Financial Performance Analysis of Royal Mail Plc - Level 5 SBLC5005

VerifiedAdded on 2023/05/27

|15

|3714

|208

Report

AI Summary

This report provides a detailed financial analysis of Royal Mail Plc from 2014 to 2018, utilizing ratio analysis to assess the company's profitability, liquidity, efficiency, and solvency. Key financial ratios such as net profit margin, return on equity, current ratio, and quick ratio are examined to evaluate the company's financial health and performance trends over the five-year period. The analysis also includes a review of the company's working capital management, capital structure, and stock price trends, offering insights into its ability to generate income, manage short-term obligations, and leverage assets. The report concludes with an assessment of the overall financial vitality of Royal Mail Plc, providing stakeholders with information to make informed investment decisions. Desklib offers a platform for students to find similar reports and past papers.

23 December 2018

Financial Management Analysis

Royal Mail Plc.

Financial Management Analysis

Royal Mail Plc.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 1

Table of Contents

Introduction................................................................................................................................2

Analysis of Financial Statements: Theoretical Framework.......................................................2

Analysis of Financial Statements: Practical Application...........................................................3

Ratio Analysis........................................................................................................................3

Profitability........................................................................................................................3

Liquidity.............................................................................................................................5

Efficiency or the Working Capital Management...............................................................6

Solvency.............................................................................................................................7

General Financial Data and Stock Price Analysis..................................................................8

Conclusion..................................................................................................................................9

References................................................................................................................................10

Table of Contents

Introduction................................................................................................................................2

Analysis of Financial Statements: Theoretical Framework.......................................................2

Analysis of Financial Statements: Practical Application...........................................................3

Ratio Analysis........................................................................................................................3

Profitability........................................................................................................................3

Liquidity.............................................................................................................................5

Efficiency or the Working Capital Management...............................................................6

Solvency.............................................................................................................................7

General Financial Data and Stock Price Analysis..................................................................8

Conclusion..................................................................................................................................9

References................................................................................................................................10

REPORT 2

Introduction

The accounting regulating organisations of various nations cast a duty of the management of

an entity to prepare and present the financial statements of an entity, which represent a true

and fair view of the affairs of the entity. The fair and transparent representation assists the

stakeholders and experts to arrive at meaningful business and other decisions (Fabozzi and

Drake, 2009). The following report is aimed at analysing the financial performance of the

entity Royal Mail Plc. The company Royal Mail Plc. is engaged in the business of postal

services and courier services in the UK. The shares of the entity are listed on the London

Stock Exchange. The company belongs to the Integrated Shipping & Logistics industry. The

company operates its business through a number of subsidiaries such as Royal Mail Group

Limited and the General Logistics Systems. The report will make use of the various ratios to

analyse the financial performance of the entity over the period of five years, i.e. the financial

years starting from year 20145 to 2018. The report is further aimed at analysing the trends in

the stock market of the share prices of the said entity. This would be followed by the

conclusion as to whether it is vital to invest in the entity on the basis of the financial health of

the company.

Analysis of Financial Statements: Theoretical Framework

As prescribed in the US GAAP framework formulated by the regulators, financial statements

are prepared with the intention to serve the various stakeholders. It must further be noted that

these statements must be in the comparative format in order to evaluate the performances in a

detailed manner. In addition, it is significant to note that, as there exist a number of

stakeholders, there is no specific purpose for the preparation and presentation of the financial

statements. This means that financial statement serves as the base for a number of decisions,

such as lending, buying, and regulating and many more (Delen, Kuzey and Uyar, 2013).

While the investors are keen to know the overall financial health of the company, the

regulators have the prime objective of ensuring that the statements comply with the corporate

governance requirements and applicable accounting framework (Robinson et. al, 2015). Thus,

in order to make the decisions, stakeholders must analyse the statements according to their

needs. Further, the statements provide a competitive analysis of the performance with respect

to the performance of the competitors belonging to the same industry.

Introduction

The accounting regulating organisations of various nations cast a duty of the management of

an entity to prepare and present the financial statements of an entity, which represent a true

and fair view of the affairs of the entity. The fair and transparent representation assists the

stakeholders and experts to arrive at meaningful business and other decisions (Fabozzi and

Drake, 2009). The following report is aimed at analysing the financial performance of the

entity Royal Mail Plc. The company Royal Mail Plc. is engaged in the business of postal

services and courier services in the UK. The shares of the entity are listed on the London

Stock Exchange. The company belongs to the Integrated Shipping & Logistics industry. The

company operates its business through a number of subsidiaries such as Royal Mail Group

Limited and the General Logistics Systems. The report will make use of the various ratios to

analyse the financial performance of the entity over the period of five years, i.e. the financial

years starting from year 20145 to 2018. The report is further aimed at analysing the trends in

the stock market of the share prices of the said entity. This would be followed by the

conclusion as to whether it is vital to invest in the entity on the basis of the financial health of

the company.

Analysis of Financial Statements: Theoretical Framework

As prescribed in the US GAAP framework formulated by the regulators, financial statements

are prepared with the intention to serve the various stakeholders. It must further be noted that

these statements must be in the comparative format in order to evaluate the performances in a

detailed manner. In addition, it is significant to note that, as there exist a number of

stakeholders, there is no specific purpose for the preparation and presentation of the financial

statements. This means that financial statement serves as the base for a number of decisions,

such as lending, buying, and regulating and many more (Delen, Kuzey and Uyar, 2013).

While the investors are keen to know the overall financial health of the company, the

regulators have the prime objective of ensuring that the statements comply with the corporate

governance requirements and applicable accounting framework (Robinson et. al, 2015). Thus,

in order to make the decisions, stakeholders must analyse the statements according to their

needs. Further, the statements provide a competitive analysis of the performance with respect

to the performance of the competitors belonging to the same industry.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REPORT 3

There have been prescribed a number of techniques for analysing the financial vitality of an

enterprise. These techniques make use of the relevant and specific data from the financial

statements and the market, about the enterprise (Stickney et al., 2009). One such technique is

ratio analysis. A comparative ratio analysis aids an individual to gain an insight about the

profitability, efficiency, liquidity, and solvency positions of an entity. The ratios are further

useful when compared with the industry average and the relative data of the competitors

(Bragg, 2012). In addition, the ratios aid in further trend analysis and thus overall financial

vitality of a company can be assessed.

Another way of evaluating the current performance and the worth of an entity is by making

use of the stock’s price, as derived from the live market or the stock exchange where the

shares of a public company are traded. It is significant to note that the analysis of the stock

price in the light of the historical performance of an enterprise would yield limited results

(Hillier, Grinblatt and Titman, 2011). The said evaluation must be done in conjunction with

the company’s future prospects and the current news in relation to recent agreements entered

into by an entity. An industry analysis must also be combined. The evaluation on the above

lines will give an overall insight at a macro level of the position of an enterprise.

Accordingly, the stakeholders can make investment and regulatory decisions.

Analysis of Financial Statements: Practical Application

Ratio Analysis

Profitability

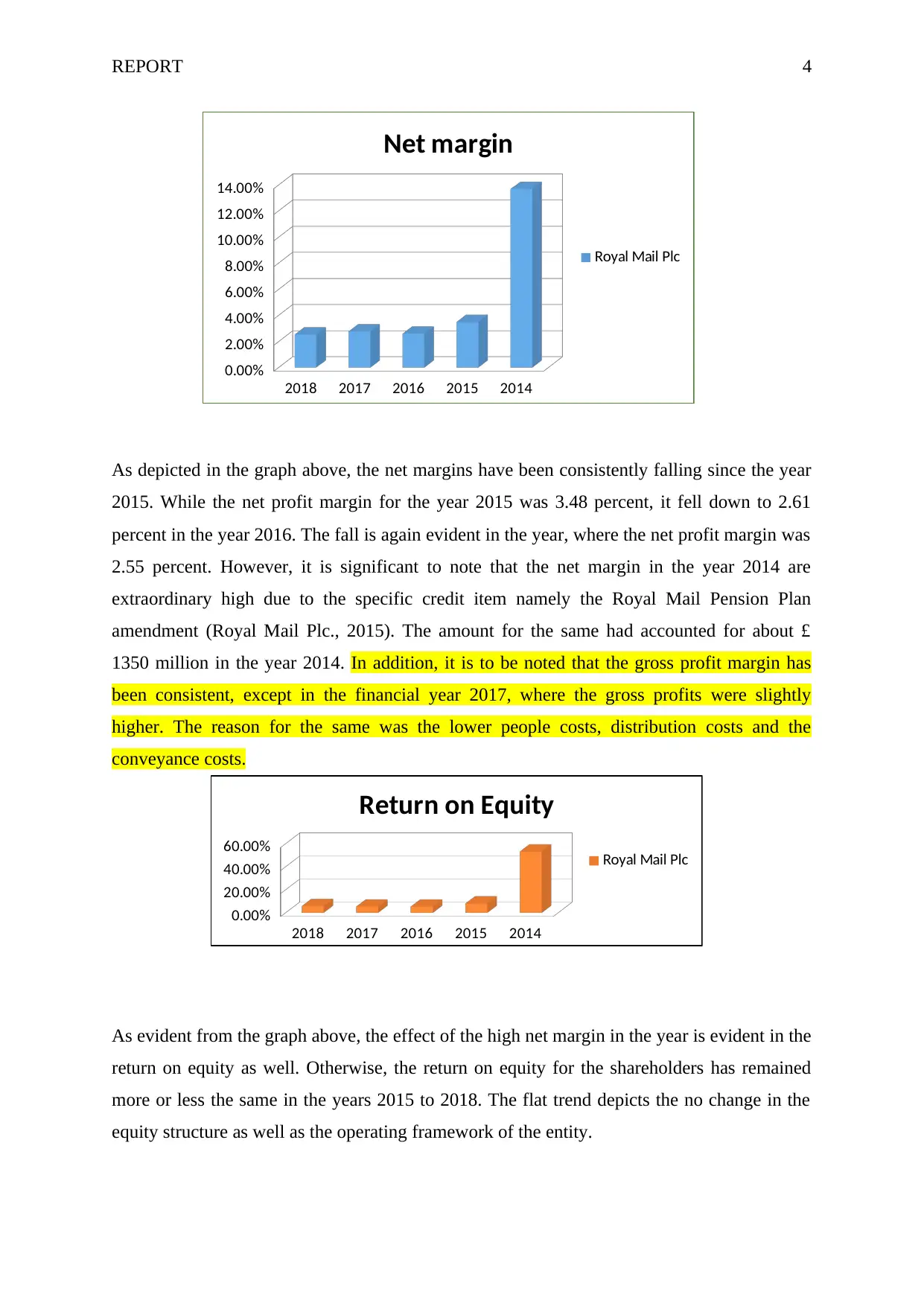

The profitability position of an entity can be primarily assessed with the help of three key

ratios namely the return on equity, the gross profit margin, and the net margin (profit) ratio.

While the net profit ratio is calculated as the percentage of profits to the revenues, the return

on equity is computed as the percentage of profit on the total shareholder’s equity. The gross

profit is calculated taking the percentage of gross profit on the revenue. These ratios aid in

the evaluation of the company’s ability to generate income against the expenses and other

incidental costs incurred towards the income generation (Gill, Biger and Mathur, 2010). The

following graph depicts the net profit ratio in respect of the Royal Mail Plc. over the last five

years.

There have been prescribed a number of techniques for analysing the financial vitality of an

enterprise. These techniques make use of the relevant and specific data from the financial

statements and the market, about the enterprise (Stickney et al., 2009). One such technique is

ratio analysis. A comparative ratio analysis aids an individual to gain an insight about the

profitability, efficiency, liquidity, and solvency positions of an entity. The ratios are further

useful when compared with the industry average and the relative data of the competitors

(Bragg, 2012). In addition, the ratios aid in further trend analysis and thus overall financial

vitality of a company can be assessed.

Another way of evaluating the current performance and the worth of an entity is by making

use of the stock’s price, as derived from the live market or the stock exchange where the

shares of a public company are traded. It is significant to note that the analysis of the stock

price in the light of the historical performance of an enterprise would yield limited results

(Hillier, Grinblatt and Titman, 2011). The said evaluation must be done in conjunction with

the company’s future prospects and the current news in relation to recent agreements entered

into by an entity. An industry analysis must also be combined. The evaluation on the above

lines will give an overall insight at a macro level of the position of an enterprise.

Accordingly, the stakeholders can make investment and regulatory decisions.

Analysis of Financial Statements: Practical Application

Ratio Analysis

Profitability

The profitability position of an entity can be primarily assessed with the help of three key

ratios namely the return on equity, the gross profit margin, and the net margin (profit) ratio.

While the net profit ratio is calculated as the percentage of profits to the revenues, the return

on equity is computed as the percentage of profit on the total shareholder’s equity. The gross

profit is calculated taking the percentage of gross profit on the revenue. These ratios aid in

the evaluation of the company’s ability to generate income against the expenses and other

incidental costs incurred towards the income generation (Gill, Biger and Mathur, 2010). The

following graph depicts the net profit ratio in respect of the Royal Mail Plc. over the last five

years.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 4

As depicted in the graph above, the net margins have been consistently falling since the year

2015. While the net profit margin for the year 2015 was 3.48 percent, it fell down to 2.61

percent in the year 2016. The fall is again evident in the year, where the net profit margin was

2.55 percent. However, it is significant to note that the net margin in the year 2014 are

extraordinary high due to the specific credit item namely the Royal Mail Pension Plan

amendment (Royal Mail Plc., 2015). The amount for the same had accounted for about £

1350 million in the year 2014. In addition, it is to be noted that the gross profit margin has

been consistent, except in the financial year 2017, where the gross profits were slightly

higher. The reason for the same was the lower people costs, distribution costs and the

conveyance costs.

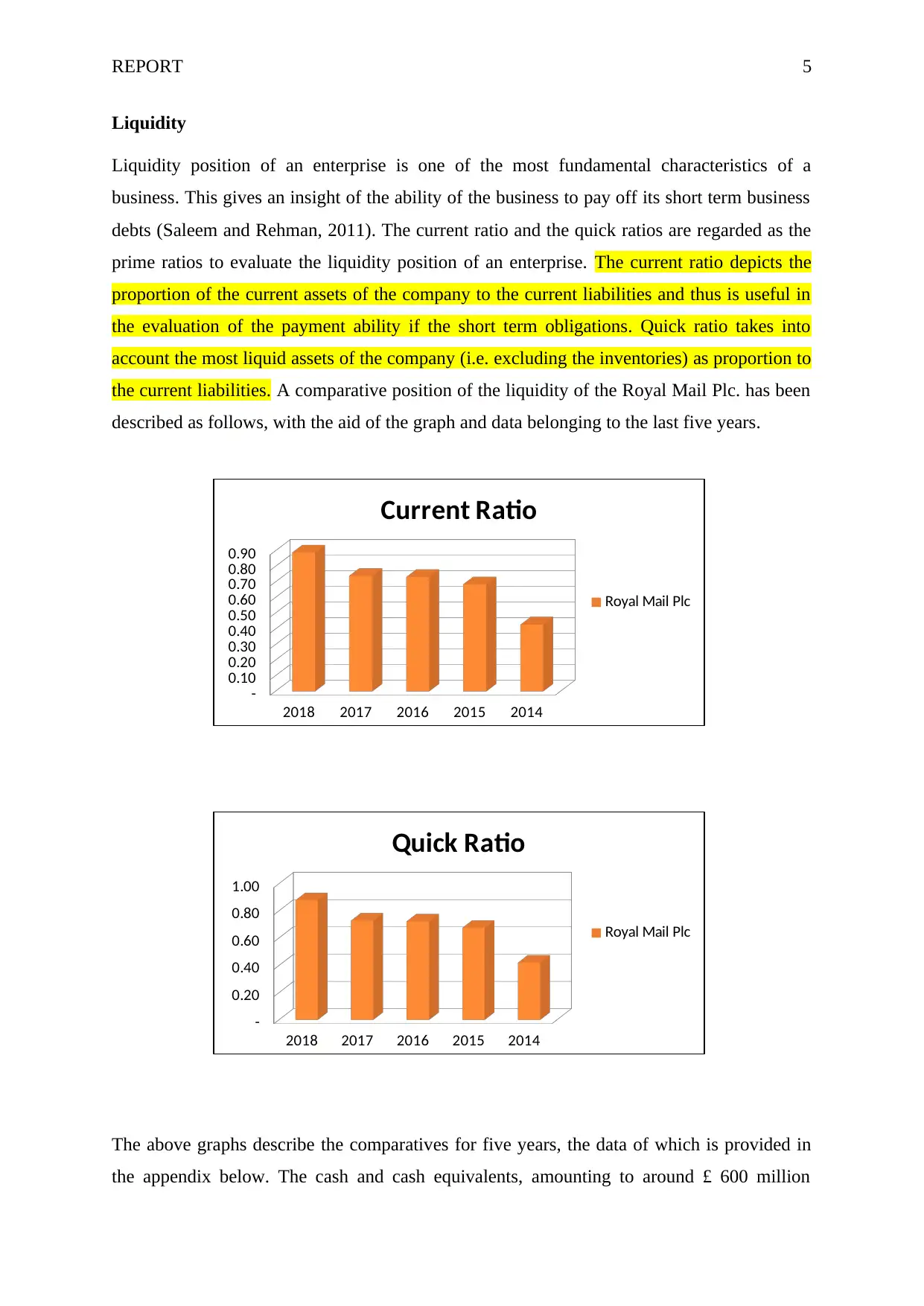

As evident from the graph above, the effect of the high net margin in the year is evident in the

return on equity as well. Otherwise, the return on equity for the shareholders has remained

more or less the same in the years 2015 to 2018. The flat trend depicts the no change in the

equity structure as well as the operating framework of the entity.

2018 2017 2016 2015 2014

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Net margin

Royal Mail Plc

2018 2017 2016 2015 2014

0.00%

20.00%

40.00%

60.00%

Return on Equity

Royal Mail Plc

As depicted in the graph above, the net margins have been consistently falling since the year

2015. While the net profit margin for the year 2015 was 3.48 percent, it fell down to 2.61

percent in the year 2016. The fall is again evident in the year, where the net profit margin was

2.55 percent. However, it is significant to note that the net margin in the year 2014 are

extraordinary high due to the specific credit item namely the Royal Mail Pension Plan

amendment (Royal Mail Plc., 2015). The amount for the same had accounted for about £

1350 million in the year 2014. In addition, it is to be noted that the gross profit margin has

been consistent, except in the financial year 2017, where the gross profits were slightly

higher. The reason for the same was the lower people costs, distribution costs and the

conveyance costs.

As evident from the graph above, the effect of the high net margin in the year is evident in the

return on equity as well. Otherwise, the return on equity for the shareholders has remained

more or less the same in the years 2015 to 2018. The flat trend depicts the no change in the

equity structure as well as the operating framework of the entity.

2018 2017 2016 2015 2014

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Net margin

Royal Mail Plc

2018 2017 2016 2015 2014

0.00%

20.00%

40.00%

60.00%

Return on Equity

Royal Mail Plc

REPORT 5

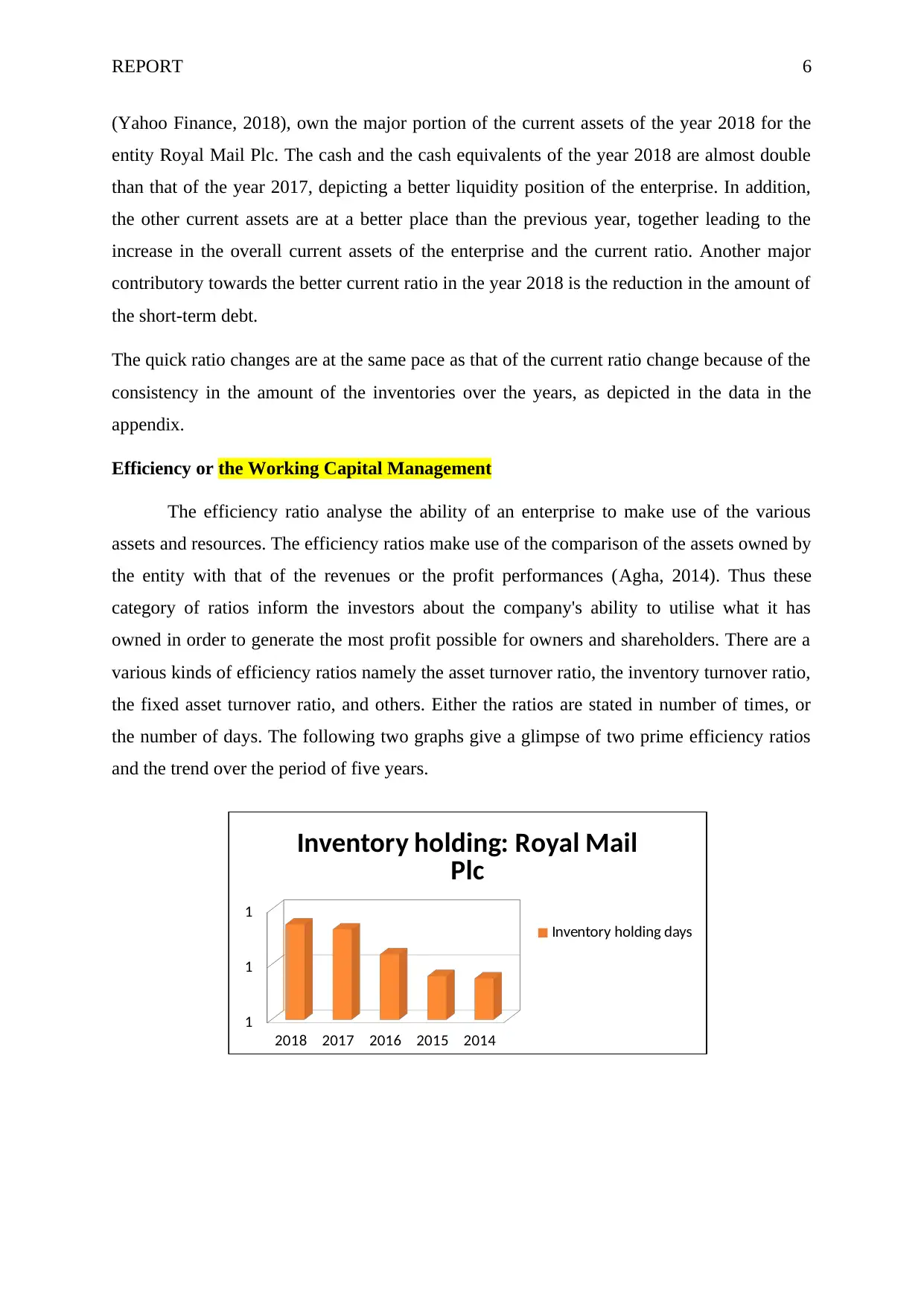

Liquidity

Liquidity position of an enterprise is one of the most fundamental characteristics of a

business. This gives an insight of the ability of the business to pay off its short term business

debts (Saleem and Rehman, 2011). The current ratio and the quick ratios are regarded as the

prime ratios to evaluate the liquidity position of an enterprise. The current ratio depicts the

proportion of the current assets of the company to the current liabilities and thus is useful in

the evaluation of the payment ability if the short term obligations. Quick ratio takes into

account the most liquid assets of the company (i.e. excluding the inventories) as proportion to

the current liabilities. A comparative position of the liquidity of the Royal Mail Plc. has been

described as follows, with the aid of the graph and data belonging to the last five years.

The above graphs describe the comparatives for five years, the data of which is provided in

the appendix below. The cash and cash equivalents, amounting to around £ 600 million

2018 2017 2016 2015 2014

-

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

Current Ratio

Royal Mail Plc

2018 2017 2016 2015 2014

-

0.20

0.40

0.60

0.80

1.00

Quick Ratio

Royal Mail Plc

Liquidity

Liquidity position of an enterprise is one of the most fundamental characteristics of a

business. This gives an insight of the ability of the business to pay off its short term business

debts (Saleem and Rehman, 2011). The current ratio and the quick ratios are regarded as the

prime ratios to evaluate the liquidity position of an enterprise. The current ratio depicts the

proportion of the current assets of the company to the current liabilities and thus is useful in

the evaluation of the payment ability if the short term obligations. Quick ratio takes into

account the most liquid assets of the company (i.e. excluding the inventories) as proportion to

the current liabilities. A comparative position of the liquidity of the Royal Mail Plc. has been

described as follows, with the aid of the graph and data belonging to the last five years.

The above graphs describe the comparatives for five years, the data of which is provided in

the appendix below. The cash and cash equivalents, amounting to around £ 600 million

2018 2017 2016 2015 2014

-

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

Current Ratio

Royal Mail Plc

2018 2017 2016 2015 2014

-

0.20

0.40

0.60

0.80

1.00

Quick Ratio

Royal Mail Plc

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REPORT 6

(Yahoo Finance, 2018), own the major portion of the current assets of the year 2018 for the

entity Royal Mail Plc. The cash and the cash equivalents of the year 2018 are almost double

than that of the year 2017, depicting a better liquidity position of the enterprise. In addition,

the other current assets are at a better place than the previous year, together leading to the

increase in the overall current assets of the enterprise and the current ratio. Another major

contributory towards the better current ratio in the year 2018 is the reduction in the amount of

the short-term debt.

The quick ratio changes are at the same pace as that of the current ratio change because of the

consistency in the amount of the inventories over the years, as depicted in the data in the

appendix.

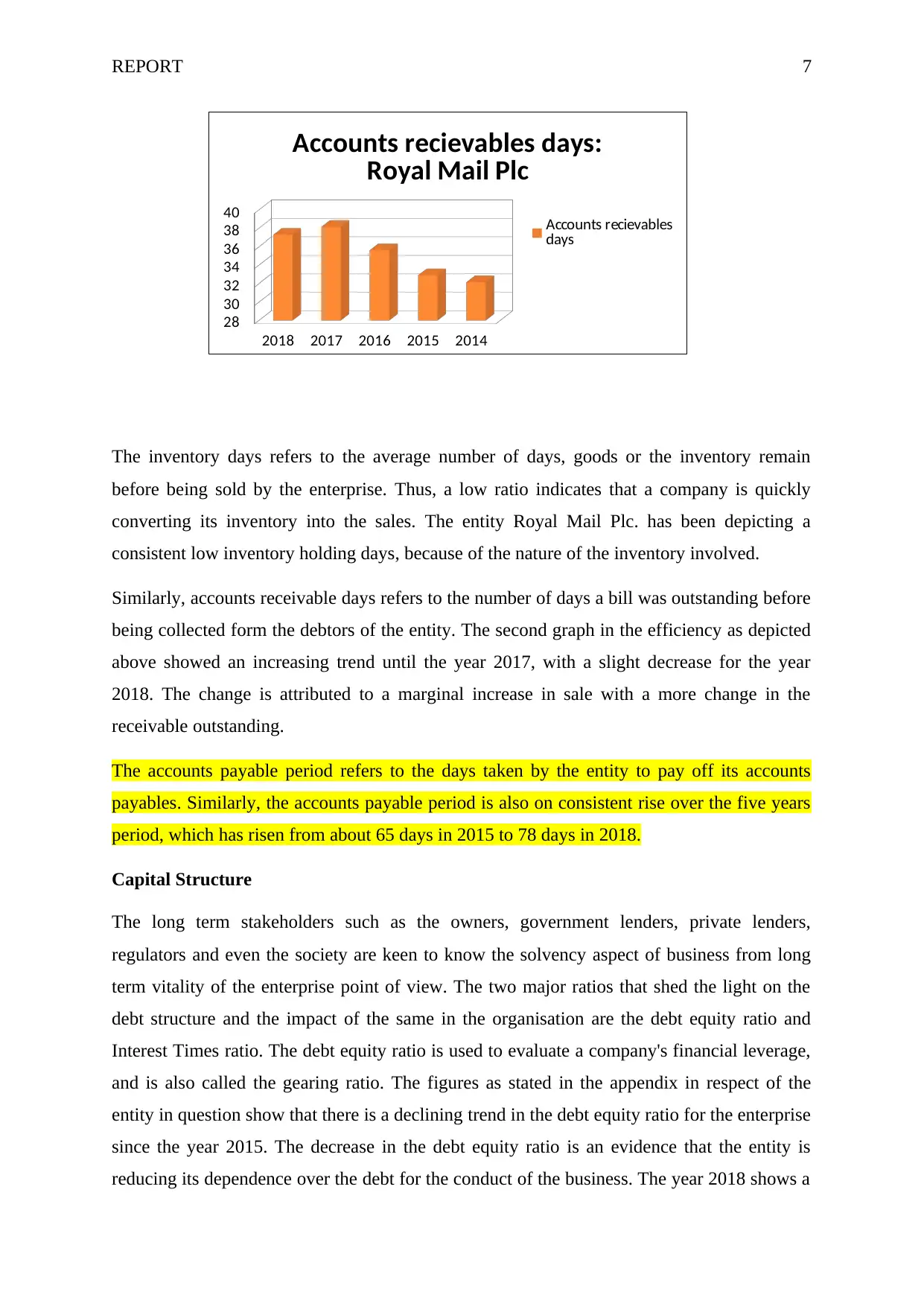

Efficiency or the Working Capital Management

The efficiency ratio analyse the ability of an enterprise to make use of the various

assets and resources. The efficiency ratios make use of the comparison of the assets owned by

the entity with that of the revenues or the profit performances (Agha, 2014). Thus these

category of ratios inform the investors about the company's ability to utilise what it has

owned in order to generate the most profit possible for owners and shareholders. There are a

various kinds of efficiency ratios namely the asset turnover ratio, the inventory turnover ratio,

the fixed asset turnover ratio, and others. Either the ratios are stated in number of times, or

the number of days. The following two graphs give a glimpse of two prime efficiency ratios

and the trend over the period of five years.

2018 2017 2016 2015 2014

1

1

1

Inventory holding: Royal Mail

Plc

Inventory holding days

(Yahoo Finance, 2018), own the major portion of the current assets of the year 2018 for the

entity Royal Mail Plc. The cash and the cash equivalents of the year 2018 are almost double

than that of the year 2017, depicting a better liquidity position of the enterprise. In addition,

the other current assets are at a better place than the previous year, together leading to the

increase in the overall current assets of the enterprise and the current ratio. Another major

contributory towards the better current ratio in the year 2018 is the reduction in the amount of

the short-term debt.

The quick ratio changes are at the same pace as that of the current ratio change because of the

consistency in the amount of the inventories over the years, as depicted in the data in the

appendix.

Efficiency or the Working Capital Management

The efficiency ratio analyse the ability of an enterprise to make use of the various

assets and resources. The efficiency ratios make use of the comparison of the assets owned by

the entity with that of the revenues or the profit performances (Agha, 2014). Thus these

category of ratios inform the investors about the company's ability to utilise what it has

owned in order to generate the most profit possible for owners and shareholders. There are a

various kinds of efficiency ratios namely the asset turnover ratio, the inventory turnover ratio,

the fixed asset turnover ratio, and others. Either the ratios are stated in number of times, or

the number of days. The following two graphs give a glimpse of two prime efficiency ratios

and the trend over the period of five years.

2018 2017 2016 2015 2014

1

1

1

Inventory holding: Royal Mail

Plc

Inventory holding days

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 7

The inventory days refers to the average number of days, goods or the inventory remain

before being sold by the enterprise. Thus, a low ratio indicates that a company is quickly

converting its inventory into the sales. The entity Royal Mail Plc. has been depicting a

consistent low inventory holding days, because of the nature of the inventory involved.

Similarly, accounts receivable days refers to the number of days a bill was outstanding before

being collected form the debtors of the entity. The second graph in the efficiency as depicted

above showed an increasing trend until the year 2017, with a slight decrease for the year

2018. The change is attributed to a marginal increase in sale with a more change in the

receivable outstanding.

The accounts payable period refers to the days taken by the entity to pay off its accounts

payables. Similarly, the accounts payable period is also on consistent rise over the five years

period, which has risen from about 65 days in 2015 to 78 days in 2018.

Capital Structure

The long term stakeholders such as the owners, government lenders, private lenders,

regulators and even the society are keen to know the solvency aspect of business from long

term vitality of the enterprise point of view. The two major ratios that shed the light on the

debt structure and the impact of the same in the organisation are the debt equity ratio and

Interest Times ratio. The debt equity ratio is used to evaluate a company's financial leverage,

and is also called the gearing ratio. The figures as stated in the appendix in respect of the

entity in question show that there is a declining trend in the debt equity ratio for the enterprise

since the year 2015. The decrease in the debt equity ratio is an evidence that the entity is

reducing its dependence over the debt for the conduct of the business. The year 2018 shows a

2018 2017 2016 2015 2014

28

30

32

34

36

38

40

Accounts recievables days:

Royal Mail Plc

Accounts recievables

days

The inventory days refers to the average number of days, goods or the inventory remain

before being sold by the enterprise. Thus, a low ratio indicates that a company is quickly

converting its inventory into the sales. The entity Royal Mail Plc. has been depicting a

consistent low inventory holding days, because of the nature of the inventory involved.

Similarly, accounts receivable days refers to the number of days a bill was outstanding before

being collected form the debtors of the entity. The second graph in the efficiency as depicted

above showed an increasing trend until the year 2017, with a slight decrease for the year

2018. The change is attributed to a marginal increase in sale with a more change in the

receivable outstanding.

The accounts payable period refers to the days taken by the entity to pay off its accounts

payables. Similarly, the accounts payable period is also on consistent rise over the five years

period, which has risen from about 65 days in 2015 to 78 days in 2018.

Capital Structure

The long term stakeholders such as the owners, government lenders, private lenders,

regulators and even the society are keen to know the solvency aspect of business from long

term vitality of the enterprise point of view. The two major ratios that shed the light on the

debt structure and the impact of the same in the organisation are the debt equity ratio and

Interest Times ratio. The debt equity ratio is used to evaluate a company's financial leverage,

and is also called the gearing ratio. The figures as stated in the appendix in respect of the

entity in question show that there is a declining trend in the debt equity ratio for the enterprise

since the year 2015. The decrease in the debt equity ratio is an evidence that the entity is

reducing its dependence over the debt for the conduct of the business. The year 2018 shows a

2018 2017 2016 2015 2014

28

30

32

34

36

38

40

Accounts recievables days:

Royal Mail Plc

Accounts recievables

days

REPORT 8

drastic reduction in the entity’s other liabilities, and hence the fall. On the lines of the same, it

must be noted that the interest time’s ratio has significantly reduced from the financial year

2017 to the financial year 2018. The change is of almost 50 percent.

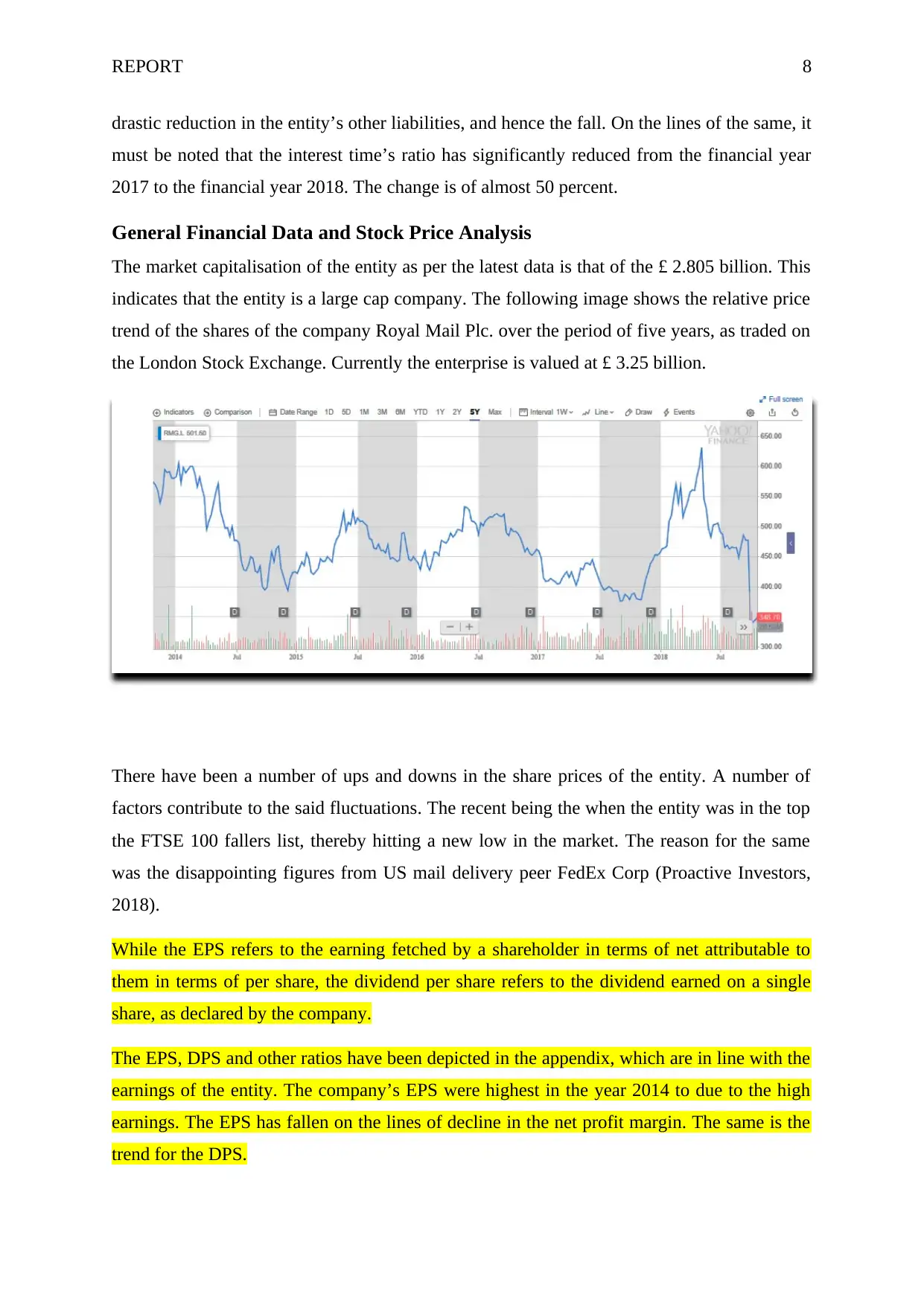

General Financial Data and Stock Price Analysis

The market capitalisation of the entity as per the latest data is that of the £ 2.805 billion. This

indicates that the entity is a large cap company. The following image shows the relative price

trend of the shares of the company Royal Mail Plc. over the period of five years, as traded on

the London Stock Exchange. Currently the enterprise is valued at £ 3.25 billion.

There have been a number of ups and downs in the share prices of the entity. A number of

factors contribute to the said fluctuations. The recent being the when the entity was in the top

the FTSE 100 fallers list, thereby hitting a new low in the market. The reason for the same

was the disappointing figures from US mail delivery peer FedEx Corp (Proactive Investors,

2018).

While the EPS refers to the earning fetched by a shareholder in terms of net attributable to

them in terms of per share, the dividend per share refers to the dividend earned on a single

share, as declared by the company.

The EPS, DPS and other ratios have been depicted in the appendix, which are in line with the

earnings of the entity. The company’s EPS were highest in the year 2014 to due to the high

earnings. The EPS has fallen on the lines of decline in the net profit margin. The same is the

trend for the DPS.

drastic reduction in the entity’s other liabilities, and hence the fall. On the lines of the same, it

must be noted that the interest time’s ratio has significantly reduced from the financial year

2017 to the financial year 2018. The change is of almost 50 percent.

General Financial Data and Stock Price Analysis

The market capitalisation of the entity as per the latest data is that of the £ 2.805 billion. This

indicates that the entity is a large cap company. The following image shows the relative price

trend of the shares of the company Royal Mail Plc. over the period of five years, as traded on

the London Stock Exchange. Currently the enterprise is valued at £ 3.25 billion.

There have been a number of ups and downs in the share prices of the entity. A number of

factors contribute to the said fluctuations. The recent being the when the entity was in the top

the FTSE 100 fallers list, thereby hitting a new low in the market. The reason for the same

was the disappointing figures from US mail delivery peer FedEx Corp (Proactive Investors,

2018).

While the EPS refers to the earning fetched by a shareholder in terms of net attributable to

them in terms of per share, the dividend per share refers to the dividend earned on a single

share, as declared by the company.

The EPS, DPS and other ratios have been depicted in the appendix, which are in line with the

earnings of the entity. The company’s EPS were highest in the year 2014 to due to the high

earnings. The EPS has fallen on the lines of decline in the net profit margin. The same is the

trend for the DPS.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REPORT 9

However, the market value of shares is on consistent rise and that is a positive sign. The price

earnings ratio refers to the ratio of market price of a company’s share to its earning per share.

Accordingly, the price earnings ratio of the company has improved over the five years. The

increasing trend in the price earnings ratio indicates that the investors are bullish on the stock

and are expecting from the company to post higher earnings. The dividend yield is the ratio

of a company's annual dividend compared to its share price. The high dividend yields are

stated to be attractive. Lower dividend in the year 2018 has dragged down the dividend yield

as well, as compared to the year 2017.

Conclusion

As per the discussions conducted in the previous parts, it can be concluded that the

preparation and the presentation of the financial statements forms the integral part of the

businesses. These are essential not only in terms of the fair representation of the transactions

and events to the various stakeholders, but also make the entities accountable towards the

regulators of the accounting and the compliance provisions. It must further be noted that the

analysis of such financial statements assist the stakeholders in gaining the useful information

about the business enterprise on the lines of investment, financial wellness and the overall

competitiveness in the industry to which an entity relates. The report was an attempt to

analyse the financial data of the entity Royal Mail Plc, which is a popular name in the courier

and postal service industry. The ratio analysis technique was adopted for the analysis and the

same was presented with the aid of the graphical representations. The various ratios gave an

insight of the various facets such as the capital structure, the effectiveness of the utilisation of

the assets, the ability to pay off the debts and many more.

It has been recommended to the company to manage its short term liabilities and assets in a

better way, as the accounts receivable and payable periods are on rising trends, as shown by

the ratio analysis. The increasing trend in these ratios is an alarming trend for the entity.

In addition, a brief evaluation of the market vitals was done. Thus, it can be stated that

financial analysis serves a number of purposes for various stakeholders.

However, the market value of shares is on consistent rise and that is a positive sign. The price

earnings ratio refers to the ratio of market price of a company’s share to its earning per share.

Accordingly, the price earnings ratio of the company has improved over the five years. The

increasing trend in the price earnings ratio indicates that the investors are bullish on the stock

and are expecting from the company to post higher earnings. The dividend yield is the ratio

of a company's annual dividend compared to its share price. The high dividend yields are

stated to be attractive. Lower dividend in the year 2018 has dragged down the dividend yield

as well, as compared to the year 2017.

Conclusion

As per the discussions conducted in the previous parts, it can be concluded that the

preparation and the presentation of the financial statements forms the integral part of the

businesses. These are essential not only in terms of the fair representation of the transactions

and events to the various stakeholders, but also make the entities accountable towards the

regulators of the accounting and the compliance provisions. It must further be noted that the

analysis of such financial statements assist the stakeholders in gaining the useful information

about the business enterprise on the lines of investment, financial wellness and the overall

competitiveness in the industry to which an entity relates. The report was an attempt to

analyse the financial data of the entity Royal Mail Plc, which is a popular name in the courier

and postal service industry. The ratio analysis technique was adopted for the analysis and the

same was presented with the aid of the graphical representations. The various ratios gave an

insight of the various facets such as the capital structure, the effectiveness of the utilisation of

the assets, the ability to pay off the debts and many more.

It has been recommended to the company to manage its short term liabilities and assets in a

better way, as the accounts receivable and payable periods are on rising trends, as shown by

the ratio analysis. The increasing trend in these ratios is an alarming trend for the entity.

In addition, a brief evaluation of the market vitals was done. Thus, it can be stated that

financial analysis serves a number of purposes for various stakeholders.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 10

References

Agha, H., (2014) Impact of working capital management on Profitability. European

Scientific Journal, ESJ, 10(1).

Bragg, S. M. (2012) Financial analysis: a controller's guide. UK: John Wiley & Sons.

Delen, D., Kuzey, C., and Uyar, A. (2013) Measuring firm performance using financial

ratios: A decision tree approach. Expert Systems with Applications, 40(10), pp. 3970-3983.

Fabozzi, F. J. and Drake, P. P. (2009) Finance: Capital Markets, Financial Management,

and Investment Management. UK: John Wiley & Sons.

Fridson, M. S. and Alvarez, F. (2011) Financial statement analysis: a practitioner's

guide (Vol. 597). UK: John Wiley & Sons.

Gill, A., Biger, N. and Mathur, N. (2010) The relationship between working capital

management and profitability: Evidence from the United States. Business and economics

journal, 10(1), pp. 1-9.

Hillier, D., Grinblatt, M., & Titman, S. (2011). Financial markets and corporate

strategy (No. 2nd Eu). UK: McGraw Hill.

Proactive Investors (2018) Royal Mail shares hit new record low as investors react to

disappointing numbers from FedEx. [online] Available from:

https://www.proactiveinvestors.co.uk/companies/news/211485/royal-mail-shares-hit-new-

record-low-as-investors-react-to-disappointing-numbers-from-fedex-211485.html [Accessed

on 24 December 2018].

Robinson, T. R., Henry, E., Pirie, W. L., and Broihahn, M. A. (2015) International Financial

Statement Analysis Workbook. UK: John Wiley & Sons.

References

Agha, H., (2014) Impact of working capital management on Profitability. European

Scientific Journal, ESJ, 10(1).

Bragg, S. M. (2012) Financial analysis: a controller's guide. UK: John Wiley & Sons.

Delen, D., Kuzey, C., and Uyar, A. (2013) Measuring firm performance using financial

ratios: A decision tree approach. Expert Systems with Applications, 40(10), pp. 3970-3983.

Fabozzi, F. J. and Drake, P. P. (2009) Finance: Capital Markets, Financial Management,

and Investment Management. UK: John Wiley & Sons.

Fridson, M. S. and Alvarez, F. (2011) Financial statement analysis: a practitioner's

guide (Vol. 597). UK: John Wiley & Sons.

Gill, A., Biger, N. and Mathur, N. (2010) The relationship between working capital

management and profitability: Evidence from the United States. Business and economics

journal, 10(1), pp. 1-9.

Hillier, D., Grinblatt, M., & Titman, S. (2011). Financial markets and corporate

strategy (No. 2nd Eu). UK: McGraw Hill.

Proactive Investors (2018) Royal Mail shares hit new record low as investors react to

disappointing numbers from FedEx. [online] Available from:

https://www.proactiveinvestors.co.uk/companies/news/211485/royal-mail-shares-hit-new-

record-low-as-investors-react-to-disappointing-numbers-from-fedex-211485.html [Accessed

on 24 December 2018].

Robinson, T. R., Henry, E., Pirie, W. L., and Broihahn, M. A. (2015) International Financial

Statement Analysis Workbook. UK: John Wiley & Sons.

REPORT 11

Saleem, Q. and Rehman, R. U. (2011) Impacts of liquidity ratios on

profitability. Interdisciplinary Journal of Research in Business, 1(7), pp. 95-98.

Stickney, C. P., Weil, R. L., Schipper, K., Francis, J. (2009) Financial Accounting: An

Introduction to Concepts, Methods and Uses. Boston MA: Cengage Learning.

Yahoo Finance (2018a) Royal Mail plc (RMG.L). [online] Available from:

https://uk.finance.yahoo.com/quote/RMG.L/balance-sheet?p=RMG.L [Accessed on 24

December 2018].

Yahoo Finance (2018b) Royal Mail plc (RMG.L). [online] Available from:

https://uk.finance.yahoo.com/quote/RMG.L/history?

period1=1396117800&period2=1522348200&interval=1mo&filter=history&frequency=1mo

[Accessed on 27 December 2018].

Saleem, Q. and Rehman, R. U. (2011) Impacts of liquidity ratios on

profitability. Interdisciplinary Journal of Research in Business, 1(7), pp. 95-98.

Stickney, C. P., Weil, R. L., Schipper, K., Francis, J. (2009) Financial Accounting: An

Introduction to Concepts, Methods and Uses. Boston MA: Cengage Learning.

Yahoo Finance (2018a) Royal Mail plc (RMG.L). [online] Available from:

https://uk.finance.yahoo.com/quote/RMG.L/balance-sheet?p=RMG.L [Accessed on 24

December 2018].

Yahoo Finance (2018b) Royal Mail plc (RMG.L). [online] Available from:

https://uk.finance.yahoo.com/quote/RMG.L/history?

period1=1396117800&period2=1522348200&interval=1mo&filter=history&frequency=1mo

[Accessed on 27 December 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.