Financial Reporting: Regulatory Framework and Company Analysis

VerifiedAdded on 2020/12/18

|18

|4797

|439

Report

AI Summary

This report provides a comprehensive analysis of financial reporting, encompassing regulatory frameworks, the purpose of financial reporting, and the benefits of International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS). It delves into the interpretation of profit and loss statements, balance sheets, and cash flow statements, alongside the application of financial ratios for assessing organizational performance and investment potential. The report also examines the differences in financial reporting practices across countries, using the Lloyd Banking Group Ltd as a case study to illustrate key concepts and provide practical examples. The analysis includes an interpretation of the company's financial statements, highlighting key performance indicators and financial positions. The report concludes with a discussion on the significance of financial reporting in organizational development, objectives, and growth.

FINANCIAL

REPORTING

REPORTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Regulatory frameworks and governance of financial accounting..........................................3

P2 The purpose of the financial reporting for meeting the organisational development,

objectives and growth..................................................................................................................4

TASK 2............................................................................................................................................6

P3 Interpretation of profit & loss, balance sheet and cash flows.................................................6

P4 Financial ratios for organisational performance and investment...........................................7

TASK 3............................................................................................................................................8

P5 Benefits of international financial reporting standards (IFRS) and international accounting

standard (IAS)..............................................................................................................................8

P6 Models of financial reporting and auditing............................................................................9

TASK 4..........................................................................................................................................11

P7 Differences and importance of the financial reporting across the countries........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

APPENDIX....................................................................................................................................16

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Regulatory frameworks and governance of financial accounting..........................................3

P2 The purpose of the financial reporting for meeting the organisational development,

objectives and growth..................................................................................................................4

TASK 2............................................................................................................................................6

P3 Interpretation of profit & loss, balance sheet and cash flows.................................................6

P4 Financial ratios for organisational performance and investment...........................................7

TASK 3............................................................................................................................................8

P5 Benefits of international financial reporting standards (IFRS) and international accounting

standard (IAS)..............................................................................................................................8

P6 Models of financial reporting and auditing............................................................................9

TASK 4..........................................................................................................................................11

P7 Differences and importance of the financial reporting across the countries........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

APPENDIX....................................................................................................................................16

INTRODUCTION

Financial reporting is the presentation of financial result of the organisations in a

particular format (Jung and Weber, 2014). Eventually, financial reporting states about the

financial performance of the companies for a particular time period as well as it is necessary to

the companies to prepare the financial reports not only for the own purpose but also for external

parties. Herein, the project report, the objectives and regulatory frameworks of the financial

reporting are mentioned. As well as benefits of IFRS (international financial reporting standards)

and IAS (international accounting standards) are described in the report. In this report Lloyd

banking group Ltd company is selected to understand in detail about the financial reporting and

company's financial statements are also described.

TASK 1.

P1 Regulatory frameworks and governance of financial accounting.

Financial reporting: It is a combination or discloser of financial results which include

the various information which help the internal as well as external stakeholders to take their

decision on the basis of these financial reports (Ryan, 2012). It plays very crucial role in the

world's economy and it's main purpose is to provide relevant information to their users such as

owners. Division between the ownership or control over the company and it occurs in the public

limited company. Where shares are sold to the general public through share market. At the time

of preparing reports, shareholders are not interfere in the management decision that's why they

appoint directors. Important decision taken by the directors to the interest of shareholders. Owner

of the company get the final report which include the summary and financial reports which

shows the financial position of the company. It further helps in taking decision regarding further

investment and strategies.

Regulatory framework: It is a set of accounting practices which include the various

standards and it also contain some rules and principle to handle companies accounts. Purpose of

this framework is to prepare financial statements and it is important to fulfil the requirement.

Lloyd banking limited company follow the International Financial Reporting Standards (IFRS)

to produce their financial statement.

International Financial Reporting Standards (IFRS): It is a set of accounting

standards which is develop by the non- profit organisation and it also called International

Financial reporting is the presentation of financial result of the organisations in a

particular format (Jung and Weber, 2014). Eventually, financial reporting states about the

financial performance of the companies for a particular time period as well as it is necessary to

the companies to prepare the financial reports not only for the own purpose but also for external

parties. Herein, the project report, the objectives and regulatory frameworks of the financial

reporting are mentioned. As well as benefits of IFRS (international financial reporting standards)

and IAS (international accounting standards) are described in the report. In this report Lloyd

banking group Ltd company is selected to understand in detail about the financial reporting and

company's financial statements are also described.

TASK 1.

P1 Regulatory frameworks and governance of financial accounting.

Financial reporting: It is a combination or discloser of financial results which include

the various information which help the internal as well as external stakeholders to take their

decision on the basis of these financial reports (Ryan, 2012). It plays very crucial role in the

world's economy and it's main purpose is to provide relevant information to their users such as

owners. Division between the ownership or control over the company and it occurs in the public

limited company. Where shares are sold to the general public through share market. At the time

of preparing reports, shareholders are not interfere in the management decision that's why they

appoint directors. Important decision taken by the directors to the interest of shareholders. Owner

of the company get the final report which include the summary and financial reports which

shows the financial position of the company. It further helps in taking decision regarding further

investment and strategies.

Regulatory framework: It is a set of accounting practices which include the various

standards and it also contain some rules and principle to handle companies accounts. Purpose of

this framework is to prepare financial statements and it is important to fulfil the requirement.

Lloyd banking limited company follow the International Financial Reporting Standards (IFRS)

to produce their financial statement.

International Financial Reporting Standards (IFRS): It is a set of accounting

standards which is develop by the non- profit organisation and it also called International

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting Standards Board (IASB). Lloyd banking limited company follow IFRS regulatory

framework to identify how public or private organisation disclose their financial reports. This

framework provide the general guidelines which is required by the business at the time of

preparing their financial statements. Their are various standards followed by the Lloyd banking

limited company but some of it discussed below:

IFRS-2 (Share based payment): Organisation need to specify this standard if they

undertake a share based payment which include the issue of share options (Martínez‐Ferrero,

Garcia‐Sanchez, Cuadrado‐Ballesteros, 2015). Lloyd banking limited company required to

include these things in the financial statements.

IFRS-3 (Business Combination): It include 3 principles which define that how business

combination acquire. Firstly recognise their financial statements in terms of assets or liability of

the company and how much they acquire interest from other parties. Secondly acquire the

goodwill at the time of combining business. Last one is to determine that, what information

required to be disclose for their users.

IFRS-4 (Insurance Contract): In this accounting standard, organisation need to specify

some aspects for the financial reporting regarding insurance contract. It will be issued when this

contract not applied in the IFRS-17. Insurance contract means, when one party accept the

insurance risk from another party and it also important that front party agree to be compensate

for this.

IFRS-7 (Discloser of Financial Instruments): This accounting standard include the

discloser of financial instrument in the financial statement. So internal as well as external users

can evaluate the performances and financial position of the company (Albu and Albu, 2012). It

also include the information regarding risk which occur through financial statements. These are

the quantitative discloser but it also include the qualitative discloser too. Such as management

objective, aim of the organisation, different policies and process to reduce risk.

P2 The purpose of the financial reporting for meeting the organisational development, objectives

and growth.

Financial reports shows the actual image of the companies with the help of different

financial statements like balance sheet, profit & loss etc. In broad sense, the financial reports are

beneficial for the development and growth of the companies. Herein, the aspect of the project

report the Lloyd banking limited company prepares different kind of financial reports like

framework to identify how public or private organisation disclose their financial reports. This

framework provide the general guidelines which is required by the business at the time of

preparing their financial statements. Their are various standards followed by the Lloyd banking

limited company but some of it discussed below:

IFRS-2 (Share based payment): Organisation need to specify this standard if they

undertake a share based payment which include the issue of share options (Martínez‐Ferrero,

Garcia‐Sanchez, Cuadrado‐Ballesteros, 2015). Lloyd banking limited company required to

include these things in the financial statements.

IFRS-3 (Business Combination): It include 3 principles which define that how business

combination acquire. Firstly recognise their financial statements in terms of assets or liability of

the company and how much they acquire interest from other parties. Secondly acquire the

goodwill at the time of combining business. Last one is to determine that, what information

required to be disclose for their users.

IFRS-4 (Insurance Contract): In this accounting standard, organisation need to specify

some aspects for the financial reporting regarding insurance contract. It will be issued when this

contract not applied in the IFRS-17. Insurance contract means, when one party accept the

insurance risk from another party and it also important that front party agree to be compensate

for this.

IFRS-7 (Discloser of Financial Instruments): This accounting standard include the

discloser of financial instrument in the financial statement. So internal as well as external users

can evaluate the performances and financial position of the company (Albu and Albu, 2012). It

also include the information regarding risk which occur through financial statements. These are

the quantitative discloser but it also include the qualitative discloser too. Such as management

objective, aim of the organisation, different policies and process to reduce risk.

P2 The purpose of the financial reporting for meeting the organisational development, objectives

and growth.

Financial reports shows the actual image of the companies with the help of different

financial statements like balance sheet, profit & loss etc. In broad sense, the financial reports are

beneficial for the development and growth of the companies. Herein, the aspect of the project

report the Lloyd banking limited company prepares different kind of financial reports like

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

balance sheet, income statements etc. The benefits of the financial reporting are mentioned

below:

Helps in decision-making- The financial reporting is important for the companies in

making appropriate decision (Maffett, 2012). This is why because with the use of the

financial statements, businesses can check about their performance and on the basis of it

important decisions can be taken. As well as, the financial statements provides detailed

information about the profitability, loss, assets and liabilities. Herein, the Lloyd banking

limited company makes their financial reports and on the basis of it they make their

major decisions.

Beneficial in getting the credit- Mostly financials institutions and banks provide the

loans on the basis of financial reports of the companies. In other words, the credit limit of

the companies depend on their financial performance and it is presented by the financial

statements. If a company's financial condition is good from last few years then it would

be easy for the company to get the loan instantly of huge amount. Majorly, banks

evaluate the income statement, balance sheets to provide the loan. Herein, it is important

that financial statements should be prepare as per the particular accounting standards.

Like the Lloyd banking limited company offers loan to the different small companies on

the basis of their financial reports. As well as this company also gets the loan from the

central bank of UK, on the basis of their financial reports.

Provide financial information to external parties- Financial reporting is useful in

providing the financial informations to the external parties like shareholders, stakeholders

etc. Eventually, it is beneficial for the company because if company's financial condition

is good then more investor will invest in the company and it will increase company's

capital. As well as goodwill will also increase. So it is a big advantage of the financial

reporting. Herein, it is important that company should publish their financial reports

accurately without any manipulation in the financial statements. The Lloyd banking

limited company presents their financial information in front of the stakeholders so that

they can invest in their company.

Determine company's future- Different types of financial statements are useful in

predicting the company's future (Beaver, Correia and McNichols, 2012). This is why

because if company's financial performance is improving in each financial year and then

below:

Helps in decision-making- The financial reporting is important for the companies in

making appropriate decision (Maffett, 2012). This is why because with the use of the

financial statements, businesses can check about their performance and on the basis of it

important decisions can be taken. As well as, the financial statements provides detailed

information about the profitability, loss, assets and liabilities. Herein, the Lloyd banking

limited company makes their financial reports and on the basis of it they make their

major decisions.

Beneficial in getting the credit- Mostly financials institutions and banks provide the

loans on the basis of financial reports of the companies. In other words, the credit limit of

the companies depend on their financial performance and it is presented by the financial

statements. If a company's financial condition is good from last few years then it would

be easy for the company to get the loan instantly of huge amount. Majorly, banks

evaluate the income statement, balance sheets to provide the loan. Herein, it is important

that financial statements should be prepare as per the particular accounting standards.

Like the Lloyd banking limited company offers loan to the different small companies on

the basis of their financial reports. As well as this company also gets the loan from the

central bank of UK, on the basis of their financial reports.

Provide financial information to external parties- Financial reporting is useful in

providing the financial informations to the external parties like shareholders, stakeholders

etc. Eventually, it is beneficial for the company because if company's financial condition

is good then more investor will invest in the company and it will increase company's

capital. As well as goodwill will also increase. So it is a big advantage of the financial

reporting. Herein, it is important that company should publish their financial reports

accurately without any manipulation in the financial statements. The Lloyd banking

limited company presents their financial information in front of the stakeholders so that

they can invest in their company.

Determine company's future- Different types of financial statements are useful in

predicting the company's future (Beaver, Correia and McNichols, 2012). This is why

because if company's financial performance is improving in each financial year and then

it can be predict that company will be better side in future. Apart from it, if company's

financial performance is decreasing continuously then it can be predict that company will

not exist in future. So financial performance is the key of success and it is presented with

the help of financial reports. Like in the Lloyd banking limited company, they make a

wide range of financial statements which help them in evaluating their future situation.

Helps in better management- The financial reporting is also beneficial in effective

management of the companies. This is possible with the help of the financial statements

and reports. If company's financial position is weak then they can plan to make efficient

use of resources and it overall result in the better management. With the help of financial

reports, company can check that which activities are high profitable and which ones are

not. The Lloyd banking limited company manage their activities on the basis of their

financial reports..

So on the basis of above benefits of the financial reporting, it can be analysed that

financials statements are useful in the development and growth of the organisations.

TASK 2.

P3 Interpretation of profit & loss, balance sheet and cash flows.

1. Profit & loss account- Mentioned in the appendix.

Interpretation- The profit and loss account defines about the profits and losses of

companies. On the basis of profit and loss account of year 2018, company is generating the profit

of £24834. This profit is less in compare to last year. Their total interest income is of £14671 and

they do not have any interest expenses in 2018. As well as their other assets are of £14671. So

company is earning good revenue but less in compare to 2017.

2.Balance sheet- Mentioned in appendix.

Interpretation- Balance sheet states about the assets and liabilities for a particular time

period. The balance sheet of Lloyd banking limited company showing the assets of £797,598 for

year 2018 and their total liabilities are of £797,324 (About financial statement of company,

2018). Herein, company's assets are more then the liabilities. Though, difference is not of too

much amount. They have additional assets of £274 in their balance sheet. As well as it shows

that company has enough assets to pay their liabilities.

financial performance is decreasing continuously then it can be predict that company will

not exist in future. So financial performance is the key of success and it is presented with

the help of financial reports. Like in the Lloyd banking limited company, they make a

wide range of financial statements which help them in evaluating their future situation.

Helps in better management- The financial reporting is also beneficial in effective

management of the companies. This is possible with the help of the financial statements

and reports. If company's financial position is weak then they can plan to make efficient

use of resources and it overall result in the better management. With the help of financial

reports, company can check that which activities are high profitable and which ones are

not. The Lloyd banking limited company manage their activities on the basis of their

financial reports..

So on the basis of above benefits of the financial reporting, it can be analysed that

financials statements are useful in the development and growth of the organisations.

TASK 2.

P3 Interpretation of profit & loss, balance sheet and cash flows.

1. Profit & loss account- Mentioned in the appendix.

Interpretation- The profit and loss account defines about the profits and losses of

companies. On the basis of profit and loss account of year 2018, company is generating the profit

of £24834. This profit is less in compare to last year. Their total interest income is of £14671 and

they do not have any interest expenses in 2018. As well as their other assets are of £14671. So

company is earning good revenue but less in compare to 2017.

2.Balance sheet- Mentioned in appendix.

Interpretation- Balance sheet states about the assets and liabilities for a particular time

period. The balance sheet of Lloyd banking limited company showing the assets of £797,598 for

year 2018 and their total liabilities are of £797,324 (About financial statement of company,

2018). Herein, company's assets are more then the liabilities. Though, difference is not of too

much amount. They have additional assets of £274 in their balance sheet. As well as it shows

that company has enough assets to pay their liabilities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. Cash flow- Mentioned in appendix.

Interpretation- Cash-flows of company presents about that movement of cash in the

organisation. Herein, the cash-flows of Lloyd banking limited showing that company has the

cash out flow of £(11107) from the operating activities. As well as their cash inflow from

investing activities is of £11921. Apart from it, their cash out flow from the financing activities is

of £(4301). So company has more cash out flows which means company is spending more cash

in compare to earning. Their cash at beginning is of £58708 and cash at end of period is of

£55,224.

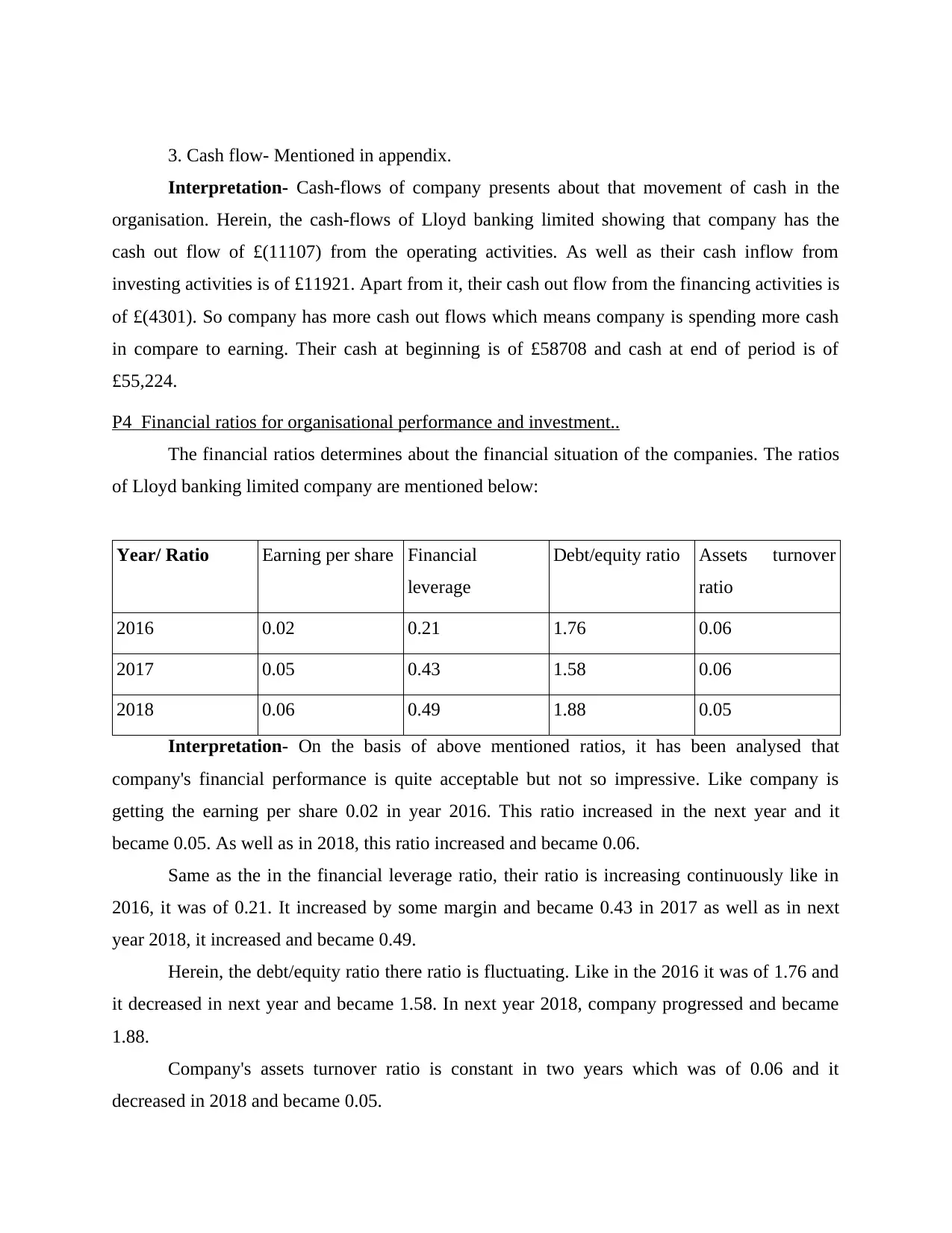

P4 Financial ratios for organisational performance and investment..

The financial ratios determines about the financial situation of the companies. The ratios

of Lloyd banking limited company are mentioned below:

Year/ Ratio Earning per share Financial

leverage

Debt/equity ratio Assets turnover

ratio

2016 0.02 0.21 1.76 0.06

2017 0.05 0.43 1.58 0.06

2018 0.06 0.49 1.88 0.05

Interpretation- On the basis of above mentioned ratios, it has been analysed that

company's financial performance is quite acceptable but not so impressive. Like company is

getting the earning per share 0.02 in year 2016. This ratio increased in the next year and it

became 0.05. As well as in 2018, this ratio increased and became 0.06.

Same as the in the financial leverage ratio, their ratio is increasing continuously like in

2016, it was of 0.21. It increased by some margin and became 0.43 in 2017 as well as in next

year 2018, it increased and became 0.49.

Herein, the debt/equity ratio there ratio is fluctuating. Like in the 2016 it was of 1.76 and

it decreased in next year and became 1.58. In next year 2018, company progressed and became

1.88.

Company's assets turnover ratio is constant in two years which was of 0.06 and it

decreased in 2018 and became 0.05.

Interpretation- Cash-flows of company presents about that movement of cash in the

organisation. Herein, the cash-flows of Lloyd banking limited showing that company has the

cash out flow of £(11107) from the operating activities. As well as their cash inflow from

investing activities is of £11921. Apart from it, their cash out flow from the financing activities is

of £(4301). So company has more cash out flows which means company is spending more cash

in compare to earning. Their cash at beginning is of £58708 and cash at end of period is of

£55,224.

P4 Financial ratios for organisational performance and investment..

The financial ratios determines about the financial situation of the companies. The ratios

of Lloyd banking limited company are mentioned below:

Year/ Ratio Earning per share Financial

leverage

Debt/equity ratio Assets turnover

ratio

2016 0.02 0.21 1.76 0.06

2017 0.05 0.43 1.58 0.06

2018 0.06 0.49 1.88 0.05

Interpretation- On the basis of above mentioned ratios, it has been analysed that

company's financial performance is quite acceptable but not so impressive. Like company is

getting the earning per share 0.02 in year 2016. This ratio increased in the next year and it

became 0.05. As well as in 2018, this ratio increased and became 0.06.

Same as the in the financial leverage ratio, their ratio is increasing continuously like in

2016, it was of 0.21. It increased by some margin and became 0.43 in 2017 as well as in next

year 2018, it increased and became 0.49.

Herein, the debt/equity ratio there ratio is fluctuating. Like in the 2016 it was of 1.76 and

it decreased in next year and became 1.58. In next year 2018, company progressed and became

1.88.

Company's assets turnover ratio is constant in two years which was of 0.06 and it

decreased in 2018 and became 0.05.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3.

P5 Benefits of international financial reporting standards (IFRS) and international accounting

standard (IAS).

International financial reporting standards (IFRS)- The IFRS evolves the common

rules and regulations to prepare the financial statements (Council and Britain, 2015). The main

objective of the IFRS is to make the financial statements transparent, accurate and comparable

all around the word. Generally, the IFRS are issued by the international accounting standard

board (IASB). Different rules of the international financial reporting standards defines about way

through which companies can maintain their financial statements. Additionally, IFRS was

evolved to develop a common and equal accounting language through which companies and

their financial statements can be consistent from company to company. The Lloyd banking group

limited company follows the rules of the international financial reporting standards to prepare

their financial statements. Herein, some advantages of IFRS are mentioned below:

Provides comparability- The international financial reporting standards offers

comparability to the business in the financial statements. Specially, those companies

which have branches in different countries then this can be useful for them in preparing

the financial statements with an equal standard. As well as due to this, companies can

compare their financial reports effectively. The Lloyd banking group limited company

applies the IFRS to make their financial documents more comparable.

Flexibility- The IFRS provides flexibility to the companies in adopting the rules and

regulation as per their need. Though, there are certain standards which are compulsory to

be followed but it offers some flexibility to the organisations in preparation of the

financial statements. The Lloyd banking group limited company has the flexibility in the

implementation of the accounting standards for making their financial reports.

Beneficial for small and new business- The international financial reporting standards

are useful for the new and small business (FRS 102Johnston and Petacchi, 2017). This is

why because it can help the new business in preparation of financial reports with higher

accuracy and quality. As well as it can guide to the new and small business to follow a

P5 Benefits of international financial reporting standards (IFRS) and international accounting

standard (IAS).

International financial reporting standards (IFRS)- The IFRS evolves the common

rules and regulations to prepare the financial statements (Council and Britain, 2015). The main

objective of the IFRS is to make the financial statements transparent, accurate and comparable

all around the word. Generally, the IFRS are issued by the international accounting standard

board (IASB). Different rules of the international financial reporting standards defines about way

through which companies can maintain their financial statements. Additionally, IFRS was

evolved to develop a common and equal accounting language through which companies and

their financial statements can be consistent from company to company. The Lloyd banking group

limited company follows the rules of the international financial reporting standards to prepare

their financial statements. Herein, some advantages of IFRS are mentioned below:

Provides comparability- The international financial reporting standards offers

comparability to the business in the financial statements. Specially, those companies

which have branches in different countries then this can be useful for them in preparing

the financial statements with an equal standard. As well as due to this, companies can

compare their financial reports effectively. The Lloyd banking group limited company

applies the IFRS to make their financial documents more comparable.

Flexibility- The IFRS provides flexibility to the companies in adopting the rules and

regulation as per their need. Though, there are certain standards which are compulsory to

be followed but it offers some flexibility to the organisations in preparation of the

financial statements. The Lloyd banking group limited company has the flexibility in the

implementation of the accounting standards for making their financial reports.

Beneficial for small and new business- The international financial reporting standards

are useful for the new and small business (FRS 102Johnston and Petacchi, 2017). This is

why because it can help the new business in preparation of financial reports with higher

accuracy and quality. As well as it can guide to the new and small business to follow a

particular rules and format for financial statements. Though Lloyd banking group is not a

new venture but it helps them in preparation of their financial statements fair and

accurate.

International accounting standards (IAS) – The international accounting standards are

replaced by the IFRS in 2001. Eventually, the IAS were the first accounting standards which

were issued by the international accounting standard committee (Skaife, Wangerin,2013). It has

following advantages:

Facilitate ethical compliance- The culture and tradition of countries are different from

each other as well as their process of making financial statement is also different. Herein,

the international accounting standard plays an important role in managing the ethical

compliances by applying an equal method of preparation of financial standards.

Improves the international investment- One of the key advantage of the IAS is that it

improves the international investment. This is why because if companies follow the

standards and rules of the international accounting standards then it becomes easy for the

investors to assess the financial situation. Due to the level of the investment can be

increase by the investors. If Lloyd company applies the IAS in their financial reports then

more investors will invest in their business all around the world.

Sets generalized standards- International accounting standards are beneficial in setting the

standards (K. Johl, S., Kaur Johl, Subramaniam and Cooper, 2013). This is why because

with the help of international accounting standards, companies can fix a particular

standard for preparation of the financial reports. As well as due to international

accounting standards, the financial statement of the companies becomes comparative and

reliable. So overall the international accounting standards are useful in setting the

generalized standards.

P6 Models of financial reporting and auditing.

The models of financial reporting and auditing are useful for preparation of financial

reporting and auditing. There are different kind of models of financial reporting and auditing.

Some of these models are being used by the Lloyd company for financial reporting and auditing

which are mentioned below:

new venture but it helps them in preparation of their financial statements fair and

accurate.

International accounting standards (IAS) – The international accounting standards are

replaced by the IFRS in 2001. Eventually, the IAS were the first accounting standards which

were issued by the international accounting standard committee (Skaife, Wangerin,2013). It has

following advantages:

Facilitate ethical compliance- The culture and tradition of countries are different from

each other as well as their process of making financial statement is also different. Herein,

the international accounting standard plays an important role in managing the ethical

compliances by applying an equal method of preparation of financial standards.

Improves the international investment- One of the key advantage of the IAS is that it

improves the international investment. This is why because if companies follow the

standards and rules of the international accounting standards then it becomes easy for the

investors to assess the financial situation. Due to the level of the investment can be

increase by the investors. If Lloyd company applies the IAS in their financial reports then

more investors will invest in their business all around the world.

Sets generalized standards- International accounting standards are beneficial in setting the

standards (K. Johl, S., Kaur Johl, Subramaniam and Cooper, 2013). This is why because

with the help of international accounting standards, companies can fix a particular

standard for preparation of the financial reports. As well as due to international

accounting standards, the financial statement of the companies becomes comparative and

reliable. So overall the international accounting standards are useful in setting the

generalized standards.

P6 Models of financial reporting and auditing.

The models of financial reporting and auditing are useful for preparation of financial

reporting and auditing. There are different kind of models of financial reporting and auditing.

Some of these models are being used by the Lloyd company for financial reporting and auditing

which are mentioned below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Models of financial reporting-

Three statement model- The three statement model is a kind of model which is related to

the preparation of balance sheet, income statement and cash flows in combine.

Eventually, this model is useful for the companies and for the investors because due to

this model all three statements can be viewed in a combine statement (Shivakumar,

2013). Basically this model is used on the excel sheet with the use of appropriate

formulas. This model of financial reporting is being used by the Lloyd company for

preparation of balance sheet, income statement and cash flows jointly.

Merger model- The merger model is useful in analysing about the merger of two or more

companies in a joint company. This model is advanced model that states about the merger

and acquisition of the firms. Additionally, this model defines all the financial details

including the assets, liabilities, incomes, profits etc. of the merged companies. This

model can be used by the Lloyd banking group limited if they merge in any other

company.

Budget model- This model is being used by the companies for financial planning and

analysis to get the budgets together for upcoming time periods (.Cassell, Giroux, Myers

and Omer, 2013). Eventually, budgets models are designed on the basis of previous

information of the budgets. The Lloyd banking group limited company implements this

model for their future financial planning.

Consolidation model- The consolidation model is a type of financial model which is

prepared by combination of financial results of two or more businesses into a single

model. Generally, the first sheet of this model defines the highest figures of income

statement, balance sheet or profit & loss in the terms of charts and tables. On the other

hand, the other sheets of this model states about the financial data of any particular

product or business activity.

Models of auditing-

The models of the auditing includes the model audit which assures that mistakes in the

spreadsheets are eliminated. Generally, the model audit is used by those organisation which are

from the banking sector. In these organisations this model ensures that the data which is entered

in the spreadsheets is accurate and correct.

Three statement model- The three statement model is a kind of model which is related to

the preparation of balance sheet, income statement and cash flows in combine.

Eventually, this model is useful for the companies and for the investors because due to

this model all three statements can be viewed in a combine statement (Shivakumar,

2013). Basically this model is used on the excel sheet with the use of appropriate

formulas. This model of financial reporting is being used by the Lloyd company for

preparation of balance sheet, income statement and cash flows jointly.

Merger model- The merger model is useful in analysing about the merger of two or more

companies in a joint company. This model is advanced model that states about the merger

and acquisition of the firms. Additionally, this model defines all the financial details

including the assets, liabilities, incomes, profits etc. of the merged companies. This

model can be used by the Lloyd banking group limited if they merge in any other

company.

Budget model- This model is being used by the companies for financial planning and

analysis to get the budgets together for upcoming time periods (.Cassell, Giroux, Myers

and Omer, 2013). Eventually, budgets models are designed on the basis of previous

information of the budgets. The Lloyd banking group limited company implements this

model for their future financial planning.

Consolidation model- The consolidation model is a type of financial model which is

prepared by combination of financial results of two or more businesses into a single

model. Generally, the first sheet of this model defines the highest figures of income

statement, balance sheet or profit & loss in the terms of charts and tables. On the other

hand, the other sheets of this model states about the financial data of any particular

product or business activity.

Models of auditing-

The models of the auditing includes the model audit which assures that mistakes in the

spreadsheets are eliminated. Generally, the model audit is used by those organisation which are

from the banking sector. In these organisations this model ensures that the data which is entered

in the spreadsheets is accurate and correct.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In general term, the main objective of the auditing is to evaluate that financial statements

of the companies are accurate or not. The auditing checks the errors of the financial statements.

The model audit makes the task of auditing more reliable and accurate by cross checking of the

results to protect from any error. This model is being used by the Lloyd banking limited

company in their auditing process to make the auditing accurate. As well as to ensure the

external users that company's financial reports are accurate and without any error.

TASK 4.

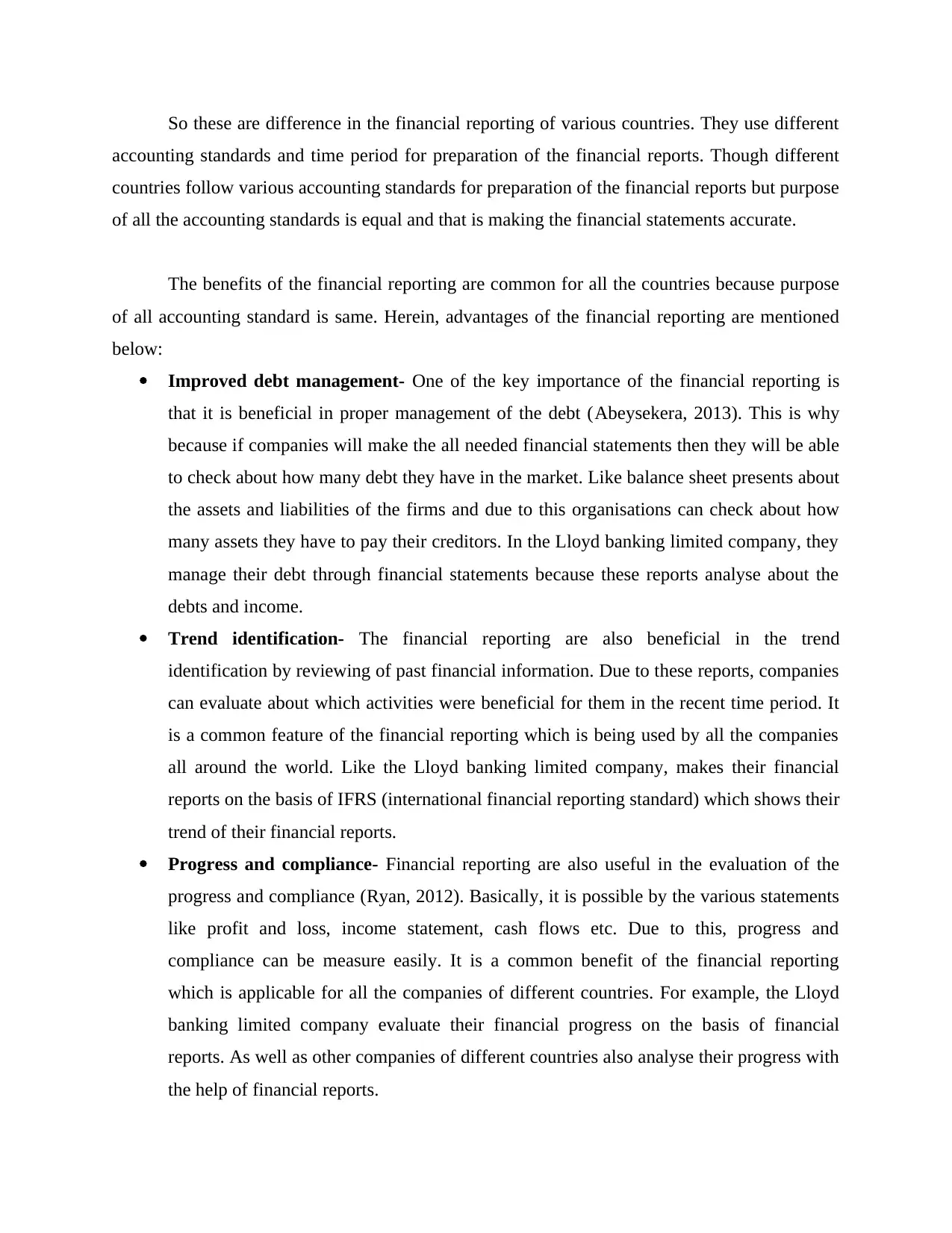

P7 Differences and importance of the financial reporting across the countries.

Financial reporting is a mandatory part for all the businesses to present their financial

position and performance (Shivakumar, 2013). Eventually, companies from different countries

follow various kind of accounting standards and formats. Like in the USA the financial

statements are being prepared with the use of GAAP (Generally accepted accounting principle).

As well as in the UK, if companies securities are traded in the regulated market then they follow

the IFRS. So different countries use various kind of accounting standards. For example, the

Lloyd banking limited company operates in the United Kingdom and they make their financial

reports on the basis of IFRS. Herein, the differences of financial reporting among some countries

are mentioned below:

UK USA AUSTRALIA

Accounting standard IFRS (international

financial reporting

standard) for

preparation of

financial reports.

GAAP (Generally

accepted accounting

principles).

AASB (Australian

accounting standard

board).

Accounting time

period

In the UK, the

financial year runs

from 1st April to 31st

March.

USA makes their

financial reports as per

the time period of 1st

October to 30th

September.

In the Australia, the

financial reports are

prepared for the time

period of 1st July to

30th June.

of the companies are accurate or not. The auditing checks the errors of the financial statements.

The model audit makes the task of auditing more reliable and accurate by cross checking of the

results to protect from any error. This model is being used by the Lloyd banking limited

company in their auditing process to make the auditing accurate. As well as to ensure the

external users that company's financial reports are accurate and without any error.

TASK 4.

P7 Differences and importance of the financial reporting across the countries.

Financial reporting is a mandatory part for all the businesses to present their financial

position and performance (Shivakumar, 2013). Eventually, companies from different countries

follow various kind of accounting standards and formats. Like in the USA the financial

statements are being prepared with the use of GAAP (Generally accepted accounting principle).

As well as in the UK, if companies securities are traded in the regulated market then they follow

the IFRS. So different countries use various kind of accounting standards. For example, the

Lloyd banking limited company operates in the United Kingdom and they make their financial

reports on the basis of IFRS. Herein, the differences of financial reporting among some countries

are mentioned below:

UK USA AUSTRALIA

Accounting standard IFRS (international

financial reporting

standard) for

preparation of

financial reports.

GAAP (Generally

accepted accounting

principles).

AASB (Australian

accounting standard

board).

Accounting time

period

In the UK, the

financial year runs

from 1st April to 31st

March.

USA makes their

financial reports as per

the time period of 1st

October to 30th

September.

In the Australia, the

financial reports are

prepared for the time

period of 1st July to

30th June.

So these are difference in the financial reporting of various countries. They use different

accounting standards and time period for preparation of the financial reports. Though different

countries follow various accounting standards for preparation of the financial reports but purpose

of all the accounting standards is equal and that is making the financial statements accurate.

The benefits of the financial reporting are common for all the countries because purpose

of all accounting standard is same. Herein, advantages of the financial reporting are mentioned

below:

Improved debt management- One of the key importance of the financial reporting is

that it is beneficial in proper management of the debt (Abeysekera, 2013). This is why

because if companies will make the all needed financial statements then they will be able

to check about how many debt they have in the market. Like balance sheet presents about

the assets and liabilities of the firms and due to this organisations can check about how

many assets they have to pay their creditors. In the Lloyd banking limited company, they

manage their debt through financial statements because these reports analyse about the

debts and income.

Trend identification- The financial reporting are also beneficial in the trend

identification by reviewing of past financial information. Due to these reports, companies

can evaluate about which activities were beneficial for them in the recent time period. It

is a common feature of the financial reporting which is being used by all the companies

all around the world. Like the Lloyd banking limited company, makes their financial

reports on the basis of IFRS (international financial reporting standard) which shows their

trend of their financial reports.

Progress and compliance- Financial reporting are also useful in the evaluation of the

progress and compliance (Ryan, 2012). Basically, it is possible by the various statements

like profit and loss, income statement, cash flows etc. Due to this, progress and

compliance can be measure easily. It is a common benefit of the financial reporting

which is applicable for all the companies of different countries. For example, the Lloyd

banking limited company evaluate their financial progress on the basis of financial

reports. As well as other companies of different countries also analyse their progress with

the help of financial reports.

accounting standards and time period for preparation of the financial reports. Though different

countries follow various accounting standards for preparation of the financial reports but purpose

of all the accounting standards is equal and that is making the financial statements accurate.

The benefits of the financial reporting are common for all the countries because purpose

of all accounting standard is same. Herein, advantages of the financial reporting are mentioned

below:

Improved debt management- One of the key importance of the financial reporting is

that it is beneficial in proper management of the debt (Abeysekera, 2013). This is why

because if companies will make the all needed financial statements then they will be able

to check about how many debt they have in the market. Like balance sheet presents about

the assets and liabilities of the firms and due to this organisations can check about how

many assets they have to pay their creditors. In the Lloyd banking limited company, they

manage their debt through financial statements because these reports analyse about the

debts and income.

Trend identification- The financial reporting are also beneficial in the trend

identification by reviewing of past financial information. Due to these reports, companies

can evaluate about which activities were beneficial for them in the recent time period. It

is a common feature of the financial reporting which is being used by all the companies

all around the world. Like the Lloyd banking limited company, makes their financial

reports on the basis of IFRS (international financial reporting standard) which shows their

trend of their financial reports.

Progress and compliance- Financial reporting are also useful in the evaluation of the

progress and compliance (Ryan, 2012). Basically, it is possible by the various statements

like profit and loss, income statement, cash flows etc. Due to this, progress and

compliance can be measure easily. It is a common benefit of the financial reporting

which is applicable for all the companies of different countries. For example, the Lloyd

banking limited company evaluate their financial progress on the basis of financial

reports. As well as other companies of different countries also analyse their progress with

the help of financial reports.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.