Financial Management Project: Capital Structure of Coca-Cola Amatil

VerifiedAdded on 2021/05/30

|11

|2624

|255

Project

AI Summary

This project report provides a financial analysis of Coca-Cola Amatil's capital structure. It begins with an executive summary and introduction to financial management and capital structure. The report calculates the Weighted Average Cost of Capital (WACC) for Coca-Cola Amatil, using the cost of debt and cost of equity, and analyzes the company's gearing ratios to assess its risk position. The WACC calculation uses market values for debt and equity, risk-free rates, market risk premiums, and beta. The gearing ratio calculation involves long-term and current liabilities and total assets. The findings suggest a strong capital structure with recommendations to enhance the debt level to manage performance and reduce the cost of capital. The report concludes with a reflection on the project, highlighting the use of market data and the interesting nature of analyzing a real company's financials.

Running Head: Financial Management

1

Project report: Financial Management

1

Project report: Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

2

Executive Summary

The report has been prepared to evaluate the capital structure of Australian company,

Coca cola Amatil. For calculating and identifying the total capital structure of an

organization, WACC of the company has been calculated as well as the study has been done

on the gearing ratio of the company. The WACC techniques evaluate about the total cost of

the capital of the company and the gearing ratio explains about the total risk position of the

organization. On the basis of executive summary, it has been found that the capital structure

position of the company is quite strong.

2

Executive Summary

The report has been prepared to evaluate the capital structure of Australian company,

Coca cola Amatil. For calculating and identifying the total capital structure of an

organization, WACC of the company has been calculated as well as the study has been done

on the gearing ratio of the company. The WACC techniques evaluate about the total cost of

the capital of the company and the gearing ratio explains about the total risk position of the

organization. On the basis of executive summary, it has been found that the capital structure

position of the company is quite strong.

Financial Management

3

Contents

Introduction.......................................................................................................................4

Coca Cola Amatil.............................................................................................................4

WACC..............................................................................................................................5

Explanation and Judgment................................................................................................6

Gearing ratios and difficulties..........................................................................................7

Findings............................................................................................................................7

Recommendation..............................................................................................................8

Reflection..........................................................................................................................8

References.......................................................................................................................10

Appendix.........................................................................................................................11

3

Contents

Introduction.......................................................................................................................4

Coca Cola Amatil.............................................................................................................4

WACC..............................................................................................................................5

Explanation and Judgment................................................................................................6

Gearing ratios and difficulties..........................................................................................7

Findings............................................................................................................................7

Recommendation..............................................................................................................8

Reflection..........................................................................................................................8

References.......................................................................................................................10

Appendix.........................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

4

Introduction:

Financial management is a very effective and efficient way to manage the operations

of the comapny and assists organization to achiever the objectives of the company. Financial

management is associated with the top level management of the company. Capital structure is

also a part of financial management of an organization. Capital structure is the combination

of various sources which has helped the company to raise the funds. Capital structure is a

way through which an organization fiancés it resources through debt, equity and hybrid

securities. Capital structure of an organization explains about the total capital of the

organization as well as it briefs that how are the position of the company in terms of risk and

how much cost are bear by the company for the total capital.

In the report, capital structure of Coca cola Amatil has been discussed. For calculating

and identifying the total capital of an organization, WACC of the company has been

calculated as well as the study has been done on the gearing ratio of the company in this

report to identify the performance of the company. Few suggestions have also been given to

the company.

Coca Cola Amatil:

Coca cola Amatil is an Australian company which is operating its business is non

alcoholic beverages industry. The company has been awarded as largest company in the non

alcoholic beverages industry. The company is the subsidiary company of Coca cola. It is an

international company which is running its business in 5 more countries except the Australia

which are New Zealand, Fiji, Samoa and Papua New Guinea and Indonesia. Company has

diversified the product line a lot to capture and grab the entire market. The current products

of the company are Coca cola, Fanta, sprite, canned tomatoes, mother, Sprite zero, spreads,

Coca cola zero, diet coke etc. (Home, 2018). Currently, the company is following the strategy

of diversification and the corporate social responsibilities of the company are also better. The

annual report of the company expresses that the financial performance of the company has

been better.

Currently, the total turnover of the company is $ 4881 million which has been

increased from last year. The annual reports of the organization brief the changes into the

capital structure of the organization in current year from last year. Annual report (2017)

explains about14700 people who are employed by the company to manage the operations and

4

Introduction:

Financial management is a very effective and efficient way to manage the operations

of the comapny and assists organization to achiever the objectives of the company. Financial

management is associated with the top level management of the company. Capital structure is

also a part of financial management of an organization. Capital structure is the combination

of various sources which has helped the company to raise the funds. Capital structure is a

way through which an organization fiancés it resources through debt, equity and hybrid

securities. Capital structure of an organization explains about the total capital of the

organization as well as it briefs that how are the position of the company in terms of risk and

how much cost are bear by the company for the total capital.

In the report, capital structure of Coca cola Amatil has been discussed. For calculating

and identifying the total capital of an organization, WACC of the company has been

calculated as well as the study has been done on the gearing ratio of the company in this

report to identify the performance of the company. Few suggestions have also been given to

the company.

Coca Cola Amatil:

Coca cola Amatil is an Australian company which is operating its business is non

alcoholic beverages industry. The company has been awarded as largest company in the non

alcoholic beverages industry. The company is the subsidiary company of Coca cola. It is an

international company which is running its business in 5 more countries except the Australia

which are New Zealand, Fiji, Samoa and Papua New Guinea and Indonesia. Company has

diversified the product line a lot to capture and grab the entire market. The current products

of the company are Coca cola, Fanta, sprite, canned tomatoes, mother, Sprite zero, spreads,

Coca cola zero, diet coke etc. (Home, 2018). Currently, the company is following the strategy

of diversification and the corporate social responsibilities of the company are also better. The

annual report of the company expresses that the financial performance of the company has

been better.

Currently, the total turnover of the company is $ 4881 million which has been

increased from last year. The annual reports of the organization brief the changes into the

capital structure of the organization in current year from last year. Annual report (2017)

explains about14700 people who are employed by the company to manage the operations and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

5

the performance of the company. In the report, capital structure of the company has been

identified on the basis of WACC and gearing ratios.

WACC:

WACC is a tool to recognize the total cost of capital which would be bear by an

organization against the total capital amount. WACC briefs about the total cost expenses of

an organization. This tool deals with all the capital related factors of an organization to

identify the total cost f an organization. WACC techniques explain that firstly the cost of each

individual source must be calculated along with the total portion of that share in the total

capital of the organization. In addition, the fraction must be multiplied by the total cost of that

source and hence, the total amount is the total WACC of an organization.

In the case of Coca cola, it has been found that the main sources of capital of the

company are debt and the equity only. For calculating the WACC of the company total debt

and total equity amount has been identified first. Annual report (2017) explains that the total

debt of the company is $ 1930 and the total equity amount of the company is $ 1549 on the

basis of annual report and $ 7,111 on the basis of market value (yahoo finance). It explains

that the fraction of debt amount is 21% and the equity amount is 79% in total market capital

of the company.

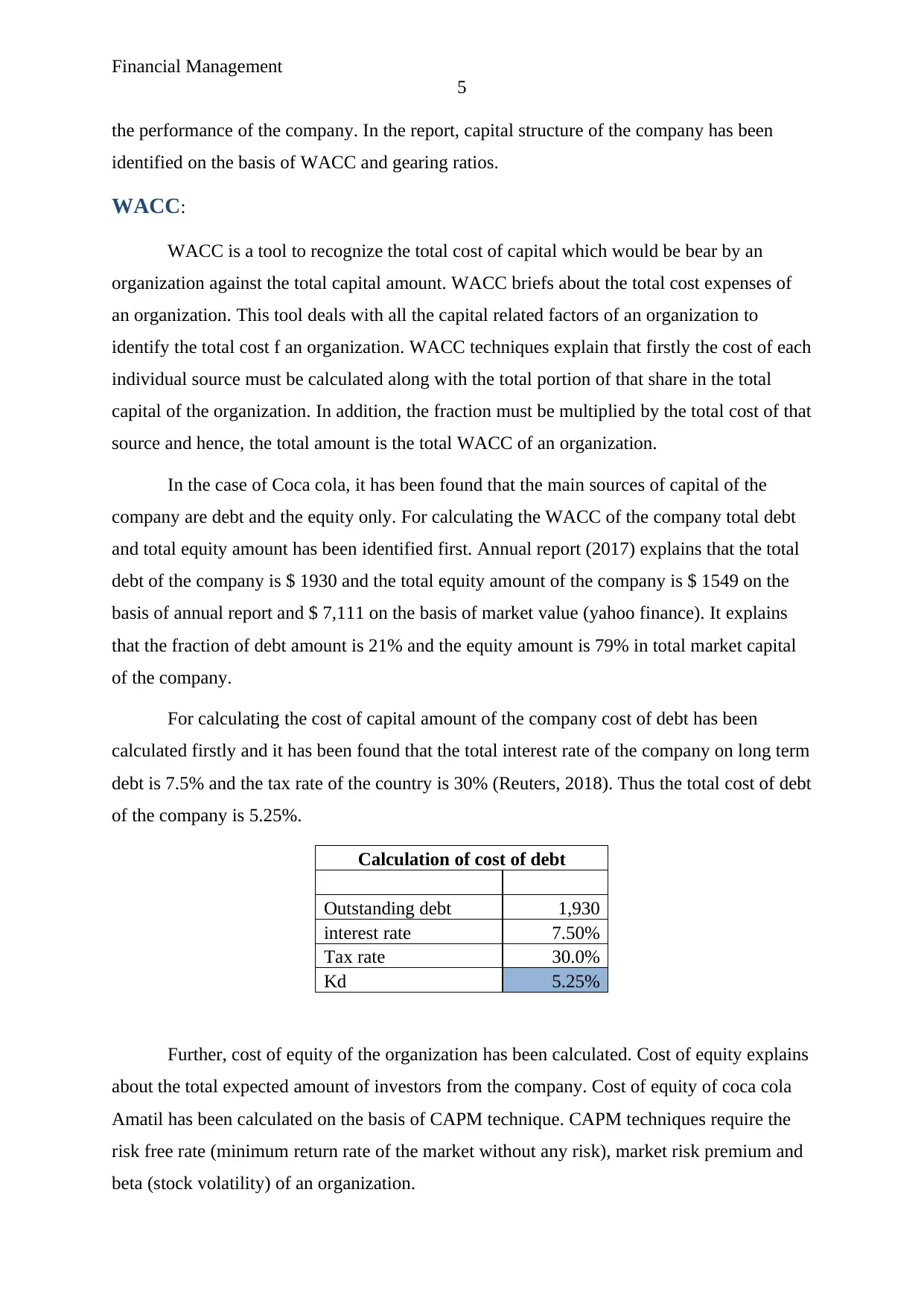

For calculating the cost of capital amount of the company cost of debt has been

calculated firstly and it has been found that the total interest rate of the company on long term

debt is 7.5% and the tax rate of the country is 30% (Reuters, 2018). Thus the total cost of debt

of the company is 5.25%.

Calculation of cost of debt

Outstanding debt 1,930

interest rate 7.50%

Tax rate 30.0%

Kd 5.25%

Further, cost of equity of the organization has been calculated. Cost of equity explains

about the total expected amount of investors from the company. Cost of equity of coca cola

Amatil has been calculated on the basis of CAPM technique. CAPM techniques require the

risk free rate (minimum return rate of the market without any risk), market risk premium and

beta (stock volatility) of an organization.

5

the performance of the company. In the report, capital structure of the company has been

identified on the basis of WACC and gearing ratios.

WACC:

WACC is a tool to recognize the total cost of capital which would be bear by an

organization against the total capital amount. WACC briefs about the total cost expenses of

an organization. This tool deals with all the capital related factors of an organization to

identify the total cost f an organization. WACC techniques explain that firstly the cost of each

individual source must be calculated along with the total portion of that share in the total

capital of the organization. In addition, the fraction must be multiplied by the total cost of that

source and hence, the total amount is the total WACC of an organization.

In the case of Coca cola, it has been found that the main sources of capital of the

company are debt and the equity only. For calculating the WACC of the company total debt

and total equity amount has been identified first. Annual report (2017) explains that the total

debt of the company is $ 1930 and the total equity amount of the company is $ 1549 on the

basis of annual report and $ 7,111 on the basis of market value (yahoo finance). It explains

that the fraction of debt amount is 21% and the equity amount is 79% in total market capital

of the company.

For calculating the cost of capital amount of the company cost of debt has been

calculated firstly and it has been found that the total interest rate of the company on long term

debt is 7.5% and the tax rate of the country is 30% (Reuters, 2018). Thus the total cost of debt

of the company is 5.25%.

Calculation of cost of debt

Outstanding debt 1,930

interest rate 7.50%

Tax rate 30.0%

Kd 5.25%

Further, cost of equity of the organization has been calculated. Cost of equity explains

about the total expected amount of investors from the company. Cost of equity of coca cola

Amatil has been calculated on the basis of CAPM technique. CAPM techniques require the

risk free rate (minimum return rate of the market without any risk), market risk premium and

beta (stock volatility) of an organization.

Financial Management

6

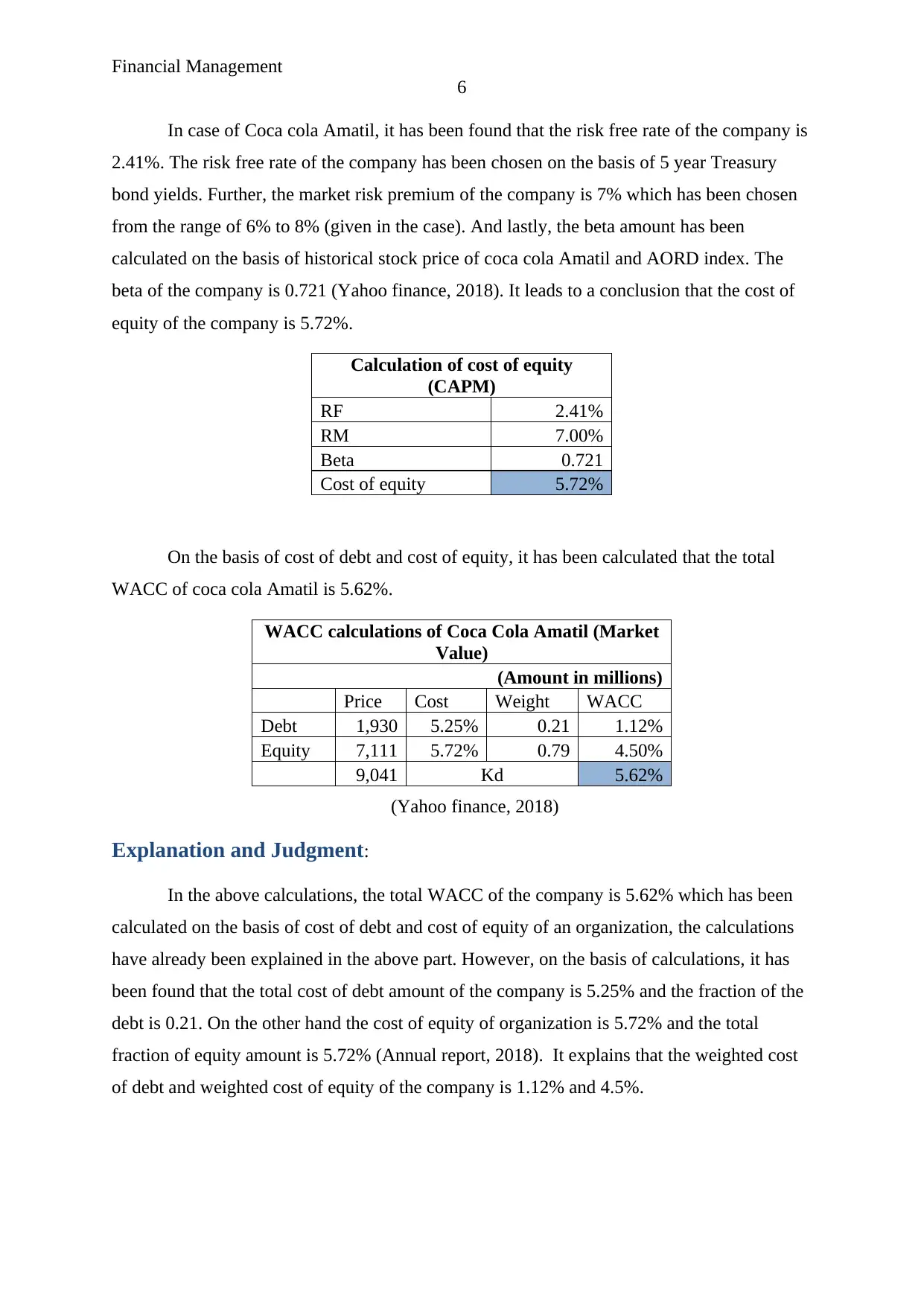

In case of Coca cola Amatil, it has been found that the risk free rate of the company is

2.41%. The risk free rate of the company has been chosen on the basis of 5 year Treasury

bond yields. Further, the market risk premium of the company is 7% which has been chosen

from the range of 6% to 8% (given in the case). And lastly, the beta amount has been

calculated on the basis of historical stock price of coca cola Amatil and AORD index. The

beta of the company is 0.721 (Yahoo finance, 2018). It leads to a conclusion that the cost of

equity of the company is 5.72%.

Calculation of cost of equity

(CAPM)

RF 2.41%

RM 7.00%

Beta 0.721

Cost of equity 5.72%

On the basis of cost of debt and cost of equity, it has been calculated that the total

WACC of coca cola Amatil is 5.62%.

WACC calculations of Coca Cola Amatil (Market

Value)

(Amount in millions)

Price Cost Weight WACC

Debt 1,930 5.25% 0.21 1.12%

Equity 7,111 5.72% 0.79 4.50%

9,041 Kd 5.62%

(Yahoo finance, 2018)

Explanation and Judgment:

In the above calculations, the total WACC of the company is 5.62% which has been

calculated on the basis of cost of debt and cost of equity of an organization, the calculations

have already been explained in the above part. However, on the basis of calculations, it has

been found that the total cost of debt amount of the company is 5.25% and the fraction of the

debt is 0.21. On the other hand the cost of equity of organization is 5.72% and the total

fraction of equity amount is 5.72% (Annual report, 2018). It explains that the weighted cost

of debt and weighted cost of equity of the company is 1.12% and 4.5%.

6

In case of Coca cola Amatil, it has been found that the risk free rate of the company is

2.41%. The risk free rate of the company has been chosen on the basis of 5 year Treasury

bond yields. Further, the market risk premium of the company is 7% which has been chosen

from the range of 6% to 8% (given in the case). And lastly, the beta amount has been

calculated on the basis of historical stock price of coca cola Amatil and AORD index. The

beta of the company is 0.721 (Yahoo finance, 2018). It leads to a conclusion that the cost of

equity of the company is 5.72%.

Calculation of cost of equity

(CAPM)

RF 2.41%

RM 7.00%

Beta 0.721

Cost of equity 5.72%

On the basis of cost of debt and cost of equity, it has been calculated that the total

WACC of coca cola Amatil is 5.62%.

WACC calculations of Coca Cola Amatil (Market

Value)

(Amount in millions)

Price Cost Weight WACC

Debt 1,930 5.25% 0.21 1.12%

Equity 7,111 5.72% 0.79 4.50%

9,041 Kd 5.62%

(Yahoo finance, 2018)

Explanation and Judgment:

In the above calculations, the total WACC of the company is 5.62% which has been

calculated on the basis of cost of debt and cost of equity of an organization, the calculations

have already been explained in the above part. However, on the basis of calculations, it has

been found that the total cost of debt amount of the company is 5.25% and the fraction of the

debt is 0.21. On the other hand the cost of equity of organization is 5.72% and the total

fraction of equity amount is 5.72% (Annual report, 2018). It explains that the weighted cost

of debt and weighted cost of equity of the company is 1.12% and 4.5%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

7

It explains that the cost of debt of the company is lower and so the portion of debt

amount in capital. It leads to a conclusion that company is required to enhance the level of

debt amount to manage the performance and reduce the total cost of capital of the company.

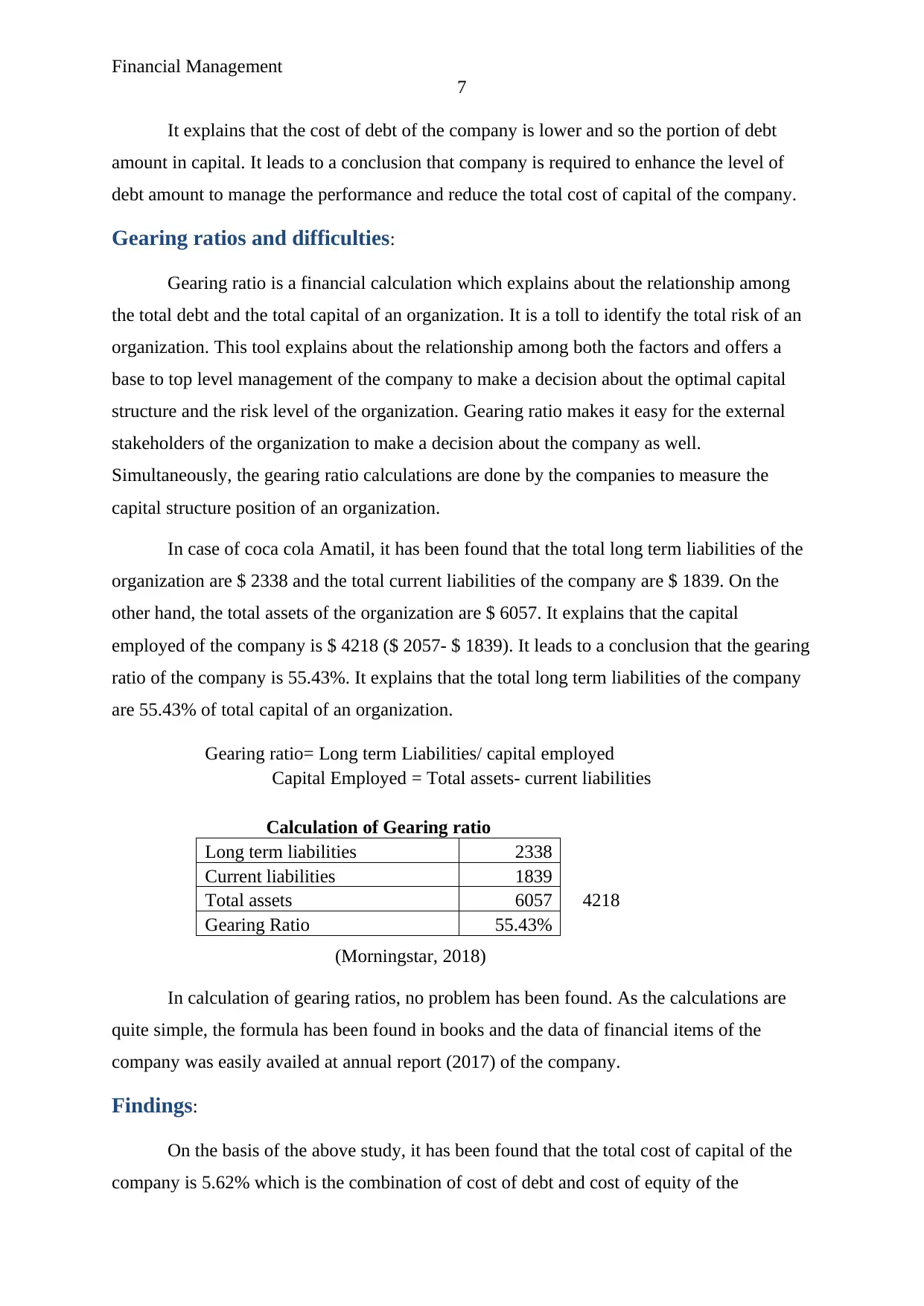

Gearing ratios and difficulties:

Gearing ratio is a financial calculation which explains about the relationship among

the total debt and the total capital of an organization. It is a toll to identify the total risk of an

organization. This tool explains about the relationship among both the factors and offers a

base to top level management of the company to make a decision about the optimal capital

structure and the risk level of the organization. Gearing ratio makes it easy for the external

stakeholders of the organization to make a decision about the company as well.

Simultaneously, the gearing ratio calculations are done by the companies to measure the

capital structure position of an organization.

In case of coca cola Amatil, it has been found that the total long term liabilities of the

organization are $ 2338 and the total current liabilities of the company are $ 1839. On the

other hand, the total assets of the organization are $ 6057. It explains that the capital

employed of the company is $ 4218 ($ 2057- $ 1839). It leads to a conclusion that the gearing

ratio of the company is 55.43%. It explains that the total long term liabilities of the company

are 55.43% of total capital of an organization.

Gearing ratio= Long term Liabilities/ capital employed

Capital Employed = Total assets- current liabilities

Calculation of Gearing ratio

Long term liabilities 2338

Current liabilities 1839

Total assets 6057 4218

Gearing Ratio 55.43%

(Morningstar, 2018)

In calculation of gearing ratios, no problem has been found. As the calculations are

quite simple, the formula has been found in books and the data of financial items of the

company was easily availed at annual report (2017) of the company.

Findings:

On the basis of the above study, it has been found that the total cost of capital of the

company is 5.62% which is the combination of cost of debt and cost of equity of the

7

It explains that the cost of debt of the company is lower and so the portion of debt

amount in capital. It leads to a conclusion that company is required to enhance the level of

debt amount to manage the performance and reduce the total cost of capital of the company.

Gearing ratios and difficulties:

Gearing ratio is a financial calculation which explains about the relationship among

the total debt and the total capital of an organization. It is a toll to identify the total risk of an

organization. This tool explains about the relationship among both the factors and offers a

base to top level management of the company to make a decision about the optimal capital

structure and the risk level of the organization. Gearing ratio makes it easy for the external

stakeholders of the organization to make a decision about the company as well.

Simultaneously, the gearing ratio calculations are done by the companies to measure the

capital structure position of an organization.

In case of coca cola Amatil, it has been found that the total long term liabilities of the

organization are $ 2338 and the total current liabilities of the company are $ 1839. On the

other hand, the total assets of the organization are $ 6057. It explains that the capital

employed of the company is $ 4218 ($ 2057- $ 1839). It leads to a conclusion that the gearing

ratio of the company is 55.43%. It explains that the total long term liabilities of the company

are 55.43% of total capital of an organization.

Gearing ratio= Long term Liabilities/ capital employed

Capital Employed = Total assets- current liabilities

Calculation of Gearing ratio

Long term liabilities 2338

Current liabilities 1839

Total assets 6057 4218

Gearing Ratio 55.43%

(Morningstar, 2018)

In calculation of gearing ratios, no problem has been found. As the calculations are

quite simple, the formula has been found in books and the data of financial items of the

company was easily availed at annual report (2017) of the company.

Findings:

On the basis of the above study, it has been found that the total cost of capital of the

company is 5.62% which is the combination of cost of debt and cost of equity of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

8

company. On the basis of calculations, it has been found that the total cost of debt amount of

the company is 5.25% and the fraction of the debt is 0.21. On the other hand the cost of

equity of organization is 5.72% and the total fraction of equity amount is 5.72%. It explains

that the weighted cost of debt and weighted cost of equity of the company is 1.12% and 4.5%.

The entire data for calculating the cost of debt and cost of equity of an organization has been

calculated on the basis of historical data, annual report and the Bloomberg (2018).

Further, the risk position of the company has also been evaluated and it has been

found that the gearing ratio of the company is 55.43%. It explains that the total long term

liabilities of the company are 55.43% of total capital of an organization. It is an optimal

capital structure position of an organization. The risk level of the company is balanced in

current scenario.

Recommendation:

To recommend, the capital structure performance, cost and risk, all actors are in the

favour of the organization. The cost of capital of the company is competitive as well as the

risk level of the company is balanced. However, it has been recognized that the cost of debt

of the company is lower and so the portion of debt amount in capital. It leads to a conclusion

that company is required to enhance the level of debt amount to manage the performance and

reduce the total cost of capital of the company. The company could raise the fraction of total

debt amount to 55% to manage the cost and the performance of the capital structure in the

organization. However, the current performance of the company is also better.

Reflection:

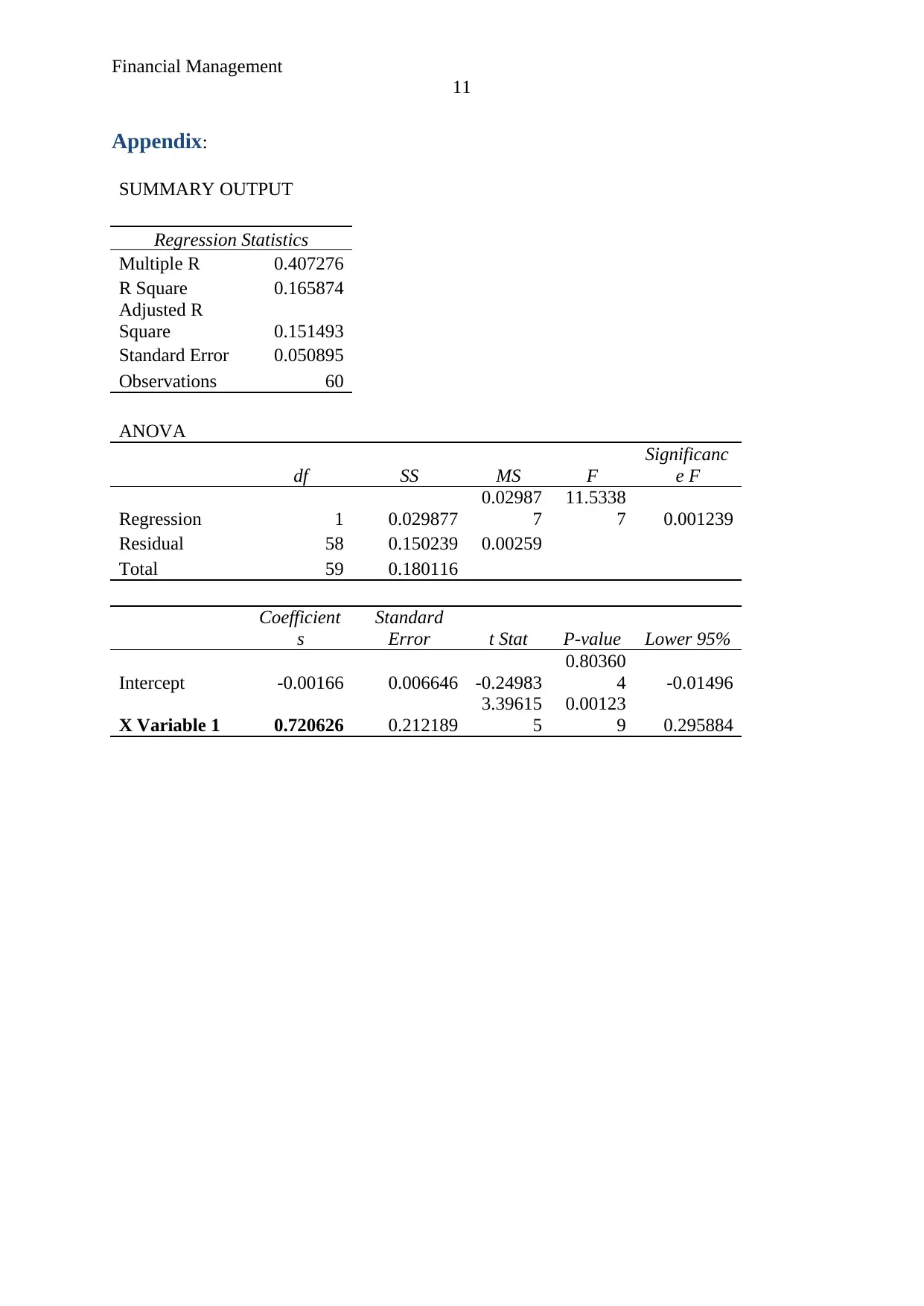

The report was quite interesting to undertake. Study on a real company is quite

interesting as you can evaluate lot of the figures to make decision about the company. In the

report, I have used the market data of equity rather than book value of equity to measure the

WACC. The market value has been calculated on the basis of market stock price and the total

outstanding shares of the company. However, there was no much difference among the cost

of capital on the basis of book value and the market value.

Further, the risk free rate of the company is 2.41%. The risk free rate of the company

has been chosen on the basis of 5 year Treasury bond yields as the historical data of the

company were also of 5 years. The different risk free rate directly impacts on the cost of

equity. Further, the market risk premium of the company is 7% which has been chosen from

8

company. On the basis of calculations, it has been found that the total cost of debt amount of

the company is 5.25% and the fraction of the debt is 0.21. On the other hand the cost of

equity of organization is 5.72% and the total fraction of equity amount is 5.72%. It explains

that the weighted cost of debt and weighted cost of equity of the company is 1.12% and 4.5%.

The entire data for calculating the cost of debt and cost of equity of an organization has been

calculated on the basis of historical data, annual report and the Bloomberg (2018).

Further, the risk position of the company has also been evaluated and it has been

found that the gearing ratio of the company is 55.43%. It explains that the total long term

liabilities of the company are 55.43% of total capital of an organization. It is an optimal

capital structure position of an organization. The risk level of the company is balanced in

current scenario.

Recommendation:

To recommend, the capital structure performance, cost and risk, all actors are in the

favour of the organization. The cost of capital of the company is competitive as well as the

risk level of the company is balanced. However, it has been recognized that the cost of debt

of the company is lower and so the portion of debt amount in capital. It leads to a conclusion

that company is required to enhance the level of debt amount to manage the performance and

reduce the total cost of capital of the company. The company could raise the fraction of total

debt amount to 55% to manage the cost and the performance of the capital structure in the

organization. However, the current performance of the company is also better.

Reflection:

The report was quite interesting to undertake. Study on a real company is quite

interesting as you can evaluate lot of the figures to make decision about the company. In the

report, I have used the market data of equity rather than book value of equity to measure the

WACC. The market value has been calculated on the basis of market stock price and the total

outstanding shares of the company. However, there was no much difference among the cost

of capital on the basis of book value and the market value.

Further, the risk free rate of the company is 2.41%. The risk free rate of the company

has been chosen on the basis of 5 year Treasury bond yields as the historical data of the

company were also of 5 years. The different risk free rate directly impacts on the cost of

equity. Further, the market risk premium of the company is 7% which has been chosen from

Financial Management

9

the range of 6% to 8% (given in the case). And lastly, the beta amount has been calculated on

the basis of historical stock price of coca cola Amatil and AORD index. The beta of the

company is 0.721. The total interest rate of the company on long term debt is 7.5% which has

been evaluated from its annual report and the tax rate of the country is 30%.

In short, the study was quite interesting. It has helped me a lot to understand about the

market, capital structure position of an organization and the cost and risk factor of the capital

structure.

9

the range of 6% to 8% (given in the case). And lastly, the beta amount has been calculated on

the basis of historical stock price of coca cola Amatil and AORD index. The beta of the

company is 0.721. The total interest rate of the company on long term debt is 7.5% which has

been evaluated from its annual report and the tax rate of the country is 30%.

In short, the study was quite interesting. It has helped me a lot to understand about the

market, capital structure position of an organization and the cost and risk factor of the capital

structure.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

10

References:

Annual report. (2017). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2018/Annual-

Report-2017.ashx.

Bloomberg. (2018). Australian bonds and rates. (Online). Retrieved on 14 May 2018 from:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia.

Home. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/.

Morningstar. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

http://financials.morningstar.com/income-statement/is.html?t=CCL®ion=aus.

Reuters. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.reuters.com/finance/stocks/overview/CCL.AX.

Yahoo Finance. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://finance.yahoo.com/quote/CCL.AX?ltr=1.

10

References:

Annual report. (2017). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2018/Annual-

Report-2017.ashx.

Bloomberg. (2018). Australian bonds and rates. (Online). Retrieved on 14 May 2018 from:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia.

Home. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.ccamatil.com/.

Morningstar. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

http://financials.morningstar.com/income-statement/is.html?t=CCL®ion=aus.

Reuters. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://www.reuters.com/finance/stocks/overview/CCL.AX.

Yahoo Finance. (2018). Coca cola Amatil. (Online). Retrieved on 14 May 2018 from:

https://finance.yahoo.com/quote/CCL.AX?ltr=1.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

11

Appendix:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.407276

R Square 0.165874

Adjusted R

Square 0.151493

Standard Error 0.050895

Observations 60

ANOVA

df SS MS F

Significanc

e F

Regression 1 0.029877

0.02987

7

11.5338

7 0.001239

Residual 58 0.150239 0.00259

Total 59 0.180116

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Intercept -0.00166 0.006646 -0.24983

0.80360

4 -0.01496

X Variable 1 0.720626 0.212189

3.39615

5

0.00123

9 0.295884

11

Appendix:

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.407276

R Square 0.165874

Adjusted R

Square 0.151493

Standard Error 0.050895

Observations 60

ANOVA

df SS MS F

Significanc

e F

Regression 1 0.029877

0.02987

7

11.5338

7 0.001239

Residual 58 0.150239 0.00259

Total 59 0.180116

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Intercept -0.00166 0.006646 -0.24983

0.80360

4 -0.01496

X Variable 1 0.720626 0.212189

3.39615

5

0.00123

9 0.295884

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.