Financial Securities Analysis: Options, Hedging, and CAPM Analysis

VerifiedAdded on 2021/01/02

|9

|2522

|257

Report

AI Summary

This report provides a comprehensive analysis of financial securities, encompassing employee stock options and their valuation, fuel hedging strategies, and the application of the Capital Asset Pricing Model (CAPM). The report delves into the determinants influencing decisions related to employee stock options, including volatility, expiration period, and the price of underlying assets. It calculates intrinsic and maximum values to determine whether to exercise options. Furthermore, the report explores the pros and cons of fuel hedging, particularly within the airline industry, highlighting its role in mitigating price volatility and protecting budgets. The report also illustrates the use of CAPM to assess the share price of Tesco, determining whether it is over-priced, under-priced, or at par. Overall, the report offers valuable insights into financial securities analysis, providing a practical understanding of key concepts and their applications.

FINANCIAL

SECURITIES

ANALYSIS

COURSEWORK

SECURITIES

ANALYSIS

COURSEWORK

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART 1: FINANCIAL SECURITIES ANALYSIS........................................................................1

Determinants in Exercising Options related Decisions...............................................................1

Option Valuation: Minimum and Maximum..............................................................................2

PART 2: HEDGING FUEL PRICES..............................................................................................3

Pros..............................................................................................................................................3

Cons.............................................................................................................................................5

PART 3: CAPITAL ASSET PRICING MODEL (CAPM).............................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................1

PART 1: FINANCIAL SECURITIES ANALYSIS........................................................................1

Determinants in Exercising Options related Decisions...............................................................1

Option Valuation: Minimum and Maximum..............................................................................2

PART 2: HEDGING FUEL PRICES..............................................................................................3

Pros..............................................................................................................................................3

Cons.............................................................................................................................................5

PART 3: CAPITAL ASSET PRICING MODEL (CAPM).............................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Financial Securities Analysis refers to the critical evaluation of tradable financial

instruments such as equities, debt securities or combination of both (Kevin, 2015). This report

aims to provide a detailed account in regards to Employee Stock Options and their valuations,

ascertaining of minimum and maximum value that facilitate the decision of whether to exercise

an option or not. In addition to this, the concept of fuel hedging and its related pros as well as

cons have been explored. Along with this, application of Capital Asset Pricing Model (CAPM)

has been used to ascertain whether the share price of a company is over-priced, under-priced or

at par.

PART 1: FINANCIAL SECURITIES ANALYSIS

Employee Stock Options Scheme is an incentive-based method used by many companies

to provide rewards to their hard-working employees. A share option is one which is a right to

purchase a definite number of shares at a future date for a fixed price within an organization

(Carpenter, Stanton and Wallace, 2012).

Determinants in Exercising Options related Decisions

The main deciding factors for taking a decision regarding Employee Stock Options

include volatility, expiration period, risk free interest rates, strike price and the price of

underlying assets, which here relates to common stock of Ocean Cuisines PLC. These Options

can be further segregated into Intrinsic and Extrinsic Values (Time Value). The following

information has been provided:

Strike Price at the time of buying shares = £65

Exercise Price = Current Stock (Underlying) Price (at the end of 3 years) = £55

Volatility = Annual Average Standard Deviation = 0.25 or 25%

Risk-Free Interest Rate = Yield on Treasury Note with 3 year expiration period = 0.034 or 3.4%

Time to Expiration = 3 years

Dividend Payouts = Zero

These factors are the main determinants which define whether or not to exercise the

functions regarding any option, which in this case is of Call Option Type as the Employee Stock

Option scheme provides the option to buy shares at the end of vesting period.

1

Financial Securities Analysis refers to the critical evaluation of tradable financial

instruments such as equities, debt securities or combination of both (Kevin, 2015). This report

aims to provide a detailed account in regards to Employee Stock Options and their valuations,

ascertaining of minimum and maximum value that facilitate the decision of whether to exercise

an option or not. In addition to this, the concept of fuel hedging and its related pros as well as

cons have been explored. Along with this, application of Capital Asset Pricing Model (CAPM)

has been used to ascertain whether the share price of a company is over-priced, under-priced or

at par.

PART 1: FINANCIAL SECURITIES ANALYSIS

Employee Stock Options Scheme is an incentive-based method used by many companies

to provide rewards to their hard-working employees. A share option is one which is a right to

purchase a definite number of shares at a future date for a fixed price within an organization

(Carpenter, Stanton and Wallace, 2012).

Determinants in Exercising Options related Decisions

The main deciding factors for taking a decision regarding Employee Stock Options

include volatility, expiration period, risk free interest rates, strike price and the price of

underlying assets, which here relates to common stock of Ocean Cuisines PLC. These Options

can be further segregated into Intrinsic and Extrinsic Values (Time Value). The following

information has been provided:

Strike Price at the time of buying shares = £65

Exercise Price = Current Stock (Underlying) Price (at the end of 3 years) = £55

Volatility = Annual Average Standard Deviation = 0.25 or 25%

Risk-Free Interest Rate = Yield on Treasury Note with 3 year expiration period = 0.034 or 3.4%

Time to Expiration = 3 years

Dividend Payouts = Zero

These factors are the main determinants which define whether or not to exercise the

functions regarding any option, which in this case is of Call Option Type as the Employee Stock

Option scheme provides the option to buy shares at the end of vesting period.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Intrinsic Value can be calculated as under:

Maximum (0, Exercise Price- Strike Price)

If the option is exercised immediately:

Intrinsic Value = Maximum(0, (40-65)) = Max.(0,-15) = 0

If the option is exercised in three years time:

Intrinsic Value = Maximum(0, (55-65)) = Max.(0, -10) = 0

In both cases, one can say that the options must not be exercised anytime before the end

of three years as the underlying value of common stock for Ocean Cuisines PLC is Over-the-

Money. This means that Strike Price is higher than the underlying stock price. Until and unless

the value of common stock reaches In-the-money, that is, exercise price is greater than strike

price, the shareholder will not receive any sort of incentive whatsoever (Option Valuation, 2018).

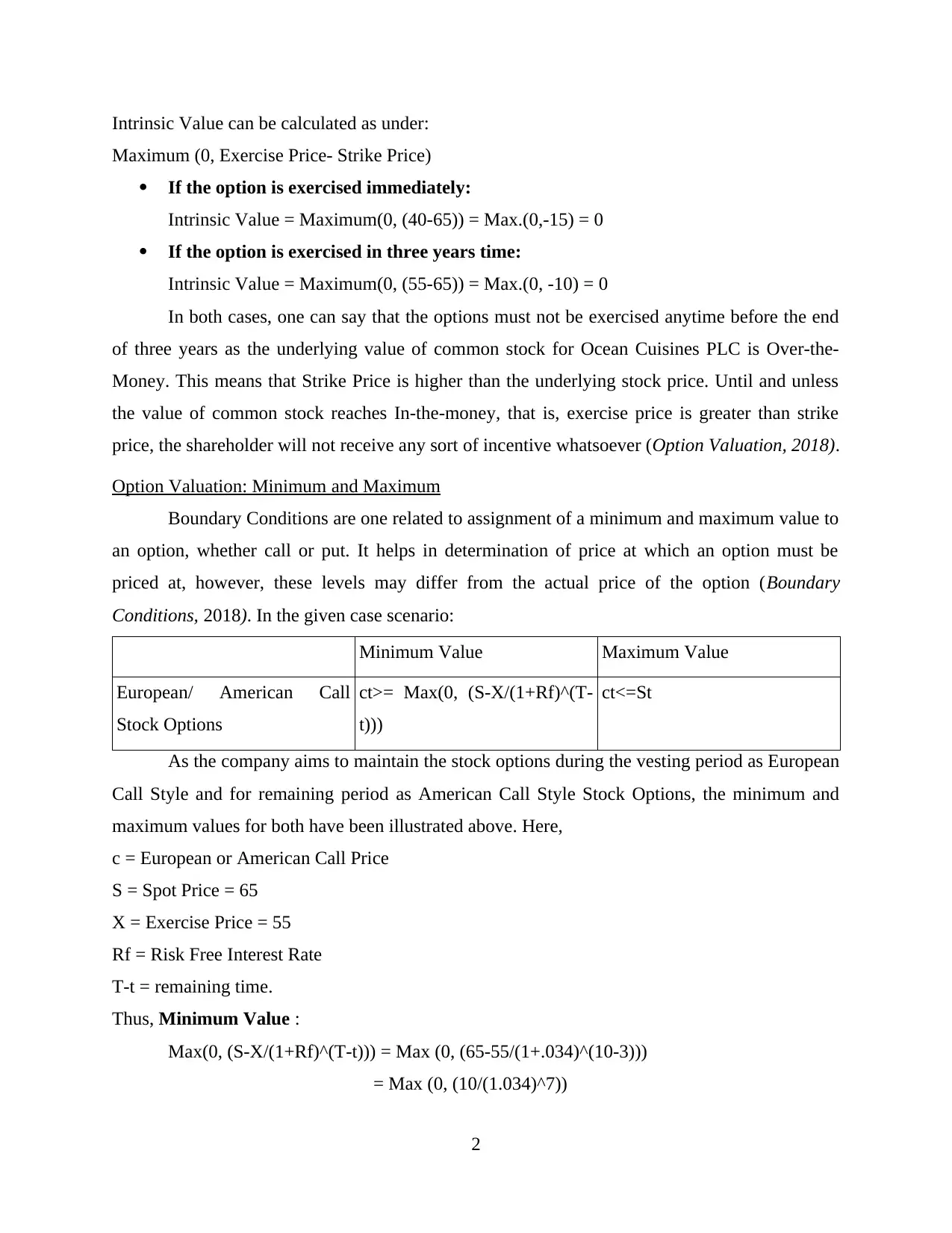

Option Valuation: Minimum and Maximum

Boundary Conditions are one related to assignment of a minimum and maximum value to

an option, whether call or put. It helps in determination of price at which an option must be

priced at, however, these levels may differ from the actual price of the option (Boundary

Conditions, 2018). In the given case scenario:

Minimum Value Maximum Value

European/ American Call

Stock Options

ct>= Max(0, (S-X/(1+Rf)^(T-

t)))

ct<=St

As the company aims to maintain the stock options during the vesting period as European

Call Style and for remaining period as American Call Style Stock Options, the minimum and

maximum values for both have been illustrated above. Here,

c = European or American Call Price

S = Spot Price = 65

X = Exercise Price = 55

Rf = Risk Free Interest Rate

T-t = remaining time.

Thus, Minimum Value :

Max(0, (S-X/(1+Rf)^(T-t))) = Max (0, (65-55/(1+.034)^(10-3)))

= Max (0, (10/(1.034)^7))

2

Maximum (0, Exercise Price- Strike Price)

If the option is exercised immediately:

Intrinsic Value = Maximum(0, (40-65)) = Max.(0,-15) = 0

If the option is exercised in three years time:

Intrinsic Value = Maximum(0, (55-65)) = Max.(0, -10) = 0

In both cases, one can say that the options must not be exercised anytime before the end

of three years as the underlying value of common stock for Ocean Cuisines PLC is Over-the-

Money. This means that Strike Price is higher than the underlying stock price. Until and unless

the value of common stock reaches In-the-money, that is, exercise price is greater than strike

price, the shareholder will not receive any sort of incentive whatsoever (Option Valuation, 2018).

Option Valuation: Minimum and Maximum

Boundary Conditions are one related to assignment of a minimum and maximum value to

an option, whether call or put. It helps in determination of price at which an option must be

priced at, however, these levels may differ from the actual price of the option (Boundary

Conditions, 2018). In the given case scenario:

Minimum Value Maximum Value

European/ American Call

Stock Options

ct>= Max(0, (S-X/(1+Rf)^(T-

t)))

ct<=St

As the company aims to maintain the stock options during the vesting period as European

Call Style and for remaining period as American Call Style Stock Options, the minimum and

maximum values for both have been illustrated above. Here,

c = European or American Call Price

S = Spot Price = 65

X = Exercise Price = 55

Rf = Risk Free Interest Rate

T-t = remaining time.

Thus, Minimum Value :

Max(0, (S-X/(1+Rf)^(T-t))) = Max (0, (65-55/(1+.034)^(10-3)))

= Max (0, (10/(1.034)^7))

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=Max (0, (10/1.26))

= Max (0, 7.91)

= £7.91

Maximum Value:

S*t= 65*3 = £195

Thus, the minimum value for Ocean Cuisines PLC Call Option is £7.91 and Maximum

Value comes to £195.

PART 2: HEDGING FUEL PRICES

Derivatives are a financial security contract the value of which depends upon the values

of an underlying asset. The most common derivative instruments include options and futures. In

order to control the exposure of such financial contracts, managers adopt hedging strategies to

control risk arising due to change in prices. Hedging refers to a financial transaction executed in

the light of reducing or eliminating the financial risk exposure with a derivative contract, either

option or futures. Hedging is done with a rationale that reduced volatility in the market is

rewarded by profits, thus, increasing the stock price of the airlines (Lim and Hong, 2014).

In the context of given case scenario, Fuel Hedging Contracts fall in the latter category

wherein many organizations, especially airlines, enter into futures contract for reducing the

degree of volatility and potential rising fuel costs. A future contract is an over-the-counter (OTC)

agreement which relates to the Such contracts allow these airline business enterprises to cap or

fix their costs by way of a commodity swap or option. These swaps usually pertain to Plain

Vanilla Instruments. This helps these companies to ascertain costs that are effectual in the

development of their budgeting plans. Usually, the hedging strategies pertain to future prices of

jet fuel or crude oil as they are generally correlated with latter being a source of former.

Pros

Protects from volatility: As price of fuel fluctuate rapidly, there is a high chance of

incurring a loss due to exorbitant prices paid for their accumulation by the airline

companies. This, in return, affects their fares since fuel costs form 15% of their total air

expense and hence, profitability.£ One can say that fuel hedging acts as an insurance

against price fluctuations.

3

= Max (0, 7.91)

= £7.91

Maximum Value:

S*t= 65*3 = £195

Thus, the minimum value for Ocean Cuisines PLC Call Option is £7.91 and Maximum

Value comes to £195.

PART 2: HEDGING FUEL PRICES

Derivatives are a financial security contract the value of which depends upon the values

of an underlying asset. The most common derivative instruments include options and futures. In

order to control the exposure of such financial contracts, managers adopt hedging strategies to

control risk arising due to change in prices. Hedging refers to a financial transaction executed in

the light of reducing or eliminating the financial risk exposure with a derivative contract, either

option or futures. Hedging is done with a rationale that reduced volatility in the market is

rewarded by profits, thus, increasing the stock price of the airlines (Lim and Hong, 2014).

In the context of given case scenario, Fuel Hedging Contracts fall in the latter category

wherein many organizations, especially airlines, enter into futures contract for reducing the

degree of volatility and potential rising fuel costs. A future contract is an over-the-counter (OTC)

agreement which relates to the Such contracts allow these airline business enterprises to cap or

fix their costs by way of a commodity swap or option. These swaps usually pertain to Plain

Vanilla Instruments. This helps these companies to ascertain costs that are effectual in the

development of their budgeting plans. Usually, the hedging strategies pertain to future prices of

jet fuel or crude oil as they are generally correlated with latter being a source of former.

Pros

Protects from volatility: As price of fuel fluctuate rapidly, there is a high chance of

incurring a loss due to exorbitant prices paid for their accumulation by the airline

companies. This, in return, affects their fares since fuel costs form 15% of their total air

expense and hence, profitability.£ One can say that fuel hedging acts as an insurance

against price fluctuations.

3

Budget Protection: Hedging of fuel prices for budgeting purposes can help Airline

Enterprises minimizing their ticket prices ensuring that they remain competitive in their

frequently changing business environment. Hence, fuel costs are the only element that

remains static for almost all companies unless one has an edge in this regards too

(Soumaré and et.al., 2013).

Minimization of Basis Risk: As far as jet fuel markets are concerned, there remains a

need to increase the liquidity of this industry in terms of futures or any other types of

exchange-traded contracts. Even though these contracts offer low credit risk with high

liquidity, they still remain standardized and inflexible, exposing the parties to such

contracts to a large Basis Risk. Basis Risk relates to the risk that is experienced when

there is an uneven change in the value of commodity with respect to the value of

derivative contracts entered into due to hedging. Fuel Hedging contracts undertaken by

Airline businesses would ensure that the underlying position of the asset is duly matched

with the price thus removing or minimization of basis risk altogether.

Differential Swaps: Unlike other cases of hedging risks, airline companies take note of

differential swaps that help them in managing risks, especially basis. These swaps are

generally in the form of Plain Vanilla Swaps. A swap is an agreement accepted by two

parties that involves a series of cash flow exchanges between them for a stipulated period

of time. It is important to note that under these types of swap contracts, there is a notional

principal involved with floating interest rate and flow of cash in same currency. Airlines

companies can use these contracts to hedge its fuel exposure to market volatility on the

difference between fixed and floating prices for the same commodity thus, minimizing its

risk to a greater extent.

Balancing Returns discretely: A vast portfolio of future contracts created by the Airline

Organizations can help them in balancing returns in a discrete manner as they are aware

of what contracts present in the portfolio would render them maximum returns as well as

prevention from extreme financial risk exposure. In addition to this, oil prices or fuel

costs are the base for various other commodity prices that include fuel or oil as their basic

element. Hence, if oil prices are hedged, an airline company can control other highly

correlated commodities accordingly, thus, reducing its overall risks and maintaining its

comparative as well as competitive advantage.

4

Enterprises minimizing their ticket prices ensuring that they remain competitive in their

frequently changing business environment. Hence, fuel costs are the only element that

remains static for almost all companies unless one has an edge in this regards too

(Soumaré and et.al., 2013).

Minimization of Basis Risk: As far as jet fuel markets are concerned, there remains a

need to increase the liquidity of this industry in terms of futures or any other types of

exchange-traded contracts. Even though these contracts offer low credit risk with high

liquidity, they still remain standardized and inflexible, exposing the parties to such

contracts to a large Basis Risk. Basis Risk relates to the risk that is experienced when

there is an uneven change in the value of commodity with respect to the value of

derivative contracts entered into due to hedging. Fuel Hedging contracts undertaken by

Airline businesses would ensure that the underlying position of the asset is duly matched

with the price thus removing or minimization of basis risk altogether.

Differential Swaps: Unlike other cases of hedging risks, airline companies take note of

differential swaps that help them in managing risks, especially basis. These swaps are

generally in the form of Plain Vanilla Swaps. A swap is an agreement accepted by two

parties that involves a series of cash flow exchanges between them for a stipulated period

of time. It is important to note that under these types of swap contracts, there is a notional

principal involved with floating interest rate and flow of cash in same currency. Airlines

companies can use these contracts to hedge its fuel exposure to market volatility on the

difference between fixed and floating prices for the same commodity thus, minimizing its

risk to a greater extent.

Balancing Returns discretely: A vast portfolio of future contracts created by the Airline

Organizations can help them in balancing returns in a discrete manner as they are aware

of what contracts present in the portfolio would render them maximum returns as well as

prevention from extreme financial risk exposure. In addition to this, oil prices or fuel

costs are the base for various other commodity prices that include fuel or oil as their basic

element. Hence, if oil prices are hedged, an airline company can control other highly

correlated commodities accordingly, thus, reducing its overall risks and maintaining its

comparative as well as competitive advantage.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cons

Early expiration of Futures: Based on the principle of 'Caveat Emptor' that states buyer

is solely responsible for checking the quality and suitability of goods before purchasing

them. Most airline companies find it difficult to hedge according to their budgeting plans

as most of the future contracts expire on a specific day of a month. This contradicts with

the fact that fuel is consumed by airline businesses on a daily basis all around the world.

Whereas hedging of fuel cost exposure can only be managed by them for some period of

time, thus, providing them with a temporary protection shield against their current as well

as future losses.

No guarantee for airlines: Even though hedging reduces risk, there is no guarantee that

adopting this strategy would reduce the fuel costs for the airlines businesses in the long-

run. In the recent years, the price of fuel has been highly fluctuating which has made

determination of lock-in (fixed) price difficult for the investors. This eventually leads to

payment of higher monies to the sellers of such contracts in order to get more out of these

arrangements. This means that hedging, in itself acts as an additional risk for an airline

company when its supposed to be reducing the amount of volatility-related exposure

existing in the market for a given organization.

Hedge Duration: Effectiveness of Hedge Performance highly depends on hedge

duration. If the duration of futures contract undertaken for hedging of fuel costs is small,

the optimality of the strategy as well as its performance tends to reduce. Until and unless,

the duration of hedge is on the long-term side, a hedging strategy is of no use to the

investor. In addition to this, if the strategy of hedge is not effective in the first place, it

can result in creating substantial financial vulnerability and instability for the airlines

resulting in considerable losses for them.

PART 3: CAPITAL ASSET PRICING MODEL (CAPM)

For the purpose of simplification of calculations, Tesco has been selected as the public

limited company for determining whether its share price is over-priced, under-priced or at par.

For this purpose, Capital Asset Pricing Model has been implemented. The Capital Asset Pricing

(CAPM) Model is one which is employed by businesses to calculate expected returns for its

common stock given its risk is (Berghöfer and Lucey, 2014) :

ERi = Rf+ Bi*( ERm – Rf) ; where

5

Early expiration of Futures: Based on the principle of 'Caveat Emptor' that states buyer

is solely responsible for checking the quality and suitability of goods before purchasing

them. Most airline companies find it difficult to hedge according to their budgeting plans

as most of the future contracts expire on a specific day of a month. This contradicts with

the fact that fuel is consumed by airline businesses on a daily basis all around the world.

Whereas hedging of fuel cost exposure can only be managed by them for some period of

time, thus, providing them with a temporary protection shield against their current as well

as future losses.

No guarantee for airlines: Even though hedging reduces risk, there is no guarantee that

adopting this strategy would reduce the fuel costs for the airlines businesses in the long-

run. In the recent years, the price of fuel has been highly fluctuating which has made

determination of lock-in (fixed) price difficult for the investors. This eventually leads to

payment of higher monies to the sellers of such contracts in order to get more out of these

arrangements. This means that hedging, in itself acts as an additional risk for an airline

company when its supposed to be reducing the amount of volatility-related exposure

existing in the market for a given organization.

Hedge Duration: Effectiveness of Hedge Performance highly depends on hedge

duration. If the duration of futures contract undertaken for hedging of fuel costs is small,

the optimality of the strategy as well as its performance tends to reduce. Until and unless,

the duration of hedge is on the long-term side, a hedging strategy is of no use to the

investor. In addition to this, if the strategy of hedge is not effective in the first place, it

can result in creating substantial financial vulnerability and instability for the airlines

resulting in considerable losses for them.

PART 3: CAPITAL ASSET PRICING MODEL (CAPM)

For the purpose of simplification of calculations, Tesco has been selected as the public

limited company for determining whether its share price is over-priced, under-priced or at par.

For this purpose, Capital Asset Pricing Model has been implemented. The Capital Asset Pricing

(CAPM) Model is one which is employed by businesses to calculate expected returns for its

common stock given its risk is (Berghöfer and Lucey, 2014) :

ERi = Rf+ Bi*( ERm – Rf) ; where

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ERi = Expected Returns

Rf = Risk Free Rates

Bi = Beta of the investment

ERm = Expected return of market

(ERm-Rf) = Market Risk Premium

In regards to Tesco PLC, the following information has been ascertained from its official

website:

Current Market Price = £248.43

Looking at the changes in Tesco's share price, there has been a decline of -1.30 points or

0.52% in the recent time (Tesco Share Information, 2019). This shows that the stock has become

cheap, thus, indicating that the clients who have not been trading in this stock can buy it whereas

those who were holding this stock at a higher price must sell it as the sooner it falls the lower

investors' profits will be.

CONCLUSION

From the above discussion it can be concluded that Employee Stock Option is an

incentive-based tool adopted by companies worldwide which is mainly affected by time value

and volatility factors among others. In addition to this, Fuel Hedging is a technique used by

airline businesses to hedge financial risk exposure so that they may not lose their competitive

advantage. However, they may not be ideal if the company is not investing from a long-term

perspective. Lastly, CAPM Method helps in deciding whether a share is over-priced, under-

priced or at par, which in return, can help an investor in deciding whether to hold, buy or sell

them in order to gain profits.

6

Rf = Risk Free Rates

Bi = Beta of the investment

ERm = Expected return of market

(ERm-Rf) = Market Risk Premium

In regards to Tesco PLC, the following information has been ascertained from its official

website:

Current Market Price = £248.43

Looking at the changes in Tesco's share price, there has been a decline of -1.30 points or

0.52% in the recent time (Tesco Share Information, 2019). This shows that the stock has become

cheap, thus, indicating that the clients who have not been trading in this stock can buy it whereas

those who were holding this stock at a higher price must sell it as the sooner it falls the lower

investors' profits will be.

CONCLUSION

From the above discussion it can be concluded that Employee Stock Option is an

incentive-based tool adopted by companies worldwide which is mainly affected by time value

and volatility factors among others. In addition to this, Fuel Hedging is a technique used by

airline businesses to hedge financial risk exposure so that they may not lose their competitive

advantage. However, they may not be ideal if the company is not investing from a long-term

perspective. Lastly, CAPM Method helps in deciding whether a share is over-priced, under-

priced or at par, which in return, can help an investor in deciding whether to hold, buy or sell

them in order to gain profits.

6

REFERENCES

Books and Journal

Berghöfer, B. and Lucey, B., 2014. Fuel hedging, operational hedging and risk exposure—

Evidence from the global airline industry. International Review of Financial

Analysis. 34. pp.124-139.

Carpenter, J. N., Stanton, R. and Wallace, N., 2012. Estimation of employee stock option

exercise rates and firm cost.

Kevin, S., 2015. Security analysis and portfolio management. PHI Learning Pvt. Ltd..

Lim, S. H. and Hong, Y., 2014. Fuel hedging and airline operating costs. Journal of Air

Transport Management. 36. pp.33-40.

Soumaré, I. and et.al., 2013. Applying the CAPM and the Fama–French models to the BRVM

stock market. Applied Financial Economics. 23(4). pp.275-285.

Online

Option Valuation. 2018. [Online]. Available Through:

<https://financetrain.com/minimum-and-maximum-value-of-europeanamerican-

options/>

Boundary Conditions. 2018. [Online]. Available Through:

<https://www.investopedia.com/terms/b/boundary-conditions.asp>

Tesco Share Information. 2019. [Online]. Available Through:

<https://www.tescoplc.com/investors/share-price-information/share-price-chart/>

7

Books and Journal

Berghöfer, B. and Lucey, B., 2014. Fuel hedging, operational hedging and risk exposure—

Evidence from the global airline industry. International Review of Financial

Analysis. 34. pp.124-139.

Carpenter, J. N., Stanton, R. and Wallace, N., 2012. Estimation of employee stock option

exercise rates and firm cost.

Kevin, S., 2015. Security analysis and portfolio management. PHI Learning Pvt. Ltd..

Lim, S. H. and Hong, Y., 2014. Fuel hedging and airline operating costs. Journal of Air

Transport Management. 36. pp.33-40.

Soumaré, I. and et.al., 2013. Applying the CAPM and the Fama–French models to the BRVM

stock market. Applied Financial Economics. 23(4). pp.275-285.

Online

Option Valuation. 2018. [Online]. Available Through:

<https://financetrain.com/minimum-and-maximum-value-of-europeanamerican-

options/>

Boundary Conditions. 2018. [Online]. Available Through:

<https://www.investopedia.com/terms/b/boundary-conditions.asp>

Tesco Share Information. 2019. [Online]. Available Through:

<https://www.tescoplc.com/investors/share-price-information/share-price-chart/>

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.