Financial Reporting: IFRS, Stakeholders, and Financial Statements

VerifiedAdded on 2021/02/20

|17

|5120

|35

Report

AI Summary

This report provides a comprehensive overview of financial reporting, focusing on its purpose, the underlying accounting principles, and how various stakeholders benefit from financial information. It explores the differences between International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS), highlighting the advantages of IFRS adoption. The report further examines the presentation of financial statements, including profit and loss statements and changes in equity, with calculations and examples. Additionally, it delves into the factors influencing compliance with IFRS and analyzes the impact of financial reporting on organizational goals, such as making economic decisions and influencing employee and customer behavior. The report uses Deloitte as a case study to illustrate the practical application of these concepts, making it a valuable resource for understanding the significance and implications of financial reporting in a business context.

Financial reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Accounting principles and their purpose.................................................................................2

3. How stakeholders of company benefit from financial information........................................3

4. Benefits of financial reporting in meeting organisation goals................................................4

5. Presentation of Financial statements.......................................................................................6

6. Interpretation and Analysis of Hilton Ltd...............................................................................8

7. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS)......................................................................................................10

8. Benefits of IFRS....................................................................................................................11

9. Compliances with IFRS and factors which impact on these compliances............................12

CONCLSUION..............................................................................................................................13

REFERENCES .............................................................................................................................14

INTRODUCTION...........................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Accounting principles and their purpose.................................................................................2

3. How stakeholders of company benefit from financial information........................................3

4. Benefits of financial reporting in meeting organisation goals................................................4

5. Presentation of Financial statements.......................................................................................6

6. Interpretation and Analysis of Hilton Ltd...............................................................................8

7. Difference between International Accounting Standards (IAS) and International Financial

Reporting Standards (IFRS)......................................................................................................10

8. Benefits of IFRS....................................................................................................................11

9. Compliances with IFRS and factors which impact on these compliances............................12

CONCLSUION..............................................................................................................................13

REFERENCES .............................................................................................................................14

INTRODUCTION

Financial reporting is very important aspect in determining the financial position of

business (Leuz and Wysocki, 2016). Financial information is beneficial for external shareholders

and management of the company so that they have a clear idea where to invest. Generally GAAP

and IFRS standards are used to prepare financial statements. Present report is based on Deloitte

who is audit, consultancy and tax service company. It is a private company. Report will contain

the purpose of financial reporting, purpose of accounting principles and how shareholders

benefits from financial information. Study will further cover the difference between IAS and

IFRS, how financial information is useful in reaching company goals and objectives, benefits of

IFRS. Lastly report will contain cash flows, profit and loss statements and factors which impact

compliance in the nation.

1. Purpose of financial reporting

Financial reporting:

Financial report of a company reveal the finance related information to external

shareholders (e.g. governments, customers, investors etc.) and management to check the

performance of the company over a period of time (Flower, 2018). Financial reports are usually

maintained or issued on quarterly basis or annual basis. Public and private company perform

their financial report with GAPP (generally accepted accounting guidelines). While companies

working in international markets perform their financial report with IFRS (international financial

reporting standards). These standards provide the guideline under which financial report is

prepared. Financial reports of Deloitte include the following :

Balance sheet, which shows the assets, liabilities and equities of company.

Income statement, which shows the income earned and expense incurred of the company.

Statement of preserved earnings, which shows changes made by the company in its

equity.

Cash flows, which shows the cash related activities which includes financing, investing

and operating activity (Williams and Dobelman, 2017).

The main purpose of preparing financial reports are as follows: Provides company's financial information: The purpose of making financial statement is

to provide information to its shareholders and management about the performance and

how much potential a company has. If company uses IFRS then they need to provide 5

1

Financial reporting is very important aspect in determining the financial position of

business (Leuz and Wysocki, 2016). Financial information is beneficial for external shareholders

and management of the company so that they have a clear idea where to invest. Generally GAAP

and IFRS standards are used to prepare financial statements. Present report is based on Deloitte

who is audit, consultancy and tax service company. It is a private company. Report will contain

the purpose of financial reporting, purpose of accounting principles and how shareholders

benefits from financial information. Study will further cover the difference between IAS and

IFRS, how financial information is useful in reaching company goals and objectives, benefits of

IFRS. Lastly report will contain cash flows, profit and loss statements and factors which impact

compliance in the nation.

1. Purpose of financial reporting

Financial reporting:

Financial report of a company reveal the finance related information to external

shareholders (e.g. governments, customers, investors etc.) and management to check the

performance of the company over a period of time (Flower, 2018). Financial reports are usually

maintained or issued on quarterly basis or annual basis. Public and private company perform

their financial report with GAPP (generally accepted accounting guidelines). While companies

working in international markets perform their financial report with IFRS (international financial

reporting standards). These standards provide the guideline under which financial report is

prepared. Financial reports of Deloitte include the following :

Balance sheet, which shows the assets, liabilities and equities of company.

Income statement, which shows the income earned and expense incurred of the company.

Statement of preserved earnings, which shows changes made by the company in its

equity.

Cash flows, which shows the cash related activities which includes financing, investing

and operating activity (Williams and Dobelman, 2017).

The main purpose of preparing financial reports are as follows: Provides company's financial information: The purpose of making financial statement is

to provide information to its shareholders and management about the performance and

how much potential a company has. If company uses IFRS then they need to provide 5

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

statements. a) balance sheet b) profit and loss statement c) cash flow d) change in equity

e) notes of financial statement. Assist potential investors: It is beneficial for investors to obtain information of target

companies from financial reports so that they can use this information to make

investment decision like withdraw the old investment or invest more in existing

investment. This information is beneficial for both old and new investors to analyse and

crack-up the investment decision (Acharya and Ryan, 2016). Investors can evaluate the

company's profitability against competitors and their return on investment. Investors also

have an idea that company is using its resources efficiently.

Overview of future cash flow: The purpose of this report is to not only give information

about how good or bad a company's position is but it is also used to determine the future

cash flows. It is beneficial for employees of the company to measure the stability so that

their job is secured. It evaluate the actual cash flow in determining future cash flows and

profitability (Flower, 2018).

2. Accounting principles and their purpose

Accounting principles:

It is basic guidelines or rules that companies follow in preparing financial reports.

Accounting principles are different in every country (Tschopp and Huefner, 2015). Investors

need to be cautious while comparing companies because accounting principles differ from

country to country. There are some principles that rule the accounting are: Full disclosure principle: This principle states that it is very important to disclose all the

information related to financial statement so that potential of company can be identified.

It is required to disclose every detail in the statements. The purpose of this principle is to

provide all the essential information to the people who want to invest in the company. It

is beneficial for Deloitte to disclose its information to build its goodwill (Acharya and

Ryan, 2016). Going concern principle: This principles states that the company will exist for longer

period and continue its business to earn objectives and fulfil its commitments. Company

will not liquidate in future if its sales are low. The purpose of this principle is to show the

stability of company to the shareholders which impact the price of stock (Abbott and

2

e) notes of financial statement. Assist potential investors: It is beneficial for investors to obtain information of target

companies from financial reports so that they can use this information to make

investment decision like withdraw the old investment or invest more in existing

investment. This information is beneficial for both old and new investors to analyse and

crack-up the investment decision (Acharya and Ryan, 2016). Investors can evaluate the

company's profitability against competitors and their return on investment. Investors also

have an idea that company is using its resources efficiently.

Overview of future cash flow: The purpose of this report is to not only give information

about how good or bad a company's position is but it is also used to determine the future

cash flows. It is beneficial for employees of the company to measure the stability so that

their job is secured. It evaluate the actual cash flow in determining future cash flows and

profitability (Flower, 2018).

2. Accounting principles and their purpose

Accounting principles:

It is basic guidelines or rules that companies follow in preparing financial reports.

Accounting principles are different in every country (Tschopp and Huefner, 2015). Investors

need to be cautious while comparing companies because accounting principles differ from

country to country. There are some principles that rule the accounting are: Full disclosure principle: This principle states that it is very important to disclose all the

information related to financial statement so that potential of company can be identified.

It is required to disclose every detail in the statements. The purpose of this principle is to

provide all the essential information to the people who want to invest in the company. It

is beneficial for Deloitte to disclose its information to build its goodwill (Acharya and

Ryan, 2016). Going concern principle: This principles states that the company will exist for longer

period and continue its business to earn objectives and fulfil its commitments. Company

will not liquidate in future if its sales are low. The purpose of this principle is to show the

stability of company to the shareholders which impact the price of stock (Abbott and

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

et.al., 2016). Company need to prepare financial report by assuming the company is

going concern. Revenue recognition principle: This principles states that company need to recognize its

revenue when the product is sold. Company need to recognize its revenue irrespective of

when the money is received. For e.g. Deloitte completes its services for £2000 , company

need to recognise £2000 as early as possible irrespective of whether money is received or

not. The purpose of this principle is to show real time profit and loss of the company.

This gives accurate financial position of the company (Johnston and Petacchi, 2017).

Conservatism principle: This principles states that if there is a condition where 2

acceptable alternative are there for reporting a component, this principle guides the

accountant to select second option which results to a lesser extent of net income.

Conservatism principle tells accountant to to disclose all the losses but this does not mean

to disclose profits (Accounting principles, 2019). It expects accountant to be impartial

and be objective oriented. The purpose of this principle is to predict future loss but not

profits. It also predicts doubtful debts and forecast whether cost will reduce or not.

3. How stakeholders of company benefit from financial information

Stakeholders:

Stakeholders are are group of people who are interested in the company. These people are

affected by the business (Call and et.al., 2017). Stakeholders use this information in making

decision to invest in the particular company or not. There stakeholders of the Deloitte are

investors, employees, customers, government, suppliers, creditors, lenders and competitors.

These stakeholders benefits a lot from financial information of the company are as follows: Investors: Financial information is beneficial for both potential and actual investors.

Actual investors uses this information in checking that how their funds are used by the

managers and the expected performance of enterprise in coming days to earn growth and

profit. It is beneficial for potential investors, with the help of financial information

investors make decision whether this company is suitable for investment or not

(Lawrence Minutti-Meza and Vyas, 2017). Lenders: Lenders are financial institutions who lend money to enterprise to earn income.

Financial information is beneficial for them so that they can evaluate the performance of

company and check where the company stands (Ewers, 2017). This helps them to decide

3

going concern. Revenue recognition principle: This principles states that company need to recognize its

revenue when the product is sold. Company need to recognize its revenue irrespective of

when the money is received. For e.g. Deloitte completes its services for £2000 , company

need to recognise £2000 as early as possible irrespective of whether money is received or

not. The purpose of this principle is to show real time profit and loss of the company.

This gives accurate financial position of the company (Johnston and Petacchi, 2017).

Conservatism principle: This principles states that if there is a condition where 2

acceptable alternative are there for reporting a component, this principle guides the

accountant to select second option which results to a lesser extent of net income.

Conservatism principle tells accountant to to disclose all the losses but this does not mean

to disclose profits (Accounting principles, 2019). It expects accountant to be impartial

and be objective oriented. The purpose of this principle is to predict future loss but not

profits. It also predicts doubtful debts and forecast whether cost will reduce or not.

3. How stakeholders of company benefit from financial information

Stakeholders:

Stakeholders are are group of people who are interested in the company. These people are

affected by the business (Call and et.al., 2017). Stakeholders use this information in making

decision to invest in the particular company or not. There stakeholders of the Deloitte are

investors, employees, customers, government, suppliers, creditors, lenders and competitors.

These stakeholders benefits a lot from financial information of the company are as follows: Investors: Financial information is beneficial for both potential and actual investors.

Actual investors uses this information in checking that how their funds are used by the

managers and the expected performance of enterprise in coming days to earn growth and

profit. It is beneficial for potential investors, with the help of financial information

investors make decision whether this company is suitable for investment or not

(Lawrence Minutti-Meza and Vyas, 2017). Lenders: Lenders are financial institutions who lend money to enterprise to earn income.

Financial information is beneficial for them so that they can evaluate the performance of

company and check where the company stands (Ewers, 2017). This helps them to decide

3

to whom are they lending and is company able to repay its amount on time and pay

interest as well. Owners:Owners of the company need to know the accurate information because they

invest capital in business and their objective is to earn profits. They need to know the

position of company i.e. what it has earned and missed over time. This information

benefits owners in making future decision to expand the company or not. Government: Government benefits from this information by checking whether company

has paid tax or not (Beatty, Liao and Zhang, 2019). Financial information confirms that

company is running under rules and regulations given by the government and also

protects the interest of shareholders. Employees: Employees are also stakeholders of the company who want to know the

stability of company. Financial information tells the potential of employers in providing

remuneration, employment and retirement benefits. It is beneficial for employees to

make decision in leaving the organisation or continue working for them.

Customers: Accounting information tells customer about the position of company to

make decisions in future. Customers are of 3 types manufacturers, wholesalers and

retailers. It benefits customer in deciding whether to provide raw materials to company or

nor, whether company is able to repay money or not. Thus financial information is

essential for all (Lawrence Minutti-Meza and Vyas, 2017).

4. Benefits of financial reporting in meeting organisation goals

Financial reporting has many benefits in achieving organisation objectives: Making economic decision: The goal of economy is to reduce social welfare for which

proper resource allocation is required. Financial reporting tells the position of all the

companies thus help in finding growth of economy. Change in economic conditions like

increase and decrease in the rates of inflation, interest, foreign exchange etc. affects the

company's stock price. These economic decisions is beneficial for Deloitte in making

decisions and maximise their wealth (Flower, 2018). It helps in better allocation of

resources which makes company reach its goals and objectives. Cost of capital: Disclosure of financial reports is anticipated to enhance the price of share

for long run. Higher share price shown in the disclosure have pleasing impact on the cost

of capital (Ghosh and Tang, 2015). It benefits company in enhancing future price to issue

4

interest as well. Owners:Owners of the company need to know the accurate information because they

invest capital in business and their objective is to earn profits. They need to know the

position of company i.e. what it has earned and missed over time. This information

benefits owners in making future decision to expand the company or not. Government: Government benefits from this information by checking whether company

has paid tax or not (Beatty, Liao and Zhang, 2019). Financial information confirms that

company is running under rules and regulations given by the government and also

protects the interest of shareholders. Employees: Employees are also stakeholders of the company who want to know the

stability of company. Financial information tells the potential of employers in providing

remuneration, employment and retirement benefits. It is beneficial for employees to

make decision in leaving the organisation or continue working for them.

Customers: Accounting information tells customer about the position of company to

make decisions in future. Customers are of 3 types manufacturers, wholesalers and

retailers. It benefits customer in deciding whether to provide raw materials to company or

nor, whether company is able to repay money or not. Thus financial information is

essential for all (Lawrence Minutti-Meza and Vyas, 2017).

4. Benefits of financial reporting in meeting organisation goals

Financial reporting has many benefits in achieving organisation objectives: Making economic decision: The goal of economy is to reduce social welfare for which

proper resource allocation is required. Financial reporting tells the position of all the

companies thus help in finding growth of economy. Change in economic conditions like

increase and decrease in the rates of inflation, interest, foreign exchange etc. affects the

company's stock price. These economic decisions is beneficial for Deloitte in making

decisions and maximise their wealth (Flower, 2018). It helps in better allocation of

resources which makes company reach its goals and objectives. Cost of capital: Disclosure of financial reports is anticipated to enhance the price of share

for long run. Higher share price shown in the disclosure have pleasing impact on the cost

of capital (Ghosh and Tang, 2015). It benefits company in enhancing future price to issue

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company shares. Higher stock price will reduce cost of capital and make company earn

higher and achieve objectives. Equilibrium in share price: Adequate disclosure of financial information decreases the

share price. Fluctuation in the price of stock occurs when uncertainty is ignored in the

investment market. If there is full information available then uncertainty can be avoided.

Full disclosure of information prevent manipulation and fraud. This benefits company in

smooth functioning and achieving goals. Employee decision: Employees decision is affected by the financial information.

Employees use this financial reports in evaluating growth and risk of company, therefore

knowing the possibility of job security and promotions (Leuz and Wysocki, 2016). If

employees see growth and development of themselves in the company then they work

better in order to achieve objectives of enterprise. Hence employees perception matters in

increasing profitability of organisation.

Customer decision: From the data disclosed in the financial statement affects the

customers of company, thus change in the demand and supply of economy. From the

financial information customers predict whether company will run for longer period or go

bankrupt and unable to meets its commitments. This information is important in

predicting availability of services provided by company. If company fulfils all its

commitment then automatically goal is achieved and customers are also satisfied (Flower,

2018).

5

higher and achieve objectives. Equilibrium in share price: Adequate disclosure of financial information decreases the

share price. Fluctuation in the price of stock occurs when uncertainty is ignored in the

investment market. If there is full information available then uncertainty can be avoided.

Full disclosure of information prevent manipulation and fraud. This benefits company in

smooth functioning and achieving goals. Employee decision: Employees decision is affected by the financial information.

Employees use this financial reports in evaluating growth and risk of company, therefore

knowing the possibility of job security and promotions (Leuz and Wysocki, 2016). If

employees see growth and development of themselves in the company then they work

better in order to achieve objectives of enterprise. Hence employees perception matters in

increasing profitability of organisation.

Customer decision: From the data disclosed in the financial statement affects the

customers of company, thus change in the demand and supply of economy. From the

financial information customers predict whether company will run for longer period or go

bankrupt and unable to meets its commitments. This information is important in

predicting availability of services provided by company. If company fulfils all its

commitment then automatically goal is achieved and customers are also satisfied (Flower,

2018).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

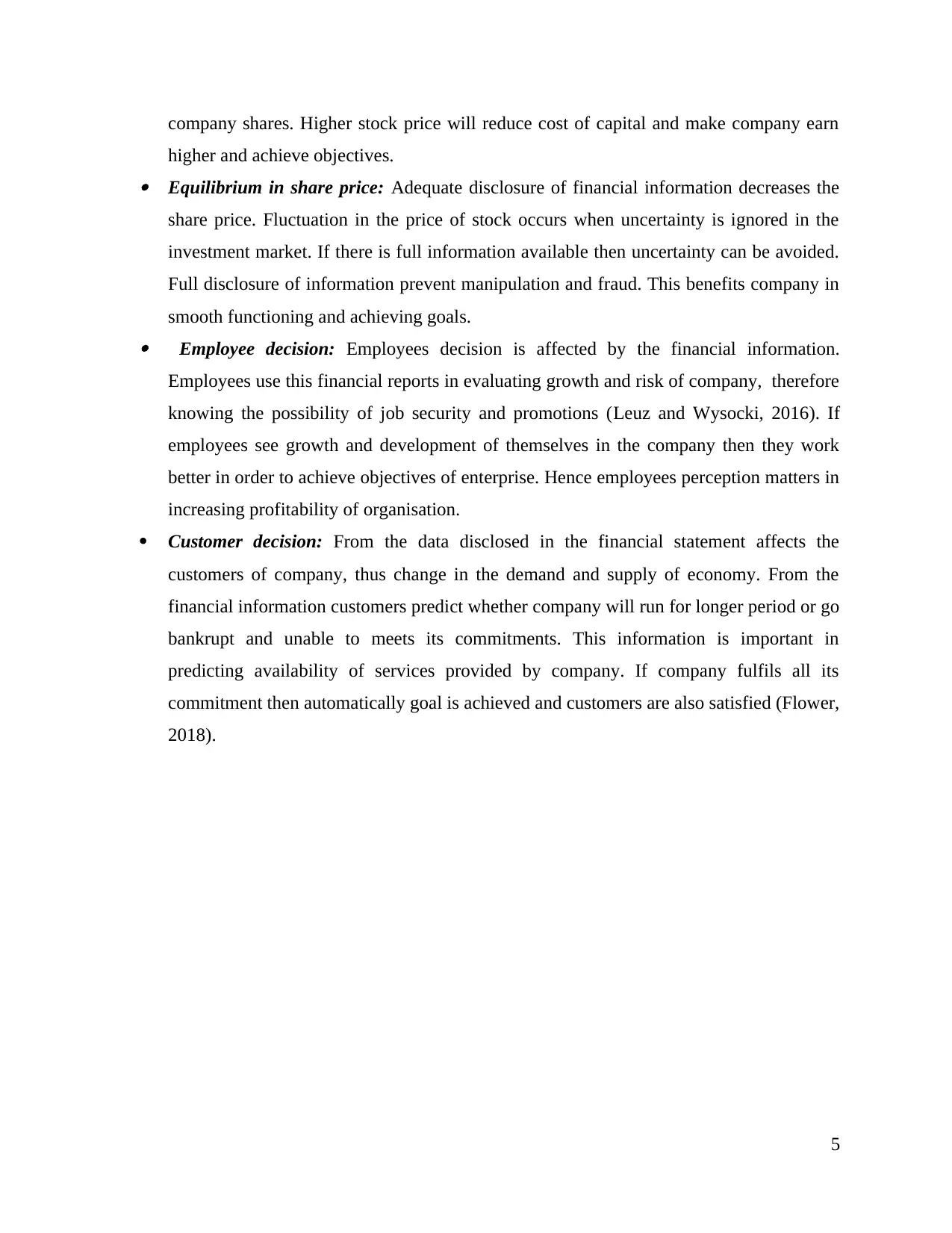

5. Presentation of Financial statements

Calculation of statement of Profit & Loss for the year ending 31st December 2018

Statement of Profit & Loss for the year ending 31st December 2018

Particulars Amount (£)

Revenues 585100

Less: Cost of sales -391700

Profit 193400

Add:Other Income 9600

Gross Profit 203000

Less: Operating expenses -101277.5

Operating Profit 101722.5

Less: Finance cost -1200

Profit before tax 100522.5

Less: tax -9500

Profit after Tax 91022.5

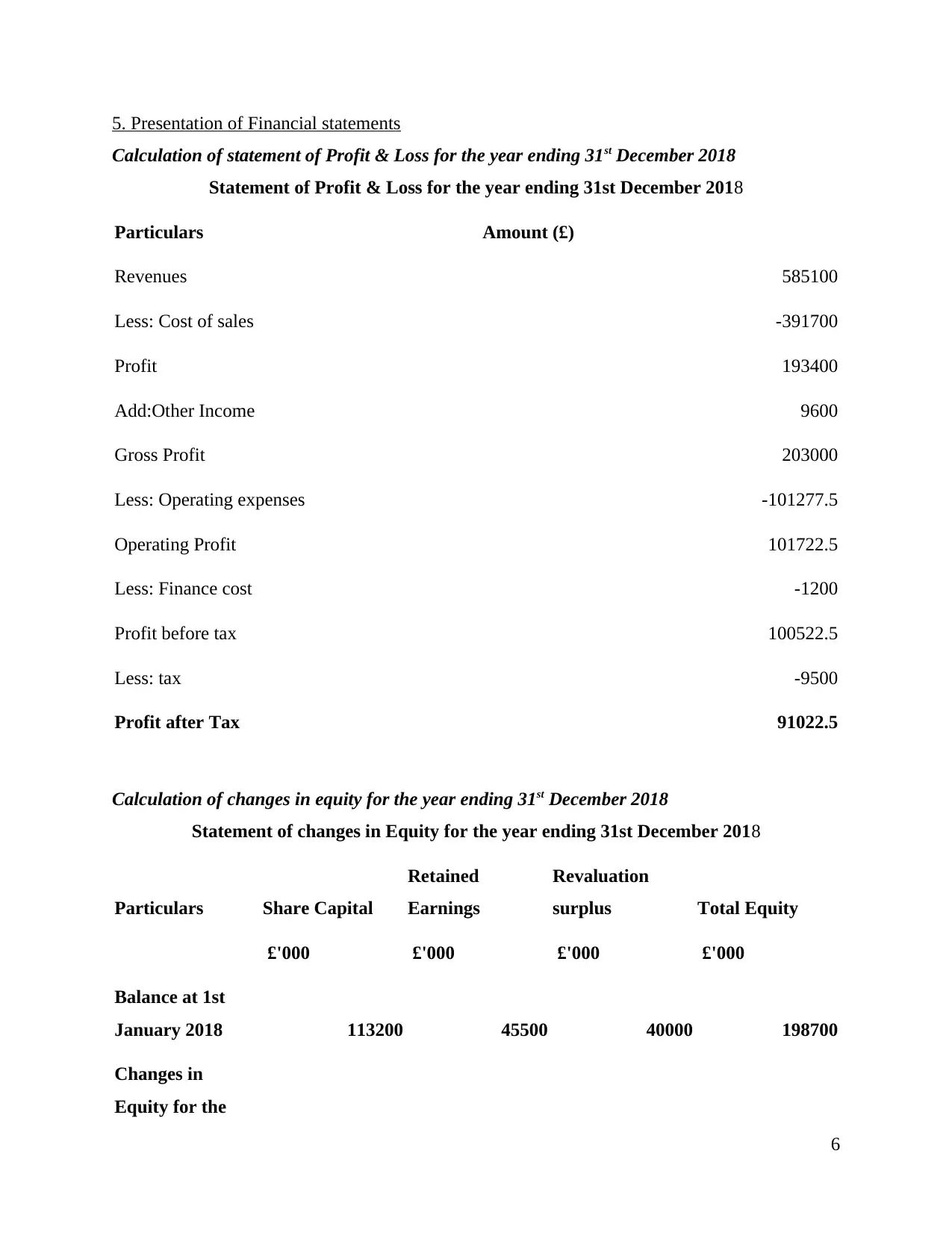

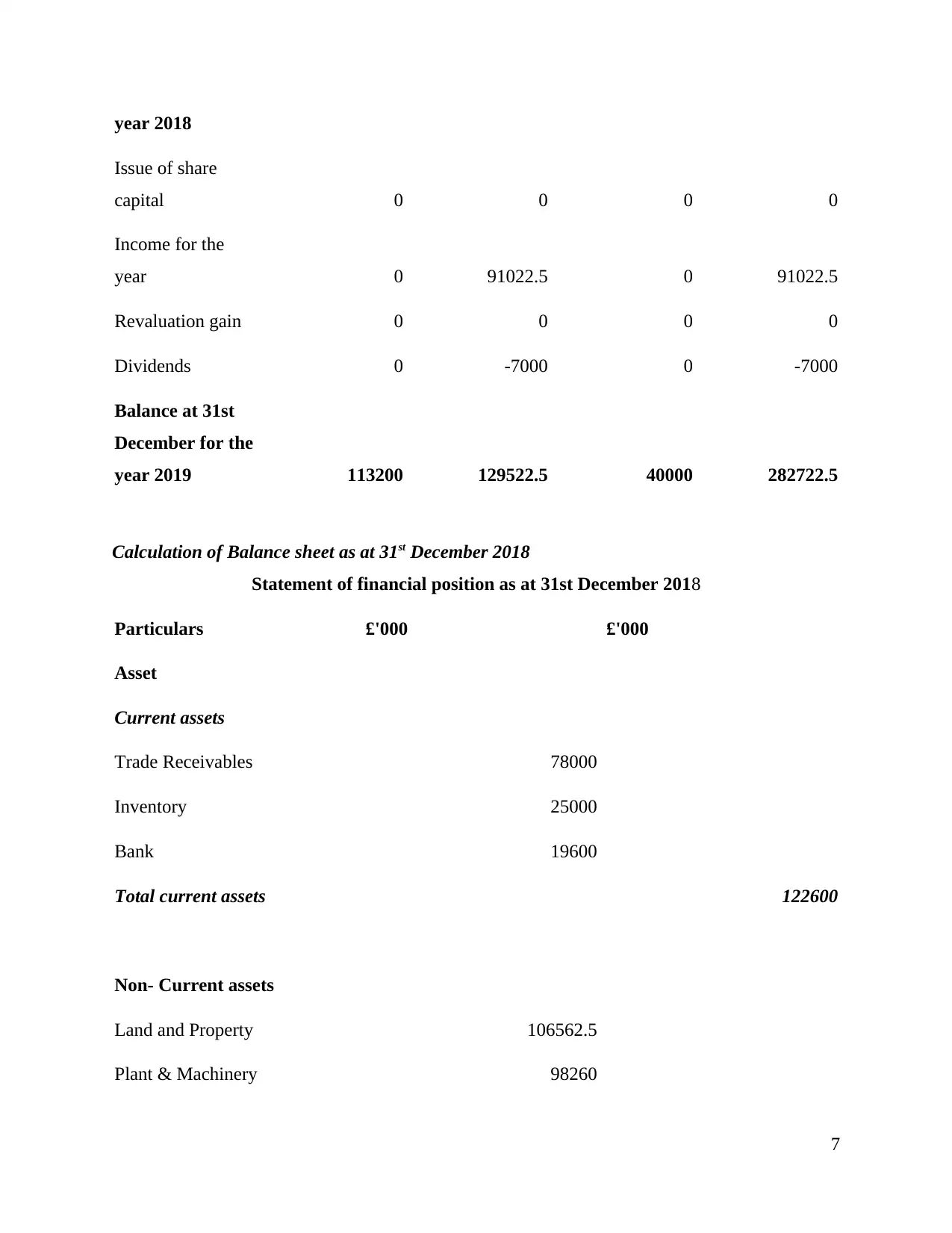

Calculation of changes in equity for the year ending 31st December 2018

Statement of changes in Equity for the year ending 31st December 2018

Particulars Share Capital

Retained

Earnings

Revaluation

surplus Total Equity

£'000 £'000 £'000 £'000

Balance at 1st

January 2018 113200 45500 40000 198700

Changes in

Equity for the

6

Calculation of statement of Profit & Loss for the year ending 31st December 2018

Statement of Profit & Loss for the year ending 31st December 2018

Particulars Amount (£)

Revenues 585100

Less: Cost of sales -391700

Profit 193400

Add:Other Income 9600

Gross Profit 203000

Less: Operating expenses -101277.5

Operating Profit 101722.5

Less: Finance cost -1200

Profit before tax 100522.5

Less: tax -9500

Profit after Tax 91022.5

Calculation of changes in equity for the year ending 31st December 2018

Statement of changes in Equity for the year ending 31st December 2018

Particulars Share Capital

Retained

Earnings

Revaluation

surplus Total Equity

£'000 £'000 £'000 £'000

Balance at 1st

January 2018 113200 45500 40000 198700

Changes in

Equity for the

6

year 2018

Issue of share

capital 0 0 0 0

Income for the

year 0 91022.5 0 91022.5

Revaluation gain 0 0 0 0

Dividends 0 -7000 0 -7000

Balance at 31st

December for the

year 2019 113200 129522.5 40000 282722.5

Calculation of Balance sheet as at 31st December 2018

Statement of financial position as at 31st December 2018

Particulars £'000 £'000

Asset

Current assets

Trade Receivables 78000

Inventory 25000

Bank 19600

Total current assets 122600

Non- Current assets

Land and Property 106562.5

Plant & Machinery 98260

7

Issue of share

capital 0 0 0 0

Income for the

year 0 91022.5 0 91022.5

Revaluation gain 0 0 0 0

Dividends 0 -7000 0 -7000

Balance at 31st

December for the

year 2019 113200 129522.5 40000 282722.5

Calculation of Balance sheet as at 31st December 2018

Statement of financial position as at 31st December 2018

Particulars £'000 £'000

Asset

Current assets

Trade Receivables 78000

Inventory 25000

Bank 19600

Total current assets 122600

Non- Current assets

Land and Property 106562.5

Plant & Machinery 98260

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

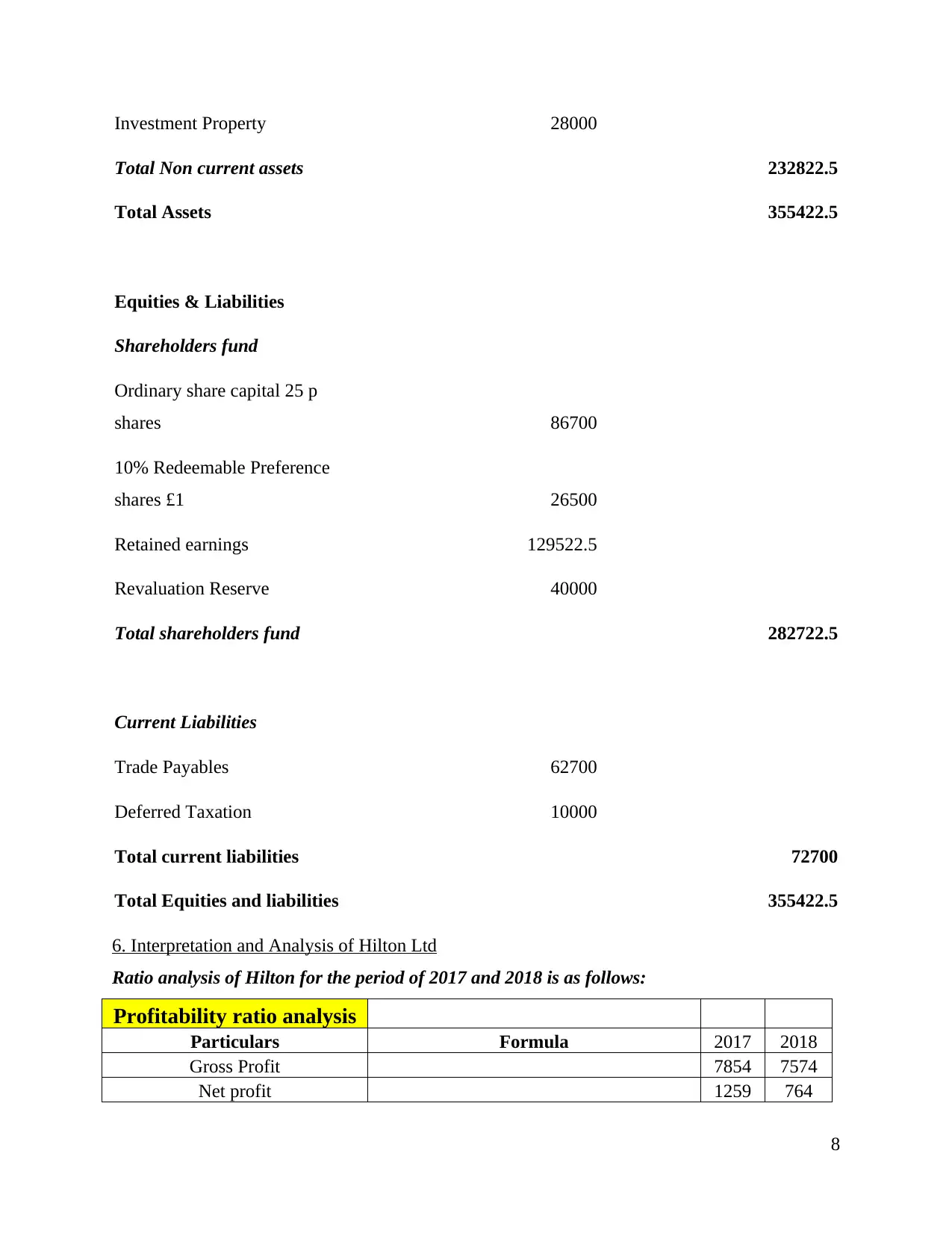

Investment Property 28000

Total Non current assets 232822.5

Total Assets 355422.5

Equities & Liabilities

Shareholders fund

Ordinary share capital 25 p

shares 86700

10% Redeemable Preference

shares £1 26500

Retained earnings 129522.5

Revaluation Reserve 40000

Total shareholders fund 282722.5

Current Liabilities

Trade Payables 62700

Deferred Taxation 10000

Total current liabilities 72700

Total Equities and liabilities 355422.5

6. Interpretation and Analysis of Hilton Ltd

Ratio analysis of Hilton for the period of 2017 and 2018 is as follows:

Profitability ratio analysis

Particulars Formula 2017 2018

Gross Profit 7854 7574

Net profit 1259 764

8

Total Non current assets 232822.5

Total Assets 355422.5

Equities & Liabilities

Shareholders fund

Ordinary share capital 25 p

shares 86700

10% Redeemable Preference

shares £1 26500

Retained earnings 129522.5

Revaluation Reserve 40000

Total shareholders fund 282722.5

Current Liabilities

Trade Payables 62700

Deferred Taxation 10000

Total current liabilities 72700

Total Equities and liabilities 355422.5

6. Interpretation and Analysis of Hilton Ltd

Ratio analysis of Hilton for the period of 2017 and 2018 is as follows:

Profitability ratio analysis

Particulars Formula 2017 2018

Gross Profit 7854 7574

Net profit 1259 764

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

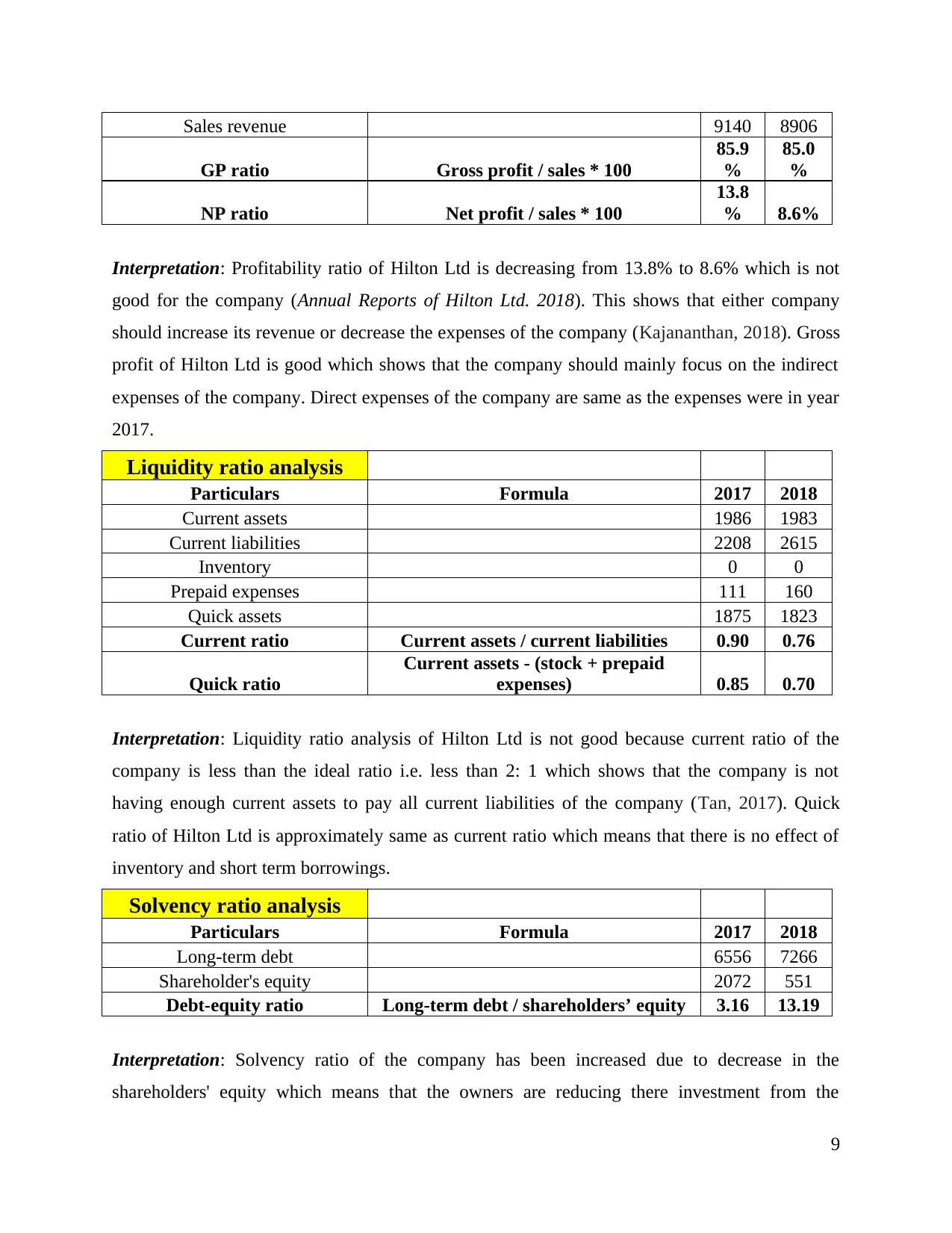

Sales revenue 9140 8906

GP ratio Gross profit / sales * 100

85.9

%

85.0

%

NP ratio Net profit / sales * 100

13.8

% 8.6%

Interpretation: Profitability ratio of Hilton Ltd is decreasing from 13.8% to 8.6% which is not

good for the company (Annual Reports of Hilton Ltd. 2018). This shows that either company

should increase its revenue or decrease the expenses of the company (Kajananthan, 2018). Gross

profit of Hilton Ltd is good which shows that the company should mainly focus on the indirect

expenses of the company. Direct expenses of the company are same as the expenses were in year

2017.

Liquidity ratio analysis

Particulars Formula 2017 2018

Current assets 1986 1983

Current liabilities 2208 2615

Inventory 0 0

Prepaid expenses 111 160

Quick assets 1875 1823

Current ratio Current assets / current liabilities 0.90 0.76

Quick ratio

Current assets - (stock + prepaid

expenses) 0.85 0.70

Interpretation: Liquidity ratio analysis of Hilton Ltd is not good because current ratio of the

company is less than the ideal ratio i.e. less than 2: 1 which shows that the company is not

having enough current assets to pay all current liabilities of the company (Tan, 2017). Quick

ratio of Hilton Ltd is approximately same as current ratio which means that there is no effect of

inventory and short term borrowings.

Solvency ratio analysis

Particulars Formula 2017 2018

Long-term debt 6556 7266

Shareholder's equity 2072 551

Debt-equity ratio Long-term debt / shareholders’ equity 3.16 13.19

Interpretation: Solvency ratio of the company has been increased due to decrease in the

shareholders' equity which means that the owners are reducing there investment from the

9

GP ratio Gross profit / sales * 100

85.9

%

85.0

%

NP ratio Net profit / sales * 100

13.8

% 8.6%

Interpretation: Profitability ratio of Hilton Ltd is decreasing from 13.8% to 8.6% which is not

good for the company (Annual Reports of Hilton Ltd. 2018). This shows that either company

should increase its revenue or decrease the expenses of the company (Kajananthan, 2018). Gross

profit of Hilton Ltd is good which shows that the company should mainly focus on the indirect

expenses of the company. Direct expenses of the company are same as the expenses were in year

2017.

Liquidity ratio analysis

Particulars Formula 2017 2018

Current assets 1986 1983

Current liabilities 2208 2615

Inventory 0 0

Prepaid expenses 111 160

Quick assets 1875 1823

Current ratio Current assets / current liabilities 0.90 0.76

Quick ratio

Current assets - (stock + prepaid

expenses) 0.85 0.70

Interpretation: Liquidity ratio analysis of Hilton Ltd is not good because current ratio of the

company is less than the ideal ratio i.e. less than 2: 1 which shows that the company is not

having enough current assets to pay all current liabilities of the company (Tan, 2017). Quick

ratio of Hilton Ltd is approximately same as current ratio which means that there is no effect of

inventory and short term borrowings.

Solvency ratio analysis

Particulars Formula 2017 2018

Long-term debt 6556 7266

Shareholder's equity 2072 551

Debt-equity ratio Long-term debt / shareholders’ equity 3.16 13.19

Interpretation: Solvency ratio of the company has been increased due to decrease in the

shareholders' equity which means that the owners are reducing there investment from the

9

company or company is not retaining its profits for investing back into company (Rahman,

2017). It is not good sign for the company because it shows that the company is borrowing more

debt from outside the company which increases the finance cost of Hilton Ltd.

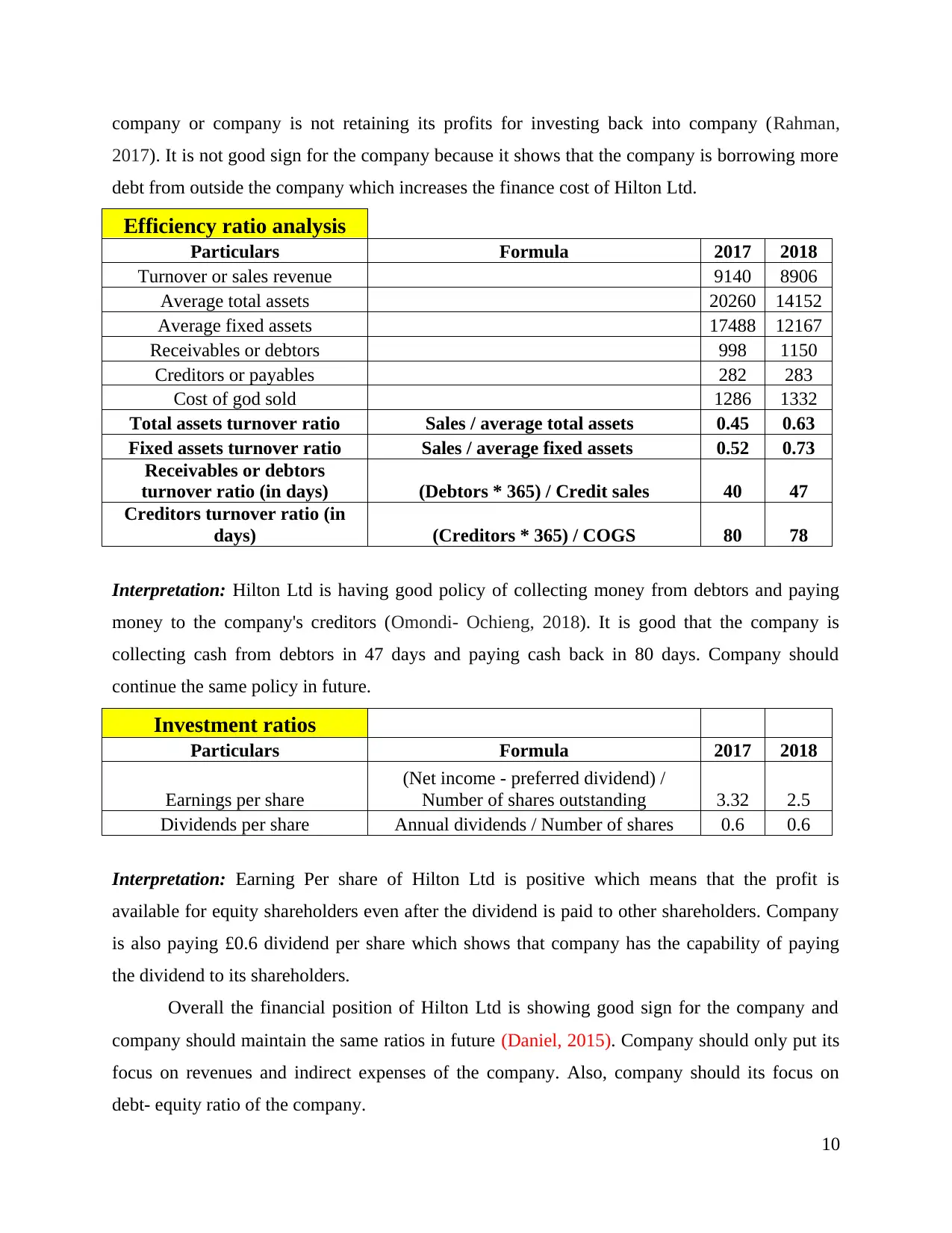

Efficiency ratio analysis

Particulars Formula 2017 2018

Turnover or sales revenue 9140 8906

Average total assets 20260 14152

Average fixed assets 17488 12167

Receivables or debtors 998 1150

Creditors or payables 282 283

Cost of god sold 1286 1332

Total assets turnover ratio Sales / average total assets 0.45 0.63

Fixed assets turnover ratio Sales / average fixed assets 0.52 0.73

Receivables or debtors

turnover ratio (in days) (Debtors * 365) / Credit sales 40 47

Creditors turnover ratio (in

days) (Creditors * 365) / COGS 80 78

Interpretation: Hilton Ltd is having good policy of collecting money from debtors and paying

money to the company's creditors (Omondi- Ochieng, 2018). It is good that the company is

collecting cash from debtors in 47 days and paying cash back in 80 days. Company should

continue the same policy in future.

Investment ratios

Particulars Formula 2017 2018

Earnings per share

(Net income - preferred dividend) /

Number of shares outstanding 3.32 2.5

Dividends per share Annual dividends / Number of shares 0.6 0.6

Interpretation: Earning Per share of Hilton Ltd is positive which means that the profit is

available for equity shareholders even after the dividend is paid to other shareholders. Company

is also paying £0.6 dividend per share which shows that company has the capability of paying

the dividend to its shareholders.

Overall the financial position of Hilton Ltd is showing good sign for the company and

company should maintain the same ratios in future (Daniel, 2015). Company should only put its

focus on revenues and indirect expenses of the company. Also, company should its focus on

debt- equity ratio of the company.

10

2017). It is not good sign for the company because it shows that the company is borrowing more

debt from outside the company which increases the finance cost of Hilton Ltd.

Efficiency ratio analysis

Particulars Formula 2017 2018

Turnover or sales revenue 9140 8906

Average total assets 20260 14152

Average fixed assets 17488 12167

Receivables or debtors 998 1150

Creditors or payables 282 283

Cost of god sold 1286 1332

Total assets turnover ratio Sales / average total assets 0.45 0.63

Fixed assets turnover ratio Sales / average fixed assets 0.52 0.73

Receivables or debtors

turnover ratio (in days) (Debtors * 365) / Credit sales 40 47

Creditors turnover ratio (in

days) (Creditors * 365) / COGS 80 78

Interpretation: Hilton Ltd is having good policy of collecting money from debtors and paying

money to the company's creditors (Omondi- Ochieng, 2018). It is good that the company is

collecting cash from debtors in 47 days and paying cash back in 80 days. Company should

continue the same policy in future.

Investment ratios

Particulars Formula 2017 2018

Earnings per share

(Net income - preferred dividend) /

Number of shares outstanding 3.32 2.5

Dividends per share Annual dividends / Number of shares 0.6 0.6

Interpretation: Earning Per share of Hilton Ltd is positive which means that the profit is

available for equity shareholders even after the dividend is paid to other shareholders. Company

is also paying £0.6 dividend per share which shows that company has the capability of paying

the dividend to its shareholders.

Overall the financial position of Hilton Ltd is showing good sign for the company and

company should maintain the same ratios in future (Daniel, 2015). Company should only put its

focus on revenues and indirect expenses of the company. Also, company should its focus on

debt- equity ratio of the company.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.