Financial Management : Sample Assignment

VerifiedAdded on 2021/05/31

|12

|817

|24

Presentation

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL MANAGEMENT

ASSIGNMENT 1 (FIN5FMA) –

SEMESTER 1, 2018

ASSIGNMENT 1 (FIN5FMA) –

SEMESTER 1, 2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Fortescue metal group is a pioneer when it

comes to the production of iron ore and

exploration (Fortescue Metals Group, 2017)

Major competitor BHP Billiton, Rio Tinto and

Woodside petroleum.

Objective - Massive iron ore production

Presence of aggressive policies

Fortescue metal group is a pioneer when it

comes to the production of iron ore and

exploration (Fortescue Metals Group, 2017)

Major competitor BHP Billiton, Rio Tinto and

Woodside petroleum.

Objective - Massive iron ore production

Presence of aggressive policies

FINANCIAL POLICIES AND WORKING CAPITAL

INVESTMENT UNDERTAKEN BY THE COMPANY

Working capital = Current assets – current

liabilities

current ratio of more than one in the five-

year span which shows the optimum strength

of the company to short-lived liquidity (Bodie

et. al, 2014)

In 2017 going below 1 that emphasize the

attention of the management

INVESTMENT UNDERTAKEN BY THE COMPANY

Working capital = Current assets – current

liabilities

current ratio of more than one in the five-

year span which shows the optimum strength

of the company to short-lived liquidity (Bodie

et. al, 2014)

In 2017 going below 1 that emphasize the

attention of the management

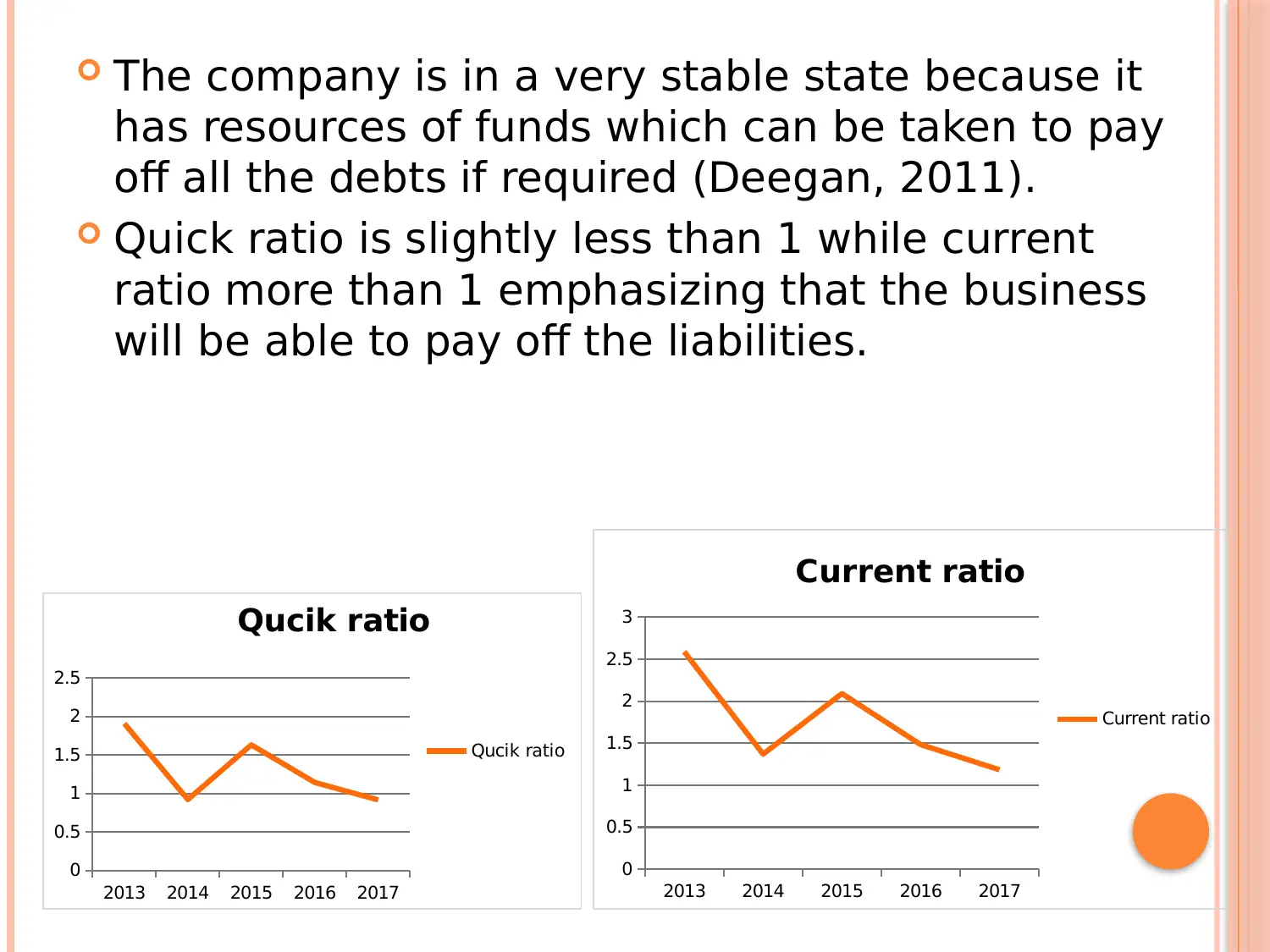

The company is in a very stable state because it

has resources of funds which can be taken to pay

off all the debts if required (Deegan, 2011).

Quick ratio is slightly less than 1 while current

ratio more than 1 emphasizing that the business

will be able to pay off the liabilities.

2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

Current ratio

Current ratio

2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

Qucik ratio

Qucik ratio

has resources of funds which can be taken to pay

off all the debts if required (Deegan, 2011).

Quick ratio is slightly less than 1 while current

ratio more than 1 emphasizing that the business

will be able to pay off the liabilities.

2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

Current ratio

Current ratio

2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

Qucik ratio

Qucik ratio

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ASCERTAINMENT OF CAPITAL STRUCTURE

MEASURE THAT IS ADOPTED BY THE COMPANY

Expanded empire of the Fortescue Company is

estimated to be $10897.02 billion (Fortescue

Metals Group, 2017)

liability reduced from $14719 to about $12214

which is quite impressive

The present statements show that the liabilities

and the loans have been eliminated a bit but then

also the ratio is above 0.5 with an advice to pay

off some better part to keep the statements in the

future intact

MEASURE THAT IS ADOPTED BY THE COMPANY

Expanded empire of the Fortescue Company is

estimated to be $10897.02 billion (Fortescue

Metals Group, 2017)

liability reduced from $14719 to about $12214

which is quite impressive

The present statements show that the liabilities

and the loans have been eliminated a bit but then

also the ratio is above 0.5 with an advice to pay

off some better part to keep the statements in the

future intact

DETERMINATION OF THE EARNINGS DISTRIBUTION

AND DIVIDEND POLICY EMPLOYED BY THE FIRM

It is seen that in the year 2013 and 2014 the

dividend payment was at a maximum which

certainly declined in the year 2015 due to the

decrease in the overall revenue generation of

the company.

In 2017 witnessed a strong jump in dividend

that is 45 cents (Fortescue Metals Group,

2017).

Accumulated data show that though there was

is an increase in the revenue generation and

profits of the company but then also the

dividend payment was low as compared to

other years.

AND DIVIDEND POLICY EMPLOYED BY THE FIRM

It is seen that in the year 2013 and 2014 the

dividend payment was at a maximum which

certainly declined in the year 2015 due to the

decrease in the overall revenue generation of

the company.

In 2017 witnessed a strong jump in dividend

that is 45 cents (Fortescue Metals Group,

2017).

Accumulated data show that though there was

is an increase in the revenue generation and

profits of the company but then also the

dividend payment was low as compared to

other years.

DETERMINATION OF THE CORPORATE GOVERNANCE

STRUCTURE AND POLICIES EMPLOYED BY THE FIRM

Members of the board and also the company

management are delivering their best to

complete the targets and the objectives of

the company

integrity, transparency, stewardship and

corporate accountability are regularly

followed by the company.

Gender, race, age and physical capabilities

are barred while selecting the candidates by

the directors.

STRUCTURE AND POLICIES EMPLOYED BY THE FIRM

Members of the board and also the company

management are delivering their best to

complete the targets and the objectives of

the company

integrity, transparency, stewardship and

corporate accountability are regularly

followed by the company.

Gender, race, age and physical capabilities

are barred while selecting the candidates by

the directors.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Workings of the senior post executives of the

company are strictly monitored

The doubts prevailing in the company were

settled because of the platform provided by

the corporate governance structure (Davies

& Crawford, 2012)

Board members had the opinion that the

numbers of independent directors are

enough but in 2017 they said that the

numbers are lesser than though

company are strictly monitored

The doubts prevailing in the company were

settled because of the platform provided by

the corporate governance structure (Davies

& Crawford, 2012)

Board members had the opinion that the

numbers of independent directors are

enough but in 2017 they said that the

numbers are lesser than though

ASSOCIATIONS AND RELATIONSHIPS BETWEEN THE

VARIOUS MANAGEMENT POLICIES EMPLOYED BY THE FIRM

Policies of the company have led the company to

gain the upper hand in the market.

. Dividend policy has been strict as the dividend

payouts have been followed for the last five years

straight.

Permanent current assets, fixed assets, and

temporary current assets have been seen to have

the backup of many sources of investments as per

a conservative policy with a fat cat policy of the

year 2013 and 2014

VARIOUS MANAGEMENT POLICIES EMPLOYED BY THE FIRM

Policies of the company have led the company to

gain the upper hand in the market.

. Dividend policy has been strict as the dividend

payouts have been followed for the last five years

straight.

Permanent current assets, fixed assets, and

temporary current assets have been seen to have

the backup of many sources of investments as per

a conservative policy with a fat cat policy of the

year 2013 and 2014

The company needs to changes its policies

and plans as soon as possible.

Retained earnings and the storage of the

same has been the first priority operations of

the company now

It is advised for the company that it should

eliminate the use of loans and should now

lay more stress on equity financing for

carrying on the daily operations (Deegan,

2011)

and plans as soon as possible.

Retained earnings and the storage of the

same has been the first priority operations of

the company now

It is advised for the company that it should

eliminate the use of loans and should now

lay more stress on equity financing for

carrying on the daily operations (Deegan,

2011)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CONCLUSION

FMG is a competitive organization and has

strong fundamentals through which it has

been able to cement its place in the industry

Though the liquidity is slight low yet it has

the power to meet the obligations as it has

global presence.

FMG is a competitive organization and has

strong fundamentals through which it has

been able to cement its place in the industry

Though the liquidity is slight low yet it has

the power to meet the obligations as it has

global presence.

REFERENCES

Bodie, Z., Kane, A. and Marcus, A. J. (2014) Investments.

McGraw Hill

Brigham, E. & Daves, P. (2012) Intermediate Financial

Management. USA: Cengage Learning.

Choi, R.D. and Meek, G.K. (2011) International

accounting. Pearson .

Davies, T. and Crawford, I. (2012) Financial accounting.

Harlow, England: Pearson.

Deegan, C. M. (2011) In Financial accounting theory.

North Ryde, N.S.W: McGraw-Hill

Fortescue Metals Group. (2017) Fortescue Metal Group

Annual report and accounts 2017 [Online]. Available at:

https://www.fmgl.com.au/docs/default-source/default-do

cument-library/fy2017-annual-report.pdf?sfvrsn=1f9318

75_2

[Accessed 25 May 2017].

Bodie, Z., Kane, A. and Marcus, A. J. (2014) Investments.

McGraw Hill

Brigham, E. & Daves, P. (2012) Intermediate Financial

Management. USA: Cengage Learning.

Choi, R.D. and Meek, G.K. (2011) International

accounting. Pearson .

Davies, T. and Crawford, I. (2012) Financial accounting.

Harlow, England: Pearson.

Deegan, C. M. (2011) In Financial accounting theory.

North Ryde, N.S.W: McGraw-Hill

Fortescue Metals Group. (2017) Fortescue Metal Group

Annual report and accounts 2017 [Online]. Available at:

https://www.fmgl.com.au/docs/default-source/default-do

cument-library/fy2017-annual-report.pdf?sfvrsn=1f9318

75_2

[Accessed 25 May 2017].

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.