Financial Reporting and Analysis of Sims Metal Management - ACC510

VerifiedAdded on 2023/06/04

|13

|2251

|319

Report

AI Summary

This report provides a detailed financial analysis of Sims Metal Management, focusing on key aspects of its financial reporting. It evaluates the company's recognition and measurement of property, plant, and equipment, intangible assets, provisions, contingent liabilities, leases, and revenue, based on its 2017 annual report. The analysis considers the appropriateness of the accounting methods used, such as historical cost and straight-line depreciation, and suggests potential improvements like fair value accounting. The report also examines the company's compliance with AASB 16 for lease accounting and identifies the main revenue streams. The conclusion assesses the overall quality and transparency of Sims Metal Management's financial reporting practices, highlighting its adherence to financial reporting standards.

Running head: FINANCIAL REPORTING

Financial Reporting

Name of the Student:

Name of the University:

Authors Note:

Financial Reporting

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL REPORTING

1

Table of Contents

1. Introduction:...........................................................................................................................2

2. Property, plant and equipment:..............................................................................................2

3. Intangible assets:....................................................................................................................4

4. Provisions, contingent liabilities (commitments) and contingent assets:...............................5

5. Leases:....................................................................................................................................7

6. Revenue:.................................................................................................................................8

7. Conclusion:............................................................................................................................9

References and Bibliography:..................................................................................................11

1

Table of Contents

1. Introduction:...........................................................................................................................2

2. Property, plant and equipment:..............................................................................................2

3. Intangible assets:....................................................................................................................4

4. Provisions, contingent liabilities (commitments) and contingent assets:...............................5

5. Leases:....................................................................................................................................7

6. Revenue:.................................................................................................................................8

7. Conclusion:............................................................................................................................9

References and Bibliography:..................................................................................................11

FINANCIAL REPORTING

2

1. Introduction:

The assessment aims in evaluating the current financial position of Sims Metal

Management, where different assets of the organisation has been evaluated. The overall lease,

revenue and continent liabilities of the organisation has been analysed for identifying the

level of operations and current financial position of the company. Sims Metal Management is

one of the leading organisations in recycling, where its operations are to salvage metals and

electronic products. In addition, the organisation deals in ferrous metal, non-ferrous metals,

post-consumer electronic goods and municipal waste for recycling purposes. The operations

of the organisation have been situated to United Sates, Australia and UK, where different

division have been maintained for conducting their operations. The divisions such as metals

recycling, electronic recycling and municipal recycling has been conducted by the

management of Sims Metal Management for smoothly conducting its operations. During the

fiscal year of 2017 the total revenue of the company has accounted for $5.1 billion, where the

net income was at the levels of $120 million.

2. Property, plant and equipment:

Figure 1: Depicting the Recognition Method

2

1. Introduction:

The assessment aims in evaluating the current financial position of Sims Metal

Management, where different assets of the organisation has been evaluated. The overall lease,

revenue and continent liabilities of the organisation has been analysed for identifying the

level of operations and current financial position of the company. Sims Metal Management is

one of the leading organisations in recycling, where its operations are to salvage metals and

electronic products. In addition, the organisation deals in ferrous metal, non-ferrous metals,

post-consumer electronic goods and municipal waste for recycling purposes. The operations

of the organisation have been situated to United Sates, Australia and UK, where different

division have been maintained for conducting their operations. The divisions such as metals

recycling, electronic recycling and municipal recycling has been conducted by the

management of Sims Metal Management for smoothly conducting its operations. During the

fiscal year of 2017 the total revenue of the company has accounted for $5.1 billion, where the

net income was at the levels of $120 million.

2. Property, plant and equipment:

Figure 1: Depicting the Recognition Method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL REPORTING

3

(Source: Simsmm.com, 2018)

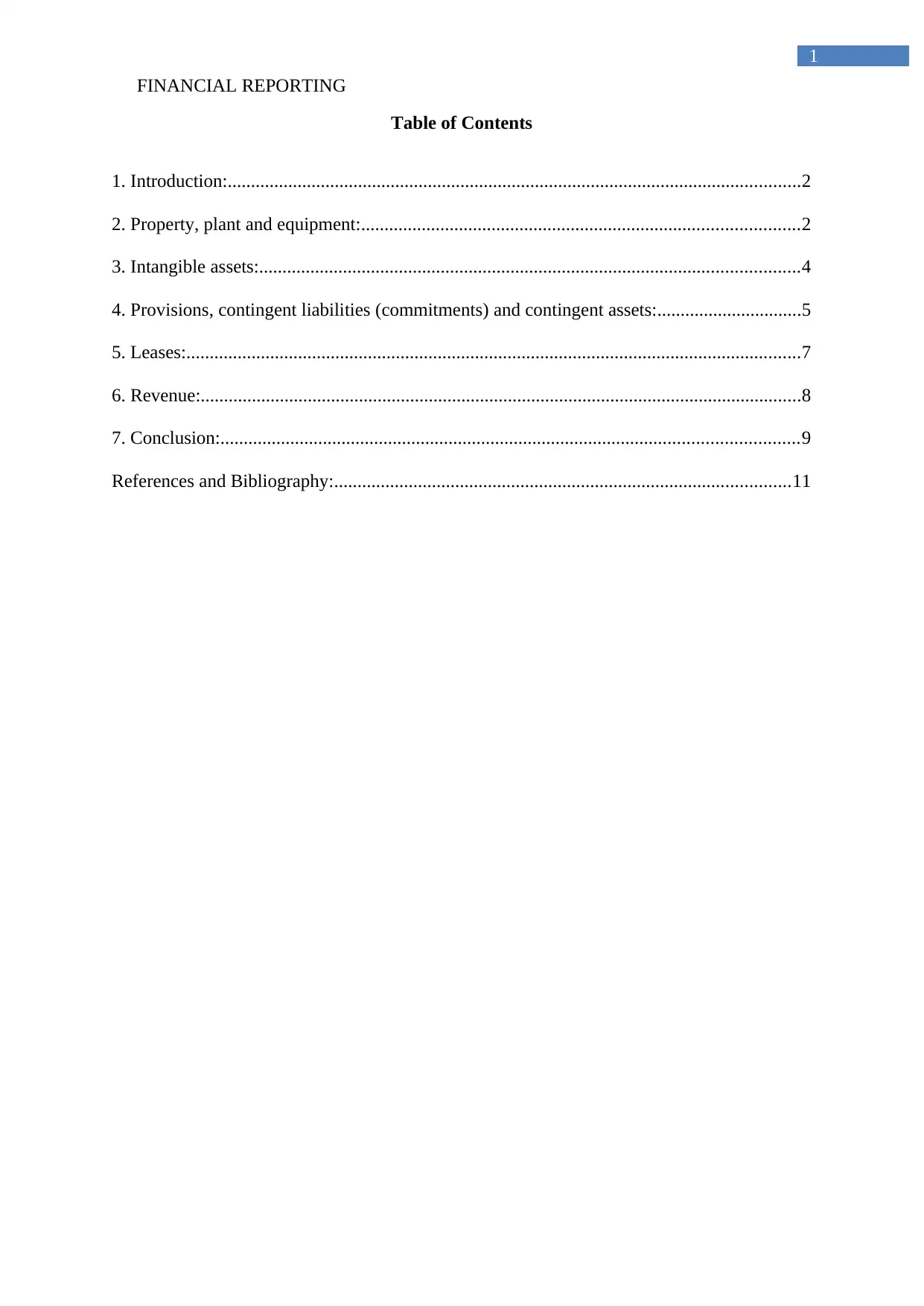

The non-current assets, which has been taken into consideration for Sims Metal

Management is Property, plant and equipment that is adequately recognised in their annual

report. After evaluating the annual report adequate recognition and measures has been used

by the organisation, where the carrying value, deprecation, proceeds from sales and

impairment is used by the organisation for evaluating its non-current assets. The company

uses the historical values of the non-current assets, where straight line deprecation is used for

reducing values of the assets and determining the correct valuation of the non-current assets.

The proceeds from sales are recognised at the date of the unconditional contract sales, which

has been conducted over the period, where the carrying amount is used for recognising the

profit and loss. The impairment loss is also initiated by the company, when the overall

carrying amount is greater than the recoverable amount (Dalnial et al., 2014).

The different recognition method such as fair value accounting can be used for the

non-current assets of the organisation, which might help in detecting the current values of

their non-current assets. The fair value measure allows the company to accurately portray the

current valuation of their noncurrent assets, which can help in detecting the current valuation

of the organisation. The fair value measure can evaluate the non-current assets such as

property accurately for depicting the current financial condition of the organisation.

3

(Source: Simsmm.com, 2018)

The non-current assets, which has been taken into consideration for Sims Metal

Management is Property, plant and equipment that is adequately recognised in their annual

report. After evaluating the annual report adequate recognition and measures has been used

by the organisation, where the carrying value, deprecation, proceeds from sales and

impairment is used by the organisation for evaluating its non-current assets. The company

uses the historical values of the non-current assets, where straight line deprecation is used for

reducing values of the assets and determining the correct valuation of the non-current assets.

The proceeds from sales are recognised at the date of the unconditional contract sales, which

has been conducted over the period, where the carrying amount is used for recognising the

profit and loss. The impairment loss is also initiated by the company, when the overall

carrying amount is greater than the recoverable amount (Dalnial et al., 2014).

The different recognition method such as fair value accounting can be used for the

non-current assets of the organisation, which might help in detecting the current values of

their non-current assets. The fair value measure allows the company to accurately portray the

current valuation of their noncurrent assets, which can help in detecting the current valuation

of the organisation. The fair value measure can evaluate the non-current assets such as

property accurately for depicting the current financial condition of the organisation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL REPORTING

4

3. Intangible assets:

Figure 2: Depicting the Intangible assets

(Source: Simsmm.com, 2018)

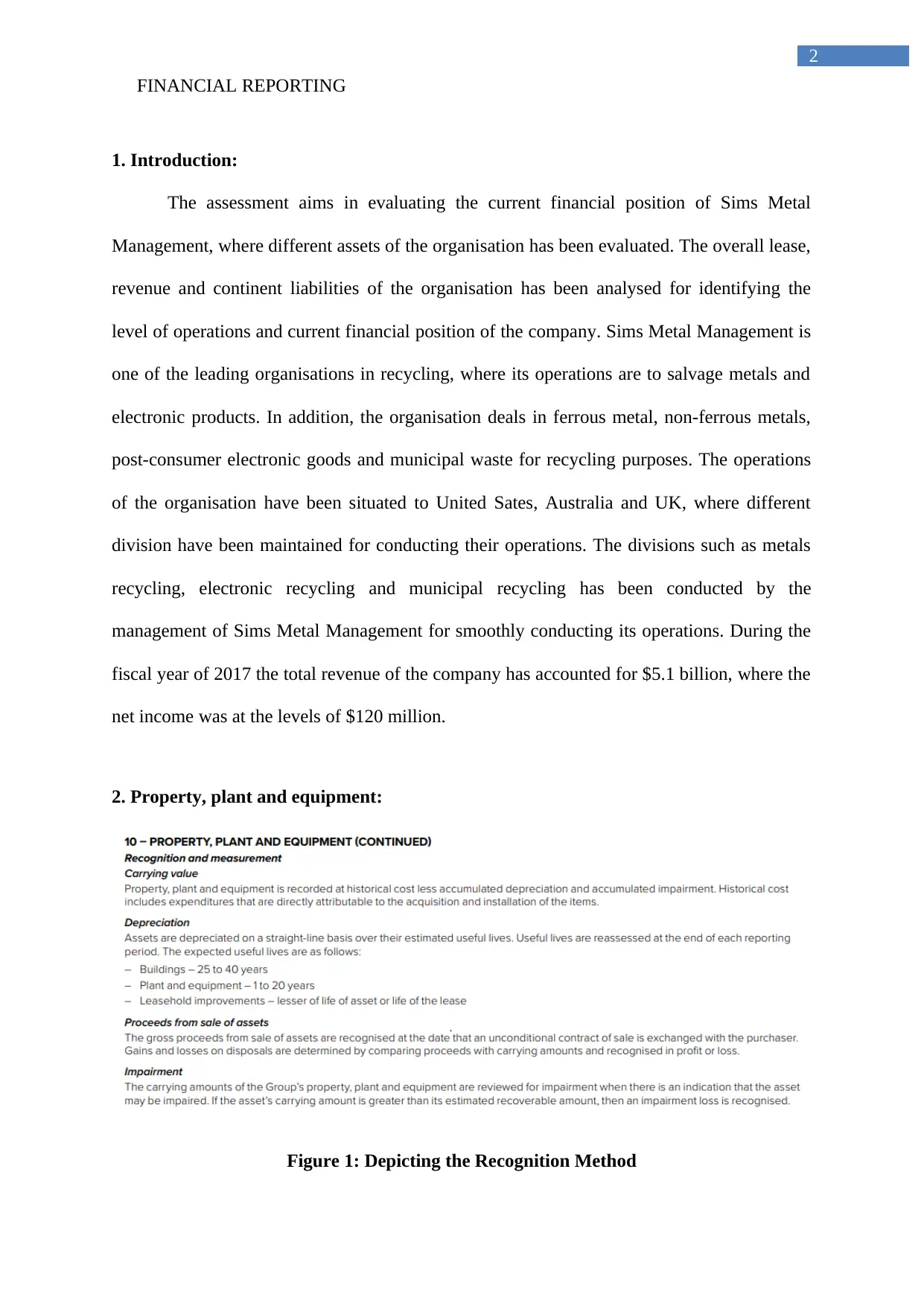

The above figure indicates the level of different intangible assets, which are

conducted by Sims Metal Management. The company uses intangible assets such as

goodwill, supplier relationships, permits, licences/contracts, and trade names. The identified

intangible assets have been used by Sims Metal Management for detecting the level of assets,

which has been maintained by the management during the fiscal year of 2017. The relevant

reduction in the current total intangible assets of the organisation is relevantly seen from 2016

to 2017. This decline is relevantly conducted by the organisation with the help of

accumulated impairment, accumulated amortisation, amortisation expense and foreign

exchange difference (DeFusco et al., 2015). The overall intangible assets of the organisation

have mainly declined from the levels of 169.8 million in 2016 to 158.4 million in 2017. This

4

3. Intangible assets:

Figure 2: Depicting the Intangible assets

(Source: Simsmm.com, 2018)

The above figure indicates the level of different intangible assets, which are

conducted by Sims Metal Management. The company uses intangible assets such as

goodwill, supplier relationships, permits, licences/contracts, and trade names. The identified

intangible assets have been used by Sims Metal Management for detecting the level of assets,

which has been maintained by the management during the fiscal year of 2017. The relevant

reduction in the current total intangible assets of the organisation is relevantly seen from 2016

to 2017. This decline is relevantly conducted by the organisation with the help of

accumulated impairment, accumulated amortisation, amortisation expense and foreign

exchange difference (DeFusco et al., 2015). The overall intangible assets of the organisation

have mainly declined from the levels of 169.8 million in 2016 to 158.4 million in 2017. This

FINANCIAL REPORTING

5

decline in the intangible assts is relevantly conducted due to the measurements and valuation

that has been conducted by the organisation.

After analysing the overall annual report of the organisation, it could be detected that

Sims Metal Management has adequately fulfilled the requirements needed for the disclosure

of the intangible assets. In addition, the entire intangible assets of the organisation have

adequately depicted in the annual report, where the accurate financial performance of the

company is detected from the evaluation. Fazzini (2018) mentioned that with the detection

intangible assets organisation are able to mention the accurate financial condition and the

recognition method used by the management.

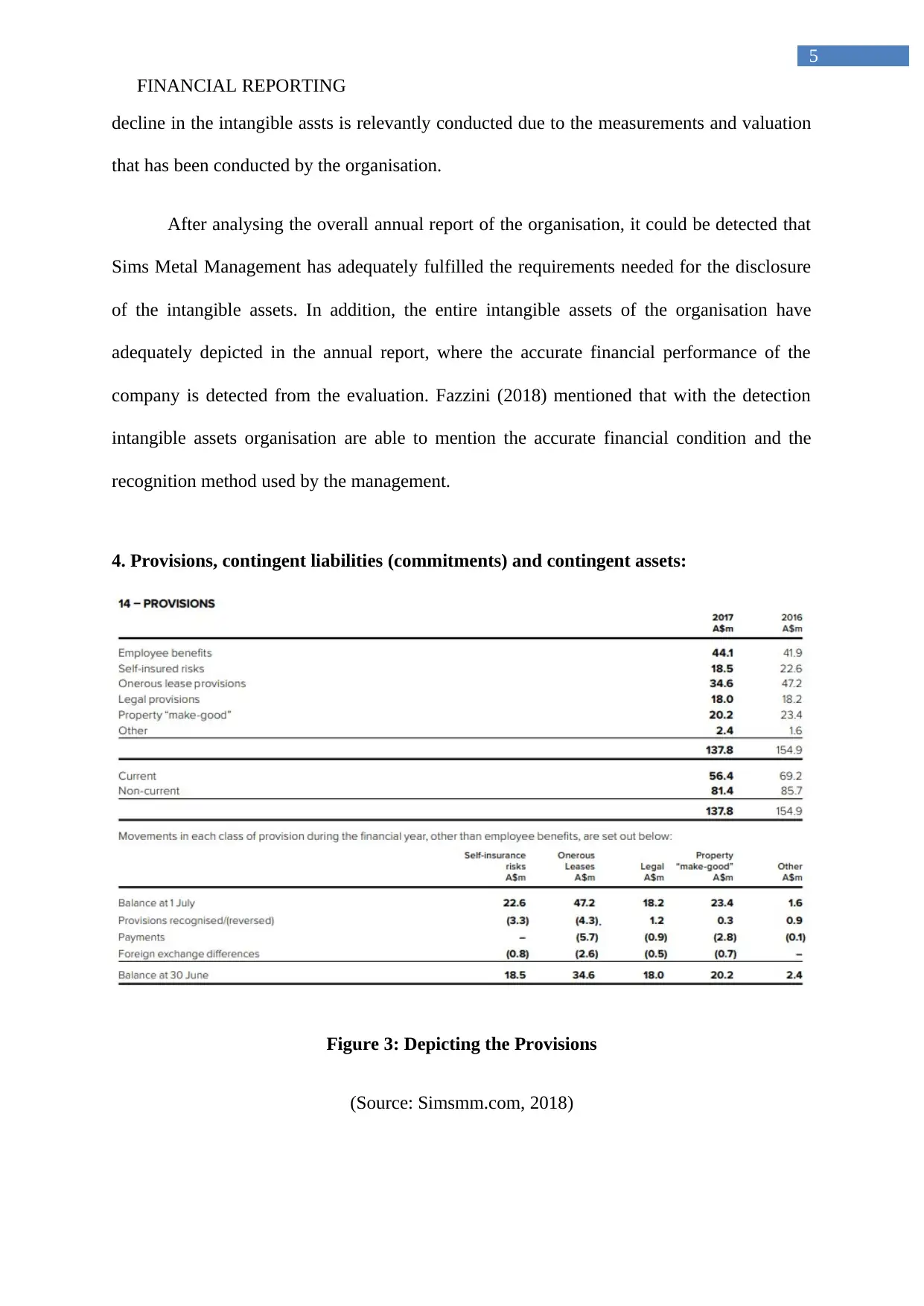

4. Provisions, contingent liabilities (commitments) and contingent assets:

Figure 3: Depicting the Provisions

(Source: Simsmm.com, 2018)

5

decline in the intangible assts is relevantly conducted due to the measurements and valuation

that has been conducted by the organisation.

After analysing the overall annual report of the organisation, it could be detected that

Sims Metal Management has adequately fulfilled the requirements needed for the disclosure

of the intangible assets. In addition, the entire intangible assets of the organisation have

adequately depicted in the annual report, where the accurate financial performance of the

company is detected from the evaluation. Fazzini (2018) mentioned that with the detection

intangible assets organisation are able to mention the accurate financial condition and the

recognition method used by the management.

4. Provisions, contingent liabilities (commitments) and contingent assets:

Figure 3: Depicting the Provisions

(Source: Simsmm.com, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL REPORTING

6

After analysing the annual report of Sims Metal Management, the contingencies are

not recorded within the operations of the organisation. However, there are different

provisions, which has been maintained by the organisation over the period, which has been

used for supporting their activities. The provisions have been conducted on employee

benefits, self-insured risk, onerous lease provisions, legal provisions, property make good,

and other. These provisions are mainly segregated in two different segments such as current

and non-current assets, which has helped in depicting the level of provisions that is being

made by the company during the fiscal year of 2017. The overall decline in the current

provisions of the organisation is mainly witnessed, which has helped in depicting the measure

used by the company for supporting its operations.

From the evaluation of the annual report there is no specific contingency asset or

liability, which is detected in their financial report. There are certain level of contingency

assets and liabilities, which are conducted by the organisations in their annual report.

Therefore, inclusion of the contingency assets and liabilities within the annual report has

certain advantages, which allow the organisation to accurately depict their current financial

position by deducting their liabilities. Grant (2016) mentioned that there are three different

segments of contingent liabilities section, which needs to be evaluated by the organisation

before depicting it in their annual report.

6

After analysing the annual report of Sims Metal Management, the contingencies are

not recorded within the operations of the organisation. However, there are different

provisions, which has been maintained by the organisation over the period, which has been

used for supporting their activities. The provisions have been conducted on employee

benefits, self-insured risk, onerous lease provisions, legal provisions, property make good,

and other. These provisions are mainly segregated in two different segments such as current

and non-current assets, which has helped in depicting the level of provisions that is being

made by the company during the fiscal year of 2017. The overall decline in the current

provisions of the organisation is mainly witnessed, which has helped in depicting the measure

used by the company for supporting its operations.

From the evaluation of the annual report there is no specific contingency asset or

liability, which is detected in their financial report. There are certain level of contingency

assets and liabilities, which are conducted by the organisations in their annual report.

Therefore, inclusion of the contingency assets and liabilities within the annual report has

certain advantages, which allow the organisation to accurately depict their current financial

position by deducting their liabilities. Grant (2016) mentioned that there are three different

segments of contingent liabilities section, which needs to be evaluated by the organisation

before depicting it in their annual report.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL REPORTING

7

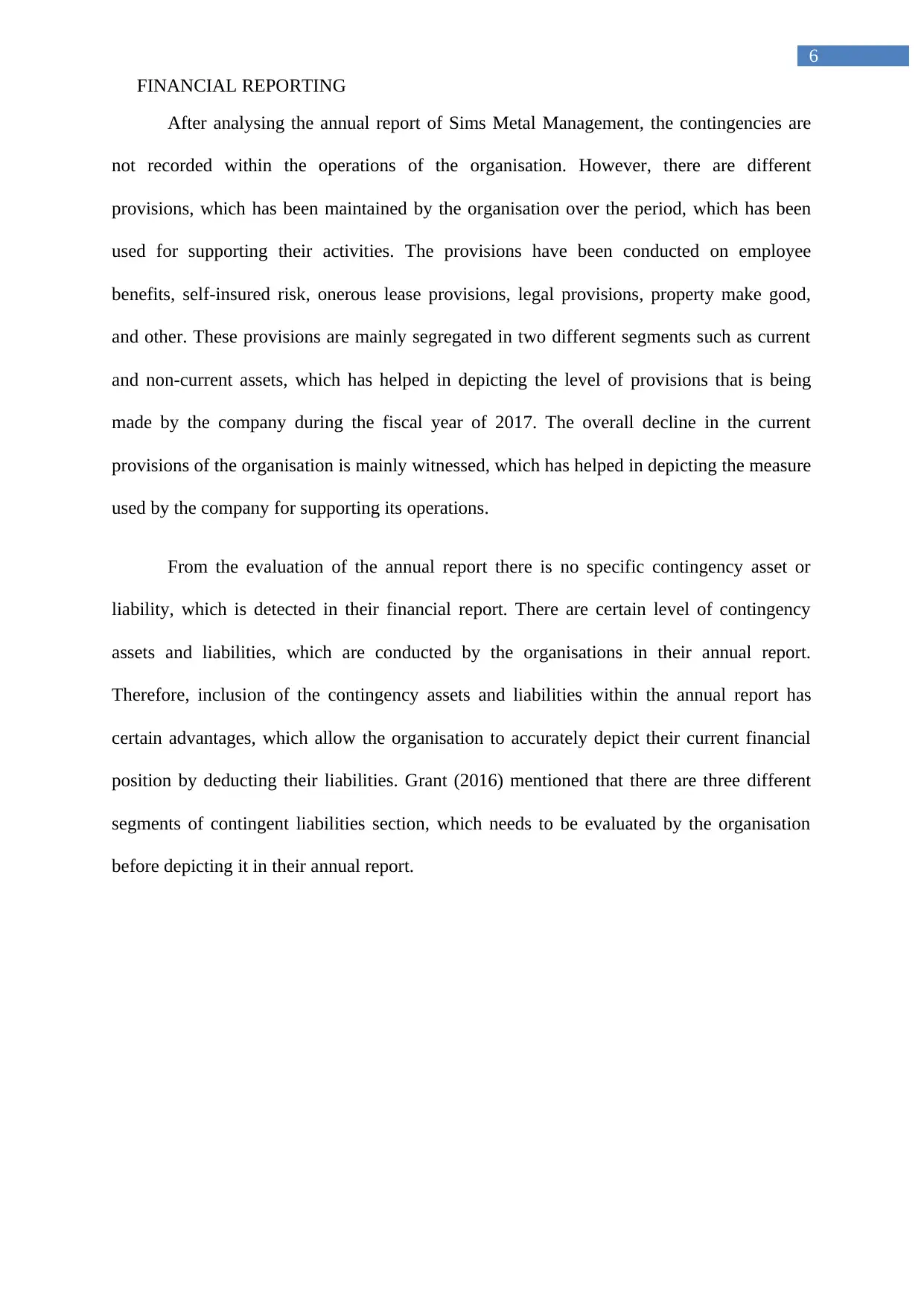

5. Leases:

Figure 4: Depicting the lease

(Source: Simsmm.com, 2018)

The above figure indicates the level of leased item, which has been used by Sims

Metal Management during the financial year of 2016 and 2017. The rent lease item is

relevantly depicted in the annual report of Sims Metal Management, which has declined from

the level of A$100.7 million in 2016 to A$84.4 million in 2017. In addition, the net asset

acquired through the finance lease was A$3.7 million in 2017 as compared to 2016. The

overall net book values of assets mainly declined over the period of one fiscal year. Onerous

lease provision is mainly calculated during the financial year of 2016 and 2017, where the

values have declined from the levels of A$47.2 million to A$36.4 million.

The relevant classification and presentation requirements of the leased items can be

used for detecting the level of exposures, which the organisation has conducted. In addition,

the Sims Metal Management has used the retail lease measures in its operations, where the

7

5. Leases:

Figure 4: Depicting the lease

(Source: Simsmm.com, 2018)

The above figure indicates the level of leased item, which has been used by Sims

Metal Management during the financial year of 2016 and 2017. The rent lease item is

relevantly depicted in the annual report of Sims Metal Management, which has declined from

the level of A$100.7 million in 2016 to A$84.4 million in 2017. In addition, the net asset

acquired through the finance lease was A$3.7 million in 2017 as compared to 2016. The

overall net book values of assets mainly declined over the period of one fiscal year. Onerous

lease provision is mainly calculated during the financial year of 2016 and 2017, where the

values have declined from the levels of A$47.2 million to A$36.4 million.

The relevant classification and presentation requirements of the leased items can be

used for detecting the level of exposures, which the organisation has conducted. In addition,

the Sims Metal Management has used the retail lease measures in its operations, where the

FINANCIAL REPORTING

8

AASB 16 Leases has been used for recognising its leased operations. the AASB 16 provision

has highlighted the overall measure that needs to be taken into consideration for accounting

the lease requirements of the organisation. The repayment of lease has been conducted by the

organisation over the fiscal years. therefore, the leased item is adequately depicted in the

annual report of the organisation, which has helped in detecting the level of expenses that has

been conducted by the organisation for conducting their operations (Grimm & Blazovich,

2016).

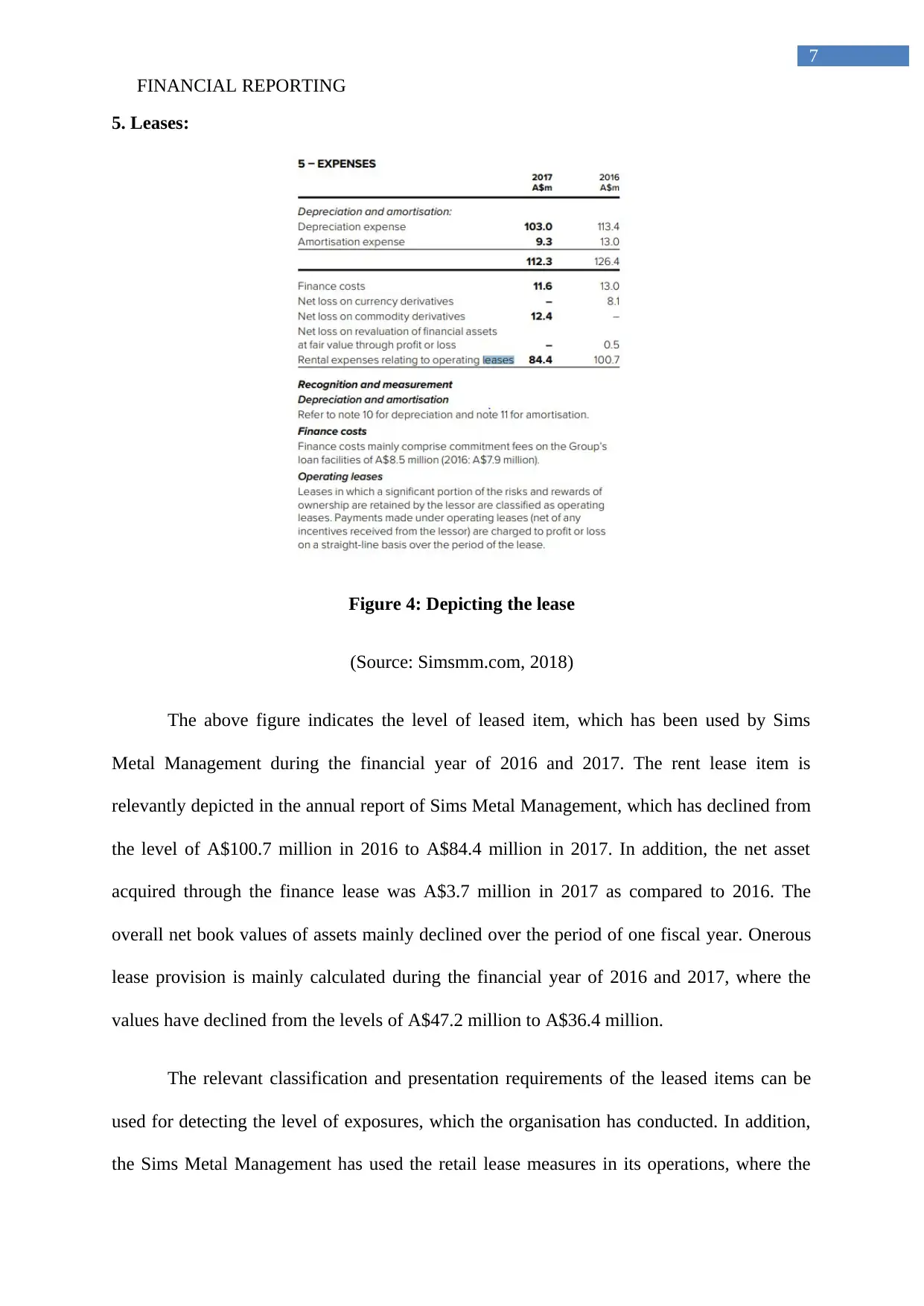

6. Revenue:

Figure 5: Depicting the Revenues

(Source: Simsmm.com, 2018)

8

AASB 16 Leases has been used for recognising its leased operations. the AASB 16 provision

has highlighted the overall measure that needs to be taken into consideration for accounting

the lease requirements of the organisation. The repayment of lease has been conducted by the

organisation over the fiscal years. therefore, the leased item is adequately depicted in the

annual report of the organisation, which has helped in detecting the level of expenses that has

been conducted by the organisation for conducting their operations (Grimm & Blazovich,

2016).

6. Revenue:

Figure 5: Depicting the Revenues

(Source: Simsmm.com, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL REPORTING

9

The figure directly depicts the level of revenues, which has been obtained by Sims

Metal Management during the fiscal year of 2016 and 2017. In addition, the figure indicates

the level of incomes, which has been generated by the organisation from sales of goods,

service revenue, interest income, rental income and dividend income. The main revenues that

is generated by Sims Metal Management is from the sales of goods, which comprises of the

maximum value. However, the increment in the current revenues of the organisation can be

witnessed from the figure, which has allowed the organisation to improve its financial

performance (Kaur, Aggarwal & Gupta, 2017).

Sims Metal Management has relevant recognition and measurement methods, which

has allowed the organisation to adequate recognise the level of income that has occurred

during the fiscal year. The sales revenue recognition method is different from other incomes,

which is generated by Sims Metal Management, where the revenues from the goods is

recognised, where adequate evidence is of the transfer is detected. On the other hand, the

overall other income such as service revenue, interest income, rental income and dividend

income is mainly recognised, when the actual truncation of cash is being conducted by the

organisation.

7. Conclusion:

The assessment has mainly evaluated the financial position of Sims Metal

Management, which can be used by investors in analysing the current financial position of

the organisation. In addition, the evaluation of the annual report directly initiatives that the

company has utilised adequate measure in recognising the Property, plant and equipment. In

addition, the intangible assets, provisions, leases, and revenue has adequately depicted in the

annual report of Sims Metal Management, which can help in understanding the current

financial position of the company. The company has adequality utilised the AASB 16 for

9

The figure directly depicts the level of revenues, which has been obtained by Sims

Metal Management during the fiscal year of 2016 and 2017. In addition, the figure indicates

the level of incomes, which has been generated by the organisation from sales of goods,

service revenue, interest income, rental income and dividend income. The main revenues that

is generated by Sims Metal Management is from the sales of goods, which comprises of the

maximum value. However, the increment in the current revenues of the organisation can be

witnessed from the figure, which has allowed the organisation to improve its financial

performance (Kaur, Aggarwal & Gupta, 2017).

Sims Metal Management has relevant recognition and measurement methods, which

has allowed the organisation to adequate recognise the level of income that has occurred

during the fiscal year. The sales revenue recognition method is different from other incomes,

which is generated by Sims Metal Management, where the revenues from the goods is

recognised, where adequate evidence is of the transfer is detected. On the other hand, the

overall other income such as service revenue, interest income, rental income and dividend

income is mainly recognised, when the actual truncation of cash is being conducted by the

organisation.

7. Conclusion:

The assessment has mainly evaluated the financial position of Sims Metal

Management, which can be used by investors in analysing the current financial position of

the organisation. In addition, the evaluation of the annual report directly initiatives that the

company has utilised adequate measure in recognising the Property, plant and equipment. In

addition, the intangible assets, provisions, leases, and revenue has adequately depicted in the

annual report of Sims Metal Management, which can help in understanding the current

financial position of the company. The company has adequality utilised the AASB 16 for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL REPORTING

10

recognising the level of lease, which has been used for complementing their operations. The

company has conducted its operations adequately, which allowed the management to

accurately depict their current financial position in their annual report. Therefore, its could be

detected that Sims Metal Management has accurately followed the financial reporting system

for disclosing the items in their annual report.

10

recognising the level of lease, which has been used for complementing their operations. The

company has conducted its operations adequately, which allowed the management to

accurately depict their current financial position in their annual report. Therefore, its could be

detected that Sims Metal Management has accurately followed the financial reporting system

for disclosing the items in their annual report.

FINANCIAL REPORTING

11

References and Bibliography:

Dalnial, H., Kamaluddin, A., Sanusi, Z. M., & Khairuddin, K. S. (2014). Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced

Management Science, 2(1).

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

Fazzini, M. (2018). Financial Statement Analysis. In Business Valuation (pp. 39-76).

Palgrave Macmillan, Cham.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Grimm, S. D., & Blazovich, J. L. (2016). Developing student competencies: An integrated

approach to a financial statement analysis project. Journal of Accounting

Education, 35, 69-101.

Kaur, M., Aggarwal, N., & Gupta, M. (2017). An Investigation into Returns from Financial

Statement Analysis among High Book-to-Market Stocks. Indian Journal of

Economics and Development, 13(2), 353-358.

Mohanram, P., Saiy, S., & Vyas, D. (2018). Fundamental analysis of banks: the use of

financial statement information to screen winners from losers. Review of Accounting

Studies, 23(1), 200-233.

Papanastasopoulos, G. A. (2018). JM WahlenS. P. BaginskiM. BradshawReview of Financial

Reporting, Financial Statement Analysis and Valuation: A Strategic Perspective9th

ed. 2018Cengage Learning978-1337614689 (995 pp., $228.25).

11

References and Bibliography:

Dalnial, H., Kamaluddin, A., Sanusi, Z. M., & Khairuddin, K. S. (2014). Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced

Management Science, 2(1).

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

Fazzini, M. (2018). Financial Statement Analysis. In Business Valuation (pp. 39-76).

Palgrave Macmillan, Cham.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Grimm, S. D., & Blazovich, J. L. (2016). Developing student competencies: An integrated

approach to a financial statement analysis project. Journal of Accounting

Education, 35, 69-101.

Kaur, M., Aggarwal, N., & Gupta, M. (2017). An Investigation into Returns from Financial

Statement Analysis among High Book-to-Market Stocks. Indian Journal of

Economics and Development, 13(2), 353-358.

Mohanram, P., Saiy, S., & Vyas, D. (2018). Fundamental analysis of banks: the use of

financial statement information to screen winners from losers. Review of Accounting

Studies, 23(1), 200-233.

Papanastasopoulos, G. A. (2018). JM WahlenS. P. BaginskiM. BradshawReview of Financial

Reporting, Financial Statement Analysis and Valuation: A Strategic Perspective9th

ed. 2018Cengage Learning978-1337614689 (995 pp., $228.25).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.