Financial Reporting Assignment - Consolidation and Equity Accounting

VerifiedAdded on 2020/07/22

|10

|1607

|51

Homework Assignment

AI Summary

This financial reporting assignment provides a detailed analysis of consolidation accounting, equity accounting, and foreign exchange transactions. Question 1 focuses on the consolidation of a subsidiary, including the calculation of goodwill, capital reserves, and non-controlling interest (NCI). It involves preparing consolidation entries, pre-acquisition entries, and NCI adjustments. Question 2 delves into equity accounting, presenting journal entries for investments in associates, including asset revaluation and profit recognition. Question 3 addresses foreign exchange transactions, detailing journal entries for purchases and asset acquisitions in different currencies. The assignment utilizes examples and working notes to illustrate the accounting principles, and includes references to relevant academic sources. The assignment covers topics like consolidation, equity accounting, and foreign exchange accounting, providing a comprehensive overview of financial reporting practices, demonstrating the application of accounting principles in various scenarios.

Financial reporting

assignment

assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1........................................................................................................................................1

Question: 2.......................................................................................................................................3

Question 3........................................................................................................................................5

Question 1........................................................................................................................................1

Question: 2.......................................................................................................................................3

Question 3........................................................................................................................................5

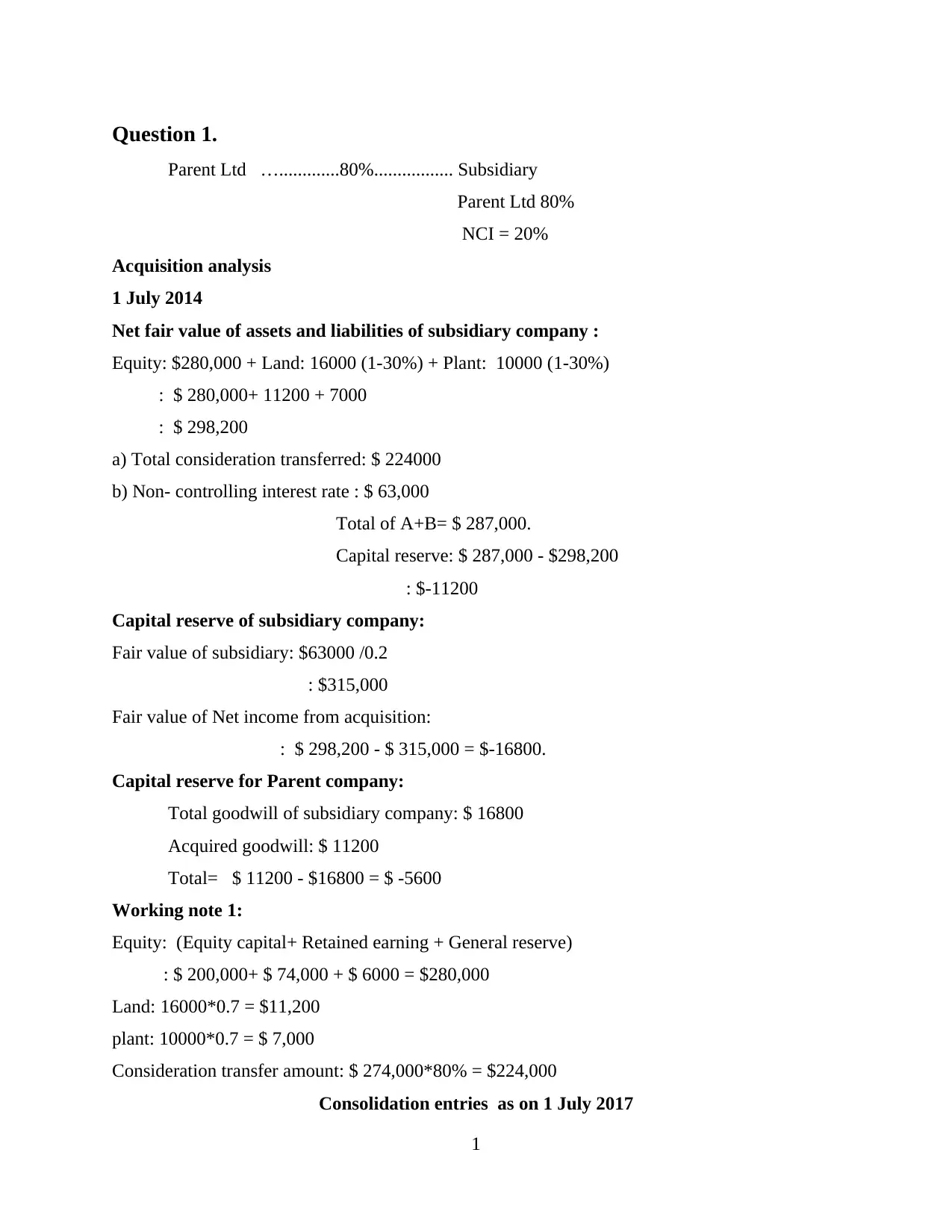

Question 1.

Parent Ltd ….............80%................. Subsidiary

Parent Ltd 80%

NCI = 20%

Acquisition analysis

1 July 2014

Net fair value of assets and liabilities of subsidiary company :

Equity: $280,000 + Land: 16000 (1-30%) + Plant: 10000 (1-30%)

: $ 280,000+ 11200 + 7000

: $ 298,200

a) Total consideration transferred: $ 224000

b) Non- controlling interest rate : $ 63,000

Total of A+B= $ 287,000.

Capital reserve: $ 287,000 - $298,200

: $-11200

Capital reserve of subsidiary company:

Fair value of subsidiary: $63000 /0.2

: $315,000

Fair value of Net income from acquisition:

: $ 298,200 - $ 315,000 = $-16800.

Capital reserve for Parent company:

Total goodwill of subsidiary company: $ 16800

Acquired goodwill: $ 11200

Total= $ 11200 - $16800 = $ -5600

Working note 1:

Equity: (Equity capital+ Retained earning + General reserve)

: $ 200,000+ $ 74,000 + $ 6000 = $280,000

Land: 16000*0.7 = $11,200

plant: 10000*0.7 = $ 7,000

Consideration transfer amount: $ 274,000*80% = $224,000

Consolidation entries as on 1 July 2017

1

Parent Ltd ….............80%................. Subsidiary

Parent Ltd 80%

NCI = 20%

Acquisition analysis

1 July 2014

Net fair value of assets and liabilities of subsidiary company :

Equity: $280,000 + Land: 16000 (1-30%) + Plant: 10000 (1-30%)

: $ 280,000+ 11200 + 7000

: $ 298,200

a) Total consideration transferred: $ 224000

b) Non- controlling interest rate : $ 63,000

Total of A+B= $ 287,000.

Capital reserve: $ 287,000 - $298,200

: $-11200

Capital reserve of subsidiary company:

Fair value of subsidiary: $63000 /0.2

: $315,000

Fair value of Net income from acquisition:

: $ 298,200 - $ 315,000 = $-16800.

Capital reserve for Parent company:

Total goodwill of subsidiary company: $ 16800

Acquired goodwill: $ 11200

Total= $ 11200 - $16800 = $ -5600

Working note 1:

Equity: (Equity capital+ Retained earning + General reserve)

: $ 200,000+ $ 74,000 + $ 6000 = $280,000

Land: 16000*0.7 = $11,200

plant: 10000*0.7 = $ 7,000

Consideration transfer amount: $ 274,000*80% = $224,000

Consolidation entries as on 1 July 2017

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

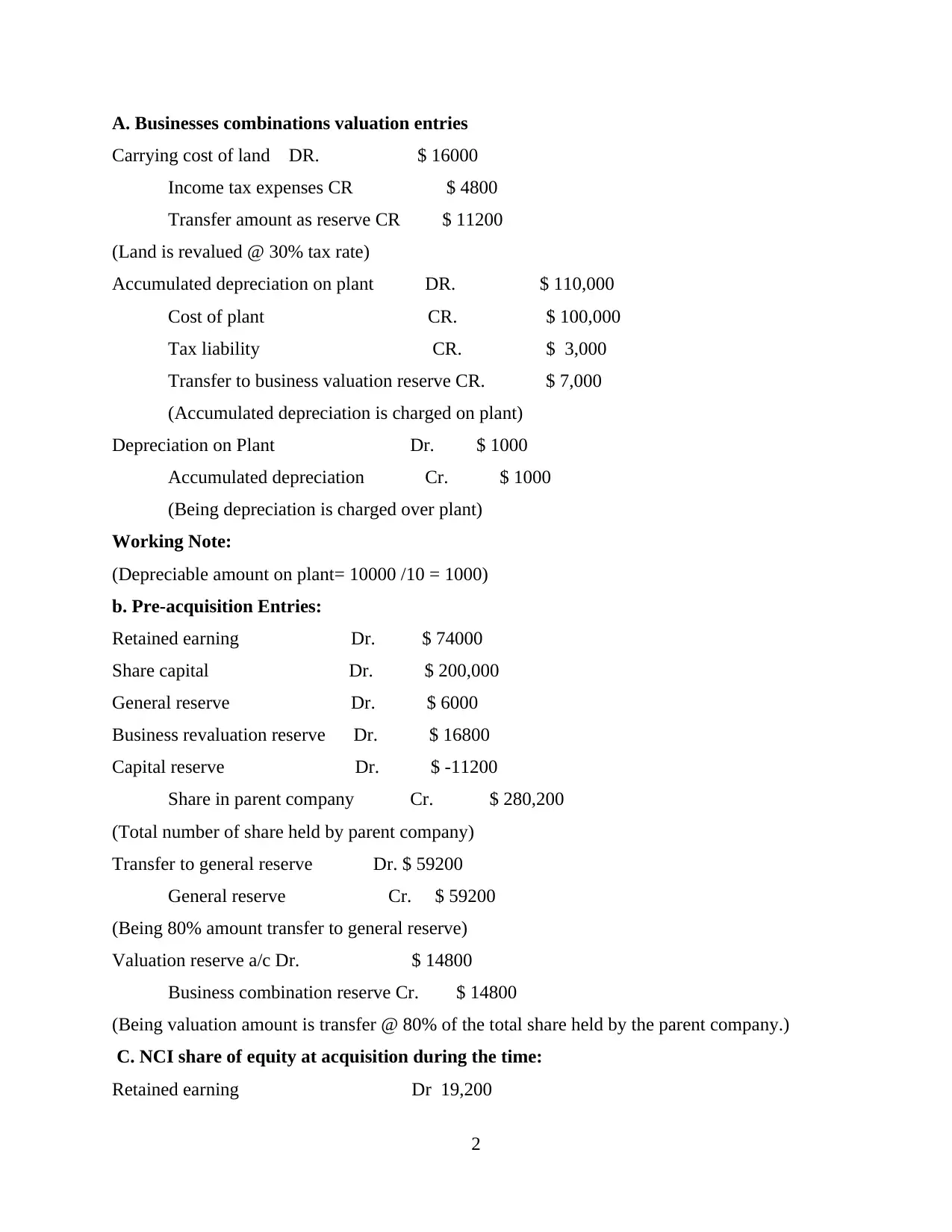

A. Businesses combinations valuation entries

Carrying cost of land DR. $ 16000

Income tax expenses CR $ 4800

Transfer amount as reserve CR $ 11200

(Land is revalued @ 30% tax rate)

Accumulated depreciation on plant DR. $ 110,000

Cost of plant CR. $ 100,000

Tax liability CR. $ 3,000

Transfer to business valuation reserve CR. $ 7,000

(Accumulated depreciation is charged on plant)

Depreciation on Plant Dr. $ 1000

Accumulated depreciation Cr. $ 1000

(Being depreciation is charged over plant)

Working Note:

(Depreciable amount on plant= 10000 /10 = 1000)

b. Pre-acquisition Entries:

Retained earning Dr. $ 74000

Share capital Dr. $ 200,000

General reserve Dr. $ 6000

Business revaluation reserve Dr. $ 16800

Capital reserve Dr. $ -11200

Share in parent company Cr. $ 280,200

(Total number of share held by parent company)

Transfer to general reserve Dr. $ 59200

General reserve Cr. $ 59200

(Being 80% amount transfer to general reserve)

Valuation reserve a/c Dr. $ 14800

Business combination reserve Cr. $ 14800

(Being valuation amount is transfer @ 80% of the total share held by the parent company.)

C. NCI share of equity at acquisition during the time:

Retained earning Dr 19,200

2

Carrying cost of land DR. $ 16000

Income tax expenses CR $ 4800

Transfer amount as reserve CR $ 11200

(Land is revalued @ 30% tax rate)

Accumulated depreciation on plant DR. $ 110,000

Cost of plant CR. $ 100,000

Tax liability CR. $ 3,000

Transfer to business valuation reserve CR. $ 7,000

(Accumulated depreciation is charged on plant)

Depreciation on Plant Dr. $ 1000

Accumulated depreciation Cr. $ 1000

(Being depreciation is charged over plant)

Working Note:

(Depreciable amount on plant= 10000 /10 = 1000)

b. Pre-acquisition Entries:

Retained earning Dr. $ 74000

Share capital Dr. $ 200,000

General reserve Dr. $ 6000

Business revaluation reserve Dr. $ 16800

Capital reserve Dr. $ -11200

Share in parent company Cr. $ 280,200

(Total number of share held by parent company)

Transfer to general reserve Dr. $ 59200

General reserve Cr. $ 59200

(Being 80% amount transfer to general reserve)

Valuation reserve a/c Dr. $ 14800

Business combination reserve Cr. $ 14800

(Being valuation amount is transfer @ 80% of the total share held by the parent company.)

C. NCI share of equity at acquisition during the time:

Retained earning Dr 19,200

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

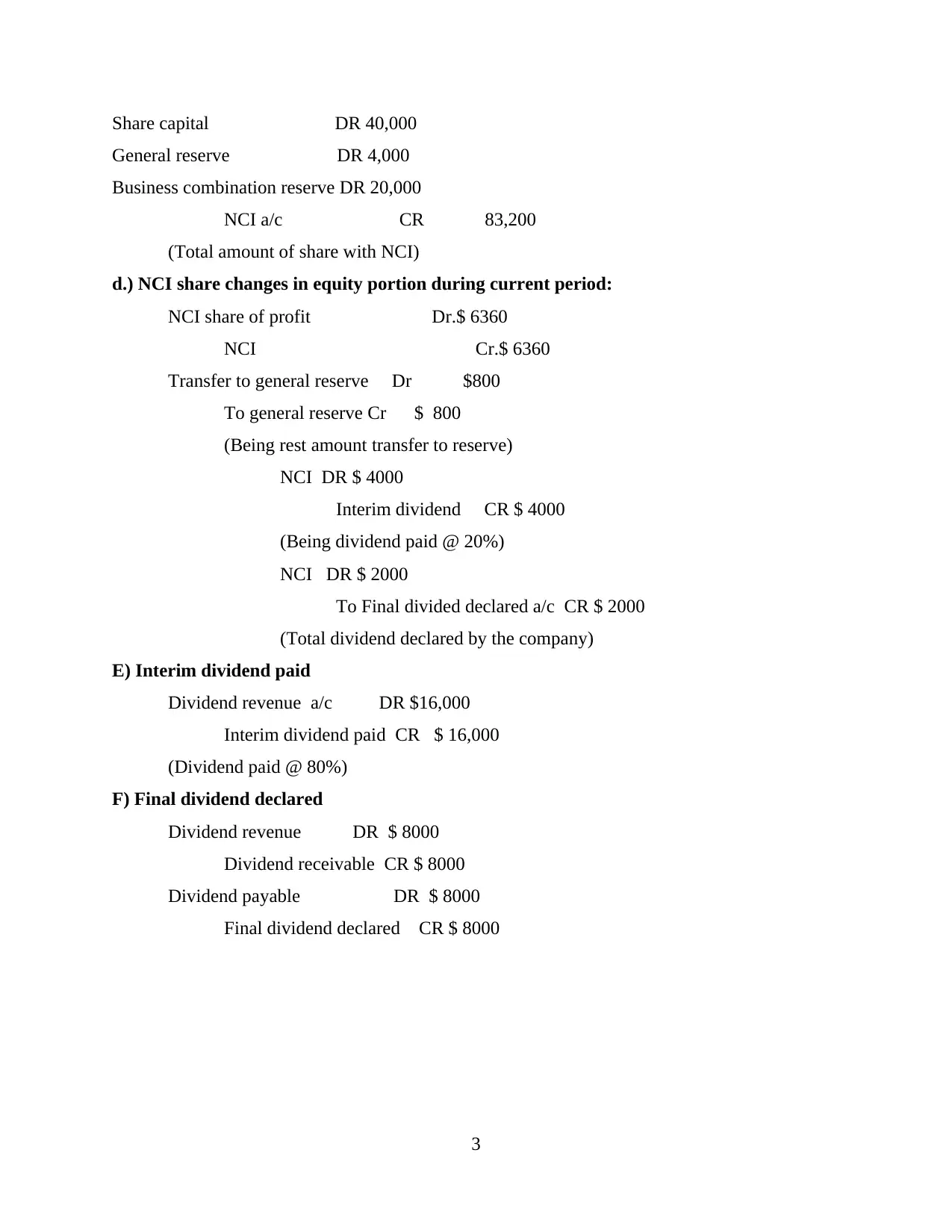

Share capital DR 40,000

General reserve DR 4,000

Business combination reserve DR 20,000

NCI a/c CR 83,200

(Total amount of share with NCI)

d.) NCI share changes in equity portion during current period:

NCI share of profit Dr.$ 6360

NCI Cr.$ 6360

Transfer to general reserve Dr $800

To general reserve Cr $ 800

(Being rest amount transfer to reserve)

NCI DR $ 4000

Interim dividend CR $ 4000

(Being dividend paid @ 20%)

NCI DR $ 2000

To Final divided declared a/c CR $ 2000

(Total dividend declared by the company)

E) Interim dividend paid

Dividend revenue a/c DR $16,000

Interim dividend paid CR $ 16,000

(Dividend paid @ 80%)

F) Final dividend declared

Dividend revenue DR $ 8000

Dividend receivable CR $ 8000

Dividend payable DR $ 8000

Final dividend declared CR $ 8000

3

General reserve DR 4,000

Business combination reserve DR 20,000

NCI a/c CR 83,200

(Total amount of share with NCI)

d.) NCI share changes in equity portion during current period:

NCI share of profit Dr.$ 6360

NCI Cr.$ 6360

Transfer to general reserve Dr $800

To general reserve Cr $ 800

(Being rest amount transfer to reserve)

NCI DR $ 4000

Interim dividend CR $ 4000

(Being dividend paid @ 20%)

NCI DR $ 2000

To Final divided declared a/c CR $ 2000

(Total dividend declared by the company)

E) Interim dividend paid

Dividend revenue a/c DR $16,000

Interim dividend paid CR $ 16,000

(Dividend paid @ 80%)

F) Final dividend declared

Dividend revenue DR $ 8000

Dividend receivable CR $ 8000

Dividend payable DR $ 8000

Final dividend declared CR $ 8000

3

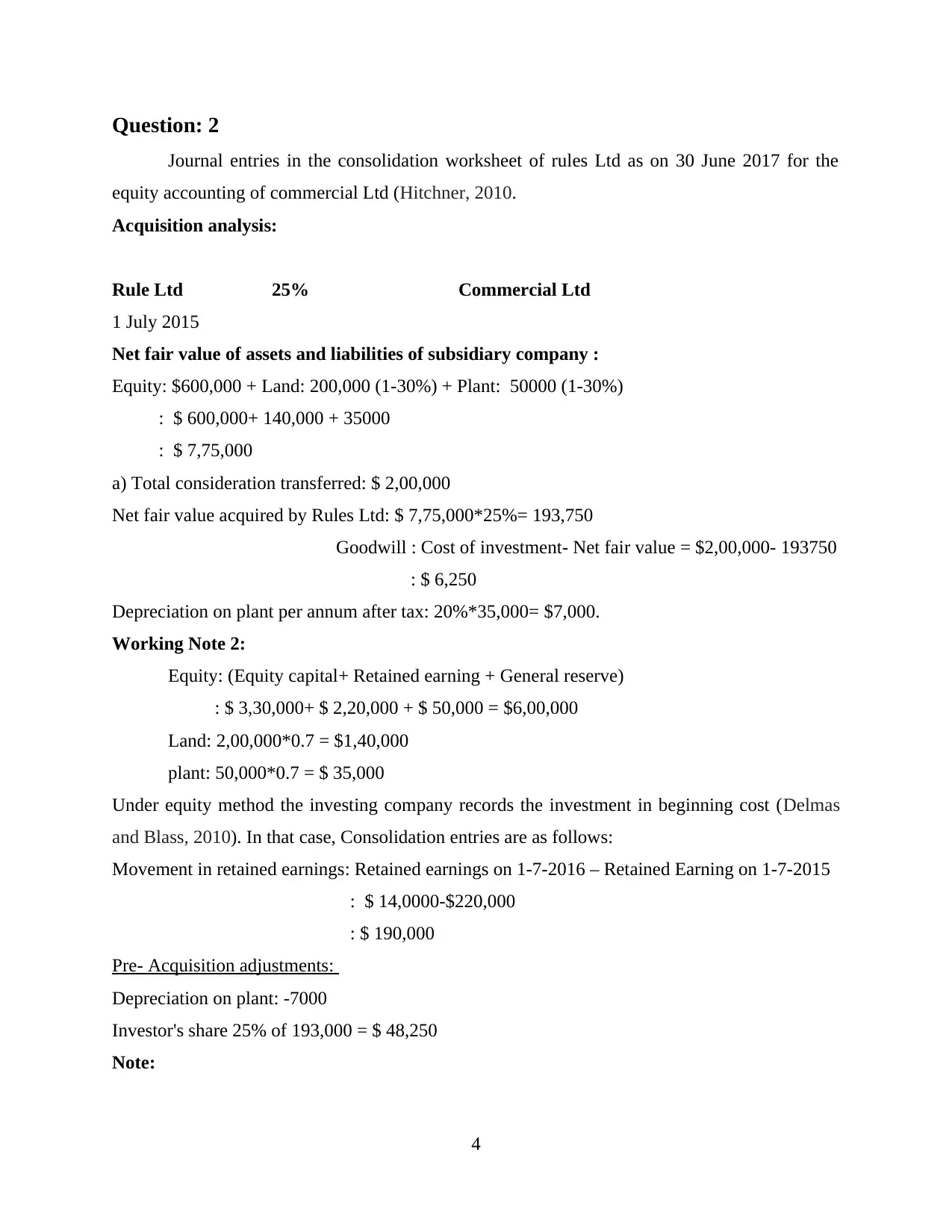

Question: 2

Journal entries in the consolidation worksheet of rules Ltd as on 30 June 2017 for the

equity accounting of commercial Ltd (Hitchner, 2010.

Acquisition analysis:

Rule Ltd 25% Commercial Ltd

1 July 2015

Net fair value of assets and liabilities of subsidiary company :

Equity: $600,000 + Land: 200,000 (1-30%) + Plant: 50000 (1-30%)

: $ 600,000+ 140,000 + 35000

: $ 7,75,000

a) Total consideration transferred: $ 2,00,000

Net fair value acquired by Rules Ltd: $ 7,75,000*25%= 193,750

Goodwill : Cost of investment- Net fair value = $2,00,000- 193750

: $ 6,250

Depreciation on plant per annum after tax: 20%*35,000= $7,000.

Working Note 2:

Equity: (Equity capital+ Retained earning + General reserve)

: $ 3,30,000+ $ 2,20,000 + $ 50,000 = $6,00,000

Land: 2,00,000*0.7 = $1,40,000

plant: 50,000*0.7 = $ 35,000

Under equity method the investing company records the investment in beginning cost (Delmas

and Blass, 2010). In that case, Consolidation entries are as follows:

Movement in retained earnings: Retained earnings on 1-7-2016 – Retained Earning on 1-7-2015

: $ 14,0000-$220,000

: $ 190,000

Pre- Acquisition adjustments:

Depreciation on plant: -7000

Investor's share 25% of 193,000 = $ 48,250

Note:

4

Journal entries in the consolidation worksheet of rules Ltd as on 30 June 2017 for the

equity accounting of commercial Ltd (Hitchner, 2010.

Acquisition analysis:

Rule Ltd 25% Commercial Ltd

1 July 2015

Net fair value of assets and liabilities of subsidiary company :

Equity: $600,000 + Land: 200,000 (1-30%) + Plant: 50000 (1-30%)

: $ 600,000+ 140,000 + 35000

: $ 7,75,000

a) Total consideration transferred: $ 2,00,000

Net fair value acquired by Rules Ltd: $ 7,75,000*25%= 193,750

Goodwill : Cost of investment- Net fair value = $2,00,000- 193750

: $ 6,250

Depreciation on plant per annum after tax: 20%*35,000= $7,000.

Working Note 2:

Equity: (Equity capital+ Retained earning + General reserve)

: $ 3,30,000+ $ 2,20,000 + $ 50,000 = $6,00,000

Land: 2,00,000*0.7 = $1,40,000

plant: 50,000*0.7 = $ 35,000

Under equity method the investing company records the investment in beginning cost (Delmas

and Blass, 2010). In that case, Consolidation entries are as follows:

Movement in retained earnings: Retained earnings on 1-7-2016 – Retained Earning on 1-7-2015

: $ 14,0000-$220,000

: $ 190,000

Pre- Acquisition adjustments:

Depreciation on plant: -7000

Investor's share 25% of 193,000 = $ 48,250

Note:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

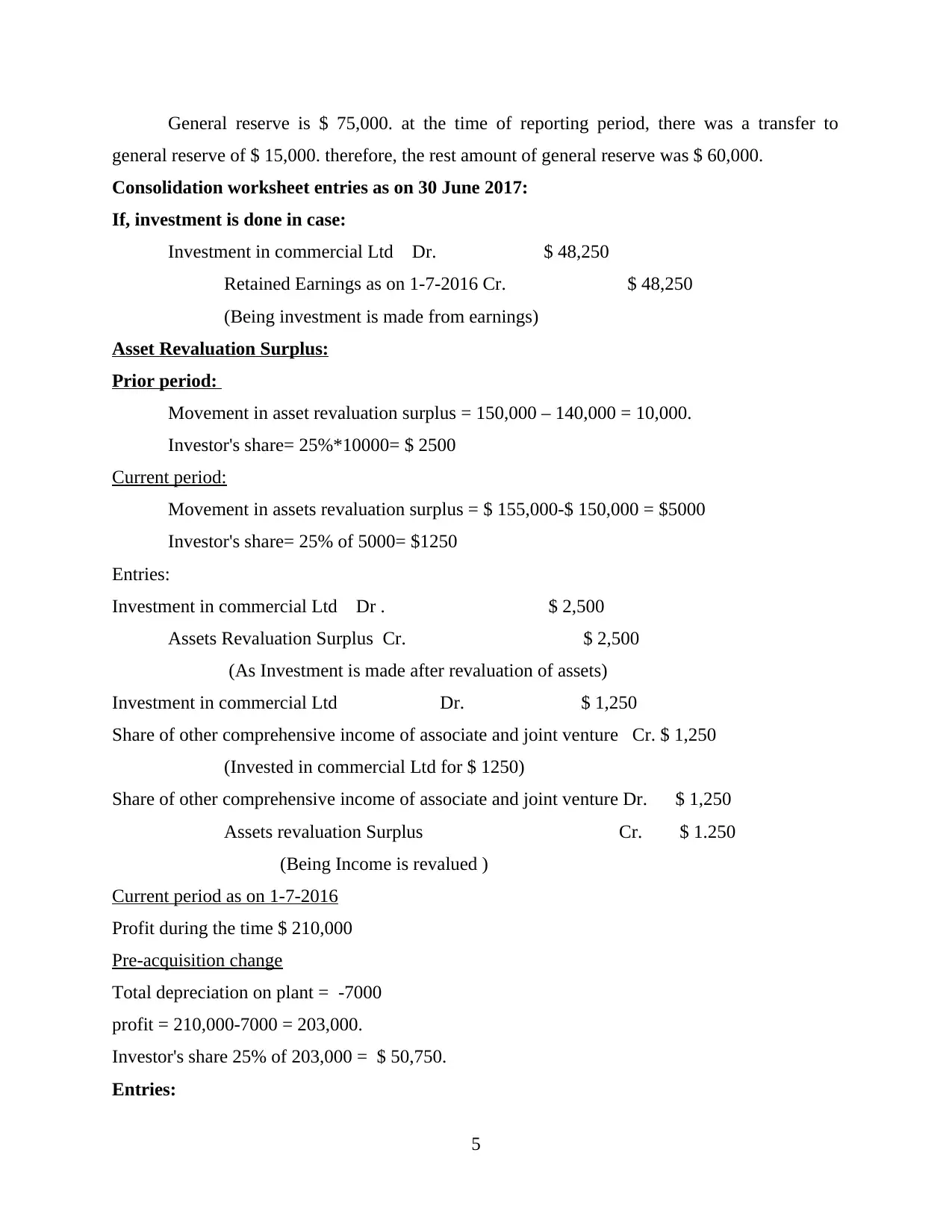

General reserve is $ 75,000. at the time of reporting period, there was a transfer to

general reserve of $ 15,000. therefore, the rest amount of general reserve was $ 60,000.

Consolidation worksheet entries as on 30 June 2017:

If, investment is done in case:

Investment in commercial Ltd Dr. $ 48,250

Retained Earnings as on 1-7-2016 Cr. $ 48,250

(Being investment is made from earnings)

Asset Revaluation Surplus:

Prior period:

Movement in asset revaluation surplus = 150,000 – 140,000 = 10,000.

Investor's share= 25%*10000= $ 2500

Current period:

Movement in assets revaluation surplus = $ 155,000-$ 150,000 = $5000

Investor's share= 25% of 5000= $1250

Entries:

Investment in commercial Ltd Dr . $ 2,500

Assets Revaluation Surplus Cr. $ 2,500

(As Investment is made after revaluation of assets)

Investment in commercial Ltd Dr. $ 1,250

Share of other comprehensive income of associate and joint venture Cr. $ 1,250

(Invested in commercial Ltd for $ 1250)

Share of other comprehensive income of associate and joint venture Dr. $ 1,250

Assets revaluation Surplus Cr. $ 1.250

(Being Income is revalued )

Current period as on 1-7-2016

Profit during the time $ 210,000

Pre-acquisition change

Total depreciation on plant = -7000

profit = 210,000-7000 = 203,000.

Investor's share 25% of 203,000 = $ 50,750.

Entries:

5

general reserve of $ 15,000. therefore, the rest amount of general reserve was $ 60,000.

Consolidation worksheet entries as on 30 June 2017:

If, investment is done in case:

Investment in commercial Ltd Dr. $ 48,250

Retained Earnings as on 1-7-2016 Cr. $ 48,250

(Being investment is made from earnings)

Asset Revaluation Surplus:

Prior period:

Movement in asset revaluation surplus = 150,000 – 140,000 = 10,000.

Investor's share= 25%*10000= $ 2500

Current period:

Movement in assets revaluation surplus = $ 155,000-$ 150,000 = $5000

Investor's share= 25% of 5000= $1250

Entries:

Investment in commercial Ltd Dr . $ 2,500

Assets Revaluation Surplus Cr. $ 2,500

(As Investment is made after revaluation of assets)

Investment in commercial Ltd Dr. $ 1,250

Share of other comprehensive income of associate and joint venture Cr. $ 1,250

(Invested in commercial Ltd for $ 1250)

Share of other comprehensive income of associate and joint venture Dr. $ 1,250

Assets revaluation Surplus Cr. $ 1.250

(Being Income is revalued )

Current period as on 1-7-2016

Profit during the time $ 210,000

Pre-acquisition change

Total depreciation on plant = -7000

profit = 210,000-7000 = 203,000.

Investor's share 25% of 203,000 = $ 50,750.

Entries:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Investment in commercial Ltd Dr. $ 50,750

Share of profit and loss account Cr. $ 50,750

(Investment amount is transfer to profit and loss account)

Profit from dividend Dr. $ 11,250

Investment in commercial Ltd Cr. $ 11,250

(Being Dividend is received after investment)

Working Note:

Calculation of Dividend amount = 25% of 20000+25000=11250.

Question 3

1.

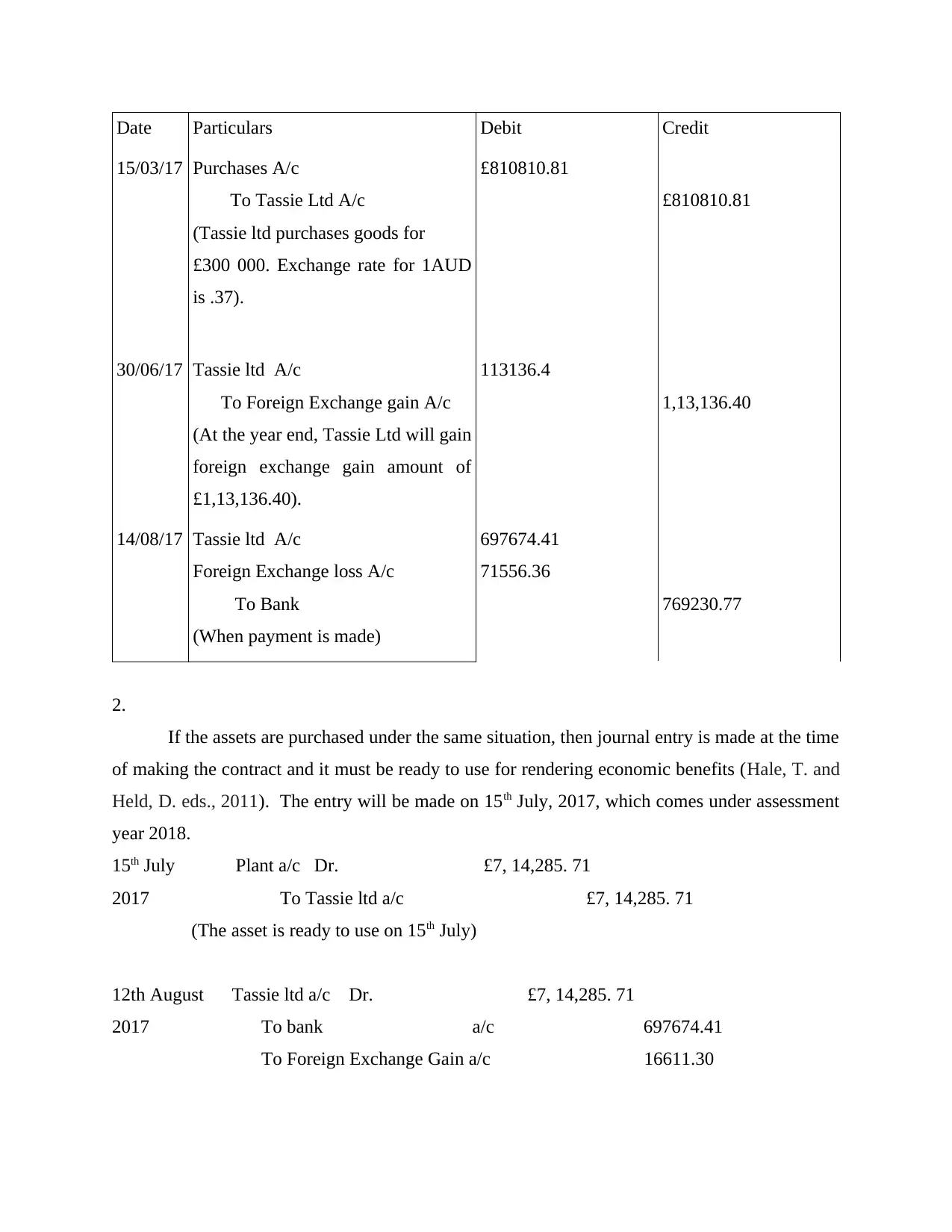

Under the given case, the first two above mentioned entries are made in the assessment

year 2017 and the payment is made in assessment year 2018 (Pratt and Salimi, 2010).

6

Share of profit and loss account Cr. $ 50,750

(Investment amount is transfer to profit and loss account)

Profit from dividend Dr. $ 11,250

Investment in commercial Ltd Cr. $ 11,250

(Being Dividend is received after investment)

Working Note:

Calculation of Dividend amount = 25% of 20000+25000=11250.

Question 3

1.

Under the given case, the first two above mentioned entries are made in the assessment

year 2017 and the payment is made in assessment year 2018 (Pratt and Salimi, 2010).

6

Date Particulars Debit Credit

15/03/17 Purchases A/c

To Tassie Ltd A/c

(Tassie ltd purchases goods for

£300 000. Exchange rate for 1AUD

is .37).

£810810.81

£810810.81

30/06/17 Tassie ltd A/c

To Foreign Exchange gain A/c

(At the year end, Tassie Ltd will gain

foreign exchange gain amount of

£1,13,136.40).

113136.4

1,13,136.40

14/08/17 Tassie ltd A/c

Foreign Exchange loss A/c

To Bank

(When payment is made)

697674.41

71556.36

769230.77

2.

If the assets are purchased under the same situation, then journal entry is made at the time

of making the contract and it must be ready to use for rendering economic benefits (Hale, T. and

Held, D. eds., 2011). The entry will be made on 15th July, 2017, which comes under assessment

year 2018.

15th July Plant a/c Dr. £7, 14,285. 71

2017 To Tassie ltd a/c £7, 14,285. 71

(The asset is ready to use on 15th July)

12th August Tassie ltd a/c Dr. £7, 14,285. 71

2017 To bank a/c 697674.41

To Foreign Exchange Gain a/c 16611.30

15/03/17 Purchases A/c

To Tassie Ltd A/c

(Tassie ltd purchases goods for

£300 000. Exchange rate for 1AUD

is .37).

£810810.81

£810810.81

30/06/17 Tassie ltd A/c

To Foreign Exchange gain A/c

(At the year end, Tassie Ltd will gain

foreign exchange gain amount of

£1,13,136.40).

113136.4

1,13,136.40

14/08/17 Tassie ltd A/c

Foreign Exchange loss A/c

To Bank

(When payment is made)

697674.41

71556.36

769230.77

2.

If the assets are purchased under the same situation, then journal entry is made at the time

of making the contract and it must be ready to use for rendering economic benefits (Hale, T. and

Held, D. eds., 2011). The entry will be made on 15th July, 2017, which comes under assessment

year 2018.

15th July Plant a/c Dr. £7, 14,285. 71

2017 To Tassie ltd a/c £7, 14,285. 71

(The asset is ready to use on 15th July)

12th August Tassie ltd a/c Dr. £7, 14,285. 71

2017 To bank a/c 697674.41

To Foreign Exchange Gain a/c 16611.30

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Hale, T. and Held, D. eds., 2011. Handbook of transnational governance. Polity.

Delmas, M. and Blass, V.D., 2010. Measuring corporate environmental performance: the trade‐

offs of sustainability ratings. Business Strategy and the Environment. 19(4). pp.245-

260.

Hitchner, J.R., 2010. Financial Valuation,+ Website: Applications and Models (Vol. 545). John

Wiley & Sons.

Pratt, J. and Salimi, A.Y., 2010. Financial accounting in an economic context. Issues in

Accounting Education. 25(1). pp.178-179.

Online

Accounting for investment in associates, 2016.[Online]. Available through:

<https://www2.deloitte.com/ng/en/pages/audit/articles/financial-reporting/accounting-

investment-associates2.html>. [Accessed on 16th September 2017].

8

Books and Journals

Hale, T. and Held, D. eds., 2011. Handbook of transnational governance. Polity.

Delmas, M. and Blass, V.D., 2010. Measuring corporate environmental performance: the trade‐

offs of sustainability ratings. Business Strategy and the Environment. 19(4). pp.245-

260.

Hitchner, J.R., 2010. Financial Valuation,+ Website: Applications and Models (Vol. 545). John

Wiley & Sons.

Pratt, J. and Salimi, A.Y., 2010. Financial accounting in an economic context. Issues in

Accounting Education. 25(1). pp.178-179.

Online

Accounting for investment in associates, 2016.[Online]. Available through:

<https://www2.deloitte.com/ng/en/pages/audit/articles/financial-reporting/accounting-

investment-associates2.html>. [Accessed on 16th September 2017].

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.