Case Analysis of Financial Reporting

VerifiedAdded on 2020/04/15

|7

|824

|35

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL REPORTING

Financial Reporting

Name of the Student:

Name of the University:

Authors Note:

Financial Reporting

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

FINANCIAL REPORTING

Table of Contents

a)......................................................................................................................................................2

b)......................................................................................................................................................3

c)......................................................................................................................................................4

Reference.........................................................................................................................................6

FINANCIAL REPORTING

Table of Contents

a)......................................................................................................................................................2

b)......................................................................................................................................................3

c)......................................................................................................................................................4

Reference.........................................................................................................................................6

2

FINANCIAL REPORTING

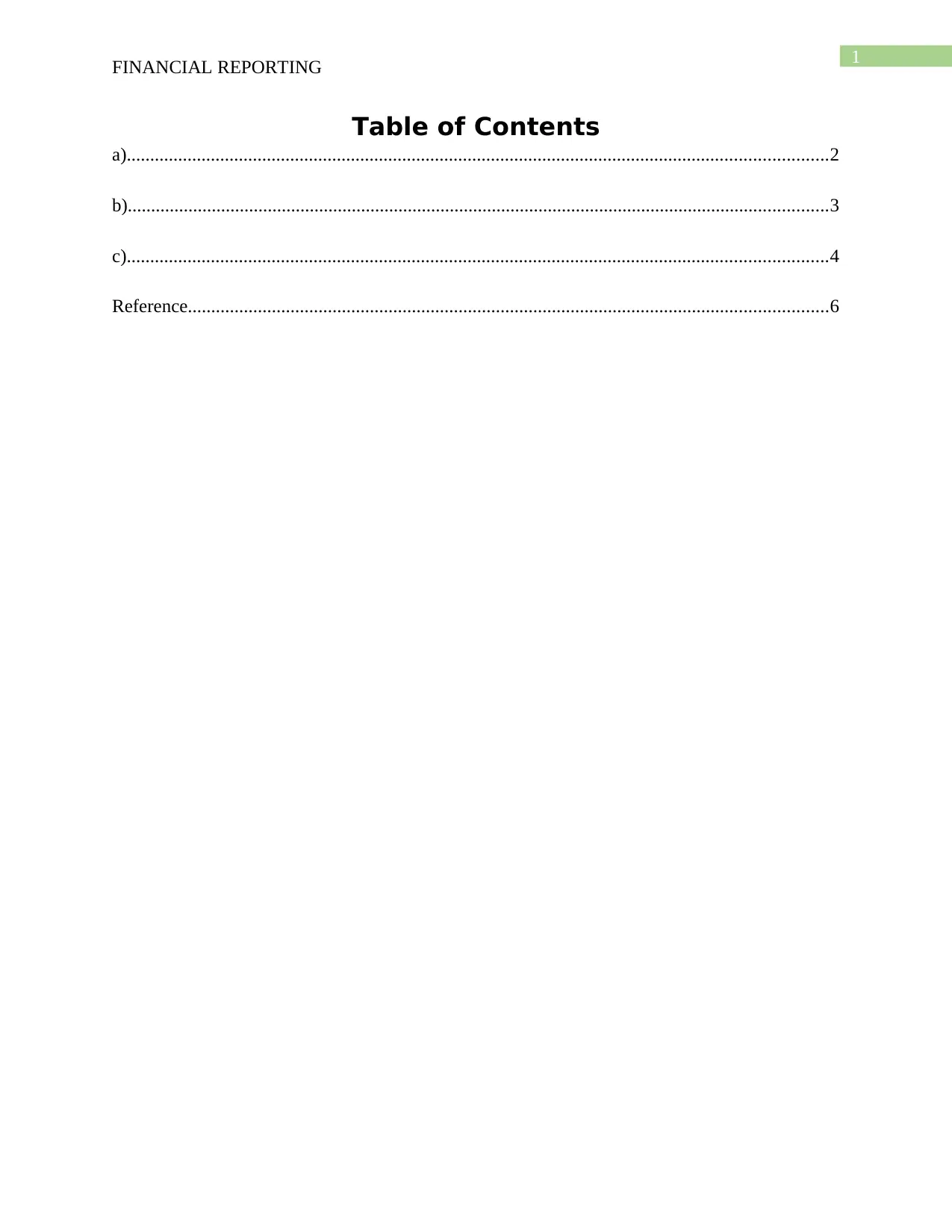

a)

In the books of San Pedro Industries

Balance sheet (using account format)

Liabilities and Equities Amount Amount Assets

Amoun

t Amount

Current Liability Current Assets

Accounts Payable $710.00 Cash in hand $88.00

Income Tax Payable $105.00

Accounts

Receivable

$895.0

0

Dividends Payable $50.00

Provision for

doubtful debt -$95.00

Net Accounts

Receivable $800.00

Total Current

Liabilities $865.00

Interest

Receivable $60.00

Installment

receivables $120.00

Non-Current Liability

Merchandise

Inventory $100.00

Notes Payable $1,000.00 Supplies $28.00

Unearned revenue $125.00 Prepaid expenses $46.00

Total Current

Assets $1,242.00

Total Noncurrent

Liability $1,125.00

Non-Current

Assets

Note Receivable $475.00

Total Liability $1,990.00

Building and

Equipment

$1,425.

00

Accumulated

depreciation

-

$375.0

0

Shareholders’ Equity

Net Building and

Equipment $1,050.00

Common stock at par $90.00 Land $600.00

Additional capital $725.00 Patent $85.00

Retained earning $647.00

Total Non-

Current Assets $2,210.00

Total Shareholders’

Equity $1,462.00

Total Liability and

Shareholders’ Equity $3,452.00 Total Assets $3,452.00

FINANCIAL REPORTING

a)

In the books of San Pedro Industries

Balance sheet (using account format)

Liabilities and Equities Amount Amount Assets

Amoun

t Amount

Current Liability Current Assets

Accounts Payable $710.00 Cash in hand $88.00

Income Tax Payable $105.00

Accounts

Receivable

$895.0

0

Dividends Payable $50.00

Provision for

doubtful debt -$95.00

Net Accounts

Receivable $800.00

Total Current

Liabilities $865.00

Interest

Receivable $60.00

Installment

receivables $120.00

Non-Current Liability

Merchandise

Inventory $100.00

Notes Payable $1,000.00 Supplies $28.00

Unearned revenue $125.00 Prepaid expenses $46.00

Total Current

Assets $1,242.00

Total Noncurrent

Liability $1,125.00

Non-Current

Assets

Note Receivable $475.00

Total Liability $1,990.00

Building and

Equipment

$1,425.

00

Accumulated

depreciation

-

$375.0

0

Shareholders’ Equity

Net Building and

Equipment $1,050.00

Common stock at par $90.00 Land $600.00

Additional capital $725.00 Patent $85.00

Retained earning $647.00

Total Non-

Current Assets $2,210.00

Total Shareholders’

Equity $1,462.00

Total Liability and

Shareholders’ Equity $3,452.00 Total Assets $3,452.00

3

FINANCIAL REPORTING

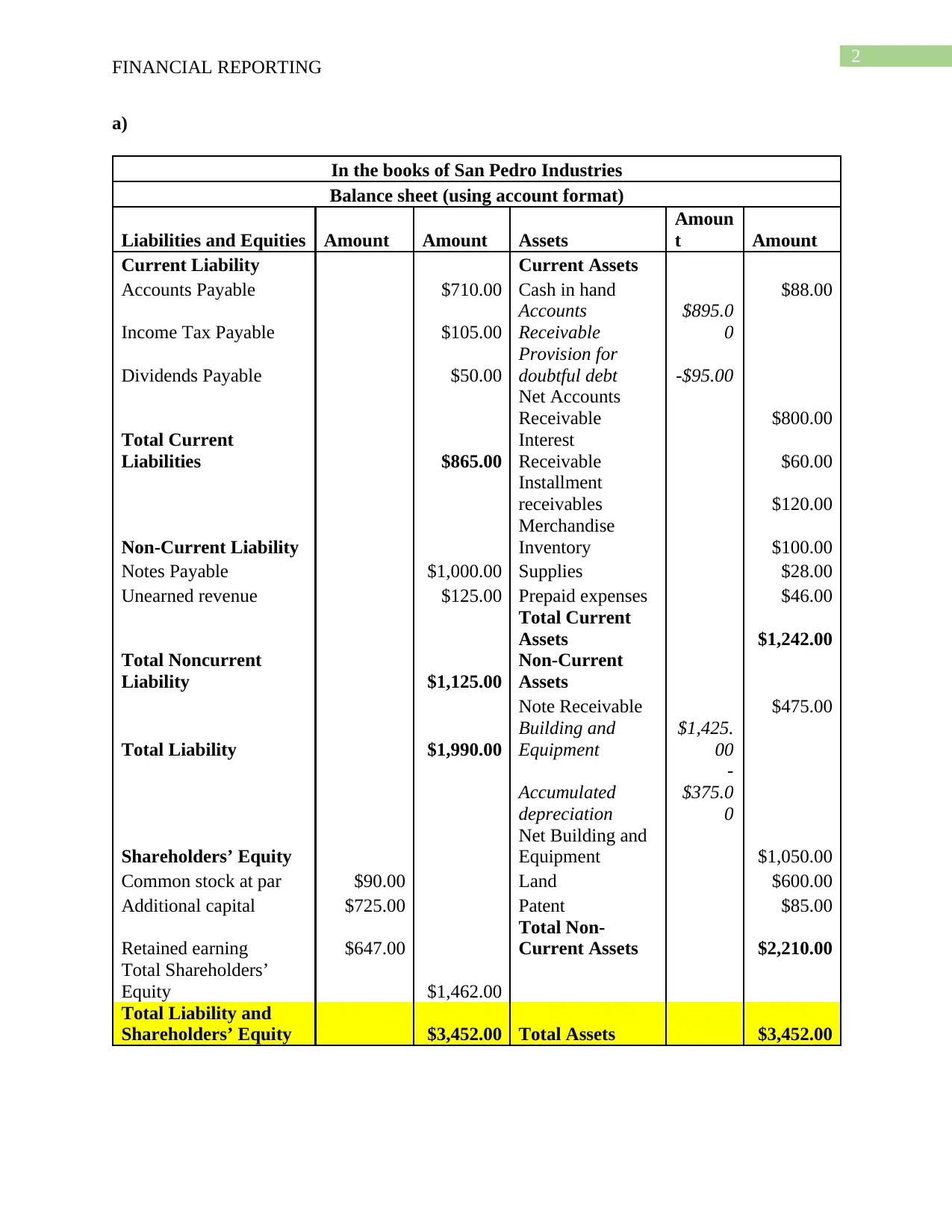

b)

In the books of San Pedro Industries

Balance sheet (Report format)

Particulars Amount Amount

Current Assets

Cash in hand $88.00

Accounts Receivable $895.00 $0.00

Provision for doubtful debt -$95.00 $0.00

Net Accounts Receivable $800.00

Interest Receivable $60.00

Installment receivables $120.00

Merchandise Inventory $100.00

Supplies $28.00

Prepaid expenses $46.00

Total Current Assets $1,242.00

Non-Current Assets

Note Receivable $475.00

Building and Equipment $1,425.00

Accumulated depreciation -$375.00

Net Building and Equipment $1,050.00

Land $600.00

Patent $85.00

Total Non-Current Assets $2,210.00

Total Assets $3,452.00

Current Liability

Accounts Payable $710.00

Income Tax Payable $105.00

Dividends Payable $50.00

Total Current Liabilities $865.00

Non-Current Liability

Notes Payable $1,000.00

Unearned revenue $125.00

Total Noncurrent Liability $1,125.00

Total Liability $1,990.00

FINANCIAL REPORTING

b)

In the books of San Pedro Industries

Balance sheet (Report format)

Particulars Amount Amount

Current Assets

Cash in hand $88.00

Accounts Receivable $895.00 $0.00

Provision for doubtful debt -$95.00 $0.00

Net Accounts Receivable $800.00

Interest Receivable $60.00

Installment receivables $120.00

Merchandise Inventory $100.00

Supplies $28.00

Prepaid expenses $46.00

Total Current Assets $1,242.00

Non-Current Assets

Note Receivable $475.00

Building and Equipment $1,425.00

Accumulated depreciation -$375.00

Net Building and Equipment $1,050.00

Land $600.00

Patent $85.00

Total Non-Current Assets $2,210.00

Total Assets $3,452.00

Current Liability

Accounts Payable $710.00

Income Tax Payable $105.00

Dividends Payable $50.00

Total Current Liabilities $865.00

Non-Current Liability

Notes Payable $1,000.00

Unearned revenue $125.00

Total Noncurrent Liability $1,125.00

Total Liability $1,990.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

FINANCIAL REPORTING

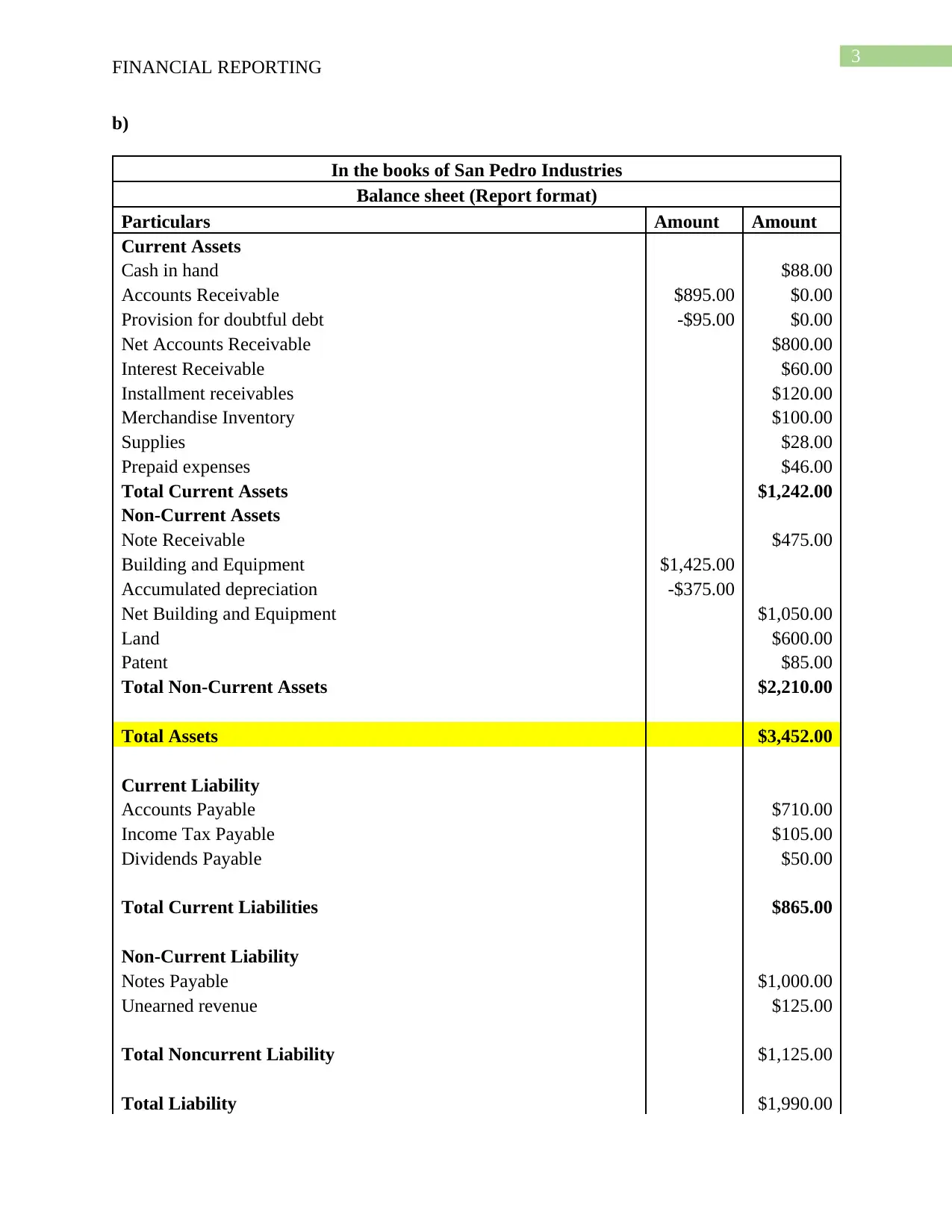

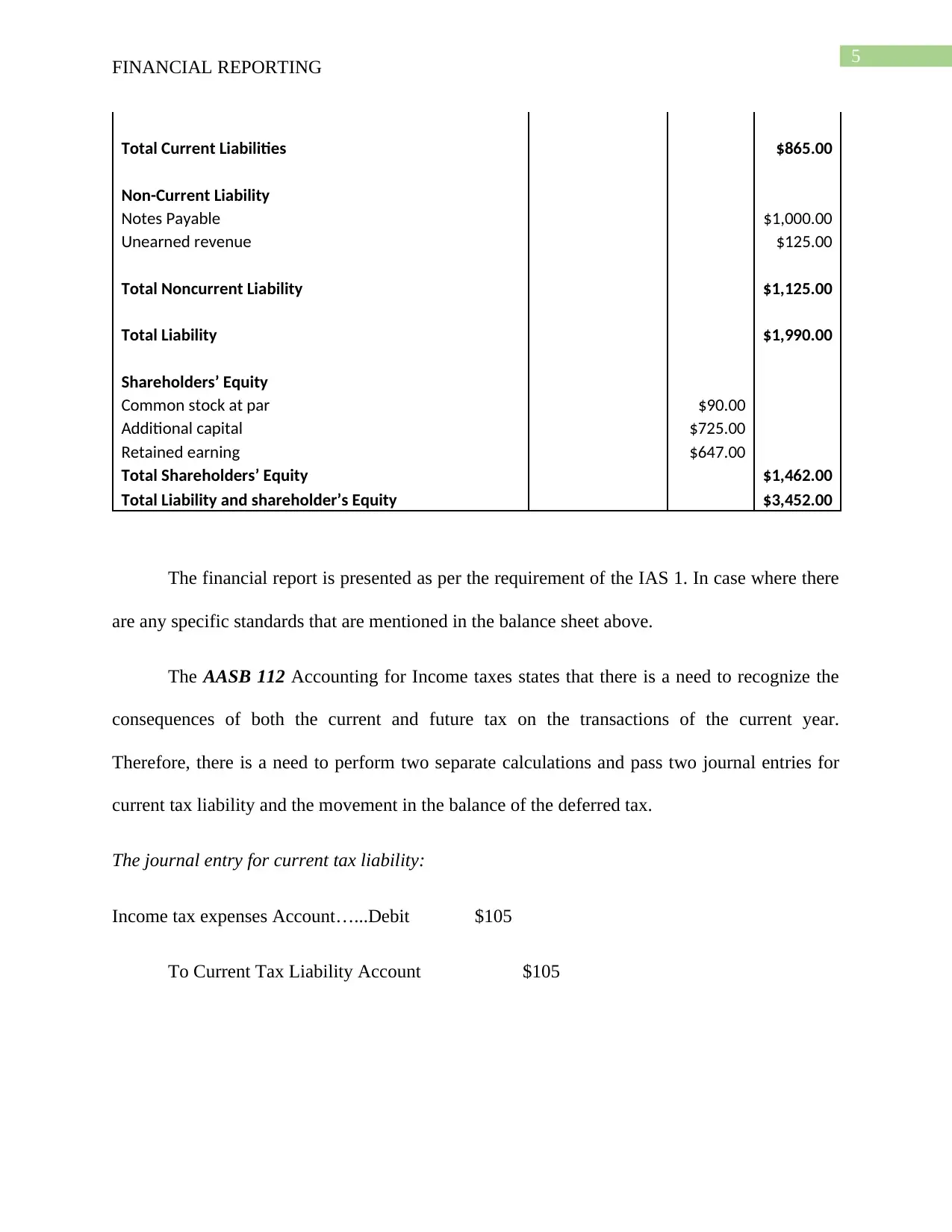

Shareholders’ Equity

Common stock at par $90.00

Additional capital $725.00

Retained earning $647.00

Total Shareholders’ Equity $1,462.00

Total Liability and shareholder’s Equity $3,452.00

c)

In the books of San pedro Industries

Balance sheet (IFRS format)

Particulars IFRS Standard Amount Amount

Non-Current Assets

Patent AIS 38 $85.00

Land $600.00

Building and Equipment IAS 16 $1,425.00

Accumulated depreciation -$375.00

Net Building and Equipment $1,050.00

Note Receivable $475.00

Total Non-Current Assets $2,210.00

Current Assets

Cash in hand $88.00

Accounts Receivable $895.00

Provision for doubtful debt IAS 8 -$95.00

Net Accounts Receivable $800.00

Interest Receivable $60.00

Installment receivables $120.00

Merchandise Inventory IAS 2 $100.00

Supplies $28.00

Prepaid expenses $46.00

Total Current Assets $1,242.00

Current Liability

Accounts Payable $710.00

Income Tax Payable $105.00

Dividends Payable $50.00

FINANCIAL REPORTING

Shareholders’ Equity

Common stock at par $90.00

Additional capital $725.00

Retained earning $647.00

Total Shareholders’ Equity $1,462.00

Total Liability and shareholder’s Equity $3,452.00

c)

In the books of San pedro Industries

Balance sheet (IFRS format)

Particulars IFRS Standard Amount Amount

Non-Current Assets

Patent AIS 38 $85.00

Land $600.00

Building and Equipment IAS 16 $1,425.00

Accumulated depreciation -$375.00

Net Building and Equipment $1,050.00

Note Receivable $475.00

Total Non-Current Assets $2,210.00

Current Assets

Cash in hand $88.00

Accounts Receivable $895.00

Provision for doubtful debt IAS 8 -$95.00

Net Accounts Receivable $800.00

Interest Receivable $60.00

Installment receivables $120.00

Merchandise Inventory IAS 2 $100.00

Supplies $28.00

Prepaid expenses $46.00

Total Current Assets $1,242.00

Current Liability

Accounts Payable $710.00

Income Tax Payable $105.00

Dividends Payable $50.00

5

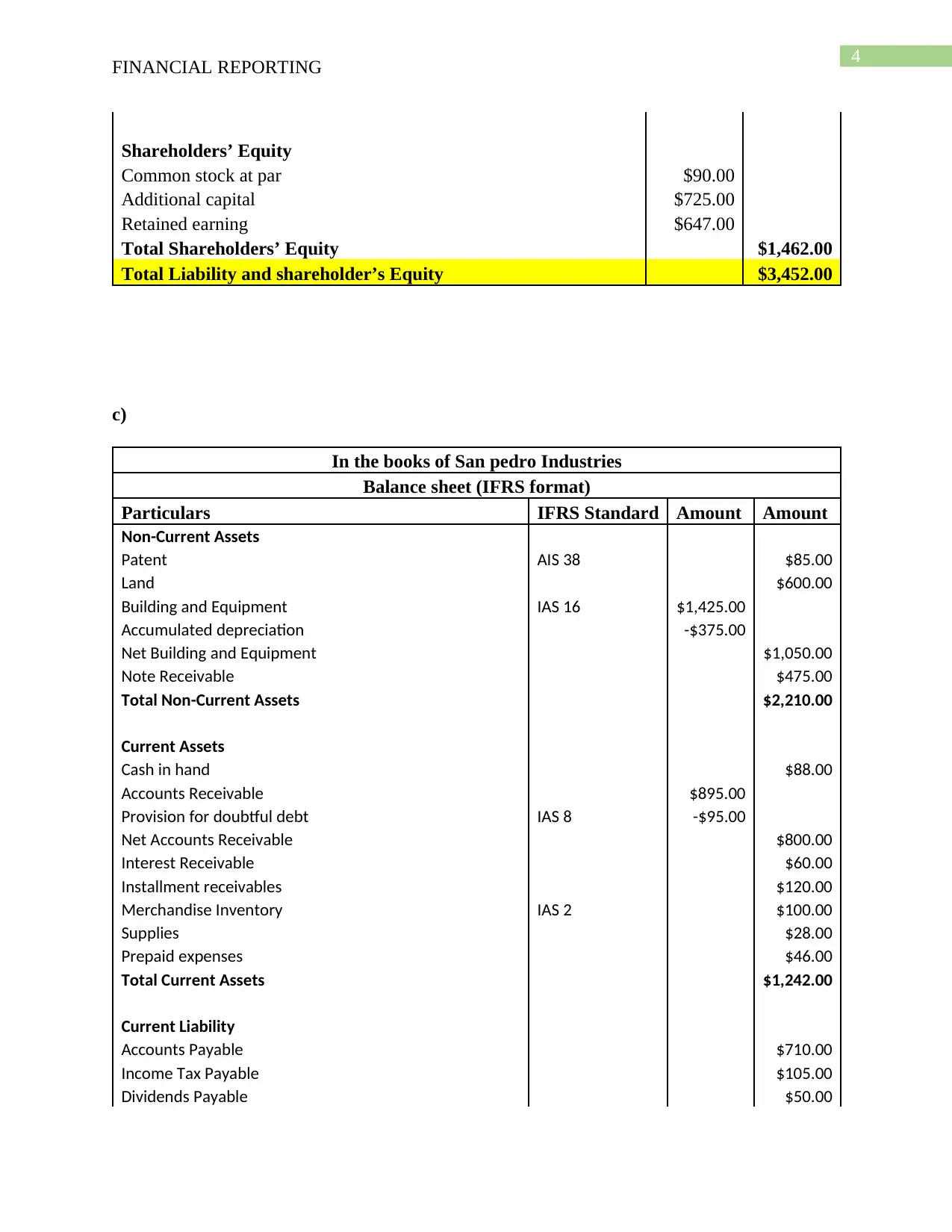

FINANCIAL REPORTING

Total Current Liabilities $865.00

Non-Current Liability

Notes Payable $1,000.00

Unearned revenue $125.00

Total Noncurrent Liability $1,125.00

Total Liability $1,990.00

Shareholders’ Equity

Common stock at par $90.00

Additional capital $725.00

Retained earning $647.00

Total Shareholders’ Equity $1,462.00

Total Liability and shareholder’s Equity $3,452.00

The financial report is presented as per the requirement of the IAS 1. In case where there

are any specific standards that are mentioned in the balance sheet above.

The AASB 112 Accounting for Income taxes states that there is a need to recognize the

consequences of both the current and future tax on the transactions of the current year.

Therefore, there is a need to perform two separate calculations and pass two journal entries for

current tax liability and the movement in the balance of the deferred tax.

The journal entry for current tax liability:

Income tax expenses Account…...Debit $105

To Current Tax Liability Account $105

FINANCIAL REPORTING

Total Current Liabilities $865.00

Non-Current Liability

Notes Payable $1,000.00

Unearned revenue $125.00

Total Noncurrent Liability $1,125.00

Total Liability $1,990.00

Shareholders’ Equity

Common stock at par $90.00

Additional capital $725.00

Retained earning $647.00

Total Shareholders’ Equity $1,462.00

Total Liability and shareholder’s Equity $3,452.00

The financial report is presented as per the requirement of the IAS 1. In case where there

are any specific standards that are mentioned in the balance sheet above.

The AASB 112 Accounting for Income taxes states that there is a need to recognize the

consequences of both the current and future tax on the transactions of the current year.

Therefore, there is a need to perform two separate calculations and pass two journal entries for

current tax liability and the movement in the balance of the deferred tax.

The journal entry for current tax liability:

Income tax expenses Account…...Debit $105

To Current Tax Liability Account $105

6

FINANCIAL REPORTING

Reference

Dudin, M.N., Prokofev, M.N., Fedorova, I.J.E., Frygin, A.V. and Kucuri, G.N., 2015.

International Practice of Generation of the National Budget Income on the Basis of the Generally

Accepted Financial Reporting Standards (IFRS).

Gassen, J., 2017. The effect of IFRS for SMEs on the financial reporting environment of private

firms: an exploratory interview study. Accounting and Business Research, 47(5), pp.540-563.

KAAYA, I.D., 2015. The Impact of International Financial Reporting Standards (IFRS) on

Earnings Management: A Review of Empirical Evidence. Journal of Finance, 3(3), pp.57-65.

Nobes, C., 2014. International Classification of Financial Reporting 3e. Routledge.

FINANCIAL REPORTING

Reference

Dudin, M.N., Prokofev, M.N., Fedorova, I.J.E., Frygin, A.V. and Kucuri, G.N., 2015.

International Practice of Generation of the National Budget Income on the Basis of the Generally

Accepted Financial Reporting Standards (IFRS).

Gassen, J., 2017. The effect of IFRS for SMEs on the financial reporting environment of private

firms: an exploratory interview study. Accounting and Business Research, 47(5), pp.540-563.

KAAYA, I.D., 2015. The Impact of International Financial Reporting Standards (IFRS) on

Earnings Management: A Review of Empirical Evidence. Journal of Finance, 3(3), pp.57-65.

Nobes, C., 2014. International Classification of Financial Reporting 3e. Routledge.

1 out of 7

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.