Financial Performance Analysis Report for FNN6800 Module

VerifiedAdded on 2022/12/28

|10

|2545

|47

Report

AI Summary

This report comprehensively analyzes financial performance management, addressing key aspects such as activity-based costing (ABC), variance analysis, and budgeting methods. Question 1 explores the computation of total cost and profit per unit using both labor-hour absorption and ABC approaches, followed by a critical evaluation of the results and the benefits of ABC. It also examines the role of sensitivity analysis in managing uncertainties. Question 2 delves into variance analysis, including the calculation of material usage, mix, and yield variances, alongside a discussion of issues with current variance calculation and reporting systems. Finally, Question 3 focuses on budgeting, comparing and contrasting incremental and zero-based budgeting methods, highlighting their advantages and disadvantages. The report utilizes calculations, tables, and critical evaluations to provide a thorough understanding of financial performance management principles and their practical applications, offering valuable insights for students studying this subject.

FINANACIAL

PERFORMANCE

MANAGEMENT

PERFORMANCE

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

(a) Statement showing computation of total cost and profit per unit absorbing all overheads on

the basis of labour hours..............................................................................................................3

(b) Statement showing computation of total cost and profit per unit absorbing overheads on

activity based costing...................................................................................................................3

(c) Critical evaluation of result and benefits of activity based costing approaches.....................4

(d) Role of sensitive analysis to help the managers to cope with uncertainties...........................4

Question 2........................................................................................................................................5

(a) Calculation of material usage variance...................................................................................5

(b) Calculation of total material mix variance.............................................................................5

(c) Calculation of total material yield variance............................................................................6

(d) Addressing problem with the current system of calculating and reporting variance.............6

Question 3........................................................................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

(a) Statement showing computation of total cost and profit per unit absorbing all overheads on

the basis of labour hours..............................................................................................................3

(b) Statement showing computation of total cost and profit per unit absorbing overheads on

activity based costing...................................................................................................................3

(c) Critical evaluation of result and benefits of activity based costing approaches.....................4

(d) Role of sensitive analysis to help the managers to cope with uncertainties...........................4

Question 2........................................................................................................................................5

(a) Calculation of material usage variance...................................................................................5

(b) Calculation of total material mix variance.............................................................................5

(c) Calculation of total material yield variance............................................................................6

(d) Addressing problem with the current system of calculating and reporting variance.............6

Question 3........................................................................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................1

INTRODUCTION

MAIN BODY

Question 1

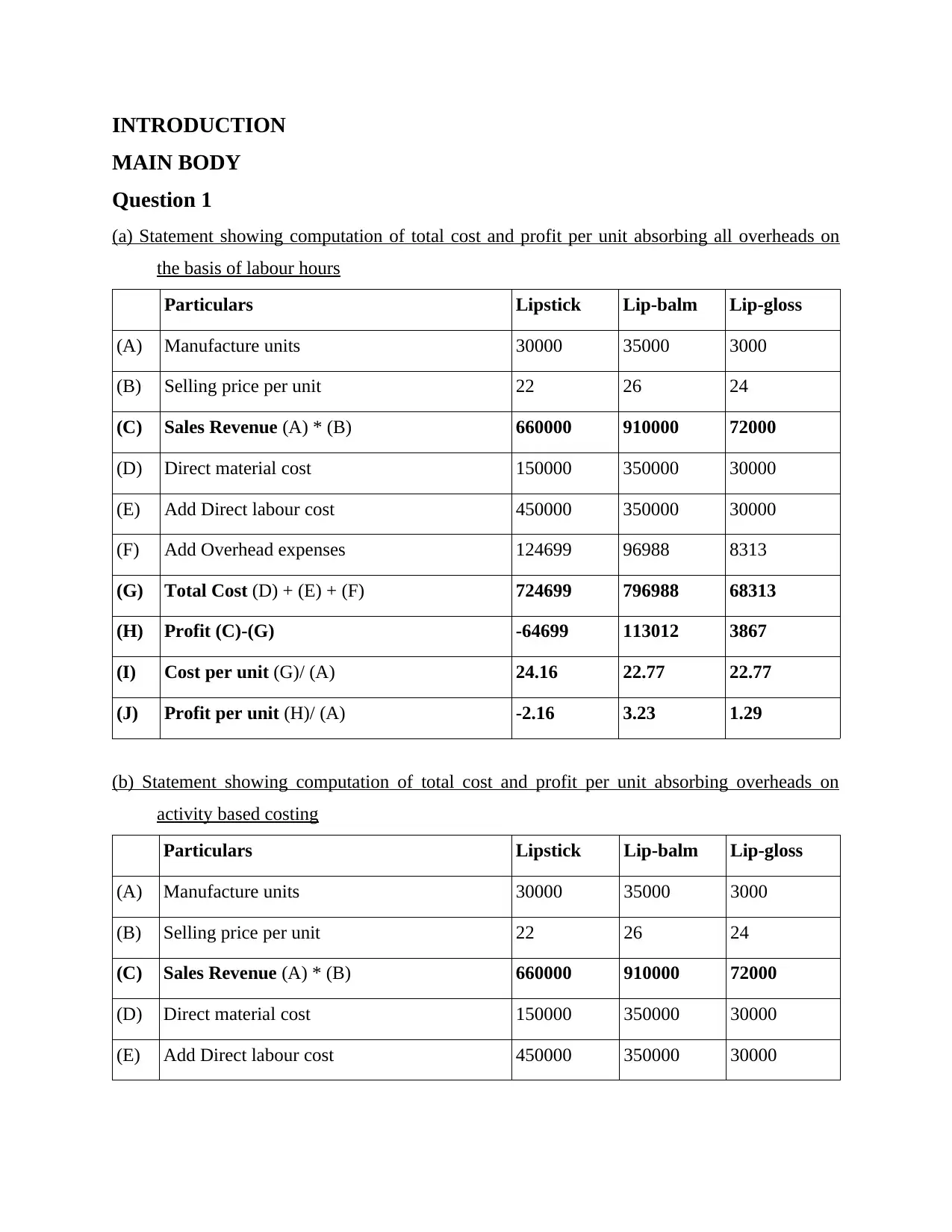

(a) Statement showing computation of total cost and profit per unit absorbing all overheads on

the basis of labour hours

Particulars Lipstick Lip-balm Lip-gloss

(A) Manufacture units 30000 35000 3000

(B) Selling price per unit 22 26 24

(C) Sales Revenue (A) * (B) 660000 910000 72000

(D) Direct material cost 150000 350000 30000

(E) Add Direct labour cost 450000 350000 30000

(F) Add Overhead expenses 124699 96988 8313

(G) Total Cost (D) + (E) + (F) 724699 796988 68313

(H) Profit (C)-(G) -64699 113012 3867

(I) Cost per unit (G)/ (A) 24.16 22.77 22.77

(J) Profit per unit (H)/ (A) -2.16 3.23 1.29

(b) Statement showing computation of total cost and profit per unit absorbing overheads on

activity based costing

Particulars Lipstick Lip-balm Lip-gloss

(A) Manufacture units 30000 35000 3000

(B) Selling price per unit 22 26 24

(C) Sales Revenue (A) * (B) 660000 910000 72000

(D) Direct material cost 150000 350000 30000

(E) Add Direct labour cost 450000 350000 30000

MAIN BODY

Question 1

(a) Statement showing computation of total cost and profit per unit absorbing all overheads on

the basis of labour hours

Particulars Lipstick Lip-balm Lip-gloss

(A) Manufacture units 30000 35000 3000

(B) Selling price per unit 22 26 24

(C) Sales Revenue (A) * (B) 660000 910000 72000

(D) Direct material cost 150000 350000 30000

(E) Add Direct labour cost 450000 350000 30000

(F) Add Overhead expenses 124699 96988 8313

(G) Total Cost (D) + (E) + (F) 724699 796988 68313

(H) Profit (C)-(G) -64699 113012 3867

(I) Cost per unit (G)/ (A) 24.16 22.77 22.77

(J) Profit per unit (H)/ (A) -2.16 3.23 1.29

(b) Statement showing computation of total cost and profit per unit absorbing overheads on

activity based costing

Particulars Lipstick Lip-balm Lip-gloss

(A) Manufacture units 30000 35000 3000

(B) Selling price per unit 22 26 24

(C) Sales Revenue (A) * (B) 660000 910000 72000

(D) Direct material cost 150000 350000 30000

(E) Add Direct labour cost 450000 350000 30000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

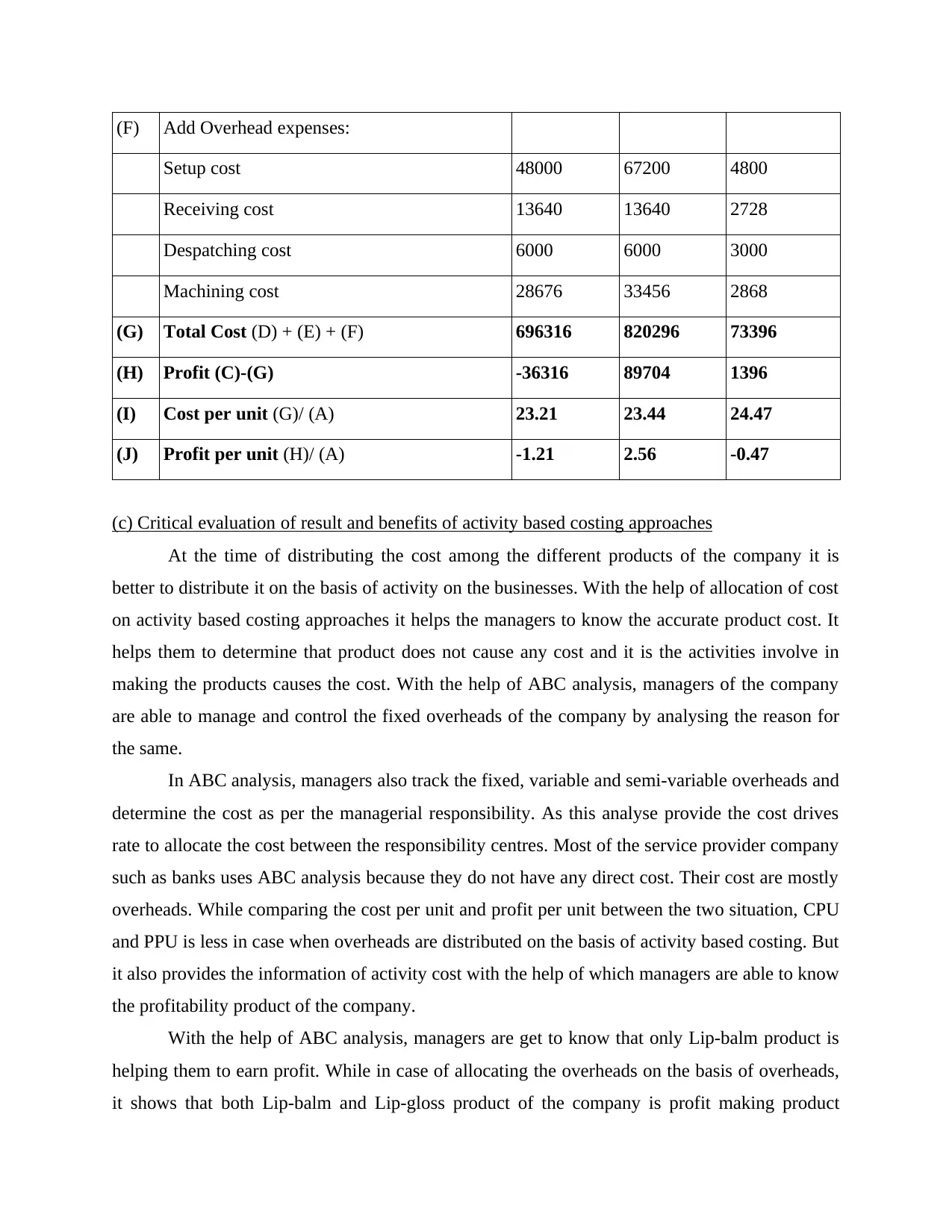

(F) Add Overhead expenses:

Setup cost 48000 67200 4800

Receiving cost 13640 13640 2728

Despatching cost 6000 6000 3000

Machining cost 28676 33456 2868

(G) Total Cost (D) + (E) + (F) 696316 820296 73396

(H) Profit (C)-(G) -36316 89704 1396

(I) Cost per unit (G)/ (A) 23.21 23.44 24.47

(J) Profit per unit (H)/ (A) -1.21 2.56 -0.47

(c) Critical evaluation of result and benefits of activity based costing approaches

At the time of distributing the cost among the different products of the company it is

better to distribute it on the basis of activity on the businesses. With the help of allocation of cost

on activity based costing approaches it helps the managers to know the accurate product cost. It

helps them to determine that product does not cause any cost and it is the activities involve in

making the products causes the cost. With the help of ABC analysis, managers of the company

are able to manage and control the fixed overheads of the company by analysing the reason for

the same.

In ABC analysis, managers also track the fixed, variable and semi-variable overheads and

determine the cost as per the managerial responsibility. As this analyse provide the cost drives

rate to allocate the cost between the responsibility centres. Most of the service provider company

such as banks uses ABC analysis because they do not have any direct cost. Their cost are mostly

overheads. While comparing the cost per unit and profit per unit between the two situation, CPU

and PPU is less in case when overheads are distributed on the basis of activity based costing. But

it also provides the information of activity cost with the help of which managers are able to know

the profitability product of the company.

With the help of ABC analysis, managers are get to know that only Lip-balm product is

helping them to earn profit. While in case of allocating the overheads on the basis of overheads,

it shows that both Lip-balm and Lip-gloss product of the company is profit making product

Setup cost 48000 67200 4800

Receiving cost 13640 13640 2728

Despatching cost 6000 6000 3000

Machining cost 28676 33456 2868

(G) Total Cost (D) + (E) + (F) 696316 820296 73396

(H) Profit (C)-(G) -36316 89704 1396

(I) Cost per unit (G)/ (A) 23.21 23.44 24.47

(J) Profit per unit (H)/ (A) -1.21 2.56 -0.47

(c) Critical evaluation of result and benefits of activity based costing approaches

At the time of distributing the cost among the different products of the company it is

better to distribute it on the basis of activity on the businesses. With the help of allocation of cost

on activity based costing approaches it helps the managers to know the accurate product cost. It

helps them to determine that product does not cause any cost and it is the activities involve in

making the products causes the cost. With the help of ABC analysis, managers of the company

are able to manage and control the fixed overheads of the company by analysing the reason for

the same.

In ABC analysis, managers also track the fixed, variable and semi-variable overheads and

determine the cost as per the managerial responsibility. As this analyse provide the cost drives

rate to allocate the cost between the responsibility centres. Most of the service provider company

such as banks uses ABC analysis because they do not have any direct cost. Their cost are mostly

overheads. While comparing the cost per unit and profit per unit between the two situation, CPU

and PPU is less in case when overheads are distributed on the basis of activity based costing. But

it also provides the information of activity cost with the help of which managers are able to know

the profitability product of the company.

With the help of ABC analysis, managers are get to know that only Lip-balm product is

helping them to earn profit. While in case of allocating the overheads on the basis of overheads,

it shows that both Lip-balm and Lip-gloss product of the company is profit making product

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

which is not true. It also helps the managers to take decision regarding whether to continue the

operation of particular product or discontinue the operations.

(d) Role of sensitive analysis to help the managers to cope with uncertainties

Sensitive analysis is a what if situation in the company which help the managers of the

company to deals with the uncertainties arises in the near future. It is a tool used by almost all

companies in order to know what if the predictions of the managers of the company is not come

true. Each department managers prepare their own budgets by estimating the income and

expenses of the particular department. With the help of sensitive analysis managers of the

company are going to examine how the operating income of the company reacts in case their

predictions will not come true. The following analysis is done by the managers in what if

situations:

What if the actual fixed and variable cost vary from the estimated one because of internal

and external forces.

What if the actual volume of sales are different from the estimated one because of

changes in the demand of the products.

What if the selling price they estimate do not attract the consumers.

In the context of sensitive analysis, margin of safety is also one of the most important

components. MOS states the point at which the company is able to protect themselves from

declining before they start incurring their fixed cost. It helps the managers of the company to

know the extent to which company will suffer losses. With the help of sensitive analysis,

managers of the company is able to prepare the proper and stable cost structure of the product of

the company. In order to know the impact of cost structure on the profit, managers also involve

the tools of operating leverage into the sensitive analysis.

Question 2

(a) Calculation of material usage variance

Formula to calculate material usage variance =

(Standard Quantity for actual production – Actual Quantity) * Standard Price

Calculation for each ingredients

Alpha = {(40/100 *4600)- 2200} * 2 = (720) Adverse

Beta = {(60/100 *4600) - 2500} * 5 = 1300 Favourable

Gamma = {(20/100 *4600) - 920} * 1 = 0

operation of particular product or discontinue the operations.

(d) Role of sensitive analysis to help the managers to cope with uncertainties

Sensitive analysis is a what if situation in the company which help the managers of the

company to deals with the uncertainties arises in the near future. It is a tool used by almost all

companies in order to know what if the predictions of the managers of the company is not come

true. Each department managers prepare their own budgets by estimating the income and

expenses of the particular department. With the help of sensitive analysis managers of the

company are going to examine how the operating income of the company reacts in case their

predictions will not come true. The following analysis is done by the managers in what if

situations:

What if the actual fixed and variable cost vary from the estimated one because of internal

and external forces.

What if the actual volume of sales are different from the estimated one because of

changes in the demand of the products.

What if the selling price they estimate do not attract the consumers.

In the context of sensitive analysis, margin of safety is also one of the most important

components. MOS states the point at which the company is able to protect themselves from

declining before they start incurring their fixed cost. It helps the managers of the company to

know the extent to which company will suffer losses. With the help of sensitive analysis,

managers of the company is able to prepare the proper and stable cost structure of the product of

the company. In order to know the impact of cost structure on the profit, managers also involve

the tools of operating leverage into the sensitive analysis.

Question 2

(a) Calculation of material usage variance

Formula to calculate material usage variance =

(Standard Quantity for actual production – Actual Quantity) * Standard Price

Calculation for each ingredients

Alpha = {(40/100 *4600)- 2200} * 2 = (720) Adverse

Beta = {(60/100 *4600) - 2500} * 5 = 1300 Favourable

Gamma = {(20/100 *4600) - 920} * 1 = 0

Calculation in total usage variance

= (720) + 1300 + 0 = 580 Favourable

(b) Calculation of total material mix variance

Formula of material mix variance is =

(Revised Standard quantity – Actual quantity) * Standard price

Alpha = {(40/120 * 5620) – 2200} * 2 = (653.34) Adverse

Beta = {(60/120 * 5620) – 2500} * 5 = 1550 Favourable

Gamma = {20/120 * 5620) – 920} * 1 = 16.67 Favourable

Total = (653.34) + 1550 + 16.67 = 913.33 Favourable

(c) Calculation of total material yield variance

Formula to calculate material yield variance is =

(Standard quantity – Revised Standard quantity) * Standard cost per unit

Alpha = (1840-1873.33) * 2 = (66.67) Adverse

Beta = (2760-2810) * 5 = (250) Adverse

Gamma = (920-936.67) * 1 = (16.67) Adverse

Total = (66.67) + (250) + (16.66) = (333.33) Adverse

(d) Addressing problem with the current system of calculating and reporting variance

Variance analysis is a tool to calculate the difference between the actual numbers and the

planned numbers. But the problem with the variance analysis is that it is time taking. It takes

long period to analyse the variance numbers such as material, fixed cost, variable cost, profit etc.

and also make delay in taking corrective actions. Standard costing is suitable for the

organisations who have large production cycle and produce different goods using various raw

materials. But the organisations with small manufacturing do not use their time in calculating

variance. The analysis of variance is also not suitable for the service provider industry.

Assigning the responsibility of any variance to individual person is difficult because the

variances arises due to many reasons which can't be identifiable. An adverse result of standard

costing variance create negative image of the company's performance in the mind of internal and

external users. It also creates behavioural issues in the employees mind and in order to avoid it

is better for the managers of the company to involve employees as well in budget setting process.

Because of variance analysis, there is also delay in decision-making.

= (720) + 1300 + 0 = 580 Favourable

(b) Calculation of total material mix variance

Formula of material mix variance is =

(Revised Standard quantity – Actual quantity) * Standard price

Alpha = {(40/120 * 5620) – 2200} * 2 = (653.34) Adverse

Beta = {(60/120 * 5620) – 2500} * 5 = 1550 Favourable

Gamma = {20/120 * 5620) – 920} * 1 = 16.67 Favourable

Total = (653.34) + 1550 + 16.67 = 913.33 Favourable

(c) Calculation of total material yield variance

Formula to calculate material yield variance is =

(Standard quantity – Revised Standard quantity) * Standard cost per unit

Alpha = (1840-1873.33) * 2 = (66.67) Adverse

Beta = (2760-2810) * 5 = (250) Adverse

Gamma = (920-936.67) * 1 = (16.67) Adverse

Total = (66.67) + (250) + (16.66) = (333.33) Adverse

(d) Addressing problem with the current system of calculating and reporting variance

Variance analysis is a tool to calculate the difference between the actual numbers and the

planned numbers. But the problem with the variance analysis is that it is time taking. It takes

long period to analyse the variance numbers such as material, fixed cost, variable cost, profit etc.

and also make delay in taking corrective actions. Standard costing is suitable for the

organisations who have large production cycle and produce different goods using various raw

materials. But the organisations with small manufacturing do not use their time in calculating

variance. The analysis of variance is also not suitable for the service provider industry.

Assigning the responsibility of any variance to individual person is difficult because the

variances arises due to many reasons which can't be identifiable. An adverse result of standard

costing variance create negative image of the company's performance in the mind of internal and

external users. It also creates behavioural issues in the employees mind and in order to avoid it

is better for the managers of the company to involve employees as well in budget setting process.

Because of variance analysis, there is also delay in decision-making.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 3

Budgeting is an important component of management control system, as it provides a

systematic planning, coordination and control for management. There are two main methods of

budgeting which includes Incremental budgeting and Zero based budgeting.

— Incremental Budgeting

It is the traditional budgeting method in which the budget is prepared by taking the

current duration's budget into consideration or actual performance as a base, with incremental

amounts being added for the new budget period. The incremental amounts include adjustment in

inflation rates, and planned increases in sales prices and costs. There are various benefits of this

method such as it is easy to prepare and is therefore fast to create, as it is being easy to prepare

then also easy to understand, requires less preparation time which leads to less preparation cost

and also helps to prevent conflicts between departmental managers since a consistent approach is

adopted throughout the organization (Henrydoss, 2017).

However, there are various drawbacks also of this particular method which includes that

this method assumes hypothetically all current activities and costs which are still needed, even

without examining the situations in detail. This method promotes unnecessary spendings for a

company. This type of budgeting may discourage the production of innovative ideas and growth

within the employees of the organization. Incremental budgeting method adopts conservative

business environment. The budgets prepared with this method are generally not responsive to

potential changes that can result from unforeseen factors. The stability of incremental budgets

does not provide any incentives to the company management for reviewing the budget with a

view to realize savings in expenditures.

— Zero-based Budgeting

This method includes preparation of budgeting from the scratch with a zero base. It

involves re-evaluation of items of cash flow statement and justifying the expenditures that is to

be incurred by the department within the organization (Ibrahim, 2019). Zero base budgeting

includes various steps which includes identification of tasks, then finding ways and means of

completing the tasks, evaluating the solutions along with searching the alternatives of sources of

Budgeting is an important component of management control system, as it provides a

systematic planning, coordination and control for management. There are two main methods of

budgeting which includes Incremental budgeting and Zero based budgeting.

— Incremental Budgeting

It is the traditional budgeting method in which the budget is prepared by taking the

current duration's budget into consideration or actual performance as a base, with incremental

amounts being added for the new budget period. The incremental amounts include adjustment in

inflation rates, and planned increases in sales prices and costs. There are various benefits of this

method such as it is easy to prepare and is therefore fast to create, as it is being easy to prepare

then also easy to understand, requires less preparation time which leads to less preparation cost

and also helps to prevent conflicts between departmental managers since a consistent approach is

adopted throughout the organization (Henrydoss, 2017).

However, there are various drawbacks also of this particular method which includes that

this method assumes hypothetically all current activities and costs which are still needed, even

without examining the situations in detail. This method promotes unnecessary spendings for a

company. This type of budgeting may discourage the production of innovative ideas and growth

within the employees of the organization. Incremental budgeting method adopts conservative

business environment. The budgets prepared with this method are generally not responsive to

potential changes that can result from unforeseen factors. The stability of incremental budgets

does not provide any incentives to the company management for reviewing the budget with a

view to realize savings in expenditures.

— Zero-based Budgeting

This method includes preparation of budgeting from the scratch with a zero base. It

involves re-evaluation of items of cash flow statement and justifying the expenditures that is to

be incurred by the department within the organization (Ibrahim, 2019). Zero base budgeting

includes various steps which includes identification of tasks, then finding ways and means of

completing the tasks, evaluating the solutions along with searching the alternatives of sources of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

funds and at last setting the budgeted numbers and priorities. The benefits of zero based

budgeting includes that this method provides clear picture of costs against the desired

performance. It provides accuracy to each and every item of the cash flow and compute their

operation costs. The method helps the organization in efficient allocation of resources as it does

not look back the previous numbers but look at the actual current figures. It leads towards the

identification of opportunities and find more cost effective ways by removing all unproductive

activities. It also improves coordination among various departments and helps to motivate

employees by involving each individual in decision-making.

On the other hand, there are some disadvantages of this method which includes that this

particular method is really time-consuming exercise for the organization as compare to

incremental budgeting which is a far easier method to be adopted in the company. For making an

entire budget, this method requires the involvement of numerous skilled employees or

manpower. as many departments may not have that much manpower and adequate time to adopt

this method into consideration. As it is highly skilled labourer method and thus requires high

level training to the managers as explaining every line item in cash flow and cost is a difficult

task for the company.

CONCLUSION

budgeting includes that this method provides clear picture of costs against the desired

performance. It provides accuracy to each and every item of the cash flow and compute their

operation costs. The method helps the organization in efficient allocation of resources as it does

not look back the previous numbers but look at the actual current figures. It leads towards the

identification of opportunities and find more cost effective ways by removing all unproductive

activities. It also improves coordination among various departments and helps to motivate

employees by involving each individual in decision-making.

On the other hand, there are some disadvantages of this method which includes that this

particular method is really time-consuming exercise for the organization as compare to

incremental budgeting which is a far easier method to be adopted in the company. For making an

entire budget, this method requires the involvement of numerous skilled employees or

manpower. as many departments may not have that much manpower and adequate time to adopt

this method into consideration. As it is highly skilled labourer method and thus requires high

level training to the managers as explaining every line item in cash flow and cost is a difficult

task for the company.

CONCLUSION

REFERENCES

Books and journals

Wegmann, G., 2019. A typology of cost accounting practices based on Activity-Based Costing-a

strategic cost management approach. Asia-Pacific Management Accounting

Journal. 14. pp.161-184.

Sangiumvibool, P. and Chonglerttham, S., 2017. Performance-based budgeting for continuing

and lifelong education services: the Thai higher education perspective. Journal of

Higher Education Policy and Management. 39(1). pp.58-74.

Kamiński, B., Jakubczyk, M. and Szufel, P., 2018. A framework for sensitivity analysis of

decision trees. Central European journal of operations research. 26(1). pp.135-159.

Delgarm, N. and et.al., 2018. Sensitivity analysis of building energy performance: A simulation-

based approach using OFAT and variance-based sensitivity analysis

methods. Journal of Building Engineering. 15. pp.181-193.

Marzlin Marzuki, N. A. R. and Ismail, J., 2019. Benefits and limitations of variance analysis in

management accounting. ACCOUNTING BULLETIN. p.15.

Apunda, M. A. and Ndede, F. W., 2020. The effect of adoption of management accounting

practices on financial performance of commercial parastatals in Kenya. International

Academic Journal of Economics and Finance. 3(6). pp.119-130.

Oyewo, B., Ajibolade, S. and Obazee, A., 2019. The influence of stakeholders on management

accounting practice. Journal of Sustainable Finance & Investment. 9(4). pp.295-324.

Ibrahim, M. M., 2019. Designing zero-based budgeting for public organizations. Problems and

Perspectives in Management. 17(2).

Pavlik, A., 2020. Familiarize yourself with budgeting best practices to boost your department's

success. Student Affairs Today. 22(12). pp.6-7.

Online

Financial Performance Management. 2021 [Online]. Available

through:<https://www.silvon.com/financial-performance.php>

1

Books and journals

Wegmann, G., 2019. A typology of cost accounting practices based on Activity-Based Costing-a

strategic cost management approach. Asia-Pacific Management Accounting

Journal. 14. pp.161-184.

Sangiumvibool, P. and Chonglerttham, S., 2017. Performance-based budgeting for continuing

and lifelong education services: the Thai higher education perspective. Journal of

Higher Education Policy and Management. 39(1). pp.58-74.

Kamiński, B., Jakubczyk, M. and Szufel, P., 2018. A framework for sensitivity analysis of

decision trees. Central European journal of operations research. 26(1). pp.135-159.

Delgarm, N. and et.al., 2018. Sensitivity analysis of building energy performance: A simulation-

based approach using OFAT and variance-based sensitivity analysis

methods. Journal of Building Engineering. 15. pp.181-193.

Marzlin Marzuki, N. A. R. and Ismail, J., 2019. Benefits and limitations of variance analysis in

management accounting. ACCOUNTING BULLETIN. p.15.

Apunda, M. A. and Ndede, F. W., 2020. The effect of adoption of management accounting

practices on financial performance of commercial parastatals in Kenya. International

Academic Journal of Economics and Finance. 3(6). pp.119-130.

Oyewo, B., Ajibolade, S. and Obazee, A., 2019. The influence of stakeholders on management

accounting practice. Journal of Sustainable Finance & Investment. 9(4). pp.295-324.

Ibrahim, M. M., 2019. Designing zero-based budgeting for public organizations. Problems and

Perspectives in Management. 17(2).

Pavlik, A., 2020. Familiarize yourself with budgeting best practices to boost your department's

success. Student Affairs Today. 22(12). pp.6-7.

Online

Financial Performance Management. 2021 [Online]. Available

through:<https://www.silvon.com/financial-performance.php>

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Performance

Management

[Online]. Available through:<>

2

Management

[Online]. Available through:<>

2

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.