Evaluating Financial Performance: GlaxoSmithKline, Shire, Astrazeneca

VerifiedAdded on 2023/06/13

Accounting and Finance for Managers

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Table of Contents

Question 1:.........................................................................................................................2

Answer to Part (a):.........................................................................................................2

Answer to Part (b):.......................................................................................................12

Answer to Part (c):.......................................................................................................14

Question 2:.......................................................................................................................14

Answer to Part (a):.......................................................................................................15

Answer to Part (b):.......................................................................................................16

References:......................................................................................................................19

Appendices:.....................................................................................................................22

Question 1:

The current section aims to evaluate the financial performance of the three top

pharmaceutical organisations in UK for which the financial ratios and non-financial ratios

are taken into consideration. These three organisations comprise of GlaxoSmithKline

Plc, Shire Plc and Astrazeneca Plc.

Answer to Part (a):

For evaluating the financial position and performance of the three selected

organisations, the following ratios are taken into consideration:

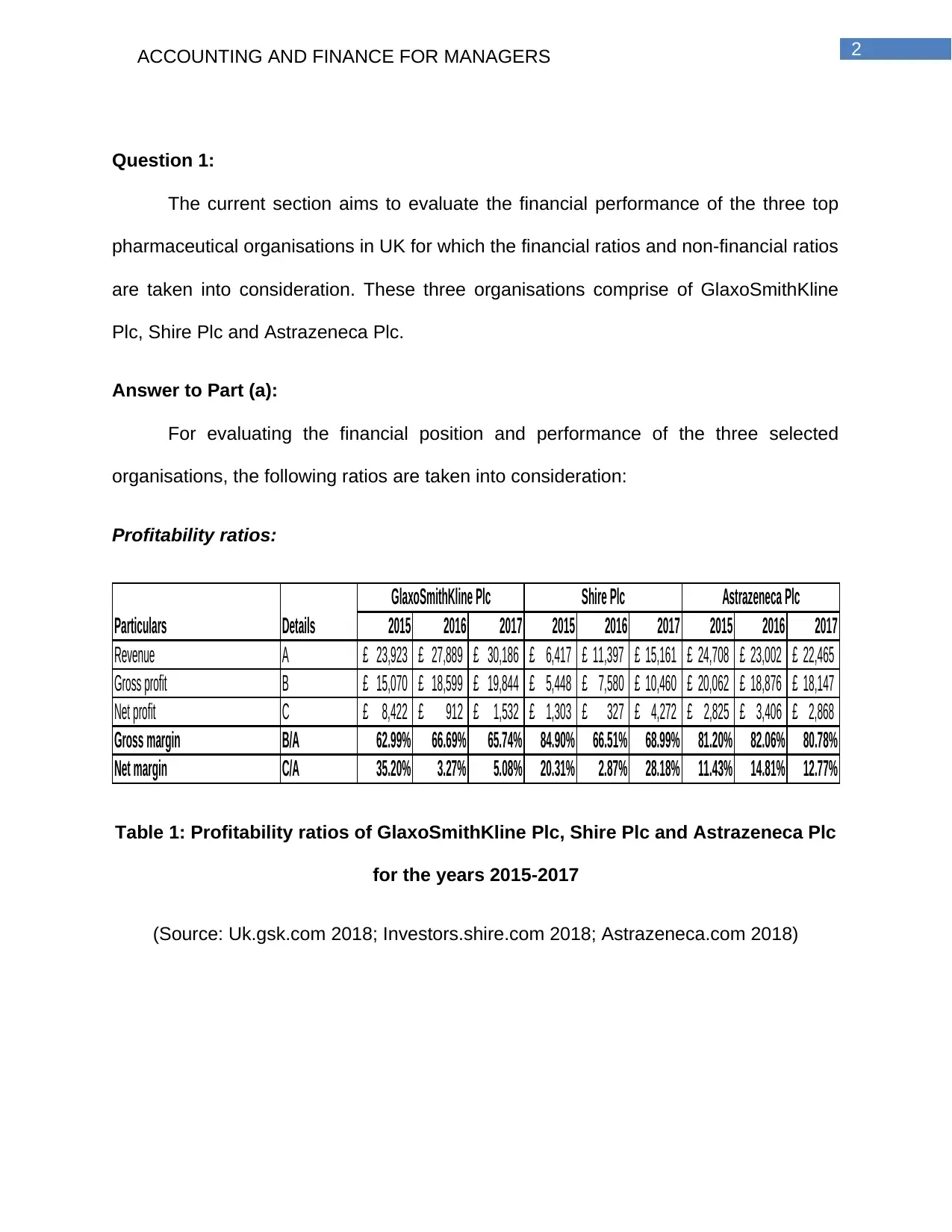

Profitability ratios:

2015 2016 2017 2015 2016 2017 2015 2016 2017

Revenue A 23,923£ 27,889£ 30,186£ 6,417£ 11,397£ 15,161£ 24,708£ 23,002£ 22,465£

Gross profit B 15,070£ 18,599£ 19,844£ 5,448£ 7,580£ 10,460£ 20,062£ 18,876£ 18,147£

Net profit C 8,422£ 912£ 1,532£ 1,303£ 327£ 4,272£ 2,825£ 3,406£ 2,868£

Gross margin B/A 62.99% 66.69% 65.74% 84.90% 66.51% 68.99% 81.20% 82.06% 80.78%

Net margin C/A 35.20% 3.27% 5.08% 20.31% 2.87% 28.18% 11.43% 14.81% 12.77%

GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Particulars Details

Table 1: Profitability ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2015 2016 2017 2015 2016 2017 2015 2016 2017

GlaxoSmithKline

Plc Shire Plc Astrazeneca Plc

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

Profitability Ratios

Gross margin

Net margin

Figure 1: Profitability ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca

Plc for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

Based on the above figure, it could be evaluated that the gross margin of

GlaxoSmithKline Plc has increased from 62.99% in 2015 to 66.69% in 2016; however, it

has declined slightly to 65.74% in 2017. On the other hand, the ratio of Shire Plc has

fallen significantly from 84.90% in 2015 to 66.51% in 2016; however, it has increased

slightly to 68.99% in 2017. In case of Astrazeneca Plc, the gross margin has increased

from 81.20% in 2015 to 82.06% in 2016; however, the decline is slightly inherent to

80.78% in 2017.

With the help of gross margin, it is possible for the organisations in gauging their

production costs in relation to their revenues (Vogel 2014). The higher the margin, the

better it is for the organisation. In this case, Astrazeneca Plc is leading in terms of gross

margin followed by Shire Plc and GlaxoSmithKline Plc.

Paraphrase This Document

The net margin of GlaxoSmithKline Plc has fallen drastically to 3.27% in 2016

from 35.20% in 2015; however, it has increased to 5.08% in 2017. The trend is similar in

case of Shire Plc as well; however, the only exception is Astrazeneca Plc, as its net

margin has increased in 2016 compared to the previous year and it has declined in

2017. Net margin is the income that an organisation makes after it has incurred all

expenses and taxes (Warren and Jones 2018). In terms of net margin, Shire Plc is the

leading organisation, since its net margin has increased massively in 2017.

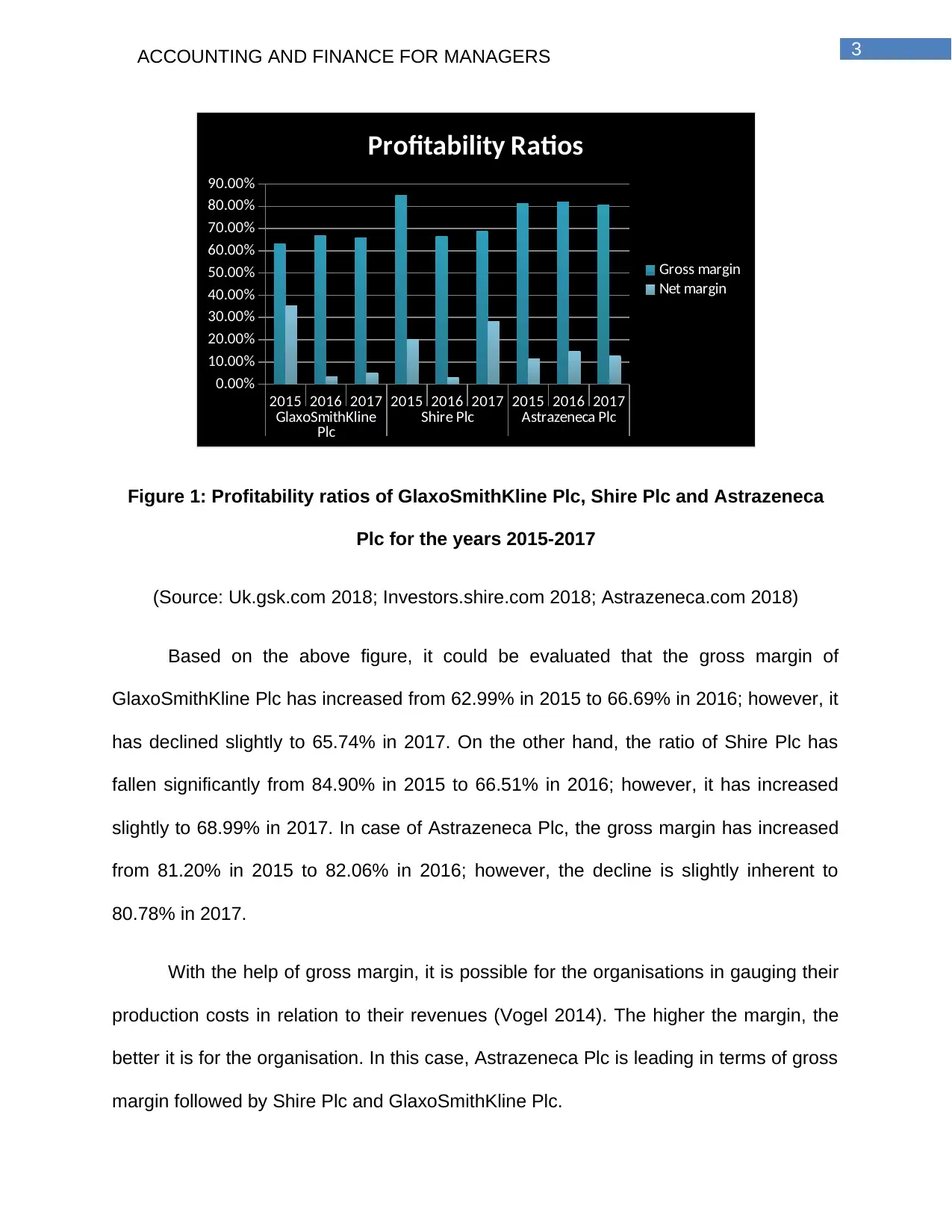

Liquidity ratios:

2015 2016 2017 2015 2016 2017 2015 2016 2017

Current assets A 16,587£ 16,711£ 15,907£ 2,256£ 7,540£ 7,608£ 16,007£ 13,262£ 13,150£

Inventories B 4,716£ 5,102£ 5,557£ 635£ 3,562£ 3,292£ 2,143£ 2,334£ 3,035£

Current liabilities C 13,417£ 19,001£ 26,569£ 3,706£ 7,743£ 7,882£ 14,869£ 15,256£ 16,383£

Current ratio A/C 1.24 0.88 0.60 0.61 0.97 0.97 1.08 0.87 0.80

Quick ratio (A-B)/C 0.88 0.61 0.39 0.44 0.51 0.55 0.93 0.72 0.62

Liquidity Ratios:-

Particulars Details

GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Table 2: Liquidity ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc for

the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

2015 2016 2017 2015 2016 2017 2015 2016 2017

GlaxoSmithKline

Plc Shire Plc Astrazeneca Plc

-

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Liquidity Ratios

Current ratio

Quick ratio

Figure 2: Liquidity ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

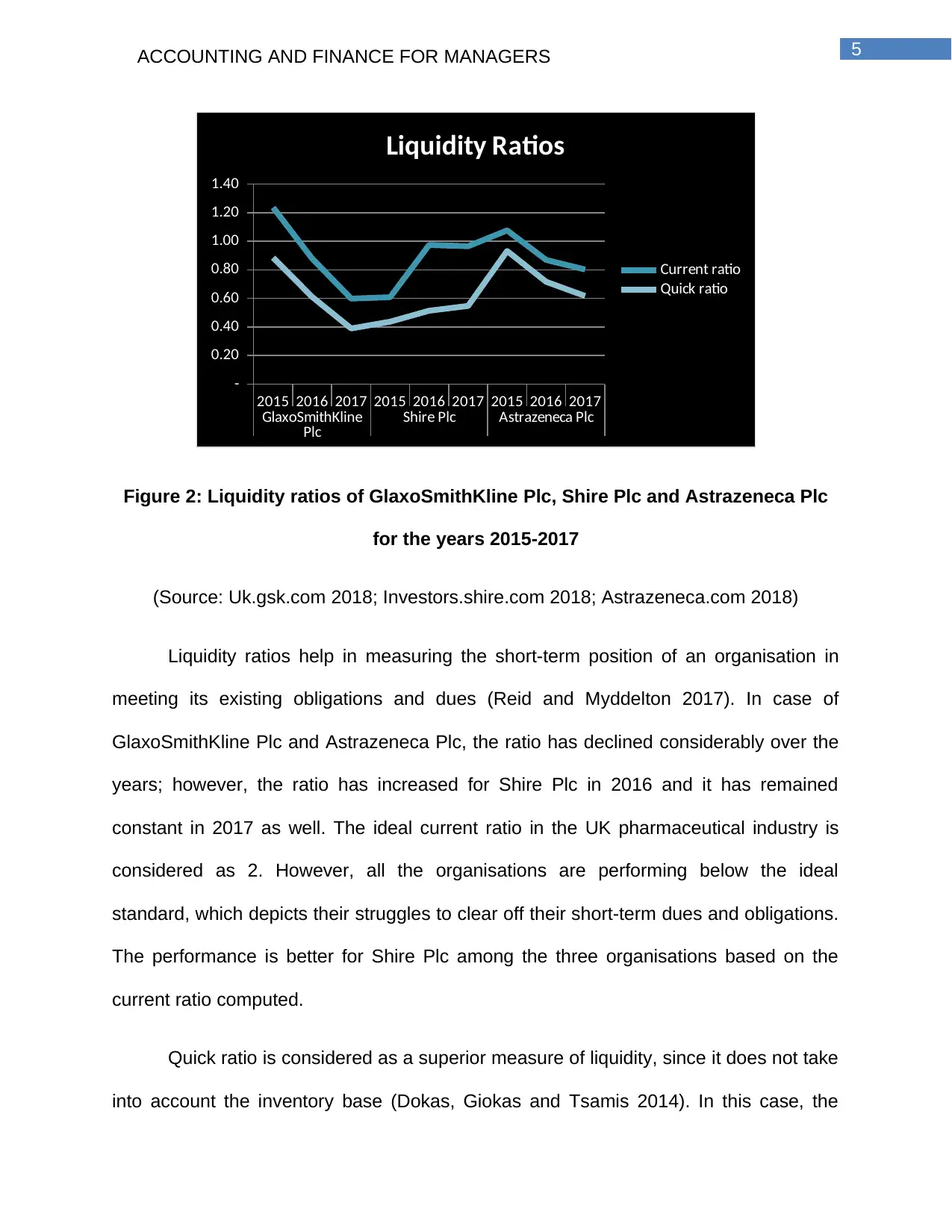

Liquidity ratios help in measuring the short-term position of an organisation in

meeting its existing obligations and dues (Reid and Myddelton 2017). In case of

GlaxoSmithKline Plc and Astrazeneca Plc, the ratio has declined considerably over the

years; however, the ratio has increased for Shire Plc in 2016 and it has remained

constant in 2017 as well. The ideal current ratio in the UK pharmaceutical industry is

considered as 2. However, all the organisations are performing below the ideal

standard, which depicts their struggles to clear off their short-term dues and obligations.

The performance is better for Shire Plc among the three organisations based on the

current ratio computed.

Quick ratio is considered as a superior measure of liquidity, since it does not take

into account the inventory base (Dokas, Giokas and Tsamis 2014). In this case, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

trend is similar for GlaxoSmithKline Plc, as the ratio has declined from 0.88 in 2015 to

0.61 in 2016 and 0.39 in 2017. However, the ratio has increased for Shire Plc from 0.44

in 2015 to 0.51 in 2016 and 0.55 in 2017. Even though the ratio has declined from

Astrazeneca Plc, it is still higher compared to the other two organisations and higher the

ratio, the better is for the organisation. Hence, in terms of liquidity, Astrozeneca Plc is in

a better position in the UK pharmaceutical industry.

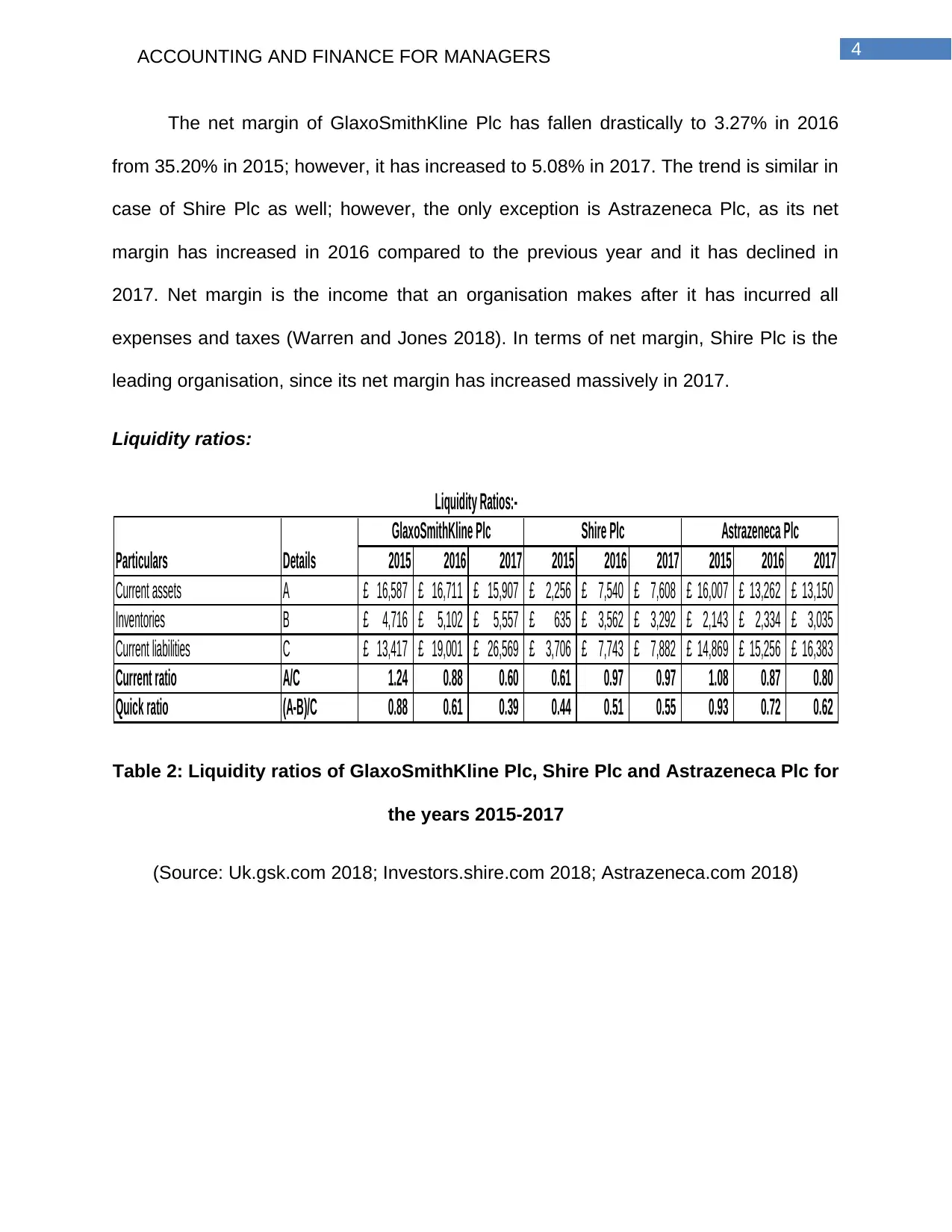

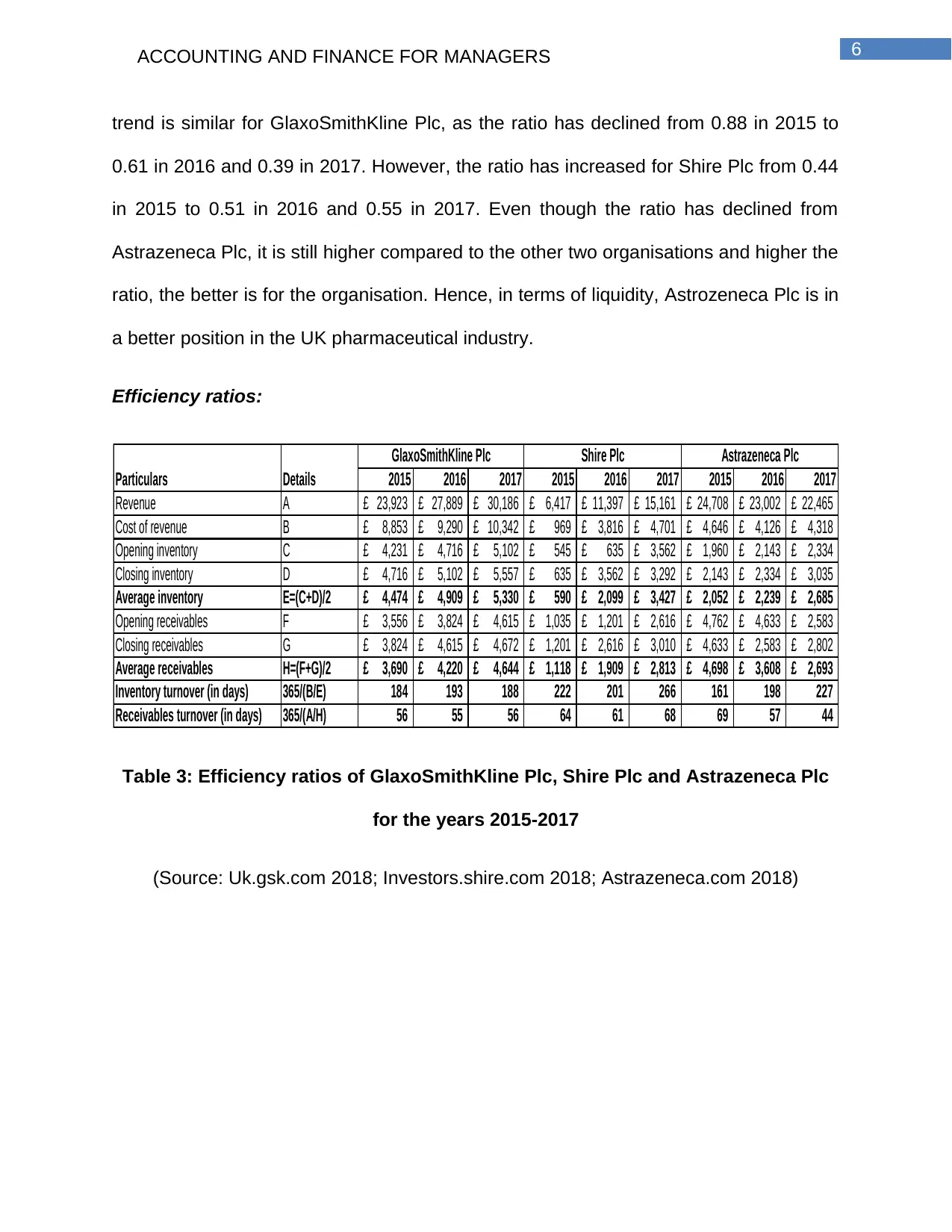

Efficiency ratios:

2015 2016 2017 2015 2016 2017 2015 2016 2017

Revenue A 23,923£ 27,889£ 30,186£ 6,417£ 11,397£ 15,161£ 24,708£ 23,002£ 22,465£

Cost of revenue B 8,853£ 9,290£ 10,342£ 969£ 3,816£ 4,701£ 4,646£ 4,126£ 4,318£

Opening inventory C 4,231£ 4,716£ 5,102£ 545£ 635£ 3,562£ 1,960£ 2,143£ 2,334£

Closing inventory D 4,716£ 5,102£ 5,557£ 635£ 3,562£ 3,292£ 2,143£ 2,334£ 3,035£

Average inventory E=(C+D)/2 4,474£ 4,909£ 5,330£ 590£ 2,099£ 3,427£ 2,052£ 2,239£ 2,685£

Opening receivables F 3,556£ 3,824£ 4,615£ 1,035£ 1,201£ 2,616£ 4,762£ 4,633£ 2,583£

Closing receivables G 3,824£ 4,615£ 4,672£ 1,201£ 2,616£ 3,010£ 4,633£ 2,583£ 2,802£

Average receivables H=(F+G)/2 3,690£ 4,220£ 4,644£ 1,118£ 1,909£ 2,813£ 4,698£ 3,608£ 2,693£

Inventory turnover (in days) 365/(B/E) 184 193 188 222 201 266 161 198 227

Receivables turnover (in days) 365/(A/H) 56 55 56 64 61 68 69 57 44

Particulars Details

GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Table 3: Efficiency ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

Paraphrase This Document

2015

2016

2017

2015

2016

2017

2015

2016

2017

GlaxoSmithKlin

e Plc Shire Plc Astrazeneca Plc

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Efficiency Ratios

Receivables turnover (in

days)

Inventory turnover (in

days)

Figure 3: Efficiency ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

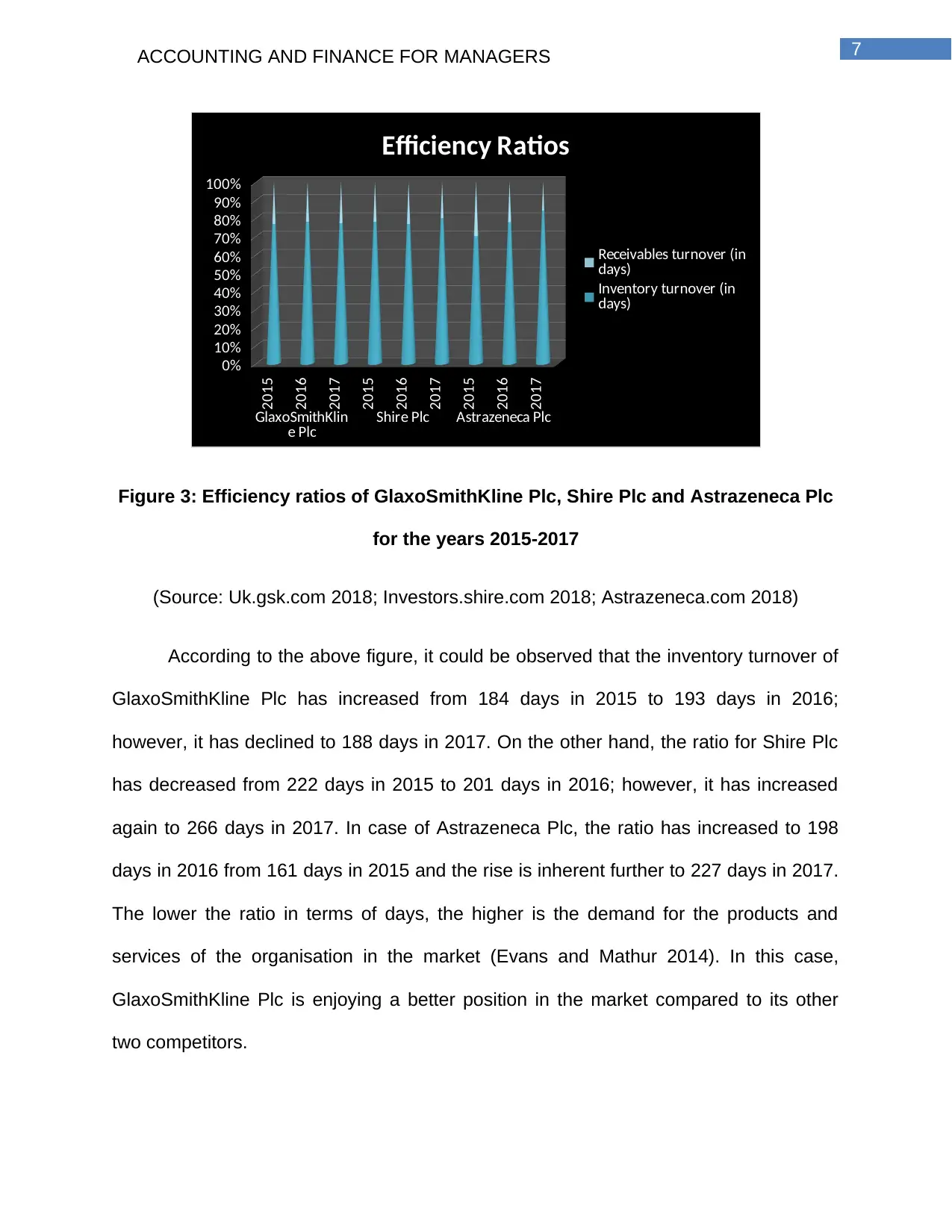

According to the above figure, it could be observed that the inventory turnover of

GlaxoSmithKline Plc has increased from 184 days in 2015 to 193 days in 2016;

however, it has declined to 188 days in 2017. On the other hand, the ratio for Shire Plc

has decreased from 222 days in 2015 to 201 days in 2016; however, it has increased

again to 266 days in 2017. In case of Astrazeneca Plc, the ratio has increased to 198

days in 2016 from 161 days in 2015 and the rise is inherent further to 227 days in 2017.

The lower the ratio in terms of days, the higher is the demand for the products and

services of the organisation in the market (Evans and Mathur 2014). In this case,

GlaxoSmithKline Plc is enjoying a better position in the market compared to its other

two competitors.

Receivables turnover denotes the time, in which an organisation collects its dues

from the customers for the products and services rendered at a past date (Almamy,

Aston and Ngwa 2016). The lower the ratio, the better it is for the organisation in

collecting cash from its customers to increase its working capital. In this case, the ratio

is lower for GlaxoSmithKline Plc and hence, in terms of efficiency, it could be inferred

that the organisation is enjoying competitive supremacy over the other two

organisations in the UK pharmaceutical industry.

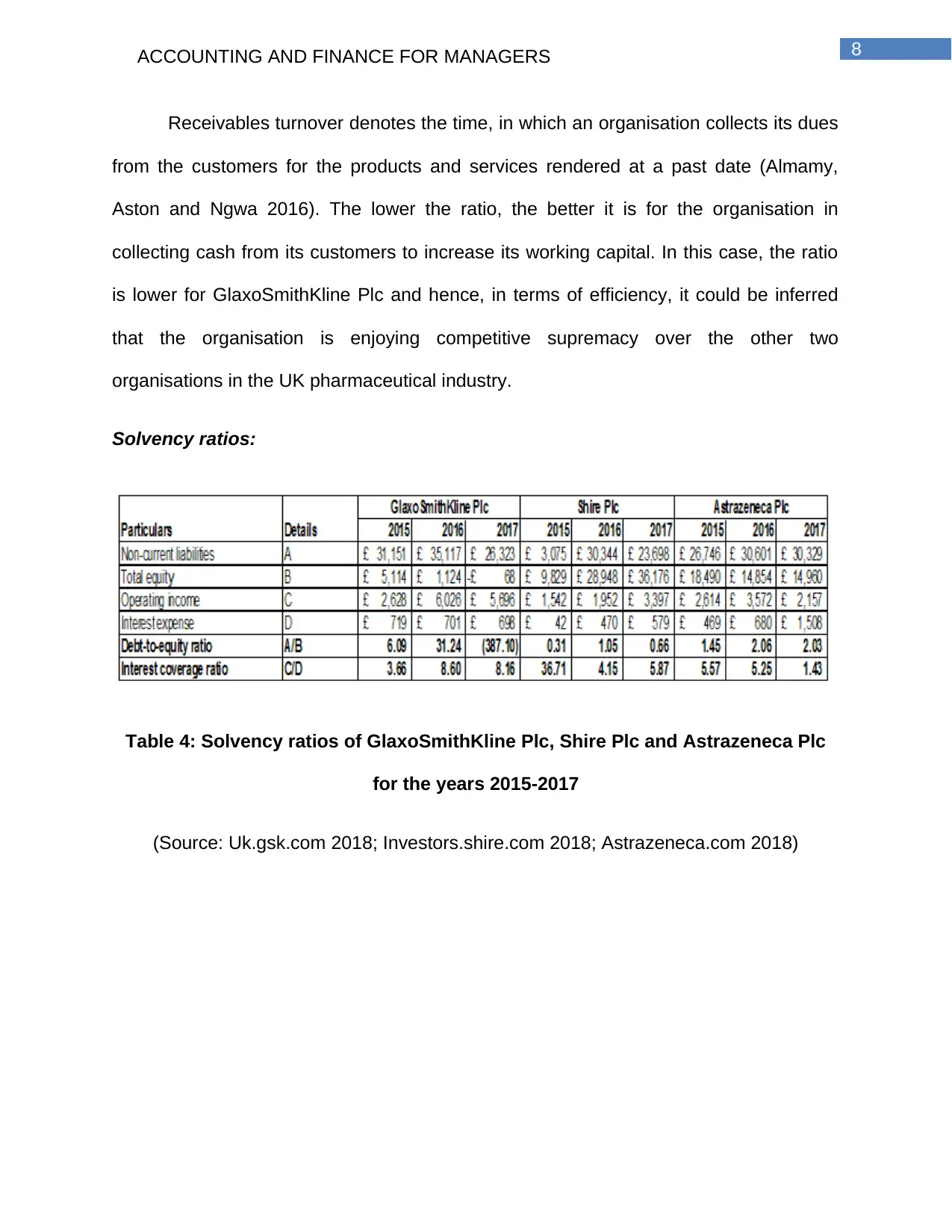

Solvency ratios:

Table 4: Solvency ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2015

2016

2017

2015

2016

2017

2015

2016

2017

GlaxoSmithKli

ne Plc Shire Plc Astrazeneca

Plc

-400.00

-350.00

-300.00

-250.00

-200.00

-150.00

-100.00

-50.00

-

50.00

Solvency Ratios

Interest coverage ratio

Debt-to-equity ratio

Figure 4: Solvency ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

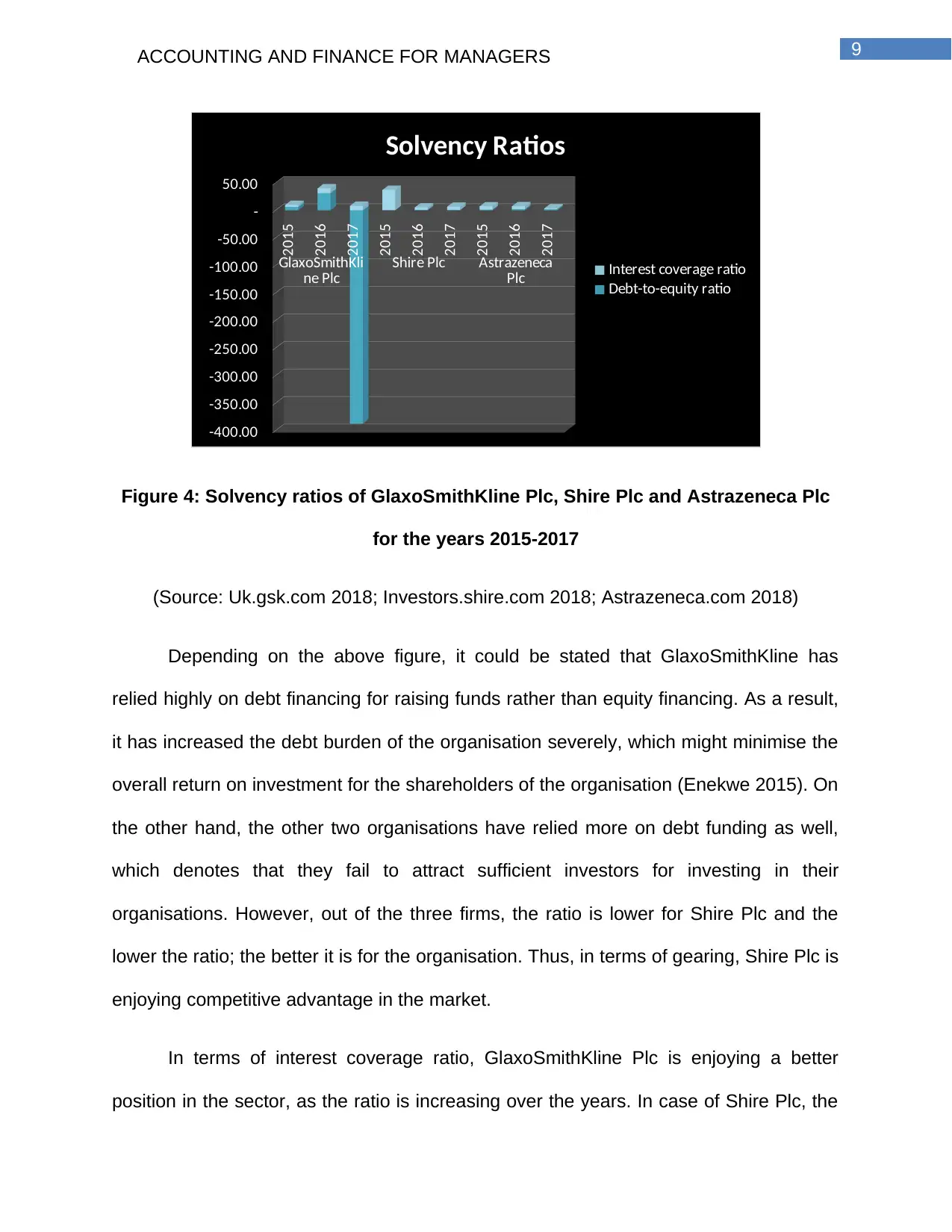

Depending on the above figure, it could be stated that GlaxoSmithKline has

relied highly on debt financing for raising funds rather than equity financing. As a result,

it has increased the debt burden of the organisation severely, which might minimise the

overall return on investment for the shareholders of the organisation (Enekwe 2015). On

the other hand, the other two organisations have relied more on debt funding as well,

which denotes that they fail to attract sufficient investors for investing in their

organisations. However, out of the three firms, the ratio is lower for Shire Plc and the

lower the ratio; the better it is for the organisation. Thus, in terms of gearing, Shire Plc is

enjoying competitive advantage in the market.

In terms of interest coverage ratio, GlaxoSmithKline Plc is enjoying a better

position in the sector, as the ratio is increasing over the years. In case of Shire Plc, the

Paraphrase This Document

ratio has fallen massively in 2016 even though a slight increase is observed in 2017.

For Astrazeneca Plc, the ratio has declined over the years. Hence, it could be stated

that GlaxoSmithKline has better capability of clearing off its financing cost with the help

of adequate operating income.

Investment ratios:

2015 2016 2017 2015 2016 2017 2015 2016 2017

Marke value per share A 0.4035£ 0.3779£ 0.3547£ 0.2050£ 0.1703£ 0.1551£ 0.3395£ 0.2732£ 0.3470£

Earnings per share B 3.49£ 0.38£ 0.63£ 6.62£ 1.29£ 14.13£ 2.23£ 2.77£ 2.37£

Annual dividend C 3,892£ 3,892£ 3,892£ 134.40£ 171.30£ 281.30£ 3,519£ 3,561£ 3,486£

Net profit D 8,422£ 912£ 1,532£ 1,303£ 327£ 4,272£ 2,825£ 3,406£ 2,868£

Price/earnings ratio A/B 0.12 0.99 0.56 0.03 0.13 0.01 0.15 0.10 0.15

Dividend payout ratio C/D 0.46 4.27 2.54 0.10 0.52 0.07 1.25 1.05 1.22

Particulars Details

GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Table 5: Investment ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

2015

2016

2017

2015

2016

2017

2015

2016

2017

GlaxoSmithKlin

e Plc Shire Plc Astrazeneca Plc

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

Investment Ratios

Price/earnings ratio

Dividend payout ratio

Figure 5: Investment ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

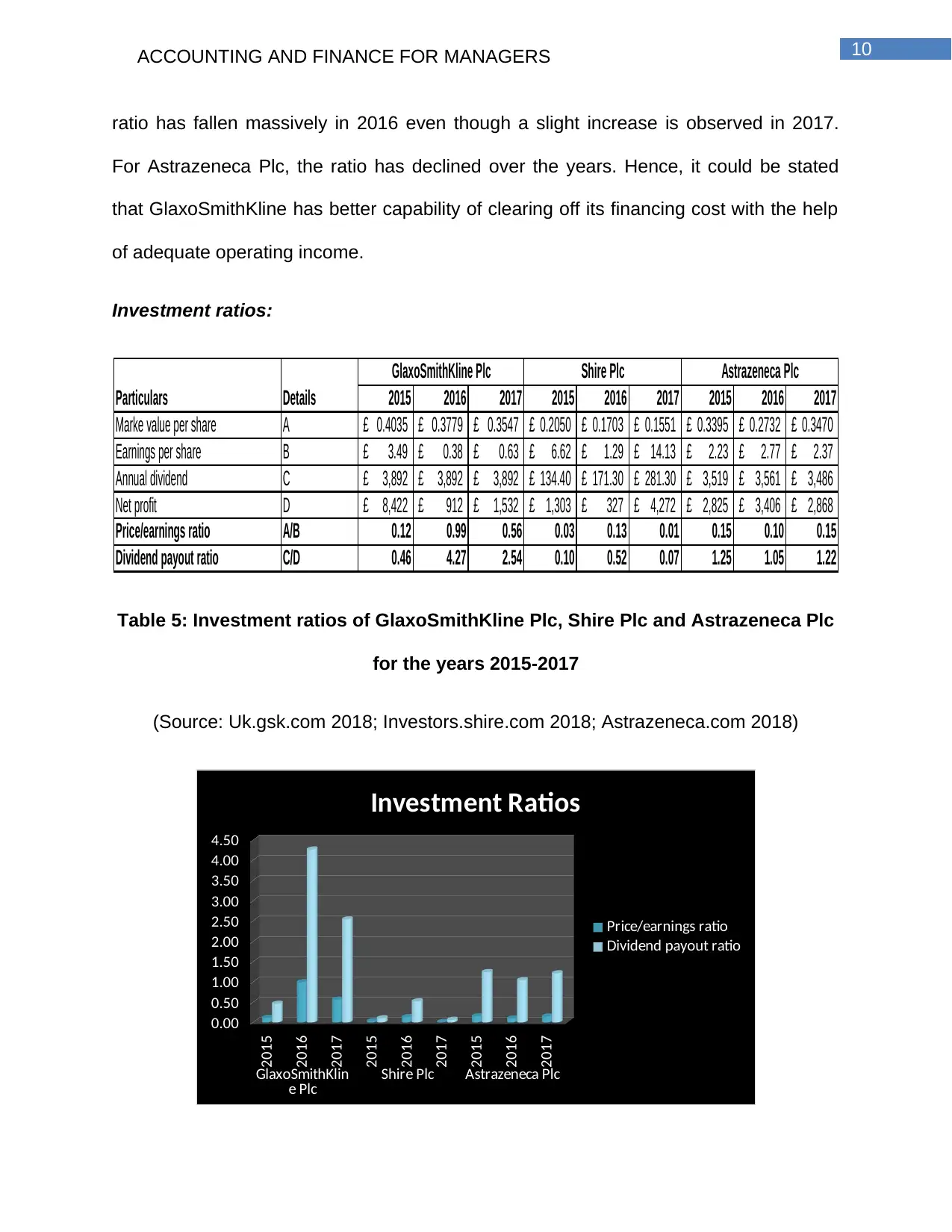

The price earnings ratio denotes the ability of a firm in generating adequate

returns in future to the shareholders (Lin et al. 2015). The higher the ratio, the better it is

for the organisation. In this case, GlaxoSmithKline is enjoying competitive advantage

over the two other chosen organisations as well, as its ratio is higher in contrast to

them. In addition, the dividend payout ratio is higher for GlaxoSmithKline as well, which

denotes that the organisation has maintained paying its dividends at a stable rate to its

shareholders despite the lowering income and falling demand in the market. Hence,

from the investing point of view, GlaxoSmithKline is in a favourable position in the UK

pharmaceuticals industry.

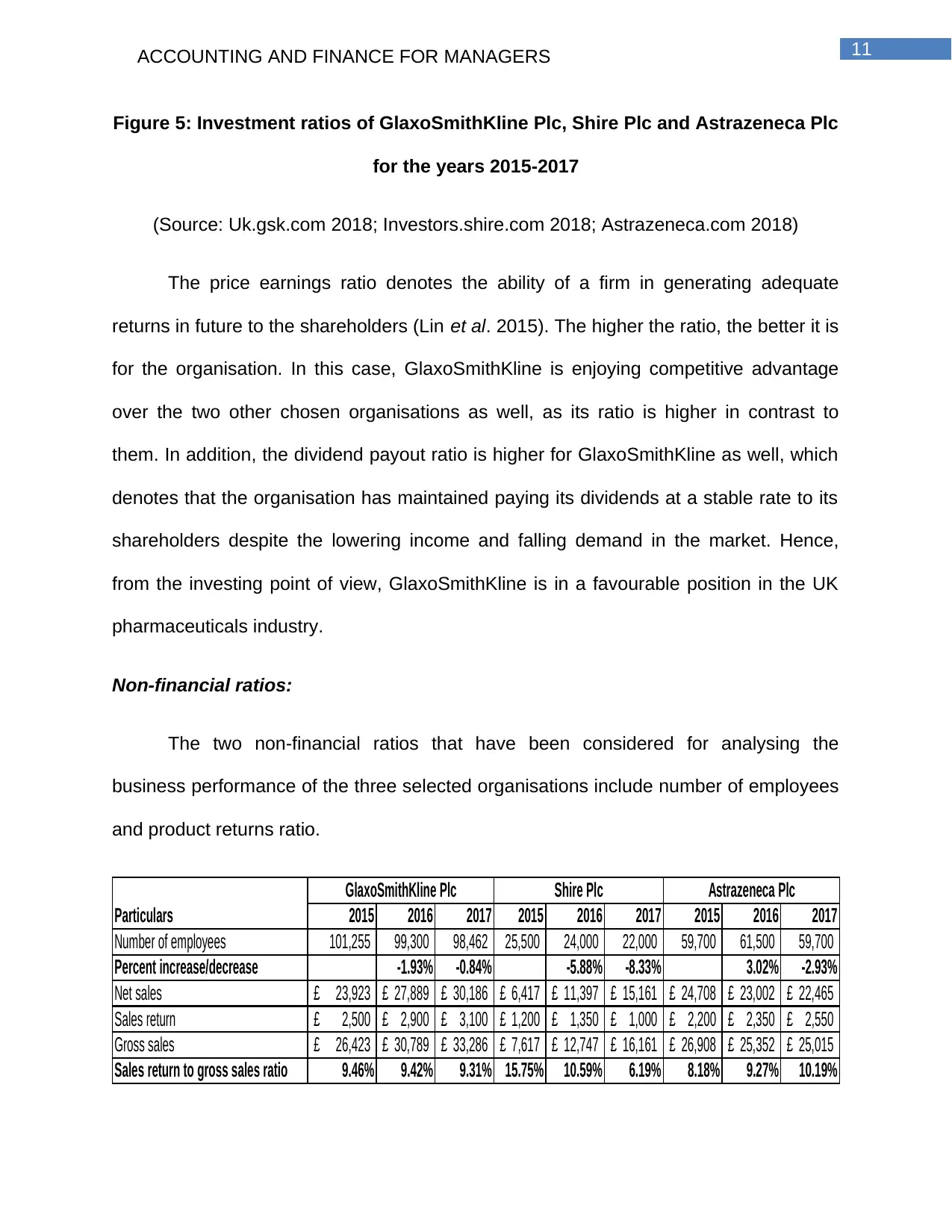

Non-financial ratios:

The two non-financial ratios that have been considered for analysing the

business performance of the three selected organisations include number of employees

and product returns ratio.

2015 2016 2017 2015 2016 2017 2015 2016 2017

Number of employees 101,255 99,300 98,462 25,500 24,000 22,000 59,700 61,500 59,700

Percent increase/decrease -1.93% -0.84% -5.88% -8.33% 3.02% -2.93%

Net sales 23,923£ 27,889£ 30,186£ 6,417£ 11,397£ 15,161£ 24,708£ 23,002£ 22,465£

Sales return 2,500£ 2,900£ 3,100£ 1,200£ 1,350£ 1,000£ 2,200£ 2,350£ 2,550£

Gross sales 26,423£ 30,789£ 33,286£ 7,617£ 12,747£ 16,161£ 26,908£ 25,352£ 25,015£

Sales return to gross sales ratio 9.46% 9.42% 9.31% 15.75% 10.59% 6.19% 8.18% 9.27% 10.19%

GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Particulars

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Table 6: Non-financial ratios of GlaxoSmithKline Plc, Shire Plc and Astrazeneca

Plc for the years 2015-2017

(Source: Uk.gsk.com 2018; Investors.shire.com 2018; Astrazeneca.com 2018)

According to the above table, it could be observed that the staff turnover ratio for

GlaxoSmithKline Plc has been lower in 2017 compared to the other two organisations.

In addition, the sales return to gross sales ratio is lower for GlaxoSmithKline Plc as well,

which implies that the organisation has better management policies in line to keep pace

with the constantly changing global business environment (Damodaran 2016).

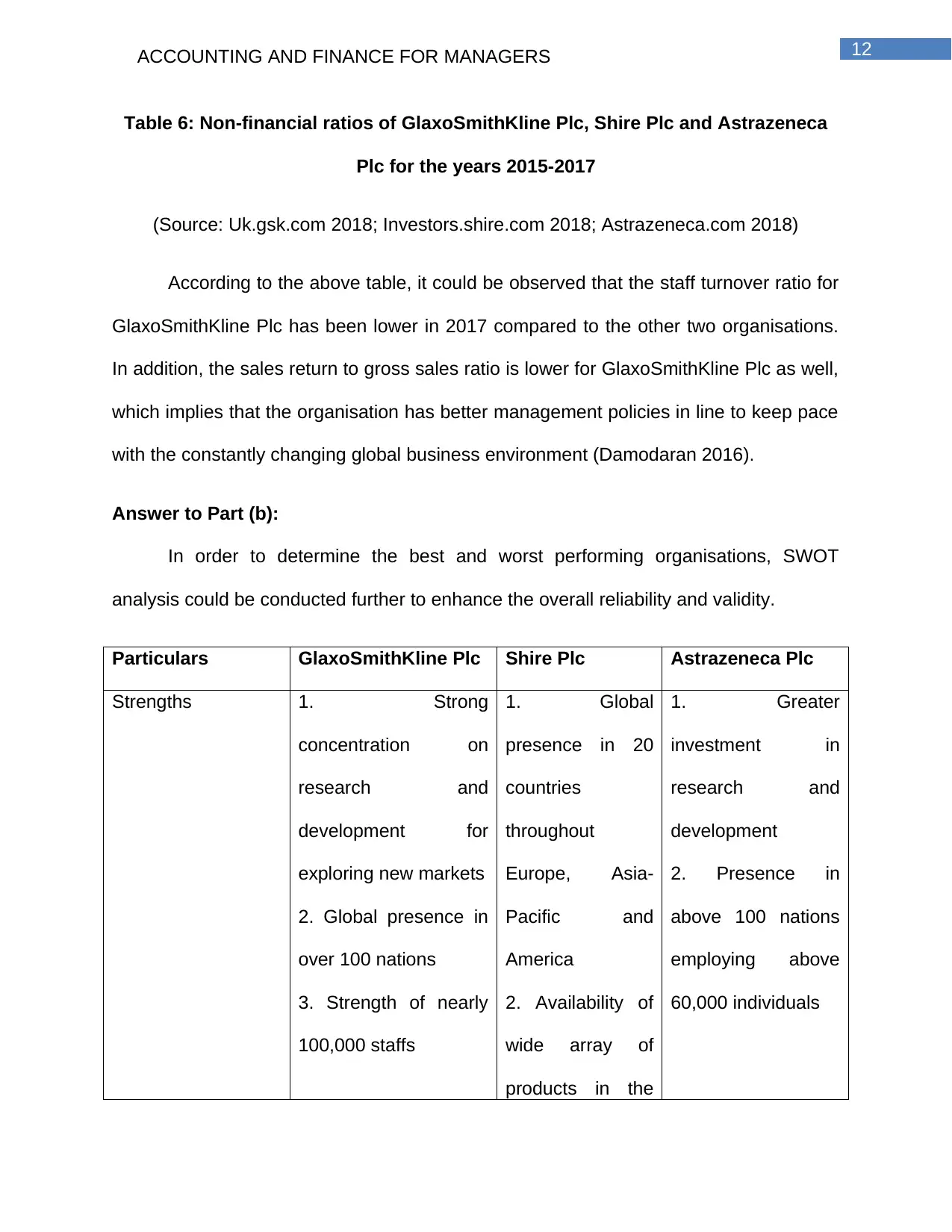

Answer to Part (b):

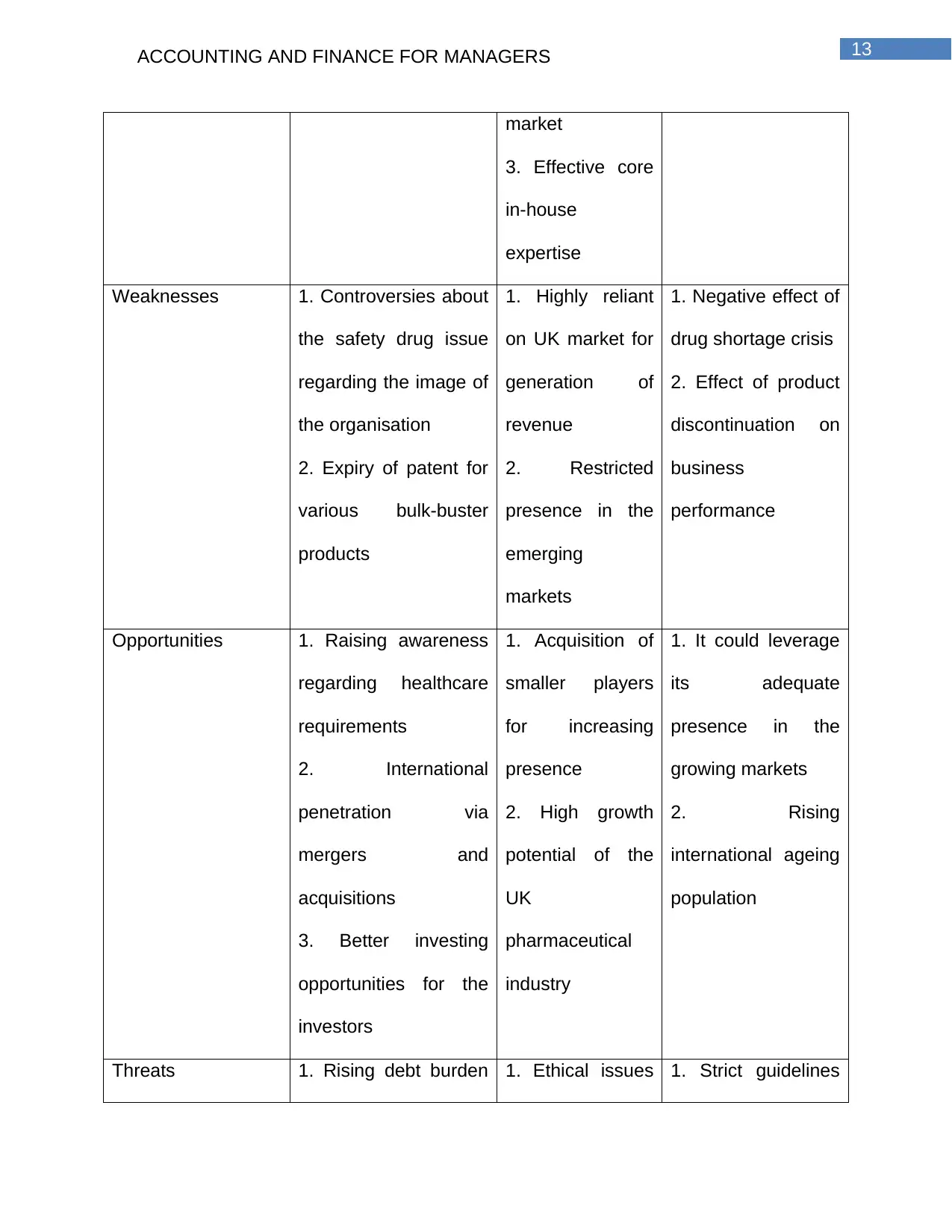

In order to determine the best and worst performing organisations, SWOT

analysis could be conducted further to enhance the overall reliability and validity.

Particulars GlaxoSmithKline Plc Shire Plc Astrazeneca Plc

Strengths 1. Strong

concentration on

research and

development for

exploring new markets

2. Global presence in

over 100 nations

3. Strength of nearly

100,000 staffs

1. Global

presence in 20

countries

throughout

Europe, Asia-

Pacific and

America

2. Availability of

wide array of

products in the

1. Greater

investment in

research and

development

2. Presence in

above 100 nations

employing above

60,000 individuals

Paraphrase This Document

market

3. Effective core

in-house

expertise

Weaknesses 1. Controversies about

the safety drug issue

regarding the image of

the organisation

2. Expiry of patent for

various bulk-buster

products

1. Highly reliant

on UK market for

generation of

revenue

2. Restricted

presence in the

emerging

markets

1. Negative effect of

drug shortage crisis

2. Effect of product

discontinuation on

business

performance

Opportunities 1. Raising awareness

regarding healthcare

requirements

2. International

penetration via

mergers and

acquisitions

3. Better investing

opportunities for the

investors

1. Acquisition of

smaller players

for increasing

presence

2. High growth

potential of the

UK

pharmaceutical

industry

1. It could leverage

its adequate

presence in the

growing markets

2. Rising

international ageing

population

Threats 1. Rising debt burden 1. Ethical issues 1. Strict guidelines

could have negative

impact on liquidity

position of the

business

2. Economic slow in

the markets of Europe

pertaining to

testing

2. Strict

guidelines for

drug

development

for drug

development

2. Rivalry coming up

with appropriate

drugs

Table 7: SWOT analysis of GlaxoSmithKline Plc, Shire Plc and Astrazeneca Plc

(Source: As created by author)

Based on the above table and financial analysis, it could be inferred that

GlaxoSmithKline Plc is enjoying better position in the UK pharmaceutical sector due to

its greater dividend payout and positive future returns to the shareholders coupled with

adequate employee base and increasing global presence.

Answer to Part (c):

With reference to the above table, it could be inferred that the most poorly

performing organisation is Shire Plc due to its lower dividend payout, instability in future

growth and ethical complexities confronting the organisation.

Question 2:

Memorandum

To: The Directors of GlaxoSmithKline Plc

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

From:

Date: 09/04/2018

Subject: Investment Appraisal

The following memorandum is prepared in order to provide key details regarding

the importance of using investment appraisal techniques for the organisation. This is

elucidated in the following two parts:

Answer to Part (a):

Capital budgeting is a technique that helps the business organisations in

analysing several alternatives of capital investments and choosing the feasible

alternatives providing maximum returns (Burns and Walker 2015). This would be highly

important for the owners of GlaxoSmithKline Plc for gauging the profitability of a project

and the risks involved in the project. The main stages in the decision-making process of

capital investment and the role of investment appraisal in this process are described as

follows:

Identification of opportunities

Assessment of opportunities

Projections of cash flows

Selection of projects

Implementation

For instance, it is assumed that GlaxoSmithKline Plc is planning to purchase a

piece of machinery. In this case, the process of capital budgeting would start from the

Paraphrase This Document

identification of opportunities (Revellino and Mouritsen 2015). Therefore, the

organisation is looking for opportunities to double its production due to the high demand

of its products in the market. This could be identified in the form of opportunity available

to GlaxoSmithKline Plc. After exploring this opportunity, the organisation would shift to

the next stage of the capital budgeting process, which is evaluation of opportunities.

Thus, under this stage, the organisation would assess the opportunities like buying

machinery to double production from Company A or Company B, purchasing the semi-

automatic machine, subcontracting machinery or buying from outside (Baum and

Crosby 2014).

In this case, the organisation would decide to buy new machinery and after this

stage, it would project the future cash flows related to the decision of capital budgeting

to purchase automatic machine from Company A (Andor, Mohanty and Toth 2015). In

the fourth stage, depending on the estimation of cash flows and carrying out analysis of

net present value, internal rate of return and profitability index, the most feasible

outcome by using the mentioned techniques would be chosen. After this stage, the

machinery would be purchased and it would be set up in the factor. This is the way of

undertaking the capital budgeting decision in an organisation (Gotze, Northcott and

Schuster 2016).

Answer to Part (b):

It is assumed that GlaxoSmithKline Plc is considering two mutually exclusive

projects and the project having the maximum benefits would be considered. The cost of

capital or discount rate is assumed as 10%. The following example is considered, in

which the different types of investment appraisal techniques are applied:

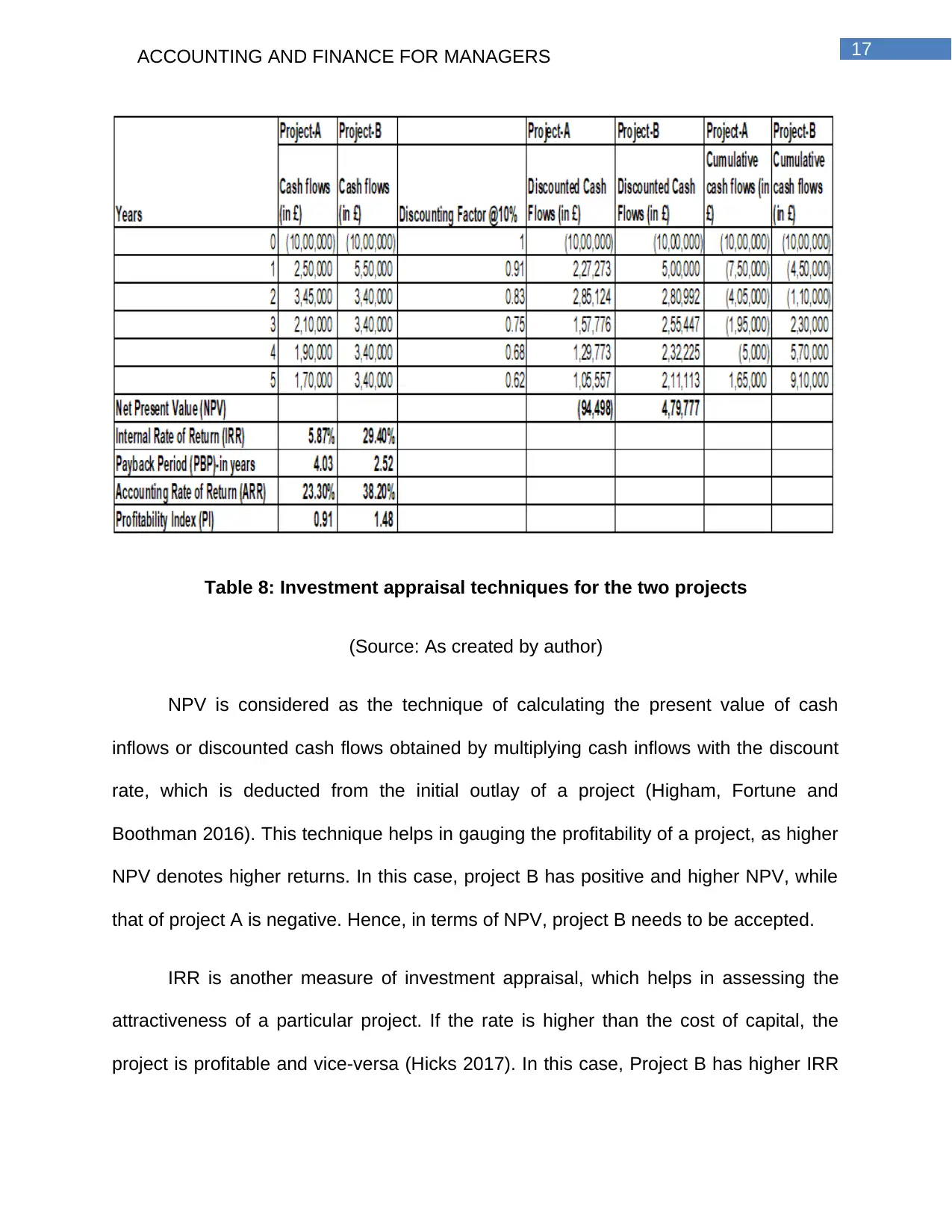

Table 8: Investment appraisal techniques for the two projects

(Source: As created by author)

NPV is considered as the technique of calculating the present value of cash

inflows or discounted cash flows obtained by multiplying cash inflows with the discount

rate, which is deducted from the initial outlay of a project (Higham, Fortune and

Boothman 2016). This technique helps in gauging the profitability of a project, as higher

NPV denotes higher returns. In this case, project B has positive and higher NPV, while

that of project A is negative. Hence, in terms of NPV, project B needs to be accepted.

IRR is another measure of investment appraisal, which helps in assessing the

attractiveness of a particular project. If the rate is higher than the cost of capital, the

project is profitable and vice-versa (Hicks 2017). In this case, Project B has higher IRR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

than the cost of capital, while the situation is just reverse in case of Project A. Thus,

project B needs to be accepted in this case.

PBP helps in estimating the time at which the initial investment made in the

project would be recovered. The lower the period, the better it is for the organisation. In

this case, project B has lower payback period compared to project A, which denotes the

feasibility of the former project.

ARR signifies the amount of profit in percentage form that an individual or an

organisation could make from the investment made. The higher the percentage, the

more profitable is the investment (Li and Trutnevyte 2017). In this case, ARR is higher

for project B than project A. Therefore, project B is to be accepted.

PI is an investment appraisal technique that helps in ranking projects, as it would

enable in quantifying the amount of value developed per unit of investment. A PI above

1 is considered feasible. In this case, the PI for project B is above 1, while that of project

B is below 1. Thus, it denotes that project B would be more profitable for

GlaxoSmithKline Plc.

Based on the hypothetical example, it is advised to the management of

GlaxoSmithKline Plc to progress ahead with project B, since it would help in maximising

the overall return on investment.

Paraphrase This Document

References:

Almamy, J., Aston, J. and Ngwa, L.N., 2016. An evaluation of Altman's Z-score using

cash flow ratio to predict corporate failure amid the recent financial crisis: Evidence from

the UK. Journal of Corporate Finance, 36, pp.278-285.

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of

Central and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Astrazeneca.com., 2018. Investor relations. [online] Available at:

https://www.astrazeneca.com/investor-relations.html [Accessed 9 Apr. 2018].

Baum, A.E. and Crosby, N., 2014. Property investment appraisal. John Wiley & Sons.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and

corporate finance (Vol. 324). John Wiley & Sons.

Dokas, I., Giokas, D. and Tsamis, A., 2014. Liquidity efficiency in the Greek listed firms:

a financial ratio based on data envelopment analysis. International Journal of Corporate

Finance and Accounting (IJCFA), 1(1), pp.40-59.

Enekwe, C.I., 2015. The relationship between financial ratio analysis and corporate

profitability: a study of selected quoted oil and gas companies in Nigeria. European

Journal of Accounting, Auditing and Finance Research, 3(2), pp.17-34.

Evans, J.R. and Mathur, A., 2014. Retailing and the period leading up to the Great

Recession: a model and a 25-year financial ratio analysis of US retailing. The

International Review of Retail, Distribution and Consumer Research, 24(1), pp.30-58.

Gotze, U., Northcott, D. and Schuster, P., 2016. INVESTMENT APPRAISAL.

SPRINGER-VERLAG BERLIN AN.

Hicks, C.L., 2017, July. MODERN PROJECT INVESTMENT APPRAISAL: RETURN TO

SIMPLICITY. In Process Optimisation: A Three-Day Symposium Organised by the

Midlands Branch of the Institution of Chemical Engineers and Held at the University of

Nottingham, 7–9 April 1987 (No. 61, p. 53). Elsevier.

Higham, A.P., Fortune, C. and Boothman, J.C., 2016. Sustainability and investment

appraisal for housing regeneration projects. Structural Survey, 34(2), pp.150-167.

Investors.shire.com.,2018. Archive. [online] Available at:

http://investors.shire.com/presentations-and-reports/annual-and-interim-reports/

archive.aspx [Accessed 9 Apr. 2018].

Li, F.G. and Trutnevyte, E., 2017. Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, pp.89-

109.

Lin, C.C., Chiu, A.A., Huang, S.Y. and Yen, D.C., 2015. Detecting the financial

statement fraud: The analysis of the differences between data mining techniques and

experts’ judgments. Knowledge-Based Systems, 89, pp.459-470.

Reid, W. and Myddelton, D.R., 2017. The meaning of company accounts. Routledge.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Revellino, S. and Mouritsen, J., 2015. The Maieutic Force of Mediating Instruments:

Compromising in Capital Budgeting. In IPA Conference 2015.

Uk.gsk.com., 2018. Annual reports | GSK UK. [online] Available at:

http://uk.gsk.com/en-gb/investors/annual-reports/ [Accessed 9 Apr. 2018].

Vogel, H.L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

Paraphrase This Document

Appendices:

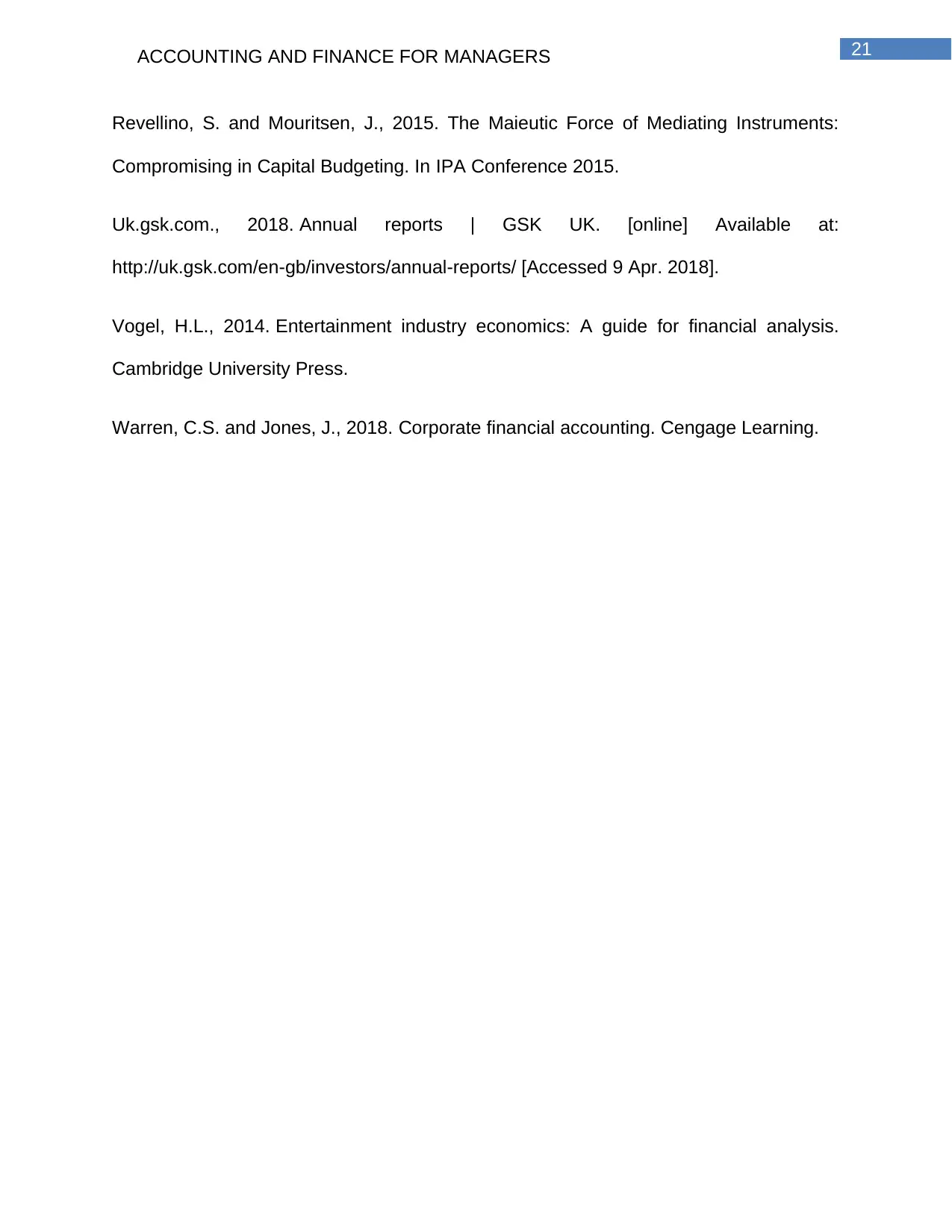

Appendix 1: Income statement of GlaxoSmithKline Plc for the years 2015-2017

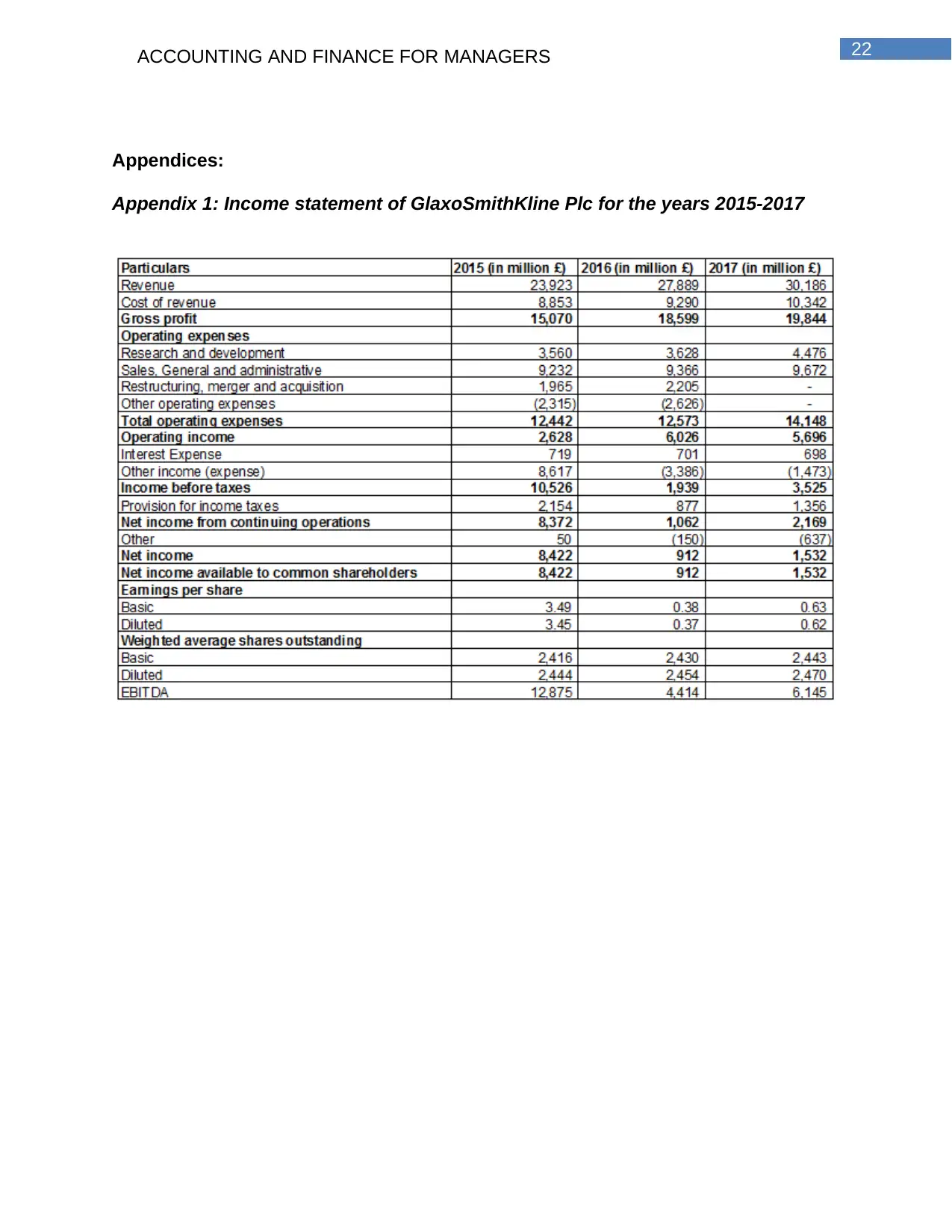

Appendix 2: Balance sheet statement of GlaxoSmithKline Plc for the years 2014-

2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

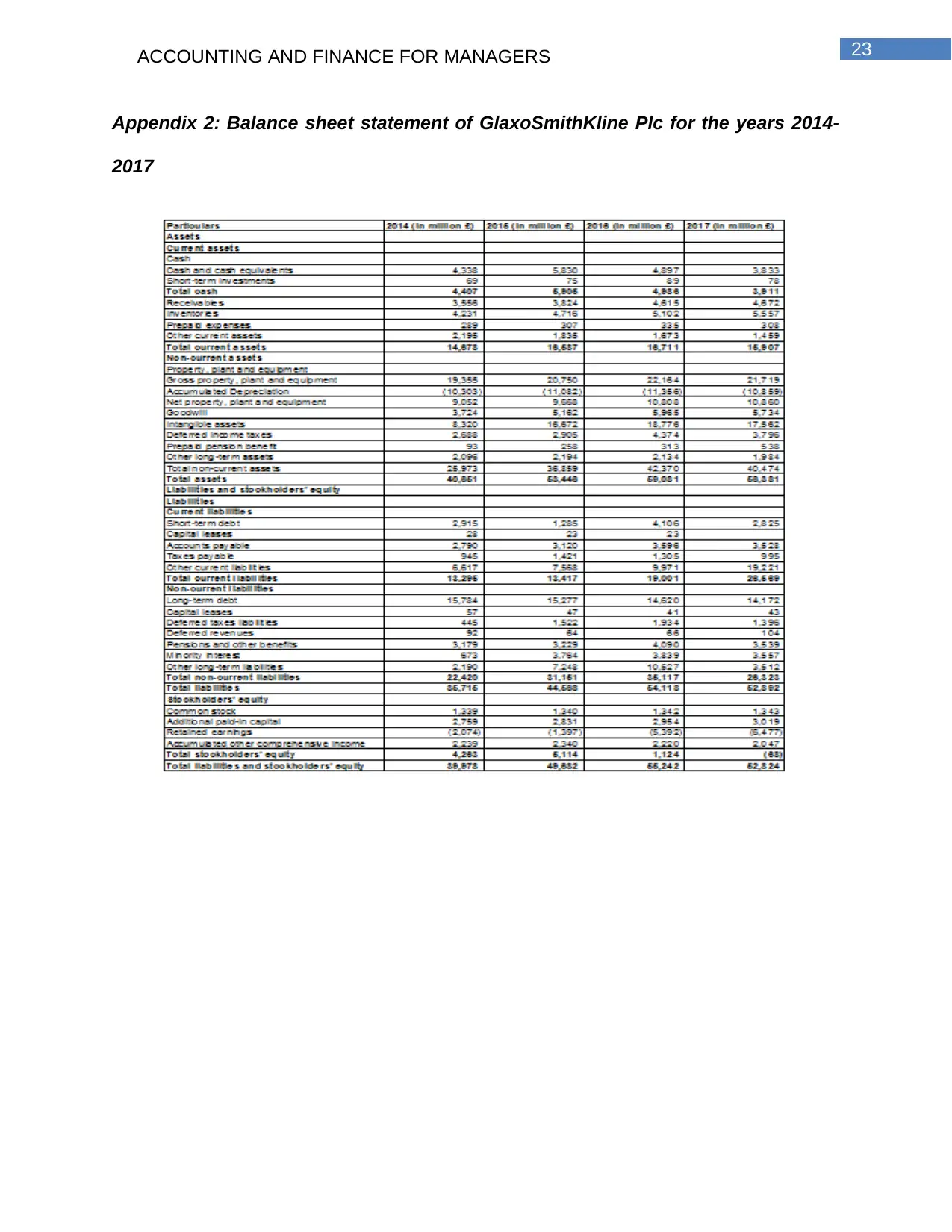

Appendix 3: Income statement of Shire Plc for the years 2015-2017

Paraphrase This Document

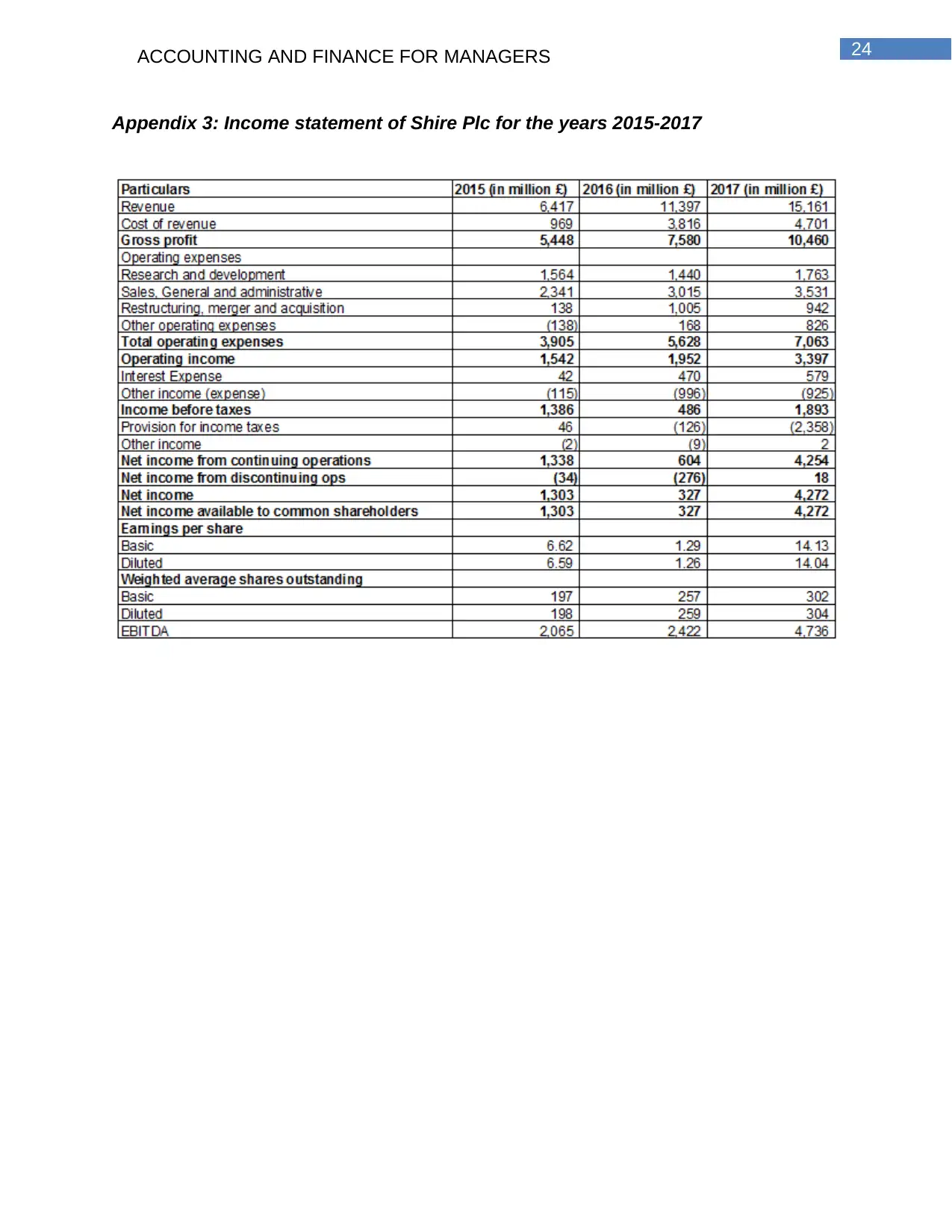

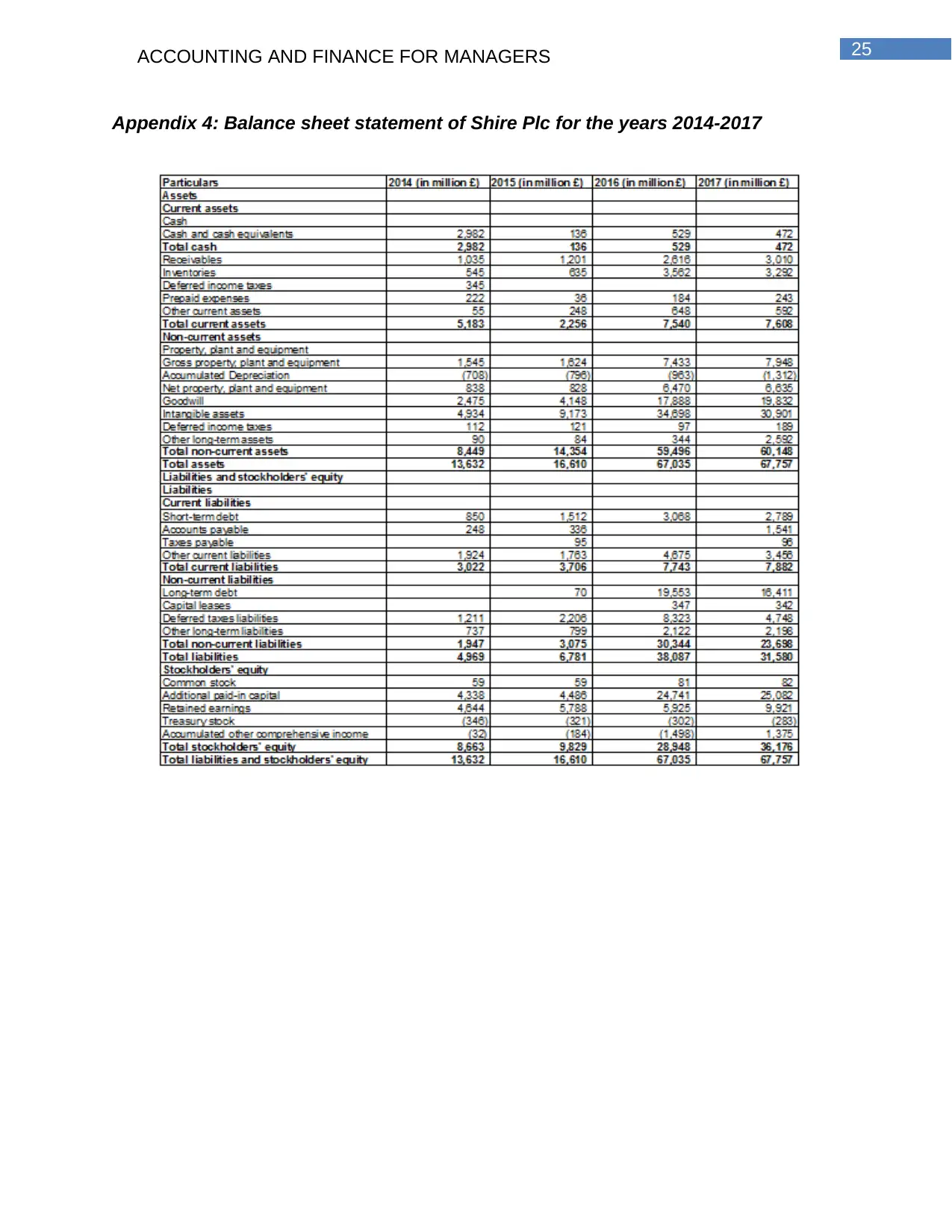

Appendix 4: Balance sheet statement of Shire Plc for the years 2014-2017

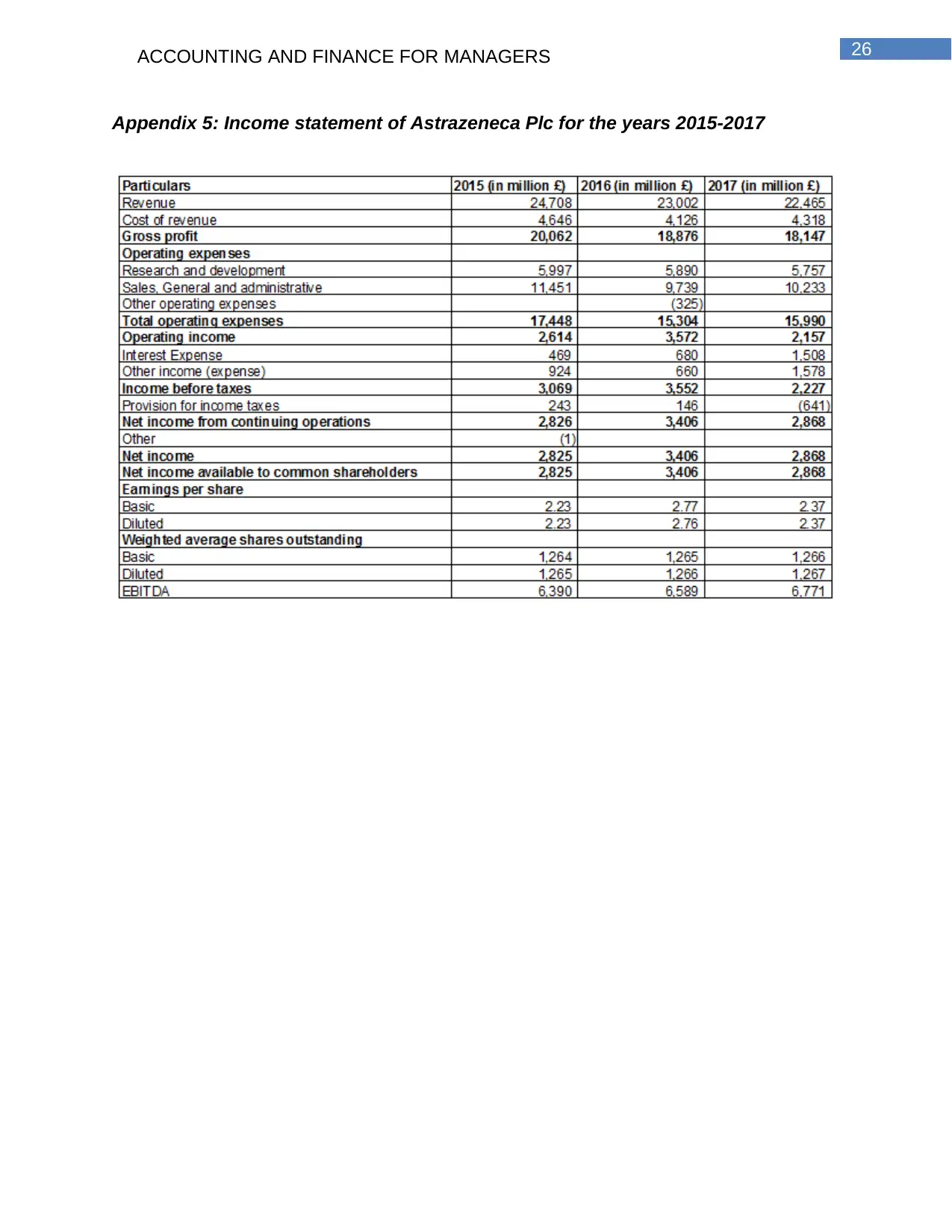

Appendix 5: Income statement of Astrazeneca Plc for the years 2015-2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

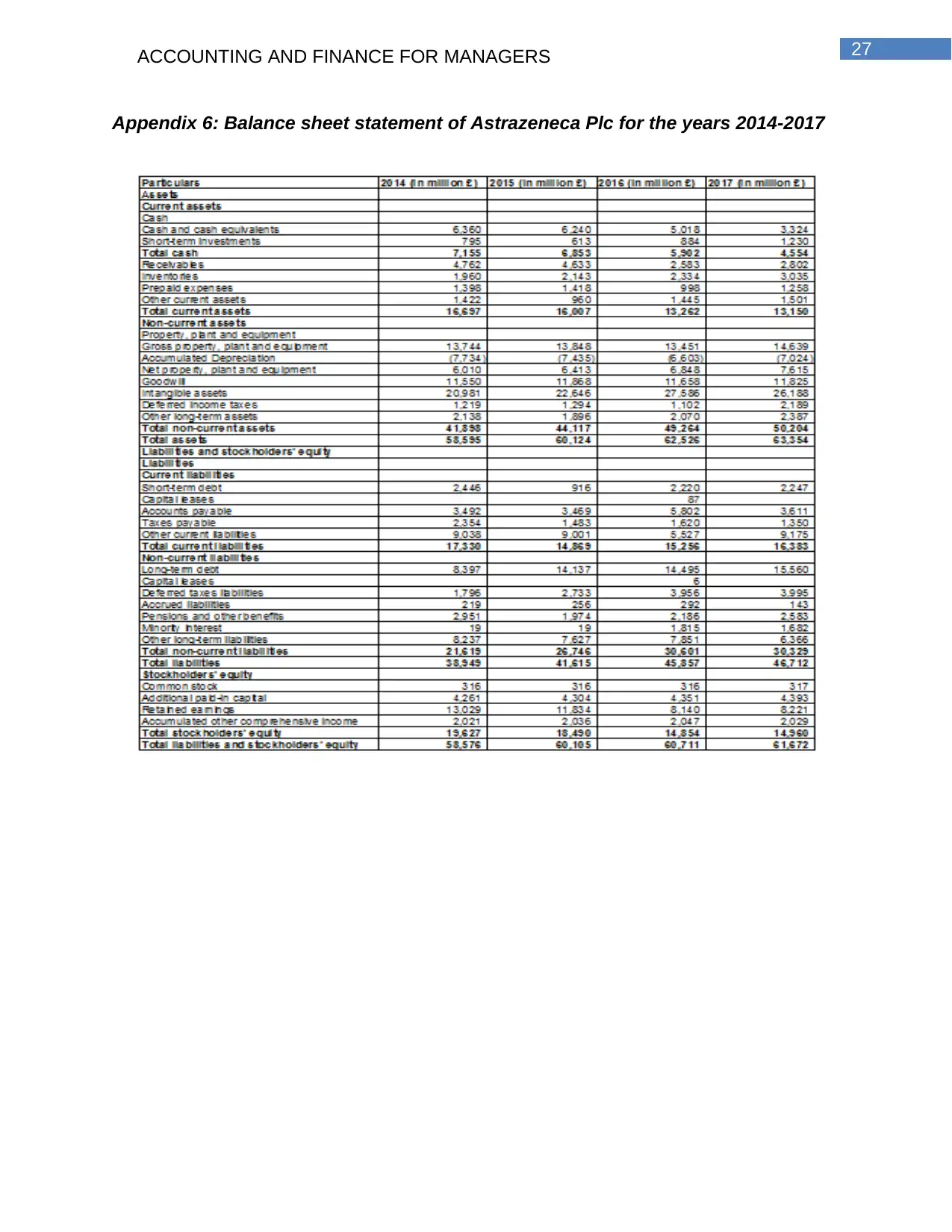

Appendix 6: Balance sheet statement of Astrazeneca Plc for the years 2014-2017

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.