ACC3015: Financial Statement Analysis and Investment Appraisal

VerifiedAdded on 2023/06/12

|29

|6102

|177

Case Study

AI Summary

This case study provides a comprehensive financial analysis of GlaxoSmithKline (GSK), AstraZeneca (AZN), and Shire (SHP) using a range of financial ratios (profitability, liquidity, gearing, investing, and share performance) and non-financial ratios. It identifies the best and worst performing companies based on these analyses, offering investment recommendations and strategies for improving financial performance. The study also explores key stages in capital investment decision-making and investment appraisal methods, supported by numerical examples. The analysis covers the years 2015-2017, providing insights into the financial health and strategic direction of each company.

ACCOUNTING FOR MANAGERS

TABLE OF CONTENT

TABLE OF CONTENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

S

Section A....................................................................................................................................1

Question 1...............................................................................................................................1

a) Select and justify 10 financial ratios and 2 non-financial ratios in analyzing the financial

performance of the three companies.......................................................................................1

b) Identify the best performing company and state the reasons if the company would be

consider as a positive investment opportunity......................................................................17

c) Identify worst performing company and discuss the recommendations of how the

financial performance of the firm can be improved.............................................................18

Section B..................................................................................................................................18

Question 2................................................................................................................................18

a) Identify and explain the key stages in the capital investment decision-making process

and the role of investment appraisal in the process..............................................................18

b) Identify and explain the main methods of investment appraisal used in practice with the

help of numerical examples..................................................................................................21

REFERENCES.........................................................................................................................26

Section A....................................................................................................................................1

Question 1...............................................................................................................................1

a) Select and justify 10 financial ratios and 2 non-financial ratios in analyzing the financial

performance of the three companies.......................................................................................1

b) Identify the best performing company and state the reasons if the company would be

consider as a positive investment opportunity......................................................................17

c) Identify worst performing company and discuss the recommendations of how the

financial performance of the firm can be improved.............................................................18

Section B..................................................................................................................................18

Question 2................................................................................................................................18

a) Identify and explain the key stages in the capital investment decision-making process

and the role of investment appraisal in the process..............................................................18

b) Identify and explain the main methods of investment appraisal used in practice with the

help of numerical examples..................................................................................................21

REFERENCES.........................................................................................................................26

SECTION A

Question 1

a) Select and justify 10 financial ratios and 2 non-financial ratios in analyzing the financial

performance of the three companies.

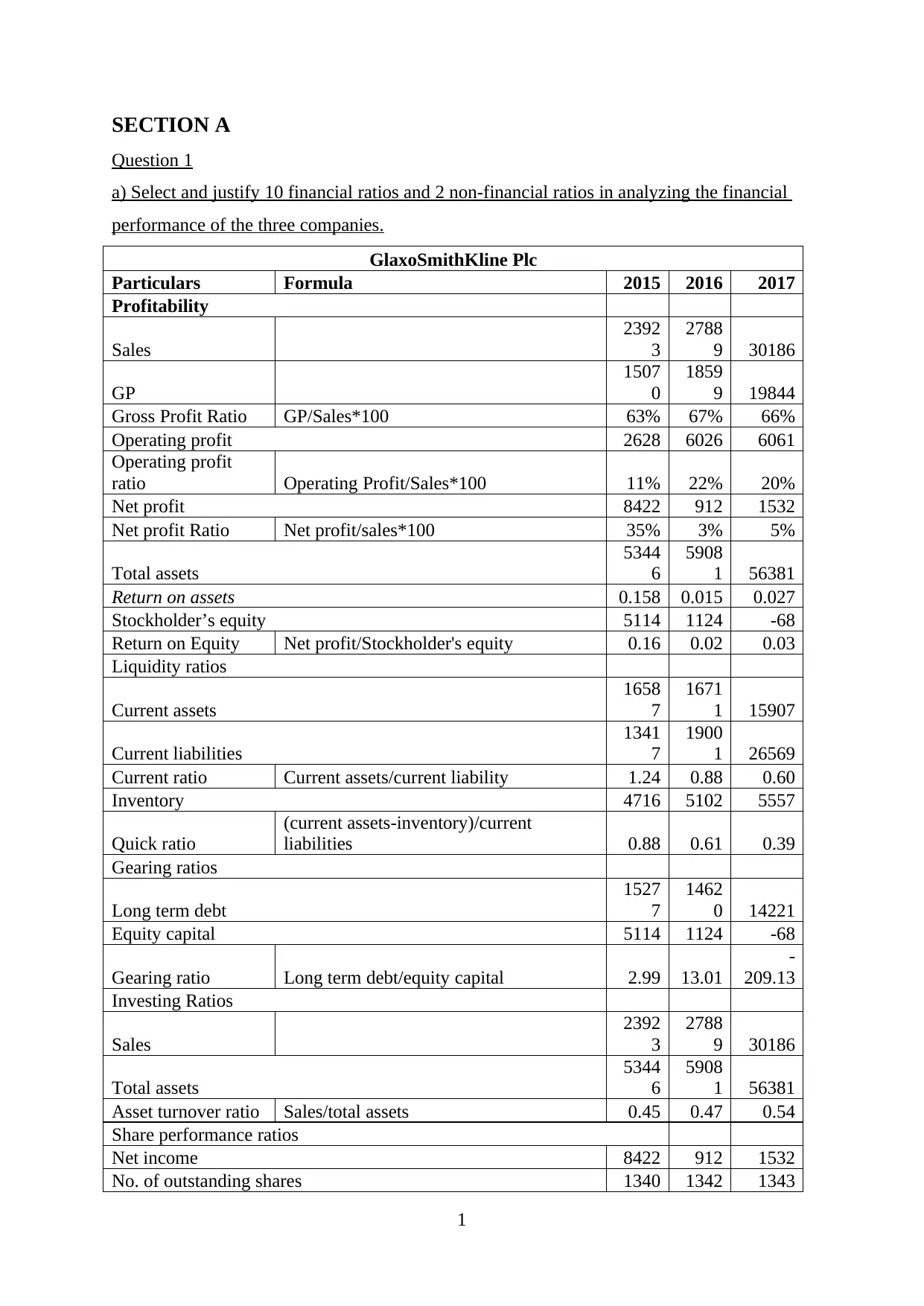

GlaxoSmithKline Plc

Particulars Formula 2015 2016 2017

Profitability

Sales

2392

3

2788

9 30186

GP

1507

0

1859

9 19844

Gross Profit Ratio GP/Sales*100 63% 67% 66%

Operating profit 2628 6026 6061

Operating profit

ratio Operating Profit/Sales*100 11% 22% 20%

Net profit 8422 912 1532

Net profit Ratio Net profit/sales*100 35% 3% 5%

Total assets

5344

6

5908

1 56381

Return on assets 0.158 0.015 0.027

Stockholder’s equity 5114 1124 -68

Return on Equity Net profit/Stockholder's equity 0.16 0.02 0.03

Liquidity ratios

Current assets

1658

7

1671

1 15907

Current liabilities

1341

7

1900

1 26569

Current ratio Current assets/current liability 1.24 0.88 0.60

Inventory 4716 5102 5557

Quick ratio

(current assets-inventory)/current

liabilities 0.88 0.61 0.39

Gearing ratios

Long term debt

1527

7

1462

0 14221

Equity capital 5114 1124 -68

Gearing ratio Long term debt/equity capital 2.99 13.01

-

209.13

Investing Ratios

Sales

2392

3

2788

9 30186

Total assets

5344

6

5908

1 56381

Asset turnover ratio Sales/total assets 0.45 0.47 0.54

Share performance ratios

Net income 8422 912 1532

No. of outstanding shares 1340 1342 1343

1

Question 1

a) Select and justify 10 financial ratios and 2 non-financial ratios in analyzing the financial

performance of the three companies.

GlaxoSmithKline Plc

Particulars Formula 2015 2016 2017

Profitability

Sales

2392

3

2788

9 30186

GP

1507

0

1859

9 19844

Gross Profit Ratio GP/Sales*100 63% 67% 66%

Operating profit 2628 6026 6061

Operating profit

ratio Operating Profit/Sales*100 11% 22% 20%

Net profit 8422 912 1532

Net profit Ratio Net profit/sales*100 35% 3% 5%

Total assets

5344

6

5908

1 56381

Return on assets 0.158 0.015 0.027

Stockholder’s equity 5114 1124 -68

Return on Equity Net profit/Stockholder's equity 0.16 0.02 0.03

Liquidity ratios

Current assets

1658

7

1671

1 15907

Current liabilities

1341

7

1900

1 26569

Current ratio Current assets/current liability 1.24 0.88 0.60

Inventory 4716 5102 5557

Quick ratio

(current assets-inventory)/current

liabilities 0.88 0.61 0.39

Gearing ratios

Long term debt

1527

7

1462

0 14221

Equity capital 5114 1124 -68

Gearing ratio Long term debt/equity capital 2.99 13.01

-

209.13

Investing Ratios

Sales

2392

3

2788

9 30186

Total assets

5344

6

5908

1 56381

Asset turnover ratio Sales/total assets 0.45 0.47 0.54

Share performance ratios

Net income 8422 912 1532

No. of outstanding shares 1340 1342 1343

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Earnings per share Net income/no. of outstanding shares 6.29 0.68 1.14

Source: GSK, 2017

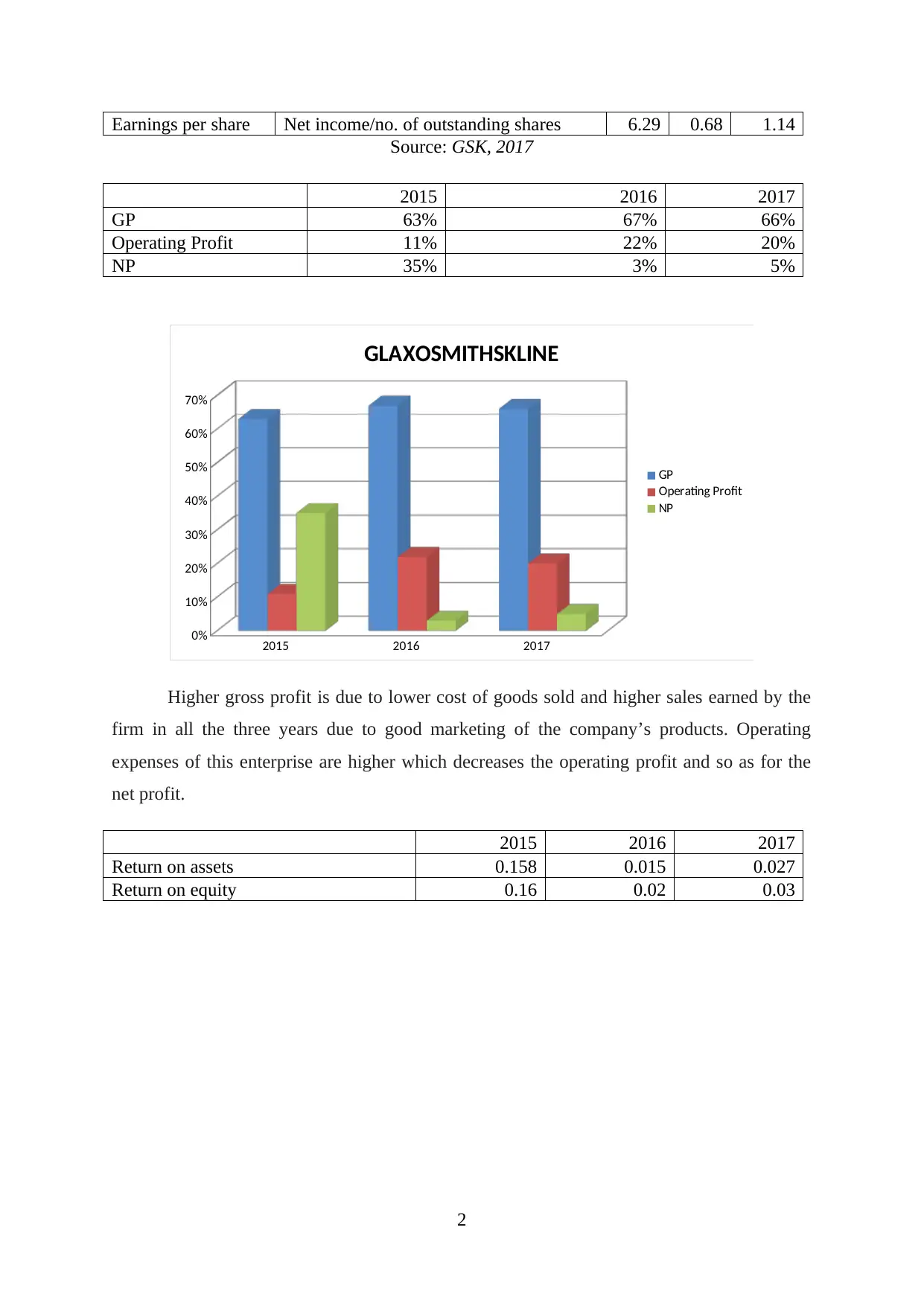

2015 2016 2017

GP 63% 67% 66%

Operating Profit 11% 22% 20%

NP 35% 3% 5%

2015 2016 2017

0%

10%

20%

30%

40%

50%

60%

70%

GLAXOSMITHSKLINE

GP

Operating Profit

NP

Higher gross profit is due to lower cost of goods sold and higher sales earned by the

firm in all the three years due to good marketing of the company’s products. Operating

expenses of this enterprise are higher which decreases the operating profit and so as for the

net profit.

2015 2016 2017

Return on assets 0.158 0.015 0.027

Return on equity 0.16 0.02 0.03

2

Source: GSK, 2017

2015 2016 2017

GP 63% 67% 66%

Operating Profit 11% 22% 20%

NP 35% 3% 5%

2015 2016 2017

0%

10%

20%

30%

40%

50%

60%

70%

GLAXOSMITHSKLINE

GP

Operating Profit

NP

Higher gross profit is due to lower cost of goods sold and higher sales earned by the

firm in all the three years due to good marketing of the company’s products. Operating

expenses of this enterprise are higher which decreases the operating profit and so as for the

net profit.

2015 2016 2017

Return on assets 0.158 0.015 0.027

Return on equity 0.16 0.02 0.03

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2015

2016

2017

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16

Return on equity

Return on assets

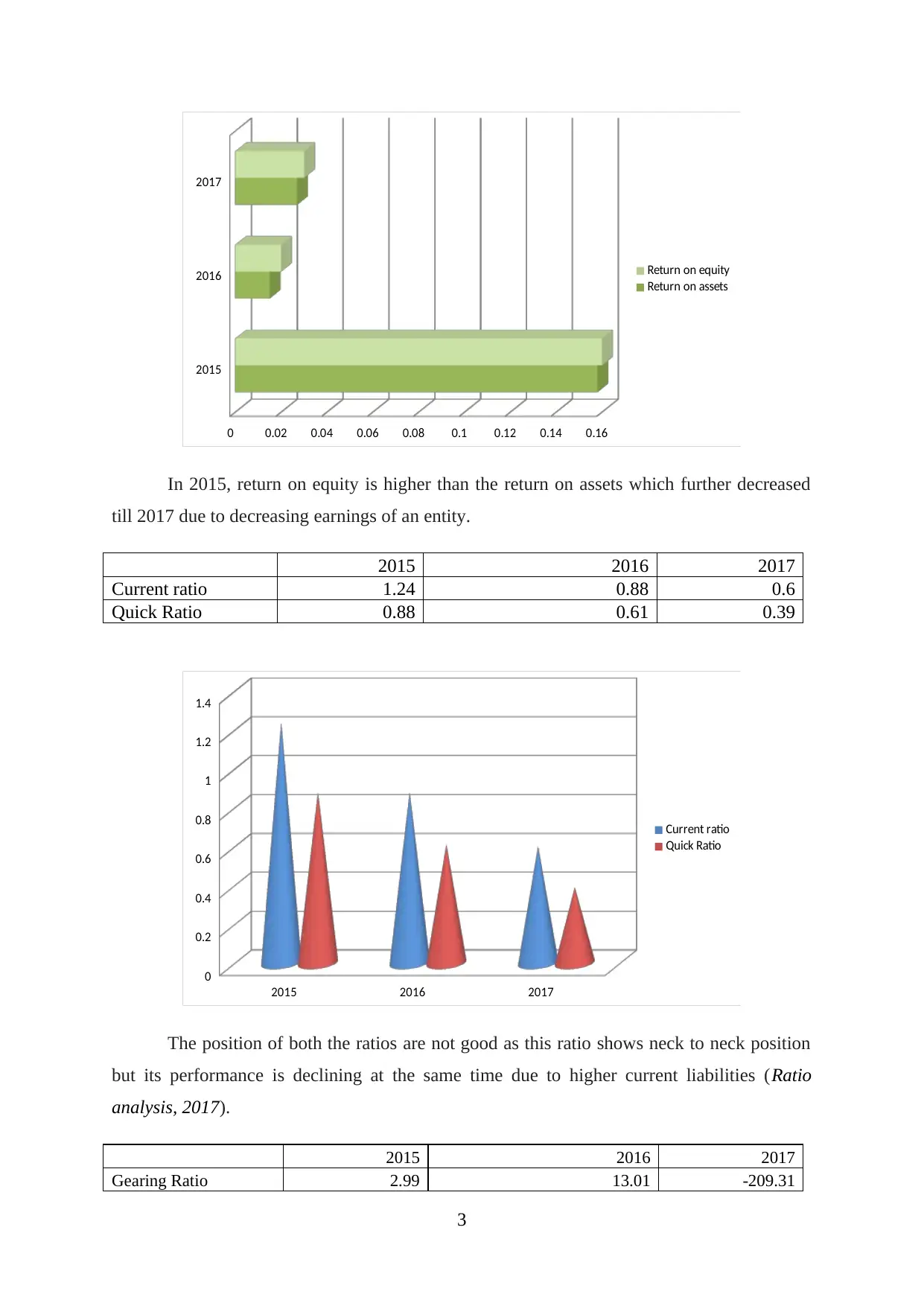

In 2015, return on equity is higher than the return on assets which further decreased

till 2017 due to decreasing earnings of an entity.

2015 2016 2017

Current ratio 1.24 0.88 0.6

Quick Ratio 0.88 0.61 0.39

2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

Current ratio

Quick Ratio

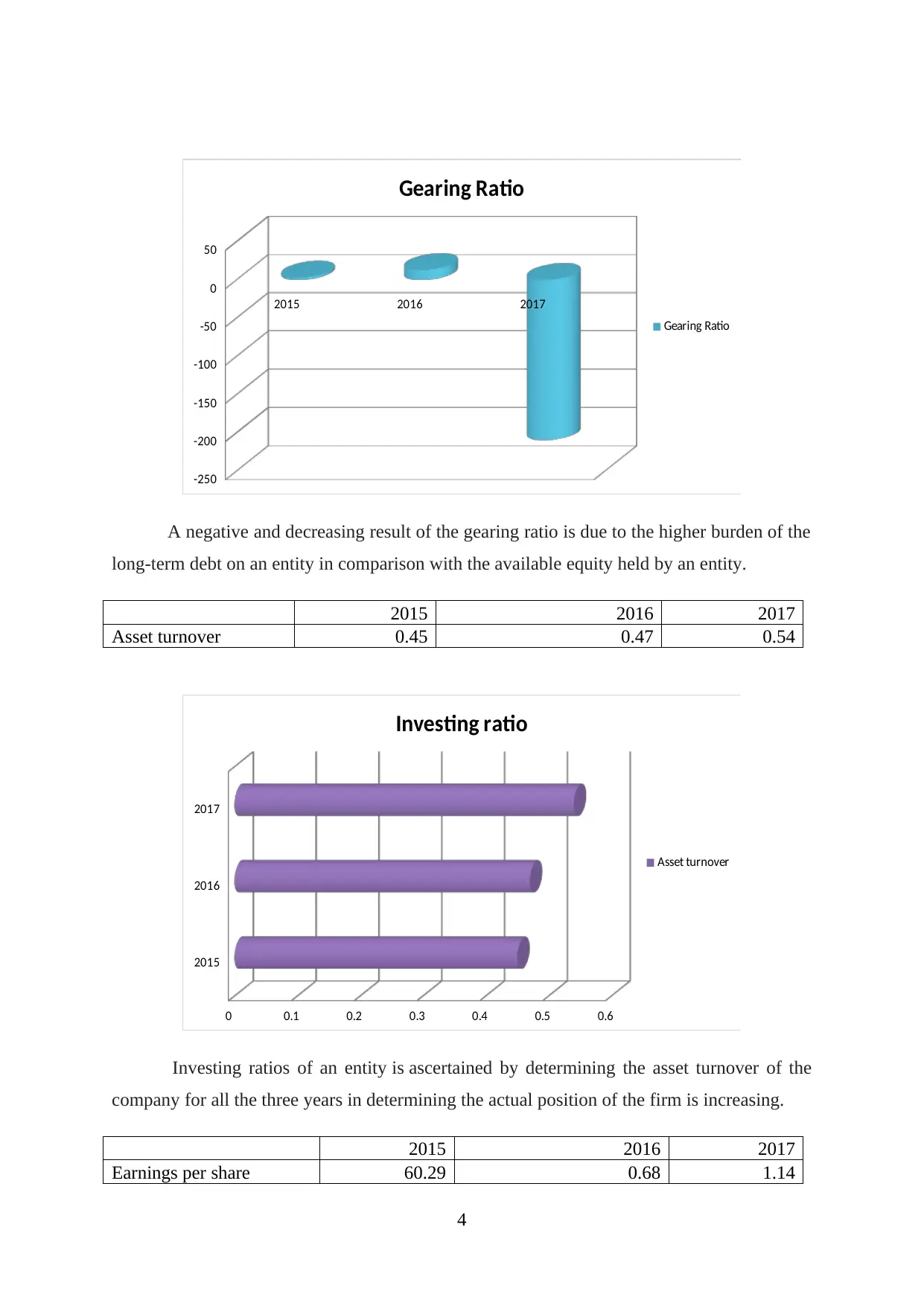

The position of both the ratios are not good as this ratio shows neck to neck position

but its performance is declining at the same time due to higher current liabilities (Ratio

analysis, 2017).

2015 2016 2017

Gearing Ratio 2.99 13.01 -209.31

3

2016

2017

0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16

Return on equity

Return on assets

In 2015, return on equity is higher than the return on assets which further decreased

till 2017 due to decreasing earnings of an entity.

2015 2016 2017

Current ratio 1.24 0.88 0.6

Quick Ratio 0.88 0.61 0.39

2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

Current ratio

Quick Ratio

The position of both the ratios are not good as this ratio shows neck to neck position

but its performance is declining at the same time due to higher current liabilities (Ratio

analysis, 2017).

2015 2016 2017

Gearing Ratio 2.99 13.01 -209.31

3

2015 2016 2017

-250

-200

-150

-100

-50

0

50

Gearing Ratio

Gearing Ratio

A negative and decreasing result of the gearing ratio is due to the higher burden of the

long-term debt on an entity in comparison with the available equity held by an entity.

2015 2016 2017

Asset turnover 0.45 0.47 0.54

2015

2016

2017

0 0.1 0.2 0.3 0.4 0.5 0.6

Investing ratio

Asset turnover

Investing ratios of an entity is ascertained by determining the asset turnover of the

company for all the three years in determining the actual position of the firm is increasing.

2015 2016 2017

Earnings per share 60.29 0.68 1.14

4

-250

-200

-150

-100

-50

0

50

Gearing Ratio

Gearing Ratio

A negative and decreasing result of the gearing ratio is due to the higher burden of the

long-term debt on an entity in comparison with the available equity held by an entity.

2015 2016 2017

Asset turnover 0.45 0.47 0.54

2015

2016

2017

0 0.1 0.2 0.3 0.4 0.5 0.6

Investing ratio

Asset turnover

Investing ratios of an entity is ascertained by determining the asset turnover of the

company for all the three years in determining the actual position of the firm is increasing.

2015 2016 2017

Earnings per share 60.29 0.68 1.14

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2015

2016

2017

0 10 20 30 40 50 60 70

SHARE PERFORMANCE RATIO

Series2

Earning per share

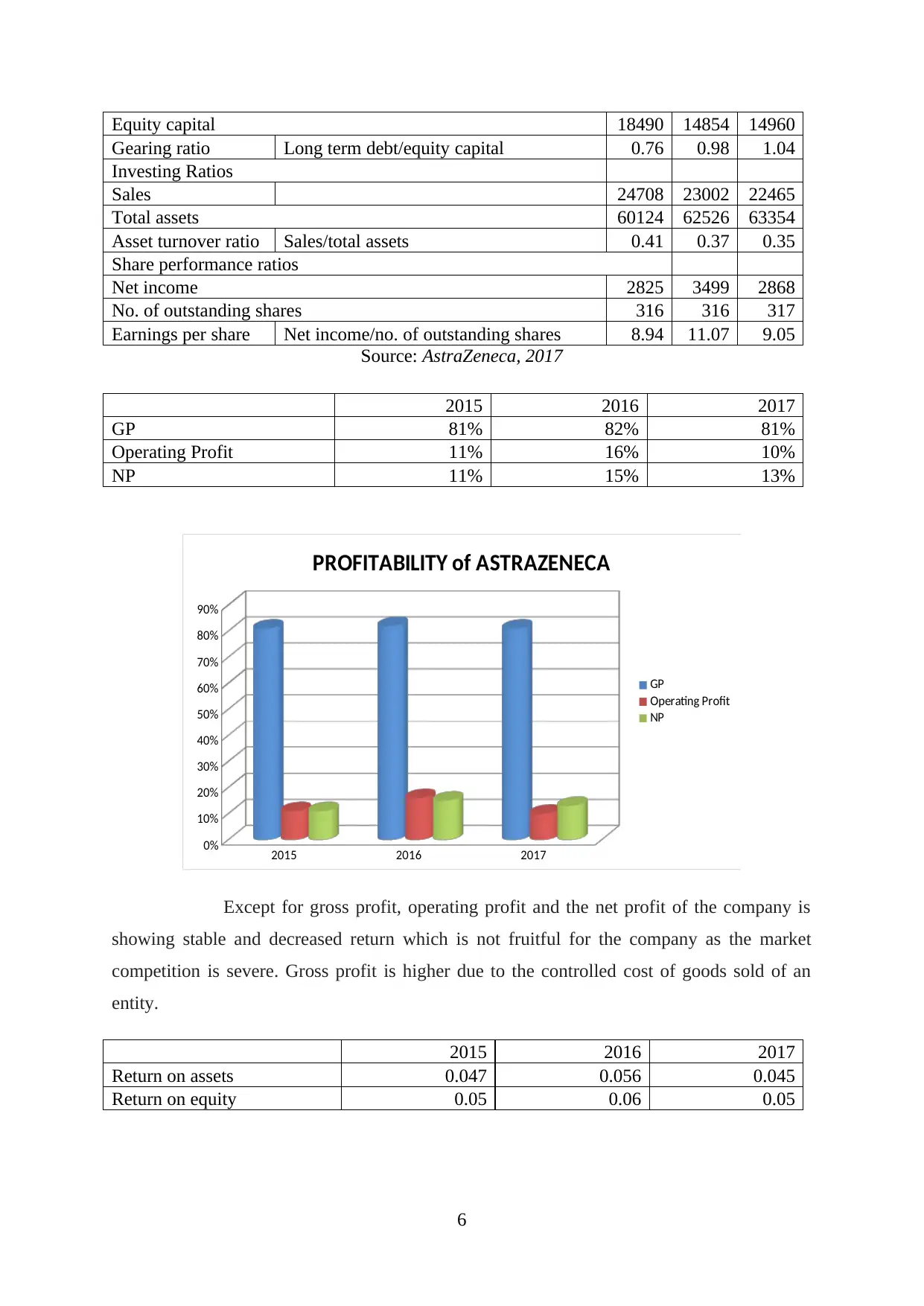

The poor performance of GlaxoSmithKline is due to decreased net income of an

entity which is clearly visible with the help of this bar chart. This needs to be improved by

increasing the sources of income.

ASTRAZENECA PLC

Particulars Formula 2015 2016 2017

Profitability

Sales 24708 23002 22465

GP 20062 18876 18147

Gross Profit Ratio GP/Sales*100 81% 82% 81%

Operating profit 2614 3572 2157

Operating profit

ratio Operating Profit/Sales*100 11% 16% 10%

Net profit 2825 3499 2868

Net profit Ratio Net profit/sales*100 11% 15% 13%

Total assets 60124 62526 63354

Return on assets Net profit/total assets 0.047 0.056 0.045

Stockholder’s equity 18490 14854 14960

Return on Equity Net profit/Stockholder's equity 0.05 0.06 0.05

Liquidity ratios

Current assets 16007 13262 13150

Current liabilities 14869 15256 16383

Current ratio Current assets/current liability 1.08 0.87 0.80

Inventory 2143 2334 3035

Quick ratio

(current assets-inventory)/current

liabilities 0.93 0.72 0.62

Gearing ratios

Long term debt 14137 14495 15560

5

2016

2017

0 10 20 30 40 50 60 70

SHARE PERFORMANCE RATIO

Series2

Earning per share

The poor performance of GlaxoSmithKline is due to decreased net income of an

entity which is clearly visible with the help of this bar chart. This needs to be improved by

increasing the sources of income.

ASTRAZENECA PLC

Particulars Formula 2015 2016 2017

Profitability

Sales 24708 23002 22465

GP 20062 18876 18147

Gross Profit Ratio GP/Sales*100 81% 82% 81%

Operating profit 2614 3572 2157

Operating profit

ratio Operating Profit/Sales*100 11% 16% 10%

Net profit 2825 3499 2868

Net profit Ratio Net profit/sales*100 11% 15% 13%

Total assets 60124 62526 63354

Return on assets Net profit/total assets 0.047 0.056 0.045

Stockholder’s equity 18490 14854 14960

Return on Equity Net profit/Stockholder's equity 0.05 0.06 0.05

Liquidity ratios

Current assets 16007 13262 13150

Current liabilities 14869 15256 16383

Current ratio Current assets/current liability 1.08 0.87 0.80

Inventory 2143 2334 3035

Quick ratio

(current assets-inventory)/current

liabilities 0.93 0.72 0.62

Gearing ratios

Long term debt 14137 14495 15560

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Equity capital 18490 14854 14960

Gearing ratio Long term debt/equity capital 0.76 0.98 1.04

Investing Ratios

Sales 24708 23002 22465

Total assets 60124 62526 63354

Asset turnover ratio Sales/total assets 0.41 0.37 0.35

Share performance ratios

Net income 2825 3499 2868

No. of outstanding shares 316 316 317

Earnings per share Net income/no. of outstanding shares 8.94 11.07 9.05

Source: AstraZeneca, 2017

2015 2016 2017

GP 81% 82% 81%

Operating Profit 11% 16% 10%

NP 11% 15% 13%

2015 2016 2017

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

PROFITABILITY of ASTRAZENECA

GP

Operating Profit

NP

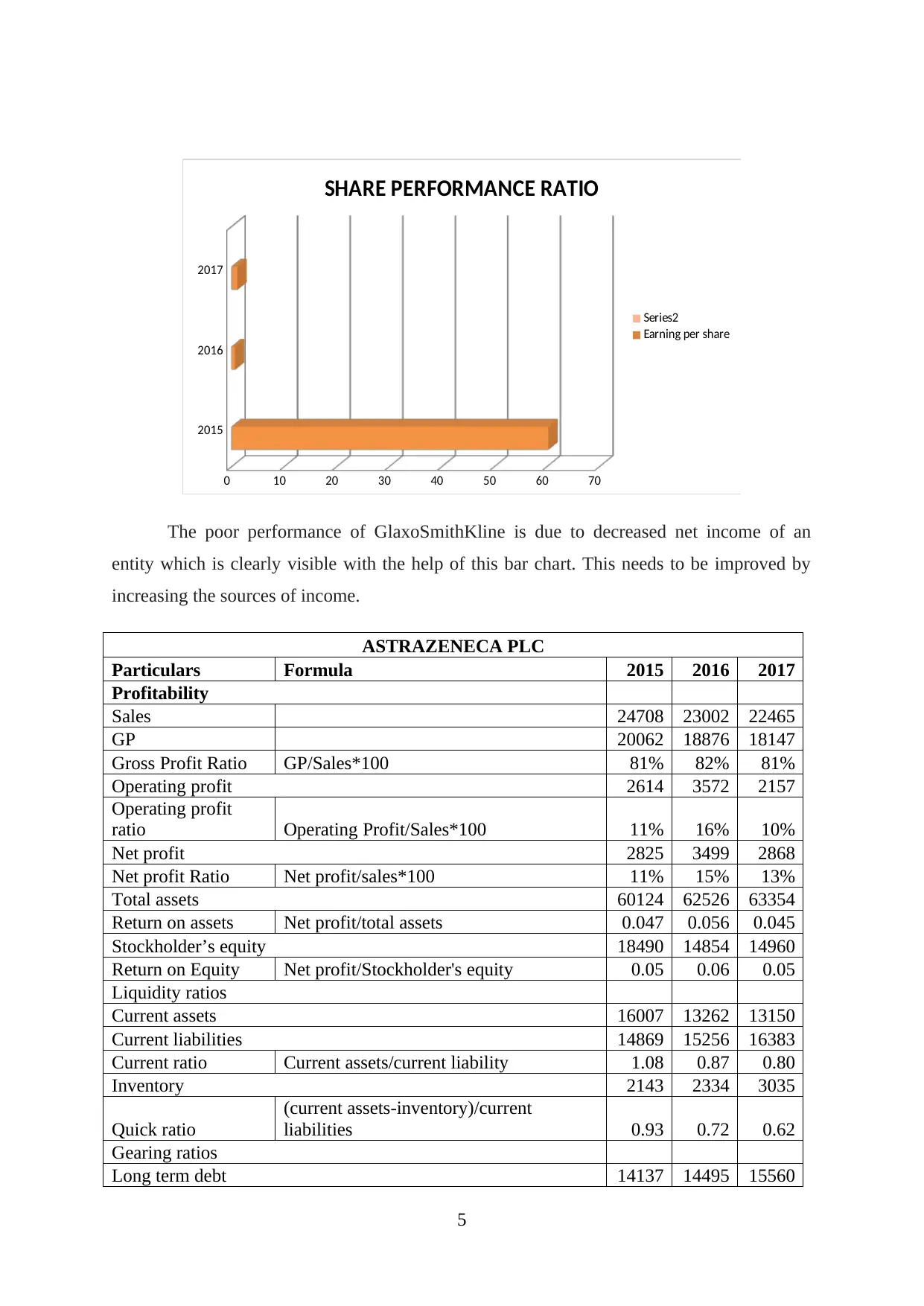

Except for gross profit, operating profit and the net profit of the company is

showing stable and decreased return which is not fruitful for the company as the market

competition is severe. Gross profit is higher due to the controlled cost of goods sold of an

entity.

2015 2016 2017

Return on assets 0.047 0.056 0.045

Return on equity 0.05 0.06 0.05

6

Gearing ratio Long term debt/equity capital 0.76 0.98 1.04

Investing Ratios

Sales 24708 23002 22465

Total assets 60124 62526 63354

Asset turnover ratio Sales/total assets 0.41 0.37 0.35

Share performance ratios

Net income 2825 3499 2868

No. of outstanding shares 316 316 317

Earnings per share Net income/no. of outstanding shares 8.94 11.07 9.05

Source: AstraZeneca, 2017

2015 2016 2017

GP 81% 82% 81%

Operating Profit 11% 16% 10%

NP 11% 15% 13%

2015 2016 2017

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

PROFITABILITY of ASTRAZENECA

GP

Operating Profit

NP

Except for gross profit, operating profit and the net profit of the company is

showing stable and decreased return which is not fruitful for the company as the market

competition is severe. Gross profit is higher due to the controlled cost of goods sold of an

entity.

2015 2016 2017

Return on assets 0.047 0.056 0.045

Return on equity 0.05 0.06 0.05

6

2015

2016

2017

0 0.01 0.02 0.03 0.04 0.05 0.06

PROFITABILITY RATIOS

Return on equity

Return on assets

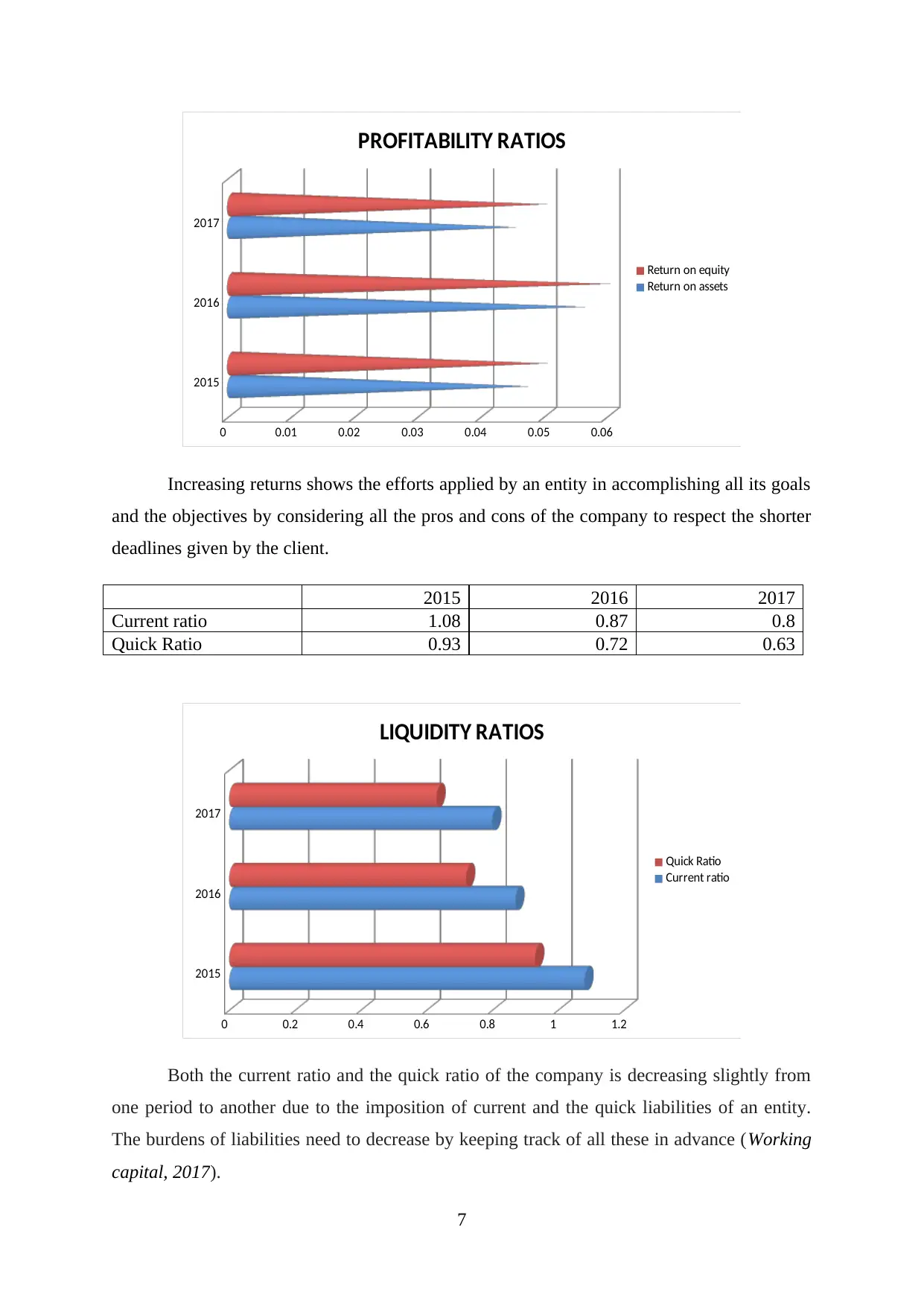

Increasing returns shows the efforts applied by an entity in accomplishing all its goals

and the objectives by considering all the pros and cons of the company to respect the shorter

deadlines given by the client.

2015 2016 2017

Current ratio 1.08 0.87 0.8

Quick Ratio 0.93 0.72 0.63

2015

2016

2017

0 0.2 0.4 0.6 0.8 1 1.2

LIQUIDITY RATIOS

Quick Ratio

Current ratio

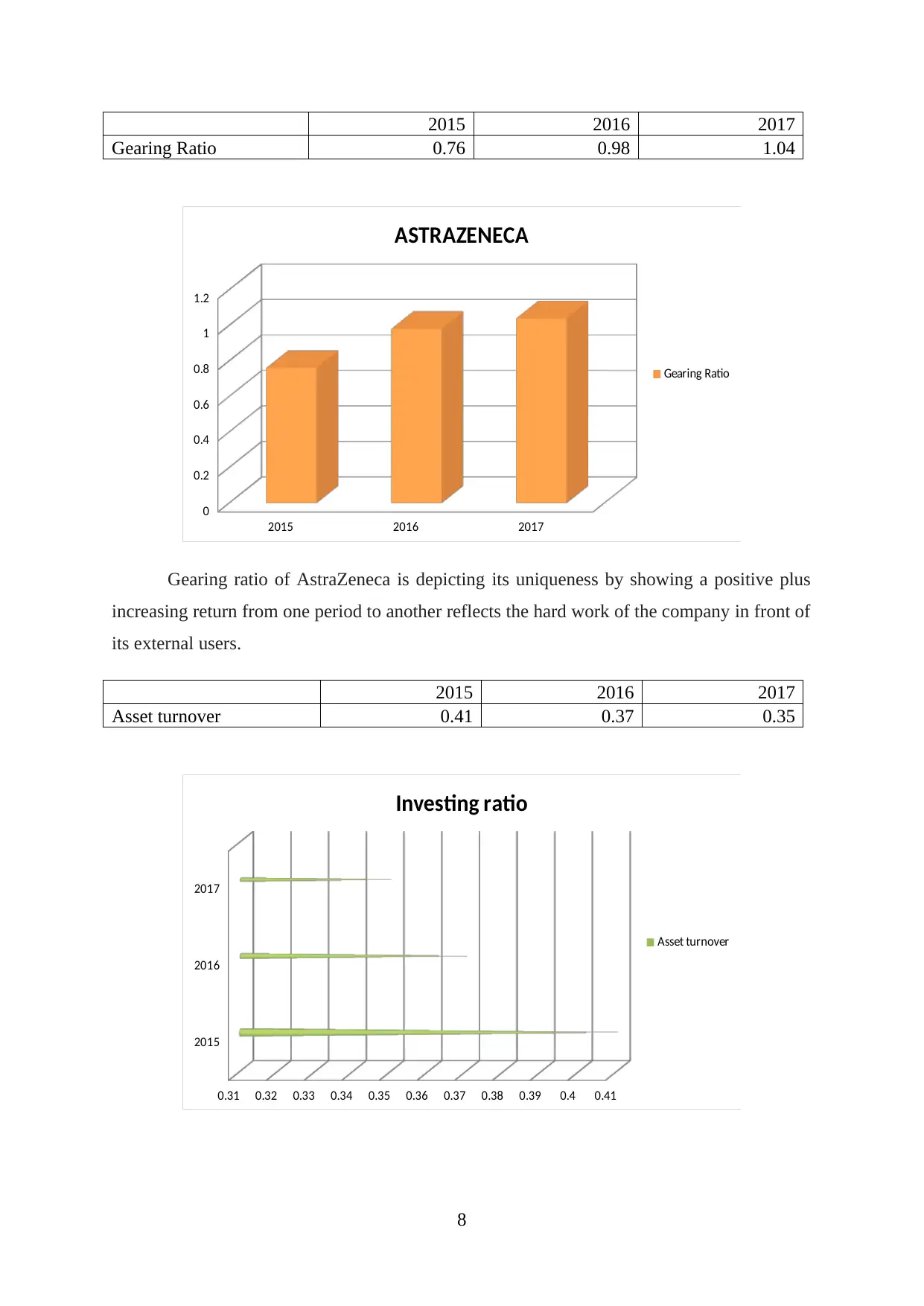

Both the current ratio and the quick ratio of the company is decreasing slightly from

one period to another due to the imposition of current and the quick liabilities of an entity.

The burdens of liabilities need to decrease by keeping track of all these in advance (Working

capital, 2017).

7

2016

2017

0 0.01 0.02 0.03 0.04 0.05 0.06

PROFITABILITY RATIOS

Return on equity

Return on assets

Increasing returns shows the efforts applied by an entity in accomplishing all its goals

and the objectives by considering all the pros and cons of the company to respect the shorter

deadlines given by the client.

2015 2016 2017

Current ratio 1.08 0.87 0.8

Quick Ratio 0.93 0.72 0.63

2015

2016

2017

0 0.2 0.4 0.6 0.8 1 1.2

LIQUIDITY RATIOS

Quick Ratio

Current ratio

Both the current ratio and the quick ratio of the company is decreasing slightly from

one period to another due to the imposition of current and the quick liabilities of an entity.

The burdens of liabilities need to decrease by keeping track of all these in advance (Working

capital, 2017).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2015 2016 2017

Gearing Ratio 0.76 0.98 1.04

2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

ASTRAZENECA

Gearing Ratio

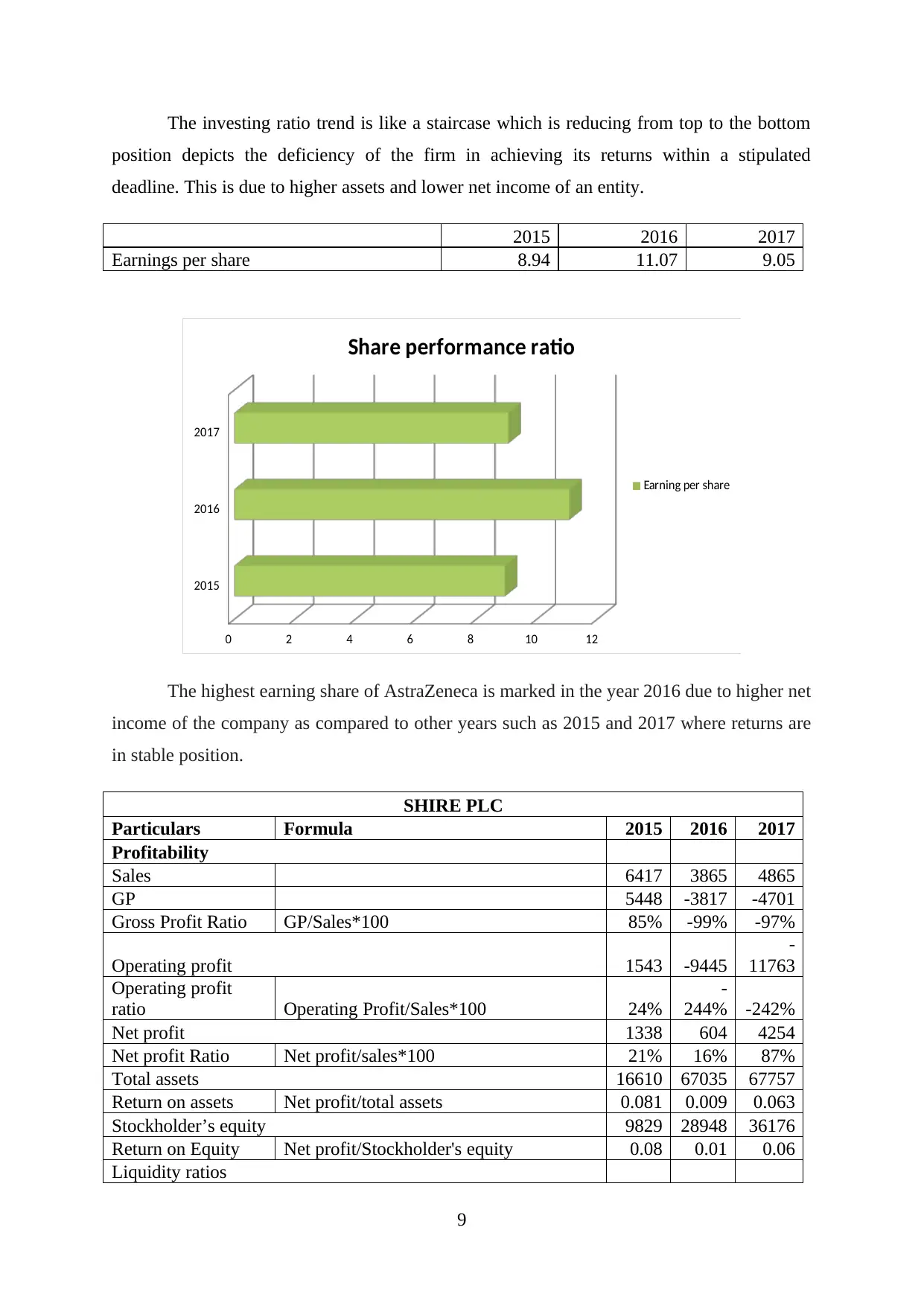

Gearing ratio of AstraZeneca is depicting its uniqueness by showing a positive plus

increasing return from one period to another reflects the hard work of the company in front of

its external users.

2015 2016 2017

Asset turnover 0.41 0.37 0.35

2015

2016

2017

0.31 0.32 0.33 0.34 0.35 0.36 0.37 0.38 0.39 0.4 0.41

Investing ratio

Asset turnover

8

Gearing Ratio 0.76 0.98 1.04

2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

ASTRAZENECA

Gearing Ratio

Gearing ratio of AstraZeneca is depicting its uniqueness by showing a positive plus

increasing return from one period to another reflects the hard work of the company in front of

its external users.

2015 2016 2017

Asset turnover 0.41 0.37 0.35

2015

2016

2017

0.31 0.32 0.33 0.34 0.35 0.36 0.37 0.38 0.39 0.4 0.41

Investing ratio

Asset turnover

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The investing ratio trend is like a staircase which is reducing from top to the bottom

position depicts the deficiency of the firm in achieving its returns within a stipulated

deadline. This is due to higher assets and lower net income of an entity.

2015 2016 2017

Earnings per share 8.94 11.07 9.05

2015

2016

2017

0 2 4 6 8 10 12

Share performance ratio

Earning per share

The highest earning share of AstraZeneca is marked in the year 2016 due to higher net

income of the company as compared to other years such as 2015 and 2017 where returns are

in stable position.

SHIRE PLC

Particulars Formula 2015 2016 2017

Profitability

Sales 6417 3865 4865

GP 5448 -3817 -4701

Gross Profit Ratio GP/Sales*100 85% -99% -97%

Operating profit 1543 -9445

-

11763

Operating profit

ratio Operating Profit/Sales*100 24%

-

244% -242%

Net profit 1338 604 4254

Net profit Ratio Net profit/sales*100 21% 16% 87%

Total assets 16610 67035 67757

Return on assets Net profit/total assets 0.081 0.009 0.063

Stockholder’s equity 9829 28948 36176

Return on Equity Net profit/Stockholder's equity 0.08 0.01 0.06

Liquidity ratios

9

position depicts the deficiency of the firm in achieving its returns within a stipulated

deadline. This is due to higher assets and lower net income of an entity.

2015 2016 2017

Earnings per share 8.94 11.07 9.05

2015

2016

2017

0 2 4 6 8 10 12

Share performance ratio

Earning per share

The highest earning share of AstraZeneca is marked in the year 2016 due to higher net

income of the company as compared to other years such as 2015 and 2017 where returns are

in stable position.

SHIRE PLC

Particulars Formula 2015 2016 2017

Profitability

Sales 6417 3865 4865

GP 5448 -3817 -4701

Gross Profit Ratio GP/Sales*100 85% -99% -97%

Operating profit 1543 -9445

-

11763

Operating profit

ratio Operating Profit/Sales*100 24%

-

244% -242%

Net profit 1338 604 4254

Net profit Ratio Net profit/sales*100 21% 16% 87%

Total assets 16610 67035 67757

Return on assets Net profit/total assets 0.081 0.009 0.063

Stockholder’s equity 9829 28948 36176

Return on Equity Net profit/Stockholder's equity 0.08 0.01 0.06

Liquidity ratios

9

Current assets 2256 7540 7608

Current liabilities 3706 7743 7882

Current ratio Current assets/current liability 0.61 0.97 0.97

Inventory 635 3562 3292

Quick ratio

(current assets-inventory)/current

liabilities 0.44 0.51 0.55

Gearing ratios

Long term debt 70 19553 16411

Equity capital 9829 28948 36176

Gearing ratio Long term debt/equity capital 0.01 0.68 0.45

Investing Ratios

Sales 6417 3865 4865

Total assets 16610 67035 67757

Asset turnover ratio Sales/total assets 0.39 0.06 0.07

Share performance ratios

Net income 1338 604 4254

No. of outstanding shares 59 59 81

Earnings per share Net income/no. of outstanding shares 22.68 10.24 52.52

Source: Shire, 2017

2015 2016 2017

GP 85% -99% -97%

Operating Profit 24% -244% -241%

NP 21% 16% 87%

2015 2016 2017

-300%

-250%

-200%

-150%

-100%

-50%

0%

50%

100%

150%

SHIRE PLC

GP

Operating Profit

NP

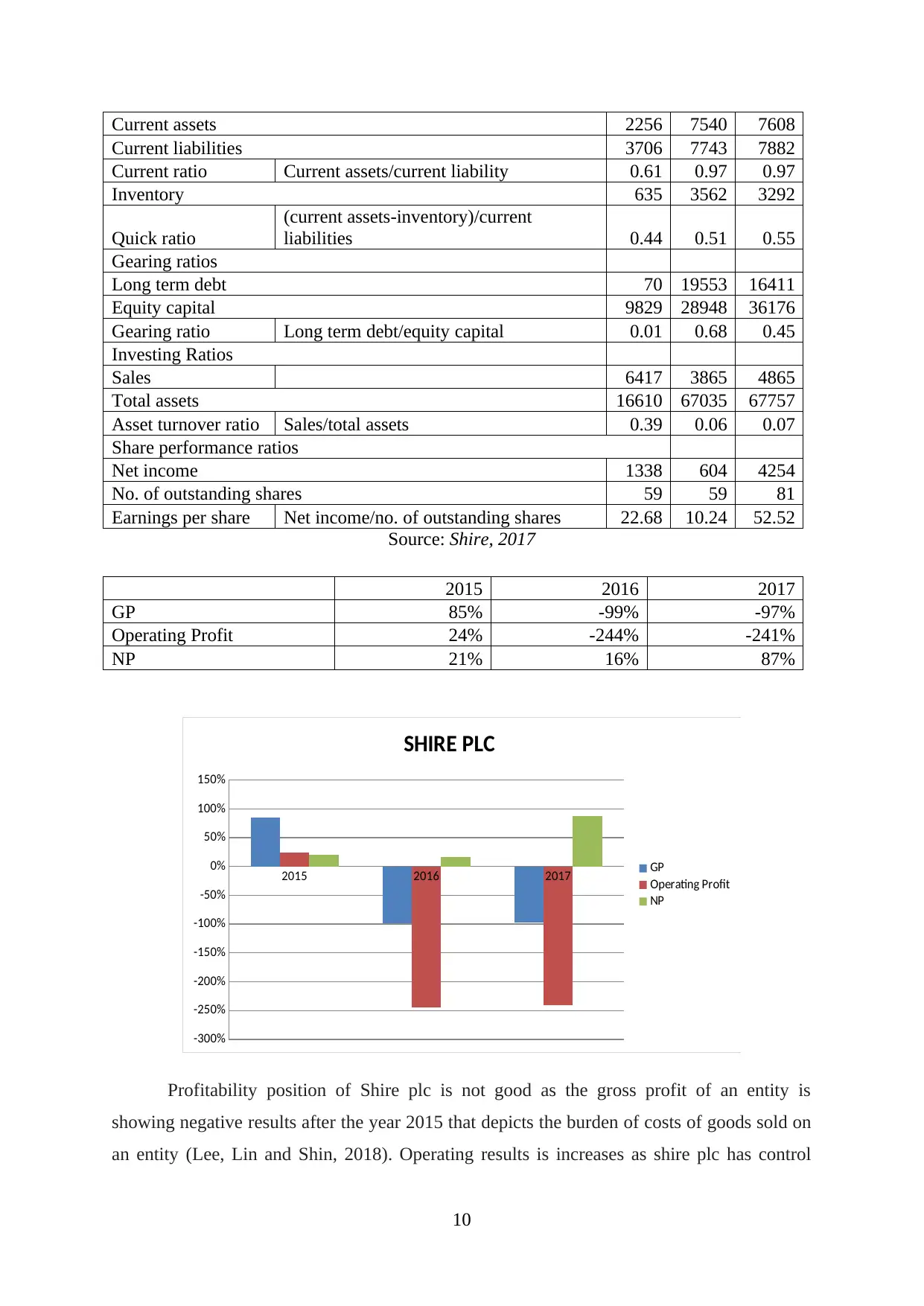

Profitability position of Shire plc is not good as the gross profit of an entity is

showing negative results after the year 2015 that depicts the burden of costs of goods sold on

an entity (Lee, Lin and Shin, 2018). Operating results is increases as shire plc has control

10

Current liabilities 3706 7743 7882

Current ratio Current assets/current liability 0.61 0.97 0.97

Inventory 635 3562 3292

Quick ratio

(current assets-inventory)/current

liabilities 0.44 0.51 0.55

Gearing ratios

Long term debt 70 19553 16411

Equity capital 9829 28948 36176

Gearing ratio Long term debt/equity capital 0.01 0.68 0.45

Investing Ratios

Sales 6417 3865 4865

Total assets 16610 67035 67757

Asset turnover ratio Sales/total assets 0.39 0.06 0.07

Share performance ratios

Net income 1338 604 4254

No. of outstanding shares 59 59 81

Earnings per share Net income/no. of outstanding shares 22.68 10.24 52.52

Source: Shire, 2017

2015 2016 2017

GP 85% -99% -97%

Operating Profit 24% -244% -241%

NP 21% 16% 87%

2015 2016 2017

-300%

-250%

-200%

-150%

-100%

-50%

0%

50%

100%

150%

SHIRE PLC

GP

Operating Profit

NP

Profitability position of Shire plc is not good as the gross profit of an entity is

showing negative results after the year 2015 that depicts the burden of costs of goods sold on

an entity (Lee, Lin and Shin, 2018). Operating results is increases as shire plc has control

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 29

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.