Analysis of Financial Statement of AMP Ltd for 2017

VerifiedAdded on 2023/06/05

|14

|3638

|493

AI Summary

This assessment analyzes the financial statement of AMP ltd for the year 2017, debt equity position, key financial ratios, changes in capital structure, and risk management policies.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING AND FINANCE

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

ACCOUNTING AND FINANCE

Executive Summary

The main purpose of this assessment is to conduct an analysis of the financial statement of AMP

ltd for the year 2017 in order to ensure that the business is meeting the performance standards.

The assessment also analyzes the debt equity position of the business and also makes comment

on the changes which have taken place in the same over the years. In order to analyze the

financial performance of the business, key financial ratios of the business are computed and

analyzed in a similar manner. Lastly, the assessment considers the material risks which are

disclosed in the annual report of the business for the year 2017 and how well the business has

managed such risks.

ACCOUNTING AND FINANCE

Executive Summary

The main purpose of this assessment is to conduct an analysis of the financial statement of AMP

ltd for the year 2017 in order to ensure that the business is meeting the performance standards.

The assessment also analyzes the debt equity position of the business and also makes comment

on the changes which have taken place in the same over the years. In order to analyze the

financial performance of the business, key financial ratios of the business are computed and

analyzed in a similar manner. Lastly, the assessment considers the material risks which are

disclosed in the annual report of the business for the year 2017 and how well the business has

managed such risks.

2

ACCOUNTING AND FINANCE

Table of Contents

Buddy Capital Investment...............................................................................................................3

Part B...............................................................................................................................................7

Introduction......................................................................................................................................7

Discussion........................................................................................................................................7

Capital Structure..........................................................................................................................7

Weighted Average Cost of Capital..............................................................................................8

CAPM Model...............................................................................................................................8

Comparison with NAB................................................................................................................9

Key Financial Ratios....................................................................................................................9

Changes in Capital Structure.....................................................................................................11

Risk Management Policies........................................................................................................11

Reference.......................................................................................................................................13

ACCOUNTING AND FINANCE

Table of Contents

Buddy Capital Investment...............................................................................................................3

Part B...............................................................................................................................................7

Introduction......................................................................................................................................7

Discussion........................................................................................................................................7

Capital Structure..........................................................................................................................7

Weighted Average Cost of Capital..............................................................................................8

CAPM Model...............................................................................................................................8

Comparison with NAB................................................................................................................9

Key Financial Ratios....................................................................................................................9

Changes in Capital Structure.....................................................................................................11

Risk Management Policies........................................................................................................11

Reference.......................................................................................................................................13

3

ACCOUNTING AND FINANCE

Buddy Capital Investment

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $20,000,000 $20,470,000 $20,951,045 $21,443,395 $21,947,314 $22,463,076 $22,990,959 $23,531,246 $24,084,230 $24,650,210

Raw Material & Packaging Cost -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000

Gross Profit $6,000,000 $6,470,000 $6,951,045 $7,443,395 $7,947,314 $8,463,076 $8,990,959 $9,531,246 $10,084,230 $10,650,210

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $10,500,000 $11,440,000 $12,402,090 $13,386,789 $14,394,629 $15,426,152 $16,481,917 $17,562,492 $18,668,461 $19,800,419

Less: Income Tax @ 30% -$3,150,000 -$3,432,000 -$3,720,627 -$4,016,037 -$4,318,389 -$4,627,846 -$4,944,575 -$5,268,748 -$5,600,538 -$5,940,126

Net Profit after Tax $7,350,000 $8,008,000 $8,681,463 $9,370,752 $10,076,240 $10,798,307 $11,537,342 $12,293,744 $13,067,922 $13,860,294

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Net Cash Flow -$20,000,000 $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Cumulative Cash Flow -$20,000,000 -$11,150,000 -$1,642,000 $8,539,463 $19,410,215 $30,986,455 $43,284,762 $56,322,104 $70,115,849 $84,683,771 $105,044,065

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,375,000 $6,602,778 $5,892,050 $5,242,454 $4,652,231 $4,118,678 $3,638,483 $3,207,984 $2,823,361 $3,288,301

Payback Period (in years) 2.214

Net Present Value $26,841,320

Profitability Index 2.342

Years

Capital Budgeting Analysis for "Buddy":

ACCOUNTING AND FINANCE

Buddy Capital Investment

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $20,000,000 $20,470,000 $20,951,045 $21,443,395 $21,947,314 $22,463,076 $22,990,959 $23,531,246 $24,084,230 $24,650,210

Raw Material & Packaging Cost -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000

Gross Profit $6,000,000 $6,470,000 $6,951,045 $7,443,395 $7,947,314 $8,463,076 $8,990,959 $9,531,246 $10,084,230 $10,650,210

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $10,500,000 $11,440,000 $12,402,090 $13,386,789 $14,394,629 $15,426,152 $16,481,917 $17,562,492 $18,668,461 $19,800,419

Less: Income Tax @ 30% -$3,150,000 -$3,432,000 -$3,720,627 -$4,016,037 -$4,318,389 -$4,627,846 -$4,944,575 -$5,268,748 -$5,600,538 -$5,940,126

Net Profit after Tax $7,350,000 $8,008,000 $8,681,463 $9,370,752 $10,076,240 $10,798,307 $11,537,342 $12,293,744 $13,067,922 $13,860,294

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Net Cash Flow -$20,000,000 $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Cumulative Cash Flow -$20,000,000 -$11,150,000 -$1,642,000 $8,539,463 $19,410,215 $30,986,455 $43,284,762 $56,322,104 $70,115,849 $84,683,771 $105,044,065

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,375,000 $6,602,778 $5,892,050 $5,242,454 $4,652,231 $4,118,678 $3,638,483 $3,207,984 $2,823,361 $3,288,301

Payback Period (in years) 2.214

Net Present Value $26,841,320

Profitability Index 2.342

Years

Capital Budgeting Analysis for "Buddy":

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

ACCOUNTING AND FINANCE

5% lower Sales:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $19,000,000 $19,446,500 $19,903,493 $20,371,225 $20,849,949 $21,339,922 $21,841,411 $22,354,684 $22,880,019 $23,417,699

Raw Material & Packaging Cost -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,050,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000

Gross Profit $5,700,000 $5,866,500 $6,323,493 $6,791,225 $7,269,949 $7,759,922 $8,261,411 $8,774,684 $9,300,019 $9,837,699

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $9,900,000 $10,233,000 $11,146,986 $12,082,450 $13,039,897 $14,019,845 $15,022,821 $16,049,367 $17,100,038 $18,175,398

Less: Income Tax @ 30% -$2,970,000 -$3,069,900 -$3,344,096 -$3,624,735 -$3,911,969 -$4,205,953 -$4,506,846 -$4,814,810 -$5,130,011 -$5,452,620

Net Profit after Tax $6,930,000 $7,163,100 $7,802,890 $8,457,715 $9,127,928 $9,813,891 $10,515,975 $11,234,557 $11,970,026 $12,722,779

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,430,000 $8,663,100 $9,302,890 $9,957,715 $10,627,928 $11,313,891 $12,015,975 $12,734,557 $13,470,026 $19,222,779

Net Cash Flow -$20,000,000 $8,430,000 $8,663,100 $9,302,890 $9,957,715 $10,627,928 $11,313,891 $12,015,975 $12,734,557 $13,470,026 $19,222,779

Cumulative Cash Flow -$20,000,000 -$11,570,000 -$2,906,900 $6,395,990 $16,353,705 $26,981,633 $38,295,524 $50,311,499 $63,046,056 $76,516,082 $95,738,861

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,025,000 $6,016,042 $5,383,617 $4,802,139 $4,271,126 $3,788,999 $3,353,438 $2,961,651 $2,610,581 $3,104,586

Payback Period (in years) 2.358

Net Present Value $23,317,179

Profitability Index 2.166

Capital Budgeting Analysis for "Buddy":

Years

ACCOUNTING AND FINANCE

5% lower Sales:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000 15200000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $19,000,000 $19,446,500 $19,903,493 $20,371,225 $20,849,949 $21,339,922 $21,841,411 $22,354,684 $22,880,019 $23,417,699

Raw Material & Packaging Cost -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000 -$6,650,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,050,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000 -$1,330,000

Gross Profit $5,700,000 $5,866,500 $6,323,493 $6,791,225 $7,269,949 $7,759,922 $8,261,411 $8,774,684 $9,300,019 $9,837,699

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $9,900,000 $10,233,000 $11,146,986 $12,082,450 $13,039,897 $14,019,845 $15,022,821 $16,049,367 $17,100,038 $18,175,398

Less: Income Tax @ 30% -$2,970,000 -$3,069,900 -$3,344,096 -$3,624,735 -$3,911,969 -$4,205,953 -$4,506,846 -$4,814,810 -$5,130,011 -$5,452,620

Net Profit after Tax $6,930,000 $7,163,100 $7,802,890 $8,457,715 $9,127,928 $9,813,891 $10,515,975 $11,234,557 $11,970,026 $12,722,779

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,430,000 $8,663,100 $9,302,890 $9,957,715 $10,627,928 $11,313,891 $12,015,975 $12,734,557 $13,470,026 $19,222,779

Net Cash Flow -$20,000,000 $8,430,000 $8,663,100 $9,302,890 $9,957,715 $10,627,928 $11,313,891 $12,015,975 $12,734,557 $13,470,026 $19,222,779

Cumulative Cash Flow -$20,000,000 -$11,570,000 -$2,906,900 $6,395,990 $16,353,705 $26,981,633 $38,295,524 $50,311,499 $63,046,056 $76,516,082 $95,738,861

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,025,000 $6,016,042 $5,383,617 $4,802,139 $4,271,126 $3,788,999 $3,353,438 $2,961,651 $2,610,581 $3,104,586

Payback Period (in years) 2.358

Net Present Value $23,317,179

Profitability Index 2.166

Capital Budgeting Analysis for "Buddy":

Years

5

ACCOUNTING AND FINANCE

5% Higher Sales:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $21,000,000 $21,493,500 $21,998,597 $22,515,564 $23,044,680 $23,586,230 $24,140,506 $24,707,808 $25,288,442 $25,882,720

Raw Material & Packaging Cost -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,750,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000

Gross Profit $6,300,000 $7,073,500 $7,578,597 $8,095,564 $8,624,680 $9,166,230 $9,720,506 $10,287,808 $10,868,442 $11,462,720

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $11,100,000 $12,647,000 $13,657,195 $14,691,129 $15,749,360 $16,832,460 $17,941,013 $19,075,617 $20,236,884 $21,425,440

Less: Income Tax @ 30% -$3,330,000 -$3,794,100 -$4,097,158 -$4,407,339 -$4,724,808 -$5,049,738 -$5,382,304 -$5,722,685 -$6,071,065 -$6,427,632

Net Profit after Tax $7,770,000 $8,852,900 $9,560,036 $10,283,790 $11,024,552 $11,782,722 $12,558,709 $13,352,932 $14,165,819 $14,997,808

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $9,270,000 $10,352,900 $11,060,036 $11,783,790 $12,524,552 $13,282,722 $14,058,709 $14,852,932 $15,665,819 $21,497,808

Net Cash Flow -$20,000,000 $9,270,000 $10,352,900 $11,060,036 $11,783,790 $12,524,552 $13,282,722 $14,058,709 $14,852,932 $15,665,819 $21,497,808

Cumulative Cash Flow -$20,000,000 -$10,730,000 -$377,100 $10,682,936 $22,466,726 $34,991,278 $48,274,000 $62,332,709 $77,185,641 $92,851,459 $114,349,268

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,725,000 $7,189,514 $6,400,484 $5,682,769 $5,033,337 $4,448,357 $3,923,528 $3,454,317 $3,036,141 $3,472,016

Payback Period (in years) 2.093

Net Present Value $30,365,462

Profitability Index 2.518

Years

Capital Budgeting Analysis for "Buddy":

ACCOUNTING AND FINANCE

5% Higher Sales:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000 16800000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $21,000,000 $21,493,500 $21,998,597 $22,515,564 $23,044,680 $23,586,230 $24,140,506 $24,707,808 $25,288,442 $25,882,720

Raw Material & Packaging Cost -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000 -$7,350,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,750,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000 -$1,470,000

Gross Profit $6,300,000 $7,073,500 $7,578,597 $8,095,564 $8,624,680 $9,166,230 $9,720,506 $10,287,808 $10,868,442 $11,462,720

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $11,100,000 $12,647,000 $13,657,195 $14,691,129 $15,749,360 $16,832,460 $17,941,013 $19,075,617 $20,236,884 $21,425,440

Less: Income Tax @ 30% -$3,330,000 -$3,794,100 -$4,097,158 -$4,407,339 -$4,724,808 -$5,049,738 -$5,382,304 -$5,722,685 -$6,071,065 -$6,427,632

Net Profit after Tax $7,770,000 $8,852,900 $9,560,036 $10,283,790 $11,024,552 $11,782,722 $12,558,709 $13,352,932 $14,165,819 $14,997,808

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $9,270,000 $10,352,900 $11,060,036 $11,783,790 $12,524,552 $13,282,722 $14,058,709 $14,852,932 $15,665,819 $21,497,808

Net Cash Flow -$20,000,000 $9,270,000 $10,352,900 $11,060,036 $11,783,790 $12,524,552 $13,282,722 $14,058,709 $14,852,932 $15,665,819 $21,497,808

Cumulative Cash Flow -$20,000,000 -$10,730,000 -$377,100 $10,682,936 $22,466,726 $34,991,278 $48,274,000 $62,332,709 $77,185,641 $92,851,459 $114,349,268

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,725,000 $7,189,514 $6,400,484 $5,682,769 $5,033,337 $4,448,357 $3,923,528 $3,454,317 $3,036,141 $3,472,016

Payback Period (in years) 2.093

Net Present Value $30,365,462

Profitability Index 2.518

Years

Capital Budgeting Analysis for "Buddy":

6

ACCOUNTING AND FINANCE

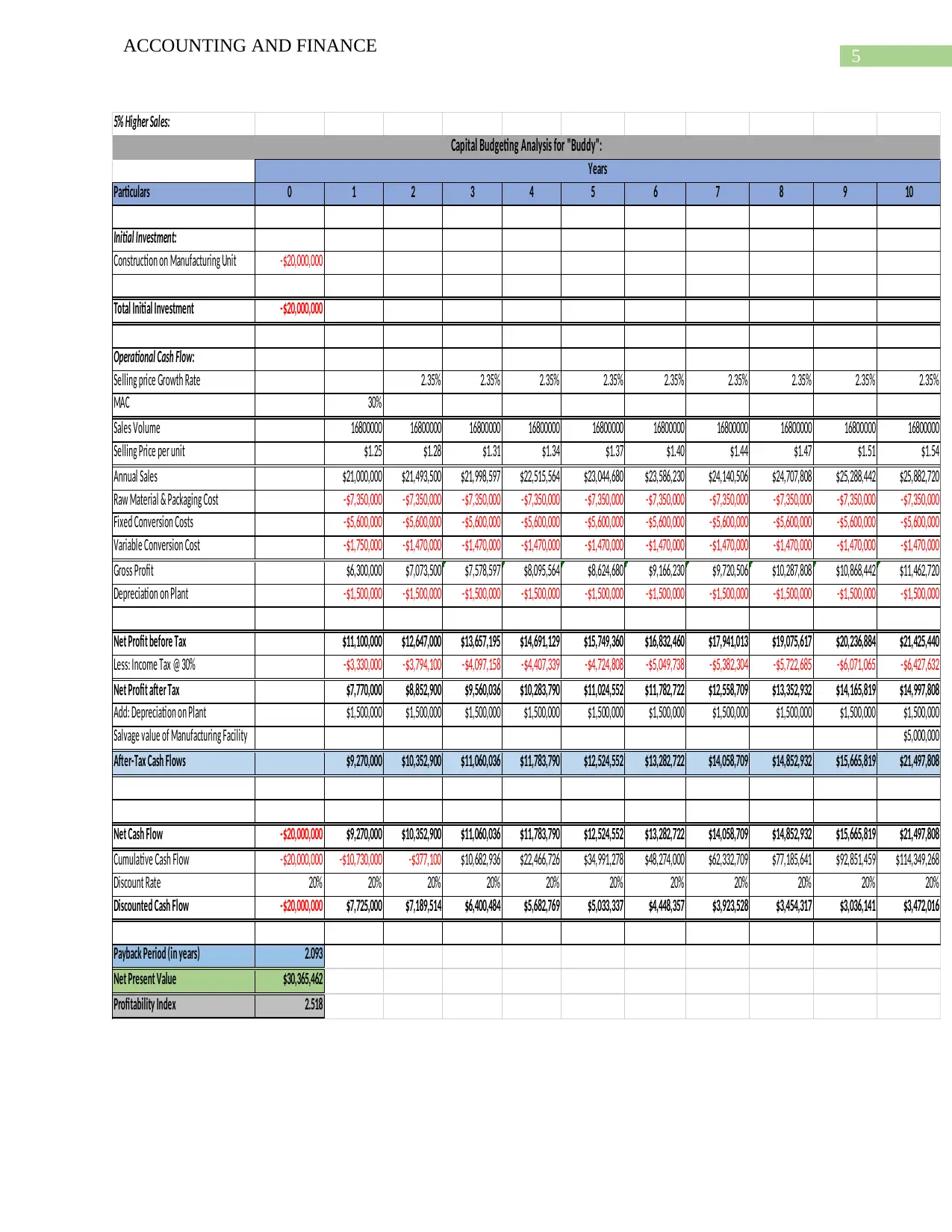

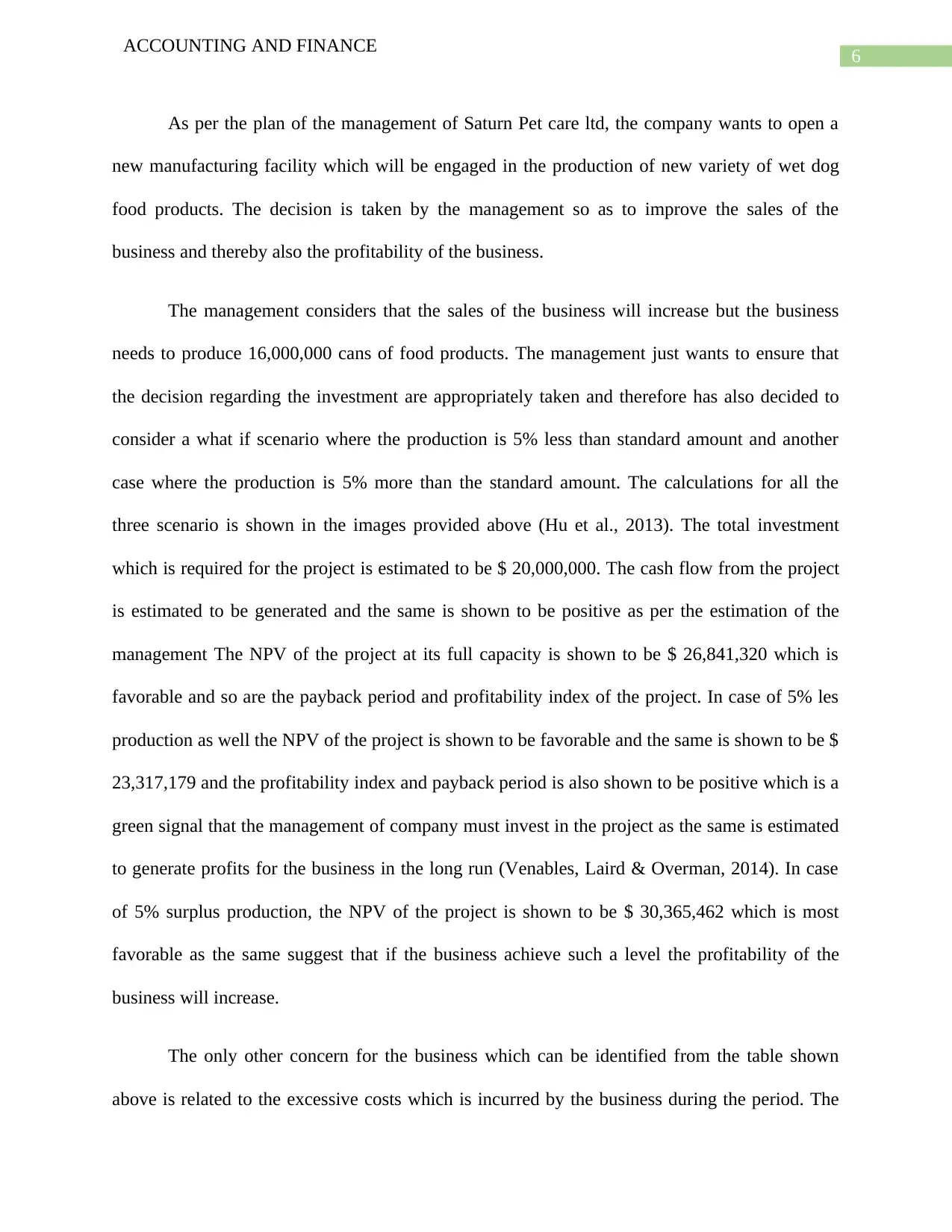

As per the plan of the management of Saturn Pet care ltd, the company wants to open a

new manufacturing facility which will be engaged in the production of new variety of wet dog

food products. The decision is taken by the management so as to improve the sales of the

business and thereby also the profitability of the business.

The management considers that the sales of the business will increase but the business

needs to produce 16,000,000 cans of food products. The management just wants to ensure that

the decision regarding the investment are appropriately taken and therefore has also decided to

consider a what if scenario where the production is 5% less than standard amount and another

case where the production is 5% more than the standard amount. The calculations for all the

three scenario is shown in the images provided above (Hu et al., 2013). The total investment

which is required for the project is estimated to be $ 20,000,000. The cash flow from the project

is estimated to be generated and the same is shown to be positive as per the estimation of the

management The NPV of the project at its full capacity is shown to be $ 26,841,320 which is

favorable and so are the payback period and profitability index of the project. In case of 5% les

production as well the NPV of the project is shown to be favorable and the same is shown to be $

23,317,179 and the profitability index and payback period is also shown to be positive which is a

green signal that the management of company must invest in the project as the same is estimated

to generate profits for the business in the long run (Venables, Laird & Overman, 2014). In case

of 5% surplus production, the NPV of the project is shown to be $ 30,365,462 which is most

favorable as the same suggest that if the business achieve such a level the profitability of the

business will increase.

The only other concern for the business which can be identified from the table shown

above is related to the excessive costs which is incurred by the business during the period. The

ACCOUNTING AND FINANCE

As per the plan of the management of Saturn Pet care ltd, the company wants to open a

new manufacturing facility which will be engaged in the production of new variety of wet dog

food products. The decision is taken by the management so as to improve the sales of the

business and thereby also the profitability of the business.

The management considers that the sales of the business will increase but the business

needs to produce 16,000,000 cans of food products. The management just wants to ensure that

the decision regarding the investment are appropriately taken and therefore has also decided to

consider a what if scenario where the production is 5% less than standard amount and another

case where the production is 5% more than the standard amount. The calculations for all the

three scenario is shown in the images provided above (Hu et al., 2013). The total investment

which is required for the project is estimated to be $ 20,000,000. The cash flow from the project

is estimated to be generated and the same is shown to be positive as per the estimation of the

management The NPV of the project at its full capacity is shown to be $ 26,841,320 which is

favorable and so are the payback period and profitability index of the project. In case of 5% les

production as well the NPV of the project is shown to be favorable and the same is shown to be $

23,317,179 and the profitability index and payback period is also shown to be positive which is a

green signal that the management of company must invest in the project as the same is estimated

to generate profits for the business in the long run (Venables, Laird & Overman, 2014). In case

of 5% surplus production, the NPV of the project is shown to be $ 30,365,462 which is most

favorable as the same suggest that if the business achieve such a level the profitability of the

business will increase.

The only other concern for the business which can be identified from the table shown

above is related to the excessive costs which is incurred by the business during the period. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING AND FINANCE

increase in production capacity will increase the sales of the business tremendously and thereby

also the costs of the business will increase.

Part B

Introduction

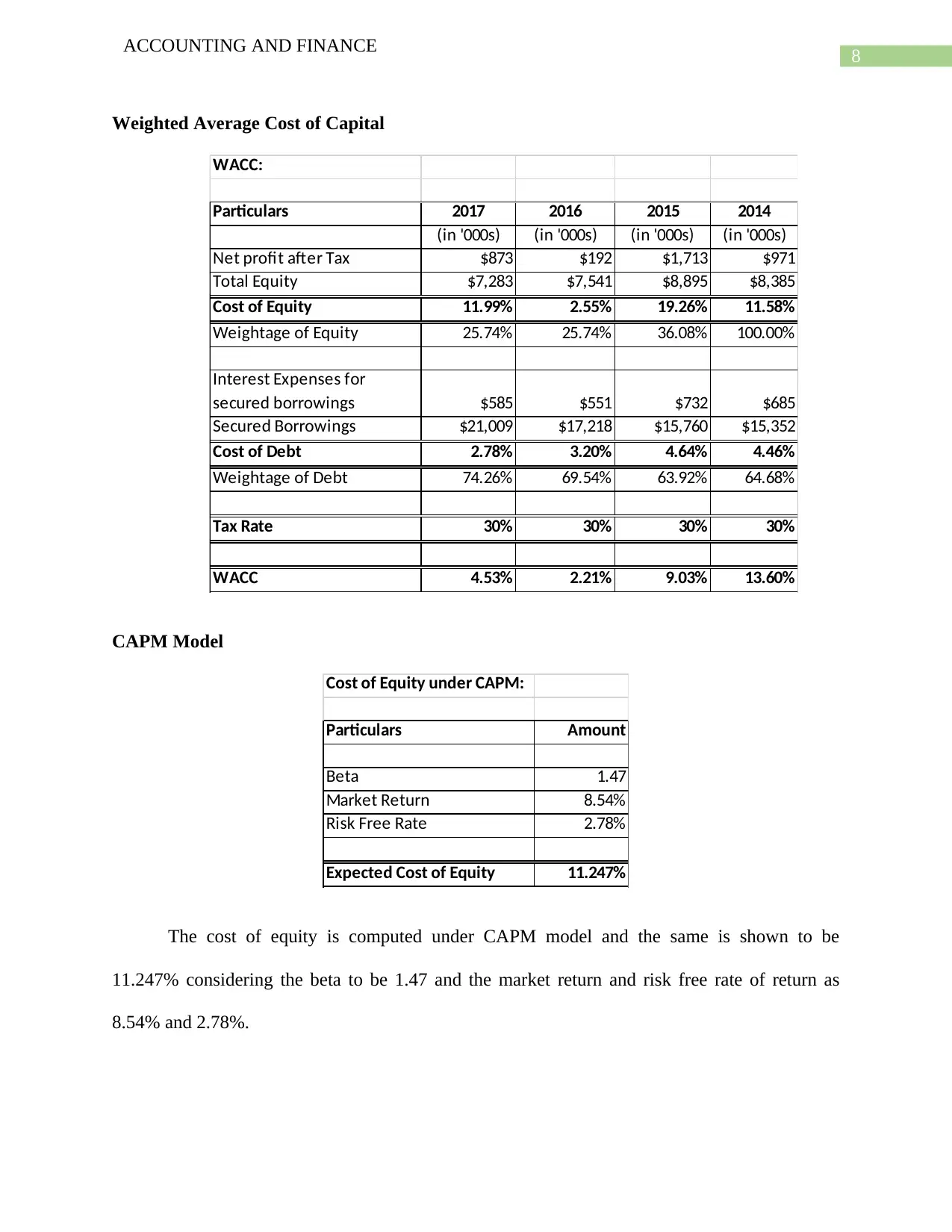

The main purpose of this assessment is to analyze the financial performance of AMP ltd

which is engaged in financial sector in Australia. The assessment also shows analysis of debt and

equity capital which is utilized by the business for meeting the day to day business requirements

of the business (Corporate.amp.com.au. 2018).. The report also analyzes the key financial ratios

of the business for the year 2017. The report will also identify the materials risks which the

business faces as identified in the annual report of the business for the year 2017.

Discussion

Capital Structure

Particulars Amount Weightage

(in $m)

Total Equity $7,283 26%

Secured Borrowings $21,009 74%

TOTAL CAPITAL $28,292 100%

CURRENT CAPITAL STRUCTURE:

The capital structure of the business is shown to be dominated by more of borrowings of

the business and the weightage of debt is shown to be 74%.

ACCOUNTING AND FINANCE

increase in production capacity will increase the sales of the business tremendously and thereby

also the costs of the business will increase.

Part B

Introduction

The main purpose of this assessment is to analyze the financial performance of AMP ltd

which is engaged in financial sector in Australia. The assessment also shows analysis of debt and

equity capital which is utilized by the business for meeting the day to day business requirements

of the business (Corporate.amp.com.au. 2018).. The report also analyzes the key financial ratios

of the business for the year 2017. The report will also identify the materials risks which the

business faces as identified in the annual report of the business for the year 2017.

Discussion

Capital Structure

Particulars Amount Weightage

(in $m)

Total Equity $7,283 26%

Secured Borrowings $21,009 74%

TOTAL CAPITAL $28,292 100%

CURRENT CAPITAL STRUCTURE:

The capital structure of the business is shown to be dominated by more of borrowings of

the business and the weightage of debt is shown to be 74%.

8

ACCOUNTING AND FINANCE

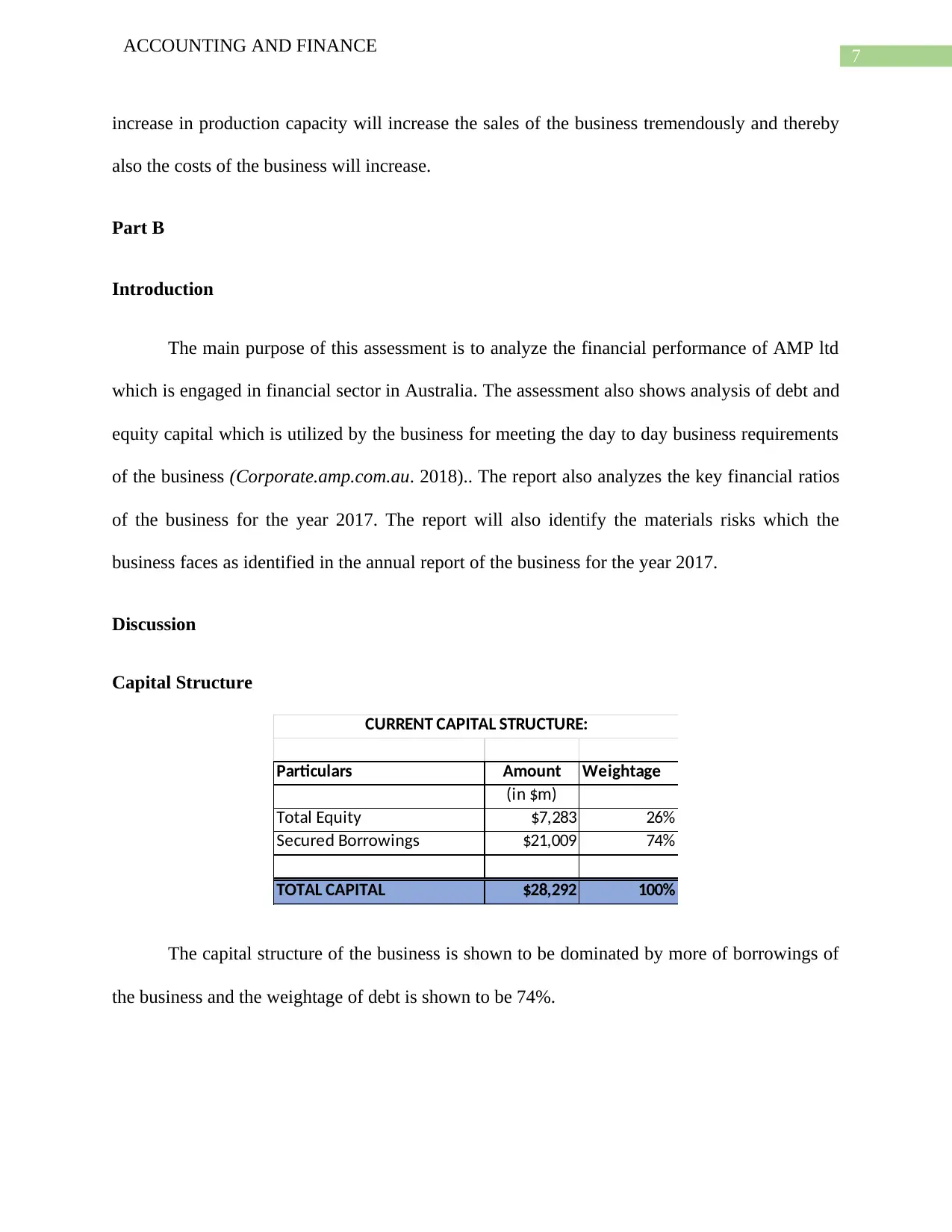

Weighted Average Cost of Capital

WACC:

Particulars 2017 2016 2015 2014

(in '000s) (in '000s) (in '000s) (in '000s)

Net profit after Tax $873 $192 $1,713 $971

Total Equity $7,283 $7,541 $8,895 $8,385

Cost of Equity 11.99% 2.55% 19.26% 11.58%

Weightage of Equity 25.74% 25.74% 36.08% 100.00%

Interest Expenses for

secured borrowings $585 $551 $732 $685

Secured Borrowings $21,009 $17,218 $15,760 $15,352

Cost of Debt 2.78% 3.20% 4.64% 4.46%

Weightage of Debt 74.26% 69.54% 63.92% 64.68%

Tax Rate 30% 30% 30% 30%

WACC 4.53% 2.21% 9.03% 13.60%

CAPM Model

Cost of Equity under CAPM:

Particulars Amount

Beta 1.47

Market Return 8.54%

Risk Free Rate 2.78%

Expected Cost of Equity 11.247%

The cost of equity is computed under CAPM model and the same is shown to be

11.247% considering the beta to be 1.47 and the market return and risk free rate of return as

8.54% and 2.78%.

ACCOUNTING AND FINANCE

Weighted Average Cost of Capital

WACC:

Particulars 2017 2016 2015 2014

(in '000s) (in '000s) (in '000s) (in '000s)

Net profit after Tax $873 $192 $1,713 $971

Total Equity $7,283 $7,541 $8,895 $8,385

Cost of Equity 11.99% 2.55% 19.26% 11.58%

Weightage of Equity 25.74% 25.74% 36.08% 100.00%

Interest Expenses for

secured borrowings $585 $551 $732 $685

Secured Borrowings $21,009 $17,218 $15,760 $15,352

Cost of Debt 2.78% 3.20% 4.64% 4.46%

Weightage of Debt 74.26% 69.54% 63.92% 64.68%

Tax Rate 30% 30% 30% 30%

WACC 4.53% 2.21% 9.03% 13.60%

CAPM Model

Cost of Equity under CAPM:

Particulars Amount

Beta 1.47

Market Return 8.54%

Risk Free Rate 2.78%

Expected Cost of Equity 11.247%

The cost of equity is computed under CAPM model and the same is shown to be

11.247% considering the beta to be 1.47 and the market return and risk free rate of return as

8.54% and 2.78%.

9

ACCOUNTING AND FINANCE

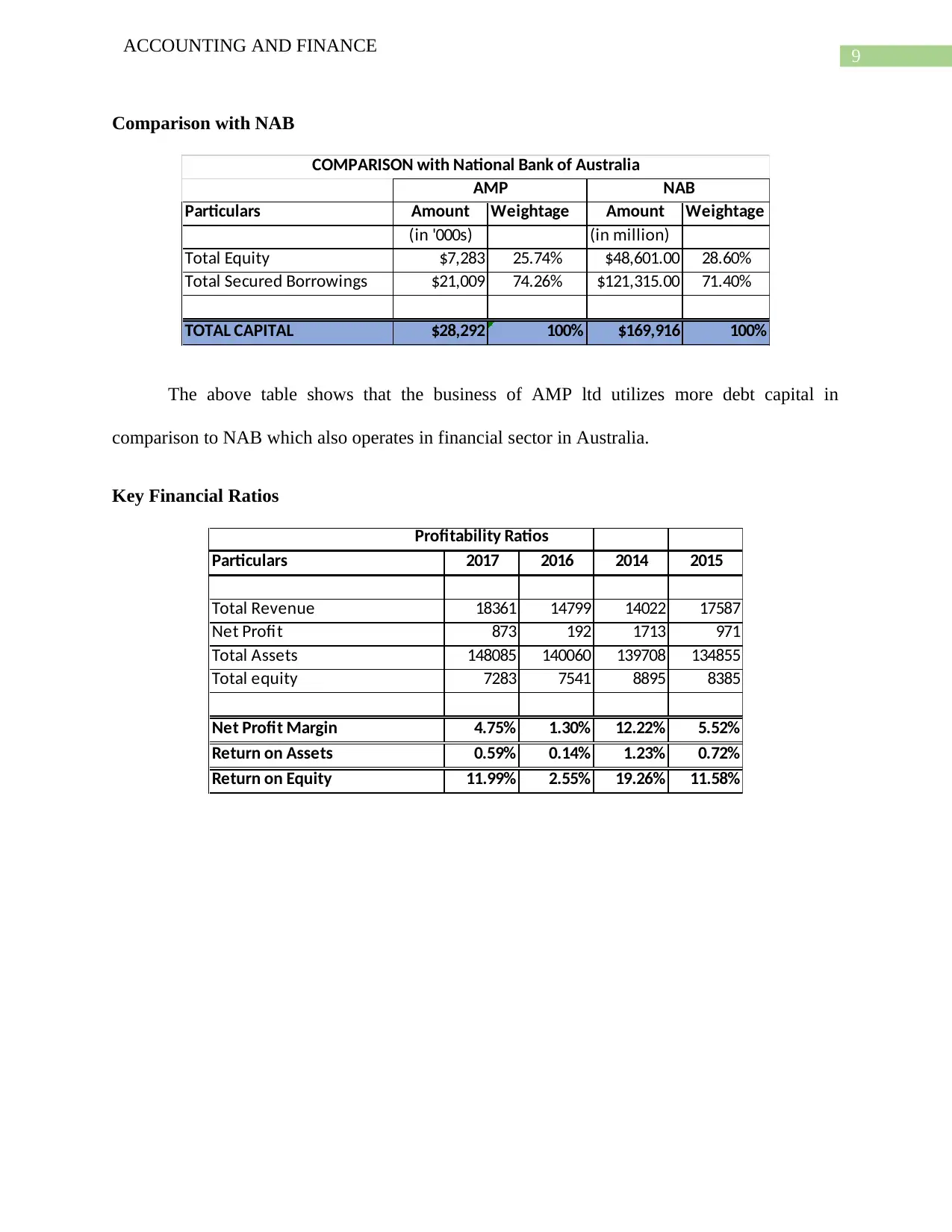

Comparison with NAB

Particulars Amount Weightage Amount Weightage

(in '000s) (in million)

Total Equity $7,283 25.74% $48,601.00 28.60%

Total Secured Borrowings $21,009 74.26% $121,315.00 71.40%

TOTAL CAPITAL $28,292 100% $169,916 100%

AMP NAB

COMPARISON with National Bank of Australia

The above table shows that the business of AMP ltd utilizes more debt capital in

comparison to NAB which also operates in financial sector in Australia.

Key Financial Ratios

Profitability Ratios

Particulars 2017 2016 2014 2015

Total Revenue 18361 14799 14022 17587

Net Profit 873 192 1713 971

Total Assets 148085 140060 139708 134855

Total equity 7283 7541 8895 8385

Net Profit Margin 4.75% 1.30% 12.22% 5.52%

Return on Assets 0.59% 0.14% 1.23% 0.72%

Return on Equity 11.99% 2.55% 19.26% 11.58%

ACCOUNTING AND FINANCE

Comparison with NAB

Particulars Amount Weightage Amount Weightage

(in '000s) (in million)

Total Equity $7,283 25.74% $48,601.00 28.60%

Total Secured Borrowings $21,009 74.26% $121,315.00 71.40%

TOTAL CAPITAL $28,292 100% $169,916 100%

AMP NAB

COMPARISON with National Bank of Australia

The above table shows that the business of AMP ltd utilizes more debt capital in

comparison to NAB which also operates in financial sector in Australia.

Key Financial Ratios

Profitability Ratios

Particulars 2017 2016 2014 2015

Total Revenue 18361 14799 14022 17587

Net Profit 873 192 1713 971

Total Assets 148085 140060 139708 134855

Total equity 7283 7541 8895 8385

Net Profit Margin 4.75% 1.30% 12.22% 5.52%

Return on Assets 0.59% 0.14% 1.23% 0.72%

Return on Equity 11.99% 2.55% 19.26% 11.58%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

ACCOUNTING AND FINANCE

Particulars 2017 2016 2014 2015

Total Assets 148085 140060 139708 134855

Total equity 7283 7541 8895 8385

Total Liabilities 140802 132519 130813 126470

Finance Costs 585 551 732 685

Operating Profit 2221 909 2725 2499

Time Interest Earned Ratio 3.797 1.650 3.723 3.648

Debt-to-Equity Ratio 19.333 17.573 14.706 15.083

Debt Ratio 0.951 0.946 0.936 0.938

Equity Ratio 0.049 0.054 0.064 0.062

Solvency Ratio

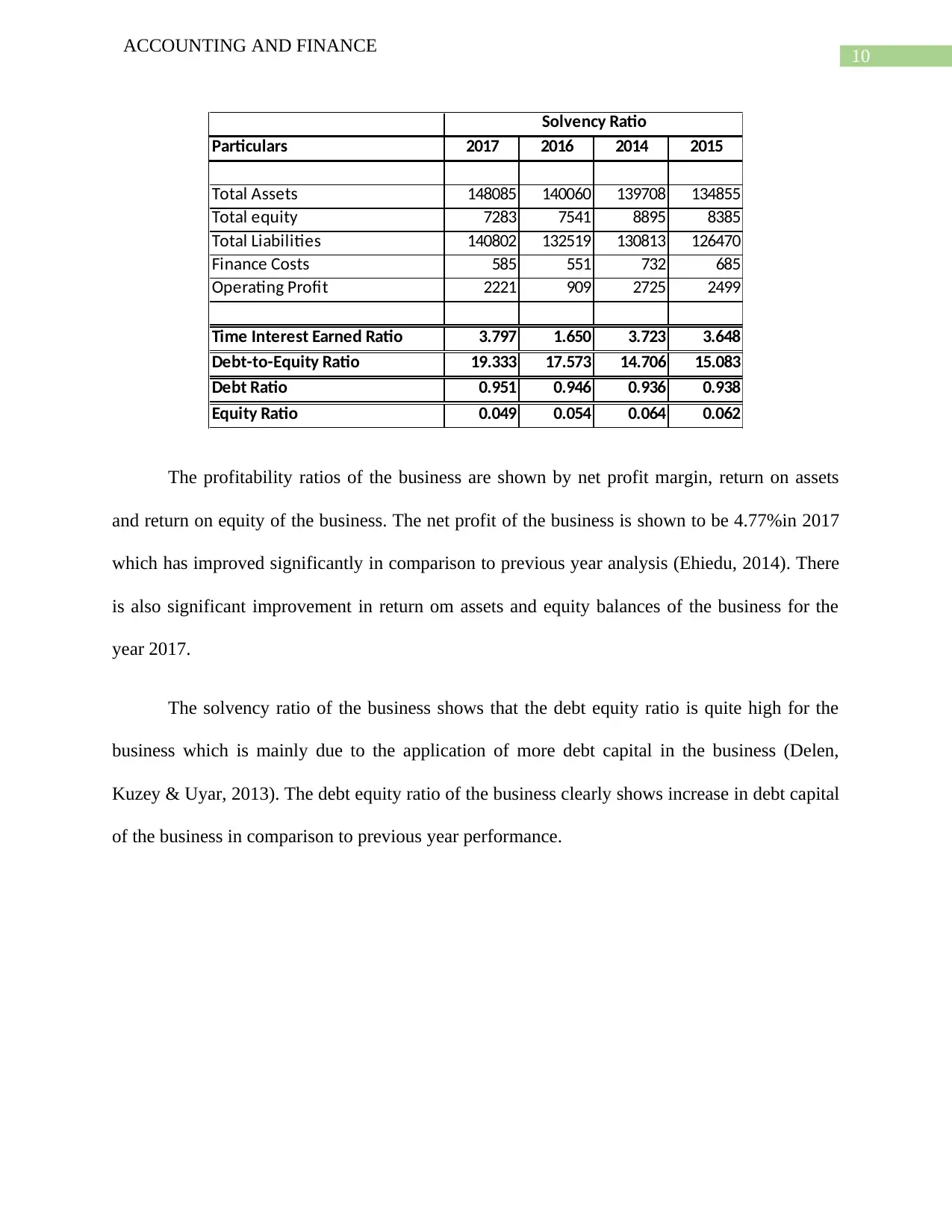

The profitability ratios of the business are shown by net profit margin, return on assets

and return on equity of the business. The net profit of the business is shown to be 4.77%in 2017

which has improved significantly in comparison to previous year analysis (Ehiedu, 2014). There

is also significant improvement in return om assets and equity balances of the business for the

year 2017.

The solvency ratio of the business shows that the debt equity ratio is quite high for the

business which is mainly due to the application of more debt capital in the business (Delen,

Kuzey & Uyar, 2013). The debt equity ratio of the business clearly shows increase in debt capital

of the business in comparison to previous year performance.

ACCOUNTING AND FINANCE

Particulars 2017 2016 2014 2015

Total Assets 148085 140060 139708 134855

Total equity 7283 7541 8895 8385

Total Liabilities 140802 132519 130813 126470

Finance Costs 585 551 732 685

Operating Profit 2221 909 2725 2499

Time Interest Earned Ratio 3.797 1.650 3.723 3.648

Debt-to-Equity Ratio 19.333 17.573 14.706 15.083

Debt Ratio 0.951 0.946 0.936 0.938

Equity Ratio 0.049 0.054 0.064 0.062

Solvency Ratio

The profitability ratios of the business are shown by net profit margin, return on assets

and return on equity of the business. The net profit of the business is shown to be 4.77%in 2017

which has improved significantly in comparison to previous year analysis (Ehiedu, 2014). There

is also significant improvement in return om assets and equity balances of the business for the

year 2017.

The solvency ratio of the business shows that the debt equity ratio is quite high for the

business which is mainly due to the application of more debt capital in the business (Delen,

Kuzey & Uyar, 2013). The debt equity ratio of the business clearly shows increase in debt capital

of the business in comparison to previous year performance.

11

ACCOUNTING AND FINANCE

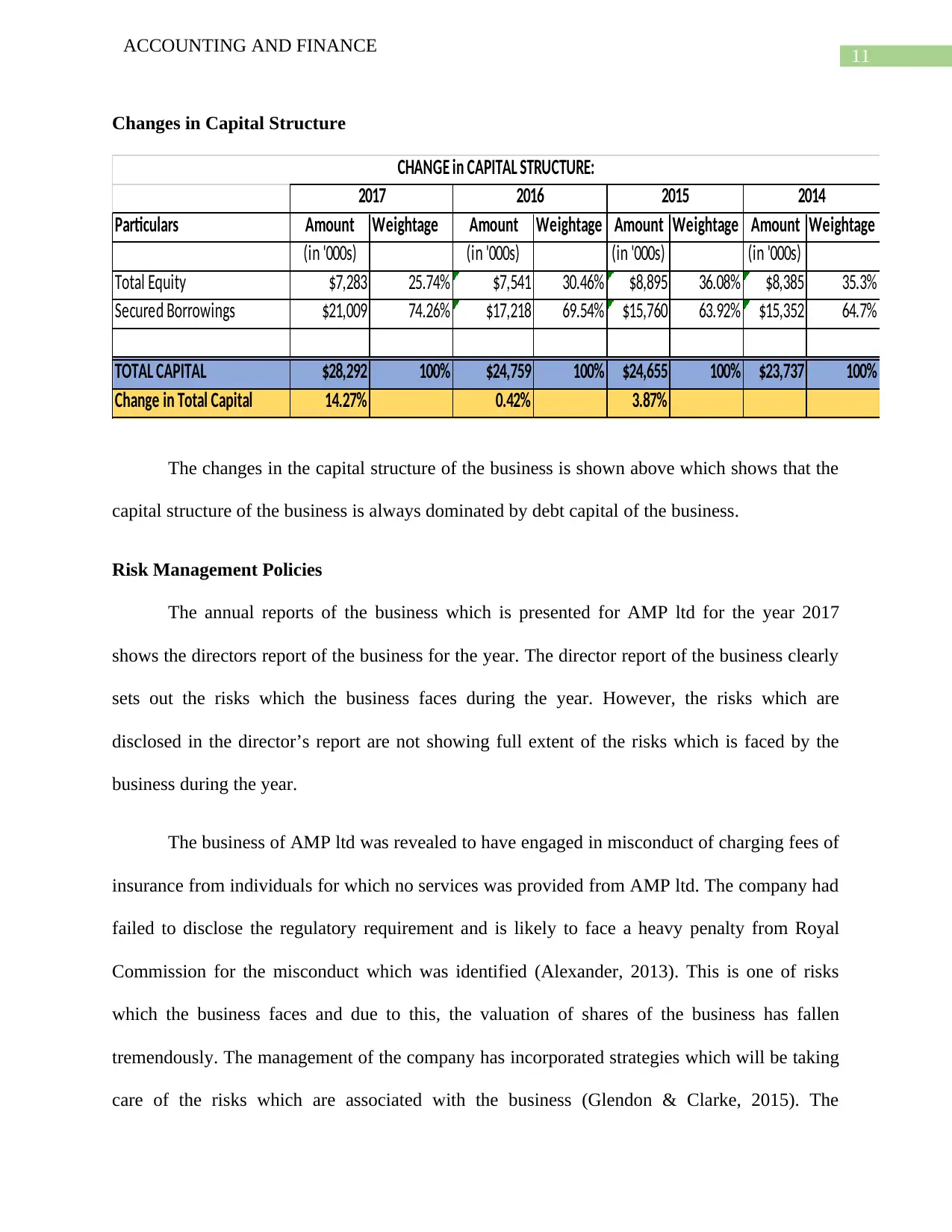

Changes in Capital Structure

Particulars Amount Weightage Amount Weightage Amount Weightage Amount Weightage

(in '000s) (in '000s) (in '000s) (in '000s)

Total Equity $7,283 25.74% $7,541 30.46% $8,895 36.08% $8,385 35.3%

Secured Borrowings $21,009 74.26% $17,218 69.54% $15,760 63.92% $15,352 64.7%

TOTAL CAPITAL $28,292 100% $24,759 100% $24,655 100% $23,737 100%

Change in Total Capital 14.27% 0.42% 3.87%

2015 2014

CHANGE in CAPITAL STRUCTURE:

2017 2016

The changes in the capital structure of the business is shown above which shows that the

capital structure of the business is always dominated by debt capital of the business.

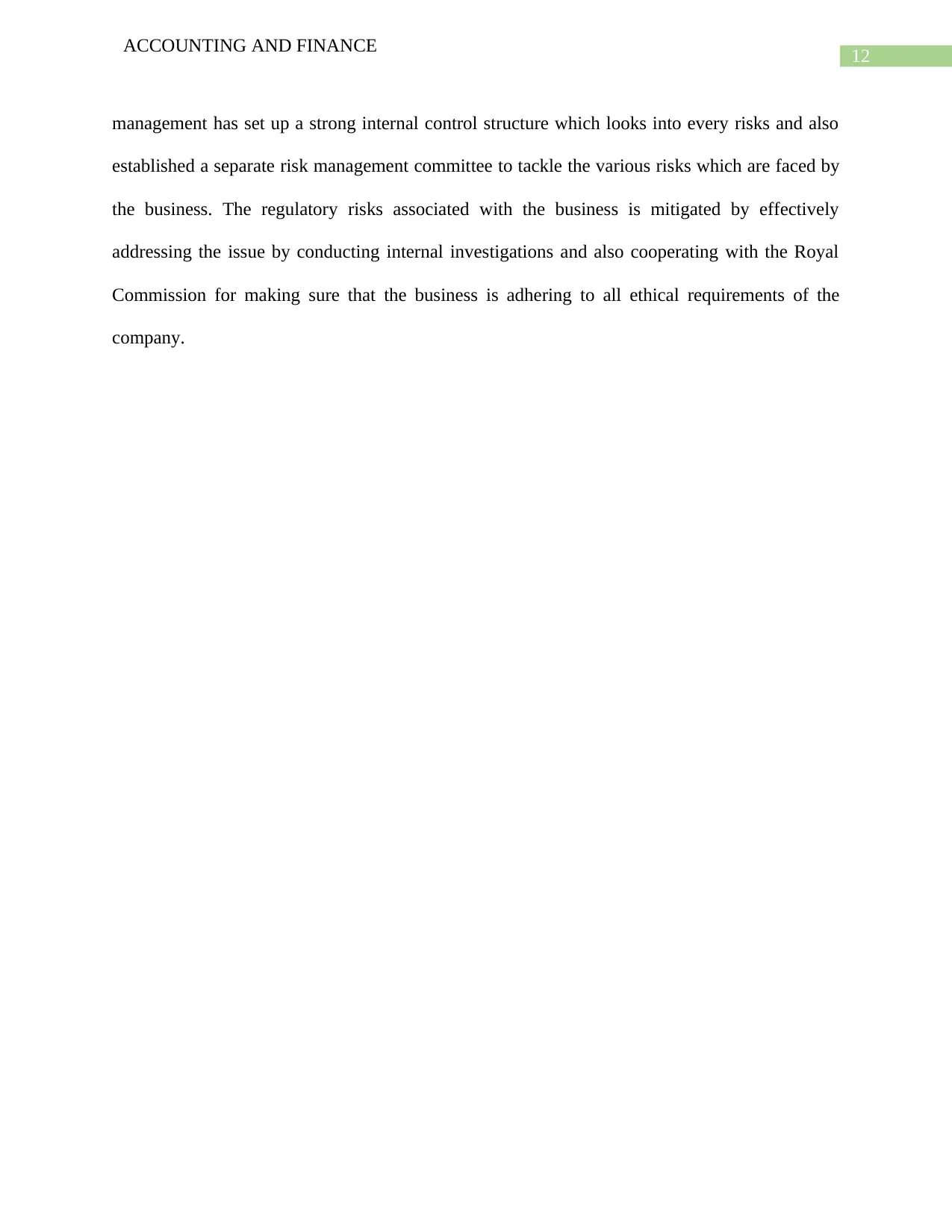

Risk Management Policies

The annual reports of the business which is presented for AMP ltd for the year 2017

shows the directors report of the business for the year. The director report of the business clearly

sets out the risks which the business faces during the year. However, the risks which are

disclosed in the director’s report are not showing full extent of the risks which is faced by the

business during the year.

The business of AMP ltd was revealed to have engaged in misconduct of charging fees of

insurance from individuals for which no services was provided from AMP ltd. The company had

failed to disclose the regulatory requirement and is likely to face a heavy penalty from Royal

Commission for the misconduct which was identified (Alexander, 2013). This is one of risks

which the business faces and due to this, the valuation of shares of the business has fallen

tremendously. The management of the company has incorporated strategies which will be taking

care of the risks which are associated with the business (Glendon & Clarke, 2015). The

ACCOUNTING AND FINANCE

Changes in Capital Structure

Particulars Amount Weightage Amount Weightage Amount Weightage Amount Weightage

(in '000s) (in '000s) (in '000s) (in '000s)

Total Equity $7,283 25.74% $7,541 30.46% $8,895 36.08% $8,385 35.3%

Secured Borrowings $21,009 74.26% $17,218 69.54% $15,760 63.92% $15,352 64.7%

TOTAL CAPITAL $28,292 100% $24,759 100% $24,655 100% $23,737 100%

Change in Total Capital 14.27% 0.42% 3.87%

2015 2014

CHANGE in CAPITAL STRUCTURE:

2017 2016

The changes in the capital structure of the business is shown above which shows that the

capital structure of the business is always dominated by debt capital of the business.

Risk Management Policies

The annual reports of the business which is presented for AMP ltd for the year 2017

shows the directors report of the business for the year. The director report of the business clearly

sets out the risks which the business faces during the year. However, the risks which are

disclosed in the director’s report are not showing full extent of the risks which is faced by the

business during the year.

The business of AMP ltd was revealed to have engaged in misconduct of charging fees of

insurance from individuals for which no services was provided from AMP ltd. The company had

failed to disclose the regulatory requirement and is likely to face a heavy penalty from Royal

Commission for the misconduct which was identified (Alexander, 2013). This is one of risks

which the business faces and due to this, the valuation of shares of the business has fallen

tremendously. The management of the company has incorporated strategies which will be taking

care of the risks which are associated with the business (Glendon & Clarke, 2015). The

12

ACCOUNTING AND FINANCE

management has set up a strong internal control structure which looks into every risks and also

established a separate risk management committee to tackle the various risks which are faced by

the business. The regulatory risks associated with the business is mitigated by effectively

addressing the issue by conducting internal investigations and also cooperating with the Royal

Commission for making sure that the business is adhering to all ethical requirements of the

company.

ACCOUNTING AND FINANCE

management has set up a strong internal control structure which looks into every risks and also

established a separate risk management committee to tackle the various risks which are faced by

the business. The regulatory risks associated with the business is mitigated by effectively

addressing the issue by conducting internal investigations and also cooperating with the Royal

Commission for making sure that the business is adhering to all ethical requirements of the

company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

ACCOUNTING AND FINANCE

Reference

Alexander, K. (2013). Facilities management: theory and practice. Routledge.

Corporate.amp.com.au. 2018. Reports. Retrieved 30 September 2018, from

https://corporate.amp.com.au/shareholder-centre/results-reporting/reports

Delen, D., Kuzey, C., & Uyar, A. (2013). Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

Ehiedu, V. C. (2014). The impact of liquidity on profitability of some selected companies: the

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), 81-90.

Glendon, A. I., & Clarke, S. (2015). Human safety and risk management: A psychological

perspective. Crc Press.

Hu, Y., Li, X., Li, H., & Yan, J. (2013). Peak and off-peak operations of the air separation unit in

oxy-coal combustion power generation systems. Applied energy, 112, 747-754.

Venables, A., Laird, J. J., & Overman, H. G. (2014). Transport investment and economic

performance: Implications for project appraisal.

ACCOUNTING AND FINANCE

Reference

Alexander, K. (2013). Facilities management: theory and practice. Routledge.

Corporate.amp.com.au. 2018. Reports. Retrieved 30 September 2018, from

https://corporate.amp.com.au/shareholder-centre/results-reporting/reports

Delen, D., Kuzey, C., & Uyar, A. (2013). Measuring firm performance using financial ratios: A

decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

Ehiedu, V. C. (2014). The impact of liquidity on profitability of some selected companies: the

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), 81-90.

Glendon, A. I., & Clarke, S. (2015). Human safety and risk management: A psychological

perspective. Crc Press.

Hu, Y., Li, X., Li, H., & Yan, J. (2013). Peak and off-peak operations of the air separation unit in

oxy-coal combustion power generation systems. Applied energy, 112, 747-754.

Venables, A., Laird, J. J., & Overman, H. G. (2014). Transport investment and economic

performance: Implications for project appraisal.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.

![[UNLOCK] Income Statement Analysis](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fcd%2F13d7a2dc37654b80b8558c2cd598b02d.jpg&w=256&q=75)