Comprehensive Analysis of Financial Reporting for TESCO

VerifiedAdded on 2020/06/06

|16

|4152

|117

Report

AI Summary

This report offers a comprehensive analysis of financial reporting, focusing on the context, purpose, and conceptual framework of financial statements. It examines the role of stakeholders, particularly in the context of TESCO, and highlights the importance of financial reporting for decision-making and strategic planning within the organization. The report delves into the main financial statements, including income statements, balance sheets, and cash flow statements, to interpret TESCO's financial performance. Furthermore, it compares International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS), discusses the degree of IFRS compliance, and outlines the benefits of IFRS implementation. The report concludes with an overview of the key findings and implications for TESCO's financial reporting practices.

Financial Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Q.1 Context and purpose of financial reporting..........................................................................1

Q2. Conceptual framework using in financial reporting.............................................................3

Q3: Identification of main stakeholders of TESCO and its benefits...........................................4

Q4: Interest of financial reporting in organisation .....................................................................5

Q5: Main financial statements....................................................................................................6

Q6: Interpretation of financial performance of TESCO.............................................................8

Q7: Comparison between IFRS and IAS..................................................................................10

Q9: Determine various degree of compliance...........................................................................11

Q8: Benefits of IFRS.................................................................................................................11

Q.9 Degree of compliance of with IFRS by organisation across the world ............................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

Q.1 Context and purpose of financial reporting..........................................................................1

Q2. Conceptual framework using in financial reporting.............................................................3

Q3: Identification of main stakeholders of TESCO and its benefits...........................................4

Q4: Interest of financial reporting in organisation .....................................................................5

Q5: Main financial statements....................................................................................................6

Q6: Interpretation of financial performance of TESCO.............................................................8

Q7: Comparison between IFRS and IAS..................................................................................10

Q9: Determine various degree of compliance...........................................................................11

Q8: Benefits of IFRS.................................................................................................................11

Q.9 Degree of compliance of with IFRS by organisation across the world ............................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Financial position of an organisation can only be determined by evaluating the financial

statements and reports. These reports are published in the end of the year when final accounts are

made and set off (Nobes, 2014). This report is framed to explain the meaning of financial

reporting and its important as decision making and strategic planning. Conceptual and regulatory

framework is defined with the purpose and principles. Effectiveness of qualitative characteristic

is evaluated subject to make financial information reliable. Importance of stakeholders are

defined in respect of defining financial information of company. Financial statements of TESCO

are interpreted to explain the importance of finance reporting. Meaning of IAS and IFRS with

difference are defined in this context. Degree of compliance with IFRS explained in this report

and benefits of IFRS also elaborated in financial reporting.

Q.1 Context and purpose of financial reporting

Purpose of financial reporting in TESCO

Financial reports of given organisation discloses present position information of a firm

which is of great importance for its different stakeholders and investors. Typical components of

financial reporting are financial statements, prospectus, quarterly and annual reports (Rajgopal

and Venkatachalam, 2011). Main objectives of this document is to provide information about

financial position and changes in the same of an enterprises. Purpose of preparing financial

reports in TESCO is explained below.

It has two purpose of itself. First is within the organisation and second is for outside the

organisation.

Financial report requirement within the organisation:-

Help in taking effective decision regarding companies objectives and overall strategies.

Maintaining financial health of the organisation. Good Financial health is necessary for referred

enterprise for survive in competitive market.

Financial reports of cited organisation include cash-flow, fund flow, balance sheet etc. which

help in easily knowing about the financial, operational activities and also shows the inflow

and outflow of funds (Rensburg and Botha, 2014).

It help TISCO in knowing their market position.

In organisation employs need this to discuss their ranking, promotion and compensation.

1

Financial position of an organisation can only be determined by evaluating the financial

statements and reports. These reports are published in the end of the year when final accounts are

made and set off (Nobes, 2014). This report is framed to explain the meaning of financial

reporting and its important as decision making and strategic planning. Conceptual and regulatory

framework is defined with the purpose and principles. Effectiveness of qualitative characteristic

is evaluated subject to make financial information reliable. Importance of stakeholders are

defined in respect of defining financial information of company. Financial statements of TESCO

are interpreted to explain the importance of finance reporting. Meaning of IAS and IFRS with

difference are defined in this context. Degree of compliance with IFRS explained in this report

and benefits of IFRS also elaborated in financial reporting.

Q.1 Context and purpose of financial reporting

Purpose of financial reporting in TESCO

Financial reports of given organisation discloses present position information of a firm

which is of great importance for its different stakeholders and investors. Typical components of

financial reporting are financial statements, prospectus, quarterly and annual reports (Rajgopal

and Venkatachalam, 2011). Main objectives of this document is to provide information about

financial position and changes in the same of an enterprises. Purpose of preparing financial

reports in TESCO is explained below.

It has two purpose of itself. First is within the organisation and second is for outside the

organisation.

Financial report requirement within the organisation:-

Help in taking effective decision regarding companies objectives and overall strategies.

Maintaining financial health of the organisation. Good Financial health is necessary for referred

enterprise for survive in competitive market.

Financial reports of cited organisation include cash-flow, fund flow, balance sheet etc. which

help in easily knowing about the financial, operational activities and also shows the inflow

and outflow of funds (Rensburg and Botha, 2014).

It help TISCO in knowing their market position.

In organisation employs need this to discuss their ranking, promotion and compensation.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Owner and manager also need this to take important decision that effect continuous operations.

It also shows income statements of TISCO which provides profit and loss, revenues, expenses of

a particular financial year.

Another use of same statement of the organisation is for stakeholders and investors that

are present outside.

Financial report requirement for outsider :-

It help investors in taking decision regarding investment. Report of TESCO is basically

used by different parties to take their investment decision.

Stakeholders make use of report to asses the assets and liabilities of enterprise

It provide information to stakeholders about financial health and activities related to

finance.

It includes balance sheet and it assist in identifying that from what all resources company

is raising its funds.

Helps in making money by providing financial reports to shareholders.

Importance and significance of financial reporting to TESCO:-

Financial transparency- It is very necessary for the company to know actual financial

position of company. Assets never having same value at the time of purchasing and selling.

Evaluate tax liability- Help in knowing the tax liabilities of given organisation to be

paid. Tax rate of this firm is high.

Mitigate errors- Accurate financial report are required to reduce costly errors. It help in

removing mistakes and errors.

Build trust- Accurate report build trust in the eyes of investors and stakeholders. They

only need a sign of accuracy to but their money in TESCO.

Improved payment cycles- In payment mode accounts payable, accounts receivable and

accurate financial report play a wide role.

Better decision making, planning and forecasting- Financial report is necessary when

decision in TESCO needs to be made. Planning and forecasting can be done after seeing the

assets and liabilities of the company.

Q2. Conceptual framework using in financial reporting

Every business organisation need to follow some guideline in order to get better

outcomes during the year. For this purpose, accounts managers used to analyse various financial

2

It also shows income statements of TISCO which provides profit and loss, revenues, expenses of

a particular financial year.

Another use of same statement of the organisation is for stakeholders and investors that

are present outside.

Financial report requirement for outsider :-

It help investors in taking decision regarding investment. Report of TESCO is basically

used by different parties to take their investment decision.

Stakeholders make use of report to asses the assets and liabilities of enterprise

It provide information to stakeholders about financial health and activities related to

finance.

It includes balance sheet and it assist in identifying that from what all resources company

is raising its funds.

Helps in making money by providing financial reports to shareholders.

Importance and significance of financial reporting to TESCO:-

Financial transparency- It is very necessary for the company to know actual financial

position of company. Assets never having same value at the time of purchasing and selling.

Evaluate tax liability- Help in knowing the tax liabilities of given organisation to be

paid. Tax rate of this firm is high.

Mitigate errors- Accurate financial report are required to reduce costly errors. It help in

removing mistakes and errors.

Build trust- Accurate report build trust in the eyes of investors and stakeholders. They

only need a sign of accuracy to but their money in TESCO.

Improved payment cycles- In payment mode accounts payable, accounts receivable and

accurate financial report play a wide role.

Better decision making, planning and forecasting- Financial report is necessary when

decision in TESCO needs to be made. Planning and forecasting can be done after seeing the

assets and liabilities of the company.

Q2. Conceptual framework using in financial reporting

Every business organisation need to follow some guideline in order to get better

outcomes during the year. For this purpose, accounts managers used to analyse various financial

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

statements of TESCO plc. It is done so to prepare perfect reporting framework in order to attain

the aims and pre-determine objectives. It is a set of positive concepts that every accountant need

to follow while recording financial transaction into the account books. It provide measurement,

presentation and disclosure of every material aspects those are appearing into the financial

statements of the company. The reporting framework is categorised into two parts. Such as:

Conceptual framework:

In financial reporting, this framework is a concept of accounting which is prepared by

standard setting body in accordance with practical issues those are proven objectively (Morris,

2011). It deals with various important financial reporting problems like purpose and users of

financial statements, its feature that make more useful. The basic component of statements are

assets, liabilities, equity and expenses.

Benefits

It is use to establish precise concept that assist discussion of financial problems.

It provide proper guidance to accounting standard at the time of reviewing financial rule and

regulation.

It help to ensure that accounting standards are properly implemented at internal level of an

organization.

The ethical format of organisation in accordance with reporting and standards are taken as most

valuable part under these framework.

Regulatory framework:

It is related with various rules and regulation that are made by an government in order to

report various financial transactions. Every entries need to be recorded according the set pattern

mention under the policies. It consists of certain theories and issues those are used in financial

reporting. It is most effective and systematic format that are used during preparation of reports.

It helps to develop and enhance IFRS and utilise effective measure to promote accounting facts

and standard in more systematic manner (IFRS. 2018). It is used to separate assets, liabilities,

profit and losses and other useful information at the time recording reporting. All the mention

standard and policies are consider under regulatory and conceptual framework those are related

to maintenance of the organisation performances. It is crucial for every stakeholder for multiple

purpose and decision-making.

3

the aims and pre-determine objectives. It is a set of positive concepts that every accountant need

to follow while recording financial transaction into the account books. It provide measurement,

presentation and disclosure of every material aspects those are appearing into the financial

statements of the company. The reporting framework is categorised into two parts. Such as:

Conceptual framework:

In financial reporting, this framework is a concept of accounting which is prepared by

standard setting body in accordance with practical issues those are proven objectively (Morris,

2011). It deals with various important financial reporting problems like purpose and users of

financial statements, its feature that make more useful. The basic component of statements are

assets, liabilities, equity and expenses.

Benefits

It is use to establish precise concept that assist discussion of financial problems.

It provide proper guidance to accounting standard at the time of reviewing financial rule and

regulation.

It help to ensure that accounting standards are properly implemented at internal level of an

organization.

The ethical format of organisation in accordance with reporting and standards are taken as most

valuable part under these framework.

Regulatory framework:

It is related with various rules and regulation that are made by an government in order to

report various financial transactions. Every entries need to be recorded according the set pattern

mention under the policies. It consists of certain theories and issues those are used in financial

reporting. It is most effective and systematic format that are used during preparation of reports.

It helps to develop and enhance IFRS and utilise effective measure to promote accounting facts

and standard in more systematic manner (IFRS. 2018). It is used to separate assets, liabilities,

profit and losses and other useful information at the time recording reporting. All the mention

standard and policies are consider under regulatory and conceptual framework those are related

to maintenance of the organisation performances. It is crucial for every stakeholder for multiple

purpose and decision-making.

3

Q3: Identification of main stakeholders of TESCO and its benefits

Stakeholders are considered as person, parties, bodies and authorities which retain a

specific interest in company. They affect the organisation's actions, aims and objectives, policies

and regulations (Maffett, 2012). Creditors, debtors, stockholders, shareholders, directors,

employees, government, owners, agencies, suppliers, unions, specific communities are the key

stakeholders. All are important at their stage and plays crucial role to accelerate and boost the

level of organisation to next level. Criteria of stakeholders remain differ as per the structure and

nature of an organisation. Customers of company also plays a roles of stakeholder keep aligned

with trading practices but their consideration and contribution remain limited.

Importance of stockholder

these are the individual person who are found outside the organisation. They work as

critics and keep specific share in company's growth, profitability and market share. In large scale

of organisations it become difficult to analyse the customer interest and involvement.

Stakeholders help to get all required sources and information related to customers, information of

latest trend and interest, technology and advancements. All these informations are useful to

managers. They help the company to moving out the operations and activities subject to mission

and vision statement of company.

Maintain long term relation: stakeholders are important for instrumental and

performance based reasons. If the stakeholders remain the part of company for long term period

then it helps the organisation to achieve the competence and sustainability. Stakeholders of

TESCO help the company in providing the informations related the retail products as food and

beverages, grocery products and daily consumables.

Feedbacks and suggestions: They provide required suggestions and advise subject to

smooth formations and operation. TESCO deals in retail products and customer feedbacks and

suggestion are the essential factors which are heard and implemented to improve the quality of

products. They are the part of continuous process of delivering the products and services to end

customers. Review and suggestion of old stakeholders are considered firstly because they

understand the basic structure and nature of organisation. Their suggestions and feedbacks are

also help in making decisions.

4

Stakeholders are considered as person, parties, bodies and authorities which retain a

specific interest in company. They affect the organisation's actions, aims and objectives, policies

and regulations (Maffett, 2012). Creditors, debtors, stockholders, shareholders, directors,

employees, government, owners, agencies, suppliers, unions, specific communities are the key

stakeholders. All are important at their stage and plays crucial role to accelerate and boost the

level of organisation to next level. Criteria of stakeholders remain differ as per the structure and

nature of an organisation. Customers of company also plays a roles of stakeholder keep aligned

with trading practices but their consideration and contribution remain limited.

Importance of stockholder

these are the individual person who are found outside the organisation. They work as

critics and keep specific share in company's growth, profitability and market share. In large scale

of organisations it become difficult to analyse the customer interest and involvement.

Stakeholders help to get all required sources and information related to customers, information of

latest trend and interest, technology and advancements. All these informations are useful to

managers. They help the company to moving out the operations and activities subject to mission

and vision statement of company.

Maintain long term relation: stakeholders are important for instrumental and

performance based reasons. If the stakeholders remain the part of company for long term period

then it helps the organisation to achieve the competence and sustainability. Stakeholders of

TESCO help the company in providing the informations related the retail products as food and

beverages, grocery products and daily consumables.

Feedbacks and suggestions: They provide required suggestions and advise subject to

smooth formations and operation. TESCO deals in retail products and customer feedbacks and

suggestion are the essential factors which are heard and implemented to improve the quality of

products. They are the part of continuous process of delivering the products and services to end

customers. Review and suggestion of old stakeholders are considered firstly because they

understand the basic structure and nature of organisation. Their suggestions and feedbacks are

also help in making decisions.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Q4: Interest of financial reporting in organisation

For every organisation whether small or large, it is necessary to record there financial

transaction in systematic manner (Mackenzie and et. al., 2012). By this purpose, accounts

managers uses various system and techniques that are capable enough in recording the entries.

According to management view point it is considered as more valuable aspects. Because, by the

help this they can make necessary planning and decision for the upcoming projects. The benefits

of financial reporting cannot be over emphasized. It play an effective role to make business

plans, decision-making process and selecting proper utilisation of resources for the purpose of

organisational sustainability. It consists of cash-flows, financial statement and other crucial

reporting those are useful for the purpose of decision-making.

The entire statements are summarise in an individual format to make an effective reports.

Like for example, the financial statement of TESCO plc indicate overall performance of total

turnover and productivity they are generating to the company. The two of the most crucial

statement can help the managers to analyse valuable impacts over the performance of TESCO.

By the help of these analyses the current position and investment structure can be identify by an

organisation. Managers can utilise the resources in best possible manner to determine strength

and weaknesses of company in order to repay there short-term and long term obligations. After

summarising all those information into a single format then transfer to accountant and auditor to

make essential solution and investment proposal. This will be more helpful in order to support

crucial decision-making. The three statements those are considered for analysis are:

Income statements: It is one of the primary tools of company's financial statement that

will help them to analyse performance over a particular period of time. It consists of detail

summary of how well an operations of TESCO plc is regulating there total revenue and expenses

those are generated from operating activities.

Balance sheet: It is known as the most vital statement which can be utilise by the

investors to take financial decision for the upcoming time. It will be helpful to analyse the total

capability of the firm to pay there short-term or long term debts.

Cash-flows: It related with the total cash inflows and outflow that are collected from

various activities such as investing, operating and financing. It is more suitable for making

proper reporting by evaluating total cash generating ability of the firm.

5

For every organisation whether small or large, it is necessary to record there financial

transaction in systematic manner (Mackenzie and et. al., 2012). By this purpose, accounts

managers uses various system and techniques that are capable enough in recording the entries.

According to management view point it is considered as more valuable aspects. Because, by the

help this they can make necessary planning and decision for the upcoming projects. The benefits

of financial reporting cannot be over emphasized. It play an effective role to make business

plans, decision-making process and selecting proper utilisation of resources for the purpose of

organisational sustainability. It consists of cash-flows, financial statement and other crucial

reporting those are useful for the purpose of decision-making.

The entire statements are summarise in an individual format to make an effective reports.

Like for example, the financial statement of TESCO plc indicate overall performance of total

turnover and productivity they are generating to the company. The two of the most crucial

statement can help the managers to analyse valuable impacts over the performance of TESCO.

By the help of these analyses the current position and investment structure can be identify by an

organisation. Managers can utilise the resources in best possible manner to determine strength

and weaknesses of company in order to repay there short-term and long term obligations. After

summarising all those information into a single format then transfer to accountant and auditor to

make essential solution and investment proposal. This will be more helpful in order to support

crucial decision-making. The three statements those are considered for analysis are:

Income statements: It is one of the primary tools of company's financial statement that

will help them to analyse performance over a particular period of time. It consists of detail

summary of how well an operations of TESCO plc is regulating there total revenue and expenses

those are generated from operating activities.

Balance sheet: It is known as the most vital statement which can be utilise by the

investors to take financial decision for the upcoming time. It will be helpful to analyse the total

capability of the firm to pay there short-term or long term debts.

Cash-flows: It related with the total cash inflows and outflow that are collected from

various activities such as investing, operating and financing. It is more suitable for making

proper reporting by evaluating total cash generating ability of the firm.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

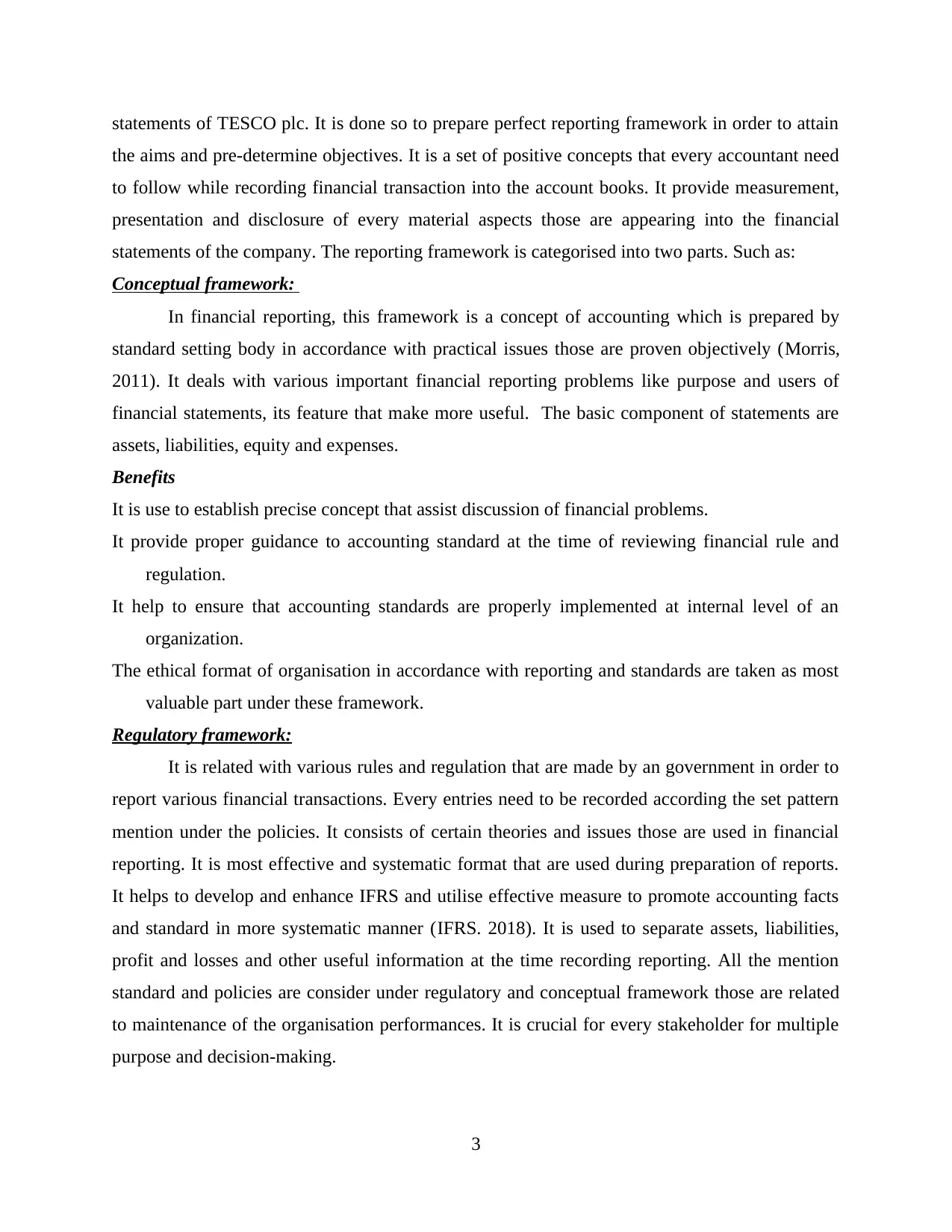

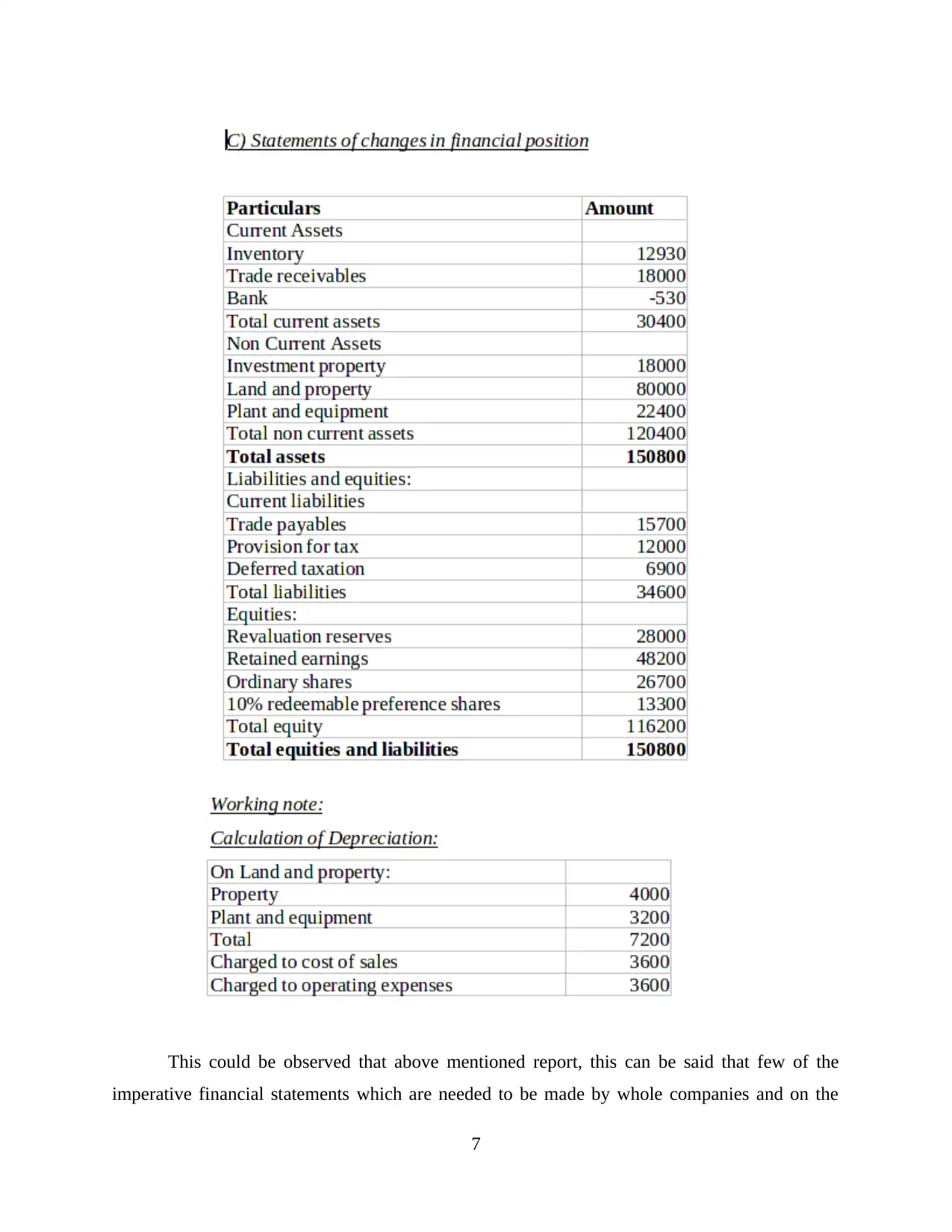

Q5: Main financial statements

a) Income statements

6

a) Income statements

6

This could be observed that above mentioned report, this can be said that few of the

imperative financial statements which are needed to be made by whole companies and on the

7

imperative financial statements which are needed to be made by whole companies and on the

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

basis of them diverse decisions are needed to framed by whole companies and on the basis of

them diverse decisions are to be framed in order to prosperity can be achieved. Apart from that,

cash flow statement is likewise required so that the help of which cash position of the firm is

determined. Whole transactions which are related to the cash are covered under this and they are

segregated into three parts. Which covers operating, financing and investing related activity. In

the rendered case, entire amounts which are required to covered in statements comprises of sales,

rent that are extracted from income statement and bank amount from the statement of financial

position. They would represent the amount which is applied by the organisation in the present

period. By taking help of financial position of a firm which is analysed and this is determined

that whether resources are being allocated in an adequate manner.

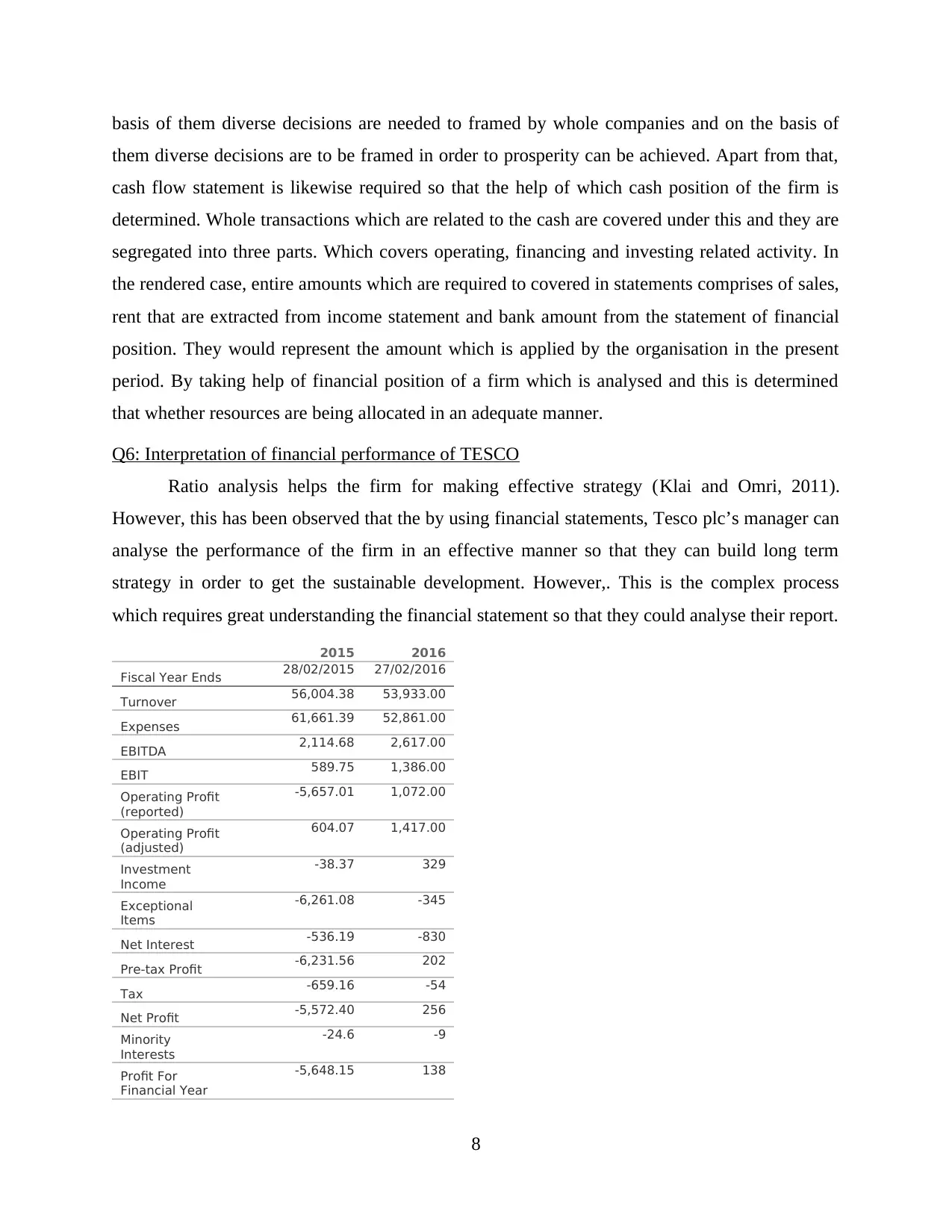

Q6: Interpretation of financial performance of TESCO

Ratio analysis helps the firm for making effective strategy (Klai and Omri, 2011).

However, this has been observed that the by using financial statements, Tesco plc’s manager can

analyse the performance of the firm in an effective manner so that they can build long term

strategy in order to get the sustainable development. However,. This is the complex process

which requires great understanding the financial statement so that they could analyse their report.

2015 2016

Fiscal Year Ends 28/02/2015 27/02/2016

Turnover 56,004.38 53,933.00

Expenses 61,661.39 52,861.00

EBITDA 2,114.68 2,617.00

EBIT 589.75 1,386.00

Operating Profit

(reported)

-5,657.01 1,072.00

Operating Profit

(adjusted)

604.07 1,417.00

Investment

Income

-38.37 329

Exceptional

Items

-6,261.08 -345

Net Interest -536.19 -830

Pre-tax Profit -6,231.56 202

Tax -659.16 -54

Net Profit -5,572.40 256

Minority

Interests

-24.6 -9

Profit For

Financial Year

-5,648.15 138

8

them diverse decisions are to be framed in order to prosperity can be achieved. Apart from that,

cash flow statement is likewise required so that the help of which cash position of the firm is

determined. Whole transactions which are related to the cash are covered under this and they are

segregated into three parts. Which covers operating, financing and investing related activity. In

the rendered case, entire amounts which are required to covered in statements comprises of sales,

rent that are extracted from income statement and bank amount from the statement of financial

position. They would represent the amount which is applied by the organisation in the present

period. By taking help of financial position of a firm which is analysed and this is determined

that whether resources are being allocated in an adequate manner.

Q6: Interpretation of financial performance of TESCO

Ratio analysis helps the firm for making effective strategy (Klai and Omri, 2011).

However, this has been observed that the by using financial statements, Tesco plc’s manager can

analyse the performance of the firm in an effective manner so that they can build long term

strategy in order to get the sustainable development. However,. This is the complex process

which requires great understanding the financial statement so that they could analyse their report.

2015 2016

Fiscal Year Ends 28/02/2015 27/02/2016

Turnover 56,004.38 53,933.00

Expenses 61,661.39 52,861.00

EBITDA 2,114.68 2,617.00

EBIT 589.75 1,386.00

Operating Profit

(reported)

-5,657.01 1,072.00

Operating Profit

(adjusted)

604.07 1,417.00

Investment

Income

-38.37 329

Exceptional

Items

-6,261.08 -345

Net Interest -536.19 -830

Pre-tax Profit -6,231.56 202

Tax -659.16 -54

Net Profit -5,572.40 256

Minority

Interests

-24.6 -9

Profit For

Financial Year

-5,648.15 138

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

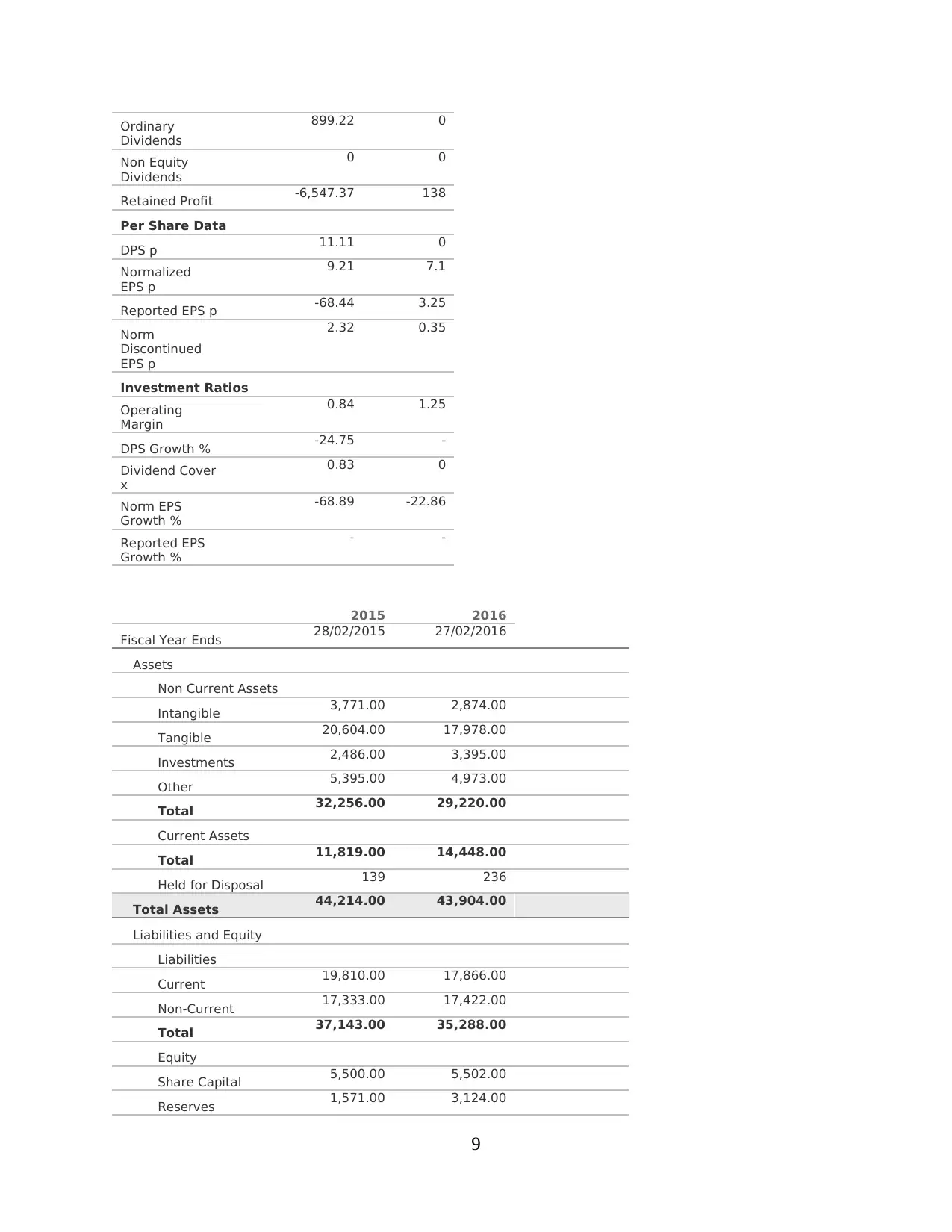

Ordinary

Dividends

899.22 0

Non Equity

Dividends

0 0

Retained Profit -6,547.37 138

Per Share Data

DPS p 11.11 0

Normalized

EPS p

9.21 7.1

Reported EPS p -68.44 3.25

Norm

Discontinued

EPS p

2.32 0.35

Investment Ratios

Operating

Margin

0.84 1.25

DPS Growth % -24.75 -

Dividend Cover

x

0.83 0

Norm EPS

Growth %

-68.89 -22.86

Reported EPS

Growth %

- -

2015 2016

Fiscal Year Ends 28/02/2015 27/02/2016

Assets

Non Current Assets

Intangible 3,771.00 2,874.00

Tangible 20,604.00 17,978.00

Investments 2,486.00 3,395.00

Other 5,395.00 4,973.00

Total 32,256.00 29,220.00

Current Assets

Total 11,819.00 14,448.00

Held for Disposal 139 236

Total Assets 44,214.00 43,904.00

Liabilities and Equity

Liabilities

Current 19,810.00 17,866.00

Non-Current 17,333.00 17,422.00

Total 37,143.00 35,288.00

Equity

Share Capital 5,500.00 5,502.00

Reserves 1,571.00 3,124.00

9

Dividends

899.22 0

Non Equity

Dividends

0 0

Retained Profit -6,547.37 138

Per Share Data

DPS p 11.11 0

Normalized

EPS p

9.21 7.1

Reported EPS p -68.44 3.25

Norm

Discontinued

EPS p

2.32 0.35

Investment Ratios

Operating

Margin

0.84 1.25

DPS Growth % -24.75 -

Dividend Cover

x

0.83 0

Norm EPS

Growth %

-68.89 -22.86

Reported EPS

Growth %

- -

2015 2016

Fiscal Year Ends 28/02/2015 27/02/2016

Assets

Non Current Assets

Intangible 3,771.00 2,874.00

Tangible 20,604.00 17,978.00

Investments 2,486.00 3,395.00

Other 5,395.00 4,973.00

Total 32,256.00 29,220.00

Current Assets

Total 11,819.00 14,448.00

Held for Disposal 139 236

Total Assets 44,214.00 43,904.00

Liabilities and Equity

Liabilities

Current 19,810.00 17,866.00

Non-Current 17,333.00 17,422.00

Total 37,143.00 35,288.00

Equity

Share Capital 5,500.00 5,502.00

Reserves 1,571.00 3,124.00

9

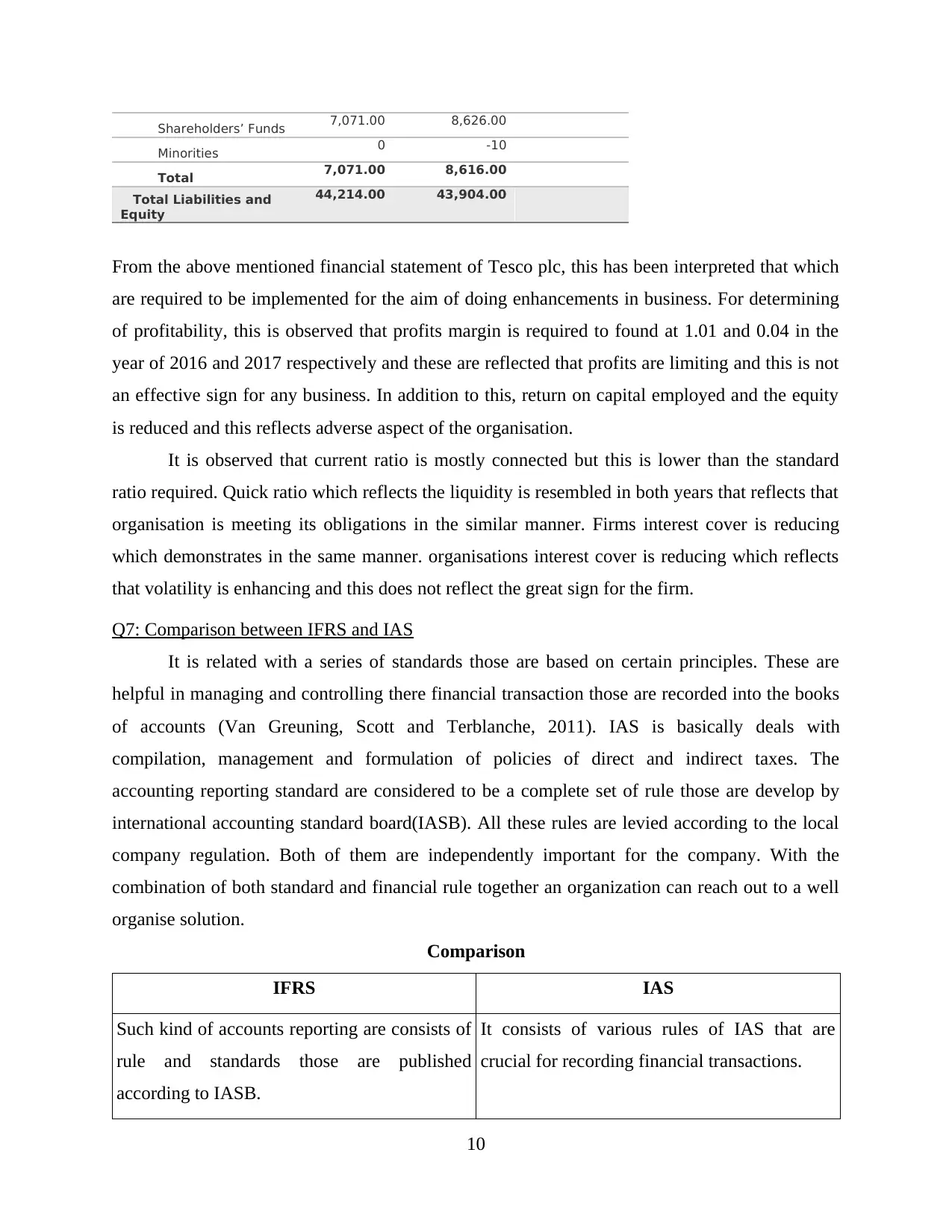

Shareholders’ Funds 7,071.00 8,626.00

Minorities 0 -10

Total 7,071.00 8,616.00

Total Liabilities and

Equity

44,214.00 43,904.00

From the above mentioned financial statement of Tesco plc, this has been interpreted that which

are required to be implemented for the aim of doing enhancements in business. For determining

of profitability, this is observed that profits margin is required to found at 1.01 and 0.04 in the

year of 2016 and 2017 respectively and these are reflected that profits are limiting and this is not

an effective sign for any business. In addition to this, return on capital employed and the equity

is reduced and this reflects adverse aspect of the organisation.

It is observed that current ratio is mostly connected but this is lower than the standard

ratio required. Quick ratio which reflects the liquidity is resembled in both years that reflects that

organisation is meeting its obligations in the similar manner. Firms interest cover is reducing

which demonstrates in the same manner. organisations interest cover is reducing which reflects

that volatility is enhancing and this does not reflect the great sign for the firm.

Q7: Comparison between IFRS and IAS

It is related with a series of standards those are based on certain principles. These are

helpful in managing and controlling there financial transaction those are recorded into the books

of accounts (Van Greuning, Scott and Terblanche, 2011). IAS is basically deals with

compilation, management and formulation of policies of direct and indirect taxes. The

accounting reporting standard are considered to be a complete set of rule those are develop by

international accounting standard board(IASB). All these rules are levied according to the local

company regulation. Both of them are independently important for the company. With the

combination of both standard and financial rule together an organization can reach out to a well

organise solution.

Comparison

IFRS IAS

Such kind of accounts reporting are consists of

rule and standards those are published

according to IASB.

It consists of various rules of IAS that are

crucial for recording financial transactions.

10

Minorities 0 -10

Total 7,071.00 8,616.00

Total Liabilities and

Equity

44,214.00 43,904.00

From the above mentioned financial statement of Tesco plc, this has been interpreted that which

are required to be implemented for the aim of doing enhancements in business. For determining

of profitability, this is observed that profits margin is required to found at 1.01 and 0.04 in the

year of 2016 and 2017 respectively and these are reflected that profits are limiting and this is not

an effective sign for any business. In addition to this, return on capital employed and the equity

is reduced and this reflects adverse aspect of the organisation.

It is observed that current ratio is mostly connected but this is lower than the standard

ratio required. Quick ratio which reflects the liquidity is resembled in both years that reflects that

organisation is meeting its obligations in the similar manner. Firms interest cover is reducing

which demonstrates in the same manner. organisations interest cover is reducing which reflects

that volatility is enhancing and this does not reflect the great sign for the firm.

Q7: Comparison between IFRS and IAS

It is related with a series of standards those are based on certain principles. These are

helpful in managing and controlling there financial transaction those are recorded into the books

of accounts (Van Greuning, Scott and Terblanche, 2011). IAS is basically deals with

compilation, management and formulation of policies of direct and indirect taxes. The

accounting reporting standard are considered to be a complete set of rule those are develop by

international accounting standard board(IASB). All these rules are levied according to the local

company regulation. Both of them are independently important for the company. With the

combination of both standard and financial rule together an organization can reach out to a well

organise solution.

Comparison

IFRS IAS

Such kind of accounts reporting are consists of

rule and standards those are published

according to IASB.

It consists of various rules of IAS that are

crucial for recording financial transactions.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.