Financial Statement Analysis Report: E&A Limited Performance Review

VerifiedAdded on 2020/04/07

|8

|1350

|42

Report

AI Summary

This report presents a comprehensive financial statement analysis of E&A Limited, focusing on the years 2015 and 2016. It utilizes various financial ratios, including current, quick, debt-equity, return on assets, return on equity, and net profit ratios, to assess the company's liquidity, profitability, solvency, and activity. The analysis reveals that E&A Limited experienced challenges in maintaining adequate liquidity, with a low current ratio and increasing debt-equity ratio, which is an indicator of high financial risk. The report also indicates poor profitability, with negative returns on assets and equity, as well as a negative net profit margin, suggesting that the company is inefficient in generating profits from its assets and investor funds. Furthermore, the solvency analysis highlights an increased reliance on creditors, which elevates the company's financial risk. The activity ratio analysis shows an improvement in the receivable turnover ratio, indicating better efficiency in converting credit sales into cash. The report concludes by discussing the impact of ratio analysis on the audit process, emphasizing its role in helping auditors understand financial performance and identify key areas for decision-making.

Running Head: Financial Statement Analysis

RATIO ANLYSIS OF

E & A LIMITED

RATIO ANLYSIS OF

E & A LIMITED

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Statement Analysis

1

Table of Contents

Ratio Analysis........................................................................................................................................2

Comments on company’s financial position..........................................................................................3

Impact of ratio analysis on audit...........................................................................................................4

References.............................................................................................................................................5

Appendix...............................................................................................................................................6

1

Table of Contents

Ratio Analysis........................................................................................................................................2

Comments on company’s financial position..........................................................................................3

Impact of ratio analysis on audit...........................................................................................................4

References.............................................................................................................................................5

Appendix...............................................................................................................................................6

Financial Statement Analysis

2

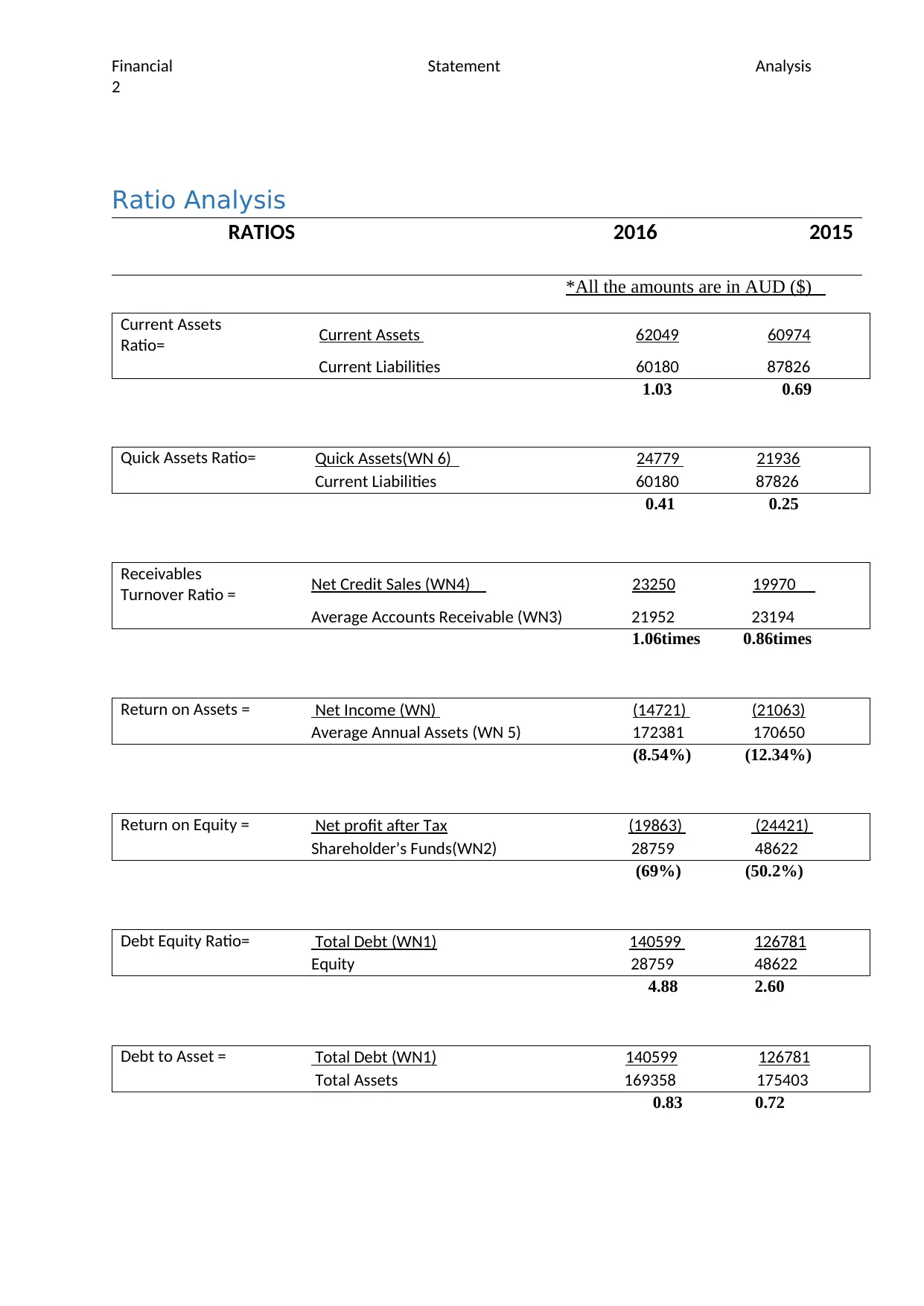

Ratio Analysis

RATIOS 2016 2015

*All the amounts are in AUD ($)

Current Assets

Ratio= Current Assets 62049 60974

Current Liabilities 60180 87826

1.03 0.69

Quick Assets Ratio= Quick Assets(WN 6) 24779 21936

Current Liabilities 60180 87826

0.41 0.25

Receivables

Turnover Ratio = Net Credit Sales (WN4) 23250 19970

Average Accounts Receivable (WN3) 21952 23194

1.06times 0.86times

Return on Assets = Net Income (WN) (14721) (21063)

Average Annual Assets (WN 5) 172381 170650

(8.54%) (12.34%)

Return on Equity = Net profit after Tax (19863) (24421)

Shareholder’s Funds(WN2) 28759 48622

(69%) (50.2%)

Debt Equity Ratio= Total Debt (WN1) 140599 126781

Equity 28759 48622

4.88 2.60

Debt to Asset = Total Debt (WN1) 140599 126781

Total Assets 169358 175403

0.83 0.72

2

Ratio Analysis

RATIOS 2016 2015

*All the amounts are in AUD ($)

Current Assets

Ratio= Current Assets 62049 60974

Current Liabilities 60180 87826

1.03 0.69

Quick Assets Ratio= Quick Assets(WN 6) 24779 21936

Current Liabilities 60180 87826

0.41 0.25

Receivables

Turnover Ratio = Net Credit Sales (WN4) 23250 19970

Average Accounts Receivable (WN3) 21952 23194

1.06times 0.86times

Return on Assets = Net Income (WN) (14721) (21063)

Average Annual Assets (WN 5) 172381 170650

(8.54%) (12.34%)

Return on Equity = Net profit after Tax (19863) (24421)

Shareholder’s Funds(WN2) 28759 48622

(69%) (50.2%)

Debt Equity Ratio= Total Debt (WN1) 140599 126781

Equity 28759 48622

4.88 2.60

Debt to Asset = Total Debt (WN1) 140599 126781

Total Assets 169358 175403

0.83 0.72

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Statement Analysis

3

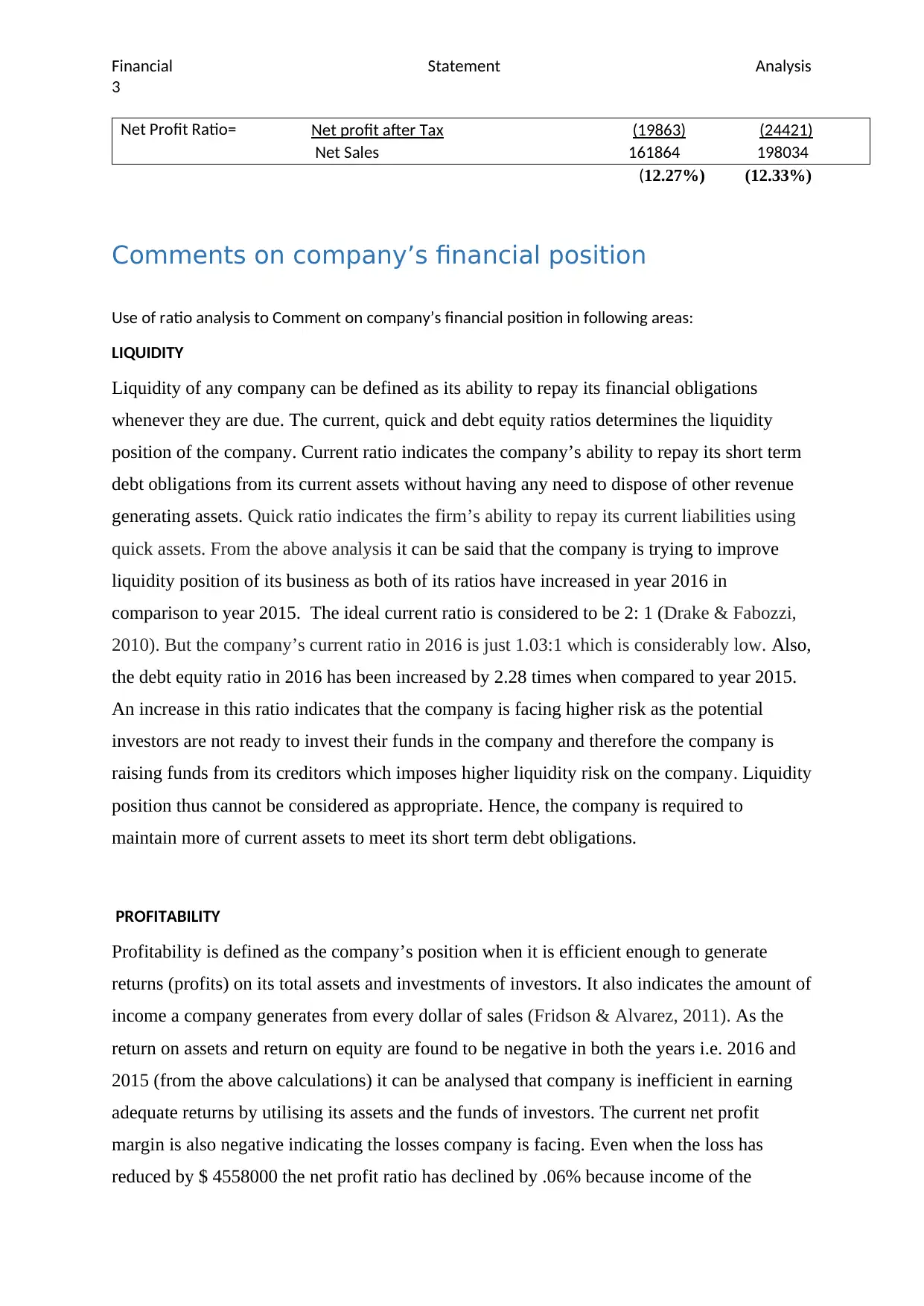

Net Profit Ratio= Net profit after Tax (19863) (24421)

Net Sales 161864 198034

(12.27%) (12.33%)

Comments on company’s financial position

Use of ratio analysis to Comment on company’s financial position in following areas:

LIQUIDITY

Liquidity of any company can be defined as its ability to repay its financial obligations

whenever they are due. The current, quick and debt equity ratios determines the liquidity

position of the company. Current ratio indicates the company’s ability to repay its short term

debt obligations from its current assets without having any need to dispose of other revenue

generating assets. Quick ratio indicates the firm’s ability to repay its current liabilities using

quick assets. From the above analysis it can be said that the company is trying to improve

liquidity position of its business as both of its ratios have increased in year 2016 in

comparison to year 2015. The ideal current ratio is considered to be 2: 1 (Drake & Fabozzi,

2010). But the company’s current ratio in 2016 is just 1.03:1 which is considerably low. Also,

the debt equity ratio in 2016 has been increased by 2.28 times when compared to year 2015.

An increase in this ratio indicates that the company is facing higher risk as the potential

investors are not ready to invest their funds in the company and therefore the company is

raising funds from its creditors which imposes higher liquidity risk on the company. Liquidity

position thus cannot be considered as appropriate. Hence, the company is required to

maintain more of current assets to meet its short term debt obligations.

PROFITABILITY

Profitability is defined as the company’s position when it is efficient enough to generate

returns (profits) on its total assets and investments of investors. It also indicates the amount of

income a company generates from every dollar of sales (Fridson & Alvarez, 2011). As the

return on assets and return on equity are found to be negative in both the years i.e. 2016 and

2015 (from the above calculations) it can be analysed that company is inefficient in earning

adequate returns by utilising its assets and the funds of investors. The current net profit

margin is also negative indicating the losses company is facing. Even when the loss has

reduced by $ 4558000 the net profit ratio has declined by .06% because income of the

3

Net Profit Ratio= Net profit after Tax (19863) (24421)

Net Sales 161864 198034

(12.27%) (12.33%)

Comments on company’s financial position

Use of ratio analysis to Comment on company’s financial position in following areas:

LIQUIDITY

Liquidity of any company can be defined as its ability to repay its financial obligations

whenever they are due. The current, quick and debt equity ratios determines the liquidity

position of the company. Current ratio indicates the company’s ability to repay its short term

debt obligations from its current assets without having any need to dispose of other revenue

generating assets. Quick ratio indicates the firm’s ability to repay its current liabilities using

quick assets. From the above analysis it can be said that the company is trying to improve

liquidity position of its business as both of its ratios have increased in year 2016 in

comparison to year 2015. The ideal current ratio is considered to be 2: 1 (Drake & Fabozzi,

2010). But the company’s current ratio in 2016 is just 1.03:1 which is considerably low. Also,

the debt equity ratio in 2016 has been increased by 2.28 times when compared to year 2015.

An increase in this ratio indicates that the company is facing higher risk as the potential

investors are not ready to invest their funds in the company and therefore the company is

raising funds from its creditors which imposes higher liquidity risk on the company. Liquidity

position thus cannot be considered as appropriate. Hence, the company is required to

maintain more of current assets to meet its short term debt obligations.

PROFITABILITY

Profitability is defined as the company’s position when it is efficient enough to generate

returns (profits) on its total assets and investments of investors. It also indicates the amount of

income a company generates from every dollar of sales (Fridson & Alvarez, 2011). As the

return on assets and return on equity are found to be negative in both the years i.e. 2016 and

2015 (from the above calculations) it can be analysed that company is inefficient in earning

adequate returns by utilising its assets and the funds of investors. The current net profit

margin is also negative indicating the losses company is facing. Even when the loss has

reduced by $ 4558000 the net profit ratio has declined by .06% because income of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Statement Analysis

4

company was not enough to cover its expenses. It shows that the profitability position of the

company is below average. Therefore it needs to improve it by making proper utilisation of

investor’s funds and its assets.

SOLVENCY

Solvency position of a company determines its ability to repay all its financial obligations

whether short term or long term (Babalola & Abiola, 2013). Solvency ratio of debt to asset

measures the quantum of total assets financed by the creditor’s loan compared to the quantum

of asset financed by investor’s funds. The company with higher ratio is riskier since it is

involves higher interest cost. An increase in 2016’s ratio means that the finance expenses

have increased. The report also shows increase in finance from $480300 to $7356000

indicating that company relies heavily on creditor’s to expand business.

ACTIVITY

Activity ratios are used to determine the company’s ability to turn its assets liabilities into

cash or in sales. Higher the activity ratios higher is the firm’s efficiency to convert its assets

and liabilities into cash (Brigham & Houston, 2012). In the present case it can be said that the

receivable turnover ratio of year 2016 has increased by .20 times in comparison with the year

2015. It indicates that the firm is efficient enough to convert its credit sales into cash by

collecting cash from the customers on time.

Impact of ratio analysis on audit:

Ratio Analysis helps the auditors to undertake audit process by using functions like analytical

procedures. Analytical procedure enables the auditor to compare and contrast various facts

which are the results of ratio analysis. In the present case of E&A Limited the ratio analysis

has helped the auditors to compare the results of previous year with that of current year. With

the help of ratio analysis the auditor could understand the root causes of deviations that

resulted in degrading the company’ financial performance. Moreover, this analysis has

enabled the auditor to identify the key areas were users attention is required so that it can

influence their decision.

4

company was not enough to cover its expenses. It shows that the profitability position of the

company is below average. Therefore it needs to improve it by making proper utilisation of

investor’s funds and its assets.

SOLVENCY

Solvency position of a company determines its ability to repay all its financial obligations

whether short term or long term (Babalola & Abiola, 2013). Solvency ratio of debt to asset

measures the quantum of total assets financed by the creditor’s loan compared to the quantum

of asset financed by investor’s funds. The company with higher ratio is riskier since it is

involves higher interest cost. An increase in 2016’s ratio means that the finance expenses

have increased. The report also shows increase in finance from $480300 to $7356000

indicating that company relies heavily on creditor’s to expand business.

ACTIVITY

Activity ratios are used to determine the company’s ability to turn its assets liabilities into

cash or in sales. Higher the activity ratios higher is the firm’s efficiency to convert its assets

and liabilities into cash (Brigham & Houston, 2012). In the present case it can be said that the

receivable turnover ratio of year 2016 has increased by .20 times in comparison with the year

2015. It indicates that the firm is efficient enough to convert its credit sales into cash by

collecting cash from the customers on time.

Impact of ratio analysis on audit:

Ratio Analysis helps the auditors to undertake audit process by using functions like analytical

procedures. Analytical procedure enables the auditor to compare and contrast various facts

which are the results of ratio analysis. In the present case of E&A Limited the ratio analysis

has helped the auditors to compare the results of previous year with that of current year. With

the help of ratio analysis the auditor could understand the root causes of deviations that

resulted in degrading the company’ financial performance. Moreover, this analysis has

enabled the auditor to identify the key areas were users attention is required so that it can

influence their decision.

Financial Statement Analysis

5

References

Babalola, Y.A. and Abiola, F.R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences, 1(4), pp.132-137.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Drake, P.P. and Fabozzi, F.J., 2010. Financial ratio analysis. Handbook of

Finance.

Fridson, M.S. and Alvarez, F., 2011. Financial statement analysis: a

practitioner's guide (Vol. 597). John Wiley & Sons.

5

References

Babalola, Y.A. and Abiola, F.R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences, 1(4), pp.132-137.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Drake, P.P. and Fabozzi, F.J., 2010. Financial ratio analysis. Handbook of

Finance.

Fridson, M.S. and Alvarez, F., 2011. Financial statement analysis: a

practitioner's guide (Vol. 597). John Wiley & Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Statement Analysis

6

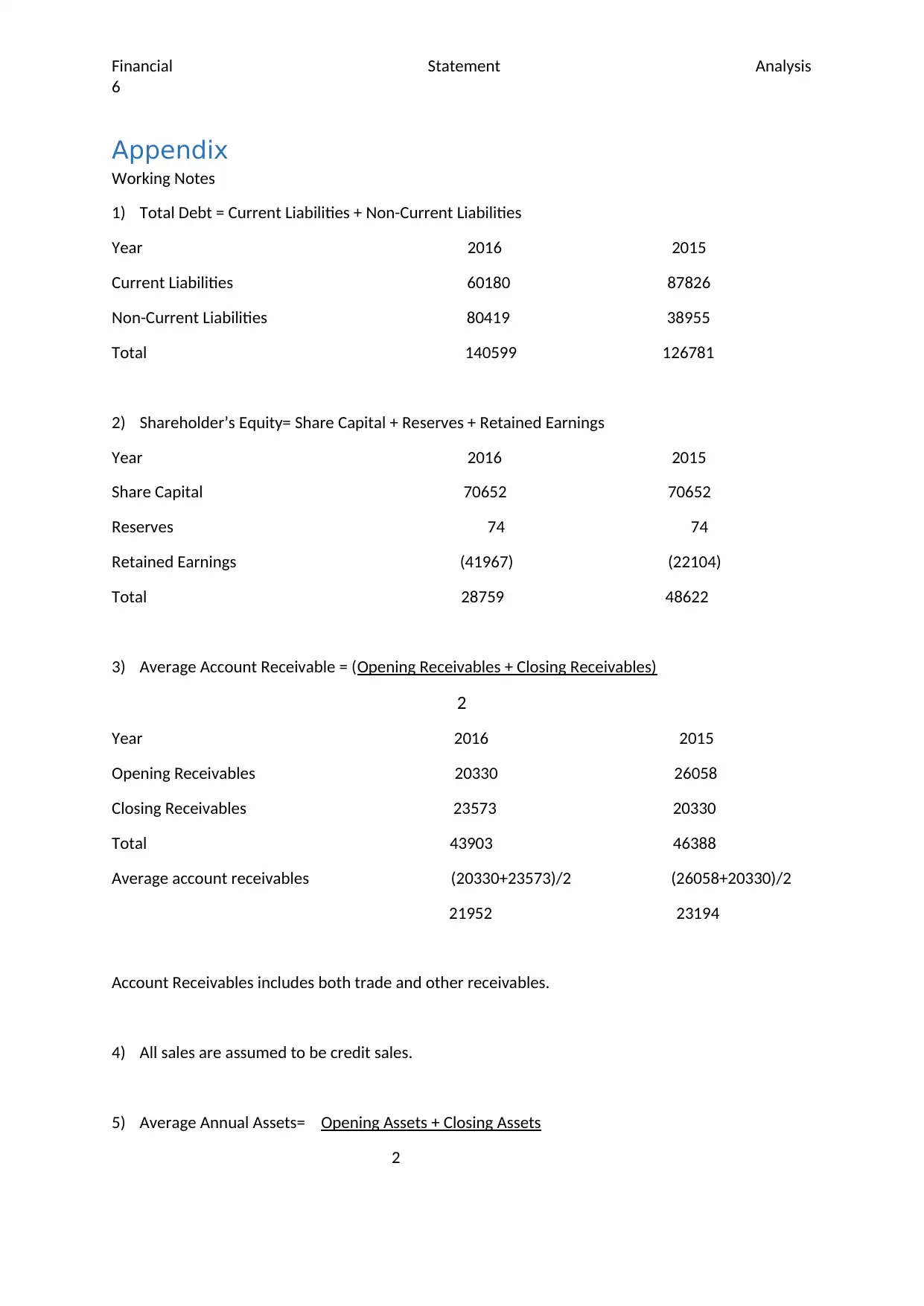

Appendix

Working Notes

1) Total Debt = Current Liabilities + Non-Current Liabilities

Year 2016 2015

Current Liabilities 60180 87826

Non-Current Liabilities 80419 38955

Total 140599 126781

2) Shareholder’s Equity= Share Capital + Reserves + Retained Earnings

Year 2016 2015

Share Capital 70652 70652

Reserves 74 74

Retained Earnings (41967) (22104)

Total 28759 48622

3) Average Account Receivable = (Opening Receivables + Closing Receivables)

2

Year 2016 2015

Opening Receivables 20330 26058

Closing Receivables 23573 20330

Total 43903 46388

Average account receivables (20330+23573)/2 (26058+20330)/2

21952 23194

Account Receivables includes both trade and other receivables.

4) All sales are assumed to be credit sales.

5) Average Annual Assets= Opening Assets + Closing Assets

2

6

Appendix

Working Notes

1) Total Debt = Current Liabilities + Non-Current Liabilities

Year 2016 2015

Current Liabilities 60180 87826

Non-Current Liabilities 80419 38955

Total 140599 126781

2) Shareholder’s Equity= Share Capital + Reserves + Retained Earnings

Year 2016 2015

Share Capital 70652 70652

Reserves 74 74

Retained Earnings (41967) (22104)

Total 28759 48622

3) Average Account Receivable = (Opening Receivables + Closing Receivables)

2

Year 2016 2015

Opening Receivables 20330 26058

Closing Receivables 23573 20330

Total 43903 46388

Average account receivables (20330+23573)/2 (26058+20330)/2

21952 23194

Account Receivables includes both trade and other receivables.

4) All sales are assumed to be credit sales.

5) Average Annual Assets= Opening Assets + Closing Assets

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Statement Analysis

7

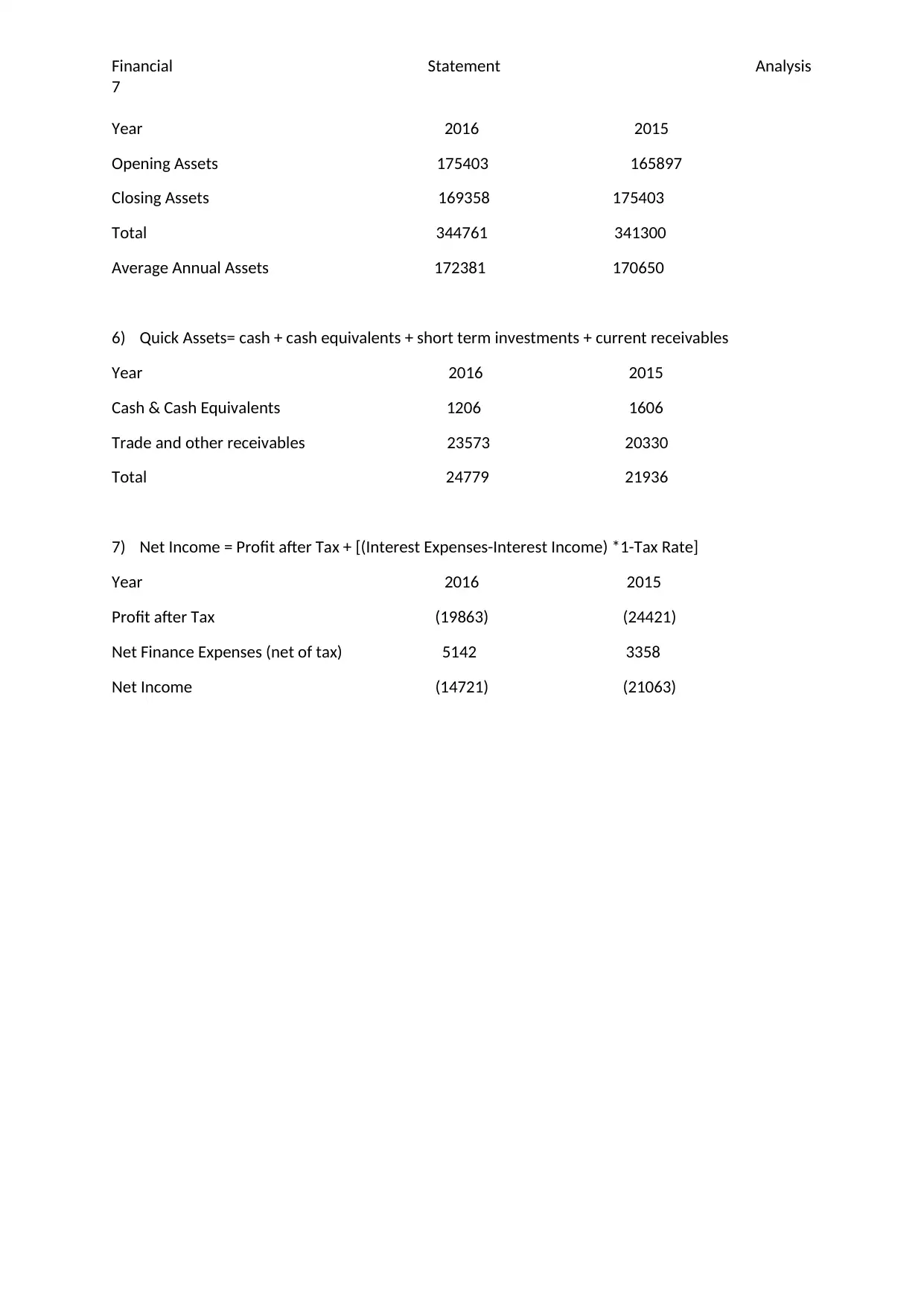

Year 2016 2015

Opening Assets 175403 165897

Closing Assets 169358 175403

Total 344761 341300

Average Annual Assets 172381 170650

6) Quick Assets= cash + cash equivalents + short term investments + current receivables

Year 2016 2015

Cash & Cash Equivalents 1206 1606

Trade and other receivables 23573 20330

Total 24779 21936

7) Net Income = Profit after Tax + [(Interest Expenses-Interest Income) *1-Tax Rate]

Year 2016 2015

Profit after Tax (19863) (24421)

Net Finance Expenses (net of tax) 5142 3358

Net Income (14721) (21063)

7

Year 2016 2015

Opening Assets 175403 165897

Closing Assets 169358 175403

Total 344761 341300

Average Annual Assets 172381 170650

6) Quick Assets= cash + cash equivalents + short term investments + current receivables

Year 2016 2015

Cash & Cash Equivalents 1206 1606

Trade and other receivables 23573 20330

Total 24779 21936

7) Net Income = Profit after Tax + [(Interest Expenses-Interest Income) *1-Tax Rate]

Year 2016 2015

Profit after Tax (19863) (24421)

Net Finance Expenses (net of tax) 5142 3358

Net Income (14721) (21063)

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.