Financial Reporting and Analysis: Framework, Purpose, Interpretation, and Ratio Calculation

VerifiedAdded on 2023/06/18

|16

|4992

|460

AI Summary

This study discusses the financial reporting framework, purpose, interpretation, and ratio calculation for better performance and investment. It also analyses the benefits and drawbacks of IFRS and the critical analysis of various regulatory frameworks for stakeholders. The study interprets the profit and loss, cash flow, and balance sheet statements and evaluates the financial ratios for better performance. It also highlights the importance of financial reporting in different countries.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENT

.........................................................................................................................................................3

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1 Analysing the financial reporting including framework and governance of regulatory

reporting:......................................................................................................................................3

M1 The purpose of financial reporting and expectations of stakeholder:...................................4

D1 Critical analysis of various regulatory frameworks for stakeholder:.....................................5

P2 analysing the purpose of financial reporting in the organizations:.........................................6

P3 interpretation of profit and loss, cash flow and balance sheet and other statements:.............7

P4 Calculation of financial ratio for better performance and investment:..................................9

P5 benefits of international accounting standards and international financial reporting

standards:...................................................................................................................................11

P6 evaluation of financial reporting and auditing model:..........................................................12

Uniformity in financial accounting standard:............................................................................13

M3 Critical evaluation of financial reporting and auditing through theories support judgement

and conclusion:..........................................................................................................................14

P7 difference and importance of financial reporting in different countries:..............................14

M4 Critical evaluation factors that influence the financial reporting in the international:........14

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

.........................................................................................................................................................3

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1 Analysing the financial reporting including framework and governance of regulatory

reporting:......................................................................................................................................3

M1 The purpose of financial reporting and expectations of stakeholder:...................................4

D1 Critical analysis of various regulatory frameworks for stakeholder:.....................................5

P2 analysing the purpose of financial reporting in the organizations:.........................................6

P3 interpretation of profit and loss, cash flow and balance sheet and other statements:.............7

P4 Calculation of financial ratio for better performance and investment:..................................9

P5 benefits of international accounting standards and international financial reporting

standards:...................................................................................................................................11

P6 evaluation of financial reporting and auditing model:..........................................................12

Uniformity in financial accounting standard:............................................................................13

M3 Critical evaluation of financial reporting and auditing through theories support judgement

and conclusion:..........................................................................................................................14

P7 difference and importance of financial reporting in different countries:..............................14

M4 Critical evaluation factors that influence the financial reporting in the international:........14

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

INTRODUCTION

Financial reporting refers standard accounting practice in which companies use financial

statements in order to show its financial performance. It helps investors in making investment

related decision. This present study is going to discuss effectiveness or reasons of financial

reporting as how it can help companies in analysing its performance. Further, it will discuss

financial reporting standards that companies need to follow and ways in which it protects them

against poor decision (Aifuwa and Embele, 2019). It will also discuss some international

differences in financial reporting and some common ratios that are being calculated by

companies for knowing their actual financial performance. International accounting standards as

well as financial reporting standards also plays a vital role as it support judgement to businesses.

Different countries have different financial reporting standards that companies of that country

need to follow for protecting against lawsuit and measuring performance.

MAIN BODY

P1 Analysing the financial reporting including framework and governance of regulatory

reporting:

Financial reporting means the details and information of finance in the company,

reporting is done to analyse the financial position and present the report in front of the

stakeholders of the company (Acharya and Ryan, 2016). This reporting is very important for the

company as this provide the notes and quarterly and annual reports, the stakeholders of the

company carefully look at these financial data. Financial reporting include two major elements

such as:

Regulatory framework: The Financial Reporting Council (FRC) regulate the UK based firms

and promote their transparency in business world. The regulatory frameworks include the

auditors, accounting and set of various government corporation. Many business like Deloitte

provide prepare financial reporting for their clients with the help of FRC.

Governance: for investors it is very important to trust the company according to the strength and

financial reporting statement of the company, governance here is not referred the interference of

the government but it is concern with the detailed accounting and financial progress of the

Financial reporting refers standard accounting practice in which companies use financial

statements in order to show its financial performance. It helps investors in making investment

related decision. This present study is going to discuss effectiveness or reasons of financial

reporting as how it can help companies in analysing its performance. Further, it will discuss

financial reporting standards that companies need to follow and ways in which it protects them

against poor decision (Aifuwa and Embele, 2019). It will also discuss some international

differences in financial reporting and some common ratios that are being calculated by

companies for knowing their actual financial performance. International accounting standards as

well as financial reporting standards also plays a vital role as it support judgement to businesses.

Different countries have different financial reporting standards that companies of that country

need to follow for protecting against lawsuit and measuring performance.

MAIN BODY

P1 Analysing the financial reporting including framework and governance of regulatory

reporting:

Financial reporting means the details and information of finance in the company,

reporting is done to analyse the financial position and present the report in front of the

stakeholders of the company (Acharya and Ryan, 2016). This reporting is very important for the

company as this provide the notes and quarterly and annual reports, the stakeholders of the

company carefully look at these financial data. Financial reporting include two major elements

such as:

Regulatory framework: The Financial Reporting Council (FRC) regulate the UK based firms

and promote their transparency in business world. The regulatory frameworks include the

auditors, accounting and set of various government corporation. Many business like Deloitte

provide prepare financial reporting for their clients with the help of FRC.

Governance: for investors it is very important to trust the company according to the strength and

financial reporting statement of the company, governance here is not referred the interference of

the government but it is concern with the detailed accounting and financial progress of the

company. Governance of financial reporting help business to improve the position in the

financial market and efficiency of the company. Legal regulation and standard of UK FRS 102

highlights the simplified accounting report for the business.

Benefit and drawback of IFRS:

There are certain benefits and drawback of IFRS such as:

Single purpose: IFRS is international accounting standards which a business organization can

adopt this benefit and can manager multiple accounts with one same accounting standard around

the world.

Reduce affords: the biggest and one of the most beneficial thing of using IFRS is, this help a

business organization to reduce cost, time and affords because this accounting standard follow

single set rather than multiple accounting standard which consumer more time affords and cost.

Limitation:

High cost: IFRS may be beneficial for large scale business organization but this is costly for

small scale businesses, if there is any changes in the accounting standards than these small

business have to bear such impact which will cost them high to make changes.

Manipulation: IFRS may create various benefits for the business organization but this also have

some limitation, this accounting standard can create manipulation in the surplus profit of the

company which sometime lead to fraudulent case.

Company Act 2006

Company Act 2006 of UK highlight the legal and governance guidelines to the company to trade

fairly within the country, this Act help company to modernize and simplify their business

process under such Law. Company Act is primary source of UK legislation that favour all type

of companies of UK.

M1 The purpose of financial reporting and expectations of stakeholder:

Financial reporting have only one main purpose which is to provide financial details of

the company (Aifuwa and Embele, 2019). Financial data, later this can be used to know the

financial position and performance of the company. Stakeholder of the company take this report

into consideration to:

Provide information and details to management team which later analyse and make

decision accordingly (Albu, Albu and Gray, 2020). Stakeholder and management team critically

examine the income and expenditure of the company with the help of financial reporting.

financial market and efficiency of the company. Legal regulation and standard of UK FRS 102

highlights the simplified accounting report for the business.

Benefit and drawback of IFRS:

There are certain benefits and drawback of IFRS such as:

Single purpose: IFRS is international accounting standards which a business organization can

adopt this benefit and can manager multiple accounts with one same accounting standard around

the world.

Reduce affords: the biggest and one of the most beneficial thing of using IFRS is, this help a

business organization to reduce cost, time and affords because this accounting standard follow

single set rather than multiple accounting standard which consumer more time affords and cost.

Limitation:

High cost: IFRS may be beneficial for large scale business organization but this is costly for

small scale businesses, if there is any changes in the accounting standards than these small

business have to bear such impact which will cost them high to make changes.

Manipulation: IFRS may create various benefits for the business organization but this also have

some limitation, this accounting standard can create manipulation in the surplus profit of the

company which sometime lead to fraudulent case.

Company Act 2006

Company Act 2006 of UK highlight the legal and governance guidelines to the company to trade

fairly within the country, this Act help company to modernize and simplify their business

process under such Law. Company Act is primary source of UK legislation that favour all type

of companies of UK.

M1 The purpose of financial reporting and expectations of stakeholder:

Financial reporting have only one main purpose which is to provide financial details of

the company (Aifuwa and Embele, 2019). Financial data, later this can be used to know the

financial position and performance of the company. Stakeholder of the company take this report

into consideration to:

Provide information and details to management team which later analyse and make

decision accordingly (Albu, Albu and Gray, 2020). Stakeholder and management team critically

examine the income and expenditure of the company with the help of financial reporting.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

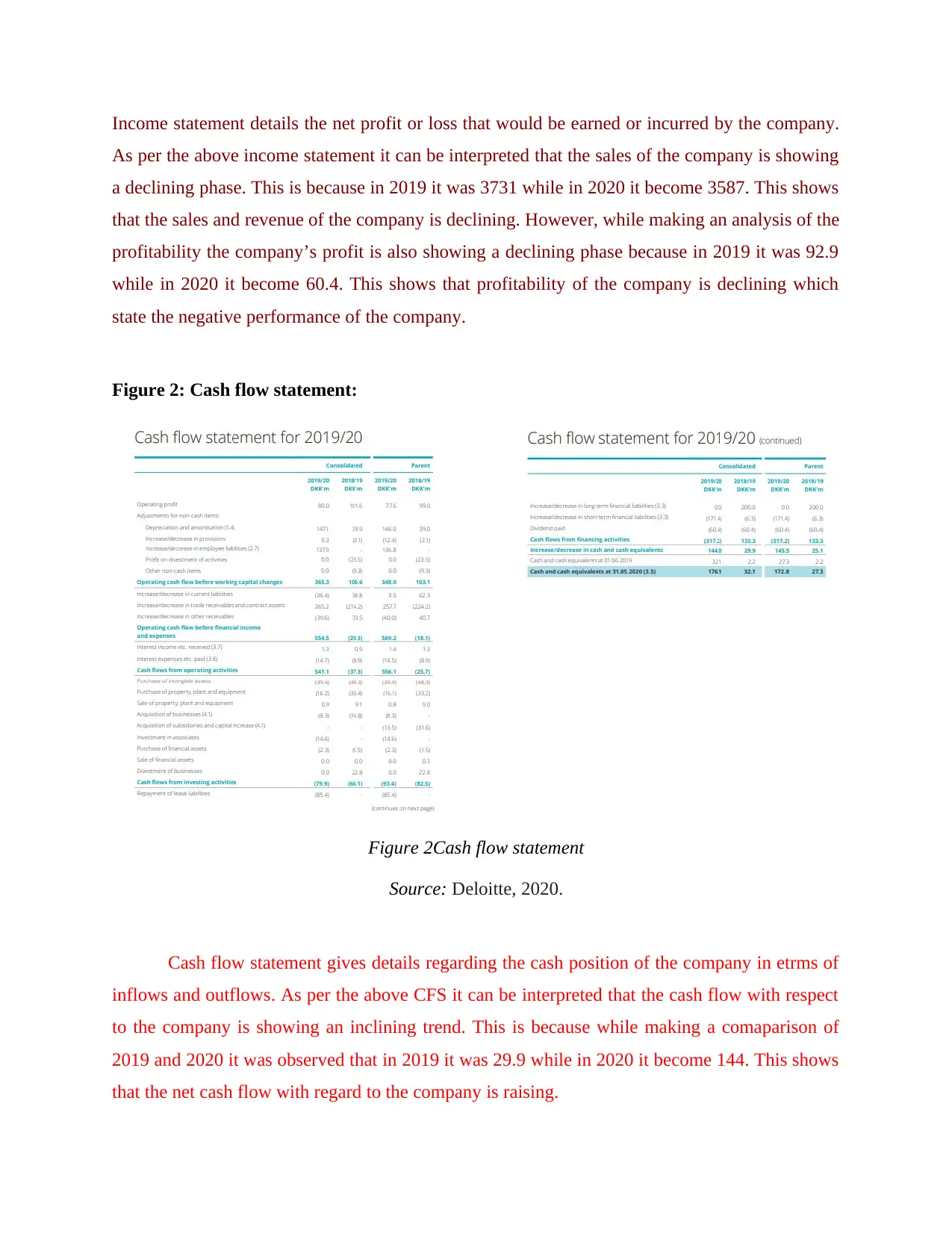

Stakeholders Expectation from financial reporting

Management The manager demand financial reporting to identify the flow of money in

the business, this reporting is very important for management to make

further expenditure and expense strategies. Financial reporting play an

important role management activities.

Bank Banks and financial institution have various expectation from the financial

reporting, this provide them the detail and information about the company’s

stability and make further loan related decision for the business

organization.

Investor The investor of company have certain expectation from the financial

reporting of the business organization such as, by looking at these they also

can make further loan related or investment related decision for the

business organization.

Suppliers Supplier of the company are very important, they provide raw material in

reasonable rate and even on credit which later company pay their bills on

time. Financial reporting build goodwill among supplier and business

organization.

Information to stakeholder such as investors, promoters and loan provider. They ask company to

provide detailed financial information for further investment in the company. There are certain

limitation of financial reporting for stakeholders of the company:

Easy to manipulate: financial reporting of the company is easy to manipulate, when a manager

assess to these financial information they have unlimited assess to the information which they

can use in fraudulent activities. The biggest limitation of these financial reporting is manager can

use some information for their illegal or fraudulent activities.

Investor: some investor try to manipulate these financial reporting, for their financial benefits.

There are some investor who can easily assess to crucial financial information of the company

and later can use it for various fraudulent activities.

D1 Critical analysis of various regulatory frameworks for stakeholder:

Stakeholders demand proper financial reporting of the company, many stakeholders like

investor critically analyse the regulatory framework of the company by understand the position

Management The manager demand financial reporting to identify the flow of money in

the business, this reporting is very important for management to make

further expenditure and expense strategies. Financial reporting play an

important role management activities.

Bank Banks and financial institution have various expectation from the financial

reporting, this provide them the detail and information about the company’s

stability and make further loan related decision for the business

organization.

Investor The investor of company have certain expectation from the financial

reporting of the business organization such as, by looking at these they also

can make further loan related or investment related decision for the

business organization.

Suppliers Supplier of the company are very important, they provide raw material in

reasonable rate and even on credit which later company pay their bills on

time. Financial reporting build goodwill among supplier and business

organization.

Information to stakeholder such as investors, promoters and loan provider. They ask company to

provide detailed financial information for further investment in the company. There are certain

limitation of financial reporting for stakeholders of the company:

Easy to manipulate: financial reporting of the company is easy to manipulate, when a manager

assess to these financial information they have unlimited assess to the information which they

can use in fraudulent activities. The biggest limitation of these financial reporting is manager can

use some information for their illegal or fraudulent activities.

Investor: some investor try to manipulate these financial reporting, for their financial benefits.

There are some investor who can easily assess to crucial financial information of the company

and later can use it for various fraudulent activities.

D1 Critical analysis of various regulatory frameworks for stakeholder:

Stakeholders demand proper financial reporting of the company, many stakeholders like

investor critically analyse the regulatory framework of the company by understand the position

and performance (Barth, 2018). They make decision of investment after understanding the

reporting which include the cash flow and balance sheet and profit and loss statement.

P2 analysing the purpose of financial reporting in the organizations:

Financial reporting have various purpose, mainly to understand the position and

performance of the company. Many organization try to maintain the report by completing all the

criteria for the management of finance, financial reporting is one of the most important thing in

the organization. The purpose behind understanding the report is to provide details and

information such as:

Management team: management team of the company try to understand the financial report

which help them to plan the up coming strategies. Every strategy of the business need financial

support for example, the business operation required the most amount of money in the working

and progress so the management team have to allot accordingly (Crawford, Morgan and Cordery,

2018). Management teams are responsible for up coming business development and growth

strategies so understanding the financial report is very important.

Stakeholders: stakeholders are the potential growth booster of the company, they invest huge

amount in smooth running of the business. Stakeholders mainly investors carefully examine the

financial report and develop investment strategies accordingly, if the company is doing well in

the report, then the investors will happily invest in the upcoming plans of the company but if the

financial report is not favourable then it impacts the growth of the business (Dichev, 2017).

Stakeholder participation is very important in the development and growth of the company, a

clear report will be very beneficial for the company.

Shareholders: financial reporting help company to attract new shareholders to invest in the

company. Shareholders analyse the reporting carefully before making any investment, many

listed companies provide detail financial report which include the up coming plan of the

company. It is very important for the company to keep all their financial report clear to attract

new investment opportunities (Mbobo and Ekpo, 2016). Business plan development strategies

according to the collection of the investment from certain shareholders and stakeholder.

Resource: a company get effected with various economic resources such as liabilities and equity

ownership, it is very important for the management to grab those resources in the growth and

development plan. Sometimes it becomes very difficult for the company to find the right

reporting which include the cash flow and balance sheet and profit and loss statement.

P2 analysing the purpose of financial reporting in the organizations:

Financial reporting have various purpose, mainly to understand the position and

performance of the company. Many organization try to maintain the report by completing all the

criteria for the management of finance, financial reporting is one of the most important thing in

the organization. The purpose behind understanding the report is to provide details and

information such as:

Management team: management team of the company try to understand the financial report

which help them to plan the up coming strategies. Every strategy of the business need financial

support for example, the business operation required the most amount of money in the working

and progress so the management team have to allot accordingly (Crawford, Morgan and Cordery,

2018). Management teams are responsible for up coming business development and growth

strategies so understanding the financial report is very important.

Stakeholders: stakeholders are the potential growth booster of the company, they invest huge

amount in smooth running of the business. Stakeholders mainly investors carefully examine the

financial report and develop investment strategies accordingly, if the company is doing well in

the report, then the investors will happily invest in the upcoming plans of the company but if the

financial report is not favourable then it impacts the growth of the business (Dichev, 2017).

Stakeholder participation is very important in the development and growth of the company, a

clear report will be very beneficial for the company.

Shareholders: financial reporting help company to attract new shareholders to invest in the

company. Shareholders analyse the reporting carefully before making any investment, many

listed companies provide detail financial report which include the up coming plan of the

company. It is very important for the company to keep all their financial report clear to attract

new investment opportunities (Mbobo and Ekpo, 2016). Business plan development strategies

according to the collection of the investment from certain shareholders and stakeholder.

Resource: a company get effected with various economic resources such as liabilities and equity

ownership, it is very important for the management to grab those resources in the growth and

development plan. Sometimes it becomes very difficult for the company to find the right

resources or the supplier denied providing the resources just because of the financial report of the

company.

Conclusion

In part 1 we have discussed financial reporting which include regulatory framework and

governance of financial reporting. Later it have provide benefits and drawbacks of IFRS and

understand the benefits and drawback. Later in part 2 it have provide the purpose of financial

reporting for the completion of business organizational goals and objectives. Later it have

provide role of stakeholders in the financial reporting and their expectation from the financial

reporting of the business organization.

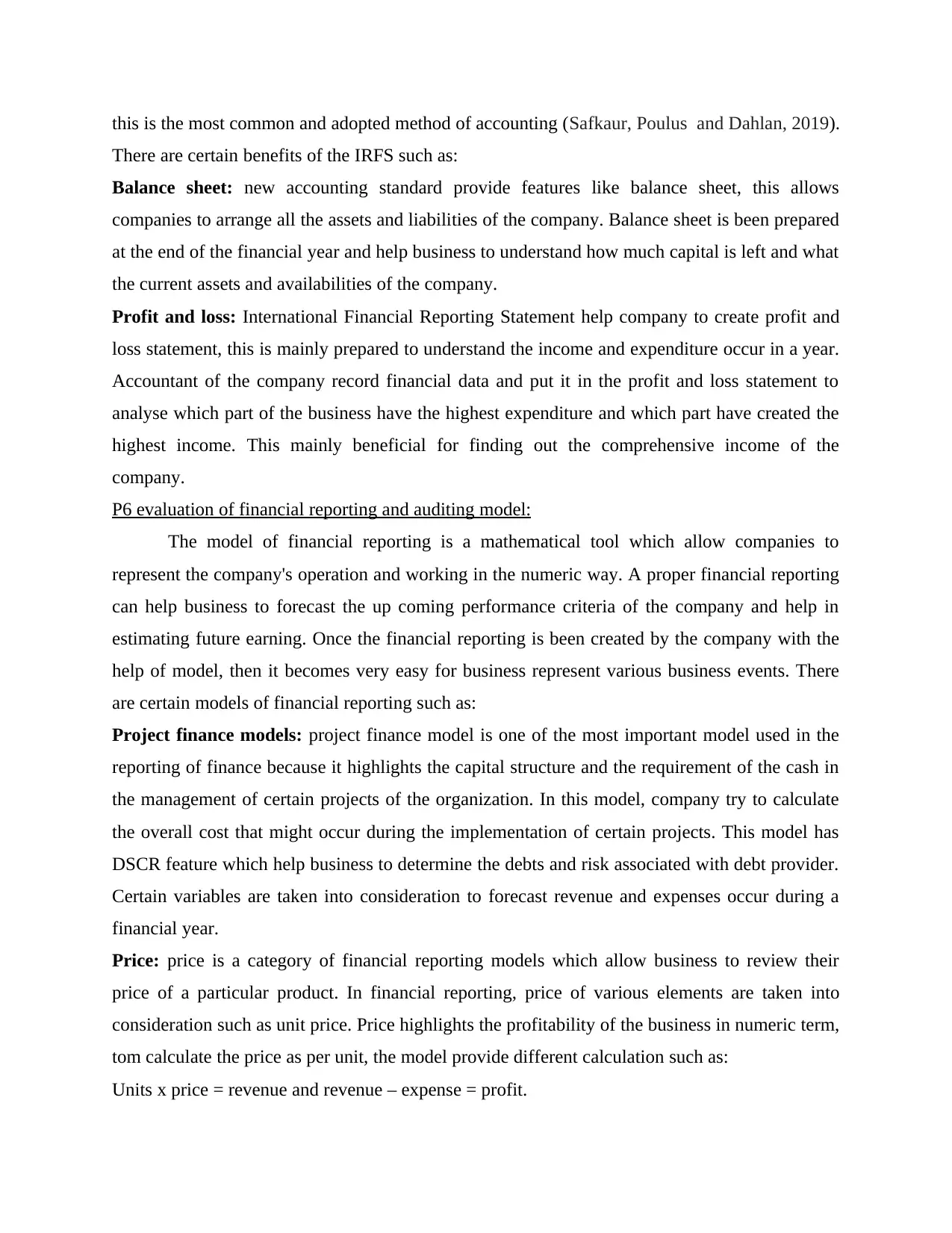

P3 interpretation of profit and loss, cash flow and balance sheet and other statements:

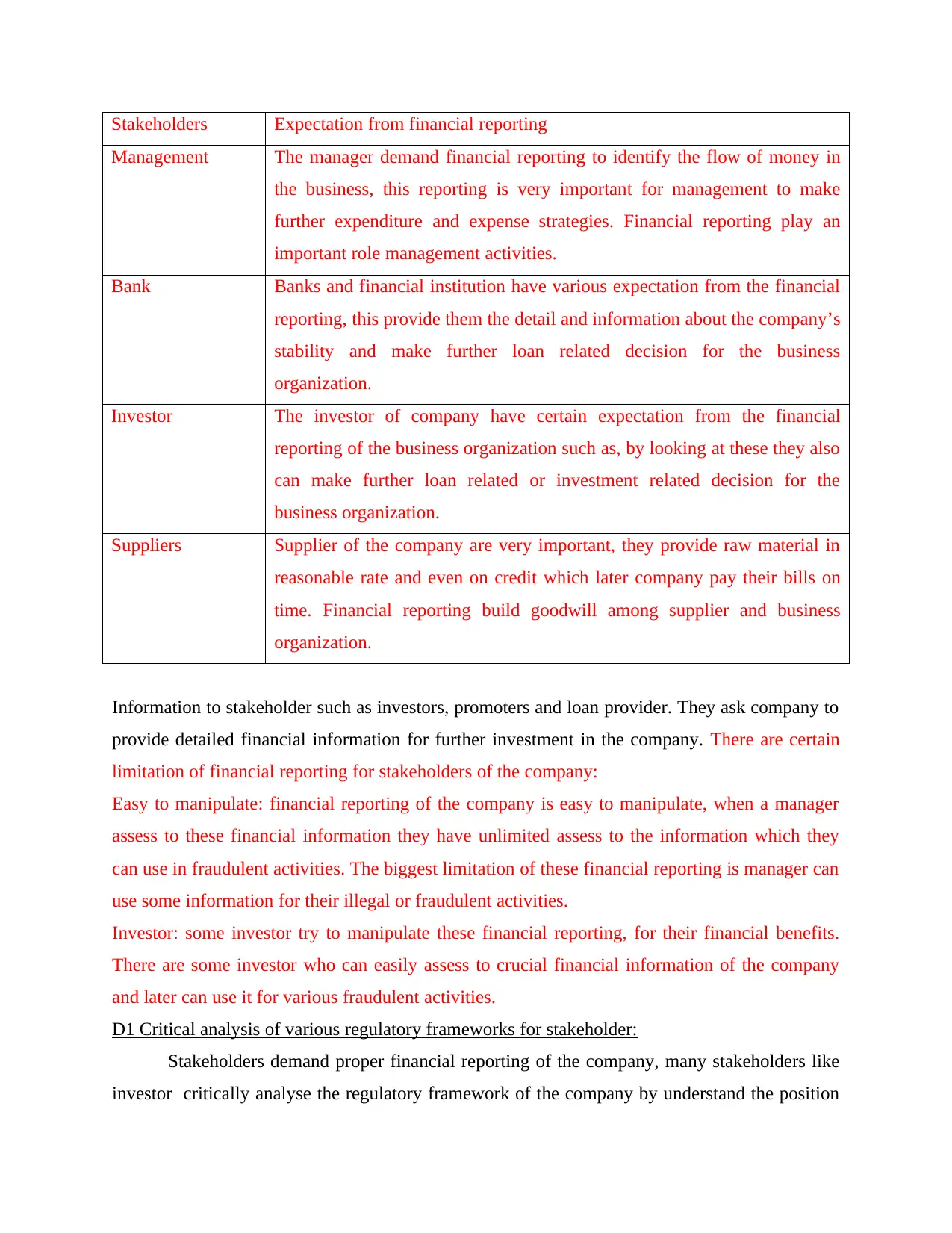

Figure 1: Profit and loss statement of Deloitte:

Figure 1P&L account

Source: Deloitte, 2020

company.

Conclusion

In part 1 we have discussed financial reporting which include regulatory framework and

governance of financial reporting. Later it have provide benefits and drawbacks of IFRS and

understand the benefits and drawback. Later in part 2 it have provide the purpose of financial

reporting for the completion of business organizational goals and objectives. Later it have

provide role of stakeholders in the financial reporting and their expectation from the financial

reporting of the business organization.

P3 interpretation of profit and loss, cash flow and balance sheet and other statements:

Figure 1: Profit and loss statement of Deloitte:

Figure 1P&L account

Source: Deloitte, 2020

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Income statement details the net profit or loss that would be earned or incurred by the company.

As per the above income statement it can be interpreted that the sales of the company is showing

a declining phase. This is because in 2019 it was 3731 while in 2020 it become 3587. This shows

that the sales and revenue of the company is declining. However, while making an analysis of the

profitability the company’s profit is also showing a declining phase because in 2019 it was 92.9

while in 2020 it become 60.4. This shows that profitability of the company is declining which

state the negative performance of the company.

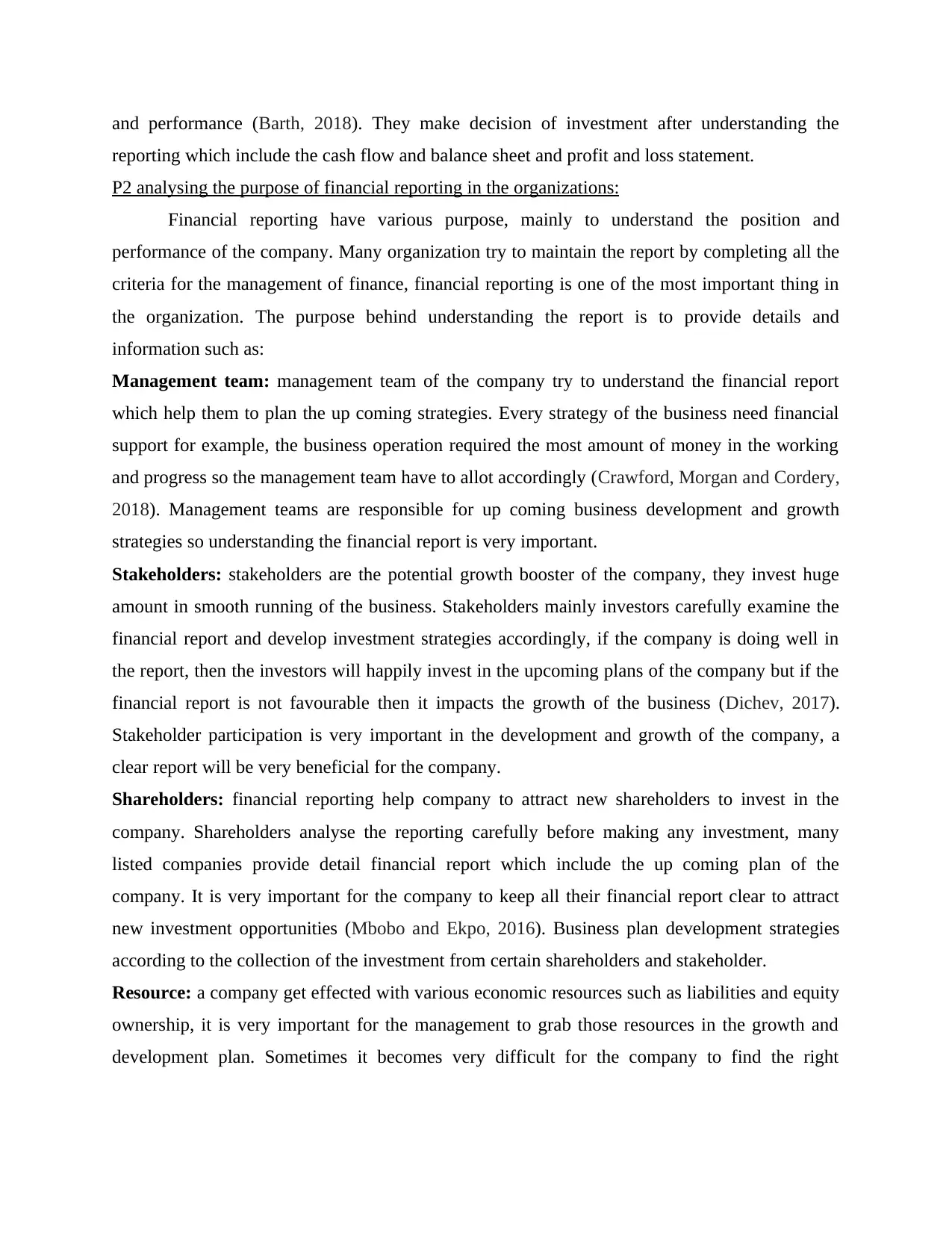

Figure 2: Cash flow statement:

Figure 2Cash flow statement

Source: Deloitte, 2020.

Cash flow statement gives details regarding the cash position of the company in etrms of

inflows and outflows. As per the above CFS it can be interpreted that the cash flow with respect

to the company is showing an inclining trend. This is because while making a comaparison of

2019 and 2020 it was observed that in 2019 it was 29.9 while in 2020 it become 144. This shows

that the net cash flow with regard to the company is raising.

As per the above income statement it can be interpreted that the sales of the company is showing

a declining phase. This is because in 2019 it was 3731 while in 2020 it become 3587. This shows

that the sales and revenue of the company is declining. However, while making an analysis of the

profitability the company’s profit is also showing a declining phase because in 2019 it was 92.9

while in 2020 it become 60.4. This shows that profitability of the company is declining which

state the negative performance of the company.

Figure 2: Cash flow statement:

Figure 2Cash flow statement

Source: Deloitte, 2020.

Cash flow statement gives details regarding the cash position of the company in etrms of

inflows and outflows. As per the above CFS it can be interpreted that the cash flow with respect

to the company is showing an inclining trend. This is because while making a comaparison of

2019 and 2020 it was observed that in 2019 it was 29.9 while in 2020 it become 144. This shows

that the net cash flow with regard to the company is raising.

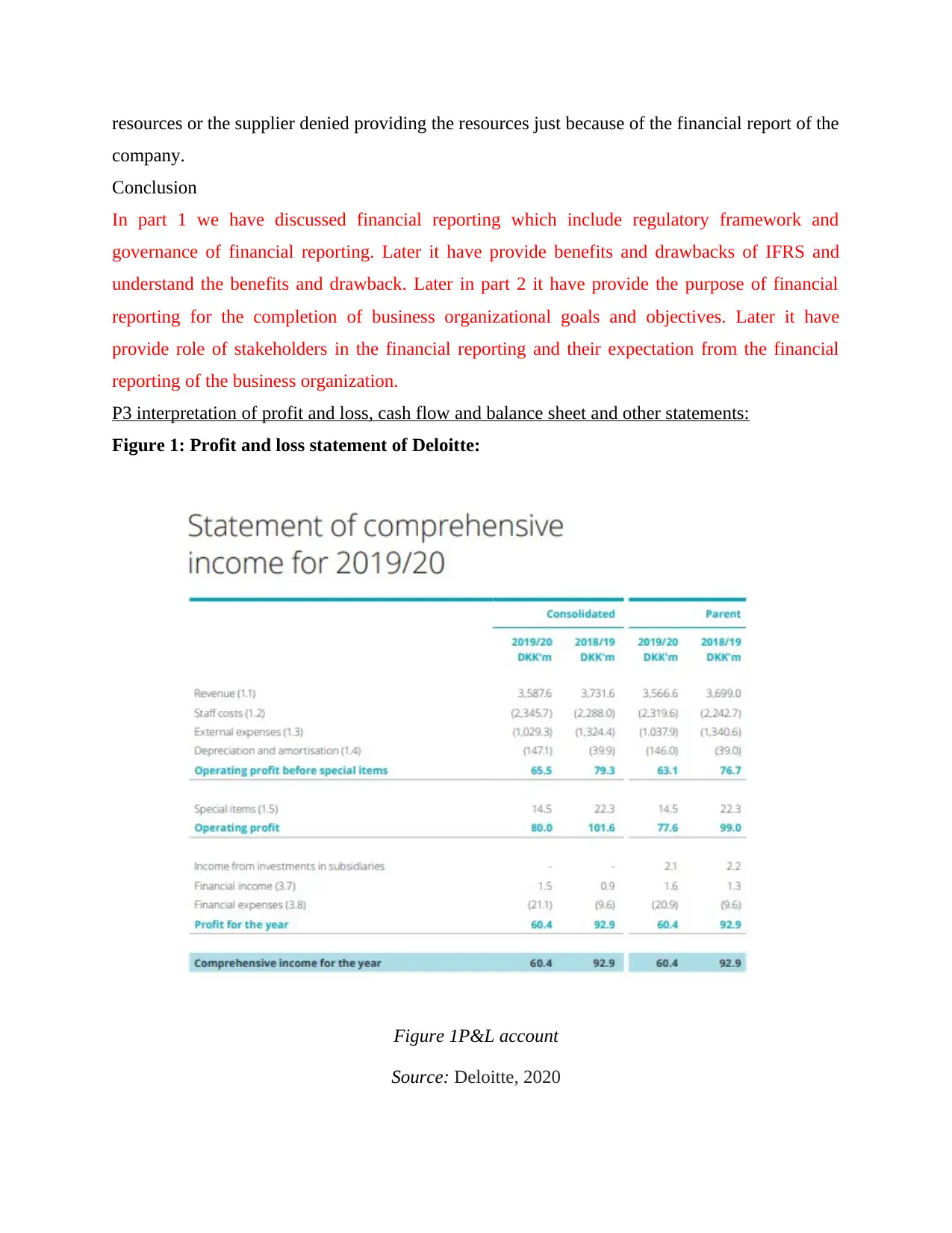

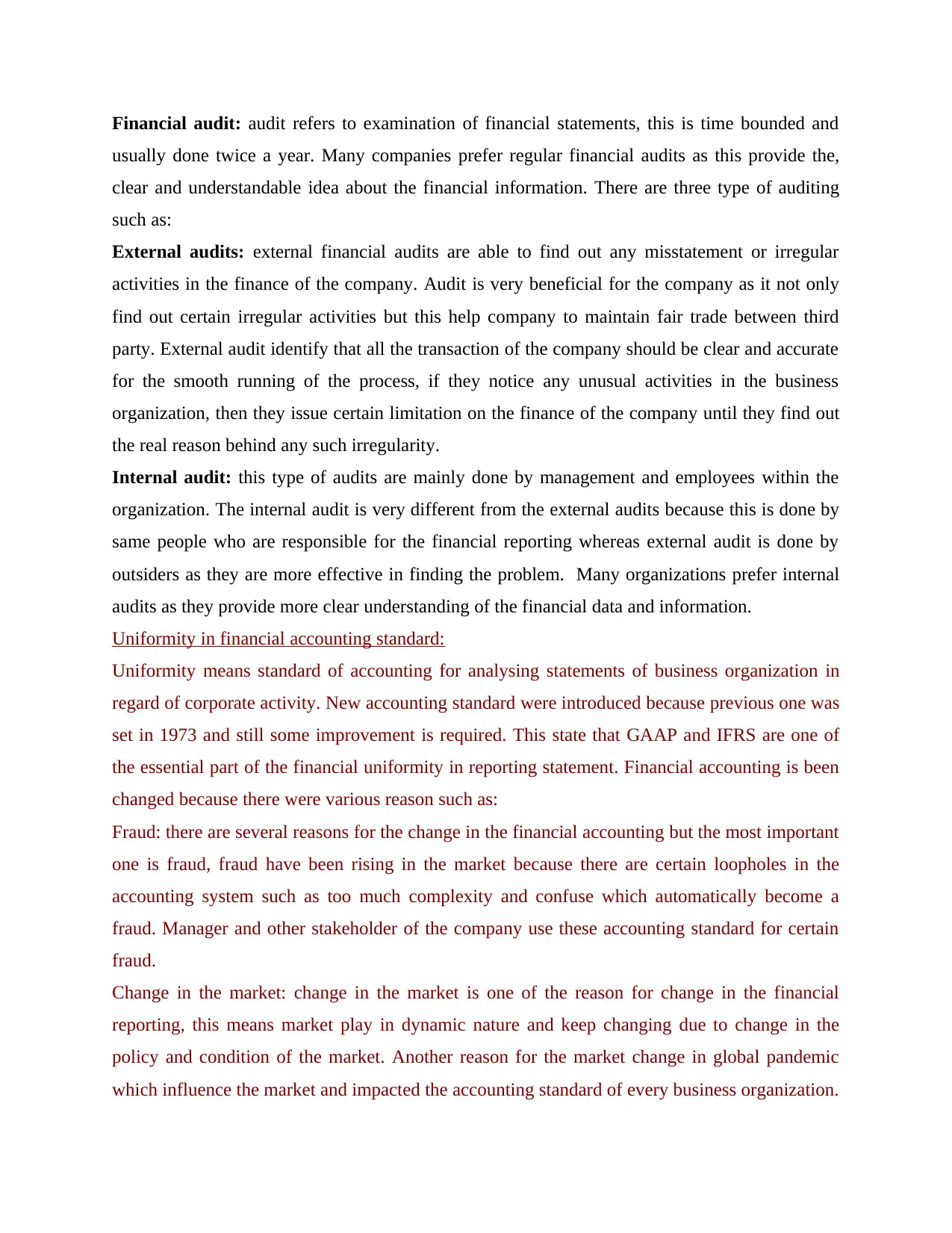

Figure 3: Balance sheet:

Figure 3Balance sheet

Source: Deloitte, 2020.

Balance sheet is one of the important financial statement of the company that gives

information about the assets and liabilities. With the above balance sheet it is observed that

accounting equation in terms of assets is equal to the sum of liabilities and equities is justified.

Figure 3Balance sheet

Source: Deloitte, 2020.

Balance sheet is one of the important financial statement of the company that gives

information about the assets and liabilities. With the above balance sheet it is observed that

accounting equation in terms of assets is equal to the sum of liabilities and equities is justified.

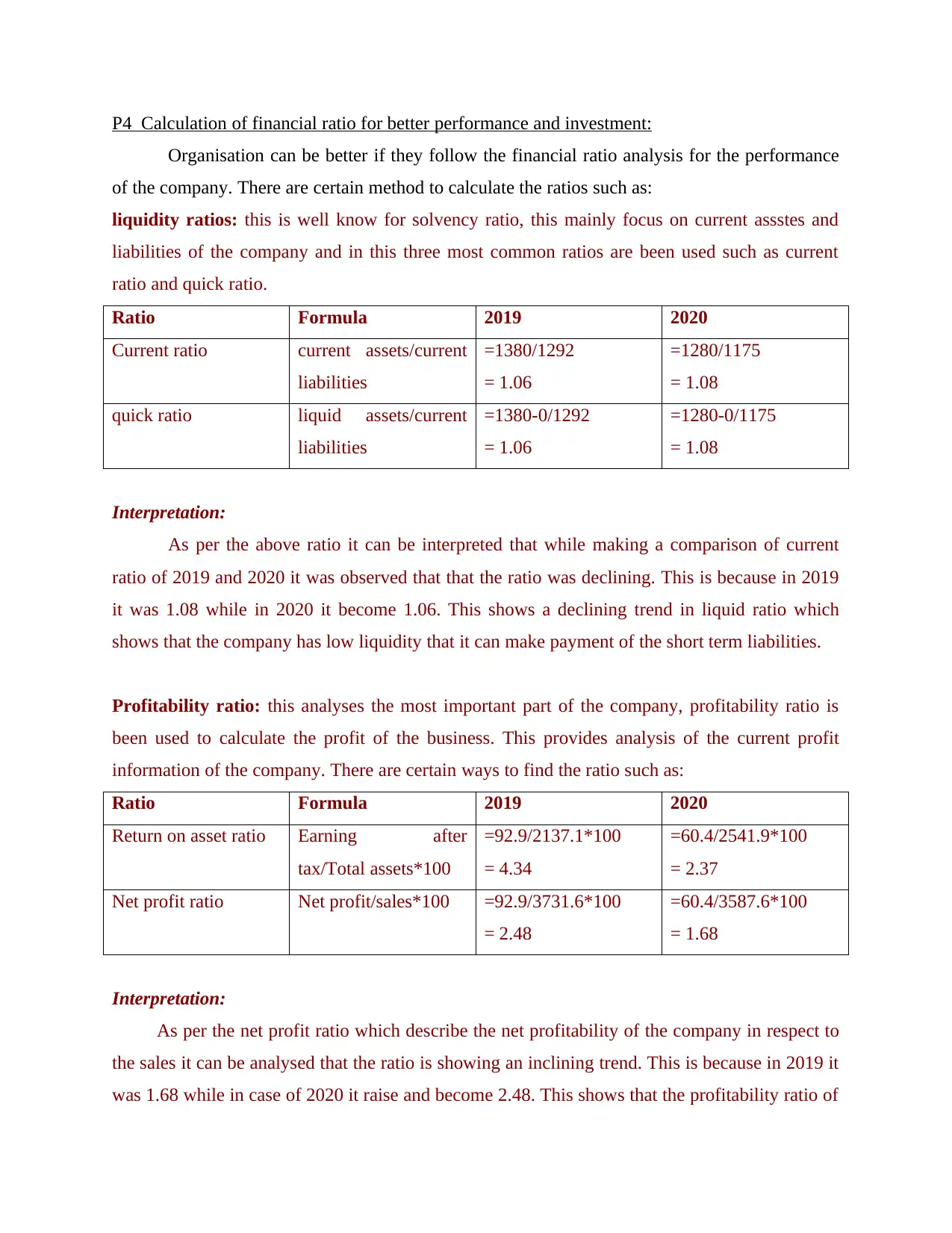

P4 Calculation of financial ratio for better performance and investment:

Organisation can be better if they follow the financial ratio analysis for the performance

of the company. There are certain method to calculate the ratios such as:

liquidity ratios: this is well know for solvency ratio, this mainly focus on current assstes and

liabilities of the company and in this three most common ratios are been used such as current

ratio and quick ratio.

Ratio Formula 2019 2020

Current ratio current assets/current

liabilities

=1380/1292

= 1.06

=1280/1175

= 1.08

quick ratio liquid assets/current

liabilities

=1380-0/1292

= 1.06

=1280-0/1175

= 1.08

Interpretation:

As per the above ratio it can be interpreted that while making a comparison of current

ratio of 2019 and 2020 it was observed that that the ratio was declining. This is because in 2019

it was 1.08 while in 2020 it become 1.06. This shows a declining trend in liquid ratio which

shows that the company has low liquidity that it can make payment of the short term liabilities.

Profitability ratio: this analyses the most important part of the company, profitability ratio is

been used to calculate the profit of the business. This provides analysis of the current profit

information of the company. There are certain ways to find the ratio such as:

Ratio Formula 2019 2020

Return on asset ratio Earning after

tax/Total assets*100

=92.9/2137.1*100

= 4.34

=60.4/2541.9*100

= 2.37

Net profit ratio Net profit/sales*100 =92.9/3731.6*100

= 2.48

=60.4/3587.6*100

= 1.68

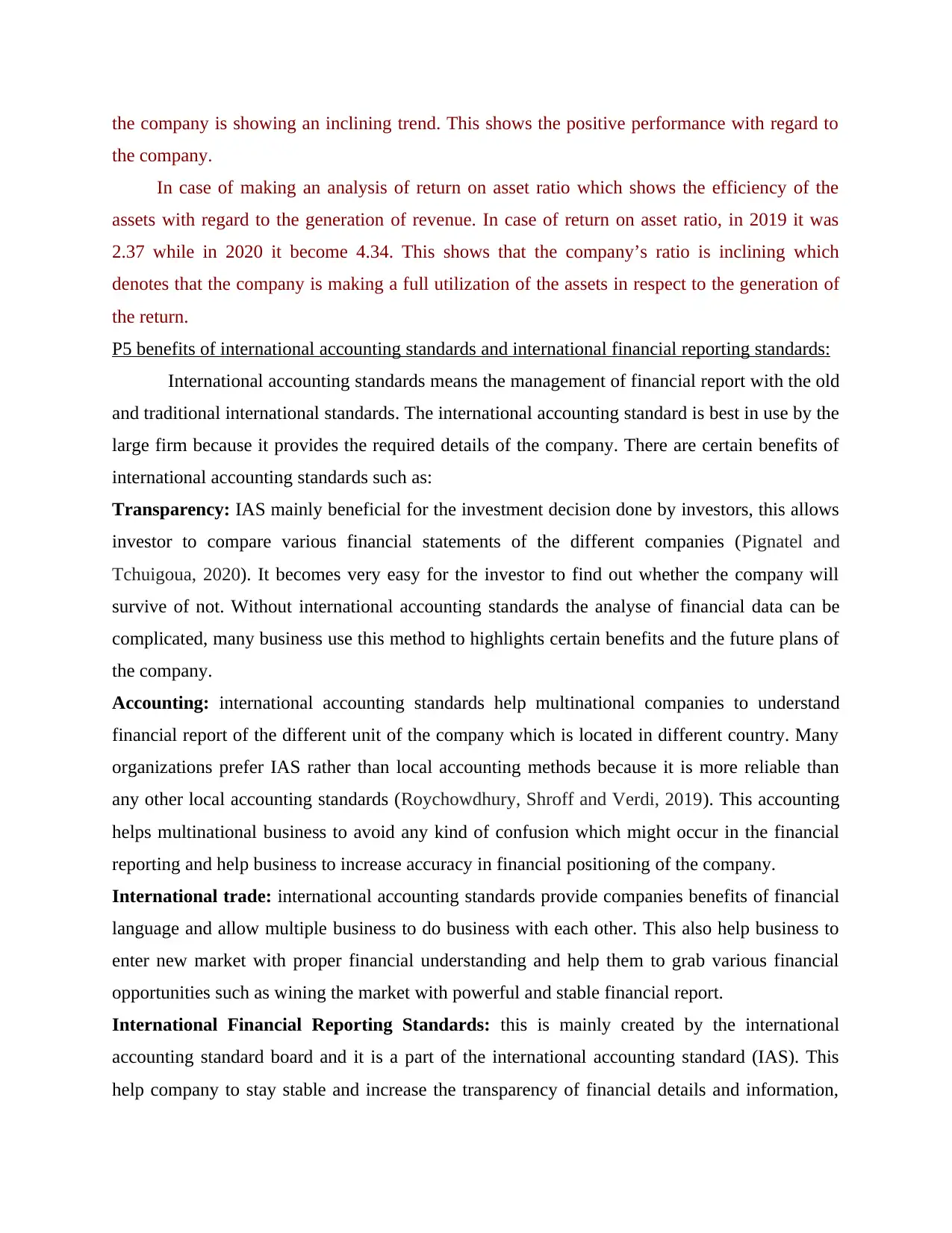

Interpretation:

As per the net profit ratio which describe the net profitability of the company in respect to

the sales it can be analysed that the ratio is showing an inclining trend. This is because in 2019 it

was 1.68 while in case of 2020 it raise and become 2.48. This shows that the profitability ratio of

Organisation can be better if they follow the financial ratio analysis for the performance

of the company. There are certain method to calculate the ratios such as:

liquidity ratios: this is well know for solvency ratio, this mainly focus on current assstes and

liabilities of the company and in this three most common ratios are been used such as current

ratio and quick ratio.

Ratio Formula 2019 2020

Current ratio current assets/current

liabilities

=1380/1292

= 1.06

=1280/1175

= 1.08

quick ratio liquid assets/current

liabilities

=1380-0/1292

= 1.06

=1280-0/1175

= 1.08

Interpretation:

As per the above ratio it can be interpreted that while making a comparison of current

ratio of 2019 and 2020 it was observed that that the ratio was declining. This is because in 2019

it was 1.08 while in 2020 it become 1.06. This shows a declining trend in liquid ratio which

shows that the company has low liquidity that it can make payment of the short term liabilities.

Profitability ratio: this analyses the most important part of the company, profitability ratio is

been used to calculate the profit of the business. This provides analysis of the current profit

information of the company. There are certain ways to find the ratio such as:

Ratio Formula 2019 2020

Return on asset ratio Earning after

tax/Total assets*100

=92.9/2137.1*100

= 4.34

=60.4/2541.9*100

= 2.37

Net profit ratio Net profit/sales*100 =92.9/3731.6*100

= 2.48

=60.4/3587.6*100

= 1.68

Interpretation:

As per the net profit ratio which describe the net profitability of the company in respect to

the sales it can be analysed that the ratio is showing an inclining trend. This is because in 2019 it

was 1.68 while in case of 2020 it raise and become 2.48. This shows that the profitability ratio of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the company is showing an inclining trend. This shows the positive performance with regard to

the company.

In case of making an analysis of return on asset ratio which shows the efficiency of the

assets with regard to the generation of revenue. In case of return on asset ratio, in 2019 it was

2.37 while in 2020 it become 4.34. This shows that the company’s ratio is inclining which

denotes that the company is making a full utilization of the assets in respect to the generation of

the return.

P5 benefits of international accounting standards and international financial reporting standards:

International accounting standards means the management of financial report with the old

and traditional international standards. The international accounting standard is best in use by the

large firm because it provides the required details of the company. There are certain benefits of

international accounting standards such as:

Transparency: IAS mainly beneficial for the investment decision done by investors, this allows

investor to compare various financial statements of the different companies (Pignatel and

Tchuigoua, 2020). It becomes very easy for the investor to find out whether the company will

survive of not. Without international accounting standards the analyse of financial data can be

complicated, many business use this method to highlights certain benefits and the future plans of

the company.

Accounting: international accounting standards help multinational companies to understand

financial report of the different unit of the company which is located in different country. Many

organizations prefer IAS rather than local accounting methods because it is more reliable than

any other local accounting standards (Roychowdhury, Shroff and Verdi, 2019). This accounting

helps multinational business to avoid any kind of confusion which might occur in the financial

reporting and help business to increase accuracy in financial positioning of the company.

International trade: international accounting standards provide companies benefits of financial

language and allow multiple business to do business with each other. This also help business to

enter new market with proper financial understanding and help them to grab various financial

opportunities such as wining the market with powerful and stable financial report.

International Financial Reporting Standards: this is mainly created by the international

accounting standard board and it is a part of the international accounting standard (IAS). This

help company to stay stable and increase the transparency of financial details and information,

the company.

In case of making an analysis of return on asset ratio which shows the efficiency of the

assets with regard to the generation of revenue. In case of return on asset ratio, in 2019 it was

2.37 while in 2020 it become 4.34. This shows that the company’s ratio is inclining which

denotes that the company is making a full utilization of the assets in respect to the generation of

the return.

P5 benefits of international accounting standards and international financial reporting standards:

International accounting standards means the management of financial report with the old

and traditional international standards. The international accounting standard is best in use by the

large firm because it provides the required details of the company. There are certain benefits of

international accounting standards such as:

Transparency: IAS mainly beneficial for the investment decision done by investors, this allows

investor to compare various financial statements of the different companies (Pignatel and

Tchuigoua, 2020). It becomes very easy for the investor to find out whether the company will

survive of not. Without international accounting standards the analyse of financial data can be

complicated, many business use this method to highlights certain benefits and the future plans of

the company.

Accounting: international accounting standards help multinational companies to understand

financial report of the different unit of the company which is located in different country. Many

organizations prefer IAS rather than local accounting methods because it is more reliable than

any other local accounting standards (Roychowdhury, Shroff and Verdi, 2019). This accounting

helps multinational business to avoid any kind of confusion which might occur in the financial

reporting and help business to increase accuracy in financial positioning of the company.

International trade: international accounting standards provide companies benefits of financial

language and allow multiple business to do business with each other. This also help business to

enter new market with proper financial understanding and help them to grab various financial

opportunities such as wining the market with powerful and stable financial report.

International Financial Reporting Standards: this is mainly created by the international

accounting standard board and it is a part of the international accounting standard (IAS). This

help company to stay stable and increase the transparency of financial details and information,

this is the most common and adopted method of accounting (Safkaur, Poulus and Dahlan, 2019).

There are certain benefits of the IRFS such as:

Balance sheet: new accounting standard provide features like balance sheet, this allows

companies to arrange all the assets and liabilities of the company. Balance sheet is been prepared

at the end of the financial year and help business to understand how much capital is left and what

the current assets and availabilities of the company.

Profit and loss: International Financial Reporting Statement help company to create profit and

loss statement, this is mainly prepared to understand the income and expenditure occur in a year.

Accountant of the company record financial data and put it in the profit and loss statement to

analyse which part of the business have the highest expenditure and which part have created the

highest income. This mainly beneficial for finding out the comprehensive income of the

company.

P6 evaluation of financial reporting and auditing model:

The model of financial reporting is a mathematical tool which allow companies to

represent the company's operation and working in the numeric way. A proper financial reporting

can help business to forecast the up coming performance criteria of the company and help in

estimating future earning. Once the financial reporting is been created by the company with the

help of model, then it becomes very easy for business represent various business events. There

are certain models of financial reporting such as:

Project finance models: project finance model is one of the most important model used in the

reporting of finance because it highlights the capital structure and the requirement of the cash in

the management of certain projects of the organization. In this model, company try to calculate

the overall cost that might occur during the implementation of certain projects. This model has

DSCR feature which help business to determine the debts and risk associated with debt provider.

Certain variables are taken into consideration to forecast revenue and expenses occur during a

financial year.

Price: price is a category of financial reporting models which allow business to review their

price of a particular product. In financial reporting, price of various elements are taken into

consideration such as unit price. Price highlights the profitability of the business in numeric term,

tom calculate the price as per unit, the model provide different calculation such as:

Units x price = revenue and revenue – expense = profit.

There are certain benefits of the IRFS such as:

Balance sheet: new accounting standard provide features like balance sheet, this allows

companies to arrange all the assets and liabilities of the company. Balance sheet is been prepared

at the end of the financial year and help business to understand how much capital is left and what

the current assets and availabilities of the company.

Profit and loss: International Financial Reporting Statement help company to create profit and

loss statement, this is mainly prepared to understand the income and expenditure occur in a year.

Accountant of the company record financial data and put it in the profit and loss statement to

analyse which part of the business have the highest expenditure and which part have created the

highest income. This mainly beneficial for finding out the comprehensive income of the

company.

P6 evaluation of financial reporting and auditing model:

The model of financial reporting is a mathematical tool which allow companies to

represent the company's operation and working in the numeric way. A proper financial reporting

can help business to forecast the up coming performance criteria of the company and help in

estimating future earning. Once the financial reporting is been created by the company with the

help of model, then it becomes very easy for business represent various business events. There

are certain models of financial reporting such as:

Project finance models: project finance model is one of the most important model used in the

reporting of finance because it highlights the capital structure and the requirement of the cash in

the management of certain projects of the organization. In this model, company try to calculate

the overall cost that might occur during the implementation of certain projects. This model has

DSCR feature which help business to determine the debts and risk associated with debt provider.

Certain variables are taken into consideration to forecast revenue and expenses occur during a

financial year.

Price: price is a category of financial reporting models which allow business to review their

price of a particular product. In financial reporting, price of various elements are taken into

consideration such as unit price. Price highlights the profitability of the business in numeric term,

tom calculate the price as per unit, the model provide different calculation such as:

Units x price = revenue and revenue – expense = profit.

Financial audit: audit refers to examination of financial statements, this is time bounded and

usually done twice a year. Many companies prefer regular financial audits as this provide the,

clear and understandable idea about the financial information. There are three type of auditing

such as:

External audits: external financial audits are able to find out any misstatement or irregular

activities in the finance of the company. Audit is very beneficial for the company as it not only

find out certain irregular activities but this help company to maintain fair trade between third

party. External audit identify that all the transaction of the company should be clear and accurate

for the smooth running of the process, if they notice any unusual activities in the business

organization, then they issue certain limitation on the finance of the company until they find out

the real reason behind any such irregularity.

Internal audit: this type of audits are mainly done by management and employees within the

organization. The internal audit is very different from the external audits because this is done by

same people who are responsible for the financial reporting whereas external audit is done by

outsiders as they are more effective in finding the problem. Many organizations prefer internal

audits as they provide more clear understanding of the financial data and information.

Uniformity in financial accounting standard:

Uniformity means standard of accounting for analysing statements of business organization in

regard of corporate activity. New accounting standard were introduced because previous one was

set in 1973 and still some improvement is required. This state that GAAP and IFRS are one of

the essential part of the financial uniformity in reporting statement. Financial accounting is been

changed because there were various reason such as:

Fraud: there are several reasons for the change in the financial accounting but the most important

one is fraud, fraud have been rising in the market because there are certain loopholes in the

accounting system such as too much complexity and confuse which automatically become a

fraud. Manager and other stakeholder of the company use these accounting standard for certain

fraud.

Change in the market: change in the market is one of the reason for change in the financial

reporting, this means market play in dynamic nature and keep changing due to change in the

policy and condition of the market. Another reason for the market change in global pandemic

which influence the market and impacted the accounting standard of every business organization.

usually done twice a year. Many companies prefer regular financial audits as this provide the,

clear and understandable idea about the financial information. There are three type of auditing

such as:

External audits: external financial audits are able to find out any misstatement or irregular

activities in the finance of the company. Audit is very beneficial for the company as it not only

find out certain irregular activities but this help company to maintain fair trade between third

party. External audit identify that all the transaction of the company should be clear and accurate

for the smooth running of the process, if they notice any unusual activities in the business

organization, then they issue certain limitation on the finance of the company until they find out

the real reason behind any such irregularity.

Internal audit: this type of audits are mainly done by management and employees within the

organization. The internal audit is very different from the external audits because this is done by

same people who are responsible for the financial reporting whereas external audit is done by

outsiders as they are more effective in finding the problem. Many organizations prefer internal

audits as they provide more clear understanding of the financial data and information.

Uniformity in financial accounting standard:

Uniformity means standard of accounting for analysing statements of business organization in

regard of corporate activity. New accounting standard were introduced because previous one was

set in 1973 and still some improvement is required. This state that GAAP and IFRS are one of

the essential part of the financial uniformity in reporting statement. Financial accounting is been

changed because there were various reason such as:

Fraud: there are several reasons for the change in the financial accounting but the most important

one is fraud, fraud have been rising in the market because there are certain loopholes in the

accounting system such as too much complexity and confuse which automatically become a

fraud. Manager and other stakeholder of the company use these accounting standard for certain

fraud.

Change in the market: change in the market is one of the reason for change in the financial

reporting, this means market play in dynamic nature and keep changing due to change in the

policy and condition of the market. Another reason for the market change in global pandemic

which influence the market and impacted the accounting standard of every business organization.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Need of uniformity: the reason why financial accounting changed because of the need of

uniformity, this means set new rules and regulation to keep the record of accounting information

of business organization. Uniformity is much needed to stop fluctuation in the financial

statements of the business organization.

M3 Critical evaluation of financial reporting and auditing through theories support judgement

and conclusion:

Financial reporting is been done by practising certain financial standards, this help

company to disclose the information of overall performance of the company in a particular

period. Certain theories that support financial reporting and auditing provide details and

information in various statements such as income statement, cash flow statement and financial

overviews (Schneider, Michelon and Maier, 2017). Certain accounting theories provide

assumption that can be applied on the reporting of finance, methodologies is also been included

in set of reporting. Theories continue to develop and evolve y following the international

accounting standard board. The many organization use modern portfolio theory to manage their

financial accounting.

P7 difference and importance of financial reporting in different countries:

Many economies of various countries are still in developing stage whereas some

countries are fully developed but the large organization of these countries depends and use

financial reporting depending on cross border transactions and effective flow of capital in the

international market (Weygandt, Kimmel and Kieso, 2018). Different countries have their own

accounting standard which is quite better as well as complicated, they tend to use certain patch of

accounting which help them solve complexity of the business. There are certain importance of

financial reporting in different countries such as:

International trade: the financial reporting of the company allow them to trade freely in the

international market, many multinational organization deals in various different countries and it

becomes very complex for them to manage the reporting, they try to follow International

Financial Reporting Standards to segregate the financial overview of all units of the company.

Sometimes same business unit use local financial accounting standards which disturb the process

as a whole. So it is very important for multinational companies to use IFRS to manage all their

units across different countries.

uniformity, this means set new rules and regulation to keep the record of accounting information

of business organization. Uniformity is much needed to stop fluctuation in the financial

statements of the business organization.

M3 Critical evaluation of financial reporting and auditing through theories support judgement

and conclusion:

Financial reporting is been done by practising certain financial standards, this help

company to disclose the information of overall performance of the company in a particular

period. Certain theories that support financial reporting and auditing provide details and

information in various statements such as income statement, cash flow statement and financial

overviews (Schneider, Michelon and Maier, 2017). Certain accounting theories provide

assumption that can be applied on the reporting of finance, methodologies is also been included

in set of reporting. Theories continue to develop and evolve y following the international

accounting standard board. The many organization use modern portfolio theory to manage their

financial accounting.

P7 difference and importance of financial reporting in different countries:

Many economies of various countries are still in developing stage whereas some

countries are fully developed but the large organization of these countries depends and use

financial reporting depending on cross border transactions and effective flow of capital in the

international market (Weygandt, Kimmel and Kieso, 2018). Different countries have their own

accounting standard which is quite better as well as complicated, they tend to use certain patch of

accounting which help them solve complexity of the business. There are certain importance of

financial reporting in different countries such as:

International trade: the financial reporting of the company allow them to trade freely in the

international market, many multinational organization deals in various different countries and it

becomes very complex for them to manage the reporting, they try to follow International

Financial Reporting Standards to segregate the financial overview of all units of the company.

Sometimes same business unit use local financial accounting standards which disturb the process

as a whole. So it is very important for multinational companies to use IFRS to manage all their

units across different countries.

M4 Critical evaluation factors that influence the financial reporting in the international:

Financial reporting is mainly done by the organization to find details of the financial

working of the company, there are certain factors that influence the financial reporting such as:

Legal system: the legal system of various countries are different from each other which can be

challenging for the multinational companies to report the financial statements. Government have

certain legal system which is adopted by many organizations to manage the finance of the

company (Weygandt, Kimmel and Kieso, 2018). This legal system of accounting provide

guideline to companies how fairly they can calculate their financial data and information.

Capital market: the international market and the capital share plays an vital role in the

accounting of the multinational companies. Capital market use various methods to calculate the

financial report and many large organization simple follow the steps of these capital market.

Financial reporting of the company can be effected with the flow of capital from international

market. Although companies have their own accounting standards, and they also follow

international financial reporting standard.

Level of inflation: the level of inflation plays an important role in the accounting of the firm,

financial report can be effected by the inflation level of the economy. If the economy of the

country have high inflation rates then it become challenging for multinational companies to

report the financial statements of the company which operate in different country.

CONCLUSION

It has been summarised from the above study that financial reporting plays a vital role as it helps

companies in knowing as how much money they have and how much they will require for

performing business functions. It shows them the actual financial situation of their company and

accordingly they develop strategies. It has further discussed reasons of following all financial

reporting standards and ways in which it helps companies in improving decision-making process.

This study has discussed some factors that need to be considered while financial reporting such

as capital market, level of inflation and others. International trade is one of the main reason of

following financial reporting standards of different countries by multinational companies and it

has discussed different frameworks and standards.

Financial reporting is mainly done by the organization to find details of the financial

working of the company, there are certain factors that influence the financial reporting such as:

Legal system: the legal system of various countries are different from each other which can be

challenging for the multinational companies to report the financial statements. Government have

certain legal system which is adopted by many organizations to manage the finance of the

company (Weygandt, Kimmel and Kieso, 2018). This legal system of accounting provide

guideline to companies how fairly they can calculate their financial data and information.

Capital market: the international market and the capital share plays an vital role in the

accounting of the multinational companies. Capital market use various methods to calculate the

financial report and many large organization simple follow the steps of these capital market.

Financial reporting of the company can be effected with the flow of capital from international

market. Although companies have their own accounting standards, and they also follow

international financial reporting standard.

Level of inflation: the level of inflation plays an important role in the accounting of the firm,

financial report can be effected by the inflation level of the economy. If the economy of the

country have high inflation rates then it become challenging for multinational companies to

report the financial statements of the company which operate in different country.

CONCLUSION

It has been summarised from the above study that financial reporting plays a vital role as it helps

companies in knowing as how much money they have and how much they will require for

performing business functions. It shows them the actual financial situation of their company and

accordingly they develop strategies. It has further discussed reasons of following all financial

reporting standards and ways in which it helps companies in improving decision-making process.

This study has discussed some factors that need to be considered while financial reporting such

as capital market, level of inflation and others. International trade is one of the main reason of

following financial reporting standards of different countries by multinational companies and it

has discussed different frameworks and standards.

REFERENCES

Books and journals

Acharya, V.V. and Ryan, S.G., 2016. Banks’ financial reporting and financial system

stability. Journal of Accounting Research. 54(2). pp.277-340.

Aifuwa, H.O. and Embele, K., 2019. Board Characteristics and Financial Reporting. Journal of

Accounting and Financial Management. 5(1). pp.30-44.

Albu, N., Albu, C.N. and Gray, S.J., 2020, July. Institutional factors and the impact of

international financial reporting standards: the Central and Eastern European

experience. In Accounting Forum (Vol. 44, No. 3, pp. 184-214). Routledge.

Barth, M.E., 2018. The future of financial reporting: Insights from research. Abacus, 54(1),

pp.66-78.

Crawford, L., Morgan, G.G. and Cordery, C.J., 2018. Accountability and not‐for‐profit

organisations: Implications for developing international financial reporting

standards. Financial Accountability & Management. 34(2). pp.181-205.

Dichev, I.D., 2017. On the conceptual foundations of financial reporting. Accounting and

Business Research. 47(6). pp.617-632.

Flower, J. and Ebbers, G., 2018. Global financial reporting. Macmillan International Higher

Education.

Mbobo, M.E. and Ekpo, N.B., 2016. Operationalising the qualitative characteristics of financial

reporting. International Journal of Finance and Accounting. 5(4). pp.184-192.

Pignatel, I. and Tchuigoua, H.T., 2020. Microfinance institutions and International Financial

Reporting Standards: an exploratory analysis. Research in International Business and

Finance. 54. p.101309.

Roychowdhury, S., Shroff, N. and Verdi, R.S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and

Economics. 68(2-3). p.101246.

Safkaur, O., Afiah, N.N., Poulus, S. and Dahlan, M., 2019. The effect of quality financial

reporting on good governance. International Journal of Economics and Financial

Issues. 9(3). p.277.

Schneider, T., Michelon, G. and Maier, M., 2017. Environmental liabilities and diversity in

practice under international financial reporting standards. Accounting, Auditing &

Accountability Journal.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2018. Financial Accounting with International

Financial Reporting Standards. John Wiley & Sons.

Online reference

Deloitte., 2020. [Online]. Available through

<https://www2.deloitte.com/content/dam/Deloitte/dk/Documents/about-deloitte/

Downloads/deloitte-annual-report-19-20.pdf>

1

Books and journals

Acharya, V.V. and Ryan, S.G., 2016. Banks’ financial reporting and financial system

stability. Journal of Accounting Research. 54(2). pp.277-340.

Aifuwa, H.O. and Embele, K., 2019. Board Characteristics and Financial Reporting. Journal of

Accounting and Financial Management. 5(1). pp.30-44.

Albu, N., Albu, C.N. and Gray, S.J., 2020, July. Institutional factors and the impact of

international financial reporting standards: the Central and Eastern European

experience. In Accounting Forum (Vol. 44, No. 3, pp. 184-214). Routledge.

Barth, M.E., 2018. The future of financial reporting: Insights from research. Abacus, 54(1),

pp.66-78.

Crawford, L., Morgan, G.G. and Cordery, C.J., 2018. Accountability and not‐for‐profit

organisations: Implications for developing international financial reporting

standards. Financial Accountability & Management. 34(2). pp.181-205.

Dichev, I.D., 2017. On the conceptual foundations of financial reporting. Accounting and

Business Research. 47(6). pp.617-632.

Flower, J. and Ebbers, G., 2018. Global financial reporting. Macmillan International Higher

Education.

Mbobo, M.E. and Ekpo, N.B., 2016. Operationalising the qualitative characteristics of financial

reporting. International Journal of Finance and Accounting. 5(4). pp.184-192.

Pignatel, I. and Tchuigoua, H.T., 2020. Microfinance institutions and International Financial

Reporting Standards: an exploratory analysis. Research in International Business and

Finance. 54. p.101309.

Roychowdhury, S., Shroff, N. and Verdi, R.S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and

Economics. 68(2-3). p.101246.

Safkaur, O., Afiah, N.N., Poulus, S. and Dahlan, M., 2019. The effect of quality financial

reporting on good governance. International Journal of Economics and Financial

Issues. 9(3). p.277.

Schneider, T., Michelon, G. and Maier, M., 2017. Environmental liabilities and diversity in

practice under international financial reporting standards. Accounting, Auditing &

Accountability Journal.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2018. Financial Accounting with International

Financial Reporting Standards. John Wiley & Sons.

Online reference

Deloitte., 2020. [Online]. Available through

<https://www2.deloitte.com/content/dam/Deloitte/dk/Documents/about-deloitte/

Downloads/deloitte-annual-report-19-20.pdf>

1

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.