Report: Financial Preparedness of Older Australians for Retirement

VerifiedAdded on 2022/09/18

|8

|1168

|26

Report

AI Summary

This report assesses the financial preparedness of older Australians for retirement, analyzing data from a survey of 1,525 participants aged 60 and over. The study examines primary income sources after retirement, the prevalence of high mortgage debt among low-income individuals, and the respondents' comfort levels with their retirement plans. The analysis reveals that pension and superannuation are primary income sources, and part-time employment is common. The report identifies that only a small percentage of low-income individuals have high mortgage debt. Additionally, the study highlights a statistically significant difference in comfort levels with retirement plans between older males and females, with males expressing greater comfort. The report includes statistical analysis, such as t-tests, to support its findings and discusses the limitations of the study, suggesting future research directions, such as reducing the survey's length and exploring the relationship between financial knowledge and retirement planning. The report is a result of the assignment based on the provided dataset from data.gov.au, modified for the purpose of the assignment.

1

Assignment [Enter Assignment number]

Financial Preparedness of Older Australians for their Retirement

Assignment [Enter Assignment number]

Financial Preparedness of Older Australians for their Retirement

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

Introduction...........................................................................................................................................3

Methods................................................................................................................................................3

Results...................................................................................................................................................4

Task 1.................................................................................................................................................4

Task 2.................................................................................................................................................4

Task 3.................................................................................................................................................5

Task 4.................................................................................................................................................5

Task 5.................................................................................................................................................6

Conclusion.............................................................................................................................................7

References.............................................................................................................................................8

Table of Contents

Introduction...........................................................................................................................................3

Methods................................................................................................................................................3

Results...................................................................................................................................................4

Task 1.................................................................................................................................................4

Task 2.................................................................................................................................................4

Task 3.................................................................................................................................................5

Task 4.................................................................................................................................................5

Task 5.................................................................................................................................................6

Conclusion.............................................................................................................................................7

References.............................................................................................................................................8

3

Introduction

Decisions such as the allocation of funds to pension portfolios, the valuation of mortgage

products and/or post retirement earnings require thorough preplanning (Wijeratne, Earl,

Peisah, Luscombe, & Tibbertsma, 2017). This research scrutinizes the preparedness of

Australian people for retirement planning using a descriptive analysis that includes

exploration of questions collected from a tailored survey to an illustrative sample of 1,525

Australians.

The primary objective of the study was to assess people from primary source of income after

retirement, number of low income group people (annual income ≤ $100,000) with high

mortgage, and comfort with retirement plans. These three factors are expected to define the

financial knowledge and awareness of people for the retirement expenses.

Methods

The survey data was retrieved from data.gov.au, and was specifically modified for this

research. The present sample contains response from 1,525 Australians (60 years or older),

which was representative of Australia’s general older and retired population.

MS Excel has been used for statistical analysis. The study decisions are based on exploratory

data analysis and graphical representation. Also, an independent sample t-test has been

performed to evaluate the difference between the two genders regarding their comfort with

retirement planning (Kim, 2015). Significance level of 1% has been used for the inferential

analysis.

Introduction

Decisions such as the allocation of funds to pension portfolios, the valuation of mortgage

products and/or post retirement earnings require thorough preplanning (Wijeratne, Earl,

Peisah, Luscombe, & Tibbertsma, 2017). This research scrutinizes the preparedness of

Australian people for retirement planning using a descriptive analysis that includes

exploration of questions collected from a tailored survey to an illustrative sample of 1,525

Australians.

The primary objective of the study was to assess people from primary source of income after

retirement, number of low income group people (annual income ≤ $100,000) with high

mortgage, and comfort with retirement plans. These three factors are expected to define the

financial knowledge and awareness of people for the retirement expenses.

Methods

The survey data was retrieved from data.gov.au, and was specifically modified for this

research. The present sample contains response from 1,525 Australians (60 years or older),

which was representative of Australia’s general older and retired population.

MS Excel has been used for statistical analysis. The study decisions are based on exploratory

data analysis and graphical representation. Also, an independent sample t-test has been

performed to evaluate the difference between the two genders regarding their comfort with

retirement planning (Kim, 2015). Significance level of 1% has been used for the inferential

analysis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Results

Task 1

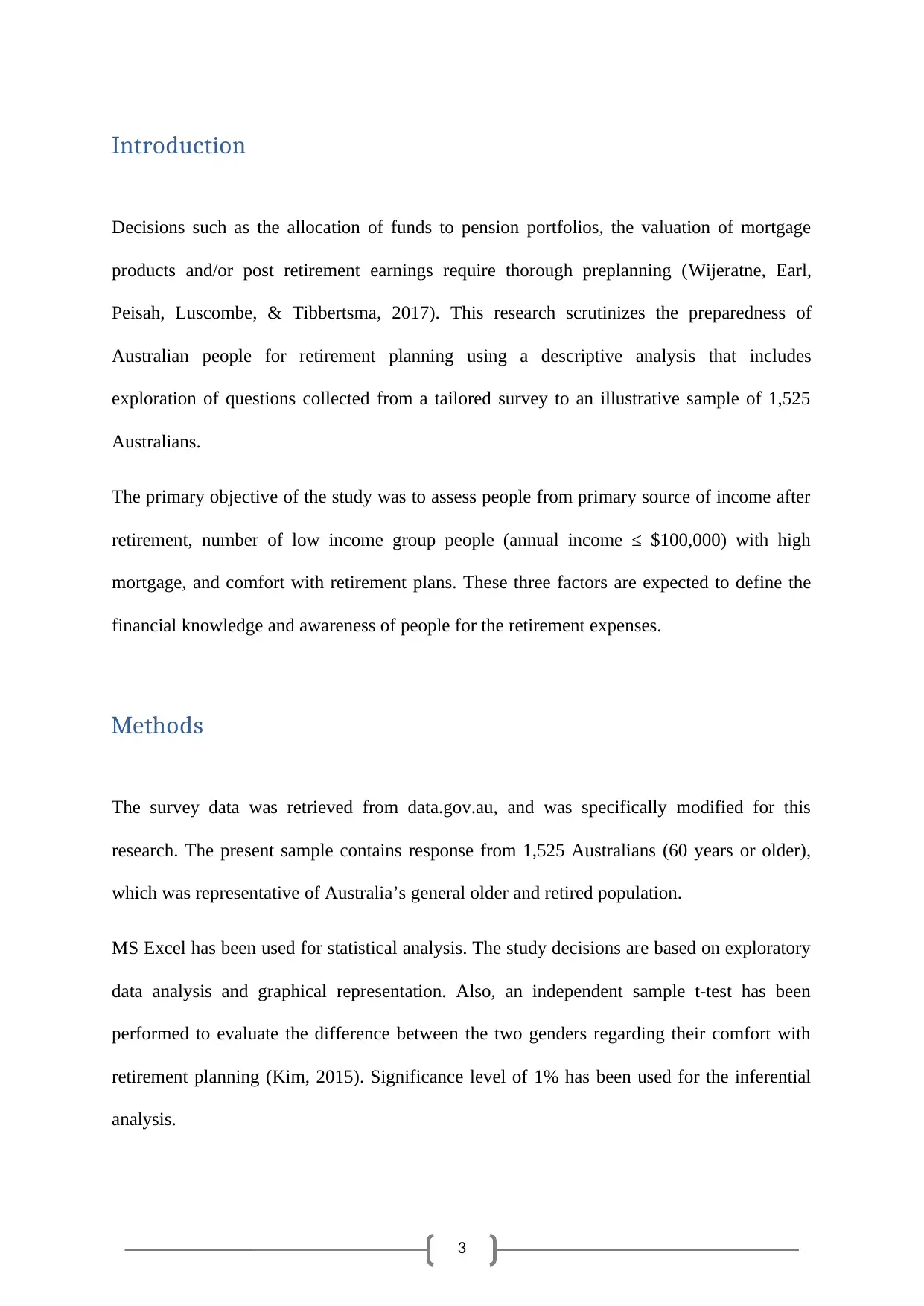

Figure 1 represents the distribution of number of respondents from the five age groups. It can

be noted that most of the participants belonged to either age group of 60-64 or 65-69. Gender

wise exploration in Table 1 reflects that there was an equal representation of both the genders

in the sample, especially in age groups of 60-64 and 65-69. A skewed representation of males

can be noted for age groups 75-80 and 80+.

Table 1: Gender wise age group of respondents

Figure 1: Bar Chart for representation of five age groups

Task 2

Individual time to complete the survey for each participant has been calculated in hour,

minute, and second format, where median time to complete the survey was found to be 18

minutes and 51 seconds.

Results

Task 1

Figure 1 represents the distribution of number of respondents from the five age groups. It can

be noted that most of the participants belonged to either age group of 60-64 or 65-69. Gender

wise exploration in Table 1 reflects that there was an equal representation of both the genders

in the sample, especially in age groups of 60-64 and 65-69. A skewed representation of males

can be noted for age groups 75-80 and 80+.

Table 1: Gender wise age group of respondents

Figure 1: Bar Chart for representation of five age groups

Task 2

Individual time to complete the survey for each participant has been calculated in hour,

minute, and second format, where median time to complete the survey was found to be 18

minutes and 51 seconds.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

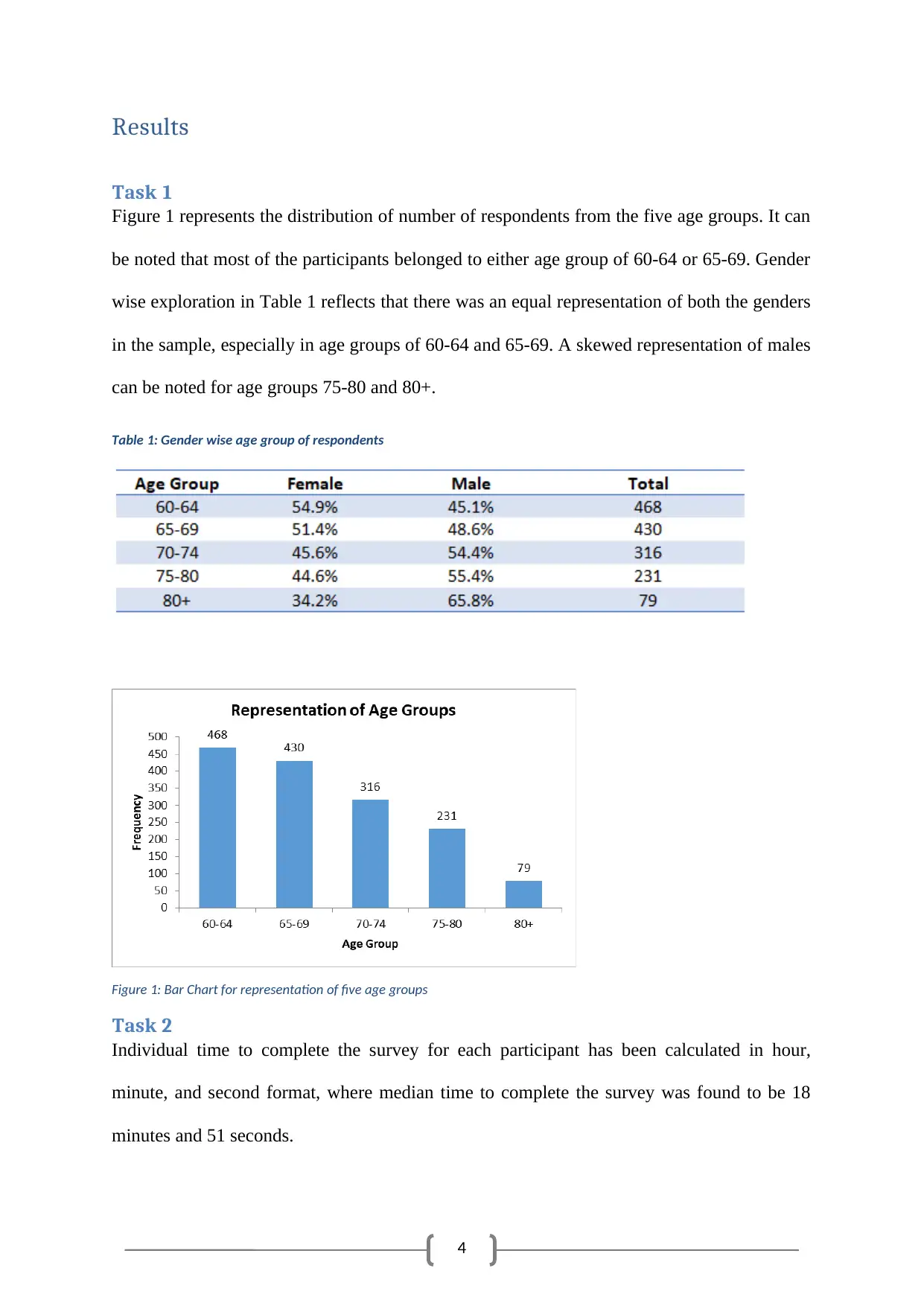

Task 3

The graphical summary in Figure 2 indicates that pension, superannuation benefits were the

two primary source of income of retired people, mostly worked in part time employment.

Other government sources of income and savings were the next two sources of income, but

interestingly, most of the people are unemployed under these employment arrangements.

Figure 2: Clustered bar chart used to represents primary source of income based on employment classification

Task 4

Financial planning for mortgage, especially for respondents aged 65 or over and with annual

income of $100,000 or less was calculated. For this consideration, debt of people more than

$50,000 was considered as the benchmark for mortgage. Formula based calculation yield that

29 respondents belonged to this category of financially risky situation.

Task 3

The graphical summary in Figure 2 indicates that pension, superannuation benefits were the

two primary source of income of retired people, mostly worked in part time employment.

Other government sources of income and savings were the next two sources of income, but

interestingly, most of the people are unemployed under these employment arrangements.

Figure 2: Clustered bar chart used to represents primary source of income based on employment classification

Task 4

Financial planning for mortgage, especially for respondents aged 65 or over and with annual

income of $100,000 or less was calculated. For this consideration, debt of people more than

$50,000 was considered as the benchmark for mortgage. Formula based calculation yield that

29 respondents belonged to this category of financially risky situation.

6

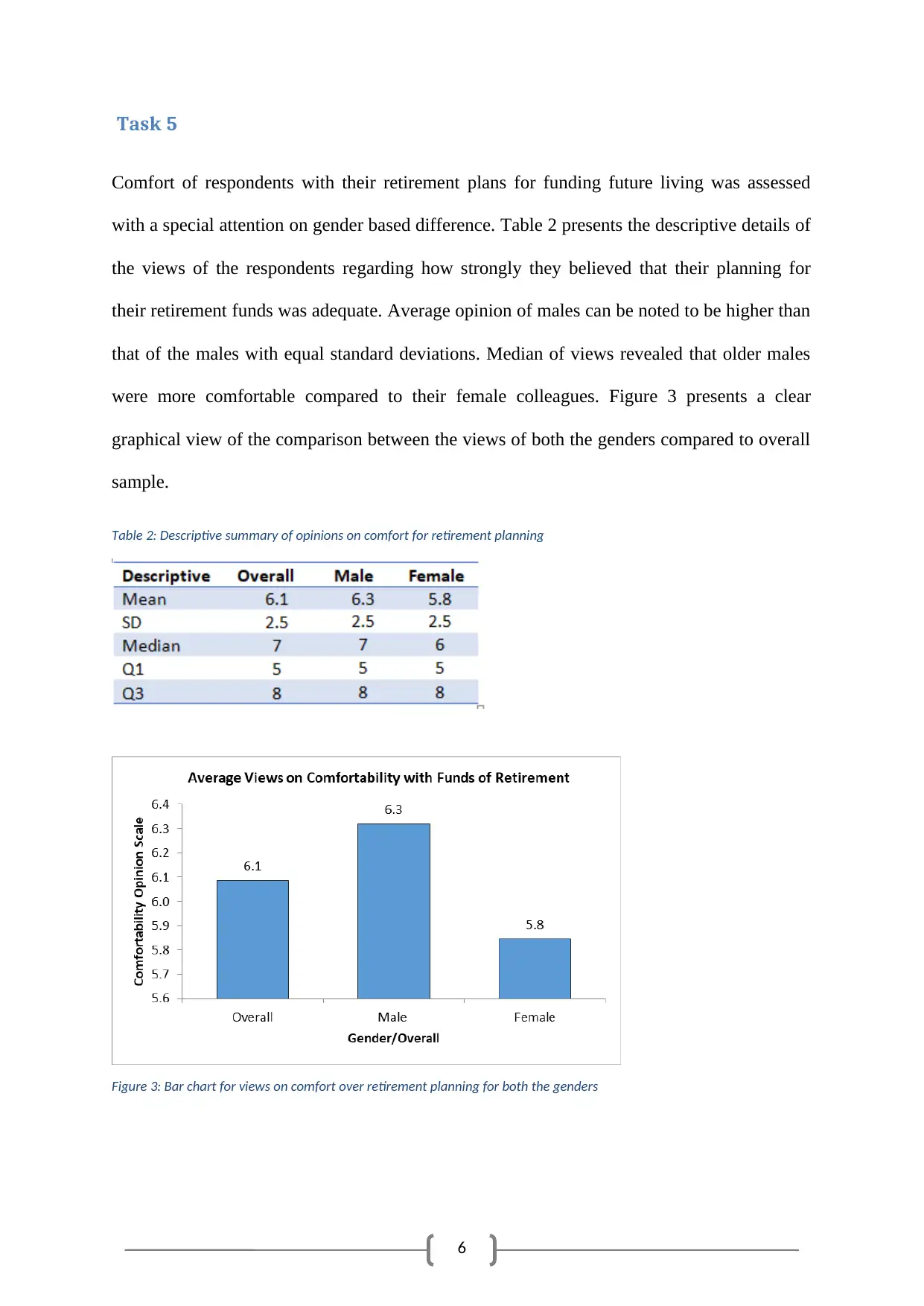

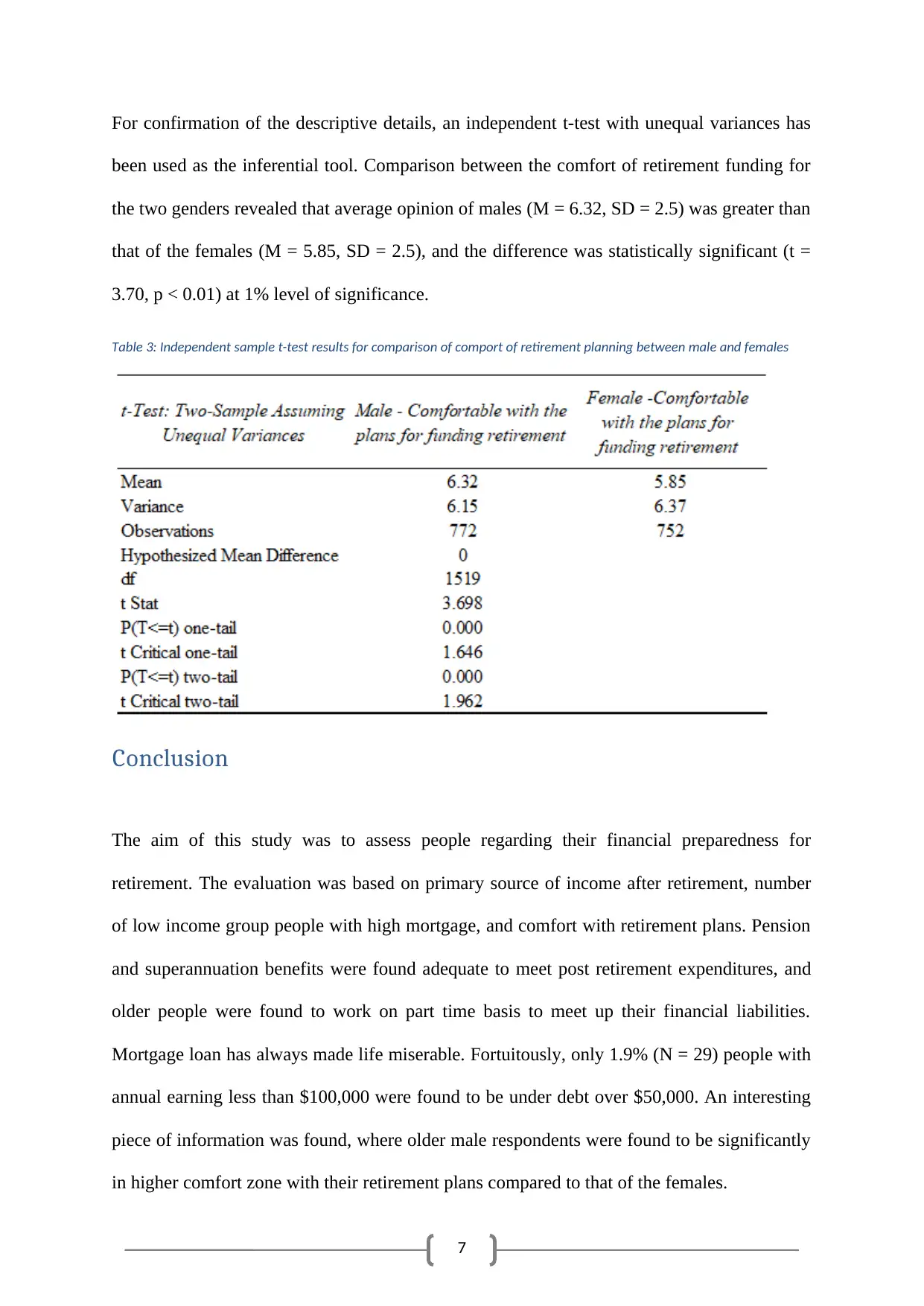

Task 5

Comfort of respondents with their retirement plans for funding future living was assessed

with a special attention on gender based difference. Table 2 presents the descriptive details of

the views of the respondents regarding how strongly they believed that their planning for

their retirement funds was adequate. Average opinion of males can be noted to be higher than

that of the males with equal standard deviations. Median of views revealed that older males

were more comfortable compared to their female colleagues. Figure 3 presents a clear

graphical view of the comparison between the views of both the genders compared to overall

sample.

Table 2: Descriptive summary of opinions on comfort for retirement planning

Figure 3: Bar chart for views on comfort over retirement planning for both the genders

Task 5

Comfort of respondents with their retirement plans for funding future living was assessed

with a special attention on gender based difference. Table 2 presents the descriptive details of

the views of the respondents regarding how strongly they believed that their planning for

their retirement funds was adequate. Average opinion of males can be noted to be higher than

that of the males with equal standard deviations. Median of views revealed that older males

were more comfortable compared to their female colleagues. Figure 3 presents a clear

graphical view of the comparison between the views of both the genders compared to overall

sample.

Table 2: Descriptive summary of opinions on comfort for retirement planning

Figure 3: Bar chart for views on comfort over retirement planning for both the genders

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

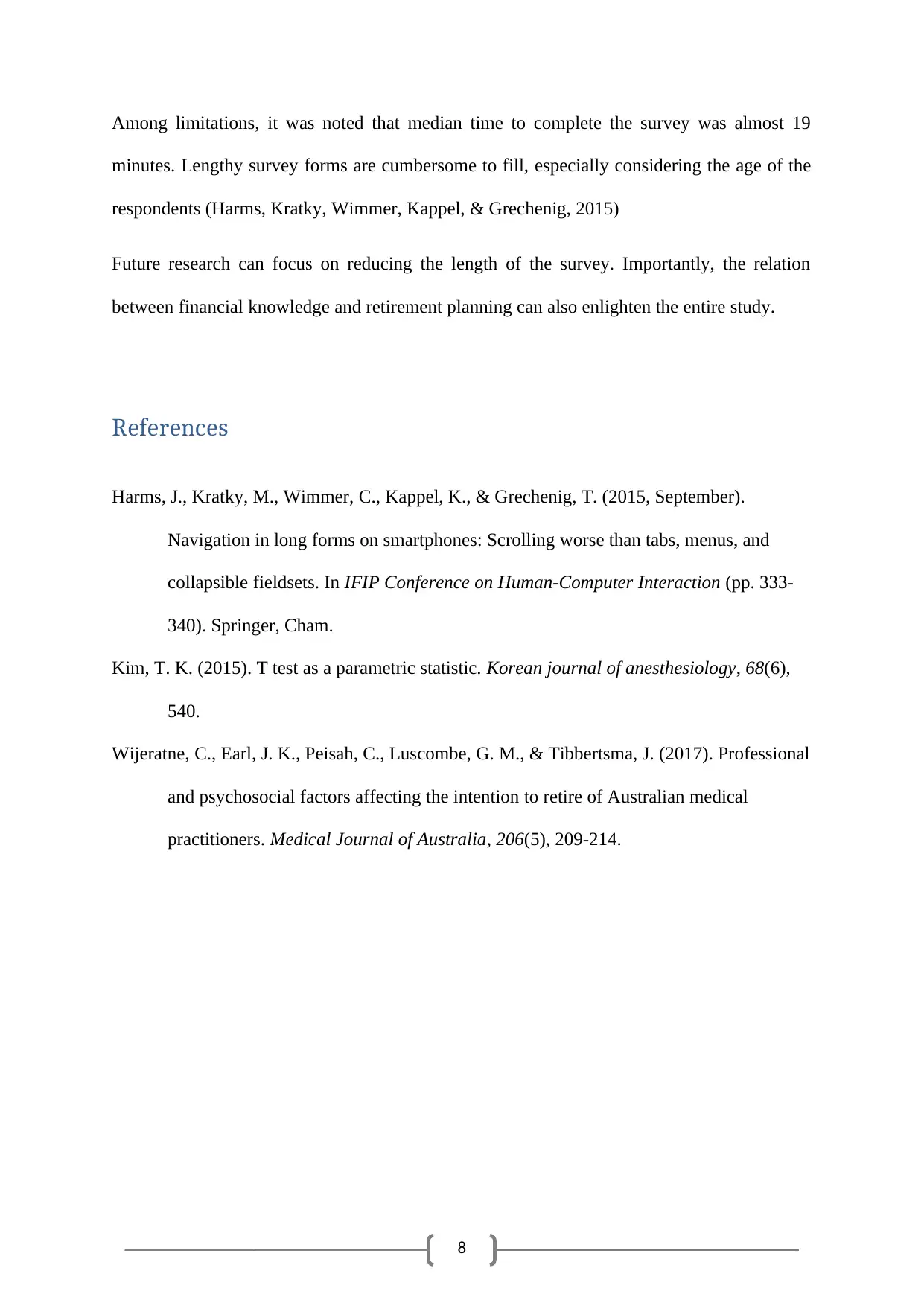

For confirmation of the descriptive details, an independent t-test with unequal variances has

been used as the inferential tool. Comparison between the comfort of retirement funding for

the two genders revealed that average opinion of males (M = 6.32, SD = 2.5) was greater than

that of the females (M = 5.85, SD = 2.5), and the difference was statistically significant (t =

3.70, p < 0.01) at 1% level of significance.

Table 3: Independent sample t-test results for comparison of comport of retirement planning between male and females

Conclusion

The aim of this study was to assess people regarding their financial preparedness for

retirement. The evaluation was based on primary source of income after retirement, number

of low income group people with high mortgage, and comfort with retirement plans. Pension

and superannuation benefits were found adequate to meet post retirement expenditures, and

older people were found to work on part time basis to meet up their financial liabilities.

Mortgage loan has always made life miserable. Fortuitously, only 1.9% (N = 29) people with

annual earning less than $100,000 were found to be under debt over $50,000. An interesting

piece of information was found, where older male respondents were found to be significantly

in higher comfort zone with their retirement plans compared to that of the females.

For confirmation of the descriptive details, an independent t-test with unequal variances has

been used as the inferential tool. Comparison between the comfort of retirement funding for

the two genders revealed that average opinion of males (M = 6.32, SD = 2.5) was greater than

that of the females (M = 5.85, SD = 2.5), and the difference was statistically significant (t =

3.70, p < 0.01) at 1% level of significance.

Table 3: Independent sample t-test results for comparison of comport of retirement planning between male and females

Conclusion

The aim of this study was to assess people regarding their financial preparedness for

retirement. The evaluation was based on primary source of income after retirement, number

of low income group people with high mortgage, and comfort with retirement plans. Pension

and superannuation benefits were found adequate to meet post retirement expenditures, and

older people were found to work on part time basis to meet up their financial liabilities.

Mortgage loan has always made life miserable. Fortuitously, only 1.9% (N = 29) people with

annual earning less than $100,000 were found to be under debt over $50,000. An interesting

piece of information was found, where older male respondents were found to be significantly

in higher comfort zone with their retirement plans compared to that of the females.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Among limitations, it was noted that median time to complete the survey was almost 19

minutes. Lengthy survey forms are cumbersome to fill, especially considering the age of the

respondents (Harms, Kratky, Wimmer, Kappel, & Grechenig, 2015)

Future research can focus on reducing the length of the survey. Importantly, the relation

between financial knowledge and retirement planning can also enlighten the entire study.

References

Harms, J., Kratky, M., Wimmer, C., Kappel, K., & Grechenig, T. (2015, September).

Navigation in long forms on smartphones: Scrolling worse than tabs, menus, and

collapsible fieldsets. In IFIP Conference on Human-Computer Interaction (pp. 333-

340). Springer, Cham.

Kim, T. K. (2015). T test as a parametric statistic. Korean journal of anesthesiology, 68(6),

540.

Wijeratne, C., Earl, J. K., Peisah, C., Luscombe, G. M., & Tibbertsma, J. (2017). Professional

and psychosocial factors affecting the intention to retire of Australian medical

practitioners. Medical Journal of Australia, 206(5), 209-214.

Among limitations, it was noted that median time to complete the survey was almost 19

minutes. Lengthy survey forms are cumbersome to fill, especially considering the age of the

respondents (Harms, Kratky, Wimmer, Kappel, & Grechenig, 2015)

Future research can focus on reducing the length of the survey. Importantly, the relation

between financial knowledge and retirement planning can also enlighten the entire study.

References

Harms, J., Kratky, M., Wimmer, C., Kappel, K., & Grechenig, T. (2015, September).

Navigation in long forms on smartphones: Scrolling worse than tabs, menus, and

collapsible fieldsets. In IFIP Conference on Human-Computer Interaction (pp. 333-

340). Springer, Cham.

Kim, T. K. (2015). T test as a parametric statistic. Korean journal of anesthesiology, 68(6),

540.

Wijeratne, C., Earl, J. K., Peisah, C., Luscombe, G. M., & Tibbertsma, J. (2017). Professional

and psychosocial factors affecting the intention to retire of Australian medical

practitioners. Medical Journal of Australia, 206(5), 209-214.

1 out of 8