Financial Modeling Assignment: Portfolio Analysis and Option Pricing

VerifiedAdded on 2020/04/13

|10

|1832

|364

Practical Assignment

AI Summary

This financial modeling assignment delves into various aspects of investment analysis and portfolio management. It begins with calculating the mean, variance, and standard deviation of monthly returns for several stocks, followed by computing their betas relative to the S&P 500. The assignment then proceeds to construct a covariance matrix and two envelope portfolios. Furthermore, it involves plotting the optimal portfolio on a graph and calculating its mean, variance, and beta. The solution also includes the computation of an optimum portfolio under short-sale constraints. The assignment extends to option pricing using both the binomial model and the Black-Scholes model, with a comparison of the results and a percentage error calculation. Finally, it presents a graph illustrating a put strategy, providing a comprehensive overview of financial modeling techniques.

Running head: FINANCIAL MODELLING

Financial Modelling

Name of the Student:

Name of the University:

Authors Note:

Financial Modelling

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MODELLING

1

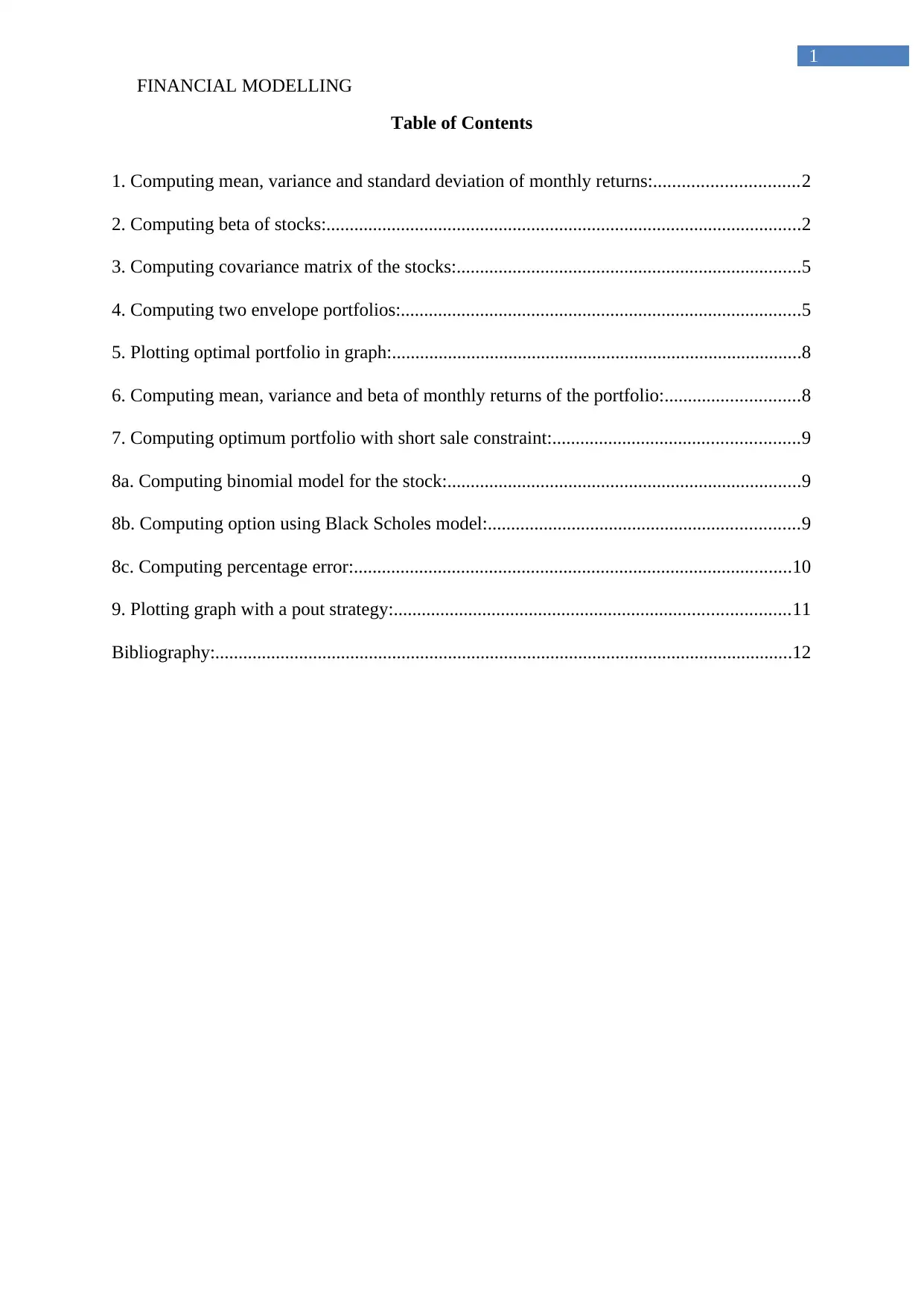

Table of Contents

1. Computing mean, variance and standard deviation of monthly returns:...............................2

2. Computing beta of stocks:......................................................................................................2

3. Computing covariance matrix of the stocks:..........................................................................5

4. Computing two envelope portfolios:......................................................................................5

5. Plotting optimal portfolio in graph:........................................................................................8

6. Computing mean, variance and beta of monthly returns of the portfolio:.............................8

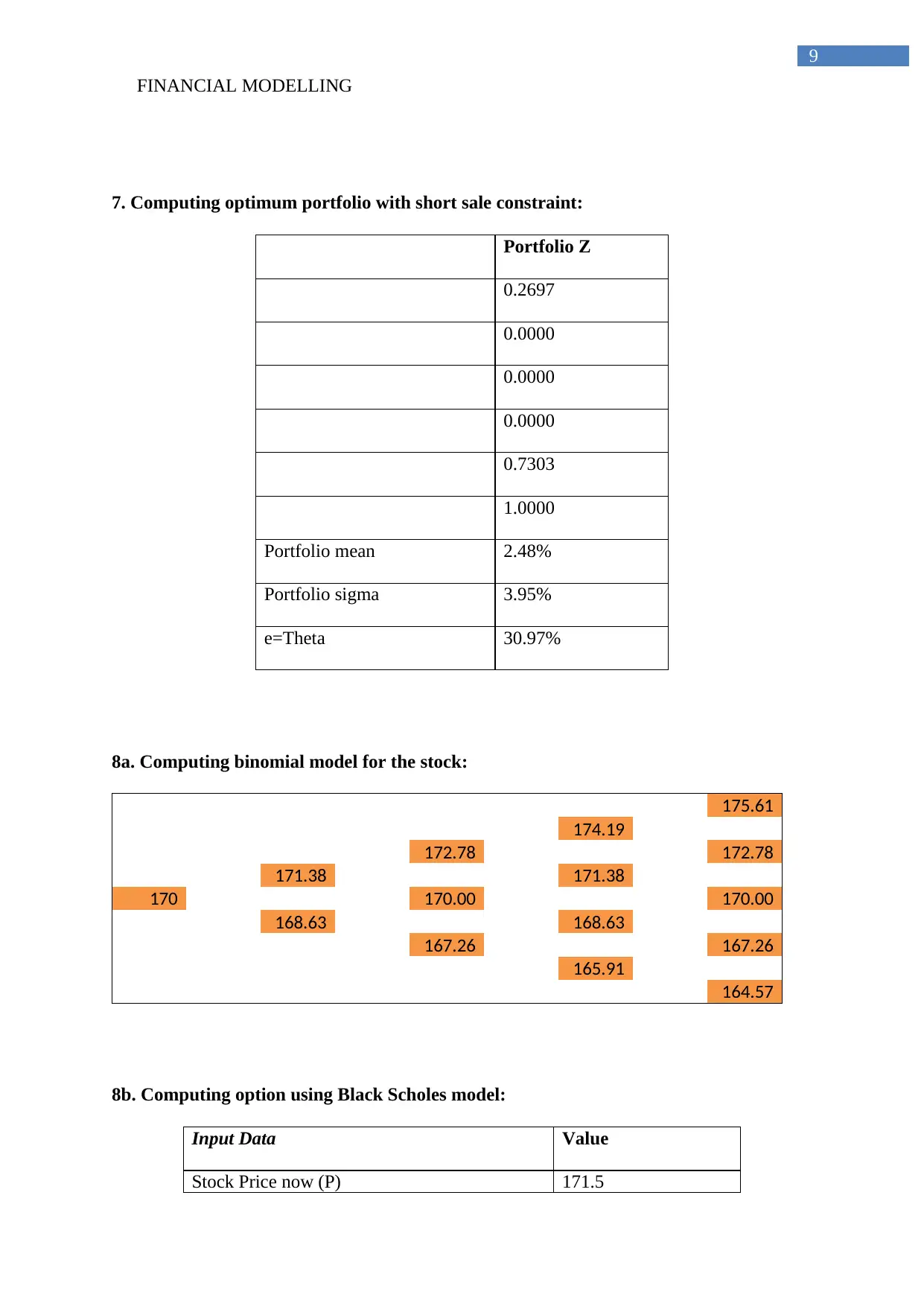

7. Computing optimum portfolio with short sale constraint:.....................................................9

8a. Computing binomial model for the stock:............................................................................9

8b. Computing option using Black Scholes model:...................................................................9

8c. Computing percentage error:..............................................................................................10

9. Plotting graph with a pout strategy:.....................................................................................11

Bibliography:............................................................................................................................12

1

Table of Contents

1. Computing mean, variance and standard deviation of monthly returns:...............................2

2. Computing beta of stocks:......................................................................................................2

3. Computing covariance matrix of the stocks:..........................................................................5

4. Computing two envelope portfolios:......................................................................................5

5. Plotting optimal portfolio in graph:........................................................................................8

6. Computing mean, variance and beta of monthly returns of the portfolio:.............................8

7. Computing optimum portfolio with short sale constraint:.....................................................9

8a. Computing binomial model for the stock:............................................................................9

8b. Computing option using Black Scholes model:...................................................................9

8c. Computing percentage error:..............................................................................................10

9. Plotting graph with a pout strategy:.....................................................................................11

Bibliography:............................................................................................................................12

FINANCIAL MODELLING

2

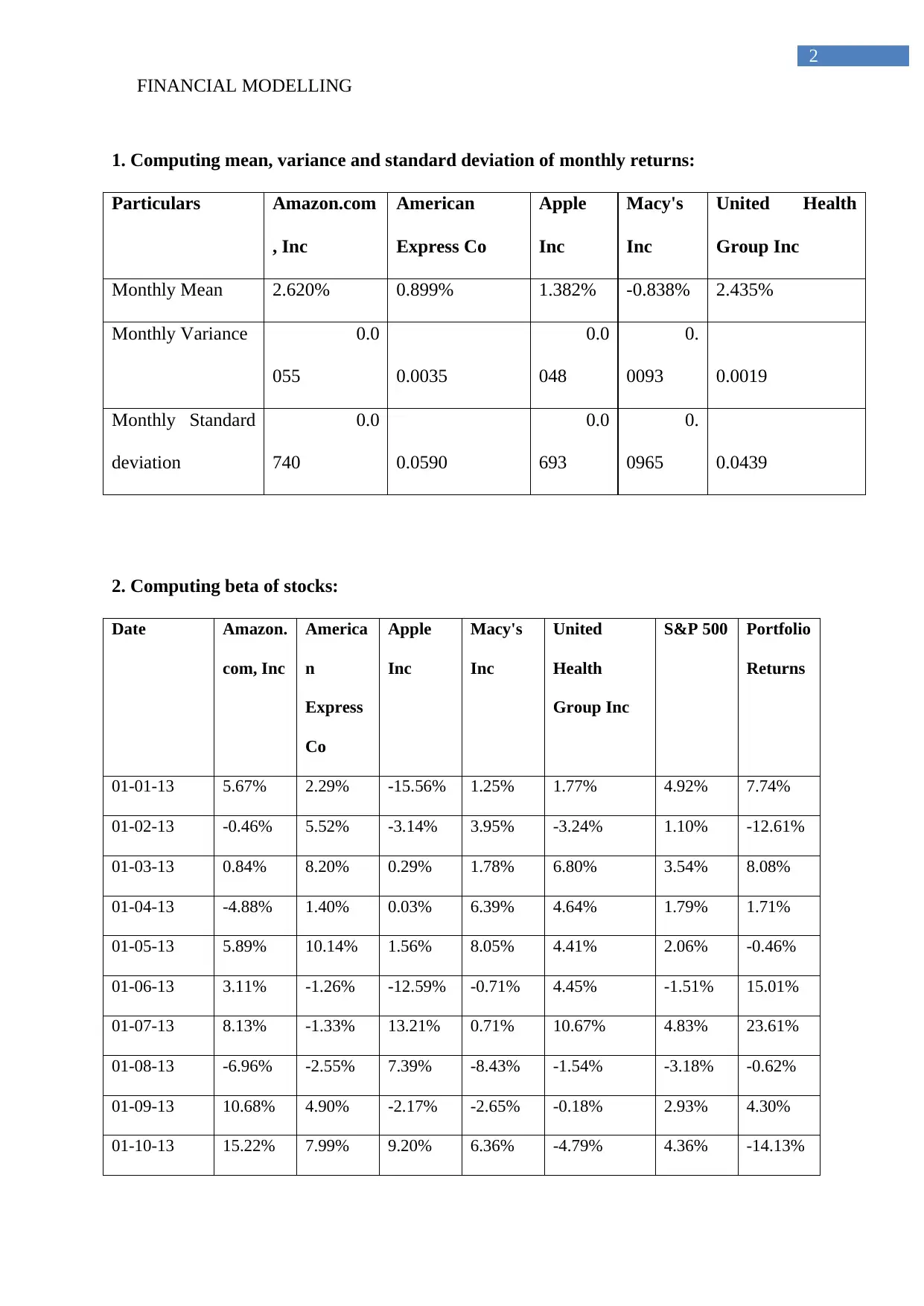

1. Computing mean, variance and standard deviation of monthly returns:

Particulars Amazon.com

, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Monthly Mean 2.620% 0.899% 1.382% -0.838% 2.435%

Monthly Variance 0.0

055 0.0035

0.0

048

0.

0093 0.0019

Monthly Standard

deviation

0.0

740 0.0590

0.0

693

0.

0965 0.0439

2. Computing beta of stocks:

Date Amazon.

com, Inc

America

n

Express

Co

Apple

Inc

Macy's

Inc

United

Health

Group Inc

S&P 500 Portfolio

Returns

01-01-13 5.67% 2.29% -15.56% 1.25% 1.77% 4.92% 7.74%

01-02-13 -0.46% 5.52% -3.14% 3.95% -3.24% 1.10% -12.61%

01-03-13 0.84% 8.20% 0.29% 1.78% 6.80% 3.54% 8.08%

01-04-13 -4.88% 1.40% 0.03% 6.39% 4.64% 1.79% 1.71%

01-05-13 5.89% 10.14% 1.56% 8.05% 4.41% 2.06% -0.46%

01-06-13 3.11% -1.26% -12.59% -0.71% 4.45% -1.51% 15.01%

01-07-13 8.13% -1.33% 13.21% 0.71% 10.67% 4.83% 23.61%

01-08-13 -6.96% -2.55% 7.39% -8.43% -1.54% -3.18% -0.62%

01-09-13 10.68% 4.90% -2.17% -2.65% -0.18% 2.93% 4.30%

01-10-13 15.22% 7.99% 9.20% 6.36% -4.79% 4.36% -14.13%

2

1. Computing mean, variance and standard deviation of monthly returns:

Particulars Amazon.com

, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Monthly Mean 2.620% 0.899% 1.382% -0.838% 2.435%

Monthly Variance 0.0

055 0.0035

0.0

048

0.

0093 0.0019

Monthly Standard

deviation

0.0

740 0.0590

0.0

693

0.

0965 0.0439

2. Computing beta of stocks:

Date Amazon.

com, Inc

America

n

Express

Co

Apple

Inc

Macy's

Inc

United

Health

Group Inc

S&P 500 Portfolio

Returns

01-01-13 5.67% 2.29% -15.56% 1.25% 1.77% 4.92% 7.74%

01-02-13 -0.46% 5.52% -3.14% 3.95% -3.24% 1.10% -12.61%

01-03-13 0.84% 8.20% 0.29% 1.78% 6.80% 3.54% 8.08%

01-04-13 -4.88% 1.40% 0.03% 6.39% 4.64% 1.79% 1.71%

01-05-13 5.89% 10.14% 1.56% 8.05% 4.41% 2.06% -0.46%

01-06-13 3.11% -1.26% -12.59% -0.71% 4.45% -1.51% 15.01%

01-07-13 8.13% -1.33% 13.21% 0.71% 10.67% 4.83% 23.61%

01-08-13 -6.96% -2.55% 7.39% -8.43% -1.54% -3.18% -0.62%

01-09-13 10.68% 4.90% -2.17% -2.65% -0.18% 2.93% 4.30%

01-10-13 15.22% 7.99% 9.20% 6.36% -4.79% 4.36% -14.13%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MODELLING

3

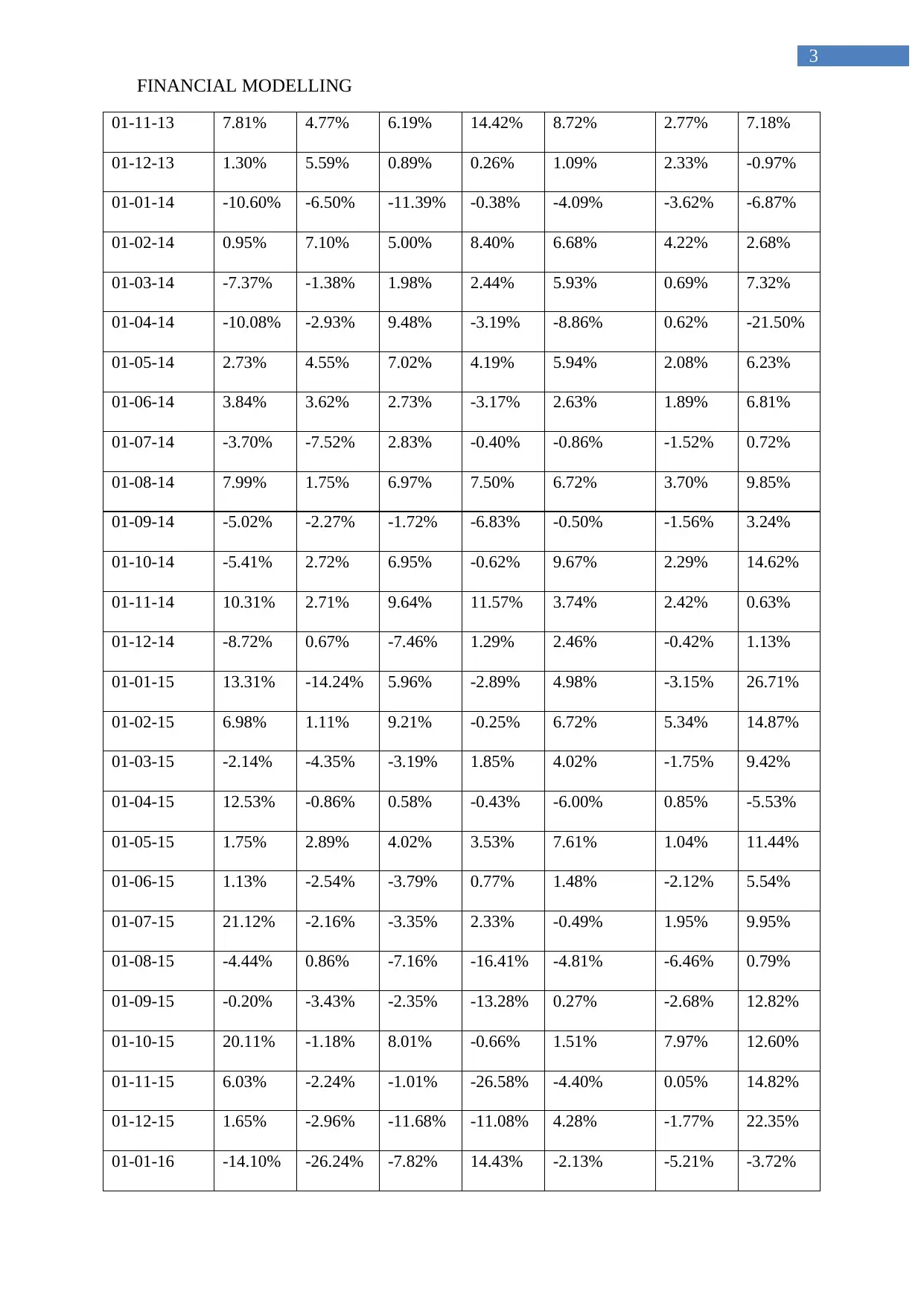

01-11-13 7.81% 4.77% 6.19% 14.42% 8.72% 2.77% 7.18%

01-12-13 1.30% 5.59% 0.89% 0.26% 1.09% 2.33% -0.97%

01-01-14 -10.60% -6.50% -11.39% -0.38% -4.09% -3.62% -6.87%

01-02-14 0.95% 7.10% 5.00% 8.40% 6.68% 4.22% 2.68%

01-03-14 -7.37% -1.38% 1.98% 2.44% 5.93% 0.69% 7.32%

01-04-14 -10.08% -2.93% 9.48% -3.19% -8.86% 0.62% -21.50%

01-05-14 2.73% 4.55% 7.02% 4.19% 5.94% 2.08% 6.23%

01-06-14 3.84% 3.62% 2.73% -3.17% 2.63% 1.89% 6.81%

01-07-14 -3.70% -7.52% 2.83% -0.40% -0.86% -1.52% 0.72%

01-08-14 7.99% 1.75% 6.97% 7.50% 6.72% 3.70% 9.85%

01-09-14 -5.02% -2.27% -1.72% -6.83% -0.50% -1.56% 3.24%

01-10-14 -5.41% 2.72% 6.95% -0.62% 9.67% 2.29% 14.62%

01-11-14 10.31% 2.71% 9.64% 11.57% 3.74% 2.42% 0.63%

01-12-14 -8.72% 0.67% -7.46% 1.29% 2.46% -0.42% 1.13%

01-01-15 13.31% -14.24% 5.96% -2.89% 4.98% -3.15% 26.71%

01-02-15 6.98% 1.11% 9.21% -0.25% 6.72% 5.34% 14.87%

01-03-15 -2.14% -4.35% -3.19% 1.85% 4.02% -1.75% 9.42%

01-04-15 12.53% -0.86% 0.58% -0.43% -6.00% 0.85% -5.53%

01-05-15 1.75% 2.89% 4.02% 3.53% 7.61% 1.04% 11.44%

01-06-15 1.13% -2.54% -3.79% 0.77% 1.48% -2.12% 5.54%

01-07-15 21.12% -2.16% -3.35% 2.33% -0.49% 1.95% 9.95%

01-08-15 -4.44% 0.86% -7.16% -16.41% -4.81% -6.46% 0.79%

01-09-15 -0.20% -3.43% -2.35% -13.28% 0.27% -2.68% 12.82%

01-10-15 20.11% -1.18% 8.01% -0.66% 1.51% 7.97% 12.60%

01-11-15 6.03% -2.24% -1.01% -26.58% -4.40% 0.05% 14.82%

01-12-15 1.65% -2.96% -11.68% -11.08% 4.28% -1.77% 22.35%

01-01-16 -14.10% -26.24% -7.82% 14.43% -2.13% -5.21% -3.72%

3

01-11-13 7.81% 4.77% 6.19% 14.42% 8.72% 2.77% 7.18%

01-12-13 1.30% 5.59% 0.89% 0.26% 1.09% 2.33% -0.97%

01-01-14 -10.60% -6.50% -11.39% -0.38% -4.09% -3.62% -6.87%

01-02-14 0.95% 7.10% 5.00% 8.40% 6.68% 4.22% 2.68%

01-03-14 -7.37% -1.38% 1.98% 2.44% 5.93% 0.69% 7.32%

01-04-14 -10.08% -2.93% 9.48% -3.19% -8.86% 0.62% -21.50%

01-05-14 2.73% 4.55% 7.02% 4.19% 5.94% 2.08% 6.23%

01-06-14 3.84% 3.62% 2.73% -3.17% 2.63% 1.89% 6.81%

01-07-14 -3.70% -7.52% 2.83% -0.40% -0.86% -1.52% 0.72%

01-08-14 7.99% 1.75% 6.97% 7.50% 6.72% 3.70% 9.85%

01-09-14 -5.02% -2.27% -1.72% -6.83% -0.50% -1.56% 3.24%

01-10-14 -5.41% 2.72% 6.95% -0.62% 9.67% 2.29% 14.62%

01-11-14 10.31% 2.71% 9.64% 11.57% 3.74% 2.42% 0.63%

01-12-14 -8.72% 0.67% -7.46% 1.29% 2.46% -0.42% 1.13%

01-01-15 13.31% -14.24% 5.96% -2.89% 4.98% -3.15% 26.71%

01-02-15 6.98% 1.11% 9.21% -0.25% 6.72% 5.34% 14.87%

01-03-15 -2.14% -4.35% -3.19% 1.85% 4.02% -1.75% 9.42%

01-04-15 12.53% -0.86% 0.58% -0.43% -6.00% 0.85% -5.53%

01-05-15 1.75% 2.89% 4.02% 3.53% 7.61% 1.04% 11.44%

01-06-15 1.13% -2.54% -3.79% 0.77% 1.48% -2.12% 5.54%

01-07-15 21.12% -2.16% -3.35% 2.33% -0.49% 1.95% 9.95%

01-08-15 -4.44% 0.86% -7.16% -16.41% -4.81% -6.46% 0.79%

01-09-15 -0.20% -3.43% -2.35% -13.28% 0.27% -2.68% 12.82%

01-10-15 20.11% -1.18% 8.01% -0.66% 1.51% 7.97% 12.60%

01-11-15 6.03% -2.24% -1.01% -26.58% -4.40% 0.05% 14.82%

01-12-15 1.65% -2.96% -11.68% -11.08% 4.28% -1.77% 22.35%

01-01-16 -14.10% -26.24% -7.82% 14.43% -2.13% -5.21% -3.72%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MODELLING

4

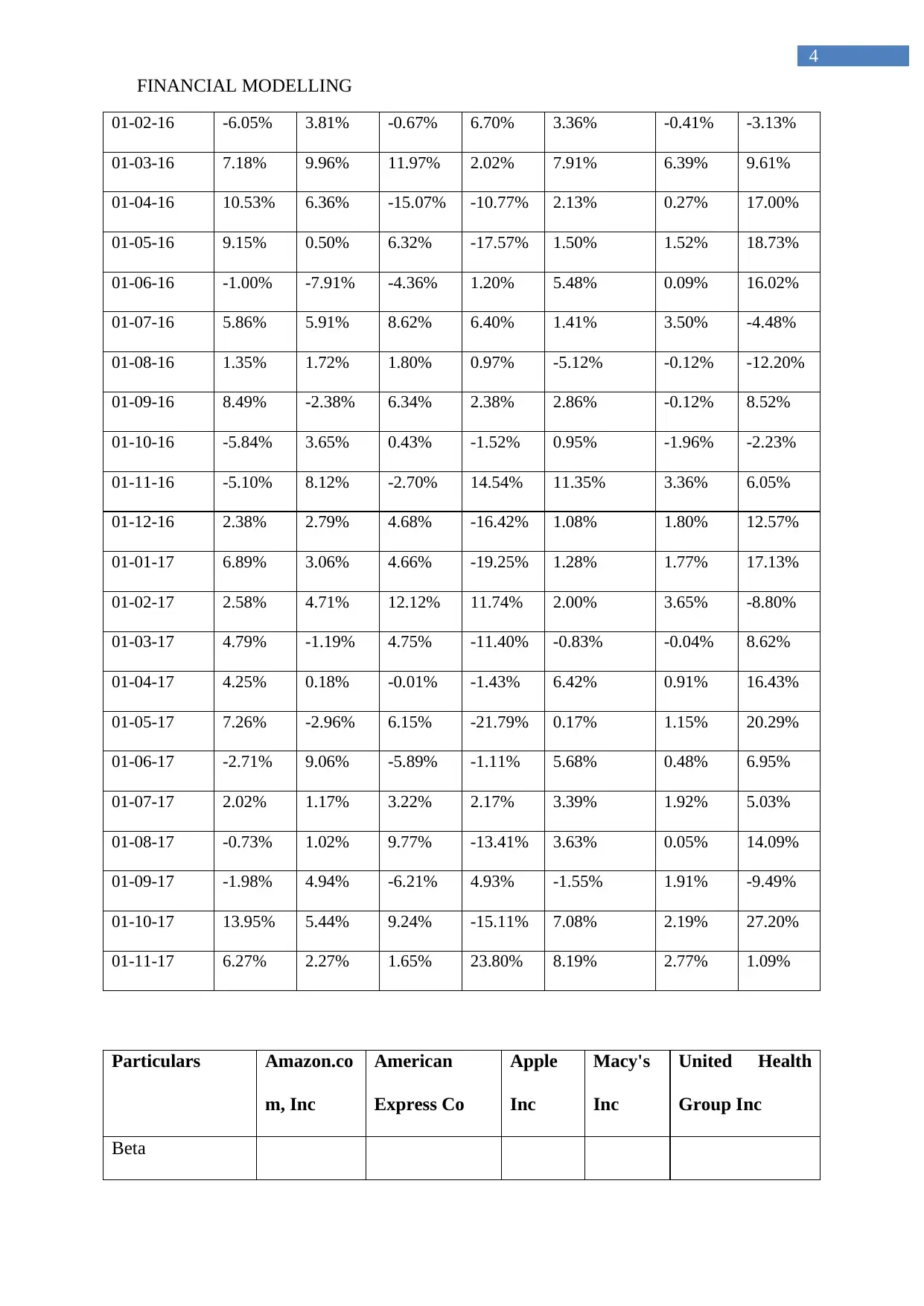

01-02-16 -6.05% 3.81% -0.67% 6.70% 3.36% -0.41% -3.13%

01-03-16 7.18% 9.96% 11.97% 2.02% 7.91% 6.39% 9.61%

01-04-16 10.53% 6.36% -15.07% -10.77% 2.13% 0.27% 17.00%

01-05-16 9.15% 0.50% 6.32% -17.57% 1.50% 1.52% 18.73%

01-06-16 -1.00% -7.91% -4.36% 1.20% 5.48% 0.09% 16.02%

01-07-16 5.86% 5.91% 8.62% 6.40% 1.41% 3.50% -4.48%

01-08-16 1.35% 1.72% 1.80% 0.97% -5.12% -0.12% -12.20%

01-09-16 8.49% -2.38% 6.34% 2.38% 2.86% -0.12% 8.52%

01-10-16 -5.84% 3.65% 0.43% -1.52% 0.95% -1.96% -2.23%

01-11-16 -5.10% 8.12% -2.70% 14.54% 11.35% 3.36% 6.05%

01-12-16 2.38% 2.79% 4.68% -16.42% 1.08% 1.80% 12.57%

01-01-17 6.89% 3.06% 4.66% -19.25% 1.28% 1.77% 17.13%

01-02-17 2.58% 4.71% 12.12% 11.74% 2.00% 3.65% -8.80%

01-03-17 4.79% -1.19% 4.75% -11.40% -0.83% -0.04% 8.62%

01-04-17 4.25% 0.18% -0.01% -1.43% 6.42% 0.91% 16.43%

01-05-17 7.26% -2.96% 6.15% -21.79% 0.17% 1.15% 20.29%

01-06-17 -2.71% 9.06% -5.89% -1.11% 5.68% 0.48% 6.95%

01-07-17 2.02% 1.17% 3.22% 2.17% 3.39% 1.92% 5.03%

01-08-17 -0.73% 1.02% 9.77% -13.41% 3.63% 0.05% 14.09%

01-09-17 -1.98% 4.94% -6.21% 4.93% -1.55% 1.91% -9.49%

01-10-17 13.95% 5.44% 9.24% -15.11% 7.08% 2.19% 27.20%

01-11-17 6.27% 2.27% 1.65% 23.80% 8.19% 2.77% 1.09%

Particulars Amazon.co

m, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Beta

4

01-02-16 -6.05% 3.81% -0.67% 6.70% 3.36% -0.41% -3.13%

01-03-16 7.18% 9.96% 11.97% 2.02% 7.91% 6.39% 9.61%

01-04-16 10.53% 6.36% -15.07% -10.77% 2.13% 0.27% 17.00%

01-05-16 9.15% 0.50% 6.32% -17.57% 1.50% 1.52% 18.73%

01-06-16 -1.00% -7.91% -4.36% 1.20% 5.48% 0.09% 16.02%

01-07-16 5.86% 5.91% 8.62% 6.40% 1.41% 3.50% -4.48%

01-08-16 1.35% 1.72% 1.80% 0.97% -5.12% -0.12% -12.20%

01-09-16 8.49% -2.38% 6.34% 2.38% 2.86% -0.12% 8.52%

01-10-16 -5.84% 3.65% 0.43% -1.52% 0.95% -1.96% -2.23%

01-11-16 -5.10% 8.12% -2.70% 14.54% 11.35% 3.36% 6.05%

01-12-16 2.38% 2.79% 4.68% -16.42% 1.08% 1.80% 12.57%

01-01-17 6.89% 3.06% 4.66% -19.25% 1.28% 1.77% 17.13%

01-02-17 2.58% 4.71% 12.12% 11.74% 2.00% 3.65% -8.80%

01-03-17 4.79% -1.19% 4.75% -11.40% -0.83% -0.04% 8.62%

01-04-17 4.25% 0.18% -0.01% -1.43% 6.42% 0.91% 16.43%

01-05-17 7.26% -2.96% 6.15% -21.79% 0.17% 1.15% 20.29%

01-06-17 -2.71% 9.06% -5.89% -1.11% 5.68% 0.48% 6.95%

01-07-17 2.02% 1.17% 3.22% 2.17% 3.39% 1.92% 5.03%

01-08-17 -0.73% 1.02% 9.77% -13.41% 3.63% 0.05% 14.09%

01-09-17 -1.98% 4.94% -6.21% 4.93% -1.55% 1.91% -9.49%

01-10-17 13.95% 5.44% 9.24% -15.11% 7.08% 2.19% 27.20%

01-11-17 6.27% 2.27% 1.65% 23.80% 8.19% 2.77% 1.09%

Particulars Amazon.co

m, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Beta

FINANCIAL MODELLING

5

1.45 1.28 1.18 1.00 0.65

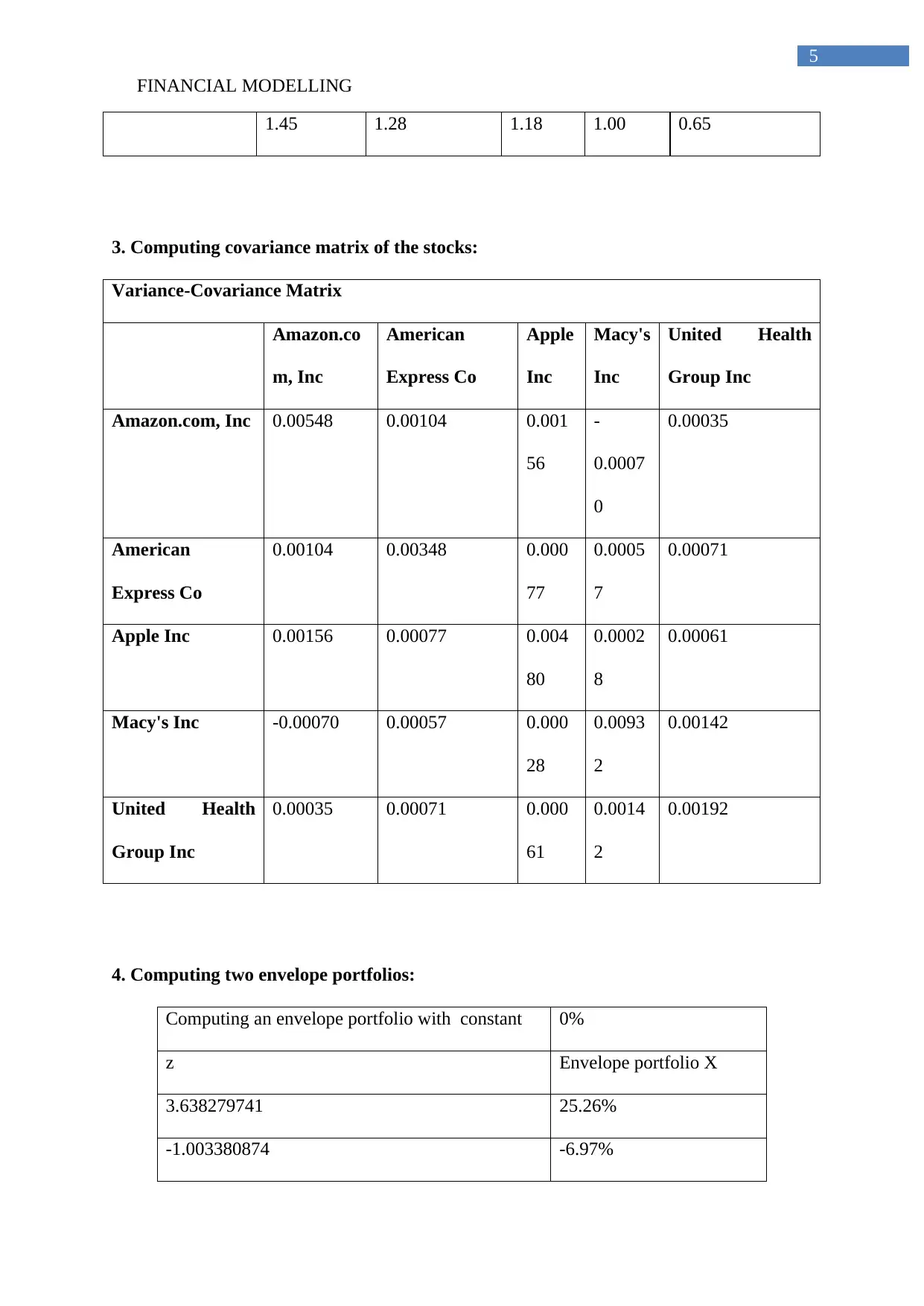

3. Computing covariance matrix of the stocks:

Variance-Covariance Matrix

Amazon.co

m, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Amazon.com, Inc 0.00548 0.00104 0.001

56

-

0.0007

0

0.00035

American

Express Co

0.00104 0.00348 0.000

77

0.0005

7

0.00071

Apple Inc 0.00156 0.00077 0.004

80

0.0002

8

0.00061

Macy's Inc -0.00070 0.00057 0.000

28

0.0093

2

0.00142

United Health

Group Inc

0.00035 0.00071 0.000

61

0.0014

2

0.00192

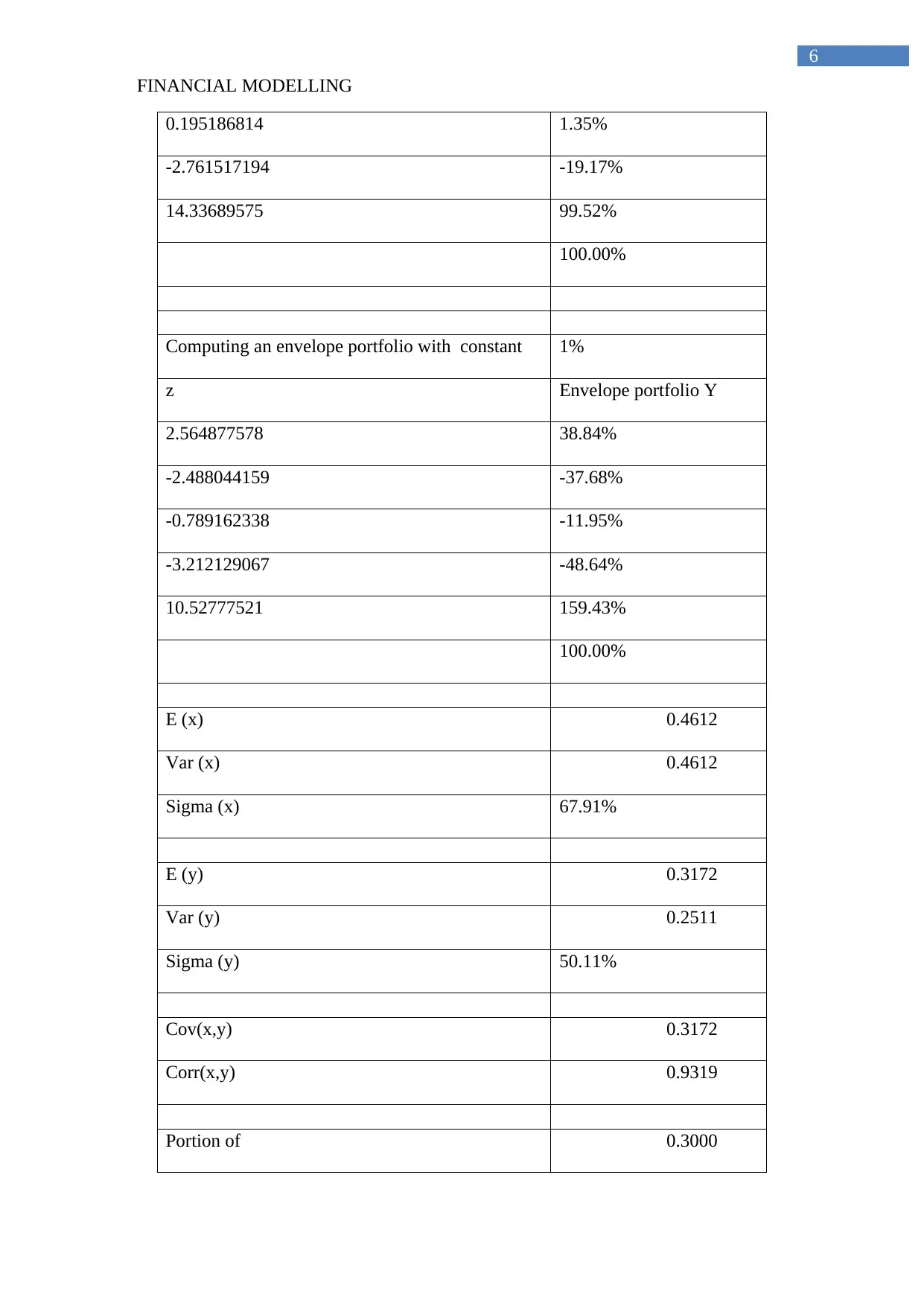

4. Computing two envelope portfolios:

Computing an envelope portfolio with constant 0%

z Envelope portfolio X

3.638279741 25.26%

-1.003380874 -6.97%

5

1.45 1.28 1.18 1.00 0.65

3. Computing covariance matrix of the stocks:

Variance-Covariance Matrix

Amazon.co

m, Inc

American

Express Co

Apple

Inc

Macy's

Inc

United Health

Group Inc

Amazon.com, Inc 0.00548 0.00104 0.001

56

-

0.0007

0

0.00035

American

Express Co

0.00104 0.00348 0.000

77

0.0005

7

0.00071

Apple Inc 0.00156 0.00077 0.004

80

0.0002

8

0.00061

Macy's Inc -0.00070 0.00057 0.000

28

0.0093

2

0.00142

United Health

Group Inc

0.00035 0.00071 0.000

61

0.0014

2

0.00192

4. Computing two envelope portfolios:

Computing an envelope portfolio with constant 0%

z Envelope portfolio X

3.638279741 25.26%

-1.003380874 -6.97%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MODELLING

6

0.195186814 1.35%

-2.761517194 -19.17%

14.33689575 99.52%

100.00%

Computing an envelope portfolio with constant 1%

z Envelope portfolio Y

2.564877578 38.84%

-2.488044159 -37.68%

-0.789162338 -11.95%

-3.212129067 -48.64%

10.52777521 159.43%

100.00%

E (x) 0.4612

Var (x) 0.4612

Sigma (x) 67.91%

E (y) 0.3172

Var (y) 0.2511

Sigma (y) 50.11%

Cov(x,y) 0.3172

Corr(x,y) 0.9319

Portion of 0.3000

6

0.195186814 1.35%

-2.761517194 -19.17%

14.33689575 99.52%

100.00%

Computing an envelope portfolio with constant 1%

z Envelope portfolio Y

2.564877578 38.84%

-2.488044159 -37.68%

-0.789162338 -11.95%

-3.212129067 -48.64%

10.52777521 159.43%

100.00%

E (x) 0.4612

Var (x) 0.4612

Sigma (x) 67.91%

E (y) 0.3172

Var (y) 0.2511

Sigma (y) 50.11%

Cov(x,y) 0.3172

Corr(x,y) 0.9319

Portion of 0.3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MODELLING

7

E(rp) 36.04%

σp2 0.2978

σp 54.57%

Proportion of x Sigma Return

54.57% 36.04%

-2.2 58.16% 0.03%

-1.9 53.09% 4.35%

-1.6 48.95% 8.67%

-1.3 45.97% 12.99%

-1 44.40% 17.31%

-0.7 44.38% 21.63%

-0.4 45.91% 25.96%

-0.1 48.86% 30.28%

0.2 52.98% 34.60%

0.5 58.02% 38.92%

0.8 63.78% 43.24%

1.1 70.06% 47.56%

1.4 76.74% 51.89%

1.7 83.73% 56.21%

2 90.96% 60.53%

2.3 98.37% 64.85%

7

E(rp) 36.04%

σp2 0.2978

σp 54.57%

Proportion of x Sigma Return

54.57% 36.04%

-2.2 58.16% 0.03%

-1.9 53.09% 4.35%

-1.6 48.95% 8.67%

-1.3 45.97% 12.99%

-1 44.40% 17.31%

-0.7 44.38% 21.63%

-0.4 45.91% 25.96%

-0.1 48.86% 30.28%

0.2 52.98% 34.60%

0.5 58.02% 38.92%

0.8 63.78% 43.24%

1.1 70.06% 47.56%

1.4 76.74% 51.89%

1.7 83.73% 56.21%

2 90.96% 60.53%

2.3 98.37% 64.85%

FINANCIAL MODELLING

8

40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% 110.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

17.31%

Efficient Frontier

Series2

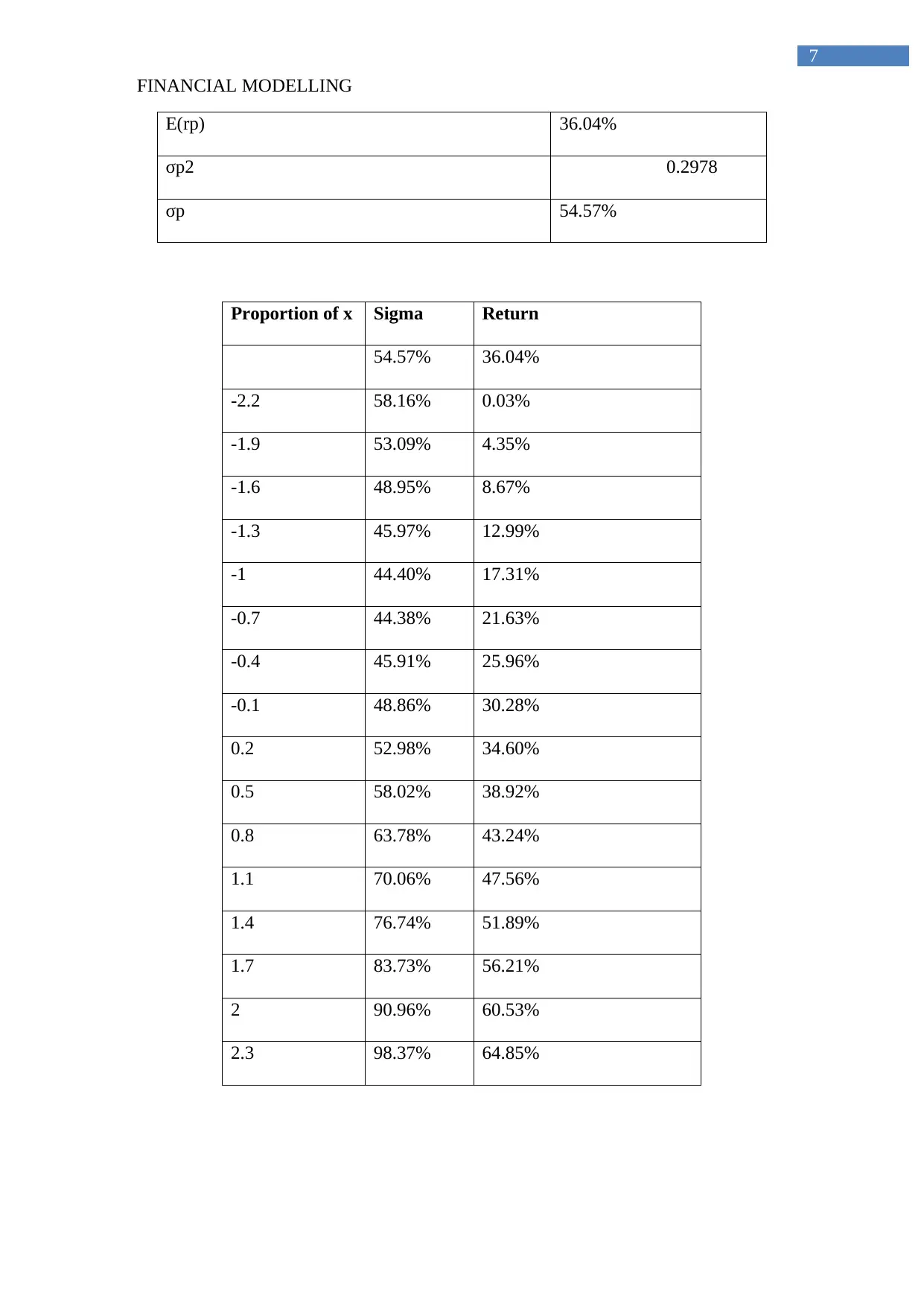

5. Plotting optimal portfolio in graph:

0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

17.31%

Efficient Frontier

Series2

Portfolio Z

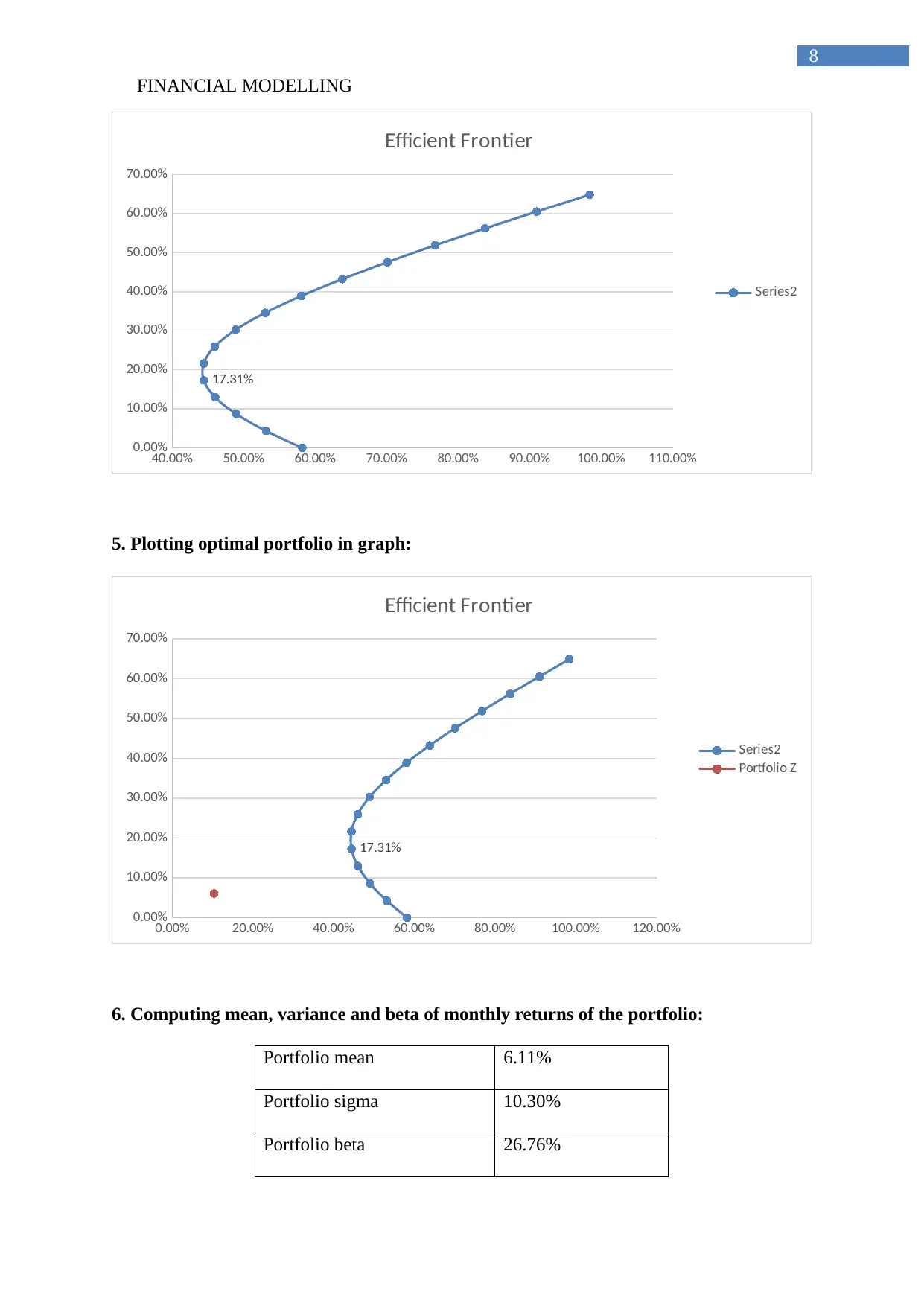

6. Computing mean, variance and beta of monthly returns of the portfolio:

Portfolio mean 6.11%

Portfolio sigma 10.30%

Portfolio beta 26.76%

8

40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% 110.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

17.31%

Efficient Frontier

Series2

5. Plotting optimal portfolio in graph:

0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

17.31%

Efficient Frontier

Series2

Portfolio Z

6. Computing mean, variance and beta of monthly returns of the portfolio:

Portfolio mean 6.11%

Portfolio sigma 10.30%

Portfolio beta 26.76%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MODELLING

9

7. Computing optimum portfolio with short sale constraint:

Portfolio Z

0.2697

0.0000

0.0000

0.0000

0.7303

1.0000

Portfolio mean 2.48%

Portfolio sigma 3.95%

e=Theta 30.97%

8a. Computing binomial model for the stock:

175.61

174.19

172.78 172.78

171.38 171.38

170 170.00 170.00

168.63 168.63

167.26 167.26

165.91

164.57

8b. Computing option using Black Scholes model:

Input Data Value

Stock Price now (P) 171.5

9

7. Computing optimum portfolio with short sale constraint:

Portfolio Z

0.2697

0.0000

0.0000

0.0000

0.7303

1.0000

Portfolio mean 2.48%

Portfolio sigma 3.95%

e=Theta 30.97%

8a. Computing binomial model for the stock:

175.61

174.19

172.78 172.78

171.38 171.38

170 170.00 170.00

168.63 168.63

167.26 167.26

165.91

164.57

8b. Computing option using Black Scholes model:

Input Data Value

Stock Price now (P) 171.5

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.