MA611 Auditing: Financial Statement Analysis of Blackmores Limited

VerifiedAdded on 2023/06/04

|14

|3515

|120

Report

AI Summary

This report provides an in-depth financial reporting analysis of Blackmores Limited, focusing on the application of auditing principles and processes. It examines analytical procedures, including simple comparisons and ratio analysis (profitability, liquidity, financial leverage, efficiency, and market value), to assess the company's financial performance over three years. The report identifies inherent risks at the financial reporting level, considering factors such as management integrity, director experience, unusual pressures, the nature of Blackmores' business, and industry influences. It also addresses the risk of material misstatement at the assertion level, providing insights into account balances, validity of risks, substantive audit procedures, and internal controls. The analysis reveals fluctuations in profitability and efficiency ratios, coupled with a dependency on long-term borrowings, which could negatively impact audit assessments. The report concludes by highlighting key considerations for auditors based on the financial analysis and risk assessments, with the complete assignment available on Desklib, where students can find a wealth of solved assignments and study resources.

Running head: FINANCIAL REPORTING

Financial Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCIAL REPORTING

Executive Summary

The study shows understanding of different types of principles, practices and processes relating to

auditing of practical situations. The important discourse of the study has identified the results of

analytical procedures for Blackmore’s limited. In addition to this, some of the other discussions have

included the risk of material misstatement or the different types of inherent risk present at financial

reporting level for Blackmore’s limited. This section of the study has discussed about the inherent risk

with five factors namely integrity of management, unusual pressure, experience of management,

business entities nature and factors influencing the industry in which the entity operates. The overall

assertions pertaining to the study shows that fluctuation in the balances of total assets and total

liabilities will have a negative repercussion on audit assessment. Furthermore, wide range of

fluctuations in terms of profitability ratios, liquidity ratios, financial leverage ratio, efficiency ratio and

market value ratio will bear a reduced reliance on audit planning and decision-making capability. The

significant present for the directors is recognized with the company struggling to maintain a positive

NPAT growth percentage. This is a mandatory requirement and comes prior to addition of STI to the

senior executives. It is also discerned hedging pertaining to foreign exchange risk are addressed in terms

of cash flow hedges. The initiation of this relationship pertaining to the documents of the entities are

seen to be maintained by following an appropriate ongoing derivative which are highly effective for

offsetting the changes pertaining to fair values and cash flows from the hedged items.

FINANCIAL REPORTING

Executive Summary

The study shows understanding of different types of principles, practices and processes relating to

auditing of practical situations. The important discourse of the study has identified the results of

analytical procedures for Blackmore’s limited. In addition to this, some of the other discussions have

included the risk of material misstatement or the different types of inherent risk present at financial

reporting level for Blackmore’s limited. This section of the study has discussed about the inherent risk

with five factors namely integrity of management, unusual pressure, experience of management,

business entities nature and factors influencing the industry in which the entity operates. The overall

assertions pertaining to the study shows that fluctuation in the balances of total assets and total

liabilities will have a negative repercussion on audit assessment. Furthermore, wide range of

fluctuations in terms of profitability ratios, liquidity ratios, financial leverage ratio, efficiency ratio and

market value ratio will bear a reduced reliance on audit planning and decision-making capability. The

significant present for the directors is recognized with the company struggling to maintain a positive

NPAT growth percentage. This is a mandatory requirement and comes prior to addition of STI to the

senior executives. It is also discerned hedging pertaining to foreign exchange risk are addressed in terms

of cash flow hedges. The initiation of this relationship pertaining to the documents of the entities are

seen to be maintained by following an appropriate ongoing derivative which are highly effective for

offsetting the changes pertaining to fair values and cash flows from the hedged items.

2

FINANCIAL REPORTING

Table of Contents

Introduction.................................................................................................................................................3

1. Observations by implementation of analytical procedures.....................................................................3

Simple Comparison.................................................................................................................................3

Ratio Analysis..........................................................................................................................................3

2. Concerns of inherent risk at financial reporting level..............................................................................8

a) Integrity of management....................................................................................................................8

b) Director experience, changes and knowledge....................................................................................8

c) Unusual pressure on directors.............................................................................................................8

d) Nature of Blackmore’s business..........................................................................................................8

e) Factors influencing the Australian health supplements industry........................................................9

3. Risk of Material Misstatement (Inherent Risk) at the Assertion Level.....................................................9

Conclusion.................................................................................................................................................12

References.................................................................................................................................................13

FINANCIAL REPORTING

Table of Contents

Introduction.................................................................................................................................................3

1. Observations by implementation of analytical procedures.....................................................................3

Simple Comparison.................................................................................................................................3

Ratio Analysis..........................................................................................................................................3

2. Concerns of inherent risk at financial reporting level..............................................................................8

a) Integrity of management....................................................................................................................8

b) Director experience, changes and knowledge....................................................................................8

c) Unusual pressure on directors.............................................................................................................8

d) Nature of Blackmore’s business..........................................................................................................8

e) Factors influencing the Australian health supplements industry........................................................9

3. Risk of Material Misstatement (Inherent Risk) at the Assertion Level.....................................................9

Conclusion.................................................................................................................................................12

References.................................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCIAL REPORTING

Introduction

The study is segregated into three section. The first excerpt aims to apply different types of

analytical procedures implemented by Blackmores Limited using ratio analysis for the last three years by

using annual report published in 2018, 2016 and 2017 respectively. The overall depictions are stated

how the analytical assessment will influence decisions pertaining to audit plan for the latest financial

year. The second part of the study has identified the risk of material misstatement or the different types

of inherent risk present at financial reporting level for Blackmore’s limited. This section of the study has

discussed about the inherent risk with five factors namely integrity of management, unusual pressure,

experience of management, business entities nature and factors influencing the industry in which the

entity operates. The latter part of the study has shown a significant risk pertaining to material

misstatement. This portion of the study has been further identified with the reasons why the account

balance of the companies is at significant risk for material misstatement, he assertions for non-validity of

risks, substantive audit procedure and application of practical internal control to mitigate such risks

(Louwers et al., 2015).

1. Observations by implementation of analytical procedures

Simple Comparison

Based on the assertions of balances pertaining to total assets and total liabilities in the last three

years it can be observed that Blackmore’s limited have shown a linear growth in terms of total assets.

However, there is also a subsequent increase in the total liabilities of the company. Henceforth this

fluctuation in the balances will have a negative repercussion on audit assessment (Chen, Srinidhi & Su,

2014).

Ratio Analysis

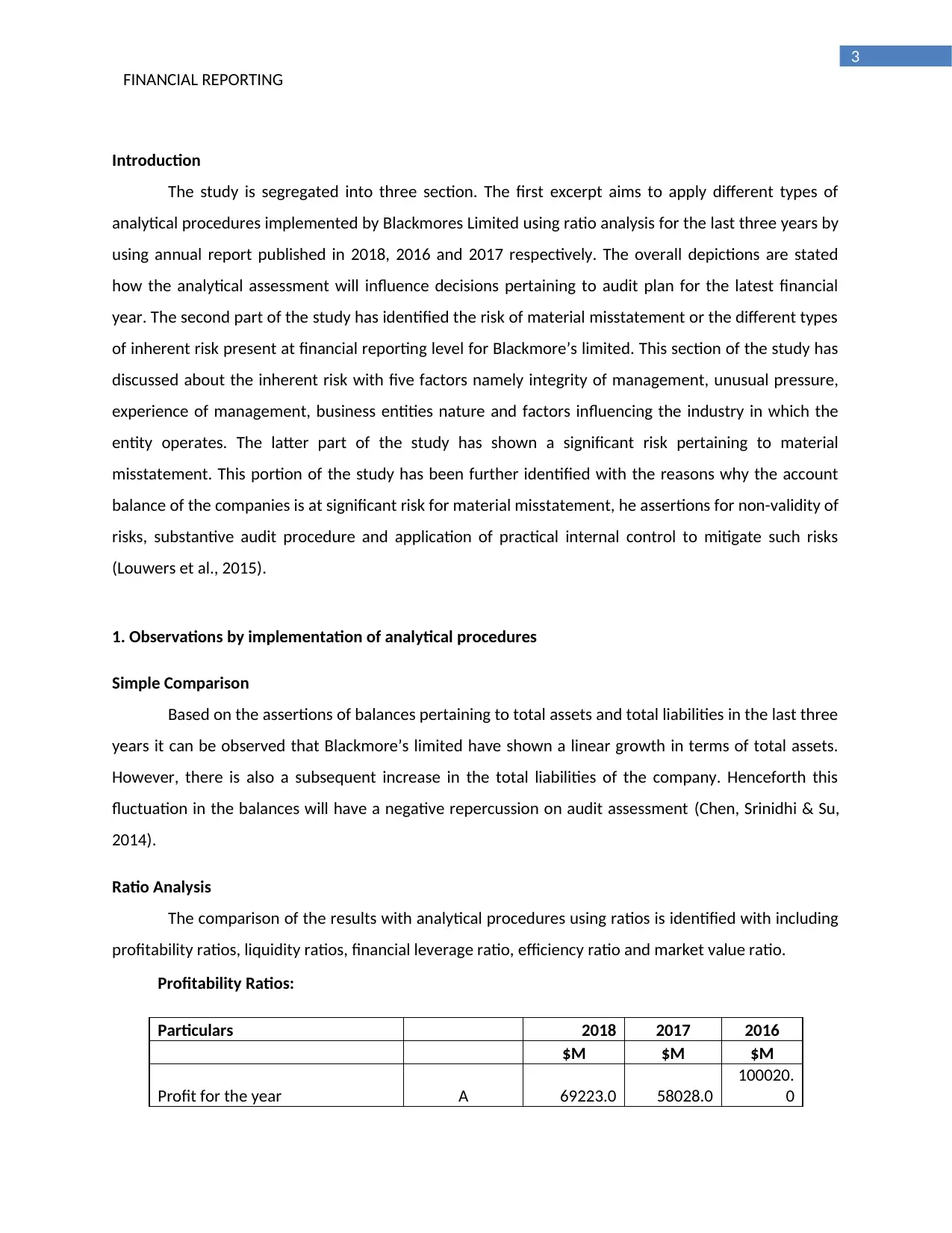

The comparison of the results with analytical procedures using ratios is identified with including

profitability ratios, liquidity ratios, financial leverage ratio, efficiency ratio and market value ratio.

Profitability Ratios:

Particulars 2018 2017 2016

$M $M $M

Profit for the year A 69223.0 58028.0

100020.

0

FINANCIAL REPORTING

Introduction

The study is segregated into three section. The first excerpt aims to apply different types of

analytical procedures implemented by Blackmores Limited using ratio analysis for the last three years by

using annual report published in 2018, 2016 and 2017 respectively. The overall depictions are stated

how the analytical assessment will influence decisions pertaining to audit plan for the latest financial

year. The second part of the study has identified the risk of material misstatement or the different types

of inherent risk present at financial reporting level for Blackmore’s limited. This section of the study has

discussed about the inherent risk with five factors namely integrity of management, unusual pressure,

experience of management, business entities nature and factors influencing the industry in which the

entity operates. The latter part of the study has shown a significant risk pertaining to material

misstatement. This portion of the study has been further identified with the reasons why the account

balance of the companies is at significant risk for material misstatement, he assertions for non-validity of

risks, substantive audit procedure and application of practical internal control to mitigate such risks

(Louwers et al., 2015).

1. Observations by implementation of analytical procedures

Simple Comparison

Based on the assertions of balances pertaining to total assets and total liabilities in the last three

years it can be observed that Blackmore’s limited have shown a linear growth in terms of total assets.

However, there is also a subsequent increase in the total liabilities of the company. Henceforth this

fluctuation in the balances will have a negative repercussion on audit assessment (Chen, Srinidhi & Su,

2014).

Ratio Analysis

The comparison of the results with analytical procedures using ratios is identified with including

profitability ratios, liquidity ratios, financial leverage ratio, efficiency ratio and market value ratio.

Profitability Ratios:

Particulars 2018 2017 2016

$M $M $M

Profit for the year A 69223.0 58028.0

100020.

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCIAL REPORTING

Revenue B 601136.0 552160.0

559526.

0

Total Assets C 464850.0 412174.0 443362

Total Equity D 193330.0 178819.0 180593

Net Profit Margin E= A/B 11.52% 10.51% 17.88%

Return on Equity (ROE) F=A/D 35.81% 32.45% 55.38%

Return on Assets G=A/C 14.89% 14.08% 22.56%

E= A/B F=A/D G=A/C

Net Profit Margin Return on Equity (ROE) Return on Assets

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

11.52%

35.81%

14.89%

10.51%

32.45%

14.08%

17.88%

55.38%

22.56%

Profitability Ratios

2018 $M 2017 $M 2016 $M

The assertions made as per the profitability ratio shows that the overall trend of profit made by

the company is fluctuating in nature over the last three years. Therefore, wide range of fluctuations in

the profitability will lead to significantly decreased reliance on audit planning and decision-making

capability (Zamboni & Litschig, 2018).

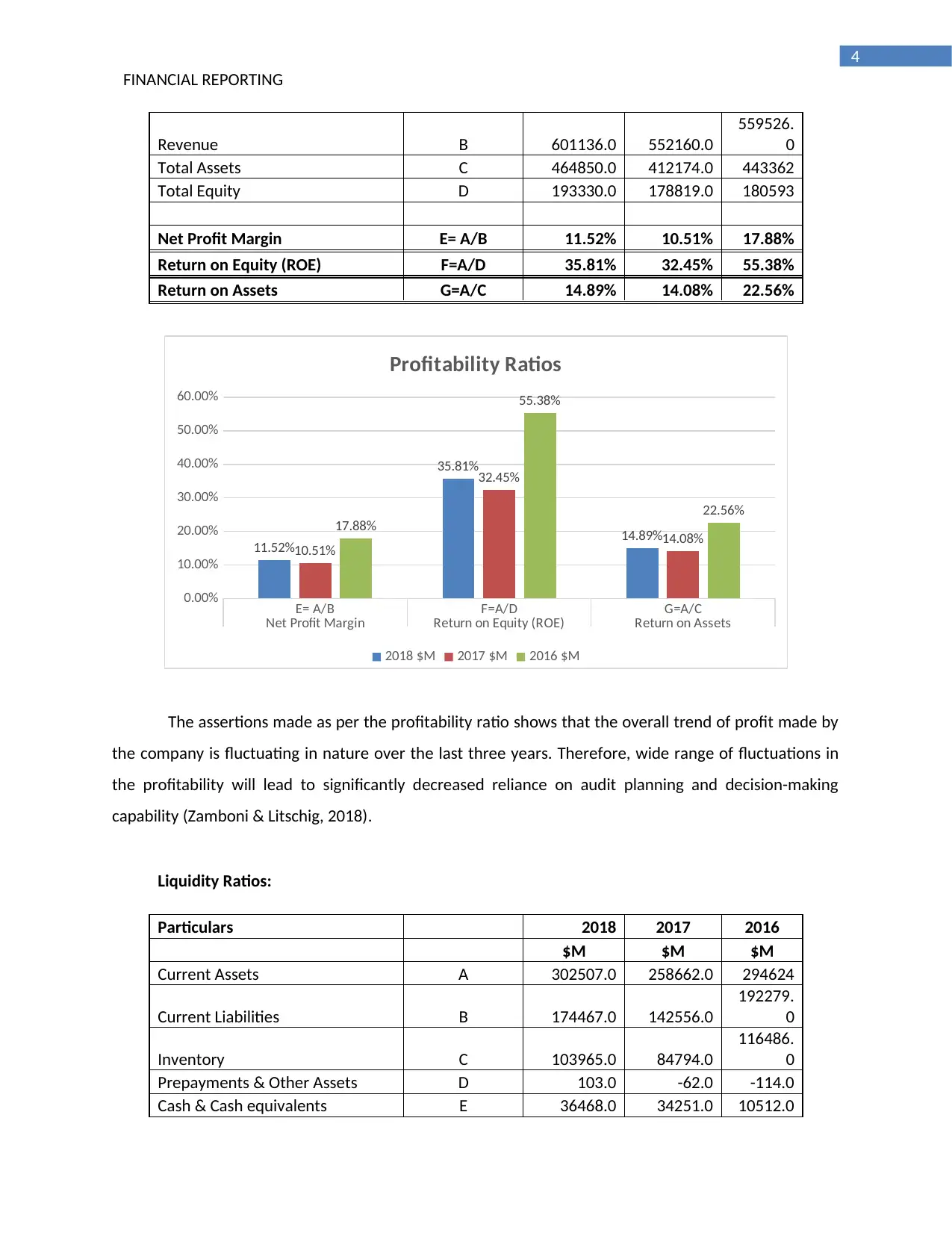

Liquidity Ratios:

Particulars 2018 2017 2016

$M $M $M

Current Assets A 302507.0 258662.0 294624

Current Liabilities B 174467.0 142556.0

192279.

0

Inventory C 103965.0 84794.0

116486.

0

Prepayments & Other Assets D 103.0 -62.0 -114.0

Cash & Cash equivalents E 36468.0 34251.0 10512.0

FINANCIAL REPORTING

Revenue B 601136.0 552160.0

559526.

0

Total Assets C 464850.0 412174.0 443362

Total Equity D 193330.0 178819.0 180593

Net Profit Margin E= A/B 11.52% 10.51% 17.88%

Return on Equity (ROE) F=A/D 35.81% 32.45% 55.38%

Return on Assets G=A/C 14.89% 14.08% 22.56%

E= A/B F=A/D G=A/C

Net Profit Margin Return on Equity (ROE) Return on Assets

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

11.52%

35.81%

14.89%

10.51%

32.45%

14.08%

17.88%

55.38%

22.56%

Profitability Ratios

2018 $M 2017 $M 2016 $M

The assertions made as per the profitability ratio shows that the overall trend of profit made by

the company is fluctuating in nature over the last three years. Therefore, wide range of fluctuations in

the profitability will lead to significantly decreased reliance on audit planning and decision-making

capability (Zamboni & Litschig, 2018).

Liquidity Ratios:

Particulars 2018 2017 2016

$M $M $M

Current Assets A 302507.0 258662.0 294624

Current Liabilities B 174467.0 142556.0

192279.

0

Inventory C 103965.0 84794.0

116486.

0

Prepayments & Other Assets D 103.0 -62.0 -114.0

Cash & Cash equivalents E 36468.0 34251.0 10512.0

5

FINANCIAL REPORTING

Current Ratio F=A/B 1.73 1.81 1.53

Quick Ratio G=(A-C-D)/B 1.14 1.22 0.93

Cash Ratio H=E/B 0.21 0.24 0.05

F=A/B G=(A-C-D)/B H=E/B

Current Ratio Quick Ratio Cash Ratio

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

1.73

1.14

0.21

1.81

1.22

0.24

1.53

0.93

0.05

Liquidity Ratios

2018 $M 2017 $M 2016 $M

The important depictions as per the liquidity ratio is depicted with an increasing trend among

Cash ratio, quick ratio and current ratio. Therefore, it is evident that Blackmore’s limited is consistent in

increasing its cash for operating activities. This will have a positive impact on audit assertions.

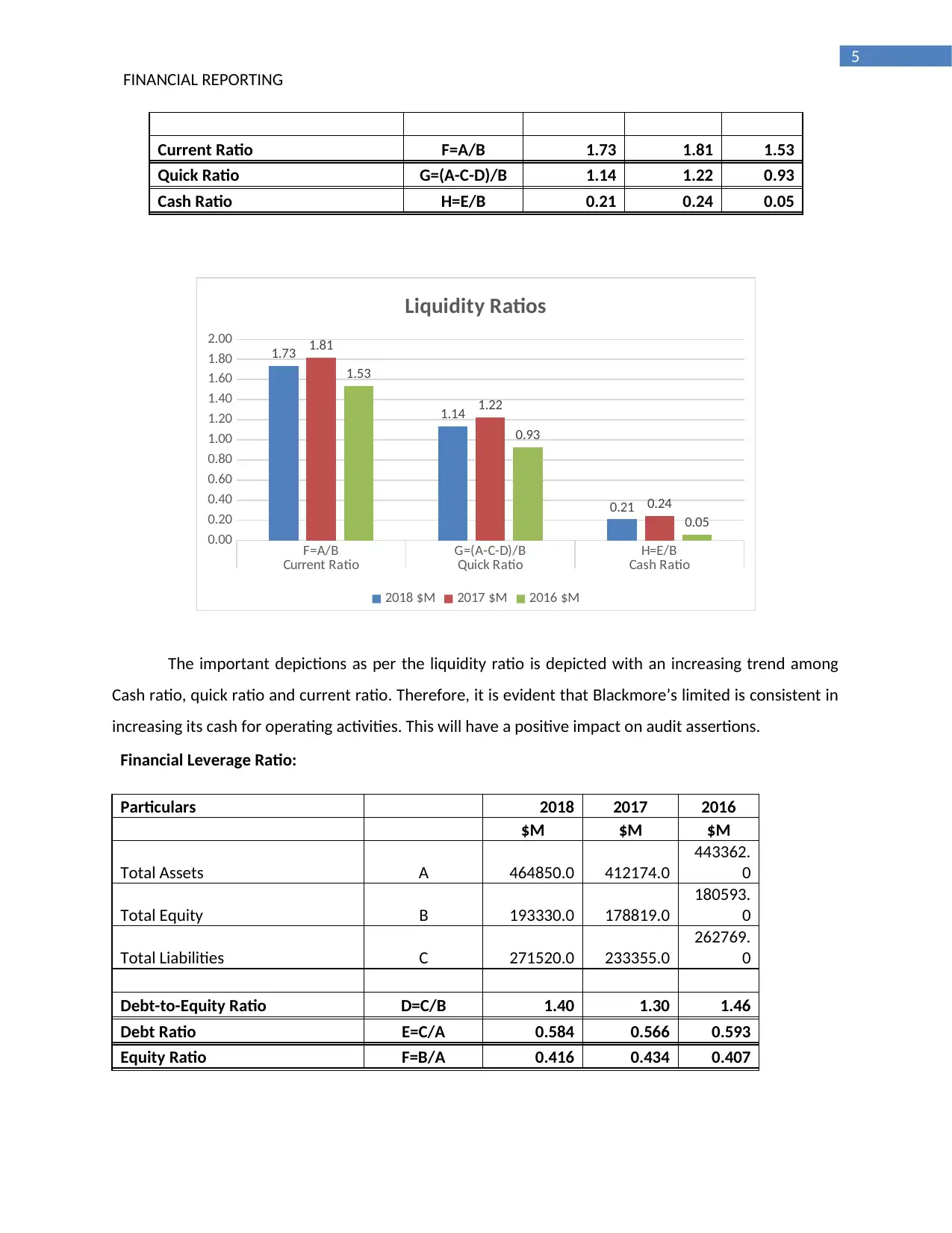

Financial Leverage Ratio:

Particulars 2018 2017 2016

$M $M $M

Total Assets A 464850.0 412174.0

443362.

0

Total Equity B 193330.0 178819.0

180593.

0

Total Liabilities C 271520.0 233355.0

262769.

0

Debt-to-Equity Ratio D=C/B 1.40 1.30 1.46

Debt Ratio E=C/A 0.584 0.566 0.593

Equity Ratio F=B/A 0.416 0.434 0.407

FINANCIAL REPORTING

Current Ratio F=A/B 1.73 1.81 1.53

Quick Ratio G=(A-C-D)/B 1.14 1.22 0.93

Cash Ratio H=E/B 0.21 0.24 0.05

F=A/B G=(A-C-D)/B H=E/B

Current Ratio Quick Ratio Cash Ratio

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

1.73

1.14

0.21

1.81

1.22

0.24

1.53

0.93

0.05

Liquidity Ratios

2018 $M 2017 $M 2016 $M

The important depictions as per the liquidity ratio is depicted with an increasing trend among

Cash ratio, quick ratio and current ratio. Therefore, it is evident that Blackmore’s limited is consistent in

increasing its cash for operating activities. This will have a positive impact on audit assertions.

Financial Leverage Ratio:

Particulars 2018 2017 2016

$M $M $M

Total Assets A 464850.0 412174.0

443362.

0

Total Equity B 193330.0 178819.0

180593.

0

Total Liabilities C 271520.0 233355.0

262769.

0

Debt-to-Equity Ratio D=C/B 1.40 1.30 1.46

Debt Ratio E=C/A 0.584 0.566 0.593

Equity Ratio F=B/A 0.416 0.434 0.407

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCIAL REPORTING

D=C/B E=C/A F=B/A

Debt-to-Equity Ratio Debt Ratio Equity Ratio

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60 1.404

0.584

0.416

1.305

0.566

0.434

1.455

0.593

0.407

Financial Leverage Ratio

2018 $M 2017 $M 2016 $M

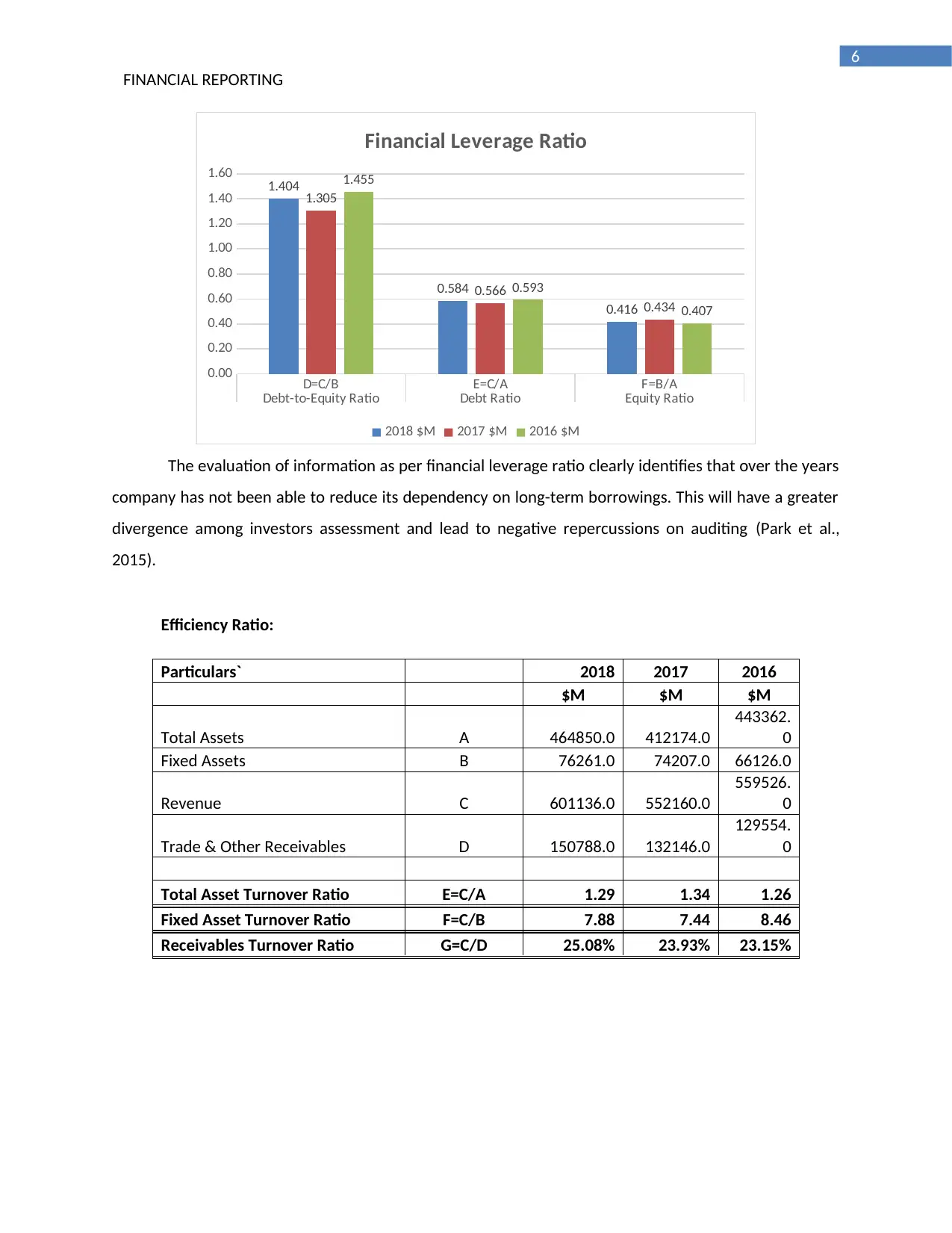

The evaluation of information as per financial leverage ratio clearly identifies that over the years

company has not been able to reduce its dependency on long-term borrowings. This will have a greater

divergence among investors assessment and lead to negative repercussions on auditing (Park et al.,

2015).

Efficiency Ratio:

Particulars` 2018 2017 2016

$M $M $M

Total Assets A 464850.0 412174.0

443362.

0

Fixed Assets B 76261.0 74207.0 66126.0

Revenue C 601136.0 552160.0

559526.

0

Trade & Other Receivables D 150788.0 132146.0

129554.

0

Total Asset Turnover Ratio E=C/A 1.29 1.34 1.26

Fixed Asset Turnover Ratio F=C/B 7.88 7.44 8.46

Receivables Turnover Ratio G=C/D 25.08% 23.93% 23.15%

FINANCIAL REPORTING

D=C/B E=C/A F=B/A

Debt-to-Equity Ratio Debt Ratio Equity Ratio

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60 1.404

0.584

0.416

1.305

0.566

0.434

1.455

0.593

0.407

Financial Leverage Ratio

2018 $M 2017 $M 2016 $M

The evaluation of information as per financial leverage ratio clearly identifies that over the years

company has not been able to reduce its dependency on long-term borrowings. This will have a greater

divergence among investors assessment and lead to negative repercussions on auditing (Park et al.,

2015).

Efficiency Ratio:

Particulars` 2018 2017 2016

$M $M $M

Total Assets A 464850.0 412174.0

443362.

0

Fixed Assets B 76261.0 74207.0 66126.0

Revenue C 601136.0 552160.0

559526.

0

Trade & Other Receivables D 150788.0 132146.0

129554.

0

Total Asset Turnover Ratio E=C/A 1.29 1.34 1.26

Fixed Asset Turnover Ratio F=C/B 7.88 7.44 8.46

Receivables Turnover Ratio G=C/D 25.08% 23.93% 23.15%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCIAL REPORTING

E=C/A F=C/B G=C/D

Total Asset Turnover Ratio Fixed Asset Turnover Ratio Receivables Turnover Ratio

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

1.29

7.88

0.25

1.34

7.44

0.24

1.26

8.46

0.23

Efficiency Ratio

2018 $M 2017 $M 2016 $M

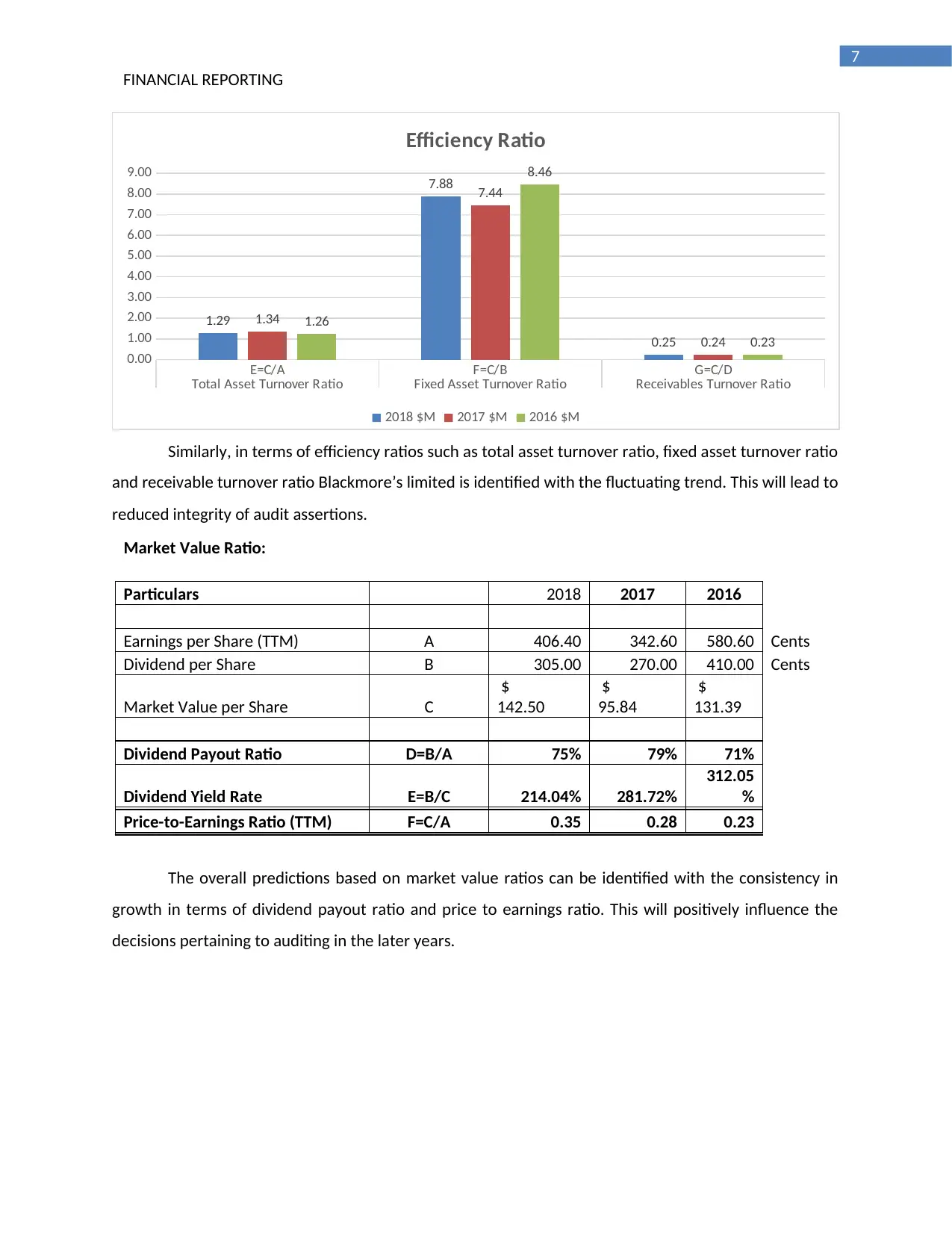

Similarly, in terms of efficiency ratios such as total asset turnover ratio, fixed asset turnover ratio

and receivable turnover ratio Blackmore’s limited is identified with the fluctuating trend. This will lead to

reduced integrity of audit assertions.

Market Value Ratio:

Particulars 2018 2017 2016

Earnings per Share (TTM) A 406.40 342.60 580.60 Cents

Dividend per Share B 305.00 270.00 410.00 Cents

Market Value per Share C

$

142.50

$

95.84

$

131.39

Dividend Payout Ratio D=B/A 75% 79% 71%

Dividend Yield Rate E=B/C 214.04% 281.72%

312.05

%

Price-to-Earnings Ratio (TTM) F=C/A 0.35 0.28 0.23

The overall predictions based on market value ratios can be identified with the consistency in

growth in terms of dividend payout ratio and price to earnings ratio. This will positively influence the

decisions pertaining to auditing in the later years.

FINANCIAL REPORTING

E=C/A F=C/B G=C/D

Total Asset Turnover Ratio Fixed Asset Turnover Ratio Receivables Turnover Ratio

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

1.29

7.88

0.25

1.34

7.44

0.24

1.26

8.46

0.23

Efficiency Ratio

2018 $M 2017 $M 2016 $M

Similarly, in terms of efficiency ratios such as total asset turnover ratio, fixed asset turnover ratio

and receivable turnover ratio Blackmore’s limited is identified with the fluctuating trend. This will lead to

reduced integrity of audit assertions.

Market Value Ratio:

Particulars 2018 2017 2016

Earnings per Share (TTM) A 406.40 342.60 580.60 Cents

Dividend per Share B 305.00 270.00 410.00 Cents

Market Value per Share C

$

142.50

$

95.84

$

131.39

Dividend Payout Ratio D=B/A 75% 79% 71%

Dividend Yield Rate E=B/C 214.04% 281.72%

312.05

%

Price-to-Earnings Ratio (TTM) F=C/A 0.35 0.28 0.23

The overall predictions based on market value ratios can be identified with the consistency in

growth in terms of dividend payout ratio and price to earnings ratio. This will positively influence the

decisions pertaining to auditing in the later years.

8

FINANCIAL REPORTING

2. Concerns of inherent risk at financial reporting level

a) Integrity of management

The group is depicted to undertake several transactions which involves foreign currency risk. As

per ASA 315.A24. Such risks are categorized under financial reporting risk. In addition to this, the

company also face of interest rate risk as it borrows considerable funds on a floating interest rate. These

risks are generally categorized as per external factors impacting an entity under ASA 315.A22

(Legislation.gov.au, 2018). The group is also depicted to be exposed to counterparty credit risk during

trade and other receivables. The categorization of this risks is evident under ASA 315.A47. Although the

risk can be identified under ASA.A121 pertaining to risk of fair value measurement. This is mainly

seeming to affect the integrity as a director consider carrying amounts of financial liabilities and financial

asset at amortized cost which gives a approximate estimate of fair values (Ifac.org, 2018).

b) Director experience, changes and knowledge

Some of the most notable directors of the company can be identified with Richard Henfrey with

having experience of more than eight years with Blackmore’s. The changes pertaining to his experience

can be identified with his tenure in Telstra Corporation as a technical sales person. Professor Lesley

Braun will presently hold the position of director of Blackmore’s Institute has experience of holding

research position at the Alfred Hospital. She was also the VP of National herbalists Association. This

change in sectors among the directors can pose a significant challenge to the audit assessment of a

company which deals in consumer staples (Botez, 2015).

c) Unusual pressure on directors

The present assertions made by the directors are seen to be consistent with the Blackmore’s

philosophy of maintaining a unified culture and goal for STI planning and incorporation of strategic

measurement components pertaining to net sales performance. However, the present hurdles are also

seen with the company struggling to maintain a positive NPAT growth percentage. This is a mandatory

requirement and comes prior to addition of STI to the senior executives (Ackermann & Marx, 2016).

d) Nature of Blackmore’s business

Blackmore’s is considered as one of the pioneering natural health entities operating in Australia.

Some of the main range of products is recognized with nutritional supplements, vitamins, minerals and

herbal products. The group has shown a leading capability in terms of bioceuticals, PAW, Blackmore’s

Institute and global therapeutics (Blackmores.com.au, 2018).

FINANCIAL REPORTING

2. Concerns of inherent risk at financial reporting level

a) Integrity of management

The group is depicted to undertake several transactions which involves foreign currency risk. As

per ASA 315.A24. Such risks are categorized under financial reporting risk. In addition to this, the

company also face of interest rate risk as it borrows considerable funds on a floating interest rate. These

risks are generally categorized as per external factors impacting an entity under ASA 315.A22

(Legislation.gov.au, 2018). The group is also depicted to be exposed to counterparty credit risk during

trade and other receivables. The categorization of this risks is evident under ASA 315.A47. Although the

risk can be identified under ASA.A121 pertaining to risk of fair value measurement. This is mainly

seeming to affect the integrity as a director consider carrying amounts of financial liabilities and financial

asset at amortized cost which gives a approximate estimate of fair values (Ifac.org, 2018).

b) Director experience, changes and knowledge

Some of the most notable directors of the company can be identified with Richard Henfrey with

having experience of more than eight years with Blackmore’s. The changes pertaining to his experience

can be identified with his tenure in Telstra Corporation as a technical sales person. Professor Lesley

Braun will presently hold the position of director of Blackmore’s Institute has experience of holding

research position at the Alfred Hospital. She was also the VP of National herbalists Association. This

change in sectors among the directors can pose a significant challenge to the audit assessment of a

company which deals in consumer staples (Botez, 2015).

c) Unusual pressure on directors

The present assertions made by the directors are seen to be consistent with the Blackmore’s

philosophy of maintaining a unified culture and goal for STI planning and incorporation of strategic

measurement components pertaining to net sales performance. However, the present hurdles are also

seen with the company struggling to maintain a positive NPAT growth percentage. This is a mandatory

requirement and comes prior to addition of STI to the senior executives (Ackermann & Marx, 2016).

d) Nature of Blackmore’s business

Blackmore’s is considered as one of the pioneering natural health entities operating in Australia.

Some of the main range of products is recognized with nutritional supplements, vitamins, minerals and

herbal products. The group has shown a leading capability in terms of bioceuticals, PAW, Blackmore’s

Institute and global therapeutics (Blackmores.com.au, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCIAL REPORTING

e) Factors influencing the Australian health supplements industry

As per the report published by IBIS world, the different factors influencing the Australian health

supplements industry needs to be identified with a strong performance over the last five years through

2017-18. The growth in the industry have shown an increasing trend among the consumer expenditures

pertaining to strong export opportunities, consumer expenditure on vitamins and supplements. The real

factors influencing the changes in the consumer are depicted with health consciousness factor, stock

maintained by other retailers and real household discretionary income level (Habib, Jiang & Zhou, 2015).

The factor affecting the vitamin and supplement manufacturing is also based on downstream demand

pertaining to food and other retailers which are depicted to stock the industry’s products. The industry

threats are derived from one number of competitive services for health-conscious individuals

(Ibisworld.com.au, 2018).

3. Risk of Material Misstatement (Inherent Risk) at the Assertion Level

Specific account balance No.:

a) Assertion of account balance at significant risk

of material misstatement

Account balance number 1.3, 2.5 and 5.1.2

It can be identified that during the preparation of

financial statement by Blackmore’s, the individual

entities have to go through functional currency

which are recognized as per the rates of

exchange prevailing on the date of transaction

(1.3). Such monetary transactions are included

under deferred tax balances which can be

considered in AB no. 2.5.2. The group is exposed

to the nature of use of hedging instruments

which are included under the derivatives and

non-derivatives pertaining to the foreign

currency risk. This type of risk is directly

concerned under financial reporting risk of ASA

315.A24 (Bullen, 2017).

b) Explanation of the assertions at risk not valid Account balance number 5.1.2

The inception of hedging pertaining to foreign

exchange risk are addressed in terms of cash flow

FINANCIAL REPORTING

e) Factors influencing the Australian health supplements industry

As per the report published by IBIS world, the different factors influencing the Australian health

supplements industry needs to be identified with a strong performance over the last five years through

2017-18. The growth in the industry have shown an increasing trend among the consumer expenditures

pertaining to strong export opportunities, consumer expenditure on vitamins and supplements. The real

factors influencing the changes in the consumer are depicted with health consciousness factor, stock

maintained by other retailers and real household discretionary income level (Habib, Jiang & Zhou, 2015).

The factor affecting the vitamin and supplement manufacturing is also based on downstream demand

pertaining to food and other retailers which are depicted to stock the industry’s products. The industry

threats are derived from one number of competitive services for health-conscious individuals

(Ibisworld.com.au, 2018).

3. Risk of Material Misstatement (Inherent Risk) at the Assertion Level

Specific account balance No.:

a) Assertion of account balance at significant risk

of material misstatement

Account balance number 1.3, 2.5 and 5.1.2

It can be identified that during the preparation of

financial statement by Blackmore’s, the individual

entities have to go through functional currency

which are recognized as per the rates of

exchange prevailing on the date of transaction

(1.3). Such monetary transactions are included

under deferred tax balances which can be

considered in AB no. 2.5.2. The group is exposed

to the nature of use of hedging instruments

which are included under the derivatives and

non-derivatives pertaining to the foreign

currency risk. This type of risk is directly

concerned under financial reporting risk of ASA

315.A24 (Bullen, 2017).

b) Explanation of the assertions at risk not valid Account balance number 5.1.2

The inception of hedging pertaining to foreign

exchange risk are addressed in terms of cash flow

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCIAL REPORTING

hedges. The initiation of this relationship

pertaining to the documents of the entities are

seen to be maintained by following an

appropriate ongoing derivative which are highly

effective for offsetting the changes pertaining to

fair values and cash flows from the hedged items.

c) Detailed report on relevant substantive audit

procedure for accessing assertion at risk

Account balance number 5.3

The substantive audit procedure for managing

risk pertaining to exchange rate exposures can be

depicted in terms of approving a particular policy

parameter by using forward exchange contracts.

The issue of forward exchange contracts will be

set to increase or decrease the Australian dollar

value against the relevant foreign currency

(Griffiths, 2016).

d) Detailed report on practical internal control

to mitigate the risk of audit assertion

Account balance number 5.4

The detailed report on maintaining the interest

rate risk is identified with use of SWAP contracts

for interest rates. The risk management for credit

sources is determined with analyzing the credit

worthiness of a supply which is recorded under

independent rating agencies (Collins, Xie & Zhu,

2015). In addition to this, the liquidity risk of the

company is undertaken by working on various

types of short-term and medium-term funding

requirements for liquidity. These are particularly

evident with initiatives such as maintaining of

adequate banking facilities and continual

monitoring of cash flow forecasts (Graham,

Bedard & Dutta, 2018).

FINANCIAL REPORTING

hedges. The initiation of this relationship

pertaining to the documents of the entities are

seen to be maintained by following an

appropriate ongoing derivative which are highly

effective for offsetting the changes pertaining to

fair values and cash flows from the hedged items.

c) Detailed report on relevant substantive audit

procedure for accessing assertion at risk

Account balance number 5.3

The substantive audit procedure for managing

risk pertaining to exchange rate exposures can be

depicted in terms of approving a particular policy

parameter by using forward exchange contracts.

The issue of forward exchange contracts will be

set to increase or decrease the Australian dollar

value against the relevant foreign currency

(Griffiths, 2016).

d) Detailed report on practical internal control

to mitigate the risk of audit assertion

Account balance number 5.4

The detailed report on maintaining the interest

rate risk is identified with use of SWAP contracts

for interest rates. The risk management for credit

sources is determined with analyzing the credit

worthiness of a supply which is recorded under

independent rating agencies (Collins, Xie & Zhu,

2015). In addition to this, the liquidity risk of the

company is undertaken by working on various

types of short-term and medium-term funding

requirements for liquidity. These are particularly

evident with initiatives such as maintaining of

adequate banking facilities and continual

monitoring of cash flow forecasts (Graham,

Bedard & Dutta, 2018).

11

FINANCIAL REPORTING

Conclusion

The overall assessment as for the ventilation of analytical procedures have shown that total

assets and total liabilities in the last three years have shown a linear growth in terms of total assets.

However, there is also a subsequent increase in the total liabilities of the company. Henceforth this

fluctuation in the balances will have a negative repercussion on audit assessment. The predictions as per

analytical procedure pertaining to ratio analysis is not seen to be in favor of the company. It can be

identified that the profitability ratio shows that the overall trend of profit made by the company is

fluctuating in nature over the last three years. Therefore, wide range of fluctuations in the profitability

will lead to significantly decreased reliance on audit planning and decision-making capability. Similarly,

various types of other ratios are identified is fluctuating trend which will not favor the auditing

decisions. This will also question on reliability of audit statements in the future financial reporting

periods. The depictions made from concerns of inherent risk at financial reporting level has been

identified under several guidelines given under Risk of Material Misstatement as per ‘ASA 315.25(a),

‘ASA 315.A105 and ASA 315.A109. Furthermore, the group is depicted to undertake several transactions

which involves foreign currency risk. As per ASA 315.A24. Such risks are categorized under financial

reporting risk. In addition to this, the company also face of interest rate risk as it borrows considerable

funds on a floating interest rate. These risks are generally categorized as per external factors impacting

an entity under ASA 315.A22. It needs to be also identified that during the preparation of financial

statement by Blackmore’s, the individual entities have to go through functional currency which are

recognized as per the rates of exchange prevailing on the date of transaction (1.3). Such monetary

transactions are included under deferred tax balances which can be considered in AB no. 2.5.2. The

group is exposed to the nature of use of hedging instruments which are included under the derivatives

and non-derivatives pertaining to the foreign currency risk.

FINANCIAL REPORTING

Conclusion

The overall assessment as for the ventilation of analytical procedures have shown that total

assets and total liabilities in the last three years have shown a linear growth in terms of total assets.

However, there is also a subsequent increase in the total liabilities of the company. Henceforth this

fluctuation in the balances will have a negative repercussion on audit assessment. The predictions as per

analytical procedure pertaining to ratio analysis is not seen to be in favor of the company. It can be

identified that the profitability ratio shows that the overall trend of profit made by the company is

fluctuating in nature over the last three years. Therefore, wide range of fluctuations in the profitability

will lead to significantly decreased reliance on audit planning and decision-making capability. Similarly,

various types of other ratios are identified is fluctuating trend which will not favor the auditing

decisions. This will also question on reliability of audit statements in the future financial reporting

periods. The depictions made from concerns of inherent risk at financial reporting level has been

identified under several guidelines given under Risk of Material Misstatement as per ‘ASA 315.25(a),

‘ASA 315.A105 and ASA 315.A109. Furthermore, the group is depicted to undertake several transactions

which involves foreign currency risk. As per ASA 315.A24. Such risks are categorized under financial

reporting risk. In addition to this, the company also face of interest rate risk as it borrows considerable

funds on a floating interest rate. These risks are generally categorized as per external factors impacting

an entity under ASA 315.A22. It needs to be also identified that during the preparation of financial

statement by Blackmore’s, the individual entities have to go through functional currency which are

recognized as per the rates of exchange prevailing on the date of transaction (1.3). Such monetary

transactions are included under deferred tax balances which can be considered in AB no. 2.5.2. The

group is exposed to the nature of use of hedging instruments which are included under the derivatives

and non-derivatives pertaining to the foreign currency risk.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.