Coursework: Financial Modelling with Excel Applications in Finance

VerifiedAdded on 2023/04/19

|13

|2664

|134

Report

AI Summary

This report demonstrates financial modelling using Excel in corporate finance. It calculates the yield to maturity (YTM) for a bond under different interest payment frequencies, analyzes the risk-return profiles of the PHLX Oil Service Sector Index and the NYSE Arca Biotech Index, constructs equal-weighted and optimal portfolios, and applies the Capital Asset Pricing Model (CAPM) to evaluate the expected returns of PCG and DUK stocks, providing a comprehensive overview of key financial concepts and their practical application in Excel. Desklib offers similar solved assignments and past papers for students.

Running head: FINANCIAL MODELLING

Financial Modelling

Name of the Student:

Name of the University:

Author’s Note:

Financial Modelling

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MODELLING

Table of Contents

In Response to Question 1..........................................................................................................2

In Response to Question 2..........................................................................................................3

In Response to Question 3..........................................................................................................8

In Response to Question 4........................................................................................................12

Table of Contents

In Response to Question 1..........................................................................................................2

In Response to Question 2..........................................................................................................3

In Response to Question 3..........................................................................................................8

In Response to Question 4........................................................................................................12

2FINANCIAL MODELLING

In Response to Question 1

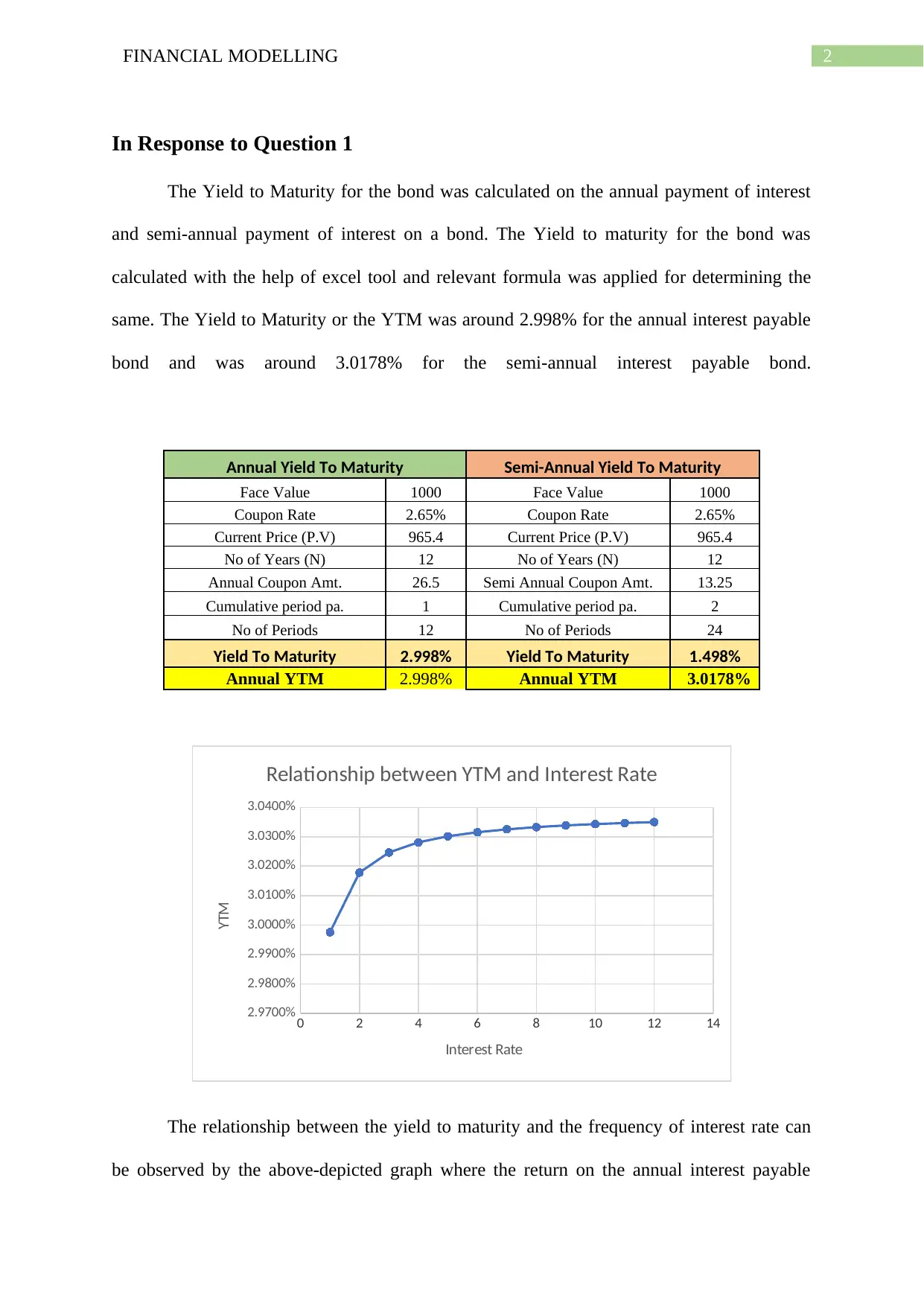

The Yield to Maturity for the bond was calculated on the annual payment of interest

and semi-annual payment of interest on a bond. The Yield to maturity for the bond was

calculated with the help of excel tool and relevant formula was applied for determining the

same. The Yield to Maturity or the YTM was around 2.998% for the annual interest payable

bond and was around 3.0178% for the semi-annual interest payable bond.

Annual Yield To Maturity Semi-Annual Yield To Maturity

Face Value 1000 Face Value 1000

Coupon Rate 2.65% Coupon Rate 2.65%

Current Price (P.V) 965.4 Current Price (P.V) 965.4

No of Years (N) 12 No of Years (N) 12

Annual Coupon Amt. 26.5 Semi Annual Coupon Amt. 13.25

Cumulative period pa. 1 Cumulative period pa. 2

No of Periods 12 No of Periods 24

Yield To Maturity 2.998% Yield To Maturity 1.498%

Annual YTM 2.998% Annual YTM 3.0178%

0 2 4 6 8 10 12 14

2.9700%

2.9800%

2.9900%

3.0000%

3.0100%

3.0200%

3.0300%

3.0400%

Relationship between YTM and Interest Rate

Interest Rate

YTM

The relationship between the yield to maturity and the frequency of interest rate can

be observed by the above-depicted graph where the return on the annual interest payable

In Response to Question 1

The Yield to Maturity for the bond was calculated on the annual payment of interest

and semi-annual payment of interest on a bond. The Yield to maturity for the bond was

calculated with the help of excel tool and relevant formula was applied for determining the

same. The Yield to Maturity or the YTM was around 2.998% for the annual interest payable

bond and was around 3.0178% for the semi-annual interest payable bond.

Annual Yield To Maturity Semi-Annual Yield To Maturity

Face Value 1000 Face Value 1000

Coupon Rate 2.65% Coupon Rate 2.65%

Current Price (P.V) 965.4 Current Price (P.V) 965.4

No of Years (N) 12 No of Years (N) 12

Annual Coupon Amt. 26.5 Semi Annual Coupon Amt. 13.25

Cumulative period pa. 1 Cumulative period pa. 2

No of Periods 12 No of Periods 24

Yield To Maturity 2.998% Yield To Maturity 1.498%

Annual YTM 2.998% Annual YTM 3.0178%

0 2 4 6 8 10 12 14

2.9700%

2.9800%

2.9900%

3.0000%

3.0100%

3.0200%

3.0300%

3.0400%

Relationship between YTM and Interest Rate

Interest Rate

YTM

The relationship between the yield to maturity and the frequency of interest rate can

be observed by the above-depicted graph where the return on the annual interest payable

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MODELLING

bond is much higher due to the compounding effect. The return provided by the semi-annual

interest payable bond was much lower compared to the annual interest payable bond and the

investor should asses the same after determining the Yield to Maturity generated from each of

the same. Investors should select the bond with the highest yield to maturity so that the

investors can create wealth by investing in higher yield bonds. The Yield to maturity on the

other hand is greater than the coupon rate because of the bond trading at a discount rate

which alternatively makes the return generated from the bond higher than the interest rate of

the bond.

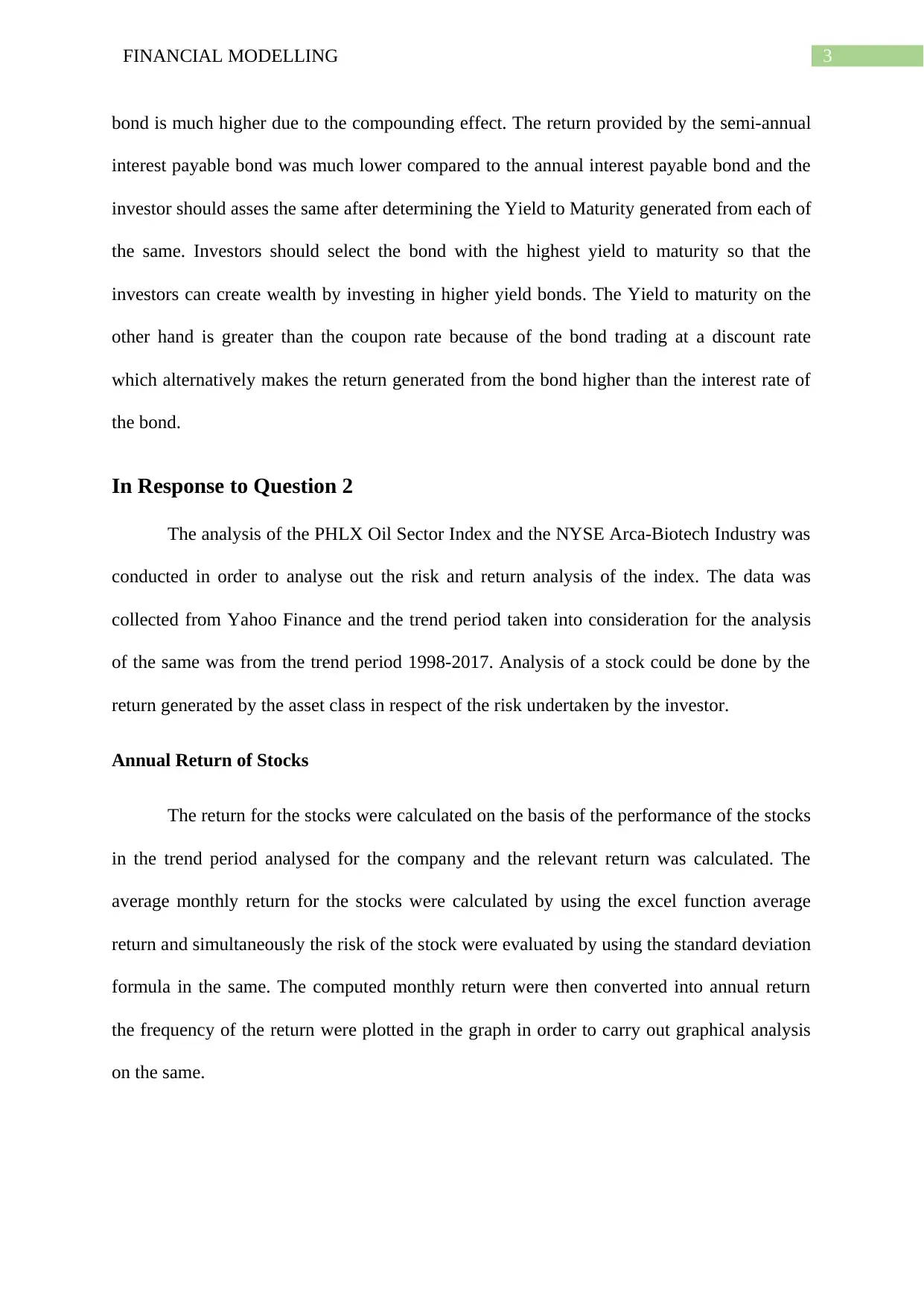

In Response to Question 2

The analysis of the PHLX Oil Sector Index and the NYSE Arca-Biotech Industry was

conducted in order to analyse out the risk and return analysis of the index. The data was

collected from Yahoo Finance and the trend period taken into consideration for the analysis

of the same was from the trend period 1998-2017. Analysis of a stock could be done by the

return generated by the asset class in respect of the risk undertaken by the investor.

Annual Return of Stocks

The return for the stocks were calculated on the basis of the performance of the stocks

in the trend period analysed for the company and the relevant return was calculated. The

average monthly return for the stocks were calculated by using the excel function average

return and simultaneously the risk of the stock were evaluated by using the standard deviation

formula in the same. The computed monthly return were then converted into annual return

the frequency of the return were plotted in the graph in order to carry out graphical analysis

on the same.

bond is much higher due to the compounding effect. The return provided by the semi-annual

interest payable bond was much lower compared to the annual interest payable bond and the

investor should asses the same after determining the Yield to Maturity generated from each of

the same. Investors should select the bond with the highest yield to maturity so that the

investors can create wealth by investing in higher yield bonds. The Yield to maturity on the

other hand is greater than the coupon rate because of the bond trading at a discount rate

which alternatively makes the return generated from the bond higher than the interest rate of

the bond.

In Response to Question 2

The analysis of the PHLX Oil Sector Index and the NYSE Arca-Biotech Industry was

conducted in order to analyse out the risk and return analysis of the index. The data was

collected from Yahoo Finance and the trend period taken into consideration for the analysis

of the same was from the trend period 1998-2017. Analysis of a stock could be done by the

return generated by the asset class in respect of the risk undertaken by the investor.

Annual Return of Stocks

The return for the stocks were calculated on the basis of the performance of the stocks

in the trend period analysed for the company and the relevant return was calculated. The

average monthly return for the stocks were calculated by using the excel function average

return and simultaneously the risk of the stock were evaluated by using the standard deviation

formula in the same. The computed monthly return were then converted into annual return

the frequency of the return were plotted in the graph in order to carry out graphical analysis

on the same.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MODELLING

Particulars OSX BTK

Monthly Return 0.67% 1.83%

Annual Return 8.76% 22.77%

Standard Deviations 36.27% 35.13%

Variance 13.16% 12.34%

Risk-Return Analysis

Risk return analysis is an important component of financial investment and the same

needs to be dealt with the analysis of the various component of the asset class. These will

include the return generated by the stock by taking a single amount of risk, and the

consistency in the return generated by the company are some of the crucial parts which needs

to be analysed. The analysis of the stock was conducted on the basis of return generated by

each of the index by taking a single amount of risk. The formula applied for the calculation of

the same was Risk/return for determining the return generated by taking a single unit of risk.

The BTK Index has performed well on a risk return basis giving a higher amount of return for

the single amount of risk taken by the investor and the same should be selected by the

investor as an optimal asset class for the purpose of investment.

-50.00% 0.00% 50.00% 100.00% 150.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

Risk Return of BTK

RISK

RETURN

-80.00% -60.00% -40.00% -20.00% 0.00% 20.00% 40.00% 60.00% 80.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Risk-Return of OSX

RISK

RETURN

Particulars OSX BTK

Monthly Return 0.67% 1.83%

Annual Return 8.76% 22.77%

Standard Deviations 36.27% 35.13%

Variance 13.16% 12.34%

Risk-Return Analysis

Risk return analysis is an important component of financial investment and the same

needs to be dealt with the analysis of the various component of the asset class. These will

include the return generated by the stock by taking a single amount of risk, and the

consistency in the return generated by the company are some of the crucial parts which needs

to be analysed. The analysis of the stock was conducted on the basis of return generated by

each of the index by taking a single amount of risk. The formula applied for the calculation of

the same was Risk/return for determining the return generated by taking a single unit of risk.

The BTK Index has performed well on a risk return basis giving a higher amount of return for

the single amount of risk taken by the investor and the same should be selected by the

investor as an optimal asset class for the purpose of investment.

-50.00% 0.00% 50.00% 100.00% 150.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

Risk Return of BTK

RISK

RETURN

-80.00% -60.00% -40.00% -20.00% 0.00% 20.00% 40.00% 60.00% 80.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Risk-Return of OSX

RISK

RETURN

5FINANCIAL MODELLING

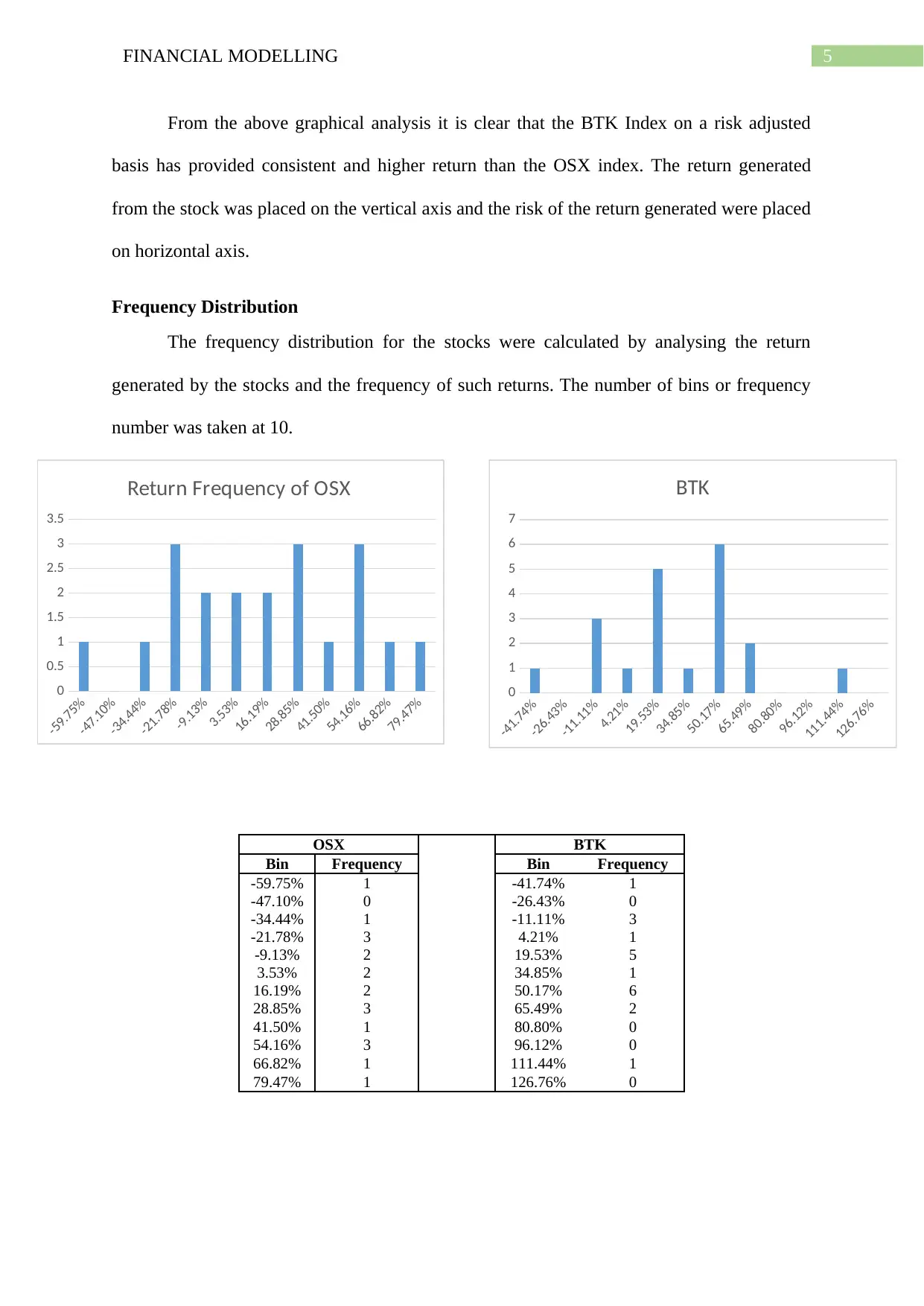

From the above graphical analysis it is clear that the BTK Index on a risk adjusted

basis has provided consistent and higher return than the OSX index. The return generated

from the stock was placed on the vertical axis and the risk of the return generated were placed

on horizontal axis.

Frequency Distribution

The frequency distribution for the stocks were calculated by analysing the return

generated by the stocks and the frequency of such returns. The number of bins or frequency

number was taken at 10.

OSX BTK

Bin Frequency Bin Frequency

-59.75% 1 -41.74% 1

-47.10% 0 -26.43% 0

-34.44% 1 -11.11% 3

-21.78% 3 4.21% 1

-9.13% 2 19.53% 5

3.53% 2 34.85% 1

16.19% 2 50.17% 6

28.85% 3 65.49% 2

41.50% 1 80.80% 0

54.16% 3 96.12% 0

66.82% 1 111.44% 1

79.47% 1 126.76% 0

-59.75%

-47.10%

-34.44%

-21.78%

-9.13%

3.53%

16.19%

28.85%

41.50%

54.16%

66.82%

79.47%

0

0.5

1

1.5

2

2.5

3

3.5

Return Frequency of OSX

-41.74%

-26.43%

-11.11%

4.21%

19.53%

34.85%

50.17%

65.49%

80.80%

96.12%

111.44%

126.76%

0

1

2

3

4

5

6

7

BTK

From the above graphical analysis it is clear that the BTK Index on a risk adjusted

basis has provided consistent and higher return than the OSX index. The return generated

from the stock was placed on the vertical axis and the risk of the return generated were placed

on horizontal axis.

Frequency Distribution

The frequency distribution for the stocks were calculated by analysing the return

generated by the stocks and the frequency of such returns. The number of bins or frequency

number was taken at 10.

OSX BTK

Bin Frequency Bin Frequency

-59.75% 1 -41.74% 1

-47.10% 0 -26.43% 0

-34.44% 1 -11.11% 3

-21.78% 3 4.21% 1

-9.13% 2 19.53% 5

3.53% 2 34.85% 1

16.19% 2 50.17% 6

28.85% 3 65.49% 2

41.50% 1 80.80% 0

54.16% 3 96.12% 0

66.82% 1 111.44% 1

79.47% 1 126.76% 0

-59.75%

-47.10%

-34.44%

-21.78%

-9.13%

3.53%

16.19%

28.85%

41.50%

54.16%

66.82%

79.47%

0

0.5

1

1.5

2

2.5

3

3.5

Return Frequency of OSX

-41.74%

-26.43%

-11.11%

4.21%

19.53%

34.85%

50.17%

65.49%

80.80%

96.12%

111.44%

126.76%

0

1

2

3

4

5

6

7

BTK

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MODELLING

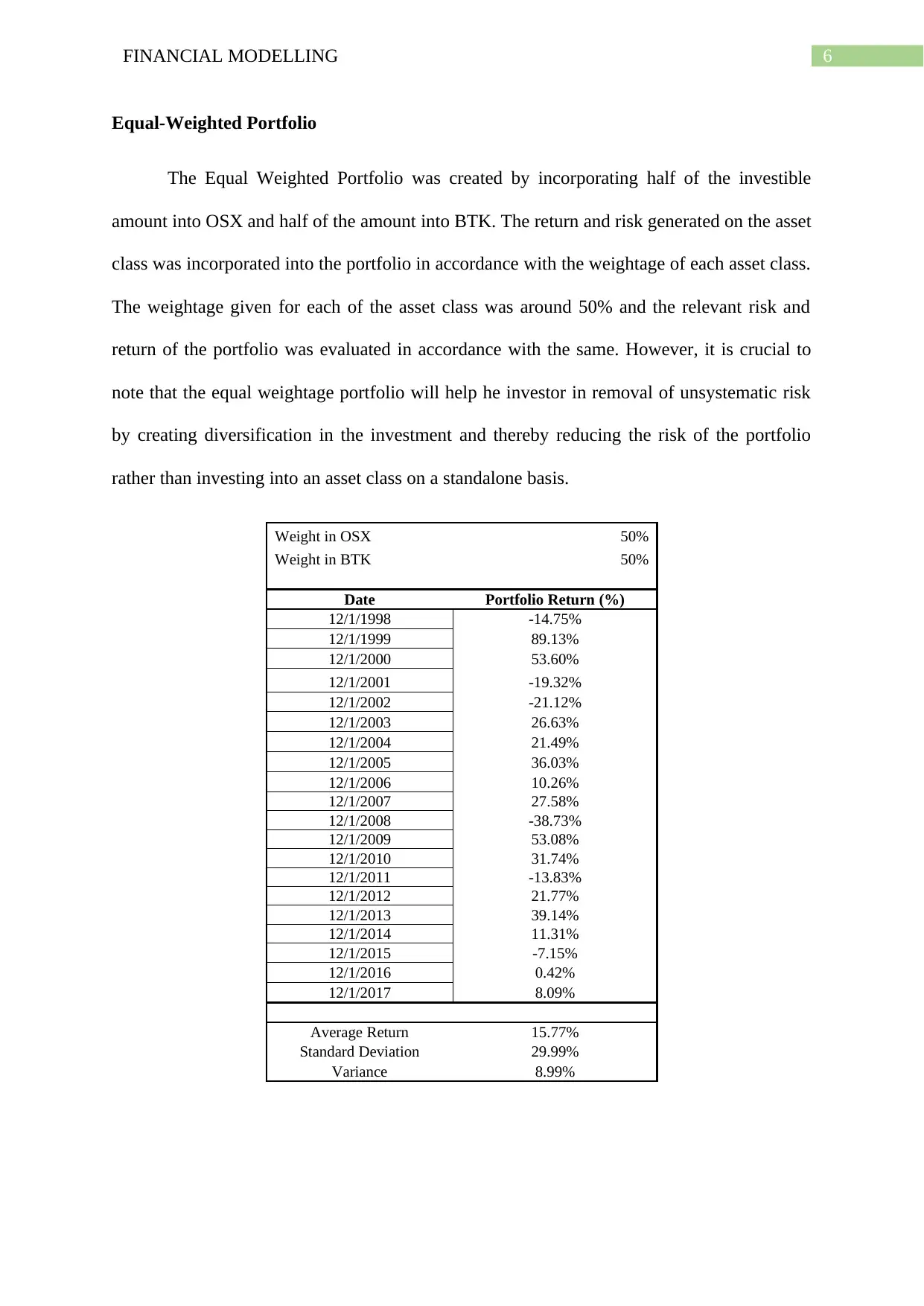

Equal-Weighted Portfolio

The Equal Weighted Portfolio was created by incorporating half of the investible

amount into OSX and half of the amount into BTK. The return and risk generated on the asset

class was incorporated into the portfolio in accordance with the weightage of each asset class.

The weightage given for each of the asset class was around 50% and the relevant risk and

return of the portfolio was evaluated in accordance with the same. However, it is crucial to

note that the equal weightage portfolio will help he investor in removal of unsystematic risk

by creating diversification in the investment and thereby reducing the risk of the portfolio

rather than investing into an asset class on a standalone basis.

Weight in OSX 50%

Weight in BTK 50%

Date Portfolio Return (%)

12/1/1998 -14.75%

12/1/1999 89.13%

12/1/2000 53.60%

12/1/2001 -19.32%

12/1/2002 -21.12%

12/1/2003 26.63%

12/1/2004 21.49%

12/1/2005 36.03%

12/1/2006 10.26%

12/1/2007 27.58%

12/1/2008 -38.73%

12/1/2009 53.08%

12/1/2010 31.74%

12/1/2011 -13.83%

12/1/2012 21.77%

12/1/2013 39.14%

12/1/2014 11.31%

12/1/2015 -7.15%

12/1/2016 0.42%

12/1/2017 8.09%

Average Return 15.77%

Standard Deviation 29.99%

Variance 8.99%

Equal-Weighted Portfolio

The Equal Weighted Portfolio was created by incorporating half of the investible

amount into OSX and half of the amount into BTK. The return and risk generated on the asset

class was incorporated into the portfolio in accordance with the weightage of each asset class.

The weightage given for each of the asset class was around 50% and the relevant risk and

return of the portfolio was evaluated in accordance with the same. However, it is crucial to

note that the equal weightage portfolio will help he investor in removal of unsystematic risk

by creating diversification in the investment and thereby reducing the risk of the portfolio

rather than investing into an asset class on a standalone basis.

Weight in OSX 50%

Weight in BTK 50%

Date Portfolio Return (%)

12/1/1998 -14.75%

12/1/1999 89.13%

12/1/2000 53.60%

12/1/2001 -19.32%

12/1/2002 -21.12%

12/1/2003 26.63%

12/1/2004 21.49%

12/1/2005 36.03%

12/1/2006 10.26%

12/1/2007 27.58%

12/1/2008 -38.73%

12/1/2009 53.08%

12/1/2010 31.74%

12/1/2011 -13.83%

12/1/2012 21.77%

12/1/2013 39.14%

12/1/2014 11.31%

12/1/2015 -7.15%

12/1/2016 0.42%

12/1/2017 8.09%

Average Return 15.77%

Standard Deviation 29.99%

Variance 8.99%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MODELLING

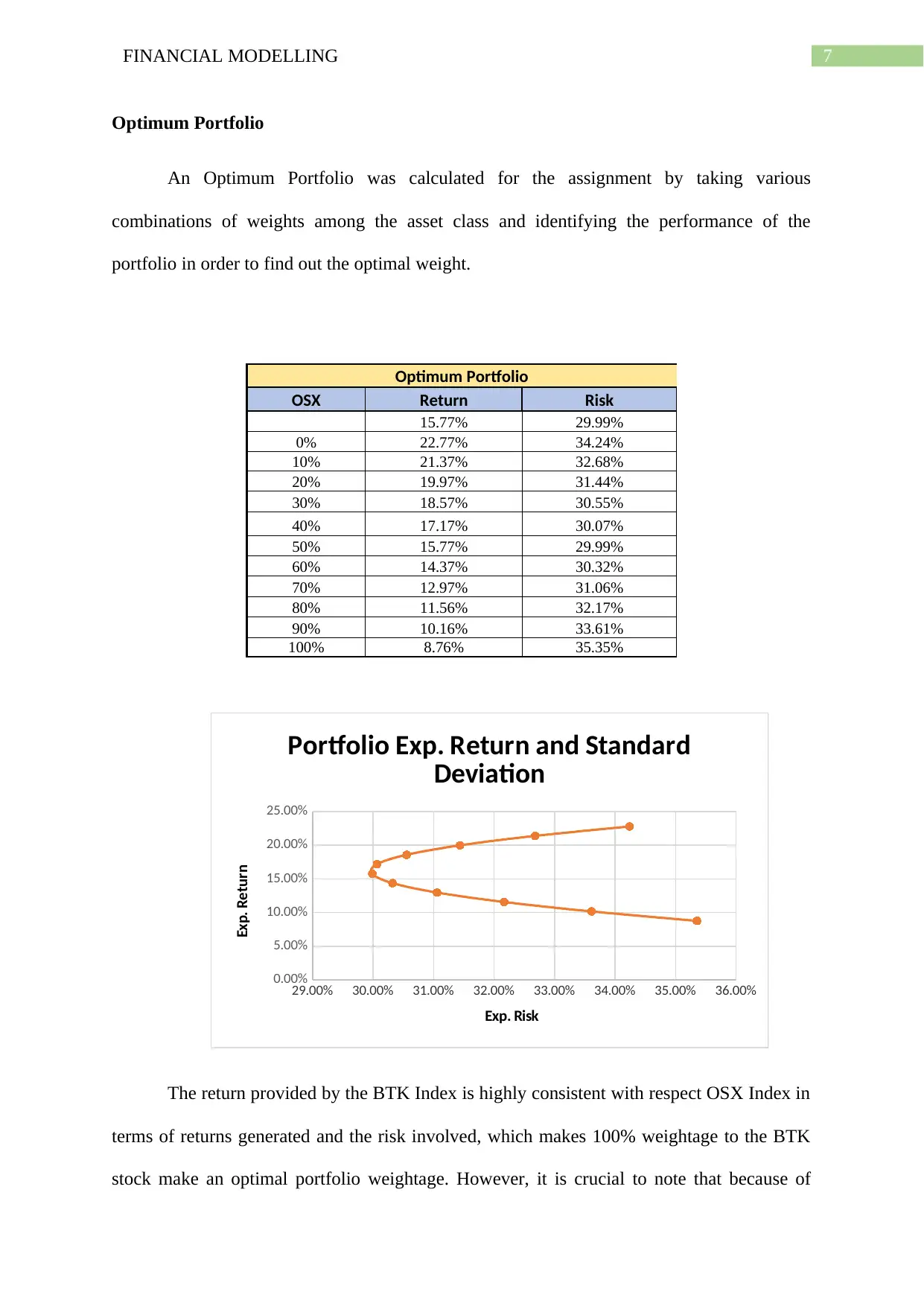

Optimum Portfolio

An Optimum Portfolio was calculated for the assignment by taking various

combinations of weights among the asset class and identifying the performance of the

portfolio in order to find out the optimal weight.

Optimum Portfolio

OSX Return Risk

15.77% 29.99%

0% 22.77% 34.24%

10% 21.37% 32.68%

20% 19.97% 31.44%

30% 18.57% 30.55%

40% 17.17% 30.07%

50% 15.77% 29.99%

60% 14.37% 30.32%

70% 12.97% 31.06%

80% 11.56% 32.17%

90% 10.16% 33.61%

100% 8.76% 35.35%

29.00% 30.00% 31.00% 32.00% 33.00% 34.00% 35.00% 36.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Portfolio Exp. Return and Standard

Deviation

Exp. Risk

Exp. Return

The return provided by the BTK Index is highly consistent with respect OSX Index in

terms of returns generated and the risk involved, which makes 100% weightage to the BTK

stock make an optimal portfolio weightage. However, it is crucial to note that because of

Optimum Portfolio

An Optimum Portfolio was calculated for the assignment by taking various

combinations of weights among the asset class and identifying the performance of the

portfolio in order to find out the optimal weight.

Optimum Portfolio

OSX Return Risk

15.77% 29.99%

0% 22.77% 34.24%

10% 21.37% 32.68%

20% 19.97% 31.44%

30% 18.57% 30.55%

40% 17.17% 30.07%

50% 15.77% 29.99%

60% 14.37% 30.32%

70% 12.97% 31.06%

80% 11.56% 32.17%

90% 10.16% 33.61%

100% 8.76% 35.35%

29.00% 30.00% 31.00% 32.00% 33.00% 34.00% 35.00% 36.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Portfolio Exp. Return and Standard

Deviation

Exp. Risk

Exp. Return

The return provided by the BTK Index is highly consistent with respect OSX Index in

terms of returns generated and the risk involved, which makes 100% weightage to the BTK

stock make an optimal portfolio weightage. However, it is crucial to note that because of

8FINANCIAL MODELLING

diversification and concentration risk it is optimal for the investor to consider for a portfolio

of investment rather than standalone investment. Systematic risk is always associated with

investments in the financial market and which cannot be removed but investors can reduce

the unsystematic risk in a portfolio by creating a diversified portfolio. The return and risk as

shown above was determined by taking the respective weights of index and the return/risk

generated by the index.

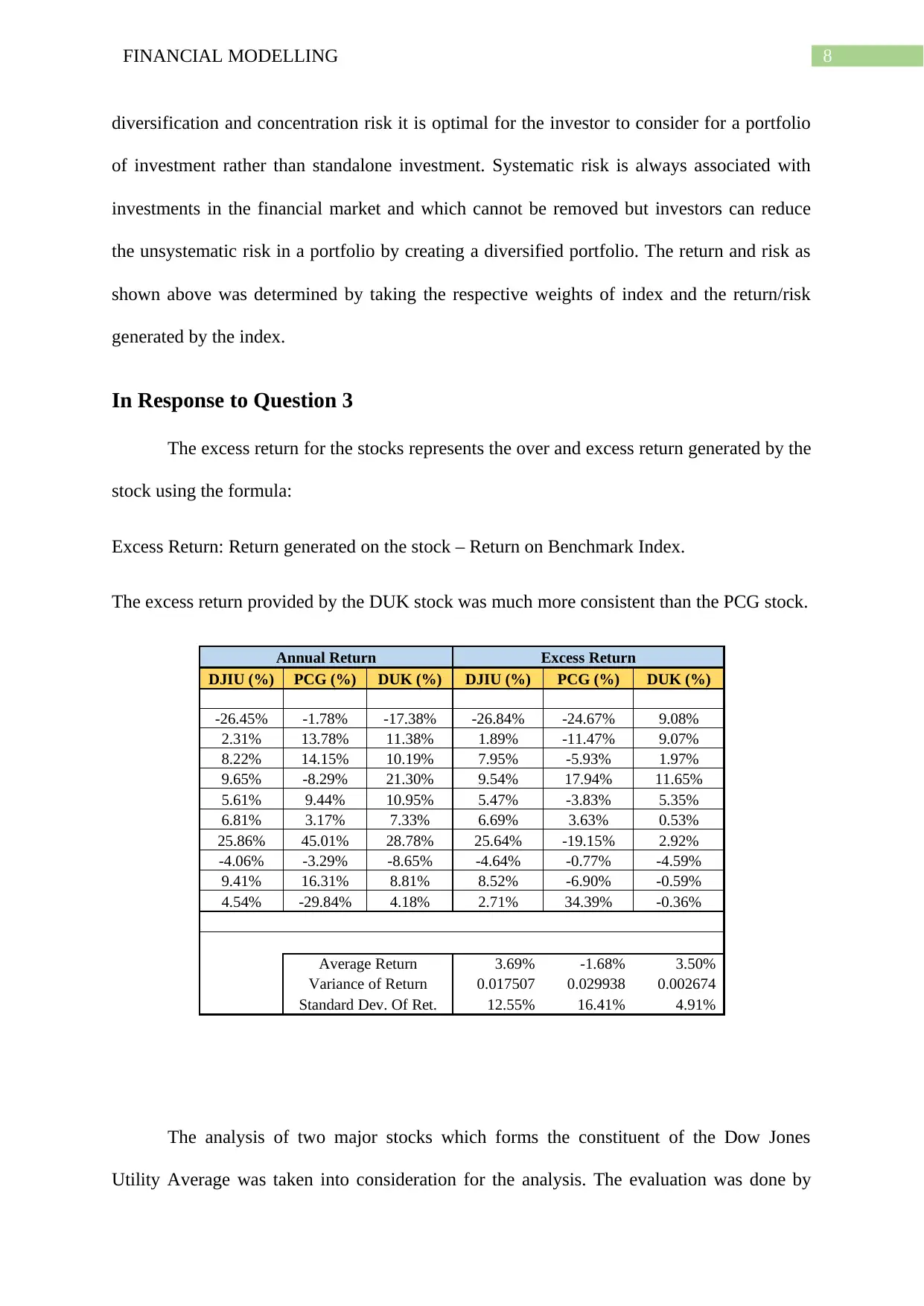

In Response to Question 3

The excess return for the stocks represents the over and excess return generated by the

stock using the formula:

Excess Return: Return generated on the stock – Return on Benchmark Index.

The excess return provided by the DUK stock was much more consistent than the PCG stock.

Annual Return Excess Return

DJIU (%) PCG (%) DUK (%) DJIU (%) PCG (%) DUK (%)

-26.45% -1.78% -17.38% -26.84% -24.67% 9.08%

2.31% 13.78% 11.38% 1.89% -11.47% 9.07%

8.22% 14.15% 10.19% 7.95% -5.93% 1.97%

9.65% -8.29% 21.30% 9.54% 17.94% 11.65%

5.61% 9.44% 10.95% 5.47% -3.83% 5.35%

6.81% 3.17% 7.33% 6.69% 3.63% 0.53%

25.86% 45.01% 28.78% 25.64% -19.15% 2.92%

-4.06% -3.29% -8.65% -4.64% -0.77% -4.59%

9.41% 16.31% 8.81% 8.52% -6.90% -0.59%

4.54% -29.84% 4.18% 2.71% 34.39% -0.36%

Average Return 3.69% -1.68% 3.50%

Variance of Return 0.017507 0.029938 0.002674

Standard Dev. Of Ret. 12.55% 16.41% 4.91%

The analysis of two major stocks which forms the constituent of the Dow Jones

Utility Average was taken into consideration for the analysis. The evaluation was done by

diversification and concentration risk it is optimal for the investor to consider for a portfolio

of investment rather than standalone investment. Systematic risk is always associated with

investments in the financial market and which cannot be removed but investors can reduce

the unsystematic risk in a portfolio by creating a diversified portfolio. The return and risk as

shown above was determined by taking the respective weights of index and the return/risk

generated by the index.

In Response to Question 3

The excess return for the stocks represents the over and excess return generated by the

stock using the formula:

Excess Return: Return generated on the stock – Return on Benchmark Index.

The excess return provided by the DUK stock was much more consistent than the PCG stock.

Annual Return Excess Return

DJIU (%) PCG (%) DUK (%) DJIU (%) PCG (%) DUK (%)

-26.45% -1.78% -17.38% -26.84% -24.67% 9.08%

2.31% 13.78% 11.38% 1.89% -11.47% 9.07%

8.22% 14.15% 10.19% 7.95% -5.93% 1.97%

9.65% -8.29% 21.30% 9.54% 17.94% 11.65%

5.61% 9.44% 10.95% 5.47% -3.83% 5.35%

6.81% 3.17% 7.33% 6.69% 3.63% 0.53%

25.86% 45.01% 28.78% 25.64% -19.15% 2.92%

-4.06% -3.29% -8.65% -4.64% -0.77% -4.59%

9.41% 16.31% 8.81% 8.52% -6.90% -0.59%

4.54% -29.84% 4.18% 2.71% 34.39% -0.36%

Average Return 3.69% -1.68% 3.50%

Variance of Return 0.017507 0.029938 0.002674

Standard Dev. Of Ret. 12.55% 16.41% 4.91%

The analysis of two major stocks which forms the constituent of the Dow Jones

Utility Average was taken into consideration for the analysis. The evaluation was done by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MODELLING

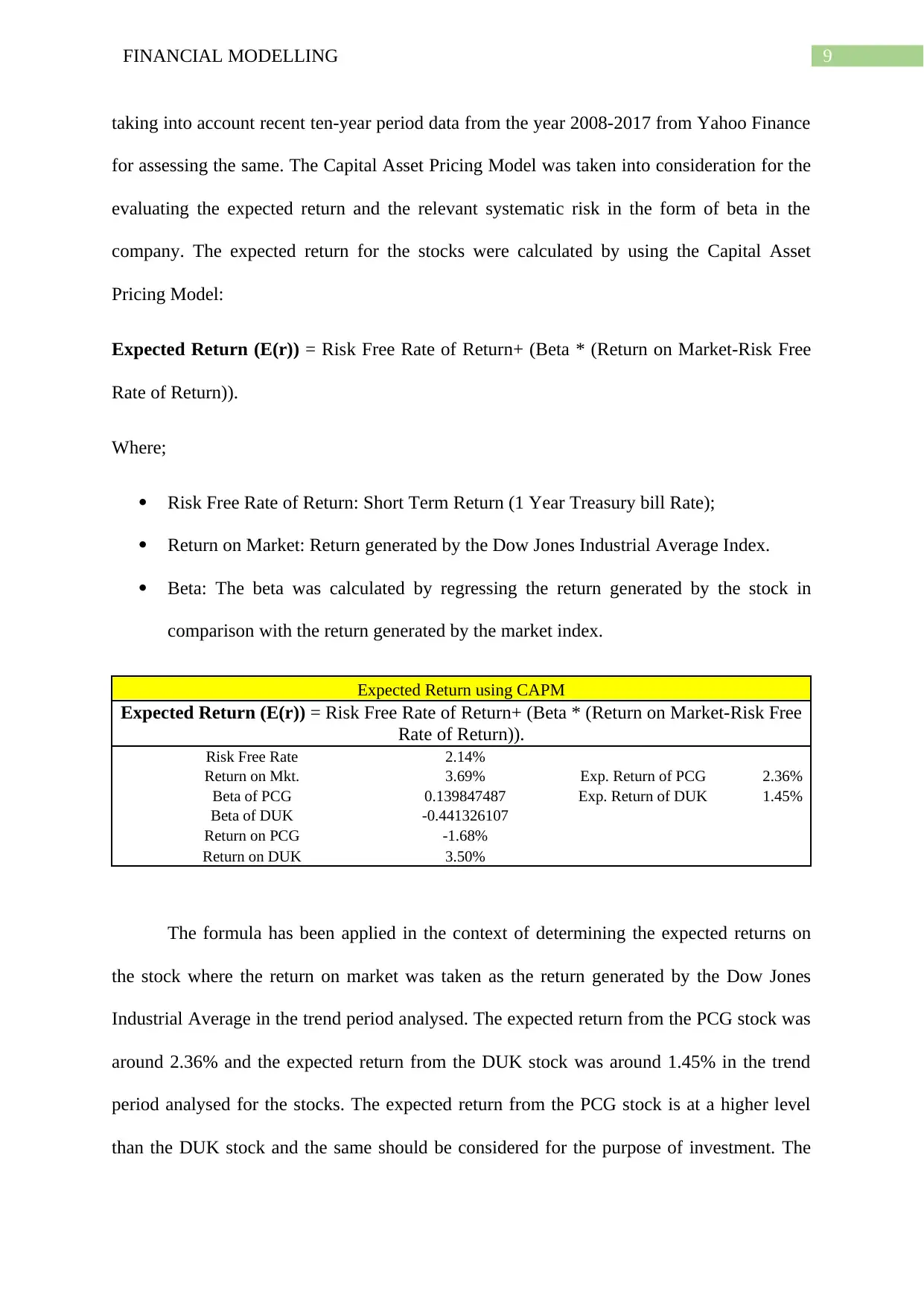

taking into account recent ten-year period data from the year 2008-2017 from Yahoo Finance

for assessing the same. The Capital Asset Pricing Model was taken into consideration for the

evaluating the expected return and the relevant systematic risk in the form of beta in the

company. The expected return for the stocks were calculated by using the Capital Asset

Pricing Model:

Expected Return (E(r)) = Risk Free Rate of Return+ (Beta * (Return on Market-Risk Free

Rate of Return)).

Where;

Risk Free Rate of Return: Short Term Return (1 Year Treasury bill Rate);

Return on Market: Return generated by the Dow Jones Industrial Average Index.

Beta: The beta was calculated by regressing the return generated by the stock in

comparison with the return generated by the market index.

Expected Return using CAPM

Expected Return (E(r)) = Risk Free Rate of Return+ (Beta * (Return on Market-Risk Free

Rate of Return)).

Risk Free Rate 2.14%

Return on Mkt. 3.69% Exp. Return of PCG 2.36%

Beta of PCG 0.139847487 Exp. Return of DUK 1.45%

Beta of DUK -0.441326107

Return on PCG -1.68%

Return on DUK 3.50%

The formula has been applied in the context of determining the expected returns on

the stock where the return on market was taken as the return generated by the Dow Jones

Industrial Average in the trend period analysed. The expected return from the PCG stock was

around 2.36% and the expected return from the DUK stock was around 1.45% in the trend

period analysed for the stocks. The expected return from the PCG stock is at a higher level

than the DUK stock and the same should be considered for the purpose of investment. The

taking into account recent ten-year period data from the year 2008-2017 from Yahoo Finance

for assessing the same. The Capital Asset Pricing Model was taken into consideration for the

evaluating the expected return and the relevant systematic risk in the form of beta in the

company. The expected return for the stocks were calculated by using the Capital Asset

Pricing Model:

Expected Return (E(r)) = Risk Free Rate of Return+ (Beta * (Return on Market-Risk Free

Rate of Return)).

Where;

Risk Free Rate of Return: Short Term Return (1 Year Treasury bill Rate);

Return on Market: Return generated by the Dow Jones Industrial Average Index.

Beta: The beta was calculated by regressing the return generated by the stock in

comparison with the return generated by the market index.

Expected Return using CAPM

Expected Return (E(r)) = Risk Free Rate of Return+ (Beta * (Return on Market-Risk Free

Rate of Return)).

Risk Free Rate 2.14%

Return on Mkt. 3.69% Exp. Return of PCG 2.36%

Beta of PCG 0.139847487 Exp. Return of DUK 1.45%

Beta of DUK -0.441326107

Return on PCG -1.68%

Return on DUK 3.50%

The formula has been applied in the context of determining the expected returns on

the stock where the return on market was taken as the return generated by the Dow Jones

Industrial Average in the trend period analysed. The expected return from the PCG stock was

around 2.36% and the expected return from the DUK stock was around 1.45% in the trend

period analysed for the stocks. The expected return from the PCG stock is at a higher level

than the DUK stock and the same should be considered for the purpose of investment. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MODELLING

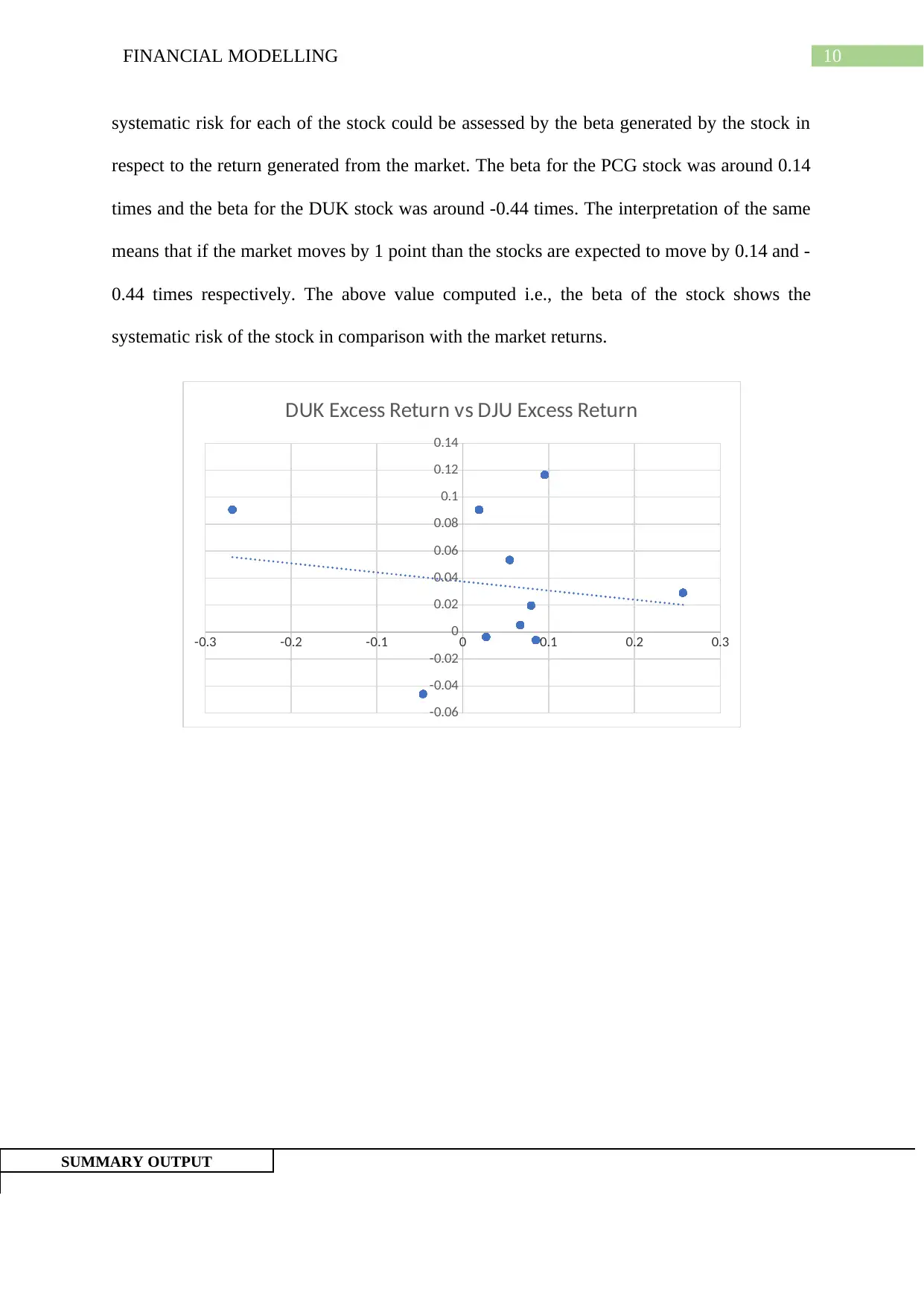

systematic risk for each of the stock could be assessed by the beta generated by the stock in

respect to the return generated from the market. The beta for the PCG stock was around 0.14

times and the beta for the DUK stock was around -0.44 times. The interpretation of the same

means that if the market moves by 1 point than the stocks are expected to move by 0.14 and -

0.44 times respectively. The above value computed i.e., the beta of the stock shows the

systematic risk of the stock in comparison with the market returns.

-0.3 -0.2 -0.1 0 0.1 0.2 0.3

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

DUK Excess Return vs DJU Excess Return

SUMMARY OUTPUT

systematic risk for each of the stock could be assessed by the beta generated by the stock in

respect to the return generated from the market. The beta for the PCG stock was around 0.14

times and the beta for the DUK stock was around -0.44 times. The interpretation of the same

means that if the market moves by 1 point than the stocks are expected to move by 0.14 and -

0.44 times respectively. The above value computed i.e., the beta of the stock shows the

systematic risk of the stock in comparison with the market returns.

-0.3 -0.2 -0.1 0 0.1 0.2 0.3

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

DUK Excess Return vs DJU Excess Return

SUMMARY OUTPUT

11FINANCIAL MODELLING

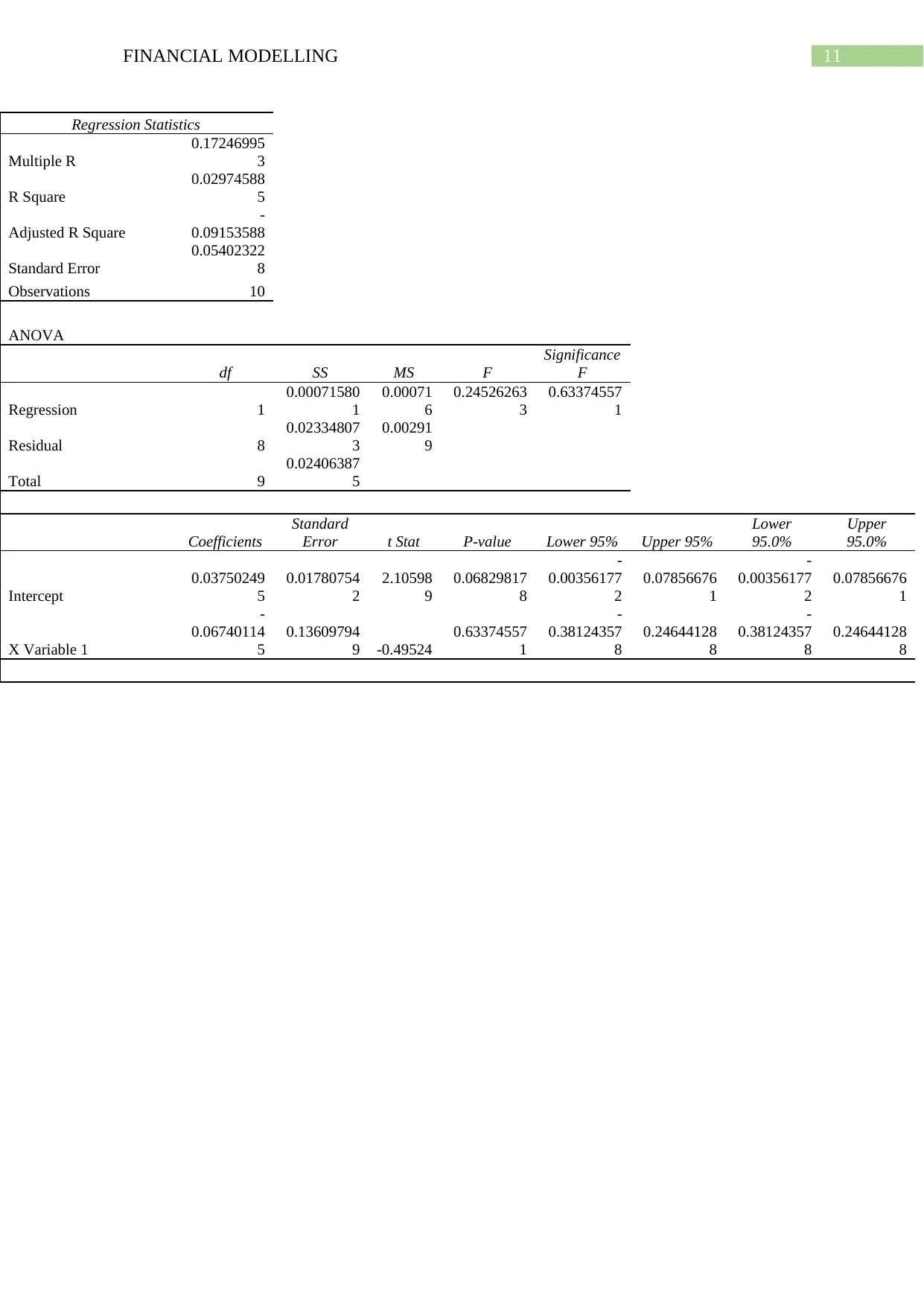

Regression Statistics

Multiple R

0.17246995

3

R Square

0.02974588

5

Adjusted R Square

-

0.09153588

Standard Error

0.05402322

8

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1

0.00071580

1

0.00071

6

0.24526263

3

0.63374557

1

Residual 8

0.02334807

3

0.00291

9

Total 9

0.02406387

5

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Lower

95.0%

Upper

95.0%

Intercept

0.03750249

5

0.01780754

2

2.10598

9

0.06829817

8

-

0.00356177

2

0.07856676

1

-

0.00356177

2

0.07856676

1

X Variable 1

-

0.06740114

5

0.13609794

9 -0.49524

0.63374557

1

-

0.38124357

8

0.24644128

8

-

0.38124357

8

0.24644128

8

Regression Statistics

Multiple R

0.17246995

3

R Square

0.02974588

5

Adjusted R Square

-

0.09153588

Standard Error

0.05402322

8

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1

0.00071580

1

0.00071

6

0.24526263

3

0.63374557

1

Residual 8

0.02334807

3

0.00291

9

Total 9

0.02406387

5

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Lower

95.0%

Upper

95.0%

Intercept

0.03750249

5

0.01780754

2

2.10598

9

0.06829817

8

-

0.00356177

2

0.07856676

1

-

0.00356177

2

0.07856676

1

X Variable 1

-

0.06740114

5

0.13609794

9 -0.49524

0.63374557

1

-

0.38124357

8

0.24644128

8

-

0.38124357

8

0.24644128

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.