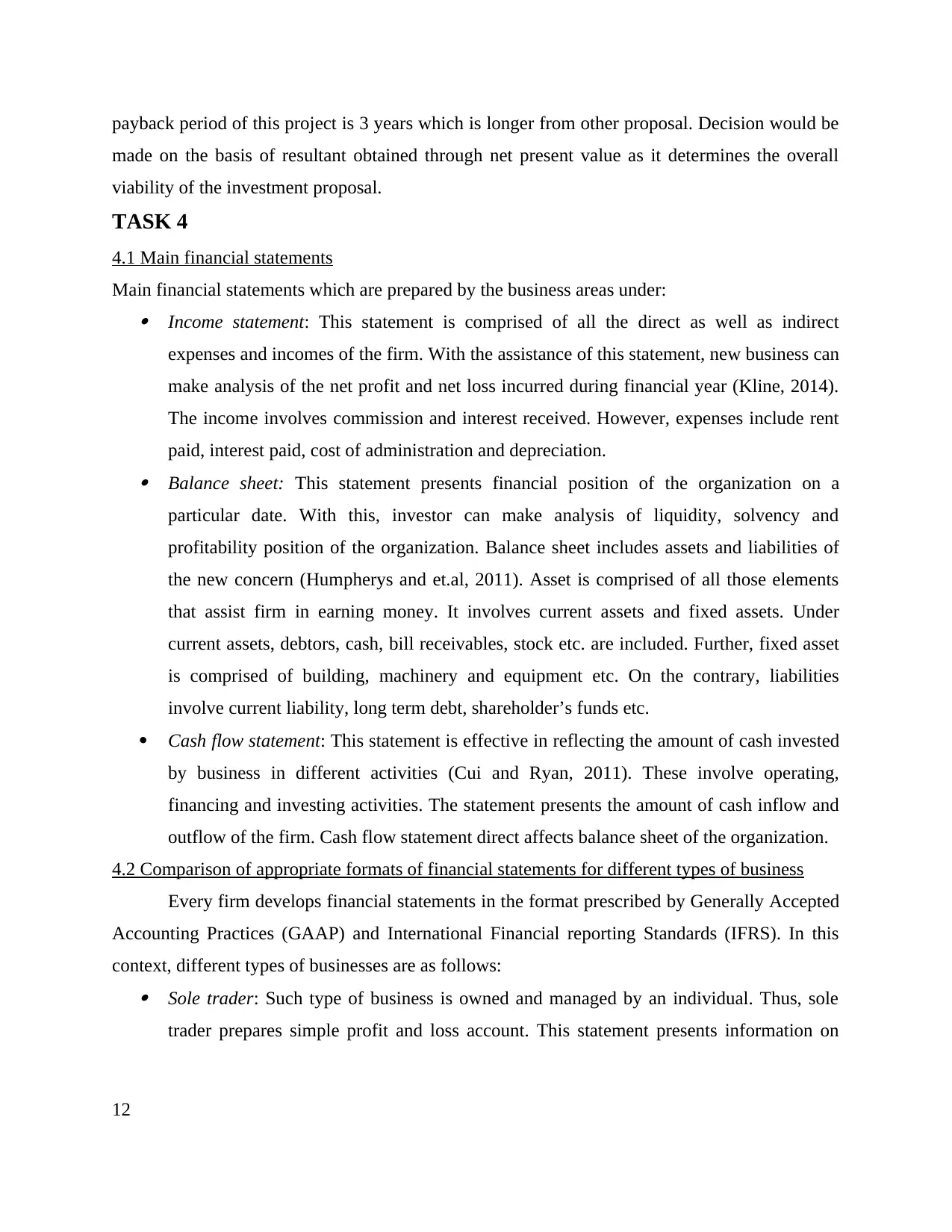

Net present value: This technique calculates the present value of future cash flow. The

proposal that possesses positive net present value will be accepted by the business

(Akers, 2014). On the contrary, the proposal with negative net present value will be

rejected as it might to be non-profitable for company in long run.

Calculation of net present value

Year Proposal 1st

Discount

factor@10% Discounted cash flow

0 (1200) 1 (1200)

1 800 0.909 727.2

2 600 0.826 495.6

3 400 0.751 300.4

4 200 0.683 136.6

5 50 0.621 31.1

Net present value 490.9 (491 Approx)

Year Proposal 2nd

Discount

factor@10% Discounted value

0

(1200)

1 (1200)

1 300 0.909 272.7

2 400 0.826 330.4

3 500 0.751 375.5

4 600 0.683 409.8

5 500 0.621 310.5

Residual value 50 0.621 31.05

NPV 529.95 (530 Approx)

Based on the above calculation, it can be determined that 2nd proposal needs to be

selected by Blue Island Restaurant as it has higher net present value that is £530. However, the

11

4 200 800 600 600

5 50 850 500 1100

Residual value 0 850 50 1150

Payback period of proposal 1st = 1 year + (400£/600£)*12 months

= 1year 8 months

Payback period of proposal 2nd = 3 year

Net present value: This technique calculates the present value of future cash flow. The

proposal that possesses positive net present value will be accepted by the business

(Akers, 2014). On the contrary, the proposal with negative net present value will be

rejected as it might to be non-profitable for company in long run.

Calculation of net present value

Year Proposal 1st

Discount

factor@10% Discounted cash flow

0 (1200) 1 (1200)

1 800 0.909 727.2

2 600 0.826 495.6

3 400 0.751 300.4

4 200 0.683 136.6

5 50 0.621 31.1

Net present value 490.9 (491 Approx)

Year Proposal 2nd

Discount

factor@10% Discounted value

0

(1200)

1 (1200)

1 300 0.909 272.7

2 400 0.826 330.4

3 500 0.751 375.5

4 600 0.683 409.8

5 500 0.621 310.5

Residual value 50 0.621 31.05

NPV 529.95 (530 Approx)

Based on the above calculation, it can be determined that 2nd proposal needs to be

selected by Blue Island Restaurant as it has higher net present value that is £530. However, the

11

payback period of this project is 3 years which is longer from other proposal. Decision would be

made on the basis of resultant obtained through net present value as it determines the overall

viability of the investment proposal.

TASK 4

4.1 Main financial statements

Main financial statements which are prepared by the business areas under: Income statement: This statement is comprised of all the direct as well as indirect

expenses and incomes of the firm. With the assistance of this statement, new business can

make analysis of the net profit and net loss incurred during financial year (Kline, 2014).

The income involves commission and interest received. However, expenses include rent

paid, interest paid, cost of administration and depreciation. Balance sheet: This statement presents financial position of the organization on a

particular date. With this, investor can make analysis of liquidity, solvency and

profitability position of the organization. Balance sheet includes assets and liabilities of

the new concern (Humpherys and et.al, 2011). Asset is comprised of all those elements

that assist firm in earning money. It involves current assets and fixed assets. Under

current assets, debtors, cash, bill receivables, stock etc. are included. Further, fixed asset

is comprised of building, machinery and equipment etc. On the contrary, liabilities

involve current liability, long term debt, shareholder’s funds etc.

Cash flow statement: This statement is effective in reflecting the amount of cash invested

by business in different activities (Cui and Ryan, 2011). These involve operating,

financing and investing activities. The statement presents the amount of cash inflow and

outflow of the firm. Cash flow statement direct affects balance sheet of the organization.

4.2 Comparison of appropriate formats of financial statements for different types of business

Every firm develops financial statements in the format prescribed by Generally Accepted

Accounting Practices (GAAP) and International Financial reporting Standards (IFRS). In this

context, different types of businesses are as follows: Sole trader: Such type of business is owned and managed by an individual. Thus, sole

trader prepares simple profit and loss account. This statement presents information on

12

made on the basis of resultant obtained through net present value as it determines the overall

viability of the investment proposal.

TASK 4

4.1 Main financial statements

Main financial statements which are prepared by the business areas under: Income statement: This statement is comprised of all the direct as well as indirect

expenses and incomes of the firm. With the assistance of this statement, new business can

make analysis of the net profit and net loss incurred during financial year (Kline, 2014).

The income involves commission and interest received. However, expenses include rent

paid, interest paid, cost of administration and depreciation. Balance sheet: This statement presents financial position of the organization on a

particular date. With this, investor can make analysis of liquidity, solvency and

profitability position of the organization. Balance sheet includes assets and liabilities of

the new concern (Humpherys and et.al, 2011). Asset is comprised of all those elements

that assist firm in earning money. It involves current assets and fixed assets. Under

current assets, debtors, cash, bill receivables, stock etc. are included. Further, fixed asset

is comprised of building, machinery and equipment etc. On the contrary, liabilities

involve current liability, long term debt, shareholder’s funds etc.

Cash flow statement: This statement is effective in reflecting the amount of cash invested

by business in different activities (Cui and Ryan, 2011). These involve operating,

financing and investing activities. The statement presents the amount of cash inflow and

outflow of the firm. Cash flow statement direct affects balance sheet of the organization.

4.2 Comparison of appropriate formats of financial statements for different types of business

Every firm develops financial statements in the format prescribed by Generally Accepted

Accounting Practices (GAAP) and International Financial reporting Standards (IFRS). In this

context, different types of businesses are as follows: Sole trader: Such type of business is owned and managed by an individual. Thus, sole

trader prepares simple profit and loss account. This statement presents information on

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.