Comprehensive Financial Reporting and Analysis of Wesfarmers Limited

VerifiedAdded on 2020/05/08

|13

|2763

|257

Report

AI Summary

This report provides a comprehensive financial analysis of Wesfarmers Limited, evaluating its performance over three years using various financial ratios. The analysis covers key areas such as profitability, efficiency, short-term and long-term solvency, and market-based ratios. The report highlights a decreasing trend in net profit margin, from 4.47% in 2014 to 0.62% in 2016, despite increasing revenue. Solvency is assessed through the debt-to-equity ratio, showing a degradation from 0.53 in 2014 to 0.78 in 2016. Profitability is examined using net profit margin, return on assets, return on equity, and asset turnover. Efficiency is evaluated using accounts receivable turnover and inventory turnover ratios. Short-term solvency is analyzed through current ratio, quick ratio, and cash flow from operations. Long-term solvency is assessed using capital structure leverage and debt-to-equity ratios. Market-based ratios, including price-earnings ratio and dividend yield, are also analyzed. The report concludes with recommendations for improvement, emphasizing the need to enhance both short-term and long-term solvency, improve profitability metrics, and increase efficiency across various financial aspects. The report is a student's submission to Desklib, a platform offering AI-powered study tools.

Running head: FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Financial Reporting and Analysis Assignment

Name of Student:

Name of University:

Author’s Note:

Financial Reporting and Analysis Assignment

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Executive Summary

The study has aimed to provide the evaluation of ratio analysis of Wesfarmers Limited. Some of

the main aspects of the report have considered overview of the company and its operations. This

has been further seen with corporate social and environmental reporting analysis and various

types of the financial ratios such as Efficiency, Short-term solvency, Long-term solvency and

Market-based ratios. The various depictions has shown with a decreasing trend of 4.47% in 2014

to 3.91% 2015 and 0.62% in 2016 in Net Profit. The main overview of the solvency aspect has

been further discerned with Debt to Equity Ratio. This has been seen with degrading condition of

0.53 in 2014 to 0.63 in 2015 to 0.78 in 2016. The profitability aspect of the study has been

considered with the calculated with Net Profit margin, Return on Assets, Return on Equity and

Asset Turnover. The significant decrease in the net profit margin has been evident with 4.47% in

2014 to 3.91% 2015 and 0.62% in 2016. Despite of increasing revenue the decreasing

profitability has been mainly due to the various types of the facts which have seen to be based on

the decreasing profit over the years.

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Executive Summary

The study has aimed to provide the evaluation of ratio analysis of Wesfarmers Limited. Some of

the main aspects of the report have considered overview of the company and its operations. This

has been further seen with corporate social and environmental reporting analysis and various

types of the financial ratios such as Efficiency, Short-term solvency, Long-term solvency and

Market-based ratios. The various depictions has shown with a decreasing trend of 4.47% in 2014

to 3.91% 2015 and 0.62% in 2016 in Net Profit. The main overview of the solvency aspect has

been further discerned with Debt to Equity Ratio. This has been seen with degrading condition of

0.53 in 2014 to 0.63 in 2015 to 0.78 in 2016. The profitability aspect of the study has been

considered with the calculated with Net Profit margin, Return on Assets, Return on Equity and

Asset Turnover. The significant decrease in the net profit margin has been evident with 4.47% in

2014 to 3.91% 2015 and 0.62% in 2016. Despite of increasing revenue the decreasing

profitability has been mainly due to the various types of the facts which have seen to be based on

the decreasing profit over the years.

2

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Table of Contents

Introduction......................................................................................................................................3

i. Overview of the company and its operations.......................................................................3

ii. Corporate social and environmental reporting analysis........................................................3

Analysis of the company over three years.......................................................................................3

i. Overall results.......................................................................................................................3

ii. Profitability...........................................................................................................................4

iii. Efficiency..........................................................................................................................4

iv. Short-term solvency..........................................................................................................5

v. Long-term solvency..............................................................................................................6

vi. Market-based ratios...........................................................................................................6

vii. Other analyses...................................................................................................................7

Conclusion.......................................................................................................................................7

Recommendations and limitations...................................................................................................8

List of References............................................................................................................................9

Appendix........................................................................................................................................10

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Table of Contents

Introduction......................................................................................................................................3

i. Overview of the company and its operations.......................................................................3

ii. Corporate social and environmental reporting analysis........................................................3

Analysis of the company over three years.......................................................................................3

i. Overall results.......................................................................................................................3

ii. Profitability...........................................................................................................................4

iii. Efficiency..........................................................................................................................4

iv. Short-term solvency..........................................................................................................5

v. Long-term solvency..............................................................................................................6

vi. Market-based ratios...........................................................................................................6

vii. Other analyses...................................................................................................................7

Conclusion.......................................................................................................................................7

Recommendations and limitations...................................................................................................8

List of References............................................................................................................................9

Appendix........................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Introduction

i. Overview of the company and its operations

Wesfarmers Limited headquartered in Perth, Western Australia has been

identified as the leader in terms of producing chemicals, fertilisers and safety products.

The company has been further seen to the private employer and constituting of 205000

employees.

ii. Corporate social and environmental reporting analysis

The social and the environmental measures have been seen with climate change

resilience. Some of this has been further seen to be based in reducing waste to landfill

and using water wherever possible.

Analysis of the company over three years

i. Overall results

The overall result of the analysis of the results has been considered with

profitability ratio, solvency ratio and market based ratio. Some of the various types of the

solvency aspect of the overall result have been discerned in from of the liquidity and

efficiency. Based on the overview of the net profit margin has been seen with a

decreasing trend of 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. The main overview

of the solvency aspect has been further discerned with Debt to Equity Ratio (Schmidgall

and DeFranco 2004). This has been seen with degrading condition of 0.53 in 2014 to 0.63

in 2015 to 0.78 in 2016. The market based ratio has been seen with price earning ration

and the overall price earnings ratio has been seen with 0.148 in 2014 which has further

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Introduction

i. Overview of the company and its operations

Wesfarmers Limited headquartered in Perth, Western Australia has been

identified as the leader in terms of producing chemicals, fertilisers and safety products.

The company has been further seen to the private employer and constituting of 205000

employees.

ii. Corporate social and environmental reporting analysis

The social and the environmental measures have been seen with climate change

resilience. Some of this has been further seen to be based in reducing waste to landfill

and using water wherever possible.

Analysis of the company over three years

i. Overall results

The overall result of the analysis of the results has been considered with

profitability ratio, solvency ratio and market based ratio. Some of the various types of the

solvency aspect of the overall result have been discerned in from of the liquidity and

efficiency. Based on the overview of the net profit margin has been seen with a

decreasing trend of 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. The main overview

of the solvency aspect has been further discerned with Debt to Equity Ratio (Schmidgall

and DeFranco 2004). This has been seen with degrading condition of 0.53 in 2014 to 0.63

in 2015 to 0.78 in 2016. The market based ratio has been seen with price earning ration

and the overall price earnings ratio has been seen with 0.148 in 2014 which has further

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

increased to 0.169 in 2015 and the most significant improvement in the price earnings

ratio for the company has been seen with 1.079 in 2016. The overview of the liquidity of

the company has been seen to be discerned in terms of the evaluation of the current ratio.

The cash for the operating activities has been seen to be decreasing in nature with the

various type of the discernment which has been seen as 1.13 in 2014 to 0.93 in 2016. In

addition to this, the efficiency has been identified with increasing Accounts Receivable

Turnover Ratio of 30.67 in 2014 to 40.99 in 2015 to 42.68 in 2016 (Ashraf, Rizwan and

L’Huillier 2016).

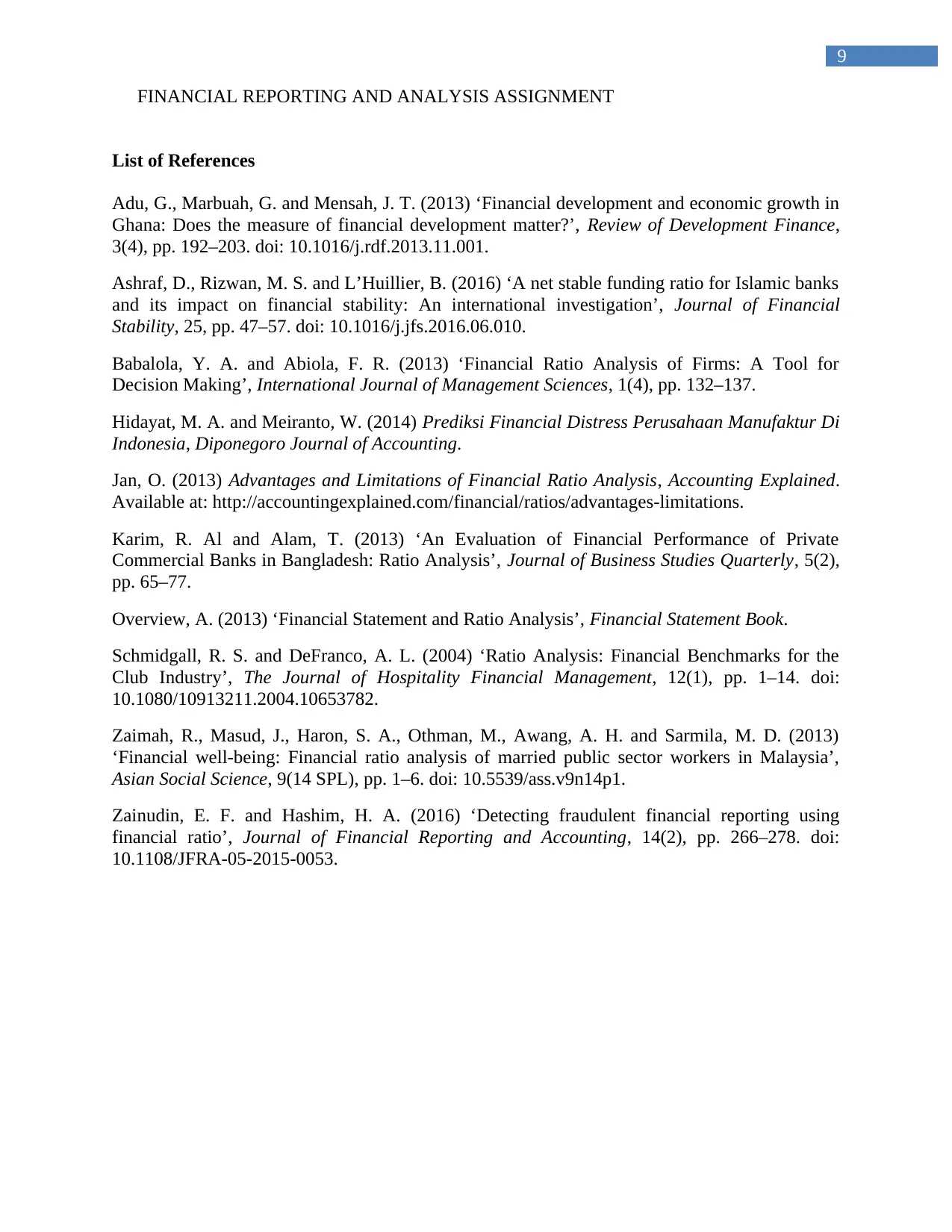

ii. Profitability

The profitability aspect of the study has been considered with the calculated with

Net Profit margin, Return on Assets, Return on Equity and Asset Turnover. The

significant decrease in the net profit margin has been evident with 4.47% in 2014 to

3.91% 2015 and 0.62% in 2016. Despite of increasing revenue the decreasing

profitability has been mainly due to the various types of the facts which have seen to be

based on the decreasing profit over the years. In similar fashion the return on assets has

been discerned with 0.06 in 2014 to 0.01 in 2016 (Hidayat and Meiranto 2014). This is

also due to the decreasing profit over the years. Return on Assets has been further seen to

be based on the evaluation of decreasing Return on Equity. This has been seen with

decreasing profitability of 10.34% in 2014 to 9.61% in 2015 and 1.71% in 2016. The

main reason for this has been further seen to be based on the various types of the

depiction which has been seen to be based on decreasing average equity (Jan 2013).

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

increased to 0.169 in 2015 and the most significant improvement in the price earnings

ratio for the company has been seen with 1.079 in 2016. The overview of the liquidity of

the company has been seen to be discerned in terms of the evaluation of the current ratio.

The cash for the operating activities has been seen to be decreasing in nature with the

various type of the discernment which has been seen as 1.13 in 2014 to 0.93 in 2016. In

addition to this, the efficiency has been identified with increasing Accounts Receivable

Turnover Ratio of 30.67 in 2014 to 40.99 in 2015 to 42.68 in 2016 (Ashraf, Rizwan and

L’Huillier 2016).

ii. Profitability

The profitability aspect of the study has been considered with the calculated with

Net Profit margin, Return on Assets, Return on Equity and Asset Turnover. The

significant decrease in the net profit margin has been evident with 4.47% in 2014 to

3.91% 2015 and 0.62% in 2016. Despite of increasing revenue the decreasing

profitability has been mainly due to the various types of the facts which have seen to be

based on the decreasing profit over the years. In similar fashion the return on assets has

been discerned with 0.06 in 2014 to 0.01 in 2016 (Hidayat and Meiranto 2014). This is

also due to the decreasing profit over the years. Return on Assets has been further seen to

be based on the evaluation of decreasing Return on Equity. This has been seen with

decreasing profitability of 10.34% in 2014 to 9.61% in 2015 and 1.71% in 2016. The

main reason for this has been further seen to be based on the various types of the

depiction which has been seen to be based on decreasing average equity (Jan 2013).

5

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

iii. Efficiency

The main form of the increasing aspect of the efficiency has been evident with

increasing Accounts Receivable Turnover Ratio of 30.67 in 2014 to 40.99 in 2015 to

42.68 in 2016. The main reason for the increasing Accounts Receivable Turnover Ratio

has been seen with increasing Accounts Receivable and revenue. The other efficiency

aspect has been seen with Inventory Turnover Ratio of 7.76 in 2014, 7.95 in 2015 and

7.74 in 2016. This shows the company has been unable to increase the COGS in

appropriate proportion with average inventory. Hence, based on the evaluation despite

of increasing Accounts Receivable Turnover Ratio the company’s Inventory Turnover

Ratio has decreased significantly (Karim and Alam 2013).

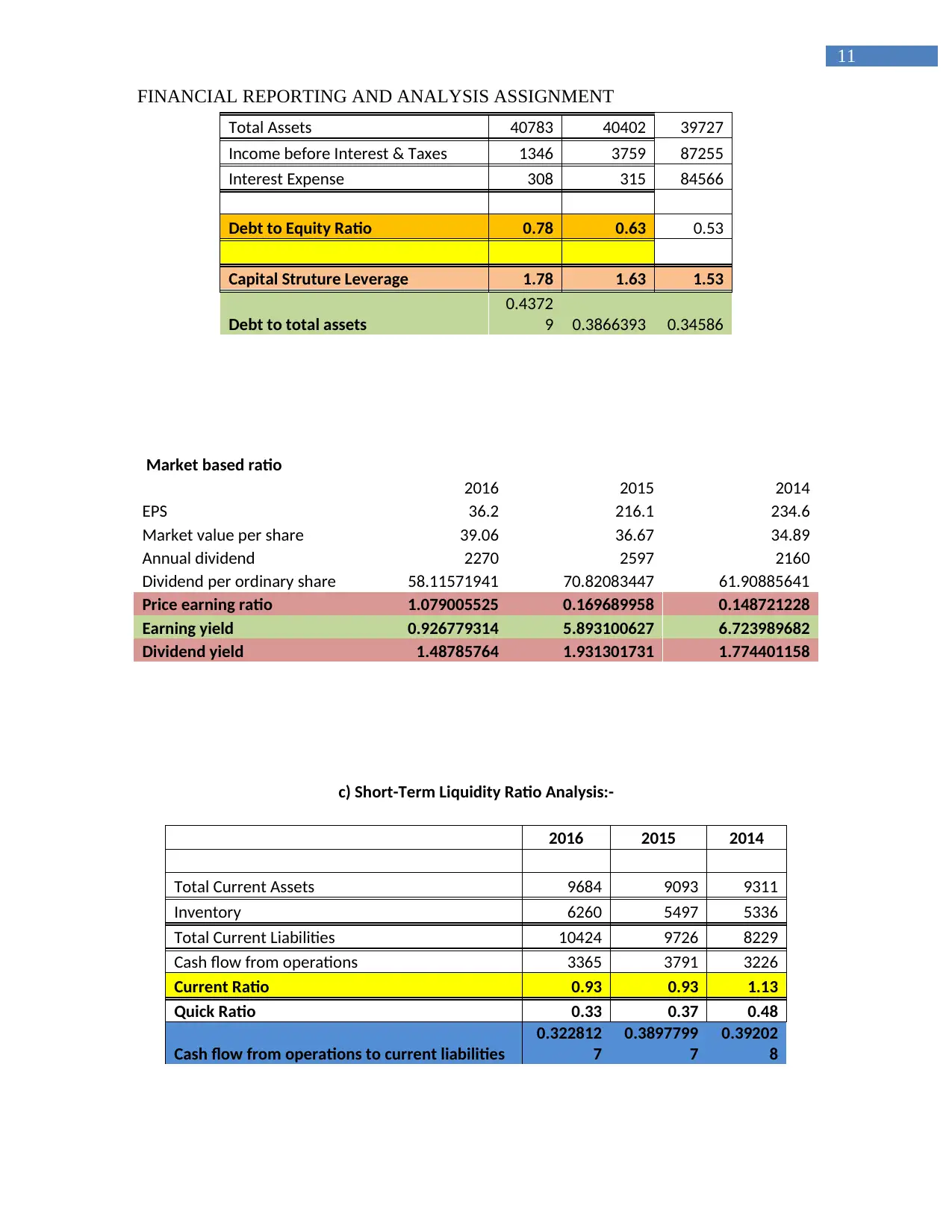

iv. Short-term solvency

The various types of the consideration for the Short-Term Liquidity Ratio

Analysis have been considered with Total Current Assets, Inventory, Total Current

Liabilities and Cash flow from operation. The main consideration for the ratio has been

further seen to be based on the different types of the evaluation of Current Ratio, Quick

Ratio and Cash flow from operations to current liabilities. It has been further discerned

that the company is seen to be having decreasing in nature for the cash for the operating

activities and the same has been seen as 1.13 in 2014 to 0.93 in 2016 in the current ratio

evaluation. Quick ratio of the company has been also seen to be decreasing in nature.

This has been discerned with 0.48 in 2014 to 0.37 to 2015 to 0.33 in 2016. Despite of the

increasing total current assets and inventory the increasing current liability has led to

degrading quick ratio for the company. The cash from the operations to current liabilities

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

iii. Efficiency

The main form of the increasing aspect of the efficiency has been evident with

increasing Accounts Receivable Turnover Ratio of 30.67 in 2014 to 40.99 in 2015 to

42.68 in 2016. The main reason for the increasing Accounts Receivable Turnover Ratio

has been seen with increasing Accounts Receivable and revenue. The other efficiency

aspect has been seen with Inventory Turnover Ratio of 7.76 in 2014, 7.95 in 2015 and

7.74 in 2016. This shows the company has been unable to increase the COGS in

appropriate proportion with average inventory. Hence, based on the evaluation despite

of increasing Accounts Receivable Turnover Ratio the company’s Inventory Turnover

Ratio has decreased significantly (Karim and Alam 2013).

iv. Short-term solvency

The various types of the consideration for the Short-Term Liquidity Ratio

Analysis have been considered with Total Current Assets, Inventory, Total Current

Liabilities and Cash flow from operation. The main consideration for the ratio has been

further seen to be based on the different types of the evaluation of Current Ratio, Quick

Ratio and Cash flow from operations to current liabilities. It has been further discerned

that the company is seen to be having decreasing in nature for the cash for the operating

activities and the same has been seen as 1.13 in 2014 to 0.93 in 2016 in the current ratio

evaluation. Quick ratio of the company has been also seen to be decreasing in nature.

This has been discerned with 0.48 in 2014 to 0.37 to 2015 to 0.33 in 2016. Despite of the

increasing total current assets and inventory the increasing current liability has led to

degrading quick ratio for the company. The cash from the operations to current liabilities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

has been further seen to be decreasing with 0.39 in 2014 to 0.38 in 2015 to 0.32 in 2016

(Zainudin and Hashim 2016).

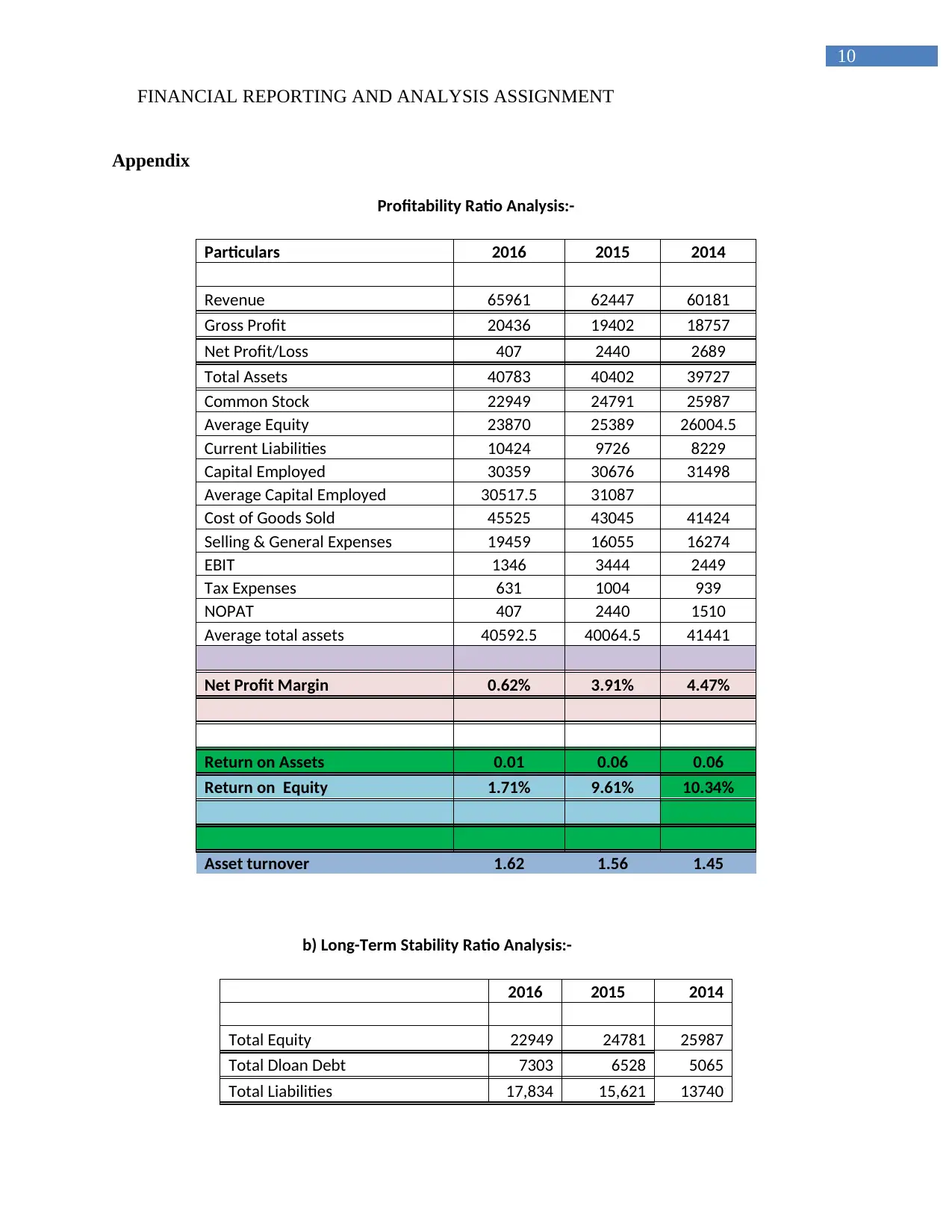

v. Long-term solvency

The main items of the particulars of the various types of the aspects associated to

the long-term solvency have been considered with Capital Structure Leverage and Debt

to total assets. The various considerations of the variables have been seen with Income

before Interest & Taxes, Interest Expense and equities. The capital structure has been

seen to be increasing with 1.53 in 2014, 1.63 in 2015 and 1.78 in 2016. Some of the

various types of the aspects of the improvement have been further seen to be discerned in

terms of increasing Debt to total assets with 0.34 in 2014 to 0.39 in 2015 to 0.44 in 2016.

The long term solvency has been further discerned with the calculation of Debt to Equity

Ratio. This has been seen with degrading condition of 0.53 in 2014 to 0.63 in 2015 to

0.78 in 2016. Both the total equities and liabilities has led to the declining Long-Term

Stability Ratio (Adu, Marbuah and Mensah 2013).

vi. Market-based ratios

The main form of the variable for the market based ratio has been seen to be

considered based on the EPS, Market value per share, Annual dividend and Dividend

per ordinary share. The different types of the ratios for the market based ratio have been

seen to be based on Price earnings ratio, Earning yield ratio and Dividend yield ratio.

Based on the variations types of depictions it has been seen with increasing Price

earnings ratio of 0.149 in 2014 to 0.17 in 2015 to 1.081 in 2016. The earning yield ratio

has been further seen to decrease with 6.72 in 2014 to 5.89 in 2015 to dramatic decrease

of 0.933 in 2016 (Zaimah et al. 2013). Moreover, as pert the market based ratio the

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

has been further seen to be decreasing with 0.39 in 2014 to 0.38 in 2015 to 0.32 in 2016

(Zainudin and Hashim 2016).

v. Long-term solvency

The main items of the particulars of the various types of the aspects associated to

the long-term solvency have been considered with Capital Structure Leverage and Debt

to total assets. The various considerations of the variables have been seen with Income

before Interest & Taxes, Interest Expense and equities. The capital structure has been

seen to be increasing with 1.53 in 2014, 1.63 in 2015 and 1.78 in 2016. Some of the

various types of the aspects of the improvement have been further seen to be discerned in

terms of increasing Debt to total assets with 0.34 in 2014 to 0.39 in 2015 to 0.44 in 2016.

The long term solvency has been further discerned with the calculation of Debt to Equity

Ratio. This has been seen with degrading condition of 0.53 in 2014 to 0.63 in 2015 to

0.78 in 2016. Both the total equities and liabilities has led to the declining Long-Term

Stability Ratio (Adu, Marbuah and Mensah 2013).

vi. Market-based ratios

The main form of the variable for the market based ratio has been seen to be

considered based on the EPS, Market value per share, Annual dividend and Dividend

per ordinary share. The different types of the ratios for the market based ratio have been

seen to be based on Price earnings ratio, Earning yield ratio and Dividend yield ratio.

Based on the variations types of depictions it has been seen with increasing Price

earnings ratio of 0.149 in 2014 to 0.17 in 2015 to 1.081 in 2016. The earning yield ratio

has been further seen to decrease with 6.72 in 2014 to 5.89 in 2015 to dramatic decrease

of 0.933 in 2016 (Zaimah et al. 2013). Moreover, as pert the market based ratio the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

dividend yield of the company has been seen to reduce by 1.77 in 2014 to 1.93 in 2015

to 1.48 in 2016. The various types of the other factors of the market based ratio has

shown reducing performance due to decreasing amount of Dividend per ordinary share.

This has been further seen to be discerned as 61.9 in 2014 to 70.82 in 2015 to 58.115 in

2016 (Babalola and Abiola 2013).

vii. Other analyses

The various types of the other analysis have been seen with return on the assets,

return on equity and return on equity. It has been discerned that the total ROA of the

company has reduced from 0.06 in 2014 to 0.01 in 2016. It has been also discerned that

the there is drastic decrease in the Return on Equity with 10.34% in 2014 to 9.61% in

2015 to 1.71% in 2016 (Overview 2013).

Conclusion

The various types of the depiction has been able to show that Net profit margin has been

seen with a decreasing trend of 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. The main

overview of the solvency aspect has been further discerned with Debt to Equity Ratio. This has

been seen with degrading condition of 0.53 in 2014 to 0.63 in 2015 to 0.78 in 2016. The

profitability aspect of the study has been considered with the calculated with Net Profit margin,

Return on Assets, Return on Equity and Asset Turnover. The significant decrease in the net

profit margin has been evident with 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. Despite of

increasing revenue the decreasing profitability has been mainly due to the various types of the

facts which have seen to be based on the decreasing profit over the years. Efficiency has been

evident with increasing Accounts Receivable Turnover Ratio of 30.67 in 2014 to 40.99 in 2015

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

dividend yield of the company has been seen to reduce by 1.77 in 2014 to 1.93 in 2015

to 1.48 in 2016. The various types of the other factors of the market based ratio has

shown reducing performance due to decreasing amount of Dividend per ordinary share.

This has been further seen to be discerned as 61.9 in 2014 to 70.82 in 2015 to 58.115 in

2016 (Babalola and Abiola 2013).

vii. Other analyses

The various types of the other analysis have been seen with return on the assets,

return on equity and return on equity. It has been discerned that the total ROA of the

company has reduced from 0.06 in 2014 to 0.01 in 2016. It has been also discerned that

the there is drastic decrease in the Return on Equity with 10.34% in 2014 to 9.61% in

2015 to 1.71% in 2016 (Overview 2013).

Conclusion

The various types of the depiction has been able to show that Net profit margin has been

seen with a decreasing trend of 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. The main

overview of the solvency aspect has been further discerned with Debt to Equity Ratio. This has

been seen with degrading condition of 0.53 in 2014 to 0.63 in 2015 to 0.78 in 2016. The

profitability aspect of the study has been considered with the calculated with Net Profit margin,

Return on Assets, Return on Equity and Asset Turnover. The significant decrease in the net

profit margin has been evident with 4.47% in 2014 to 3.91% 2015 and 0.62% in 2016. Despite of

increasing revenue the decreasing profitability has been mainly due to the various types of the

facts which have seen to be based on the decreasing profit over the years. Efficiency has been

evident with increasing Accounts Receivable Turnover Ratio of 30.67 in 2014 to 40.99 in 2015

8

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

to 42.68 in 2016. The main reason for the increasing Accounts Receivable Turnover Ratio has

been seen with increasing Accounts Receivable and revenue.

Recommendations and limitations

The company has been recommended to improve on the both long term and short term

solvency aspects. It has been further seen to be recommended to improvement of the various

types of the performance has seen to be associated to the Return on Equity and Return on Assets.

The company also needs to improve on the various types of the aspects related to the decreasing

Earning yield and Dividend yield. The efficiency of the different aspects also needs to be

improved by the company. The Accounts Receivable Turnover Ratio should be also improved by

increasing Accounts Receivable over the years.

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

to 42.68 in 2016. The main reason for the increasing Accounts Receivable Turnover Ratio has

been seen with increasing Accounts Receivable and revenue.

Recommendations and limitations

The company has been recommended to improve on the both long term and short term

solvency aspects. It has been further seen to be recommended to improvement of the various

types of the performance has seen to be associated to the Return on Equity and Return on Assets.

The company also needs to improve on the various types of the aspects related to the decreasing

Earning yield and Dividend yield. The efficiency of the different aspects also needs to be

improved by the company. The Accounts Receivable Turnover Ratio should be also improved by

increasing Accounts Receivable over the years.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

List of References

Adu, G., Marbuah, G. and Mensah, J. T. (2013) ‘Financial development and economic growth in

Ghana: Does the measure of financial development matter?’, Review of Development Finance,

3(4), pp. 192–203. doi: 10.1016/j.rdf.2013.11.001.

Ashraf, D., Rizwan, M. S. and L’Huillier, B. (2016) ‘A net stable funding ratio for Islamic banks

and its impact on financial stability: An international investigation’, Journal of Financial

Stability, 25, pp. 47–57. doi: 10.1016/j.jfs.2016.06.010.

Babalola, Y. A. and Abiola, F. R. (2013) ‘Financial Ratio Analysis of Firms: A Tool for

Decision Making’, International Journal of Management Sciences, 1(4), pp. 132–137.

Hidayat, M. A. and Meiranto, W. (2014) Prediksi Financial Distress Perusahaan Manufaktur Di

Indonesia, Diponegoro Journal of Accounting.

Jan, O. (2013) Advantages and Limitations of Financial Ratio Analysis, Accounting Explained.

Available at: http://accountingexplained.com/financial/ratios/advantages-limitations.

Karim, R. Al and Alam, T. (2013) ‘An Evaluation of Financial Performance of Private

Commercial Banks in Bangladesh: Ratio Analysis’, Journal of Business Studies Quarterly, 5(2),

pp. 65–77.

Overview, A. (2013) ‘Financial Statement and Ratio Analysis’, Financial Statement Book.

Schmidgall, R. S. and DeFranco, A. L. (2004) ‘Ratio Analysis: Financial Benchmarks for the

Club Industry’, The Journal of Hospitality Financial Management, 12(1), pp. 1–14. doi:

10.1080/10913211.2004.10653782.

Zaimah, R., Masud, J., Haron, S. A., Othman, M., Awang, A. H. and Sarmila, M. D. (2013)

‘Financial well-being: Financial ratio analysis of married public sector workers in Malaysia’,

Asian Social Science, 9(14 SPL), pp. 1–6. doi: 10.5539/ass.v9n14p1.

Zainudin, E. F. and Hashim, H. A. (2016) ‘Detecting fraudulent financial reporting using

financial ratio’, Journal of Financial Reporting and Accounting, 14(2), pp. 266–278. doi:

10.1108/JFRA-05-2015-0053.

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

List of References

Adu, G., Marbuah, G. and Mensah, J. T. (2013) ‘Financial development and economic growth in

Ghana: Does the measure of financial development matter?’, Review of Development Finance,

3(4), pp. 192–203. doi: 10.1016/j.rdf.2013.11.001.

Ashraf, D., Rizwan, M. S. and L’Huillier, B. (2016) ‘A net stable funding ratio for Islamic banks

and its impact on financial stability: An international investigation’, Journal of Financial

Stability, 25, pp. 47–57. doi: 10.1016/j.jfs.2016.06.010.

Babalola, Y. A. and Abiola, F. R. (2013) ‘Financial Ratio Analysis of Firms: A Tool for

Decision Making’, International Journal of Management Sciences, 1(4), pp. 132–137.

Hidayat, M. A. and Meiranto, W. (2014) Prediksi Financial Distress Perusahaan Manufaktur Di

Indonesia, Diponegoro Journal of Accounting.

Jan, O. (2013) Advantages and Limitations of Financial Ratio Analysis, Accounting Explained.

Available at: http://accountingexplained.com/financial/ratios/advantages-limitations.

Karim, R. Al and Alam, T. (2013) ‘An Evaluation of Financial Performance of Private

Commercial Banks in Bangladesh: Ratio Analysis’, Journal of Business Studies Quarterly, 5(2),

pp. 65–77.

Overview, A. (2013) ‘Financial Statement and Ratio Analysis’, Financial Statement Book.

Schmidgall, R. S. and DeFranco, A. L. (2004) ‘Ratio Analysis: Financial Benchmarks for the

Club Industry’, The Journal of Hospitality Financial Management, 12(1), pp. 1–14. doi:

10.1080/10913211.2004.10653782.

Zaimah, R., Masud, J., Haron, S. A., Othman, M., Awang, A. H. and Sarmila, M. D. (2013)

‘Financial well-being: Financial ratio analysis of married public sector workers in Malaysia’,

Asian Social Science, 9(14 SPL), pp. 1–6. doi: 10.5539/ass.v9n14p1.

Zainudin, E. F. and Hashim, H. A. (2016) ‘Detecting fraudulent financial reporting using

financial ratio’, Journal of Financial Reporting and Accounting, 14(2), pp. 266–278. doi:

10.1108/JFRA-05-2015-0053.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Appendix

Profitability Ratio Analysis:-

Particulars 2016 2015 2014

Revenue 65961 62447 60181

Gross Profit 20436 19402 18757

Net Profit/Loss 407 2440 2689

Total Assets 40783 40402 39727

Common Stock 22949 24791 25987

Average Equity 23870 25389 26004.5

Current Liabilities 10424 9726 8229

Capital Employed 30359 30676 31498

Average Capital Employed 30517.5 31087

Cost of Goods Sold 45525 43045 41424

Selling & General Expenses 19459 16055 16274

EBIT 1346 3444 2449

Tax Expenses 631 1004 939

NOPAT 407 2440 1510

Average total assets 40592.5 40064.5 41441

Net Profit Margin 0.62% 3.91% 4.47%

Return on Assets 0.01 0.06 0.06

Return on Equity 1.71% 9.61% 10.34%

Asset turnover 1.62 1.56 1.45

b) Long-Term Stability Ratio Analysis:-

2016 2015 2014

Total Equity 22949 24781 25987

Total Dloan Debt 7303 6528 5065

Total Liabilities 17,834 15,621 13740

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Appendix

Profitability Ratio Analysis:-

Particulars 2016 2015 2014

Revenue 65961 62447 60181

Gross Profit 20436 19402 18757

Net Profit/Loss 407 2440 2689

Total Assets 40783 40402 39727

Common Stock 22949 24791 25987

Average Equity 23870 25389 26004.5

Current Liabilities 10424 9726 8229

Capital Employed 30359 30676 31498

Average Capital Employed 30517.5 31087

Cost of Goods Sold 45525 43045 41424

Selling & General Expenses 19459 16055 16274

EBIT 1346 3444 2449

Tax Expenses 631 1004 939

NOPAT 407 2440 1510

Average total assets 40592.5 40064.5 41441

Net Profit Margin 0.62% 3.91% 4.47%

Return on Assets 0.01 0.06 0.06

Return on Equity 1.71% 9.61% 10.34%

Asset turnover 1.62 1.56 1.45

b) Long-Term Stability Ratio Analysis:-

2016 2015 2014

Total Equity 22949 24781 25987

Total Dloan Debt 7303 6528 5065

Total Liabilities 17,834 15,621 13740

11

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Total Assets 40783 40402 39727

Income before Interest & Taxes 1346 3759 87255

Interest Expense 308 315 84566

Debt to Equity Ratio 0.78 0.63 0.53

Capital Struture Leverage 1.78 1.63 1.53

Debt to total assets

0.4372

9 0.3866393 0.34586

Market based ratio

2016 2015 2014

EPS 36.2 216.1 234.6

Market value per share 39.06 36.67 34.89

Annual dividend 2270 2597 2160

Dividend per ordinary share 58.11571941 70.82083447 61.90885641

Price earning ratio 1.079005525 0.169689958 0.148721228

Earning yield 0.926779314 5.893100627 6.723989682

Dividend yield 1.48785764 1.931301731 1.774401158

c) Short-Term Liquidity Ratio Analysis:-

2016 2015 2014

Total Current Assets 9684 9093 9311

Inventory 6260 5497 5336

Total Current Liabilities 10424 9726 8229

Cash flow from operations 3365 3791 3226

Current Ratio 0.93 0.93 1.13

Quick Ratio 0.33 0.37 0.48

Cash flow from operations to current liabilities

0.322812

7

0.3897799

7

0.39202

8

FINANCIAL REPORTING AND ANALYSIS ASSIGNMENT

Total Assets 40783 40402 39727

Income before Interest & Taxes 1346 3759 87255

Interest Expense 308 315 84566

Debt to Equity Ratio 0.78 0.63 0.53

Capital Struture Leverage 1.78 1.63 1.53

Debt to total assets

0.4372

9 0.3866393 0.34586

Market based ratio

2016 2015 2014

EPS 36.2 216.1 234.6

Market value per share 39.06 36.67 34.89

Annual dividend 2270 2597 2160

Dividend per ordinary share 58.11571941 70.82083447 61.90885641

Price earning ratio 1.079005525 0.169689958 0.148721228

Earning yield 0.926779314 5.893100627 6.723989682

Dividend yield 1.48785764 1.931301731 1.774401158

c) Short-Term Liquidity Ratio Analysis:-

2016 2015 2014

Total Current Assets 9684 9093 9311

Inventory 6260 5497 5336

Total Current Liabilities 10424 9726 8229

Cash flow from operations 3365 3791 3226

Current Ratio 0.93 0.93 1.13

Quick Ratio 0.33 0.37 0.48

Cash flow from operations to current liabilities

0.322812

7

0.3897799

7

0.39202

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13