Financial Management Report: Merger, Takeovers and Appraisal

VerifiedAdded on 2023/01/11

|14

|3700

|71

Report

AI Summary

This financial management report provides a detailed analysis of mergers and takeovers, alongside an examination of investment appraisal techniques. The report begins with an introduction to financial management, emphasizing the importance of equity, debt, and financial analysis. The main body addresses two key questions: the first focuses on valuing Trojan Plc using various methods like the Price Earnings ratio, Dividend Valuation Model, and Discounted Cash Flow method, followed by a discussion of the advantages and disadvantages of each valuation model. The second question delves into investment appraisal techniques, including Payback Period, Accounting Rate of Return (ARR), Net Present Value (NPV), and Internal Rate of Return (IRR), with calculations and recommendations. The report concludes by summarizing the findings and includes references to the sources used. The assignment aims to provide a comprehensive understanding of financial management principles and their practical application in making informed investment decisions.

Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

Question 1- Merger and Takeovers.................................................................................................1

1. Calculate the value for Trojan Plc by using various valuation method...................................1

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages........................................................................................................3

Question 2 – Investment Appraisal Techniques..............................................................................4

1. Calculate following investment appraisal technique and give brief recommendations...........4

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques. 8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

MAIN BODY..................................................................................................................................1

Question 1- Merger and Takeovers.................................................................................................1

1. Calculate the value for Trojan Plc by using various valuation method...................................1

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages........................................................................................................3

Question 2 – Investment Appraisal Techniques..............................................................................4

1. Calculate following investment appraisal technique and give brief recommendations...........4

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques. 8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Financial management concentrates on proportions of equity and debt. It is valuable for fund

management, income allocation and capital raising, hedging and managing foreign exchange and

commodity process volatility (Antonopoulos and Hall, 2016). Financial analysts are the ones

who can conduct analysis and determine what kind of resources to rise to finance the company's

investments as well as increase the company's worth to all shareholders depending on the study.

In this report, two questions required to address that is about merger and takeover and the other

one is investment appraisal techniques to evaluate most favourable project to invest.

MAIN BODY

Question 1- Merger and Takeovers

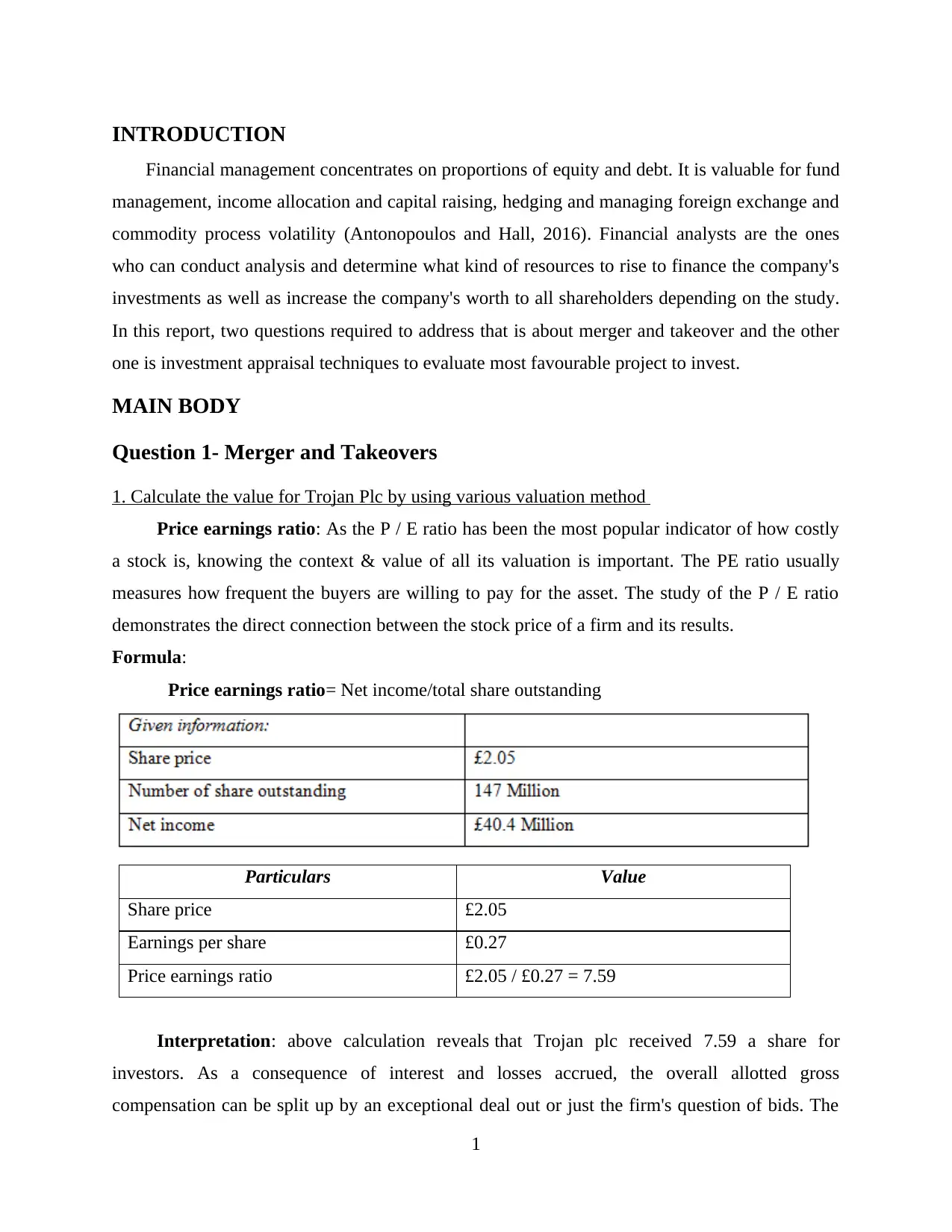

1. Calculate the value for Trojan Plc by using various valuation method

Price earnings ratio: As the P / E ratio has been the most popular indicator of how costly

a stock is, knowing the context & value of all its valuation is important. The PE ratio usually

measures how frequent the buyers are willing to pay for the asset. The study of the P / E ratio

demonstrates the direct connection between the stock price of a firm and its results.

Formula:

Price earnings ratio= Net income/total share outstanding

Particulars Value

Share price £2.05

Earnings per share £0.27

Price earnings ratio £2.05 / £0.27 = 7.59

Interpretation: above calculation reveals that Trojan plc received 7.59 a share for

investors. As a consequence of interest and losses accrued, the overall allotted gross

compensation can be split up by an exceptional deal out or just the firm's question of bids. The

1

Financial management concentrates on proportions of equity and debt. It is valuable for fund

management, income allocation and capital raising, hedging and managing foreign exchange and

commodity process volatility (Antonopoulos and Hall, 2016). Financial analysts are the ones

who can conduct analysis and determine what kind of resources to rise to finance the company's

investments as well as increase the company's worth to all shareholders depending on the study.

In this report, two questions required to address that is about merger and takeover and the other

one is investment appraisal techniques to evaluate most favourable project to invest.

MAIN BODY

Question 1- Merger and Takeovers

1. Calculate the value for Trojan Plc by using various valuation method

Price earnings ratio: As the P / E ratio has been the most popular indicator of how costly

a stock is, knowing the context & value of all its valuation is important. The PE ratio usually

measures how frequent the buyers are willing to pay for the asset. The study of the P / E ratio

demonstrates the direct connection between the stock price of a firm and its results.

Formula:

Price earnings ratio= Net income/total share outstanding

Particulars Value

Share price £2.05

Earnings per share £0.27

Price earnings ratio £2.05 / £0.27 = 7.59

Interpretation: above calculation reveals that Trojan plc received 7.59 a share for

investors. As a consequence of interest and losses accrued, the overall allotted gross

compensation can be split up by an exceptional deal out or just the firm's question of bids. The

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

firm's net payout that year was £ 40.4 million and the absolute exceptional offer is £ 147 million.

Value of each share price is £ 2.05 and earning of single share is £0.27.

Dividend valuation model: This is a dividend based valuation model which depends on a

discounted function to approximate present value of stock price that based on expectations about

its potential success in dividends (Brusca, Gómez‐villegas and Montesinos, 2016). This formula

is used to calculate the price and buyer will realistically normally pay for a share if each year it

pays gradually through dividends.

Dividend Discount Model Fair Value: £ 4.774

Calculation:

Formula:

D1 / (1 + k) + D2 / (1 + k) 2 + D3 / (1 + k) 3 + D4 / (1 + k) 4………….

Herein,

D1: Value of dividend for year one

D2: Value of dividend for year two

D3: Value of dividend for year three

D4: Value of dividend for year four

K: Expected rate of return

Calculation:

= 10p (1 + 11%) + 10.5p (1 + 11%)2 + 11p (1 + 11%)3 + 12p (1 + 11%)4

= 10 p (0.11) + 10.5p (0.11)2 + 11p (0.11)3 + 12p (0.11)4

= 11.1 + 10.5 (0.0121) + 11 (0.001331) + 12 (0.000146)

= 11.1 + 0.127 + 0.014 + 0.00175

= £11.24

Interpretation: Value of Trojan Plc shares is £11.24 and it is calculated with the help of

last 4 years dividend. Free market share prices and beta interest carry on critical roles to assess

the conditions; then the exchange rate is regarded as premium or risk prices because competition

provides a threat to this added incentive. Free board prices are impossible to hinder, due to the

unlikely loss of opportunity for the organizations.

Discounted cash flow method: This valuation model ensures that organization can

represent each spending as a single amount that is totally opposite of current cash value (Brooke,

2016). It is applied to all sorts of investment opportunities by investors, analysts and corporate

2

Value of each share price is £ 2.05 and earning of single share is £0.27.

Dividend valuation model: This is a dividend based valuation model which depends on a

discounted function to approximate present value of stock price that based on expectations about

its potential success in dividends (Brusca, Gómez‐villegas and Montesinos, 2016). This formula

is used to calculate the price and buyer will realistically normally pay for a share if each year it

pays gradually through dividends.

Dividend Discount Model Fair Value: £ 4.774

Calculation:

Formula:

D1 / (1 + k) + D2 / (1 + k) 2 + D3 / (1 + k) 3 + D4 / (1 + k) 4………….

Herein,

D1: Value of dividend for year one

D2: Value of dividend for year two

D3: Value of dividend for year three

D4: Value of dividend for year four

K: Expected rate of return

Calculation:

= 10p (1 + 11%) + 10.5p (1 + 11%)2 + 11p (1 + 11%)3 + 12p (1 + 11%)4

= 10 p (0.11) + 10.5p (0.11)2 + 11p (0.11)3 + 12p (0.11)4

= 11.1 + 10.5 (0.0121) + 11 (0.001331) + 12 (0.000146)

= 11.1 + 0.127 + 0.014 + 0.00175

= £11.24

Interpretation: Value of Trojan Plc shares is £11.24 and it is calculated with the help of

last 4 years dividend. Free market share prices and beta interest carry on critical roles to assess

the conditions; then the exchange rate is regarded as premium or risk prices because competition

provides a threat to this added incentive. Free board prices are impossible to hinder, due to the

unlikely loss of opportunity for the organizations.

Discounted cash flow method: This valuation model ensures that organization can

represent each spending as a single amount that is totally opposite of current cash value (Brooke,

2016). It is applied to all sorts of investment opportunities by investors, analysts and corporate

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

managers. It also include acquisitions and expansions that used by the organizations. There

are few excellently-recognized risks to all the benefits it offers.

Under this approach, value of share is calculated by applying such formula: CF1 / (1+r)1 +

CF2 / (1+r)2 + CF n / (1+r) n

r: 5%

= £40.4 / (1 + 5%)

= £808

Interpretation: Value of shares is £ 808 by using discounted cash flow method. Rate pf

discount considered to be 5% and value of profit assumed to be £ 40.4 each year.

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages

Price earnings ratio:

Advantages: Examination of the ratio is also critical for financial decisions; because it

lets investors realize the true value of their money. P / E ratio is beneficial when the

relative attraction of a possible investment is available. It lets investors determine how it

that they will pay for a share based on their current profits, and also shows whether the

demand overestimates or underestimates the business. It helps forecast potential

EPS from which the shareholders determine whatever the fair market value of the stock

will be.

Disadvantages: Short-term stock rates are influenced by the rumours and perceptions

that cause sentiments (Danes, Garbow and Jokela, 2016). As a result, with time to time, P

/ E ratios would get out of whack before the truth and rationality returns to the buying

public. Be sure that consider the amount over time to and the volatility that comes from

unjustified elation or fears. Management also tries to equal the financial performance by

taking accounting choices that maximize them to satisfy investor needs.

Dividend valuation model:

Advantages: Dividend valuation concept is very technically oriented. The arguments for

this are solid and unquestionable. Dividends tend to remain accurate over longer periods.

Companies face tremendous variability in metrics such as sales and free cash flow.

3

are few excellently-recognized risks to all the benefits it offers.

Under this approach, value of share is calculated by applying such formula: CF1 / (1+r)1 +

CF2 / (1+r)2 + CF n / (1+r) n

r: 5%

= £40.4 / (1 + 5%)

= £808

Interpretation: Value of shares is £ 808 by using discounted cash flow method. Rate pf

discount considered to be 5% and value of profit assumed to be £ 40.4 each year.

2. Discussed the problems associated with valuation models with the help of evaluating

advantages or disadvantages

Price earnings ratio:

Advantages: Examination of the ratio is also critical for financial decisions; because it

lets investors realize the true value of their money. P / E ratio is beneficial when the

relative attraction of a possible investment is available. It lets investors determine how it

that they will pay for a share based on their current profits, and also shows whether the

demand overestimates or underestimates the business. It helps forecast potential

EPS from which the shareholders determine whatever the fair market value of the stock

will be.

Disadvantages: Short-term stock rates are influenced by the rumours and perceptions

that cause sentiments (Danes, Garbow and Jokela, 2016). As a result, with time to time, P

/ E ratios would get out of whack before the truth and rationality returns to the buying

public. Be sure that consider the amount over time to and the volatility that comes from

unjustified elation or fears. Management also tries to equal the financial performance by

taking accounting choices that maximize them to satisfy investor needs.

Dividend valuation model:

Advantages: Dividend valuation concept is very technically oriented. The arguments for

this are solid and unquestionable. Dividends tend to remain accurate over longer periods.

Companies face tremendous variability in metrics such as sales and free cash flow.

3

Organizations usually, ensure that dividend payments are only compensated out of cash

that is thought to occur with the company each year. Daily dividend payment is a symbol

that a firm is maturing in its business. Its market is stable and, unless anything dramatic

occurs, there is not much risk of uncertainty in the future. This knowledge is important

for many buyers, who choose consistency to quickness

Disadvantages: This method only appeals to large prosperous businesses that have

established track record of regularly carrying out dividends. Although it may seem like a

positive idea, manifestly, there is a major trade-off. Investors that invest only in large,

profitable companies continue to lose out on fast growth ones. It is filled with so many

assumptions. There are conclusions that addressed above about dividends. Also there are

theories about rate of growth, interest rates and income taxes. Any of those

considerations are just beyond shareholder influence. That factor decreases the model's

credibility too.

Discounted cash flow method:

Advantages: The "most effective and efficient" approach for determining investment

decisions is to use a discounted cash flow to decline investments to the NPV (Hashim and

Piatti-Fünfkirchen, 2018). Assuming that the projections in the equations are somewhat

accurate, no other approach performs as well to determine which assets deliver optimum

value. It has a big advantage that it sometimes decreases a savings to a single number. If

the NPV is positive, it is anticipated the investment will be a money maker or if it is

negative, the capital expenditure will be a loser. It helps decisions on individual assets to

be up-to-down. Additionally, the approach helps you to make decisions between

substantially different assets.

Disadvantages: Discounted cash flow estimation is just as strong as the figures in it. If

those figures are incorrect, then the NPV may be incorrect and can make poor investment

decisions. The model has multiple probability of failure. This method used to create an

enterprise value. They will verify how accurate the figure is by doing a fact check,

analyzing whether the interest generated from the discounted cash flow correlates with

the market cap of the firm; with the company's stock interest as seen on the balance sheet;

or with the valuation of comparable firms. Basically there is no link with the real world.

4

that is thought to occur with the company each year. Daily dividend payment is a symbol

that a firm is maturing in its business. Its market is stable and, unless anything dramatic

occurs, there is not much risk of uncertainty in the future. This knowledge is important

for many buyers, who choose consistency to quickness

Disadvantages: This method only appeals to large prosperous businesses that have

established track record of regularly carrying out dividends. Although it may seem like a

positive idea, manifestly, there is a major trade-off. Investors that invest only in large,

profitable companies continue to lose out on fast growth ones. It is filled with so many

assumptions. There are conclusions that addressed above about dividends. Also there are

theories about rate of growth, interest rates and income taxes. Any of those

considerations are just beyond shareholder influence. That factor decreases the model's

credibility too.

Discounted cash flow method:

Advantages: The "most effective and efficient" approach for determining investment

decisions is to use a discounted cash flow to decline investments to the NPV (Hashim and

Piatti-Fünfkirchen, 2018). Assuming that the projections in the equations are somewhat

accurate, no other approach performs as well to determine which assets deliver optimum

value. It has a big advantage that it sometimes decreases a savings to a single number. If

the NPV is positive, it is anticipated the investment will be a money maker or if it is

negative, the capital expenditure will be a loser. It helps decisions on individual assets to

be up-to-down. Additionally, the approach helps you to make decisions between

substantially different assets.

Disadvantages: Discounted cash flow estimation is just as strong as the figures in it. If

those figures are incorrect, then the NPV may be incorrect and can make poor investment

decisions. The model has multiple probability of failure. This method used to create an

enterprise value. They will verify how accurate the figure is by doing a fact check,

analyzing whether the interest generated from the discounted cash flow correlates with

the market cap of the firm; with the company's stock interest as seen on the balance sheet;

or with the valuation of comparable firms. Basically there is no link with the real world.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

From the above discussion it is recommended that the company will follow the P / E ratio as

a value of its shares. It helps the management to make their proposed model to boost the

company's profitability or competitiveness.

Question 2 – Investment Appraisal Techniques

1. Calculate following investment appraisal technique and give brief recommendations

Payback period: It is one of the effective techniques of capital budgeting which are

mostly used by the organizations to evaluator recovery period of their investment (Karadag,

2017). It helps to assess the amount of time anticipated to retrieve the proposal's initial cash

expenditure. Simply, that is the approach used to measure the time needed by consecutive cash

inflows to recoup the costs accumulated in the investments. High payback period is not

beneficial or favourable for the organization because it takes more time to recover money.

Because of that, low payback period should be selected for the investment. Below mention

calculation of new machinery in context of Lovewell helps in evaluating payback period and

allows the managers to understand that, it is beneficial to invest or not.

Formula:

Payback Period = Initial Investment / Cash Inflow

= 275000 / 85000

= 3.79 years.

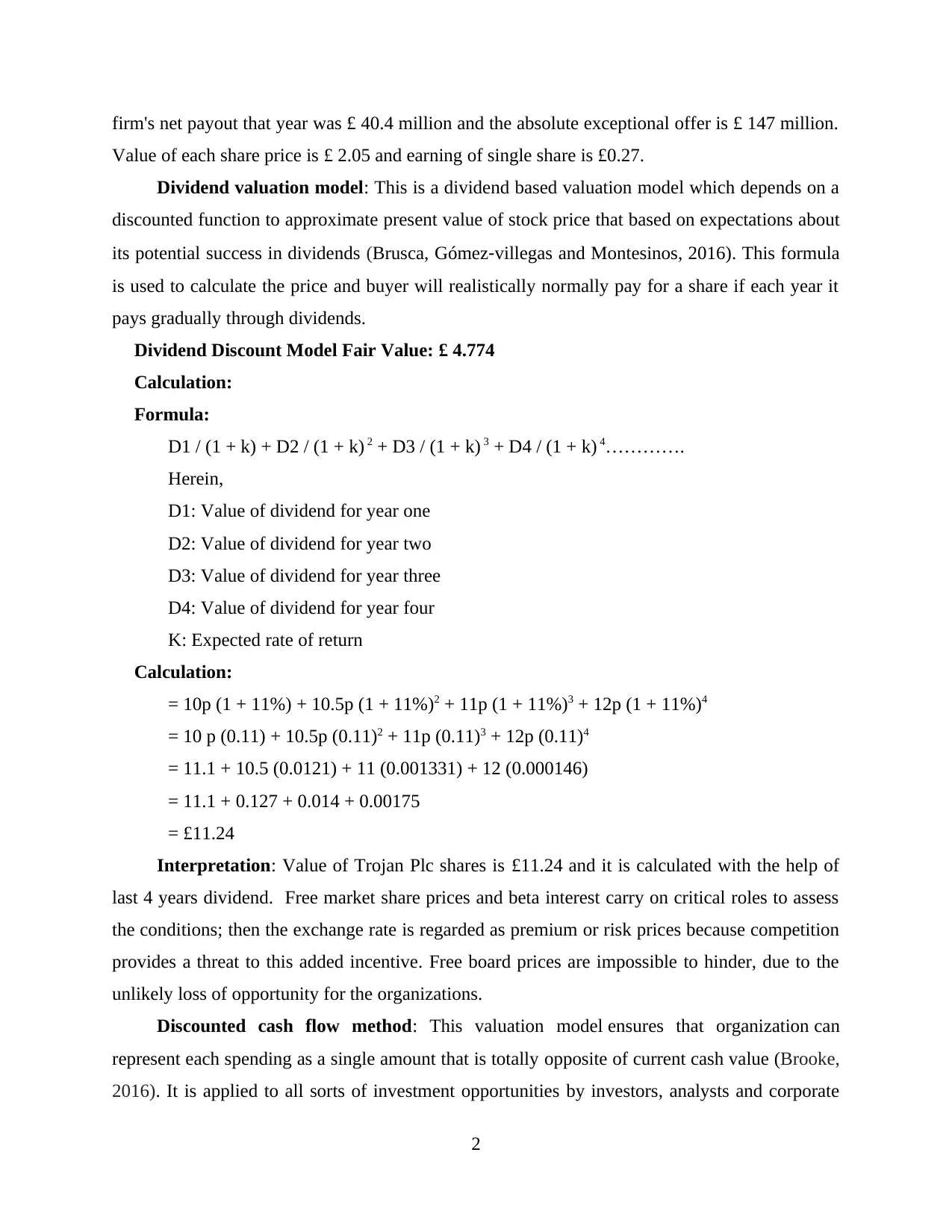

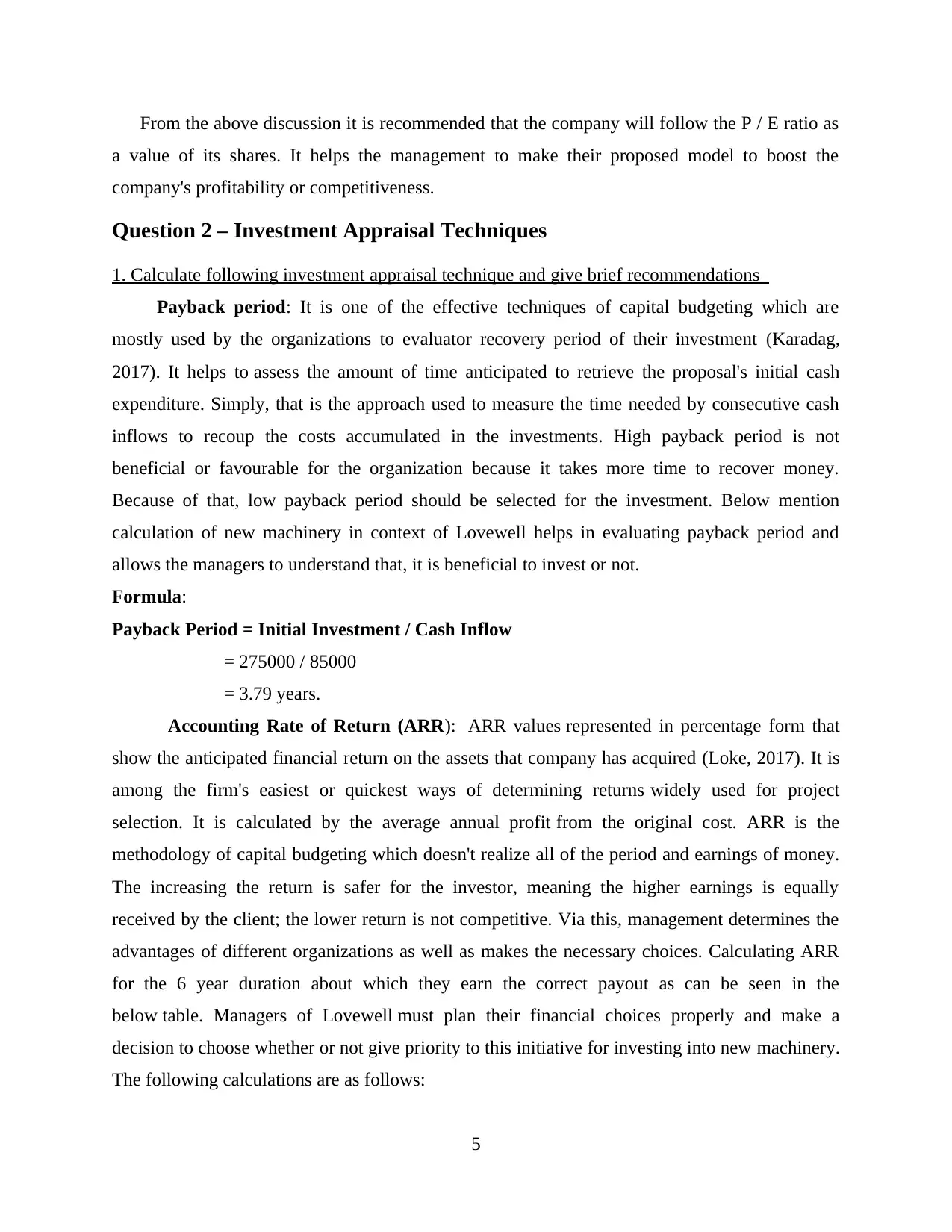

Accounting Rate of Return (ARR): ARR values represented in percentage form that

show the anticipated financial return on the assets that company has acquired (Loke, 2017). It is

among the firm's easiest or quickest ways of determining returns widely used for project

selection. It is calculated by the average annual profit from the original cost. ARR is the

methodology of capital budgeting which doesn't realize all of the period and earnings of money.

The increasing the return is safer for the investor, meaning the higher earnings is equally

received by the client; the lower return is not competitive. Via this, management determines the

advantages of different organizations as well as makes the necessary choices. Calculating ARR

for the 6 year duration about which they earn the correct payout as can be seen in the

below table. Managers of Lovewell must plan their financial choices properly and make a

decision to choose whether or not give priority to this initiative for investing into new machinery.

The following calculations are as follows:

5

a value of its shares. It helps the management to make their proposed model to boost the

company's profitability or competitiveness.

Question 2 – Investment Appraisal Techniques

1. Calculate following investment appraisal technique and give brief recommendations

Payback period: It is one of the effective techniques of capital budgeting which are

mostly used by the organizations to evaluator recovery period of their investment (Karadag,

2017). It helps to assess the amount of time anticipated to retrieve the proposal's initial cash

expenditure. Simply, that is the approach used to measure the time needed by consecutive cash

inflows to recoup the costs accumulated in the investments. High payback period is not

beneficial or favourable for the organization because it takes more time to recover money.

Because of that, low payback period should be selected for the investment. Below mention

calculation of new machinery in context of Lovewell helps in evaluating payback period and

allows the managers to understand that, it is beneficial to invest or not.

Formula:

Payback Period = Initial Investment / Cash Inflow

= 275000 / 85000

= 3.79 years.

Accounting Rate of Return (ARR): ARR values represented in percentage form that

show the anticipated financial return on the assets that company has acquired (Loke, 2017). It is

among the firm's easiest or quickest ways of determining returns widely used for project

selection. It is calculated by the average annual profit from the original cost. ARR is the

methodology of capital budgeting which doesn't realize all of the period and earnings of money.

The increasing the return is safer for the investor, meaning the higher earnings is equally

received by the client; the lower return is not competitive. Via this, management determines the

advantages of different organizations as well as makes the necessary choices. Calculating ARR

for the 6 year duration about which they earn the correct payout as can be seen in the

below table. Managers of Lovewell must plan their financial choices properly and make a

decision to choose whether or not give priority to this initiative for investing into new machinery.

The following calculations are as follows:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Formula:

ARR = Average annual profit / Initial investment * 100

Year CI CO (£) Net Cash flow Depreciation Net cash flow

Year 0 £ 275,000 -

Year 1 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 2 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 3 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 4 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 5 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 6 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Net Present Value (NPV): This is key tools that organizations use when they take

decisions regarding investment. This includes the comprehensive analysis of cash inflows

happening at various time intervals (Siminica, Motoi and Dumitru, 2017). Cash flow of net

present value depends on real and future time risk. In comparison, the discounting rate is the

most important factor which is necessary for calculating and measuring the NPV at the point of

calculation. When determining the estimated cash balance of each year, NPV assists with the

decreased period. Further it helps management where they have to examine or determine to

6

ARR = Average annual profit / Initial investment * 100

Year CI CO (£) Net Cash flow Depreciation Net cash flow

Year 0 £ 275,000 -

Year 1 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 2 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 3 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 4 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 5 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Year 6 £ 85,000 (12,500) £ 72,500 £ 38,958 £ 33542

Net Present Value (NPV): This is key tools that organizations use when they take

decisions regarding investment. This includes the comprehensive analysis of cash inflows

happening at various time intervals (Siminica, Motoi and Dumitru, 2017). Cash flow of net

present value depends on real and future time risk. In comparison, the discounting rate is the

most important factor which is necessary for calculating and measuring the NPV at the point of

calculation. When determining the estimated cash balance of each year, NPV assists with the

decreased period. Further it helps management where they have to examine or determine to

6

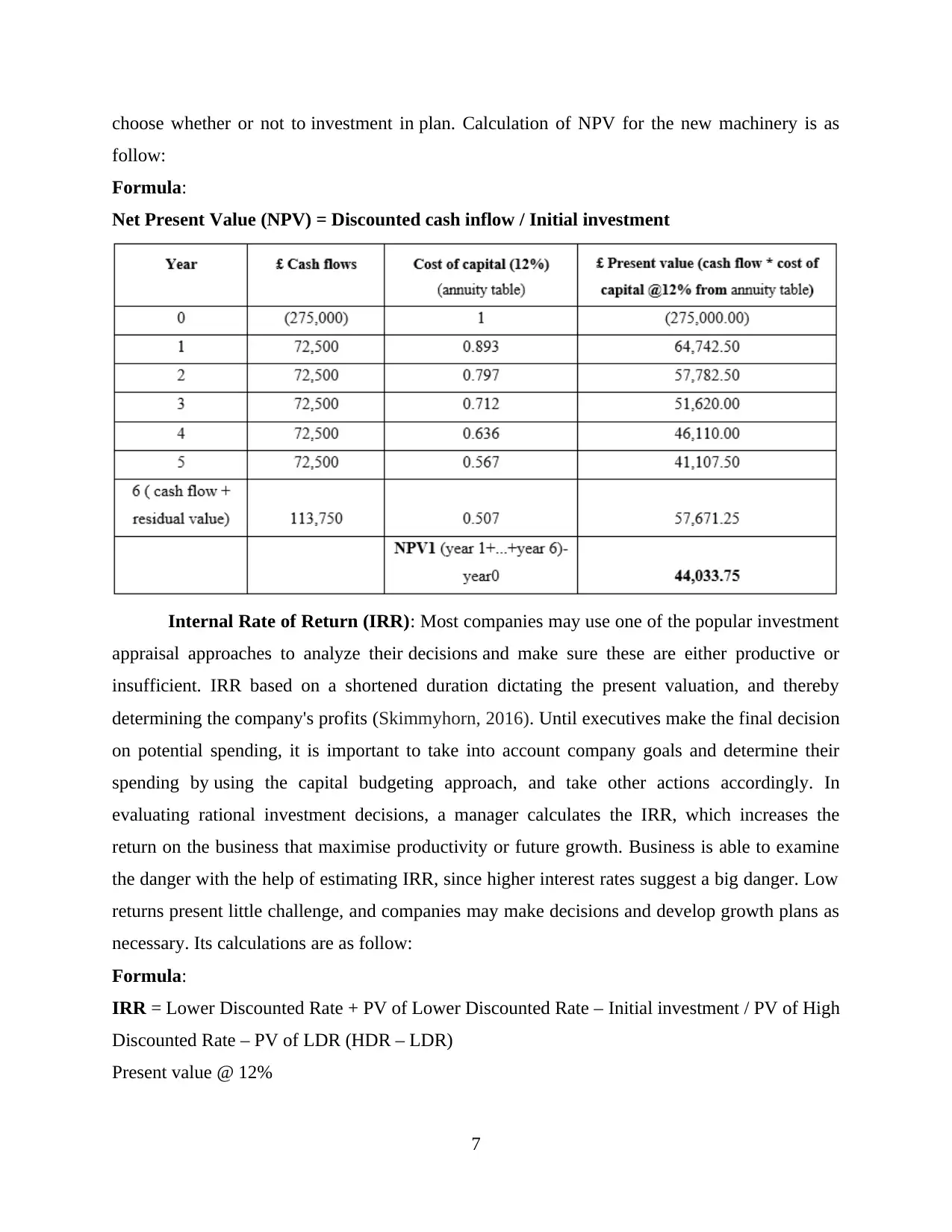

choose whether or not to investment in plan. Calculation of NPV for the new machinery is as

follow:

Formula:

Net Present Value (NPV) = Discounted cash inflow / Initial investment

Internal Rate of Return (IRR): Most companies may use one of the popular investment

appraisal approaches to analyze their decisions and make sure these are either productive or

insufficient. IRR based on a shortened duration dictating the present valuation, and thereby

determining the company's profits (Skimmyhorn, 2016). Until executives make the final decision

on potential spending, it is important to take into account company goals and determine their

spending by using the capital budgeting approach, and take other actions accordingly. In

evaluating rational investment decisions, a manager calculates the IRR, which increases the

return on the business that maximise productivity or future growth. Business is able to examine

the danger with the help of estimating IRR, since higher interest rates suggest a big danger. Low

returns present little challenge, and companies may make decisions and develop growth plans as

necessary. Its calculations are as follow:

Formula:

IRR = Lower Discounted Rate + PV of Lower Discounted Rate – Initial investment / PV of High

Discounted Rate – PV of LDR (HDR – LDR)

Present value @ 12%

7

follow:

Formula:

Net Present Value (NPV) = Discounted cash inflow / Initial investment

Internal Rate of Return (IRR): Most companies may use one of the popular investment

appraisal approaches to analyze their decisions and make sure these are either productive or

insufficient. IRR based on a shortened duration dictating the present valuation, and thereby

determining the company's profits (Skimmyhorn, 2016). Until executives make the final decision

on potential spending, it is important to take into account company goals and determine their

spending by using the capital budgeting approach, and take other actions accordingly. In

evaluating rational investment decisions, a manager calculates the IRR, which increases the

return on the business that maximise productivity or future growth. Business is able to examine

the danger with the help of estimating IRR, since higher interest rates suggest a big danger. Low

returns present little challenge, and companies may make decisions and develop growth plans as

necessary. Its calculations are as follow:

Formula:

IRR = Lower Discounted Rate + PV of Lower Discounted Rate – Initial investment / PV of High

Discounted Rate – PV of LDR (HDR – LDR)

Present value @ 12%

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

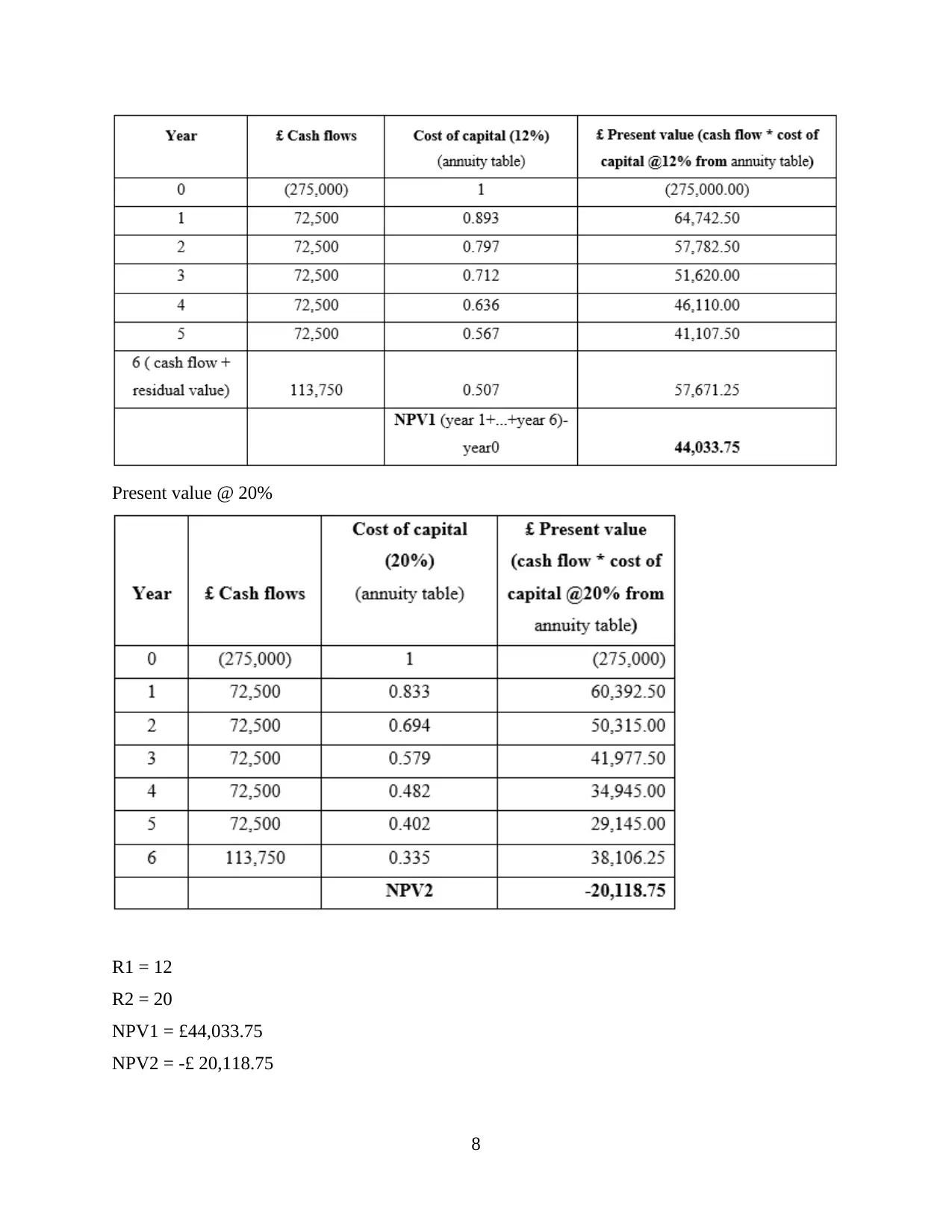

Present value @ 20%

R1 = 12

R2 = 20

NPV1 = £44,033.75

NPV2 = -£ 20,118.75

8

R1 = 12

R2 = 20

NPV1 = £44,033.75

NPV2 = -£ 20,118.75

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

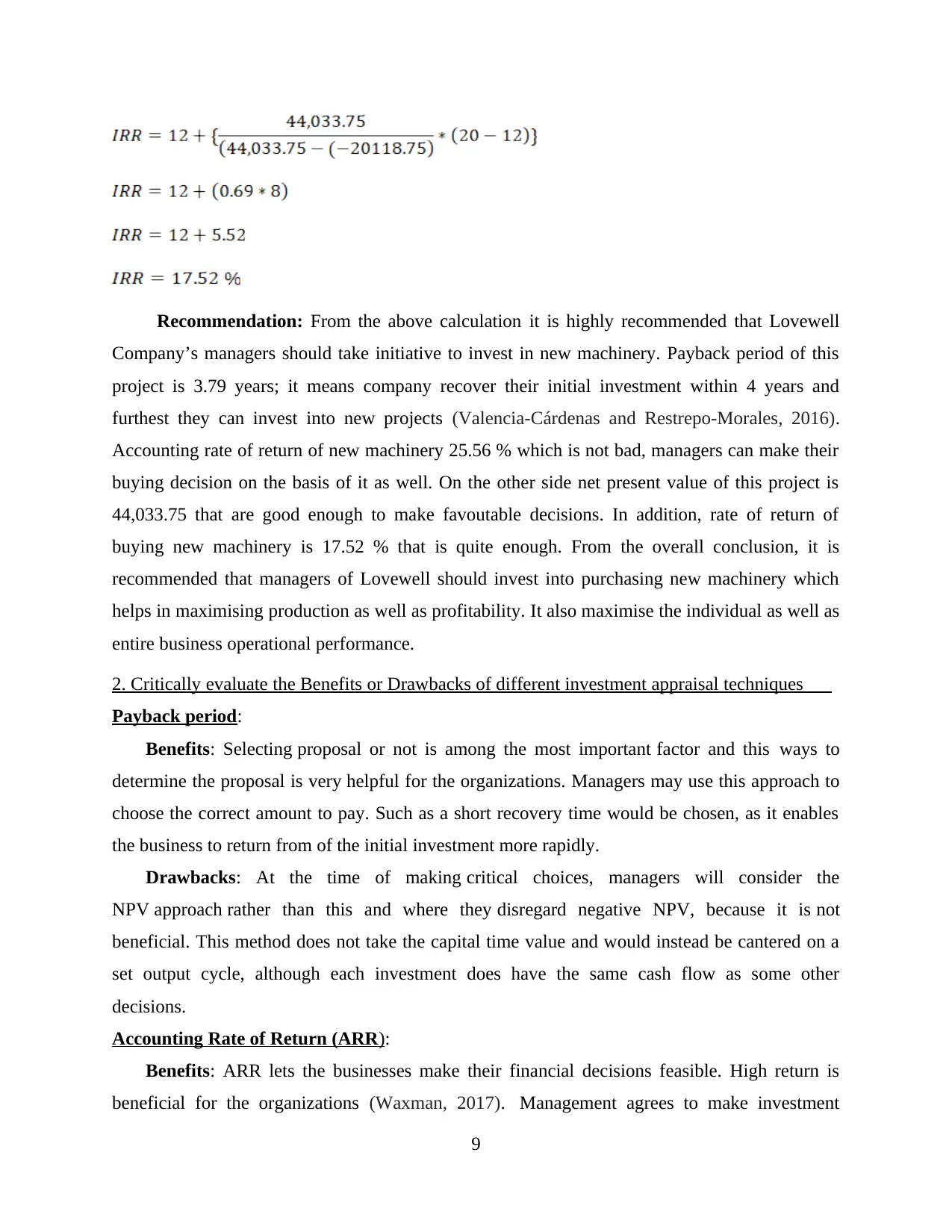

Recommendation: From the above calculation it is highly recommended that Lovewell

Company’s managers should take initiative to invest in new machinery. Payback period of this

project is 3.79 years; it means company recover their initial investment within 4 years and

furthest they can invest into new projects (Valencia-Cárdenas and Restrepo-Morales, 2016).

Accounting rate of return of new machinery 25.56 % which is not bad, managers can make their

buying decision on the basis of it as well. On the other side net present value of this project is

44,033.75 that are good enough to make favoutable decisions. In addition, rate of return of

buying new machinery is 17.52 % that is quite enough. From the overall conclusion, it is

recommended that managers of Lovewell should invest into purchasing new machinery which

helps in maximising production as well as profitability. It also maximise the individual as well as

entire business operational performance.

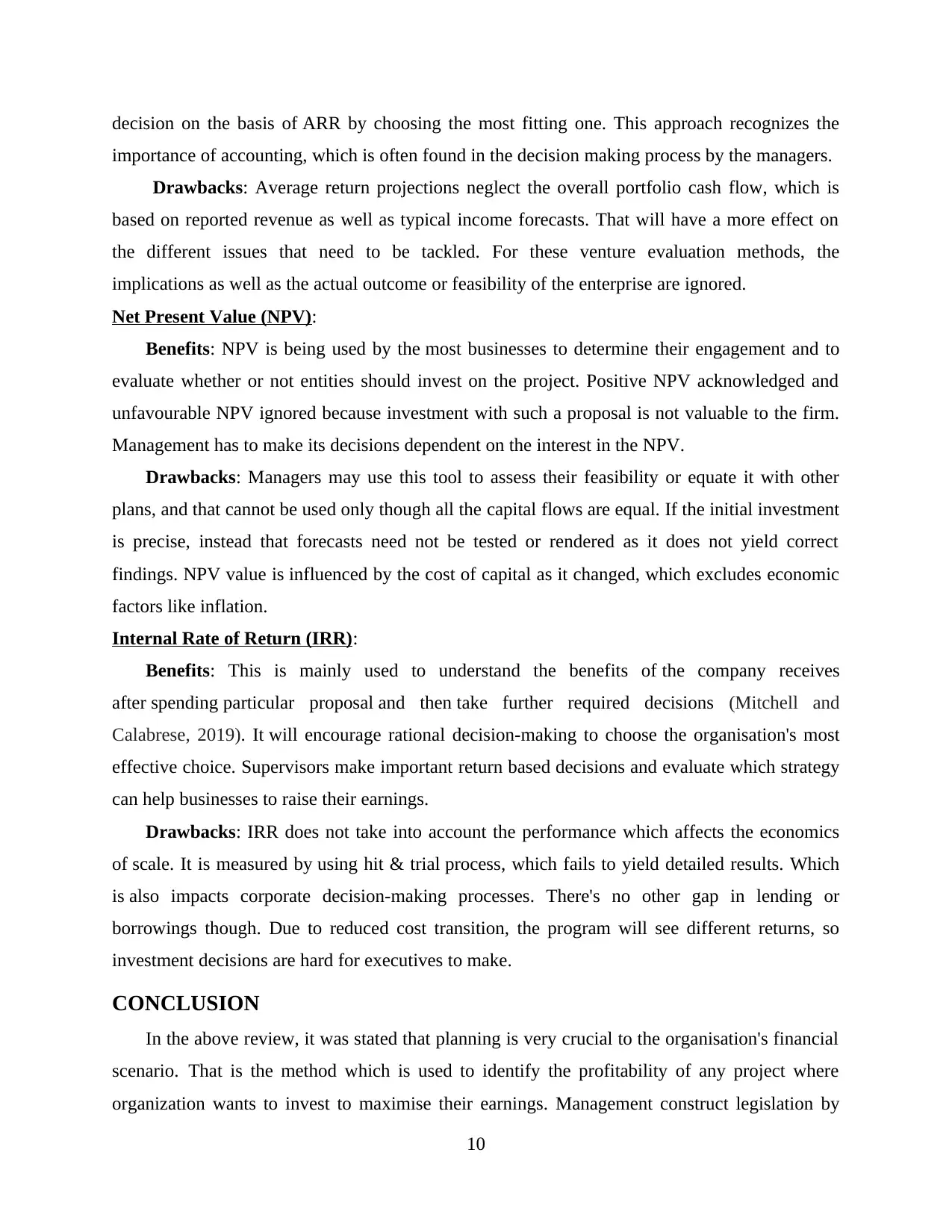

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques

Payback period:

Benefits: Selecting proposal or not is among the most important factor and this ways to

determine the proposal is very helpful for the organizations. Managers may use this approach to

choose the correct amount to pay. Such as a short recovery time would be chosen, as it enables

the business to return from of the initial investment more rapidly.

Drawbacks: At the time of making critical choices, managers will consider the

NPV approach rather than this and where they disregard negative NPV, because it is not

beneficial. This method does not take the capital time value and would instead be cantered on a

set output cycle, although each investment does have the same cash flow as some other

decisions.

Accounting Rate of Return (ARR):

Benefits: ARR lets the businesses make their financial decisions feasible. High return is

beneficial for the organizations (Waxman, 2017). Management agrees to make investment

9

Company’s managers should take initiative to invest in new machinery. Payback period of this

project is 3.79 years; it means company recover their initial investment within 4 years and

furthest they can invest into new projects (Valencia-Cárdenas and Restrepo-Morales, 2016).

Accounting rate of return of new machinery 25.56 % which is not bad, managers can make their

buying decision on the basis of it as well. On the other side net present value of this project is

44,033.75 that are good enough to make favoutable decisions. In addition, rate of return of

buying new machinery is 17.52 % that is quite enough. From the overall conclusion, it is

recommended that managers of Lovewell should invest into purchasing new machinery which

helps in maximising production as well as profitability. It also maximise the individual as well as

entire business operational performance.

2. Critically evaluate the Benefits or Drawbacks of different investment appraisal techniques

Payback period:

Benefits: Selecting proposal or not is among the most important factor and this ways to

determine the proposal is very helpful for the organizations. Managers may use this approach to

choose the correct amount to pay. Such as a short recovery time would be chosen, as it enables

the business to return from of the initial investment more rapidly.

Drawbacks: At the time of making critical choices, managers will consider the

NPV approach rather than this and where they disregard negative NPV, because it is not

beneficial. This method does not take the capital time value and would instead be cantered on a

set output cycle, although each investment does have the same cash flow as some other

decisions.

Accounting Rate of Return (ARR):

Benefits: ARR lets the businesses make their financial decisions feasible. High return is

beneficial for the organizations (Waxman, 2017). Management agrees to make investment

9

decision on the basis of ARR by choosing the most fitting one. This approach recognizes the

importance of accounting, which is often found in the decision making process by the managers.

Drawbacks: Average return projections neglect the overall portfolio cash flow, which is

based on reported revenue as well as typical income forecasts. That will have a more effect on

the different issues that need to be tackled. For these venture evaluation methods, the

implications as well as the actual outcome or feasibility of the enterprise are ignored.

Net Present Value (NPV):

Benefits: NPV is being used by the most businesses to determine their engagement and to

evaluate whether or not entities should invest on the project. Positive NPV acknowledged and

unfavourable NPV ignored because investment with such a proposal is not valuable to the firm.

Management has to make its decisions dependent on the interest in the NPV.

Drawbacks: Managers may use this tool to assess their feasibility or equate it with other

plans, and that cannot be used only though all the capital flows are equal. If the initial investment

is precise, instead that forecasts need not be tested or rendered as it does not yield correct

findings. NPV value is influenced by the cost of capital as it changed, which excludes economic

factors like inflation.

Internal Rate of Return (IRR):

Benefits: This is mainly used to understand the benefits of the company receives

after spending particular proposal and then take further required decisions (Mitchell and

Calabrese, 2019). It will encourage rational decision-making to choose the organisation's most

effective choice. Supervisors make important return based decisions and evaluate which strategy

can help businesses to raise their earnings.

Drawbacks: IRR does not take into account the performance which affects the economics

of scale. It is measured by using hit & trial process, which fails to yield detailed results. Which

is also impacts corporate decision-making processes. There's no other gap in lending or

borrowings though. Due to reduced cost transition, the program will see different returns, so

investment decisions are hard for executives to make.

CONCLUSION

In the above review, it was stated that planning is very crucial to the organisation's financial

scenario. That is the method which is used to identify the profitability of any project where

organization wants to invest to maximise their earnings. Management construct legislation by

10

importance of accounting, which is often found in the decision making process by the managers.

Drawbacks: Average return projections neglect the overall portfolio cash flow, which is

based on reported revenue as well as typical income forecasts. That will have a more effect on

the different issues that need to be tackled. For these venture evaluation methods, the

implications as well as the actual outcome or feasibility of the enterprise are ignored.

Net Present Value (NPV):

Benefits: NPV is being used by the most businesses to determine their engagement and to

evaluate whether or not entities should invest on the project. Positive NPV acknowledged and

unfavourable NPV ignored because investment with such a proposal is not valuable to the firm.

Management has to make its decisions dependent on the interest in the NPV.

Drawbacks: Managers may use this tool to assess their feasibility or equate it with other

plans, and that cannot be used only though all the capital flows are equal. If the initial investment

is precise, instead that forecasts need not be tested or rendered as it does not yield correct

findings. NPV value is influenced by the cost of capital as it changed, which excludes economic

factors like inflation.

Internal Rate of Return (IRR):

Benefits: This is mainly used to understand the benefits of the company receives

after spending particular proposal and then take further required decisions (Mitchell and

Calabrese, 2019). It will encourage rational decision-making to choose the organisation's most

effective choice. Supervisors make important return based decisions and evaluate which strategy

can help businesses to raise their earnings.

Drawbacks: IRR does not take into account the performance which affects the economics

of scale. It is measured by using hit & trial process, which fails to yield detailed results. Which

is also impacts corporate decision-making processes. There's no other gap in lending or

borrowings though. Due to reduced cost transition, the program will see different returns, so

investment decisions are hard for executives to make.

CONCLUSION

In the above review, it was stated that planning is very crucial to the organisation's financial

scenario. That is the method which is used to identify the profitability of any project where

organization wants to invest to maximise their earnings. Management construct legislation by

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.