Financial Evaluation Report for BIA Ltd. Rebranding Project Assessment

VerifiedAdded on 2022/12/27

|20

|3480

|1

Report

AI Summary

This report provides a detailed financial evaluation of BIA Ltd.'s rebranding project. It begins with an executive summary, followed by an introduction that outlines the company's situation and the report's objectives. The main body addresses key financial concepts, including the cash conversion cycle, break-even analysis, and investment appraisal techniques (NPV and payback period) under optimistic, neutral, and pessimistic scenarios. The report calculates the cash conversion cycle, break-even points, and assesses the project's viability through NPV and payback period methods at different discount rates. The findings indicate that the project is viable under most scenarios, with the report concluding with comments on the company's capital structure, and limitations. The report uses financial ratios and investment appraisal techniques to determine the project's feasibility and offers recommendations for financing options. The report is a comprehensive financial analysis of the rebranding project, covering various financial aspects and providing a clear assessment of its viability.

Title of report- “Financial Ratio Evaluation Report”

Name-

ID-

Word count-2786

Name-

ID-

Word count-2786

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The report summarizes about detailed analysis of evaluation of rebranding project of BIA limited

by using NPV and payback period. In the first part of report, cash conversion cycle is computed

and it is showing positive outcome as they have enough cash. It has been measured by using

appropriate formula of CCC. In second part of report, BEP analysis is done in order to assess

efficiency of project that it will be profitable or not in future. The BEP calculation is received in

terms of both units and cash term. In the further parts of report (3,4 and 5) investment appraisal

techniques are applied to assess viability of project and it has been under NPV and payback

period method. The NPV is measured at three different rates including 10%, 15% and 20%.

Though results are different under each scenario but project seems viable and suitable under both

payback period & NPV. From the end of report this can be abstracted that above company

should go with both option of financing including debt and equity.

The report summarizes about detailed analysis of evaluation of rebranding project of BIA limited

by using NPV and payback period. In the first part of report, cash conversion cycle is computed

and it is showing positive outcome as they have enough cash. It has been measured by using

appropriate formula of CCC. In second part of report, BEP analysis is done in order to assess

efficiency of project that it will be profitable or not in future. The BEP calculation is received in

terms of both units and cash term. In the further parts of report (3,4 and 5) investment appraisal

techniques are applied to assess viability of project and it has been under NPV and payback

period method. The NPV is measured at three different rates including 10%, 15% and 20%.

Though results are different under each scenario but project seems viable and suitable under both

payback period & NPV. From the end of report this can be abstracted that above company

should go with both option of financing including debt and equity.

Contents

EXECUTIVE SUMMARY.......................................................................................................................2

INTRODUCTION.....................................................................................................................................4

MAIN BODY.............................................................................................................................................4

Question 1...............................................................................................................................................4

Question 2...............................................................................................................................................5

Question 3...............................................................................................................................................7

Question 4.............................................................................................................................................11

Question 5.............................................................................................................................................16

CONCLUSION AND LIMITATION.....................................................................................................18

REFERENCES........................................................................................................................................20

EXECUTIVE SUMMARY.......................................................................................................................2

INTRODUCTION.....................................................................................................................................4

MAIN BODY.............................................................................................................................................4

Question 1...............................................................................................................................................4

Question 2...............................................................................................................................................5

Question 3...............................................................................................................................................7

Question 4.............................................................................................................................................11

Question 5.............................................................................................................................................16

CONCLUSION AND LIMITATION.....................................................................................................18

REFERENCES........................................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The term financial evaluation can be defined as a process of assessing various kinds of aspect of

a company from perspective of finance (Shapiro, & Hanouna, 2019). In order to do so there are a

range of techniques and approaches which are used by companies. The report is based on a

company named BIA which is a medium sized firm and located in Australia. Currently

company’s performance is not effective and it is declining, therefore they are planning to rebrand

their project. The objective of project report is to assess viability of project from three scenarios

(pessimistic, neutral and optimistic). The report includes detailed information about current cash

conversion cycle of company, BEP, Payback period and NPV analysis of their rebranding

project.

MAIN BODY

Question 1

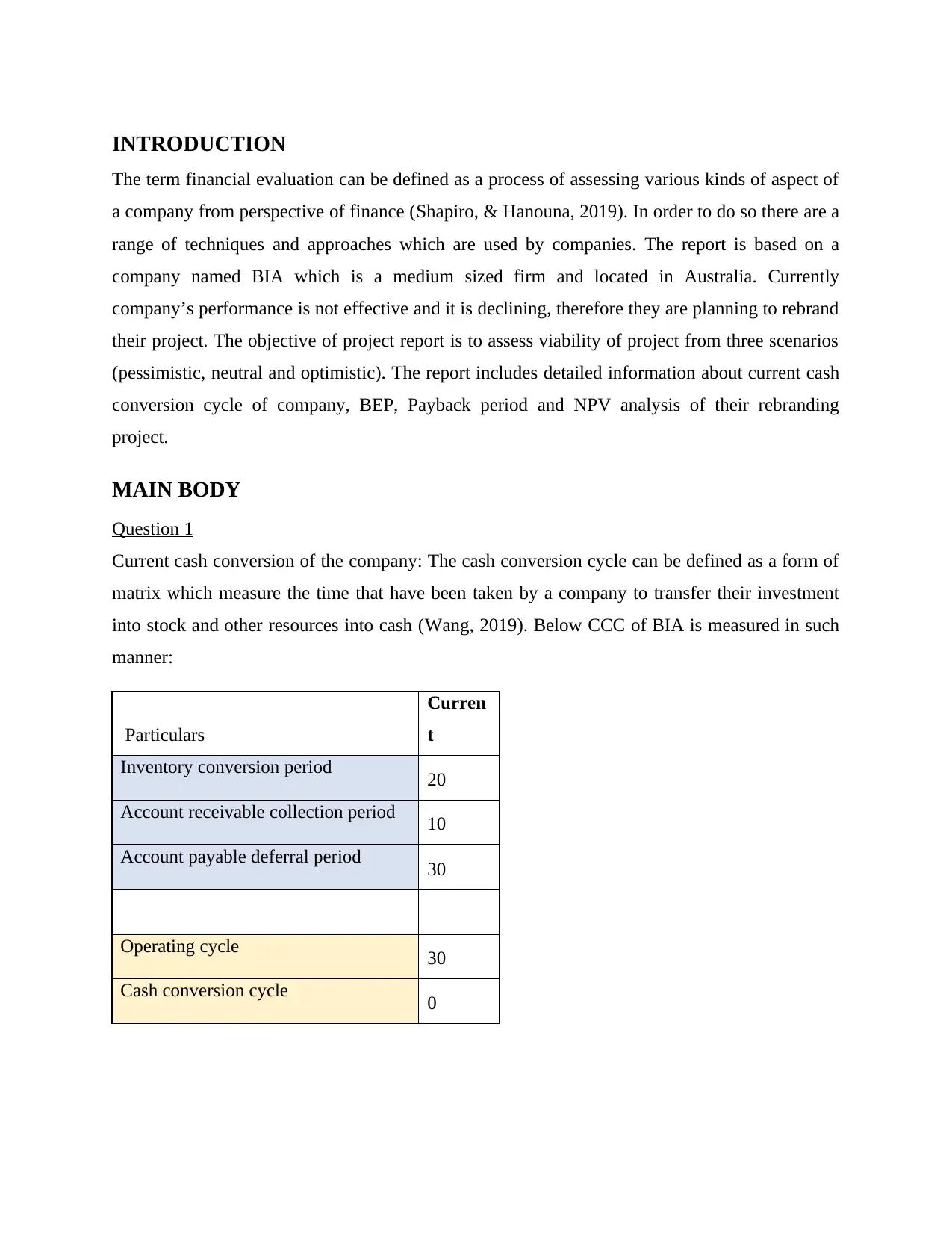

Current cash conversion of the company: The cash conversion cycle can be defined as a form of

matrix which measure the time that have been taken by a company to transfer their investment

into stock and other resources into cash (Wang, 2019). Below CCC of BIA is measured in such

manner:

Particulars

Curren

t

Inventory conversion period 20

Account receivable collection period 10

Account payable deferral period 30

Operating cycle 30

Cash conversion cycle 0

The term financial evaluation can be defined as a process of assessing various kinds of aspect of

a company from perspective of finance (Shapiro, & Hanouna, 2019). In order to do so there are a

range of techniques and approaches which are used by companies. The report is based on a

company named BIA which is a medium sized firm and located in Australia. Currently

company’s performance is not effective and it is declining, therefore they are planning to rebrand

their project. The objective of project report is to assess viability of project from three scenarios

(pessimistic, neutral and optimistic). The report includes detailed information about current cash

conversion cycle of company, BEP, Payback period and NPV analysis of their rebranding

project.

MAIN BODY

Question 1

Current cash conversion of the company: The cash conversion cycle can be defined as a form of

matrix which measure the time that have been taken by a company to transfer their investment

into stock and other resources into cash (Wang, 2019). Below CCC of BIA is measured in such

manner:

Particulars

Curren

t

Inventory conversion period 20

Account receivable collection period 10

Account payable deferral period 30

Operating cycle 30

Cash conversion cycle 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This indicates that company is taking equal time to converting resources into cash and paying

cash to creditors, there CCC is zero.

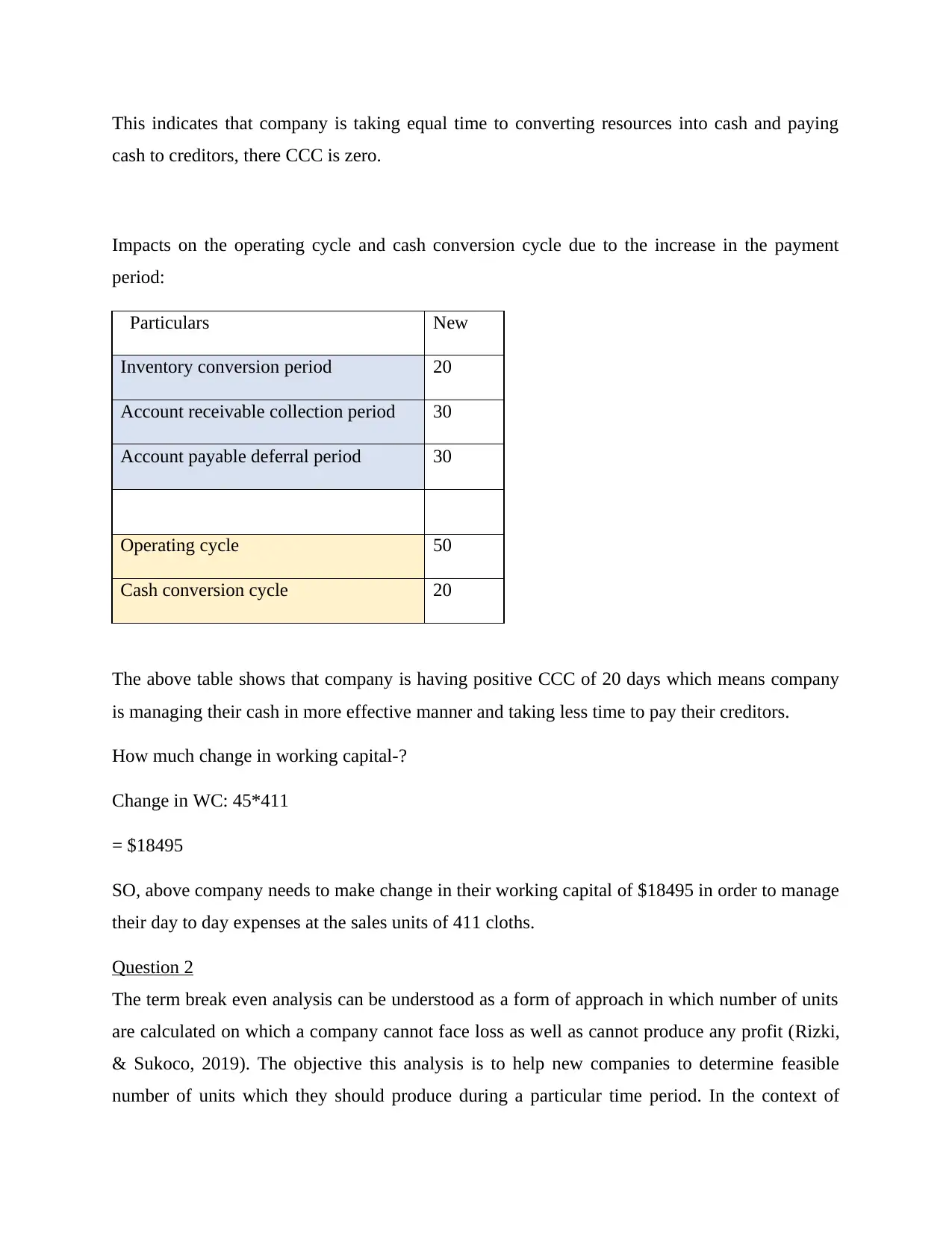

Impacts on the operating cycle and cash conversion cycle due to the increase in the payment

period:

Particulars New

Inventory conversion period 20

Account receivable collection period 30

Account payable deferral period 30

Operating cycle 50

Cash conversion cycle 20

The above table shows that company is having positive CCC of 20 days which means company

is managing their cash in more effective manner and taking less time to pay their creditors.

How much change in working capital-?

Change in WC: 45*411

= $18495

SO, above company needs to make change in their working capital of $18495 in order to manage

their day to day expenses at the sales units of 411 cloths.

Question 2

The term break even analysis can be understood as a form of approach in which number of units

are calculated on which a company cannot face loss as well as cannot produce any profit (Rizki,

& Sukoco, 2019). The objective this analysis is to help new companies to determine feasible

number of units which they should produce during a particular time period. In the context of

cash to creditors, there CCC is zero.

Impacts on the operating cycle and cash conversion cycle due to the increase in the payment

period:

Particulars New

Inventory conversion period 20

Account receivable collection period 30

Account payable deferral period 30

Operating cycle 50

Cash conversion cycle 20

The above table shows that company is having positive CCC of 20 days which means company

is managing their cash in more effective manner and taking less time to pay their creditors.

How much change in working capital-?

Change in WC: 45*411

= $18495

SO, above company needs to make change in their working capital of $18495 in order to manage

their day to day expenses at the sales units of 411 cloths.

Question 2

The term break even analysis can be understood as a form of approach in which number of units

are calculated on which a company cannot face loss as well as cannot produce any profit (Rizki,

& Sukoco, 2019). The objective this analysis is to help new companies to determine feasible

number of units which they should produce during a particular time period. In the context of

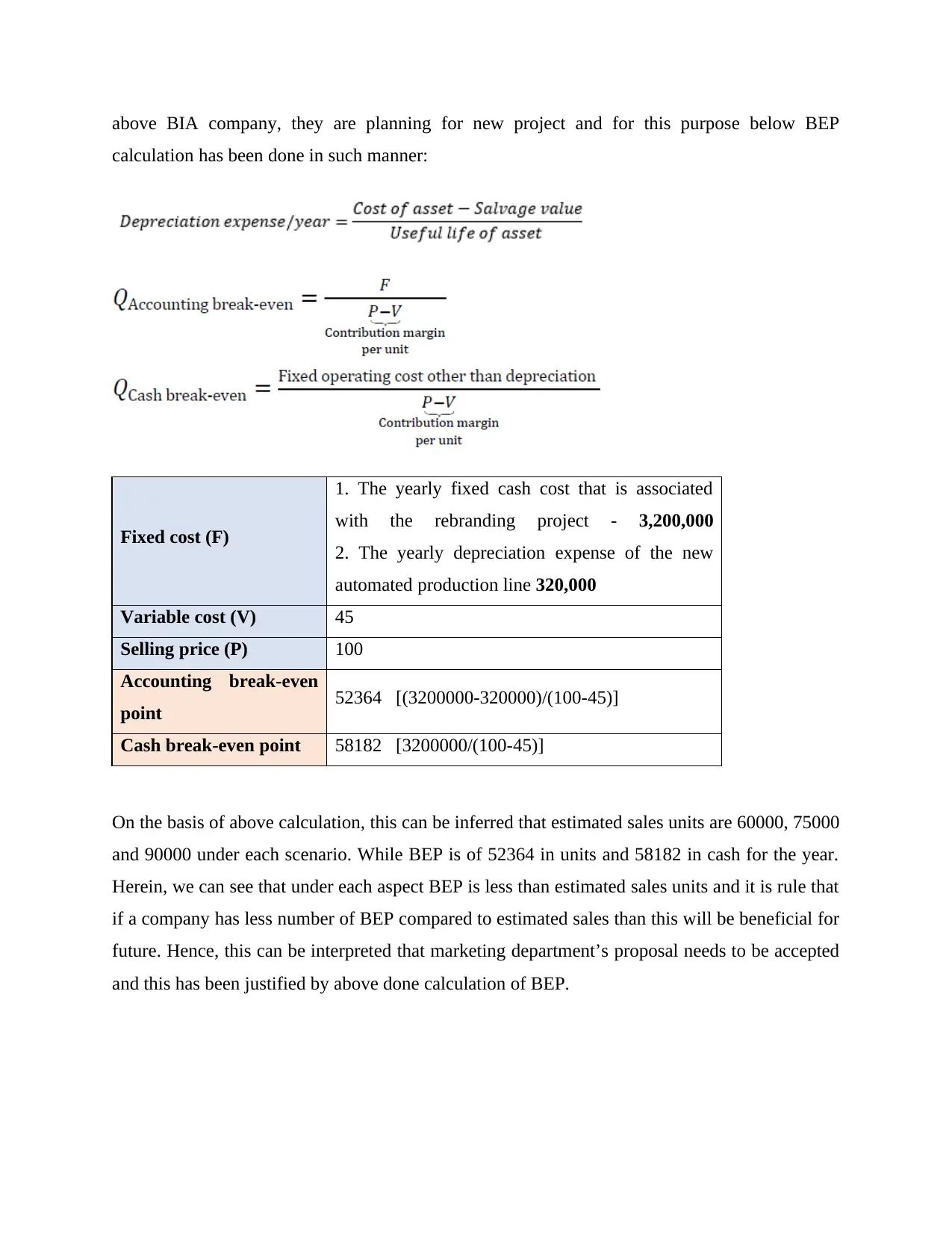

above BIA company, they are planning for new project and for this purpose below BEP

calculation has been done in such manner:

Fixed cost (F)

1. The yearly fixed cash cost that is associated

with the rebranding project - 3,200,000

2. The yearly depreciation expense of the new

automated production line 320,000

Variable cost (V) 45

Selling price (P) 100

Accounting break-even

point 52364 [(3200000-320000)/(100-45)]

Cash break-even point 58182 [3200000/(100-45)]

On the basis of above calculation, this can be inferred that estimated sales units are 60000, 75000

and 90000 under each scenario. While BEP is of 52364 in units and 58182 in cash for the year.

Herein, we can see that under each aspect BEP is less than estimated sales units and it is rule that

if a company has less number of BEP compared to estimated sales than this will be beneficial for

future. Hence, this can be interpreted that marketing department’s proposal needs to be accepted

and this has been justified by above done calculation of BEP.

calculation has been done in such manner:

Fixed cost (F)

1. The yearly fixed cash cost that is associated

with the rebranding project - 3,200,000

2. The yearly depreciation expense of the new

automated production line 320,000

Variable cost (V) 45

Selling price (P) 100

Accounting break-even

point 52364 [(3200000-320000)/(100-45)]

Cash break-even point 58182 [3200000/(100-45)]

On the basis of above calculation, this can be inferred that estimated sales units are 60000, 75000

and 90000 under each scenario. While BEP is of 52364 in units and 58182 in cash for the year.

Herein, we can see that under each aspect BEP is less than estimated sales units and it is rule that

if a company has less number of BEP compared to estimated sales than this will be beneficial for

future. Hence, this can be interpreted that marketing department’s proposal needs to be accepted

and this has been justified by above done calculation of BEP.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

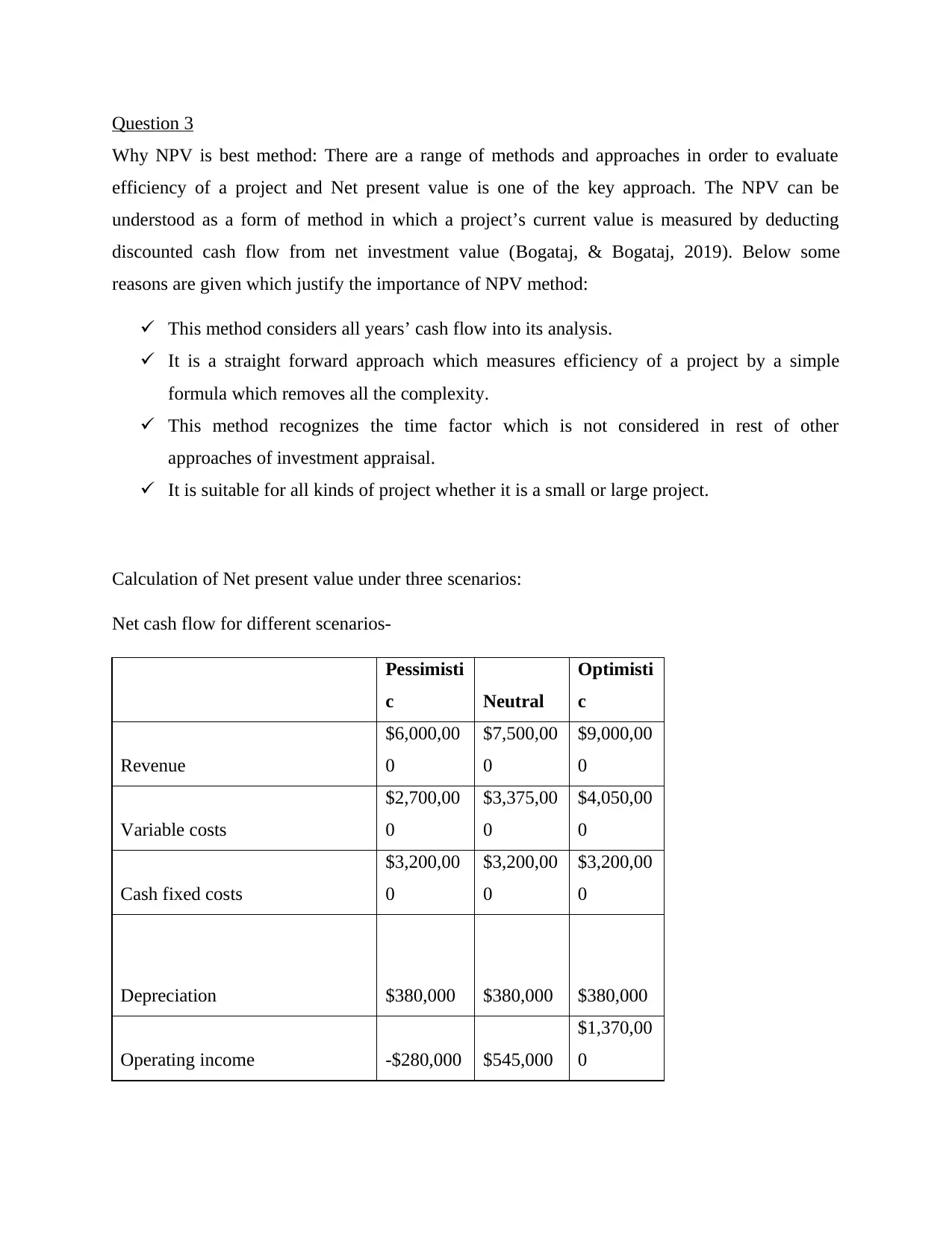

Question 3

Why NPV is best method: There are a range of methods and approaches in order to evaluate

efficiency of a project and Net present value is one of the key approach. The NPV can be

understood as a form of method in which a project’s current value is measured by deducting

discounted cash flow from net investment value (Bogataj, & Bogataj, 2019). Below some

reasons are given which justify the importance of NPV method:

This method considers all years’ cash flow into its analysis.

It is a straight forward approach which measures efficiency of a project by a simple

formula which removes all the complexity.

This method recognizes the time factor which is not considered in rest of other

approaches of investment appraisal.

It is suitable for all kinds of project whether it is a small or large project.

Calculation of Net present value under three scenarios:

Net cash flow for different scenarios-

Pessimisti

c Neutral

Optimisti

c

Revenue

$6,000,00

0

$7,500,00

0

$9,000,00

0

Variable costs

$2,700,00

0

$3,375,00

0

$4,050,00

0

Cash fixed costs

$3,200,00

0

$3,200,00

0

$3,200,00

0

Depreciation $380,000 $380,000 $380,000

Operating income -$280,000 $545,000

$1,370,00

0

Why NPV is best method: There are a range of methods and approaches in order to evaluate

efficiency of a project and Net present value is one of the key approach. The NPV can be

understood as a form of method in which a project’s current value is measured by deducting

discounted cash flow from net investment value (Bogataj, & Bogataj, 2019). Below some

reasons are given which justify the importance of NPV method:

This method considers all years’ cash flow into its analysis.

It is a straight forward approach which measures efficiency of a project by a simple

formula which removes all the complexity.

This method recognizes the time factor which is not considered in rest of other

approaches of investment appraisal.

It is suitable for all kinds of project whether it is a small or large project.

Calculation of Net present value under three scenarios:

Net cash flow for different scenarios-

Pessimisti

c Neutral

Optimisti

c

Revenue

$6,000,00

0

$7,500,00

0

$9,000,00

0

Variable costs

$2,700,00

0

$3,375,00

0

$4,050,00

0

Cash fixed costs

$3,200,00

0

$3,200,00

0

$3,200,00

0

Depreciation $380,000 $380,000 $380,000

Operating income -$280,000 $545,000

$1,370,00

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Tax -$84,000 $163,500 $411,000

After-tax income -$196,000 $381,500 $959,000

Cash flow $184,000 $761,500

$1,339,00

0

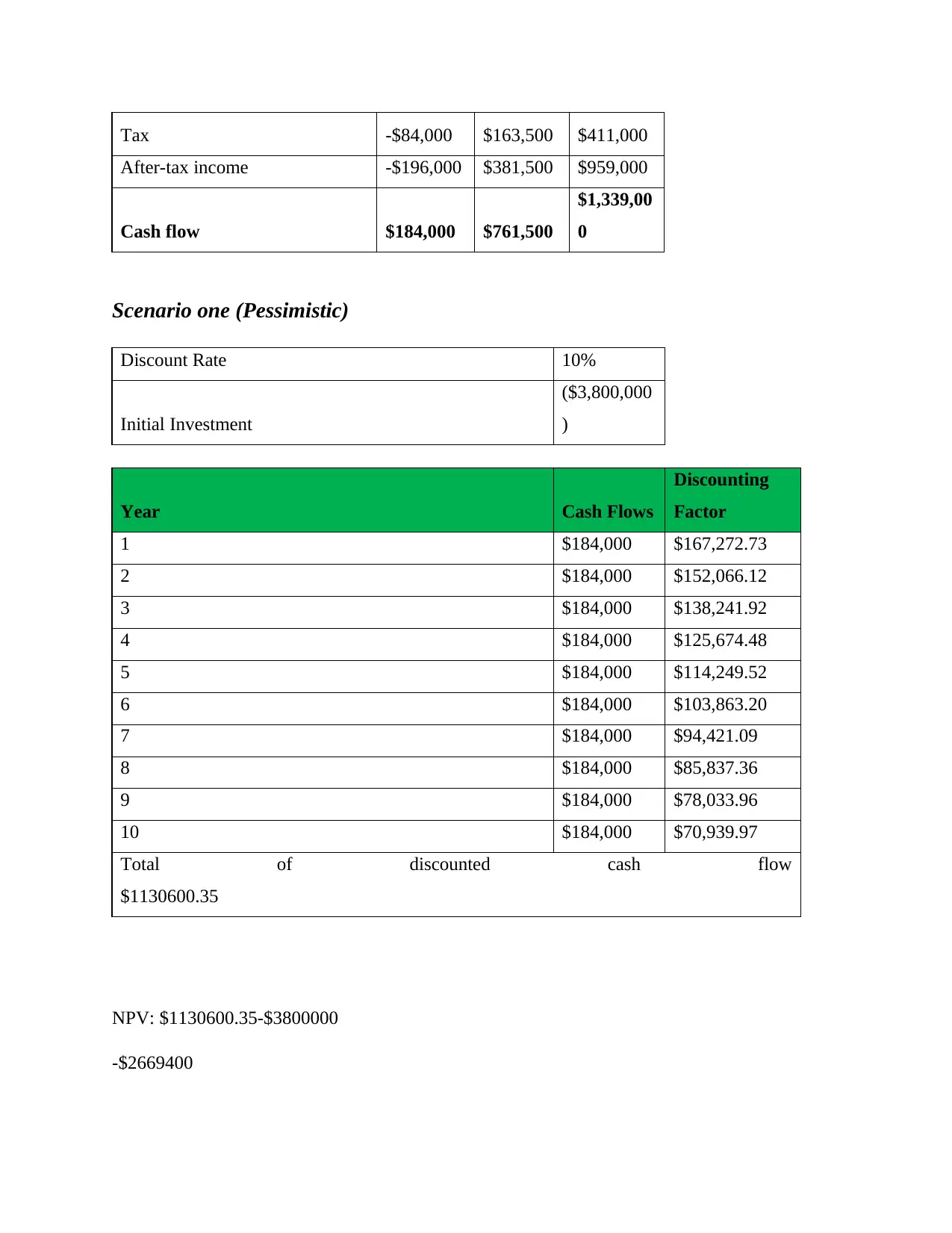

Scenario one (Pessimistic)

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $184,000 $167,272.73

2 $184,000 $152,066.12

3 $184,000 $138,241.92

4 $184,000 $125,674.48

5 $184,000 $114,249.52

6 $184,000 $103,863.20

7 $184,000 $94,421.09

8 $184,000 $85,837.36

9 $184,000 $78,033.96

10 $184,000 $70,939.97

Total of discounted cash flow

$1130600.35

NPV: $1130600.35-$3800000

-$2669400

After-tax income -$196,000 $381,500 $959,000

Cash flow $184,000 $761,500

$1,339,00

0

Scenario one (Pessimistic)

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $184,000 $167,272.73

2 $184,000 $152,066.12

3 $184,000 $138,241.92

4 $184,000 $125,674.48

5 $184,000 $114,249.52

6 $184,000 $103,863.20

7 $184,000 $94,421.09

8 $184,000 $85,837.36

9 $184,000 $78,033.96

10 $184,000 $70,939.97

Total of discounted cash flow

$1130600.35

NPV: $1130600.35-$3800000

-$2669400

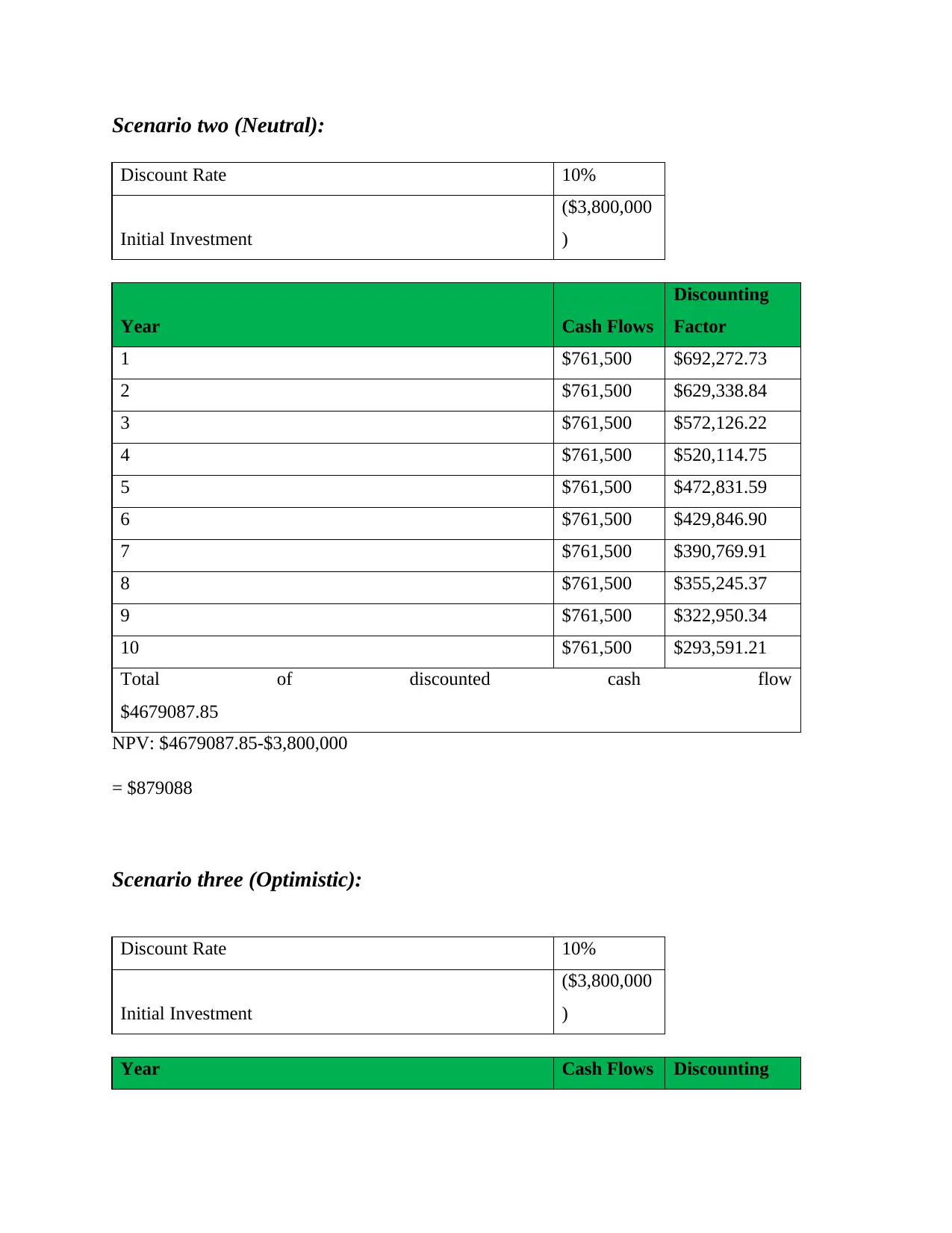

Scenario two (Neutral):

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $761,500 $692,272.73

2 $761,500 $629,338.84

3 $761,500 $572,126.22

4 $761,500 $520,114.75

5 $761,500 $472,831.59

6 $761,500 $429,846.90

7 $761,500 $390,769.91

8 $761,500 $355,245.37

9 $761,500 $322,950.34

10 $761,500 $293,591.21

Total of discounted cash flow

$4679087.85

NPV: $4679087.85-$3,800,000

= $879088

Scenario three (Optimistic):

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows Discounting

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $761,500 $692,272.73

2 $761,500 $629,338.84

3 $761,500 $572,126.22

4 $761,500 $520,114.75

5 $761,500 $472,831.59

6 $761,500 $429,846.90

7 $761,500 $390,769.91

8 $761,500 $355,245.37

9 $761,500 $322,950.34

10 $761,500 $293,591.21

Total of discounted cash flow

$4679087.85

NPV: $4679087.85-$3,800,000

= $879088

Scenario three (Optimistic):

Discount Rate 10%

Initial Investment

($3,800,000

)

Year Cash Flows Discounting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

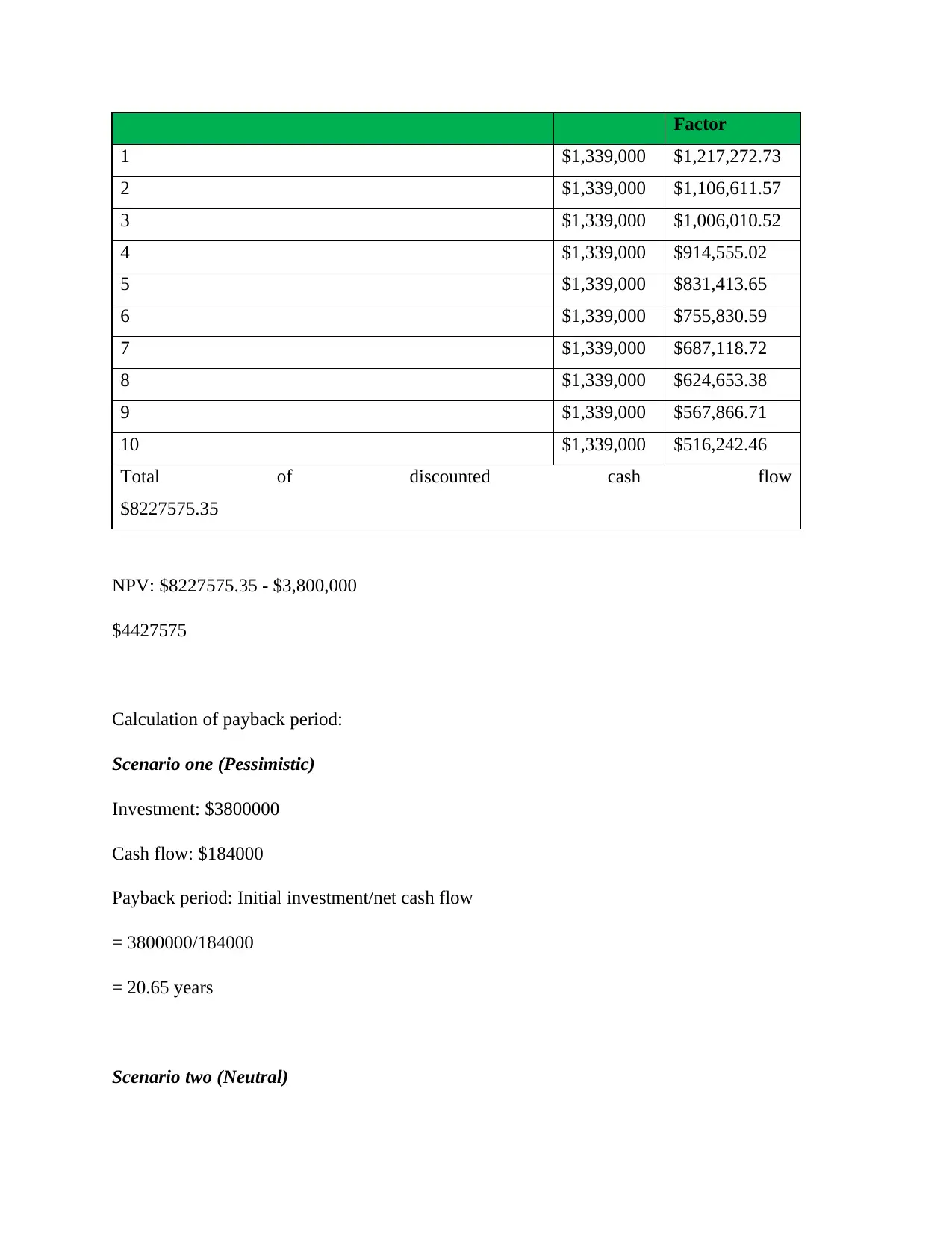

Factor

1 $1,339,000 $1,217,272.73

2 $1,339,000 $1,106,611.57

3 $1,339,000 $1,006,010.52

4 $1,339,000 $914,555.02

5 $1,339,000 $831,413.65

6 $1,339,000 $755,830.59

7 $1,339,000 $687,118.72

8 $1,339,000 $624,653.38

9 $1,339,000 $567,866.71

10 $1,339,000 $516,242.46

Total of discounted cash flow

$8227575.35

NPV: $8227575.35 - $3,800,000

$4427575

Calculation of payback period:

Scenario one (Pessimistic)

Investment: $3800000

Cash flow: $184000

Payback period: Initial investment/net cash flow

= 3800000/184000

= 20.65 years

Scenario two (Neutral)

1 $1,339,000 $1,217,272.73

2 $1,339,000 $1,106,611.57

3 $1,339,000 $1,006,010.52

4 $1,339,000 $914,555.02

5 $1,339,000 $831,413.65

6 $1,339,000 $755,830.59

7 $1,339,000 $687,118.72

8 $1,339,000 $624,653.38

9 $1,339,000 $567,866.71

10 $1,339,000 $516,242.46

Total of discounted cash flow

$8227575.35

NPV: $8227575.35 - $3,800,000

$4427575

Calculation of payback period:

Scenario one (Pessimistic)

Investment: $3800000

Cash flow: $184000

Payback period: Initial investment/net cash flow

= 3800000/184000

= 20.65 years

Scenario two (Neutral)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Investment: $380000

Cash flow: $761500

Payback period: 3800000/761500

= 4.99 years

Scenario three (Optimistic):

Investment: $380000

Cash flow: 1339000

Payback period: 3800000/1339000

= 2.84 years

Analysis on the basis of NPV: The analysis has been done on three distinct scenarios including

pessimistic, neutral and optimistic. Among these three aspects, pessimistic seems poor and

unacceptable as there is negative NPV which is of -$2669400. On the other side, in the context

of second scenario the NPV is positive which is of $879088 and for third scenario this is of

$4427575 that is highest among three. Hence above company needs to go with scenario three as

it is suitable and there is possibility of generating higher return.

Analysis on the basis of payback period: Similar to above, the payback period is also calculated

of three different scenarios. From above computed values, this can be find out that scenario one

is unacceptable because under it cost of project will be recovered in around 21 years. While in

rest of two scenarios, the payback period is much lower as it is of 4.99 years and 2.84 years

respectively. In comparative manner, it can be stated that above company should go with last

scenario as under this cost will be covered in less amount of time.

From overall analysis, this can be stated that project needs to be accepted because its

performance is quite acceptable under both scenarios except first scenario. This has been

justified by help of outcome which are produced under NPV and payback period method.

Cash flow: $761500

Payback period: 3800000/761500

= 4.99 years

Scenario three (Optimistic):

Investment: $380000

Cash flow: 1339000

Payback period: 3800000/1339000

= 2.84 years

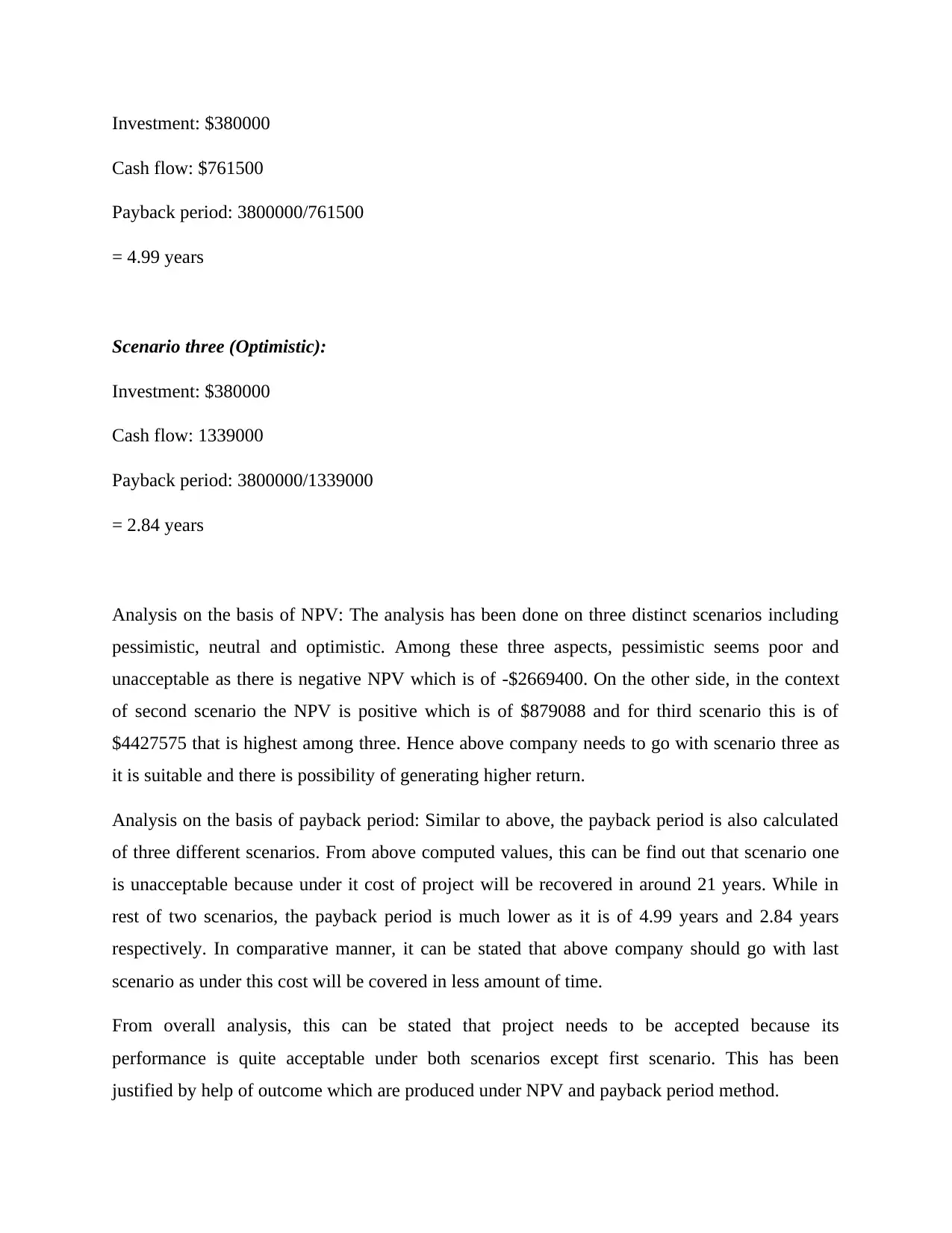

Analysis on the basis of NPV: The analysis has been done on three distinct scenarios including

pessimistic, neutral and optimistic. Among these three aspects, pessimistic seems poor and

unacceptable as there is negative NPV which is of -$2669400. On the other side, in the context

of second scenario the NPV is positive which is of $879088 and for third scenario this is of

$4427575 that is highest among three. Hence above company needs to go with scenario three as

it is suitable and there is possibility of generating higher return.

Analysis on the basis of payback period: Similar to above, the payback period is also calculated

of three different scenarios. From above computed values, this can be find out that scenario one

is unacceptable because under it cost of project will be recovered in around 21 years. While in

rest of two scenarios, the payback period is much lower as it is of 4.99 years and 2.84 years

respectively. In comparative manner, it can be stated that above company should go with last

scenario as under this cost will be covered in less amount of time.

From overall analysis, this can be stated that project needs to be accepted because its

performance is quite acceptable under both scenarios except first scenario. This has been

justified by help of outcome which are produced under NPV and payback period method.

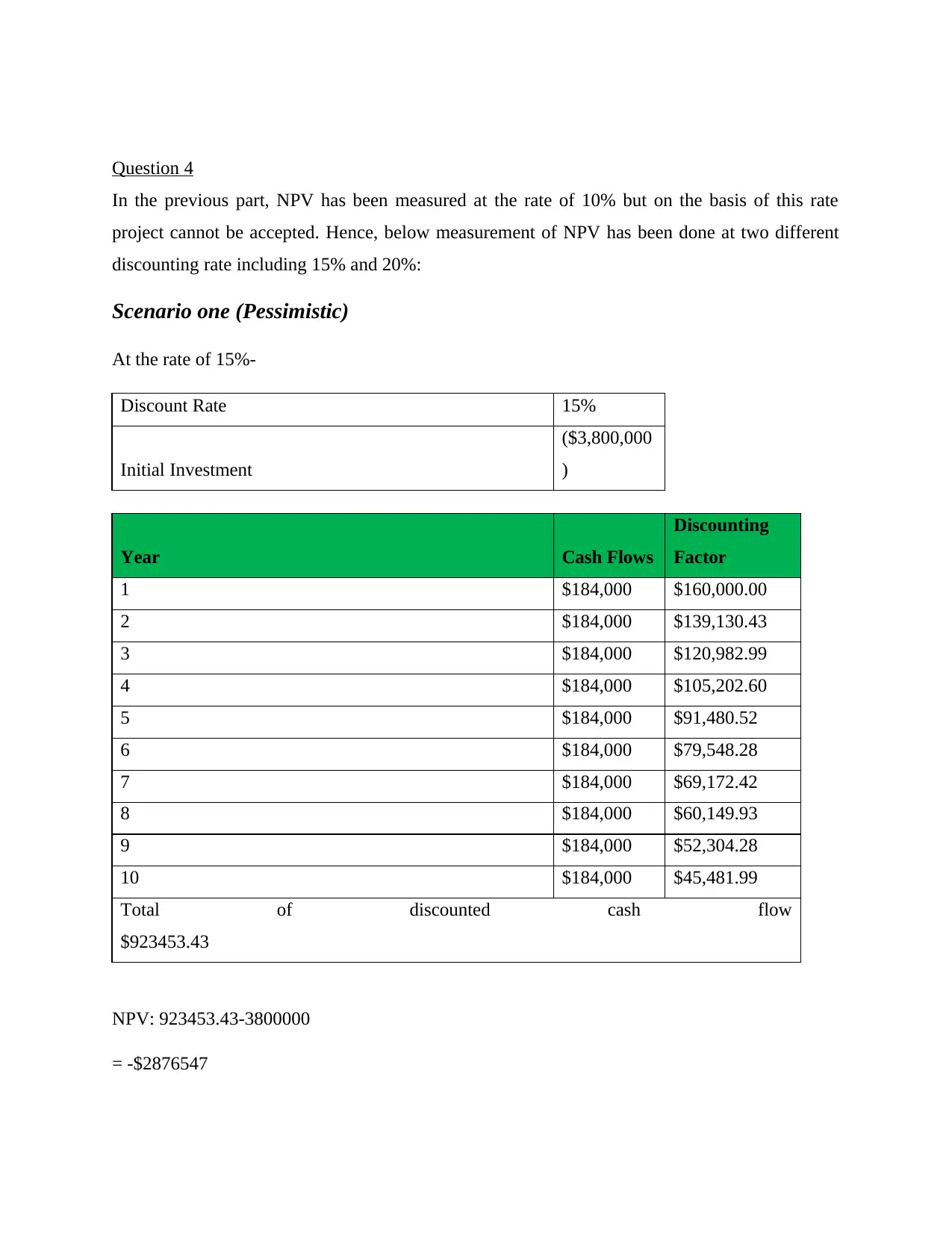

Question 4

In the previous part, NPV has been measured at the rate of 10% but on the basis of this rate

project cannot be accepted. Hence, below measurement of NPV has been done at two different

discounting rate including 15% and 20%:

Scenario one (Pessimistic)

At the rate of 15%-

Discount Rate 15%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $184,000 $160,000.00

2 $184,000 $139,130.43

3 $184,000 $120,982.99

4 $184,000 $105,202.60

5 $184,000 $91,480.52

6 $184,000 $79,548.28

7 $184,000 $69,172.42

8 $184,000 $60,149.93

9 $184,000 $52,304.28

10 $184,000 $45,481.99

Total of discounted cash flow

$923453.43

NPV: 923453.43-3800000

= -$2876547

In the previous part, NPV has been measured at the rate of 10% but on the basis of this rate

project cannot be accepted. Hence, below measurement of NPV has been done at two different

discounting rate including 15% and 20%:

Scenario one (Pessimistic)

At the rate of 15%-

Discount Rate 15%

Initial Investment

($3,800,000

)

Year Cash Flows

Discounting

Factor

1 $184,000 $160,000.00

2 $184,000 $139,130.43

3 $184,000 $120,982.99

4 $184,000 $105,202.60

5 $184,000 $91,480.52

6 $184,000 $79,548.28

7 $184,000 $69,172.42

8 $184,000 $60,149.93

9 $184,000 $52,304.28

10 $184,000 $45,481.99

Total of discounted cash flow

$923453.43

NPV: 923453.43-3800000

= -$2876547

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.