Financial Management - Sample Assignment

VerifiedAdded on 2021/05/31

|18

|3566

|59

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

KOI

Trimester 1, 2018

FIN700–Financial Management

ASSIGNMENT– GROUP

Due date: Submit to your Tutor bythe start of your Tutorial in Week 9:

Monday, 14 May, or on Tuesday, 15 May, or on Saturday, 19 May, 2018.

Keep a soft copy in case of misadventure.

Penalties for late lodgment, as per the Subject Outline, will be strictly applied.

This Assignment consists of 4 problems, each involving

calculations, and in some cases recommendations.

You are required to complete this Assignment in Groups of 2 or 3 or 4

people.**Groups of 1 or more than 4 persons will incur a penalty of 5 marks out of

30%.**

All members of the Group should come from the same Tutorial class. You may

consult and discuss the Assignment topic with others, but you must write up your

answers yourselves. Penalties for copying and plagiarism are severe.

You should follow the following typing conventions:

Answers to be typed, in the space provided after each question

If additional pages are required, use the blank pages at the end.

Times New Roman font (at minimum, 12 pitch), 1.5 line spacing; and

Left and right margins to be at least 2.5 cm from the edge of thepage.

Research,Referencing and Submission

You should quote any references used at the end of each question.

Use Harvard referencing! Seehttp://en.wikipedia.org/wiki/Harvard_referencing

As this is a calculations problem, there is no need to submit via TURNITIN.

Do not submit this page. Submit page 2 onwards, along with KOI Group Assignment Cover Page&Mark’g Rubric.

Marking Guide

The Assignment will be scored out of 70%,with 20 marks also awarded for

quality of Recommendations and 10 for Presentation, in line with the rubric

in the Subject Outline.This mark will be converted to a score out of 30%.

1

Trimester 1, 2018

FIN700–Financial Management

ASSIGNMENT– GROUP

Due date: Submit to your Tutor bythe start of your Tutorial in Week 9:

Monday, 14 May, or on Tuesday, 15 May, or on Saturday, 19 May, 2018.

Keep a soft copy in case of misadventure.

Penalties for late lodgment, as per the Subject Outline, will be strictly applied.

This Assignment consists of 4 problems, each involving

calculations, and in some cases recommendations.

You are required to complete this Assignment in Groups of 2 or 3 or 4

people.**Groups of 1 or more than 4 persons will incur a penalty of 5 marks out of

30%.**

All members of the Group should come from the same Tutorial class. You may

consult and discuss the Assignment topic with others, but you must write up your

answers yourselves. Penalties for copying and plagiarism are severe.

You should follow the following typing conventions:

Answers to be typed, in the space provided after each question

If additional pages are required, use the blank pages at the end.

Times New Roman font (at minimum, 12 pitch), 1.5 line spacing; and

Left and right margins to be at least 2.5 cm from the edge of thepage.

Research,Referencing and Submission

You should quote any references used at the end of each question.

Use Harvard referencing! Seehttp://en.wikipedia.org/wiki/Harvard_referencing

As this is a calculations problem, there is no need to submit via TURNITIN.

Do not submit this page. Submit page 2 onwards, along with KOI Group Assignment Cover Page&Mark’g Rubric.

Marking Guide

The Assignment will be scored out of 70%,with 20 marks also awarded for

quality of Recommendations and 10 for Presentation, in line with the rubric

in the Subject Outline.This mark will be converted to a score out of 30%.

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Dr Mervyn Fiedler, Subject Co-ordinator, FIN 700. 14 April, 2018.

______________________________________________________________________

***NOTE:When submitting Assignment, please submit from this page onwards,

with a KOI Group Assignment cover page in front,

and a FIN700 Marking Rubric at the back.***

Trimester T118

FIN700

GROUP ASSIGNMENT

Students:Please complete the following before submitting for marking.

Group members

Student No.Student NamePercentage Contribution to AssignmentSignature

1. ………………………………………………………………………………………………

2. ………………………………………………………………………………………………

3. ………………………………………………………………………………………………

4. ………………………………………………………………………………………………

Tutor:

Please circle one name: MsRuhina Karim;MrNishithPanthi; Mr Paul Power;

MsFarzanehOrtacand; Mr Ethan Zheng

Tutorial Day …………………………………………………and Time ……………………….

This Assignment consists of four questions. All questions must be answered.

Please answer all questions in the spaces provided after each question.

Two extra pages are included at the end of the Assignment. If more pages are

required, please copy (or extend) page 14.

2

______________________________________________________________________

***NOTE:When submitting Assignment, please submit from this page onwards,

with a KOI Group Assignment cover page in front,

and a FIN700 Marking Rubric at the back.***

Trimester T118

FIN700

GROUP ASSIGNMENT

Students:Please complete the following before submitting for marking.

Group members

Student No.Student NamePercentage Contribution to AssignmentSignature

1. ………………………………………………………………………………………………

2. ………………………………………………………………………………………………

3. ………………………………………………………………………………………………

4. ………………………………………………………………………………………………

Tutor:

Please circle one name: MsRuhina Karim;MrNishithPanthi; Mr Paul Power;

MsFarzanehOrtacand; Mr Ethan Zheng

Tutorial Day …………………………………………………and Time ……………………….

This Assignment consists of four questions. All questions must be answered.

Please answer all questions in the spaces provided after each question.

Two extra pages are included at the end of the Assignment. If more pages are

required, please copy (or extend) page 14.

2

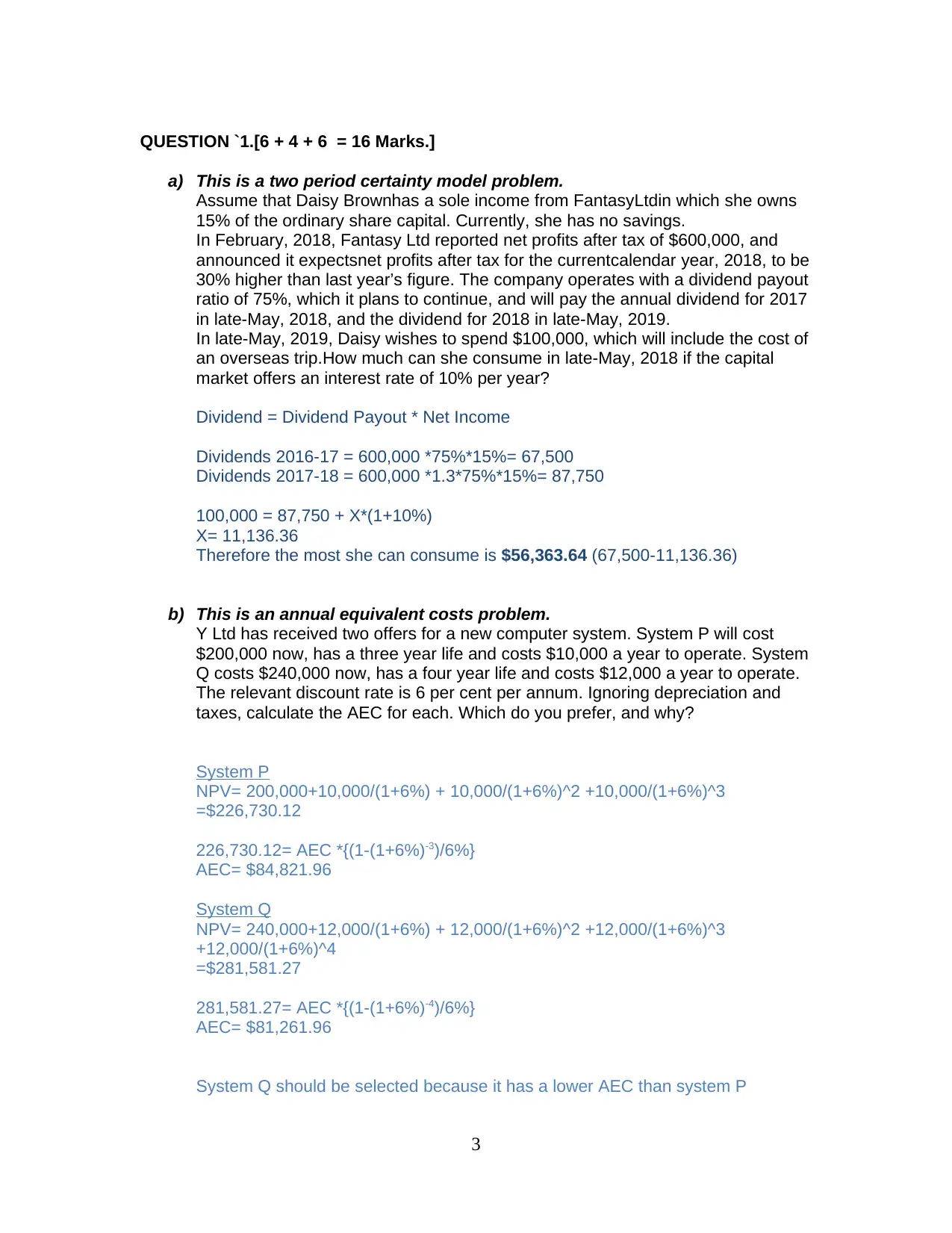

QUESTION `1.[6 + 4 + 6 = 16 Marks.]

a) This is a two period certainty model problem.

Assume that Daisy Brownhas a sole income from FantasyLtdin which she owns

15% of the ordinary share capital. Currently, she has no savings.

In February, 2018, Fantasy Ltd reported net profits after tax of $600,000, and

announced it expectsnet profits after tax for the currentcalendar year, 2018, to be

30% higher than last year’s figure. The company operates with a dividend payout

ratio of 75%, which it plans to continue, and will pay the annual dividend for 2017

in late-May, 2018, and the dividend for 2018 in late-May, 2019.

In late-May, 2019, Daisy wishes to spend $100,000, which will include the cost of

an overseas trip.How much can she consume in late-May, 2018 if the capital

market offers an interest rate of 10% per year?

Dividend = Dividend Payout * Net Income

Dividends 2016-17 = 600,000 *75%*15%= 67,500

Dividends 2017-18 = 600,000 *1.3*75%*15%= 87,750

100,000 = 87,750 + X*(1+10%)

X= 11,136.36

Therefore the most she can consume is $56,363.64 (67,500-11,136.36)

b) This is an annual equivalent costs problem.

Y Ltd has received two offers for a new computer system. System P will cost

$200,000 now, has a three year life and costs $10,000 a year to operate. System

Q costs $240,000 now, has a four year life and costs $12,000 a year to operate.

The relevant discount rate is 6 per cent per annum. Ignoring depreciation and

taxes, calculate the AEC for each. Which do you prefer, and why?

System P

NPV= 200,000+10,000/(1+6%) + 10,000/(1+6%)^2 +10,000/(1+6%)^3

=$226,730.12

226,730.12= AEC *{(1-(1+6%)-3)/6%}

AEC= $84,821.96

System Q

NPV= 240,000+12,000/(1+6%) + 12,000/(1+6%)^2 +12,000/(1+6%)^3

+12,000/(1+6%)^4

=$281,581.27

281,581.27= AEC *{(1-(1+6%)-4)/6%}

AEC= $81,261.96

System Q should be selected because it has a lower AEC than system P

3

a) This is a two period certainty model problem.

Assume that Daisy Brownhas a sole income from FantasyLtdin which she owns

15% of the ordinary share capital. Currently, she has no savings.

In February, 2018, Fantasy Ltd reported net profits after tax of $600,000, and

announced it expectsnet profits after tax for the currentcalendar year, 2018, to be

30% higher than last year’s figure. The company operates with a dividend payout

ratio of 75%, which it plans to continue, and will pay the annual dividend for 2017

in late-May, 2018, and the dividend for 2018 in late-May, 2019.

In late-May, 2019, Daisy wishes to spend $100,000, which will include the cost of

an overseas trip.How much can she consume in late-May, 2018 if the capital

market offers an interest rate of 10% per year?

Dividend = Dividend Payout * Net Income

Dividends 2016-17 = 600,000 *75%*15%= 67,500

Dividends 2017-18 = 600,000 *1.3*75%*15%= 87,750

100,000 = 87,750 + X*(1+10%)

X= 11,136.36

Therefore the most she can consume is $56,363.64 (67,500-11,136.36)

b) This is an annual equivalent costs problem.

Y Ltd has received two offers for a new computer system. System P will cost

$200,000 now, has a three year life and costs $10,000 a year to operate. System

Q costs $240,000 now, has a four year life and costs $12,000 a year to operate.

The relevant discount rate is 6 per cent per annum. Ignoring depreciation and

taxes, calculate the AEC for each. Which do you prefer, and why?

System P

NPV= 200,000+10,000/(1+6%) + 10,000/(1+6%)^2 +10,000/(1+6%)^3

=$226,730.12

226,730.12= AEC *{(1-(1+6%)-3)/6%}

AEC= $84,821.96

System Q

NPV= 240,000+12,000/(1+6%) + 12,000/(1+6%)^2 +12,000/(1+6%)^3

+12,000/(1+6%)^4

=$281,581.27

281,581.27= AEC *{(1-(1+6%)-4)/6%}

AEC= $81,261.96

System Q should be selected because it has a lower AEC than system P

3

c) This question relates to the valuation of interest-bearing securities.

Wildcat BankLtd has experienced large losses on its commercial loan portfolio

and is unable to meet its next two annual interest payments on its recent issue of

unsecured notes. The notes are of $1,000 face value each, mature in May, 2023

and bear a yearly interest coupon payment of 14% per annum.

The Bank paid the interest due this month (May, 2018), and following a meeting

of creditors, arranged to defer payment of the next two interest coupons due in

May, 2019 and May, 2020 respectively. Under the arrangement with creditors,

the Bank will pay the remaining interest coupons (due in May, 2021, May, 2022

and May, 2023) on their due dates, and pay the two deferred coupons (without

interest) along with the normal final interest payment and face value of the notes

on the maturity date.

Wildcat Bank Ltd’s notes are now seen as risky, and require an 18% per annum

return.

REQUIRED: Calculate the current value of each Wildcat Bank unsecured note.

Annual coupon= 14%*1000=140

Cashflows

T-0=140

T-1=0

T-2=0

T-3=140

T-4=140

T-5=140

T-5=140+140+1000

Present Value = 140+140*( 1−(1+18 % ¿¿¿−3)

18 )

/(1+18%)^3+1280/(1+18%)^5

=$884.77

4

Wildcat BankLtd has experienced large losses on its commercial loan portfolio

and is unable to meet its next two annual interest payments on its recent issue of

unsecured notes. The notes are of $1,000 face value each, mature in May, 2023

and bear a yearly interest coupon payment of 14% per annum.

The Bank paid the interest due this month (May, 2018), and following a meeting

of creditors, arranged to defer payment of the next two interest coupons due in

May, 2019 and May, 2020 respectively. Under the arrangement with creditors,

the Bank will pay the remaining interest coupons (due in May, 2021, May, 2022

and May, 2023) on their due dates, and pay the two deferred coupons (without

interest) along with the normal final interest payment and face value of the notes

on the maturity date.

Wildcat Bank Ltd’s notes are now seen as risky, and require an 18% per annum

return.

REQUIRED: Calculate the current value of each Wildcat Bank unsecured note.

Annual coupon= 14%*1000=140

Cashflows

T-0=140

T-1=0

T-2=0

T-3=140

T-4=140

T-5=140

T-5=140+140+1000

Present Value = 140+140*( 1−(1+18 % ¿¿¿−3)

18 )

/(1+18%)^3+1280/(1+18%)^5

=$884.77

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

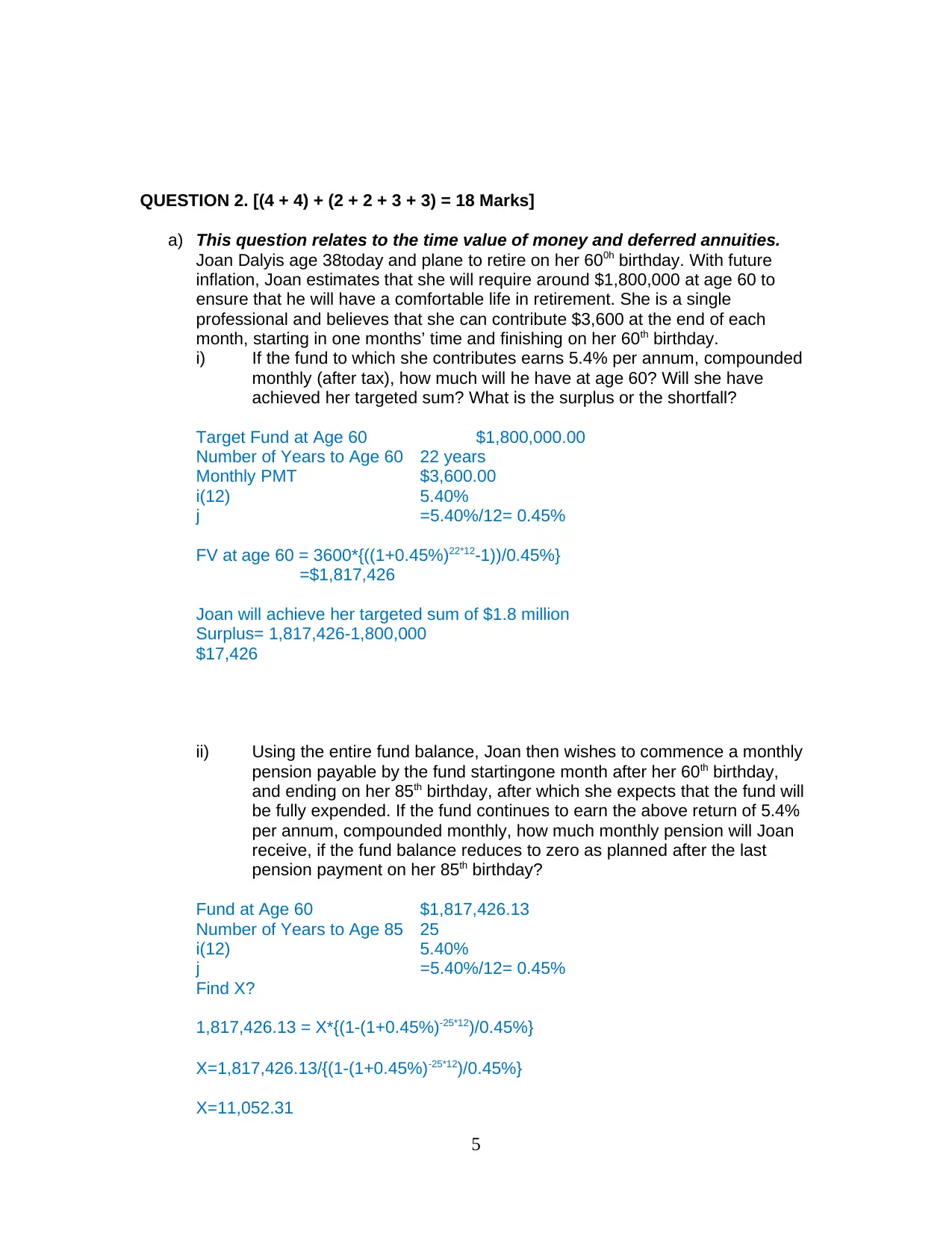

QUESTION 2. [(4 + 4) + (2 + 2 + 3 + 3) = 18 Marks]

a) This question relates to the time value of money and deferred annuities.

Joan Dalyis age 38today and plane to retire on her 600h birthday. With future

inflation, Joan estimates that she will require around $1,800,000 at age 60 to

ensure that he will have a comfortable life in retirement. She is a single

professional and believes that she can contribute $3,600 at the end of each

month, starting in one months’ time and finishing on her 60th birthday.

i) If the fund to which she contributes earns 5.4% per annum, compounded

monthly (after tax), how much will he have at age 60? Will she have

achieved her targeted sum? What is the surplus or the shortfall?

Target Fund at Age 60 $1,800,000.00

Number of Years to Age 60 22 years

Monthly PMT $3,600.00

i(12) 5.40%

j =5.40%/12= 0.45%

FV at age 60 = 3600*{((1+0.45%)22*12-1))/0.45%}

=$1,817,426

Joan will achieve her targeted sum of $1.8 million

Surplus= 1,817,426-1,800,000

$17,426

ii) Using the entire fund balance, Joan then wishes to commence a monthly

pension payable by the fund startingone month after her 60th birthday,

and ending on her 85th birthday, after which she expects that the fund will

be fully expended. If the fund continues to earn the above return of 5.4%

per annum, compounded monthly, how much monthly pension will Joan

receive, if the fund balance reduces to zero as planned after the last

pension payment on her 85th birthday?

Fund at Age 60 $1,817,426.13

Number of Years to Age 85 25

i(12) 5.40%

j =5.40%/12= 0.45%

Find X?

1,817,426.13 = X*{(1-(1+0.45%)-25*12)/0.45%}

X=1,817,426.13/{(1-(1+0.45%)-25*12)/0.45%}

X=11,052.31

5

a) This question relates to the time value of money and deferred annuities.

Joan Dalyis age 38today and plane to retire on her 600h birthday. With future

inflation, Joan estimates that she will require around $1,800,000 at age 60 to

ensure that he will have a comfortable life in retirement. She is a single

professional and believes that she can contribute $3,600 at the end of each

month, starting in one months’ time and finishing on her 60th birthday.

i) If the fund to which she contributes earns 5.4% per annum, compounded

monthly (after tax), how much will he have at age 60? Will she have

achieved her targeted sum? What is the surplus or the shortfall?

Target Fund at Age 60 $1,800,000.00

Number of Years to Age 60 22 years

Monthly PMT $3,600.00

i(12) 5.40%

j =5.40%/12= 0.45%

FV at age 60 = 3600*{((1+0.45%)22*12-1))/0.45%}

=$1,817,426

Joan will achieve her targeted sum of $1.8 million

Surplus= 1,817,426-1,800,000

$17,426

ii) Using the entire fund balance, Joan then wishes to commence a monthly

pension payable by the fund startingone month after her 60th birthday,

and ending on her 85th birthday, after which she expects that the fund will

be fully expended. If the fund continues to earn the above return of 5.4%

per annum, compounded monthly, how much monthly pension will Joan

receive, if the fund balance reduces to zero as planned after the last

pension payment on her 85th birthday?

Fund at Age 60 $1,817,426.13

Number of Years to Age 85 25

i(12) 5.40%

j =5.40%/12= 0.45%

Find X?

1,817,426.13 = X*{(1-(1+0.45%)-25*12)/0.45%}

X=1,817,426.13/{(1-(1+0.45%)-25*12)/0.45%}

X=11,052.31

5

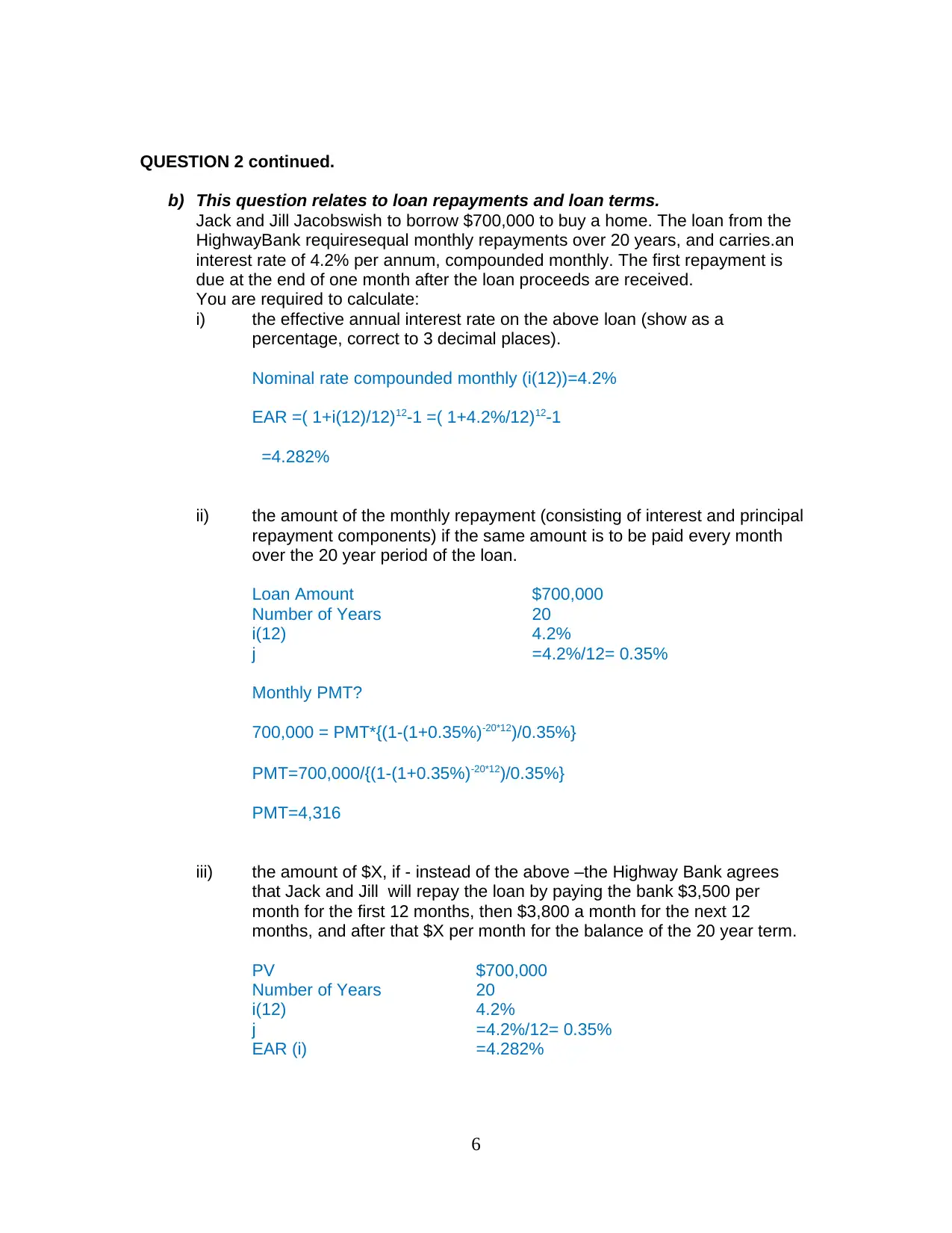

QUESTION 2 continued.

b) This question relates to loan repayments and loan terms.

Jack and Jill Jacobswish to borrow $700,000 to buy a home. The loan from the

HighwayBank requiresequal monthly repayments over 20 years, and carries.an

interest rate of 4.2% per annum, compounded monthly. The first repayment is

due at the end of one month after the loan proceeds are received.

You are required to calculate:

i) the effective annual interest rate on the above loan (show as a

percentage, correct to 3 decimal places).

Nominal rate compounded monthly (i(12))=4.2%

EAR =( 1+i(12)/12)12-1 =( 1+4.2%/12)12-1

=4.282%

ii) the amount of the monthly repayment (consisting of interest and principal

repayment components) if the same amount is to be paid every month

over the 20 year period of the loan.

Loan Amount $700,000

Number of Years 20

i(12) 4.2%

j =4.2%/12= 0.35%

Monthly PMT?

700,000 = PMT*{(1-(1+0.35%)-20*12)/0.35%}

PMT=700,000/{(1-(1+0.35%)-20*12)/0.35%}

PMT=4,316

iii) the amount of $X, if - instead of the above –the Highway Bank agrees

that Jack and Jill will repay the loan by paying the bank $3,500 per

month for the first 12 months, then $3,800 a month for the next 12

months, and after that $X per month for the balance of the 20 year term.

PV $700,000

Number of Years 20

i(12) 4.2%

j =4.2%/12= 0.35%

EAR (i) =4.282%

6

b) This question relates to loan repayments and loan terms.

Jack and Jill Jacobswish to borrow $700,000 to buy a home. The loan from the

HighwayBank requiresequal monthly repayments over 20 years, and carries.an

interest rate of 4.2% per annum, compounded monthly. The first repayment is

due at the end of one month after the loan proceeds are received.

You are required to calculate:

i) the effective annual interest rate on the above loan (show as a

percentage, correct to 3 decimal places).

Nominal rate compounded monthly (i(12))=4.2%

EAR =( 1+i(12)/12)12-1 =( 1+4.2%/12)12-1

=4.282%

ii) the amount of the monthly repayment (consisting of interest and principal

repayment components) if the same amount is to be paid every month

over the 20 year period of the loan.

Loan Amount $700,000

Number of Years 20

i(12) 4.2%

j =4.2%/12= 0.35%

Monthly PMT?

700,000 = PMT*{(1-(1+0.35%)-20*12)/0.35%}

PMT=700,000/{(1-(1+0.35%)-20*12)/0.35%}

PMT=4,316

iii) the amount of $X, if - instead of the above –the Highway Bank agrees

that Jack and Jill will repay the loan by paying the bank $3,500 per

month for the first 12 months, then $3,800 a month for the next 12

months, and after that $X per month for the balance of the 20 year term.

PV $700,000

Number of Years 20

i(12) 4.2%

j =4.2%/12= 0.35%

EAR (i) =4.282%

6

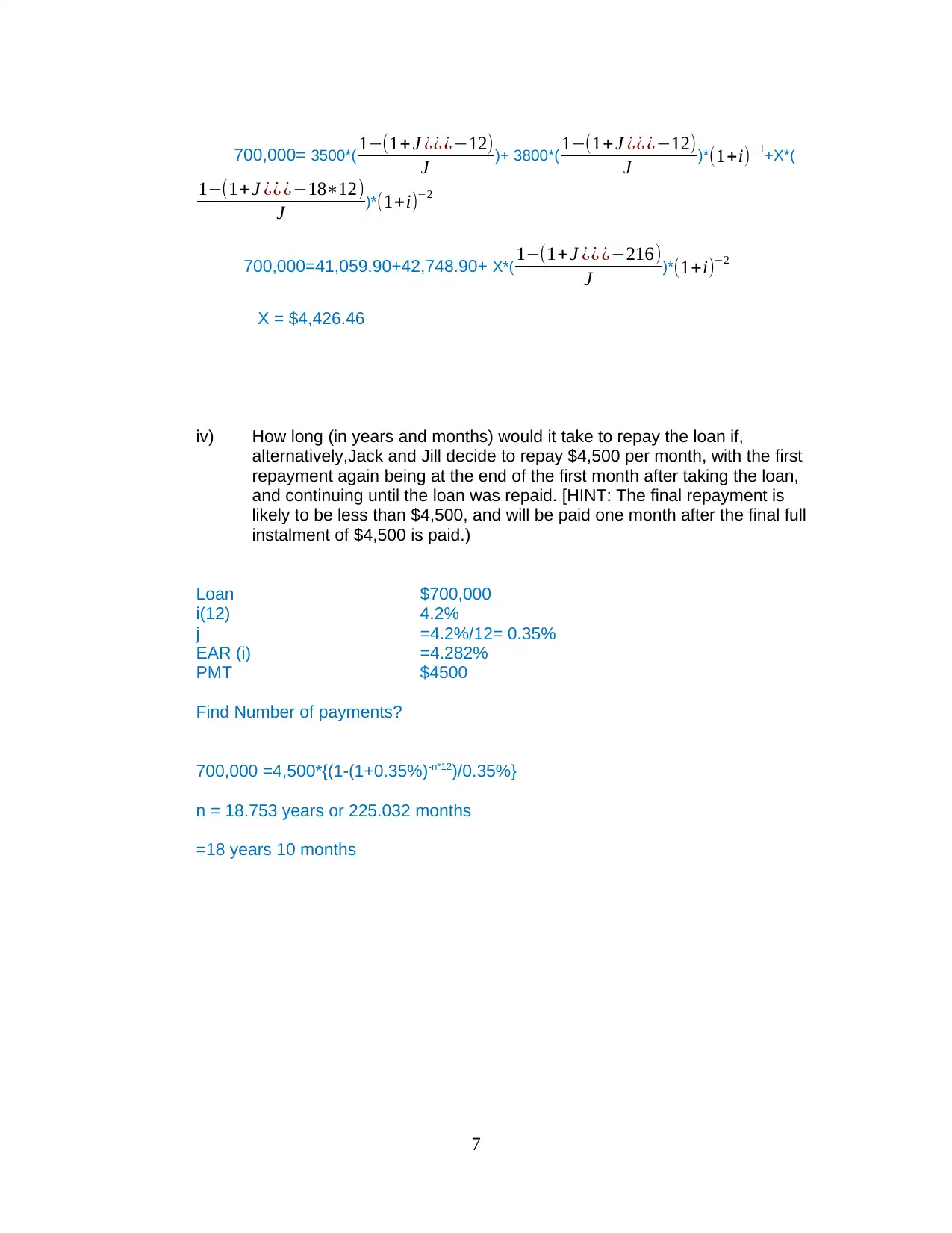

700,000= 3500*( 1−(1+ J ¿¿ ¿−12)

J )+ 3800*( 1−(1+J ¿¿ ¿−12)

J )*(1+i)−1+X*(

1−(1+J ¿¿ ¿−18∗12)

J )*(1+i)−2

700,000=41,059.90+42,748.90+ X*( 1−(1+ J ¿¿ ¿−216)

J )*(1+i)−2

X = $4,426.46

iv) How long (in years and months) would it take to repay the loan if,

alternatively,Jack and Jill decide to repay $4,500 per month, with the first

repayment again being at the end of the first month after taking the loan,

and continuing until the loan was repaid. [HINT: The final repayment is

likely to be less than $4,500, and will be paid one month after the final full

instalment of $4,500 is paid.)

Loan $700,000

i(12) 4.2%

j =4.2%/12= 0.35%

EAR (i) =4.282%

PMT $4500

Find Number of payments?

700,000 =4,500*{(1-(1+0.35%)-n*12)/0.35%}

n = 18.753 years or 225.032 months

=18 years 10 months

7

J )+ 3800*( 1−(1+J ¿¿ ¿−12)

J )*(1+i)−1+X*(

1−(1+J ¿¿ ¿−18∗12)

J )*(1+i)−2

700,000=41,059.90+42,748.90+ X*( 1−(1+ J ¿¿ ¿−216)

J )*(1+i)−2

X = $4,426.46

iv) How long (in years and months) would it take to repay the loan if,

alternatively,Jack and Jill decide to repay $4,500 per month, with the first

repayment again being at the end of the first month after taking the loan,

and continuing until the loan was repaid. [HINT: The final repayment is

likely to be less than $4,500, and will be paid one month after the final full

instalment of $4,500 is paid.)

Loan $700,000

i(12) 4.2%

j =4.2%/12= 0.35%

EAR (i) =4.282%

PMT $4500

Find Number of payments?

700,000 =4,500*{(1-(1+0.35%)-n*12)/0.35%}

n = 18.753 years or 225.032 months

=18 years 10 months

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

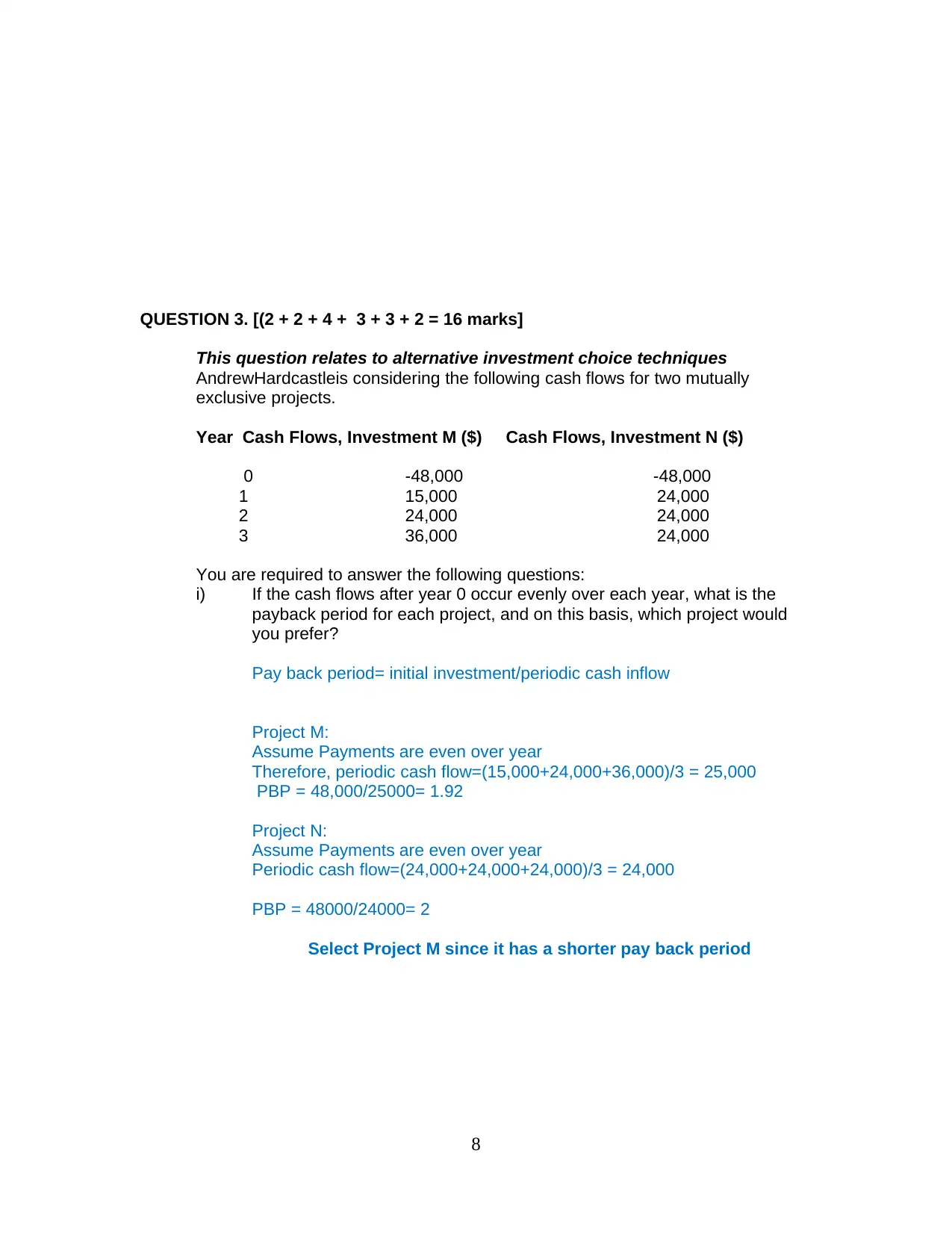

QUESTION 3. [(2 + 2 + 4 + 3 + 3 + 2 = 16 marks]

This question relates to alternative investment choice techniques

AndrewHardcastleis considering the following cash flows for two mutually

exclusive projects.

Year Cash Flows, Investment M ($) Cash Flows, Investment N ($)

0 -48,000 -48,000

1 15,000 24,000

2 24,000 24,000

3 36,000 24,000

You are required to answer the following questions:

i) If the cash flows after year 0 occur evenly over each year, what is the

payback period for each project, and on this basis, which project would

you prefer?

Pay back period= initial investment/periodic cash inflow

Project M:

Assume Payments are even over year

Therefore, periodic cash flow=(15,000+24,000+36,000)/3 = 25,000

PBP = 48,000/25000= 1.92

Project N:

Assume Payments are even over year

Periodic cash flow=(24,000+24,000+24,000)/3 = 24,000

PBP = 48000/24000= 2

Select Project M since it has a shorter pay back period

8

This question relates to alternative investment choice techniques

AndrewHardcastleis considering the following cash flows for two mutually

exclusive projects.

Year Cash Flows, Investment M ($) Cash Flows, Investment N ($)

0 -48,000 -48,000

1 15,000 24,000

2 24,000 24,000

3 36,000 24,000

You are required to answer the following questions:

i) If the cash flows after year 0 occur evenly over each year, what is the

payback period for each project, and on this basis, which project would

you prefer?

Pay back period= initial investment/periodic cash inflow

Project M:

Assume Payments are even over year

Therefore, periodic cash flow=(15,000+24,000+36,000)/3 = 25,000

PBP = 48,000/25000= 1.92

Project N:

Assume Payments are even over year

Periodic cash flow=(24,000+24,000+24,000)/3 = 24,000

PBP = 48000/24000= 2

Select Project M since it has a shorter pay back period

8

IN THE REMAINING PARTS, ASSUME THAT ALL CASH FLOWS

OCCUR AT THE END OF EACH YEAR.

ii) Would the payback periods then be any different to your answer in i)? If

so, what would the payback periods be?

Yes it would be different as follows

Payback period = Years before recovery + unrecovered cost at start year/cash

flow during the year

Project M:

Year cumulative

cash flow

0

(48,000)

1

15,000

15,000

2

24,000

39,000

3

36,000

75,000

PBP = 2 + (48,000-39,000)/36000= 2.25

Project N:

Year cumulative

cash flow

0

(48,000)

1

24,000

24,000

2

24,000

48,000

3

24,000

72,000

PBP = 2 + (48,000-48,000)/24000= 2

In this situation, select Project N because it has shorter pay back period

9

OCCUR AT THE END OF EACH YEAR.

ii) Would the payback periods then be any different to your answer in i)? If

so, what would the payback periods be?

Yes it would be different as follows

Payback period = Years before recovery + unrecovered cost at start year/cash

flow during the year

Project M:

Year cumulative

cash flow

0

(48,000)

1

15,000

15,000

2

24,000

39,000

3

36,000

75,000

PBP = 2 + (48,000-39,000)/36000= 2.25

Project N:

Year cumulative

cash flow

0

(48,000)

1

24,000

24,000

2

24,000

48,000

3

24,000

72,000

PBP = 2 + (48,000-48,000)/24000= 2

In this situation, select Project N because it has shorter pay back period

9

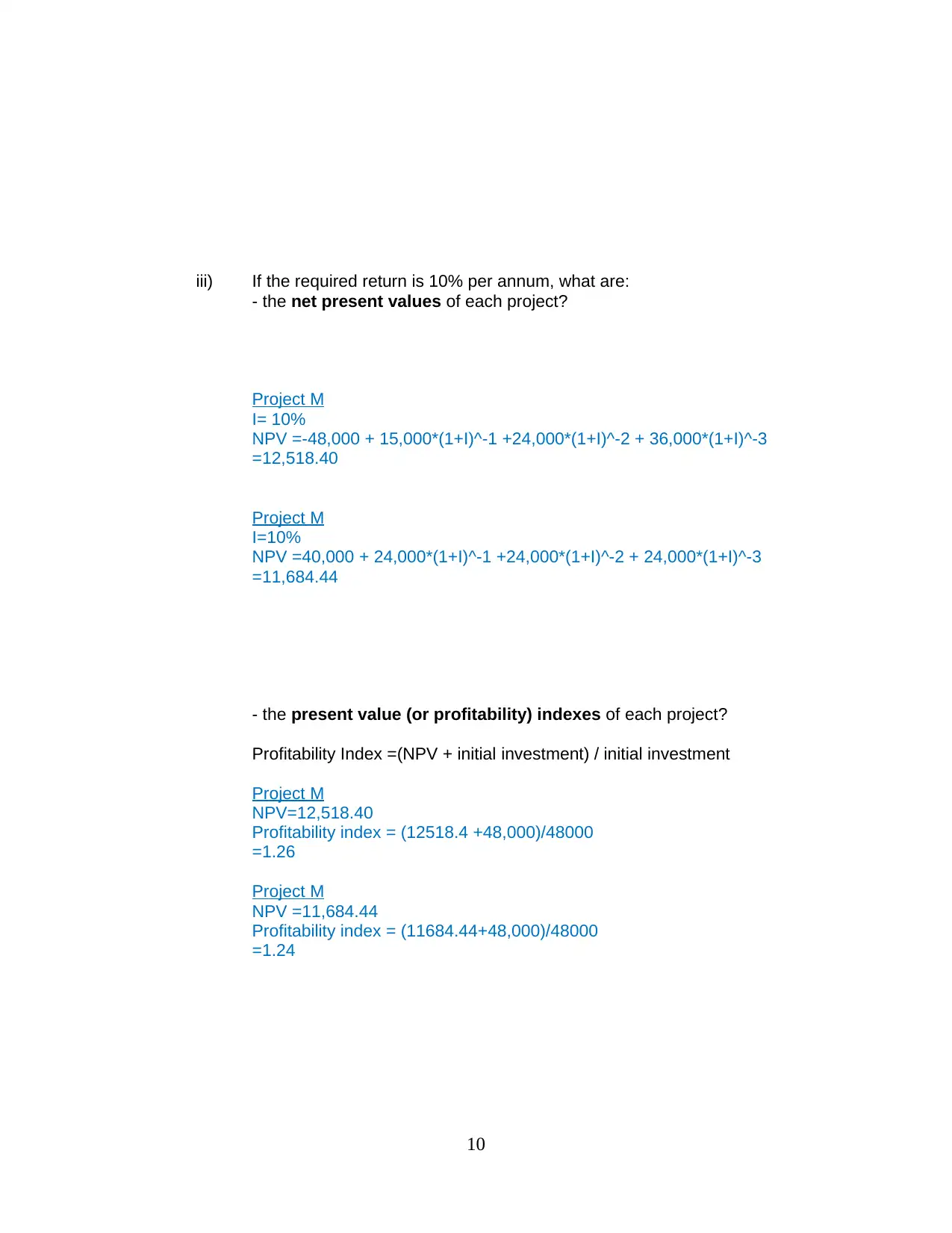

iii) If the required return is 10% per annum, what are:

- the net present values of each project?

Project M

I= 10%

NPV =-48,000 + 15,000*(1+I)^-1 +24,000*(1+I)^-2 + 36,000*(1+I)^-3

=12,518.40

Project M

I=10%

NPV =40,000 + 24,000*(1+I)^-1 +24,000*(1+I)^-2 + 24,000*(1+I)^-3

=11,684.44

- the present value (or profitability) indexes of each project?

Profitability Index =(NPV + initial investment) / initial investment

Project M

NPV=12,518.40

Profitability index = (12518.4 +48,000)/48000

=1.26

Project M

NPV =11,684.44

Profitability index = (11684.44+48,000)/48000

=1.24

10

- the net present values of each project?

Project M

I= 10%

NPV =-48,000 + 15,000*(1+I)^-1 +24,000*(1+I)^-2 + 36,000*(1+I)^-3

=12,518.40

Project M

I=10%

NPV =40,000 + 24,000*(1+I)^-1 +24,000*(1+I)^-2 + 24,000*(1+I)^-3

=11,684.44

- the present value (or profitability) indexes of each project?

Profitability Index =(NPV + initial investment) / initial investment

Project M

NPV=12,518.40

Profitability index = (12518.4 +48,000)/48000

=1.26

Project M

NPV =11,684.44

Profitability index = (11684.44+48,000)/48000

=1.24

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

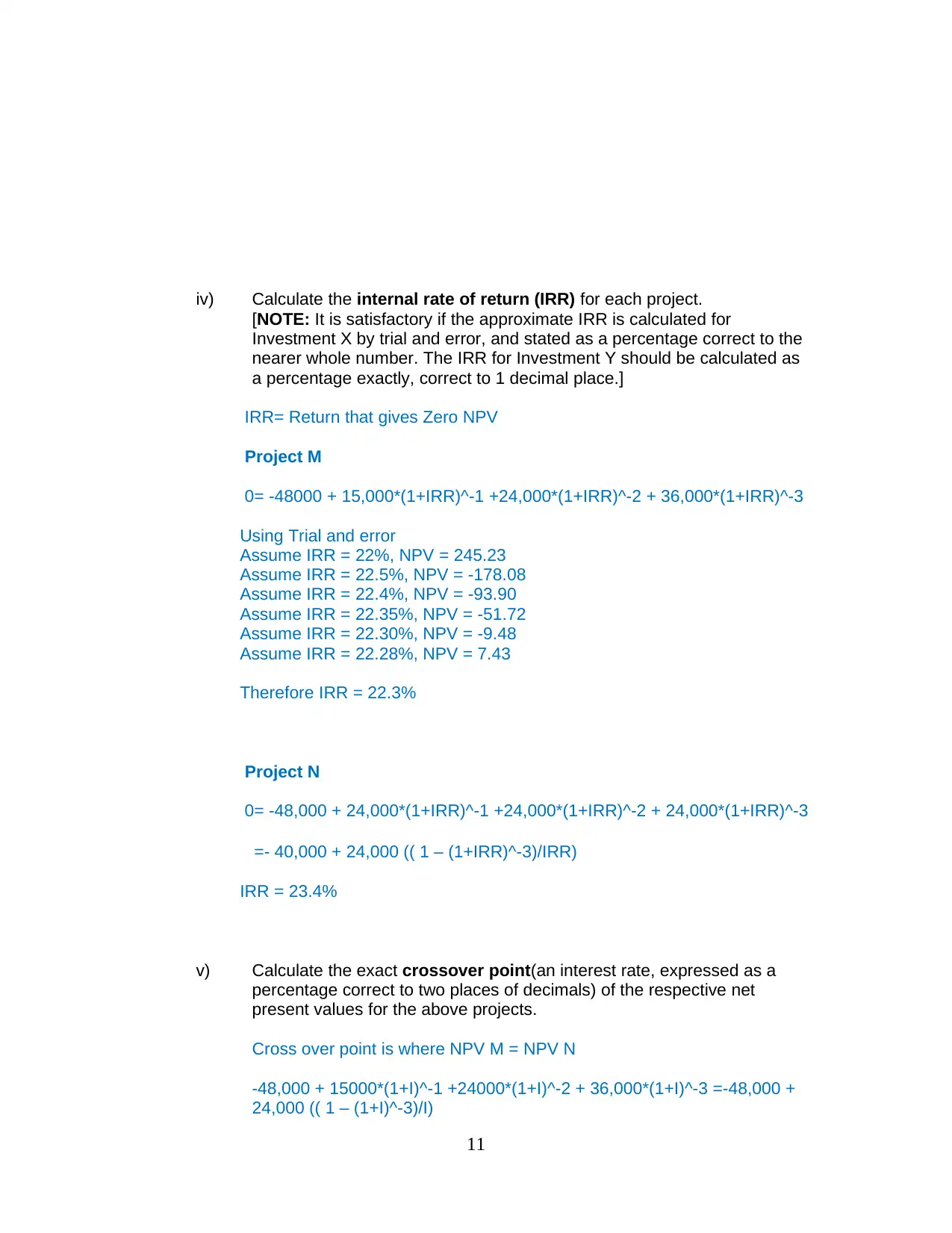

iv) Calculate the internal rate of return (IRR) for each project.

[NOTE: It is satisfactory if the approximate IRR is calculated for

Investment X by trial and error, and stated as a percentage correct to the

nearer whole number. The IRR for Investment Y should be calculated as

a percentage exactly, correct to 1 decimal place.]

IRR= Return that gives Zero NPV

Project M

0= -48000 + 15,000*(1+IRR)^-1 +24,000*(1+IRR)^-2 + 36,000*(1+IRR)^-3

Using Trial and error

Assume IRR = 22%, NPV = 245.23

Assume IRR = 22.5%, NPV = -178.08

Assume IRR = 22.4%, NPV = -93.90

Assume IRR = 22.35%, NPV = -51.72

Assume IRR = 22.30%, NPV = -9.48

Assume IRR = 22.28%, NPV = 7.43

Therefore IRR = 22.3%

Project N

0= -48,000 + 24,000*(1+IRR)^-1 +24,000*(1+IRR)^-2 + 24,000*(1+IRR)^-3

=- 40,000 + 24,000 (( 1 – (1+IRR)^-3)/IRR)

IRR = 23.4%

v) Calculate the exact crossover point(an interest rate, expressed as a

percentage correct to two places of decimals) of the respective net

present values for the above projects.

Cross over point is where NPV M = NPV N

-48,000 + 15000*(1+I)^-1 +24000*(1+I)^-2 + 36,000*(1+I)^-3 =-48,000 +

24,000 (( 1 – (1+I)^-3)/I)

11

[NOTE: It is satisfactory if the approximate IRR is calculated for

Investment X by trial and error, and stated as a percentage correct to the

nearer whole number. The IRR for Investment Y should be calculated as

a percentage exactly, correct to 1 decimal place.]

IRR= Return that gives Zero NPV

Project M

0= -48000 + 15,000*(1+IRR)^-1 +24,000*(1+IRR)^-2 + 36,000*(1+IRR)^-3

Using Trial and error

Assume IRR = 22%, NPV = 245.23

Assume IRR = 22.5%, NPV = -178.08

Assume IRR = 22.4%, NPV = -93.90

Assume IRR = 22.35%, NPV = -51.72

Assume IRR = 22.30%, NPV = -9.48

Assume IRR = 22.28%, NPV = 7.43

Therefore IRR = 22.3%

Project N

0= -48,000 + 24,000*(1+IRR)^-1 +24,000*(1+IRR)^-2 + 24,000*(1+IRR)^-3

=- 40,000 + 24,000 (( 1 – (1+IRR)^-3)/IRR)

IRR = 23.4%

v) Calculate the exact crossover point(an interest rate, expressed as a

percentage correct to two places of decimals) of the respective net

present values for the above projects.

Cross over point is where NPV M = NPV N

-48,000 + 15000*(1+I)^-1 +24000*(1+I)^-2 + 36,000*(1+I)^-3 =-48,000 +

24,000 (( 1 – (1+I)^-3)/I)

11

15,000*(1+I)^-1 +24,000*(1+I)^-2 + 36,000*(1+I)^-3 =24,000 (( 1 – (1+I)^-

3)/I)

Using Trial and error get 15.47%

vi) Having regard to the above calculations, state – with reasons - which of

investments M and N you would prefer.

Select Project M because it has a higher NPV and profitability index in

comparison to Project N. Furthermore, the IRR is greater than the

companies required return and it has a shorter payback period

12

3)/I)

Using Trial and error get 15.47%

vi) Having regard to the above calculations, state – with reasons - which of

investments M and N you would prefer.

Select Project M because it has a higher NPV and profitability index in

comparison to Project N. Furthermore, the IRR is greater than the

companies required return and it has a shorter payback period

12

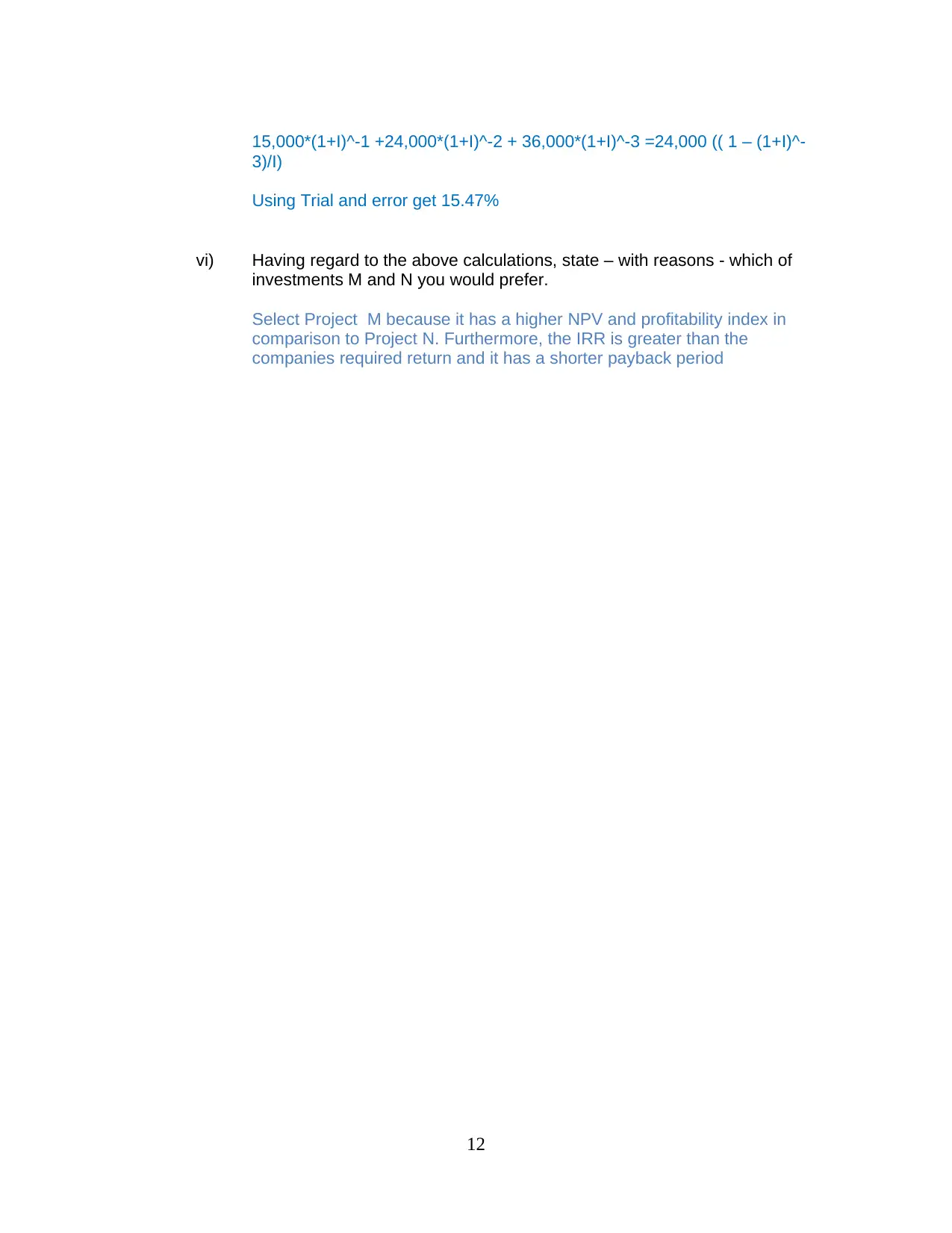

QUESTION 4. [18 + 2 = 20 marks].

This question relates to capital budgeting.

Interstate Haulage Ltdis considering the purchase of two new modern large

truckscosting $500,000 each, which it will fully financewith a fixed interest loan of 8% per

annum, with interest paid monthly and the principal repaid at the end of 4 years. The

trucks will be used in the company’s interstate and intra-state trucking business.

The two new trucks will replace three existing smaller trucks and will permit the company

to reduce its storage costs by $50,000 a year and its labour costs by $200,000 a year,

both over the next 4 years. [Assume these savings are realized at the end of each year.]

The new trucksmay be depreciated for tax purposes by the straight-line method to zero

over the next 4 years. The company thinks that it can sell the trucksat the end of 4 years

for $150,000 each.

QUESTION 4 continued.

The three smaller old trucks were bought 1 year ago for $250,000 each, with a then life

expectancy of 5 years, and have been depreciated by the straight-line method at 20% a

year. If the company proceeds with the above purchase, the old trucks will be sold this

month for $100,000 each.

This is not the first time that the company has considered this purchase and

replacement. Twelve monthsago, the company engaged Cartage Consultants, at a fee

of $20,000 paid in advance, to conduct a feasibility study on savings strategies and

Cartagemade the above recommendations. At the time, Interstate Haulage Ltd did not

proceed with the recommended strategy, but is now reconsidering the proposal.

Interstate Haulage Ltdfurther estimates that it will have to spend tax-deductible amounts

of $40,000 in 2 years’ time and $50,000 in 3 years’ time overhauling the trucks.

It will also require additions to current assets of $30,000 at the beginning of the project,

which will be fully recoverable at the end of the fourth year.

Interstate Haulage Ltd’scost of capital is 10%. The tax rate is 30%. Tax is paid in the

year in which earnings are received.

13

This question relates to capital budgeting.

Interstate Haulage Ltdis considering the purchase of two new modern large

truckscosting $500,000 each, which it will fully financewith a fixed interest loan of 8% per

annum, with interest paid monthly and the principal repaid at the end of 4 years. The

trucks will be used in the company’s interstate and intra-state trucking business.

The two new trucks will replace three existing smaller trucks and will permit the company

to reduce its storage costs by $50,000 a year and its labour costs by $200,000 a year,

both over the next 4 years. [Assume these savings are realized at the end of each year.]

The new trucksmay be depreciated for tax purposes by the straight-line method to zero

over the next 4 years. The company thinks that it can sell the trucksat the end of 4 years

for $150,000 each.

QUESTION 4 continued.

The three smaller old trucks were bought 1 year ago for $250,000 each, with a then life

expectancy of 5 years, and have been depreciated by the straight-line method at 20% a

year. If the company proceeds with the above purchase, the old trucks will be sold this

month for $100,000 each.

This is not the first time that the company has considered this purchase and

replacement. Twelve monthsago, the company engaged Cartage Consultants, at a fee

of $20,000 paid in advance, to conduct a feasibility study on savings strategies and

Cartagemade the above recommendations. At the time, Interstate Haulage Ltd did not

proceed with the recommended strategy, but is now reconsidering the proposal.

Interstate Haulage Ltdfurther estimates that it will have to spend tax-deductible amounts

of $40,000 in 2 years’ time and $50,000 in 3 years’ time overhauling the trucks.

It will also require additions to current assets of $30,000 at the beginning of the project,

which will be fully recoverable at the end of the fourth year.

Interstate Haulage Ltd’scost of capital is 10%. The tax rate is 30%. Tax is paid in the

year in which earnings are received.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

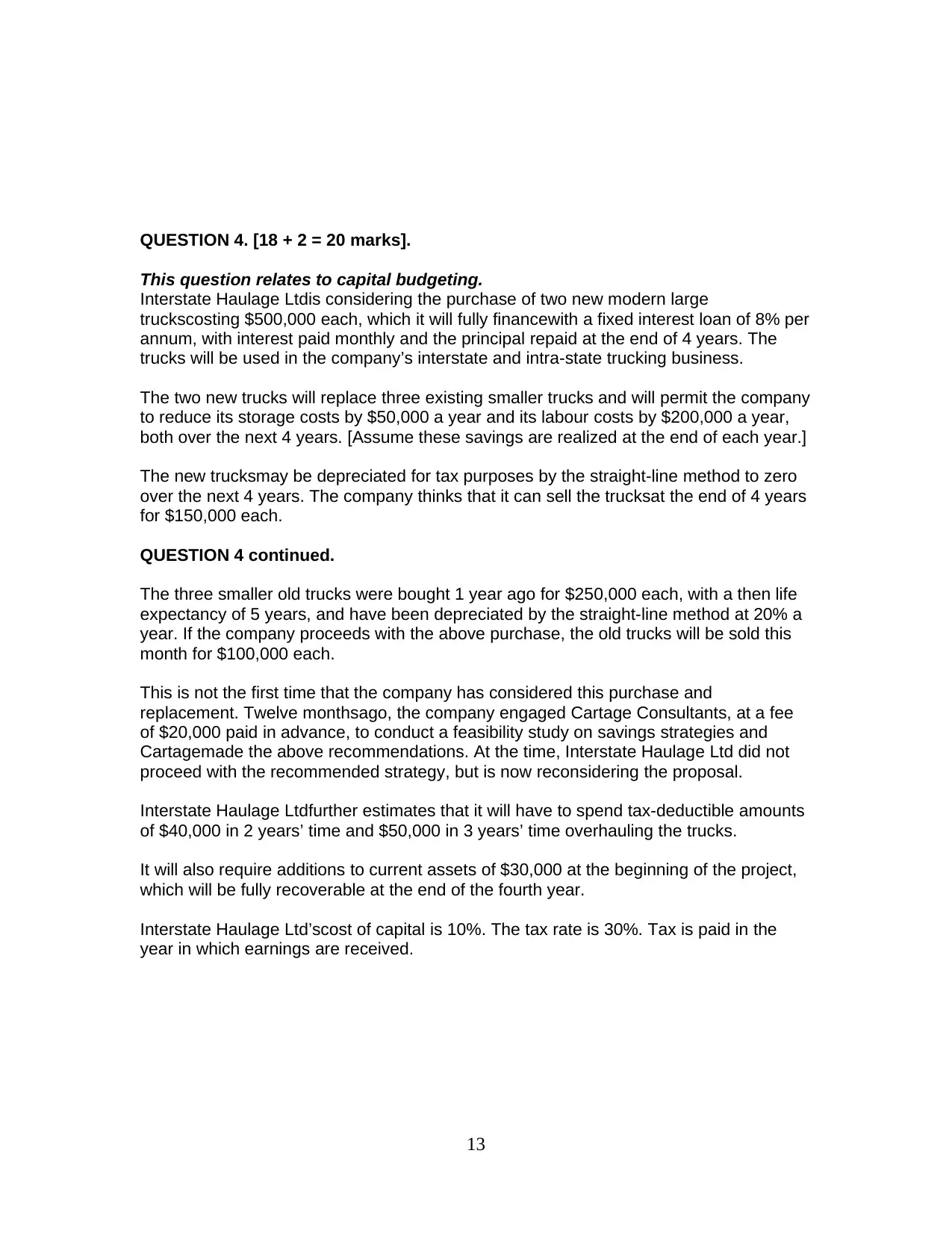

REQUIRED:

(a) Calculate the net present value (NPV), that is, the net benefit or net loss in

present value terms of the proposed purchase costs and the resultant

incremental cash flows.

[HINT: As shown in the text-book, it is recommended that for each year you

calculate the tax effect first, then identify the cash flows, then calculate the

overall net present value. Finally, make your recommendation.]

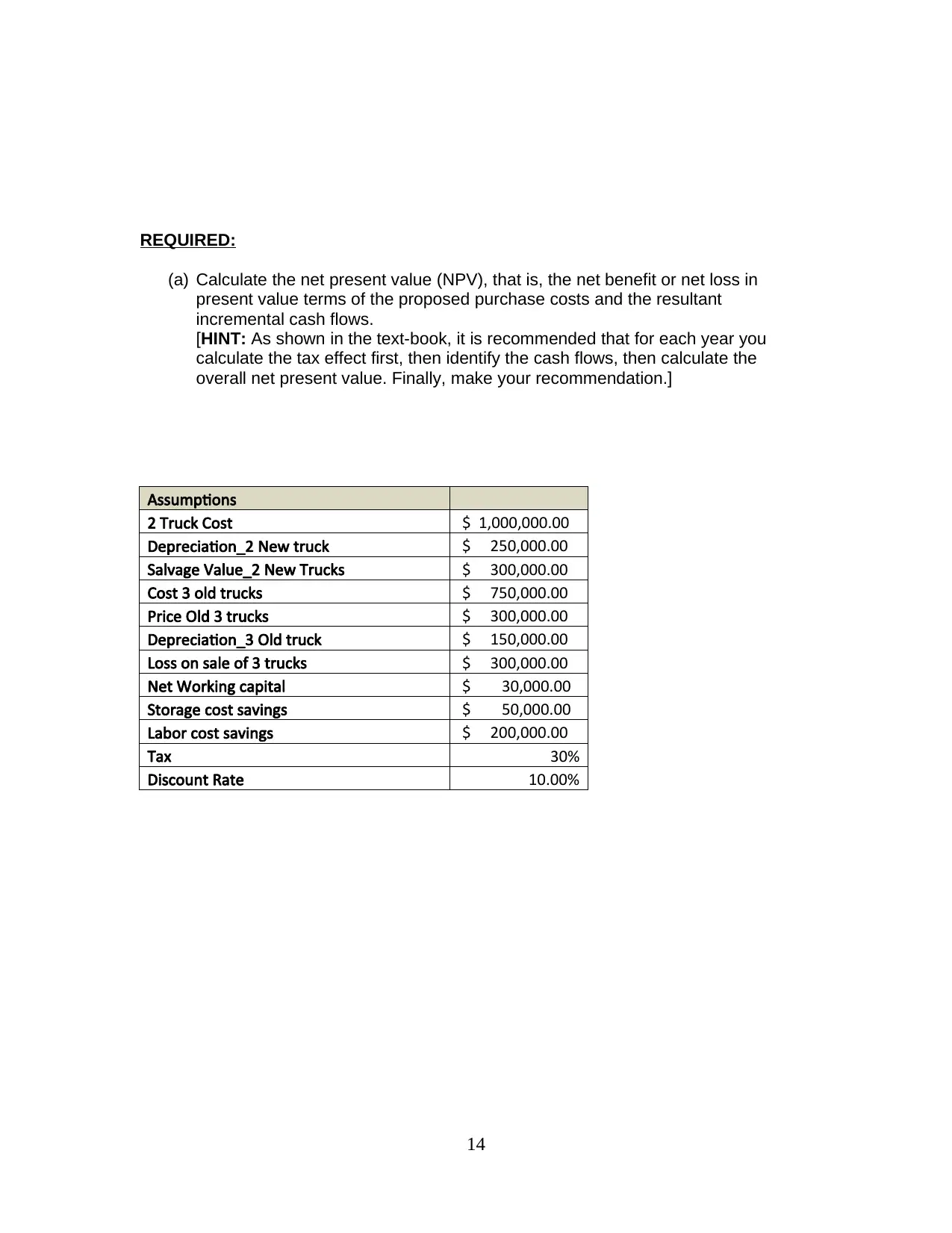

Assumptions

2 Truck Cost $ 1,000,000.00

Depreciation_2 New truck $ 250,000.00

Salvage Value_2 New Trucks $ 300,000.00

Cost 3 old trucks $ 750,000.00

Price Old 3 trucks $ 300,000.00

Depreciation_3 Old truck $ 150,000.00

Loss on sale of 3 trucks $ 300,000.00

Net Working capital $ 30,000.00

Storage cost savings $ 50,000.00

Labor cost savings $ 200,000.00

Tax 30%

Discount Rate 10.00%

14

(a) Calculate the net present value (NPV), that is, the net benefit or net loss in

present value terms of the proposed purchase costs and the resultant

incremental cash flows.

[HINT: As shown in the text-book, it is recommended that for each year you

calculate the tax effect first, then identify the cash flows, then calculate the

overall net present value. Finally, make your recommendation.]

Assumptions

2 Truck Cost $ 1,000,000.00

Depreciation_2 New truck $ 250,000.00

Salvage Value_2 New Trucks $ 300,000.00

Cost 3 old trucks $ 750,000.00

Price Old 3 trucks $ 300,000.00

Depreciation_3 Old truck $ 150,000.00

Loss on sale of 3 trucks $ 300,000.00

Net Working capital $ 30,000.00

Storage cost savings $ 50,000.00

Labor cost savings $ 200,000.00

Tax 30%

Discount Rate 10.00%

14

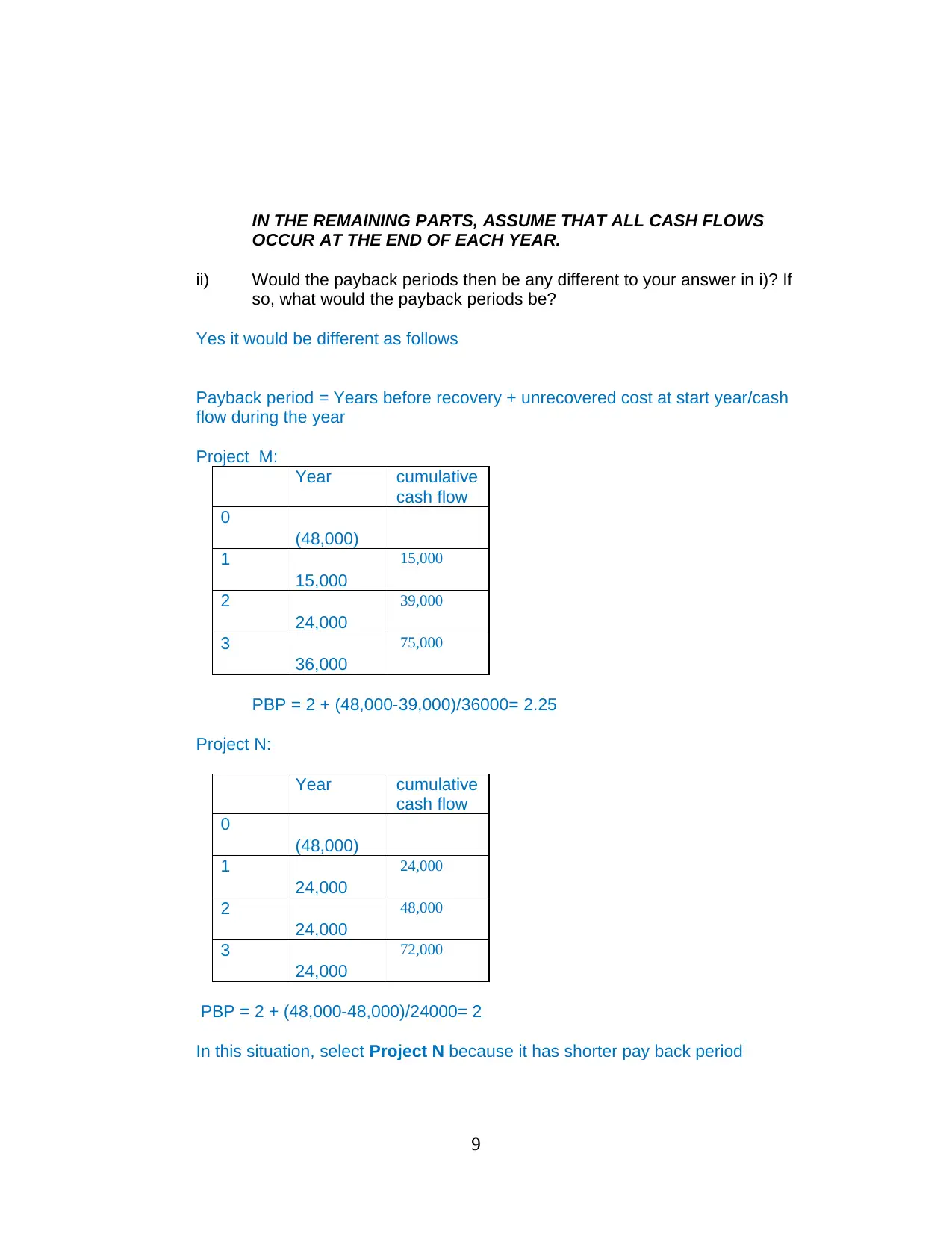

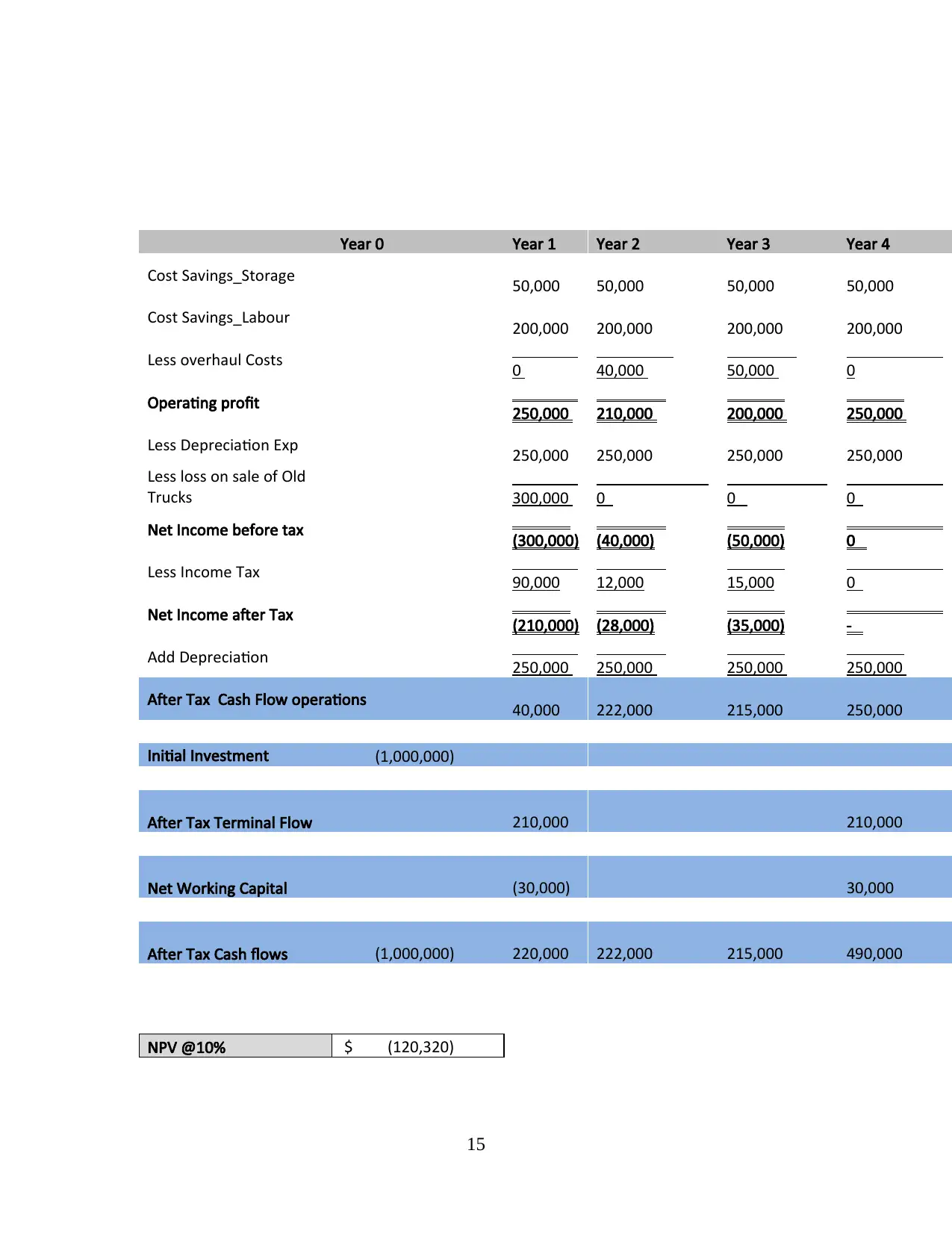

Year 0 Year 1 Year 2 Year 3 Year 4

Cost Savings_Storage 50,000 50,000 50,000 50,000

Cost Savings_Labour 200,000 200,000 200,000 200,000

Less overhaul Costs 0 40,000 50,000 0

Operating profit 250,000 210,000 200,000 250,000

Less Depreciation Exp 250,000 250,000 250,000 250,000

Less loss on sale of Old

Trucks 300,000 0 0 0

Net Income before tax (300,000) (40,000) (50,000) 0

Less Income Tax 90,000 12,000 15,000 0

Net Income after Tax (210,000) (28,000) (35,000) -

Add Depreciation 250,000 250,000 250,000 250,000

After Tax Cash Flow operations 40,000 222,000 215,000 250,000

Initial Investment (1,000,000)

After Tax Terminal Flow 210,000 210,000

Net Working Capital (30,000) 30,000

After Tax Cash flows (1,000,000) 220,000 222,000 215,000 490,000

NPV @10% $ (120,320)

15

Cost Savings_Storage 50,000 50,000 50,000 50,000

Cost Savings_Labour 200,000 200,000 200,000 200,000

Less overhaul Costs 0 40,000 50,000 0

Operating profit 250,000 210,000 200,000 250,000

Less Depreciation Exp 250,000 250,000 250,000 250,000

Less loss on sale of Old

Trucks 300,000 0 0 0

Net Income before tax (300,000) (40,000) (50,000) 0

Less Income Tax 90,000 12,000 15,000 0

Net Income after Tax (210,000) (28,000) (35,000) -

Add Depreciation 250,000 250,000 250,000 250,000

After Tax Cash Flow operations 40,000 222,000 215,000 250,000

Initial Investment (1,000,000)

After Tax Terminal Flow 210,000 210,000

Net Working Capital (30,000) 30,000

After Tax Cash flows (1,000,000) 220,000 222,000 215,000 490,000

NPV @10% $ (120,320)

15

(b) Should the company purchase the new trucks? State clearly why or why not.

Based on the above NPV analysis, the company should not proceed with

the purchase of the new truck because the NPV is negative suggesting

the project will not be profitable

END OF ASSIGNMENT QUESTIONS

ADDITIONAL PAGE 1 (for workings, or if your answers take more space.)

16

Based on the above NPV analysis, the company should not proceed with

the purchase of the new truck because the NPV is negative suggesting

the project will not be profitable

END OF ASSIGNMENT QUESTIONS

ADDITIONAL PAGE 1 (for workings, or if your answers take more space.)

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ADDITIONAL PAGE 2 (for workings, or if your answers take more space).

17

17

18

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.