ACC10707 Session 3, 2018: Financial Ratio Analysis of Two Firms

VerifiedAdded on 2023/05/28

|5

|2023

|458

Report

AI Summary

This report provides a detailed financial ratio analysis of A.P. Eagers Limited and its competitor, Automotive Holding Group Limited, both listed on the Australian Stock Exchange. The analysis covers key ratios including net profit margin, asset turnover ratio, current ratio, quick ratio, debt ratio, and cash conversion cycle, comparing the performance of both companies. The report concludes that both companies exhibit strengths and weaknesses in different areas, with a general concern for low net profit margins. The document emphasizes the importance of considering additional factors before making investment decisions. Desklib offers a range of study tools and solved assignments for students.

Introduction

The report seeks to analyse the financial ratios of A.P. Eagers Limited, an entity listed on Australian

Stock Exchange along with its competitor Automotive Holding Group Limited which is too listed on

Australian Stock Exchange. The entities are trading at AUD 5.92 and AUD 1.44 respectively on 19-12-

2018. The basic description of the business of entities are presented here-in-below:

A.P. Eagers Limited

A.P. Eagers Limited is an automotive retail company limited. The principal business of the company

consists of selling of old and new motor vehicles, distribution and sale of parts, accessories and

products on care of care, servicing and repair of vehicles, protection products of vehicles and other

products post sales. The company has investment in Automotive Holding Group Limited. The truck

retail segment of the company offers old and new trucks, maintenance of trucks, service in relation

to repair of vehicular parts. The company also deals in Property segment and is engaged in

acquisition and usage of property for official purpose.

Automotive Holding Group Limited

A.P. Eagers Limited is an automotive retail company limited with its operation base in Australasia.

The principal business segment of the entity consists of automotive retail, refrigerated logistics and

other logistics. The company has over one hundred and ninety franchisees with more than 110

dealership locations and has its business operations in Australia and New Zealand. The refrigerated

segment of the company deals in cold storage and transport operations. Further, other logistics

segment of the company deals with company’s automotive part distribution and warehousing

business, distribution of motorcycles, distribution of track and bus, storage of vehicle and

engineering.

Analysis of Financial Ratios of the Company

The following financial ratios of the company have been analysed for the purpose of comparison of

A.P Eagers Limited with that of its peer Automotive Holding Group Limited has been detailed here-n-

below:

(a) Net Profit Margin;

(b) Asset Turnover Ratio;

(c) Current Ratio;

(d) Quick Ratio;

(e) Debt Ratio;

(f) Cash Conversion Cycle.

Net Profit Margin

Net Profit Margin is computed for the purpose of analysing the profitability of the company. It

symbolise the dollar of revenue left after meting out all the expenditure of business and paying out

taxes. The higher the net profit margin, the better the company is performing. Further, higher

margin also symbolise that company is able to control its cost and able to generate sufficient

revenue for future investments. (Hamel, 2018)

The formula for Net Profit Margin= (Net Profit Margin/ Sales)*100

The report seeks to analyse the financial ratios of A.P. Eagers Limited, an entity listed on Australian

Stock Exchange along with its competitor Automotive Holding Group Limited which is too listed on

Australian Stock Exchange. The entities are trading at AUD 5.92 and AUD 1.44 respectively on 19-12-

2018. The basic description of the business of entities are presented here-in-below:

A.P. Eagers Limited

A.P. Eagers Limited is an automotive retail company limited. The principal business of the company

consists of selling of old and new motor vehicles, distribution and sale of parts, accessories and

products on care of care, servicing and repair of vehicles, protection products of vehicles and other

products post sales. The company has investment in Automotive Holding Group Limited. The truck

retail segment of the company offers old and new trucks, maintenance of trucks, service in relation

to repair of vehicular parts. The company also deals in Property segment and is engaged in

acquisition and usage of property for official purpose.

Automotive Holding Group Limited

A.P. Eagers Limited is an automotive retail company limited with its operation base in Australasia.

The principal business segment of the entity consists of automotive retail, refrigerated logistics and

other logistics. The company has over one hundred and ninety franchisees with more than 110

dealership locations and has its business operations in Australia and New Zealand. The refrigerated

segment of the company deals in cold storage and transport operations. Further, other logistics

segment of the company deals with company’s automotive part distribution and warehousing

business, distribution of motorcycles, distribution of track and bus, storage of vehicle and

engineering.

Analysis of Financial Ratios of the Company

The following financial ratios of the company have been analysed for the purpose of comparison of

A.P Eagers Limited with that of its peer Automotive Holding Group Limited has been detailed here-n-

below:

(a) Net Profit Margin;

(b) Asset Turnover Ratio;

(c) Current Ratio;

(d) Quick Ratio;

(e) Debt Ratio;

(f) Cash Conversion Cycle.

Net Profit Margin

Net Profit Margin is computed for the purpose of analysing the profitability of the company. It

symbolise the dollar of revenue left after meting out all the expenditure of business and paying out

taxes. The higher the net profit margin, the better the company is performing. Further, higher

margin also symbolise that company is able to control its cost and able to generate sufficient

revenue for future investments. (Hamel, 2018)

The formula for Net Profit Margin= (Net Profit Margin/ Sales)*100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Asset Turnover Ratio

This ratio is very significant financial tool that helps an analyst to understand revenue generate per

dollar of investment in Asset. The higher the ratio, the better the company is taken care of. The ratio

also helps company to understand how well the company is able to utilise the asset and generate

revenue from those asset. The formula for computation of the ratio has been detailed here-in-

below:

Asset Turnover Ratio= (Net Sales/ Average Asset)

Further, since the ratio involves profit and loss account and an item of balance sheet average of two

years shall be considered for the purpose of analysis. Further, there are various variant to asset

turnover ratio like fixed asset turnover ratio, intangible asset turnover ratio and current asset

turnover ratio.

The ratio is important and is generally looked by investor for understanding the affairs of the

company. Further, the same symbolise level of production, quality of inventory management,

collection practice of the company etc. Thus, a strong asset turnover ratio is very significant and

speak about asset policies of the company. (efinancemangement.com, 2018)

Current Ratio

Current Ratio of the company symbolise the working capital position of the company. It is a measure

of liquidity and efficiency which helps to measure the ability of the company to pay of the short term

liabilities with the use of current asset. The ratio is significant as it measure the short term solvency

of the company and capability of the company to pay off the liabilities which is due in short term

generally one year. Further, the time available with the company to raise funds form the market to

pay off the aforesaid liabilities is generally limited.

The ratio helps investor and creditor to understand the company’s liquidity and how efficiently shall

company be able to payoff its current liability.

The asset under current asset generally encompass cash and cash equivalent, account receivables,

inventory and other current asset of short term nature while current liabilities generally encompass

account payable, short term debt, deferred tax liability of short term nature etc.

(Accountingcourses.com, 2018)

The formula for computation of current ratio has been presented here-in-below:

Current Ratio= Current Asset/ Current Liabilities

The ideal Current ratio for the company is 2:1.

Quick Ratio

Quick Ratio or Acid Test Ratio of the company symbolise ability of the company to manage its cash

flow. The ratio measures the availability of liquid/ quick assets with the company to pay off the

current liabilities of the company. It measures the liquidity and efficiency of the company to pay off

the immediate short term liabilities.

The ratio encompass quick asset and current liabilities. The quick asset consists of Account

Receivable, cash and cash equivalent and other quick asset while current liabilities generally

encompass account payable, short term debt, deferred tax liability of short term nature etc.

This ratio is very significant financial tool that helps an analyst to understand revenue generate per

dollar of investment in Asset. The higher the ratio, the better the company is taken care of. The ratio

also helps company to understand how well the company is able to utilise the asset and generate

revenue from those asset. The formula for computation of the ratio has been detailed here-in-

below:

Asset Turnover Ratio= (Net Sales/ Average Asset)

Further, since the ratio involves profit and loss account and an item of balance sheet average of two

years shall be considered for the purpose of analysis. Further, there are various variant to asset

turnover ratio like fixed asset turnover ratio, intangible asset turnover ratio and current asset

turnover ratio.

The ratio is important and is generally looked by investor for understanding the affairs of the

company. Further, the same symbolise level of production, quality of inventory management,

collection practice of the company etc. Thus, a strong asset turnover ratio is very significant and

speak about asset policies of the company. (efinancemangement.com, 2018)

Current Ratio

Current Ratio of the company symbolise the working capital position of the company. It is a measure

of liquidity and efficiency which helps to measure the ability of the company to pay of the short term

liabilities with the use of current asset. The ratio is significant as it measure the short term solvency

of the company and capability of the company to pay off the liabilities which is due in short term

generally one year. Further, the time available with the company to raise funds form the market to

pay off the aforesaid liabilities is generally limited.

The ratio helps investor and creditor to understand the company’s liquidity and how efficiently shall

company be able to payoff its current liability.

The asset under current asset generally encompass cash and cash equivalent, account receivables,

inventory and other current asset of short term nature while current liabilities generally encompass

account payable, short term debt, deferred tax liability of short term nature etc.

(Accountingcourses.com, 2018)

The formula for computation of current ratio has been presented here-in-below:

Current Ratio= Current Asset/ Current Liabilities

The ideal Current ratio for the company is 2:1.

Quick Ratio

Quick Ratio or Acid Test Ratio of the company symbolise ability of the company to manage its cash

flow. The ratio measures the availability of liquid/ quick assets with the company to pay off the

current liabilities of the company. It measures the liquidity and efficiency of the company to pay off

the immediate short term liabilities.

The ratio encompass quick asset and current liabilities. The quick asset consists of Account

Receivable, cash and cash equivalent and other quick asset while current liabilities generally

encompass account payable, short term debt, deferred tax liability of short term nature etc.

The formula for computation of current ratio has been presented here-in-below:

Quick Ratio= Quick Asset/ Current Liabilities

The ideal Current ratio for the company is 2:1.

The Quick asset are generally those asset that can be converted into cash within a period of 90 days.

The ratio helps the analyst and investor to determine ability of the company to convert its asset to

cash in order to dispose off the liability. (ce DAta Services, 2018)

Debt Ratio

The ratio measures the total portion of asset which are funded by debt encompassing the long-term

and short-term debt. It measures the leveraged position of the company. The higher the portion of

debt in the total asset of the company, the risker the investment in such company shall be. Increase

reliance on debt generally results in higher interest burden of the company which impacts the

profitability and cash flows of the company. It is similar to debt to equity ratio which shows the

comparison between debt and equity position of the company (Audit It, 2018)

The formula for debt ratio has been presented here-in-below:

Debt Ratio = Total debt including both short term and long term/ Total Asset of the company

including both current and non-current.

Cash Conversion Cycle

This is one of the significant analysis of working capital management of the company. The ratio

analyse the ability of the company to how quickly complete one cycle of trade encompassing

inventory, receivable and payables i.e how quickly business converts its inventory into cash. The

ratio is a measure of liquidity of the company and encompass three ratios which are :

(a) Asset Turnover Ratio in days: The formula for computation of Asset Turnover Ratio has been

presented here-in-below:

Asset Turnover Ratio in days: [365/( Net Sales/ (Average Asset)]

(b) Account Receivable Turnover Ratio in days: The formula for computation of Accounts

Receivable Turnover Ratio has been presented here-in-below:

Accounts Receivable Turnover Ratio in days: [365/(Net Sales/ (Average Receivables)]

(c) Account Payable Turnover Ratio in days: The formula for computation of Accounts Payable

Turnover Ratio has been presented here-in-below:

Accounts Payable Turnover Ratio in days: [365/(Net Sales/ (Average Payables)]

Further, the formula for cash conversion cycle has been presented here-in-below:

Cash Conversion Cycle= Account Receivable Turnover Ratio in days+ Inventory Turnover Ratio in

days- Accounts Payable Turnover Ratio in days. (Prestar Capital,LLC, 2016)

Quick Ratio= Quick Asset/ Current Liabilities

The ideal Current ratio for the company is 2:1.

The Quick asset are generally those asset that can be converted into cash within a period of 90 days.

The ratio helps the analyst and investor to determine ability of the company to convert its asset to

cash in order to dispose off the liability. (ce DAta Services, 2018)

Debt Ratio

The ratio measures the total portion of asset which are funded by debt encompassing the long-term

and short-term debt. It measures the leveraged position of the company. The higher the portion of

debt in the total asset of the company, the risker the investment in such company shall be. Increase

reliance on debt generally results in higher interest burden of the company which impacts the

profitability and cash flows of the company. It is similar to debt to equity ratio which shows the

comparison between debt and equity position of the company (Audit It, 2018)

The formula for debt ratio has been presented here-in-below:

Debt Ratio = Total debt including both short term and long term/ Total Asset of the company

including both current and non-current.

Cash Conversion Cycle

This is one of the significant analysis of working capital management of the company. The ratio

analyse the ability of the company to how quickly complete one cycle of trade encompassing

inventory, receivable and payables i.e how quickly business converts its inventory into cash. The

ratio is a measure of liquidity of the company and encompass three ratios which are :

(a) Asset Turnover Ratio in days: The formula for computation of Asset Turnover Ratio has been

presented here-in-below:

Asset Turnover Ratio in days: [365/( Net Sales/ (Average Asset)]

(b) Account Receivable Turnover Ratio in days: The formula for computation of Accounts

Receivable Turnover Ratio has been presented here-in-below:

Accounts Receivable Turnover Ratio in days: [365/(Net Sales/ (Average Receivables)]

(c) Account Payable Turnover Ratio in days: The formula for computation of Accounts Payable

Turnover Ratio has been presented here-in-below:

Accounts Payable Turnover Ratio in days: [365/(Net Sales/ (Average Payables)]

Further, the formula for cash conversion cycle has been presented here-in-below:

Cash Conversion Cycle= Account Receivable Turnover Ratio in days+ Inventory Turnover Ratio in

days- Accounts Payable Turnover Ratio in days. (Prestar Capital,LLC, 2016)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

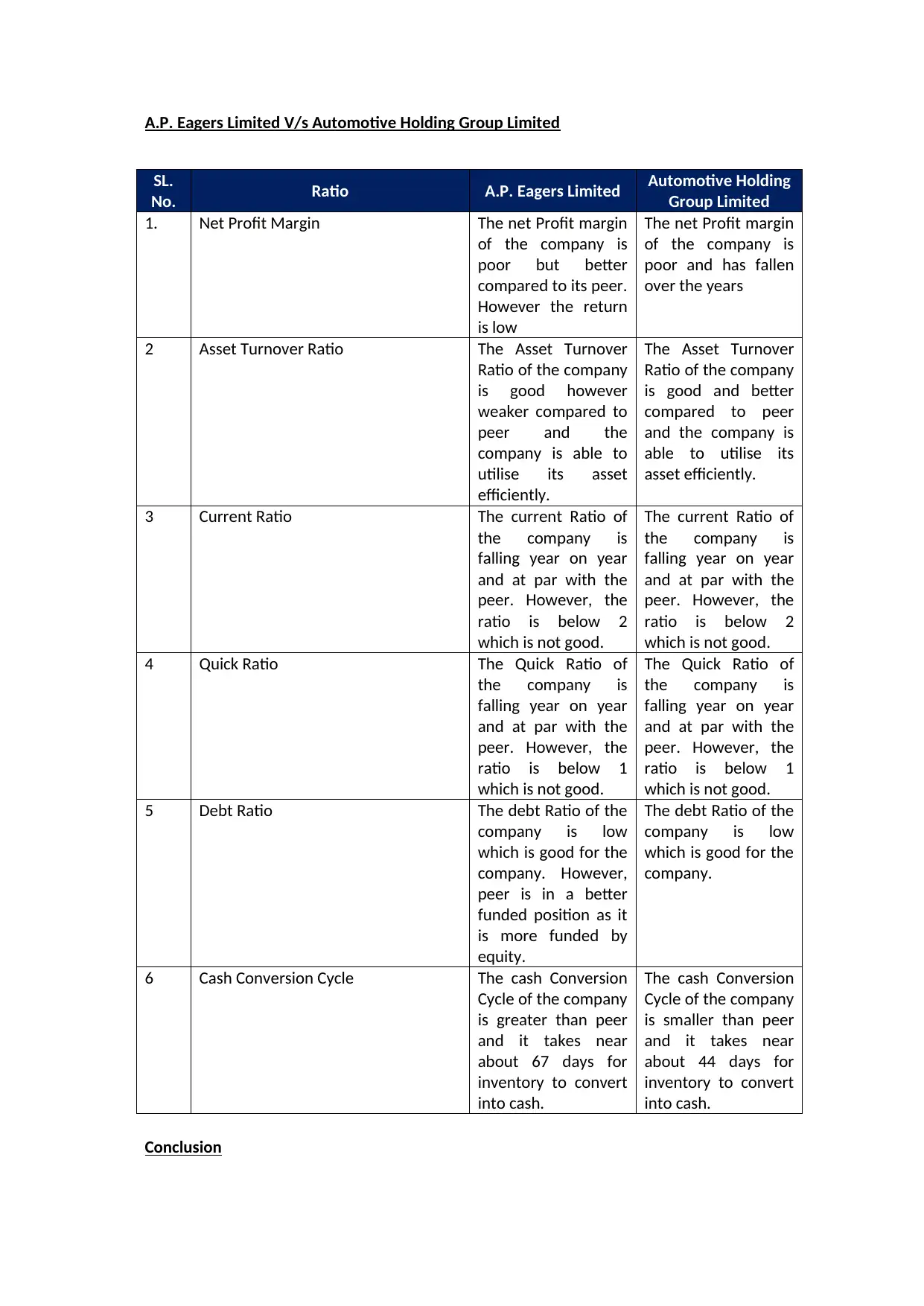

A.P. Eagers Limited V/s Automotive Holding Group Limited

SL.

No. Ratio A.P. Eagers Limited Automotive Holding

Group Limited

1. Net Profit Margin The net Profit margin

of the company is

poor but better

compared to its peer.

However the return

is low

The net Profit margin

of the company is

poor and has fallen

over the years

2 Asset Turnover Ratio The Asset Turnover

Ratio of the company

is good however

weaker compared to

peer and the

company is able to

utilise its asset

efficiently.

The Asset Turnover

Ratio of the company

is good and better

compared to peer

and the company is

able to utilise its

asset efficiently.

3 Current Ratio The current Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 2

which is not good.

The current Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 2

which is not good.

4 Quick Ratio The Quick Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 1

which is not good.

The Quick Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 1

which is not good.

5 Debt Ratio The debt Ratio of the

company is low

which is good for the

company. However,

peer is in a better

funded position as it

is more funded by

equity.

The debt Ratio of the

company is low

which is good for the

company.

6 Cash Conversion Cycle The cash Conversion

Cycle of the company

is greater than peer

and it takes near

about 67 days for

inventory to convert

into cash.

The cash Conversion

Cycle of the company

is smaller than peer

and it takes near

about 44 days for

inventory to convert

into cash.

Conclusion

SL.

No. Ratio A.P. Eagers Limited Automotive Holding

Group Limited

1. Net Profit Margin The net Profit margin

of the company is

poor but better

compared to its peer.

However the return

is low

The net Profit margin

of the company is

poor and has fallen

over the years

2 Asset Turnover Ratio The Asset Turnover

Ratio of the company

is good however

weaker compared to

peer and the

company is able to

utilise its asset

efficiently.

The Asset Turnover

Ratio of the company

is good and better

compared to peer

and the company is

able to utilise its

asset efficiently.

3 Current Ratio The current Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 2

which is not good.

The current Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 2

which is not good.

4 Quick Ratio The Quick Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 1

which is not good.

The Quick Ratio of

the company is

falling year on year

and at par with the

peer. However, the

ratio is below 1

which is not good.

5 Debt Ratio The debt Ratio of the

company is low

which is good for the

company. However,

peer is in a better

funded position as it

is more funded by

equity.

The debt Ratio of the

company is low

which is good for the

company.

6 Cash Conversion Cycle The cash Conversion

Cycle of the company

is greater than peer

and it takes near

about 67 days for

inventory to convert

into cash.

The cash Conversion

Cycle of the company

is smaller than peer

and it takes near

about 44 days for

inventory to convert

into cash.

Conclusion

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

On the basis of above it can be understood that both companies have certain better ratio and

certain week ratio. However, when compared overall the company net profit margin is very low

and effort shall be put by the company to increase the same in the near future. Further, one

shall also consider other factors before making investment in the company.

References:

Accountingcourses.com, 2018. Current Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/current-ratio

[Accessed 23 December 2018].

Audit It, 2018. Ready Ratios. [Online]

Available at: https://www.readyratios.com/reference/debt/debt_ratio.html

[Accessed 23 December 2018].

ce DAta Services, 2018. What Is an Acid-Test Ratio?. [Online]

Available at: https://www.fool.com/knowledge-center/what-is-an-acid-test-ratio.aspx

[Accessed 23 December 2018].

efinancemangement.com, 2018. How to Analyze and Improve Asset Turnover Ratio?. [Online]

Available at: https://efinancemanagement.com/financial-analysis/how-to-analyze-and-improve-

asset-turnover-ratio

[Accessed 23 December 2018].

Hamel, G., 2018. What Does Net Profit Margin Ratio Measure?. [Online]

Available at: https://smallbusiness.chron.com/net-profit-margin-ratio-measure-24448.html

[Accessed 23 December 2018].

Prestar Capital,LLC, 2016. Importance of Good Cash Conversion Cycle. [Online]

Available at: https://www.goprestar.com/importance-good-cash-conversion-cycle/

[Accessed 23 December 2018].

certain week ratio. However, when compared overall the company net profit margin is very low

and effort shall be put by the company to increase the same in the near future. Further, one

shall also consider other factors before making investment in the company.

References:

Accountingcourses.com, 2018. Current Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/current-ratio

[Accessed 23 December 2018].

Audit It, 2018. Ready Ratios. [Online]

Available at: https://www.readyratios.com/reference/debt/debt_ratio.html

[Accessed 23 December 2018].

ce DAta Services, 2018. What Is an Acid-Test Ratio?. [Online]

Available at: https://www.fool.com/knowledge-center/what-is-an-acid-test-ratio.aspx

[Accessed 23 December 2018].

efinancemangement.com, 2018. How to Analyze and Improve Asset Turnover Ratio?. [Online]

Available at: https://efinancemanagement.com/financial-analysis/how-to-analyze-and-improve-

asset-turnover-ratio

[Accessed 23 December 2018].

Hamel, G., 2018. What Does Net Profit Margin Ratio Measure?. [Online]

Available at: https://smallbusiness.chron.com/net-profit-margin-ratio-measure-24448.html

[Accessed 23 December 2018].

Prestar Capital,LLC, 2016. Importance of Good Cash Conversion Cycle. [Online]

Available at: https://www.goprestar.com/importance-good-cash-conversion-cycle/

[Accessed 23 December 2018].

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.