Financial Performance Management: Costing and Budgeting Analysis

VerifiedAdded on 2022/12/28

|9

|1888

|63

Homework Assignment

AI Summary

This assignment provides a comprehensive analysis of financial performance management. It begins with a detailed examination of absorption costing and activity-based costing (ABC), comparing their applications and implications on product costing and profitability. The solution includes calculations of cost and profit per unit under absorption costing and then applies ABC to distribute overhead costs more accurately. Furthermore, the assignment delves into variance analysis, including material usage, mix, and yield variances, with a critical discussion of the standard costing system and its limitations. Finally, it explores budgeting techniques, contrasting zero-based budgeting with incremental budgeting and highlighting the strengths and weaknesses of each approach. The assignment incorporates sensitivity analysis to assess the impact of uncertain factors on decision-making.

FINANCIAL

PERFORMANCE

MANAGEMENT

PERFORMANCE

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question: 1...................................................................................................................................3

Question: 2...................................................................................................................................6

Question: 3...................................................................................................................................7

REFERENCES................................................................................................................................1

Question: 1...................................................................................................................................3

Question: 2...................................................................................................................................6

Question: 3...................................................................................................................................7

REFERENCES................................................................................................................................1

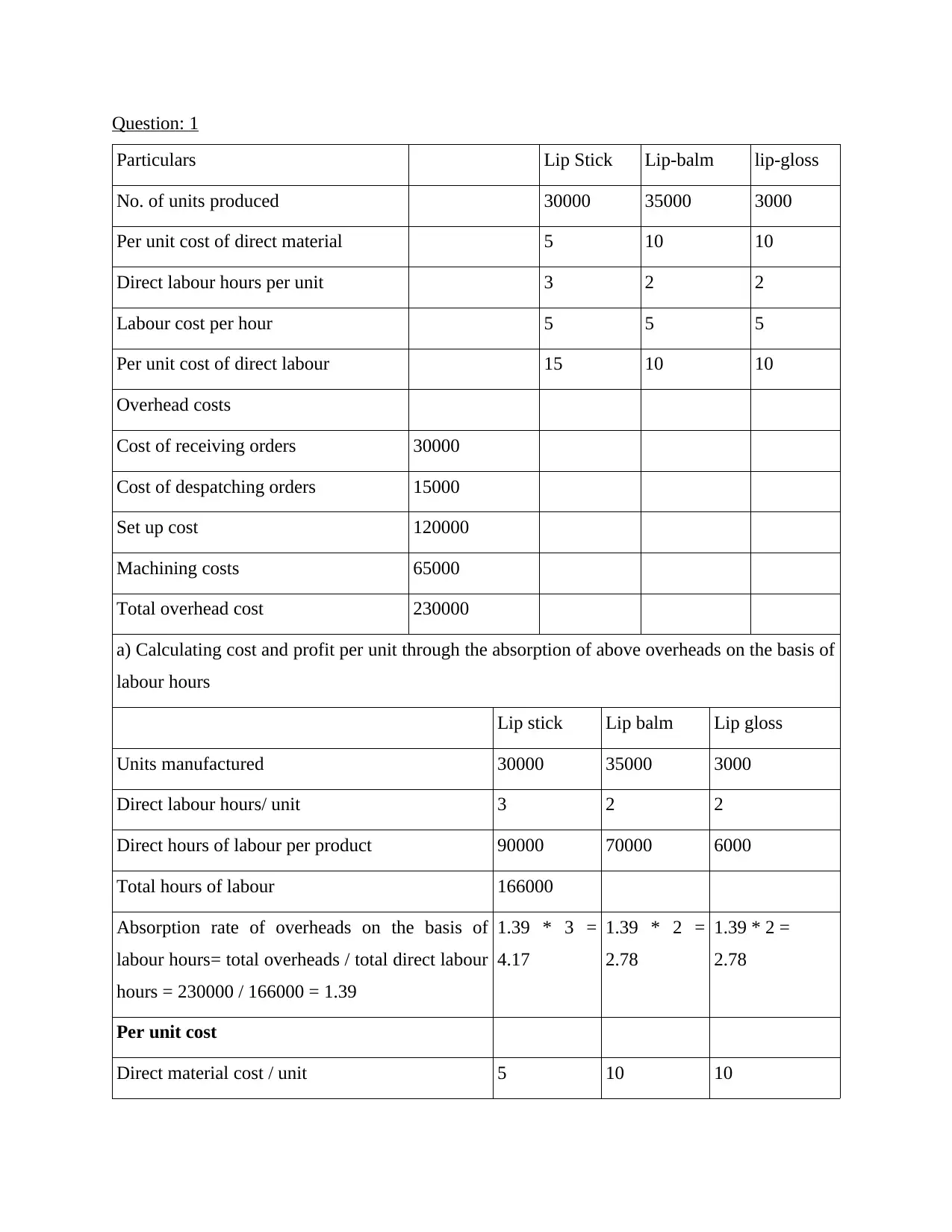

Question: 1

Particulars Lip Stick Lip-balm lip-gloss

No. of units produced 30000 35000 3000

Per unit cost of direct material 5 10 10

Direct labour hours per unit 3 2 2

Labour cost per hour 5 5 5

Per unit cost of direct labour 15 10 10

Overhead costs

Cost of receiving orders 30000

Cost of despatching orders 15000

Set up cost 120000

Machining costs 65000

Total overhead cost 230000

a) Calculating cost and profit per unit through the absorption of above overheads on the basis of

labour hours

Lip stick Lip balm Lip gloss

Units manufactured 30000 35000 3000

Direct labour hours/ unit 3 2 2

Direct hours of labour per product 90000 70000 6000

Total hours of labour 166000

Absorption rate of overheads on the basis of

labour hours= total overheads / total direct labour

hours = 230000 / 166000 = 1.39

1.39 * 3 =

4.17

1.39 * 2 =

2.78

1.39 * 2 =

2.78

Per unit cost

Direct material cost / unit 5 10 10

Particulars Lip Stick Lip-balm lip-gloss

No. of units produced 30000 35000 3000

Per unit cost of direct material 5 10 10

Direct labour hours per unit 3 2 2

Labour cost per hour 5 5 5

Per unit cost of direct labour 15 10 10

Overhead costs

Cost of receiving orders 30000

Cost of despatching orders 15000

Set up cost 120000

Machining costs 65000

Total overhead cost 230000

a) Calculating cost and profit per unit through the absorption of above overheads on the basis of

labour hours

Lip stick Lip balm Lip gloss

Units manufactured 30000 35000 3000

Direct labour hours/ unit 3 2 2

Direct hours of labour per product 90000 70000 6000

Total hours of labour 166000

Absorption rate of overheads on the basis of

labour hours= total overheads / total direct labour

hours = 230000 / 166000 = 1.39

1.39 * 3 =

4.17

1.39 * 2 =

2.78

1.39 * 2 =

2.78

Per unit cost

Direct material cost / unit 5 10 10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Direct cost of labour / unit 15 10 10

Overhead cost / unit 4.17 2.78 2.78

Total cost per unit 24.17 22.78 22.78

Sales price per unit 22 26 24

Profit / (Loss) -2.17 3.22 1.22

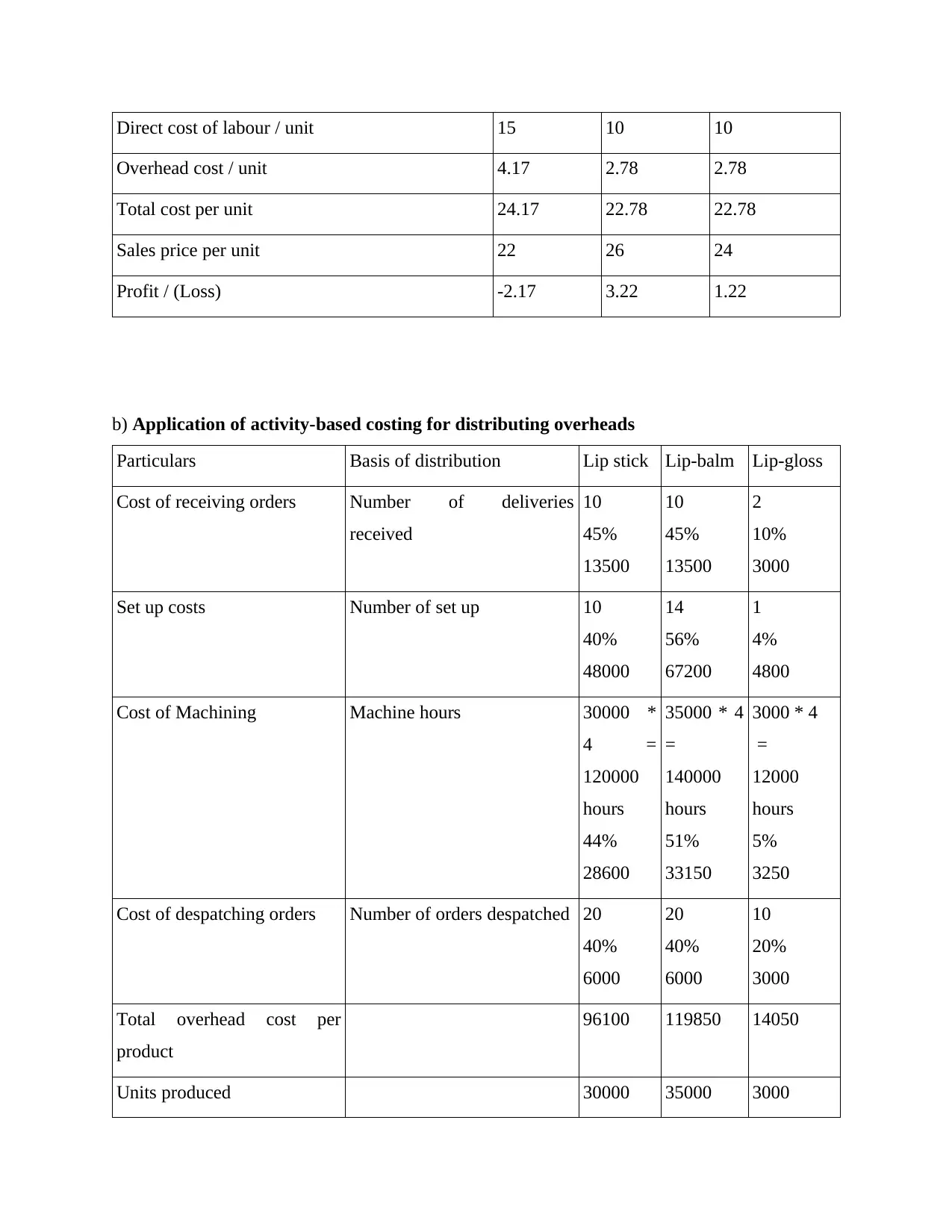

b) Application of activity-based costing for distributing overheads

Particulars Basis of distribution Lip stick Lip-balm Lip-gloss

Cost of receiving orders Number of deliveries

received

10

45%

13500

10

45%

13500

2

10%

3000

Set up costs Number of set up 10

40%

48000

14

56%

67200

1

4%

4800

Cost of Machining Machine hours 30000 *

4 =

120000

hours

44%

28600

35000 * 4

=

140000

hours

51%

33150

3000 * 4

=

12000

hours

5%

3250

Cost of despatching orders Number of orders despatched 20

40%

6000

20

40%

6000

10

20%

3000

Total overhead cost per

product

96100 119850 14050

Units produced 30000 35000 3000

Overhead cost / unit 4.17 2.78 2.78

Total cost per unit 24.17 22.78 22.78

Sales price per unit 22 26 24

Profit / (Loss) -2.17 3.22 1.22

b) Application of activity-based costing for distributing overheads

Particulars Basis of distribution Lip stick Lip-balm Lip-gloss

Cost of receiving orders Number of deliveries

received

10

45%

13500

10

45%

13500

2

10%

3000

Set up costs Number of set up 10

40%

48000

14

56%

67200

1

4%

4800

Cost of Machining Machine hours 30000 *

4 =

120000

hours

44%

28600

35000 * 4

=

140000

hours

51%

33150

3000 * 4

=

12000

hours

5%

3250

Cost of despatching orders Number of orders despatched 20

40%

6000

20

40%

6000

10

20%

3000

Total overhead cost per

product

96100 119850 14050

Units produced 30000 35000 3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

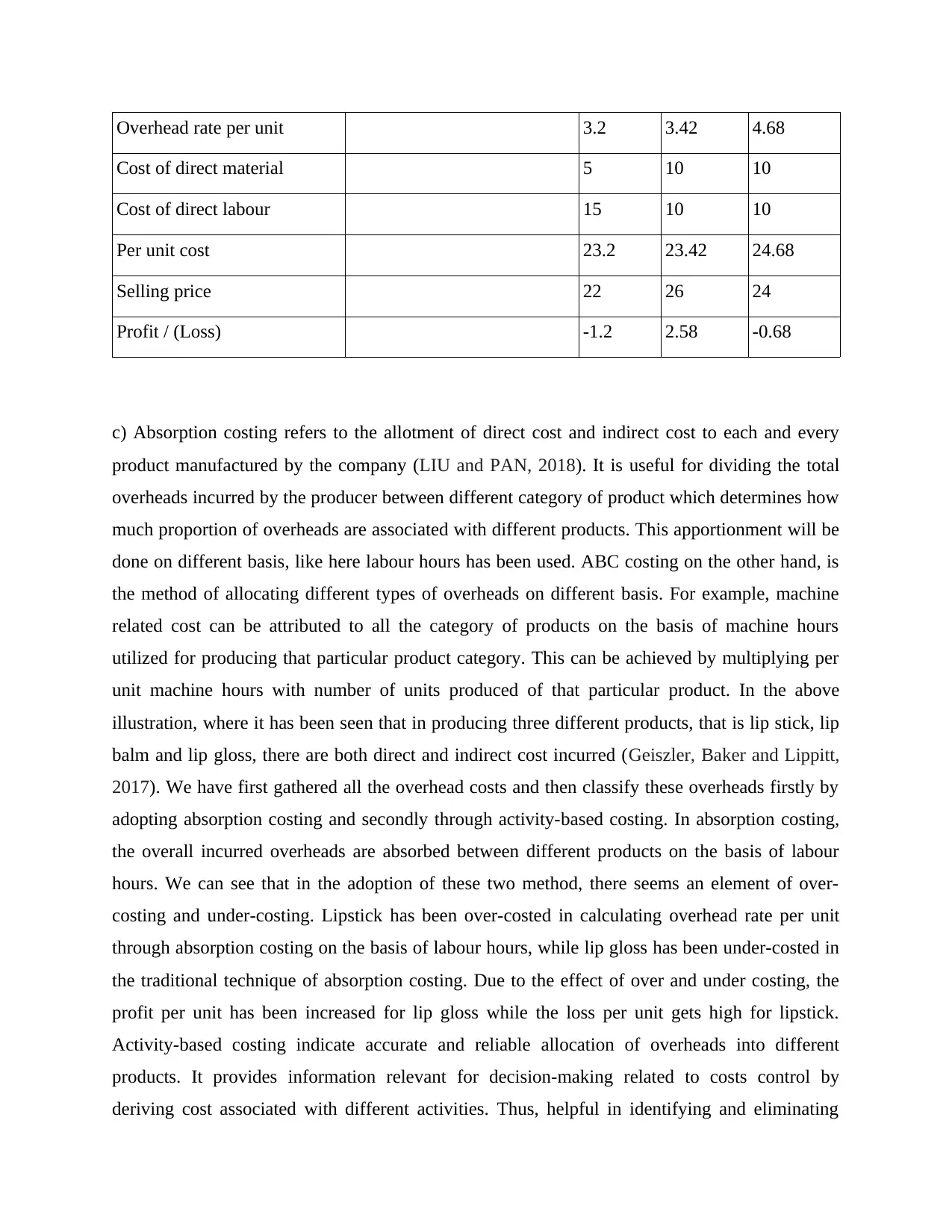

Overhead rate per unit 3.2 3.42 4.68

Cost of direct material 5 10 10

Cost of direct labour 15 10 10

Per unit cost 23.2 23.42 24.68

Selling price 22 26 24

Profit / (Loss) -1.2 2.58 -0.68

c) Absorption costing refers to the allotment of direct cost and indirect cost to each and every

product manufactured by the company (LIU and PAN, 2018). It is useful for dividing the total

overheads incurred by the producer between different category of product which determines how

much proportion of overheads are associated with different products. This apportionment will be

done on different basis, like here labour hours has been used. ABC costing on the other hand, is

the method of allocating different types of overheads on different basis. For example, machine

related cost can be attributed to all the category of products on the basis of machine hours

utilized for producing that particular product category. This can be achieved by multiplying per

unit machine hours with number of units produced of that particular product. In the above

illustration, where it has been seen that in producing three different products, that is lip stick, lip

balm and lip gloss, there are both direct and indirect cost incurred (Geiszler, Baker and Lippitt,

2017). We have first gathered all the overhead costs and then classify these overheads firstly by

adopting absorption costing and secondly through activity-based costing. In absorption costing,

the overall incurred overheads are absorbed between different products on the basis of labour

hours. We can see that in the adoption of these two method, there seems an element of over-

costing and under-costing. Lipstick has been over-costed in calculating overhead rate per unit

through absorption costing on the basis of labour hours, while lip gloss has been under-costed in

the traditional technique of absorption costing. Due to the effect of over and under costing, the

profit per unit has been increased for lip gloss while the loss per unit gets high for lipstick.

Activity-based costing indicate accurate and reliable allocation of overheads into different

products. It provides information relevant for decision-making related to costs control by

deriving cost associated with different activities. Thus, helpful in identifying and eliminating

Cost of direct material 5 10 10

Cost of direct labour 15 10 10

Per unit cost 23.2 23.42 24.68

Selling price 22 26 24

Profit / (Loss) -1.2 2.58 -0.68

c) Absorption costing refers to the allotment of direct cost and indirect cost to each and every

product manufactured by the company (LIU and PAN, 2018). It is useful for dividing the total

overheads incurred by the producer between different category of product which determines how

much proportion of overheads are associated with different products. This apportionment will be

done on different basis, like here labour hours has been used. ABC costing on the other hand, is

the method of allocating different types of overheads on different basis. For example, machine

related cost can be attributed to all the category of products on the basis of machine hours

utilized for producing that particular product category. This can be achieved by multiplying per

unit machine hours with number of units produced of that particular product. In the above

illustration, where it has been seen that in producing three different products, that is lip stick, lip

balm and lip gloss, there are both direct and indirect cost incurred (Geiszler, Baker and Lippitt,

2017). We have first gathered all the overhead costs and then classify these overheads firstly by

adopting absorption costing and secondly through activity-based costing. In absorption costing,

the overall incurred overheads are absorbed between different products on the basis of labour

hours. We can see that in the adoption of these two method, there seems an element of over-

costing and under-costing. Lipstick has been over-costed in calculating overhead rate per unit

through absorption costing on the basis of labour hours, while lip gloss has been under-costed in

the traditional technique of absorption costing. Due to the effect of over and under costing, the

profit per unit has been increased for lip gloss while the loss per unit gets high for lipstick.

Activity-based costing indicate accurate and reliable allocation of overheads into different

products. It provides information relevant for decision-making related to costs control by

deriving cost associated with different activities. Thus, helpful in identifying and eliminating

higher cost incurring activities. At last, it can be interpreted that activity-based costing provide a

better view of cost of production than traditional form of absorption costing.

d) All managers strives hard for determining and reducing the effect of uncertainties through by

applying tools and models in their decision- making task. As decisions are considered to be made

under uncertainty, sensitivity analysis is a tool through which various uncertain factors are taken

into consideration for decision-making purpose. It helps to determine how other factors

or(sensitive factors) gets affected if there is any change in one particular factor. This analysis

helps to answer question like what happen if? and it is also known as “what if analysis”

(Kamiński, Jakubczyk and Szufel, 2018.). This technique can be best utilized by managers

through incorporating decision-making information into excel spreadsheet, and then by simply

changing value to understand the sensitivity of profits and other factors like costs. It helps in

identifying how it is possible to remain profitable if the sales figure currently prevailing gets

reduced to certain level. Thus, the analysis of sensitivity helps in determining the possibility of

uncertainties, if the expected and actual figures of sales and costs differ. Such identification of

uncertainties helps in substituting variable costs from fixed costs in order to reduce uncertainties

related to cost.

Question: 2

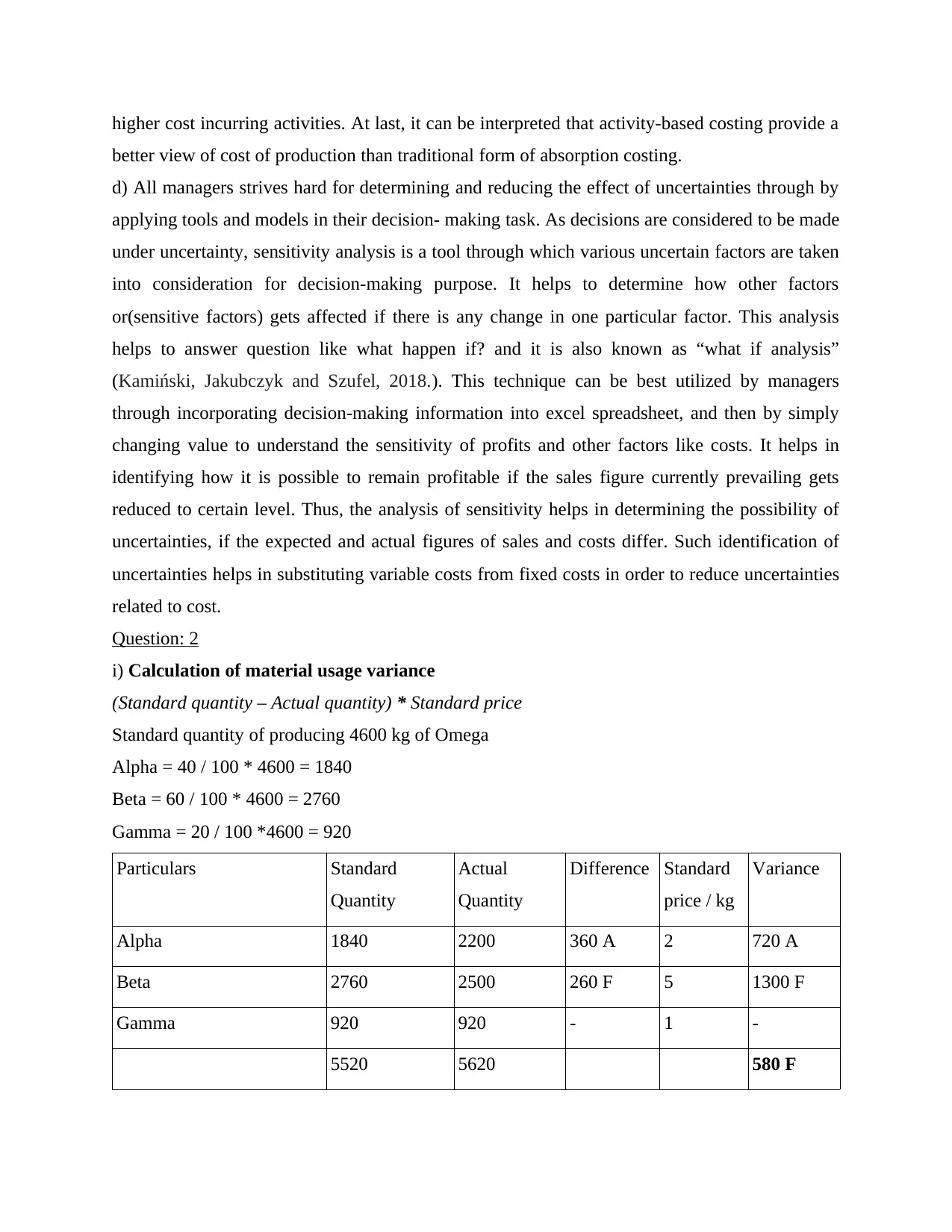

i) Calculation of material usage variance

(Standard quantity – Actual quantity) * Standard price

Standard quantity of producing 4600 kg of Omega

Alpha = 40 / 100 * 4600 = 1840

Beta = 60 / 100 * 4600 = 2760

Gamma = 20 / 100 *4600 = 920

Particulars Standard

Quantity

Actual

Quantity

Difference Standard

price / kg

Variance

Alpha 1840 2200 360 A 2 720 A

Beta 2760 2500 260 F 5 1300 F

Gamma 920 920 - 1 -

5520 5620 580 F

better view of cost of production than traditional form of absorption costing.

d) All managers strives hard for determining and reducing the effect of uncertainties through by

applying tools and models in their decision- making task. As decisions are considered to be made

under uncertainty, sensitivity analysis is a tool through which various uncertain factors are taken

into consideration for decision-making purpose. It helps to determine how other factors

or(sensitive factors) gets affected if there is any change in one particular factor. This analysis

helps to answer question like what happen if? and it is also known as “what if analysis”

(Kamiński, Jakubczyk and Szufel, 2018.). This technique can be best utilized by managers

through incorporating decision-making information into excel spreadsheet, and then by simply

changing value to understand the sensitivity of profits and other factors like costs. It helps in

identifying how it is possible to remain profitable if the sales figure currently prevailing gets

reduced to certain level. Thus, the analysis of sensitivity helps in determining the possibility of

uncertainties, if the expected and actual figures of sales and costs differ. Such identification of

uncertainties helps in substituting variable costs from fixed costs in order to reduce uncertainties

related to cost.

Question: 2

i) Calculation of material usage variance

(Standard quantity – Actual quantity) * Standard price

Standard quantity of producing 4600 kg of Omega

Alpha = 40 / 100 * 4600 = 1840

Beta = 60 / 100 * 4600 = 2760

Gamma = 20 / 100 *4600 = 920

Particulars Standard

Quantity

Actual

Quantity

Difference Standard

price / kg

Variance

Alpha 1840 2200 360 A 2 720 A

Beta 2760 2500 260 F 5 1300 F

Gamma 920 920 - 1 -

5520 5620 580 F

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

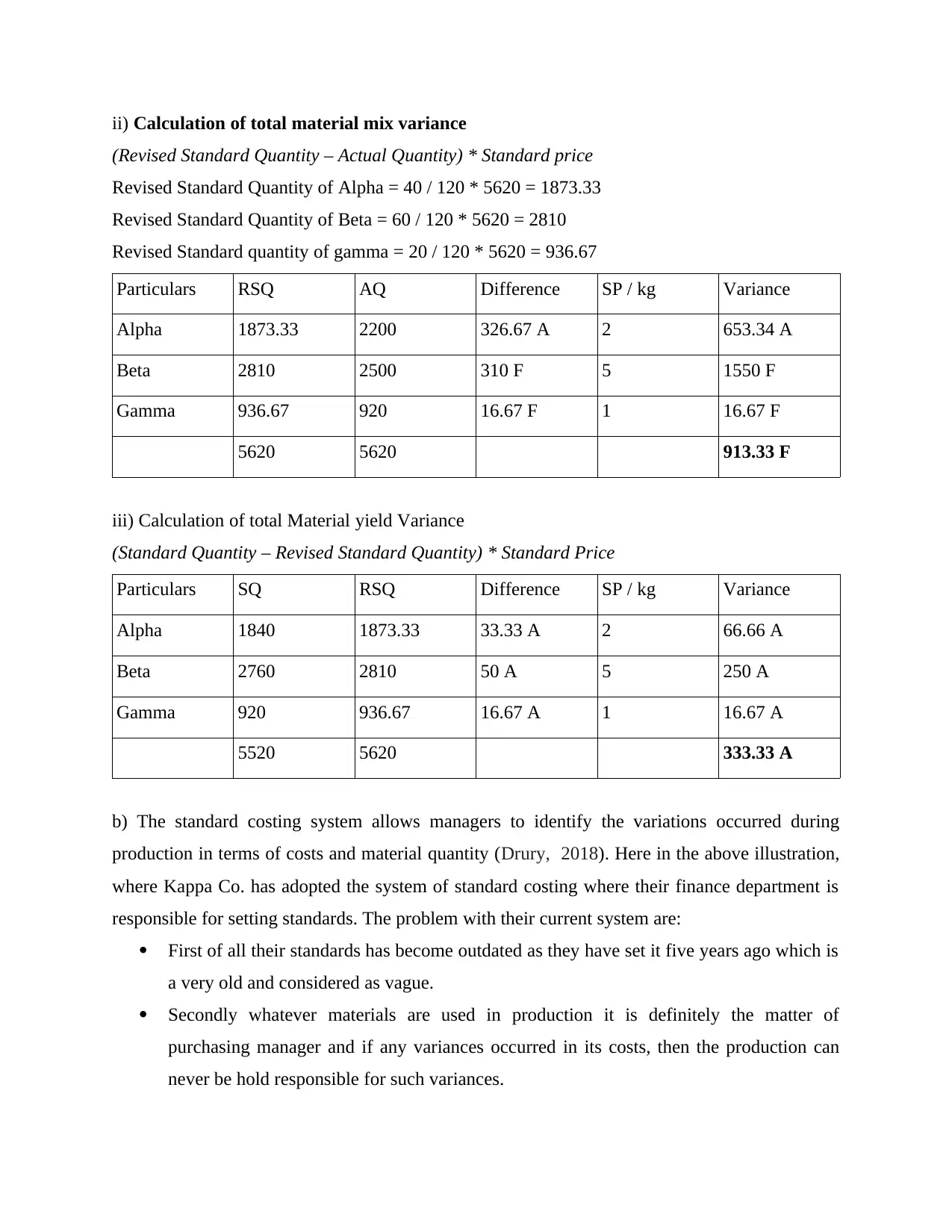

ii) Calculation of total material mix variance

(Revised Standard Quantity – Actual Quantity) * Standard price

Revised Standard Quantity of Alpha = 40 / 120 * 5620 = 1873.33

Revised Standard Quantity of Beta = 60 / 120 * 5620 = 2810

Revised Standard quantity of gamma = 20 / 120 * 5620 = 936.67

Particulars RSQ AQ Difference SP / kg Variance

Alpha 1873.33 2200 326.67 A 2 653.34 A

Beta 2810 2500 310 F 5 1550 F

Gamma 936.67 920 16.67 F 1 16.67 F

5620 5620 913.33 F

iii) Calculation of total Material yield Variance

(Standard Quantity – Revised Standard Quantity) * Standard Price

Particulars SQ RSQ Difference SP / kg Variance

Alpha 1840 1873.33 33.33 A 2 66.66 A

Beta 2760 2810 50 A 5 250 A

Gamma 920 936.67 16.67 A 1 16.67 A

5520 5620 333.33 A

b) The standard costing system allows managers to identify the variations occurred during

production in terms of costs and material quantity (Drury, 2018). Here in the above illustration,

where Kappa Co. has adopted the system of standard costing where their finance department is

responsible for setting standards. The problem with their current system are:

First of all their standards has become outdated as they have set it five years ago which is

a very old and considered as vague.

Secondly whatever materials are used in production it is definitely the matter of

purchasing manager and if any variances occurred in its costs, then the production can

never be hold responsible for such variances.

(Revised Standard Quantity – Actual Quantity) * Standard price

Revised Standard Quantity of Alpha = 40 / 120 * 5620 = 1873.33

Revised Standard Quantity of Beta = 60 / 120 * 5620 = 2810

Revised Standard quantity of gamma = 20 / 120 * 5620 = 936.67

Particulars RSQ AQ Difference SP / kg Variance

Alpha 1873.33 2200 326.67 A 2 653.34 A

Beta 2810 2500 310 F 5 1550 F

Gamma 936.67 920 16.67 F 1 16.67 F

5620 5620 913.33 F

iii) Calculation of total Material yield Variance

(Standard Quantity – Revised Standard Quantity) * Standard Price

Particulars SQ RSQ Difference SP / kg Variance

Alpha 1840 1873.33 33.33 A 2 66.66 A

Beta 2760 2810 50 A 5 250 A

Gamma 920 936.67 16.67 A 1 16.67 A

5520 5620 333.33 A

b) The standard costing system allows managers to identify the variations occurred during

production in terms of costs and material quantity (Drury, 2018). Here in the above illustration,

where Kappa Co. has adopted the system of standard costing where their finance department is

responsible for setting standards. The problem with their current system are:

First of all their standards has become outdated as they have set it five years ago which is

a very old and considered as vague.

Secondly whatever materials are used in production it is definitely the matter of

purchasing manager and if any variances occurred in its costs, then the production can

never be hold responsible for such variances.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Also, the standard mix that is set by and responsibility of finance department, who are

actually the decision-maker and if there is any problem or incorrectness in their decisions,

then the production manager can't do anything for the effect of these decisions (Paul,

2020).

Price and quality always keeps on changing. As every production manager strives for

achieving higher quality of the products. But the continuous volatility in price and quality

leads to mismatch between standard and actual mix.

Due to all these problems in reporting variances, the performance of production manager get

greatly affected for the reason that are not under their control.

Question: 3

Zero-based budgeting is the method of setting budget where the figures pertaining to budget are

set from the base zero where no reference being given for previously set budgets or any prior

performance (Ouassini, 2018). What heads are included are first justified and then included in

budget. This technique of budgeting allocate different resources of the company to the activities

to be performed on the basis of their need and importance in the achievement of objectives.

While under incremental budgeting technique all the figures of prior budget are first referred to,

and then by increasing or decreasing these figures from some percentage, the actual budget is

carried out. Both ZBB and incremental budgeting technique suffered from various limitations

which makes them unsuitable for planning, coordination and control (May, 2017). In case of

incremental budgeting, it has many limitations like there is pre-existence of assumption that

whatever activities are previously performed are needed in the future also, also no justification of

items before taking them into budget and at last no motivation for departmental managers for

controlling cost associated with their departments.

actually the decision-maker and if there is any problem or incorrectness in their decisions,

then the production manager can't do anything for the effect of these decisions (Paul,

2020).

Price and quality always keeps on changing. As every production manager strives for

achieving higher quality of the products. But the continuous volatility in price and quality

leads to mismatch between standard and actual mix.

Due to all these problems in reporting variances, the performance of production manager get

greatly affected for the reason that are not under their control.

Question: 3

Zero-based budgeting is the method of setting budget where the figures pertaining to budget are

set from the base zero where no reference being given for previously set budgets or any prior

performance (Ouassini, 2018). What heads are included are first justified and then included in

budget. This technique of budgeting allocate different resources of the company to the activities

to be performed on the basis of their need and importance in the achievement of objectives.

While under incremental budgeting technique all the figures of prior budget are first referred to,

and then by increasing or decreasing these figures from some percentage, the actual budget is

carried out. Both ZBB and incremental budgeting technique suffered from various limitations

which makes them unsuitable for planning, coordination and control (May, 2017). In case of

incremental budgeting, it has many limitations like there is pre-existence of assumption that

whatever activities are previously performed are needed in the future also, also no justification of

items before taking them into budget and at last no motivation for departmental managers for

controlling cost associated with their departments.

REFERENCES

Books and journals

LIU, B. and PAN, H. Q., 2018. Comparative Study of Absorption Costing and Variable

Costing. Journal of Qiqihar University (Philosophy & Social Science Edition), p.06.

Geiszler, M., Baker, K. and Lippitt, J., 2017. Variable Activity‐Based Costing and Decision

Making. Journal of Corporate Accounting & Finance, 28(5), pp.45-52.

Drury, C., 2018. Cost and management accounting. Cengage Learning.

Kamiński, B., Jakubczyk, M. and Szufel, P., 2018. A framework for sensitivity analysis of

decision trees. Central European journal of operations research, 26(1), pp.135-159.

Paul, D.D., 2020. STANDARD COSTING AND ABC: A COEXISTENCE. Strategic

Finance, 101(11), pp.32-39.

Ouassini, I., 2018. An introduction to the concept of Incremental Budgeting and Beyond

Budgeting. Available at SSRN 3140059.

May, A.U., 2017. Traditional budgeting in today’s business environment. Journal of Applied

Finance & Banking, 7(3), pp.111-120.

1

Books and journals

LIU, B. and PAN, H. Q., 2018. Comparative Study of Absorption Costing and Variable

Costing. Journal of Qiqihar University (Philosophy & Social Science Edition), p.06.

Geiszler, M., Baker, K. and Lippitt, J., 2017. Variable Activity‐Based Costing and Decision

Making. Journal of Corporate Accounting & Finance, 28(5), pp.45-52.

Drury, C., 2018. Cost and management accounting. Cengage Learning.

Kamiński, B., Jakubczyk, M. and Szufel, P., 2018. A framework for sensitivity analysis of

decision trees. Central European journal of operations research, 26(1), pp.135-159.

Paul, D.D., 2020. STANDARD COSTING AND ABC: A COEXISTENCE. Strategic

Finance, 101(11), pp.32-39.

Ouassini, I., 2018. An introduction to the concept of Incremental Budgeting and Beyond

Budgeting. Available at SSRN 3140059.

May, A.U., 2017. Traditional budgeting in today’s business environment. Journal of Applied

Finance & Banking, 7(3), pp.111-120.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.