Corporate Accounting: Financial Statement Analysis of Baby Bunting

VerifiedAdded on 2023/06/11

|20

|3495

|428

Report

AI Summary

This report provides a critical analysis of the financial statements of Baby Bunting Group Ltd, an Australian company listed on the ASX, for the years 2015 to 2017. The analysis focuses on the cash flow statement, other comprehensive income statement, and corporate income tax accounting. It includes a comparative analysis of cash flow categories (operating, investing, and financing activities) and an examination of the components of other comprehensive income, which are absent in Baby Bunting's reports. The report also discusses the reasons behind differences in income tax payments, deferred tax treatments, and the relationship between tax payments in the cash flow statement and tax expenses in the income statement, concluding with overall observations about the company's tax treatment. Desklib is a platform where students can find such solved assignments.

Corporate Accounting- Financial Statement Analysis of Baby Bunting Group Ltd: 2015 to 2017

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

This report will emphasize on an Australian corporate about their audited financial statement.

The comparison will be done on different types of reports for last three years to understand the

financial condition of the company. The area of concentration will be on cash flow statement,

other comprehensive income statement and income tax accounting of the company. A critical

analysis will feature different aspects of those reports for the considered three years.

Key words- cash flow, Corporate Income tax, comprehensive income statement

2

This report will emphasize on an Australian corporate about their audited financial statement.

The comparison will be done on different types of reports for last three years to understand the

financial condition of the company. The area of concentration will be on cash flow statement,

other comprehensive income statement and income tax accounting of the company. A critical

analysis will feature different aspects of those reports for the considered three years.

Key words- cash flow, Corporate Income tax, comprehensive income statement

2

Table of Contents

Introduction.................................................................................................................................................4

Cash Flow statement analysis......................................................................................................................5

Comparative analysis of broad categories cash flow...............................................................................7

Other comprehensive income statement....................................................................................................8

Accounting for corporate income tax........................................................................................................12

Reasons behind differences of income tax payment.............................................................................13

Deferred tax..........................................................................................................................................13

Current Tax liability................................................................................................................................16

Income tax – payment shown in cash flow and expense booked in income statement........................17

Overall observation about tax treatment..............................................................................................18

References:................................................................................................................................................19

3

Introduction.................................................................................................................................................4

Cash Flow statement analysis......................................................................................................................5

Comparative analysis of broad categories cash flow...............................................................................7

Other comprehensive income statement....................................................................................................8

Accounting for corporate income tax........................................................................................................12

Reasons behind differences of income tax payment.............................................................................13

Deferred tax..........................................................................................................................................13

Current Tax liability................................................................................................................................16

Income tax – payment shown in cash flow and expense booked in income statement........................17

Overall observation about tax treatment..............................................................................................18

References:................................................................................................................................................19

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The subject of this report will be critical analysis of different financial statements of any

Australian company with ASX listing. For this purpose, the chosen company is Baby Bunting

Group Ltd of Victoria. The company is enlisted in ASX in 2015 with its ASX code BBN and

GICS Industry Group – retailing. (ASX, 2018) This report will emphasize on comparison of

audited financial report of the company for three years from 2015 to 2017. Main areas of

concentration will be cash flow statement, other comprehensive income statement and

accounting of corporate income tax with critical analysis of its different heads to highlight

significant changes for last three years in those domains. (Bunting, 2016) Cash flow statement

will be analyzed with the identification of the reason for such changes. Moreover, a comparative

analysis of cash flow statement with its broad category headings like operating activities,

investing activities and financing activities will be done with proper evaluation for the specified

period. Other comprehensive income statement will be analyzed in respect of its components

with their nature and the reason behind those components not being featured in income

statement. For corporate income tax, an analysis of tax expense of the company for considered

three years as per financial statement with its similarity as per corporate tax rate, discussion on

deferred tax treatment as per balance sheet, the amount of tax paid and the amount showed in

different financial statements along with other critical aspects of income tax accounting of the

4

The subject of this report will be critical analysis of different financial statements of any

Australian company with ASX listing. For this purpose, the chosen company is Baby Bunting

Group Ltd of Victoria. The company is enlisted in ASX in 2015 with its ASX code BBN and

GICS Industry Group – retailing. (ASX, 2018) This report will emphasize on comparison of

audited financial report of the company for three years from 2015 to 2017. Main areas of

concentration will be cash flow statement, other comprehensive income statement and

accounting of corporate income tax with critical analysis of its different heads to highlight

significant changes for last three years in those domains. (Bunting, 2016) Cash flow statement

will be analyzed with the identification of the reason for such changes. Moreover, a comparative

analysis of cash flow statement with its broad category headings like operating activities,

investing activities and financing activities will be done with proper evaluation for the specified

period. Other comprehensive income statement will be analyzed in respect of its components

with their nature and the reason behind those components not being featured in income

statement. For corporate income tax, an analysis of tax expense of the company for considered

three years as per financial statement with its similarity as per corporate tax rate, discussion on

deferred tax treatment as per balance sheet, the amount of tax paid and the amount showed in

different financial statements along with other critical aspects of income tax accounting of the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company. This report will end up with some obdervations to make this report complete in all

aspect.

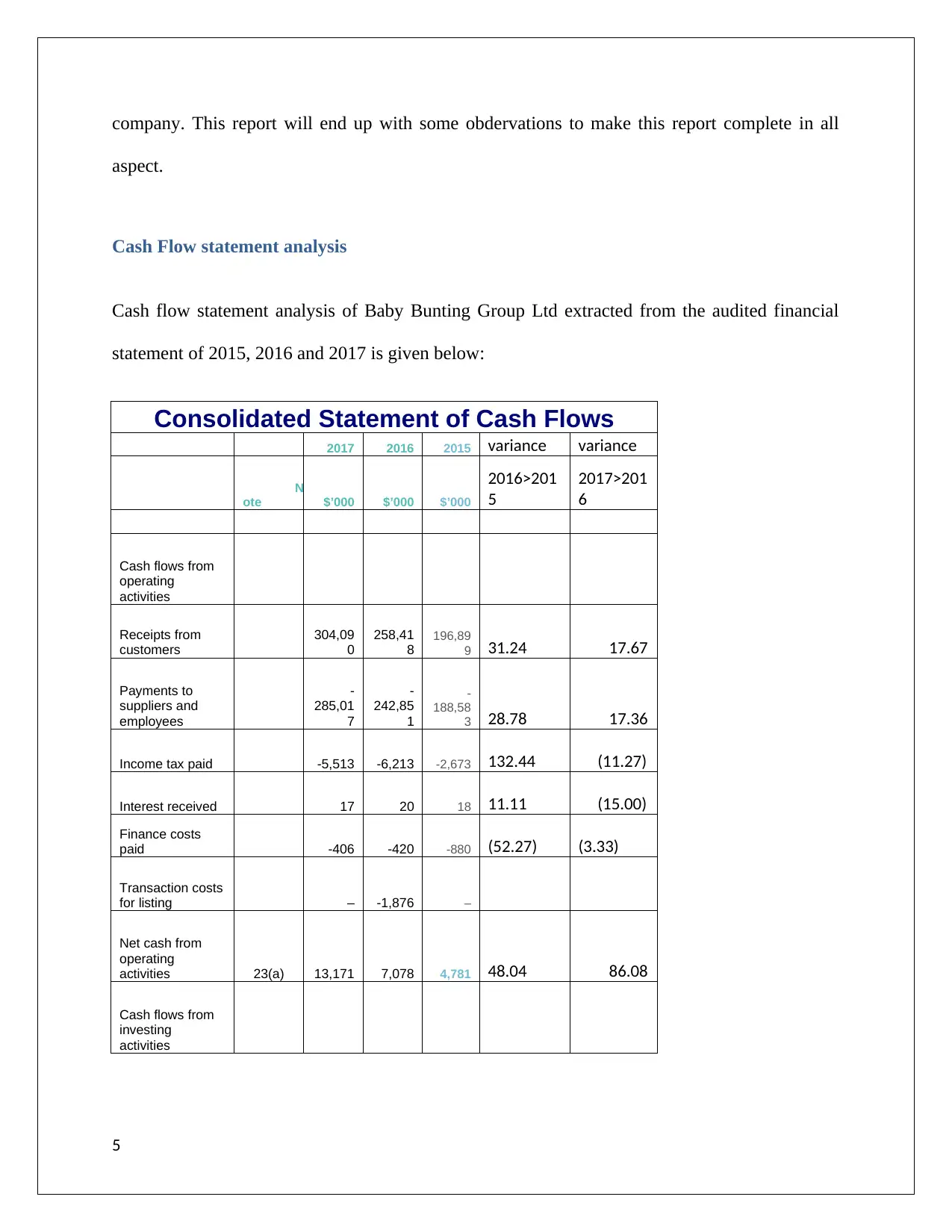

Cash Flow statement analysis

Cash flow statement analysis of Baby Bunting Group Ltd extracted from the audited financial

statement of 2015, 2016 and 2017 is given below:

Consolidated Statement of Cash Flows

2017 2016 2015 variance variance

N

ote $’000 $’000 $’000

2016>201

5

2017>201

6

Cash flows from

operating

activities

Receipts from

customers

304,09

0

258,41

8

196,89

9 31.24 17.67

Payments to

suppliers and

employees

-

285,01

7

-

242,85

1

-

188,58

3 28.78 17.36

Income tax paid -5,513 -6,213 -2,673 132.44 (11.27)

Interest received 17 20 18 11.11 (15.00)

Finance costs

paid -406 -420 -880 (52.27) (3.33)

Transaction costs

for listing – -1,876 –

Net cash from

operating

activities 23(a) 13,171 7,078 4,781 48.04 86.08

Cash flows from

investing

activities

5

aspect.

Cash Flow statement analysis

Cash flow statement analysis of Baby Bunting Group Ltd extracted from the audited financial

statement of 2015, 2016 and 2017 is given below:

Consolidated Statement of Cash Flows

2017 2016 2015 variance variance

N

ote $’000 $’000 $’000

2016>201

5

2017>201

6

Cash flows from

operating

activities

Receipts from

customers

304,09

0

258,41

8

196,89

9 31.24 17.67

Payments to

suppliers and

employees

-

285,01

7

-

242,85

1

-

188,58

3 28.78 17.36

Income tax paid -5,513 -6,213 -2,673 132.44 (11.27)

Interest received 17 20 18 11.11 (15.00)

Finance costs

paid -406 -420 -880 (52.27) (3.33)

Transaction costs

for listing – -1,876 –

Net cash from

operating

activities 23(a) 13,171 7,078 4,781 48.04 86.08

Cash flows from

investing

activities

5

Payments for

plant and

equipment and

intangibles 9,10 -7,352 -6,185 -6,047 2.28 18.87

Proceeds on sale

of plant and

equipment 1 6 25 (76.00) (83.33)

Net cash used in

investing

activities -7,351 -6,179 -6,022 2.61 18.97

Cash flows from

financing

activities

Proceeds from

issue of shares 15,19 – 28,717 1,532 1,774.48

Transaction costs

for issue of

shares – -1,754 –

Dividends paid 16

-

11,558

-

16,117 – (28.29)

Proceeds

from/(Repayment

of) borrowings 4,800 -7,950 -100 7,850.00 (160.38)

Net cash (used

in)/provided by

financing

activities -6,758 2,896 1,432 102.23 (333.36)

Net

(decrease)/increa

se in cash and

cash equivalents -938 3,795 191 1,886.91 (124.72)

Cash and cash

equivalents at

beginning of the

financial year 7,363 3,568 3,377 5.66 106.36

6

plant and

equipment and

intangibles 9,10 -7,352 -6,185 -6,047 2.28 18.87

Proceeds on sale

of plant and

equipment 1 6 25 (76.00) (83.33)

Net cash used in

investing

activities -7,351 -6,179 -6,022 2.61 18.97

Cash flows from

financing

activities

Proceeds from

issue of shares 15,19 – 28,717 1,532 1,774.48

Transaction costs

for issue of

shares – -1,754 –

Dividends paid 16

-

11,558

-

16,117 – (28.29)

Proceeds

from/(Repayment

of) borrowings 4,800 -7,950 -100 7,850.00 (160.38)

Net cash (used

in)/provided by

financing

activities -6,758 2,896 1,432 102.23 (333.36)

Net

(decrease)/increa

se in cash and

cash equivalents -938 3,795 191 1,886.91 (124.72)

Cash and cash

equivalents at

beginning of the

financial year 7,363 3,568 3,377 5.66 106.36

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash and cash

equivalents at

end of the

financial year 23(b) 6,425 7,363 3,568 106.36 (12.74)

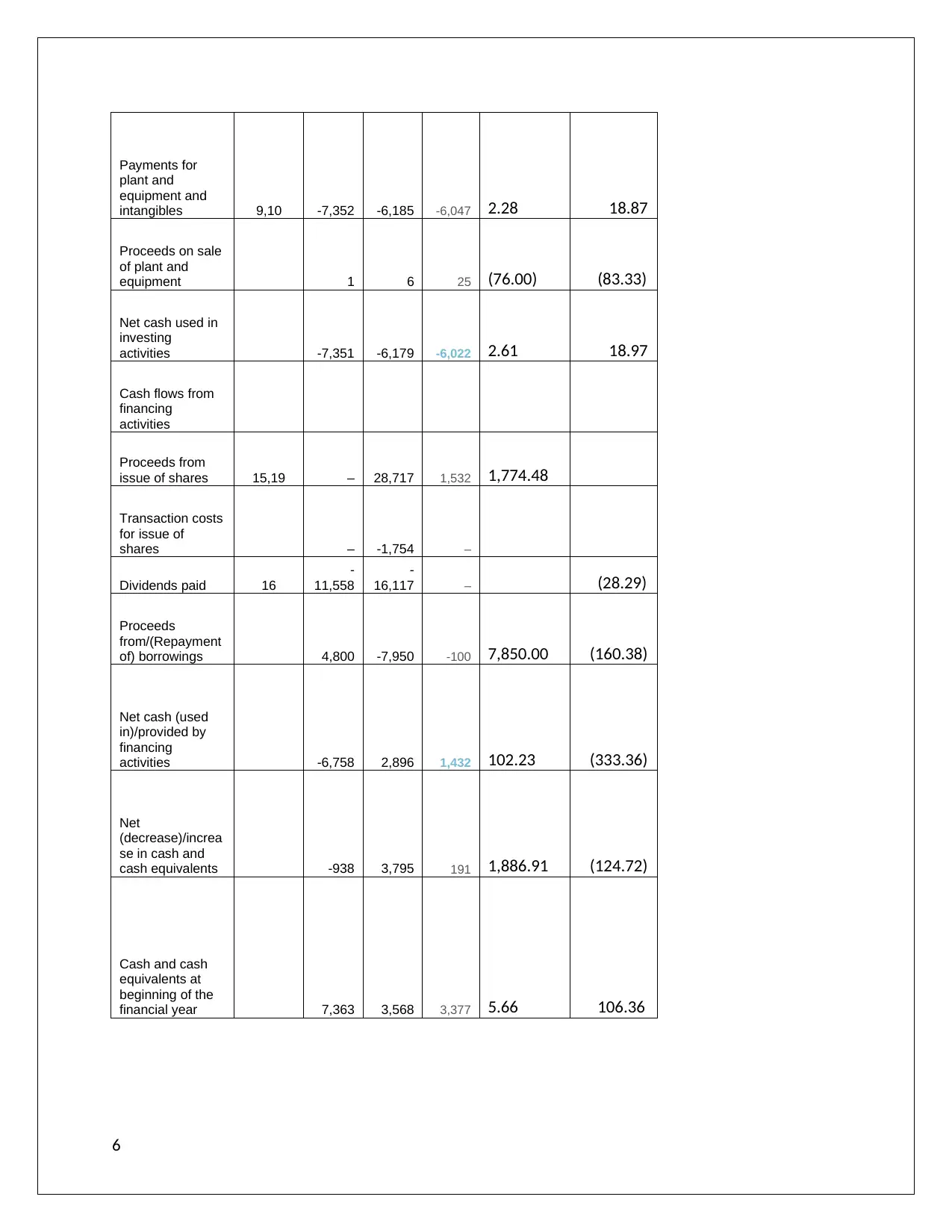

Observations:

a) Cash flow from operating activities is mainly constituted by items of operations. For this

company, operation is retailing business. Hence cash inflows from operating activities are

receipts from customers and interest received from deposits. Out of that cash, different

operating expenses are paid. The operating expenses are under the heads of payment to

supply chain associates and employees, income tax, finance cost and transaction cost for

listing. All receipts are maintaining the trend with normal growth in revenue. For

payments, also parity remains in payment to suppliers and employees and interest paid

for borrowings termed as finance cost. Transaction cost for listing is featured in 2016.

b) Cash flow from investing activities is constituted by procurement and sale of long-term

assets including intangibles.

c) Cash flows from financing activities are constituted by items like proceeds from issue of

shares, respective transaction costs, payment of dividends and proceeds from borrowings.

Out of them, proceeds from share issue and borrowings increase the cash; while payment

of dividend and transaction costs for share issue decreases the same.

d) Net impact of this financial information has constituted year-wise net cash flow of the

company. Adding this to the opening cash balance, cash and cash equivalent of the

company at the end of the year is being derived.

7

equivalents at

end of the

financial year 23(b) 6,425 7,363 3,568 106.36 (12.74)

Observations:

a) Cash flow from operating activities is mainly constituted by items of operations. For this

company, operation is retailing business. Hence cash inflows from operating activities are

receipts from customers and interest received from deposits. Out of that cash, different

operating expenses are paid. The operating expenses are under the heads of payment to

supply chain associates and employees, income tax, finance cost and transaction cost for

listing. All receipts are maintaining the trend with normal growth in revenue. For

payments, also parity remains in payment to suppliers and employees and interest paid

for borrowings termed as finance cost. Transaction cost for listing is featured in 2016.

b) Cash flow from investing activities is constituted by procurement and sale of long-term

assets including intangibles.

c) Cash flows from financing activities are constituted by items like proceeds from issue of

shares, respective transaction costs, payment of dividends and proceeds from borrowings.

Out of them, proceeds from share issue and borrowings increase the cash; while payment

of dividend and transaction costs for share issue decreases the same.

d) Net impact of this financial information has constituted year-wise net cash flow of the

company. Adding this to the opening cash balance, cash and cash equivalent of the

company at the end of the year is being derived.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

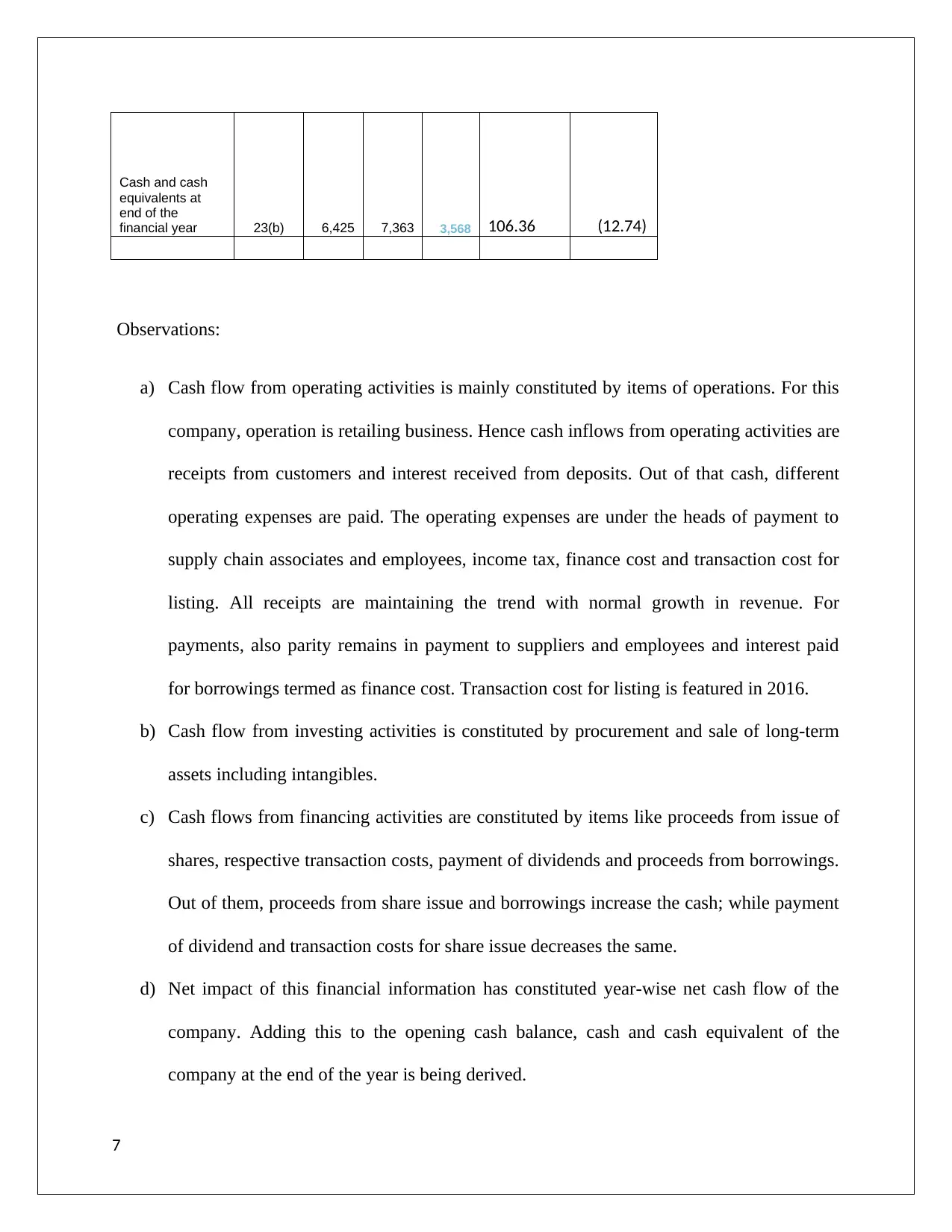

Comparative analysis of broad categories cash flow

Given below the comparative analysis of cash flow from operating, investing and finance

activities for 2015, 2016 and 2017 with variance:

2017 2016 2015 variance variance

N

ote $’000 $’000 $’000 2016>2015 2017>2016

Net cash

from

operating

activities 23(a) 13,171 7,078 4,781 48.04 86.08

Net cash

used in

investing

activities -7,351 -6,179 -6,022 2.61 18.97

Net cash

(used

in)/provided

by

financing

activities -6,758 2,896 1,432 102.23 (333.36)

Evaluation:

Cash flow from operating activities had shown steady increase with variance of 48% in

2016 in respect of 2015 (Bunting, 2015)and 86% in 2017 in respect of 2016.

Cash invested in investing activities showed increase with variance of 3% in 2016

compared to 2015 and 19% in 2017 compared to 2016.

Net cash generated from financing activities showed increase in 2016 in respect of 2015

by 102% while a decrease was observed in 2017 by 333% in 2017 compared to 2016.

Other comprehensive income statement

8

Given below the comparative analysis of cash flow from operating, investing and finance

activities for 2015, 2016 and 2017 with variance:

2017 2016 2015 variance variance

N

ote $’000 $’000 $’000 2016>2015 2017>2016

Net cash

from

operating

activities 23(a) 13,171 7,078 4,781 48.04 86.08

Net cash

used in

investing

activities -7,351 -6,179 -6,022 2.61 18.97

Net cash

(used

in)/provided

by

financing

activities -6,758 2,896 1,432 102.23 (333.36)

Evaluation:

Cash flow from operating activities had shown steady increase with variance of 48% in

2016 in respect of 2015 (Bunting, 2015)and 86% in 2017 in respect of 2016.

Cash invested in investing activities showed increase with variance of 3% in 2016

compared to 2015 and 19% in 2017 compared to 2016.

Net cash generated from financing activities showed increase in 2016 in respect of 2015

by 102% while a decrease was observed in 2017 by 333% in 2017 compared to 2016.

Other comprehensive income statement

8

The financial reporting of any company normally projects performance of a company through

profit or loss and other comprehensive income statement. As per IAS 1, Presentation of Financial

Statements profit or loss is defined as the net effect of total income less respective expenses

without items of other comprehensive income or OCI. (Coach, 2017) Other comprehensive

income is comprised of components of income and allied expenses with the consideration of

reclassification adjustments and not identified in profit or loss as per requirement and permission

of IFRS. (Tools, 2018) The definition of total comprehensive income is derived as ‘the change in

equity during a period resulting from transactions and other events, other than those changes

resulting from transactions with owners in their capacity as owners’. (accaglobal, 2016)

Other comprehensive income is constituted by those gains, revenues, losses and expenses under

GAAP (Tools, 2017) and IFRS which are not included in net income featured in the income

statement and are treated in income statement after net income. Revenues, gains, expenses and

losses feature in OCI with the condition of unrealized status. The example of such happening is

sale of any investment. Hence the investments in financial instruments with the tendency to

change its value of such instruments, the respective change in gain or losses can be treated under

the head of OCI. These instruments can be realized with respective gains or losses when the

same would be sold. Accounting treatment of post-sales of such instruments should come from

OCI then to make it part of net income in income statement. (accountingtools, 2017)

Items normally treated as components of other comprehensive income are:

o Gains or losses due to foreign exchange translation

o Gains or losses from unrealized holding on investments classified as ready for sale

o Gains or losses related to pension plan

9

profit or loss and other comprehensive income statement. As per IAS 1, Presentation of Financial

Statements profit or loss is defined as the net effect of total income less respective expenses

without items of other comprehensive income or OCI. (Coach, 2017) Other comprehensive

income is comprised of components of income and allied expenses with the consideration of

reclassification adjustments and not identified in profit or loss as per requirement and permission

of IFRS. (Tools, 2018) The definition of total comprehensive income is derived as ‘the change in

equity during a period resulting from transactions and other events, other than those changes

resulting from transactions with owners in their capacity as owners’. (accaglobal, 2016)

Other comprehensive income is constituted by those gains, revenues, losses and expenses under

GAAP (Tools, 2017) and IFRS which are not included in net income featured in the income

statement and are treated in income statement after net income. Revenues, gains, expenses and

losses feature in OCI with the condition of unrealized status. The example of such happening is

sale of any investment. Hence the investments in financial instruments with the tendency to

change its value of such instruments, the respective change in gain or losses can be treated under

the head of OCI. These instruments can be realized with respective gains or losses when the

same would be sold. Accounting treatment of post-sales of such instruments should come from

OCI then to make it part of net income in income statement. (accountingtools, 2017)

Items normally treated as components of other comprehensive income are:

o Gains or losses due to foreign exchange translation

o Gains or losses from unrealized holding on investments classified as ready for sale

o Gains or losses related to pension plan

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

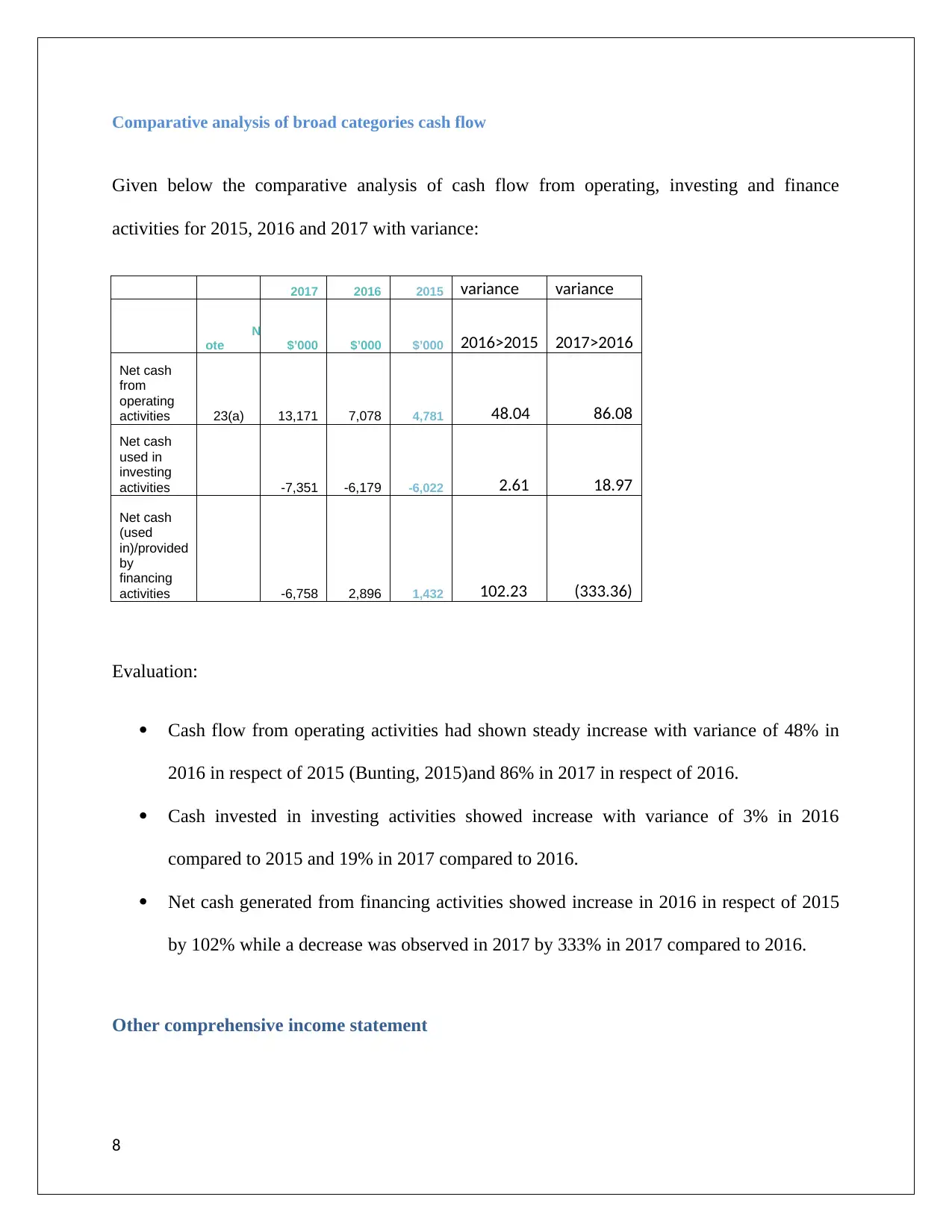

o Prior service costs or credits for pension

Normally OCI gives the concept of more comprehensive understanding of the financial status

of the business entity although it makes the reader more confused with its complexity to the

income statement.

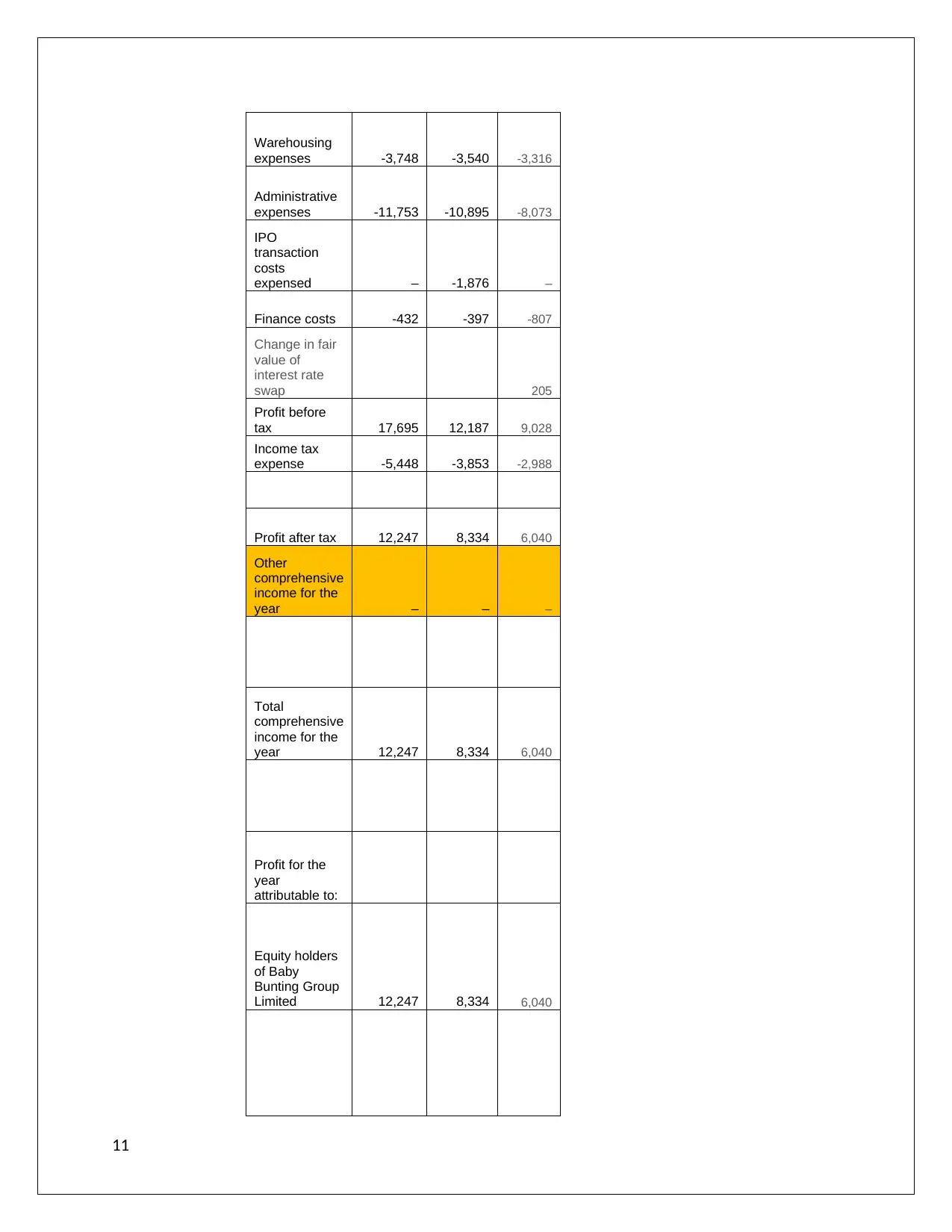

In the case of Baby Bunting Group Ltd financial reports for the financial years 2015 to 2017,

nothing has been featured as other comprehensive income and hence there is no scope of

discussion related to this subject in this article. Given below the statement of profit or loss

and other comprehensive income statement of the company for the specified period to justify

the claim of non-existence of OCI in Baby Bunting financial report for the period:

Consolidated Statement

of Profit or Loss and

Other Comprehensive

Income

2017 2016 2015

$’000 $’000 $’000

Revenue 278,027 236,840 180,175

Cost of sales -182,735 -155,678

-

118,314

Gross profit 95,292 81,162 61,861

Other revenue 17 21 45

Store

expenses -56,762 -48,305 -37,833

Marketing

expenses -4,919 -3,983 -3,054

10

Normally OCI gives the concept of more comprehensive understanding of the financial status

of the business entity although it makes the reader more confused with its complexity to the

income statement.

In the case of Baby Bunting Group Ltd financial reports for the financial years 2015 to 2017,

nothing has been featured as other comprehensive income and hence there is no scope of

discussion related to this subject in this article. Given below the statement of profit or loss

and other comprehensive income statement of the company for the specified period to justify

the claim of non-existence of OCI in Baby Bunting financial report for the period:

Consolidated Statement

of Profit or Loss and

Other Comprehensive

Income

2017 2016 2015

$’000 $’000 $’000

Revenue 278,027 236,840 180,175

Cost of sales -182,735 -155,678

-

118,314

Gross profit 95,292 81,162 61,861

Other revenue 17 21 45

Store

expenses -56,762 -48,305 -37,833

Marketing

expenses -4,919 -3,983 -3,054

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

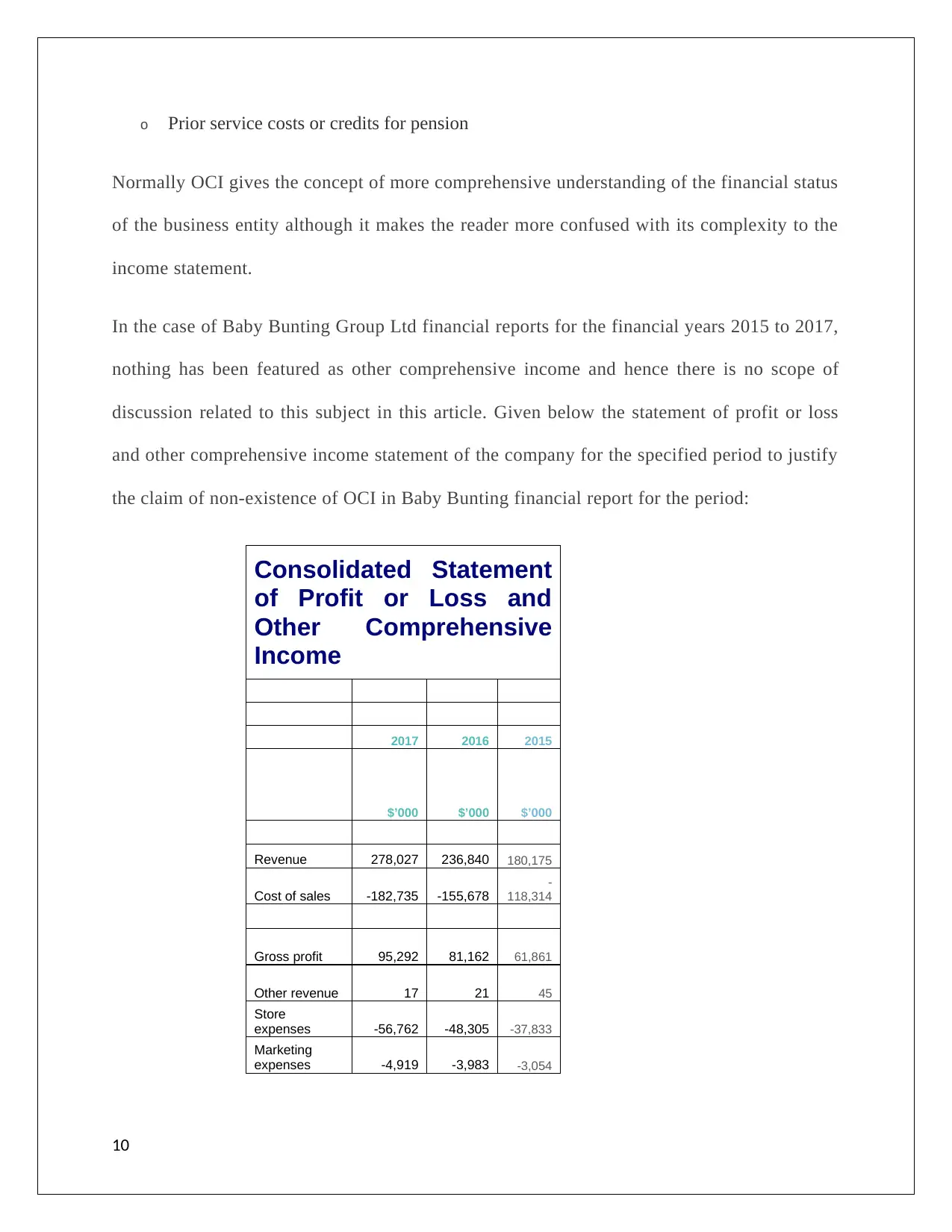

Warehousing

expenses -3,748 -3,540 -3,316

Administrative

expenses -11,753 -10,895 -8,073

IPO

transaction

costs

expensed – -1,876 –

Finance costs -432 -397 -807

Change in fair

value of

interest rate

swap 205

Profit before

tax 17,695 12,187 9,028

Income tax

expense -5,448 -3,853 -2,988

Profit after tax 12,247 8,334 6,040

Other

comprehensive

income for the

year – – –

Total

comprehensive

income for the

year 12,247 8,334 6,040

Profit for the

year

attributable to:

Equity holders

of Baby

Bunting Group

Limited 12,247 8,334 6,040

11

expenses -3,748 -3,540 -3,316

Administrative

expenses -11,753 -10,895 -8,073

IPO

transaction

costs

expensed – -1,876 –

Finance costs -432 -397 -807

Change in fair

value of

interest rate

swap 205

Profit before

tax 17,695 12,187 9,028

Income tax

expense -5,448 -3,853 -2,988

Profit after tax 12,247 8,334 6,040

Other

comprehensive

income for the

year – – –

Total

comprehensive

income for the

year 12,247 8,334 6,040

Profit for the

year

attributable to:

Equity holders

of Baby

Bunting Group

Limited 12,247 8,334 6,040

11

Earnings per

share

From

continuing

operations

Basic (cents

per share) 9.7 7 6.2

Diluted

(cents per

share) 9.6 7 6.2

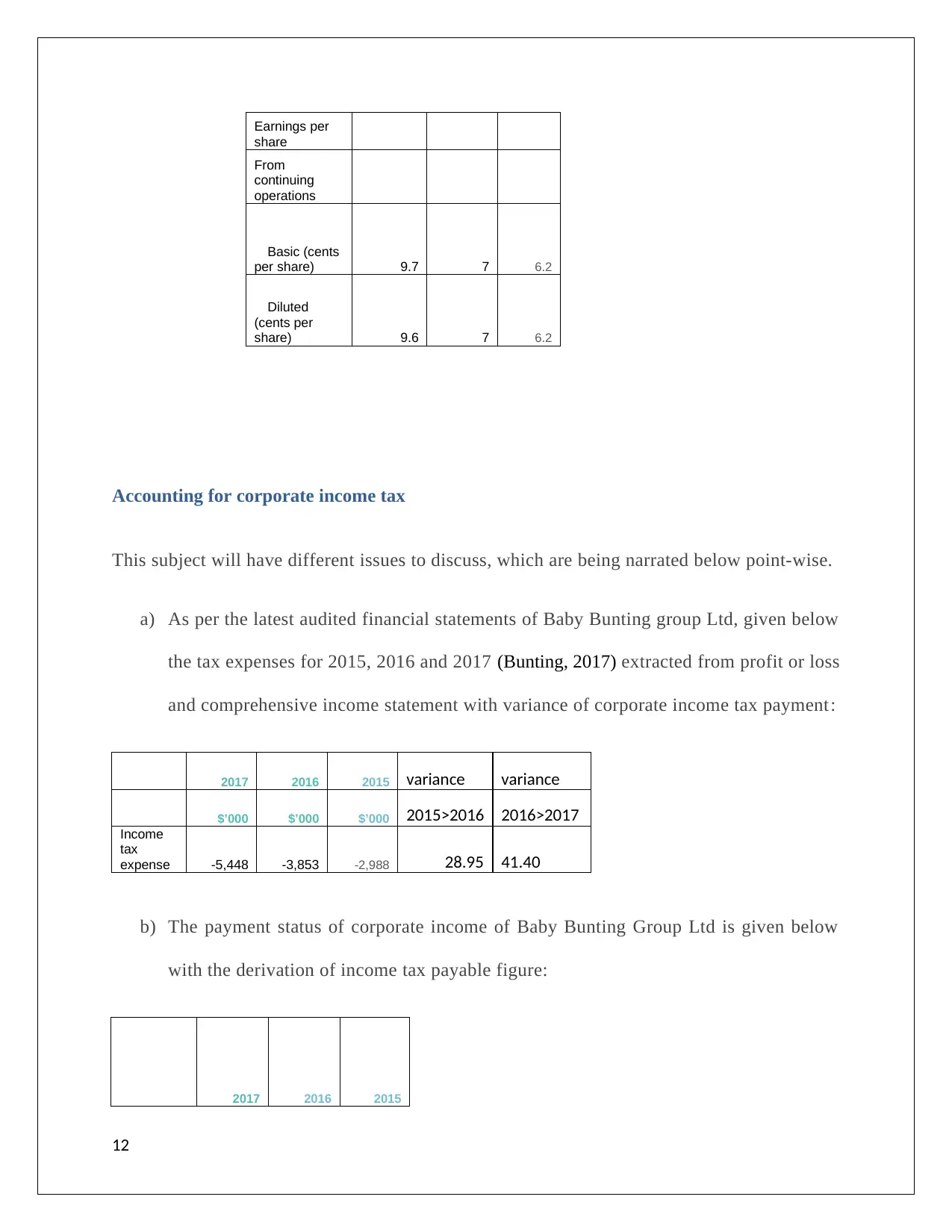

Accounting for corporate income tax

This subject will have different issues to discuss, which are being narrated below point-wise.

a) As per the latest audited financial statements of Baby Bunting group Ltd, given below

the tax expenses for 2015, 2016 and 2017 (Bunting, 2017) extracted from profit or loss

and comprehensive income statement with variance of corporate income tax payment:

2017 2016 2015 variance variance

$’000 $’000 $’000 2015>2016 2016>2017

Income

tax

expense -5,448 -3,853 -2,988 28.95 41.40

b) The payment status of corporate income of Baby Bunting Group Ltd is given below

with the derivation of income tax payable figure:

2017 2016 2015

12

share

From

continuing

operations

Basic (cents

per share) 9.7 7 6.2

Diluted

(cents per

share) 9.6 7 6.2

Accounting for corporate income tax

This subject will have different issues to discuss, which are being narrated below point-wise.

a) As per the latest audited financial statements of Baby Bunting group Ltd, given below

the tax expenses for 2015, 2016 and 2017 (Bunting, 2017) extracted from profit or loss

and comprehensive income statement with variance of corporate income tax payment:

2017 2016 2015 variance variance

$’000 $’000 $’000 2015>2016 2016>2017

Income

tax

expense -5,448 -3,853 -2,988 28.95 41.40

b) The payment status of corporate income of Baby Bunting Group Ltd is given below

with the derivation of income tax payable figure:

2017 2016 2015

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.