Ask a question from expert

Financial Reporting of Singapore Telecommunications Limited

14 Pages4227 Words58 Views

Added on 2020-05-28

Financial Reporting of Singapore Telecommunications Limited

Added on 2020-05-28

BookmarkShareRelated Documents

Running head: FINANCIAL REPORTINGFinancial Reportingof Singapore Telecommunications Limited (Sakae Holdings) and SoupRestaurant Name of the University:Name of the Student:Authors Note:

1FINANCIAL REPORTINGTable of ContentsPart 1....................................................................................................................................2Introduction......................................................................................................................2Background of Companies..................................................................................................2Discussion........................................................................................................................2Profitability Ratios.......................................................................................................2Liquidity Ratios...........................................................................................................4Asset Efficiency Ratios................................................................................................5Gearing Ratios.............................................................................................................7Conclusion.......................................................................................................................9Part 2..................................................................................................................................10Reflection.......................................................................................................................10References..........................................................................................................................11

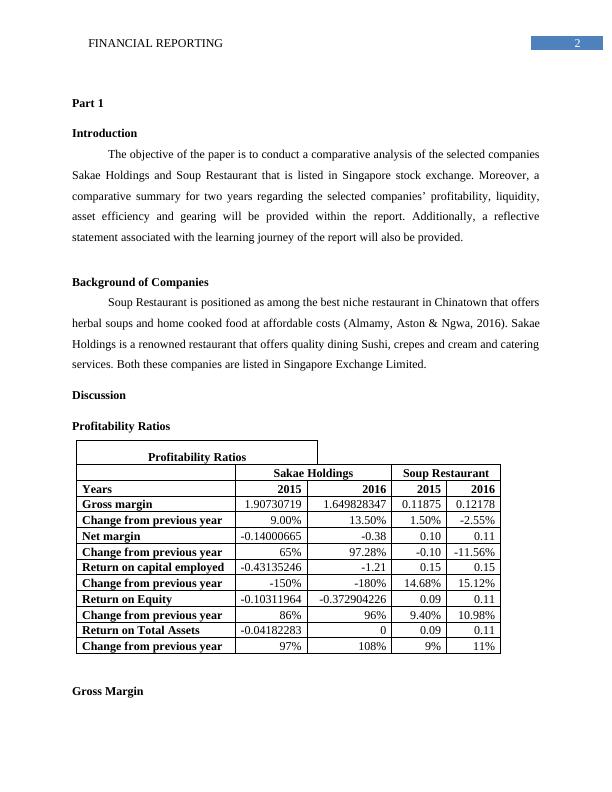

2FINANCIAL REPORTINGPart 1IntroductionThe objective of the paper is to conduct a comparative analysis of the selected companiesSakae Holdings and Soup Restaurant that is listed in Singapore stock exchange. Moreover, acomparative summary for two years regarding the selected companies’ profitability, liquidity,asset efficiency and gearing will be provided within the report. Additionally, a reflectivestatement associated with the learning journey of the report will also be provided. Background of CompaniesSoup Restaurant is positioned as among the best niche restaurant in Chinatown that offersherbal soups and home cooked food at affordable costs (Almamy, Aston & Ngwa, 2016). SakaeHoldings is a renowned restaurant that offers quality dining Sushi, crepes and cream and cateringservices. Both these companies are listed in Singapore Exchange Limited. DiscussionProfitability RatiosProfitability RatiosSakae HoldingsSoup RestaurantYears2015201620152016Gross margin1.907307191.6498283470.118750.12178Change from previous year9.00%13.50%1.50%-2.55%Net margin-0.14000665-0.380.100.11Change from previous year65%97.28%-0.10-11.56%Return on capital employed-0.43135246-1.210.150.15Change from previous year-150%-180%14.68%15.12%Return on Equity-0.10311964-0.3729042260.090.11Change from previous year86%96%9.40%10.98%Return on Total Assets-0.0418228300.090.11Change from previous year97%108%9%11%Gross Margin

3FINANCIAL REPORTINGGross margin ratio is important in measuring how much efficient will be the companiesin their business operations. Gross margin ratio of Sakae Holdings is observed to decrease by13.50% in the year 2016 in comparison to Soup Restaurant Company that is observed to increasefrom the year 2015 to year 2016 by 2.55% (Altman et al.2017). Such increasing trend of thisratio indicates that the company retains increased amount on every dollar of its sales in order toservice its debt obligations along with other costs. Sakae Holding’s decreasing percentageindicates a decrease in competitiveness of the company’s services and products (Sakae Holdings,2018). It also signifies overall profitability of the company is getting poor each year withdecreased sales of its products. Net MarginNet margin ratio is important in indicating profitability of a company. Net margin ratio ofSakae Holdings Company is observed to decrease by 97% from the year 2015 to year 2016 (Kou,Peng & Wang, 2014). Such decrease is observed because of the reason that financial health ofthe company is poor than Soup Restaurant Company and this signifies the company is proficientenough in transforming its revenue into profits which is further available for all its shareholders.It can also be gathered from the results of the company that it has less parentage of revenue leftafter all expenses are decreased from the sales and it is extracting less amount of profit after itstotal sales. Net margin ratio of Soup Restaurant Company is observed to increase by 11.56%from the year 2015 to year 2016. This indicates that the company is efficient enough inconverting its revenue into profits. This also signifies the business performance of the companyis not that effective in facilitating it to attain enough net margins.Return on Capital EmployedReturn on capital employed is important in analysing the ways in which a companyemploys its assets in attaining high revenues. Return on capital employed ratio of SakaeHoldings is observed to decrease by 15% from the year 2015 to year 2016. However, and SoupRestaurant Company has constant ROCE in both 2015 and 2016. Such results indicate thatcompany’s performance within the capital intensive sectors like the restaurants. This does notoffer a good indication regarding these companies financial performance of the significant debt(Sakae Holdings, 2018).Moreover, such decreasing and fixed trend of return of capital employed

End of preview

Want to access all the pages? Upload your documents or become a member.

Related Documents

Managing Finance: Analysis of Financial Information and Stock Valuationlg...

|10

|2016

|47

Critical Use Accounting Informationlg...

|11

|2406

|16

Financial Ratio Analysis of RS plclg...

|17

|1491

|323

Financial Reporting for Businesseslg...

|9

|1999

|28

Airlines Financial Analysis Reportlg...

|13

|2768

|274

Financial Management and Controllg...

|19

|4719

|62