Financial Statement Analysis and Modelling for Milton in the Year 2024

VerifiedAdded on 2023/06/09

|8

|1662

|250

Report

AI Summary

This report provides a comprehensive financial analysis of Milton for the year 2024. It begins with an introduction to financial statement analysis and proceeds to calculate and interpret key financial ratios, including liquidity, profitability, and long-term solvency ratios. The analysis reveals Milton's financial performance, highlighting areas for improvement. The report then recommends strategies for Milton to outperform industry averages, focusing on enhancing profitability and market positioning. Furthermore, it critically evaluates the assumptions used in financial modeling, offering suggestions for refinement. Charts supporting the analysis are presented, followed by a conclusion summarizing the findings and recommendations. The report references several academic sources to support its analysis and recommendations.

Financial Statement

Analysis and

Modelling

Analysis and

Modelling

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Analyse the financial performance of Milton in the year 2024 by calculating benchmark ratios.

.....................................................................................................................................................3

Recommend strategies for Milton to outperform the industry average in 2024..........................4

Critique the assumptions used in modelling, are they perfectly realistic or would you

recommend some changes to improve the quality of the projection?.........................................5

Present the charts for supporting the analysis..............................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Analyse the financial performance of Milton in the year 2024 by calculating benchmark ratios.

.....................................................................................................................................................3

Recommend strategies for Milton to outperform the industry average in 2024..........................4

Critique the assumptions used in modelling, are they perfectly realistic or would you

recommend some changes to improve the quality of the projection?.........................................5

Present the charts for supporting the analysis..............................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

The financial statements are analysed for finding out the monetary performance of the

company. It helps in the decision making and helps the business in improving the effectiveness

and efficiency of the working of the company (Almeida-Filho and et.al., 2021). In the following

report, the company is Milton and the financial statement of future year 2024 are being analysed

for evaluating the performance of the business entity. The objective of the report, is to assume

the strategies that the business could outperform and set an example for the industry. Also, some

of the assumptions are taken in respect of the decisions and financial modelling.

MAIN BODY

Analyse the financial performance of Milton in the year 2024 by calculating benchmark ratios.

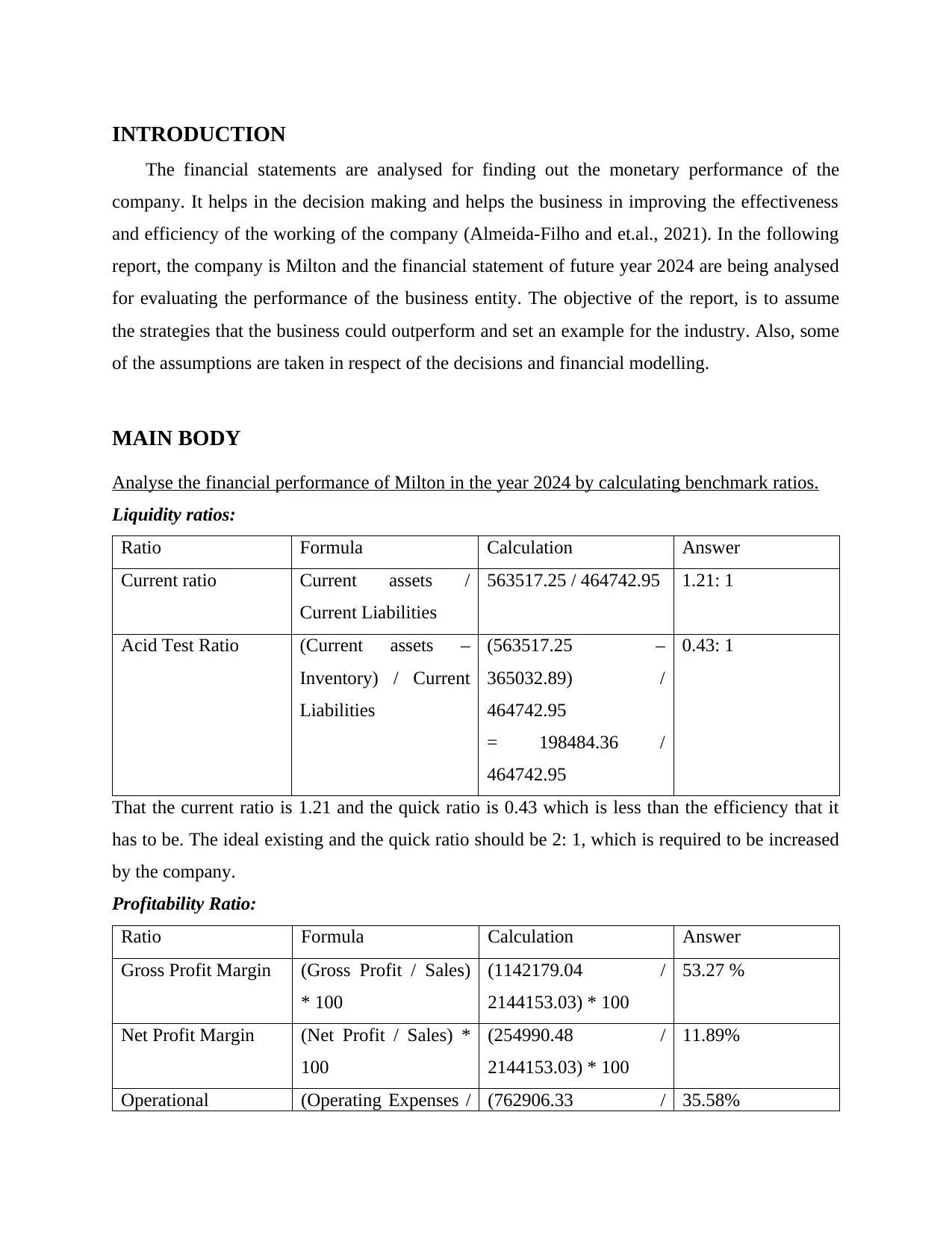

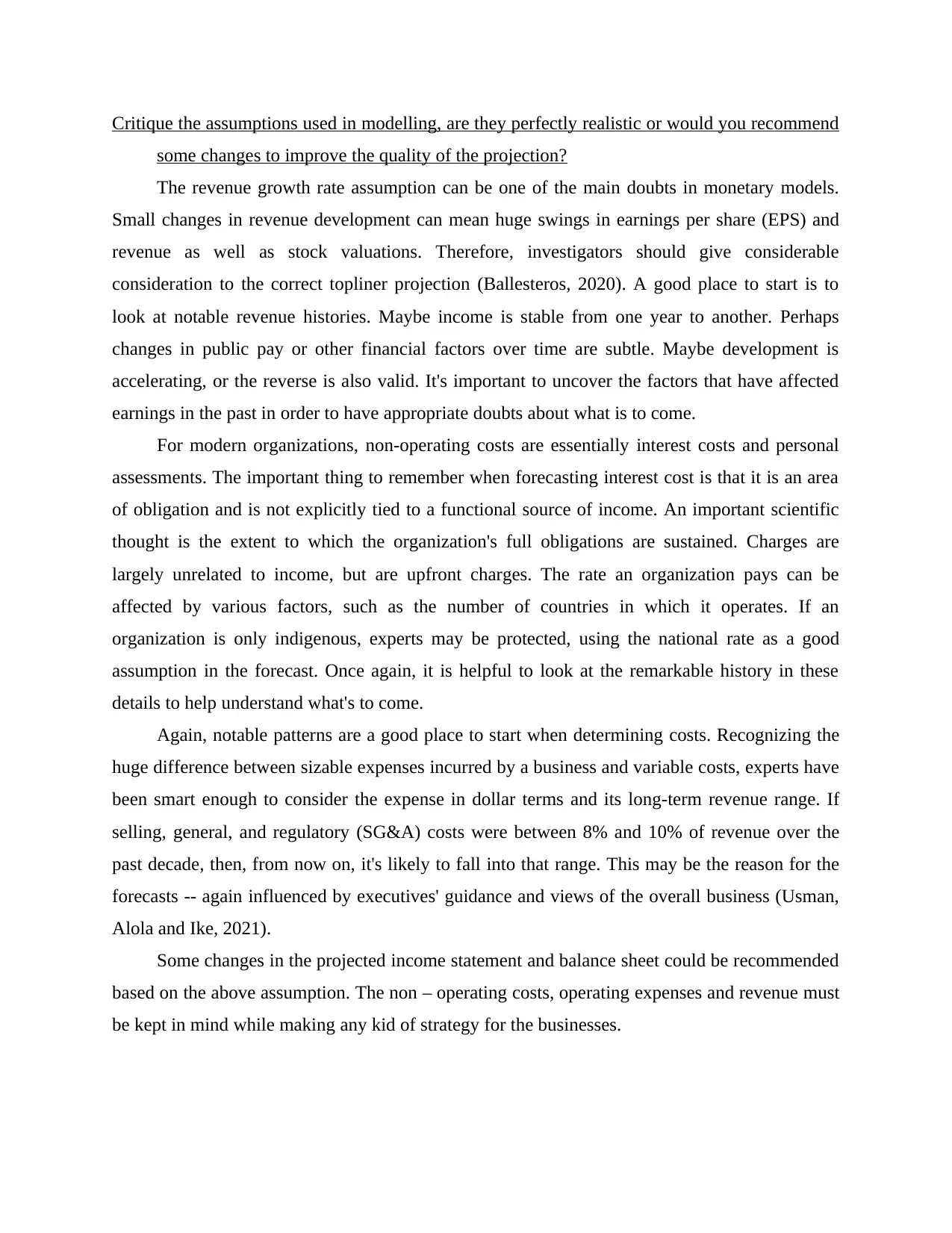

Liquidity ratios:

Ratio Formula Calculation Answer

Current ratio Current assets /

Current Liabilities

563517.25 / 464742.95 1.21: 1

Acid Test Ratio (Current assets –

Inventory) / Current

Liabilities

(563517.25 –

365032.89) /

464742.95

= 198484.36 /

464742.95

0.43: 1

That the current ratio is 1.21 and the quick ratio is 0.43 which is less than the efficiency that it

has to be. The ideal existing and the quick ratio should be 2: 1, which is required to be increased

by the company.

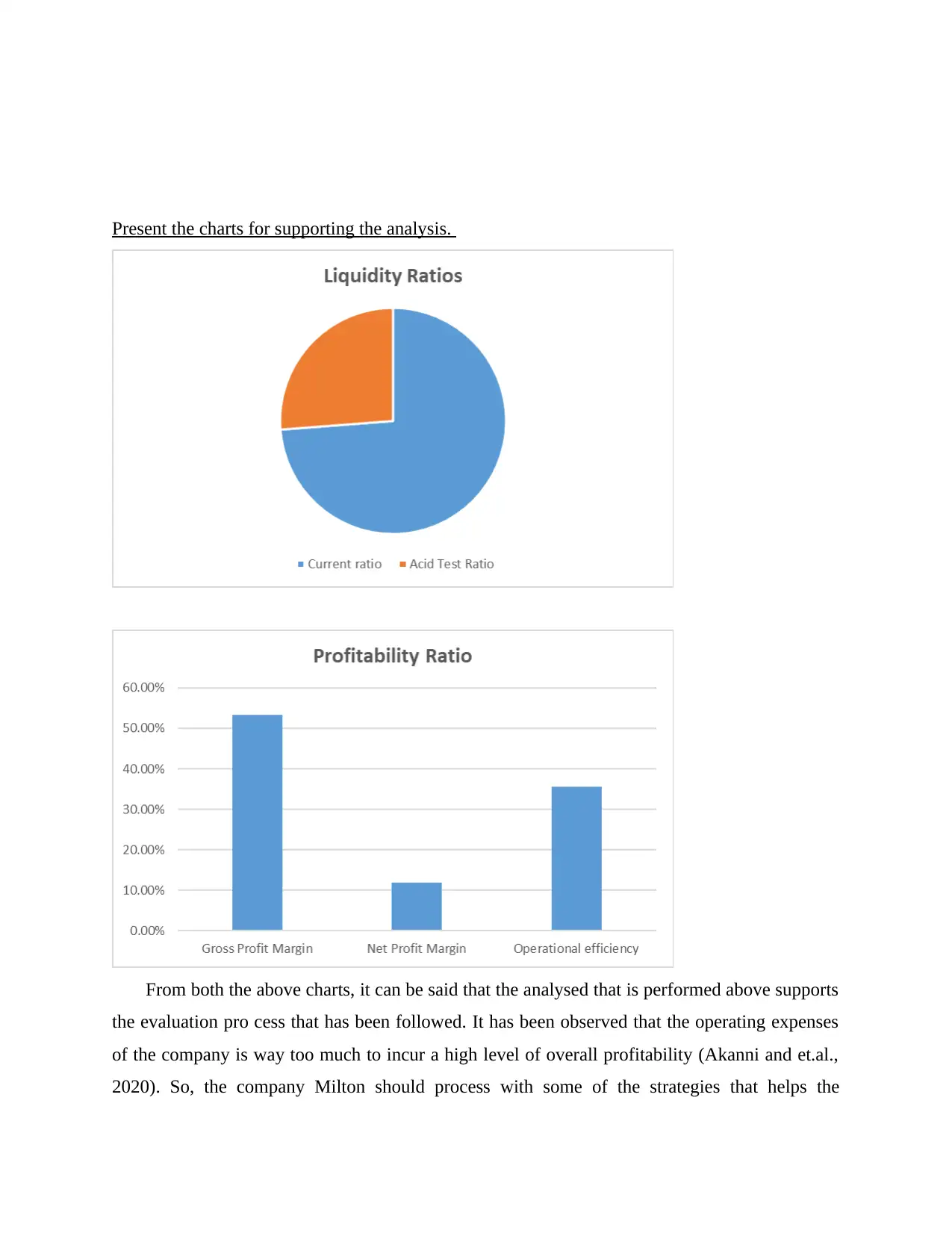

Profitability Ratio:

Ratio Formula Calculation Answer

Gross Profit Margin (Gross Profit / Sales)

* 100

(1142179.04 /

2144153.03) * 100

53.27 %

Net Profit Margin (Net Profit / Sales) *

100

(254990.48 /

2144153.03) * 100

11.89%

Operational (Operating Expenses / (762906.33 / 35.58%

The financial statements are analysed for finding out the monetary performance of the

company. It helps in the decision making and helps the business in improving the effectiveness

and efficiency of the working of the company (Almeida-Filho and et.al., 2021). In the following

report, the company is Milton and the financial statement of future year 2024 are being analysed

for evaluating the performance of the business entity. The objective of the report, is to assume

the strategies that the business could outperform and set an example for the industry. Also, some

of the assumptions are taken in respect of the decisions and financial modelling.

MAIN BODY

Analyse the financial performance of Milton in the year 2024 by calculating benchmark ratios.

Liquidity ratios:

Ratio Formula Calculation Answer

Current ratio Current assets /

Current Liabilities

563517.25 / 464742.95 1.21: 1

Acid Test Ratio (Current assets –

Inventory) / Current

Liabilities

(563517.25 –

365032.89) /

464742.95

= 198484.36 /

464742.95

0.43: 1

That the current ratio is 1.21 and the quick ratio is 0.43 which is less than the efficiency that it

has to be. The ideal existing and the quick ratio should be 2: 1, which is required to be increased

by the company.

Profitability Ratio:

Ratio Formula Calculation Answer

Gross Profit Margin (Gross Profit / Sales)

* 100

(1142179.04 /

2144153.03) * 100

53.27 %

Net Profit Margin (Net Profit / Sales) *

100

(254990.48 /

2144153.03) * 100

11.89%

Operational (Operating Expenses / (762906.33 / 35.58%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

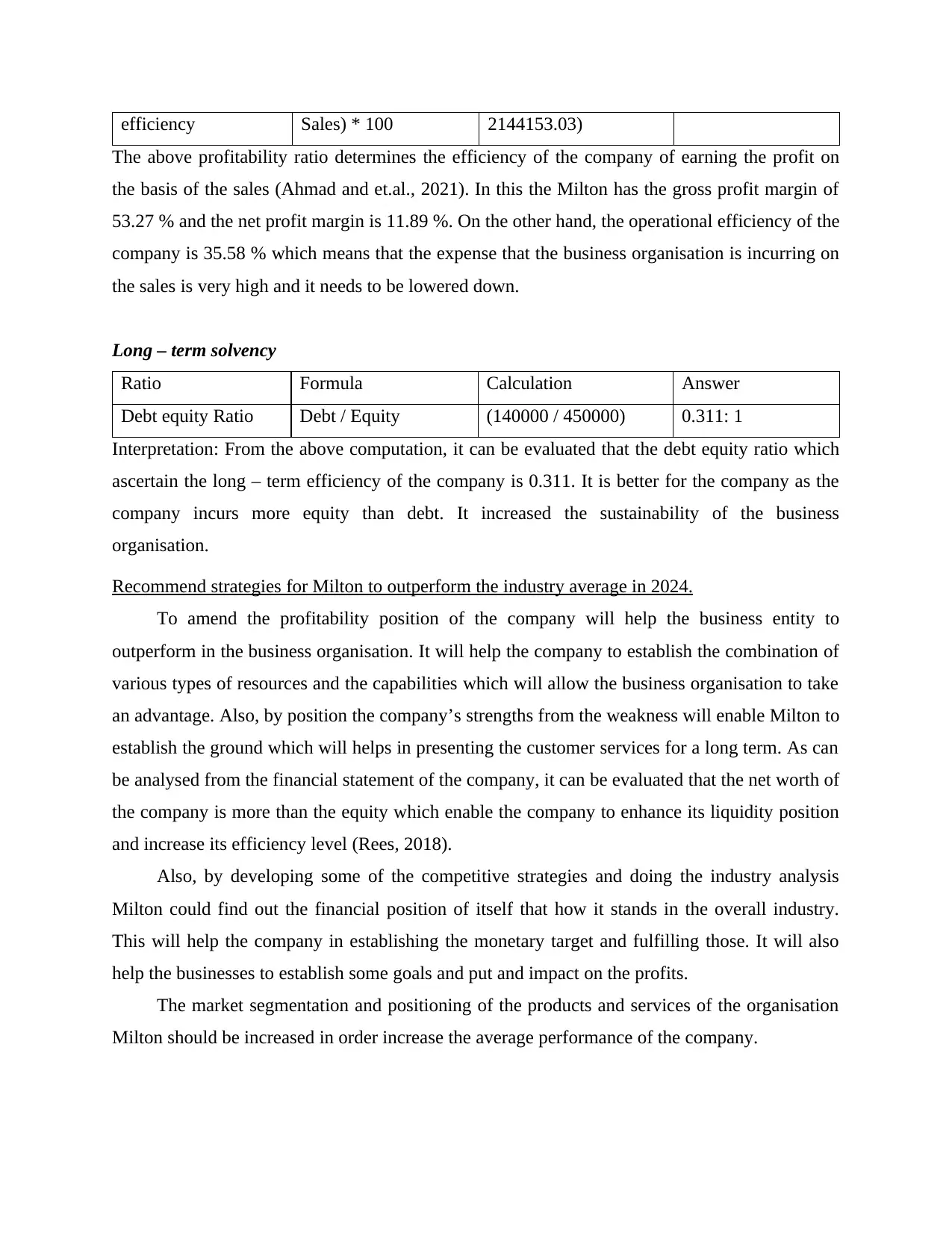

efficiency Sales) * 100 2144153.03)

The above profitability ratio determines the efficiency of the company of earning the profit on

the basis of the sales (Ahmad and et.al., 2021). In this the Milton has the gross profit margin of

53.27 % and the net profit margin is 11.89 %. On the other hand, the operational efficiency of the

company is 35.58 % which means that the expense that the business organisation is incurring on

the sales is very high and it needs to be lowered down.

Long – term solvency

Ratio Formula Calculation Answer

Debt equity Ratio Debt / Equity (140000 / 450000) 0.311: 1

Interpretation: From the above computation, it can be evaluated that the debt equity ratio which

ascertain the long – term efficiency of the company is 0.311. It is better for the company as the

company incurs more equity than debt. It increased the sustainability of the business

organisation.

Recommend strategies for Milton to outperform the industry average in 2024.

To amend the profitability position of the company will help the business entity to

outperform in the business organisation. It will help the company to establish the combination of

various types of resources and the capabilities which will allow the business organisation to take

an advantage. Also, by position the company’s strengths from the weakness will enable Milton to

establish the ground which will helps in presenting the customer services for a long term. As can

be analysed from the financial statement of the company, it can be evaluated that the net worth of

the company is more than the equity which enable the company to enhance its liquidity position

and increase its efficiency level (Rees, 2018).

Also, by developing some of the competitive strategies and doing the industry analysis

Milton could find out the financial position of itself that how it stands in the overall industry.

This will help the company in establishing the monetary target and fulfilling those. It will also

help the businesses to establish some goals and put and impact on the profits.

The market segmentation and positioning of the products and services of the organisation

Milton should be increased in order increase the average performance of the company.

The above profitability ratio determines the efficiency of the company of earning the profit on

the basis of the sales (Ahmad and et.al., 2021). In this the Milton has the gross profit margin of

53.27 % and the net profit margin is 11.89 %. On the other hand, the operational efficiency of the

company is 35.58 % which means that the expense that the business organisation is incurring on

the sales is very high and it needs to be lowered down.

Long – term solvency

Ratio Formula Calculation Answer

Debt equity Ratio Debt / Equity (140000 / 450000) 0.311: 1

Interpretation: From the above computation, it can be evaluated that the debt equity ratio which

ascertain the long – term efficiency of the company is 0.311. It is better for the company as the

company incurs more equity than debt. It increased the sustainability of the business

organisation.

Recommend strategies for Milton to outperform the industry average in 2024.

To amend the profitability position of the company will help the business entity to

outperform in the business organisation. It will help the company to establish the combination of

various types of resources and the capabilities which will allow the business organisation to take

an advantage. Also, by position the company’s strengths from the weakness will enable Milton to

establish the ground which will helps in presenting the customer services for a long term. As can

be analysed from the financial statement of the company, it can be evaluated that the net worth of

the company is more than the equity which enable the company to enhance its liquidity position

and increase its efficiency level (Rees, 2018).

Also, by developing some of the competitive strategies and doing the industry analysis

Milton could find out the financial position of itself that how it stands in the overall industry.

This will help the company in establishing the monetary target and fulfilling those. It will also

help the businesses to establish some goals and put and impact on the profits.

The market segmentation and positioning of the products and services of the organisation

Milton should be increased in order increase the average performance of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Critique the assumptions used in modelling, are they perfectly realistic or would you recommend

some changes to improve the quality of the projection?

The revenue growth rate assumption can be one of the main doubts in monetary models.

Small changes in revenue development can mean huge swings in earnings per share (EPS) and

revenue as well as stock valuations. Therefore, investigators should give considerable

consideration to the correct topliner projection (Ballesteros, 2020). A good place to start is to

look at notable revenue histories. Maybe income is stable from one year to another. Perhaps

changes in public pay or other financial factors over time are subtle. Maybe development is

accelerating, or the reverse is also valid. It's important to uncover the factors that have affected

earnings in the past in order to have appropriate doubts about what is to come.

For modern organizations, non-operating costs are essentially interest costs and personal

assessments. The important thing to remember when forecasting interest cost is that it is an area

of obligation and is not explicitly tied to a functional source of income. An important scientific

thought is the extent to which the organization's full obligations are sustained. Charges are

largely unrelated to income, but are upfront charges. The rate an organization pays can be

affected by various factors, such as the number of countries in which it operates. If an

organization is only indigenous, experts may be protected, using the national rate as a good

assumption in the forecast. Once again, it is helpful to look at the remarkable history in these

details to help understand what's to come.

Again, notable patterns are a good place to start when determining costs. Recognizing the

huge difference between sizable expenses incurred by a business and variable costs, experts have

been smart enough to consider the expense in dollar terms and its long-term revenue range. If

selling, general, and regulatory (SG&A) costs were between 8% and 10% of revenue over the

past decade, then, from now on, it's likely to fall into that range. This may be the reason for the

forecasts -- again influenced by executives' guidance and views of the overall business (Usman,

Alola and Ike, 2021).

Some changes in the projected income statement and balance sheet could be recommended

based on the above assumption. The non – operating costs, operating expenses and revenue must

be kept in mind while making any kid of strategy for the businesses.

some changes to improve the quality of the projection?

The revenue growth rate assumption can be one of the main doubts in monetary models.

Small changes in revenue development can mean huge swings in earnings per share (EPS) and

revenue as well as stock valuations. Therefore, investigators should give considerable

consideration to the correct topliner projection (Ballesteros, 2020). A good place to start is to

look at notable revenue histories. Maybe income is stable from one year to another. Perhaps

changes in public pay or other financial factors over time are subtle. Maybe development is

accelerating, or the reverse is also valid. It's important to uncover the factors that have affected

earnings in the past in order to have appropriate doubts about what is to come.

For modern organizations, non-operating costs are essentially interest costs and personal

assessments. The important thing to remember when forecasting interest cost is that it is an area

of obligation and is not explicitly tied to a functional source of income. An important scientific

thought is the extent to which the organization's full obligations are sustained. Charges are

largely unrelated to income, but are upfront charges. The rate an organization pays can be

affected by various factors, such as the number of countries in which it operates. If an

organization is only indigenous, experts may be protected, using the national rate as a good

assumption in the forecast. Once again, it is helpful to look at the remarkable history in these

details to help understand what's to come.

Again, notable patterns are a good place to start when determining costs. Recognizing the

huge difference between sizable expenses incurred by a business and variable costs, experts have

been smart enough to consider the expense in dollar terms and its long-term revenue range. If

selling, general, and regulatory (SG&A) costs were between 8% and 10% of revenue over the

past decade, then, from now on, it's likely to fall into that range. This may be the reason for the

forecasts -- again influenced by executives' guidance and views of the overall business (Usman,

Alola and Ike, 2021).

Some changes in the projected income statement and balance sheet could be recommended

based on the above assumption. The non – operating costs, operating expenses and revenue must

be kept in mind while making any kid of strategy for the businesses.

Present the charts for supporting the analysis.

From both the above charts, it can be said that the analysed that is performed above supports

the evaluation pro cess that has been followed. It has been observed that the operating expenses

of the company is way too much to incur a high level of overall profitability (Akanni and et.al.,

2020). So, the company Milton should process with some of the strategies that helps the

From both the above charts, it can be said that the analysed that is performed above supports

the evaluation pro cess that has been followed. It has been observed that the operating expenses

of the company is way too much to incur a high level of overall profitability (Akanni and et.al.,

2020). So, the company Milton should process with some of the strategies that helps the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organisation in outperforming in the industry. It will be helpful for the company, as it can also be

seen that the liquidity position of the company is not goods. It does not have the ability to fulfil

sort term obligations in the organisation.

CONCLUSION

From the above report, it can be concluded that the company forecasted financial stamen declare

and depicts that the short term liability function of the company is not good. It has to improve its

current ratio for fulfilling its obligations. For this, the company has to outperform in the business

industry and outshine in the marketplace. Therefore, certain assumption has to be taken for

fulfilling the objective of the respective business entity.

seen that the liquidity position of the company is not goods. It does not have the ability to fulfil

sort term obligations in the organisation.

CONCLUSION

From the above report, it can be concluded that the company forecasted financial stamen declare

and depicts that the short term liability function of the company is not good. It has to improve its

current ratio for fulfilling its obligations. For this, the company has to outperform in the business

industry and outshine in the marketplace. Therefore, certain assumption has to be taken for

fulfilling the objective of the respective business entity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Ahmad, M and et.al., 2021. Modelling the dynamic linkages between eco-innovation,

urbanization, economic growth and ecological footprints for G7 countries: does

financial globalization matter?. Sustainable Cities and Society, 70, p.102881.

Akanni, J.O and et.al., 2020. Modelling financial crime population dynamics: optimal control

and cost-effectiveness analysis. International Journal of Dynamics and Control, 8(2),

pp.531-544.

Almeida-Filho, A.T.D and et.al., 2021. Financial modelling with multiple criteria decision

making: A systematic literature review. Journal of the Operational Research

Society, 72(10), pp.2161-2179.

Ballesteros, E., 2020. Economic & Financial Modelling: Autumn 2020.

Rees, M., 2018. Principles of financial modelling: model design and best practices using Excel

and VBA. John Wiley & Sons.

Usman, O., Alola, A.A. and Ike, G.N., 2021, November. Modelling the effect of energy

consumption on different environmental indicators in the United States: the role of

financial development and renewable energy innovations. In Natural resources

forum (Vol. 45, No. 4, pp. 441-463). Oxford, UK: Blackwell Publishing Ltd.

Books and Journals

Ahmad, M and et.al., 2021. Modelling the dynamic linkages between eco-innovation,

urbanization, economic growth and ecological footprints for G7 countries: does

financial globalization matter?. Sustainable Cities and Society, 70, p.102881.

Akanni, J.O and et.al., 2020. Modelling financial crime population dynamics: optimal control

and cost-effectiveness analysis. International Journal of Dynamics and Control, 8(2),

pp.531-544.

Almeida-Filho, A.T.D and et.al., 2021. Financial modelling with multiple criteria decision

making: A systematic literature review. Journal of the Operational Research

Society, 72(10), pp.2161-2179.

Ballesteros, E., 2020. Economic & Financial Modelling: Autumn 2020.

Rees, M., 2018. Principles of financial modelling: model design and best practices using Excel

and VBA. John Wiley & Sons.

Usman, O., Alola, A.A. and Ike, G.N., 2021, November. Modelling the effect of energy

consumption on different environmental indicators in the United States: the role of

financial development and renewable energy innovations. In Natural resources

forum (Vol. 45, No. 4, pp. 441-463). Oxford, UK: Blackwell Publishing Ltd.

1 out of 8