FIN5FSA La Trobe University: Domino's Pizza Financial Analysis

VerifiedAdded on 2023/03/23

|17

|2527

|41

Report

AI Summary

This report provides a comprehensive financial statement analysis of Domino's Pizza Enterprises Ltd. covering a ten-year period. It utilizes common size financial statements, horizontal analysis, and cash flow analysis to evaluate the company's financial performance and position. The analysis includes a detailed examination of income statement and balance sheet trends, profitability, solvency, and liquidity ratios. Key findings indicate improvements in operating efficiency and profitability margins, along with an increasing reliance on debt financing. The report concludes with graphical representations of key financial parameters, offering insights into Domino's Pizza's financial health and strategic financial decisions.

Running head: FINANCIAL STATEMENT ANALYSIS

Financial Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Financial Statement Analysis

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL STATEMENT ANALYSIS

Table of Contents

Financial Statement Analysis:.........................................................................................................2

Financial performance analysis of Domino’s Pizza Enterprise Ltd:...............................................2

Horizontal Analysis:........................................................................................................................8

Cash Flow Analysis:........................................................................................................................9

Income and solvency Analysis:.....................................................................................................10

References and bibliography:........................................................................................................15

Table of Contents

Financial Statement Analysis:.........................................................................................................2

Financial performance analysis of Domino’s Pizza Enterprise Ltd:...............................................2

Horizontal Analysis:........................................................................................................................8

Cash Flow Analysis:........................................................................................................................9

Income and solvency Analysis:.....................................................................................................10

References and bibliography:........................................................................................................15

2FINANCIAL STATEMENT ANALYSIS

Financial Statement Analysis:

Financial statement analysis is a tool, which is used to evaluate and analyze the financial

performance and the financial position of an organization. There, are various numerical

techniques in which the financial statements of an organization can be analyzed and presented

with some pictorial presentation. Some methods of financial statement analysis include Common

size financial statement (Cao, Chychyla and Stewart 2015). It can again be prepared in horizontal

or vertical analysis format. There are various other ways, which can be applied to analyze the

financial statement. In the following paragraphs, some of such techniques have been applied to

analyze the financial statement of Domino’s Pizza Enterprise Limited.

Financial performance analysis of Domino’s Pizza Enterprise Ltd:

Common size financial statement presents all the figures and items of an income or

financial position statement as a percentage of a common base. For analyzing the income

statement in a common size income statement, sales or the revenue is considered as the base for

showing all other figures as a percentage. All the income statement items are then presented as a

percentage of the sales revenue. For the given case study of Domino’s Pizza Enterprise Limited,

all income statement items have been presented as a percentage of the total revenue in the

common size income statement (Cao, Chychyla and Stewart 2015). From a common size income

statement analysis, various trends can be known and the relationship among the various income

statement items can be explained. In the following table the income statement of Domino’s Pizza

Enterprise Limited have been presented in common size format, and based on that various

income statement parameters can be explained (Cao, Chychyla and Stewart 2015).

Financial Statement Analysis:

Financial statement analysis is a tool, which is used to evaluate and analyze the financial

performance and the financial position of an organization. There, are various numerical

techniques in which the financial statements of an organization can be analyzed and presented

with some pictorial presentation. Some methods of financial statement analysis include Common

size financial statement (Cao, Chychyla and Stewart 2015). It can again be prepared in horizontal

or vertical analysis format. There are various other ways, which can be applied to analyze the

financial statement. In the following paragraphs, some of such techniques have been applied to

analyze the financial statement of Domino’s Pizza Enterprise Limited.

Financial performance analysis of Domino’s Pizza Enterprise Ltd:

Common size financial statement presents all the figures and items of an income or

financial position statement as a percentage of a common base. For analyzing the income

statement in a common size income statement, sales or the revenue is considered as the base for

showing all other figures as a percentage. All the income statement items are then presented as a

percentage of the sales revenue. For the given case study of Domino’s Pizza Enterprise Limited,

all income statement items have been presented as a percentage of the total revenue in the

common size income statement (Cao, Chychyla and Stewart 2015). From a common size income

statement analysis, various trends can be known and the relationship among the various income

statement items can be explained. In the following table the income statement of Domino’s Pizza

Enterprise Limited have been presented in common size format, and based on that various

income statement parameters can be explained (Cao, Chychyla and Stewart 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL STATEMENT ANALYSIS

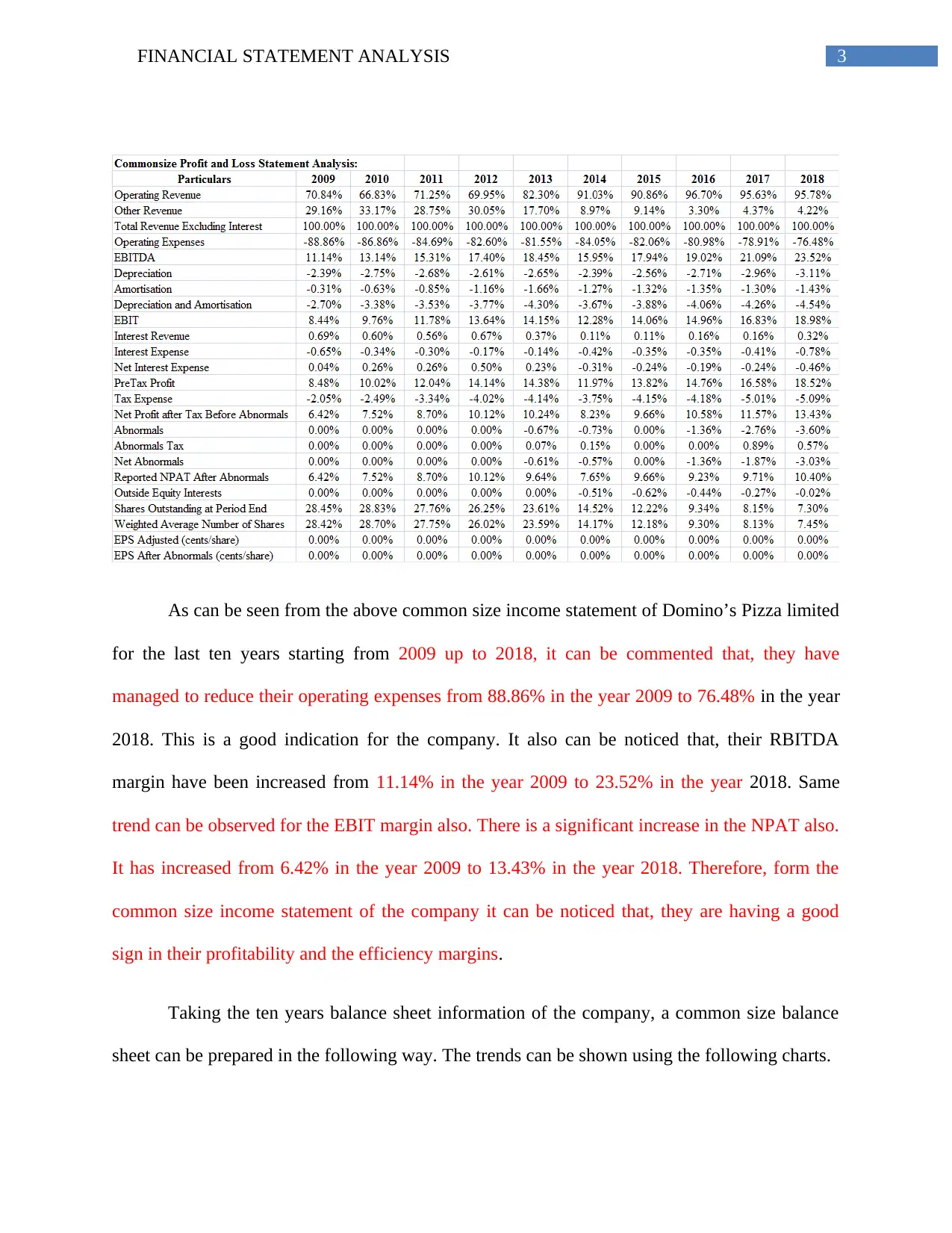

As can be seen from the above common size income statement of Domino’s Pizza limited

for the last ten years starting from 2009 up to 2018, it can be commented that, they have

managed to reduce their operating expenses from 88.86% in the year 2009 to 76.48% in the year

2018. This is a good indication for the company. It also can be noticed that, their RBITDA

margin have been increased from 11.14% in the year 2009 to 23.52% in the year 2018. Same

trend can be observed for the EBIT margin also. There is a significant increase in the NPAT also.

It has increased from 6.42% in the year 2009 to 13.43% in the year 2018. Therefore, form the

common size income statement of the company it can be noticed that, they are having a good

sign in their profitability and the efficiency margins.

Taking the ten years balance sheet information of the company, a common size balance

sheet can be prepared in the following way. The trends can be shown using the following charts.

As can be seen from the above common size income statement of Domino’s Pizza limited

for the last ten years starting from 2009 up to 2018, it can be commented that, they have

managed to reduce their operating expenses from 88.86% in the year 2009 to 76.48% in the year

2018. This is a good indication for the company. It also can be noticed that, their RBITDA

margin have been increased from 11.14% in the year 2009 to 23.52% in the year 2018. Same

trend can be observed for the EBIT margin also. There is a significant increase in the NPAT also.

It has increased from 6.42% in the year 2009 to 13.43% in the year 2018. Therefore, form the

common size income statement of the company it can be noticed that, they are having a good

sign in their profitability and the efficiency margins.

Taking the ten years balance sheet information of the company, a common size balance

sheet can be prepared in the following way. The trends can be shown using the following charts.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL STATEMENT ANALYSIS

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Other Revenue

Operating Revenue

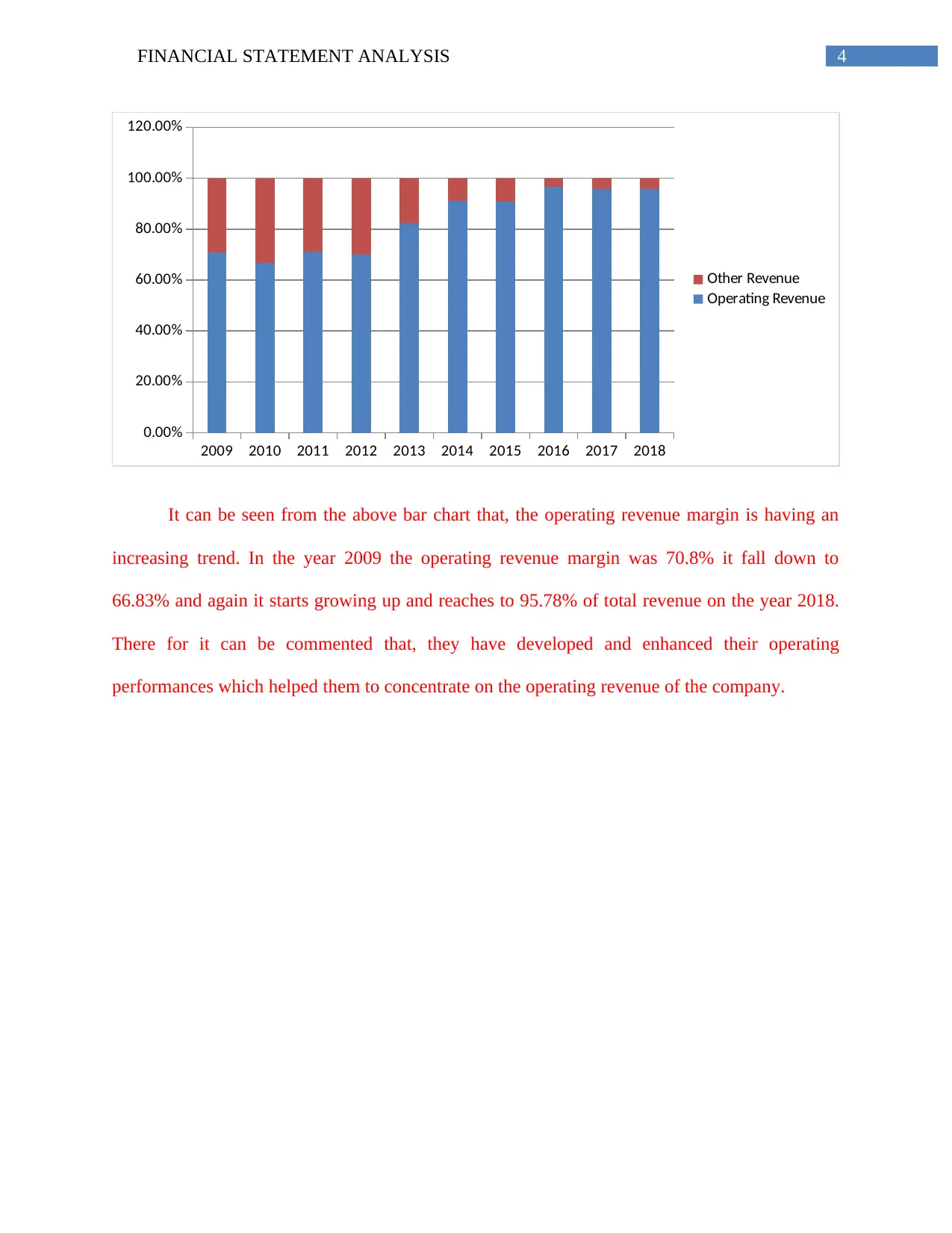

It can be seen from the above bar chart that, the operating revenue margin is having an

increasing trend. In the year 2009 the operating revenue margin was 70.8% it fall down to

66.83% and again it starts growing up and reaches to 95.78% of total revenue on the year 2018.

There for it can be commented that, they have developed and enhanced their operating

performances which helped them to concentrate on the operating revenue of the company.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Other Revenue

Operating Revenue

It can be seen from the above bar chart that, the operating revenue margin is having an

increasing trend. In the year 2009 the operating revenue margin was 70.8% it fall down to

66.83% and again it starts growing up and reaches to 95.78% of total revenue on the year 2018.

There for it can be commented that, they have developed and enhanced their operating

performances which helped them to concentrate on the operating revenue of the company.

5FINANCIAL STATEMENT ANALYSIS

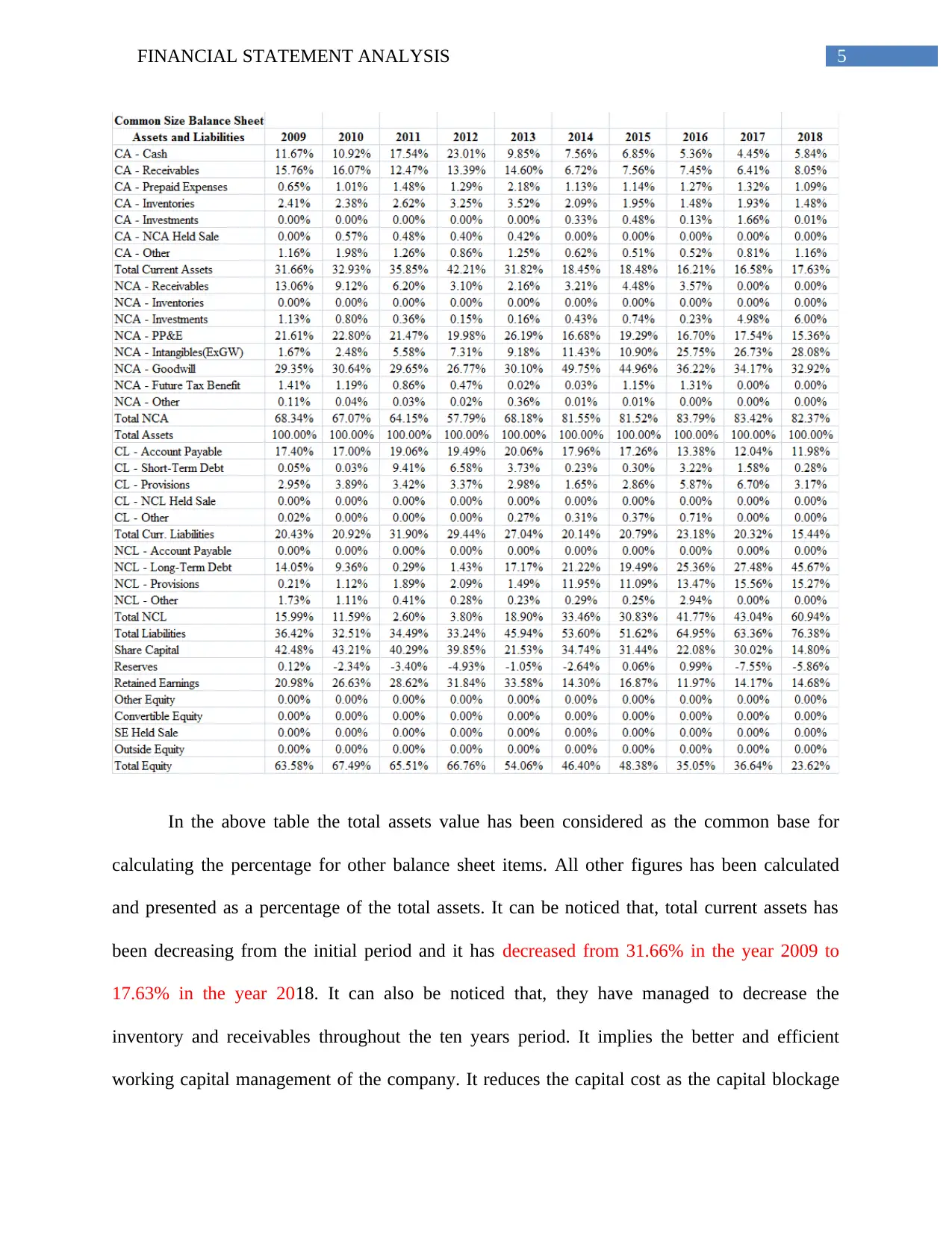

In the above table the total assets value has been considered as the common base for

calculating the percentage for other balance sheet items. All other figures has been calculated

and presented as a percentage of the total assets. It can be noticed that, total current assets has

been decreasing from the initial period and it has decreased from 31.66% in the year 2009 to

17.63% in the year 2018. It can also be noticed that, they have managed to decrease the

inventory and receivables throughout the ten years period. It implies the better and efficient

working capital management of the company. It reduces the capital cost as the capital blockage

In the above table the total assets value has been considered as the common base for

calculating the percentage for other balance sheet items. All other figures has been calculated

and presented as a percentage of the total assets. It can be noticed that, total current assets has

been decreasing from the initial period and it has decreased from 31.66% in the year 2009 to

17.63% in the year 2018. It can also be noticed that, they have managed to decrease the

inventory and receivables throughout the ten years period. It implies the better and efficient

working capital management of the company. It reduces the capital cost as the capital blockage

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL STATEMENT ANALYSIS

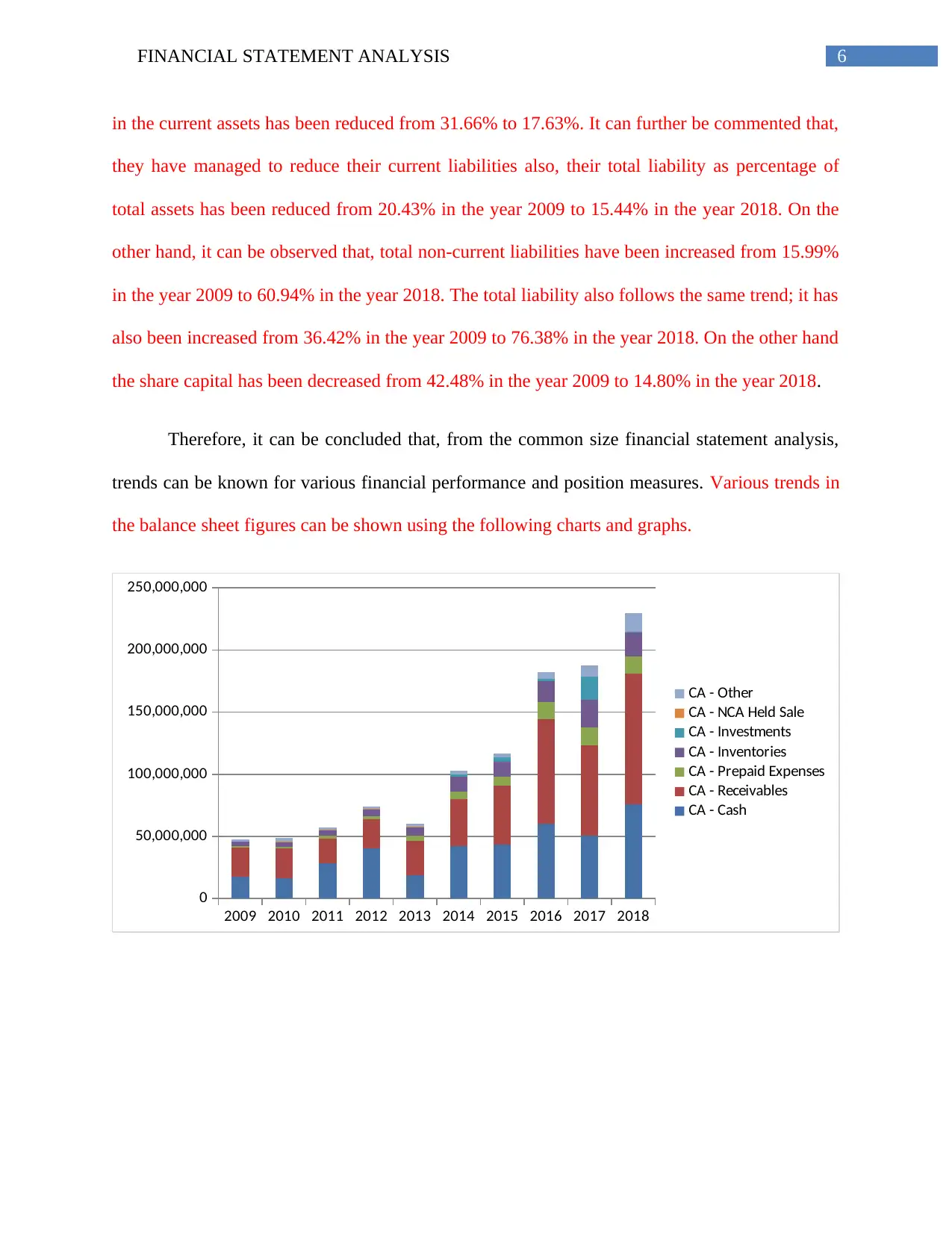

in the current assets has been reduced from 31.66% to 17.63%. It can further be commented that,

they have managed to reduce their current liabilities also, their total liability as percentage of

total assets has been reduced from 20.43% in the year 2009 to 15.44% in the year 2018. On the

other hand, it can be observed that, total non-current liabilities have been increased from 15.99%

in the year 2009 to 60.94% in the year 2018. The total liability also follows the same trend; it has

also been increased from 36.42% in the year 2009 to 76.38% in the year 2018. On the other hand

the share capital has been decreased from 42.48% in the year 2009 to 14.80% in the year 2018.

Therefore, it can be concluded that, from the common size financial statement analysis,

trends can be known for various financial performance and position measures. Various trends in

the balance sheet figures can be shown using the following charts and graphs.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

50,000,000

100,000,000

150,000,000

200,000,000

250,000,000

CA - Other

CA - NCA Held Sale

CA - Investments

CA - Inventories

CA - Prepaid Expenses

CA - Receivables

CA - Cash

in the current assets has been reduced from 31.66% to 17.63%. It can further be commented that,

they have managed to reduce their current liabilities also, their total liability as percentage of

total assets has been reduced from 20.43% in the year 2009 to 15.44% in the year 2018. On the

other hand, it can be observed that, total non-current liabilities have been increased from 15.99%

in the year 2009 to 60.94% in the year 2018. The total liability also follows the same trend; it has

also been increased from 36.42% in the year 2009 to 76.38% in the year 2018. On the other hand

the share capital has been decreased from 42.48% in the year 2009 to 14.80% in the year 2018.

Therefore, it can be concluded that, from the common size financial statement analysis,

trends can be known for various financial performance and position measures. Various trends in

the balance sheet figures can be shown using the following charts and graphs.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

50,000,000

100,000,000

150,000,000

200,000,000

250,000,000

CA - Other

CA - NCA Held Sale

CA - Investments

CA - Inventories

CA - Prepaid Expenses

CA - Receivables

CA - Cash

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL STATEMENT ANALYSIS

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

200,000,000

400,000,000

600,000,000

800,000,000

1,000,000,000

1,200,000,000

1,400,000,000

Total Assets

Total Liabilities

It can be observed that with the increase in total assets of the company the total liabilities

have also been increased. This is because of additional debt financing for funding the acquisition

of fixed assets.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total Equity

Total Liabilities

Total Assets

From the above graph their total assets backing can be easily observed. Initially their

assets were mostly backed by equity financing later on the debt capital increased significantly.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

200,000,000

400,000,000

600,000,000

800,000,000

1,000,000,000

1,200,000,000

1,400,000,000

Total Assets

Total Liabilities

It can be observed that with the increase in total assets of the company the total liabilities

have also been increased. This is because of additional debt financing for funding the acquisition

of fixed assets.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Total Equity

Total Liabilities

Total Assets

From the above graph their total assets backing can be easily observed. Initially their

assets were mostly backed by equity financing later on the debt capital increased significantly.

8FINANCIAL STATEMENT ANALYSIS

Horizontal Analysis:

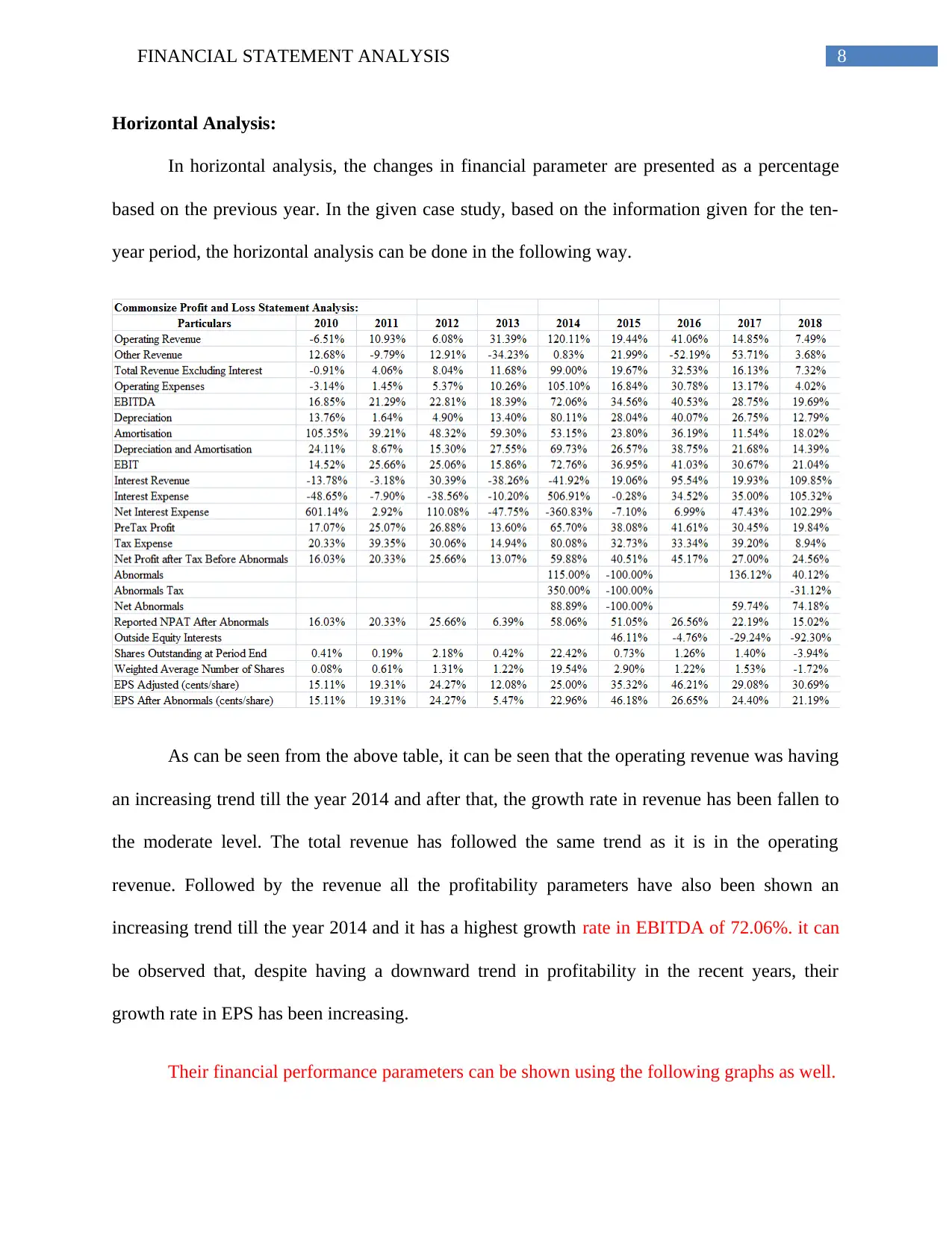

In horizontal analysis, the changes in financial parameter are presented as a percentage

based on the previous year. In the given case study, based on the information given for the ten-

year period, the horizontal analysis can be done in the following way.

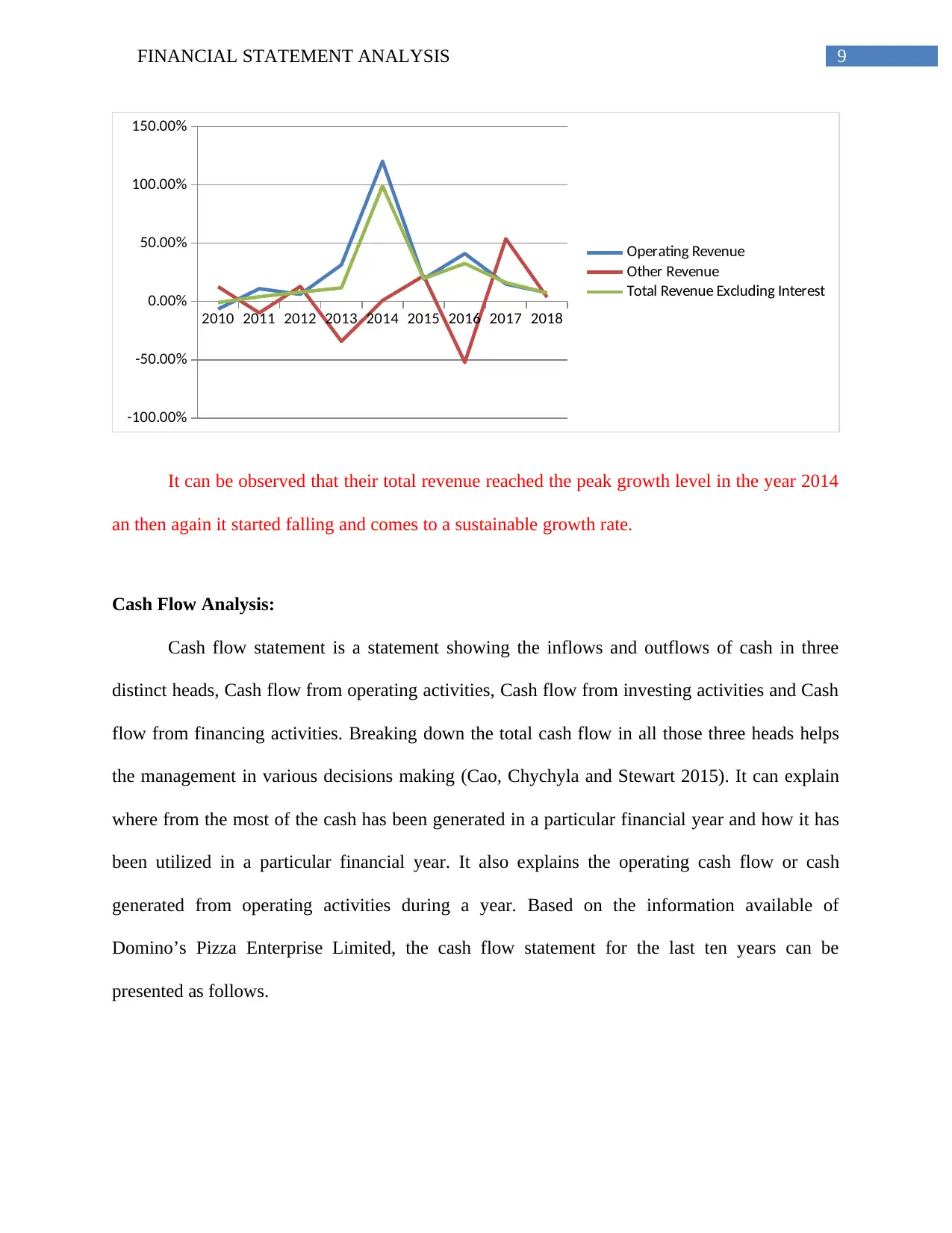

As can be seen from the above table, it can be seen that the operating revenue was having

an increasing trend till the year 2014 and after that, the growth rate in revenue has been fallen to

the moderate level. The total revenue has followed the same trend as it is in the operating

revenue. Followed by the revenue all the profitability parameters have also been shown an

increasing trend till the year 2014 and it has a highest growth rate in EBITDA of 72.06%. it can

be observed that, despite having a downward trend in profitability in the recent years, their

growth rate in EPS has been increasing.

Their financial performance parameters can be shown using the following graphs as well.

Horizontal Analysis:

In horizontal analysis, the changes in financial parameter are presented as a percentage

based on the previous year. In the given case study, based on the information given for the ten-

year period, the horizontal analysis can be done in the following way.

As can be seen from the above table, it can be seen that the operating revenue was having

an increasing trend till the year 2014 and after that, the growth rate in revenue has been fallen to

the moderate level. The total revenue has followed the same trend as it is in the operating

revenue. Followed by the revenue all the profitability parameters have also been shown an

increasing trend till the year 2014 and it has a highest growth rate in EBITDA of 72.06%. it can

be observed that, despite having a downward trend in profitability in the recent years, their

growth rate in EPS has been increasing.

Their financial performance parameters can be shown using the following graphs as well.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL STATEMENT ANALYSIS

2010 2011 2012 2013 2014 2015 2016 2017 2018

-100.00%

-50.00%

0.00%

50.00%

100.00%

150.00%

Operating Revenue

Other Revenue

Total Revenue Excluding Interest

It can be observed that their total revenue reached the peak growth level in the year 2014

an then again it started falling and comes to a sustainable growth rate.

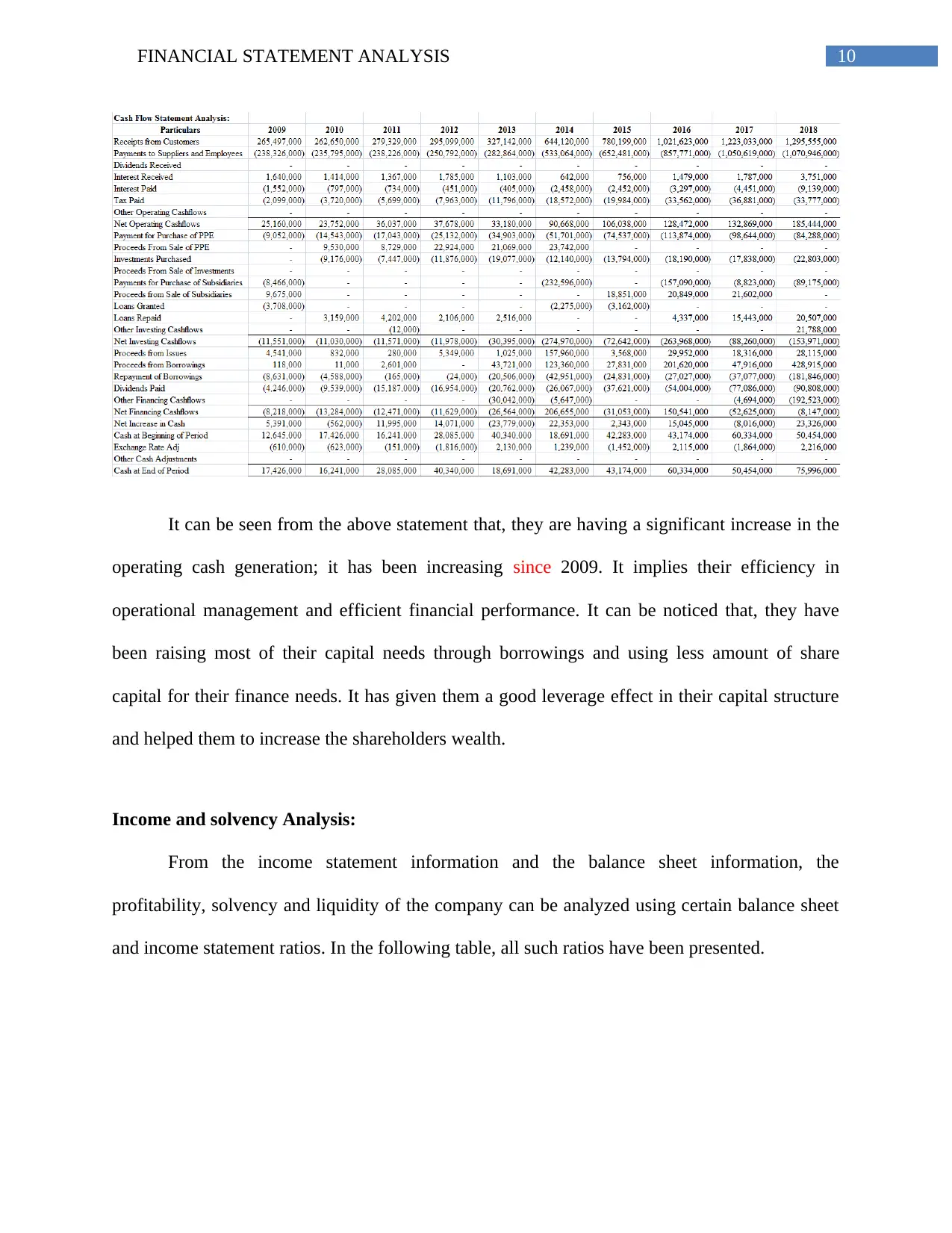

Cash Flow Analysis:

Cash flow statement is a statement showing the inflows and outflows of cash in three

distinct heads, Cash flow from operating activities, Cash flow from investing activities and Cash

flow from financing activities. Breaking down the total cash flow in all those three heads helps

the management in various decisions making (Cao, Chychyla and Stewart 2015). It can explain

where from the most of the cash has been generated in a particular financial year and how it has

been utilized in a particular financial year. It also explains the operating cash flow or cash

generated from operating activities during a year. Based on the information available of

Domino’s Pizza Enterprise Limited, the cash flow statement for the last ten years can be

presented as follows.

2010 2011 2012 2013 2014 2015 2016 2017 2018

-100.00%

-50.00%

0.00%

50.00%

100.00%

150.00%

Operating Revenue

Other Revenue

Total Revenue Excluding Interest

It can be observed that their total revenue reached the peak growth level in the year 2014

an then again it started falling and comes to a sustainable growth rate.

Cash Flow Analysis:

Cash flow statement is a statement showing the inflows and outflows of cash in three

distinct heads, Cash flow from operating activities, Cash flow from investing activities and Cash

flow from financing activities. Breaking down the total cash flow in all those three heads helps

the management in various decisions making (Cao, Chychyla and Stewart 2015). It can explain

where from the most of the cash has been generated in a particular financial year and how it has

been utilized in a particular financial year. It also explains the operating cash flow or cash

generated from operating activities during a year. Based on the information available of

Domino’s Pizza Enterprise Limited, the cash flow statement for the last ten years can be

presented as follows.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL STATEMENT ANALYSIS

It can be seen from the above statement that, they are having a significant increase in the

operating cash generation; it has been increasing since 2009. It implies their efficiency in

operational management and efficient financial performance. It can be noticed that, they have

been raising most of their capital needs through borrowings and using less amount of share

capital for their finance needs. It has given them a good leverage effect in their capital structure

and helped them to increase the shareholders wealth.

Income and solvency Analysis:

From the income statement information and the balance sheet information, the

profitability, solvency and liquidity of the company can be analyzed using certain balance sheet

and income statement ratios. In the following table, all such ratios have been presented.

It can be seen from the above statement that, they are having a significant increase in the

operating cash generation; it has been increasing since 2009. It implies their efficiency in

operational management and efficient financial performance. It can be noticed that, they have

been raising most of their capital needs through borrowings and using less amount of share

capital for their finance needs. It has given them a good leverage effect in their capital structure

and helped them to increase the shareholders wealth.

Income and solvency Analysis:

From the income statement information and the balance sheet information, the

profitability, solvency and liquidity of the company can be analyzed using certain balance sheet

and income statement ratios. In the following table, all such ratios have been presented.

11FINANCIAL STATEMENT ANALYSIS

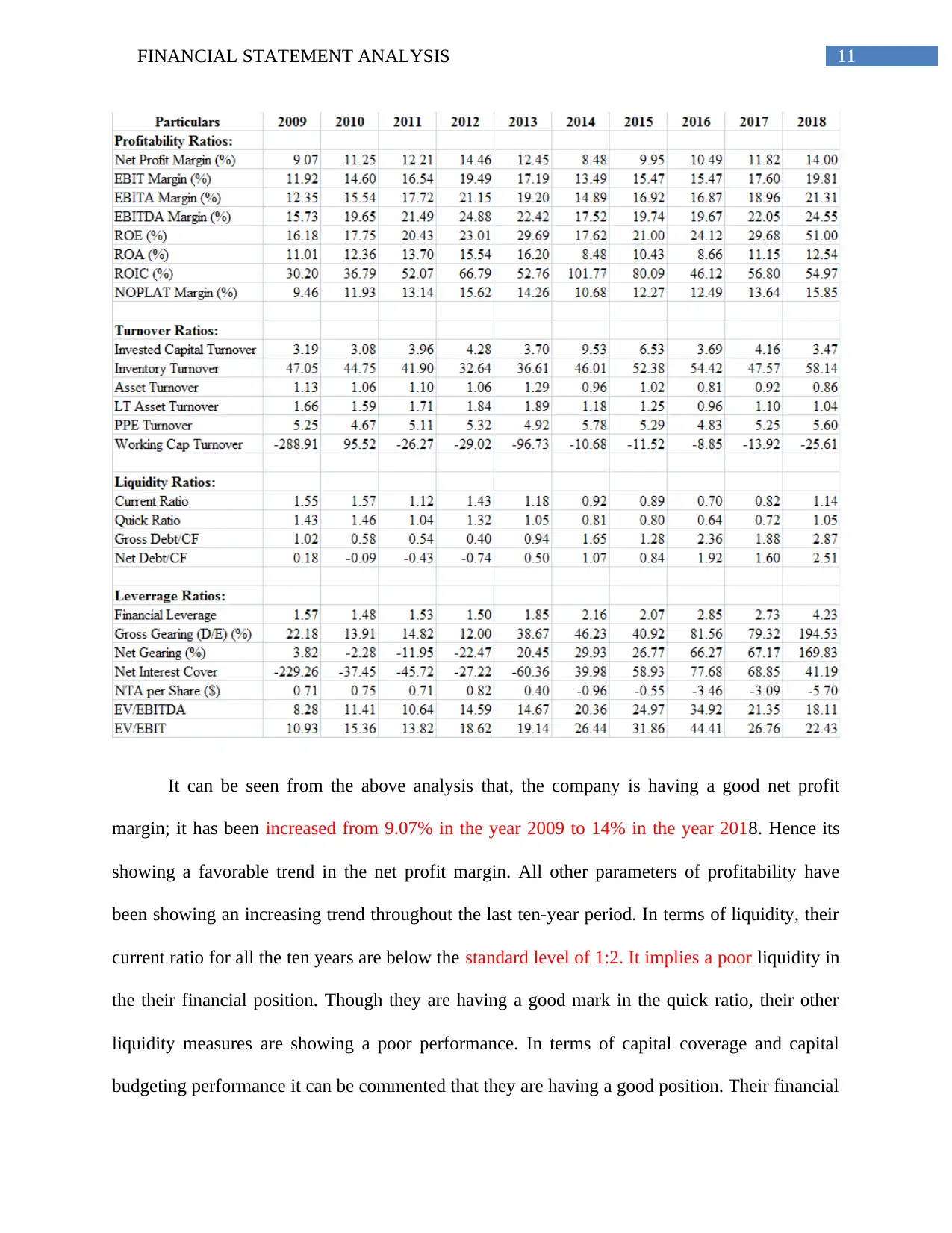

It can be seen from the above analysis that, the company is having a good net profit

margin; it has been increased from 9.07% in the year 2009 to 14% in the year 2018. Hence its

showing a favorable trend in the net profit margin. All other parameters of profitability have

been showing an increasing trend throughout the last ten-year period. In terms of liquidity, their

current ratio for all the ten years are below the standard level of 1:2. It implies a poor liquidity in

the their financial position. Though they are having a good mark in the quick ratio, their other

liquidity measures are showing a poor performance. In terms of capital coverage and capital

budgeting performance it can be commented that they are having a good position. Their financial

It can be seen from the above analysis that, the company is having a good net profit

margin; it has been increased from 9.07% in the year 2009 to 14% in the year 2018. Hence its

showing a favorable trend in the net profit margin. All other parameters of profitability have

been showing an increasing trend throughout the last ten-year period. In terms of liquidity, their

current ratio for all the ten years are below the standard level of 1:2. It implies a poor liquidity in

the their financial position. Though they are having a good mark in the quick ratio, their other

liquidity measures are showing a poor performance. In terms of capital coverage and capital

budgeting performance it can be commented that they are having a good position. Their financial

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.