Comprehensive Financial Performance Analysis of Mineral Resource Ltd

VerifiedAdded on 2020/05/16

|18

|2712

|58

Report

AI Summary

This report presents a comprehensive financial performance analysis of Mineral Resource Ltd, evaluating its financial health through various tools. It includes an overview of the company's operations, ownership structure, and governance. The analysis delves into ratio analysis, including ROA, ROE, and debt ratios, to assess the company's profitability and financial leverage over a four-year period. Furthermore, the report examines the movement of the company's share price, comparing it to the broader market index and computing the beta value. The study also incorporates the Capital Asset Pricing Model (CAPM) to determine the required rate of return and calculates the Weighted Average Cost of Capital (WACC), discussing its implications for investment decisions. The report concludes with a letter of recommendation, suggesting investment strategies based on the financial analysis. Finally, the report highlights the company's dividend policies and overall financial stability. The analysis is based on the company's annual reports and relevant financial data.

RUNNING HEAD: Financial performance analysis of Mineral resource Ltd 1

Name of the student

Topic- Financial performance analysis of Mineral resource Ltd

University name

Name of the student

Topic- Financial performance analysis of Mineral resource Ltd

University name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial performance analysis of Mineral resource Ltd

2

Table of Contents

Introduction...........................................................................................................................................2

1. Present description of the company..........................................................................................2

2. Ownership and governance structure...........................................................................................2

3. Performance ratio analysis of Mineral resource Ltd......................................................................3

4. Movement of share price of Mineral resources limited.................................................................5

4.1 Graph of share price movement of Mineral resources limited....................................................5

4.2 Comparison of share price movement of Mineral resources limited with the movement of share

price of all ordinary index..................................................................................................................6

5. Announcements............................................................................................................................7

6. Research via internet.....................................................................................................................7

6.1 The beta computation...........................................................................................................7

6.2 Computation of required rate of return by using CAPM method................................................8

6.3 Determination of conservative investment.................................................................................8

7. Weighted Average Cost of Capital (WACC)....................................................................................9

7.1 Cost of equity (calculated above using CAPM........................................................................9

7.2 Implications that a higher WACC on investment decision...........................................................9

8. Consideration of debt ratio for the company..............................................................................10

8.1 Appear to stable............................................................................................................................10

8.2 Gearing ratio discussion.............................................................................................................10

9. Divided policies of company........................................................................................................11

10. Letter of recommendation.......................................................................................................11

11. Conclusion...............................................................................................................................12

12. References...............................................................................................................................13

13. Appendix..................................................................................................................................14

2

Table of Contents

Introduction...........................................................................................................................................2

1. Present description of the company..........................................................................................2

2. Ownership and governance structure...........................................................................................2

3. Performance ratio analysis of Mineral resource Ltd......................................................................3

4. Movement of share price of Mineral resources limited.................................................................5

4.1 Graph of share price movement of Mineral resources limited....................................................5

4.2 Comparison of share price movement of Mineral resources limited with the movement of share

price of all ordinary index..................................................................................................................6

5. Announcements............................................................................................................................7

6. Research via internet.....................................................................................................................7

6.1 The beta computation...........................................................................................................7

6.2 Computation of required rate of return by using CAPM method................................................8

6.3 Determination of conservative investment.................................................................................8

7. Weighted Average Cost of Capital (WACC)....................................................................................9

7.1 Cost of equity (calculated above using CAPM........................................................................9

7.2 Implications that a higher WACC on investment decision...........................................................9

8. Consideration of debt ratio for the company..............................................................................10

8.1 Appear to stable............................................................................................................................10

8.2 Gearing ratio discussion.............................................................................................................10

9. Divided policies of company........................................................................................................11

10. Letter of recommendation.......................................................................................................11

11. Conclusion...............................................................................................................................12

12. References...............................................................................................................................13

13. Appendix..................................................................................................................................14

Financial performance analysis of Mineral resource Ltd

3

Introduction

In this report, financial performance analysis of Mineral resource Ltd has been taken

into consideration. There are several financial analysis tools such as ratio analysis, bottom up

analysis, capital budgeting tool and share price movement analysis. It is observed these tools

help investors to evaluate the financial performance of particular company in which they are

going to invest their capital.

1. Present description of the company

Mineral resources plc is an Australian listed company having extensive business of

selling mineral service, contracting, processing and commodities production factors around

the globe.

2. Ownership and governance structure

There is below given list of key main shareholders who have high investment in the Mineral

resources company.

3

Introduction

In this report, financial performance analysis of Mineral resource Ltd has been taken

into consideration. There are several financial analysis tools such as ratio analysis, bottom up

analysis, capital budgeting tool and share price movement analysis. It is observed these tools

help investors to evaluate the financial performance of particular company in which they are

going to invest their capital.

1. Present description of the company

Mineral resources plc is an Australian listed company having extensive business of

selling mineral service, contracting, processing and commodities production factors around

the globe.

2. Ownership and governance structure

There is below given list of key main shareholders who have high investment in the Mineral

resources company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial performance analysis of Mineral resource Ltd

4

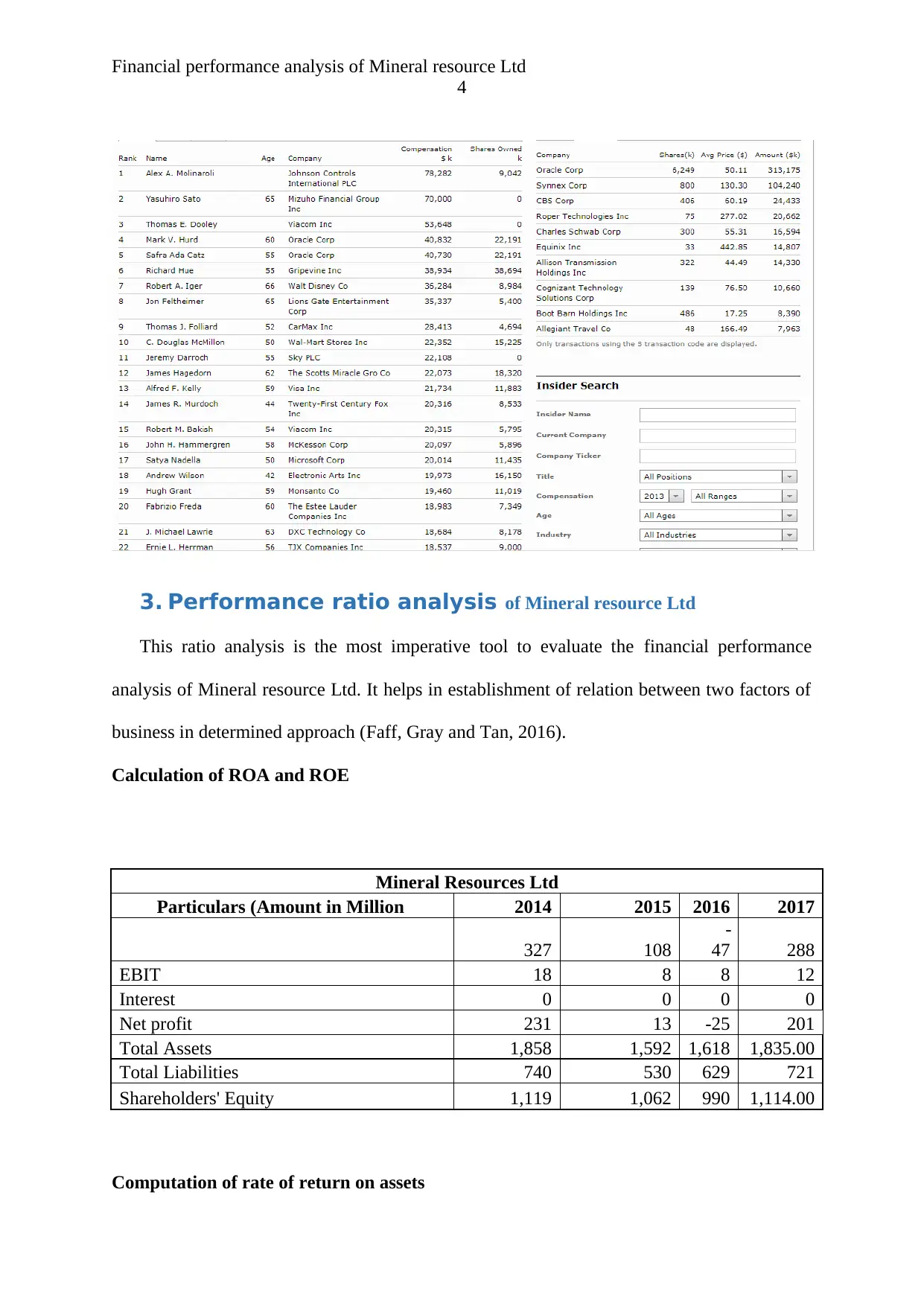

3. Performance ratio analysis of Mineral resource Ltd

This ratio analysis is the most imperative tool to evaluate the financial performance

analysis of Mineral resource Ltd. It helps in establishment of relation between two factors of

business in determined approach (Faff, Gray and Tan, 2016).

Calculation of ROA and ROE

Mineral Resources Ltd

Particulars (Amount in Million 2014 2015 2016 2017

327 108

-

47 288

EBIT 18 8 8 12

Interest 0 0 0 0

Net profit 231 13 -25 201

Total Assets 1,858 1,592 1,618 1,835.00

Total Liabilities 740 530 629 721

Shareholders' Equity 1,119 1,062 990 1,114.00

Computation of rate of return on assets

4

3. Performance ratio analysis of Mineral resource Ltd

This ratio analysis is the most imperative tool to evaluate the financial performance

analysis of Mineral resource Ltd. It helps in establishment of relation between two factors of

business in determined approach (Faff, Gray and Tan, 2016).

Calculation of ROA and ROE

Mineral Resources Ltd

Particulars (Amount in Million 2014 2015 2016 2017

327 108

-

47 288

EBIT 18 8 8 12

Interest 0 0 0 0

Net profit 231 13 -25 201

Total Assets 1,858 1,592 1,618 1,835.00

Total Liabilities 740 530 629 721

Shareholders' Equity 1,119 1,062 990 1,114.00

Computation of rate of return on assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial performance analysis of Mineral resource Ltd

5

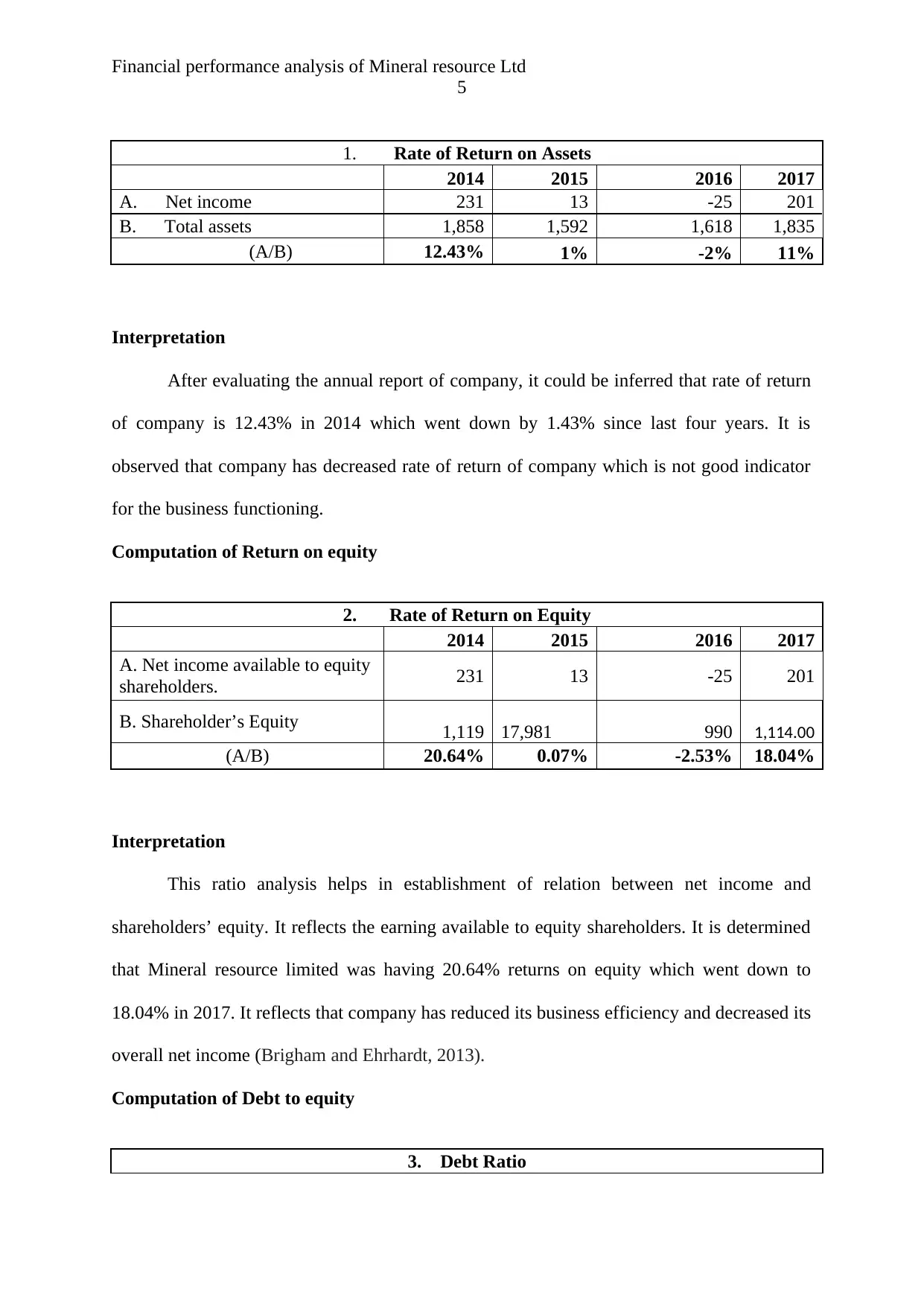

1. Rate of Return on Assets

2014 2015 2016 2017

A. Net income 231 13 -25 201

B. Total assets 1,858 1,592 1,618 1,835

(A/B) 12.43% 1% -2% 11%

Interpretation

After evaluating the annual report of company, it could be inferred that rate of return

of company is 12.43% in 2014 which went down by 1.43% since last four years. It is

observed that company has decreased rate of return of company which is not good indicator

for the business functioning.

Computation of Return on equity

2. Rate of Return on Equity

2014 2015 2016 2017

A. Net income available to equity

shareholders. 231 13 -25 201

B. Shareholder’s Equity 1,119 17,981 990 1,114.00

(A/B) 20.64% 0.07% -2.53% 18.04%

Interpretation

This ratio analysis helps in establishment of relation between net income and

shareholders’ equity. It reflects the earning available to equity shareholders. It is determined

that Mineral resource limited was having 20.64% returns on equity which went down to

18.04% in 2017. It reflects that company has reduced its business efficiency and decreased its

overall net income (Brigham and Ehrhardt, 2013).

Computation of Debt to equity

3. Debt Ratio

5

1. Rate of Return on Assets

2014 2015 2016 2017

A. Net income 231 13 -25 201

B. Total assets 1,858 1,592 1,618 1,835

(A/B) 12.43% 1% -2% 11%

Interpretation

After evaluating the annual report of company, it could be inferred that rate of return

of company is 12.43% in 2014 which went down by 1.43% since last four years. It is

observed that company has decreased rate of return of company which is not good indicator

for the business functioning.

Computation of Return on equity

2. Rate of Return on Equity

2014 2015 2016 2017

A. Net income available to equity

shareholders. 231 13 -25 201

B. Shareholder’s Equity 1,119 17,981 990 1,114.00

(A/B) 20.64% 0.07% -2.53% 18.04%

Interpretation

This ratio analysis helps in establishment of relation between net income and

shareholders’ equity. It reflects the earning available to equity shareholders. It is determined

that Mineral resource limited was having 20.64% returns on equity which went down to

18.04% in 2017. It reflects that company has reduced its business efficiency and decreased its

overall net income (Brigham and Ehrhardt, 2013).

Computation of Debt to equity

3. Debt Ratio

Financial performance analysis of Mineral resource Ltd

6

2014 2015 2016 2017

A. Total Liabilities 740 530 629 721

B. Total assets 1,858 1,592 1,618 1,835.00

(A/B) 40% 33% 39% 39%

Interpretation

Mineral resources limited are profit making company. However, since last four years,

it has decreased its overall return on income which is not good indicators. However, Mineral

resources limited has maintained stable debt ratio which was 40% in 2014 and went down by

1% only in last four years. However, company needs to reduce its financial leverage as well

with the decrease in its profit. Currently, Mineral resources limited is having 39% debt ratio

which reflects high financial leverage and should be lower down to 30% if it wants to control

its financial leverage.

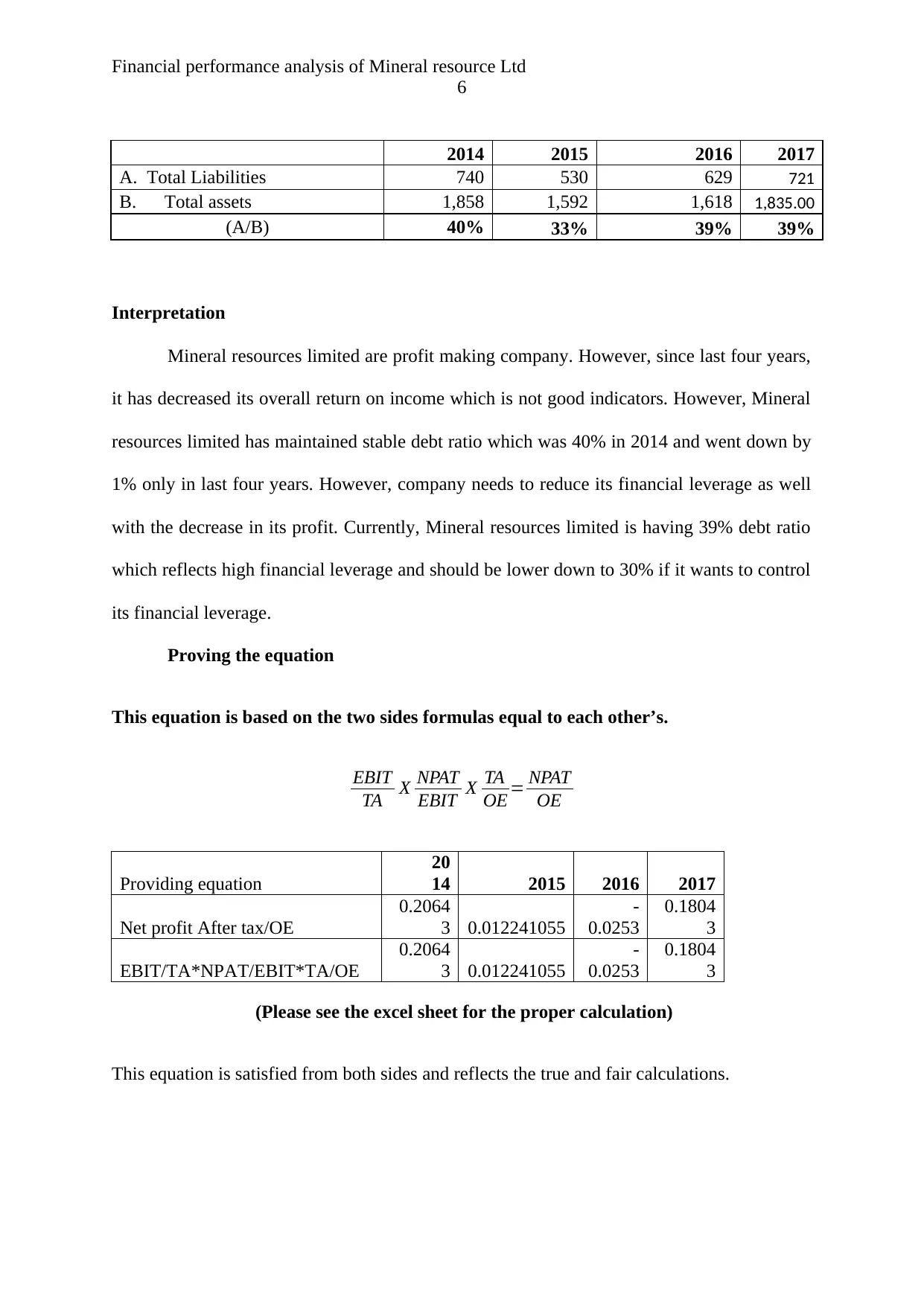

Proving the equation

This equation is based on the two sides formulas equal to each other’s.

EBIT

TA X NPAT

EBIT X TA

OE = NPAT

OE

Providing equation

20

14 2015 2016 2017

Net profit After tax/OE

0.2064

3 0.012241055

-

0.0253

0.1804

3

EBIT/TA*NPAT/EBIT*TA/OE

0.2064

3 0.012241055

-

0.0253

0.1804

3

(Please see the excel sheet for the proper calculation)

This equation is satisfied from both sides and reflects the true and fair calculations.

6

2014 2015 2016 2017

A. Total Liabilities 740 530 629 721

B. Total assets 1,858 1,592 1,618 1,835.00

(A/B) 40% 33% 39% 39%

Interpretation

Mineral resources limited are profit making company. However, since last four years,

it has decreased its overall return on income which is not good indicators. However, Mineral

resources limited has maintained stable debt ratio which was 40% in 2014 and went down by

1% only in last four years. However, company needs to reduce its financial leverage as well

with the decrease in its profit. Currently, Mineral resources limited is having 39% debt ratio

which reflects high financial leverage and should be lower down to 30% if it wants to control

its financial leverage.

Proving the equation

This equation is based on the two sides formulas equal to each other’s.

EBIT

TA X NPAT

EBIT X TA

OE = NPAT

OE

Providing equation

20

14 2015 2016 2017

Net profit After tax/OE

0.2064

3 0.012241055

-

0.0253

0.1804

3

EBIT/TA*NPAT/EBIT*TA/OE

0.2064

3 0.012241055

-

0.0253

0.1804

3

(Please see the excel sheet for the proper calculation)

This equation is satisfied from both sides and reflects the true and fair calculations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial performance analysis of Mineral resource Ltd

7

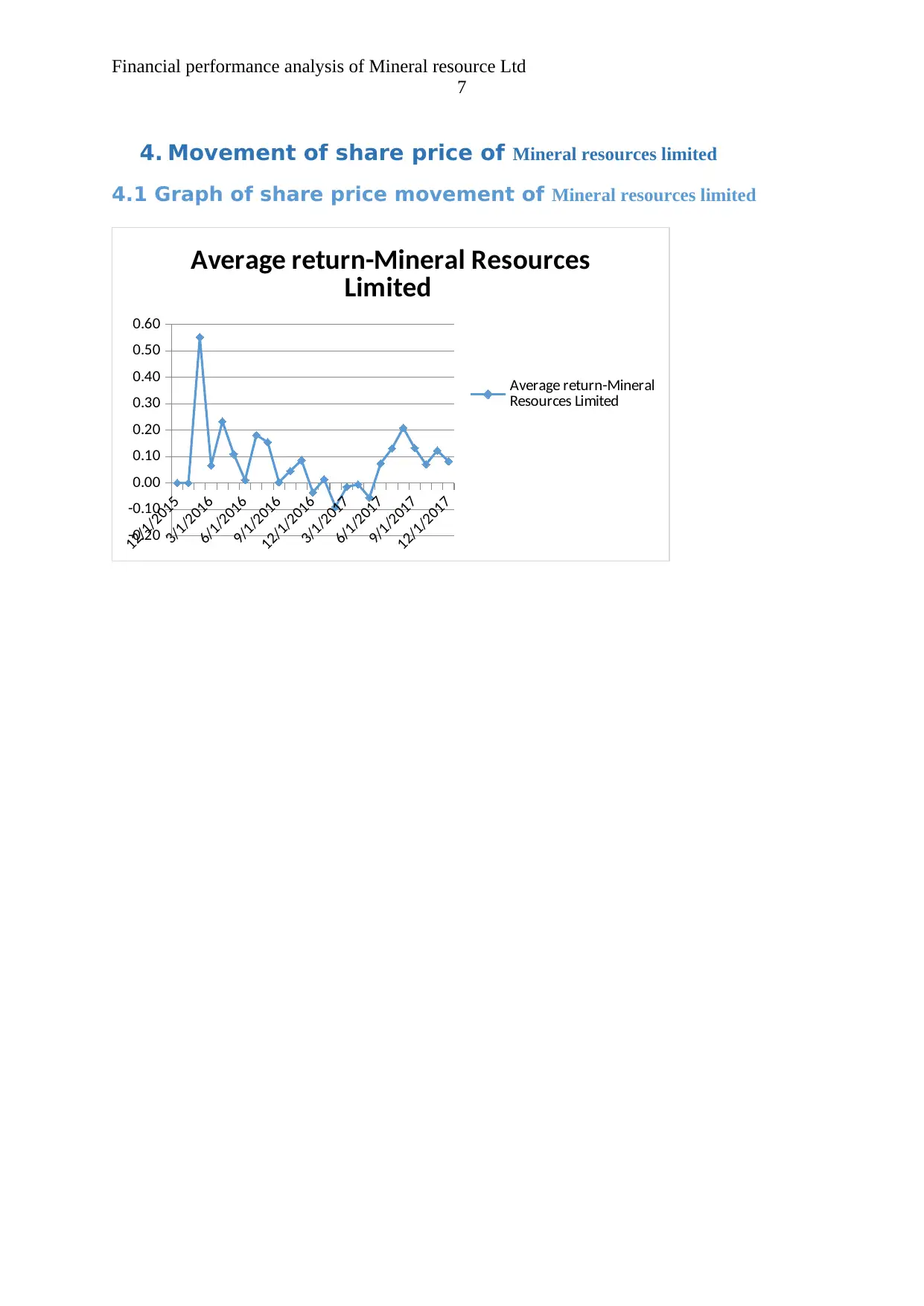

4. Movement of share price of Mineral resources limited

4.1 Graph of share price movement of Mineral resources limited

12/1/2015

3/1/2016

6/1/2016

9/1/2016

12/1/2016

3/1/2017

6/1/2017

9/1/2017

12/1/2017

-0.20

-0.10

0.00

0.10

0.20

0.30

0.40

0.50

0.60

Average return-Mineral Resources

Limited

Average return-Mineral

Resources Limited

7

4. Movement of share price of Mineral resources limited

4.1 Graph of share price movement of Mineral resources limited

12/1/2015

3/1/2016

6/1/2016

9/1/2016

12/1/2016

3/1/2017

6/1/2017

9/1/2017

12/1/2017

-0.20

-0.10

0.00

0.10

0.20

0.30

0.40

0.50

0.60

Average return-Mineral Resources

Limited

Average return-Mineral

Resources Limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial performance analysis of Mineral resource Ltd

8

4.2 Comparison of share price movement of Mineral resources

limited with the movement of share price of all ordinary index

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

1/1/2017

2/1/2017

3/1/2017

4/1/2017

5/1/2017

6/1/2017

7/1/2017

8/1/2017

9/1/2017

10/1/2017

11/1/2017

12/1/2017

-10.00

-5.00

0.00

5.00

10.00

15.00

20.00

Average Return

Average return-Mineral Resources Limited 0.00 0.00

Average Return

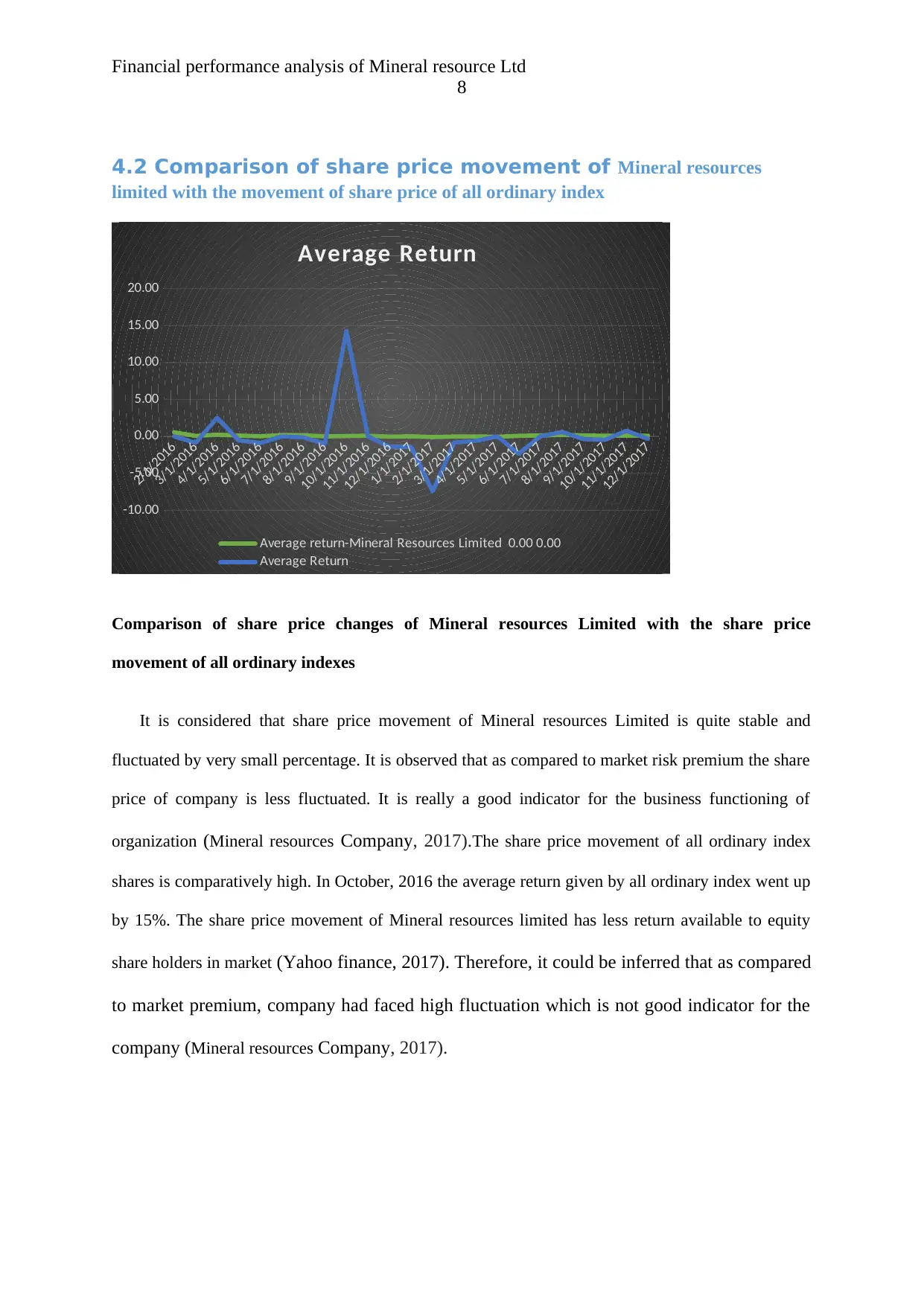

Comparison of share price changes of Mineral resources Limited with the share price

movement of all ordinary indexes

It is considered that share price movement of Mineral resources Limited is quite stable and

fluctuated by very small percentage. It is observed that as compared to market risk premium the share

price of company is less fluctuated. It is really a good indicator for the business functioning of

organization (Mineral resources Company, 2017).The share price movement of all ordinary index

shares is comparatively high. In October, 2016 the average return given by all ordinary index went up

by 15%. The share price movement of Mineral resources limited has less return available to equity

share holders in market (Yahoo finance, 2017). Therefore, it could be inferred that as compared

to market premium, company had faced high fluctuation which is not good indicator for the

company (Mineral resources Company, 2017).

8

4.2 Comparison of share price movement of Mineral resources

limited with the movement of share price of all ordinary index

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

1/1/2017

2/1/2017

3/1/2017

4/1/2017

5/1/2017

6/1/2017

7/1/2017

8/1/2017

9/1/2017

10/1/2017

11/1/2017

12/1/2017

-10.00

-5.00

0.00

5.00

10.00

15.00

20.00

Average Return

Average return-Mineral Resources Limited 0.00 0.00

Average Return

Comparison of share price changes of Mineral resources Limited with the share price

movement of all ordinary indexes

It is considered that share price movement of Mineral resources Limited is quite stable and

fluctuated by very small percentage. It is observed that as compared to market risk premium the share

price of company is less fluctuated. It is really a good indicator for the business functioning of

organization (Mineral resources Company, 2017).The share price movement of all ordinary index

shares is comparatively high. In October, 2016 the average return given by all ordinary index went up

by 15%. The share price movement of Mineral resources limited has less return available to equity

share holders in market (Yahoo finance, 2017). Therefore, it could be inferred that as compared

to market premium, company had faced high fluctuation which is not good indicator for the

company (Mineral resources Company, 2017).

Financial performance analysis of Mineral resource Ltd

9

5. Announcements

1. In 2017, company has less fluctuation in its share price movement and invested high amount

in the other business to diversify its business chain.

2. Company has planned to establish automation in its business by using cyber computing

enterprises resources planning in its value chain activities (Mineral resources Company, 2017).

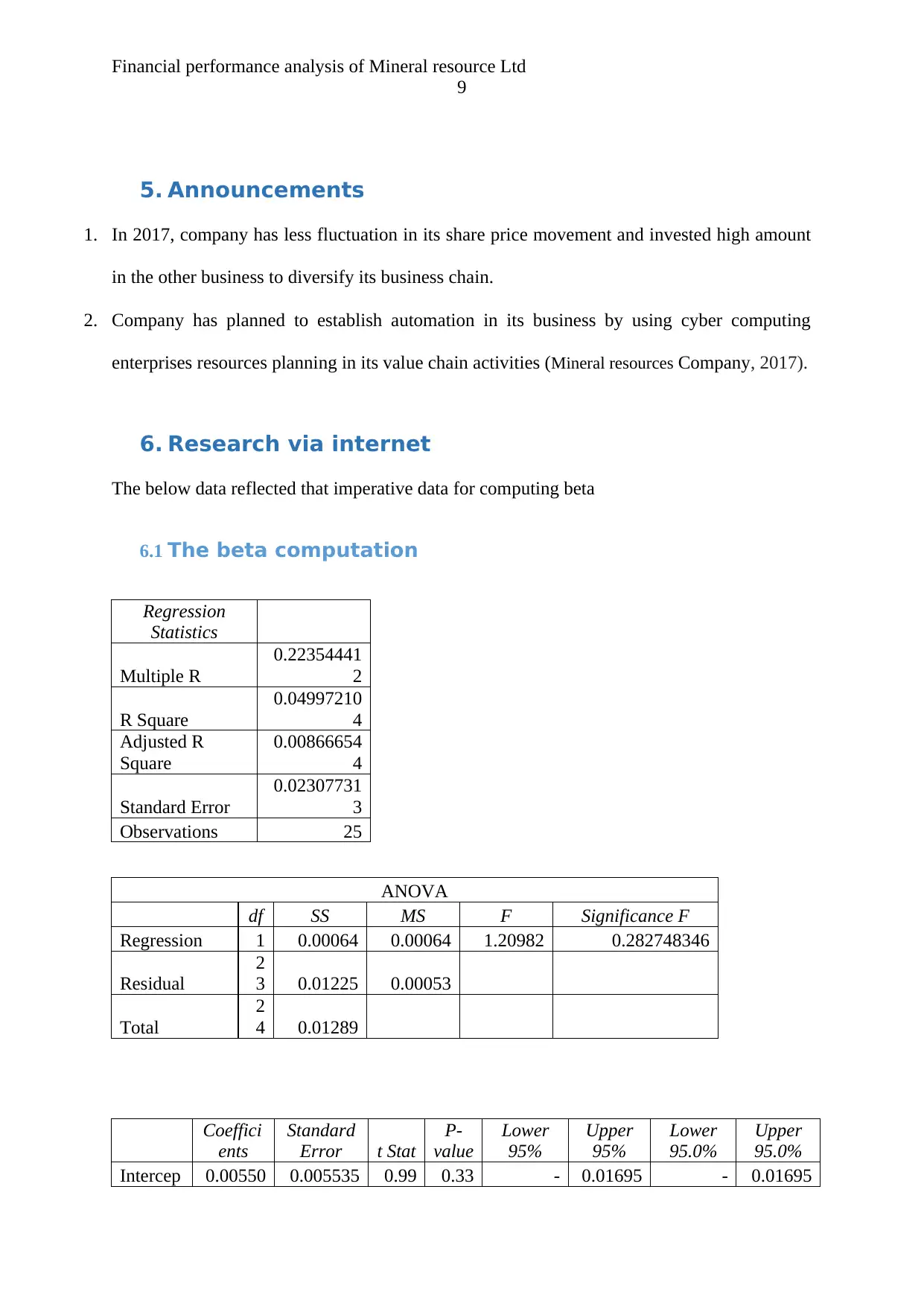

6. Research via internet

The below data reflected that imperative data for computing beta

6.1 The beta computation

Regression

Statistics

Multiple R

0.22354441

2

R Square

0.04997210

4

Adjusted R

Square

0.00866654

4

Standard Error

0.02307731

3

Observations 25

ANOVA

df SS MS F Significance F

Regression 1 0.00064 0.00064 1.20982 0.282748346

Residual

2

3 0.01225 0.00053

Total

2

4 0.01289

Coeffici

ents

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercep 0.00550 0.005535 0.99 0.33 - 0.01695 - 0.01695

9

5. Announcements

1. In 2017, company has less fluctuation in its share price movement and invested high amount

in the other business to diversify its business chain.

2. Company has planned to establish automation in its business by using cyber computing

enterprises resources planning in its value chain activities (Mineral resources Company, 2017).

6. Research via internet

The below data reflected that imperative data for computing beta

6.1 The beta computation

Regression

Statistics

Multiple R

0.22354441

2

R Square

0.04997210

4

Adjusted R

Square

0.00866654

4

Standard Error

0.02307731

3

Observations 25

ANOVA

df SS MS F Significance F

Regression 1 0.00064 0.00064 1.20982 0.282748346

Residual

2

3 0.01225 0.00053

Total

2

4 0.01289

Coeffici

ents

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercep 0.00550 0.005535 0.99 0.33 - 0.01695 - 0.01695

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial performance analysis of Mineral resource Ltd

10

t 1315 738 378 067

0.00595

0233 2862

0.00595

0233 2862

X

Variabl

e 1

0.04046

8037

0.036791

931

1.09

992

0.28

275

-

0.03564

1871

0.11657

7944

-

0.03564

1871

0.11657

7944

The beta value of company is .040. It reflects the share price movement of company

based on the market premium. It reflects the changes in share price of Mineral resources

company would be .0040 if the price of all ordinary share price changed by 1.

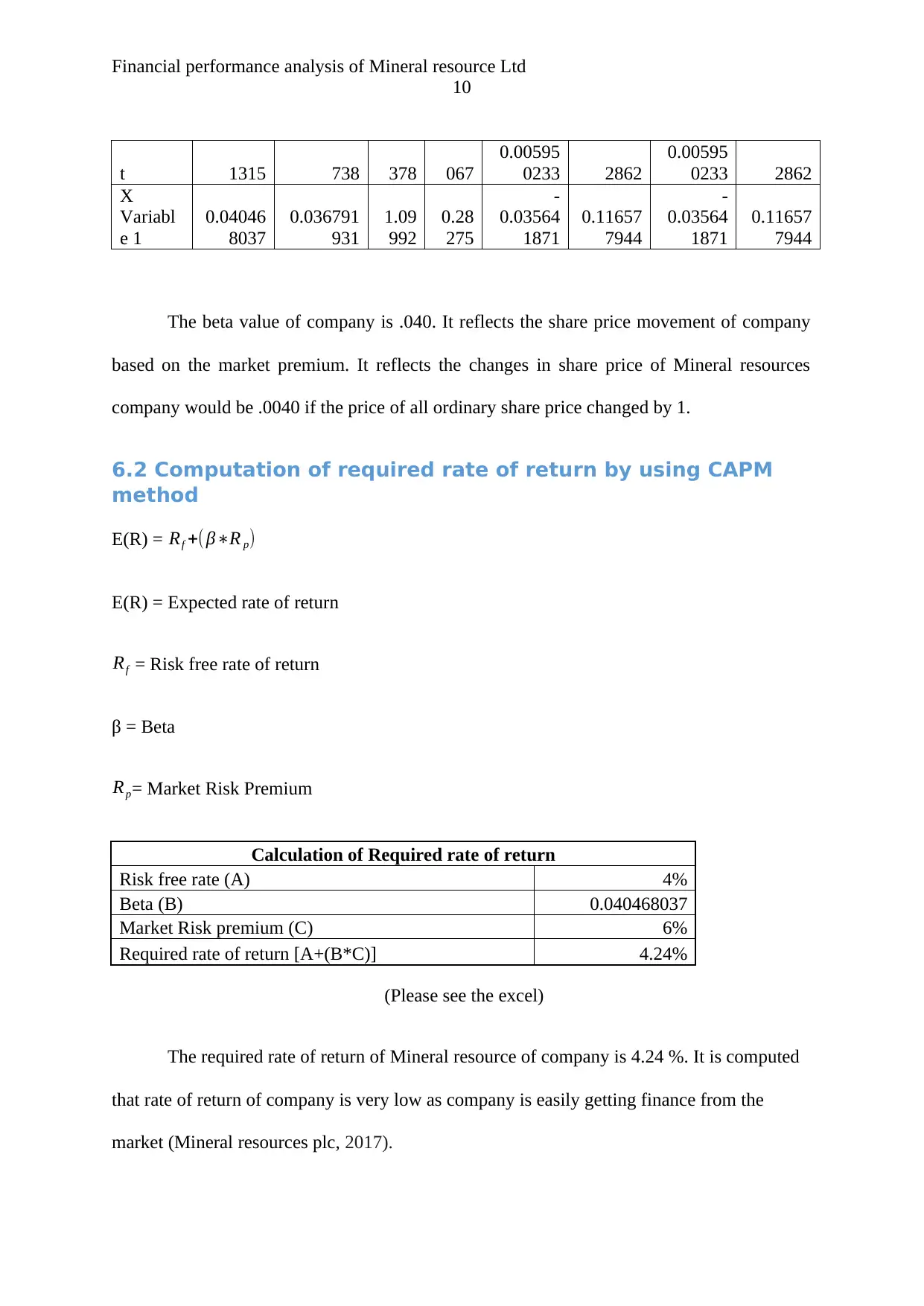

6.2 Computation of required rate of return by using CAPM

method

E(R) = Rf +( β∗R p)

E(R) = Expected rate of return

Rf = Risk free rate of return

β = Beta

Rp= Market Risk Premium

Calculation of Required rate of return

Risk free rate (A) 4%

Beta (B) 0.040468037

Market Risk premium (C) 6%

Required rate of return [A+(B*C)] 4.24%

(Please see the excel)

The required rate of return of Mineral resource of company is 4.24 %. It is computed

that rate of return of company is very low as company is easily getting finance from the

market (Mineral resources plc, 2017).

10

t 1315 738 378 067

0.00595

0233 2862

0.00595

0233 2862

X

Variabl

e 1

0.04046

8037

0.036791

931

1.09

992

0.28

275

-

0.03564

1871

0.11657

7944

-

0.03564

1871

0.11657

7944

The beta value of company is .040. It reflects the share price movement of company

based on the market premium. It reflects the changes in share price of Mineral resources

company would be .0040 if the price of all ordinary share price changed by 1.

6.2 Computation of required rate of return by using CAPM

method

E(R) = Rf +( β∗R p)

E(R) = Expected rate of return

Rf = Risk free rate of return

β = Beta

Rp= Market Risk Premium

Calculation of Required rate of return

Risk free rate (A) 4%

Beta (B) 0.040468037

Market Risk premium (C) 6%

Required rate of return [A+(B*C)] 4.24%

(Please see the excel)

The required rate of return of Mineral resource of company is 4.24 %. It is computed

that rate of return of company is very low as company is easily getting finance from the

market (Mineral resources plc, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial performance analysis of Mineral resource Ltd

11

6.3 Determination of conservative investment

It is observed that company has been decreasing its net profit throughout the time. It is

considered that company is following conservative investment policy which allows it to make

moderate investment in its business. Company needs to increase its overall profit if it wants

to create value on its equity capital. The investment decisions of management are highly

dependent upon the share price movement, net income and rate of return of company.

7. Weighted Average Cost of Capital (WACC)

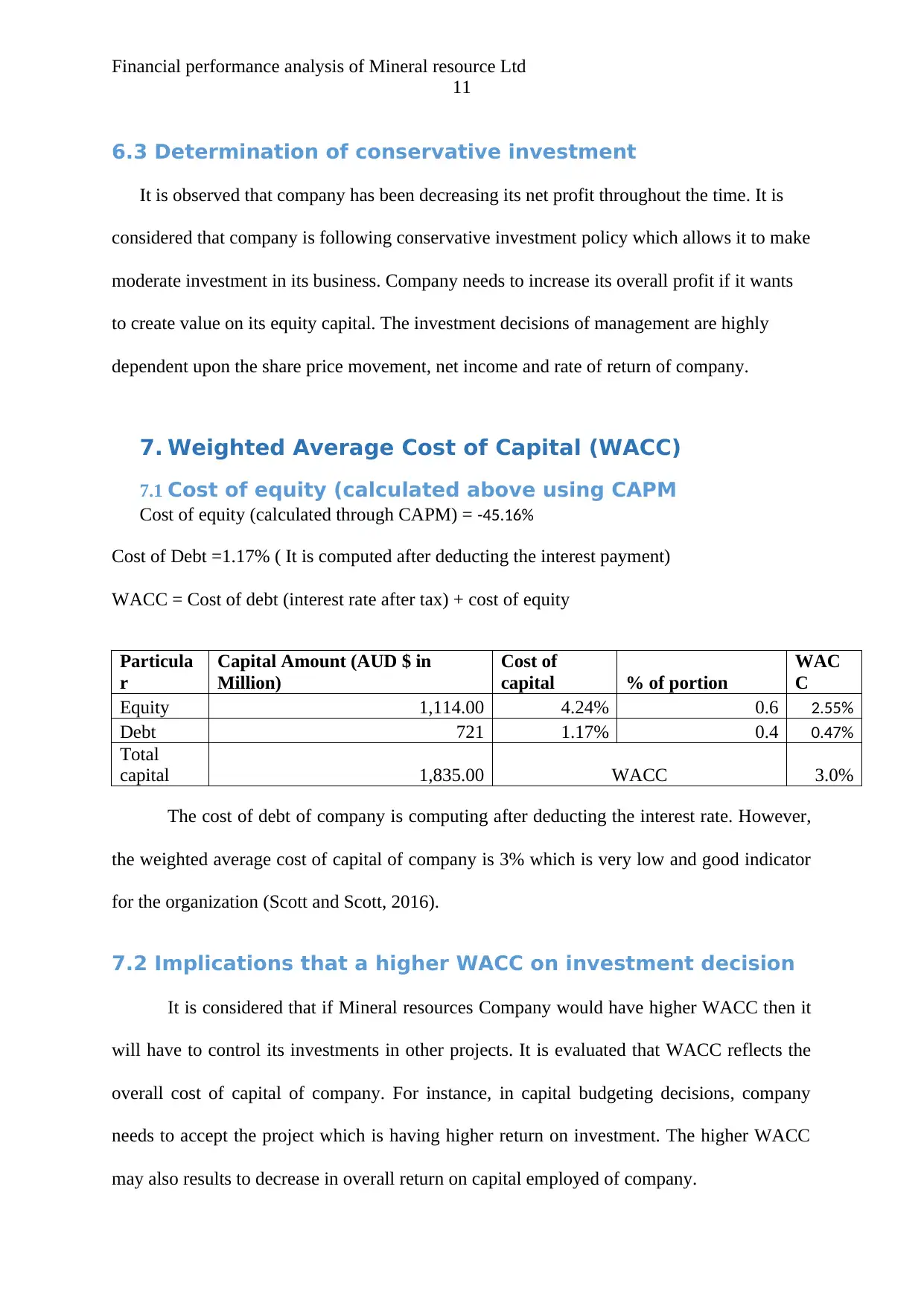

7.1 Cost of equity (calculated above using CAPM

Cost of equity (calculated through CAPM) = -45.16%

Cost of Debt =1.17% ( It is computed after deducting the interest payment)

WACC = Cost of debt (interest rate after tax) + cost of equity

Particula

r

Capital Amount (AUD $ in

Million)

Cost of

capital % of portion

WAC

C

Equity 1,114.00 4.24% 0.6 2.55%

Debt 721 1.17% 0.4 0.47%

Total

capital 1,835.00 WACC 3.0%

The cost of debt of company is computing after deducting the interest rate. However,

the weighted average cost of capital of company is 3% which is very low and good indicator

for the organization (Scott and Scott, 2016).

7.2 Implications that a higher WACC on investment decision

It is considered that if Mineral resources Company would have higher WACC then it

will have to control its investments in other projects. It is evaluated that WACC reflects the

overall cost of capital of company. For instance, in capital budgeting decisions, company

needs to accept the project which is having higher return on investment. The higher WACC

may also results to decrease in overall return on capital employed of company.

11

6.3 Determination of conservative investment

It is observed that company has been decreasing its net profit throughout the time. It is

considered that company is following conservative investment policy which allows it to make

moderate investment in its business. Company needs to increase its overall profit if it wants

to create value on its equity capital. The investment decisions of management are highly

dependent upon the share price movement, net income and rate of return of company.

7. Weighted Average Cost of Capital (WACC)

7.1 Cost of equity (calculated above using CAPM

Cost of equity (calculated through CAPM) = -45.16%

Cost of Debt =1.17% ( It is computed after deducting the interest payment)

WACC = Cost of debt (interest rate after tax) + cost of equity

Particula

r

Capital Amount (AUD $ in

Million)

Cost of

capital % of portion

WAC

C

Equity 1,114.00 4.24% 0.6 2.55%

Debt 721 1.17% 0.4 0.47%

Total

capital 1,835.00 WACC 3.0%

The cost of debt of company is computing after deducting the interest rate. However,

the weighted average cost of capital of company is 3% which is very low and good indicator

for the organization (Scott and Scott, 2016).

7.2 Implications that a higher WACC on investment decision

It is considered that if Mineral resources Company would have higher WACC then it

will have to control its investments in other projects. It is evaluated that WACC reflects the

overall cost of capital of company. For instance, in capital budgeting decisions, company

needs to accept the project which is having higher return on investment. The higher WACC

may also results to decrease in overall return on capital employed of company.

Financial performance analysis of Mineral resource Ltd

12

8. Consideration of debt ratio for the company

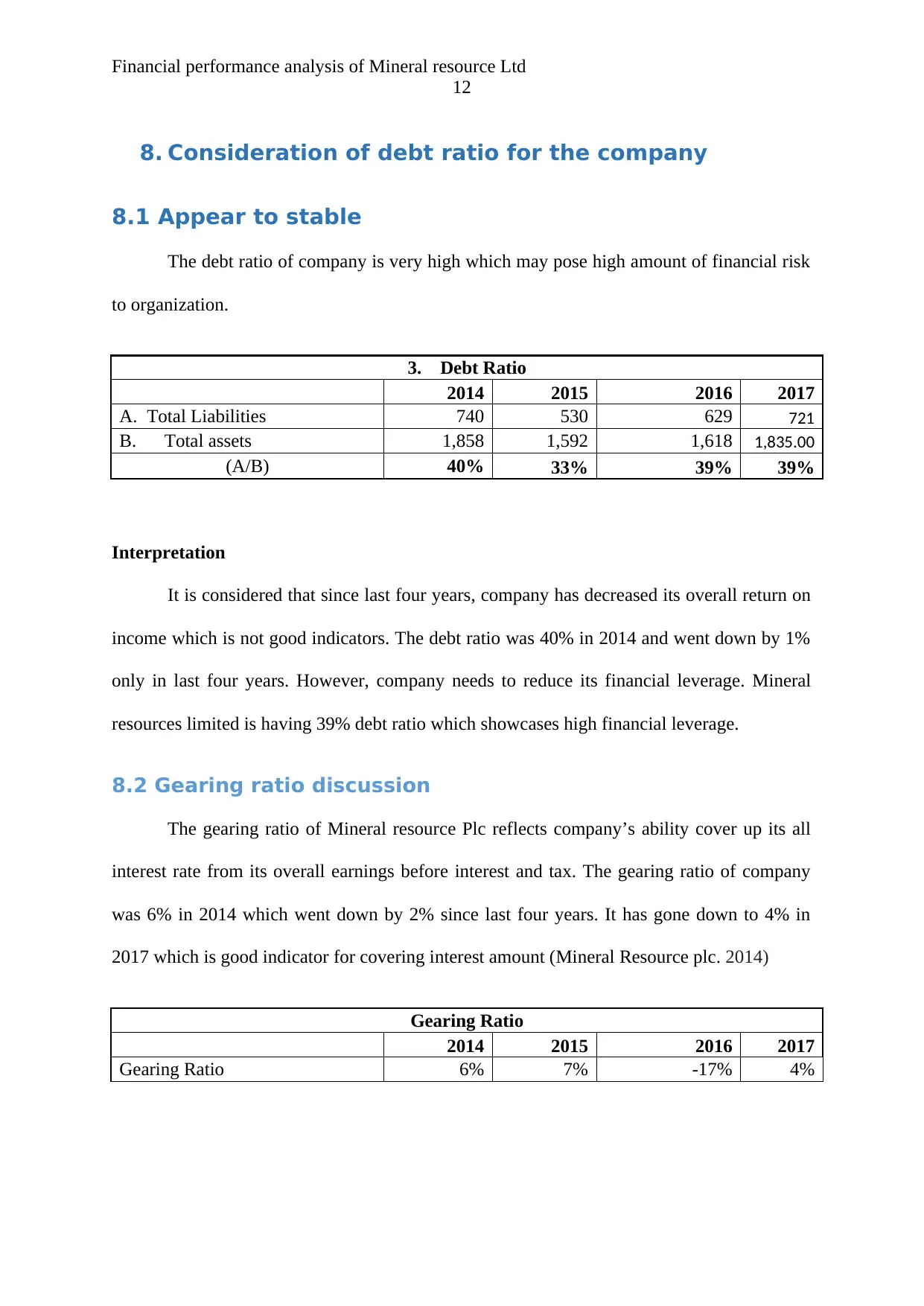

8.1 Appear to stable

The debt ratio of company is very high which may pose high amount of financial risk

to organization.

3. Debt Ratio

2014 2015 2016 2017

A. Total Liabilities 740 530 629 721

B. Total assets 1,858 1,592 1,618 1,835.00

(A/B) 40% 33% 39% 39%

Interpretation

It is considered that since last four years, company has decreased its overall return on

income which is not good indicators. The debt ratio was 40% in 2014 and went down by 1%

only in last four years. However, company needs to reduce its financial leverage. Mineral

resources limited is having 39% debt ratio which showcases high financial leverage.

8.2 Gearing ratio discussion

The gearing ratio of Mineral resource Plc reflects company’s ability cover up its all

interest rate from its overall earnings before interest and tax. The gearing ratio of company

was 6% in 2014 which went down by 2% since last four years. It has gone down to 4% in

2017 which is good indicator for covering interest amount (Mineral Resource plc. 2014)

Gearing Ratio

2014 2015 2016 2017

Gearing Ratio 6% 7% -17% 4%

12

8. Consideration of debt ratio for the company

8.1 Appear to stable

The debt ratio of company is very high which may pose high amount of financial risk

to organization.

3. Debt Ratio

2014 2015 2016 2017

A. Total Liabilities 740 530 629 721

B. Total assets 1,858 1,592 1,618 1,835.00

(A/B) 40% 33% 39% 39%

Interpretation

It is considered that since last four years, company has decreased its overall return on

income which is not good indicators. The debt ratio was 40% in 2014 and went down by 1%

only in last four years. However, company needs to reduce its financial leverage. Mineral

resources limited is having 39% debt ratio which showcases high financial leverage.

8.2 Gearing ratio discussion

The gearing ratio of Mineral resource Plc reflects company’s ability cover up its all

interest rate from its overall earnings before interest and tax. The gearing ratio of company

was 6% in 2014 which went down by 2% since last four years. It has gone down to 4% in

2017 which is good indicator for covering interest amount (Mineral Resource plc. 2014)

Gearing Ratio

2014 2015 2016 2017

Gearing Ratio 6% 7% -17% 4%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.