Financial Statement Analysis for Campbell Soup Company

VerifiedAdded on 2023/06/15

|17

|5725

|245

AI Summary

This report explains about the equity valuation and the financial statement analysis of Campbell Soup Company. The report evaluates the equity valuation of the company using two techniques, DCF and Earnings growth analysis. It also evaluates the credit risk of the company using financial statement ratios. The report concludes with a recommendation for investors and the management of the company.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Financial statement analysis

1

Project Report; financial Statement analysis

1

Project Report; financial Statement analysis

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial statement analysis

2

Contents

Introduction...........................................................................................................................................3

Company overview................................................................................................................................3

Part 1: Using financial statement for equity valuation...........................................................................3

Earnings growth analysis...................................................................................................................3

Discounted cash flow.........................................................................................................................5

Recommendation...............................................................................................................................7

Conclusion.........................................................................................................................................7

Part 2: Using financial statement for credit risk analysis.......................................................................7

Financial statement ratios:................................................................................................................7

Credit quality of the firm...................................................................................................................9

Recommendation and Conclusion...................................................................................................10

References...........................................................................................................................................11

Appendix.............................................................................................................................................13

2

Contents

Introduction...........................................................................................................................................3

Company overview................................................................................................................................3

Part 1: Using financial statement for equity valuation...........................................................................3

Earnings growth analysis...................................................................................................................3

Discounted cash flow.........................................................................................................................5

Recommendation...............................................................................................................................7

Conclusion.........................................................................................................................................7

Part 2: Using financial statement for credit risk analysis.......................................................................7

Financial statement ratios:................................................................................................................7

Credit quality of the firm...................................................................................................................9

Recommendation and Conclusion...................................................................................................10

References...........................................................................................................................................11

Appendix.............................................................................................................................................13

Financial statement analysis

3

Introduction:

Identifying the total worth of an organization contain the more reviewing revenues

and assets figures. In finance, valuation is a procedure which is conducted by the companies

and the related parties of the company such as the investors, creditors, bank, stockholders,

shareholders, debtors etc of the company to evaluate the fair market value of an asset. Equity

valuation therefore explains about the process of identifying the fair value of equity securities

(Chandra, 2011). Equity valuation makes it easy for an organization and the other parties to

identify the worth of the comapny and the market position of the company. It offers a good

base to the stakeholders of the company to make better decision about the performance of the

company.

Financial statement analysis is a process which is done by the companies and the

related parties of the company such as the investors, creditors, bank, stockholders,

shareholders, debtors etc of the company to reach over different conclusion. The main motto

of financial statement analysis is to identify the worth of the company, total profit of the

comapny and turnover of the company, changes into the final structure of the company from

last year, financial position of the company, cash flow position of the comapny etc. the

financial stataement analysis could be done by the analyst and the managers through

numerous ways such as trend analysis, capital asset pricing model, vertical analysis, ratio

analysis etc (Madhura, 2011).

This report explains about the equity valuation and the financial statement analysis of

Campbell Soup Company. For identifying the equity valuation and the financial statement

evaluation of the company, final statement of the company of 2014 to 2016 has been

evaluated. The study explains about the performance of the company on various bases.

Company overview:

Campbell Soup Company is a food company which is situated in American market.

The company is a global food company which has registered in NYSE. The headquarter of

the company is in Camden, N.J. the organization prepares and produces the high quality

meals, sups, snack, beverages, packaged fresh food etc. It is inspired and driven by the main

goal of the company which is “Real food that matters for the life movement.” The customers

and the clients of the company are loyal to the company due to flavourful, authentic and

readily available food of the company (Home, 2018). The financial position and performance

of the company has been identified and it has been evaluated that the performance of the

company has been better from last few years. The company is performing well in the market

and it has diversified its market.

Part 1: Using financial statement for equity valuation:

Equity valuation explains about the process of identifying the fair value of equity

securities. Equity valuation makes it easy for an organization and the other parties to identify

the worth of the comapny and the market position of the company. It offers a good base to the

stakeholders of the company to make better decision about the performance of the company.

There are various ways on the basis of that equity valuation could be done. In the report, two

equity valuation techniques have been used to identify the worth of the company which are

DCF and Earnings growth analysis.

Earnings growth analysis:

3

Introduction:

Identifying the total worth of an organization contain the more reviewing revenues

and assets figures. In finance, valuation is a procedure which is conducted by the companies

and the related parties of the company such as the investors, creditors, bank, stockholders,

shareholders, debtors etc of the company to evaluate the fair market value of an asset. Equity

valuation therefore explains about the process of identifying the fair value of equity securities

(Chandra, 2011). Equity valuation makes it easy for an organization and the other parties to

identify the worth of the comapny and the market position of the company. It offers a good

base to the stakeholders of the company to make better decision about the performance of the

company.

Financial statement analysis is a process which is done by the companies and the

related parties of the company such as the investors, creditors, bank, stockholders,

shareholders, debtors etc of the company to reach over different conclusion. The main motto

of financial statement analysis is to identify the worth of the company, total profit of the

comapny and turnover of the company, changes into the final structure of the company from

last year, financial position of the company, cash flow position of the comapny etc. the

financial stataement analysis could be done by the analyst and the managers through

numerous ways such as trend analysis, capital asset pricing model, vertical analysis, ratio

analysis etc (Madhura, 2011).

This report explains about the equity valuation and the financial statement analysis of

Campbell Soup Company. For identifying the equity valuation and the financial statement

evaluation of the company, final statement of the company of 2014 to 2016 has been

evaluated. The study explains about the performance of the company on various bases.

Company overview:

Campbell Soup Company is a food company which is situated in American market.

The company is a global food company which has registered in NYSE. The headquarter of

the company is in Camden, N.J. the organization prepares and produces the high quality

meals, sups, snack, beverages, packaged fresh food etc. It is inspired and driven by the main

goal of the company which is “Real food that matters for the life movement.” The customers

and the clients of the company are loyal to the company due to flavourful, authentic and

readily available food of the company (Home, 2018). The financial position and performance

of the company has been identified and it has been evaluated that the performance of the

company has been better from last few years. The company is performing well in the market

and it has diversified its market.

Part 1: Using financial statement for equity valuation:

Equity valuation explains about the process of identifying the fair value of equity

securities. Equity valuation makes it easy for an organization and the other parties to identify

the worth of the comapny and the market position of the company. It offers a good base to the

stakeholders of the company to make better decision about the performance of the company.

There are various ways on the basis of that equity valuation could be done. In the report, two

equity valuation techniques have been used to identify the worth of the company which are

DCF and Earnings growth analysis.

Earnings growth analysis:

Financial statement analysis

4

Earnings growth analysis is a way to identify the total worth of equity of a company.

Equity valuation explains about the process of identifying the fair value of equity securities.

Equity valuation is a way for an organization and the other parties to identify the worth of the

comapny and the market position of the company. It offers a good base to the stakeholders of

the company to make better decision about the performance of the company. In earnings

growth analysis, historical earnings of an organization is collected and evaluated by the

company to identify the future worth of the equity of the company (Chandra, 2011).

Earnings growth analysis model is one of the most used methods to identify and

measure the equity valuation of a company. The various financial analysts expressed about

the method and said that it is one of the reliable methods to measure the performance of the

company. Earnings growth analysis method relies on the price of the stock, earnings per

share, dividend per share, P/E ratio etc. of a company which are considered to be a reliable

value and it also eliminates the subjective accounting policies. Though, Earnings growth

analysis is significantly influenced by non economical factors as well as the market

conditions (Décamps et al, 2011). It is particularly used by the analyst when there is less

confidence on the cash flow system of the company. Though, it involves one of the sensitive

assumptions and it involves predicting the future performance of the company.

In this process, earnings per share of the organization, dividend per share, roe, Price

earnings ratio, price of the company in last few years are collected and they are evaluated to

identify the trend in the market and the company. This process makes it easier for the analyst

and the company to evaluate and identify the reasons due to which the changes have taken

place into the performance of the company in last few years (Brigham and Daves, 2012).

Earnings growth model evaluates the total growth % in the company and on the basis of it; it

evaluates the equity price per share and the total worth of the company.

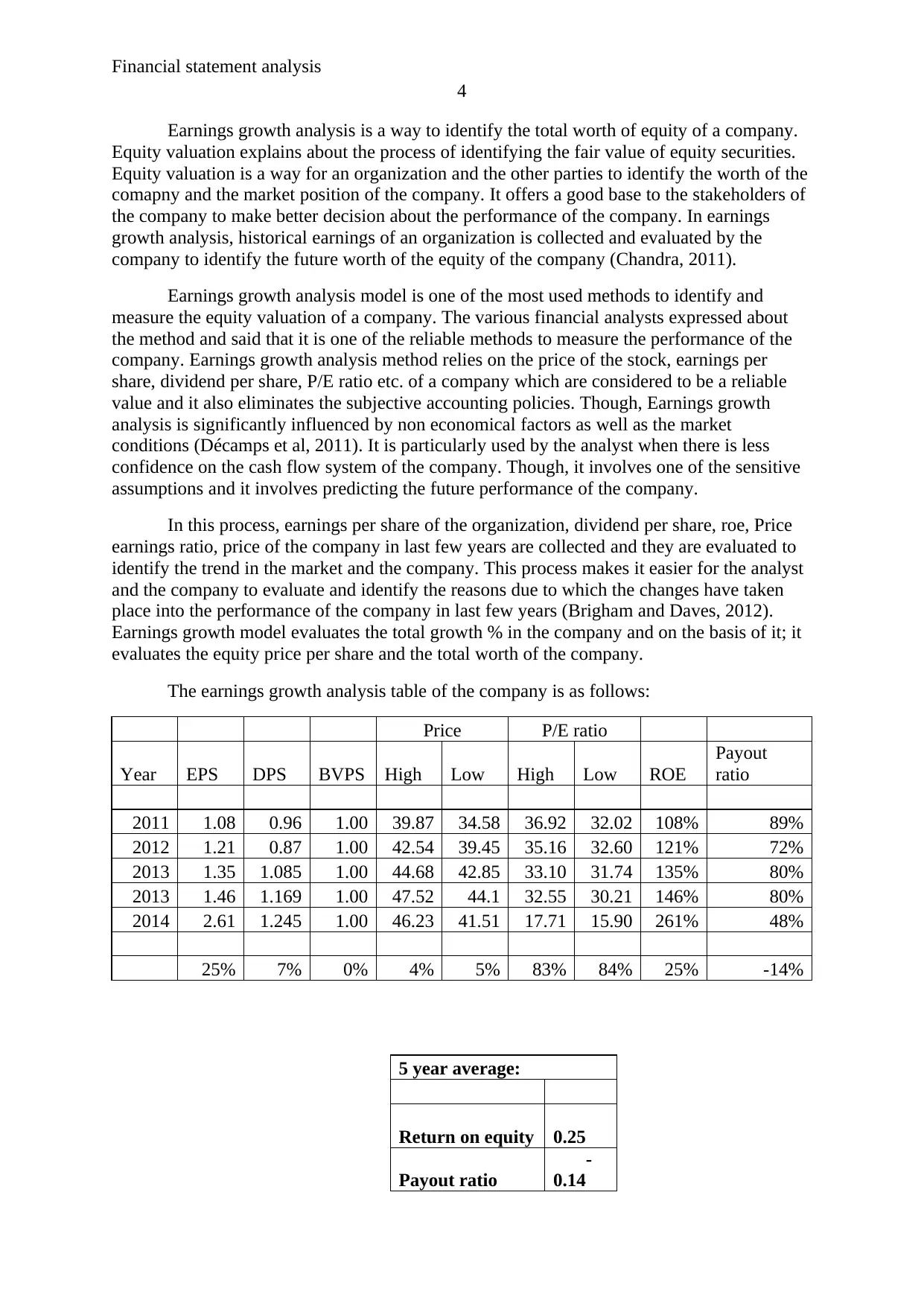

The earnings growth analysis table of the company is as follows:

Price P/E ratio

Year EPS DPS BVPS High Low High Low ROE

Payout

ratio

2011 1.08 0.96 1.00 39.87 34.58 36.92 32.02 108% 89%

2012 1.21 0.87 1.00 42.54 39.45 35.16 32.60 121% 72%

2013 1.35 1.085 1.00 44.68 42.85 33.10 31.74 135% 80%

2013 1.46 1.169 1.00 47.52 44.1 32.55 30.21 146% 80%

2014 2.61 1.245 1.00 46.23 41.51 17.71 15.90 261% 48%

25% 7% 0% 4% 5% 83% 84% 25% -14%

5 year average:

Return on equity 0.25

Payout ratio

-

0.14

4

Earnings growth analysis is a way to identify the total worth of equity of a company.

Equity valuation explains about the process of identifying the fair value of equity securities.

Equity valuation is a way for an organization and the other parties to identify the worth of the

comapny and the market position of the company. It offers a good base to the stakeholders of

the company to make better decision about the performance of the company. In earnings

growth analysis, historical earnings of an organization is collected and evaluated by the

company to identify the future worth of the equity of the company (Chandra, 2011).

Earnings growth analysis model is one of the most used methods to identify and

measure the equity valuation of a company. The various financial analysts expressed about

the method and said that it is one of the reliable methods to measure the performance of the

company. Earnings growth analysis method relies on the price of the stock, earnings per

share, dividend per share, P/E ratio etc. of a company which are considered to be a reliable

value and it also eliminates the subjective accounting policies. Though, Earnings growth

analysis is significantly influenced by non economical factors as well as the market

conditions (Décamps et al, 2011). It is particularly used by the analyst when there is less

confidence on the cash flow system of the company. Though, it involves one of the sensitive

assumptions and it involves predicting the future performance of the company.

In this process, earnings per share of the organization, dividend per share, roe, Price

earnings ratio, price of the company in last few years are collected and they are evaluated to

identify the trend in the market and the company. This process makes it easier for the analyst

and the company to evaluate and identify the reasons due to which the changes have taken

place into the performance of the company in last few years (Brigham and Daves, 2012).

Earnings growth model evaluates the total growth % in the company and on the basis of it; it

evaluates the equity price per share and the total worth of the company.

The earnings growth analysis table of the company is as follows:

Price P/E ratio

Year EPS DPS BVPS High Low High Low ROE

Payout

ratio

2011 1.08 0.96 1.00 39.87 34.58 36.92 32.02 108% 89%

2012 1.21 0.87 1.00 42.54 39.45 35.16 32.60 121% 72%

2013 1.35 1.085 1.00 44.68 42.85 33.10 31.74 135% 80%

2013 1.46 1.169 1.00 47.52 44.1 32.55 30.21 146% 80%

2014 2.61 1.245 1.00 46.23 41.51 17.71 15.90 261% 48%

25% 7% 0% 4% 5% 83% 84% 25% -14%

5 year average:

Return on equity 0.25

Payout ratio

-

0.14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial statement analysis

5

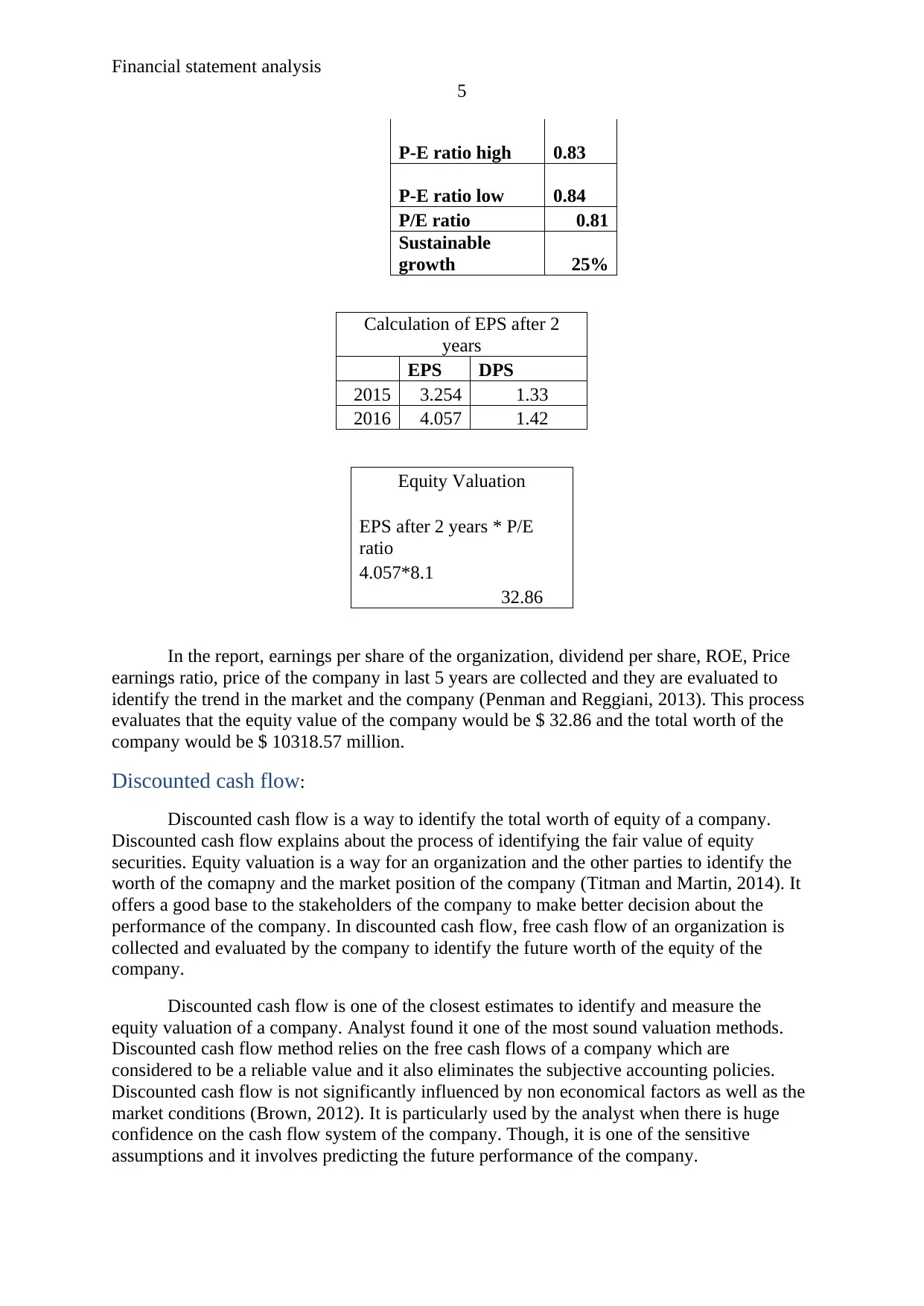

P-E ratio high 0.83

P-E ratio low 0.84

P/E ratio 0.81

Sustainable

growth 25%

Calculation of EPS after 2

years

EPS DPS

2015 3.254 1.33

2016 4.057 1.42

Equity Valuation

EPS after 2 years * P/E

ratio

4.057*8.1

32.86

In the report, earnings per share of the organization, dividend per share, ROE, Price

earnings ratio, price of the company in last 5 years are collected and they are evaluated to

identify the trend in the market and the company (Penman and Reggiani, 2013). This process

evaluates that the equity value of the company would be $ 32.86 and the total worth of the

company would be $ 10318.57 million.

Discounted cash flow:

Discounted cash flow is a way to identify the total worth of equity of a company.

Discounted cash flow explains about the process of identifying the fair value of equity

securities. Equity valuation is a way for an organization and the other parties to identify the

worth of the comapny and the market position of the company (Titman and Martin, 2014). It

offers a good base to the stakeholders of the company to make better decision about the

performance of the company. In discounted cash flow, free cash flow of an organization is

collected and evaluated by the company to identify the future worth of the equity of the

company.

Discounted cash flow is one of the closest estimates to identify and measure the

equity valuation of a company. Analyst found it one of the most sound valuation methods.

Discounted cash flow method relies on the free cash flows of a company which are

considered to be a reliable value and it also eliminates the subjective accounting policies.

Discounted cash flow is not significantly influenced by non economical factors as well as the

market conditions (Brown, 2012). It is particularly used by the analyst when there is huge

confidence on the cash flow system of the company. Though, it is one of the sensitive

assumptions and it involves predicting the future performance of the company.

5

P-E ratio high 0.83

P-E ratio low 0.84

P/E ratio 0.81

Sustainable

growth 25%

Calculation of EPS after 2

years

EPS DPS

2015 3.254 1.33

2016 4.057 1.42

Equity Valuation

EPS after 2 years * P/E

ratio

4.057*8.1

32.86

In the report, earnings per share of the organization, dividend per share, ROE, Price

earnings ratio, price of the company in last 5 years are collected and they are evaluated to

identify the trend in the market and the company (Penman and Reggiani, 2013). This process

evaluates that the equity value of the company would be $ 32.86 and the total worth of the

company would be $ 10318.57 million.

Discounted cash flow:

Discounted cash flow is a way to identify the total worth of equity of a company.

Discounted cash flow explains about the process of identifying the fair value of equity

securities. Equity valuation is a way for an organization and the other parties to identify the

worth of the comapny and the market position of the company (Titman and Martin, 2014). It

offers a good base to the stakeholders of the company to make better decision about the

performance of the company. In discounted cash flow, free cash flow of an organization is

collected and evaluated by the company to identify the future worth of the equity of the

company.

Discounted cash flow is one of the closest estimates to identify and measure the

equity valuation of a company. Analyst found it one of the most sound valuation methods.

Discounted cash flow method relies on the free cash flows of a company which are

considered to be a reliable value and it also eliminates the subjective accounting policies.

Discounted cash flow is not significantly influenced by non economical factors as well as the

market conditions (Brown, 2012). It is particularly used by the analyst when there is huge

confidence on the cash flow system of the company. Though, it is one of the sensitive

assumptions and it involves predicting the future performance of the company.

Financial statement analysis

6

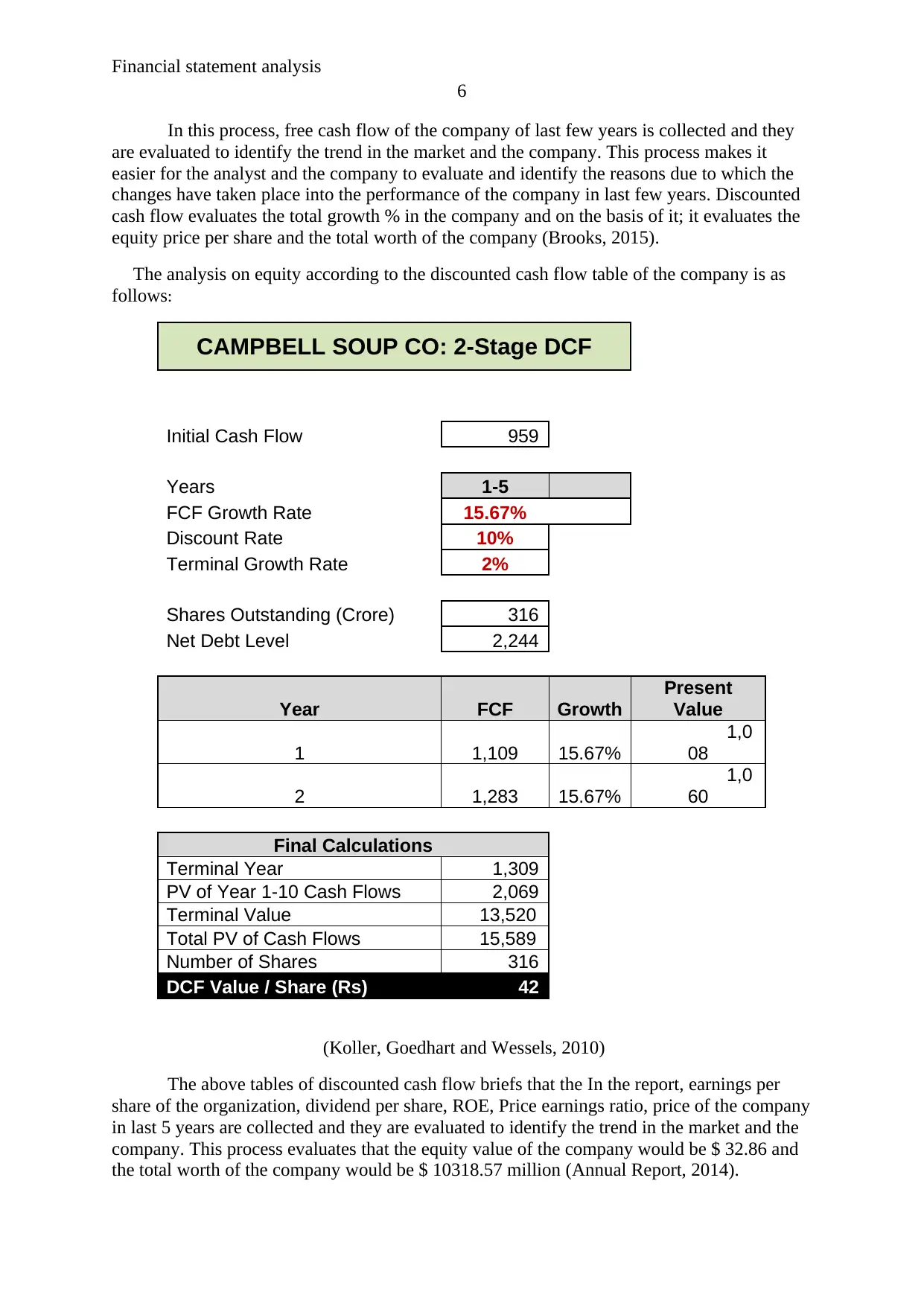

In this process, free cash flow of the company of last few years is collected and they

are evaluated to identify the trend in the market and the company. This process makes it

easier for the analyst and the company to evaluate and identify the reasons due to which the

changes have taken place into the performance of the company in last few years. Discounted

cash flow evaluates the total growth % in the company and on the basis of it; it evaluates the

equity price per share and the total worth of the company (Brooks, 2015).

The analysis on equity according to the discounted cash flow table of the company is as

follows:

CAMPBELL SOUP CO: 2-Stage DCF

Initial Cash Flow 959

Years 1-5

FCF Growth Rate 15.67%

Discount Rate 10%

Terminal Growth Rate 2%

Shares Outstanding (Crore) 316

Net Debt Level 2,244

Year FCF Growth

Present

Value

1 1,109 15.67%

1,0

08

2 1,283 15.67%

1,0

60

Final Calculations

Terminal Year 1,309

PV of Year 1-10 Cash Flows 2,069

Terminal Value 13,520

Total PV of Cash Flows 15,589

Number of Shares 316

DCF Value / Share (Rs) 42

(Koller, Goedhart and Wessels, 2010)

The above tables of discounted cash flow briefs that the In the report, earnings per

share of the organization, dividend per share, ROE, Price earnings ratio, price of the company

in last 5 years are collected and they are evaluated to identify the trend in the market and the

company. This process evaluates that the equity value of the company would be $ 32.86 and

the total worth of the company would be $ 10318.57 million (Annual Report, 2014).

6

In this process, free cash flow of the company of last few years is collected and they

are evaluated to identify the trend in the market and the company. This process makes it

easier for the analyst and the company to evaluate and identify the reasons due to which the

changes have taken place into the performance of the company in last few years. Discounted

cash flow evaluates the total growth % in the company and on the basis of it; it evaluates the

equity price per share and the total worth of the company (Brooks, 2015).

The analysis on equity according to the discounted cash flow table of the company is as

follows:

CAMPBELL SOUP CO: 2-Stage DCF

Initial Cash Flow 959

Years 1-5

FCF Growth Rate 15.67%

Discount Rate 10%

Terminal Growth Rate 2%

Shares Outstanding (Crore) 316

Net Debt Level 2,244

Year FCF Growth

Present

Value

1 1,109 15.67%

1,0

08

2 1,283 15.67%

1,0

60

Final Calculations

Terminal Year 1,309

PV of Year 1-10 Cash Flows 2,069

Terminal Value 13,520

Total PV of Cash Flows 15,589

Number of Shares 316

DCF Value / Share (Rs) 42

(Koller, Goedhart and Wessels, 2010)

The above tables of discounted cash flow briefs that the In the report, earnings per

share of the organization, dividend per share, ROE, Price earnings ratio, price of the company

in last 5 years are collected and they are evaluated to identify the trend in the market and the

company. This process evaluates that the equity value of the company would be $ 32.86 and

the total worth of the company would be $ 10318.57 million (Annual Report, 2014).

Financial statement analysis

7

Recommendation:

To recommend, the stock price of the company is quite higher than the intrinsic

values of the company. The current stock price of the company is USD 46.23 whereas the

intrinsic value of the company after 2 years would be $ 32.86 according to earnings growth

analysis and $ 42 according to the dividend discount model of the company. It explains that

the investment position of the company is not at all good. The stock price of the company

would be lower in near future and thus it is recommended to the investors to not to invest into

the stock price of the company. Further, it explains about the deductions in the performance if

the company in next few years.

Conclusion:

To conclude, investors should not invest into the stock price of the company. Further,

the management of the company is also required to look into the performance of the company

and make few changes into the performance of the company accordingly.

Part 2: Using financial statement for credit risk analysis:

Financial statement analysis explains about the process of identifying the fair value of

the company. The analysis makes it easy for an organization and the other parties to identify

the worth of the comapny and the risk position of the company. It offers a good base to the

stakeholders of the company to make better decision about the performance of the company.

There are various ways on the basis of that financial statement of the company could be

evaluated and risk of the stock could be measured. In the report, ratio analysis study has been

done to evaluate the credit risk of the company.

Financial statement ratios:

Financial statement ratios have been evaluated to identify the performance of the

company. The ratio analysis of the company is as follows:

Profitability ratio:

Profitability ratios explain about a position where the profit generation capability of a

firm could be identified. It briefs that whether the profitability position of the company is

good or not. The profitability position of Campbell Soup Company has been evaluated and it

has been found that the net profitability level of the company is 7.007% in 2016 which has

been lower from 2015 and 2014’s profit capability (Ahrendsen and Katchova, 2012). The net

profit ratio has been chosen for identifying the profitability ratio as it is one of the most used

ratio and the ratio is based on the reliable information as well as it also takes the concern of

entire profit level of the company.

It explains that the total profit of the company against the sales revenue of the

company has been lower from last year due to high COGS and the operating expenses of the

company. It briefs that the current position of the company is not at all good. It explains

about the reduction in the profitability level of the company as well as the performance of the

company. It is required for the company to manage the high revenue with less cost of goods

sold and operating expenses (Higgins, 2012). The past year data briefs that the operating

expenses and non operating expenses of the company was lower from current year.

Additionally, it briefs that the return on assets, net profit, gross profit, cash flow to sales ratio

7

Recommendation:

To recommend, the stock price of the company is quite higher than the intrinsic

values of the company. The current stock price of the company is USD 46.23 whereas the

intrinsic value of the company after 2 years would be $ 32.86 according to earnings growth

analysis and $ 42 according to the dividend discount model of the company. It explains that

the investment position of the company is not at all good. The stock price of the company

would be lower in near future and thus it is recommended to the investors to not to invest into

the stock price of the company. Further, it explains about the deductions in the performance if

the company in next few years.

Conclusion:

To conclude, investors should not invest into the stock price of the company. Further,

the management of the company is also required to look into the performance of the company

and make few changes into the performance of the company accordingly.

Part 2: Using financial statement for credit risk analysis:

Financial statement analysis explains about the process of identifying the fair value of

the company. The analysis makes it easy for an organization and the other parties to identify

the worth of the comapny and the risk position of the company. It offers a good base to the

stakeholders of the company to make better decision about the performance of the company.

There are various ways on the basis of that financial statement of the company could be

evaluated and risk of the stock could be measured. In the report, ratio analysis study has been

done to evaluate the credit risk of the company.

Financial statement ratios:

Financial statement ratios have been evaluated to identify the performance of the

company. The ratio analysis of the company is as follows:

Profitability ratio:

Profitability ratios explain about a position where the profit generation capability of a

firm could be identified. It briefs that whether the profitability position of the company is

good or not. The profitability position of Campbell Soup Company has been evaluated and it

has been found that the net profitability level of the company is 7.007% in 2016 which has

been lower from 2015 and 2014’s profit capability (Ahrendsen and Katchova, 2012). The net

profit ratio has been chosen for identifying the profitability ratio as it is one of the most used

ratio and the ratio is based on the reliable information as well as it also takes the concern of

entire profit level of the company.

It explains that the total profit of the company against the sales revenue of the

company has been lower from last year due to high COGS and the operating expenses of the

company. It briefs that the current position of the company is not at all good. It explains

about the reduction in the profitability level of the company as well as the performance of the

company. It is required for the company to manage the high revenue with less cost of goods

sold and operating expenses (Higgins, 2012). The past year data briefs that the operating

expenses and non operating expenses of the company was lower from current year.

Additionally, it briefs that the return on assets, net profit, gross profit, cash flow to sales ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial statement analysis

8

etc of the company has also been lower and explains that the performance of the company has

been lower from last year.

Return on assets of the company is 7.07% in 2016 which has been lower from 46.14%

in 2015 (Annual Report, 2016). It explains that the position of the company in terms of net

assets have also been lower. Further, return on equity also explains about the decrement in

the total return of the equity of the company (Vogel, 2014). In addition, gross profit margin

and cash flow to sales ratios have also been lowered. The calculations and data brief that the

profitability level of the company have been lower and thus the investment position has been

riskier.

Short term liquidity ratio:

Short term liquidity ratios explain about a position where the debt payment capability

of a firm could be identified. It briefs that whether the liquidity position of the company is

good or not. The liquidity position of Campbell Soup Company has been evaluated and it has

been found that the liquidity level (current ratio) of the company is 0.75 in 2016 which is

quite similar from 2015 and 2014’s liquidity capability. The current ratio has been chosen for

identifying the liquidity ratio as it is one of the most used ratio and the ratio is based on the

reliable information as well as it also takes the concern of other competitors in the market

(Gibson, 2011).

It explains that the current sources of the company against the current debt of the

company are lower from last year. Though, it briefs that the current position of the company

is not at all good. It explains about the reduction in the capability of the company to pay the

short term debts of the company. It is required for the company to manage the current

resources at a good proportion with the debts of the company (Gertler and Kiyotaki, 2010).

The past year data briefs that the level of sources has been enhanced by the company and still

few changes are required in the company. Additionally, it briefs that the quick assets of the

company has also been lower and explains that the performance of the company has been

lower from last year.

Quick liquidity ratio of the company is 0.38 in 2016 which has been lower from 0.39

in 2015. It explains that the position of the company in terms of short term debt payment have

also been lower (Annual Report, 2016). The calculations and data brief that the liquidity level

of the company have been lower and thus the investment position has been riskier.

Long term solvency ratio:

Solvency ratios are the key metric which is used by the companies to measure the

ability of an organization to pay its long term debt. Long term solvency ratios explain about a

position where the long term debt payment capability of a firm could be identified. It briefs

that whether the solvency position and long term debt payment position of the company is

good or not (Faccio, 2010). The solvency position of Campbell Soup Company has been

evaluated and it has been found that the solvency level of the company is 0.24 in 2016 which

has been reduced from 2015 and 2014’s solvency capability. The long term solvency ratio

has been chosen for identifying the solvency ratios as it is one of the reliable ratio which is

based on the structure and long term debts of the company.

It explains that the current log term sources of the company against the long term debt

of the company are lower from last year. Though, it briefs that the solvency position of the

company is not at all good. It explains about the reduction in the capability of the company to

8

etc of the company has also been lower and explains that the performance of the company has

been lower from last year.

Return on assets of the company is 7.07% in 2016 which has been lower from 46.14%

in 2015 (Annual Report, 2016). It explains that the position of the company in terms of net

assets have also been lower. Further, return on equity also explains about the decrement in

the total return of the equity of the company (Vogel, 2014). In addition, gross profit margin

and cash flow to sales ratios have also been lowered. The calculations and data brief that the

profitability level of the company have been lower and thus the investment position has been

riskier.

Short term liquidity ratio:

Short term liquidity ratios explain about a position where the debt payment capability

of a firm could be identified. It briefs that whether the liquidity position of the company is

good or not. The liquidity position of Campbell Soup Company has been evaluated and it has

been found that the liquidity level (current ratio) of the company is 0.75 in 2016 which is

quite similar from 2015 and 2014’s liquidity capability. The current ratio has been chosen for

identifying the liquidity ratio as it is one of the most used ratio and the ratio is based on the

reliable information as well as it also takes the concern of other competitors in the market

(Gibson, 2011).

It explains that the current sources of the company against the current debt of the

company are lower from last year. Though, it briefs that the current position of the company

is not at all good. It explains about the reduction in the capability of the company to pay the

short term debts of the company. It is required for the company to manage the current

resources at a good proportion with the debts of the company (Gertler and Kiyotaki, 2010).

The past year data briefs that the level of sources has been enhanced by the company and still

few changes are required in the company. Additionally, it briefs that the quick assets of the

company has also been lower and explains that the performance of the company has been

lower from last year.

Quick liquidity ratio of the company is 0.38 in 2016 which has been lower from 0.39

in 2015. It explains that the position of the company in terms of short term debt payment have

also been lower (Annual Report, 2016). The calculations and data brief that the liquidity level

of the company have been lower and thus the investment position has been riskier.

Long term solvency ratio:

Solvency ratios are the key metric which is used by the companies to measure the

ability of an organization to pay its long term debt. Long term solvency ratios explain about a

position where the long term debt payment capability of a firm could be identified. It briefs

that whether the solvency position and long term debt payment position of the company is

good or not (Faccio, 2010). The solvency position of Campbell Soup Company has been

evaluated and it has been found that the solvency level of the company is 0.24 in 2016 which

has been reduced from 2015 and 2014’s solvency capability. The long term solvency ratio

has been chosen for identifying the solvency ratios as it is one of the reliable ratio which is

based on the structure and long term debts of the company.

It explains that the current log term sources of the company against the long term debt

of the company are lower from last year. Though, it briefs that the solvency position of the

company is not at all good. It explains about the reduction in the capability of the company to

Financial statement analysis

9

pay the long term debts of the company (Fridson and Alvarez, 2011). It is required for the

company to manage the long term resources at a good proportion with the long term debts of

the company. The past year data briefs that the level of sources has been reduced by the

company and thus few changes are required in the company. The calculations and data brief

that the solvency level of the company have been lower and thus the investment position has

been riskier.

Capital structure ratio:

Capital structure ratios are the key metric which is used by the companies to measure

the ability of an organization to manage its various sources which has been raised by the

company for various long term projects and the performance of the company. Capital

structure ratios explain about a position where the debt and equity level and fund

management capability of a firm could be identified (Brigham and Ehrhardt, 2013). It briefs

that whether the good proportion of debt and equity is managed by the company or not. The

capital structure position of Campbell Soup Company has been evaluated and it has been

found that the debt to equity level of the company is 1.675 in 2016 which has been reduced

from 2015 and 2014’s debt equity level capability. The debt to equity ratio has been chosen

for identifying the capital structure position as it is one of the most used ratio and the ratio is

based on the reliable information as well as it also takes the concern of entire structure level

of the company (Annual Report, 2014).

It explains that the debt level of the company is quite higher than the equity level due

to which the position of the company is quite riskier. It explains that the cost of the company

is quite lower but on the other hand, the risk of the company is higher. Though, it briefs that

the capital structure position of the company is not at all good. Further, the other capital

structure ratio also briefs that the changes are required to be done in the company for the

better performance of the company and the position of the company (Fiordelisi, Monferrà and

Sampagnaro, 2014). The calculations and data brief that the solvency level of the company

have been lower and thus the capital structure position has been riskier.

Credit quality of the firm:

Credit quality is crucial measurement to judge the investment quality of an

organization and it also evaluates the relevant factors related to the investment in an

organization. Credit quality is an important factor for the investors to evaluate the opportunity

in the organization. The credit quality of Campbell Soup Company has been evaluated and it

has been found that the credit quality of the firm is not satisfactory (Gopalan, Song and

Yerramilli, 2014). The credit quality of the company was quite better in 2014 but after 2014,

the riskier level of the company is continuously increasing and explains that the investment

position of the company is not good. The profitability level briefs about the lower

profitability ratio from last 2 years and brief that the position of the company has been lower.

On the other hand, the liquidity level of the company briefs that the short term debt payment

capacity of the company is not good (Cetorelli and Peretto, 2012). The level of debt of the

company is quite higher than the level of its current sources. Further, the solvency level of the

company briefs that long term debt payment capacity of the company is not good. The level

of debt of the company is quite higher than the level of its net profit and the assets. Lastly, the

capital structure ratio also briefs that the risk level of the company is quite higher and thus the

credit quality of the company is not good (Mittoo and Zhang, 2010). It is not a good option

for the purpose of investment.

9

pay the long term debts of the company (Fridson and Alvarez, 2011). It is required for the

company to manage the long term resources at a good proportion with the long term debts of

the company. The past year data briefs that the level of sources has been reduced by the

company and thus few changes are required in the company. The calculations and data brief

that the solvency level of the company have been lower and thus the investment position has

been riskier.

Capital structure ratio:

Capital structure ratios are the key metric which is used by the companies to measure

the ability of an organization to manage its various sources which has been raised by the

company for various long term projects and the performance of the company. Capital

structure ratios explain about a position where the debt and equity level and fund

management capability of a firm could be identified (Brigham and Ehrhardt, 2013). It briefs

that whether the good proportion of debt and equity is managed by the company or not. The

capital structure position of Campbell Soup Company has been evaluated and it has been

found that the debt to equity level of the company is 1.675 in 2016 which has been reduced

from 2015 and 2014’s debt equity level capability. The debt to equity ratio has been chosen

for identifying the capital structure position as it is one of the most used ratio and the ratio is

based on the reliable information as well as it also takes the concern of entire structure level

of the company (Annual Report, 2014).

It explains that the debt level of the company is quite higher than the equity level due

to which the position of the company is quite riskier. It explains that the cost of the company

is quite lower but on the other hand, the risk of the company is higher. Though, it briefs that

the capital structure position of the company is not at all good. Further, the other capital

structure ratio also briefs that the changes are required to be done in the company for the

better performance of the company and the position of the company (Fiordelisi, Monferrà and

Sampagnaro, 2014). The calculations and data brief that the solvency level of the company

have been lower and thus the capital structure position has been riskier.

Credit quality of the firm:

Credit quality is crucial measurement to judge the investment quality of an

organization and it also evaluates the relevant factors related to the investment in an

organization. Credit quality is an important factor for the investors to evaluate the opportunity

in the organization. The credit quality of Campbell Soup Company has been evaluated and it

has been found that the credit quality of the firm is not satisfactory (Gopalan, Song and

Yerramilli, 2014). The credit quality of the company was quite better in 2014 but after 2014,

the riskier level of the company is continuously increasing and explains that the investment

position of the company is not good. The profitability level briefs about the lower

profitability ratio from last 2 years and brief that the position of the company has been lower.

On the other hand, the liquidity level of the company briefs that the short term debt payment

capacity of the company is not good (Cetorelli and Peretto, 2012). The level of debt of the

company is quite higher than the level of its current sources. Further, the solvency level of the

company briefs that long term debt payment capacity of the company is not good. The level

of debt of the company is quite higher than the level of its net profit and the assets. Lastly, the

capital structure ratio also briefs that the risk level of the company is quite higher and thus the

credit quality of the company is not good (Mittoo and Zhang, 2010). It is not a good option

for the purpose of investment.

Financial statement analysis

10

Recommendation and Conclusion:

To conclude, the investment position of the company is not at all good and thus, it is

recommended to the investors to not to invest into the company for the long term as well as

for short term. It briefs that it is required for the investors to invest into the company which

credit rating is quite better.

10

Recommendation and Conclusion:

To conclude, the investment position of the company is not at all good and thus, it is

recommended to the investors to not to invest into the company for the long term as well as

for short term. It briefs that it is required for the investors to invest into the company which

credit rating is quite better.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial statement analysis

11

References:

Ahrendsen, B.L. and Katchova, A.L., 2012. Financial ratio analysis using ARMS

data. Agricultural Finance Review, 72(2), pp.262-272.

Annual Report. 2014. Campbell Soup Company. [Online]. Available at:

http://media.corporate-ir.net/media_files/IROL/88/88650/2014_Annual_Report.pdf

[Accessed as on 6th April 2018].

Annual Report. 2016. Campbell Soup Company. [Online]. Available at:

https://www.campbellsoupcompany.com/wp-content/uploads/sites/31/2016/10/

AnnualReport_CampbellSouPCompany_2016.pdf [Accessed as on 6th April 2018].

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Cetorelli, N. and Peretto, P.F., 2012. Credit quantity and credit quality: Bank competition and

capital accumulation. Journal of Economic Theory, 147(3), pp.967-998.

Chandra, P., 2011. Financial management. Tata McGraw-Hill Education.

Décamps, J.P., Mariotti, T., Rochet, J.C. and Villeneuve, S., 2011. Free cash flow, issuance

costs, and stock prices. The Journal of Finance, 66(5), pp.1501-1544.

Faccio, M., 2010. Differences between politically connected and nonconnected firms: A

cross‐country analysis. Financial management, 39(3), pp.905-928.

Fiordelisi, F., Monferrà, S. and Sampagnaro, G., 2014. Relationship lending and credit

quality. Journal of Financial Services Research, 46(3), pp.295-315.

Fridson, M.S. and Alvarez, F., 2011. Financial statement analysis: a practitioner's

guide (Vol. 597). John Wiley & Sons.

Gertler, M. and Kiyotaki, N., 2010. Financial intermediation and credit policy in business

cycle analysis. In Handbook of monetary economics (Vol. 3, pp. 547-599). Elsevier.

Gibson, C.H., 2011. Financial reporting and analysis. South-Western Cengage Learning.

Gopalan, R., Song, F. and Yerramilli, V., 2014. Debt maturity structure and credit

quality. Journal of Financial and Quantitative Analysis, 49(4), pp.817-842.

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Koller, T., Goedhart, M. and Wessels, D., 2010. Valuation: measuring and managing the

value of companies (Vol. 499). john Wiley and sons.

11

References:

Ahrendsen, B.L. and Katchova, A.L., 2012. Financial ratio analysis using ARMS

data. Agricultural Finance Review, 72(2), pp.262-272.

Annual Report. 2014. Campbell Soup Company. [Online]. Available at:

http://media.corporate-ir.net/media_files/IROL/88/88650/2014_Annual_Report.pdf

[Accessed as on 6th April 2018].

Annual Report. 2016. Campbell Soup Company. [Online]. Available at:

https://www.campbellsoupcompany.com/wp-content/uploads/sites/31/2016/10/

AnnualReport_CampbellSouPCompany_2016.pdf [Accessed as on 6th April 2018].

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Cetorelli, N. and Peretto, P.F., 2012. Credit quantity and credit quality: Bank competition and

capital accumulation. Journal of Economic Theory, 147(3), pp.967-998.

Chandra, P., 2011. Financial management. Tata McGraw-Hill Education.

Décamps, J.P., Mariotti, T., Rochet, J.C. and Villeneuve, S., 2011. Free cash flow, issuance

costs, and stock prices. The Journal of Finance, 66(5), pp.1501-1544.

Faccio, M., 2010. Differences between politically connected and nonconnected firms: A

cross‐country analysis. Financial management, 39(3), pp.905-928.

Fiordelisi, F., Monferrà, S. and Sampagnaro, G., 2014. Relationship lending and credit

quality. Journal of Financial Services Research, 46(3), pp.295-315.

Fridson, M.S. and Alvarez, F., 2011. Financial statement analysis: a practitioner's

guide (Vol. 597). John Wiley & Sons.

Gertler, M. and Kiyotaki, N., 2010. Financial intermediation and credit policy in business

cycle analysis. In Handbook of monetary economics (Vol. 3, pp. 547-599). Elsevier.

Gibson, C.H., 2011. Financial reporting and analysis. South-Western Cengage Learning.

Gopalan, R., Song, F. and Yerramilli, V., 2014. Debt maturity structure and credit

quality. Journal of Financial and Quantitative Analysis, 49(4), pp.817-842.

Higgins, R.C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Koller, T., Goedhart, M. and Wessels, D., 2010. Valuation: measuring and managing the

value of companies (Vol. 499). john Wiley and sons.

Financial statement analysis

12

Madura, J., 2011. International financial management. Cengage Learning.

Mittoo, U.R. and Zhang, Z., 2010. Bond market access, credit quality, and capital structure:

Canadian evidence. Financial Review, 45(3), pp.579-602.

Penman, S. and Reggiani, F., 2013. Returns to buying earnings and book value: Accounting

for growth and risk. Review of Accounting Studies, 18(4), pp.1021-1049.

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed.

Vogel, H.L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Yahoo finance. 2018. Campbell Soup Company. [Online]. Available at:

https://finance.yahoo.com/quote/CPB?ltr=1 [Accessed as on 6th April 2018].

Yahoo finance. 2018. Campbell Soup Company. [Online]. Available at:

https://www.campbellsoupcompany.com/ [Accessed as on 6th April 2018].

12

Madura, J., 2011. International financial management. Cengage Learning.

Mittoo, U.R. and Zhang, Z., 2010. Bond market access, credit quality, and capital structure:

Canadian evidence. Financial Review, 45(3), pp.579-602.

Penman, S. and Reggiani, F., 2013. Returns to buying earnings and book value: Accounting

for growth and risk. Review of Accounting Studies, 18(4), pp.1021-1049.

Titman, S. and Martin, J.D., 2014. Valuation. Pearson Higher Ed.

Vogel, H.L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Yahoo finance. 2018. Campbell Soup Company. [Online]. Available at:

https://finance.yahoo.com/quote/CPB?ltr=1 [Accessed as on 6th April 2018].

Yahoo finance. 2018. Campbell Soup Company. [Online]. Available at:

https://www.campbellsoupcompany.com/ [Accessed as on 6th April 2018].

Financial statement analysis

13

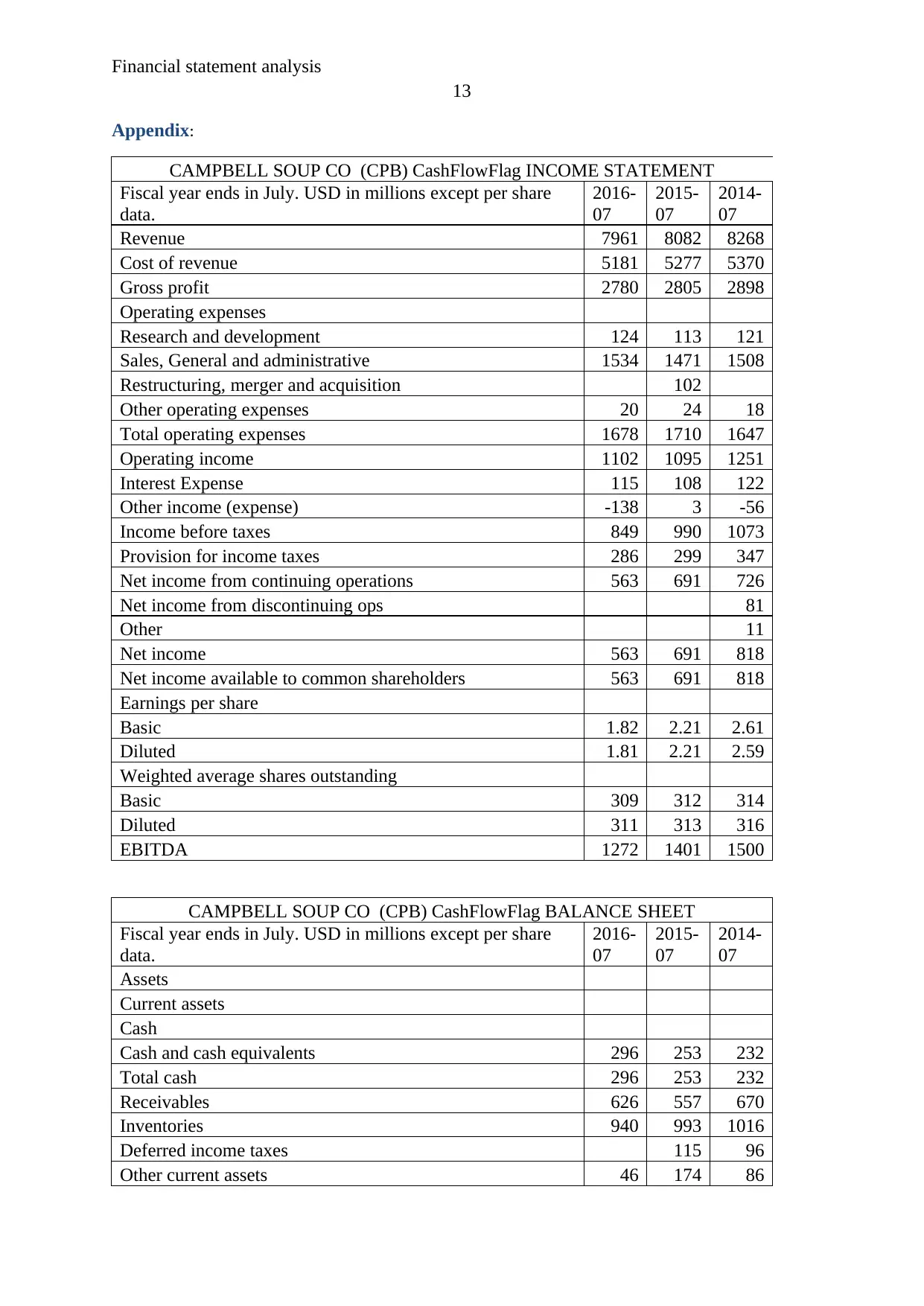

Appendix:

CAMPBELL SOUP CO (CPB) CashFlowFlag INCOME STATEMENT

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

Revenue 7961 8082 8268

Cost of revenue 5181 5277 5370

Gross profit 2780 2805 2898

Operating expenses

Research and development 124 113 121

Sales, General and administrative 1534 1471 1508

Restructuring, merger and acquisition 102

Other operating expenses 20 24 18

Total operating expenses 1678 1710 1647

Operating income 1102 1095 1251

Interest Expense 115 108 122

Other income (expense) -138 3 -56

Income before taxes 849 990 1073

Provision for income taxes 286 299 347

Net income from continuing operations 563 691 726

Net income from discontinuing ops 81

Other 11

Net income 563 691 818

Net income available to common shareholders 563 691 818

Earnings per share

Basic 1.82 2.21 2.61

Diluted 1.81 2.21 2.59

Weighted average shares outstanding

Basic 309 312 314

Diluted 311 313 316

EBITDA 1272 1401 1500

CAMPBELL SOUP CO (CPB) CashFlowFlag BALANCE SHEET

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

Assets

Current assets

Cash

Cash and cash equivalents 296 253 232

Total cash 296 253 232

Receivables 626 557 670

Inventories 940 993 1016

Deferred income taxes 115 96

Other current assets 46 174 86

13

Appendix:

CAMPBELL SOUP CO (CPB) CashFlowFlag INCOME STATEMENT

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

Revenue 7961 8082 8268

Cost of revenue 5181 5277 5370

Gross profit 2780 2805 2898

Operating expenses

Research and development 124 113 121

Sales, General and administrative 1534 1471 1508

Restructuring, merger and acquisition 102

Other operating expenses 20 24 18

Total operating expenses 1678 1710 1647

Operating income 1102 1095 1251

Interest Expense 115 108 122

Other income (expense) -138 3 -56

Income before taxes 849 990 1073

Provision for income taxes 286 299 347

Net income from continuing operations 563 691 726

Net income from discontinuing ops 81

Other 11

Net income 563 691 818

Net income available to common shareholders 563 691 818

Earnings per share

Basic 1.82 2.21 2.61

Diluted 1.81 2.21 2.59

Weighted average shares outstanding

Basic 309 312 314

Diluted 311 313 316

EBITDA 1272 1401 1500

CAMPBELL SOUP CO (CPB) CashFlowFlag BALANCE SHEET

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

Assets

Current assets

Cash

Cash and cash equivalents 296 253 232

Total cash 296 253 232

Receivables 626 557 670

Inventories 940 993 1016

Deferred income taxes 115 96

Other current assets 46 174 86

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial statement analysis

14

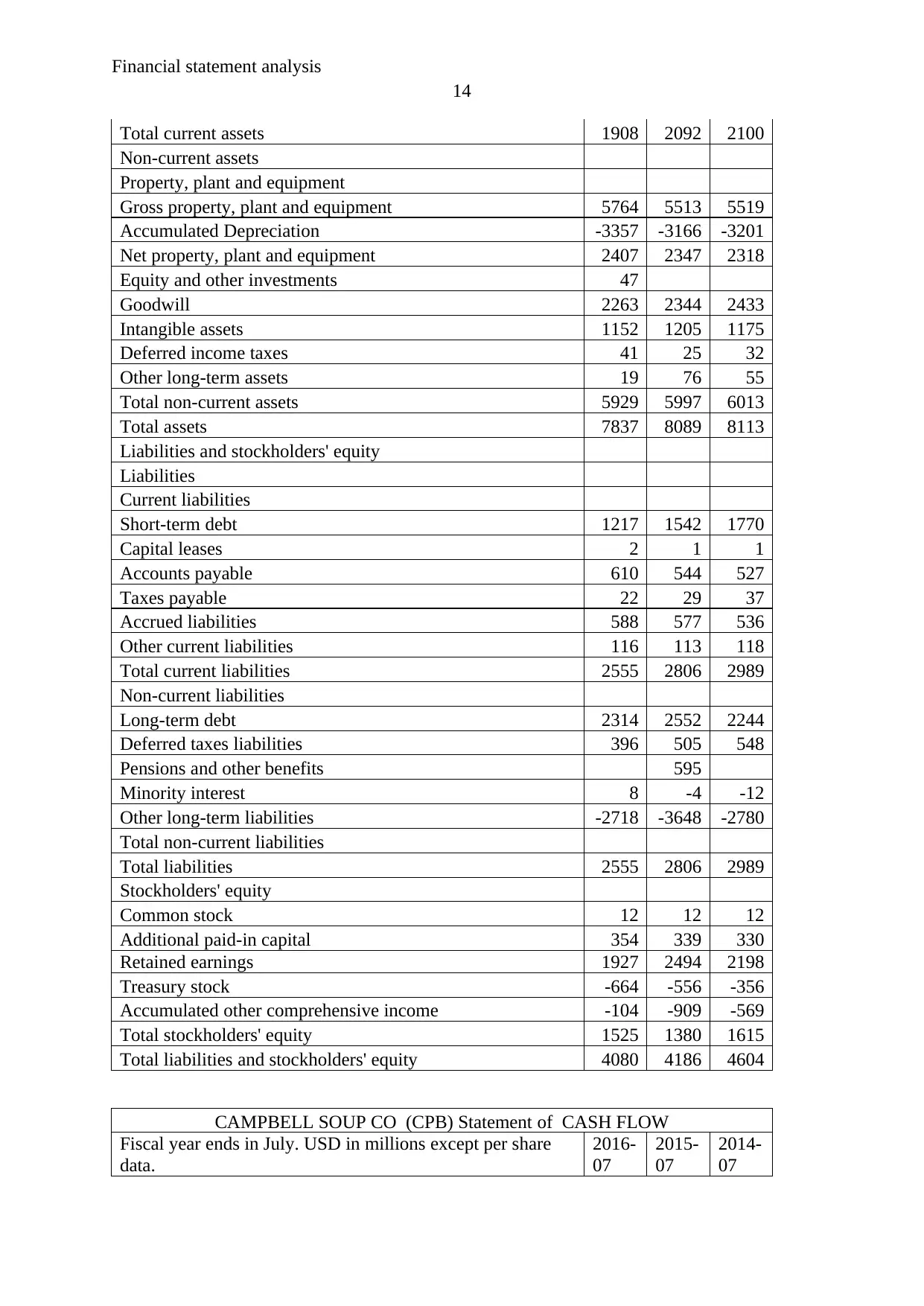

Total current assets 1908 2092 2100

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 5764 5513 5519

Accumulated Depreciation -3357 -3166 -3201

Net property, plant and equipment 2407 2347 2318

Equity and other investments 47

Goodwill 2263 2344 2433

Intangible assets 1152 1205 1175

Deferred income taxes 41 25 32

Other long-term assets 19 76 55

Total non-current assets 5929 5997 6013

Total assets 7837 8089 8113

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 1217 1542 1770

Capital leases 2 1 1

Accounts payable 610 544 527

Taxes payable 22 29 37

Accrued liabilities 588 577 536

Other current liabilities 116 113 118

Total current liabilities 2555 2806 2989

Non-current liabilities

Long-term debt 2314 2552 2244

Deferred taxes liabilities 396 505 548

Pensions and other benefits 595

Minority interest 8 -4 -12

Other long-term liabilities -2718 -3648 -2780

Total non-current liabilities

Total liabilities 2555 2806 2989

Stockholders' equity

Common stock 12 12 12

Additional paid-in capital 354 339 330

Retained earnings 1927 2494 2198

Treasury stock -664 -556 -356

Accumulated other comprehensive income -104 -909 -569

Total stockholders' equity 1525 1380 1615

Total liabilities and stockholders' equity 4080 4186 4604

CAMPBELL SOUP CO (CPB) Statement of CASH FLOW

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

14

Total current assets 1908 2092 2100

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 5764 5513 5519

Accumulated Depreciation -3357 -3166 -3201

Net property, plant and equipment 2407 2347 2318

Equity and other investments 47

Goodwill 2263 2344 2433

Intangible assets 1152 1205 1175

Deferred income taxes 41 25 32

Other long-term assets 19 76 55

Total non-current assets 5929 5997 6013

Total assets 7837 8089 8113

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 1217 1542 1770

Capital leases 2 1 1

Accounts payable 610 544 527

Taxes payable 22 29 37

Accrued liabilities 588 577 536

Other current liabilities 116 113 118

Total current liabilities 2555 2806 2989

Non-current liabilities

Long-term debt 2314 2552 2244

Deferred taxes liabilities 396 505 548

Pensions and other benefits 595

Minority interest 8 -4 -12

Other long-term liabilities -2718 -3648 -2780

Total non-current liabilities

Total liabilities 2555 2806 2989

Stockholders' equity

Common stock 12 12 12

Additional paid-in capital 354 339 330

Retained earnings 1927 2494 2198

Treasury stock -664 -556 -356

Accumulated other comprehensive income -104 -909 -569

Total stockholders' equity 1525 1380 1615

Total liabilities and stockholders' equity 4080 4186 4604

CAMPBELL SOUP CO (CPB) Statement of CASH FLOW

Fiscal year ends in July. USD in millions except per share

data.

2016-

07

2015-

07

2014-

07

Financial statement analysis

15

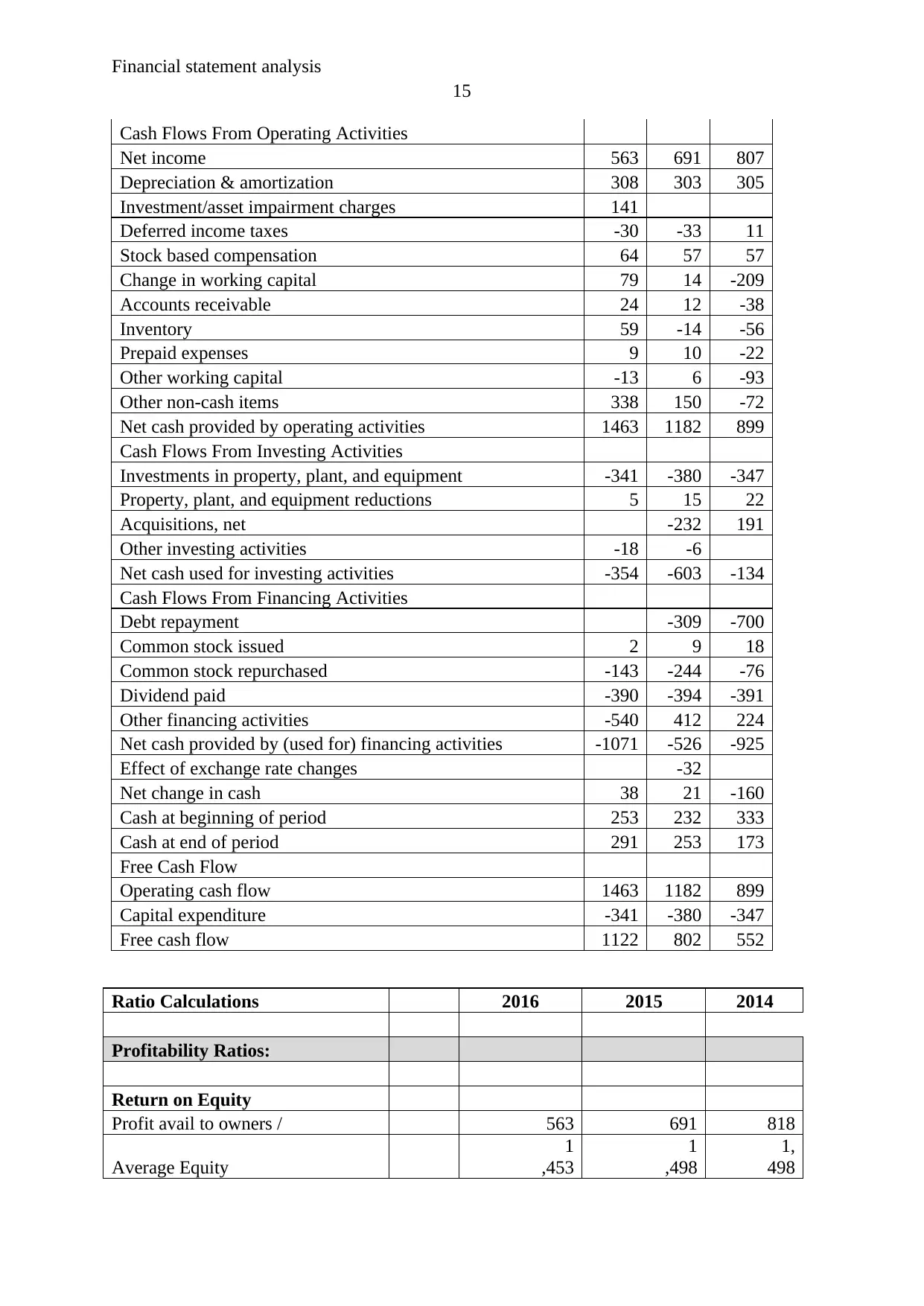

Cash Flows From Operating Activities

Net income 563 691 807

Depreciation & amortization 308 303 305

Investment/asset impairment charges 141

Deferred income taxes -30 -33 11

Stock based compensation 64 57 57

Change in working capital 79 14 -209

Accounts receivable 24 12 -38

Inventory 59 -14 -56

Prepaid expenses 9 10 -22

Other working capital -13 6 -93

Other non-cash items 338 150 -72

Net cash provided by operating activities 1463 1182 899

Cash Flows From Investing Activities

Investments in property, plant, and equipment -341 -380 -347

Property, plant, and equipment reductions 5 15 22

Acquisitions, net -232 191

Other investing activities -18 -6

Net cash used for investing activities -354 -603 -134

Cash Flows From Financing Activities

Debt repayment -309 -700

Common stock issued 2 9 18

Common stock repurchased -143 -244 -76

Dividend paid -390 -394 -391

Other financing activities -540 412 224

Net cash provided by (used for) financing activities -1071 -526 -925

Effect of exchange rate changes -32

Net change in cash 38 21 -160

Cash at beginning of period 253 232 333

Cash at end of period 291 253 173

Free Cash Flow

Operating cash flow 1463 1182 899

Capital expenditure -341 -380 -347

Free cash flow 1122 802 552

Ratio Calculations 2016 2015 2014

Profitability Ratios:

Return on Equity

Profit avail to owners / 563 691 818

Average Equity

1

,453

1

,498

1,

498

15

Cash Flows From Operating Activities

Net income 563 691 807

Depreciation & amortization 308 303 305

Investment/asset impairment charges 141

Deferred income taxes -30 -33 11

Stock based compensation 64 57 57

Change in working capital 79 14 -209

Accounts receivable 24 12 -38

Inventory 59 -14 -56

Prepaid expenses 9 10 -22

Other working capital -13 6 -93

Other non-cash items 338 150 -72

Net cash provided by operating activities 1463 1182 899

Cash Flows From Investing Activities

Investments in property, plant, and equipment -341 -380 -347

Property, plant, and equipment reductions 5 15 22

Acquisitions, net -232 191

Other investing activities -18 -6

Net cash used for investing activities -354 -603 -134

Cash Flows From Financing Activities

Debt repayment -309 -700

Common stock issued 2 9 18

Common stock repurchased -143 -244 -76

Dividend paid -390 -394 -391

Other financing activities -540 412 224

Net cash provided by (used for) financing activities -1071 -526 -925

Effect of exchange rate changes -32

Net change in cash 38 21 -160

Cash at beginning of period 253 232 333

Cash at end of period 291 253 173

Free Cash Flow

Operating cash flow 1463 1182 899

Capital expenditure -341 -380 -347

Free cash flow 1122 802 552

Ratio Calculations 2016 2015 2014

Profitability Ratios:

Return on Equity

Profit avail to owners / 563 691 818

Average Equity

1

,453

1

,498

1,

498

Financial statement analysis

16

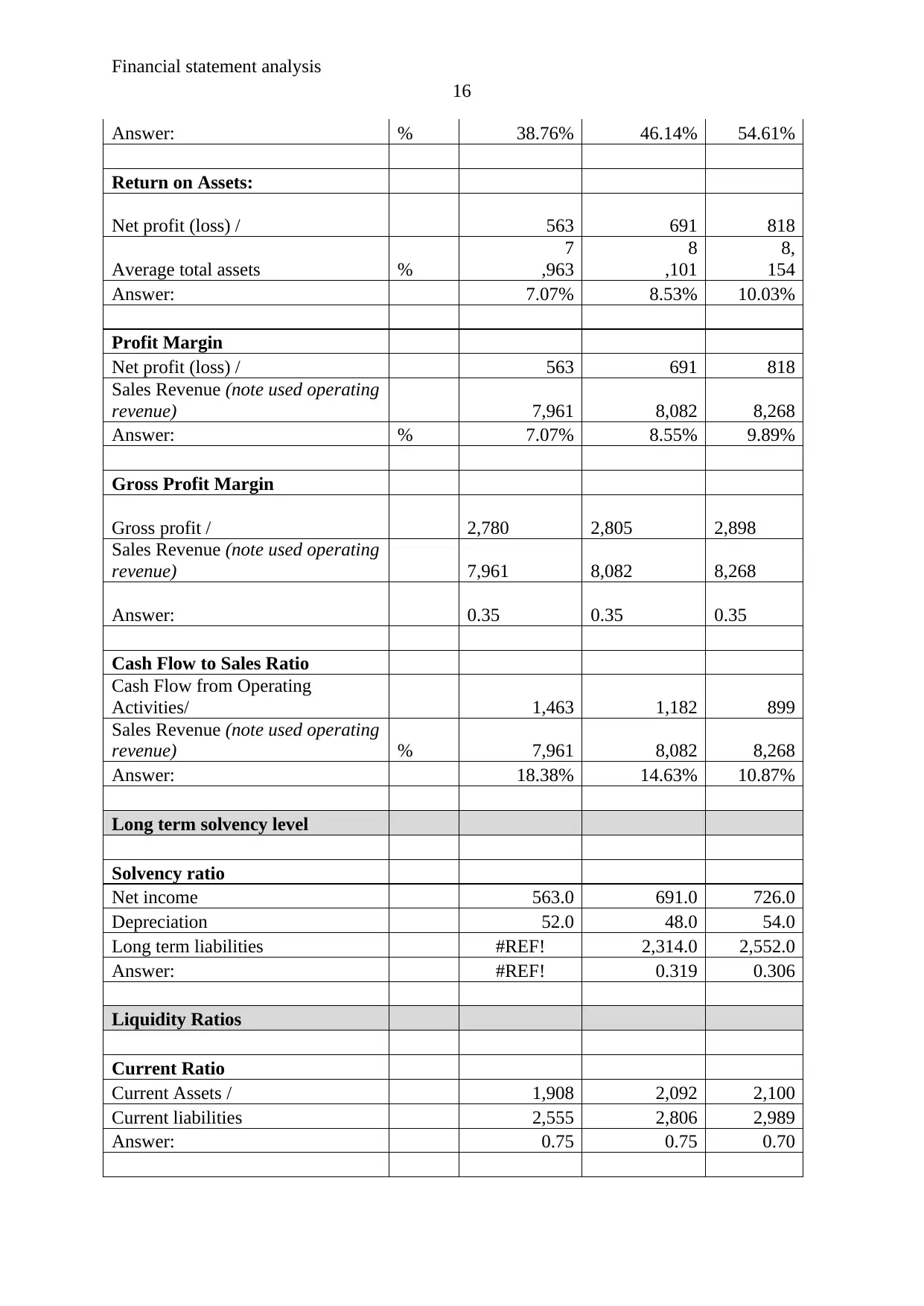

Answer: % 38.76% 46.14% 54.61%

Return on Assets:

Net profit (loss) / 563 691 818

Average total assets %

7

,963

8

,101

8,

154

Answer: 7.07% 8.53% 10.03%

Profit Margin

Net profit (loss) / 563 691 818

Sales Revenue (note used operating

revenue) 7,961 8,082 8,268

Answer: % 7.07% 8.55% 9.89%

Gross Profit Margin

Gross profit / 2,780 2,805 2,898

Sales Revenue (note used operating

revenue) 7,961 8,082 8,268

Answer: 0.35 0.35 0.35

Cash Flow to Sales Ratio

Cash Flow from Operating

Activities/ 1,463 1,182 899

Sales Revenue (note used operating

revenue) % 7,961 8,082 8,268

Answer: 18.38% 14.63% 10.87%

Long term solvency level

Solvency ratio

Net income 563.0 691.0 726.0

Depreciation 52.0 48.0 54.0

Long term liabilities #REF! 2,314.0 2,552.0

Answer: #REF! 0.319 0.306

Liquidity Ratios

Current Ratio

Current Assets / 1,908 2,092 2,100

Current liabilities 2,555 2,806 2,989

Answer: 0.75 0.75 0.70

16

Answer: % 38.76% 46.14% 54.61%

Return on Assets:

Net profit (loss) / 563 691 818

Average total assets %

7

,963

8

,101

8,

154

Answer: 7.07% 8.53% 10.03%

Profit Margin

Net profit (loss) / 563 691 818

Sales Revenue (note used operating

revenue) 7,961 8,082 8,268

Answer: % 7.07% 8.55% 9.89%

Gross Profit Margin

Gross profit / 2,780 2,805 2,898

Sales Revenue (note used operating

revenue) 7,961 8,082 8,268

Answer: 0.35 0.35 0.35

Cash Flow to Sales Ratio

Cash Flow from Operating

Activities/ 1,463 1,182 899

Sales Revenue (note used operating

revenue) % 7,961 8,082 8,268

Answer: 18.38% 14.63% 10.87%

Long term solvency level

Solvency ratio

Net income 563.0 691.0 726.0

Depreciation 52.0 48.0 54.0

Long term liabilities #REF! 2,314.0 2,552.0

Answer: #REF! 0.319 0.306

Liquidity Ratios

Current Ratio

Current Assets / 1,908 2,092 2,100

Current liabilities 2,555 2,806 2,989

Answer: 0.75 0.75 0.70

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial statement analysis

17

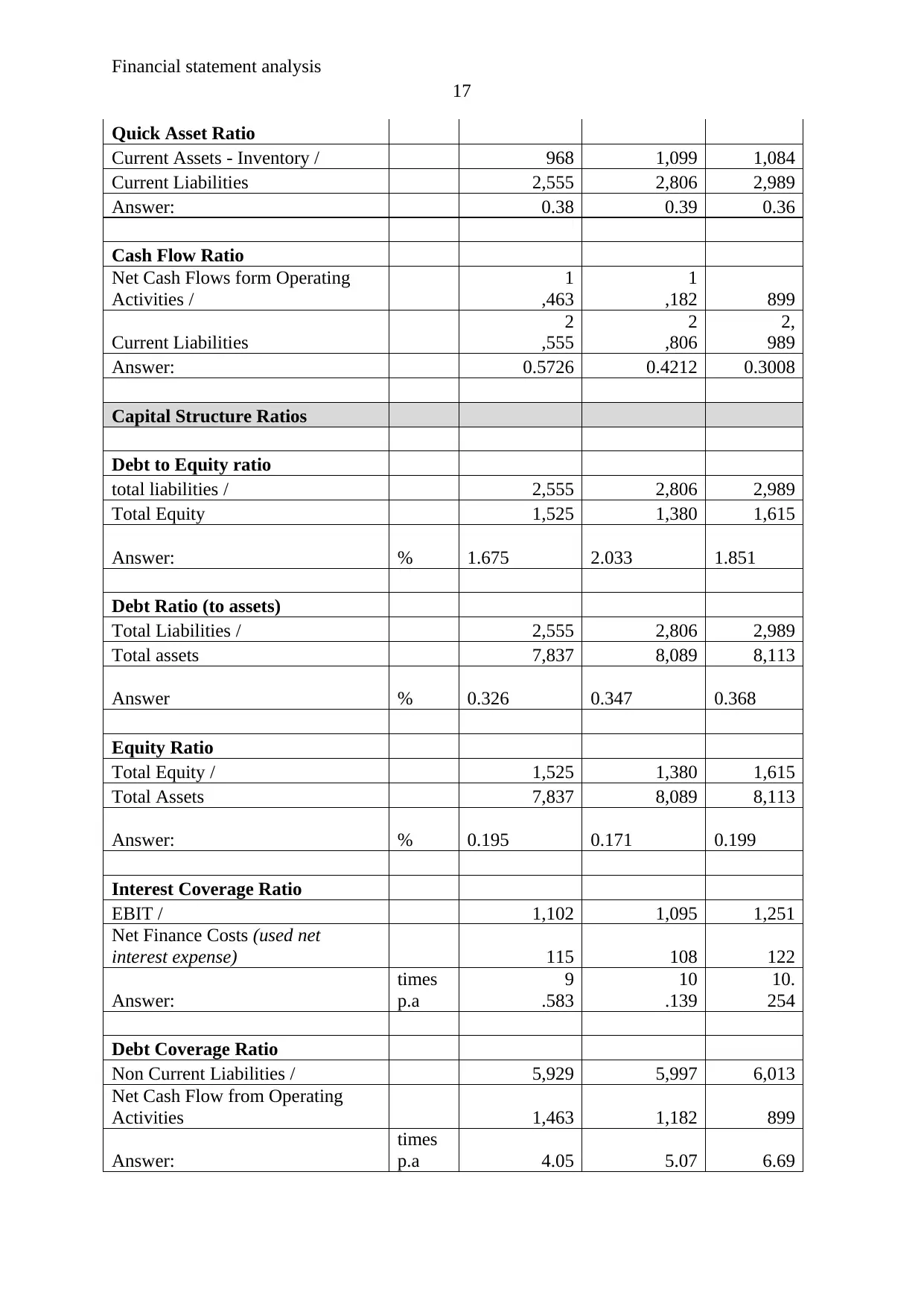

Quick Asset Ratio

Current Assets - Inventory / 968 1,099 1,084

Current Liabilities 2,555 2,806 2,989

Answer: 0.38 0.39 0.36

Cash Flow Ratio

Net Cash Flows form Operating

Activities /

1

,463

1

,182 899

Current Liabilities

2

,555

2

,806

2,

989

Answer: 0.5726 0.4212 0.3008

Capital Structure Ratios

Debt to Equity ratio

total liabilities / 2,555 2,806 2,989

Total Equity 1,525 1,380 1,615

Answer: % 1.675 2.033 1.851

Debt Ratio (to assets)

Total Liabilities / 2,555 2,806 2,989

Total assets 7,837 8,089 8,113

Answer % 0.326 0.347 0.368

Equity Ratio

Total Equity / 1,525 1,380 1,615

Total Assets 7,837 8,089 8,113

Answer: % 0.195 0.171 0.199

Interest Coverage Ratio

EBIT / 1,102 1,095 1,251

Net Finance Costs (used net

interest expense) 115 108 122

Answer:

times

p.a

9

.583

10

.139

10.

254

Debt Coverage Ratio

Non Current Liabilities / 5,929 5,997 6,013

Net Cash Flow from Operating

Activities 1,463 1,182 899

Answer:

times

p.a 4.05 5.07 6.69

17

Quick Asset Ratio

Current Assets - Inventory / 968 1,099 1,084

Current Liabilities 2,555 2,806 2,989

Answer: 0.38 0.39 0.36

Cash Flow Ratio

Net Cash Flows form Operating

Activities /

1

,463

1

,182 899

Current Liabilities

2

,555

2

,806

2,

989

Answer: 0.5726 0.4212 0.3008

Capital Structure Ratios

Debt to Equity ratio

total liabilities / 2,555 2,806 2,989

Total Equity 1,525 1,380 1,615

Answer: % 1.675 2.033 1.851

Debt Ratio (to assets)

Total Liabilities / 2,555 2,806 2,989

Total assets 7,837 8,089 8,113

Answer % 0.326 0.347 0.368

Equity Ratio

Total Equity / 1,525 1,380 1,615

Total Assets 7,837 8,089 8,113

Answer: % 0.195 0.171 0.199

Interest Coverage Ratio

EBIT / 1,102 1,095 1,251

Net Finance Costs (used net

interest expense) 115 108 122

Answer:

times

p.a

9

.583

10

.139

10.

254

Debt Coverage Ratio

Non Current Liabilities / 5,929 5,997 6,013

Net Cash Flow from Operating

Activities 1,463 1,182 899

Answer:

times

p.a 4.05 5.07 6.69

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.