Financial Reporting Analysis: IFRS, IAS, and Stakeholder Impact

VerifiedAdded on 2021/02/20

|16

|4490

|68

Report

AI Summary

This report provides a comprehensive overview of financial reporting, beginning with its context and purpose, and progressing through the conceptual and regulatory frameworks that govern it. It examines the role of financial reporting in meeting organizational objectives, including the analysis of different financial reporting models such as the three-statement model, consolidation model, and auditing model. The report also explores the benefits of International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS), and how these standards are applied by various organizations, using Marks & Spencer as a case study. It covers the importance of stakeholders and how they benefit from financial information. The report includes an analysis of financial statements, including the statement of profit or loss and the statement of changes in equity. The report concludes by highlighting the key differences between IFRS and IAS, and the degree of compliance with IFRS by various organizations. This document, contributed by a student, is available on Desklib, a platform offering AI-driven study tools to enhance learning and provide access to past papers and solved assignments.

Financial reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Q1 Context and purpose of financial reporting............................................................................1

Q2 Conceptual and regulatory framework...................................................................................1

Q3 Stakeholders of an organisation and how they are benefited by financial information.........3

Q4 Value of financial reporting for meeting organisation objectives..........................................4

Q5 Presentation of financial statements.......................................................................................5

Q6 Interpretation of financial performance.................................................................................7

.....................................................................................................................................................8

Q 7 Difference between IFRS and IAS........................................................................................8

Q8 Benefits of IFRS.....................................................................................................................8

Q9 Degree of compliance with IFRS by various organisations...................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

APPENDIX:...................................................................................................................................12

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Q1 Context and purpose of financial reporting............................................................................1

Q2 Conceptual and regulatory framework...................................................................................1

Q3 Stakeholders of an organisation and how they are benefited by financial information.........3

Q4 Value of financial reporting for meeting organisation objectives..........................................4

Q5 Presentation of financial statements.......................................................................................5

Q6 Interpretation of financial performance.................................................................................7

.....................................................................................................................................................8

Q 7 Difference between IFRS and IAS........................................................................................8

Q8 Benefits of IFRS.....................................................................................................................8

Q9 Degree of compliance with IFRS by various organisations...................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

APPENDIX:...................................................................................................................................12

INTRODUCTION

Financial reporting is defined as a framework which involves disclosure of financial

information about the company's performance during an accounting year. It consists of preparing

financial statements i.e. balance sheet, profit & loss account, cash flow statements etc. to get an

idea of the position of a firm in terms of liquidity and profitability. A regulatory framework is

one of the most important element in determining accuracy, reliability as well as faithful

representation of final accounts. The accountancy firm selected for this report is Ernst & Young

whose client is Marks & Spencer (Abata, 2015). M&S is a multinational company whose

headquarters are situated in London, UK and was founded in 1884. The company offers different

types of products as well as services including haircare, make-up, clothing, skincare etc. This

report emphases on the purpose and need of financial reporting, conceptual regulatory

framework, various reporting models and benefits of using IFRS, IAS.

MAIN BODY

Q1 Context and purpose of financial reporting

Financial reporting: This refers to a framework which involves communicating with the

users of financial information like investors, suppliers, creditors etc. It is a system which prepare

statement of accounts for companies i.e. statement of financial position, profit & loss, changes in

equity, cash flow statement (Financial reporting framework, 2019). This consists of calculating

ratios for a firm to determine their position in terms of availability of finance, working capital

position etc. Marks & Spencer prepares statement of accounts to evaluate performance of

revenue figures as well as maintaining cash stability with the use of reporting standards such as

IAS, IFRS. The purpose of financial reporting is to put together and review how much a

company is generating during an year.

Q2 Conceptual and regulatory framework

Conceptual and regulatory framework: It refers to a statement of GAAP which forms

a framework for financial reporting by providing a basis for new standards and any up gradation

in previous ones. This is a combination of both IFRS as well as IAS (Churet and Eccles, 2014). It

includes principle based and rule based systems which govern various regulations to be followed

by Marks & Spencer. These are required to ensure timeliness, relevance, completeness of

accounts. Some of them are listed below:

1

Financial reporting is defined as a framework which involves disclosure of financial

information about the company's performance during an accounting year. It consists of preparing

financial statements i.e. balance sheet, profit & loss account, cash flow statements etc. to get an

idea of the position of a firm in terms of liquidity and profitability. A regulatory framework is

one of the most important element in determining accuracy, reliability as well as faithful

representation of final accounts. The accountancy firm selected for this report is Ernst & Young

whose client is Marks & Spencer (Abata, 2015). M&S is a multinational company whose

headquarters are situated in London, UK and was founded in 1884. The company offers different

types of products as well as services including haircare, make-up, clothing, skincare etc. This

report emphases on the purpose and need of financial reporting, conceptual regulatory

framework, various reporting models and benefits of using IFRS, IAS.

MAIN BODY

Q1 Context and purpose of financial reporting

Financial reporting: This refers to a framework which involves communicating with the

users of financial information like investors, suppliers, creditors etc. It is a system which prepare

statement of accounts for companies i.e. statement of financial position, profit & loss, changes in

equity, cash flow statement (Financial reporting framework, 2019). This consists of calculating

ratios for a firm to determine their position in terms of availability of finance, working capital

position etc. Marks & Spencer prepares statement of accounts to evaluate performance of

revenue figures as well as maintaining cash stability with the use of reporting standards such as

IAS, IFRS. The purpose of financial reporting is to put together and review how much a

company is generating during an year.

Q2 Conceptual and regulatory framework

Conceptual and regulatory framework: It refers to a statement of GAAP which forms

a framework for financial reporting by providing a basis for new standards and any up gradation

in previous ones. This is a combination of both IFRS as well as IAS (Churet and Eccles, 2014). It

includes principle based and rule based systems which govern various regulations to be followed

by Marks & Spencer. These are required to ensure timeliness, relevance, completeness of

accounts. Some of them are listed below:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

IFRS 15 - Revenue from contracts with customers: Revenue is considered to be one of

the most important criteria of a business. Marks & Spencer follows this standard to determine

growth in its sales by following the following process:

Identify the contract with a customer: A contract is a written agreement of terms and

conditions which are agreed by all members in the board. It can be in written, oral or verbal.

Identify separate performance obligations: These are the promises made by a company

when a promised good or service is transferred to the customer.

Determine the transaction price: It is a price which an entity expects to receive when a

promised good or service is transferred to the customer (Aletkin, 2014).

Allocate the transaction price to each performance obligation: This is allocated to

each and every performance obligation as per the stand alone selling price. It refers to a price at

which a company would sell a good or service separately to the customer.

Recognise revenue when (or as) a performance obligation is satisfied: Revenue is

recorded only when goods are delivered to the customer. It is recognised in the income statement

of a firm.

IFRS 5 – Non-current assets held for sale and discontinued operations: This standard

sets out requirement for classification, measurement, presentation of non-current assets held at

sale. It covers both continuing as well as discontinuing operations. An entity shall classify a

NCA if carrying amount is recovered principally through a sale transaction rather than through

continuing use. It is measured at lower of carrying amount and fair value less costs to sell

(Dowdell Jr, Herda and Notbohm, 2014). This is presented in the statement of financial position

under current assets. Marks & Spencer records its non-current assets as held for sale by

calculating carrying amount and fair value of assets.

Purpose of conceptual and regulatory framework: The main purpose of conceptual

framework is to assist IASB in development of new accounting standards (Fleming and others,

2016). It aims at providing accurate, relevant, reliable etc. information top the users of financial

information. This is required to satisfy needs of external parties.

Qualitative characteristics: Qualitative characteristics for useful financial information

are faithful representation which states that information must be complete, neutral and free from

error. Marks & Spencer collects data from areas that provide accurate facts regarding statement

of accounts. Another characteristic is understandability which provide users with consistent

2

the most important criteria of a business. Marks & Spencer follows this standard to determine

growth in its sales by following the following process:

Identify the contract with a customer: A contract is a written agreement of terms and

conditions which are agreed by all members in the board. It can be in written, oral or verbal.

Identify separate performance obligations: These are the promises made by a company

when a promised good or service is transferred to the customer.

Determine the transaction price: It is a price which an entity expects to receive when a

promised good or service is transferred to the customer (Aletkin, 2014).

Allocate the transaction price to each performance obligation: This is allocated to

each and every performance obligation as per the stand alone selling price. It refers to a price at

which a company would sell a good or service separately to the customer.

Recognise revenue when (or as) a performance obligation is satisfied: Revenue is

recorded only when goods are delivered to the customer. It is recognised in the income statement

of a firm.

IFRS 5 – Non-current assets held for sale and discontinued operations: This standard

sets out requirement for classification, measurement, presentation of non-current assets held at

sale. It covers both continuing as well as discontinuing operations. An entity shall classify a

NCA if carrying amount is recovered principally through a sale transaction rather than through

continuing use. It is measured at lower of carrying amount and fair value less costs to sell

(Dowdell Jr, Herda and Notbohm, 2014). This is presented in the statement of financial position

under current assets. Marks & Spencer records its non-current assets as held for sale by

calculating carrying amount and fair value of assets.

Purpose of conceptual and regulatory framework: The main purpose of conceptual

framework is to assist IASB in development of new accounting standards (Fleming and others,

2016). It aims at providing accurate, relevant, reliable etc. information top the users of financial

information. This is required to satisfy needs of external parties.

Qualitative characteristics: Qualitative characteristics for useful financial information

are faithful representation which states that information must be complete, neutral and free from

error. Marks & Spencer collects data from areas that provide accurate facts regarding statement

of accounts. Another characteristic is understandability which provide users with consistent

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

information prepared by supervisors that carry knowledge about items listed under financial

statements. Marks & Spencer hires specialised accountants which have an expertise in the field

of accounting.

Q3 Stakeholders of an organisation and how they are benefited by financial information

Stakeholders are a group of person who can affect or be affected by the decisions made

in a company. There are three type of shareholders i.e. internal, connected and external. The

primary stakeholders of Marks & Spencer are employees, suppliers, government, customers,

shareholders, competitors, investors etc.

Internal stakeholders: These are the stakeholders who work internally for the growth

and development of an organisation and include shareholders, employees etc. They are benefited

from financial information by:

Shareholders: They are benefited by the financial information as these need it to make

decisions about investing in equity instruments like stock, reserve, options, shares etc.

as further dividend is distributed to shareholders as per their holding in the company.

Employees: They are benefited by the financial information as it gives them an idea

about the accountability of firm in which they will be working, its ability to pay debts

on time.

External stakeholders: These are the stakeholders who work outside of a business or

project and can be affected by the external environment and include customers, investors etc.

They are benefited from financial information by:

Customers: Customers are benefited by financial statements as it gives them an idea

about the liquidity as well as profitability position of an organisation.

Investors: Investors are benefited by financial statements as it gives them information

about the economic sources of an enterprise and effect of different business transactions

on preparation of accounting records.

Financial reporting helps the stakeholders by giving them an idea about the working

capital position of a company (Flower, 2015). Marks & Spencer values its stakeholders by

providing them with accurate and complete financial information which is understandable by the

users.

3

statements. Marks & Spencer hires specialised accountants which have an expertise in the field

of accounting.

Q3 Stakeholders of an organisation and how they are benefited by financial information

Stakeholders are a group of person who can affect or be affected by the decisions made

in a company. There are three type of shareholders i.e. internal, connected and external. The

primary stakeholders of Marks & Spencer are employees, suppliers, government, customers,

shareholders, competitors, investors etc.

Internal stakeholders: These are the stakeholders who work internally for the growth

and development of an organisation and include shareholders, employees etc. They are benefited

from financial information by:

Shareholders: They are benefited by the financial information as these need it to make

decisions about investing in equity instruments like stock, reserve, options, shares etc.

as further dividend is distributed to shareholders as per their holding in the company.

Employees: They are benefited by the financial information as it gives them an idea

about the accountability of firm in which they will be working, its ability to pay debts

on time.

External stakeholders: These are the stakeholders who work outside of a business or

project and can be affected by the external environment and include customers, investors etc.

They are benefited from financial information by:

Customers: Customers are benefited by financial statements as it gives them an idea

about the liquidity as well as profitability position of an organisation.

Investors: Investors are benefited by financial statements as it gives them information

about the economic sources of an enterprise and effect of different business transactions

on preparation of accounting records.

Financial reporting helps the stakeholders by giving them an idea about the working

capital position of a company (Flower, 2015). Marks & Spencer values its stakeholders by

providing them with accurate and complete financial information which is understandable by the

users.

3

Q4 Value of financial reporting for meeting organisation objectives

Financial reporting plays a very important role in defining goals and objectives of an

entity by generating high sales revenue. In order to achieve organisational objectives,

development and growth. Marks & Spencer prepares statement of accounts that reflect its ability

to pay debt and maintain a balance among assets, equity & liabilities.

There are different models in financial reporting which help in achieving organisational

objectives, development and growth. Some of them are explained below:

Financial reporting model: It is a model followed by companies to evaluate financial

performance of its statement of accounts. Marks & Spencer prepares its financial statements as

per the conceptual regulatory framework issued by International Accounting Standard Board.

Some of the models are explained below:

Three statement model: It is a type of model which is prepared by all companies to

analyse the financial position during an accounting year. This consists of three statements i.e.

balance sheet, profit & loss account, cash flow statement. Balance sheet is a statement which

includes effect of assets, equity and liabilities. This is prepared by companies to analyse their

working capital position. It's presentation involves a 'T' shaped format where assets are shown on

the top followed by equity & liabilities (Müller, 2014). Assets are the resources that bring

economic benefit to the company whereas liabilities are present obligation as a result of past

event. Profit & loss account is a statement which record gains & losses that may arise during an

accounting year. This is prepared by companies to measure their profitability position. It includes

revenue, cost of sales, administrative expenses etc. Cash flow statement is a statement which

records inflows and outflows of cash for companies. This is prepared on the basis of IAS-7

Statement of cash flows which includes three activities i.e. operating, investing and financing.

These consist of loss/profit on investment and working capital changes, purchase/sale of fixed

assets, issue/repayment of shares etc.

Consolidation model: It is a model constructed by combining financial results of various

businesses into one model. This involves a parent and subsidiary company and is prepared as per

IFRS-10 Consolidated financial statements. These are presented in the form of tables in a

spreadsheet or in the form of graphs or charts (Pelger, 2016). It includes calculation of goodwill,

group retained earnings, non controlling interest, unrealised profit etc. for preparation of final

4

Financial reporting plays a very important role in defining goals and objectives of an

entity by generating high sales revenue. In order to achieve organisational objectives,

development and growth. Marks & Spencer prepares statement of accounts that reflect its ability

to pay debt and maintain a balance among assets, equity & liabilities.

There are different models in financial reporting which help in achieving organisational

objectives, development and growth. Some of them are explained below:

Financial reporting model: It is a model followed by companies to evaluate financial

performance of its statement of accounts. Marks & Spencer prepares its financial statements as

per the conceptual regulatory framework issued by International Accounting Standard Board.

Some of the models are explained below:

Three statement model: It is a type of model which is prepared by all companies to

analyse the financial position during an accounting year. This consists of three statements i.e.

balance sheet, profit & loss account, cash flow statement. Balance sheet is a statement which

includes effect of assets, equity and liabilities. This is prepared by companies to analyse their

working capital position. It's presentation involves a 'T' shaped format where assets are shown on

the top followed by equity & liabilities (Müller, 2014). Assets are the resources that bring

economic benefit to the company whereas liabilities are present obligation as a result of past

event. Profit & loss account is a statement which record gains & losses that may arise during an

accounting year. This is prepared by companies to measure their profitability position. It includes

revenue, cost of sales, administrative expenses etc. Cash flow statement is a statement which

records inflows and outflows of cash for companies. This is prepared on the basis of IAS-7

Statement of cash flows which includes three activities i.e. operating, investing and financing.

These consist of loss/profit on investment and working capital changes, purchase/sale of fixed

assets, issue/repayment of shares etc.

Consolidation model: It is a model constructed by combining financial results of various

businesses into one model. This involves a parent and subsidiary company and is prepared as per

IFRS-10 Consolidated financial statements. These are presented in the form of tables in a

spreadsheet or in the form of graphs or charts (Pelger, 2016). It includes calculation of goodwill,

group retained earnings, non controlling interest, unrealised profit etc. for preparation of final

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accounts of a company. The effect of IFRS-3 Business combinations is also considered while

preparing consolidated financial statements.

Auditing model: It is a type of model which represents systematic examination of books,

statutory records, vouchers etc. of an organisation. This consists of various techniques to check

completeness of data. Some of them are explained below:

Reconciliation: It is a technique used by auditors to check any errors in the statement of

accounts. These are prepared to identify any misconduct, fraud or error, loss of theft that may

arise while preparing financial statements.

Physical examination: This requires verification and physical inspection of tangible

assets and other line items in balance sheet as it confirms their existence.

The financial reporting models help in achieving organisational objectives, growth by

giving a brief idea to user of how financial statements are prepared whereas the auditing models

helps the user in giving accurate, reliable, relevant and complete information regarding the

preparation of accounting records. In order to maximise profit as well as maintain completeness

of records it is necessary for Marks & Spencer to follow, prepare different financial reporting as

well as auditing models which will help in achievement of goals and objectives of an

organisation.

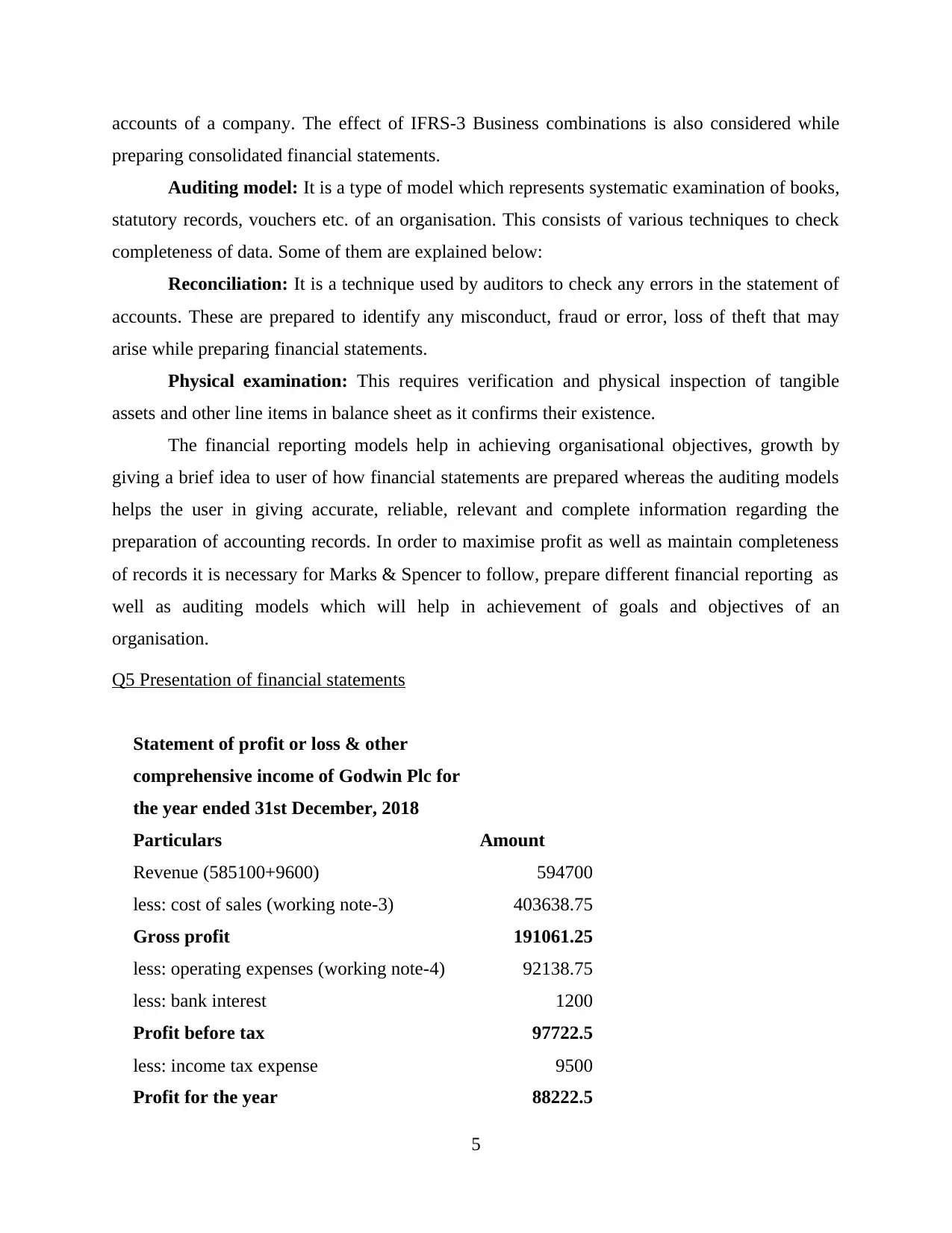

Q5 Presentation of financial statements

Statement of profit or loss & other

comprehensive income of Godwin Plc for

the year ended 31st December, 2018

Particulars Amount

Revenue (585100+9600) 594700

less: cost of sales (working note-3) 403638.75

Gross profit 191061.25

less: operating expenses (working note-4) 92138.75

less: bank interest 1200

Profit before tax 97722.5

less: income tax expense 9500

Profit for the year 88222.5

5

preparing consolidated financial statements.

Auditing model: It is a type of model which represents systematic examination of books,

statutory records, vouchers etc. of an organisation. This consists of various techniques to check

completeness of data. Some of them are explained below:

Reconciliation: It is a technique used by auditors to check any errors in the statement of

accounts. These are prepared to identify any misconduct, fraud or error, loss of theft that may

arise while preparing financial statements.

Physical examination: This requires verification and physical inspection of tangible

assets and other line items in balance sheet as it confirms their existence.

The financial reporting models help in achieving organisational objectives, growth by

giving a brief idea to user of how financial statements are prepared whereas the auditing models

helps the user in giving accurate, reliable, relevant and complete information regarding the

preparation of accounting records. In order to maximise profit as well as maintain completeness

of records it is necessary for Marks & Spencer to follow, prepare different financial reporting as

well as auditing models which will help in achievement of goals and objectives of an

organisation.

Q5 Presentation of financial statements

Statement of profit or loss & other

comprehensive income of Godwin Plc for

the year ended 31st December, 2018

Particulars Amount

Revenue (585100+9600) 594700

less: cost of sales (working note-3) 403638.75

Gross profit 191061.25

less: operating expenses (working note-4) 92138.75

less: bank interest 1200

Profit before tax 97722.5

less: income tax expense 9500

Profit for the year 88222.5

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Other comprehensive income:

gains on property revaluation -

Total OCI 88222.5

Interpretation: The above statement shows calculation of net profit for Godwin Plc by

deducting all expenses & losses, adding income & gains. A charge of income tax is subtracted

from the profit. Cost of sales figure includes depreciation on non-current assets and valuation of

closing stock. A portion of rental income is added to sales revenue (Flower, 2018). Cash flow

provides information regarding depreciation, income tax expense etc. Profit for the year is

considered while calculating value of operating activity.

Statement of changes in equity of Godwin Plc as at 31st

December, 2018

Particulars Share capital

Retained

earnings

Revaluation

reserve

As per TB 86700 45500 40000

less: preference dividend 2500

less: ordinary dividend paid 4500

Profit for the year 88222.5

Total 86700 126722.5 40000

Statement of financial position of Godwin Plc for the

year ended 31st December, 2018

Particulars Amount

ASSETS

Non-current assets

Property, plant & equipment (working note-1) 270322.5

Current assets

Trade receivables 78000

6

gains on property revaluation -

Total OCI 88222.5

Interpretation: The above statement shows calculation of net profit for Godwin Plc by

deducting all expenses & losses, adding income & gains. A charge of income tax is subtracted

from the profit. Cost of sales figure includes depreciation on non-current assets and valuation of

closing stock. A portion of rental income is added to sales revenue (Flower, 2018). Cash flow

provides information regarding depreciation, income tax expense etc. Profit for the year is

considered while calculating value of operating activity.

Statement of changes in equity of Godwin Plc as at 31st

December, 2018

Particulars Share capital

Retained

earnings

Revaluation

reserve

As per TB 86700 45500 40000

less: preference dividend 2500

less: ordinary dividend paid 4500

Profit for the year 88222.5

Total 86700 126722.5 40000

Statement of financial position of Godwin Plc for the

year ended 31st December, 2018

Particulars Amount

ASSETS

Non-current assets

Property, plant & equipment (working note-1) 270322.5

Current assets

Trade receivables 78000

6

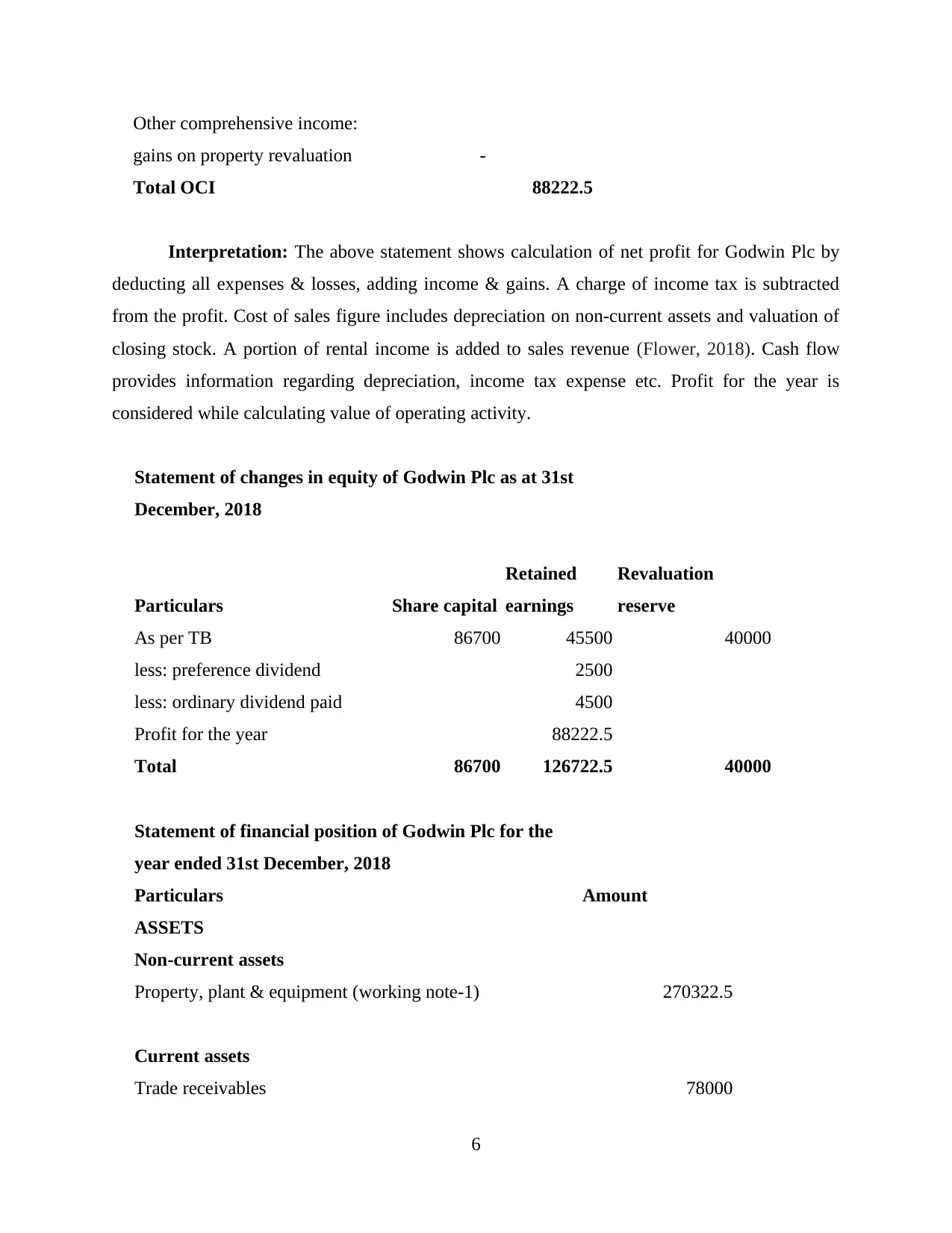

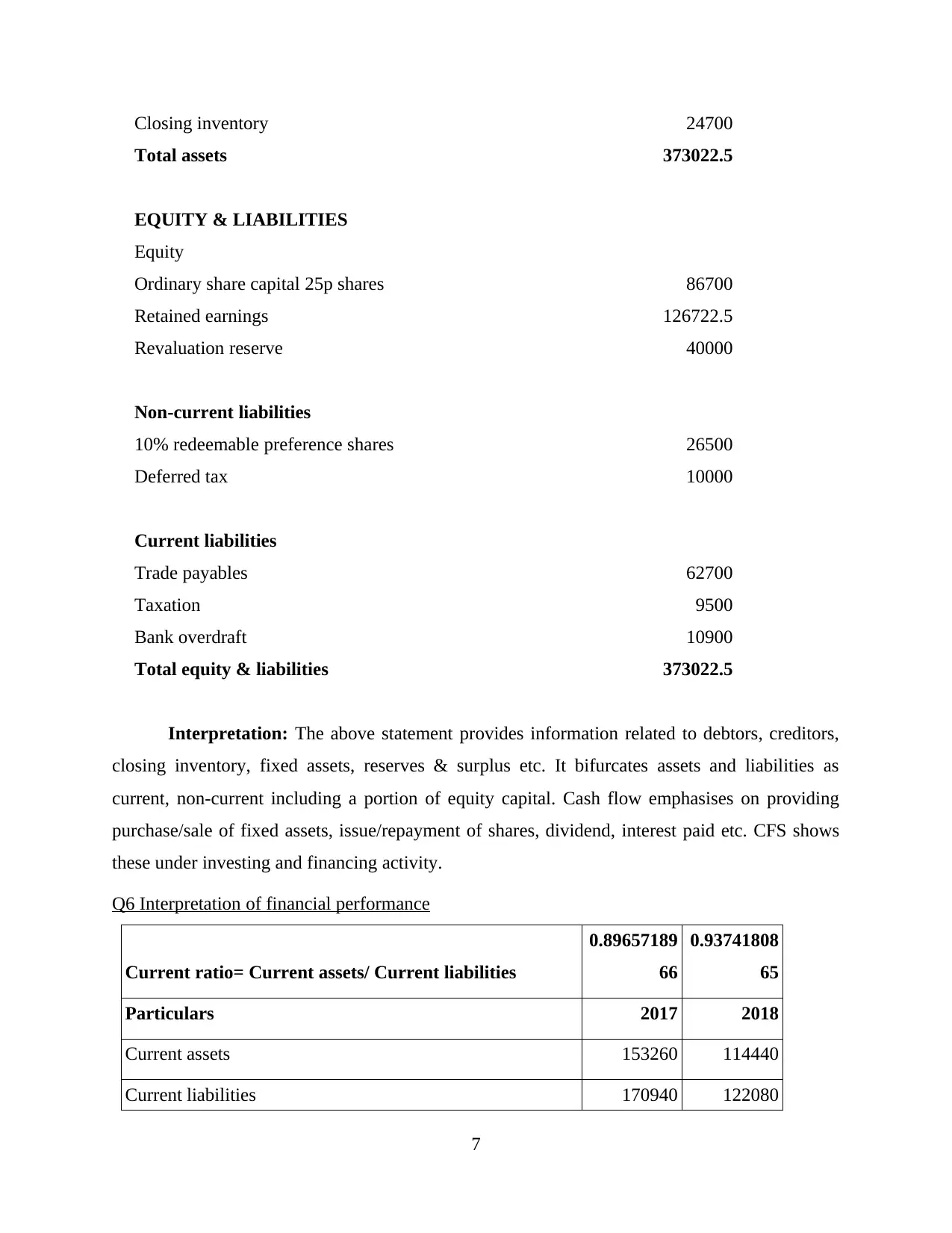

Closing inventory 24700

Total assets 373022.5

EQUITY & LIABILITIES

Equity

Ordinary share capital 25p shares 86700

Retained earnings 126722.5

Revaluation reserve 40000

Non-current liabilities

10% redeemable preference shares 26500

Deferred tax 10000

Current liabilities

Trade payables 62700

Taxation 9500

Bank overdraft 10900

Total equity & liabilities 373022.5

Interpretation: The above statement provides information related to debtors, creditors,

closing inventory, fixed assets, reserves & surplus etc. It bifurcates assets and liabilities as

current, non-current including a portion of equity capital. Cash flow emphasises on providing

purchase/sale of fixed assets, issue/repayment of shares, dividend, interest paid etc. CFS shows

these under investing and financing activity.

Q6 Interpretation of financial performance

Current ratio= Current assets/ Current liabilities

0.89657189

66

0.93741808

65

Particulars 2017 2018

Current assets 153260 114440

Current liabilities 170940 122080

7

Total assets 373022.5

EQUITY & LIABILITIES

Equity

Ordinary share capital 25p shares 86700

Retained earnings 126722.5

Revaluation reserve 40000

Non-current liabilities

10% redeemable preference shares 26500

Deferred tax 10000

Current liabilities

Trade payables 62700

Taxation 9500

Bank overdraft 10900

Total equity & liabilities 373022.5

Interpretation: The above statement provides information related to debtors, creditors,

closing inventory, fixed assets, reserves & surplus etc. It bifurcates assets and liabilities as

current, non-current including a portion of equity capital. Cash flow emphasises on providing

purchase/sale of fixed assets, issue/repayment of shares, dividend, interest paid etc. CFS shows

these under investing and financing activity.

Q6 Interpretation of financial performance

Current ratio= Current assets/ Current liabilities

0.89657189

66

0.93741808

65

Particulars 2017 2018

Current assets 153260 114440

Current liabilities 170940 122080

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

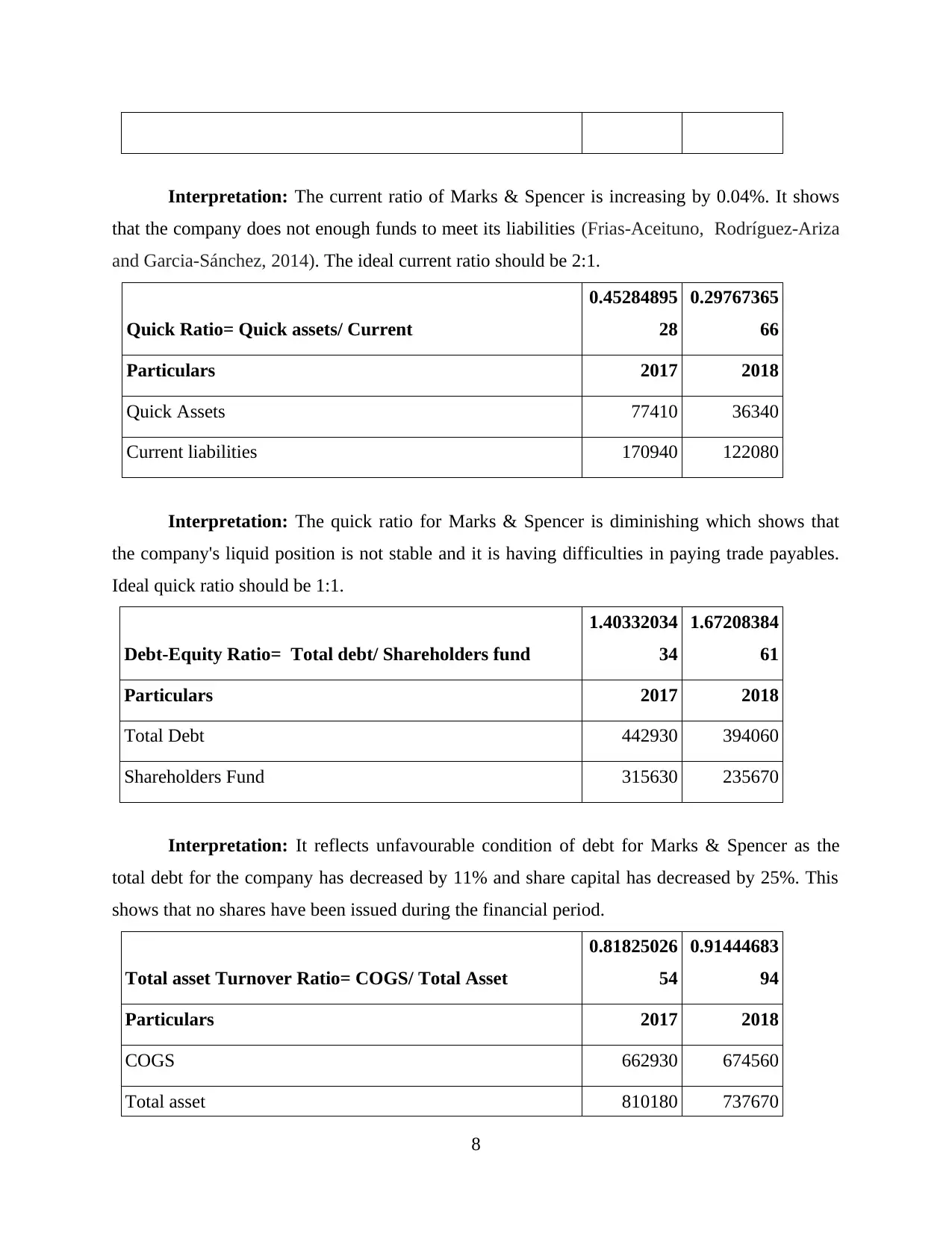

Interpretation: The current ratio of Marks & Spencer is increasing by 0.04%. It shows

that the company does not enough funds to meet its liabilities (Frias‐Aceituno, Rodríguez‐Ariza

and Garcia‐Sánchez, 2014). The ideal current ratio should be 2:1.

Quick Ratio= Quick assets/ Current

0.45284895

28

0.29767365

66

Particulars 2017 2018

Quick Assets 77410 36340

Current liabilities 170940 122080

Interpretation: The quick ratio for Marks & Spencer is diminishing which shows that

the company's liquid position is not stable and it is having difficulties in paying trade payables.

Ideal quick ratio should be 1:1.

Debt-Equity Ratio= Total debt/ Shareholders fund

1.40332034

34

1.67208384

61

Particulars 2017 2018

Total Debt 442930 394060

Shareholders Fund 315630 235670

Interpretation: It reflects unfavourable condition of debt for Marks & Spencer as the

total debt for the company has decreased by 11% and share capital has decreased by 25%. This

shows that no shares have been issued during the financial period.

Total asset Turnover Ratio= COGS/ Total Asset

0.81825026

54

0.91444683

94

Particulars 2017 2018

COGS 662930 674560

Total asset 810180 737670

8

that the company does not enough funds to meet its liabilities (Frias‐Aceituno, Rodríguez‐Ariza

and Garcia‐Sánchez, 2014). The ideal current ratio should be 2:1.

Quick Ratio= Quick assets/ Current

0.45284895

28

0.29767365

66

Particulars 2017 2018

Quick Assets 77410 36340

Current liabilities 170940 122080

Interpretation: The quick ratio for Marks & Spencer is diminishing which shows that

the company's liquid position is not stable and it is having difficulties in paying trade payables.

Ideal quick ratio should be 1:1.

Debt-Equity Ratio= Total debt/ Shareholders fund

1.40332034

34

1.67208384

61

Particulars 2017 2018

Total Debt 442930 394060

Shareholders Fund 315630 235670

Interpretation: It reflects unfavourable condition of debt for Marks & Spencer as the

total debt for the company has decreased by 11% and share capital has decreased by 25%. This

shows that no shares have been issued during the financial period.

Total asset Turnover Ratio= COGS/ Total Asset

0.81825026

54

0.91444683

94

Particulars 2017 2018

COGS 662930 674560

Total asset 810180 737670

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: There is a slight increase in the asset turnover ratio which implies that

the profitability condition of Marks & Spencer is not going very well. The company is having

difficulties in receiving money from its debtors.

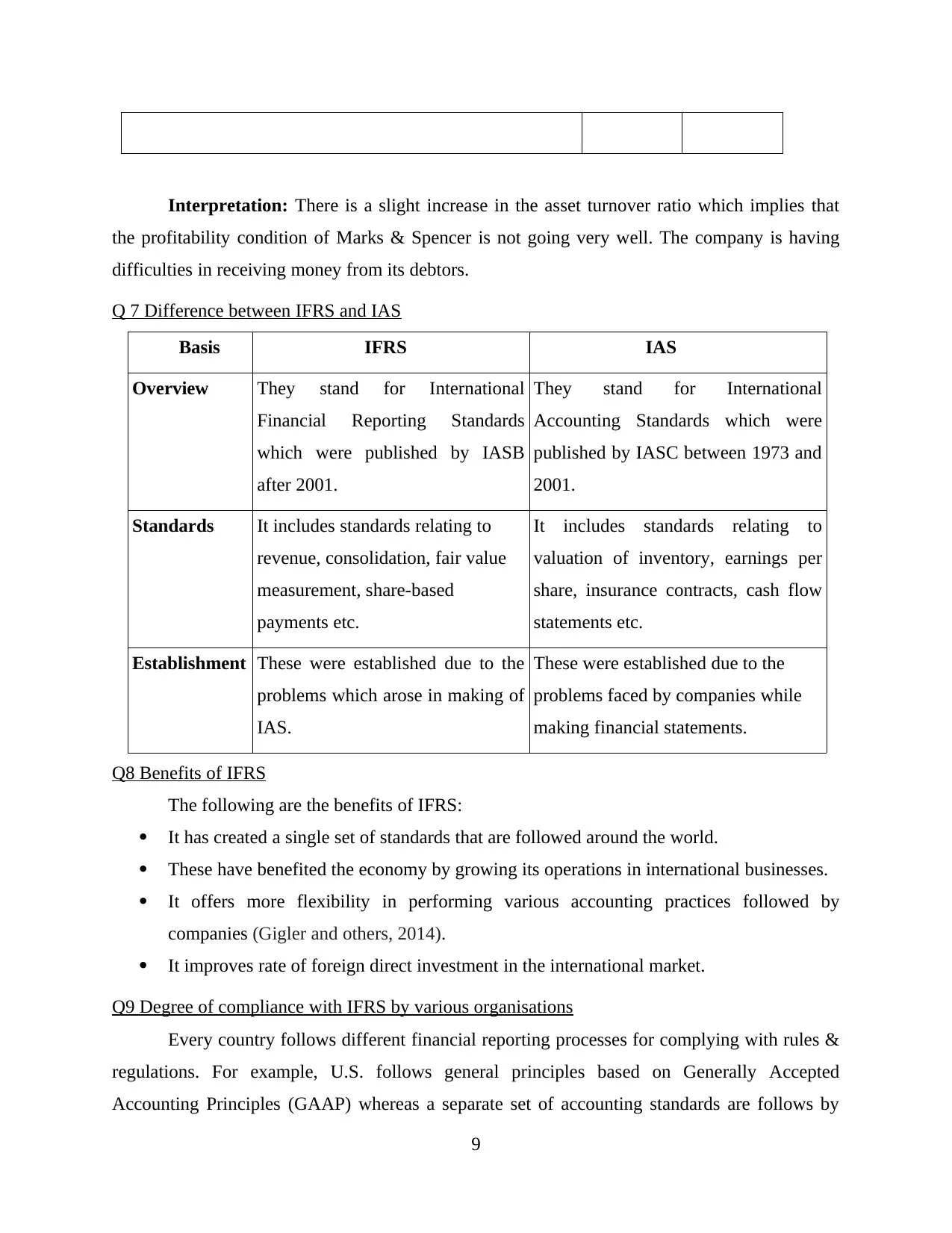

Q 7 Difference between IFRS and IAS

Basis IFRS IAS

Overview They stand for International

Financial Reporting Standards

which were published by IASB

after 2001.

They stand for International

Accounting Standards which were

published by IASC between 1973 and

2001.

Standards It includes standards relating to

revenue, consolidation, fair value

measurement, share-based

payments etc.

It includes standards relating to

valuation of inventory, earnings per

share, insurance contracts, cash flow

statements etc.

Establishment These were established due to the

problems which arose in making of

IAS.

These were established due to the

problems faced by companies while

making financial statements.

Q8 Benefits of IFRS

The following are the benefits of IFRS:

It has created a single set of standards that are followed around the world.

These have benefited the economy by growing its operations in international businesses.

It offers more flexibility in performing various accounting practices followed by

companies (Gigler and others, 2014).

It improves rate of foreign direct investment in the international market.

Q9 Degree of compliance with IFRS by various organisations

Every country follows different financial reporting processes for complying with rules &

regulations. For example, U.S. follows general principles based on Generally Accepted

Accounting Principles (GAAP) whereas a separate set of accounting standards are follows by

9

the profitability condition of Marks & Spencer is not going very well. The company is having

difficulties in receiving money from its debtors.

Q 7 Difference between IFRS and IAS

Basis IFRS IAS

Overview They stand for International

Financial Reporting Standards

which were published by IASB

after 2001.

They stand for International

Accounting Standards which were

published by IASC between 1973 and

2001.

Standards It includes standards relating to

revenue, consolidation, fair value

measurement, share-based

payments etc.

It includes standards relating to

valuation of inventory, earnings per

share, insurance contracts, cash flow

statements etc.

Establishment These were established due to the

problems which arose in making of

IAS.

These were established due to the

problems faced by companies while

making financial statements.

Q8 Benefits of IFRS

The following are the benefits of IFRS:

It has created a single set of standards that are followed around the world.

These have benefited the economy by growing its operations in international businesses.

It offers more flexibility in performing various accounting practices followed by

companies (Gigler and others, 2014).

It improves rate of foreign direct investment in the international market.

Q9 Degree of compliance with IFRS by various organisations

Every country follows different financial reporting processes for complying with rules &

regulations. For example, U.S. follows general principles based on Generally Accepted

Accounting Principles (GAAP) whereas a separate set of accounting standards are follows by

9

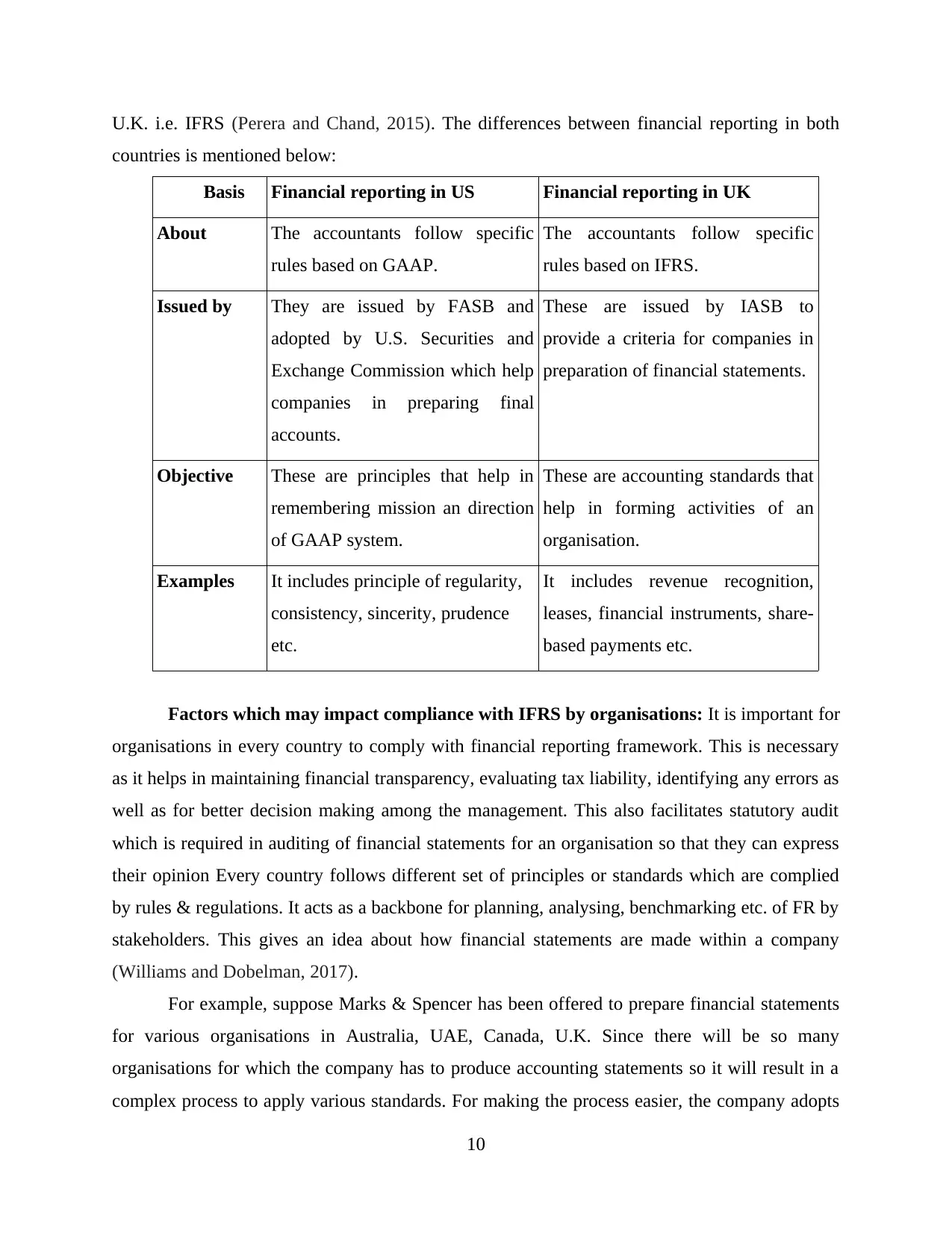

U.K. i.e. IFRS (Perera and Chand, 2015). The differences between financial reporting in both

countries is mentioned below:

Basis Financial reporting in US Financial reporting in UK

About The accountants follow specific

rules based on GAAP.

The accountants follow specific

rules based on IFRS.

Issued by They are issued by FASB and

adopted by U.S. Securities and

Exchange Commission which help

companies in preparing final

accounts.

These are issued by IASB to

provide a criteria for companies in

preparation of financial statements.

Objective These are principles that help in

remembering mission an direction

of GAAP system.

These are accounting standards that

help in forming activities of an

organisation.

Examples It includes principle of regularity,

consistency, sincerity, prudence

etc.

It includes revenue recognition,

leases, financial instruments, share-

based payments etc.

Factors which may impact compliance with IFRS by organisations: It is important for

organisations in every country to comply with financial reporting framework. This is necessary

as it helps in maintaining financial transparency, evaluating tax liability, identifying any errors as

well as for better decision making among the management. This also facilitates statutory audit

which is required in auditing of financial statements for an organisation so that they can express

their opinion Every country follows different set of principles or standards which are complied

by rules & regulations. It acts as a backbone for planning, analysing, benchmarking etc. of FR by

stakeholders. This gives an idea about how financial statements are made within a company

(Williams and Dobelman, 2017).

For example, suppose Marks & Spencer has been offered to prepare financial statements

for various organisations in Australia, UAE, Canada, U.K. Since there will be so many

organisations for which the company has to produce accounting statements so it will result in a

complex process to apply various standards. For making the process easier, the company adopts

10

countries is mentioned below:

Basis Financial reporting in US Financial reporting in UK

About The accountants follow specific

rules based on GAAP.

The accountants follow specific

rules based on IFRS.

Issued by They are issued by FASB and

adopted by U.S. Securities and

Exchange Commission which help

companies in preparing final

accounts.

These are issued by IASB to

provide a criteria for companies in

preparation of financial statements.

Objective These are principles that help in

remembering mission an direction

of GAAP system.

These are accounting standards that

help in forming activities of an

organisation.

Examples It includes principle of regularity,

consistency, sincerity, prudence

etc.

It includes revenue recognition,

leases, financial instruments, share-

based payments etc.

Factors which may impact compliance with IFRS by organisations: It is important for

organisations in every country to comply with financial reporting framework. This is necessary

as it helps in maintaining financial transparency, evaluating tax liability, identifying any errors as

well as for better decision making among the management. This also facilitates statutory audit

which is required in auditing of financial statements for an organisation so that they can express

their opinion Every country follows different set of principles or standards which are complied

by rules & regulations. It acts as a backbone for planning, analysing, benchmarking etc. of FR by

stakeholders. This gives an idea about how financial statements are made within a company

(Williams and Dobelman, 2017).

For example, suppose Marks & Spencer has been offered to prepare financial statements

for various organisations in Australia, UAE, Canada, U.K. Since there will be so many

organisations for which the company has to produce accounting statements so it will result in a

complex process to apply various standards. For making the process easier, the company adopts

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.